UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date

of event requiring this shell company report:

Commission

File Number:

(Exact name of Registrant as specified in its charter)

| Not applicable | ||

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

(Address of Principal Executive Offices)

Telephone:

Email: ir@srivarumotors.com

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The Global Market | ||||

| The

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the shell company report: ordinary shares and 10,005,000 warrants.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934. Yes

☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files).

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ☒ | |||

| Emerging growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting over Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued | ☐ | Other ☐ | ||

| by the International Accounting Standards Board |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ☐

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Shell Company Report on Form 20-F (including information incorporated by reference herein, the “Report”) includes statements that express SVH’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results of operations or financial condition and therefore are, or may be deemed to be, “forward looking statements” as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve significant risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements include information about our possible or assumed future results of operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” and variations of such words and similar expressions are intended to identify the forward-looking statements. The risk factors and cautionary language referred to or incorporated by reference in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in our forward-looking statements, including among other things, the items identified in the section entitled “Risk Factors” of the Company’s Amendment No. 3 of the Registration Statement on Form F-4 (333-272717) filed with the Securities and Exchange Commission (the “SEC”) on August 22, 2023 (the “Form F-4”), which are incorporated by reference into this Report.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements contained in this Report, or the documents to which we refer readers in this Report, to reflect any change in our expectations with respect to such statements or any change in events, conditions or circumstances upon which any statement is based.

| 1 |

DEFINED TERMS

In this Report:

“Amended and Restated Warrant Agreement” means the amended and restated warrant agreement entered into by and between SVH and Continental in connection with Closing.

“Business Combination” means the Merger and the other transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means the Agreement and Plan of Merger dated March 13, 2023, as amended from time to time, by and among SRIVARU Holding Limited, Pegasus Merger Sub Inc., and Mobiv Acquisition Corp.

“Business Combination Agreement Parties” means MOBV, SVH, and Merger Sub.

“Business Day” means a day other than a Saturday, Sunday, or other day on which commercial banks in New York (New York), Cayman Islands, Delhi (India) and Gurugram (India) are authorized or required by law to remain closed.

“Cayman Companies Act” means the Companies Act (As Revised) of the Cayman Islands.

“Closing” means the consummation of the Transactions contemplated by the Business Combination Agreement.

“Closing Date” means the date of closing of the Transactions as contemplated by the Business Combination Agreement.

“Companies Act” or “Companies Act 2013” is an act of the parliament of India which regulates incorporation of a company, responsibilities of a company, directors, dissolution of a company, and includes all amendments thereafter.

“Company Board” means the board of directors of the Company.

“Continental” means Continental Stock Transfer & Trust Company.

“Date of Adoption” has the meaning specified under the section titled “Description of SVH Securities.”

“Distributions” has the meaning specified under the section titled “Description of SVH Securities.”

“DGCL” means the General Corporation Law of the State of Delaware.

“DTC” means the Depository Trust Company.

“Exchange” means the series of transactions immediately following the Merger by which certain shareholders of SVM will have a right to transfer one or more shares owned by them in SVM to SVH in exchange for the delivery of SVH Shares or cash payment, subject to the terms and conditions set forth in the exchange agreements.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“ITA” means the Indian Income Tax Act, 1961.

| 2 |

“MAT” means the minimum alternate tax under the Income Tax Act, 1961.

“Merger” means the merger pursuant to the terms of the Business Combination Agreement whereby Merger Sub will merge with and into MOBV, with MOBV surviving the Merger as a wholly owned subsidiary of SVH.

“Merger Sub” means Pegasus Merger Sub Inc., a Delaware corporation..

“MOBV” means Mobiv Acquisition Corp, a Delaware corporation.

“MOBV Board” means the board of directors of MOBV.

“MOBV Public Shares” means the Class A common stock of MOBV, par value $0.000001 per share.

“MOBV Public Warrant” means a warrant entitling the holder to purchase one share of common stock at an exercise price of $11.50 per share.

“MOBV Securities” means, collectively, the MOBV Shares and the MOBV Warrants.

“MOBV Shares” means the shares of Class A common stock, par value $0.000001 per share, and Class B common stock, par value $0.000001 per share, of MOBV, together.

“Nasdaq” means The Nasdaq Stock Market LLC.

“RBI” means the Reserve Bank of India.

“Registration Rights Agreement” means the registration rights agreement contemplated by the Business Combination Agreement, and entered into by SVH, certain SVH shareholders, and the Sponsor dated March 13, 2023, to be effective upon the Closing.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“Subsidiary” means, with respect to any person, any corporation or other organization (including a limited liability company or a partnership), whether incorporated or unincorporated, of which such person directly or indirectly owns or controls a majority of the securities or other interests having by their terms ordinary voting power to elect a majority of the board of directors or others performing similar functions with respect to such corporation or other organization or any organization of which such person or any of its Subsidiaries is, directly or indirectly, a general partner or managing member.

“SVH” or the “Company” means SRIVARU Holding Limited, a Cayman Islands exempted company.

“SVH A&R Articles” means the amended and restated memorandum and articles of association of SVH.

“SVH Shares” means the ordinary shares of SRIVARU Holding Limited, having the conditions and rights set out in the SVH A&R Articles.

“SVH Securities” means, collectively, the SVH Shares and the SVH Warrants.

“SVH Warrants” means the warrants to purchase SVH Shares at a price of $11.50 per SVH Share.

“SVM” means SRIVARU Motors Private Limited, a company incorporated under the laws of India and a majority-owned subsidiary of SVH.

“Transactions” means the series of transactions contemplated by the Business Combination Agreement, including the Merger and the Exchange.

“Transfer Agent” means Continental.

| 3 |

EXPLANATORY NOTE

On March 13, 2023, MOBV, SVH and Merger Sub entered into the Business Combination Agreement, pursuant to which, subject to the terms and conditions set forth therein, several transactions occurred, and in connection therewith, SVH became the ultimate parent company of SVM and MOBV, or the “Business Combination.”

The Business Combination was consummated on December 8, 2023. The transaction was unanimously approved by MOBV’s Board of Directors and was approved at the special meeting of MOBV’s shareholders held on September 28, 2023 or the “MOBV Special Meeting”. As a result of the business combination, MOBV has become a wholly owned subsidiary of SVH. On December 11, 2023, SVH’s Ordinary Shares and Warrants commenced trading on The Nasdaq Stock Market LLC, or “Nasdaq” under the symbols “SVMH” and “SVMHW,” respectively.

Certain amounts that appear in this Report may not sum due to rounding.

| 4 |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

| A. | Directors and Senior Management |

The directors and executive officers of SVH upon the consummation of the Business Combination are set forth in the Form F-4, in the section entitled “Management of SVH Following the Business Combination,” which is incorporated herein by reference. The business address for each of SVH’s directors and executive officers is 2nd Floor, Regatta Office Park, West Bay Road, P.O. Box 10655, Grand Cayman, KY1-1006, Cayman Islands.

| B. | Advisers |

Norton Rose Fulbright US LLP, 1301 Avenue of the Americas, New York, New York 10019, U.S.A. has acted as US counsel for the Company and will continue to act as counsel to the Company upon and following the consummation of the Business Combination. Walkers (Cayman) LLP, 190 Elgin Avenue, George Town, Grand Cayman KY1-9001, Cayman Islands, has acted as Cayman counsel for the Company and will continue to act as counsel to the Company upon and following the consummation of the Business Combination.

| C. | Auditors |

Manohar Chowdhry & Associates acted as SVH’s (and its predecessor, SVM’s) independent auditor for each of the three years in the period ended March 31, 2023, and is expected to continue to act as SVH’s independent auditor after the Business Combination.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| A. | Selected Financial Data |

SVH

Selected financial information regarding SVH is included in the Form F-4 in the sections entitled “SVH’s Selected Historical Financial Information” and is incorporated herein by reference. The financial statements of SVH have been prepared in Indian Rupee.

| B. | Capitalization and Indebtedness |

The following table sets forth the capitalization of SVH on an unaudited pro forma combined basis as of March 31, 2023, after giving effect to the Business Combination.

| As of March 31, 2023 (pro forma for Business Combination) | $ (in thousands) | |||

| Cash and cash equivalents | $ | 3,110 | ||

| Equity | (66,328 | ) | ||

| Debt | 1,158 | |||

| Loans and borrowings (current) | 1,158 | |||

| Loans and borrowings (non-current) | - | |||

| Total debt | 1,1158 | |||

| Total capitalization(2) | (65,170 | ) | ||

| Cash and cash equivalents | $ | 3,110 | ||

| Equity | (66,328 | ) | ||

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

The risk factors associated with SVH are described in the Form F-4 in the section entitled “Risk Factors,” which is incorporated herein by reference.

| 5 |

ITEM 4. INFORMATION ON THE COMPANY

| A. | History and Development of the Company |

SVH is considered a foreign private issuer as defined in Rule 3b-4 under the Exchange Act. SVH was incorporated in the Cayman Islands on June 16, 2021, solely to serve as the holding company for 94.02% of the outstanding equity of SVM. SVH is a holding company with no current operations of its own. SVH has been the consolidating entity for purposes of SVH’s financial statements since the consummation of the Business Combination on December 8, 2023. The history and development of SVH are described in the Form F-4 under the headings “Summary of the Proxy Statements/Prospectus,” “The Business Combination Proposal,” “Information Related to SVH” and “Description of SVH Securities,” which are incorporated herein by reference.

SVH’s registered address is 2nd Floor, Regatta Office Park, West Bay Road, PO BOX 10655, Grand Cayman KY1-1006, Cayman Islands., and its telephone number is +1 (888) 227-8066. SVH’s principal website address is https://srivarumotors.com/. We do not incorporate the information contained on, or accessible through, SVH’s websites into this Report, and you should not consider it a part of this Report. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The SEC’s website is www.sec.gov.

| B. | Business Overview |

Following and as a result of the Business Combination, all of SVH’s business is conducted through its subsidiary, SVM. A description of the business is included in the Form F-4 in the sections entitled “SVH’s Business,” and “SVH Management’s Discussion and Analysis of Financial Condition and Results of Operation,” which are incorporated herein by reference.

| 6 |

| C. | Organizational Structure |

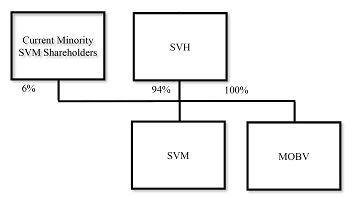

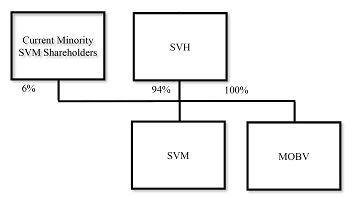

Upon consummation of the Business Combination, MOBV became a wholly owned subsidiary of SVH. The following diagram depicts the simplified organizational structure of SVH as of the date hereof. Percentages refer to voting power of the ordinary shares held by the respective shareholders or shareholder groups.

The significant subsidiaries of SVH are listed below.

| Name | Country of Incorporation and Place of Business Address | Nature of Business | Proportion of Ordinary Shares Held by SVH | |||||||

| SRIVARU MOTORS PRIVATE LIMITED | India | India | Personal Electric Transportation | 94.00 | % | |||||

| Mobiv Acquisition Corp | USA | USA | Holding unit | 100.00 | % | |||||

| D. | Property, Plants and Equipment |

SVH’s property, plants and equipment is held through SVM. Information regarding SVH’s property, plants and equipment is described in the Form F-4 under the headings “SVH’s Business—Facilities,” which information is incorporated herein by reference.

| 7 |

ITEM 4A. UNRESOLVED STAFF COMMENTS

None / Not applicable.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

The discussion and analysis of the financial condition and results of operation of SVH is included in the Form F-4 in the section entitled “SVH Management’s Discussion and Analysis of Financial Condition and Results of Operation,” which information is incorporated herein by reference.

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

| A. | Directors and Senior Management |

The directors and executive officers upon the consummation of the Business Combination are set forth in the Form F-4, in the section entitled “Management of SVH Following the Business Combination,” which is incorporated herein by reference.

| B. | Compensation |

SVH has entered into employment agreements with its Chief Executive Officer and Chief Financial Officer that became effective as of December 8, 2023, the closing date of the business combination with Mobiv Acquisition Corp.

Mohanraj Ramaswamy Employment Agreement

Mr. Ramaswamy’s employment agreement has an initial term extending through March 31, 2026, which will be renewed automatically on an annual basis thereafter unless either party gives 90 days’ notice of termination prior to the end of the term. Pursuant to the employment agreement, Mr. Ramaswamy serves as the Chief Executive Officer of SVH. The employment agreement entitles Mr. Ramaswamy to receive an annual base salary equal to $271,000, an annual target bonus equal to 25% of his base annual salary (currently $67,750) subject to the terms and conditions of the annual bonus plan adopted by the board, and an additional performance bonus of $24 million, payable in ordinary shares of the Company in four tranches of 25% (collectively, the “Additional Bonus Shares”), each of which is payable upon the successful completion of each of the following four milestones: (1) when the Company completes a strategic battery supplier agreement for continued battery supply for the Company’s product lines; (2) when the PRANA Elite is approved by the required government authorities and officially launched into the targeted market; (3) once the ALIVE product is approved by the required government authorities and officially launched into the targeted market; and (4) once the PRANA Class product is approved by the required government authorities and officially launched into the targeted market. The Additional Bonus Shares shall be deemed fully allocated, vested and owned by Mr. Ramaswamy in the event of a termination of his employment for any reason whatsoever.

Under the employment agreement, if the Company terminates Mr. Ramaswamy without “cause” or Mr. Ramaswamy resigns for “good reason” (as each such term is defined in the employment agreement), subject to Mr. Ramaswamy’s execution of a release of claims in favor of the Company, Mr. Ramaswamy will be entitled to receive (i) 12 months’ base salary, (ii) his target annual bonus for the year of termination, and (iii) continued medical coverage paid by the Company for 18 months following such qualifying termination.

Weng Kiat (Adron) Leow Employment Agreement

Mr. Leow’s employment agreement has an initial term extending through March 31, 2026, which will be renewed automatically on an annual basis thereafter unless either party gives 90 days’ notice of termination prior to the end of the term. Pursuant to the employment agreement, Mr. Leow serves as the Chief Financial Officer of SVH. The employment agreement entitles Mr. Leow to receive an annual base salary equal to $216,000, a signing bonus of $24,000, and an annual target bonus equal to 25% of his base annual salary (currently $54,000) subject to the terms and conditions of the annual bonus plan adopted by the board.

Under the employment agreement, if the Company terminates Mr. Leow without “cause” or Mr. Leow resigns for “good reason” (as each such term is defined in the employment agreement), subject to Mr. Leow’s execution of a release of claims in favor of the Company, Mr. Leow will be entitled to receive (i) 12 months’ base salary, (ii) his target annual bonus for the year of termination, and (iii) continued medical coverage paid by the Company for 18 months following such qualifying termination.

Director & Officer Indemnity Agreements

SVH has entered into indemnification agreements with each of its current directors and executive officers, and plans on entering into indemnification agreements with each director that joins the board. Under these agreements, SVH may agree to indemnify its directors against certain liabilities and expenses incurred by such persons in connection with claims made by reason of their being a director of SVH.

Further information pertaining to the compensation of the directors and executive officers of SVH is set forth in the Form F-4, in the sections entitled “Management of SVH Following the Business Combination—Officer and Director Compensation,” and “Management of SVH Following the Business Combination—Compensation Discussion and Analysis,” which are incorporated herein by reference.

| C. | Board Practices |

Information pertaining to the Company’s board practices is set forth in the Form F-4, in the section entitled “Management of SVH Following the Business Combination,” which is incorporated herein by reference.

| D. | Employees |

Information pertaining to SVH’s employees is set forth in the Form F-4, in the section entitled “SVH’s Business—Employees,” which is incorporated herein by reference.

| E. | Share Ownership |

Ownership of the Company’s shares by its directors and executive officers upon consummation of the Business Combination is set forth in Item 7.A of this Report.

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

| A. | Major Shareholders |

The following table sets forth information regarding the beneficial ownership of Ordinary Shares as of the date thereof by:

| ● | each person known by us to be the beneficial owner of more than 5% of Ordinary Shares; |

| ● | each of our directors and executive officers; and |

| ● | all our directors and executive officers as a group. |

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days, provided that any person who acquires any such right with the purpose or effect of changing or influencing the control of the issuer, or in connection with or as a participant in any transaction having such purpose or effect, immediately upon such acquisition shall be deemed to be the beneficial owner of the securities which may be acquired through the exercise of such right. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities.

| 8 |

As of the date hereof, there are 37,236,763 Ordinary Shares issued and outstanding. There are also 10,798,300 Warrants outstanding, each exercisable at $11.50 per 1 SVH Share, of which 10,005,000 are public warrants listed on Nasdaq and 543,300 private placement warrants held by Mobiv Pte. Ltd and 250,000 private warrants issued in connection with the settlement of debt.

Unless otherwise indicated, we believe that all persons named in the table below have sole voting and investment power with respect to all shares of voting shares beneficially owned by them.

Unless otherwise indicated, the business address of each of the individuals from the business address of each of the individuals from SVH is 2nd Floor, Regatta Office Park, West Bay Road, P.O. Box 10655, Grand Cayman, KY1-1006.

| Name and Address of Beneficial Owner | Total common stock | % of Total Voting Power(4) | ||||||

| Mobiv Pte. Ltd.(1) (2) | 3,477,060 | 7.23 | % | |||||

| Peter Bilitsch(2) | 3,477,060 | 7.23 | % | |||||

| Mohanraj Ramasamy | 2,419,795 | 5.03 | % | |||||

| Walleye Capital | 3,144,998 | 6.54 | % | |||||

| Mobiv Srivaru Trust | 11,855,022 | 24.63 | % | |||||

| SVM Trust | 12,020,913 | 24.98 | % | |||||

| ACP | ||||||||

| All 5% Beneficial owners of SVH as a group | 35,517,768 | 73.80 | % | |||||

| Directors and Executive Officers of SVH | ||||||||

| Mohanraj Ramasamy | 2,419,795 | 5.03 | % | |||||

| Weng Kiat (Adron) Leow(3) | 5,000 | * | ||||||

| Ganesh Iyer | — | |||||||

| Mohsen Moazami | — | |||||||

| Jonathan Reichental | — | |||||||

| Lata Gullapalli | — | |||||||

| Peter Bilitsch(2) | 3,477,060 | 7.23 | % | |||||

| All Directors and Executive Officers of SVH as a Group | 5,901,855 | 12.26 | ||||||

| * | Less than 1%. |

| (1) | Mobiv Pte. Ltd., Mobiv’s sponsor, is the record holder of the securities reported herein. Includes 543,300 Placement Units purchased in a private placement that closed simultaneously with the closing of the Initial Public Offering. Post-Business Combination, includes (i) 543,300 Private Shares, (ii) shares issuable upon exercise of 543,300 Private Warrants, (ii) shares issuable upon exercise of 250,000 Private Warrants which are expected to be issued in connection with the conversion of working capital loans related to expenses in conjunction with the Business combination. The business address of each of these entities and individuals is 850 Library Avenue, Suite 204, Newark, Delaware 19711. |

| (2) | Milan Vido Partners Pte. Ltd. owns 100% of Mobiv Pte. Ltd. and Peter Bilitsch, chief executive officer of the company, owns 100% of Milan Vido Partners Pte. Ltd. Includes 543,300 Placement Units purchased in a private placement that closed simultaneously with the closing of MOBV’s initial public offering. Post-Business Combination, includes (i) 543,300 Private Shares, (ii) 543,300 SVH Shares issuable upon exercise of 543,300 Private Warrants, (ii) 250,000 SVH Shares issuable upon exercise of 250,000 Private Warrants which are expected to be issued in connection with the conversion of working capital loans related to expenses in conjunction with the Business Combination. |

| (3) | Mr. Weng Kiat (Adron) Leow is director of our Sponsor, Mobiv Pte. Ltd., and its, holding company, Milan Vido Partners Pte. Ltd. |

| (4) | Excludes Earnout Shares. |

| B. | Related Party Transactions |

Information pertaining to SVH’s related party transactions is set forth in the Form F-4, in the section entitled “Certain Relationships and Related Party Transactions—SVH’s Related Party Transactions,” which is incorporated herein by reference.

| C. | Interests of Experts and Counsel |

None / Not applicable.

| 9 |

ITEM 8. FINANCIAL INFORMATION

| A. | Consolidated Statements and Other Financial Information |

Financial Statements

Consolidated financial statements have been filed as part of this report. See Item 18 “Financial Statements.”

Legal Proceedings

Legal or arbitration proceedings are described in the Form F-4 under the heading “SVH’s Business—Legal Proceedings,” which is incorporated herein by reference.

Dividend Policy

SVH’s policy on dividend distributions is described in the Form F-4 under the heading “Price Range of Securities and Dividends—SVH—Dividend Policy,” which is incorporated herein by reference.

| B. | Significant Changes |

None/ Not applicable.

| 10 |

ITEM 9. THE OFFER AND LISTING

| A. | Offer and Listing Details |

SVH Ordinary Shares and Warrants are listed on the Nasdaq under the symbols “SVMH” and “SVMHW,” respectively. Holders of Ordinary Shares and Warrants should obtain current market quotations for their securities.

| B. | Plan of Distribution |

Not applicable.

| C. | Markets |

SVH Ordinary Shares and Warrants are listed on the Nasdaq under the symbols “SVMH” and “SVMHW,” respectively.

| D. | Selling Shareholders |

Not applicable.

| E. | Dilution |

Not applicable.

| F. | Expenses of the Issue |

Not applicable.

| 11 |

ITEM 10. ADDITIONAL INFORMATION

| A. | Share Capital |

As of the date hereof, subsequent to the closing of the Business Combination, there were 37,236,763 Ordinary Shares outstanding and issued, excluding the Earnout Shares. There are also 10,798,300 Warrants outstanding, each exercisable at $11.50 per 1 SVH Share, of which 10,005,000 are public warrants listed on Nasdaq and 543,300 private placement warrants held by Mobiv Pte. Ltd and 250,000 private warrants issued in connection with the settlement of debt.

| B. | Memorandum and Articles of Association |

The SVH A&R Articles dated as of July 28, 2023 are filed as part of this Report.

The description of the SVH A&R Articles contained in the Form F-4 in the section entitled “Description of SVH Securities” is incorporated herein by reference.

| C. | Material Contracts |

Material Contracts Relating to SVH’s Operations

Information pertaining to SVH’s material contracts is set forth in the Form F-4, in the section entitled “Description of SVH’s Material Indebtedness” and “Certain Relationships and Related Party Transactions,” each of which is incorporated herein by reference.

Material Contracts Relating to the Business Combination

Business Combination Agreement

The description of the Business Combination Agreement in the Form F-4 in the sections entitled “The Business Combination Proposal—The Business Combination Agreement,” which is incorporated herein by reference.

Related Agreements

The description of the material provisions of certain additional agreements entered into or to be entered into pursuant to the Business Combination Agreement in the Form F-4 in the section entitled “The Business Combination Proposal—Related Agreements” is incorporated herein by reference.

| D. | Exchange Controls |

None.

| E. | Taxation |

Information pertaining to tax considerations is set forth in the Form F-4, in the sections entitled “Material Tax Considerations—Material U.S. Federal Income Tax Considerations” which is incorporated herein by reference.

| 12 |

| F. | Dividends and Paying Agents |

Information regarding SVH’s policy on dividends is described in the Form F-4 under the heading “Price Range of Securities and Dividends—SVH—Dividend Policy,” which is incorporated herein by reference. Because SVH does not expect to issue dividends for the foreseeable future, it has not identified a paying agent.

| G. | Statement by Experts |

The consolidated financial statements of SVH as of March 31, 2023 and March 31, 2022, and for each of the two years in the period ended March 31, 2023, included in this Form 20-F, have been audited by Manohar Chowdhry & Associates, independent registered public accounting firm, as set forth in their report appearing elsewhere herein, and are included in reliance upon such report given on the authority of such firm as experts in auditing and accounting.

| H. | Documents on Display |

We are subject to certain of the informational filing requirements of the Exchange Act. Since we are a “foreign private issuer,” we are exempt from the rules and regulations under the Exchange Act prescribing the furnishing and content of proxy statements, and our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions contained in Section 16 of the Exchange Act, with respect to their purchase and sale of our shares. In addition, we are not required to file reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. However, we are required to file with the SEC an Annual Report on Form 20-F containing financial statements audited by an independent accounting firm. We also furnish to the SEC, on Form 6-K, unaudited financial information after each of our first three fiscal quarters. The SEC also maintains a website at http://www.sec.gov that contains reports and other information that we file with or furnish electronically with the SEC. You may read and copy any report or document we file, including the exhibits, at the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room.

| I. | Subsidiary Information |

Not applicable.

| 13 |

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The information set forth in the section entitled “SVH Management’s Discussion and Analysis of Financial Condition and Results of Operation—Quantitative and Qualitative Disclosure about Market Risk” in the Form F-4 is incorporated herein by reference.

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

Warrants

Immediately prior to the Merger Effective Time, SVH, MOBV, and Continental entered into an assignment and assumption agreement pursuant to which MOBV assigned to SVH all of its rights, interests, and obligations in and under the Warrant Agreement, converting the MOBV Warrants as set forth in the Business Combination Agreement and providing that the SVH Warrants issued upon exchange of the MOBV Warrants held by the Sponsor are not redeemable and are exercisable for cash or on a cashless basis, at the holder’s option, so long as they are held by the Sponsor or its permitted transferees.

As of this filing, there are 10,050,000 SVH Warrants outstanding, representing up to 10,050,000 SVM Shares upon exercise. Each SVH Warrant entitles its holder to purchase one SVM Share at an exercise price of $11.50 per share. The SVH Warrants are exercisable until their expiration on December 8, 2028. The exercise price of the SVH Warrants may be adjusted in accordance with their terms.

PART II

Not applicable.

PART III

ITEM 17. FINANCIAL STATEMENTS

Not applicable.

ITEM 18. FINANCIAL STATEMENTS

The financial statements are filed as part of this Report beginning on page F-1.

| 14 |

ITEM 19. EXHIBITS

EXHIBIT INDEX

| 15 |

SIGNATURES

The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this report on its behalf.

| SRIVARU Holding Limited | ||

| December 28, 2023 | By: | /s/ Mohanraj Ramasamy |

| Name: | Mohanraj Ramasamy | |

| Title: | Chief Executive Officer | |

| 16 |

INDEX TO FINANCIAL STATEMENTS

Page No. | |

| SRIVARU HOLDING LIMITED CONSOLIDATED FINANCIAL STATEMENTS | |

| Report

of Independent Registered Public Accounting Firm (PCAOB ID: |

F-2 |

| Consolidated Balance Sheet as of March 31, 2023 | F-3 |

| Consolidated Statements of Operations and Comprehensive Income for the years ended March 31, 2023 and 2022 | F-4 |

| Consolidated Statement of Stockholders’ Equity for the years ended March 31, 2023 and 2022 | F-5 |

| Consolidated statements of Cash Flows for the years ended March 31, 2023 and 2022 | F-6 |

| Notes to Consolidated Financial Statements | F-7 |

| F-1 |

Report of Independent Registered Public Accounting Firm

To the shareholders and the board of directors of Srivaru Holding Limited

Opinion on the Consolidated Financial Statements

We have audited the accompanying Consolidated balance sheets of Srivaru Holding Limited and its subsidiary (the “Company”) as of March 31, 2023 and 2022, the related Consolidated statements of operations and comprehensive Income, stockholders’ equity and Consolidated cash flows, for the each of the two years in the year ended March 31, 2023, and the related notes (collectively referred to as the “ Consolidated financial statements”). In our opinion, the Consolidated financial statements present fairly, in all material respects, the Consolidated financial position of the Company as at March 31, 2023 and 2022, and the Consolidated results of its operations and its cash flows for each of the two years in the year ended March 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These Consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s Consolidated financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audit provides a reasonable basis for our opinion.

Critical Audit Matters

Critical audit matters are matters arising from the current period audit of the consolidated financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the consolidated financial statements and (2) involved our especially challenging, subjective, or complex judgments. We determined that there are no critical audit matters

Chartered Accountants

We are serving as the Company’s auditor for the second year.

May 25, 2023

UDIN: 23228596BHAIDX3742

| F-2 |

Srivaru Holding Limited (Successor)

Srivaru Motors Private Limited (Predecessor)

CONSOLIDATED BALANCE SHEET

(all amounts are in $, except share data)

March 31, 2023 ($) | March 31, 2022 ($) | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | ||||||||

| Marketable securities | ||||||||

| Accounts receivable, net | ||||||||

| Inventory | ||||||||

| Deposits and advances | ||||||||

| Total current assets | ||||||||

| Property, plant and equipment, net | ||||||||

| Non-Marketable securities | ||||||||

| Deferred tax assets | ||||||||

| Operating lease asset | ||||||||

| Total long-term assets | ||||||||

| Total assets | ||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | ||||||||

| Accrued liabilities and others | ||||||||

| Borrowings | ||||||||

| Total current liabilities | ||||||||

| Long-term loans | ||||||||

| Other liabilities | ||||||||

| Operating lease liability | ||||||||

| Total non-current liabilities | ||||||||

| Total liabilities | ||||||||

| Commitments and Contingencies – See Note 11 | ||||||||

| Stockholders’ equity: | ||||||||

| Common stock, $ par value: shares authorised as of March 31, 2023 (March 31, 2022; shares); (March 31, 2022; ) shares issued or outstanding as of March 31, 2023. | ||||||||

| Share Premium | ||||||||

| Profit on Consolidation | ||||||||

| Non Controlling Interest | ( | ) | ||||||

| Other Comprehensive income | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total stockholders’ equity | ( | ) | ||||||

| Total liabilities and stockholders’ equity | ||||||||

The accompanying notes should be read in connection with these consolidated financial statements.

| F-3 |

Srivaru Holding Limited (Successor)

Srivaru Motors Private Limited (Predecessor)

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(all amounts are in $, except share data)

| Successor | Predecessor | |||||||||||

| Year ended March 31, 2023 | Period from June 16, 2021 through March 31, 2022 | Period from April 1, 2021 through June 15, 2021 | ||||||||||

| ($) | ($) | ($) | ||||||||||

| Revenue | ||||||||||||

| Cost of goods Sold | ( | ) | ( | ) | ( | ) | ||||||

| Inventory write-down | ( | ) | ||||||||||

| Total Cost of Revenue | ( | ) | ( | ) | ( | ) | ||||||

| Gross Profit | ( | ) | ||||||||||

| General and administrative expenses | ( | ) | ( | ) | ( | ) | ||||||

| Selling and Distribution expenses | ( | ) | ( | ) | ( | ) | ||||||

| Depreciation and Amortisation | ( | ) | ( | ) | ||||||||

| Operating loss | ( | ) | ( | ) | ( | ) | ||||||

| Other income, net | ||||||||||||

| Finance Expenses | ( | ) | ||||||||||

| Loss before income taxes | ( | ) | ( | ) | ( | ) | ||||||

| Income tax expense/benefit | ( | ) | ( | ) | ||||||||

| Net loss attributable to common stockholders | ( | ) | ( | ) | ( | ) | ||||||

| Loss attributable to Common Stock holders of Parent Company | ( | ) | ( | ) | ( | ) | ||||||

| Loss attributable to minority Stock holders | ( | ) | ( | ) | ( | ) | ||||||

| Loss per share attributable to common stockholders: | ||||||||||||

| Basic & diluted | ||||||||||||

| Weighted-average number of shares used in computing loss per share amounts: | ||||||||||||

The accompanying notes should be read in connection with these Consolidated financial statements.

| F-4 |

Srivaru Holding Limited (Successor)

Srivaru Motors Private Limited (Predecessor)

STATEMENT OF STOCKHOLDERS’ EQUITY

(all amounts are in $, except share data)

| Predecessor | Number of Common Shares | Common Stock | Share Premium | Accumulated Deficit | Capital Reserve | Non- Controlling Interest | Other Comprehensive Income | Total

Stockholders’ | ||||||||||||||||||||||||

| Balances as of April 01, 2021 | ( | ) | ||||||||||||||||||||||||||||||

| Common stock issued during the year | - | |||||||||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | |||||||||||||||||||||||||||

| Exchange gain on translation of Foreign Subsidiaries | - | |||||||||||||||||||||||||||||||

| Balances as of June 15, 2021 | ( | ) | ||||||||||||||||||||||||||||||

Successor | Number of Common Shares | Common Stock | Share Premium | Accumulated Deficit |

Capital Reserve | Non-Controlling Interest | Other Comprehensive Income | Total Stockholders’ Equity | ||||||||||||||||||||||||

| Balances as of June 16, 2021 | ||||||||||||||||||||||||||||||||

| Common stock issued during the year | ||||||||||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Adjustments Pertaining to Business Combination | - | |||||||||||||||||||||||||||||||

| Profit on Consolidation | - | |||||||||||||||||||||||||||||||

| Exchange gain on translation of Foreign Subsidiaries | - | |||||||||||||||||||||||||||||||

| Balances as of March 31, 2022 | ( | ) | ||||||||||||||||||||||||||||||

Number of Common Shares | Common Stock | Share Premium | Accumulated Deficit |

Capital Reserve | Non- Controlling Interest | Other Comprehensive Income | Total Stockholders’ Equity | |||||||||||||||||||||||||

| Balances as of April 01 , 2022 | ( | ) | ||||||||||||||||||||||||||||||

| Common stock issued during the year | ||||||||||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Adjustments Pertaining to Business Combination | - | |||||||||||||||||||||||||||||||

| Profit on Consolidation | - | |||||||||||||||||||||||||||||||

| Exchange gain on translation of Foreign Subsidiaries | - | |||||||||||||||||||||||||||||||

| Balances as of March 31, 2023 | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||

The accompanying notes should be read in connection with these consolidated financial statements.

| F-5 |

Srivaru Holding Limited (Successor)

Srivaru Motors Private Limited (Predecessor)

CONSOLIDATED STATEMENTS OF CASH FLOWS

(all amounts are in $, except share data)

| Successor | Predecessor | |||||||||||

| Year Ended March 31, 2023 | Period from June 16, 2021 through March 31, 2022 | Period from April 1, 2021 through June 15, 2021 | ||||||||||

| ($) | ($) | ($) | ||||||||||

| Cash flows from operating activities: | ||||||||||||

| Net loss | ( | ) | ( | ) | ( | ) | ||||||

| Adjustment to reconcile net loss to net cash: | ||||||||||||

| Depreciation and amortization | ||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Accounts receivables, net | ||||||||||||

| Inventory | ( | ) | ||||||||||

| Deposits and advances | ( | ) | ( | ) | ||||||||

| Claims and advances | ||||||||||||

| Accounts payable | ( | ) | ( | ) | ||||||||

| Accrued and other liabilities | ( | ) | ||||||||||

| Net cash used in operating activities | ( | ) | ( | ) | ( | ) | ||||||

| Cash flow from investing activities: | ||||||||||||

| Net sale/(purchase) of property, plant, and equipment | ( | ) | ( | ) | ( | ) | ||||||

| Investment in/sale of marketable securities/Subsidiaries | ( | ) | ( | ) | ||||||||

| Net cash provided by/ (used in) investing activities | ( | ) | ( | ) | ( | ) | ||||||

| Cash flows from financing activities: | ||||||||||||

| Issuance of equity stock through offering (net of expenses) | ||||||||||||

| Proceeds from/Repayment of borrowings | ||||||||||||

| Net cash provided by financing activities | ||||||||||||

| Effects of exchange rate changes on cash and cash equivalents | ||||||||||||

| Net decrease in cash and cash equivalents | ( | ) | ( | ) | ||||||||

| Cash and cash equivalents at the beginning of the period | ||||||||||||

| Cash and cash equivalents at the end of the period | ||||||||||||

The accompanying notes should be read in connection with these Consolidated Financial Statements

| F-6 |

Srivaru Holding Limited

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

For Fiscal Year Ended March 31, 2023

Unless the context requires otherwise, all references in this report to “SVH,” “we,” “our” and “us” refer to Srivaru Holding Limited.

NOTE 1 – NATURE OF OPERATIONS AND MANAGEMENT’S PLANS

SVH is an investment Company incorporated outside India. The registered office of the Company is at the offices of Amicorp Cayman Fiduciary Limited, 2nd Floor, Regatta office Park, West Bay Road, P.O. Box 10655, Grand Cayman KY1 – 1006, Cayman Islands or at such other place as the Directors may from time to time decide. The Company has invested in one subsidiary, SVM, which is a clean tech electric two-wheeler manufacturer and with the goal to produce the best riding E2W vehicles for personal commuting. SVH believes that there is significant untapped engineering talent in India who are starving for an environmentally-friendly opportunity. While SVH invents, manufactures, and sells E2W vehicles it will create many opportunities at all levels for the people who are truly passionate. SVH wants these engineers to follow their hearts to create something useful for the larger community.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

a) Basis of Preparation

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP).

Business Combination

SVH (“Successor”) was formed as an investment Company incorporated outside India on June 16, 2021. SVH Acquired 94% shares of Srivaru Motors Private Limited (Predecessor or SVM). As a result of this business combination, SVH is the acquirer for accounting purposes and SVM is the acquiree. SVM was deemed the Predecessor (the “Predecessor”) for periods prior to the Business Combination, and does not include the consolidation of the Company.

b) Use of estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the U.S. (U.S. GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Management believes that the estimates and assumptions used in the preparation of the financial statements are prudent and reasonable. Significant estimates and assumptions are generally used for, but not limited to allowance for uncollectible accounts receivable; sales returns; normal loss during production; inventory write-downs; future obligations under employee benefit plans; the useful lives of property, plant, equipment; intangible assets; valuations; impairment of goodwill and investments; recoverability of advances; the valuation of options granted, and warrants issued; and income tax and deferred tax valuation allowances, if any. Actual results could differ from those estimates. Appropriate changes in estimates are made as management becomes aware of changes in circumstances surrounding the estimates. Critical accounting estimates could change from period to period and could have a material impact on SVH’s results, operations, financial position, and cash flows. Changes in estimates are reflected in the financial statements in the period in which changes are made and, if material, their effects are disclosed in the notes to the consolidated financial statements.

c) Revenue recognition

The Company recognizes revenue under ASC 606, Revenue from Contracts with Customers (“ASC 606”). The core principle of this standard is that a company should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services.

ASC 606 prescribes a 5-step process to achieve its core principle. The Company recognizes revenue from trading, rental, or product sales as follows:

| I. | Identify the contract with the customer. | |

| II. | Identify the contractual performance obligations. | |

| III. | Determine the amount of consideration/price for the transaction. | |

| IV. | Allocate the determined amount of consideration/price to the contractual obligations. | |

| V. | Recognize revenue when or as the performing party satisfies performance obligations. |

The consideration/price for the transaction (performance obligation(s)) is determined as per the agreement or invoice (contract) for the services and products in the automobile segment. Refer to Note 14 - “Revenue Recognition.”

| F-7 |

d) Cost of Revenue

Our cost of revenue includes costs associated with labor expense, components, manufacturing overhead, and outbound freight for our products division.

Basic net loss per share attributable to common stockholders is computed by dividing the net loss by the number of weighted-average outstanding common shares. Diluted net loss per share attributable to common stockholders is determined by giving effect to all potential common equivalents during the reporting period, unless including them yields an antidilutive result.

The weighted average number of shares outstanding for the years ended March 31, 2023 and 2022, used for the computation of basic earnings per share (“EPS”) is and respectively.

f) Income taxes

The Company accounts for income taxes under the asset and liability method, in accordance with ASC 740, Income Taxes, which requires an entity to recognize deferred tax liabilities and assets. Deferred tax assets and liabilities are recognized for the future tax consequence attributable to the differences between the financial statement carrying amounts of existing assets and liabilities and their tax bases and operating loss and tax credit carry forwards. Deferred tax assets and liabilities are measured using the enacted tax rate expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that included the enactment date. A valuation allowance is established and recorded when management determines that some or all of the deferred tax assets are not likely to be realized and therefore, it is necessary to reduce deferred tax assets to the amount expected to be realized.

In evaluating a tax position for recognition, management evaluates whether it is more-likely-than-not that a position will be sustained upon examination, including resolution of related appeals or litigation processes, based on technical merits of the position. If the tax position meets the more-likely-than-not recognition threshold, the tax position is measured and recognized in the Company’s financial statements as the largest amount of tax benefit that, in management’s judgment, is greater than 50% likely of being realized upon settlement. As of March 31, 2023, there was no significant liability for income tax associated with unrecognized tax benefits.

g) Accounts receivable

We

make estimates of the collectability of our accounts receivable by analyzing historical payment patterns, customer concentrations, customer

creditworthiness, and current economic trends. If the financial condition of a customer deteriorates, additional allowances may be required.

We had $

h) Cash and cash equivalents

For

financial statement purposes, the Company considers all highly liquid debt instruments with maturity of three months or less, to be cash

equivalents. The Company maintains its cash in bank accounts in India. The cash and cash equivalents in the Company on March 31, 2023

was approximately $

i) Short-term and long-term investments

Our policy for short-term and long-term investments is to establish a high-quality portfolio that preserves principal, meets liquidity needs, avoids inappropriate concentrations, and delivers an appropriate yield in relationship to our investment guidelines and market conditions. Short-term and long-term investments consist of corporate, various government agency and municipal debt securities, as well as certificates of deposit that have maturity dates that are greater than 90 days. Certificates of deposit are carried at cost which approximates fair value. Available-for-sale securities: Investments in debt securities that are classified as available for sale shall be measured subsequently at fair value in the statement of financial position.

| F-8 |

Investments are initially measured at cost, which is the fair value of the consideration given for them, including transaction costs. Where the Company’s ownership interest is in excess of 20% and the Company has a significant influence, the Company has accounted for the investment based on the equity method in accordance with ASC Topic 323, “Investments – Equity method and Joint Ventures.” Under the equity method, the Company’s share of the post-acquisition profits or losses of the equity investee is recognized in the consolidated statements of operations and its share of post-acquisition movements in accumulated other comprehensive income / (loss) is recognized in other comprehensive income / (loss). Where the Company does not have significant influence, the Company has accounted for the investment in accordance with ASC Topic 321, “Investments-Equity Securities.”

As of March 31, 2023, investment in marketable securities is valued at fair value and investment in non-marketable securities with ownership less than 20% is valued at cost as per ASC Topic 321, “Investments-Equity Securities.”

j) Property, plant, and equipment (PP&E)

Property and equipment are recorded at cost net of accumulated depreciation and depreciated over their estimated useful lives using the Written down value method.

Upon retirement or disposition, cost and related accumulated depreciation of the property and equipment are de-recognized, and any gain or loss is reflected in the results of operation. Cost of additions and substantial improvements to property and equipment are capitalized. The cost of maintenance and repairs of the property and equipment are charged to operating expenses as incurred.

k) Fair value of financial instruments

ASC 820, “Fair Value Measurement” defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. It also establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

Level 1: Observable inputs such as quoted prices in active markets;

Level 2: Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level 3: Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

The carrying amounts of the Company’s financial instruments include cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities, approximate their fair values due to the nature of the items. Please refer to Note 15, “Fair value of financial instruments,” for further information.

l) Concentration of credit risk and significant customers

Financial instruments, which potentially expose the Company to concentrations of credit risk, are primarily comprised of cash and cash equivalents, investments, accounts receivable and unbilled accounts receivable, if any. The Company places its cash, investments in highly rated financial institutions. The Company adheres to a formal investment policy with the primary objective of preservation of principal, which contains credit rating minimums and diversification requirements. Management believes its credit policies reflect normal industry terms and business risk. The Company does not anticipate non-performance by the counterparties and, accordingly, does not require collateral. During Fiscal 2023, sales were spread across customers in India and the credit concentration risk is low.

m) Commitments and contingencies

Liabilities for loss contingencies arising from claims, assessments, litigations, fines and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount of the assessment and/or remediation can be reasonably estimated. We record associated legal fees as incurred. Information regarding our commitments and contingencies is incorporated by reference in Note 11, “Commitments and contingencies” of these financial statements.

| F-9 |

n) Impairment of long – lived assets

The Company reviews its long-lived assets, with finite lives, for impairment whenever events or changes in business circumstances indicate that the carrying amount of assets may not be fully recoverable. Such circumstances include, though are not limited to, significant or sustained declines in revenues or earnings, future anticipated cash flows, business plans and material adverse changes in the economic climate, such as changes in operating environment, competitive information, and impact of changes in government policies. For assets that the Company intends to hold for use, if the total of the expected future undiscounted cash flows produced by the assets or subsidiary company is less than the carrying amount of the assets, a loss is recognized for the difference between the fair value and carrying value of the assets. For assets, the Company intends to dispose of by sale, a loss is recognized for the amount by which the estimated fair value less cost to sell is less than the carrying value of the assets. Fair value is determined based on quoted market prices, if available, or other valuation techniques including discounted future net cash flows. Unlike goodwill, long-lived assets are assessed for impairment only where there are any specific indicators for impairment.

o) Inventory

Inventory is valued at the lower of cost or net realizable value, which is defined as estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation.

Inventory consists of raw materials, finished goods related to manufacture of Electric vehicles. Inventory is primarily accounted for using the weighted average cost method. Primary costs include raw materials, packaging, direct labor, overhead, shipping and the depreciation of manufacturing equipment. Manufacturing overhead and related expenses include salaries, wages, employee benefits, utilities, maintenance, and property taxes.

Electric Vehicles are measured at net realizable value, with changes recognized in profit or loss only when the Vehicle:

| - | has a reliable, readily determinable, and realizable market value; | |

| - | has relatively insignificant and predictable costs of disposal; and | |

| - | is available for immediate delivery. |

Abnormal amounts of idle facility expense, freight, handling costs, scrap, discontinued products and wasted material (spoilage) are expensed in the period they are incurred.

p) Foreign currency translation

the Company operates in India, Cayman Islands and a substantial portion of the Company’s financials are denominated in the Indian Rupee (“INR”). As a result, changes in the relative values of the U.S. Dollar (“USD”), or the INR affect financial statements.

The accompanying financial statements are reported in USD. The INR is the functional currencies for subsidiary of the Company. The translation of the functional currencies into U.S. dollars is performed for assets and liabilities using the exchange rates in effect at the balance sheet date and for revenues and expenses using average exchange rates prevailing during the reporting periods. Adjustments resulting from the translation of functional currency financial statements to reporting currency are accumulated and reported as other comprehensive income/(loss), a separate component of shareholders’ equity.

| Year End Average Rate | Year End Rate | |||||||

| Period | (P&L rate) | (Balance sheet rate) | ||||||

| Year ended March 31, 2023 | INR | | INR | |||||

| Year ended March 31, 2022 | INR | | INR | | ||||

| F-10 |

q) Leases

Lessor Accounting

Under the current ASU guidance, contract consideration will be allocated to its lease components and non-lease components (such as maintenance). For the Company as a lessor, any non-lease components will be accounted for under ASC Topic 606, “Revenue from Contracts with Customers,” unless the Company elects a lessor practical expedient to not separate the non-lease components from the associated lease component. The amendments in ASU 2018-11 also provide lessors with a practical expedient, by class of underlying asset, to not separate non-lease components from the associated lease component and, instead, to account for those components as a single component if the non-lease components otherwise would be accounted for under the new revenue guidance (“Topic 606”). To elect the practical expedient, the timing and pattern of transfer of the lease and non-lease components must be the same and the lease component must meet the criteria to be classified as an operating lease if accounted for separately. If these criteria are met, the single component will be accounted for under either Topic 842 or Topic 606 depending on which component(s) are predominant. The lessor practical expedient to not separate non-lease components from the associated component must be elected for all existing and new leases.

As lessor, the Company expects that post-adoption substantially all existing leases will have no change in the timing of revenue recognition until their expiration or termination. The Company expects to elect the lessor practical expedient to not separate non-lease components such as maintenance from the associated lease for all existing and new leases and to account for the combined component as a single lease component. The timing of revenue recognition is expected to be the same for the majority of the Company’s new leases as compared to similar existing leases; however, certain categories of new leases could have different revenue recognition patterns as compared to similar existing leases.

For leases that are accounted for as operating leases, income is recognized on a straight-line basis over the term of the lease contract. Generally, when a lease is more than 180 days delinquent (where more than three monthly payments are owed), the lease is classified as being on nonaccrual and the Company stops recognizing leasing income on that date. Payments received on leases in nonaccrual status generally reduce the lease receivable. Leases on nonaccrual status remain classified as such until there is sustained payment performance that, in the Company’s judgment, would indicate that all contractual amounts will be collected in full.

Lessee Accounting

The Company adopted ASU 2016-02 effective April 1, 2020 using the modified retrospective approach. The standard establishes a right-of-use model (“ROU”) that requires a lessee to recognize a ROU asset and lease liability on the balance sheet for all leases with a term longer than 12 months. Leases will be classified as finance or operating, with classification affecting the pattern and classification of expense recognition in the income statement. In connection with the adoption, the Company will elect to utilize the modified retrospective presentation whereby the Company will continue to present prior period financial statements and disclosures under ASC Topic 840. In addition, the Company will elect the transition package of three practical expedients permitted within the standard, which eliminates the requirements to reassess prior conclusions about lease identification, lease classification and initial direct costs. Further, the Company will adopt a short-term lease exception policy, permitting us to not apply the recognition requirements of this standard to short-term leases (i.e., leases with terms of 12 months or less), and an accounting policy to account for lease and non-lease components as a single component for certain classes of assets.

Under ASU 2016-02 (Topic 842), lessees are required to recognize the following for all leases (with the exception of short-term leases) on the commencement date: (i) lease liability, which is a lessee’s obligation to make lease payments arising from a lease, measured on a discounted basis; and (ii) right-of-use asset, which is an asset that represents the lessee’s right to use, or control the use of, a specified asset for the lease term.

| F-11 |

At

the commencement date, the Company recognizes the lease liability at the present value of the lease payments not yet paid, discounted

using the interest rate implicit in the lease or, if that rate cannot be readily determined, the Company’s incremental borrowing

rate for the same term as the underlying lease. The right-of-use asset is recognized initially at cost, which primarily comprises the

initial amount of the lease liability, plus any initial direct costs incurred, consisting mainly of brokerage commissions, less any lease

incentives received. All right-of-use assets are reviewed for impairment. There was

The Company categorizes leases at their inception as either operating or finance leases. On certain lease agreements, the Company may receive rent holidays and other incentives. The Company recognizes lease costs on a straight-line basis without regard to deferred payment terms, such as rent holidays, that defer the commencement date of required payments. Please refer to Note 9, “Leases,” for further information.

r) Recently issued and adopted accounting pronouncements

Changes to U.S. GAAP are established by the Financial Accounting Standards Board (“FASB”) in the form of accounting standards updates (“ASUs”) to the FASB’s Accounting Standards Codification. The Company considers the applicability and impact of all ASUs. Accounting standards that have been issued or proposed by FASB that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption. The Company does not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated to its consolidated financial condition, results of operations, cash flows, or disclosures.

NOTE 3 – INVENTORY

As of March 31, 2023 ($) | As of March 31, 2022 ($) | |||||||

| Raw Materials* | ||||||||

| Work in Progress | ||||||||

| Finished Goods | ||||||||

| Total | ||||||||

| * |

NOTE 4 – DEPOSITS AND ADVANCES

As of March 31, 2023 ($) | As of March 31, 2022 ($) | |||||||

| Prepaid expense and other current assets | ||||||||

| Advance to Suppliers | ||||||||

| Advance to employees | ||||||||

| Total | ||||||||

Prepaid

and other current assets include approximately $

| F-12 |

NOTE 5 – PROPERTY, PLANT, AND EQUIPMENT

As of March 31, 2023 ($) | As of March 31, 2022 ($) | |||||||

| Computer & Software & Accessories | ||||||||

| Electrical Fittings | ||||||||

| Furniture & Fittings | ||||||||

| Office Equipment | ||||||||

| Plant & Machinery | ||||||||

| Vehicle | ||||||||

| Total Gross Value | ||||||||

| Less: Accumulated depreciation | ( | ) | ( | ) | ||||

| Total Property, plant and equipment, net | ||||||||

The

depreciation expense in Fiscal 2023 and 2022, amounted to approximately $

NOTE 6 – INVESTMENTS IN MARKETABLE SECURITIES

As of March 31, 2023 ($) | As of March 31, 2022 ($) | |||||||

| Other Bank balances | ||||||||

| Total | ||||||||

| (i) | Other bank balances represent the fixed deposits maintained by the Company with the Banks in India which has maturity of more than 3 months as at the year end. |

NOTE 7 – CLAIMS AND ADVANCES

As of March 31, 2023 ($) | As of March 31, 2022 ($) | |||||||

| Refundable taxes (1) | ||||||||

| Total | ||||||||

| (1) |

NOTE 8 – LEASES

The

Company has short-term leases primarily consisting of spaces with the remaining lease term being less than or equal to

NOTE 9 – ACCRUED LIABILITIES AND OTHERS

As of March 31, 2023 ($) | As of March 31, 2022 ($) | |||||||

| Compensation and other contributions | ||||||||

| Other current liability | ||||||||

| Advance from customers | ||||||||

| Total | ||||||||

Compensation

and other contribution related liabilities consist of accrued salaries to employees. Other current liability also includes $

| F-13 |

NOTE 10 – LOANS AND OTHER LIABILITIES

Short-term loans:

As of March 31, 2023, the Company has the following loans:

| a) | Working

capital loan and overdraft loan facility of USD | |

| b) | Loan from the related Party is taken from the Managing Director of the Company. These loans are unsecured and are repayable on demand. |

NOTE 11 – COMMITMENTS AND CONTINGENCIES

Legal Proceedings

The Company may be involved in legal proceedings, claims and assessments arising in the ordinary course of business. Such matters are subject to many uncertainties, and outcomes are not predictable with assurance. There are no such matters that are deemed material to the financial statements as of March 31, 2023 (March 31, 2022: Nil).

Merger agreement

On March 13, 2023, the Company entered into the Merger Agreement with Mobiv Acquisition Corp (‘MOBV’), and Pegasus Merger Sub Inc., a Delaware corporation (“Merger Sub”). Pursuant to the terms of the Merger Agreement, a business combination between the Company and MOBV will be effected through the merger of Merger Sub with and into the MOBV, with the Company surviving the merger as a wholly owned subsidiary of SVH.

Earnout

Pursuant to the Merger Agreement, certain shareholders of SVH (the “Pre-Closing Company Shareholders”) and certain shareholders of SVM India (as defined below) (the “Other SVM India Stockholders” and together with the Pre-Closing Company Shareholders, the “Earnout Group”) are entitled to receive their Pro Rata Portion (as defined in the Merger Agreement) of up to SVH Shares (the “Earnout Shares”).

Exchange Agreements.

At the Closing, certain shareholders of SRIVARU Motors Private Limited , a private limited company organized under the laws of India and a majority-owned subsidiary of SVH (“SVM India”) will enter into exchange agreements (the “Exchange Agreements”) with SVH, pursuant to which, among other things, such shareholders of SVM India will have a right to transfer one or more of the shares owned by them in SVM India to SVH in exchange for the delivery of SVH Shares or cash payment, subject to the terms and conditions set forth in the Exchange Agreements.

NOTE 12 – FAIR VALUE OF FINANCIAL INSTRUMENTS

As of March 31, 2023, the Company’s marketable securities consist of liquid funds, which have been classified as Level 1 of the fair value hierarchy because they have been valued using quoted prices in active markets. The Company’s cash and cash equivalents have also been classified as Level 1 on the same principle. Financial instruments are classified as current if they are expected to be liquidated within the next twelve months. The Company’s remaining investments have been classified as Level 3 instruments as there is little or no market data. Level 3 investments are valued using cost-method.