UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 29, 2023

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 001-41783

Vestis Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 92-2573927 | ||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) | ||||

500 Colonial Center Parkway, Suite 140, Roswell, Georgia | 30076 | ||||

(Address of Principal Executive Offices) | (Zip Code) | ||||

(470) 226-3655

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, par value $0.01 per share | VSTS | New York Stock Exchange | ||||||

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o | |||||||||||||||||

Non-accelerated filer | x | Smaller reporting company | o | |||||||||||||||||

Emerging growth company | o | |||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262 (b)) by the registered public accounting firm that prepared or issued its audit report. o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of September 29, 2023, the last business day of the registrant’s most recently completed fiscal quarter, there was no established public market for the registrant’s common stock, par value $0.01 per share. The registrant’s common stock began “regular-way” trading on the New York Stock Exchange on October 2, 2023. The registrant had 131,431,959 shares of common stock outstanding as of November 30, 2023.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| Page No. | ||||||||

1

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the securities laws. All statements that reflect our expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, forecasts relating to discussions of future operations and financial performance (including volume growth, pricing, sales and cash flows) and statements regarding our strategy for growth, future product development, regulatory approvals, competitive position and expenditures. These statements include, but are not limited to, statements related to our expectations regarding the performance of our business, our financial results, our operations, our liquidity and capital resources, the conditions in our industry and our growth strategy. In some cases, forward-looking statements can be identified by words such as “believe,” “aim,” “anticipate,” “estimate,” “expect,” “future,” “goal,” “have confidence,” “intend,” “likely,” “look to,” “may,” “outlook,” “project,” “plan,” “seek,” “see,” “should,” “will,” “will be,” “will continue,” “will likely,” and other words and terms of similar meaning or the negative versions of such words. These forward-looking statements are subject to risks and uncertainties that may change at any time, and actual results or outcomes may differ materially from those that we expected. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Although we believe that the expectations reflected in any forward-looking statements we make are based on reasonable assumptions, we can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties.

Such risks and uncertainties include, but are not limited to:

• unfavorable economic conditions including government shutdowns;

• increases in fuel and energy costs;

• the failure to retain current customers, renew existing customer contracts and obtain new customer contracts;

• natural disasters, global calamities, climate change, pandemics, strikes and other adverse incidents;

• competition in our industry;

• increased operating costs and obstacles to cost recovery due to the pricing and cancellation terms of our support services contracts;

• our leverage and ability to meet debt obligations;

• a determination by our customers to reduce their outsourcing or use of preferred vendors;

• risks associated with suppliers from whom our products are sourced;

• challenge of contracts by our customers;

• our expansion strategy and our ability to successfully integrate the businesses we acquire and costs and timing related thereto;

• currency risks and other risks associated with international operations, including compliance with a broad range of laws and regulations, including the United States Foreign Corrupt Practices Act;

• our inability to hire and retain key or sufficient qualified personnel or increases in labor costs;

• continued or further unionization of our workforce;

• liability resulting from our participation in multiemployer-defined benefit pension plans;

• liability associated with noncompliance with applicable law or other governmental regulations;

• laws and governmental regulations including those relating to the environment, wage and hour and government contracting;

• unanticipated changes in tax law;

• new interpretations of or changes in the enforcement of the government regulatory framework;

• a cybersecurity incident or other disruptions in the availability of our computer systems or privacy breaches;

• stakeholder expectations relating to environmental, social and governance (“ESG”) considerations which may

expose us to liabilities and other adverse effects on our business;

• the expected benefits of the Separation (as defined) from Aramark;

• the risk of increased costs from lost synergies due to the Separation;

• retention of existing management team members as a result of the Separation;

• reaction of customers, employees and other parties to the Separation, and the impact of the Separation on our business;

• any failure by Aramark to perform its obligations under the various separation agreements entered into in connection with the Separation;

• a determination by the IRS that the Separation or certain related transactions are taxable.

The above list of factors is not exhaustive or necessarily in order of importance. For additional information on identifying factors that may cause actual results to vary materially from those stated in forward-looking statements, see the discussions

2

under Item 1A "Risk Factors," Item 3 "Legal Proceedings" and Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations" and other sections of this Annual Report on Form 10-K. Any forward-looking statement speaks only as of the date on which it is made, and we assume no obligation to update or revise such statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

Summary of Risk Factors

An investment in Vestis is subject to a number of risks, including risks relating to its business and indebtedness, risks related to Vestis’ Separation from Aramark and risks related to Vestis common stock. Set forth below is a high-level summary of some, but not all, of these risks. Please read the information in the section entitled “Risk Factors” of this information statement for a more thorough description of these and other risks.

Risks Related to Vestis’ Business

•Unfavorable economic conditions have in the past adversely affected, are currently adversely affecting and in the future could adversely affect Vestis’ business, financial condition or results of operations.

•Increases in fuel and energy costs could materially and adversely affect Vestis’ business, financial condition or results of operations.

•Vestis’ failure to retain its current customers, renew its existing customer contracts on comparable terms and obtain new customer contracts could adversely affect Vestis’ business, financial condition or results of operations.

•Natural disasters, global calamities, climate change, political unrest and other adverse incidents beyond Vestis’ control could adversely affect Vestis’ business, financial condition or results of operations.

•Competition in Vestis’ industry could adversely affect Vestis’ business, financial condition or results of operations.

•Vestis may be adversely affected if customers reduce their outsourcing or use of preferred vendors.

•Risks associated with Vestis’ suppliers and service providers could adversely affect Vestis’ business, financial condition or results of operations.

•Vestis’ contracts may be subject to challenge by its customers, which, if determined adversely, could affect Vestis’ business, financial condition or results of operations.

•Vestis’ expansion strategy involves risks.

•Vestis’ international business faces risks that could have an effect on Vestis’ business, financial condition or results of operations.

•Vestis’ business may suffer if it is unable to hire and retain sufficient qualified personnel or if labor costs increase.

•Continued or further unionization may increase Vestis’ costs and work stoppages could damage Vestis’ business.

•If Vestis fails to comply with requirements imposed by applicable law or regulations, it could significantly and adversely affect Vestis’ business, financial condition or results of operations.

•Environmental regulations may subject Vestis to significant liability and limit its ability to grow.

Risks Related to Vestis’ Indebtedness

•Vestis has debt obligations that could adversely affect its business and profitability and its ability to meet other obligations.

•Vestis is subject to interest rate risk.

•If Vestis’ financial performance deteriorates, it may not be able to service its indebtedness.

•Vestis’ debt agreements contain restrictions that limit its flexibility in operating its business.

Risks Related to the Separation

•Vestis has no history of operating as an independent company, and its historical financial information is not necessarily representative of the results that it would have achieved as a separate, publicly traded company and may not be a reliable indicator of its future results.

•Following the Separation, Vestis’ financial profile has changed, and it is a smaller, less diversified company than Aramark prior to the Separation.

•Vestis may not achieve some or all of the expected benefits of the Separation.

•If Vestis is unable to replace the services that Aramark currently provides to Vestis on terms that are at least as favorable to Vestis as the terms on which Aramark is providing such services, Vestis’ business, financial condition or results of operations could be adversely affected.

•Vestis’ accounting and other management systems and resources may not be adequately prepared to meet the financial reporting and other requirements to which Vestis is subject as a standalone publicly traded company following the Separation.

•Following the Separation, Vestis will reposition its brand to remove the Aramark name, which could adversely affect its ability to attract and maintain customers.

3

•There can be no assurance that Vestis will have access to the capital markets on terms acceptable to Vestis.

•As an independent, publicly traded company, Vestis may not enjoy the same benefits that it did as a part of Aramark.

Risks Related to Vestis’ Common Stock and Organizational Documents

•Your percentage of ownership in Vestis may be diluted in the future.

•Vestis cannot guarantee the timing, declaration, amount or payment of dividends on its common stock.

•Anti-takeover provisions could enable Vestis’ Board of Directors to resist a takeover attempt by a third party and limit the power of its stockholders.

4

PART I

Item 1. Business

Overview

Vestis Corporation (“Vestis”, the “Company”, “our”, “we” or “us”) is a leading provider of uniform rentals and workplace supplies across the United States and Canada. We provide uniforms, mats, towels, linens, restroom supplies, first-aid supplies, safety products and other workplace supplies. In fiscal year 2023, we generated revenue of approximately $2.8 billion. We are one of the largest companies operating within the United States and Canada in our industry.

We have over 75 years of experience providing uniforms and workplace supplies and a broad footprint that supports efficient delivery of our services and products to more than 300,000 customer locations across the United States and Canada. Our customer base participates in a wide variety of industries including manufacturing, hospitality, retail, food processing, pharmaceuticals, healthcare and automotive. We serve customers ranging from small, family-owned operations with a single location to large corporations and national franchises with multiple locations.

Our customers value the uniforms and workplace supplies we deliver as our services and products can help them reduce operating costs, enhance brand image, maintain a safe and clean workplace and focus on their core business. We provide a full range of uniform programs, managed restroom supply services and first-aid and safety products, as well as ancillary items such as floor mats, towels and linens. Additionally, we provide garments and contamination control supplies that help customers maintain controlled, cleanroom environments commonly used in the manufacturing of electronics, pharmaceuticals and medical equipment.

Our team consists of approximately 20,000 teammates who operate over 350 sites including laundry plants, satellite plants, distribution centers and manufacturing plants. We leverage our broad footprint and our supply chain, delivery fleet and route logistics capabilities to serve customers on a recurring basis, typically weekly, and primarily through multi-year contracts. In addition, we offer customized uniforms through direct sales agreements, typically for large regional or national companies.

Vestis is led by Kim Scott, President and Chief Executive Officer, Rick Dillon, Executive Vice President and Chief Financial Officer, Angela Kervin, Executive Vice President and Chief Human Resources Officer, Chris Synek, Executive Vice President and Chief Operating Officer and Timothy Donovan, Executive Vice President, Chief Legal Officer and General Counsel. These executives have deep expertise in their respective fields. They were recruited to lead Vestis as a standalone, independent company and are complemented by long-tenured members of management across the company’s commercial and operational functions as well as newly appointed leaders who bring functional expertise, diversity and depth to the Vestis leadership team.

On September 30, 2023 (the "Distribution Date"), Vestis Corporation completed its spin-off from Aramark (the "Spin-Off," or the “Separation”). On October 2, 2023 our common stock began regular-way trading on the New York Stock Exchange (“NYSE”) under the ticker symbol “VSTS”. Our corporate headquarters are in Roswell, Georgia.

Financial Profile

In fiscal year 2023, we generated revenue of approximately $2.8 billion, operating income of $217.9 million, or 7.7% of revenue, and net income of $213.2 million, or 7.5% of revenue. Cash provided from operating activities was $257.0 million. Revenue from our recurring rental business comprised 93% of total revenue, with 7% from direct sales. The contracted and recurring nature of our business provides a meaningful level of predictability to annual revenue. Additionally, the diversity of our customer base and the variety of industries in which our customers participate results in relatively low exposure to discrete industry trends. Our revenue is diversified across numerous sectors and customers operating primarily in manufacturing, hospitality, retail, food processing, automotive and healthcare. These are all sectors where we have decades of expertise. Geographically, 91% of our fiscal year 2023 revenue was from sales in the United States, with the remaining 9% from sales in Canada.

Industry Overview

5

We operate within the uniforms, mats, towels, linens, restroom supplies, first-aid supplies and safety products industry in the United States and Canada. This includes businesses that outsource these services through rental programs or direct purchases, as well as non-programmers (which are businesses that maintain these services in-house).

We believe we are well positioned to take advantage of the various key trends and drivers that are impacting our industry. Demand in this industry is influenced primarily by macro-economic conditions, employment levels, increasing standards for workplace hygiene and safety and an ongoing trend of businesses outsourcing non-core, back-end operations. As noted above, the diversity of our customer base and the variety of industries in which our customers operate results in relatively low exposure to discrete industry trends.

Competition

Our industry is local in nature, fragmented and highly competitive. We believe we are a leading provider within this industry and we compete with national, regional and local providers who vary in size, scale, capabilities and product and service offering. Primary methods of competition include product quality, service quality and price.

Cintas Corporation and UniFirst Corporation are notable competitors of size and we have numerous local and regional competitors. Additionally, many businesses perform certain aspects of our product and service offerings in-house rather than outsourcing them.

Customers

Customers in our industry value the ability of providers to consistently deliver quality products on-time and with a high level of customer service. Additionally, they value trustworthy suppliers who partner with them to resolve workplace challenges that may arise with timely solutions that meet their needs.

We deliver to over 300,000 customer locations across the United States and Canada. We serve customers ranging from small, family-owned operations with a single location to large corporations and national franchises with multiple locations. Our revenue is diversified across our many customers as demonstrated by the revenue generated from our 10 largest customers accounting for less than 10% of total revenue in fiscal year 2023.

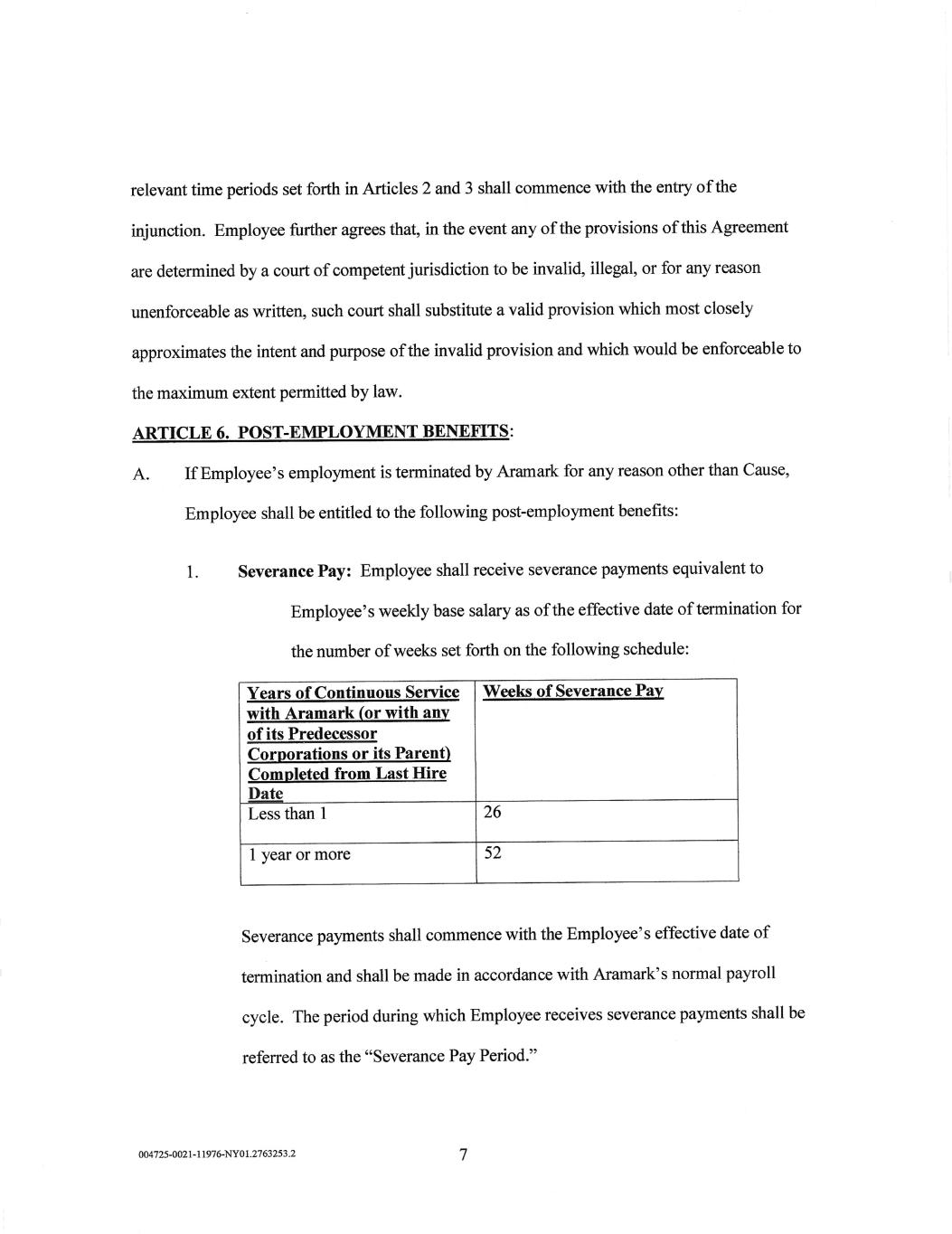

Our customers represent a diverse array of industries including sectors such as manufacturing, hospitality, retail, government, automotive, healthcare and food processing (illustrated in Figure A). The competitive landscape across these sectors for our products and services is highly fragmented and driven primarily by product quality, service quality and pricing of our competitors. We believe our competitive advantages identified below apply to each of the sectors. Across these sectors, we also serve customers who operate cleanrooms, or controlled environments where pollutants like dust, airborne microbes, and aerosol particles are removed to aid in providing clean work environments. Cleanrooms are typically used in the manufacturing of electronics, pharmaceutical products and medical equipment.

The diversity of our customers and the wide variety of industries in which they participate results in the demand for our services and products not being specifically linked to the cyclical nature of any one sector.

The vast majority of our customers are served under multi-year contracts. While customers are not required to make an up-front investment for their rental uniforms or other rented merchandise, a rental customer typically agrees to pay specified exit costs if it terminates its agreement early without cause.

6

__________________

Figure A: Revenue by Sector for fiscal 2023

Our Services and Products

We provide a full-service uniform solution on a contracted and recurring basis. Our full-service uniform offering includes the design, sourcing, manufacturing, customization, personalization, delivery, laundering, sanitization, repair and replacement of uniforms. Our uniform options include shirts, pants, outerwear, gowns, scrubs, high visibility garments, particulate-free garments and flame-resistant garments, along with shoes and accessories. In addition to uniforms, we also provide workplace supplies including managed restroom supply services, first-aid supplies and safety products, floor mats, towels and linens.

We believe our customers value our services and products for a variety of reasons:

•Our full-service programs typically offer a lower-cost solution for customers than if they were serviced in-house, as evidenced by our historical experience and customer feedback, as we leverage our scale and network to achieve procurement and operating efficiencies.

•We enable customers to focus on operating their core businesses as we take care of their needs for clean uniforms, fully stocked restrooms, complete first-aid kits and other workplace supplies.

•We help customers establish corporate identity, foster a sense of team and belonging among employees, project a professional image and enhance brand awareness.

•Our uniforms are reusable and can be assigned to another employee (rather than being discarded) when employees transition to new opportunities.

•We offer a variety of specialty garments that help customers:

◦adhere to applicable regulatory standards;

◦safeguard against contamination in the production or service of items such as food, pharmaceuticals and healthcare products;

◦operate in static-free or low-static environments;

7

◦enhance visibility and safety in work environments including construction, utility services, waste management and public safety; and

◦promote employee safety in workplace environments that involve heavy soils, heat, flame or chemicals in the production process.

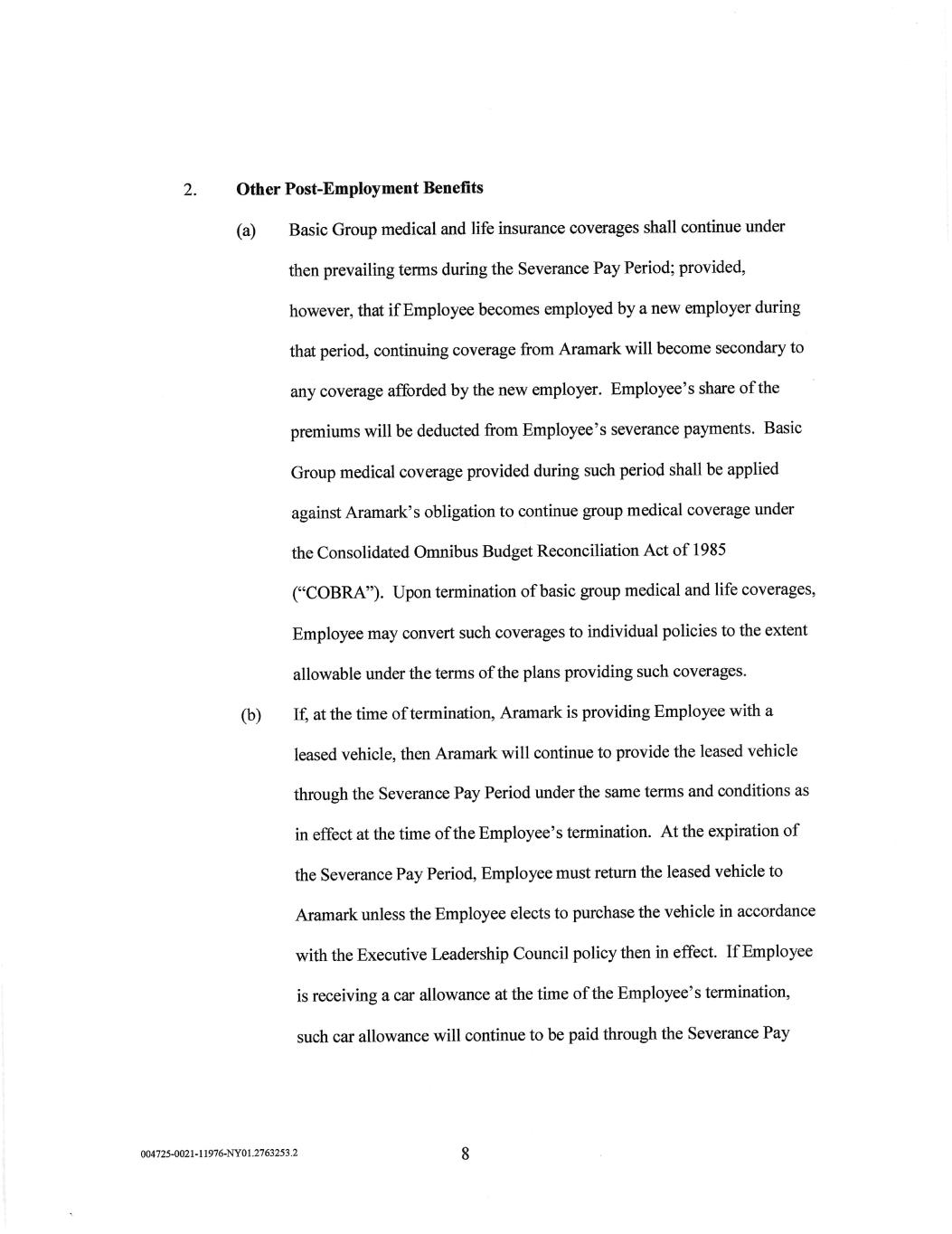

We service our customers on a recurring basis, typically weekly, delivering clean uniforms and, in the same visit, picking up worn uniforms for inspection, cleaning and repair or replacement (illustrated in Figure B). In addition, we pick up used and soiled floor mats, towels and linens and replace them with clean products. We also restock restroom supplies, first-aid supplies and safety products as needed.

__________________

Figure B: Illustrative uniform services weekly process

For our cleanroom customers who operate highly regulated and/or contamination-free processes in the healthcare, pharmaceutical and technology industries, we provide advanced static dissipative garments, sterile garments, barrier apparel and cleanroom application accessories.

We market and sell our services and products through multiple channels including sales representatives, telemarketing sales channels, our delivery drivers (who we refer to as route service representatives), territory managers and digital platforms.

Operations and Supply Chain

We operate a network of over 350 facilities including laundry plants, satellite plants, distribution centers and manufacturing plants along with a fleet of service vehicles that support over 3,400 pick-up and delivery routes. Our services and products are delivered to customers by route service representatives via delivery routes that originate from one of our laundry plants or satellite sites. Approximately 50% of our uniforms and linens are manufactured in our two manufacturing plants in Mexico. Our Mexican operations include approximately 189,000 square feet of manufacturing capacity and a 107,000 square foot distribution facility.

8

__________________

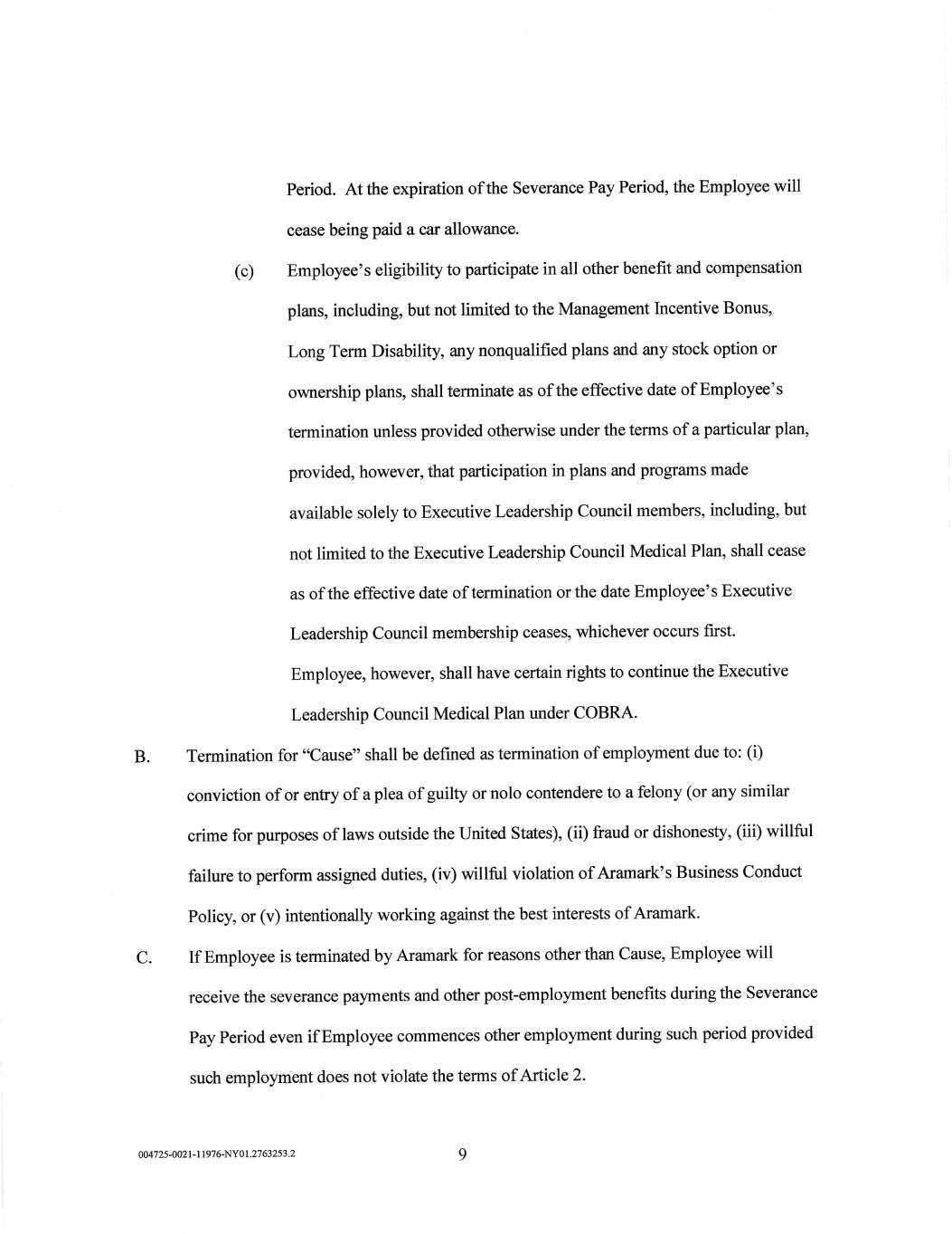

Figure C: U.S. and Canada geographic service footprint

We are committed to operating sustainably with a focus on working to minimize fuel usage on our routes and to minimize energy and water usage in our laundry plant facilities. Additionally, we repair and reuse garments whenever possible to maximize the life cycle of our uniforms and support the circular economy.

We source raw materials as well as finished goods from a variety of domestic and international suppliers. Certain of our raw materials and products are currently limited to a single supplier. We maintain a Corporate Social Compliance Policy and related Vendor Code of Conduct both of which require the international manufacturing of our private label garments to occur under safe, lawful and humane working conditions. To support our Corporate Social Compliance Policy, our international private label garment manufacturers confirm annually their commitment to comply with our Vendor Code of Conduct. Further, the factories used to produce these products are subject to annual third-party social compliance audits.

Our Competitive Advantages

We believe we have significant competitive advantages including our full-service uniform solution offering, size and scale, extensive network footprint, long-tenured customer relationships and experienced leadership team. Given our robust capabilities, scale and talent, we are well positioned to partner with customers for their future needs across a range of services, use cases and business strategies. Some of our key competitive strengths include:

Full-Service Uniforms and Workplace Supplies Offering: We offer a full-service uniform solution including the ability to design, source, manufacture, customize, personalize, deliver, launder, sanitize, mend and replace uniforms on a regular and recurring basis. Our uniform offerings include shirts, pants, outerwear, gowns, scrubs, high visibility garments and flame-resistant garments, along with shoes and accessories. In addition to uniforms, we also provide workplace supplies including managed restroom supply services, first-aid supplies and safety products, floor mats, towels, linens and other workplace supplies.

Critical Scale in Growing, Fragmented Industry: We believe the market opportunity for our services is

significant and growing. We estimate our total addressable market to be approximately $48 billion as of March 31, 2023. Within the United States and Canada, we are the second largest provider in our industry, based on publicly reported information related to revenue, number of employees and facilities data for each of Cintas, Vestis and Unifirst. We believe our size and scale provide a competitive advantage in purchasing power, route density, operating efficiencies and ability to attract and retain talent as compared to smaller local and regional competitors.

Extensive Network Footprint: We serve over 95% of the largest metropolitan statistical areas in the United States and every province in Canada. Our footprint enables us to serve large, national customers across the United States and Canada.

9

Long-Tenured Customer Relationships: We deliver to over 300,000 customer locations and serve businesses which participate across numerous industries. We maintain long-term relationships with our customers due to the quality of our services and products, our ability to deliver on-time and our ability to provide workplace supplies and services that support our customers’ individual strategies and needs.

A key differentiator in our service model is the relationship between our route service representatives and customers. We work to build relationships and trust through weekly, face-to-face interactions with our customers. Retaining existing customers affords us more opportunities to cross-sell high-value workplace supplies.

Experienced Leadership Team: The Company is led by Kim Scott, President and Chief Executive Officer, Rick Dillon, Executive Vice President and Chief Financial Officer, and Chris Synek, Executive Vice President and Chief Operating Officer. These executives have deep experience in their respective areas. They were hired to lead the Company as a standalone, independent company and are complemented by seasoned industry executives across the Company’s commercial and operational functions as well as newly appointed leaders who bring functional expertise, diversity and depth to the Company’s leadership team.

Ms. Scott has deep and relevant expertise with recurring revenue models having led and operated multiple businesses of this nature over the past 16 years. She also has extensive experience in logistics, route-based distribution and complex rental or subscription-based programs, including in her role as Chief Operating Officer of Terminix. Additionally, she has a broad operating background that includes plant management, logistics, procurement, engineering, acquisitions and large-scale integrations. She joined Aramark in October 2021 as President and CEO of Aramark Uniform Services to develop and launch an accelerated growth and value creation strategy for the company, while also preparing the Company to be a standalone, independent public company.

Mr. Dillon is a seasoned public company executive with more than 20 years of experience in finance leadership roles. Prior to joining Aramark, Mr. Dillon served as the Chief Financial Officer and Executive Vice President of two publicly traded companies, Enerpac Tool Group and Century Aluminum. He joined Aramark in May 2022 to serve as Chief Financial Officer of Aramark Uniform Services and to prepare the Company to be a standalone, independent public company.

Mr. Synek has extensive expertise in leadership roles in related recurring revenue model businesses. Previously, Mr. Synek served as Chief Executive Officer of Neovia Logistics, and President, Transportation North America for XPO Logistics, Inc. Additionally, Mr. Synek spent the first 16 years of his career developing uniform, laundry and workplace services experience at Cintas Corporation, eventually moving on to increasing roles of responsibility at Allied Waste Industries and Republic Services and Tervita Corporation. He joined Aramark in September 2023 to serve as Chief Operating Officer of Aramark Uniform Services.

Our executive leaders foster a culture of investing in our people, supporting their growth and development, instilling a sense of higher purpose, winning through teamwork with integrity and creating a safe environment for all. In addition, our commitment to diversity, equity and inclusion continues to shape our teammate engagement and recruiting efforts.

Value Creation Strategy

As an independent company, we are focused on the development, growth and expansion of our business, with increased flexibility to pursue independent strategic and financial plans, adapt quickly to the changing needs of our customers and sector dynamics, effectively allocate capital to invest in growth areas and accelerate decision-making processes. We are focused on long-term opportunities to make deliveries in our service network more effective, which we expect will drive revenue growth and margin expansion. Our new independence will enable sharper focus on our customers, which we believe will also enhance our competitive positioning and performance.

Our strategy is focused on creating shareholder value through high-quality and profitable revenue growth that is underpinned by efficient operations and a performance-driven culture. We are pursuing the following key strategies to drive value creation and grow our business:

10

High-Quality Revenue Growth

Going forward, our strategy will continue to focus on retaining customers, with an increased emphasis on increasing revenue per stop through cross-selling, investing in attractive sectors, margin accretive products and service offerings and adding new customers on existing routes to increase our route density. We believe that, by focusing on these areas, we will achieve higher growth rates with more attractive margin profiles.

Customer Retention: We serve an attractive, large and long-tenured customer base with services and products that generate recurring revenue streams that typically allow more predictability of revenue than non-recurring revenue business models. We continue to remain focused on retaining these customers, including by ensuring we are delivering new value through new or updated services and products. We will remain focused on modernizing the customer experience to make it easier for our customers to continue to do business with us. This includes investments in new technology, such as sophisticated, digital customer portals, as well as investments in our customer service process to enhance our route check-in process and predictive analytics that help us better anticipate customer service opportunities.

Increasing Revenue Per Stop Through Cross-Selling to Leverage Fixed Costs: On average, our current customers take advantage of approximately 30% to 40% of our full line of services and products. We believe there is a significant opportunity to increase our wallet share with our existing customers through cross-selling additional services and products, including compelling adjacent services such as first aid and managed restroom services. This is expected to result in high-margin growth with existing customers by increasing revenue per stop and leveraging our existing delivery costs. We have invested in tools to support our trusted and tenured route service representative teammates and we are incentivizing them to pursue these opportunities with our existing customer base.

Targeting Attractive Sectors, Services and Products: We are implementing more targeted sales strategies to drive growth across high-value sectors, services and products. Using enhanced data analytics and insights will enable us to focus on customer wins that improve our revenue mix.

Increasing Route Density: We are establishing route density metrics to target sales along existing customer routes. We will focus on implementing analytical and geographical prospecting tools that will aid and reward our sales representatives for delivering growth that increases route density and lowers our overall cost to serve per route.

Efficient Operations

Our operations currently include significant cost inputs in areas such as labor, merchandise in service costs, plant operating costs and service-related costs. We are working to instill a continuous improvement mindset in our teammates by instituting disciplined, financial metrics and reporting, key performance indicator monitoring and strengthening our leadership in key functional areas such as supply chain, logistics and plant operations.

In our collaboration with new function leaders, we have identified key areas of opportunity to reduce our operating costs and expand margins across our business:

Network Optimization: A comprehensive analysis of our plant network and customer flows (route movements from plant to customer) has revealed a significant opportunity throughout our network to lower our cost to serve. Further, we have identified a portfolio of initiatives related to routing and scheduling efficiencies and transport and logistics improvements. We believe we can deliver margin expansion through this flow optimization.

Workforce Management: We are working to reduce our labor costs by decreasing frontline turnover to improve plant productivity, reducing general and administrative costs and improving plant operations.

Merchandise Inventory Management: We are focused on lowering merchandise in service costs across our system in order to improve the profitability of new and existing business. Examples include delivering higher levels of garment and product reuse to reduce the issuance of new products and supply chain procurement strategies to reduce purchasing costs.

Performance-Driven Culture

Fostering a performance-driven culture is essential to the delivery of high-quality revenue growth and margin expansion. We are focused on further strengthening our capabilities and enhancing competencies in functional areas that

11

are core to the delivery of our strategy such as sales and marketing, pricing, procurement, logistics, technology, talent acquisition and retention and plant operations. We have invested across these areas over the past year and will continue to strengthen these teams to support our strategy. We will make decisions that are informed by data and implement performance measurements and incentives that are aligned with the achievement of our strategic objectives.

Human Capital Resources

Our success begins with our people, and ensuring a safe workplace is our first priority. Investing in, developing and caring for our teammates is paramount to retaining our teammates. We believe serving our teammates in this manner significantly improves our ability to serve and retain customers, accelerate profitable growth and enhance productivity. This requires an unwavering commitment to safety, diversity and inclusion, professional growth opportunities and competitive total compensation and benefits that meet the needs of our teammates and their families.

We have approximately 20,000 teammates, primarily based in the United States, Canada and Mexico. As of September 29, 2023, approximately 10,500 of our teammates were represented by labor unions. We work to maintain productive working relationships with these unions.

Diversity, Equity and Inclusion. We believe that it is beneficial to align our diversity, equity and inclusion priorities with our business strategy.

As of September 29, 2023, 75% of our Board of Directors is from underrepresented groups, including females who represent 63% of our Board of Directors. Additionally, 80% of our named executive officers are from underrepresented groups including females, who represent 40% of our named executive officers; 67% of our executive officers are from underrepresented groups including females who represent 33% of our executive officers; and 45% of our senior leadership team are from underrepresented groups including females, who represent 32% of our senior leadership team. Continuing to increase diversity in executive and all levels of the leadership pipeline remains an organizational priority for the coming years. We will have multiple employee resource groups; examples include those supporting women, racially and ethnically diverse employees and the LGBTQ+ community.

Talent Acquisition, Development and Retention. Hiring, developing and retaining teammates is critically important to our operations and we are focused on creating experiences and programs that foster growth, performance and retention. We sponsor training and education programs for our teammates, from hourly teammates to upper levels of management, designed to enhance leadership and managerial capability, help ensure quality execution of our programs, drive customer satisfaction and increase return on investment.

Community Engagement. Through Aramark’s legacy, we have a strong culture of community engagement. As we move forward as an independent, standalone company, we will continue to embrace that legacy and build upon it by developing a community engagement program unique to our business that is aligned with our strategy, teammates, the customers we serve and the communities where we operate.

Compensation, Benefits, Safety and Wellness. In addition to offering market competitive salaries and wages, we offer comprehensive health and retirement benefits to our teammates. Our core health and welfare benefits are supplemented with specific programs to manage or improve common health conditions and include a variety of voluntary benefits and paid time away from work programs. We also provide programs designed to promote physical, emotional and financial well-being.

Government Regulation

Our business is subject to various federal, state, international, national, provincial and local laws and regulations, in areas such as environmental, labor, employment, immigration, privacy and data security, tax, transportation, health and safety, antitrust, anti-corruption, import/export, consumer protection, false claims and lobby and procurement laws. In addition, our facilities are subject to periodic inspection by federal, state, provincial, local and international authorities. We have various controls and procedures designed to maintain compliance with applicable laws and regulations. Our compliance requirements are subject to legislative changes, or changes in regulatory interpretation, implementation or enforcement. If we fail to comply with applicable laws, we may be subject to investigations, criminal sanctions or civil remedies, including fines, penalties, damages, reimbursement, injunctions, seizures, disgorgements or debarments from government contracts.

12

Our business is subject to various environmental protection laws and regulations, including the United States Federal Clean Water Act, Clean Air Act, Resource Conservation and Recovery Act, Comprehensive Environmental Response, Compensation, and Liability Act and similar local, provincial, state, federal and international laws and regulations governing the use, treatment, management, transportation, and disposal of wastes and hazardous materials.

We use and manage chemicals and hazardous materials as part of our operations. We are mindful of the environmental concerns surrounding the use, treatment, management, transportation and disposal of these chemicals and hazardous materials, and have taken and continue to take measures to comply with environmental protection laws and regulations. In particular, industrial laundries generate wastewater, air emissions and related wastes as part of operations relating to the laundering of garments and other merchandise. Residues removed from soiled garments and other merchandise laundered at our facilities and from detergents and chemicals used in our wash process may be contained in discharges to air and water (through sanitary sewer systems and publicly owned treatment works) and in waste generated by our wastewater treatment systems. Similar to other companies in our industry, our industrial laundries are subject to certain air and water pollution discharge limits, monitoring, permitting and recordkeeping requirements. Wastewater at our laundry facilities is treated as necessary to comply with local discharge requirements and permits prior to discharge to sanitary sewer systems or publicly owned treatment works. We also own or operate a limited number of aboveground and underground storage tank systems at some locations to store petroleum or propane for use in our operations. Certain of these storage tank systems are subject to performance standards, periodic monitoring, and recordkeeping requirements.

Given the regulated nature of some of our operations, we could face penalties and fines for non-compliance. In the past, we have settled, or contributed to the settlement of, actions or claims relating to the management of underground storage tanks and the handling and disposal of chemicals or hazardous materials, either on- or off-site. We may, in the future, be required to expend material amounts to rectify the consequences of any such events. Under environmental laws, we may be liable for the costs of removal or remediation of certain hazardous materials located on or in or migrating from our owned or leased property or located at sites that we operated in the past or to which we have sent waste for off-site disposal, as well as related costs of investigation and property damage. Such laws may impose liability without regard to our fault, knowledge or responsibility for the presence of such hazardous materials. We may not know whether our acquired or leased properties have been operated in compliance with environmental laws and regulations or that our future uses or conditions will not result in the imposition of liability upon us under such laws or expose us to third-party actions such as tort suits. We routinely review and evaluate sites that may require remediation and monitoring. Based on these reviews and various estimates and assumptions, we determine our estimated costs. As of September 29, 2023, we do not anticipate any expenditures for environmental remediation that would have a material effect on our financial condition. While environmental compliance is not a material component of our costs, we invest in equipment, technology and operating expenses, primarily for water treatment and waste removal, on a regular basis in order to comply with environmental laws and regulations, to promote the safety of our teammates, customers, and communities and to enhance the sustainability of our operations.

Intellectual Property

We have patents, trademarks, trade names and licenses that support the operation of our business. Historically, the Aramark brand, including its corporate starperson logo design, and the Aramark word mark have been used to market our business. In connection with the Separation, we will be repositioning our new Vestis brand to better represent our customer value proposition and value creation strategy as an independent, standalone uniform rental and workplace supplies company. We anticipate the repositioning of our brand will occur in stages, over time, and we intend to use trade advertising and targeted digital marketing to promote recognition of our brand.

Environmental, Social and Governance (ESG)

We have been engaged in actively supporting environmental, social and governance (ESG) efforts. Below are key areas of focus the Company has undertaken and intends to continue to pursue:

•We maintain a Corporate Social Compliance Policy and related Vendor Code of Conduct that address the international manufacturing of our private label garments under safe, lawful and humane working conditions. To support our Corporate Social Compliance Policy, our international private label garment manufacturers annually confirm their commitment to comply with our Vendor Code of Conduct, and the factories used to produce these products are subject to annual third-party social compliance audits.

13

•We have made enhancements to our wash chemistry that allow us to conserve electricity, natural gas and water. Our most recent chemical enhancement has provided utility resource reductions with shorter washing machine run times (electricity), reduced water temperatures (natural gas) and fewer rinse cycles (water).

•We focus on the efficient use of fossil fuels to reduce related emissions. We seek to increase route efficiency with technology and processes that reduce travel time, distance and fuel consumption. For example, our new telematics technology allows us to proactively reduce fuel usage by limiting idling through real-time, in-cab driver alerts.

Our Board of Directors and executive leadership are committed to leading a socially responsible organization that supports the health of our planet, cares for our employees, invests in the communities we work in and conducts business in an ethical manner with appropriate governance. Our Board of Directors will oversee our ESG goals and objectives, and will support the implementation of our ESG priorities and commitments.

Available Information

We file annual, quarterly and current reports as well as other information with the Securities and Exchange Commission (“SEC”). These filings are available to the public over the internet at the SEC's website at www.sec.gov. Our principal internet address is www.vestis.com where we make available free of charge our annual, quarterly and current reports, and amendments to those reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The references to our website and the SEC's website are intended to be inactive textual references only and the contents of those websites are not incorporated by reference herein.

Item 1A. Risk Factors.

You should carefully consider the following risks and other information in this Form 10-K in evaluating Vestis and Vestis’s common stock. Any of the following risks and uncertainties could materially adversely affect our business, financial condition or results of operations.

Risks Related to Our Business

Operational Risks

Unfavorable economic conditions have in the past adversely affected, are currently adversely affecting and in the future could adversely affect our business, financial condition or results of operations.

Unfavorable economic conditions may arise during times of national and international economic downturns, or may be attributed to natural disasters, calamities, public health crises, political unrest and global conflicts. Unfavorable economic conditions may also contribute to supply chain disruptions, geopolitical events, global energy shortages, major central bank policy actions including interest rate increases, public health crises or other factors. Unfavorable economic conditions could adversely affect the demand for our products and services. For example, in the early stages of the COVID-19 pandemic, we were negatively affected by reduced employment levels at our customers’ locations and declining levels of business and customer spending. In addition, adverse economic conditions, including increases in labor costs, labor shortages, higher materials and other costs, supply chain disruptions, inflation and other economic factors could increase our costs of selling and providing the products and services we offer, which in turn could have a material adverse impact on our business, financial condition or results of operations. Moreover, the impact of inflation on various areas of our business, including labor and product costs, has recently affected our business, financial condition or results of operations, and we may not be able to mitigate any future impacts of inflation by increases in pricing for our goods and services. We are unable to predict any future trends in the rate of inflation, and if (and to the extent that) we are unable to recover higher costs in the event of future increases in inflation, such increases in inflation could adversely affect our business, financial condition or results of operations.

Conditions or events that adversely affect our current customers or sales prospects may cause such customers or prospects to restrict expenditures, reduce workforces or even to cease to conduct their businesses. Any of these circumstances would have the effect of reducing the number of employees utilizing our uniform services, which could have a material adverse impact on our business, financial condition or results of operations. In addition, financial distress and insolvency experienced by customers, especially larger customers, has in the past made it difficult and in the future could make it difficult for us to collect amounts we are owed and could result in the voiding, termination or modification of

14

existing contracts. For example, in response to the changed circumstances caused by shutdowns earlier in the COVID-19 pandemic, we worked with customers to renegotiate contracts in order to mitigate lost revenues caused by partial or full closure of customer premises. Similarly, financial distress or insolvency, if experienced by our key vendors and service providers such as insurance carriers, could significantly increase our costs.

Increases in fuel and energy costs could materially and adversely affect our business, financial condition or results of operations.

The prices of fuel and energy to run our vehicles, equipment and facilities are volatile and fluctuate based on factors outside of our control. For example, the ongoing conflict between Russia and Ukraine has disrupted supply chains and caused increases in fuel prices. Our operating margins have been and may continue to be impacted by such increased fuel prices. Continuing or additional increases in fuel and energy costs could have a material adverse effect on our business, financial condition or our results of operations.

Our failure to retain our current customers, renew our existing customer contracts on comparable terms and obtain new customer contracts could adversely affect our business, financial condition or results of operations.

Our success depends on our ability to retain our current customers, renew our existing customer contracts and obtain new business on commercially favorable terms. Our ability to do so generally depends on a variety of factors, including the quality, price and responsiveness of our services, as well as our ability to market these services effectively and differentiate ourself from our competitors. In addition, customers are increasingly focused on and requiring us to set targets and meet standards related to environmental sustainability matters, such as greenhouse gas emissions, packaging, waste and wastewater. When we renew existing customer contracts, it is often on terms that are less favorable or less profitable for us than the then-current contract terms. In addition, we typically incur substantial start-up and operating costs and experiences lower profit margin and operating cash flows in connection with the establishment of new business, and in periods with higher rates of new business, we have experienced and expect to continue to experience negative impact to our profit margin and our cash flows. There can be no assurance that we will be able to obtain new business, renew existing customer contracts at the same or higher levels of pricing or that our current customers will not turn to competitors, cease operations, elect to in-source or terminate contracts with us. These risks may be exacerbated by current economic conditions due to, among other things, increased cost pressure at our customers, tight labor markets and heightened competition in a contracted marketplace. The failure to renew a significant number of our existing contracts, including on the same or more favorable terms, could have a material adverse effect on our business, financial condition or results of operations, and the failure to obtain new business could have an adverse impact on our growth and financial results.

Natural disasters, global calamities, climate change, political unrest and other adverse incidents beyond our control could adversely affect our business, financial condition or results of operations.

Natural disasters, including hurricanes and earthquakes, global calamities and political unrest have affected, and in the future could affect, our business, financial condition or results of operations. In the past, due to more geographically isolated natural disasters, such as wildfires in the western United States and hurricanes and extreme cold conditions in the southern United States, we experienced lost and closed customer locations, business disruptions and delays, the loss of inventory and other assets, and asset impairments. The effects of global climate change will likely increase the frequency and severity of such natural disasters and may also impact the availability of water resources, forests or other natural resources.

In addition, political unrest and global conflicts like the ongoing conflict between Russia and Ukraine have disrupted, and in the future may further continue to disrupt, global supply chains and heighten volatility and disruption of global financial markets. While we do not have direct operations within Russia or Ukraine, the conflict involving these nations has heightened the disruption to our supply chain, triggered inflation in our labor costs and may increase our risk of cyberattacks. We do not have direct operations in the Middle East but the recent Israel-Hamas War and escalating tensions in the region may disrupt global markets and impact our supply chain. The impact of these global events on our longer-term operational and financial performance will depend on future developments, our response and governmental response to inflation, and the duration and severity of the conflict in Ukraine and the Middle East. Any terrorist attacks or incidents prompted by political unrest also may adversely affect our revenue and operating results.

15

Competition in our industry could adversely affect our business, financial condition or results of operations.

The uniform apparel and workplace supply services industry is highly competitive. We face competition from major national competitors with significant financial resources. In addition, there are regional and local uniform suppliers whom we believe have strong customer loyalty. The primary areas of competition within the industry are price, design, quality of products and quality of services. While many customers focus primarily on quality of service, uniform rental is also a price-sensitive service and if existing or future competitors seek to gain customers or accounts by reducing prices, we may be required to lower prices, which would reduce our revenue and profits. Our industry competitors are also competitors for acquisitions, which may increase the cost of acquisitions or lower the number of potential targets. The uniform rental business requires investment capital for growth. Failure to maintain capital investment in this business would put us at a competitive disadvantage. In addition, to maintain a cost structure that allows for competitive pricing, it is important for us to source garments and other products internationally. To the extent we are not able to effectively source such products internationally and gain the related cost savings, we may be at a disadvantage in relation to some of our competitors. An increase in competition, from any of the foregoing or other sources, may require us to reduce prices and/or result in reduced profits and loss of market share, which may have a material adverse impact on our business, financial condition and results of operations.

We may be adversely affected if customers reduce their outsourcing or use of preferred vendors.

Our business and growth strategies depend in large part on the continuation of a current trend toward outsourcing services. Customers will outsource if they perceive that outsourcing may provide quality services at a lower overall cost and permit them to focus on their core business activities. We cannot be certain this trend will continue or not be reversed or that customers that have outsourced functions will not decide to perform these functions themselves. Unfavorable developments with respect to either outsourcing or the use of preferred vendors could have a material adverse effect on our business, financial condition and results of operations.

Risks associated with our suppliers and service providers could adversely affect our business, financial condition or results of operations.

The raw materials we use in our business and the finished products we sell are sourced from a variety of domestic and international suppliers. We seek to require our suppliers and service providers to comply with applicable laws and otherwise meet our quality and/or conduct standards. In addition, customer and stakeholder expectations regarding environmental, social and governance consideration for suppliers are evolving. Our ability to find qualified suppliers who meet our standards and to access raw materials and finished products in a timely and efficient manner can be a challenge, especially with respect to suppliers located and goods sourced outside the United States.

Insolvency or business disruption experienced by suppliers could make it difficult for us to source the items we need to run our business. Political and economic stability in the countries in which foreign suppliers are located, the financial stability of suppliers, suppliers’ failure to meet our standards, labor problems experienced by our suppliers, the availability of raw materials and labor to suppliers, cybersecurity issues, currency exchange rates, transport availability and cost, tariffs, inflation and other factors relating to the suppliers and the countries in which they are located are beyond our control. Certain of our raw materials and products are currently and may in the future be limited to a single supplier, and if such a supplier faces any difficulty in supplying the materials or products, we may not be able to find an alternative supplier in a timely manner or at all. Current global supply chain disruptions caused by the current macroeconomic environment, the COVID-19 pandemic and the Russia/Ukraine conflict have resulted, and may continue to result, in delivery delays as well as lower fill rates and higher substitution rates for a wide-range of products. We do not have direct operations in the Middle East but the recent Israel-Hamas War and escalating tensions in the region may disrupt global markets and impact our supply chain. While we have continued to modify our business model in response to the current environment, including proactively managing inflation and global supply chain disruption, through supply chain initiatives and by implementing pricing, including temporary fees, as appropriate, to cover incremental costs, there is no guarantee that we will be able to continue to do so successfully or on comparable terms in the future if supply chain disruptions continue or worsen.

Domestic foreign trade policies, tariffs and other impositions on imported goods, trade sanctions imposed on certain countries, the limitation on the importation of certain types of goods or of goods containing certain materials from other countries and other factors relating to foreign trade are beyond our control. If one of our suppliers were to violate the law, or engage in conduct that results in adverse publicity, our reputation may be harmed simply due to our association with that supplier. Drought, flood, natural disasters and other extreme weather events caused by climate change or other

16

environmental conditions could also result in supply chain disruptions. These and other factors affecting our suppliers and our access to raw materials and finished products could adversely affect our business, financial condition or results of operations.

Our contracts may be subject to challenge by our customers, which, if determined adversely, could affect our business, financial condition or results of operations.

Our business is contract-intensive, and we are party to many contracts with customers. From time to time, our customers may challenge our contract terms or our interpretation of our contract terms. These challenges could result in disputes between us and our customers. The resolution of these disputes in a manner adverse to our interests could negatively affect revenue and operating results. If a large number of our customer arrangements were modified in response to any such matter, the effect could be materially adverse to our business, financial condition or results of operations.

Our expansion strategy involves risks.

We may seek to acquire companies or interests in companies, or enter into joint ventures that complement our business. Our inability to complete acquisitions, integrate acquired companies successfully or enter into joint ventures may render us less competitive. Our ability to engage in acquisitions, joint ventures and related business opportunities may be subject to additional limitations due to the Separation.

At any given time, we may be evaluating one or more acquisitions or engaging in acquisition negotiations. We cannot be sure that we will be able to continue to identify acquisition candidates or joint venture partners on commercially reasonable terms or at all. If we make acquisitions, we also cannot be sure that any benefits anticipated from the acquisitions will actually be realized. Likewise, we cannot be sure we will be able to obtain necessary financing for acquisitions. Such financing could be restricted by the terms of our debt agreements or it could be more expensive than our current debt. The amount of such debt financing for acquisitions could be significant and the terms of such debt instruments could be more restrictive than our current covenants. In addition, our ability to control the planning and operations of our joint ventures and other less than majority-owned affiliates may be subject to numerous restrictions imposed by the joint venture agreements and majority stockholders. Our joint venture partners may also have interests which differ from ours.

The process of integrating acquired operations into our existing operations may result in operating, contract and supply chain difficulties, such as the failure to retain existing customers or attract new customers, maintain relationships with suppliers and other contractual parties, or retain and integrate acquired personnel. In addition, cost savings that we expect to achieve, for example, from the elimination of duplicative expenses and the realization of economies of scale or synergies, may take longer than expected to realize or may ultimately be smaller than we expect. Also, in connection with any acquisition, we could fail to discover liabilities of the acquired company for which we may be responsible as a successor owner or operator in spite of any investigation we make prior to the acquisition, or significant compliance issues which require remediation, resulting in additional unanticipated costs, risk creation and potential reputational harm. In addition, labor laws in certain countries may require us to retain more employees than would otherwise be optimal from entities we acquire. Such integration difficulties may divert significant financial, operational and managerial resources from our existing operations and make it more difficult to achieve our operating and strategic objectives, which could have a material adverse effect on our business, financial condition or results of operations. Similarly, our business depends on effective information technology and financial reporting systems. Delays in or poor execution of the integration of these systems could disrupt our operations and increase costs, and could also potentially adversely impact the effectiveness of our disclosure controls and internal controls over financial reporting.

Possible future acquisitions could also result in additional contingent liabilities and amortization expenses related to intangible assets being incurred, which could have a material adverse effect on our business, financial condition or results of operations. In addition, goodwill and other intangible assets resulting from business combinations represent a significant portion of our assets. If goodwill or other intangible assets were deemed to be impaired, we would need to take a charge to earnings to write down these assets to their fair value.

Our international business faces risks that could have an effect on our business, financial condition or results of operations.

We operate primarily in the United States and Canada. During fiscal 2023, approximately 91% of our revenue was generated in the United States and approximately 9% of our revenue was generated in Canada. In addition, we operate

17

manufacturing plants and a distribution center in Mexico that collectively employ approximately 2,000 personnel as of September 29, 2023. Our international operations are subject to risks that are different from those we face in the United States, including the requirement to comply with changing or conflicting national and local regulatory requirements and laws, as well as cybersecurity, data protection and supply chain laws; potential difficulties in staffing and labor disputes; managing and obtaining support and distribution for local operations; credit risk or financial condition of local customers; potential imposition of restrictions on investments; potentially adverse tax consequences, including imposition or increase of withholding, value-added tax (“VAT”) and other taxes on remittances and other payments by subsidiaries; foreign exchange controls; local political and social conditions; and the ability to comply with the terms of government assistance programs.

The operating results of our international subsidiaries (which are currently primarily in Canada) are translated into U.S. dollars and such results are affected by movements in foreign currencies relative to the U.S. dollar. Recently, the strength of the U.S. dollar has generally increased as compared to other currencies (including the Canadian dollar), which has had, and may continue to have, an adverse effect on our operating results as reported in U.S. dollars.

We own and operate facilities in Mexico. Violence, crime and instability in Mexico may have an adverse effect on our operations. We are not insured against such criminal attacks and there can be no assurance that losses that could result from an attack on our trucks or personnel would not have a material adverse effect on our business, financial condition or results of operations.

We may continue to consider opportunities to develop our business in emerging countries over the long term. Emerging international operations present several additional risks, including greater fluctuation in currencies relative to the U.S. dollar; economic and governmental instability; civil disturbances; volatility in gross domestic production; and nationalization and expropriation of private assets.

There can be no assurance that the foregoing factors will not have a material adverse effect on our international operations or on our consolidated financial condition and results of operations.

Labor-Related Risks

Our business may suffer if we are unable to hire and retain sufficient qualified personnel or if labor costs increase.

We believe much of our future growth and success depends on the continued availability, service and well-being of entry level personnel. We have had and may continue to have difficulty in hiring and retaining qualified personnel, particularly at the entry level. We will continue to have significant requirements to hire such personnel. At times when the United States or other geographic regions experience reduced levels of unemployment or a general scarcity of labor as has been seen in recent periods, there may be a shortage of qualified workers at all levels. Given that our workforce requires large numbers of entry level and skilled workers and managers, a general difficulty finding sufficient employees or mismatches between the labor markets and our skill requirements can compromise our ability in certain areas of our businesses to continue to provide quality service or compete for new business. We are also impacted by the costs and other effects of compliance with U.S. and international regulations affecting our workforce. These regulations are increasingly focused on employment issues, including wage and hour, healthcare, immigration, retirement and other employee benefits and workplace practices. Compliance and claims of non-compliance with these regulations could result in liability and expense to us. Competition for labor has at times resulted in wage increases in the past and future competition could substantially increase our labor costs. Due to the labor-intensive nature of our businesses, a shortage of labor or increases in wage levels in excess of normal levels could have a material adverse effect on our business, financial condition or results of operations.

Continued or further unionization of our workforce may increase our costs and work stoppages could damage our business.

As of September 29, 2023, approximately 10,500 of our employees were represented by labor unions and covered by over 200 collective bargaining agreements with various terms and dates of expiration. There can be no assurance that any current or future issues with our employees will be resolved or that we will not encounter future strikes, work stoppages or other disputes with labor unions or our employees. A work stoppage or other limitations on our operations and facilities for any reason could have an adverse effect on our business, financial condition or results of operations.

The continued or further unionization of our workforce could increase our overall costs and adversely affect our flexibility to run our business in the most efficient manner, to remain competitive and acquire new business. In addition,

18

any significant increase in the number of work stoppages at any of our operations could adversely affect our business, financial condition or results of operations.

We may incur significant liability as a result of our participation in multiemployer-defined benefit pension plans.

A number of our locations operate under collective bargaining agreements. Under some of these agreements, we are obligated to contribute to multiemployer-defined benefit pension plans. As a contributing employer to such plans, should we trigger either a “complete” or “partial” withdrawal, or should the plan experience a “mass” withdrawal, we could be subject to withdrawal liability for our proportionate share of any unfunded, vested benefits which may exist for the particular plan. In addition, if a multiemployer-defined benefit pension plan fails to satisfy the minimum funding standards, we could be liable to increase our contributions to meet minimum funding standards. Also, if another participating employer withdraws from the plan or experiences financial difficulty, including bankruptcy, our obligation could increase. The financial status of a small number of the plans to which we contribute has deteriorated in the recent past and continues to deteriorate. We proactively monitor the financial status of these and the other multiemployer-defined benefit pension plans in which we participate. In addition, any increased funding obligations for underfunded multiemployer-defined benefit pension plans could have an adverse financial impact on us.

Legal, Regulatory, Safety and Security Risks

If we fail to comply with requirements imposed by applicable law or other governmental regulations, we could become subject to lawsuits, investigations and other liabilities and restrictions on our operations that could significantly and adversely affect our business, financial condition or results of operations.

We are subject to governmental regulation at the federal, state, international, national, provincial and local levels in many areas of our business, such as employment laws, wage and hour laws, discrimination laws, immigration laws, human health and safety laws, import and export controls and customs laws, environmental laws, false claims or whistleblower statutes, tax codes, antitrust and competition laws, customer protection statutes, procurement regulations, intellectual property laws, supply chain laws, the Foreign Corrupt Practices Act and anti-corruption laws, lobbying laws, motor carrier safety laws and data privacy and security laws. We are, from time to time, subject to varied and changing rules and regulations at the federal, state, international, national, provincial and local level, including vaccine and testing mandates, capacity limitations and cleaning and sanitation standards, which may in the future impact our operations across customer locations and business sectors.

From time to time, government agencies have conducted reviews and audits of certain of our practices as part of routine inquiries of providers of services under government contracts, or otherwise. Like others in our industry, we also receive requests for information from government agencies in connection with these reviews and audits.

While we attempt to comply with all applicable laws and regulations, there can be no assurance that we are in full compliance with all applicable laws and regulations or interpretations of these laws and regulations at all times or that we will be able to comply with any future laws, regulations or interpretations of these laws and regulations.