true

0001973368

F-1/A

P3Y

P3Y

P3Y

P3Y

P3Y

0001973368

2023-04-01

2024-03-31

0001973368

2024-03-31

0001973368

2023-03-31

0001973368

SVMH:CommonStockOneMember

2024-03-31

0001973368

SVMH:CommonStockOneMember

2023-03-31

0001973368

us-gaap:CommonClassAMember

2024-03-31

0001973368

us-gaap:CommonClassAMember

2023-03-31

0001973368

2022-04-01

2023-03-31

0001973368

us-gaap:CommonStockMember

2022-03-31

0001973368

SVMH:SharePremiumMember

2022-03-31

0001973368

us-gaap:RetainedEarningsMember

2022-03-31

0001973368

SVMH:CapitalReserveMember

2022-03-31

0001973368

us-gaap:NoncontrollingInterestMember

2022-03-31

0001973368

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0001973368

SVMH:OtherEquityMember

2022-03-31

0001973368

2022-03-31

0001973368

us-gaap:CommonStockMember

2023-03-31

0001973368

SVMH:SharePremiumMember

2023-03-31

0001973368

us-gaap:RetainedEarningsMember

2023-03-31

0001973368

SVMH:CapitalReserveMember

2023-03-31

0001973368

us-gaap:NoncontrollingInterestMember

2023-03-31

0001973368

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001973368

SVMH:OtherEquityMember

2023-03-31

0001973368

us-gaap:CommonStockMember

2022-04-01

2023-03-31

0001973368

SVMH:SharePremiumMember

2022-04-01

2023-03-31

0001973368

us-gaap:RetainedEarningsMember

2022-04-01

2023-03-31

0001973368

SVMH:CapitalReserveMember

2022-04-01

2023-03-31

0001973368

us-gaap:NoncontrollingInterestMember

2022-04-01

2023-03-31

0001973368

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-01

2023-03-31

0001973368

SVMH:OtherEquityMember

2022-04-01

2023-03-31

0001973368

us-gaap:CommonStockMember

2023-04-01

2024-03-31

0001973368

SVMH:SharePremiumMember

2023-04-01

2024-03-31

0001973368

us-gaap:RetainedEarningsMember

2023-04-01

2024-03-31

0001973368

SVMH:CapitalReserveMember

2023-04-01

2024-03-31

0001973368

us-gaap:NoncontrollingInterestMember

2023-04-01

2024-03-31

0001973368

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2024-03-31

0001973368

SVMH:OtherEquityMember

2023-04-01

2024-03-31

0001973368

us-gaap:CommonStockMember

2024-03-31

0001973368

SVMH:SharePremiumMember

2024-03-31

0001973368

us-gaap:RetainedEarningsMember

2024-03-31

0001973368

SVMH:CapitalReserveMember

2024-03-31

0001973368

us-gaap:NoncontrollingInterestMember

2024-03-31

0001973368

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0001973368

SVMH:OtherEquityMember

2024-03-31

0001973368

SVMH:MergerAgreementMember

2024-03-31

0001973368

SVMH:MergerAgreementMember

2023-04-01

2024-03-31

0001973368

SVMH:ExchangeAgreementMember

2023-04-01

2024-03-31

0001973368

SVMH:MergerAgreementMember

srt:MaximumMember

2023-04-01

2024-03-31

0001973368

2023-03-13

2023-03-13

0001973368

SVMH:MergerAgreementMember

srt:BoardOfDirectorsChairmanMember

2023-04-01

2024-03-31

0001973368

us-gaap:SubsequentEventMember

2024-07-01

2024-07-01

0001973368

us-gaap:SubsequentEventMember

2024-07-01

0001973368

us-gaap:SubsequentEventMember

2024-07-02

2024-07-02

0001973368

us-gaap:ComputerEquipmentMember

2024-03-31

0001973368

us-gaap:ComputerEquipmentMember

2023-03-31

0001973368

SVMH:ElectricalFittingsMember

2024-03-31

0001973368

SVMH:ElectricalFittingsMember

2023-03-31

0001973368

us-gaap:FurnitureAndFixturesMember

2024-03-31

0001973368

us-gaap:FurnitureAndFixturesMember

2023-03-31

0001973368

us-gaap:OfficeEquipmentMember

2024-03-31

0001973368

us-gaap:OfficeEquipmentMember

2023-03-31

0001973368

SVMH:PlantAndMachineryMember

2024-03-31

0001973368

SVMH:PlantAndMachineryMember

2023-03-31

0001973368

us-gaap:VehiclesMember

2024-03-31

0001973368

us-gaap:VehiclesMember

2023-03-31

0001973368

us-gaap:LeaseholdImprovementsMember

2024-03-31

0001973368

us-gaap:LeaseholdImprovementsMember

2023-03-31

0001973368

SVMH:TranslationDifferenceMember

2024-03-31

0001973368

SVMH:TranslationDifferenceMember

2023-03-31

0001973368

2023-12-31

0001973368

SVMH:HSBCFacilityMember

2024-03-31

0001973368

SVMH:ExchangeAgreementsMember

2023-04-01

2024-03-31

0001973368

SVMH:ExchangeAgreementsMember

2023-03-13

2023-03-13

0001973368

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

2024-03-31

0001973368

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2024-03-31

0001973368

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001973368

us-gaap:FairValueMeasurementsRecurringMember

2024-03-31

0001973368

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

2023-03-31

0001973368

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2023-03-31

0001973368

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

2023-03-31

0001973368

us-gaap:FairValueMeasurementsRecurringMember

2023-03-31

0001973368

SVMH:VehicleSalesMember

2023-04-01

2024-03-31

0001973368

SVMH:VehicleSalesMember

2022-04-01

2023-03-31

0001973368

SVMH:OthersMember

2023-04-01

2024-03-31

0001973368

SVMH:OthersMember

2022-04-01

2023-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SVMH:Integer

xbrli:pure

SVMH:times

As

filed with the Securities and Exchange Commission

on

October 21, 2024.

Registration

No. 333-282429

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment

No. 4 to

FORM

F-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

SRIVARU

Holding Limited

(Exact

Name of Registrant as Specified in Its Charter)

Not

Applicable

(Translation

of Registrant’s name into English)

| Cayman

Islands |

|

3711 |

|

Not

Applicable |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

3rd

Floor, Genesis House, Unit 18

Genesis

Close, George Town

P.O.

Box 10655

Grand

Cayman, KY1-1006

Cayman

Islands

+1

(888) 227-8066

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Maxim Group LLC

Chief Executive Officer

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Rajiv

Khanna, Esq.

Norton Rose Fulbright LLP

1301

Avenue of the Americas

New

York, NY 10019

(212)

318-3168 |

|

M.

Ali Panjwani, Esq.

Pryor

Cashman LLP

7

Times Square

New

York, New York 10036

(212)

421-4100 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth

company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act.

The

term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board

to its Accounting Standards Codification after April 5, 2012.

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY

PROSPECTUS FOR 75,000,000 UNITS

EACH

UNIT CONSISTING OF

ONE

ORDINARY SHARE OR

ONE

PRE-FUNDED WARRANT TO PURCHASE ONE ORDINARY SHARE

AND

ONE

WARRANT TO PURCHASE ONE ORDINARY SHARE

OF

SRIVARU HOLDING LIMITED

SUBJECT TO COMPLETION,

DATED OCTOBER 21, 2024

SRIVARU

Holding Limited

75,000,000

Units

75,000,000

Ordinary Shares or 75,000,000 Pre-Funded

Warrants

75,000,000

Warrants

75,000,000 Ordinary Shares underlying

Warrants

This

is a firm commitment public offering of 75,000,000 units (“Units”), each Unit consisting of one ordinary share, par

value $0.01 per share (“ordinary share”) or one pre-funded warrant (“pre-funded warrant”), and one warrant (“warrant”)

to purchase one ordinary share (collectively “the Securities”) at an assumed public offering price of $0.08 per Unit, which

was the closing price of our ordinary shares on the Nasdaq Global Market (“Nasdaq”) on October 8, 2024. The public offering

price per Unit shall be the determined between us and the underwriters and will be based on market conditions at the time of pricing,

and may be at a discount to the then current market price of our ordinary shares. Therefore, the recent market price of our ordinary

shares referenced throughout this preliminary prospectus may not be indicative of the final offering price per Unit. The Units have no

stand-alone rights and will not be certified or issued as stand-alone securities. The ordinary shares or pre-funded warrants and warrants

are immediately separable and will be issued separately in this offering. Each warrant will become exercisable for one ordinary

share at an assumed exercise price of $0.12 per share (150% of the assumed public offering price per Unit) upon shareholder

approval (to the extent required by Nasdaq rules) and will expire five years from the date of shareholder approval.

We are offering to each purchaser,

with respect to the purchase of units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our

outstanding ordinary shares immediately following the consummation of this offering, the opportunity to purchase units including one

pre-funded warrant in lieu of one ordinary share in the unit. Subject to limited exceptions, a holder of pre-funded warrants will not

have the right to exercise any portion of its pre-funded warrants if the holder, together with its affiliates, would beneficially own

in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the number of ordinary shares outstanding

immediately after giving effect to such exercise. Each pre-funded warrant will be exercisable for one ordinary share. The purchase price

of each unit including a pre-funded warrant will be equal to the price per unit including one ordinary share, minus $0.001, and the remaining

exercise price of each pre-funded warrant will equal $0.001 per share. The pre-funded warrants will be immediately exercisable and may

be exercised at any time until all of the pre-funded warrants are exercised in full. For each unit including a pre-funded warrant we

sell (without regard to any limitation on exercise set forth therein), the number of units including an ordinary share we are offering

will be decreased on a one-for-one basis.

We

have granted the underwriters the option for a period of 45 days to purchase up to an additional 11,250,000 ordinary shares from us at the initial public offering price less the underwriting discounts and commissions.

Our

ordinary shares are listed on the Nasdaq Global Market, or “Nasdaq,” under the symbol “SVMH”. On October 8,

2024, the last reported sale price of our ordinary shares was $0.08 per ordinary share.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire

prospectus and any amendments or supplements carefully before you make your investment decision.

We

are an “emerging growth company” and a “foreign private issuer” as defined under the Securities and Exchange

Commission, or SEC, rules and are subject to reduced public company reporting requirements for this prospectus and future filings. See

“Prospectus Summary-Implications of Being an Emerging Growth Company and a Foreign Private Issuer.”

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus and other risk

factors contained in the documents incorporated by reference herein for a discussion of information that should be considered in connection

with an investment in our securities.

Neither

the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per

Unit | | |

Total | |

| Public offering price | |

$ | | | |

$ | | |

| Underwriting

discounts and commissions(1) | |

| | | |

| | |

| Proceeds to us, before expenses | |

$ | | | |

$ | | |

(1)

We have also agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting”

for additional information regarding total underwriting compensation, including information on underwriting discounts and offering expenses.

We

have granted Maxim Group LLC (the “Representative”) an option exercisable within 45 days of the date of this prospectus to

purchase from us up to 11,250,000 additional ordinary shares at an assumed purchase price of $[ ] per share or up to

11,250,000 additional pre-funded warrants at a purchase price of [ ] per pre-funded warrant and/or up to an additional

11,250,000 additional warrants at a purchase price of [ ] per warrant, less, in each case, the underwriting discounts and commissions

to cover over-allotments, if any. If the Representative exercises the option in full, the total underwriting discounts and commissions

payable will be $ [ ], and the total proceeds to us, before expenses, will be $[ ].

| |

Sole

Book-Running Manager |

|

| |

Maxim

Group LLC |

|

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form F-1 filed with the Securities and Exchange Commission, or the “SEC,”

by SRIVARU Holding Limited, a Cayman Islands exempted company, the “Company” or “SVH,” and constitutes a prospectus

of SVH under Section 5 of the Securities Act with respect to the Securities.

The

following summary highlights information contained or incorporated by reference elsewhere in this prospectus and does not contain all

of the information that you should consider in making your investment decision. Before investing in our ordinary shares, you should carefully

read this entire prospectus, including our consolidated financial statements and the related notes and other documents incorporated by

reference herein, as well as the information under the caption “Risk Factors” herein and under similar headings in the other

documents that are incorporated by reference into this prospectus including documents that are filed after the date hereof. Some of the

statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note

Regarding Forward-Looking Statements.” Our actual results could differ materially from those anticipated in such forward-looking

statements as a result of certain factors, including those discussed in the “Risk Factors” and other sections included in

or incorporated by reference herein. In this prospectus, unless otherwise stated or the context otherwise requires, references to “SRIVARU,”

“SRIVARU Motors Private Limited”, “SVM”, “SVH” the “Company,” “we,” “us,”

“our,” or similar references mean SRIVARU Holdings Limited and its subsidiaries on a consolidated basis.

You should read this prospectus together with the additional information about us described in the section below entitled “Where

You Can Find More Information.” You should rely only on information contained in this prospectus. We have not, and the placement

agent has not, authorized anyone to provide you with information different from that contained in this prospectus. The information

contained in this prospectus is accurate only as of the date on the front cover of the prospectus. You should not assume that the information

contained in this prospectus is accurate as of any other date.

Unless

otherwise indicated, references to a particular “fiscal year” are to SVH’s fiscal year ended March 31 of that year.

SVH’s fiscal year ends on March 31 each year and its fiscal quarters are on June 30, September 30, and December 31.

References

to a year other than a “Fiscal”, “FY” or “fiscal year” are to the calendar year ended December 31.

References to “U.S. Dollars” and “$” in this prospectus are to United States dollars, the legal currency of the

United States. References to “Indian Rupee,” “INR” and “Rs.” in this prospectus are to the Indian

Rupee, the legal currency of the Republic of India. Any discrepancies in any table between totals and sums of the amounts listed are

due to rounding. Certain amounts and percentages have been rounded; consequently, certain figures may add up to be more or less than

the total amount and certain percentages may add up to be more or less than 100%. In particular and without limitation, amounts expressed

in millions contained in this prospectus have been rounded to a single decimal place for the convenience of readers.

We

have granted the underwriters an option, exercisable for 45 days after the date of this prospectus, to purchase up to an additional 11,250,000

ordinary shares at an assumed purchase price of $[ ] per share or up to 11,250,000 additional pre-funded warrants at

a purchase price of [ ] per pre-funded warrant and/or warrants to purchase up to an additional 11,250,000 ordinary

shares at a purchase price of $[ ] per warrant less, in each case, the underwriting discounts payable by us, solely to cover over-allotments,

if any.

The

information on taxation contained in this prospectus is a summary of certain tax considerations but is not intended to be a complete

discussion of all tax considerations. The contents of this prospectus are not to be construed as investment, legal, or tax advice. Investors

should consult their own counsel, accountant or investment advisor as to legal, tax, and related matters concerning their investment.

EXCHANGE

RATE PRESENTATION

SVH

reports its financial results in U.S. Dollars, but its functional currency is Indian Rupees. Solely for the convenience of the reader,

this prospectus contains translations of certain Indian Rupee amounts into U.S. Dollars at specified rates. Except as otherwise stated

in this prospectus, all translations from Indian Rupees to U.S. Dollars are based on the rates of Rs. 83.3739 per $1.00 being

the closing exchange rate published by the Reserve Bank of India as of March 31, 2024. No representation is made that the Indian

Rupee amounts referred to in this prospectus could have been or could be converted into U.S. Dollars at such rates or any other rates.

FINANCIAL

STATEMENT PRESENTATION

This

prospectus contains the audited consolidated financial statements of SVH as of and for the years ended March 31, 2024 and 2023.

Unless

indicated otherwise, financial data presented in this prospectus has been taken from the audited financial statements of SVH included

in this prospectus. Where information is identified as “unaudited,” it has not been subject to an audit.

SVH

is a “foreign private issuer,” as defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and has prepared its financial statements in accordance with U.S. GAAP denominated in U.S. Dollars. Accordingly, the audited condensed

combined financial information and the comparative per share information that will be presented in this prospectus will be prepared in

accordance with Article 11 of Regulation S-X and denominated in U.S. Dollars.

SVH

refers in various places in this prospectus to non-U.S. GAAP financial measures, including EBITDA and EBITDA margin, which are more fully

explained in “Selected Historical Financial Information—Other Financial Data”. The presentation of the non-U.S.

GAAP information is not meant to be considered in isolation or as a substitute for SVH’s audited financial results prepared in

accordance with U.S. GAAP.

INDUSTRY

AND MARKET DATA

Unless

otherwise indicated, information contained in this prospectus concerning SVH’s industry and the regions in which it operates, including

SVH’s general expectations and market position, market opportunity, market share and other management estimates, is based on information

obtained from various independent publicly available sources. SVH has not independently verified the accuracy or completeness of any

third-party information. Similarly, internal surveys, industry forecasts and market research, which SVH believes to be reliable based

upon its management’s knowledge of the industry, have not been independently verified. While SVH believes that the market data,

industry forecasts and similar information included in this prospectus are generally reliable and reasonable, such information

is inherently imprecise. Forecasts and other forward-looking information obtained from third parties are subject to the same qualifications

and uncertainties as the other forward-looking statements in this prospectus. In addition, assumptions and estimates of SVH’s future

performance and growth objectives and the future performance of its industry and the markets in which it operates are necessarily subject

to a high degree of uncertainty and risk due to a variety of factors, including those discussed under the headings “Risk Factors,”

“Cautionary Note Regarding Forward-Looking Statements” and “SVH Management’s Discussion and Analysis

of Financial Condition and Results of Operations” in this prospectus.

TRADEMARKS,

TRADE NAMES AND SERVICE MARKS

SVH

and its respective subsidiaries (including SVM) own or have rights to trademarks and trade names that they use in connection with the

operation of their business. In addition, their names, logos and website names and addresses are their trademarks. All other trademarks,

trade names or service marks appearing in this prospectus are, to SVH’s knowledge, the property of their respective owners. Solely

for convenience, in some cases, the trademarks, trade names and service marks referred to in this prospectus are listed without the applicable

™ or ® symbols, but such references are not intended to indicate, in any way, that the applicable licensor will

not assert, to the fullest extent under applicable law, its rights to these trademarks, trade names and service marks. SVH does not intend

its use or display of other entities’ trade names, trademarks or service marks to imply a relationship with, or endorsement or

sponsorship of SVH by, any other entities.

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

prospectus and the information incorporated by reference herein include certain “forward-looking statements” within the meaning

of Section 27A of the Securities Act, and Section 21E of the Exchange Act. These forward-looking statements can generally be identified

by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,”

“expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will”

or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements

include all matters that are not historical facts. They appear in a number of places throughout this prospectus and include statements

regarding our intentions, beliefs or current expectations concerning, among other things, the Business Combination (as defined below),

the benefits and synergies of the Business Combination, including anticipated cost savings, results of operations, financial condition,

liquidity, prospects, growth, strategies, future market conditions or economic performance and developments in the capital and credit

markets and expected future financial performance, the markets in which we operate, as well as any information concerning possible or

assumed future results of our operations.

Many

factors could cause actual results or performance to be materially different from those expressed or implied by the forward-looking statements

in this prospectus, including without limitation:

| |

● |

the

effect of the public listing of our securities on our business relationships, performance, financial condition and business generally; |

| |

● |

the

ability to maintain the listing of our securities on the Nasdaq; |

| |

|

|

| |

● |

our

ability to implement business plans, forecasts, and other expectations, and identify opportunities; |

| |

|

|

| |

● |

changes

adversely affecting the renewable energy industry; |

| |

|

|

| |

● |

the

impact of pandemics or other adverse public health developments on our business; |

| |

|

|

| |

● |

the

outcome of any legal proceedings that may be instituted against us or our directors or officers related to or arising out of the

Business Combination or otherwise; |

| |

|

|

| |

● |

changes

in applicable laws or regulations; |

| |

|

|

| |

● |

our

ability to build our brand and consumers’ recognition, acceptance and adoption of our brand; |

| |

|

|

| |

● |

risks

relating to our dependence on and use of certain intellectual property and technology; |

| |

|

|

| |

● |

general

economic conditions; |

| |

|

|

| |

● |

our

estimates of expenses, ongoing losses, future revenue, capital requirements and needs for or ability to obtain additional financing;

and |

| |

|

|

| |

● |

other

factors discussed under the section titled “Risk Factors” in this prospectus, which section is incorporated herein

by reference. |

The

forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future developments

and their potential effects. There can be no assurance that future developments will be those that we have anticipated. These forward-looking

statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual

results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and

uncertainties include, but are not limited to, those factors described under the heading “Risk Factors.” Should one or more

of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects

from those projected in these forward-looking statements, we will not undertake any obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities

laws.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus. This

summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in the

securities covered by this prospectus. You should read the following summary together with the more detailed information in this prospectus,

any related prospectus supplement and any related free writing prospectus, including the information set forth in the section titled

“Risk Factors” in this prospectus, any related prospectus supplement and any related free writing prospectus in their entirety

before making an investment decision. Some of the statements in this prospectus constitute forward-looking statements that involve

risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements” for more information.

Our Company

SVH’s

mission is to revolutionize two-wheeled vehicles (“TWV”) by developing premium products powered by renewable energy, which

are best-in-class for safety, performance, and comfort, thereby providing the best riding experience to our customers. SVH is the holding

company for 94% of the outstanding ownership interests of SVM, our primary operating subsidiary.

SVM

was founded in 2018 and is currently focusing on India, the largest market for TWV where the population growing; it is younger than the

global median, urbanizing rapidly, and has growing personal incomes and consumption rates. India’s infrastructure has lagged its

growth, leading to traffic congestion, bad road conditions, and environmental pollution, which have compelled the government to develop

policies favorable to TWV, especially Electric Two-Wheeled (“E2W”) vehicles. Consequently, demand for E2W vehicles has grown,

leading SVH to develop the next generation of E2W vehicles, named “Prana™”, which means “life energy”.

Prana™ is designed to offer consumers a “Fast, Fun and Safe” vehicle that is safe and comfortable to ride, and contributes

to improved health and a cleaner environment.

By

combining SVH’s E2W vehicle skills with its proprietary know-how and intellectual property, SVH (i) designs, engineers, and builds

premium E2W vehicles, (ii) offers a unique customer experience, and (iii) has a robust product development roadmap of e-mobility products

and technologies. SVH has enlisted the support of purchase financing providers to allow customers to lease their vehicles and benefit

from SVH’s compelling Total Cost of Ownership (“TCO”).

SVH’s

first product line, the Prana™, is a premium E2W vehicle that is redefining the category. This achievement is enabled by its patented

technology, which also results in increased safety, stability, and comfort. “Prana-Grand™” is the first variant of

the Prana line of products. SVH began prototype production and testing of the Prana in 2018 and started delivering the Prana-Grand

to customers in February 2021.

The Prana’s many innovations include

its superior balance, ease in riding, single-gear and clutch-free automatic direct drive in-wheel motor, dual channel braking

systems that, once activated, apply automatically in an optimal braking sequence, battery management, drive mode selection, which

customizes the power delivered by the motor, built-in charging system that allows the use of standard 16Amp outlets, proprietary

integrated IT platform and process, “OmniPresence,” which is a single point of contact desk to cater to customers, and planned

integrated helmet. These are among the many breakthroughs that place the Prana as the elite combination of rider experience, performance,

safety, stability, and lowered TCO in the world’s largest market for TWV.

Corporate

Information

SVH

is considered a foreign private issuer as defined in Rule 3b-4 under the Exchange Act. SVH was incorporated in the Cayman Islands on

June 16, 2021, solely to serve as the holding company for 94% of the outstanding equity of SVM. SVH is a holding company with no current

operations of its own. The address for our website is www.svmh.ai. The information contained on, or that can be accessed through, our

website is not part of, and is not incorporated into, this prospectus, and you should not rely on any such information in making the

decision of whether to purchase our ordinary shares.

SVH’s

registered address is 3rd Floor, Genesis House, Unit 18, Genesis Close, George Town, PO BOX 10655, Grand Cayman KY1-1006, Cayman

Islands., and its telephone number is +1 (888) 227-8066.

Our

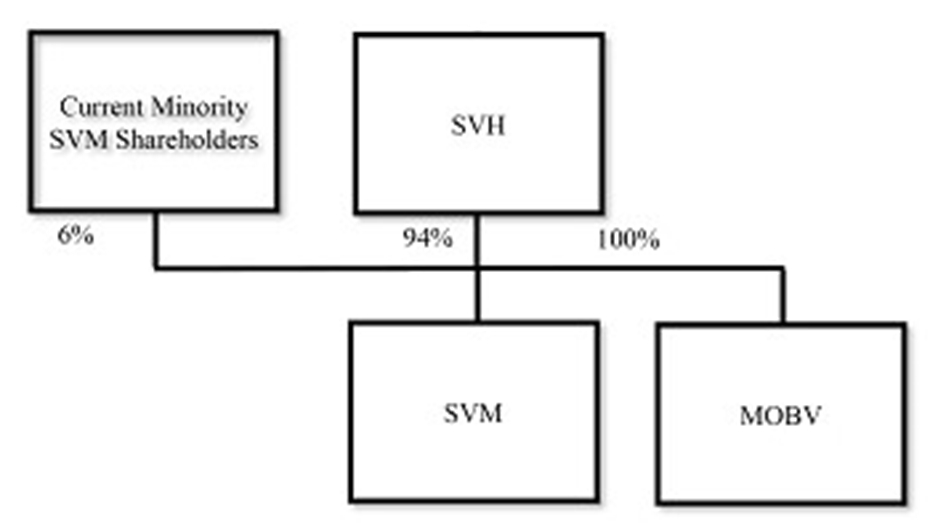

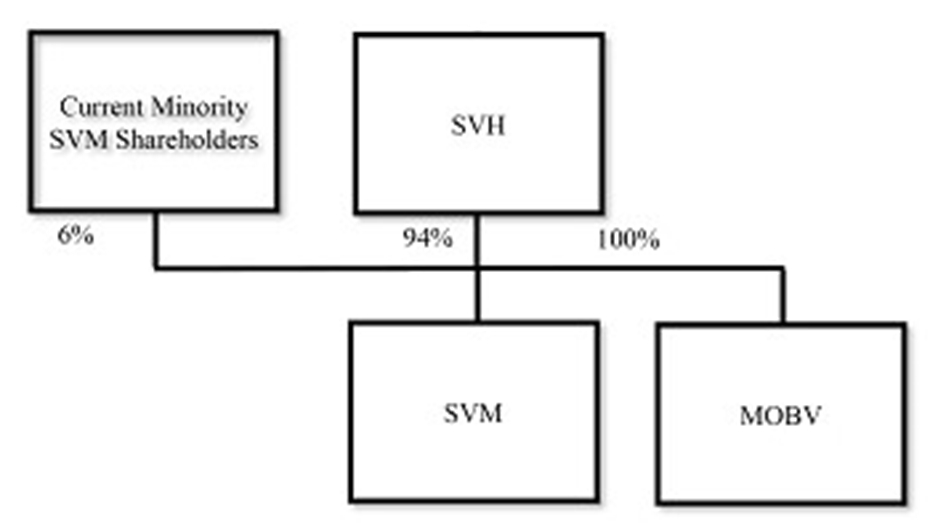

Organizational Structure

Upon

consummation of the Business Combination, MOBV became a wholly owned subsidiary of SVH. The following diagram depicts the simplified

organizational structure of SVH as of the date hereof. Percentages refer to voting power of the ordinary shares held by the respective

shareholders or shareholder groups.

Tax

Residence

As

more fully described in the section titled “Material Tax Considerations — Material U.S. Federal Income Tax Considerations

— U.S. Federal Income Tax Treatment of SVH — Tax Residence of SVH for U.S. Federal Income Tax Purposes,” we believe

that, pursuant to Section 7874 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), SVH is not expected to

be treated as a U.S. corporation for U.S. federal income tax purposes under Code Section 7874. However, the application of Section 7874

of the Code is complex, is subject to detailed regulations (the application of which is uncertain in various respects and would be impacted

by changes in such U.S. tax laws and regulations with possible retroactive effect), and is subject to certain factual uncertainties.

Accordingly, there can be no assurance that the IRS will not challenge the status of SVH as a foreign corporation under Code Section

7874 or that such challenge would not be sustained by a court.

If

the IRS were to successfully challenge under Code Section 7874 SVH’s status as a foreign corporation for U.S. federal income tax

purposes, SVH and certain SVH shareholders could be subject to significant adverse tax consequences, including a higher effective corporate

income tax rate on SVH and future withholding taxes on certain SVH shareholders, depending on the application of any income tax treaty

that might apply to reduce such withholding taxes. In particular, holders of SVH Shares and/or SVH Warrants would be treated as holders

of stock and warrants of a U.S. corporation.

See

“Material Tax Considerations — Material U.S. Federal Income Tax Considerations — U.S. Federal Income Tax Treatment

of SVH — Tax Residence of SVH for U.S. Federal Income Tax Purposes” for a more detailed discussion of the application

of Code Section 7874. Investors in SVH should consult their own advisors regarding the application of Code Section 7874.

Recent

Developments

Closing

of the Business Combination

On

December 8, 2023 (the “Closing Date” and such closing, the “Closing”), we consummated the previously announced

business combination pursuant to the Business Combination Agreement, dated as of March 13, 2023 (the “Business Combination Agreement”),

by and among us, Pegasus Merger Sub Inc., a Delaware corporation and direct, wholly owned subsidiary of the Company (“Merger Sub”)

and MOBV. As of the Closing Date, pursuant to the terms of the Business Combination Agreement, Merger Sub merged with and into MOBV (the

“Merger”), with MOBV surviving the Merger as a wholly owned subsidiary of the Company (the “Business Combination”).

In

connection with the execution of the Business Combination Agreement, the Company entered into, among other arrangements, (1) exchange

agreements (the “Exchange Agreements”) with certain shareholders of SVM, pursuant to which, among other things such shareholders

of SVM have a right to transfer one or more of the shares owned by them in SVM to us in exchange for the delivery of Shares or cash payment,

subject to the terms and conditions set forth in the Exchange Agreements, and (2) a registration rights agreement (the “Registration

Rights Agreement”) with certain of its shareholders and the Sponsor.

On

December 11, 2023, our ordinary shares commenced trading on the Nasdaq under the symbol “SVMH”.

Launch

of PRANA 2.0

On

August 22, 2024, the Company successfully completed the launch of its product platform, PRANA 2.0, and product variants, PRANA

2.0 Grand and PRANA 2.0 Elite, respectively, in Chennai, India. This event represents a significant milestone for the Company. The launch event was attended by members of the media, key vendors, and representatives from the Company’s dealer

network. The PRANA 2.0 electric motorcycle features advanced technology, including an extended driving range and a superior battery system,

which were highlighted during the launch. The Company believes that the favorable reception of the PRANA 2.0 positions it well for commercial

success.

Ionic

Purchase Agreement

We

entered into the Purchase Agreement with Ionic Ventures, LLC (“Ionic”) on July 1, 2024, which provides that, upon the terms

and subject to the conditions and limitations set forth therein, we have the right to direct Ionic to purchase up to an aggregate of

US$25,000,000 of ordinary shares of the Company, par value $0.01 per share (the “Ordinary Shares”) over the 36-month term

of the Purchase Agreement (the “Purchase Shares”). We issued an initial exemption purchase notice to Ionic for US$1

million on July 1, 2024. The Purchase Agreement prohibits the Company from issuing Shares to Ionic in excess of 4.99% of the then outstanding

ordinary shares of the Company at any given time.

After

the satisfaction of the commencement conditions, we will have the right to present Ionic with a regular purchase notice (“Regular

Purchase Notice”) directing Ionic to purchase any amount no less than US$250,000 and no greater than US$1,000,000 of our Ordinary

Shares per trading day, at a per share price equal to 97% (or 80% if the Ordinary Shares are not then trading on the Nasdaq Global Market)

of the lowest volume weighted average price (“VWAP”) over a specified measurement period, as described further in the Purchase

Agreement. If an Event of Default (as defined in the Purchase Agreement) occurs between the date on which a Regular Purchase Notice is

delivered to Ionic and such specified measurement period, such price per share will be adjusted to 85% (or 90% in the event the Ordinary

Shares are not then trading on the Nasdaq Global Market) for so long as such Event of Default remains uncured.

The

Purchase Agreement may also be terminated by us at any time after commencement, at our discretion; provided, however, that if

we have sold less than US$6,000,000 worth of Purchase Shares to Ionic (other than as a result of our inability to sell Purchase Shares

to Ionic as a result of the Beneficial Ownership Limitation or our failure to have sufficient Ordinary Shares authorized), we will pay

to Ionic a termination fee of US$300,000, which is payable, at our option, in cash or in Ordinary Shares at a price equal to the closing

price of our Ordinary Shares on the Nasdaq Global Market on the trading day immediately preceding the date of receipt of the termination

notice. Further, the Purchase Agreement will automatically terminate on the date that we sell, and Ionic purchases, the full US$25,000,000

of Purchase Shares under the agreement or, if all such Purchase Shares have not been purchased, on the expiration of the 36-month term

of the Purchase Agreement.

The

Company has currently reserved 50,000,000 ordinary shares that will be issuable pursuant to the Purchase Agreement, of which 6,242,198

have been issued. In the event such reserve is not increased, the number of Purchase Shares that may be issued will be constrained thereby.

Ionic

Registration Rights Agreement

Concurrently

with entering into the Purchase Agreement, we also entered into a registration rights agreement, dated as of July 1, 2024, by and between

us and Ionic Ventures (the “the Ionic Registration Rights Agreement”), pursuant to which we agreed to file one or more registration

statements, as necessary, to register under the Securities Act of 1933, as amended, the resale of all Ordinary Shares that may, from

time to time, be issued or become issuable to Ionic under the Purchase Agreement and the Ionic Registration Rights Agreement. The Company

currently has an effective Registration Statement on Form F-1 (File No.: 333-279843) that has registered the initial 50,000,000 ordinary

shares issuable pursuant to the Purchase Agreement.

Placement

Agency Agreement

In

connection with the transactions contemplated under the Purchase Agreement, the Company entered into a placement agency agreement (the

“Placement Agency Agreement”) with Maxim Group LLC (“Maxim”). Pursuant to the terms of the Placement Agency Agreement,

the Company must pay Maxim (i) a cash fee equal to 5.0% of the aggregate gross proceeds raised from the sale of Purchase Shares in connection

with any exemption purchase notice; and (ii) a cash fee equal to 3.0% of the aggregate gross proceeds raised from the sale of Purchase

Shares in connection with any Regular Purchase Notice. The Company must also reimburse Maxim, directly upon the initial closing under

the Purchase Agreement for all travel and other documented out-of-pocket expenses incurred by Maxim, including the reasonable fees, costs

and disbursements of its legal counsel, in an amount not to exceed an aggregate of $5,000. The Company owes Maxim a total of $50,000

from the gross proceeds of $1,000,000 due to the Company from the exemption purchase notice dated July 1, 2024. If the Company issues

additional Ordinary Shares to Ionic pursuant to the Purchase Agreement, the Company would be obligated to pay Maxim cash fees of up to

$720,000, assuming the remaining $24,000,000 of Purchase Shares are issued pursuant to Regular Purchase Notices.

The

Company also agreed to indemnify Maxim and its affiliates, directors, officers, employees and controlling persons against all losses,

claims, damages, expenses and liabilities, as the same are incurred (including the reasonable fees and expenses of counsel), relating

to or arising out of its activities pursuant to the Placement Agency Agreement.

The

foregoing descriptions of each of the Purchase Agreement, the Ionic Registration Rights Agreement, and the Placement Agency Agreement

do not purport to be complete and are qualified in their entirety to the full text of such documents, which are filed as exhibits to

this registration statement.

Nasdaq

Delisting Determination Letters and Appeal

On

July 24, 2024 and July 30, 2024, we received Staff Delisting Determination letters (the “Determinations”) from Nasdaq setting

forth a determination to delist our Ordinary Shares from Nasdaq as a result of our failure to regain compliance with each of their rules

with respect to (i) minimum Bid Price of $1.00, (ii) minimum Market Value of Publicly Held Shares of $15,000,000, and (iii) a minimum

Market Value of Listed Securities of $50,000,000. On July 30, 2024, we submitted a request for a hearing before a Hearings Panel (the

“Panel”) to appeal the Determinations. The hearing request was accepted by Nasdaq and the hearing is scheduled for September

5, 2024. The hearing request will stay the delisting of our Ordinary Shares and warrants until a determination is made by the Panel. The Ordinary

Shares will continue to trade on Nasdaq pending the outcome of the hearing before the Panel.

We

addressed the ongoing non-compliance matters before the Panel on September 5, 2024, and requested additional time to cure

the deficiency. On September 18, 2024, we received of a letter from the Office of the General Counsel of Nasdaq notifying us that

the Nasdaq Hearing Panel (the “Panel”) had granted our request for continued listing on Nasdaq for a limited time to pursue

our plan to regain compliance with the Nasdaq listing requirements (the “Plan”). The Panel is requiring us fulfill the below

requirements by November 14, 2024:

●

Submitting a public filing and financial statements that confirm the Company meets Nasdaq’s shareholder equity requirements; and

●

Providing detailed income projections for the next 12 months, including all underlying assumptions. If the Company is able to demonstrate

compliance with the stockholders’ equity standard by November 14, 2024, the Panel will consider granting the Company additional

time to complete a reverse share split, if necessary to meet the Nasdaq’s minimum bid price requirement.

During

this period, we are also required to notify Nasdaq promptly of any significant developments. The Panel has reserved the right to withdraw

this exception if any such developments impact the feasibility of the Company’s continued listing.

If our Ordinary Shares were to be

delisted by Nasdaq, the market liquidity of our Ordinary Shares could be adversely affected and the market price of our Ordinary Shares

could decline, even though such Ordinary Shares may continue to be traded “over-the-counter”. See “Risk Factors”

for more information.

Amendment

of Memorandum of Association and Release of Earnout Shares

The

Company amended its Memorandum of Association to increase its authorized share capital to US$10,000,000, comprising of 1,000,000,000

ordinary shares of US$0.01 par value with effect on August 2, 2024. The amendment was approved by special resolution of the shareholders

at the extraordinary general meeting on June 27, 2024, and subsequently implemented by the board of directors.

Pursuant

to the Extraordinary General Meeting of Shareholders (the “Meeting”) of the Company convened at June 27, 2024, the Company’s

shareholders approved the release of Earnout Shares to the Earnout Group, without the occurrence of Milestone Events (as defined in the

Merger Agreement dated March 13, 2023) and a pro rata increase in the number of Earnout Shares in proportion to certain issuances of

shares made by the Company in advance of the closing of the Business Combination. The Merger Agreement was subsequently amended on September

12, 2024, to provide for the vesting of the Earnout Shares in three tranches as follows: 129,916,660 immediately; 129,916,660

on June 27, 2025; and 129,916,660 on June 27, 2026.

Implications

of Being an Emerging Growth Company and a Foreign Private Issuer

We

are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business

Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting

requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited

to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley

Act”), reduced disclosure obligations regarding executive compensation in our periodic reports, and exemptions from the requirements

of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously

approved (to the extent applicable to a foreign private issuer). If some investors find our securities less attractive as a result, there

may be a less active trading market for our securities and the prices of our securities may be more volatile.

We

will remain an emerging growth company under the JOBS Act until the earliest of (a) the last day of our first fiscal year following the

fifth anniversary of our initial public offering, (b) the last date of our fiscal year in which we have total annual gross revenue of

at least $1.235 billion, (c) the date on which we are deemed to be a “large accelerated filer” under the rules of the SEC

with at least $700.0 million of outstanding securities held by non-affiliates or (d) the date on which we have issued more than $1.0

billion in non-convertible debt securities during the previous three years. References herein to “emerging growth company”

shall have the meaning associated with it in the JOBS Act.

We

report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging

growth company, as long as we qualify as a foreign private issuer under the Exchange Act we will be exempt from certain provisions of

the Exchange Act that are applicable to U.S. domestic public companies, including, but not limited to:

| |

● |

the

rules under the Exchange Act requiring domestic filers to issue financial statements prepared in accordance with U.S. GAAP; |

| |

|

|

| |

● |

the

sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered

under the Exchange Act; |

| |

|

|

| |

● |

the

sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability

for insiders who profit from trades made in a short period of time; and |

| |

|

|

| |

● |

the

rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and

other specific information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

We

intend to take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign

private issuer at such time as (i) more than 50% of our outstanding voting securities are held by U.S. residents and (ii) any of the

following three circumstances applies: (A) the majority of our executive officers or directors are U.S. citizens or residents, (B) more

than 50% of our assets are located in the United States or (C) our business is administered principally in the United States.

Both

foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules.

Thus, even if we no longer qualify as an emerging growth company but remain a foreign private issuer, we will continue to be exempt from

the more stringent compensation disclosures required of companies that are not emerging growth companies and will continue to be permitted

to follow our home country practice on such matters.

Risk

Factor Summary

Investing

in our securities entails a high degree of risk as more fully described under “Risk Factors.” You should carefully

consider such risks before deciding to invest in our securities. The occurrence of one or more of the events or circumstances described

below, alone or in combination with other events or circumstances, may have an adverse effect on our business, cash flows, financial

condition and the results of our operations. Such risks include, but are not limited to:

| |

● |

Our

limited operating history makes evaluating its business and future prospects difficult and may increase the risk of your investment. |

| |

|

|

| |

● |

We

have incurred net losses every year since our inception and expect to incur increasing expenses and losses in the foreseeable

future. |

| |

|

|

| |

● |

Our

forecasted operating and financial results rely in large part upon assumptions and analyses we have developed and our actual results

of operations may be materially different from our forecasted results. |

| |

|

|

| |

● |

Our

sales will depend in part on our ability to establish and maintain confidence in its long-term business prospects among consumers,

analysts, and others within our industry. |

| |

|

|

| |

● |

We

have experienced, and may in the future experience, significant delays in the design, manufacture, launch and financing of our

vehicles, which could harm our business and prospects. |

| |

|

|

| |

● |

If

we fail to manage our growth effectively, we may not be able to develop, manufacture, distribute, market and sell our vehicles successfully. |

| |

|

|

| |

● |

Our

vehicles may not perform in line with customer expectations due to design and durability factors, and our ability to develop, market

and sell or lease our products could be harmed as a result. |

| |

|

|

| |

● |

We

are subject to evolving laws, regulations, standards, policies, and contractual obligations related to data privacy and security,

and any actual or perceived failure to comply with such obligations could harm our reputation and brand, subject us to significant

fines and liability, or otherwise adversely affect our business. |

| |

|

|

| |

● |

The

loss of key personnel or an inability to attract, retain and motivate qualified personnel, particularly in full-scale commercial

manufacturing operations, as well as presence of labor and union activities, may impair our ability to expand its business. |

| |

|

|

| |

● |

We

may not be able to register, maintain, enforce and protect our intellectual property rights, may incur substantial costs

as a result of litigation or other proceedings relating to the registration, protection or enforcement of our intellectual property

rights, and may not be able to prevent third parties from unauthorized use of our intellectual property rights, and proprietary

technology. If we are unsuccessful in any of the foregoing, our competitive position could be harmed and it could be required to

incur significant expenses to enforce its rights. |

| |

|

|

| |

● |

We

may not effectively prosecute actions against third-party infringement, which could result in misappropriation of our intellectual

property and could adversely affect our financial condition and results of operations. |

| |

|

|

| |

● |

Our ability to adequately protect our trade names, trademarks

and patents could have an impact on our brand images, reputation and ability to penetrate new markets. |

| |

|

|

| |

● |

The failure of our information technology systems or

a security breach involving consumer or employee personal data and the remediation of any such failure or breach could materially

impact our reputation and adversely affect our business, results of operations or financial condition. |

| |

|

|

| |

● |

We rely on confidentiality agreements with our suppliers,

employees, consultants and other parties; the breach of such agreements could adversely affect our business and results of operations. |

| |

|

|

| |

● |

A

change in our tax residency could have a negative effect on our future profitability, and may trigger taxes on dividends or exit

charges. |

| |

|

|

| |

● |

We

may encounter difficulties in obtaining lower rates of Indian withholding income tax for dividends distributed from India. |

| |

|

|

| |

● |

Our

shareholders may be subject to Indian taxes on income arising through the sale of their Shares. |

| |

|

|

| |

● |

Changes

in India’s economic, political or social conditions or government policies could have a material and adverse effect on our

business and results of operations. |

| |

|

|

| |

● |

The

Indian EV market is still in a nascent stage and faces infrastructure and other challenges. |

| |

|

|

| |

● |

Our

management team has limited experience managing a public company. |

| |

|

|

| |

● |

Our

Ordinary Shares and warrants may be delisted from Nasdaq. |

| |

|

|

| |

● |

As

a “foreign private issuer” under the rules and regulations of the SEC, we are permitted to, and may, file less or different

information with the SEC than a company incorporated in the United States or otherwise not filing as a “foreign private issuer,”

and will follow certain home country corporate governance practices in lieu of certain Nasdaq requirements applicable to U.S. issuers. |

THE

OFFERING

The

summary below describes the principal terms of the offering. The “Description of Securities” section of this prospectus contains

a more detailed description of our Ordinary Shares.

| Issuer

|

|

SRIVARU

Holdings Limited |

| |

|

|

| Securities

being offered |

|

75,000,000

Units,

each Unit consisting of one of our ordinary shares or one pre-funded warrant and one warrant

to purchase one ordinary share. Each warrant will have an exercise price of $0.12

per share (150% of the public offering price of one Unit), will be exercisable upon

approval by our shareholders and expire five years from the date of shareholder approval.

We are offering to each purchaser, with

respect to the purchase of units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our

outstanding ordinary shares immediately following the consummation of this offering, the opportunity to purchase units including

one pre-funded warrant in lieu of one ordinary share in the unit. Subject to limited exceptions, a holder of pre-funded warrants

will not have the right to exercise any portion of its pre-funded warrant if the holder, together with its affiliates, would beneficially

own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the number of ordinary

shares outstanding immediately after giving effect to such exercise. Each pre-funded warrant will be exercisable for one ordinary

share. The purchase price of each unit including a pre-funded warrant will be equal to the price per unit including one ordinary

share, minus $0.001, and the remaining exercise price of each pre-funded warrant will equal $0.001 per share. The pre-funded warrants

will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full.

The

Units will not be certificated or issued in stand-alone form. The ordinary shares or pre-funded warrants and the warrants

comprising the Units are immediately separable upon issuance and will be issued separately in this offering. |

| |

|

|

| Number

of ordinary shares or pre-funded warrants being offered |

|

75,000,000

ordinary shares or pre-funded warrants (or 86,250,000

ordinary shares or pre-funded warrants if the underwriters exercise their over-allotment option for ordinary shares in full). |

| |

|

|

| Number

of warrants being offered |

|

Warrants

to purchase 75,000,000 ordinary shares (or warrants to purchase 86,250,000 ordinary shares if the underwriters exercise

their over-allotment option for warrants in full). |

| |

|

|

| Assumed

public offering price |

|

$0.08

per Unit (which was the closing price of the Company’s ordinary shares on the Nasdaq Global Market on October 8, 2024)

. |

| |

|

|

| Number

of ordinary shares outstanding immediately prior to this offering |

|

441,901,509

ordinary shares |

| |

|

|

| Number

of ordinary shares to be outstanding immediately after this offering(1) |

|

516,901,509

ordinary shares (or 528,151,509 ordinary

shares if the underwriters exercise their over-allotment option for ordinary shares in full) |

| |

|

|

| Over-allotment

option |

|

We

have granted the underwriters an option, exercisable for 45 days after the date of this prospectus, to purchase up to an additional

11,250,000 ordinary shares at an assumed purchase price of $[ ] per share or 11,250,000 pre-paid warrants

at an assumed purchase price per warrant of $[ ] per pre-funded warrant and/or warrants to purchase up to an additional 11,250,000

ordinary shares at a purchase price of $0.01 per warrant less, in each case, the underwriting discounts payable by us, solely

to cover over-allotments, if any. |

| |

|

|

| Use

of proceeds |

|

We

intend to use the net proceeds from this offering for general business purposes and for the specific purposes set forth in “Use

of Proceeds” of this prospectus. |

| |

|

|

| Description

of Warrants |

|

Each

warrant will have an exercise price per share of 150% of the public offering price

per Unit, will be exercisable upon shareholder approval, and expire on the fifth anniversary

of the shareholder approval. Each warrant will be exercisable for one ordinary share,

subject to adjustment in the event of stock dividends, stock splits, stock combinations,

reclassifications, reorganizations or similar events affecting our ordinary shares as described

herein.

Each

holder of warrants will be prohibited from exercising its warrant if, as a result of such exercise, the holder, together with its

affiliates, would own more than 4.99% of the total number of shares of our ordinary shares then issued and outstanding. However,

any holder may increase such percentage to any other percentage not in excess of 9.99%. The terms of the warrants will be governed

by a Warrant Agent Agreement, dated as of the closing date of this offering, between us and VStock Transfer, LLC, as the warrant

agent (the “Warrant Agent”).

This

offering also relates to the offering of the shares of ordinary shares issuable upon the exercise of the warrants. For more information

regarding the warrants, you should carefully read the section titled “Description of Securities - Warrants” in this prospectus. |

Underwriter

compensation:

|

|

The

underwriters will receive an underwriting discount equal to 7.0% of the gross proceeds from the sale of securities in the offering.

We will also reimburse the underwriters for certain out-of-pocket actual expenses related to the offering. See “Underwriting.” |

| |

|

|

| Market

for our ordinary shares |

|

Our

ordinary shares are listed on the Nasdaq Global Market under the symbol “SVMH”. |

| |

|

|

| |

|

|

| Transfer

and Warrant Agent |

|

The

transfer agent and registrar for our ordinary shares and the Warrant Agent for the warrants is VStock Transfer LLC. |

| |

|

|

| Lock-up

restrictions |

|

Subject

to certain exceptions, we and all of our executive officers and directors, as of the effective date of the registration statement

have agreed not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of

our common shares or other securities convertible into or exercisable or exchangeable for shares of our common shares for a period

of 90 days after this offering is completed without the prior written consent of the underwriters.

See “Securities Eligible for Future Sales-Lock-Up.” |

| |

|

|

| Dividend

policy |

|

We

have never declared or paid any cash dividends. Our board of directors (“Board”) will consider whether or not to institute

a dividend policy. We presently intend to retain our earnings for use in business operations and, accordingly, it is not anticipated

that our Board will declare dividends in the foreseeable future. We have not identified a paying agent. See “Dividend Policy.” |

| |

|

|

| Risk

factors |

|

The

securities offered by this prospectus are speculative and involve a high degree of risk. Prospective investors should carefully consider

the section titled “Risk Factors” in this prospectus for a discussion of factors you should carefully consider

before deciding to invest in the securities offered hereby. |

| (1) |

The

number of shares of our ordinary shares to be outstanding following this offering is based on 441,901,509 outstanding ordinary shares

as of October 8, 2024, and excludes: |

| |

|

|

| |

● |

10,798,300

ordinary shares issuable upon the exercise of

the warrants at a weighted average exercise price of $11.50 per share (the “Outstanding Warrants”); |

| |

● |

3,800,000

ordinary shares available for issuance under our 2023 Equity Incentive Plan (the “2023 Plan”); and |

| |

● |

75,000,000

ordinary shares issuable upon the exercise of

the warrants to be issued in this offering. |

|

|

| Unless

otherwise indicated, this prospectus also assumes no exercise by the underwriters of their option to purchase up to an additional

11,250,000 ordinary shares or pre-funded warrants and/or warrants to purchase up to an additional 11,250,000 ordinary

shares from us to cover over-allotments, if any. |

RISK

FACTORS

You

should carefully consider the risks described below before making an investment decision, as well as the risks and uncertainties described

in the section entitled “Risk Factors” contained in our Annual Report on Form 20-F for the year ended March 31, 2023, and

in our subsequent reports filed with the Securities and Exchange Commission (“SEC”), which filings are incorporated in this

prospectus by reference in their entirety, as well as in any prospectus supplement hereto. Additional risks not presently known to us

or that we currently deem immaterial may also impair our business operations. Our business, financial condition or results of operations

could be materially and adversely affected by any of these risks. The trading price and value of our Shares could decline due to any

of these risks, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve

risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result

of certain factors, including the risks faced by us described below and elsewhere in this prospectus. As stated elsewhere in this prospectus,

unless otherwise stated or the context otherwise requires, all references in this subsection to the “Company,” “we,”

“us” or “our” refer to SRIVARU Holdings Limited, an exempted company incorporated with limited liability under

the laws of the Cayman Islands, and its subsidiaries.

Risks

Related to Our Business and Industry

SVH’s

limited operating history makes evaluating its business and future prospects difficult and may increase the risk of your investment.

SVH

has a limited operating history, and operates in a rapidly evolving market. As a result, there is limited information that investors

can use in evaluating SVH’s business, strategy, operating plan, results, and prospects. Furthermore, SVH does not have experience

assembling or selling a commercial product at scale. SVH’s business is capital-intensive and SVH expects to continue to incur substantial

operating losses for the foreseeable future.

SVH

has encountered and expects to continue to encounter risks and uncertainties frequently experienced by companies in rapidly changing

markets, including risks relating to its ability to, among other things:

| |

● |

successfully

scale commercial production and sales on the schedule and with the specifications SVH had planned; |

| |

|

|

| |

● |

hire,

integrate and retain professional and technical talent, including key members of management; |

| |

|

|

| |

● |

continue

to make significant investments in research, development, assembly, manufacturing, marketing, and sales; |

| |

|

|

| |

● |

successfully

obtain, register, maintain, protect and enforce its intellectual property and defend against claims of intellectual property

infringement, misappropriation or other violations; |

| |

|

|

| |

● |

build

a well-recognized and respected brand; |

| |

|

|

| |

● |

establish

and refine its commercial manufacturing capabilities and distribution infrastructure; |

| |

|

|

| |

● |

establish

and maintain satisfactory arrangements with third-party suppliers; |

| |

|

|

| |

● |

establish

and expand a customer base; |

| |

|

|

| |

● |

navigate

an evolving and complex regulatory environment; |

| |

|

|

| |

● |

anticipate

and adapt to changing market conditions, including consumer demand for certain vehicle types, models or trim levels, technological

developments, and changes in competitive landscape; and |

| |

|

|

| |

● |

successfully

design, build, manufacture, and market new models of electric vehicles to follow the Prana–Grand launch. |

If SVH does not address these risks successfully,

or if the assumptions it uses to plan and operate its business are incorrect or market conditions change, its results of operations could

differ materially from its expectations and SVH’s business, financial condition and results of operations could be materially adversely

affected.

SVH

has incurred net losses every year since its inception and SVH expects to incur increasing expenses and losses in the foreseeable future.

SVH

has incurred consolidated net losses every year since its inception, including a net loss attributable to common shareholders of approximately

$3.659 million, $0.674 million and $0.382 million for the nine-month period ended March 31, 2024 and the years ended March 31, 2023 and

2022, respectively. As of March 31, 2024 and March 31, 2023, SVH’s consolidated accumulated deficit was approximately $4.445 million

and $0.971 million, respectively. SVH expects to continue to incur substantial losses and to increase expenses in the foreseeable future.

If

SVH’s product development or commercialization is delayed, SVH’s costs and expenses may be significantly higher than it currently

expects. Because SVH will incur the costs and expenses from these efforts before it receives any incremental revenues with respect thereto,

SVH expects to incur losses in future periods. SVH’s ability to generate product revenues will depend on its ability to scale commercial

production of the Prana Grand, and start production of its products in volume, which it does not expect will occur until the first

half of 2024. If SVH is delayed or unable to achieve production in scale or if production is less efficient than expected, SVH’s

financial results may be materially adversely affected.

SVH

may be unable to adequately control the costs associated with its operations.

SVH

will require capital to develop and grow its business. SVH has incurred and expects to continue to incur expenses as its builds its brand

and markets its vehicles; expenses relating to developing and assembling its vehicles, tooling and expanding its assembly facilities;

research and development expenses; raw material procurement costs; and general and administrative expenses as it scales its operations

and incurs the costs of being a public company. SVH expects to incur costs servicing and maintaining customers’ vehicles, including

establishing its service operations and facilities. SVH does not have a record of forecasting and budgeting for any of these expenses,

or monitoring actual versus forecast numbers, and these expenses could be higher than SVH currently anticipates. In addition, any delays

in the production of Prana–Grand and the production of its other products, obtaining necessary equipment or supplies, expansion

of SVH’s assembly facilities, or the procurement of permits and licenses relating to SVH’s assembly, products, sales and

distribution could significantly increase SVH’s expenses. In such events, SVH could be required to seek additional financing earlier

than it expects, and such financing may not be available on commercially reasonable terms, or at all. SVH’s ability to become profitable

in the future will depend on its ability not only to control costs, but also to sell in quantities and at prices sufficient to achieve