England | | | 1040 | | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification Number) |

† | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

• | incorporated documents are considered part of this prospectus; |

• | NewCo can disclose important information to you by referring you to another document that AGA has filed separately with the SEC; |

• | information in this prospectus automatically updates and supersedes information in earlier documents that are incorporated by reference in this prospectus; |

• | information in a document incorporated by reference in this prospectus automatically updates and supersedes information in earlier documents that are incorporated by reference in this prospectus; and |

• | information that we file in the future with the SEC that we incorporate by reference in this prospectus will automatically update and supersede information in this prospectus. |

Q: | Why am I receiving this prospectus? |

A: | You are receiving this prospectus because, as of the relevant record date for distribution of this prospectus, you held AGA Ordinary Shares or AGA ADSs (each AGA ADS representing one AGA Ordinary Share). This prospectus describes the proposal to the AGA shareholders to approve the Reorganization. This prospectus also gives you information about NewCo and AGA and other background information to assist you in making an informed decision. |

Q: | What is the Reorganization? |

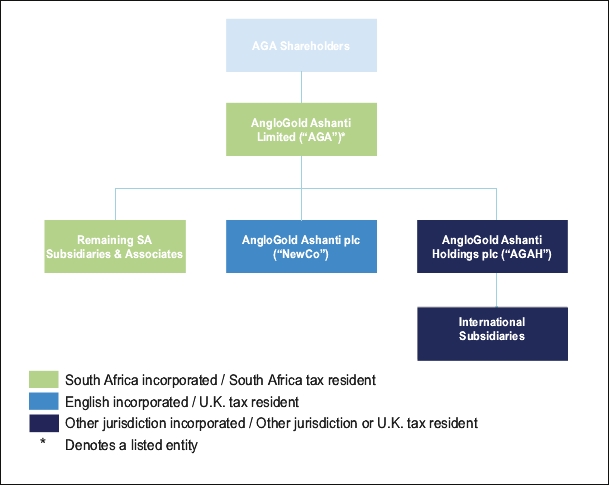

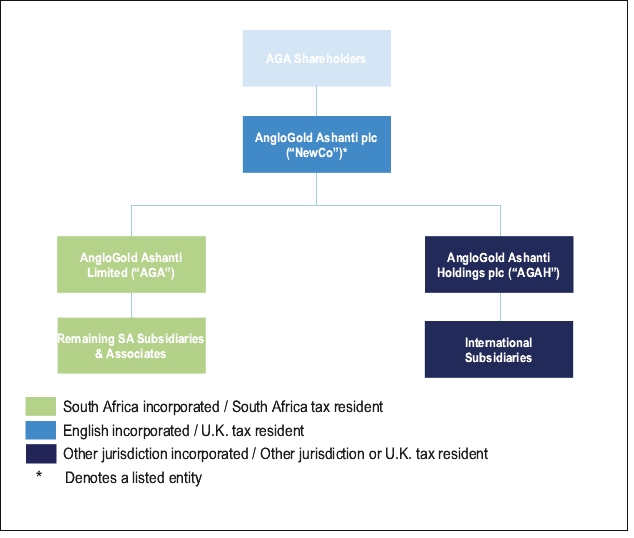

A: | AGA is proposing to its shareholders to establish a new holding company, NewCo, incorporated under the laws of England and Wales. AGA expects to implement this proposal in three sequential, separate and fully interconditional steps consisting of (i) the Spin-Off; (ii) the AGAH Sale; and (iii) the Scheme, pursuant to the terms of an agreement between AGA and NewCo dated as of [•], 2023 (the “Implementation Agreement”). |

Q: | What is the purpose of the Reorganization? |

A: | The purpose of the Reorganization is to enhance the Group’s strategic position. While the business carried out by the Group following the implementation of the Reorganization will remain the same, AGA intends to change its primary listing from the JSE to the NYSE in connection with the transaction. We believe that a primary listing on the NYSE will broaden the appeal of the Group to North American and international investors, which could generate incremental demand and share trading liquidity and improve valuation comparisons with North American industry peers. Additionally, NewCo’s incorporation in the United Kingdom will take the Group to a leading, low-risk jurisdiction where the Group already has a corporate presence. See “The Reorganization —Reasons for the Reorganization”. |

Q: | Will any other transactions be implemented in connection with the Reorganization? |

A: | Prior to the completion of the Reorganization, AGA will transfer 100 per cent. (100%) of the issued and outstanding stock in AngloGold Ashanti USA Incorporated (a wholly owned subsidiary of AGA) to AGAH, resulting in AngloGold Ashanti USA Incorporated becoming a wholly owned subsidiary of AGAH. |

• | AGA will be converted to a private company under South African law (the “Conversion”) and will make an election to be disregarded for U.S. federal income tax purposes (the “Election”, together with the Reorganization and the Conversion, the “U.S. Tax Reorganization”); and |

• | NewCo intends to undertake a capital reduction to create distributable reserves. See “Terms of the Reorganization and the Shareholders’ Meeting—The Capital Reduction.” |

Q: | What are the conditions to the Reorganization? |

A: | The completion of the Reorganization is subject to the fulfillment or, alternatively the waiver (to the extent permitted by applicable law and the Implementation Agreement) of the fulfillment, as the case may be, of certain conditions precedent (the “Reorganization Conditions”), including that: |

• | the AGAH Sale Special Resolution and the Scheme Special Resolution (each as defined herein) have been passed by the requisite majorities, as applicable, of AGA shareholders entitled to vote on the AGAH Sale and the Scheme, respectively, approving each of the AGAH Sale and the Scheme under the South African Companies Act, and (i) to the extent required by the South African Companies Act, the AGAH Sale and the implementation of the Scheme is approved by the High Court of South Africa and (ii) if applicable, AGA has not elected to treat the Scheme Special Resolution as a nullity under the South African Companies Act; |

• | AGA has received no valid demands as contemplated in section 164(5) to (8) of the South African Companies Act (whether in relation to the AGAH Sale or the Scheme) which in aggregate represent more than two per cent. (2%) of the voting rights attaching to the AGA Ordinary Shares. See “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting—Dissenters’, Appraisal, Cash Exit or Similar Rights”; |

• | the JSE has granted all approvals required for the AGAH Sale and Scheme (such approval being in such form as is customarily issued by the JSE in relation to similar transactions) and the secondary listing of the NewCo Ordinary Shares on the Main Board of the JSE and approval of all documentation required by the JSE to be submitted to it in connection with the AGAH Sale, Scheme and such listing; |

• | the Takeover Regulation Panel of South Africa (the “Takeover Regulation Panel”) has issued a compliance certificate with respect to the AGAH Sale and the Scheme and their implementation as contemplated in section 121(b)(i) of the South African Companies Act, to the extent that such compliance certificate is required; |

• | the SEC has made a declaration confirming the effectiveness of this registration statement on Form F-4 and no stop order suspending the effectiveness of such registration statement on Form F-4 is in effect and no proceedings for such purpose are pending before or threatened by the SEC; |

• | the NYSE has granted all approvals required for the listing of the NewCo Ordinary Shares on the NYSE, subject to notice of issuance; |

• | to the extent required, other regulatory approvals, consents or rulings necessary to implement the Reorganization have been obtained; and |

• | AGA has not, prior to 10:00 a.m. South African Standard Time on the Long Stop Date, exercised its right to cancel the Implementation Agreement as a result of the occurrence of a Material Adverse Effect. |

Q: | What will I receive in connection with the Reorganization? |

A: | As a result of the Reorganization, each AGA shareholder will own one NewCo Ordinary Share for each AGA Ordinary Share (including the AGA Ordinary Shares represented by AGA ADSs) held on the Reorganization Consideration Record Date. The NewCo Ordinary Shares to be issued in connection with the Reorganization are sometimes referred to in this prospectus as the “Reorganization Consideration”. See “Terms of the Reorganization and the Shareholders’ Meeting—Reorganization Consideration”, and “Terms of the Reorganization and the Shareholders’ Meeting—The Effect of the Reorganization on AGA Ordinary Shares, AGA ADSs and Ghanaian depositary shares”. |

Q: | When is the Reorganization expected to be completed? |

A: | The Reorganization is currently expected to be completed on or around [•], 2023, subject to the fulfillment of the Reorganization Conditions, several of which are not under our control. See “Terms of the Reorganization and the Shareholders’ Meeting—Reorganization Conditions” and “Risk Factors—Risks Related to the Reorganization and NewCo Ordinary Shares—Failure to timely implement the Reorganization could negatively affect the market price of AGA Ordinary Shares and AGA ADSs”. |

Q: | What potential negative consequences did AGA consider regarding the Reorganization? |

A: | The AGA Board considered potential negative consequences and risks that may arise from the Reorganization, including the following factors: (1) while the Group will incur significant nonrecurring transaction costs and expenses in connection with the implementation of the Reorganization and the NewCo Notes Distribution, the Reorganization is not expected to result in any significant cost savings or synergies for the Group, despite the other benefits identified under “The Reorganization—Reasons for the Reorganization”; and (2) the Group’s failure to timely implement the Reorganization could negatively affect the market price of AGA Ordinary Shares and AGA ADSs. However, the AGA Board in its deliberations considered that the expected benefits of the Reorganization outweigh the potential negative consequences and risks. See “Risk Factors—Risks Related to the Reorganization and NewCo Ordinary Shares”. |

Q: | Do any of AGA’s directors or executive officers have interests in the Reorganization that may be additional to those of other shareholders? |

A: | Yes. You should be aware that certain members of the AGA Board and management participated in determining the terms of the Reorganization. These individuals may have certain interests in the proposed Reorganization that are additional to the interests of AGA shareholders generally and that may have caused them to view the Reorganization more favorably or differently from the way other AGA shareholders would view it. |

Q: | Are there any risks related to the Reorganization that I should consider? |

A: | Yes. There are risks associated with all corporate reorganizations, including the implementation of the Reorganization. See “Risk Factors”. |

Q: | If the Reorganization is implemented, will my NewCo Ordinary Shares be listed for trading? |

A: | The NewCo Ordinary Shares will be listed on the NYSE on the Operative Date and entitlements thereto will start trading on the JSE two business days before the Operative Date. Additionally, NewCo expects to be listed on the A2X and the GhSE. It is a condition to the completion of the Reorganization that the NewCo Ordinary Shares be approved for listing on the NYSE, subject to notice of issuance, and be admitted to listing on the main board of the JSE. The listings on the NYSE, the JSE, the A2X and the GhSE are intended to maintain the Group’s and its shareholders’ access to AGA’s key historic trading markets, with the primary listing on the NYSE expected to facilitate enhanced access to the Group’s North American investor base. Following the implementation of the Reorganization, AGA will cease to be listed on the JSE, the A2X, the NYSE and the GhSE. Additionally, AGA expects to terminate its listing on the ASX regardless of whether the Reorganization is implemented. |

Q: | What happens if the Reorganization is not implemented? |

A: | If the requisite majority of AGA shareholders do not approve the AGAH Sale and the Scheme at the Shareholders’ Meeting, or if the Reorganization is not implemented for any other reason, the holders of AGA Ordinary Shares and AGA ADSs will continue to hold their AGA Ordinary Shares and AGA ADSs, respectively, and any exercise of appraisal rights by the holders of AGA Ordinary Shares will not be effective. In that case, AGA will continue to be the holding company of the Group and will remain a publicly traded company with AGA Ordinary Shares listed on the JSE and AGA ADSs listed on the NYSE, as well as a listing on the A2X and the GhSE. AGA expects to terminate its listing on the ASX regardless of whether the Reorganization is implemented. To the extent one or both of the AGAH Sale and the Scheme are not ultimately implemented after the Spin-Off and, if applicable, the AGAH Sale is implemented, the steps that have been completed will be unwound. See “The Implementation Agreement” and “The Irrevocable Offer to Purchase”. |

Q: | What are the material tax consequences of the Reorganization and the related transactions to AGA shareholders? |

A: | The tax consequences of the Reorganization and the related transactions for any particular AGA shareholder will depend on the shareholder’s particular facts and circumstances. Moreover, the description below and elsewhere in this prospectus does not relate to the tax laws of any jurisdiction other than the United States, the United Kingdom and the Republic of South Africa. Accordingly, AGA shareholders are urged to consult their tax advisors to determine the tax consequences of the Reorganization and the related transactions to them in light of their particular circumstances, including the effect of any state, local or national law. |

Q. | If the Reorganization is implemented, how will my rights as an AGA shareholder or AGA ADS Holder change? |

A. | The rights of holders of AGA Ordinary Shares are governed by South African law and by the AGA MOI. If the Reorganization is completed, holders of AGA Ordinary Shares and AGA ADSs will become beneficial owners of NewCo Ordinary Shares (subject to any adjustments to reflect the exercise of appraisal rights as described under “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting—Dissenters’, Appraisal, Cash Exit or Similar Rights”). The rights of holders of NewCo Ordinary Shares will be governed by the laws of England and Wales and NewCo’s articles of association (the “NewCo Articles”). If the Reorganization is completed, your future rights as a beneficial owner of NewCo Ordinary Shares under English company law will differ from your current rights as a shareholder under South African company law. See “Risk Factors—Risks Related to the Reorganization and NewCo Ordinary Shares—The NewCo Ordinary Shares to be received as a result of the Reorganization have different rights from the AGA Ordinary Shares”. |

Q: | When and where will the Shareholders’ Meeting be held? |

A: | The Shareholders’ Meeting of the AGA shareholders will be held on [•], 2023, beginning at [•] South African Standard Time at 112 Oxford Road, Houghton Estate, Johannesburg, 2198, South Africa, or such other postponed date and time or location as determined in accordance with the provisions of the AGA MOI, the South African Companies Act, and the JSE Listings Requirements. |

Q: | What matters will be voted on at the Shareholders’ Meeting? |

A: | At the Shareholders’ Meeting, AGA shareholders will be asked to consider and vote, among other things, on a special resolution (the “AGAH Sale Special Resolution”) to approve the AGAH Sale, pursuant to which NewCo will make an irrevocable offer to AGA to purchase 100 per cent. (100%) of the shares in AGAH, which it is the present, non-binding intention of AGA to accept, and on a special resolution (the “Scheme Special Resolution”) to approve the Scheme, pursuant to which NewCo will acquire all of the issued and outstanding AGA Ordinary Shares from AGA shareholders in consideration for the issuance of NewCo Ordinary Shares. See “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting”. |

Q: | When will the Shareholders’ Meeting of the AGA shareholders be considered regularly convened and the resolutions at such Shareholders’ Meeting validly adopted? |

A: | The Shareholders’ Meeting will be considered regularly convened when AGA shareholders representing at least 25 per cent. (25%) of all of the voting rights that are entitled to be exercised in respect of at least one matter to be decided at the meeting are in attendance, in person or by proxy. In addition, at least three AGA shareholders must be present, in person or by proxy. Once such a quorum has been established, the meeting may continue, so long as the shareholders that constituted the quorum continue to be present at the meeting, in person or by proxy. Abstentions and broker non-votes will be included in the calculation of the number of AGA Ordinary Shares represented at the Shareholders’ Meeting for purposes of determining whether such a quorum has been achieved. For a special resolution to be approved by AGA shareholders, it must be supported by at least 75 per cent. (75%) of the voting rights exercised on the resolution by the holders of AGA Ordinary Shares (including AGA Ordinary Shares represented by AGA ADSs) present or represented by proxy at the Shareholders’ Meeting and entitled to vote on the resolution. Votes to abstain and broker non-votes will not be counted as voting rights exercised for the purpose of calculating the aforementioned percentage (i.e., these votes are excluded from both the numerator and the denominator). |

Q: | Who is entitled to vote at the Shareholders’ Meeting? |

A: | The record date on which holders of AGA Ordinary Shares must be recorded in the securities register of AGA in order to vote at the Shareholders’ Meeting is [•], 2023 (the “Ordinary Share Voting Record Date”). The last day to trade AGA Ordinary Shares on the JSE in order to be recorded in the register on the Ordinary Share Voting Record Date is [•], 2023. Anyone becoming an AGA shareholder subsequent to the Ordinary Share Voting Record Date will not be entitled to attend or vote at the Shareholders’ Meeting either by person or by proxy. In addition, any such AGA shareholder will be bound by the results of the votes on the AGAH Sale Special Resolution and the Scheme Special Resolution at the Shareholders’ Meeting to the extent that they remain on the securities register of AGA as of the Reorganization Consideration Record Date and may not exercise appraisal rights. See “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting—Dissenters’, Appraisal, Cash Exit or Similar Rights”. |

Q: | As a holder of AGA Ordinary Shares, how do I vote? |

A: | Record holders of AGA Ordinary Shares (including certificated AGA Ordinary Shares) on the Ordinary Share Voting Record Date are entitled to attend, speak and vote (or abstain from voting) in person at the Shareholders’ Meeting or may appoint a proxy in writing, using the relevant proxy form. |

Q: | As a holder of AGA Ordinary Shares, what will be the consequences if I do not attend the Shareholders’ Meeting in person or by proxy? |

A: | In order to vote your AGA Ordinary Shares at the Shareholders’ Meeting, you must either attend the Shareholders’ Meeting and vote in person or confer your proxy (or, to the extent applicable, have your CSDP, bank, broker or custodian record your instructions and vote the AGA Ordinary Shares you hold in accordance with your instructions). If you do not attend the Shareholders’ Meeting in person or confer your proxy (or, to the extent applicable, have your CSDP, bank, broker or custodian record your instructions and vote the AGA Ordinary Shares you hold in accordance with your instructions), your AGA Ordinary Shares will not be counted to establish a quorum to open the Shareholders’ Meeting, voted in respect of the proposed resolutions, or taken into account in calculating whether the requisite majority required to approve the AGAH Sale and the Scheme has been achieved. See “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting”. |

Q: | As a holder of AGA ADSs, how do I vote? |

A: | As a holder of AGA ADSs on the ADS Voting Record Date, you are entitled to instruct the ADS Depositary on how to vote the AGA Ordinary Shares that your AGA ADSs represent. If you are a registered holder of AGA ADSs, you should receive a voting instruction card from the ADS Depositary, which you should mark, sign and return to the ADS Depositary, to be received prior to 5:00 p.m. Eastern Standard Time on [•], 2023. If you hold AGA ADSs in a securities account through a broker or other securities intermediary, you should receive voting materials from your intermediary, which you should use to give voting instructions to your intermediary, to be received prior to the cut-off date and time specified in those materials. See “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting”. |

Q: | As a holder of AGA ADSs, may I attend the Shareholders’ Meeting to vote? |

A: | No. AGA ADS holders are not entitled to attend the Shareholders’ Meeting in person. Instead, those AGA ADS holders that provide clear and timely instructions to the ADS Depositary as to how to vote the AGA Ordinary Shares underlying their AGA ADSs will be represented at the Shareholders’ Meeting by the ADS Depositary, which will endeavor to vote those shares as instructed by those holders. See “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting”. |

Q: | As a holder of AGA ADSs, what will be the consequences if I do not provide the ADS Depositary with voting instructions? |

A: | If you do not timely provide the ADS Depositary or relevant broker or securities intermediary with voting instructions, the AGA Ordinary Shares underlying your AGA ADSs will not be counted to establish a quorum to open the Shareholders’ Meeting, voted in respect of the proposed resolutions, or taken into account in calculating whether the requisite majority required to approve the AGAH Sale and the Scheme has been achieved. See “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting”. |

Q: | May I change my voting instructions after conferring a proxy or withdraw my proxy? May I provide voting instructions for only some of the resolutions to be voted at the Shareholders’ Meeting? |

A: | Yes. Holders of AGA Ordinary Shares may change their proxy voting instructions or withdraw their proxies at any time prior to voting taking place at the Shareholders’ Meeting. Please note that holders of AGA Ordinary Shares that change their proxy voting instructions or withdraw their proxies must deliver the written instrument changing their voting instructions or withdrawing their proxies to their proxies and AGA prior to commencement of voting at the Shareholder’s Meeting. Holders of AGA Ordinary Shares are also entitled to provide voting instructions for only some of the resolutions to be voted on at the Shareholders’ Meeting. |

Q: | As a holder of AGA Ordinary Shares, AGA ADSs or Ghanaian depositary shares, when will I receive the Reorganization Consideration, and what should I do to receive it? |

A: | In order to receive the Reorganization Consideration, holders of AGA Ordinary Shares must be recorded in the securities register of AGA at 5:00 p.m. South African Standard Time on the Reorganization Consideration Record Date, and holders of AGA ADSs and Ghanaian depositary shares must be recorded on the applicable depositary register at 5:00 p.m. on the Reorganization Consideration Record Date in the jurisdiction of the applicable depositary. |

• | Computershare Trust Company, N.A. (“CTCNA”) in its capacity as custodian for securities to be issued into Strate to various CSDPs (including the Computershare CSDP) in South Africa, |

• | the applicable brokers, custodians or nominees of holders of AGA ADSs holding through DTC and |

• | CTCNA in its capacity as the U.S. exchange agent (the “U.S. Exchange Agent”). |

How you currently hold your interest in AGA Ordinary Shares | | | How you will receive your NewCo Ordinary Shares (or local book-entry interests) |

Holders of AGA Ordinary Shares via a CSDP (in South Africa) | | | Strate will automatically deliver NewCo Ordinary Share book-entry interests to the same CSDP account as held the AGA Ordinary Shares |

Holders of AGA Ordinary Shares in registered certificated form (in South Africa) | | | Strate will deliver NewCo Ordinary Share book-entry interests to the valid CSDP account which was identified on the holder’s Form of Surrender and Transfer* |

Holders of AGA ADSs via a DTC participant account (in the United States) | | | DTC will automatically deliver NewCo Ordinary Share book-entry interests to the same DTC participant account as held the AGA ADSs |

Holders of AGA ADSs in registered uncertificated form (via the Direct Registration System) (in the United States) | | | DTC will deliver NewCo Ordinary Share book-entry interests to the DTC participant account of the U.S. Exchange Agent** |

Holders of AGA ADSs in registered certificated form (via AGA ADRs) (in the United States) | | | DTC will deliver NewCo Ordinary Share book-entry interests to the DTC participant account of the U.S. Exchange Agent** |

Holders of AGA depositary shares (in Ghana) | | | Strate will automatically deliver NewCo Ordinary Share book-entry interests to the same CSDP account of the Ghana depositary as held the AGA Ordinary Shares, and the Ghana depositary will automatically deliver NewCo Ghanaian depositary share book-entry interests to the same GhSE participant accounts as held the AGA GhDSs |

* | If you fail to deliver a Form of Surrender and Transfer, or, in the Form of Surrender and Transfer, you fail to provide any account details, or provide incorrect account details, of your CSDP, into which your NewCo Ordinary Shares are to be transferred, your NewCo Ordinary Shares will be delivered, on your behalf, to the Computershare CSDP. Following completion of the Reorganization, you will be sent instructions by the Computershare CSDP explaining the procedure for surrendering your share certificates and obtaining full access to your NewCo Ordinary Shares. |

** | If you are a registered uncertificated holder or a registered certificated holder of AGA ADSs, you will be sent instructions after completion of the Reorganization by the U.S. Exchange Agent explaining the procedure for (i) surrendering your AGA ADSs or AGA ADRs and (ii) obtaining full access to your NewCo Ordinary Shares. |

Q: | How should I surrender my AGA Ordinary Share certificates? |

A: | To surrender your AGA Ordinary Share certificates, you must complete and return the Form of Surrender and Transfer (a form of which will be attached as Exhibit 99.10 to the registration statement on Form F-4 of which this prospectus forms a part) prior to [•] South African Standard Time on [•], 2023, the Reorganization Consideration Record Date. In the Form of Surrender and Transfer, you must specify a valid CSDP account into which the Reorganization Consideration will be delivered. |

Q: | What if I am a registered certificated holder of AGA Ordinary Shares (in South Africa) and do nothing? |

A: | The Computershare CSDP will hold the NewCo Ordinary Shares that you are entitled to receive until (1) you duly surrender your share certificates to the Computershare CSDP and (2) you instruct the Computershare CSDP as to your preferred manner of delivery of your NewCo Ordinary Shares. See “Terms of the Reorganization and the Shareholders’ Meeting—The Effect of the Reorganization on AGA Ordinary Shares, AGA ADSs and Ghanaian depositary shares”. |

Q: | How should I surrender my AGA ADRs? |

A: | You will be sent instructions after completion of the Reorganization by the U.S. Exchange Agent explaining the procedure for surrendering your AGA ADRs and obtaining full access to your NewCo Ordinary Shares. Alternatively, you may dematerialize your AGA ADRs and obtain uncertificated AGA ADSs in the ordinary course in accordance with the terms of the AGA Deposit Agreement (as defined herein) prior to the Reorganization Consideration Record Date. |

Q: | What if I am a registered holder of AGA ADSs (in the United States), including AGA ADSs represented by AGA ADRs, and do nothing? |

A: | The U.S. Exchange Agent will hold the NewCo Ordinary Shares that you are entitled to receive until (1) where applicable, you duly surrender your AGA ADSs or AGA ADRs to the U.S. Exchange Agent and (2) you instruct the U.S. Exchange Agent as to your preferred manner of delivery of your NewCo Ordinary Shares. You will be sent instructions after completion of the Reorganization by the U.S. Exchange Agent explaining the procedures for the foregoing. See “Terms of the Reorganization and the Shareholders’ Meeting—The Effect of the Reorganization on AGA Ordinary Shares, AGA ADSs and Ghanaian depositary shares”. Following termination of the AGA ADS facility, holders of AGA ADSs will not be entitled to have the NewCo Ordinary Shares underlying AGA ADSs that have not been surrendered for cancelation sold on their behalf. |

Q: | If I hold AGA Ordinary Shares (in South Africa), will I have to pay brokerage commissions in connection with the exchange of my AGA Ordinary Shares? |

A: | You will not have to pay brokerage commissions as a result of the exchange of your AGA Ordinary Shares into NewCo Ordinary Shares in connection with the Reorganization if your AGA Ordinary Shares are registered in your name in the share register of AGA. If your AGA Ordinary Shares are held through a CSDP, bank, broker or a custodian linked to a stock exchange, you should consult with such CSDP, bank, broker or custodian as to whether or not such CSDP, bank, broker or custodian may charge any transaction fee or service charge in connection with the exchange of shares in connection with the Reorganization. See “Terms of the Reorganization and the Shareholders’ Meeting—Brokerage Commissions and Depositary Fees”. |

Q: | If I hold AGA ADSs (in the United States), will I have to pay fees to the ADS Depositary or other fees in connection with the exchange of my AGA ADSs? |

A: | You will not have to pay any fees to the ADS Depositary for the cancellation of AGA ADSs or the issuance of NewCo Ordinary Shares in connection with the Reorganization. However, if you hold AGA ADSs in a securities account through a broker or other securities intermediary, your intermediary may charge you a fee in connection with the exchange. See “Terms of the Reorganization and the Shareholders’ Meeting—Brokerage Commissions and Depositary Fees”. |

Q: | Are AGA shareholders entitled to exercise dissenters’, appraisal, cash exit or similar rights? |

A: | South African law provides dissenting AGA shareholders with appraisal rights in respect of the AGAH Sale and the Scheme, which allow them to sell their AGA Ordinary Shares to AGA at the fair value as at the date on which, and the time immediately before, AGA adopted the AGAH Sale Special Resolution and/or the Scheme |

Q: | How will AGA’s directors and executive officers vote at the Shareholders’ Meeting on the resolutions to approve the AGAH Sale and the Scheme? |

A: | AGA currently expects that all directors and executive officers who beneficially own AGA Ordinary Shares will vote all of their AGA Ordinary Shares (representing less than one per cent. (1%) of the outstanding AGA Ordinary Shares as of [•], 2023, without taking into consideration AGA share grants granted to the directors and executive officers) in favor of the AGAH Sale Special Resolution and the Scheme Special Resolution. |

Q: | What do I need to do now? |

A: | You are urged to read this prospectus carefully, including the information incorporated into it by reference. You may also want to review the documents referenced under “Where You Can Find More Information” and consult with your accounting, legal and tax advisors in light of your particular circumstances. Once you have considered all relevant information, you are encouraged to vote in person, by proxy, or by instructing your CSDP or bank or broker or custodian, so that your AGA Ordinary Shares are represented and voted at the Shareholders’ Meeting. |

Q: | Who can help answer my questions? |

A: | If you have any further questions about the Reorganization or if you need additional copies of this prospectus, please contact: |

Q: | Where can I find more information about AGA? |

A: | You can find more information about AGA in the documents described under “Where You Can Find More Information.” |

• | the AGAH Sale Special Resolution and the Scheme Special Resolution have been passed by the requisite majorities, as applicable, of AGA shareholders entitled to vote on the AGAH Sale and the Scheme, respectively, approving each of the AGAH Sale and the Scheme under the South African Companies Act, and (i) to the extent required by the South African Companies Act, the AGAH Sale and the implementation of the Scheme is approved by the High Court of South Africa and (ii) if applicable, AGA has not elected to treat the Scheme Special Resolution as a nullity under the South African Companies Act; |

• | AGA has received no valid demands as contemplated in section 164(5) to (8) of the South African Companies Act (whether in relation to the AGAH Sale or the Scheme) which in aggregate represent more than two per cent. (2%) of the voting rights attaching to the AGA Ordinary Shares. See “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting—Dissenters’, Appraisal, Cash Exit or Similar Rights”; |

• | the JSE has granted all approvals required for the AGAH Sale and Scheme (such approval being in such form as is customarily issued by the JSE in relation to similar transactions) and the secondary listing of the NewCo Ordinary Shares on the Main Board of the JSE and approval of all documentation required by the JSE to be submitted to it in connection with the AGAH Sale, Scheme and such listing; |

• | the Takeover Regulation Panel has issued a compliance certificate with respect to the AGAH Sale and the Scheme and their implementation as contemplated in section 121(b)(i) of the South African Companies Act, to the extent that such compliance certificate is required; |

• | the SEC has made a declaration confirming the effectiveness of this registration statement on Form F-4 and no stop order suspending the effectiveness of such registration statement on Form F-4 is in effect and no proceedings for such purpose are pending before or threatened by the SEC; |

• | the NYSE has granted all approvals required for the listing of the NewCo Ordinary Shares on the NYSE, subject to notice of issuance; |

• | to the extent required, other regulatory approvals, consents or rulings necessary to implement the Reorganization have been obtained; and |

• | AGA has not, prior to 10:00 a.m. South African Standard Time on the Long Stop Date, exercised its right to cancel the Implementation Agreement as a result of the occurrence of a Material Adverse Effect. |

| | | As of and for the year ended December 31, 2022 (in $) | | | For the year ended December 31, 2021 (in $) | | | For the year ended December 31, 2020 (in $) | |

Earnings per ordinary share from continuing operations | | | 0.71 | | | 1.48 | | | 2.34 |

Cash dividends per ordinary share | | | 0.43 | | | 0.54 | | | 0.11 |

Pro forma cash dividends per ordinary share | | | 0.43 | | | 0.54 | | | 0.11 |

Net assets (book value) per ordinary share | | | 987.58 | | | — | | | — |

| | | As of and for the year ended December 31, 2022 (in $) | | | For the year ended December 31, 2021 (in $) | | | For the year ended December 31, 2020 (in $) | |

Pro forma net assets (book value) per ordinary share | | | 862.40 | | | — | | | — |

| | | AGA Ordinary Shares (in ZAR) | | | AGA ADSs (in $) | |

[•], 2023 | | | [•] | | | [•] |

April 20, 2023 | | | 481.57 | | | 26.58 |

• | the AGAH Sale Special Resolution and the Scheme Special Resolution have been passed by the requisite majorities, as applicable, of AGA shareholders entitled to vote on the AGAH Sale and the Scheme, respectively, approving each of the AGAH Sale and the Scheme under the South African Companies Act, and (i) to the extent required by the South African Companies Act, the AGAH Sale and the implementation of the Scheme is approved by the High Court of South Africa and (ii) if applicable, AGA has not elected to treat the Scheme Special Resolution as a nullity under the South African Companies Act; |

• | AGA has received no valid demands as contemplated in section 164(5) to (8) of the South African Companies Act (whether in relation to the AGAH Sale or the Scheme) which in aggregate represent more than two per cent. (2%) of the voting rights attaching to the AGA Ordinary Shares. See “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting—Dissenters’, Appraisal, Cash Exit or Similar Rights”; |

• | the JSE has granted all approvals required for the AGAH Sale and Scheme (such approval being in such form as is customarily issued by the JSE in relation to similar transactions) and the secondary listing of the NewCo Ordinary Shares on the Main Board of the JSE and approval of all documentation required by the JSE to be submitted to it in connection with the AGAH Sale, Scheme and such listing; |

• | the Takeover Regulation Panel has issued a compliance certificate with respect to the AGAH Sale and the Scheme and their implementation as contemplated in section 121(b)(i) of the South African Companies Act, to the extent that such compliance certificate is required; |

• | the SEC has made a declaration confirming the effectiveness of this registration statement on Form F-4 and no stop order suspending the effectiveness of such registration statement on Form F-4 is in effect and no proceedings for such purpose are pending before or threatened by the SEC; |

• | the NYSE has granted all approvals required for the listing of the NewCo Ordinary Shares on the NYSE, subject to notice of issuance; |

• | to the extent required, other regulatory approvals, consents or rulings necessary to implement the Reorganization have been obtained; and |

• | AGA has not, prior to 10:00 a.m. South African Standard Time on the Long Stop Date, exercised its right to cancel the Implementation Agreement as a result of the occurrence of a Material Adverse Effect. |

• | Enhancing access to deeper pools of capital. We believe that a change in primary listing to the NYSE will increase access and broaden appeal to North American and other international investors. We believe this enhanced position could generate incremental demand and share trading liquidity. We also expect the broader investment appeal and related shift in regulatory environment to enhance the Group’s strategic and financing flexibility. |

• | Improving the Group’s competitive position in line with its global peers. Major global gold mining peers with primary listings in North America have significantly higher valuations and greater trading liquidity on U.S. exchanges than the Group does. We believe that a change in primary listing to the NYSE will increase the Group’s proximity to North American institutional investors and analysts, which is expected to improve valuation comparisons to North American peers and enhance share trading liquidity. |

• | Redomiciling to a leading, low-risk jurisdiction where the Group has a corporate presence. As a result of the Reorganization, all of the Group’s operating entities will be held under NewCo, a U.K.-incorporated entity subject to English corporate law. We believe this will provide an efficient legal, regulatory and tax framework for the Group and its shareholders which is expected to enhance strategic and financing flexibility thereby broadening the appeal of the Group to investors. We also expect to build upon the existing corporate infrastructure, relationships and knowledge of the Group in the United Kingdom, which stems from the management of AGAH, AGA’s principal holding company subsidiary, having been tax resident and headquartered there since 2017. |

• | Minimal disruption for existing stakeholders. In addition to a primary listing of the NewCo Ordinary Shares on the NYSE, NewCo will seek inward listings on the JSE and A2X in South Africa and a secondary listing on the GhSE in Ghana. As a result, the Group will continue to build upon established listings and pools of liquidity. Furthermore, the Group proposes no changes to the membership of the board or to management, who remain focused on executing the Group’s strategy. The Reorganization is not expected to result in any job losses, and certain core corporate functions servicing the Group are |

• | Continuity of shareholding structure. The Reorganization will allow existing AGA shareholders to maintain their investment in the Group in the same percentages as they held prior to the implementation of the Reorganization (subject to any adjustments to reflect the exercise of appraisal rights as described under “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting—Dissenters’, Appraisal, Cash Exit or Similar Rights”). |

• | Tax treatment. The Reorganization is not expected to be subject to U.S. federal or South African income tax generally, or to U.K. income tax or corporation tax for Non-U.K. Holders (as defined herein), and is expected to be broadly tax neutral for the Group on a going-forward basis, following the payment of one-off transaction taxes in South Africa and Australia. See “The Reorganization—Tax Consequences of the Reorganization and the NewCo Notes Distribution for the Group” and “Tax Consequences” for a description of the material tax consequences relating to the Reorganization. |

• | Accounting treatment. For accounting purposes, the Reorganization does not result in a business combination as defined under IFRS 3 “Business Combinations”. This is because no party to the Reorganization can be identified as an accounting acquirer in the transaction and the Reorganization does not result in any change in ownership, economic substance or carrying values for the Group. As such, the consolidated financial statements of the successor (NewCo) will reflect that the Reorganization is in substance a continuation of the Group and the consolidated financial statements of the predecessor (AGA) will become the comparative consolidated financial statements of that successor, adjusted for any reclassification between share capital and other reserves as of the Operative Date. See “—Accounting Treatment”. |

• | Significant transaction costs and expenses. While the Group will incur significant nonrecurring transaction costs and expenses in connection with the implementation of the Reorganization and the NewCo Notes Distribution, the Reorganization is not expected to result in any significant cost savings or synergies for the Group, despite the other benefits outlined above; and |

• | Risk of failure to timely implement the Reorganization. Our failure to timely implement the Reorganization could negatively affect the market price of AGA Ordinary Shares and AGA ADSs. |

| | | Beneficial | ||||||||||

| | | Direct | | | Indirect | |||||||

| | | March 31, 2023 | ||||||||||

| | | AGA Ordinary Shares | | | % of AGA Ordinary Shares Outstanding | | | AGA Ordinary Shares | | | % of AGA Ordinary Shares Outstanding | |

Non-Executive Directors | | | | | | | | | ||||

MDC Ramos | | | — | | | — | | | — | | | — |

R Gasant | | | — | | | — | | | — | | | — |

KOF Busia | | | 2,000 | | | 0.0005 | | | — | | | — |

AM Ferguson | | | 5,000 | | | 0.0012 | | | — | | | — |

AH Garner | | | 22,500 | | | 0.0054 | | | — | | | — |

MC Richter | | | 10,300 | | | 0.0025 | | | 1,000 | | | 0.0002 |

S Lawson | | | 2,830 | | | 0.0007 | | | — | | | — |

JE Tilk | | | 2,800 | | | 0.0007 | | | — | | | — |

Total-Non-Executive Directors | | | 45,430 | | | 0.0108 | | | 1,000 | | | 0.0002 |

| | | | | | | | | |||||

Executive Directors | | | | | | | | | ||||

A Calderon | | | 26,370 | | | 0.0063 | | | — | | | — |

G Doran | | | — | | | — | | | — | | | — |

Total-Executive Directors | | | 26,370 | | | 0.0063 | | | — | | | — |

| | | | | | | | | |||||

Members of the Executive Committee | | | | | | | | | ||||

L Ali | | | — | | | — | | | — | | | — |

SD Bailey | | | 13,039 | | | 0.0031 | | | — | | | — |

T Briggs | | | — | | | — | | | — | | | — |

L Eybers | | | — | | | — | | | — | | | — |

MC Godoy | | | 32,643 | | | 0.0078 | | | — | | | — |

L Marwick | | | — | | | — | | | — | | | — |

Total-Members of the Executive Committee | | | 45,682 | | | 0.0109 | | | — | | | — |

| | | | | | | | | |||||

Grand Total | | | 72,052 | | | 0.0172 | | | — | | | — |

| | | AGA Share Awards Balance at March 31, 2023(1)(2) | |

Executive Directors | | | |

A Calderon | | | 41,601 |

G Doran | | | — |

Total-Executive Directors | | | 41,601 |

| | | ||

Members of the Executive Committee | | | |

L Ali | | | 44,233 |

SD Bailey | | | 155,469 |

T Briggs | | | 47,004 |

L Eybers | | | 342,916 |

MC Godoy | | | 69,224 |

| | | AGA Share Awards Balance at March 31, 2023(1)(2) | |

L Marwick | | | 100,658 |

Total-Members of the Executive Committee | | | 759,504 |

| | | ||

Grand Total | | | 801,105 |

(1) | The latest expiry date of all share awards granted and outstanding at March 31, 2023 is February 24, 2032. |

(2) | This table includes all vested and unvested share awards of executive members of the AGA Board and members of the Executive Committee of AGA. |

• | The Irrevocable Offer to Purchase has been signed by NewCo and delivered to AGA; |

• | NewCo has procured that the NewCo Ordinary Shares are approved for listing on the NYSE, subject only to official notice of issuance; |

• | should the implementation of the AGAH Sale and/or Scheme be subject to approval by a court in terms of the provisions of section 115(2)(c) of the South African Companies Act, such approval has been obtained; |

• | AGA has not, by the expiry of the 20 business day period contemplated in section 164(7)(a) or (b) of the South African Companies Act (as the case may be), received valid demands as contemplated in section 164(5) to (8) of the South African Companies Act (whether in relation to the AGAH Sale or the Scheme) which in aggregate represent more than two per cent. (2%) of the voting rights attaching to the AGA Ordinary Shares; |

• | the AGA shareholders have passed such resolutions by the requisite majority of AGA shareholders as may be required in terms of the South African Companies Act and the Companies Regulations to approve the AGAH Sale and the Scheme, including in particular, the resolution contemplated in section 115(2) of the South African Companies Act and the resolution required in terms of section 112 and section 115(2) of the South African Companies Act; |

• | the AGA shareholders have conditionally passed special resolutions pursuant to section 164(9)(c) of the South African Companies Act revoking each of the abovementioned resolutions; |

• | such approvals from the JSE as may be required by and in terms of the JSE Listings Requirements in connection with the Reorganization have been received, including (among other things): |

• | the approval by the JSE of the AGAH Sale and the Scheme (such approval being in such form as is customarily issued by the JSE in relation to transactions similar to the AGAH Sale and the Scheme) and of all documentation required by the JSE to be submitted to it in connection with the AGAH Sale and the Scheme; and |

• | the admission to listing by way of the secondary listing of all NewCo Ordinary Shares on the Main Board of the JSE and the approval by the JSE of all documentation required by the JSE to be submitted to it in connection with such listing; |

• | the Takeover Regulation Panel has issued a compliance certificate with respect to the AGAH Sale and the Scheme and their implementation as contemplated in section 121(b)(i) of the South African Companies Act, to the extent that such approval is required; |

• | the SEC has made a declaration confirming the effectiveness of this registration statement on Form F-4 and no stop order suspending the effectiveness of such registration statement on Form F-4 is in effect and no proceedings for such purpose are pending before or threatened by the SEC; |

• | NewCo and AGAH have executed and delivered to The Bank of New York Mellon, as trustee an indenture supplemental to the indenture dated as of 28 April 2010 and entered into between AGAH (as issuer), AGA (as guarantor) and the aforesaid trustee, in connection with the assumption by NewCo of the due and punctual performance of the guarantees and the performance or observance of every covenant of the aforesaid indenture on the part of AGA to be performed or observed, which supplemental indenture will become effective upon the implementation of the AGAH Sale; |

• | if and to the extent required, any other regulatory approvals, consents or rulings necessary to implement the Reorganization have been obtained; and |

• | AGA has not, prior to 10:00 a.m. South African Standard Time on the Long Stop Date, exercised its right to cancel the Implementation Agreement as a result of the occurrence of a Material Adverse Effect. |

• | CTCNA in its capacity as custodian for securities to be issued into Strate to various CSDPs (including the Computershare CSDP) in South Africa, |

• | the applicable brokers, custodians or nominees of holders of AGA ADSs holding through DTC and |

• | CTCNA in its capacity as the U.S. Exchange Agent. |

How you currently hold your interest in AGA Ordinary Shares | | | How you will receive your NewCo Ordinary Shares (or local book-entry interests) |

Holders of AGA Ordinary Shares via a CSDP (in South Africa) | | | Strate will automatically deliver NewCo Ordinary Share book-entry interests to the same CSDP account as held the AGA Ordinary Shares |

Holders of AGA Ordinary Shares in registered certificated form (in South Africa) | | | Strate will deliver NewCo Ordinary Share book-entry interests to the valid CSDP account which was identified on the holder’s Form of Surrender and Transfer* |

Holders of AGA ADSs via a DTC participant account (in the United States) | | | DTC will automatically deliver NewCo Ordinary Share book-entry interests to the same DTC participant account as held the AGA ADSs |

Holders of AGA ADSs in registered uncertificated form (via the Direct Registration System) (in the United States) | | | DTC will deliver NewCo Ordinary Share book-entry interests to the DTC participant account of the U.S. Exchange Agent** |

Holders of AGA ADSs in registered certificated form (via AGA ADRs) (in the United States) | | | DTC will deliver NewCo Ordinary Share book-entry interests to the DTC participant account of the U.S. Exchange Agent** |

Holders of AGA depositary shares (in Ghana) | | | Strate will automatically deliver NewCo Ordinary Share book-entry interests to the same CSDP account of the Ghana depositary as held the AGA Ordinary Shares, and the Ghana depositary will automatically deliver NewCo Ghanaian depositary share book-entry interests to the same GhSE participant accounts as held the AGA GhDSs |

* | If you fail to deliver a Form of Surrender and Transfer, or, in the Form of Surrender and Transfer, you fail to provide any account details, or provide incorrect account details, of your CSDP, into which your NewCo Ordinary Shares are to be transferred, your NewCo Ordinary Shares will be delivered, on your behalf, to the Computershare CSDP. Following completion of the Reorganization, you will be sent instructions by the Computershare CSDP explaining the procedure for surrendering your share certificates and obtaining full access to your NewCo Ordinary Shares. |

** | If you are a registered uncertificated holder or a registered certificated holder of AGA ADSs, you will be sent instructions after completion of the Reorganization by the U.S. Exchange Agent explaining the procedure for (i) surrendering your AGA ADSs or AGA ADRs and (ii) obtaining full access to your NewCo Ordinary Shares. |

• | the Reorganization is subject to conditions precedent, as set out in more detail in the section entitled “Terms of the Reorganization and the Shareholders’ Meeting—Reorganization Conditions” above; |

• | prior to the implementation of the Reorganization, AGA and NewCo will have taken the following actions in connection with NewCo’s re-registration as a public limited company: |

• | AGA will subscribe for, and NewCo will issue to AGA, 50,000 (fifty thousand) redeemable preference shares of GBP 1.00 (one Pound) nominal value (the “Redeemable Preference Shares”) at a premium of GBP 1.20 (one Pound and twenty pence) per share (the total subscription price therefore being GBP 2.20 (two Pounds and twenty pence) per share including nominal value); and |

• | NewCo will have undertaken a share capital reduction to reduce GBP 1.00 (one Pound) of the premium paid on each of the Redeemable Preference Shares thereby creating distributable reserves totalling GBP 50,000 (fifty thousand Pounds) which NewCo will apply to funding the redemption of the Redeemable Preference Shares (as described below); |

• | with respect to the Spin-Off: |

• | AGA will pay USD 46,000 to NewCo; |

• | AGA will effect a distribution in specie to the AGA shareholders who are registered in the AGA register on the Reorganization Consideration Record Date (and have not exercised their appraisal rights as described under “Terms of the Reorganization and the Shareholders’ Meeting—The Shareholders’ Meeting—Dissenters’, Appraisal, Cash Exit or Similar Rights”) (such shareholders the “Scheme Participants”), and will simultaneously direct NewCo to issue the Spin-Off Shares to the Scheme Participants (via a nominee); |

• | NewCo will redeem the Redeemable Preference Shares at nominal value, as a result of which the Redeemable Preference Shares will then automatically be treated as canceled under English law; |

• | AGA will transfer for nil consideration the one NewCo Ordinary Share held by AGA (the “Founder Share”) to NewCo; and |

• | NewCo will cancel the Founder Share, following which AGA will no longer holder any shares in NewCo; |

• | subject to completion of the Spin-Off, it is the present, non-binding intention of AGA to accept NewCo’s irrevocable offer to purchase 100 per cent. (100%) of the shares in AGAH (the “AGAH Sale Shares”) and to sell the AGAH Sale Shares to NewCo in consideration for the issue by NewCo to AGA of notes in an aggregate principal amount equal to the fair market value of the AGAH Sale Shares (the “NewCo Notes”). The terms of the AGAH Sale are governed by the Irrevocable Offer to Purchase (see “The Irrevocable Offer to Purchase”); and |

• | with respect to the Scheme: |

• | subject to the completion of the AGAH Sale, on the Operative Date the Scheme Participants will exchange their AGA Ordinary Shares for the right and obligation to have, ipso facto and without any action on the part of such Scheme Participants, the respective pro rata portions of the Scheme Consideration Shares issued to them (via a nominee); and |

• | NewCo will procure that (i) the legal title to the number of Spin-Off Shares and Scheme Consideration Shares attributable to Scheme Participants who are not NewCo affiliates is |

• | The Implementation Agreement further provides that AGA and NewCo will undertake the following covenants, among others: |

• | AGA will comply with the provisions of the South African Companies Act and the regulations published in terms of the Companies Regulations applicable to it in terms of the Scheme, including: |

• | preparing and circulating the Reorganization Circular to the AGA shareholders; |

• | having the Independent Board communicate its opinion to the AGA shareholders, in the Reorganization Circular, which opinion will comply with Regulation 110 of the South African Companies Act; |

• | convening the Shareholders’ Meeting; |

• | procuring the transmittal of the Reorganization Circular and any required notices (including a voter instruction card), reports and/or communications to the AGA ADS holders, in accordance with the procedures described in the AGA Deposit Agreement; |

• | in respect of those AGA shareholders who (a) have validly delivered an appraisal rights demand to AGA in terms of section 164(5) to (8) of the South African Companies Act; and (b) have not had their rights validly reinstated in terms of section 164(10) of the South African Companies Act, pay to such AGA shareholders, in cash, an amount equal to the fair value of their AGA Ordinary Shares in accordance with section 164 of the South African Companies Act, whereafter such AGA Ordinary Shares will be cancelled by AGA and restored to the authorized, but unissued, share capital of AGA; and |

• | NewCo will comply with the provisions of the JSE Listings Requirements, U.S. securities laws and the rules and regulations of the SEC applicable to it in connection with the issuance of NewCo Ordinary Shares pursuant to the Reorganization; |

• | with respect to the distribution of the NewCo Notes (the “NewCo Notes Distribution”): |

• | following the Reorganization, AGA intends to declare a distribution in specie to NewCo of a portion of the NewCo Notes (the “Distributed Notes”) and retain the balance of the NewCo Notes (the “Retained Notes”), with the principal amount of the Retained Notes being equal to the aggregate amount of dividends tax that will be payable by AGA as a result of the NewCo Notes Distribution, and the Distributed Notes being extinguished by operation of law by virtue of NewCo being both the issuer and holder of the Distributed Notes; and |

• | in order to ensure that when AGA makes the abovementioned distribution it is solvent and liquid for purposes of section 46 of the South African Companies Act, AGA intends, before declaring the distribution, to enter into a credit support agreement with AGAH; |

• | with respect to the AGA conversion: |

• | AGA will amend the AGA MOI to convert AGA from a public company to a private company (and thereby amending its registered name from “AngloGold Ashanti Limited” to “AngloGold Ashanti Proprietary Limited”) and, upon receiving an amended registration certificate, become a private company; and |

• | upon becoming a private company, AGA will effect the Election by electing, on IRS Form 8832, to be treated as disregarded from NewCo for U.S. federal tax purposes; and |

• | upon the implementation of the Scheme, the AGA Ordinary Shares will be delisted from the JSE in accordance with the JSE Listings Requirements, and AGA will procure the delisting of any other secondary registrations it may have in any and all other jurisdictions and cause the termination of the AGA ADS facility and the delisting of the AGA ADSs from the NYSE. |

• | it is and will throughout the performance of its obligations under the Implementation Agreement remain validly incorporated in accordance with all applicable laws; |

• | it has and will continue to have the necessary legal capacity to enter into and perform each of its obligations under the Implementation Agreement; |

• | the execution of the Implementation Agreement and performance by it of its obligations thereunder do not and will not contravene any law or regulation to which it is subject or contravene any provision of its founding documents or conflict with, or result in a breach of any of the terms of, or constitute a default under any agreement or other instrument to which it is a party or subject or by which its assets are bound; and |

• | it is and will throughout the performance of its obligations under the Implementation Agreement remain solvent and liquid. |

• | NewCo irrevocably offers to purchase all (and not part only) of the AGAH Sale Shares from AGA in consideration for the issue of the NewCo Notes; |

• | AGA will be entitled to accept the offer, in respect of all (but not part only) of the AGAH Sale Shares, by countersigning the Irrevocable Offer to Purchase at any time (i) after the Spin-Off has been implemented as contemplated in the Implementation Agreement; but (ii) before the end of the third business day thereafter (the “Implementation Deadline”); |

• | upon AGA countersigning the Irrevocable Offer to Purchase, the AGAH Sale Shares will be sold by AGA to NewCo in consideration of the NewCo Notes (which will be issued to AGA on the date that the AGAH Sale is effective (the “Sale Effective Date”)), after which all risks in and benefits attaching to the AGAH Sale Shares will transfer from AGA to NewCo; |

• | the AGAH Sale is subject to the resolutive condition that if the Spin-Off and AGAH Sale are both implemented, but the Scheme is not implemented by the Implementation Deadline, then the AGAH Sale will terminate ipso facto and without any action on the part of AGA or NewCo and the status quo ante immediately prior to the implementation of the AGAH Sale will be restored as near as may be possible; |

• | AGA warrants to NewCo that, as of the Sale Effective Date: |

• | AGA is the sole legal and beneficial owner of the AGAH Sale Shares and is reflected as the sole registered holder of the AGAH Sale Shares in the register of members of AGAH, and no person has any right to obtain an order for the rectification of such register; and |

• | AGA is entitled to dispose of the AGAH Sale Shares to NewCo; and |

• | each of AGA and NewCo undertakes and warrants to the other that, as of the Sale Effective Date: |

• | it is and will remain validly incorporated in accordance with all applicable laws; |

• | it has and will continue to have the necessary legal capacity to enter into and perform each of its obligations under the Irrevocable Offer to Purchase; |

• | the execution of the Irrevocable Offer to Purchase and performance by it of its obligations thereunder do not and will not contravene any law or regulation to which it is subject or contravene any provision of its founding documents or conflict with, or result in a breach of any of the terms of, or constitute a default under any agreement or other instrument to which it is a party or subject or by which its assets are bound; and |

• | it is and will throughout the performance of its obligations under the Irrevocable Offer to Purchase remain solvent and liquid. |

• | a bank or other financial institution; |

• | a tax-exempt organization; |

• | a real estate investment trust or real estate mortgage investment conduit; |

• | an entity or arrangement classified as a partnership for U.S. federal income tax purposes or other pass-through entity such as a subchapter S corporation (or an investor in such an entity or arrangement); |

• | an insurance company; |

• | a regulated investment company; |

• | a dealer or broker in stocks and securities, or currencies; |

• | a trader in securities that elects mark-to-market treatment; |

• | a person subject to the alternative minimum tax; |

• | a person that received shares through the exercise of an employee stock option, through a tax qualified retirement plan or otherwise as compensation; |

• | a person that owns or has owned directly, indirectly or constructively, 10 per cent. (10%) or more of the voting stock of AGA prior to the Reorganization; |

• | a person that holds AGA Ordinary Shares, AGA ADSs or NewCo Ordinary Shares as part of a straddle, a hedge, constructive sale, conversion or other integrated transaction; |

• | a person that acquires or sells AGA Ordinary Shares, AGA ADSs or NewCo Ordinary Shares as part of a wash sale for tax purposes; |

• | a person that acquires AGA Ordinary Shares, AGA ADSs or NewCo Ordinary Shares pursuant to the exercise of an employee stock option or otherwise as compensation; |

• | a U.S. Shareholder (as defined below) whose functional currency is not the U.S. dollar; or |

• | a U.S. expatriate. |

1. | a citizen or resident of the U.S.; |

2. | a corporation, or any entity treated as a corporation, created or organized under the laws of the United States or any of its political subdivisions; |

3. | an estate the income of which is subject to U.S. federal income taxation regardless of its source; or |

4. | a trust that (i) a U.S. court can exercise primary supervision over the trust’s administration and one or more U.S. persons are authorized to control all substantial decisions of the trust or (ii) has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person. |

1. | the gain is “effectively connected” with your conduct of a trade or business in the United States, and the gain is attributable to a permanent establishment that you maintain in the United States if that is required by an applicable income tax treaty as a condition for subjecting you to United States taxation on a net income basis, or |

2. | you are an individual, you are present in the United States for 183 or more days in the taxable year of the sale and certain other conditions exist. |

• | charities; |

• | trustees; |

• | persons carrying on certain financial activities (including market makers, brokers, dealers in securities, intermediaries and persons connected with depository arrangements or clearance services); |

• | persons who have or could be treated for tax purposes as having acquired their AGA Issued Shares or NewCo Ordinary Shares (as applicable), by reason of their employment or as carried interest; |

• | persons connected with AGA or NewCo; |

• | collective investment schemes; |

• | persons subject to U.K. tax on the remittance basis; and |

• | insurance companies. |

1. | a natural person who is ordinarily resident in South Africa; |

2. | not ordinarily resident in South Africa but physically present in South Africa for a period exceeding (i) ninety-one days in aggregate during the current year as well as for a period exceeding ninety-one days in aggregate during each of the five preceding years and (ii) for a period exceeding nine hundred and fifteen days in aggregate during those five preceding years of assessment; |

3. | an entity which is incorporated, established or formed in South Africa; or |

4. | an entity which has its place of effective management in South Africa. |

1. | a company which is tax resident in South Africa; |

2. | a public benefit organization approved in terms of section 30(3) of the ITA; |

3. | a mining rehabilitation trust in compliance with section 37A of the ITA; |

4. | an institution, board, or body established by or under any law in compliance with section 10(1)(cA) of the ITA; |

5. | a pension fund, provident fund and medical schemes in compliance with section 10(1)(d) of the ITA; |

6. | a portfolio of collective investment schemes in securities; |

7. | a person (being natural person, company or trust) to the extent that the dividend constitutes income of that person for South African income tax purposes; |

8. | a fidelity or indemnity fund as contemplated in section 10(1)(d)(iii) of the ITA; or |

9. | a small business funding entity as contemplated in section 10(1)(cQ) of the ITA. |

Robert Paul Harling Hayes (57) | | | | | ||

BSc Engineering, MBA | | | | | ||

Executive director | | | | | ||

Appointed (NewCo): February 10, 2023 and as Principal Financial Officer and Principal Accounting Officer on [•], 2023 | ||||||

Board committee memberships: | | | • | | | None |

Name | | | Age | | | Position | | | Year first appointed(1) |

Alberto Calderon | | | 63 | | | Executive director and chief executive officer | | | 2023 |

Gillian Doran | | | 46 | | | Executive director and chief financial officer | | | 2023 |

Maria Ramos | | | 64 | | | Independent non-executive director and chairperson | | | 2023 |

Kojo Busia | | | 60 | | | Independent non-executive director | | | 2023 |

Alan Ferguson | | | 65 | | | Independent non-executive director | | | 2023 |

Albert Garner | | | 67 | | | Independent non-executive director | | | 2023 |

Rhidwaan Gasant | | | 63 | | | Independent non-executive director | | | 2023 |

Scott Lawson | | | 61 | | | Independent non-executive director | | | 2023 |

Maria Richter | | | 68 | | | Independent non-executive director | | | 2023 |

Jochen Tilk | | | 59 | | | Independent non-executive director | | | 2023 |

(1) | At every annual general meeting all the directors at the date of the notice convening the annual general meeting will retire from office and may offer themselves for reappointment by the NewCo shareholders. |

Maria Ramos (64) | | | | | ||

MSc, BCom (Hons), Banker Diploma, Certified Associate of the Institute of Bankers (South Africa) | ||||||

Independent Non-Executive Director and Chairperson | ||||||

Appointed (AGA): A director on June 1, 2019 and Chairperson of the Board on December 5, 2020 | ||||||

Board committee memberships: | | | • | | | Nominations and Governance Committee (Chairperson) |

Rhidwaan Gasant (63) | | | | | ||

BCompt (Hons), CA (SA), ACIMA, Executive Development Programme | ||||||

Lead Independent Non-Executive Director | | | | | ||

Appointed (AGA): August 12, 2010 | | | | | ||

Board committee memberships: | | | • | | | Audit and Risk Committee |

| | | • | | | Nominations and Governance Committee | |

| | | • | | | Remuneration and Human Resources Committee | |

| | | • | | | Social, Ethics and Sustainability Committee | |

Alberto Calderon (63) | | | | | ||

PhD, MPhil, MA, Juris Doctor, BA | | | | | ||

Chief Executive Officer and Executive Director | | | | | ||

Appointed (NewCo): February 10, 2023 and as Principal Executive Officer on [•], 2023 | ||||||

Appointed (AGA): September 1, 2021 and as CEO on September 1, 2021 | ||||||

Board committee memberships: | | | • | | | None |

Gillian Doran (46) | | | | | | ||||

Fellow Member of Association of Chartered Certified Accountants (FCCA) | | ||||||||

Chief Financial Officer and Executive Director | | ||||||||

Appointed (AGA): January 1, 2023 and as CFO on January 1, 2023 | | | |||||||

Board committee memberships: | | | • | | | Investment Committee | | ||

Kojo Busia (60) | | | | | ||

PhD, MA, BA | | | | | ||

Independent Non-Executive Director | | | | | ||

Appointed (AGA): August 1, 2020 | | | | | ||

Board committee memberships: | | | • | | | Social, Ethics and Sustainability Committee (Chairperson) |

| | | • | | | Nominations and Governance Committee | |

| | | • | | | Investment Committee |

Alan Ferguson (65) | | | | | ||

BSc, CA (Scotland) | | | | | ||

Independent Non-Executive Director | | | | | ||

Appointed (AGA): October 1, 2018 | | | | | ||

Board committee memberships: | | | • | | | Audit and Risk Committee (Chairperson) |

| | | • | | | Remuneration and Human Resources Committee | |

| | | • | | | Nominations and Governance Committee |

Albert Garner (67) | | | | | ||

BSE | | | | | ||

Independent Non-Executive Director | | | | | ||

Appointed (AGA): January 1, 2015 | | | | | ||

Board committee memberships: | | | • | | | Investment Committee |

| | | • | | | Remuneration and Human Resources Committee |

Maria Richter (68) | | | | | ||

BA, Juris Doctor | | | | | ||

Independent Non-Executive Director | | | | | ||

Appointed (AGA): January 1, 2015 | | | | | ||

Board committee memberships: | | | • | | | Remuneration and Human Resources Committee (Chairperson) |

| | | • | | | Social, Ethics and Sustainability Committee | |

| | | • | | | Nominations and Governance Committee |

Scott Lawson (61) | | | | | ||

BSc, MBA | | | | | ||

Independent Non-Executive Director | | | | | ||

Appointed (AGA): December 1, 2021 | | | | | ||

Board committee memberships: | | | • | | | Social, Ethics and Sustainability Committee |

| | | • | | | Investment Committee |

Jochen Tilk (59) | | | | | | ||||

Bachelors Mining Engineering, Masters Mining Engineering | | | |||||||

Independent Non-Executive Director | | | | | | ||||

Appointed (AGA): January 1, 2019 | | | | | | ||||

Board committee memberships: | | | • | | | Audit and Risk Committee | | ||

| | | • | | | Social, Ethics and Sustainability Committee | | |||

| | | • | | | Nominations and Governance Committee | | |||

| | | • | | | Investment Committee (Chairperson) | | |||

Ordinary Shares held at | | | March 31, 2023 | |||

Shareholder | | | Number of AGA Ordinary Shares | | | Percentage of Voting Rights |

Public Investment Corporation of South Africa | | | 51,080,896 | | | 12.20 |

BlackRock Inc. | | | 27,267,610 | | | 6.51 |

Van Eck Associates Corporation | | | 23,772,377 | | | 5.68 |

| | | JSE | | | NYSE | |||||||

| | | Ordinary Shares | | | American Depositary Shares | |||||||

| | | High | | | Low | | | High | | | Low | |

| | | (in ZAR) | | | (in dollars) | |||||||

Year ended December 31, 2018 | | | 184.00 | | | 100.21 | | | 12.70 | | | 7.16 |

Year ended December 31, 2019 | | | 356.57 | | | 163.22 | | | 23.50 | | | 11.35 |

Year ended December 31, 2020 | | | 401.61 | | | 215.25 | | | 37.91 | | | 14.05 |

Year ended December 31, 2021 | | | 378.10 | | | 215.25 | | | 25.73 | | | 14.78 |

First Quarter 2021 | | | 378.10 | | | 295.00 | | | 25.49 | | | 19.86 |

Second Quarter 2021 | | | 371.10 | | | 261.97 | | | 25.73 | | | 18.33 |

Third Quarter 2021 | | | 299.14 | | | 215.25 | | | 20.31 | | | 14.78 |

Fourth Quarter 2021 | | | 354.90 | | | 237.49 | | | 21.11 | | | 16.23 |

Year ended December 31, 2022 | | | 401.61 | | | 213.35 | | | 25.76 | | | 12.16 |

First Quarter 2022 | | | 401.61 | | | 280.48 | | | 25.76 | | | 17.94 |

Second Quarter 2022 | | | 350.78 | | | 243.85 | | | 24.47 | | | 14.79 |

Third Quarter 2022 | | | 263.28 | | | 213.35 | | | 16.14 | | | 12.16 |

Fourth Quarter 2022 | | | 339.36 | | | 228.06 | | | 19.71 | | | 12.38 |

Month ended | | | | | | | | | ||||

January 31, 2023 | | | 390.02 | | | 345.46 | | | 23.18 | | | 20.16 |

February 28, 2023 | | | 364.41 | | | 306.79 | | | 21.16 | | | 16.66 |

March 31, 2023 | | | 431.40 | | | 311.49 | | | 24.19 | | | 16.87 |

April 2023 (through April 20, 2023) | | | 512.33 | | | 424.68 | | | 28.13 | | | 24.06 |

• | the chair of the meeting; |

• | at least five persons at the meeting who are entitled to vote; |

• | one or more shareholders at the meeting who are entitled to vote (or their proxies) and who hold between them at least 10 per cent. (10%) of the total votes of all shareholders who have the right to vote at the meeting, provided that where a shareholder is present by one or more proxies, each proxy will be treated as holding only the shares in respect of which it is authorized to exercise voting rights; or |

• | one or more shareholders at the meeting who are entitled to vote (or their proxies) and on which the total amount which has been paid up is at least 10 per cent. (10%) of the total sum paid up on all shares which give the right to vote at the meeting, provided that where a shareholder is present by one or more proxies, each proxy will be treated as holding only the shares in respect of which it is authorized to exercise voting rights. |

• | which is not a fully paid share; |

• | where the transfer is not lodged at the registered office or such other place as the NewCo Board has appointed; |

• | where the share transfer form is not properly stamped to show payment of any applicable stamp duty or certified or otherwise shown to the satisfaction of the NewCo Board to be exempt from stamp duty; |

• | where the transfer is not accompanied by the share certificate to which it relates (unless the transfer is being made by a person to whom NewCo was not required to, and did not send, a certificate), or such other evidence as the NewCo Board may reasonably require to show the transferor’s right to make the transfer, or evidence of the right of someone other than the transferor to make the transfer on the transferor’s behalf; |

• | where the share transfer form is used to transfer more than one class of share; |

• | where the number of joint holders to whom the share is to be transferred exceeds four; |

• | in other circumstances set out in the uncertificated securities rules; and |

• | in the case of shares held by an Identified Person or a Breaching Person (see “—Disclosure of interest in shares” and “—Takeover Code” below). |

• | for a period of 12 years, the shares have been in issue and at least three cash dividends have become payable (whether interim or final) but no such dividend has been cashed or otherwise satisfied by the transfer of funds to a bank account or through a relevant system by the shareholder or person concerned; |

• | NewCo has, after the expiration of that period, sent a notice to the last known address NewCo has for the relevant shareholder stating that it intends to sell the shares; and |

• | NewCo has not, during such period and the further period of three months after sending the notice and prior to the sale of the NewCo share, received any communication from the shareholder or person concerned. |

• | for any shareholder nominating a person for appointment as director to the NewCo Board (and the beneficial owner, if any, on whose behalf the nomination is being made), such letter must include a representation that the shareholder giving notice and/or beneficial owner will, to the extent any proxies in support of director nominees other than NewCo’s nominees are solicited, (a) solicit proxies from holders of NewCo’s outstanding shares representing at least 67 per cent. (67%) of the voting power of shares entitled to vote on the election of directors, (b) include a statement to that effect in its proxy statement and/or the proxy form, (c) otherwise comply with Rule 14a-19 promulgated under the Exchange Act and (d) provide the secretary of NewCo not less than five days prior to the meeting or any adjournment, rescheduling or postponement thereof, with reasonable documentary evidence (as determined by the secretary of NewCo in good faith) that such shareholder and/or beneficial owner complied with such representations; |

• | if a shareholder providing notice and/or beneficial owner that intends to solicit proxies in support of director nominees other than NewCo’s nominees no longer intends to solicit proxies in accordance with its representation pursuant to the above requirements, such shareholder and/or beneficial owner will inform NewCo of this change by delivering a writing to the secretary of NewCo no later than two business days after the occurrence of such change; and |