UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission

File Number:

(Exact name of Registrant as specified in its charter)

| Not applicable | ||

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

(Address of Principal Executive Offices)

Telephone:

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The Global Market | ||||

| The

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the shell company report: ordinary shares and 10,005,000 warrants.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files).

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ☒ | |||

| Emerging growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting over Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued | ☐ | Other ☐ | ||

| by the International Accounting Standards Board |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ☐ No

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F (including information incorporated by reference herein, the “Report”) includes statements that express SVH’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results of operations or financial condition and therefore are, or may be deemed to be, “forward looking statements” as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve significant risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements include information about our possible or assumed future results of operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” and variations of such words and similar expressions are intended to identify the forward-looking statements. The risk factors and cautionary language referred to or incorporated by reference in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in our forward-looking statements, including among other things, the items identified in the section entitled “Risk Factors” of the Company’s Amendment No. 3 of the Registration Statement on Form F-4 (333-272717) filed with the Securities and Exchange Commission (the “SEC”) on August 22, 2023 (the “Form F-4”), which are incorporated by reference into this Report.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements contained in this Report, or the documents to which we refer readers in this Report, to reflect any change in our expectations with respect to such statements or any change in events, conditions or circumstances upon which any statement is based.

| 1 |

DEFINED TERMS

In this Report:

“Board” means the board of directors of the Company.

“Business Combination” means the Merger and the other transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means the Agreement and Plan of Merger dated March 13, 2023, as amended from time to time, by and among SRIVARU Holding Limited, Pegasus Merger Sub Inc., and Mobiv Acquisition Corp.

“Business Day” means a day other than a Saturday, Sunday, or other day on which commercial banks in New York (New York), Cayman Islands, Delhi (India) and Gurugram (India) are authorized or required by law to remain closed.

“Cayman Companies Act” means the Companies Act (As Revised) of the Cayman Islands.

“Closing” means the consummation of the Transactions contemplated by the Business Combination Agreement.

“Closing Date” means the date of closing of the Transactions as contemplated by the Business Combination Agreement.

“Companies Act” or “Companies Act 2013” is an act of the parliament of India which regulates incorporation of a company, responsibilities of a company, directors, dissolution of a company, and includes all amendments thereafter.

“Dodd-Frank Act” means the Dodd-Frank Wall Street Reform and Consumer Protection Act.

“DTC” means the Depository Trust Company.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“ITA” means the Indian Income Tax Act, 1961.

| 2 |

“Merger” means the merger pursuant to the terms of the Business Combination Agreement whereby Merger Sub will merge with and into MOBV, with MOBV surviving the Merger as a wholly owned subsidiary of SVH.

“Merger Sub” means Pegasus Merger Sub Inc., a Delaware corporation..

“MOBV” means Mobiv Acquisition Corp, a Delaware corporation.

“MOBV Public Shares” means the Class A common stock of MOBV, par value $0.000001 per share.

“MOBV Public Warrant” means a warrant entitling the holder to purchase one share of common stock at an exercise price of $11.50 per share.

“MOBV Shares” means the shares of Class A common stock, par value $0.000001 per share, and Class B common stock, par value $0.000001 per share, of MOBV, together.

“Nasdaq” means The Nasdaq Stock Market LLC.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“Subsidiary” means, with respect to any person, any corporation or other organization (including a limited liability company or a partnership), whether incorporated or unincorporated, of which such person directly or indirectly owns or controls a majority of the securities or other interests having by their terms ordinary voting power to elect a majority of the board of directors or others performing similar functions with respect to such corporation or other organization or any organization of which such person or any of its Subsidiaries is, directly or indirectly, a general partner or managing member.

“SVH” or the “Company” means SRIVARU Holding Limited, a Cayman Islands exempted company.

“SVH A&R Articles” means the amended and restated memorandum and articles of association of SVH.

“SVH Shares” means the ordinary shares of SRIVARU Holding Limited, having the conditions and rights set out in the SVH A&R Articles.

“SVH Securities” means, collectively, the SVH Shares and the SVH Warrants.

“SVH Warrants” means the warrants to purchase SVH Shares at a price of $11.50 per SVH Share.

“SVM” means SRIVARU Motors Private Limited, a company incorporated under the laws of India and a majority-owned subsidiary of SVH.

| 3 |

EXPLANATORY NOTE

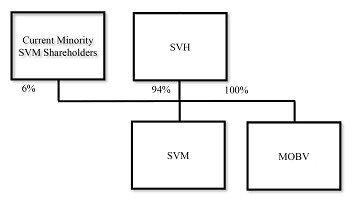

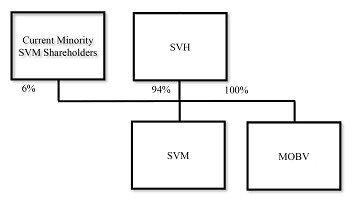

On March 13, 2023, MOBV, SVH and Merger Sub entered into the Business Combination Agreement, pursuant to which, subject to the terms and conditions set forth therein, several transactions occurred, and in connection therewith, SVH became the ultimate parent company of SVM and MOBV, or the “Business Combination.”

The Business Combination was consummated on December 8, 2023. The transaction was unanimously approved by MOBV’s Board of Directors and was approved at the special meeting of MOBV’s shareholders held on September 28, 2023 or the “MOBV Special Meeting”. As a result of the business combination, MOBV has become a wholly owned subsidiary of SVH. On December 11, 2023, SVH’s Ordinary Shares and Warrants commenced trading on The Nasdaq Stock Market LLC, or “Nasdaq” under the symbols “SVMH” and “SVMHW,” respectively.

Certain amounts that appear in this Report may not sum due to rounding.

| 4 |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

An investment in our Class A Ordinary Shares and Warrants involves significant risks. You should carefully consider the risks described below before making an investment decision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition or results of operations could be materially and adversely affected by any of these risks. The trading price and value of our Shares could decline due to any of these risks, and you may lose all or part of your investment.

| 5 |

Risks Related to Our Business and Industry

SVH’s limited operating history makes evaluating its business and future prospects difficult and may increase the risk of your investment

SVH has a limited operating history, and operates in a rapidly evolving market. As a result, there is limited information that investors can use in evaluating SVH’s business, strategy, operating plan, results, and prospects. Furthermore, SVH does not have experience assembling or selling a commercial product at scale. SVH’s business is capital-intensive and SVH expects to continue to incur substantial operating losses for the foreseeable future.

SVH has encountered and expects to continue to encounter risks and uncertainties frequently experienced by companies in rapidly changing markets, including risks relating to its ability to, among other things:

| ● | successfully scale commercial production and sales on the schedule and with the specifications SVH had planned; |

| ● | hire, integrate and retain professional and technical talent, including key members of management; |

| ● | continue to make significant investments in research, development, assembly, manufacturing, marketing, and sales; |

| ● | successfully obtain, maintain, protect and enforce its intellectual property and defend against claims of intellectual property infringement, misappropriation or other violations; |

| ● | build a well-recognized and respected brand; |

| ● | establish and refine its commercial manufacturing capabilities and distribution infrastructure; |

| ● | establish and maintain satisfactory arrangements with third-party suppliers; |

| ● | establish and expand a customer base; |

| ● | navigate an evolving and complex regulatory environment; |

| ● | anticipate and adapt to changing market conditions, including consumer demand for certain vehicle types, models or trim levels, technological developments, and changes in competitive landscape; and |

| ● | successfully design, build, manufacture, and market new models of electric vehicles to follow the Prana–Grand launch; |

| ● | the impact of pandemics or other adverse public health developments on our business; |

| ● | our estimates of expenses, ongoing losses, future revenue, capital requirements and needs for or ability to obtain additional financing; and |

| ● | the ability to maintain the listing of our securities on the Nasdaq. |

If SVH does not address these risks successfully, or if the assumptions it uses to plan and operate its business are incorrect or market conditions change, its results of operations could differ materially from its expectations and SVH’s business, financial condition and results of operations could be materially adversely affected.

SVH has incurred net losses every year since its inception and SVH expects to incur increasing expenses and losses in the foreseeable future.

SVH has incurred consolidated net losses every year since its inception, including a net loss attributable to common shareholders of approximately $11.482 million and $0.674 million years ended March 31, 2024 and 2023, respectively. As of March 31, 2024 and March 31, 2023, SVH’s consolidated accumulated deficit was approximately $12.247 million and $0.971 million, respectively. SVH expects to continue to incur substantial losses and to increase expenses in the foreseeable future.

| 6 |

If SVH’s product development or commercialization is delayed, SVH’s costs and expenses may be significantly higher than it currently expects. Because SVH will incur the costs and expenses from these efforts before it receives any incremental revenues with respect thereto, SVH expects to incur losses in future periods. SVH’s ability to generate product revenues will depend on its ability to scale commercial production of the Prana Grand, and start production of its products in volume, which it does not expect will occur until the first half of 2024. If SVH is delayed or unable to achieve production in scale or if production is less efficient than expected, SVH’s financial results may be materially adversely affected.

SVH may be unable to adequately control the costs associated with its operations.

SVH will require capital to develop and grow its business. SVH has incurred and expects to continue to incur expenses as its builds its brand and markets its vehicles; expenses relating to developing and assembling its vehicles, tooling and expanding its assembly facilities; research and development expenses; raw material procurement costs; and general and administrative expenses as it scales its operations and incurs the costs of being a public company. SVH expects to incur costs servicing and maintaining customers’ vehicles, including establishing its service operations and facilities. SVH does not have a record of forecasting and budgeting for any of these expenses, or monitoring actual versus forecast numbers, and these expenses could be higher than SVH currently anticipates. In addition, any delays in the production of Prana–Grand and the production of its other products, obtaining necessary equipment or supplies, expansion of SVH’s assembly facilities, or the procurement of permits and licenses relating to SVH’s assembly, products, sales and distribution could significantly increase SVH’s expenses. In such events, SVH could be required to seek additional financing earlier than it expects, and such financing may not be available on commercially reasonable terms, or at all. SVH’s ability to become profitable in the future will depend on its ability not only to control costs, but also to sell in quantities and at prices sufficient to achieve its expected margins. If SVH is unable to cost-efficiently design, manufacture, market, sell, distribute and service its vehicles, its margins, profitability and prospects would be materially adversely affected.

SVH has sold only a limited number of vehicles and has received limited reservations for additional Prana-Grand units, all of which may be cancelled.

As of March 31, 2023, SVH had sold more than 160 vehicles. Since the launch of the Prana–Grand, SVH has received reservations for approximately 12,000 units, however, SVH has not taken deposits to secure reservations and its customers may cancel their reservations at any time and for any reason, until they place orders for their vehicle. Any delays in the current production line of the Prana-Grand could result in customer cancellations. No assurance can be given that reservations will not be cancelled and will ultimately result in the final sale and delivery of vehicles. Accordingly, the number of current reservations should not be considered a reliable indicator of demand for SVH’s vehicles, or for future vehicle sales. The cancellation of the reservations could materially negatively impact SVH’s results of operation and financial conditions.

SVH’s forecasted operating and financial results rely in large part upon assumptions and analyses it has developed and SVH’s actual results of operations may be materially different from its projections.

The projections prepared by SVH in November 2022 and revised in February and March 2023 that previously appeared in the proxy statement/prospectus regarding the Business Combination (the “Projections”) reflect SVH’s targets for future performance required to earn the Earn Out Shares under the Business Combination Agreement and incorporate certain financial and operational assumptions based on information available at the time the forecasts were made. None of the Projections were prepared with a view toward public disclosure other than to certain parties that were involved in the Business Combination. The Projections were prepared based on numerous variables and assumptions which are inherently uncertain and may be beyond the control of SVH.

Whether actual operating and financial results and business developments will be consistent with the expectations and assumptions reflected in the Projections depends on a number of factors, many of which are outside of SVH’s control. If SVH fails to meet its own financial or operating forecasts or those of securities analysts, the value of SVH’s shares could be significantly adversely affected.

| 7 |

The TWV market is highly competitive, and SVH may not be successful in competing in this industry.

The global TWV market is highly competitive, and SVH expects it will become even more so in the future as additional vendors enter the market within the next several years. E2W manufacturers with which SVH competes include existing manufacturers in India, as well as an increasing number of international entrants. SVH also competes with established premium TWV vendors, many of which have entered or have announced plans to enter the E2W market. Many of SVH’s current and potential competitors have significantly greater financial, technical, manufacturing, marketing, and other resources than SVH does, and may be able to devote greater resources to the design, development, manufacturing, distribution, promotion, sale, servicing, and support of their products. In addition, many of these companies have longer operating histories, greater name recognition and branding, larger and more established sales forces, broader customer and industry relationships and other resources than SVH does. SVH’s competitors may be in a stronger position to respond quickly to new technologies and may be able to design, develop, market, and sell their products more effectively. SVH expects competition in its industry to significantly intensify in the future in light of increased demand for E2W vehicles, continuing globalization, favorable governmental policies and consolidation in the worldwide automotive industry. SVH’s ability to successfully compete in its industry will be fundamental to its future success. There can be no assurance that SVH will be able to compete successfully in the global TWV markets.

The TWV industry has significant barriers to entry that SVH must overcome in order to manufacture and sell E2W at scale.

The TWV industry is characterized by significant barriers to entry, including large capital requirements, costs of designing, manufacturing, and distributing vehicles, long lead times to bring vehicles to market from the concept and design stage, the need for specialized design and development expertise, safety and regulatory requirements, establishing a brand name and image, and the need to establish sales and service locations. Since SVH is focused on the design of E2W, it faces various challenges to entry that a traditional vehicle manufacturer would not encounter, including additional costs of developing and producing an electric powertrain that has comparable performance to an internal combustion engine, or ICE, lack of experience with servicing electric vehicles, regulations associated with the transport and storage of batteries, the need for charging infrastructure, and other challenges that may arise for a nascent product. While SVH has assembled and delivered more than 160 units of the Prana-Grand, it has not begun mass assembly or deployed a nation-wide sales and service network. If SVH is not able to overcome these barriers, its business, prospects, results of operations and financial condition will be negatively impacted, and its ability to grow its business will be harmed.

SVH will initially depend on revenue generated from a single model and, in the foreseeable future, will be significantly dependent on a limited number of models.

SVH will initially depend on revenue generated from a single vehicle model, the Prana-Grand, and in the foreseeable future, will be significantly dependent on a single or limited number of models. Although SVH has other vehicle models on its product roadmap, it currently does not expect to introduce another vehicle model for sale until 2024, at the earliest. SVH expects to rely on sales from the Prana-Grand, among other sources of financing, for the capital that will be required to develop and commercialize those subsequent models. If production of the Prana-Grand is delayed or reduced, or if the Prana-Grand is not well-received by the market for any reason, SVH’s revenue and cash flow would be adversely affected, and it may need to seek additional financing earlier than it expects. Such financing may not be available to it on commercially reasonable terms, or at all.

SVH’s sales will depend in part on its ability to establish and maintain confidence in its long-term business prospects among consumers, analysts, and others within its industry.

Consumers may be less likely to purchase SVH’s products if they do not believe that its business will succeed or that its operations, including service and customer support operations, will endure. Similarly, suppliers and other third parties will be less likely to invest time and resources in developing business relationships with SVH if they are not convinced that its business will succeed. Accordingly, to build, maintain and grow its business, SVH will be required to establish and maintain confidence among customers, suppliers, financing sources, and other parties with respect to its liquidity and long-term business prospects. Maintaining such confidence may be difficult as a result of many factors, including SVH’s limited operating history, others’ unfamiliarity with its products, uncertainty regarding the future of electric vehicles, any delays in scaling production, delivery and service operations to meet demand, competition, and SVH’s production and sales performance compared with market expectations. Many of these factors are largely outside of SVH’s control, and any negative perceptions about SVH’s long-term business prospects, even if exaggerated or unfounded, would likely harm its business and make it more difficult to raise additional capital in the future. In addition, as discussed above, a significant number of new electric vehicle companies have recently entered the market. If these new entrants or other manufacturers of electric vehicles go out of business, produce vehicles that do not perform as expected or otherwise fail to meet expectations, such failures may have the effect of increasing scrutiny of others in the industry, including SVH, and further challenging customers’, suppliers’, and analysts’ confidence in SVH’s long-term prospects.

| 8 |

SVH’s ability to generate meaningful product revenue will depend on consumers’ demand for electric vehicles.

SVH is focused on E2W and, accordingly, its ability to generate meaningful product revenue will depend on demand for E2W vehicles. If the market for E2W vehicles does not develop as SVH expects or develops more slowly than it expects, or if there is a decrease in consumer demand for E2W vehicles, SVH’s business, prospects, financial condition and results of operations will be negatively affected. The market for E2W vehicles is relatively new, rapidly evolving, characterized by rapidly changing technologies, competition, evolving government policies and regulation (including government incentives and subsidies) and industry standards, frequent new vehicle announcements, and changing consumer demands and behaviors. Any changes in the industry could negatively affect consumer demand for E2W vehicles in general and for SVH’s vehicles in particular.

Volatility in demand may lead to lower vehicle unit sales, which may result in downward price pressure and adversely affect SVH’s business, prospects, financial condition and results of operations. Further, sales of vehicles tend to be cyclical in many markets, which may expose SVH to increased volatility, especially as it expands its operations and retail strategies.

Developments in E2Ws or alternative fuel technologies or improvements in the internal combustion engine may adversely affect the demand for SVH’s vehicles.

SVH may be unable to keep up with changes in E2W technology or alternatives to electricity as a fuel source and, as a result, its competitiveness may suffer. Significant developments in alternative technologies, such as alternative battery technologies, hydrogen fuel cell technology, advanced gasoline, biofuels, natural gas, or improvements in the fuel economy of the internal combustion engine, may adversely affect SVH’s business and prospects in ways it does not currently anticipate. Existing and other battery technologies, fuels or sources of energy may emerge as customers’ preferred alternative to the technologies utilized in SVH’s E2W vehicles. Any failure by SVH to develop new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay its development and introduction of new and enhanced E2W vehicles, which could result in the loss of competitiveness of its vehicles, decreased revenue and a loss of market share to competitors. In addition, SVH expects to compete in part on the basis of its vehicles’ range, efficiency, charging speeds, and performance. Improvements in the technologies offered by competitors could reduce demand for SVH’s vehicles. As technologies change, SVH plans to upgrade or adapt its vehicles and introduce new models that reflect such technological developments, but its vehicles may become obsolete, and its research and development efforts may not be sufficient to adapt to changes in alternative fuel and E2W technologies. Additionally, as new companies and larger, existing vehicle manufacturers enter the E2W market, SVH may lose any technological advantage it may have and suffer a decline in its competitive position. Any failure by SVH to successfully anticipate or react to changes in technologies or the development of new technologies could materially harm its competitive position and growth prospects.

Extended periods of low gasoline or other fossil fuel prices could adversely affect demand for SVH’s vehicles, which would adversely affect its business, prospects, results of operations and financial condition.

A portion of the current and expected demand for electric vehicles results from government policies, regulations and economic incentives promoting fuel efficiency and alternative forms of energy, concerns about climate change resulting in part from the burning of fossil fuels and concerns about volatility in the cost of gasoline and other petroleum-based fuel, and the sourcing of oil from unstable or hostile countries. If the cost of gasoline and other petroleum-based fuel decreases and remains deflated for extended time periods, the outlook for the long-term supply of oil improves, the government eliminates or modifies its policies, regulations or economic incentives related to fuel efficiency and alternative forms of energy, or there is a change in the perception that the burning of fossil fuels negatively impacts the environment, the demand for electric vehicles, including SVH’s vehicles, could be reduced, and SVH’s business and revenue may be negatively impacted.

| 9 |

SVH may not be able to obtain or agree on acceptable terms and conditions for all or a significant portion of the grants, loans and other incentives for which it may apply. As a result, SVH’s business and prospects may be adversely affected.

SVH anticipates that in the future there may be new opportunities for it to apply for grants, loans, and other incentives from governments in jurisdictions in which it will operate, designed to stimulate the economy and support the production of alternative fuel and electric vehicles and related technologies. SVH’s ability to obtain funds or incentives from government sources is subject to the availability of funds under applicable government programs and approval of SVH’s applications to participate in such programs. The application process for these funds and other incentives will likely be competitive. SVH cannot assure you that it will be successful in obtaining any of these grants, loans and other incentives. If SVH is not successful in obtaining any of these additional incentives and it is unable to find alternative sources of funding to meet its planned capital needs, SVH’s business and prospects could be materially adversely affected.

SVH faces risks associated with international operations, including unfavorable regulatory, political, tax and labor conditions, which could adversely impact its business.

SVH anticipates having operations and subsidiaries in more countries and markets that will be subject to the legal, political, regulatory and social requirements and economic conditions in those jurisdictions. SVH also intends to expand its sales, maintenance and repair services and its assembly activities outside India. However, SVH has no experience assembling, selling or servicing its vehicles other than in India, and such expansion would require it to make significant capital and operating expenditures, including establishing facilities, hiring local employees, and setting up distribution and supply chain systems, in advance of generating any revenues. Other risks associated with international business activities include but are not limited to conforming SVH’s vehicles to various regulatory and safety requirements in jurisdictions outside India, difficulties in establishing international assembly operations, difficulties in attracting customers in new markets, foreign taxes, permit and labor requirements and regulations, trade restrictions and regulations, changes in diplomatic and trade relationships, and fluctuations in foreign currency exchange rates and interest rates. If SVH fails to successfully address these risks, its business, prospects, results of operations and financial condition could be materially harmed.

Uninsured losses could result in payment of substantial damages, which would decrease SVH’s cash reserves and could harm its cash flow and financial condition.

In the ordinary course of business, SVH may be subject to losses resulting from product liability, accidents, acts of God, and other claims against it, for which it may have no insurance coverage. While SVH currently carries liability insurance policies that it deems appropriate for its business, it may not maintain as much insurance coverage as other original equipment manufacturers do, and in some cases, it may not maintain any at all. Additionally, the policies it has may include significant deductibles, and SVH cannot be certain that its insurance coverage, including the directors’ and officers’ insurance policies that SVH will purchase, will be sufficient to cover all or any future claims against it. A loss that is uninsured or exceeds policy limits may require SVH to pay substantial amounts, which could adversely affect its financial condition and results of operations. Further, insurance coverage may not continue to be available to SVH or, if available, may be at a significantly higher cost, especially if insurance providers perceive any increase in SVH’s risk profile in the future.

The ongoing Russian military action in Ukraine could adversely affect SVH’s business, financial condition and operating results.

Global markets are experiencing volatility and disruption following the escalation of geopolitical tensions and the start of the military incursion by Russia in Ukraine. On February 24, 2022, Russian military forces launched a military action in Ukraine, and since then sustained conflict and disruption in the region has occurred and is likely to continue. Although the length, impact and outcome of the ongoing military conflict in Ukraine is highly unpredictable, this conflict has led to and could lead to significant market and other disruptions, including significant volatility in commodity prices and supply of energy resources, instability in financial markets, supply chain interruptions, political and social instability, changes in consumer or purchaser preferences as well as increase in cyberattacks and espionage.

| 10 |

While SVH does not currently have operations in Ukraine, Russia or Belarus, it is nevertheless actively monitoring the situation in Ukraine and assessing its impact on our business, including our business partners and customers. To date SVH has not experienced any material interruptions in our infrastructure, supplies, technology systems or networks needed to support our operations. SVH has no way to predict the progress or outcome of the conflict in Ukraine or its impacts in Ukraine, Russia or Belarus as the conflict, and any resulting government reactions, are rapidly developing and beyond our control. The extent and duration of the military action, sanctions and resulting market and/or supply disruptions could be significant and could potentially have substantial impact on the global economy and our business for an unknown period of time. Any of the above factors could negatively affect SVH’s business, financial condition and operating results. Any such disruptions may also magnify the impact of other risks described in this prospectus.

In addition, there may be an increased risk of cyberattacks by state actors due to the current conflict between Russia and Ukraine. Any increase in such attacks on us or our systems could adversely affect our network systems or other operations. Although we maintain cybersecurity policies and procedures to manage risk to our information systems and, continuously adapt our systems and processes to mitigate such threats, we may not be able to address these cybersecurity threats proactively or implement adequate preventative measures and there can be no assurance that we will promptly detect and address any such disruption or security breach, if at all. See “Risk Factors—Any unauthorized control, manipulation, interruption, or compromise of, or access to, SVH’s products or information technology systems could result in loss of confidence in SVH and its products, fines or other sanctions by regulators, harm SVH’s business and materially adversely affect its financial performance, results of operations or prospects.”

Climate changes and the occurrence of natural disasters may adversely affect our business, financial condition and results of operations.

Natural calamities such as earthquakes, excessive rains, monsoons, floods, droughts, tsunamis, and adverse and unusual weather patterns have occurred globally in the past few years. The extent and severity of these natural disasters determine their impact on the global economy, which may adversely affect SVH’s business operations and financial position. In particular, excessive rains and floods often result in electricity becoming unavailable across large areas and for extended periods of time, which could lead to unavailability of electricity at charging stations. Additionally, excessive rains and floods, can also cause significant health hazards as submerged vehicles can lead to debilitating electrical shocks and short circuits.

Risks Related to Manufacturing and Supply Chain

SVH has experienced, and may in the future experience, delays in the design, manufacture, launch and financing of its vehicles, and supply chain issues arising from its reliance on third-party suppliers for many key components, which could harm its business and prospects.

SVH is in the early-stage production of the Prana-Grand vehicles and in the development stage of the Prana-Elite vehicles. Production of the Alive scooter is not expected to begin until 2024 and may occur later or not at all. Any delay in the financing, design, manufacture and launch of SVH’s product lines could materially damage SVH’s business, prospects, financial condition and results of operations. Prior to mass production of its electric vehicles, SVH will also need the vehicles to be fully approved for sale in its intended markets. If SVH fails to scale up the production of Prana-Grand, its first product, its growth prospects could be adversely affected.

Furthermore, SVH relies on third-party suppliers for many of the key components and materials used in its vehicles. To the extent SVH’s suppliers experience any delays in providing SVH with necessary components, SVH could experience delays in bringing its vehicles to market. Likewise, SVH may encounter delays with the design, construction and regulatory or other approvals necessary to expand its India assembly facilities, or other future assembly facilities. Any significant delay or other complication in the production ramp of the Prana-Grand or the development, manufacture, launch and production ramp of SVH’s future products and services, could materially damage SVH’s brand, business, prospects, financial condition and results of operations. The continued development of and the ability to start manufacturing SVH’s vehicles are and will be subject to risks, such as the ability to finalize product specifications; secure necessary funding; obtain required regulatory approvals and certifications; and secure necessary components, services, or licenses on acceptable terms and in a timely manner.

| 11 |

If our electric vehicle owners modify our electric vehicles, regardless of whether third-party aftermarket products are used, the electric vehicle may not operate properly, which may create negative publicity and could harm our business.

Vehicle enthusiasts may seek to alter SVH’s electric vehicles to modify their performance which could compromise vehicle safety and security systems. Also, customers may customize their electric vehicles with aftermarket parts that can compromise rider safety. SVH does not test, nor does it endorse, such changes or products. In addition, customers may attempt to modify SVH’s electric vehicles’ charging systems or use improper external cabling or unsafe charging outlets that can compromise the vehicle systems or expose our customers to injury from high-voltage electricity. Such unauthorized modifications could reduce the safety and security of SVH’s electric vehicles and any injuries resulting from such modifications could result in adverse publicity, which would negatively affect SVH’s brand and thus harm its business, prospects, financial condition and operating results.

If SVH fails to manage its growth effectively, it may not be able to develop, manufacture, distribute, market and sell its vehicles successfully.

Any failure to manage SVH’s growth effectively could materially and adversely affect its business, prospects, results of operations and financial condition. SVH intends to expand its operations significantly, and intends to hire a significant number of additional personnel, including design and manufacturing personnel and service technicians. Because its vehicles are based on a different technology platform than ICE vehicles, individuals with sufficient training in electric vehicles may not be readily available and as a result, SVH may need to expend significant resources training the employees it will hire. Competition for individuals with experience designing, manufacturing, and servicing electric vehicles is intense, and SVH may not be able to attract, integrate, train, motivate or retain additional qualified personnel in the future. The failure to attract, integrate, train, motivate and retain these additional employees could harm SVH’s business and prospects. In addition, SVH has no experience in high volume manufacturing of its vehicles. SVH cannot assure you that it will be able to develop efficient, automated, low-cost manufacturing capabilities and processes, and reliable sources of component supply that will enable it to meet the quality, price, engineering, design, and production standards, as well as the production volumes it anticipates, and SVH may not be able to achieve economies of scale required to successfully and profitably market its vehicles. Any failure to develop such manufacturing processes and capabilities within SVH’s projected costs and timelines could stunt its future growth and impair its ability to produce, market, service, and sell its vehicles successfully.

Financial service providers may be unable to offer attractive leasing and financing options for SVH’s vehicles, which would adversely affect consumer demand.

While purchase financing for SVH’s vehicles is available in India, increasing the financing facilities to support SVH’s sales could take additional time or not occur. SVH is working on establishing a nation-wide network of providers to offer vehicle loan programs, however, SVH currently has agreements in place with a small number of financing sources. SVH can provide no assurance that third-party financing sources would be able or willing to provide purchase financing on terms acceptable to SVH’s customers, or at all. Furthermore, because SVH has sold a limited number of vehicles and no secondary market for its vehicles exists, the future resale value of SVH’s vehicles is difficult to predict, and the possibility that resale values could be lower than SVH expects, or that no resale market emerges, increases the difficulty of obtaining third-party financing on terms that appeal to potential customers. SVH believes that its ability to access additional markets will depend on the availability of attractive leasing and financing options, and if SVH is unable to make available to its customers attractive options to finance the purchase or lease of its vehicles, such failure could substantially reduce the addressable market and decrease demand for SVH’s vehicles.

SVH’s business and prospects depend significantly on the “Prana” brand.

SVH’s business and prospects will depend on its ability to develop, maintain and strengthen the “Prana” brand associated with premium products and technological excellence. Promoting and positioning its brand will likely depend significantly on SVH’s ability to provide a consistently premium customer experience, an area in which it has limited experience. To promote its brand across multiple geographies, SVH may be required to change its customer development and branding practices and develop local content, which could result in substantially higher expenses, including the need to use traditional media such as television, radio and print advertising. In particular, any negative publicity, whether or not true, can quickly proliferate on social media and harm consumer perception and confidence in SVH’s brand. SVH’s ability to successfully position its brand could also be adversely affected by perceptions about the quality of its competitors’ vehicles or its competitors’ success. For example, certain of SVH’s competitors have been subject to significant scrutiny for incidents involving their battery fires, which could result in similar scrutiny of SVH.

| 12 |

In addition, from time to time, SVH’s vehicles may be evaluated and reviewed by third parties. Any negative reviews or reviews which compares SVH unfavorably to competitors could adversely affect consumer perception about its vehicles and reduce demand for its vehicles, which could have a material adverse effect on SVH’s business, results of operations, prospects and financial condition.

SVH’s products may not meet customer expectations due to design, performance, or durability factors, and its ability to develop, market and sell or lease its products could be harmed as a result.

SVH’s products may not perform in line with customers’ expectations. For example, the vehicles may not have the durability or longevity, and may not be as easy and convenient to maintain and repair as other vehicles on the market. Although SVH will attempt to remedy any issues it observes in its products as effectively and rapidly as possible, such efforts may not be timely, may hamper production or may not be to the satisfaction of its customers. Further, if certain features of SVH’s products take longer than expected to become available, are legally restricted or become subject to additional regulation, SVH’s ability to develop, market and sell its products and services could be harmed.

SVH’s vehicles may contain product or design defects, which could have a material adverse impact on SVH’s business, financial condition, operating results and prospects.

SVH’s vehicles include certain features of its modular system, mode function, advanced sequential combined braking system, and energy management software. SVH plans to add features in the future to its new models, as well as by upgrading the software of its current models. SVH’s products may contain defects in design and manufacture that may cause them not to perform as expected or that may require repair. Its current features or future enhancements may not perform in line with expectations. While SVH performs extensive internal testing of its vehicles’ software and hardware systems, and has successfully sold vehicles with those systems, given SVH’s limited operating history, it has a limited frame of reference by which to evaluate the long-term performance of its systems and vehicles. SVH may not be able to detect and fix any defects in the vehicles prior to their sale. Any product or design defects or any other failure of SVH’s vehicles to perform as expected could harm SVH’s reputation and result in adverse publicity, lost revenue, delivery delays, product recalls, product liability claims, harm to its brand and reputation, and significant warranty and other expenses. All of the foregoing could negatively affect SVH’s business, prospects, results of operations and financial condition.

The battery efficiency and the range of the vehicles will decline over time, which may affect consumers’ purchasing choices and can negatively impact SVH’s business and financial conditions.

Even if its vehicles function as designed, all battery-powered vehicles lose efficiency, and hence range, over time. Other factors, such as usage, time and charging patterns, may also impact the battery’s ability to hold a charge, or could require SVH to limit vehicles’ battery charging capacity, including via over-the-air or other software updates, which could further decrease SVH’s vehicles’ range. Current battery technology may limit SVH’s ability to improve the performance of its battery packs, or increase its vehicles’ range, in the future. Any such battery deterioration or capacity limitations and related decreases in range may negatively impact SVH’s brand and reputation and lead to customer complaints or warranty claims, and its business, prospects, results of operations and financial condition could be materially harmed.

Adequate charging solutions for SVH’s vehicles may affect demand for its products.

Demand for SVH’s vehicles may depend in part on the availability of charging infrastructure. While the prevalence of charging stations has been increasing, charging station locations are significantly less widespread than gas stations. Although SVH designed a standard 16Amp charger into the Prana product line, which allows ubiquitous charging, the charging infrastructure available to its customers may be insufficient to meet their needs or expectations. Some potential customers may choose not to purchase SVH’s E2W because of the lack of a more widespread charging infrastructure.

| 13 |

SVH has only limited experience servicing its vehicles and their integrated software. If SVH or its partners are unable to adequately service its vehicles, SVH’s business, prospects, financial condition, and results of operations may be materially adversely affected.

Because SVH does not plan to begin large-scale commercial production of the Prana-Grand until 2023, SVH has only limited experience servicing or repairing its vehicles. Servicing electric vehicles is different than servicing vehicles with internal combustion engines and requires specialized skills, including high voltage training and servicing techniques. In addition, SVH plans to partner with certain third parties to perform some of the service on SVH’s vehicles, and there can be no assurance that SVH will be able to enter into acceptable arrangements with any such third-party providers. Further, although such servicing partners may have experience in servicing other electric vehicles, they will initially have no experience in servicing SVH’s vehicles. There can be no assurance that SVH’s service arrangements will adequately address the service requirements of its customers to their satisfaction, or that SVH and its servicing partners will have sufficient resources, experience, or inventory to meet these service requirements in a timely manner as the volume of vehicles SVH delivers increases. This risk is enhanced by SVH’s limited operating history and its limited data regarding its vehicles’ real-world reliability and service requirements. In addition, if SVH is unable to roll out and establish a widespread service network that provides satisfactory customer service, its customer loyalty, brand and reputation could be adversely affected, which in turn could materially adversely affect its sales, results of operations, prospects and financial condition.

SVH’s customer support team may not grow quickly enough as the company expands, which could limit its growth, result in increased costs, and negatively affect SVH’s results of operations.

SVH’s customers will depend on SVH’s customer support team to resolve technical and operational issues relating to the software integrated into its vehicles, a large portion of which SVH has developed in-house. As SVH grows, its customer support team and service network may be required to address a growing number of issues, and SVH may be unable to accommodate short-term increases in customer demand for technical support. SVH also may be unable to modify the future scope and delivery of its technical support to compete with the technical support provided by its competitors. If SVH is unable to successfully address the service requirements of its customers, or if the market perceives that it does not maintain high-quality support, its brand and reputation could be adversely affected, and it may be subject to claims from its customers, which could result in loss of revenue or damages, and its business, results of operations, prospects and financial condition could be materially adversely affected.

Insufficient reserves to cover future warranty or part replacement needs or other vehicle repair requirements, including any potential software upgrades, could materially adversely affect SVH’s business, prospects, financial condition and results of operations.

Since the commencement of commercial production in 2021, SVH has been providing and will continue to provide its manufacturer’s warranty on all vehicles it sells. SVH has been maintaining and will need to continue maintaining reserves to cover part replacement and other vehicle repair needs, including any potential software upgrades. Warranty reserves will include the SVH management team’s best estimate of the projected costs to repair or to replace items under warranty. Such estimates are inherently uncertain, particularly, in light of SVH’s limited operating history and the limited field data available to it, and changes to such estimates based on real-world observations may cause material changes to SVH’s warranty reserves in the future. SVH may become subject to significant and unexpected expenses as well as claims from SVH’s customers, including loss of revenue or damages. There can be no assurances that the warranty reserves will be sufficient to cover all claims. In addition, if future laws or regulations impose additional warranty obligations on SVH that go beyond SVH’s manufacturer’s warranty, SVH may be exposed to higher warranty, parts replacement and repair expenses than it expects, and its reserves may be insufficient to cover such expenses. If SVH’s reserves are inadequate to cover future warranty claims and maintenance requirements, its business, prospects, financial condition, and results of operations could be materially adversely affected.

| 14 |

If SVH’s assembly facilities become inoperable, it will be unable to produce its vehicles within its current and anticipated time and cost structure and its business will be harmed.

SVH’s assembly plans contemplate that its facilities may need to be expanded or new production lines may need to be set up. SVH may not be able to expand its facilities or production lines in a timely and cost-effective manner, or within its budgeted expenditures, which could adversely impact SVH’s sales and profitability. Additionally, if incremental external financing would be required for expansion, such financing may not be obtained on favorable terms, or at all. These risks could be exacerbated because SVH may invest in production and assembly facilities to support its production processes, which differ substantially from ICE vehicle production processes for which expertise is more readily available. SVH will also need to hire and train a significant number of additional employees and integrate a yet-to-be-fully-developed supply chain to scaleup commercial production at its facilities, and SVH may fail to scale up commercial production on schedule. If any of SVH’s assembly facilities do not conform to its requirements, repair or remediation may be required, and SVH could be required to take production offline, delay implementation of its planned growth, construct alternate facilities, outsource manufacturing, or bear substantial additional costs including potentially costly litigation costs. SVH’s insurance policies or other recoveries may not be sufficient to cover all or any of such costs. Any of the foregoing consequences could have a material adverse effect on SVH’s business, prospects, results of operations and financial condition.

SVH must develop complex software and technology systems, including in coordination with vendors and suppliers, to produce its products, and there can be no assurance such systems will be successfully developed.

SVH’s vehicles use and will continue to use a substantial amount of third-party and in-house software and complex technological hardware to operate, some of which is subject to further development and testing. The development and implementation of such advanced technologies is inherently complex, and SVH will need to coordinate with its vendors and suppliers in order to integrate such technology into its products and ensure these technologies interoperate with other complex systems as designed and as expected. SVH may fail to detect defects and errors in the software and technologies, and its control over the performance of third-party services and systems may be limited. Any defects or errors in, or which adversely affect the safety, performance or cost of its products, could result in delayed production and delivery of SVH’s vehicles, damage to SVH’s brand or reputation, increased service and warranty costs and legal action by customers or third parties, including product liability claims, among other things, which could negatively impact the financial results of SVH.

SVH’s facilities or operations could be adversely affected by events outside of its control, such as natural disasters, wars, health epidemics or pandemics, or security incidents.

SVH may be impacted by natural disasters, wars, health epidemics or pandemics, or other events outside of its control. If major disasters such as earthquakes, wildfires, monsoons, floods, or other events occur, or the information system or communications network used by SVH malfunctions, its headquarters and assembly facilities may be seriously damaged, or SVH may have to stop or delay production and shipment of its products. In addition, SVH may in the future be adversely affected as a result of health epidemics or pandemics. Furthermore, SVH could be impacted by physical security incidents at its facilities, which could result in significant damage to such facilities that could require SVH to delay or discontinue production. SVH may incur significant expenses or delays relating to such events outside of its control, which could have a material adverse impact on its business, results of operations and financial condition.

If SVH updates or discontinues the use of its assembly equipment more quickly than expected, it may have to shorten the useful lives of any equipment to be retired as a result of any such update, and the resulting acceleration in SVH’s depreciation or amortization could negatively affect its financial results.

SVH expects to invest significantly in tools, machinery, and other assembly equipment, and SVH will depreciate the cost of such equipment and amortize its investment in intangible assets over their expected useful lives. However, assembly technology and intangible assets evolve rapidly, and SVH may decide to update its assembly processes more quickly than expected. Moreover, as SVH initiates and accelerates the commercial production of its vehicles, SVH’s experience may cause it to discontinue the use of some equipment or discontinue the use of certain intangible assets. The useful life of any assets that would be retired sooner than expected would be shortened, causing the depreciation and amortization on such assets to be accelerated, and SVH’s results of operations could be negatively impacted.

| 15 |

SVH’s vehicles utilize lithium-ion battery cells, which have been observed to catch fire or vent smoke and flame and could negatively affect SVH’s business.

The battery packs within SVH’s vehicles utilize lithium-ion cells. On rare occasions, lithium-ion cells can rapidly release the energy they contain by venting smoke and flames in a manner that can ignite nearby materials. While SVH’s lithium ferro-phosphate (LFP) based packs do not emit flames, and SVH has introduced a new battery design which passively contains a single cell’s release of energy, failure of its vehicles’ battery packs may occur. Any such events or failures of SVH’s vehicles, battery packs or warning systems could subject SVH to lawsuits, product recalls, or redesign efforts. Also, negative public perceptions regarding the suitability of lithium-ion cells for mobility applications or any future incident involving lithium-ion cells, such as a vehicle or other fire, even if such incident does not involve SVH’s vehicles, could seriously harm SVH’s business and reputation. Once SVH scales up manufacturing its vehicles SVH will need to store a significant number of lithium-ion cells at its facilities. Any mishandling of battery cells, safety issues, or fire related to the cells could disrupt its operations and lead to adverse publicity and potentially a safety recall. In addition, any failure to comply with the relevant regulations could result in fines, loss of permits and licenses, or other regulatory consequences. Moreover, any failure of a competitor’s electric vehicle or energy storage product may cause indirect adverse publicity for SVH and its products. All of the foregoing could negatively affect SVH’s brand and harm SVH’s business, prospects, results of operations and financial condition.

Risks Related to Cybersecurity and Data Privacy

Any unauthorized control, manipulation, interruption, or compromise of, or access to, SVH’s products or information technology systems could result in loss of confidence in SVH and its products, fines or other sanctions by regulators, harm SVH’s business and materially adversely affect its financial performance, results of operations or prospects.

SVH’s operations depends upon continued development, maintenance and improvement of its information technology and communication systems, such as systems for product data management, procurement, inventory management, production planning and execution, sales, service and logistics. If these systems or their functionality do not operate as SVH expects them to or conform to any new regulatory requirements, SVH may be required to expend significant resources to make corrections or find alternative sources for performing these functions. The technological complexity of SVH’s products and systems, and any updates to such, may increase the risk of a potential compromise or breach of the measures that SVH or its third-party service providers employ.

If SVH is unable to protect its systems (and the information stored in its systems) from unauthorized access, use, disclosure, disruption, modification, destruction or other breach, such problems or security breaches could have negative consequences for SVH’s business and prospects. This type of breach can lead to losses, fines, penalties, damages, loss of reputation, or liabilities under SVH’s contracts or applicable laws and regulations. There would be additional costs to respond to breach and other unauthorized disclosure including investigations and to remedy such incidents. In addition, SVH may be mandated by laws, regulations or contractual obligations to notify individuals, regulatory authorities and other third parties in the event of a security breach. Such mandatory disclosures are costly, could lead to negative publicity, penalties or fines, litigation and SVH’s customers losing confidence in the effectiveness of SVH’s security measures. SVH may not have adequate insurance coverage to cover losses associated with such breach or incidents, if any. In addition, SVH cannot assure that its existing insurance coverage will continue to be available on acceptable terms or that its insurers will not deny coverage as to any future claim.

Any of the foregoing could materially adversely affect SVH’s business, prospects, results of operations and financial condition.

SVH is subject to evolving laws, regulations, standards, policies, and contractual obligations related to data privacy and security, and any actual or perceived failure to comply with such obligations could harm SVH’s reputation and brand, subject SVH to significant fines and liability, or otherwise adversely affect its business.

In the course of its operations, SVH collects, uses, stores, discloses, transfers, and otherwise processes personal information from its customers, employees, and third parties with whom SVH conducts business, including names, accounts, user IDs and passwords, and payment or transaction related information. Additionally, SVH will use its vehicles’ electronic systems to log information about each vehicle’s use, such as charge time, battery usage, mileage, location and the drivers’ behavior, in order to aid it in vehicle diagnostics, repair and maintenance, as well as to help SVH customize and improve the driving and riding experience. Accordingly, SVH is subject to or affected by a number of Indian and international laws and regulations, as well as contractual obligations and industry standards, that impose certain obligations and restrictions with respect to data privacy and security. These laws, regulations and standards may be interpreted and applied differently over time and from jurisdiction to jurisdiction, and it is possible that they will be interpreted and applied in ways that may have a material adverse impact on SVH’s business, financial condition and results of operations.

| 16 |

Compliance with applicable privacy and data security laws, regulations and standards is a rigorous and time-intensive process, and SVH may be required to put in place additional mechanisms to comply with such, which could cause SVH to incur substantial costs or require SVH to change its business and data practices in a manner adverse to its business.

The global data protection landscape is rapidly evolving, and implementation standards and enforcement practices are likely to remain uncertain for the foreseeable future. SVH may not be able to monitor and react to all developments in a timely manner.

Risks Related to SVH’s Employees and Human Resources

The loss of key personnel or an inability to attract, retain and motivate qualified personnel, particularly in full-scale commercial manufacturing operations, as well as presence of labor and union activities, may impair SVH’s ability to expand its business.

SVH’s success depends upon the continued service and performance of its senior management team and key technical personnel. SVH’s employees, including SVH’s senior management team, are at-will employees, and therefore may terminate employment with SVH at any time with no advance notice. Although SVH retained its management and key personnel in place following the Business Combination, it is possible that SVH could lose some key personnel. The replacement of any members of SVH’s senior management team or other key personnel likely would involve significant time and costs and may significantly delay or prevent the achievement of SVH’s business objectives.

SVH’s future success also depends, in part, on its ability to continue to attract, integrate and retain highly skilled personnel, particularly to engage in full-scale commercial manufacturing operations. This needs to be accomplished quickly in order for SVH to scale-up commercial production and sales. There are various risks and challenges associated with hiring, training, and managing a large workforce, and these risks and challenges may be exacerbated by the short period in which SVH intends to scale up its workforce, as well as increasing competition for skilled personnel, especially in India. Although the area surrounding SVH’s facilities is home to a trained workforce with experience in engineering and manufacturing, this workforce does not have significant experience with electric vehicle manufacturing, and many jobs will require training. Moreover, as SVH seeks to expand across India, such skilled workforce may not be easily available owing to the limited supply of skilled personnel, and such individuals may be subject to non-competition and other agreements that restrict their ability to work for SVH. There can be no guarantee that SVH will be able to attract such individuals. If SVH is unsuccessful in hiring and training a workforce in a timely and cost-effective manner, its business, financial condition and results of operations could be adversely affected.

Additionally, it is common throughout the vehicle manufacturing industry generally, including in India, for many employees at vehicle manufacturing companies to belong to a union, which can result in higher employee costs and increased risk of work stoppages. Moreover, regulations in some jurisdictions mandate employee participation in industrial collective bargaining agreements and work councils with certain consultation rights with respect to the relevant companies’ operations. Although none of SVH’s employees are currently represented by a labor union, in the event SVH’s employees seek to join or form a labor union, SVH could be subject to risks as it engages in and attempts to finalize negotiations with any such union, including potential work slowdowns or stoppages, delays, and increased costs. Furthermore, SVH may be directly or indirectly dependent upon companies with unionized work forces, such as parts suppliers and trucking and freight companies, and work stoppages or strikes organized by such unions could have a material adverse impact on SVH’s business, financial condition, or results of operations.

| 17 |

SVH is highly dependent on certain key employees.

SVH is highly dependent on the services of certain key employees. If its key employees were to discontinue their service to SVH due to death, disability, or any other reason, SVH would be significantly disadvantaged.

Misconduct by SVH’s employees and independent contractors during and before their employment with SVH could expose SVH to potentially significant legal liabilities, reputational harm and/or other damages to its business.

Many of SVH’s employees play critical roles in ensuring the safety and reliability of its vehicles and/or its compliance with relevant laws and regulations. Certain SVH employees have access to sensitive information and/or proprietary technologies and know-how. While SVH has adopted codes of conduct for all its employees and implemented detailed policies and procedures relating to intellectual property, proprietary information, and trade secrets, SVH cannot assure you that its employees will always abide by these codes, policies, and procedures nor that the precautions SVH takes to detect and prevent employee misconduct will always be effective. If any of SVH’s employees engage in any misconduct, illegal or suspicious activities, including but not limited to misappropriation or leakage of sensitive customer information or proprietary information, SVH and such employees could be subject to legal claims and liabilities and SVH’s reputation and business could be adversely affected as a result. Such negative impacts can include, without limitation, the imposition of civil, criminal and administrative penalties, damages, monetary fines, disgorgement, integrity oversight and reporting obligations to resolve allegations of non-compliance, imprisonment, other sanctions, contractual damages, reputational harm, diminished profits and future earnings and curtailment of SVH’s operations, any of which could adversely affect its business, prospects, financial condition and results of operations.

Risks Related to Litigation and Regulation

SVH is subject to laws and regulations that could impose substantial costs, legal prohibitions, or unfavorable changes upon its operations or products, and any failure to comply with these laws and regulations, including as they evolve, could substantially harm its business and results of operations.

SVH is and will be subject to environmental, manufacturing, and health and safety laws and regulations at numerous jurisdictional levels, including laws relating to the use, handling, storage, recycling, disposal and human exposure to hazardous materials and with respect to constructing, expanding and maintaining its facilities. Any violations of these laws may result in substantial fines and penalties, remediation costs, third party damages, or a suspension or cessation of SVH’s operations. The costs of compliance, including remediating contamination, if any, is found on SVH’s properties, or any related changes to SVH’s operations, may be significant. SVH may also face unexpected delays in obtaining permits and approvals required by such laws in connection with its manufacturing facilities, which would hinder its ability to commence or continue its commercial manufacturing operations. Such costs and delays may adversely impact SVH’s business prospects and results of operations.

In addition, motor vehicles are subject to regulation under international, federal, state and local laws. SVH has incurred, and expects to continue to incur, significant costs in complying with these regulations. Any failures to comply could result in significant expenses, delays, fines, or other sanctions. These laws, regulations and standards are further subject to change from time to time, and SVH may be subject to amended or additional regulations that would increase the effort and expense of compliance.

SVH also expects to become subject to laws and regulations applicable to the supply, manufacture, import, sale, and service of E2W, including in those countries and markets it intends to enter in the future. Compliance with such regulations will require additional time, effort and expense to ensure regulatory compliance in those countries. There can be no assurance that SVH will be able to achieve foreign regulatory compliance in a timely manner and at its expected cost, or at all, and the costs of achieving international regulatory compliance or the failure to achieve international regulatory compliance could harm SVH’s business, prospects, results of operations and financial condition.

| 18 |

SVH may face regulatory limitations on its ability to sell vehicles, which could materially and adversely affect its ability to sell its vehicles.

SVH’s business plan includes the direct sale of vehicles to retail consumers as well as through its dealers network via a franchise model. SVH may be required to obtain licenses or permits, and take other actions to ensure its distribution model complies with the applicable legal requirements. Because such requirements vary across jurisdictions and evolve over time, SVH’s distribution model must be carefully established, its sales and service processes must be continually monitored, and a competent team needs to be recruited to monitor the compliance efficiently and proactively, which may add to the cost of SVH’s business.

Additionally, in India, dealers works on a “single brand franchise” model are often required under the dealership agreements to sell only vehicles of a particular OEM in the primary market. SVH may find it difficult to sign franchise agreements with such dealers to expand its dealership network. Such limitation could adversely impact SVHs expansion plans across India.

SVH may choose to or be compelled to undertake product recalls or take other actions, which could adversely affect its business, prospects, results of operations, reputation and financial condition.