As filed with the U.S. Securities and Exchange Commission on July 24, 2024

Registration No. 333-276234

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 3

TO

FORM

F-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

LZ Technology Holdings Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation

of Registrant’s Name into English)

| Cayman Islands | 7371 | Not Applicable | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification No.) |

Unit 311, Floor 3, No. 5999 Wuxing Avenue, Zhili Town, Wuxing District

Huzhou City, Zhejiang province, People’s Republic of China 313000

+86 18605929066

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(800) 221-0102

(Names, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Kevin (Qixiang) Sun, Esq. Bevilacqua PLLC 1050 Connecticut Avenue, NW, Suite 500 Washington, DC 20036 (202) 869-0888 |

Ying Li, Esq. Guillaume de Sampigny, Esq. Hunter Taubman Fischer & Li LLC 950 Third Avenue, 19th Floor New York, NY 10022 (212) 530-2206 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains two prospectuses, as set forth below.

| ● | Public Offering Prospectus. A prospectus to be used for the public offering of our Class B Ordinary Shares (as defined below) through the underwriter named on the cover page of this prospectus, which we refer to as the Public Offering Prospectus. |

| ● | The Resale Prospectus. A prospectus to be used for the resale by the selling shareholder set forth therein (the “Selling Shareholder”) of 10,000,000 Class B Ordinary Shares, which we refer to as the Resale Prospectus. |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| ● | they contain different front and back covers; |

| ● | they contain different Offering sections in the Prospectus Summary; |

| ● | they contain different Use of Proceeds sections; |

| ● | the Capitalization and Dilution sections are deleted from the Resale Prospectus; |

| ● | a Selling Shareholder section is included in the Resale Prospectus; |

| ● | the Underwriting section from the Public Offering Prospectus is deleted from the Resale Prospectus and a Plan of Distribution section is inserted in its place; and |

| ● | the Legal Matters section in the Resale Prospectus deletes the reference to counsel for the underwriters. |

The registrant has included in this registration statement a set of alternate pages after the back cover page of the Public Offering Prospectus, which we refer to as the Alternate Pages, to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the Selling Shareholder.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED JULY 24, 2024

LZ Technology Holdings Limited

10,000,000 Class B Ordinary Shares

This is the initial public offering, on a firm commitment basis, of 10,000,000 Class B ordinary shares, par value $0.000025 per share (the “Class B Ordinary Shares”) of LZ Technology Holdings Limited, a Cayman Islands exempted company with substantially all of its operations in China, through its subsidiary, Lianzhang Portal Network Technology Co., Ltd., a company incorporated on September 10, 2014 in China. Throughout this prospectus, unless the context indicates otherwise, references to “LZ Technology” refer to LZ Technology Holdings Limited, the Cayman Islands holding company, and references to “we,” the “Company” or “our company” are to the combined business of LZ Technology and its consolidated subsidiaries.

We anticipate that the initial public offering price per Class B Ordinary Share will be between $4.00 and $6.00. In addition, 10,000,000 Class B Ordinary Shares will be offered for resale by the Selling Shareholder pursuant to the Resale Prospectus. We will not receive any proceeds from the sale of the Class B Ordinary Shares by the Selling Shareholder.

Our issued and outstanding share capital consists of Class A ordinary shares, par value $0.000025 per share (the “Class A Ordinary Shares”), and Class B Ordinary Shares. Class A Ordinary Shares are entitled to ten (10) votes per share. Class B Ordinary Shares are entitled to one (1) vote per share. Pursuant to the Company’s current memorandum and articles of association, Class A Ordinary Shares are not convertible into Class B Ordinary Shares. The post offering memorandum and articles of association that will become effective and replace the current memorandum and articles of association upon the effectiveness of this registration statement, will make Class A Ordinary Shares convertible at the option of the holder into Class B Ordinary Shares on a 1:1 basis. Class A Ordinary Shares and Class B Ordinary Shares, collectively, are referred to as “Ordinary Shares” in this prospectus.

Prior to this offering, there has been no public market for either our Class A Ordinary Shares or Class B Ordinary Shares. We have applied for listing the Class B Ordinary Shares on the Nasdaq Capital Market under the symbol “LZMH.” We believe that upon the completion of this offering, we will meet the standards for listing the Class B Ordinary Shares on the Nasdaq Capital Market. We cannot guarantee that we will be successful in listing the Class B Ordinary Shares on the Nasdaq Capital Market; however, we will not complete this offering unless the Class B Ordinary Shares are so listed.

We are an “emerging growth company” and a “foreign private issuer” as defined under the U.S. federal securities laws, and, as such, are eligible for reduced public company reporting requirements for this and future filings. As of the date of this prospectus, our founder and Chairman, Mr. Andong Zhang, the beneficial owner of all of our outstanding Class A Ordinary Shares and 65,065,243 Class B Ordinary Shares, held approximately 82.29% of the voting power of our outstanding share capital. Following this offering, taking into consideration the Class B Ordinary Shares expected to be offered hereby, Mr. Andong Zhang will retain controlling voting power in the Company based on having approximately 80.02% (or approximately 79.69% if the underwriters exercise the over-allotment option in full) of all voting rights and we will meet the definition of a “controlled company” under the corporate governance standards for Nasdaq listed companies. As a “controlled company,” we will be eligible to utilize certain exemptions from the corporate governance requirements of the Nasdaq Stock Market although we do not intend to avail ourselves of these exemptions. See “Prospectus Summary—Implications of Being an Emerging Growth Company,” “Prospectus Summary—Implications of Being a Foreign Private Issuer” and “Prospectus Summary—Implications of Being a Controlled Company.”

INVESTORS PURCHASING SECURITIES IN THIS OFFERING ARE PURCHASING SECURITIES OF LZ Technology, A CAYMAN ISLANDS HOLDING COMPANY, RATHER THAN SECURITIES OF LZ Technology’s SUBSIDIARIES THAT CONDUCT SUBSTANTIVE BUSINESS OPERATIONS IN CHINA. This structure involves unique risks to investors aND investors may never hold equity interests in the Chinese operating companies. Chinese regulatory authorities could disallow this structure, which would likely result in a material change in OUR operations and/or a material change in the value of the securities WE are registering for sale, including that it could cause the value of such securities to significantly decline or become worthless. See “Risk Factors—Risks Related to Doing Business in China” beginning on page 21. LZ Technology is not a Chinese operating company but rather a holding company incorporated in the Cayman Islands. Because LZ Technology has no material operations of its own, we conduct all of our operations through the operating entities established in China, or the PRC, primarily Lianzhang Portal Network Technology Co., Ltd. (“Lianzhang Portal”), LZ Technology’s 96.85% owned indirect subsidiary and Lianzhang Portal’s subsidiaries. All of our subsidiaries are controlled by LZ Technology through direct or indirect equity ownership and we do not have a variable interest entities (“VIE”) structure. For a description of our corporate structure, see “Our Corporate History and Structure” beginning on page 8.

You are specifically cautioned that there are significant legal and operational risks associated with having substantially all of our operations in China, including risks related to the legal, political and economic policies of the Chinese government, the relations between China and the United States, and applicable PRC and United States regulations, which risks could result in a material change in our operations and/or cause the value of the Class B Ordinary Shares to significantly decline or become worthless and affect LZ Technology’s ability to offer or continue to offer its securities to investors. Moreover, the Chinese regulatory authorities may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our PRC subsidiaries’ operations at any time. Recent statements by the Chinese regulatory authorities indicate an intent to strengthen oversight and control over offerings conducted overseas and/or foreign investment in China-based issuers, including without limitation, the cybersecurity review and regulatory review requirements for overseas listing by Chinese companies, whether or not through an offshore holding company. The PRC regulatory authorities also initiated a series of actions and statements to regulate business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement.

On February 17, 2023, the China Securities Regulatory Commission (“CSRC”) promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”) and five supporting guidelines (collectively, the “Overseas Listing Rules”), which came into effect on March 31, 2023. We are required to make a filing with the CSRC for this offering under the Trial Measures. We submitted the required filing materials to the CSRC on August 29, 2023, and obtained the final confirmation from the CSRC regarding the completion of the filing process on April 30, 2024. Notwithstanding the foregoing, as of the date of this prospectus, according to our PRC counsel, Beijing Hylands Law Firm, no other relevant PRC laws or regulations in effect require that we obtain permission from any PRC authorities to issue securities to foreign investors, and we have not received any inquiry, notice, warning, sanction, or any regulatory objection to this offering from the CSRC, the CAC, or any other PRC authorities that have jurisdiction over our operations. See “Risk Factors—Risks Related to Doing Business in China” beginning on page 21 of this prospectus for a discussion of these legal and operational risks that should be considered before making a decision to purchase the Class B Ordinary Shares.

Furthermore, as more stringent standards have been imposed by the U.S. Securities and Exchange Commission (the “SEC”) and the Public Company Accounting Oversight Board (the “PCAOB”) recently, LZ Technology’s securities may be prohibited from trading if our auditor cannot be fully inspected. Pursuant to the Holding Foreign Companies Accountable Act (the “HFCA Act”) enacted in 2020, if the auditor of a U.S. listed company’s financial statements is not subject to PCAOB inspections for three consecutive “non-inspection” years, the SEC is required to prohibit the securities of such issuer from being traded on a U.S. national securities exchange, such as NYSE and Nasdaq, or in U.S. over-the-counter markets. On December 23, 2022, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act and amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period for triggering the prohibition on trading. On December 16, 2021, the PCAOB issued its determination that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in China, because of positions taken by authorities in the jurisdiction, and the PCAOB included in the report of its determination a list of the accounting firms that are headquartered in China. This list does not include our auditor, Marcum Asia CPAs LLP. On August 26, 2022, the CSRC, the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”) governing inspections and investigations of accounting firms based in mainland China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB made a statement announcing that it was able, in 2022, to inspect and investigate completely issuer audit engagements of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong. However, uncertainties still exist as to whether the PCAOB will have continued access for complete inspections and investigations in the future. The PCAOB has indicated that it will act immediately to consider the need to issue new determinations with the HFCA Act if needed.

While our auditor is based in the U.S. and is registered with PCAOB and subject to PCAOB inspection, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor because of a position taken by an authority in a jurisdiction outside the United States, then such lack of inspection could cause our securities to be delisted from the stock exchange. See “Risk Factors—Risks Related to Doing Business in China—The recent joint statement by the SEC, proposed rule changes submitted by Nasdaq, and acts passed by the U.S. Senate and the U.S. House of Representatives, all call for additional and more stringent criteria to be applied to U.S.-listed companies with significant operations in China. These developments could add uncertainties to our listing, future offerings, business operations, share price and reputation” on page 24. We cannot assure you that Nasdaq or regulatory agencies will not apply additional or more stringent requirements to us. Such uncertainty could cause the market price of the Class B Ordinary Shares to be materially and adversely affected.

Funds may be transferred among LZ Technology and its subsidiaries in the following manners: (1) funds may be transferred to Lianzhang Menhu (Zhejiang) Holding Co., Ltd., a wholly foreign-owned enterprise (the “WFOE” or “LZ Menhu”) from LZ Technology as needed through our subsidiaries in the BVI and/or Hong Kong in the form of capital contribution or shareholder loan, as the case may be; (2) dividends or other distributions may be paid by the WFOE to LZ Technology through our subsidiaries in Hong Kong and the BVI; and (3) our PRC subsidiaries may lend to and borrow from each other from time to time for business operation purposes. LZ Technology, our subsidiaries in BVI and Hong Kong are permitted under PRC laws and regulations to provide funding to our subsidiaries in the form of loans or capital contributions, provided that the applicable governmental registration and approval requirements are satisfied. In the future, cash proceeds raised from financings conducted outside of China, including this offering, may be transferred by LZ Technology to our PRC subsidiaries via capital contribution or shareholder loans, as the case may be. As a holding company, LZ Technology may rely on dividends and other distributions on equity paid by our PRC operating subsidiaries for its cash and financing requirements. Current PRC regulations permit PRC companies to distribute dividends only out of their accumulated profits, and additionally, PRC companies are required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of the company’s registered capital. Funds under such reserve is not distributable as cash dividends. The articles of association of each of our PRC subsidiaries contain provisions that incorporate the foregoing legal restrictions on distribution of dividends under PRC regulations. In addition, if any of our PRC subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends. None of our subsidiaries has made any dividends or other distributions to LZ Technology as of the date of this prospectus. As of the date of this prospectus, neither LZ Technology nor its subsidiaries have made any dividend or distribution to U.S. investors. LZ Technology and its subsidiaries currently do not have plans to distribute earnings in the foreseeable future. See “Prospectus Summary—Transfer of Funds Through Our Organization” beginning on page 13, “Dividend Policy” on page 51 and the consolidated financial statements and the accompanying footnotes beginning on page F-1 of this prospectus.

As of the date of this prospectus, no cash flows or transfers of other assets have occurred between LZ Technology, our Cayman Islands holding company, and its subsidiaries. However, funds are sometimes transferred among our PRC subsidiaries for working capital purposes. As advised by our PRC counsel, Beijing Hylands Law Firm, the PRC regulations allow affiliated companies to provide each other operating funds through loans, provided that such loans should have a clear term and the interest rate does not exceed the legal maximum limits stipulated by relevant laws or regulations. Currently, other than complying with the applicable PRC laws and regulations, we do not have our own cash management policy and procedures that dictate how funds are transferred. See “Prospectus Summary—Transfer of Funds Through Our Organization” beginning on page 13. While there are currently no foreign exchange restrictions affecting the transfer of funds or assets among LZ Technology, the BVI Subsidiary and the HK Subsidiary, if relevant PRC regulations change, such funds or assets may not be available due to the PRC government’s interventions in or imposition of restrictions on the transfer of funds by our PRC subsidiaries to LZ Technology, whether directly or through HK and/or BVI Subsidiaries, which may adversely affect our business, financial condition and results of operations. See “Risk Factors—Risks Related to Doing Business in China—Currency conversion policies may limit the Company’s ability to utilize the Company’s revenues effectively and affect the value of your investment” on page 26.

| Per Class B Ordinary Share | Total Without Over-Allotment Option | Total With Over-Allotment Option | ||||||||||

| Initial public offering price | $ | $ | ||||||||||

| Underwriting discounts(1) | $ | $ | ||||||||||

| Proceeds to us, before expenses | $ | $ | ||||||||||

| (1) | Represents underwriting discounts equal to 7% per Class B Ordinary Share purchased by investors introduced by the underwriters and 3.5% per Class B Ordinary Share purchased by investors sourced by the Company, which does not include the non-accountable expense allowance, payable to the underwriters, or the reimbursement of certain expenses of the underwriter. See “Underwriting” beginning on page 147 of this prospectus for additional information regarding total underwriting compensation. |

We have granted the underwriter an option, exercisable for 45 days from the date of the closing of this offering, to purchase up to an additional 1,500,000 Class B Ordinary Shares on the same terms as the other Class B Ordinary Shares being purchased by the underwriter from us. For additional information regarding our arrangement with the underwriter, please see “Underwriting” beginning on page 147.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the Class B Ordinary Shares to purchasers in this offering on or about [ ], 2024.

EF HUTTON LLC

The date of this prospectus is [ ], 2024

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we, nor the underwriter has authorized anyone to provide you with different information. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus, or any free writing prospectus, as the case may be, or any sale of the Class B Ordinary Shares.

For investors outside the United States: Neither we, nor the underwriter has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Class B Ordinary Shares and the distribution of this prospectus outside the United States.

i

COMMONLY USED DEFINED TERMS

Except as otherwise indicated by the context and for the purposes of this prospectus only, references in this prospectus to:

| ● | “CAC” are to the Cyberspace Administration of China; |

| ● | “CSRC” are to the China Securities Regulatory Commission; |

| ● | “Henduoka” are to Fujian Henduoka Network Technology Co., Ltd., a related party and the provider of the SaaS software for the Company’s intelligent access control and safety management system. Henduoka is a former subsidiary of the Company that was disposed of in November 2022; |

| ● | “Hong Kong” are to the Hong Kong Special Administrative Region of the People’s Republic of China; |

| ● | “IoT” are to Internet of Things which means a network of interconnected physical devices, vehicles, appliances and other items embedded with sensors, software, and connectivity. Through IoT, various devices can be automated and controlled remotely, enhancing efficiency and offering economic benefits; |

| ● | “Lianzhang Portal” are to LZ Menhu’s 96.85% owned subsidiary, Lianzhang Portal Network Technology Co., Ltd., a PRC company; |

| ● | “LZ Menhu” or “WFOE” are to Lianzhang Menhu (Zhejiang) Holding Co., Ltd., a PRC company; |

| ● | “LZ Technology” are to LZ Technology Holdings Limited, a holding company incorporated in the Cayman Islands as an exempted company; |

| ● | “monitors” and “screens,” used interchangeably, are to the Company’s display device utilized in its access control system; |

| ● | “PRC” and “China” are to the People’s Republic of China, and the term “Chinese” has a correlative meaning. |

| ● | “RMB” or “Renminbi” are to the legal currency of China; |

| ● | “SaaS” are to software as a service which means a way of delivering applications remotely over the Internet; |

| ● | “U.S. dollars,” “dollars,” “USD” or “$” are to the legal currency of the United States; |

| ● | “we,” “us,” “the Company,” “our” or “our company” are to LZ Technology and its consolidated subsidiaries; and |

| ● | “Xiamen Infinity” are to Lianzhang Portal’s 100% owned subsidiary, Xiamen Infinity Network Technology Co., Ltd., a PRC company. |

This registration statement contains translations of certain RMB amounts into U.S. dollar amounts at specified rates solely for the convenience of the reader. Translations of amounts from RMB into U.S. dollars were calculated at the rate of $1.00=RMB7.0999 representing the middle rate as set forth in the statistical release of the Federal Reserve as of December 31, 2023.

Numerical figures included in this registration statement have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

Our fiscal year end is December 31. References to a particular “fiscal year” are to our fiscal year ended December 31 of that calendar year. Our consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP.

For the sake of clarity, this registration statement follows the English naming convention of given name followed by family name, regardless of whether an individual’s name is Chinese or English. For example, the name of our Chairman will be presented as “Andong Zhang” even though, in Chinese, Mr. Zhang’s name is presented as “Zhang Andong.”

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, you are cautioned not to give undue weight to this information.

We have proprietary rights to trademarks used in this prospectus that are important to our business. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are without the ®, ™ and other similar symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

This prospectus may contain additional trademarks, service marks and trade names of others. All trademarks, service marks and trade names appearing in this prospectus are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other person.

ii

Investors are cautioned that you are buying shares of a Cayman Islands holding company without operations of its own.

This summary highlights information appearing elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. You should carefully read this entire prospectus, including the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” sections and the financial statements and the related notes, before deciding whether to invest in the Class B Ordinary Shares.

The Company

Overview

As a holding company with no material operations of its own, LZ Technology conducts its operations through its operating entities formed in the PRC, primarily Lianzhang Portal and its subsidiaries. See “Our Corporate History and Structure” beginning on page 8 for more information of our operating structure. The Company’s total revenues increased by RMB405.9 million, or 249.1%, to RMB568.9 million ($80.1 million) for the year ended December 31, 2023, compared to RMB163.0 million for the year ended December 31, 2022. We had net loss of RMB6.4 million ($0.9 million) for the year ended December 31, 2023, compared to net loss of RMB14.8 million for the year ended December 31, 2022. For the years ended December 31, 2022 and 2023, the Company had a total of 247 and 255 customers, respectively, who entered into contracts with the Company to purchase the Company’s products and services. The Company, however, has derived a large portion of its revenues from a few customers. For the years ended December 31, 2022 and 2023, the Company’s top three customers collectively accounted for approximately 84.4% and 24.2% of its total revenue, respectively. For more detailed information regarding our financial performance, see “Summary Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The Company is an information technology and advertising company. Its operations are organized primarily into three business verticals: (i) Smart Community, (ii) Out-of-Home Advertising, and (iii) Local Life.

Smart Community. The Company provides intelligent community building access and safety management systems through access control monitors and vendor-provided SaaS platforms. The Company’s intelligent community access control system makes resident access to properties simpler. As of the date of this prospectus, approximately 73,817 of the Company’s access control screens have been installed in over 4,000 residential communities, serving over 2.7 million households.

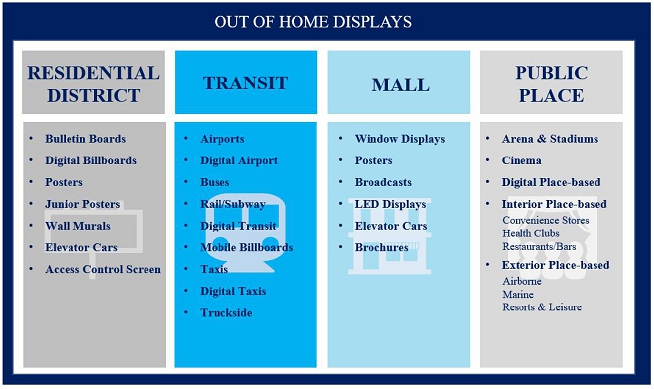

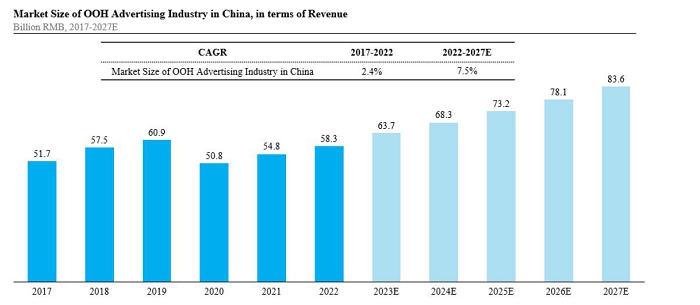

Out-of-Home Advertising. The Company offers clients one-stop multi-channel advertising solutions. Capitalizing on the Company’s network of monitors that span approximately 120 cities in China such as Shanghai, Beijing, Guangzhou, Shenzhen, Nanjing, Xiamen, Hefei, Dalian, Ningbo, Chengdu, Hangzhou, Wuhan, Chongqing, Changsha, the Company’s Out-of-Home Advertising services help merchants display advertisements in a variety of formats across its intelligent access control and safety management system. Advertisements are placed on the monitors and within the SaaS software. Residents are exposed to these advertisements each time they enter and exit community buildings or open the SaaS software. This level of visibility serves as a highly effective means of advertising, assisting merchants in effectively promoting their brands and accelerating their product sales. Moreover, the Company partners with other outdoor advertising providers to maximize coverage by placing the advertisements on the partners’ numerous displays in public transportation, hotels and other settings as well as deploying posters at events. This broad approach provides clients with a truly comprehensive out-of-home advertising solution.

Local Life. The Company connects local businesses with consumers via online promotions and transactions. With its strong technological capabilities, the Company helps local restaurants, hotels, tourist companies, retail stores, cinemas and other merchants offer deals and coupons to consumers on social media platforms such as WeChat, Douyin (the Chinese version of TikTok) and Xiaohongshu. The Local Life vertical bridges the businesses’ need for product sales and promotions and the consumers’ need for dining, shopping, entertainment, tourist attractions and other local services. In addition, deals from local businesses can also be displayed on the access control screens. In this way, clients of the Company’s Local Life services can also reach the Smart Community residents, leveraging the Company’s access control screens’ extensive coverage and high exposure potential. Since early 2023, we have embarked on executing the strategy of deepening engagement with merchants and manufacturers within our Local Life space through facilitating retail sales of diversified goods and services, including beverages, groceries and travel packages.

The Company reports financial results in one segment. Currently, a substantial portion of the Company’s revenues are generated from advertising and promotional activities, namely by the Out-of-Home Advertising and Local Life verticals. Revenues from Smart Community, which mainly consist of product sales of access control devices and service fees, contribute only a small portion to the Company’s total revenues. Thus, the Smart Community revenues are grouped with other miscellaneous revenue sources, such as advertising design and production and social media account operations, under the catch-all category titled “Other Revenues” in the description of the Company’s revenues.

1

Our Competitive Strengths

The Company distinguishes itself through the following competitive strengths:

| ● | Strong branding effect. Currently serving a large number of communities and households, we continue to expand our network of access control screens by seizing opportunities in the urban renewal market. By collaborating with property managers and developers, we are solidifying our position in this segmented field. |

| ● | Robust Research and Development capabilities. We have a dedicated research and development team responsible for constructing and maintaining our devices and hardware system, as well as developing new products and features. This team, with extensive experience in discerning IoT smart technology requirements, spearheading product innovation and carrying out technical implementation, ensures ongoing solutions to challenges and consistent upgrades to our technology infrastructure. |

| ● | Experienced leadership team. The founders of our team have successful entrepreneurial experiences. The founder and Chairman, Andong Zhang, is an expert in intelligent construction designated by the Ministry of Housing and Urban-Rural Development and a distinguished entrepreneur in China. Mr. Zhang is responsible for overall company strategy, positioning, and operational management. Prior to founding the Company, Mr. Zhang founded Qiushi, our hardware supplier and a company engaged in manufacturing monitors and other IoT products. As a model company in the IoT industry, Qiushi received multiple site-visits from industrial associations and governmental officials. With years of deep involvement in intelligent digital technology, products and services, Mr. Zhang has amassed a wealth of industry resources and developed strategic acumen. Since our establishment in 2014, we have broadened our offerings beyond access control systems and related advertising to provide comprehensive advertising packages to clients. This strategic diversification leverages our robust technological capabilities and our strategic alliances with partner outdoor advertising providers to deliver superior value to our clients. |

| ● | Mature business model. The Company’s three business verticals—Smart Community, Out-of-Home Advertising and Local Life—possess a potent synergy. The growth in one vertical can drive improvements in others. Our Smart Community provides crucial access points. These resources benefit our Out-of-Home Advertising by offering an invaluable advertising platform, At the same time, our Local Life services leverage Smart Community’s access points and network to amplify reach and enhance effectiveness. As the number of access control screens increases in Smart Community, the sales volume and bargaining power of our Out-of-Home Advertising grow. Our Local Life vertical complements our Out-of-Home Advertising by providing social media advertising and promotional services. By capitalizing on our operational and technological capabilities, the Company has connected these three sectors within the community landscape, creating a flywheel effect where 1+1+1 > 3 and achieving a more resilient business model. |

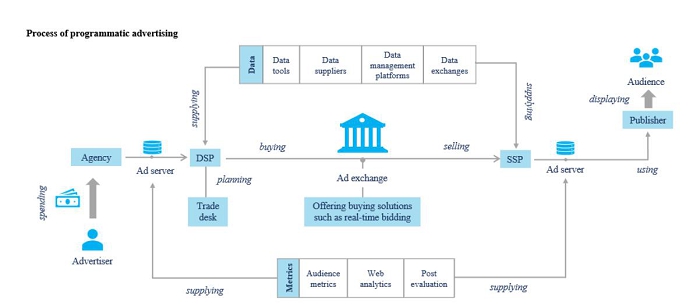

| ● | Integration of solutions from various suppliers. The Company aggregates and empowers other outdoor advertising platforms, such as screens in public transportation, building elevators and hotel rooms, as well as advertising opportunities in offline events and activities. We provide customers with integrated multi-channel marketing solutions and precise programmatic delivery. Based on specific customer needs, we can offer tailored advertising planning and broadcasting solutions, using a mix of multi-scene out-of-home advertising, poster displays in events and social media marketing. Through strategic collaborations with other advertising providers and resource owners, we deliver comprehensive and effective advertising services to our clients, helping them achieve maximum brand promotion and product success, truly integrating brand visibility and effectiveness. |

| ● | Favorable marketing ecosystem. Our meticulously planned and executed marketing efforts have forged a robust alliance within the out-of-home advertising industry that pools customer bases. In addition, by employing a model that combines our in-house marketing team with third-party city partners, we continually expand into new strategic cities, enabling us to maintain a solid position in the Smart Community field while simultaneously expanding our advertising platform. |

2

Our Growth Strategies

We plan to pursue the following strategies to grow our business:

| ● | Solidify our industry position. We intend to continue expanding our marketing efforts to increase awareness of our offerings and brand, aiming to attract new buyers of our intelligent access control and safety management systems and recruit additional city partners. We plan to conduct further regional expansions in 2024, in order to strategically enhance our geographic coverage. In addition, we are committed to the continual development and innovation of our content, service offerings, hardware and software development and integration capabilities, which forms our core competitiveness in penetrating existing and new markets. |

| ● | Enhance our ability to attract, incentivize and retain merchant customers. We aim to further enhance our offerings to attract and retain merchant customers. Leveraging our technological capabilities and network of access control screens, our Local Life vertical bridges residents’ needs for convenient selection and purchase of reliable and competitively priced products and services and merchants’ demands for effective product and service promotion. Recognizing the vast sales potential in the residential community landscape, we plan to deepen our engagement with merchants and manufacturers within our Local Life space. We intend to enable them to offer home delivery services for household supplies and food, coordinate flight and train tickets, hotel accommodation and admission tickets for residents, and present top deals from leading e-commerce platforms. We have started to execute this strategy since the beginning of 2023. We intend to utilize our integrated multi-channel advertising solutions to provide promotional services to merchants and manufacturers that focus on improving their sales performance. At the same time, we provide community households with easy access to high-quality and low-cost products and services, which attracts more communities to join our Smart Community platform, expanding both the audience scope and the marketing resources of the platform. To achieve this, we will continuously refine our business model. |

| ● | Expand into overseas markets. We plan to apply the Company’s model beyond China, targeting foreign markets. The overseas community access control markets show positive trends in technological innovation and demand for security and intelligence, despite regional differences. With the increasing need for safety and convenience, we project completion of our overseas market expansion within the next 3-5 years. |

Our Risks and Challenges

Investing in the Class B Ordinary Shares involves a high degree of risk. Investors purchasing securities in this offering are purchasing securities of LZ Technology, a Cayman Islands holding company, rather than securities of LZ Technology’s subsidiaries that conduct substantive business operations in China. This structure involves unique risks to investors and investors may never hold equity interests in the Chinese operating companies. Chinese regulatory authorities could disallow this structure, which would likely result in a material change in our operations and/or a material change in the value of the securities we are registering for sale, including that it could cause the value of such securities to significantly decline or become worthless. You should carefully consider the risks and uncertainties summarized below and the risks described under the “Risk Factors” section beginning on page 21, including “Risks Related to Doing Business in China” beginning on page 21, “Risks Related to Our Business and Industry” beginning on page 28, “Risks Related to the Smart Community Business” beginning on page 35, “Risks Related to the Out-of-Home Advertising Services” beginning on page 37, “Risks Related to the Local Life Services” beginning on page 39, “Risks Related to this Offering and Ownership of the Class B Ordinary Shares” beginning on page 41, and the other information contained in this prospectus before you decide whether to purchase the Class B Ordinary Shares.

Risks Related to Doing Business in China

As a business operating in China, the Company is subject to risks and uncertainties relating to doing business in China in general, including without limitation, the following:

| ● | Since all of the Company’s operations are in China, the Company’s business is subject to the complex and rapidly evolving laws and regulations there. The Chinese regulatory authorities may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our PRC subsidiaries’ operations at any time, which could result in a material change in the Company’s operations and/or the value of the Class B Ordinary Shares. See “Risk Factors—Risks Related to Doing Business in China—The economic, political and social conditions in China could affect our business, results of operations, financial conditions and prospects which could result in a material change in the Company’s operations and/or the value of the Class B Ordinary Shares” on page 21; |

| ● | The development of the PRC legal system and changes in the interpretation and enforcement of PRC laws, regulations and policies in China could adversely affect us. See “Risk Factors—Risks Related to Doing Business in China—The development of the PRC legal system and changes in the interpretation and enforcement of PRC laws, regulations and policies in China could adversely affect us” on page 21; |

| ● | Actions by the Chinese regulatory authorities to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. See “Risk Factors—Risks Related to Doing Business in China—The development of the PRC legal system and changes in the interpretation and enforcement of PRC laws, regulations and policies in China could adversely affect us” on page 21. |

3

| ● | The CSRC has released rules for China-based companies seeking to conduct initial public offerings in foreign markets with respect to filing procedures to be completed with the CSRC. According to these rules, we expect to perform necessary recordation filings with the CSRC for this offering and future securities offerings outside of China, which will subject us to additional compliance requirements. See “Risk Factors—Risks Related to Doing Business in China—The CSRC has released rules for China-based companies seeking to conduct initial public offerings in foreign markets with respect to filing procedures to be completed with the CSRC. According to these rules, we expect to perform necessary recordation filings with the CSRC for this offering and future securities offerings outside of China, which will subject us to additional compliance requirements” on page 22; |

| ● | LZ Technology may rely on dividends and other distributions on equity from our PRC subsidiaries for its cash requirements. See “Risk Factors—Risks Related to Doing Business in China—LZ Technology may rely on dividends and other distributions on equity from our PRC subsidiaries for its cash requirements” on page 22; |

| ● | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and currency conversion policies may delay us from using the proceeds of this offering to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect the Company’s liquidity and the Company’s ability to fund and expand its business. See “Risk Factors—Risks Related to Doing Business in China—PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and currency conversion policies may delay us from using the proceeds of this offering to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect the Company’s liquidity and the Company’s ability to fund and expand its business” on page 23; |

| ● | The recent joint statement by the SEC, proposed rule changes submitted by Nasdaq, and acts passed by the U.S. Senate and the U.S. House of Representatives, all call for additional and more stringent criteria to be applied to U.S.-listed companies with significant operations in China. These developments could add uncertainties to our listing, future offerings, business operations, share price and reputation. See “Risk Factors—Risks Related to Doing Business in China—The recent joint statement by the SEC, proposed rule changes submitted by Nasdaq, and acts passed by the U.S. Senate and the U.S. House of Representatives, all call for additional and more stringent criteria to be applied to U.S.-listed companies with significant operations in China. These developments could add uncertainties to our listing, future offerings, business operations, share price and reputation” on page 24; |

Risks Related to Our Business and Industry

Risks and uncertainties related to the Company’s business and industry include, without limitation, the following:

| ● | Due to the Company’s accumulated deficit as of December 31, 2023, and net losses from operations for the years ended December 31, 2022 and 2023, there is substantial doubt about the Company’s ability to continue as a going concern. |

| ● | The outbreak of the COVID-19 pandemic has and may continue to adversely affect the Company’s business and results of operations. |

| ● | A significant portion of the Company’s revenue is concentrated in a small number of large customers. Any loss or significant reduction of business with, one or more of them could have a material adverse effect on the Company’s business, financial condition and results of operations. |

| ● | The Company has engaged in transactions with related parties, and terms obtained or consideration that it paid in connection with these transactions may not be comparable to terms available or the amounts that would be paid in arm’s length transactions. |

| ● | The Company has incurred indebtedness and may incur other debt in the future, which may adversely affect its financial condition and future financial results. |

| ● | The Company invests in research and development, and to the extent the Company’s research and development investments are not directed efficiently or do not result in cost-efficient enhancements to the Company’s products and services, the Company’s business and results of operations would be harmed. |

| ● | We may fail to protect our intellectual properties. |

4

| ● | We may be subject to intellectual property infringement claims. |

| ● | The growth of our business may be adversely affected if we do not implement our growth strategies and initiatives successfully or if we are unable to manage our growth or operations effectively. |

| ● | We may fail to make necessary or desirable strategic alliances, acquisitions or investments, and we may not be able to achieve the benefits we expect from the alliances, acquisition or investments we make. |

| ● | Our success depends on the continuing efforts of our senior management and key employees. |

| ● | If we are unable to recruit, train and retain talents, our business may be materially and adversely affected. |

| ● | Our lack of insurance could expose us to significant costs and business disruption. |

| ● | We may not be able to raise additional capital when desired, on favorable terms or at all. |

| ● | If we fail to implement and maintain an effective system of internal controls to remediate our material weakness over financial reporting, we may be unable to accurately report our results of operations, meet our reporting obligations or prevent fraud. |

Risks Related to the Smart Community Business

| ● | Any harm to the Company’s brand or reputation may materially and adversely affect its business. |

| ● | The Company depends on one affiliated manufacturer for substantially all of its hardware manufacturing needs. If this manufacturer experiences any delay, disruption, or quality control problems in its operations and the Company fails to find a replacement manufacturer in a timely manner and on acceptable terms, the Company could lose or fail to grow its market share and its brand may suffer. |

| ● | Defects or performance problems in the Company’s Smart Community devices could result in a loss of customers, reputational damage and decreased revenue. Additionally, the Company may face warranty, indemnity, and product liability claims that may arise from malfunctions. |

| ● | The Company may face disruption to its technology systems, leading to interruptions in the availability of its services. |

| ● | Delays, costs, and disruptions that result from upgrading, integrating, and maintaining the security of the information and technology networks and systems integral to the intelligent access control and safety management system could materially adversely affect the Company’s business. |

| ● | Due to the ever-changing threat landscape, the Company’s Smart Community system may be subject to potential vulnerabilities of wireless and IoT devices, as well as risks related to hacking or other unauthorized access to control or view systems and obtain private information, which may disrupt the normal function of the Smart Community system. |

| ● | The success of the Company’s Smart Community business is dependent upon its ability to obtain and renew contracts with various communities and property managers, which the Company may not be able to obtain on favorable terms. |

Risks Related to the Out-of-Home Advertising Services

| ● | The Company has generated revenues primarily from advertising and promotional activities, namely by the Out-of-Home Advertising and Local Life business verticals, and any loss or significant reduction of business in these verticals could have a material adverse effect on the Company’s revenues, financial positions and operating results. |

| ● | The Company’s advertising strategies depend on its Smart Community monitors to a great extent. If defects were found on the access control monitors, this could have a material adverse impact on the Company’s revenues, financial position and operating results. |

5

| ● | The Company depends on third-party providers for components of its Out-of-Home Advertising services. Any failure or interruption in the services provided by these third parties could negatively impact the Company’s ability to deliver the advertising packages to clients. |

| ● | The Company relies on third-party telecommunications providers and signal processing centers to transmit and communicate signals to its Smart Community systems. |

| ● | The Company faces intense competition in the Out-of-Home Advertising business. |

| ● | Restrictions on advertising of certain products may restrict the categories of clients that can advertise using the Company’s services. |

| ● | If the Company’s security measures are breached, the Company could lose valuable information, suffer disruptions to its business, and incur expenses and liabilities, including damage to its relationships with customers and business partners. |

Risks Related to the Local Life Services

| ● | The Company expects the Local Life vertical to be a new growth area, and one of its growth strategies is to enhance its ability to attract, incentivize and retain merchant customers for the Local Life services. However, this focus on the Local Life vertical may be unsuccessful. |

| ● | The future success of the Local Life vertical depends upon the Company’s ability to attract and retain high quality merchants. |

| ● | If some of the Company’s merchant customers fail to provide a superior consumer experience, consumers may lose confidence in the products and services the Company promotes generally, which could have a material adverse impact on the Local Life business. |

| ● | The Company faces intense competition in the Local Life business, and it may lose market share and consumers if it fails to compete effectively. |

Risks Relating to this Offering and Ownership of the Class B Ordinary Shares

The Company is also subject to risks relating to the Class B Ordinary Shares and this offering, including without limitation, the following:

| ● | Our dual class voting structure has the effect of concentrating the voting control in holders of our Class A Ordinary Shares, which will limit or preclude your ability to influence corporate matters, and your interests may conflict with the interests of these shareholders. It may also adversely affect the trading market for our Class B Ordinary Shares due to exclusion from certain stock market indices. |

| ● | There has been no public market for the Class B Ordinary Shares prior to this offering and an active trading market for the Class B Ordinary Shares may not develop following the completion of this offering. |

| ● | The initial public offering price for the Class B Ordinary Shares may not be indicative of prices that will prevail in the trading market and such market prices may be volatile. |

| ● | The market price of the Class B Ordinary Shares may be volatile or may decline regardless of our operating performance, and you may not be able to resell your shares at or above the initial public offering price. |

6

| ● | We may experience extreme stock price volatility unrelated to our actual or expected operating performance, financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of the Class B Ordinary Shares. |

| ● | We may not be able to maintain a listing of the Class B Ordinary Shares on Nasdaq. |

| ● | If securities or industry analysts publish unfavorable research, or do not continue to cover us, the Company’s share price and trading volume could decline. |

| ● | As the initial public offering price of the Class B Ordinary Shares is substantially higher than our net tangible book value per share, you will experience immediate and substantial dilution. | |

| ● | We have broad discretion as to the use of the net proceeds from this offering and our use of the offering proceeds may not yield a favorable return on your investment. Additionally, we may use these proceeds in ways with which you may not agree or in the most effective way. |

| ● | We have not historically declared or paid dividends on the Class B Ordinary Shares and, consequently, your ability to achieve a return on your investment will depend on appreciation in the price of the Class B Ordinary Shares. |

| ● | Substantial future sales of the Class B Ordinary Shares or the anticipation of future sales of the Class B Ordinary Shares in the public market could cause the price of the Class B Ordinary Shares to decline. |

| ● | The offering price of the primary offering and resale offering could differ. |

| ● | The resale by the Selling Shareholder may cause the market price of our Class B Ordinary Shares to decline. |

| ● | We may issue additional equity or debt securities, which are senior to the Class B Ordinary Shares as to distributions and in liquidation, which could materially adversely affect the market price of the Class B Ordinary Shares. |

| ● | We will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not emerging growth companies, and the shareholders could receive less information than they might expect to receive from more mature public companies. |

| ● | Our Chairman, Mr. Andong Zhang, has significant voting power and may take actions that may not be in the best interests of our other shareholders. |

| ● | Upon the completion of this offering, we expect to be a “controlled company” under the rules of Nasdaq and as a result, we may choose to exempt our company from certain corporate governance requirements that could have an adverse effect on our public shareholders. |

| ● | We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies. |

| ● | As a foreign private issuer, we are permitted to rely on exemptions from certain Nasdaq corporate governance standards applicable to domestic U.S. issuers. This may afford less protection to holders of the Class B Ordinary Shares. |

| ● | We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses. |

| ● | You will be unable to present proposals before annual general meetings or extraordinary general meetings. |

| ● | Certain judgments obtained against us by LZ Technology’s shareholders may not be enforceable. |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because LZ Technology is incorporated under Cayman Islands law. |

| ● | LZ Technology’s memorandum and articles of association contain anti-takeover provisions that could discourage a third party from acquiring us, which could limit LZ Technology’s shareholders’ opportunity to sell their shares at a premium. |

| ● | There is a risk that we will be a passive foreign investment company for any taxable year, which could result in adverse U.S. federal income tax consequences to U.S. investors in the Class B Ordinary Shares. |

7

Our Corporate History and Structure

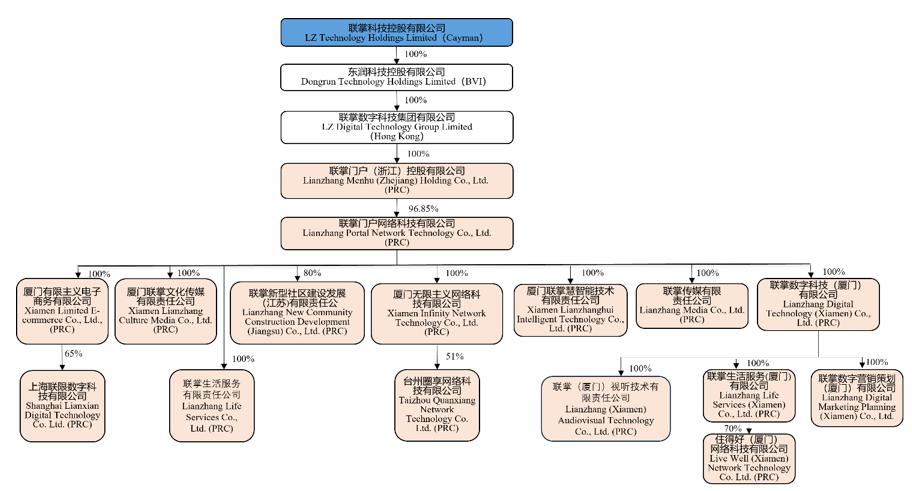

The following diagram illustrates our corporate structure as of the date of this prospectus:

Blue Box – The entity in which investors are purchasing the Class B Ordinary Shares being offered.

Orange Boxes – The entities in which the Company’s operations are conducted.

Upon LZ Technology’s incorporation on November 23, 2022, it had an authorized share capital of $50,000 divided into 50,000 shares of a par value of $1.00 each. On November 23, 2022, one ordinary share, par value of $1.00, was allotted and issued to the initial subscriber, Sertus Nominees (Cayman) Limited, who transferred the share to LZ Digital Technology Holdings Co., Ltd, a British Virgin Islands company (“LZ Holdings”), on the same day. In addition, an additional 49,999 ordinary shares, par value of $1.00 each, were allotted and issued to LZ Holdings for a total consideration of $49,999. As a result, LZ Technology had 50,000 ordinary shares, par value of $1.00 each, issued and outstanding on November 23, 2022.

On June 23, 2023, LZ Technology repurchased 49,999 ordinary shares, $1.00 par value, from LZ Holdings for $49,999. LZ Technology paid the purchase price out of its capital and the repurchased shares were immediately cancelled. As a result of the repurchase, LZ Technology had one ordinary share, $1.00 par value issued and outstanding, which was owned by LZ Holdings.

Immediately following the above repurchase of shares, each issued and unissued share of LZ Technology, par value of $1.00 was subdivided into 10,000 shares, par value of $0.0001 each. As a result of the subdivision, the authorized share capital of LZ Technology changed from $50,000 divided into 50,000 shares with a par value of $1.00 each to $50,000 divided into 500,000,000 shares with a par value of $0.0001 each. In addition, immediately after the subdivision, the authorized share capital of LZ Technology was re-classified and re-designated into $50,000 divided into 20,000,000 Class A Ordinary Shares, par value of $0.0001 each and 480,000,000 Class B Ordinary Shares, par value of $0.0001 each. The then-issued, post-subdivision 10,000 ordinary shares owned by LZ Holdings, were re-classified and re-designated as 10,000 Class A Ordinary Shares.

8

Following the re-classification and re-designation referred to above, LZ Technology allotted and issued the following shares:

| ● | 9,579,248 Class A Ordinary Shares to LZ Holdings for $957.9248; |

| ● | 11,807,883 Class B Ordinary Shares to LZ Holdings for $1,180.7883; |

| ● | 6,239,909 Class B Ordinary Shares to BJ Tojoy Shared Enterprise Consulting Ltd for $623.9909; |

| ● | 15,000,000 Class B Ordinary Shares to Vanshion Investment Group Limited (万盛投资集团有限公司)for $1,500; |

| ● | 16,942,491 Class B Ordinary Shares to Youder Investment Group Limited (友达投资集团有限公司)for $1,694.2491; |

| ● | 1,259,273 Class B Ordinary Shares to Sing Family Investment Limited for $125.9273; and |

| ● | 3,032,846 Class B Ordinary Shares to Kim Full Investment Company Limited for $303.2846. |

Upon completion of the above reorganization, the authorized share capital of LZ Technology became $50,000 divided into 500,000,000 shares of a nominal or par value of $0.0001 each, comprising 20,000,000 Class A Ordinary Shares of a par value of $0.0001 each and 480,000,000 Class B Ordinary Shares of a par value of $0.0001 each. As of June 23, 2023, there were 9,589,248 Class A Ordinary Shares, and 54,282,402 Class B Ordinary Shares issued and outstanding.

On May 24, 2024, Dongling Technology (as defined below) transferred 3.15% of Lianzhang Portal it acquired from Wuxi Xinqu Fin-tech Venture Capital Co., Ltd. (“Wuxi Fin-tech”), a former minority shareholder of Lianzhang Portal, to our WFOE, LZ Menhu. Considering this transaction, LZ Technology’s board of directors amended the resolutions adopted on June 23, 2023 (the “June 2023 Resolutions”) to change the numbers of Class A and Class B Ordinary Shares allotted and issued to LZ Holdings: (i) from 9,579,248 Class A Ordinary Shares to 9,891,163 Class A Ordinary Shares, and (ii) from 11,807,883 Class B Ordinary Shares to 13,632,068 Class B Ordinary Shares. On May 24, 2024, we issued 311,915 Class A Ordinary Shares and 1,824,185 Class B Ordinary Shares to LZ Holdings. For more information, please see “Corporate History and Structure—Lianzhang Portal’s Minority Shareholder.” As of May 24, 2024, there were 9,901,163 Class A Ordinary Shares and 56,106,587 Class B Ordinary Shares issued and outstanding.

On July 15, 2024, LZ Technology effected a subdivision of each of its existing issued and unissued Ordinary Shares with a par value of $0.0001 each into four (4) shares with a par value of $0.000025 each (the “Share Subdivision”). As a result of the Share Subdivision, the authorized share capital of the Company became $50,000 divided into 2,000,000,000 Ordinary Shares, consisting of 80,000,000 Class A Ordinary Shares and 1,920,000,000 Class B Ordinary Shares, with a par value of $0.000025 each. Additionally, the total number of the Company’s issued and outstanding Class A Ordinary Shares increased from 9,901,163 shares to 39,604,652 shares and issued and outstanding Class B Ordinary Shares increased from 56,106,587 shares to 224,426,348.

Immediately upon the completion of the Share Subdivision, the shareholders of LZ Technology surrendered the following Ordinary Shares for no consideration and for cancellation (the “Share Surrender”):

| ● | 17,104,652 Class A Ordinary Shares surrendered by LZ Holdings; |

| ● | 23,549,935 Class B Ordinary Shares surrendered by LZ Holdings; |

| ● | 10,779,690 Class B Ordinary Shares surrendered by BJ Tojoy Shared Enterprise Consulting Ltd; |

| ● | 25,913,094 Class B Ordinary Shares surrendered by Vanshion Investment Group Limited (万盛投资集团有限公司); |

| ● | 29,268,824 Class B Ordinary Shares surrendered by Youder Investment Group Limited (友达投资集团有限公司); |

| ● | 2,175,444 Class B Ordinary Shares surrendered by Sing Family Investment Limited; and |

| ● | 5,239,361 Class B Ordinary Shares surrendered by Kim Full Investment Company Limited. |

Upon the completion of the Share Surrender, the total number of issued and outstanding Class A Ordinary Shares of LZ Technology was reduced from 39,604,652 to 22,500,000 shares and the total number of issued and outstanding Class B Ordinary Shares was reduced from 224,426,348 to 127,500,000. The ownership percentages of LZ Technology’s shareholders remained the same after the Share Subdivision and Share Surrender. We have retrospectively reflected the Share Subdivision and Share Surrender in all financial periods presented in this prospectus.

As of the date of this prospectus, there are 22,500,000 Class A Ordinary Shares and 127,500,000 Class B Ordinary Shares issued and outstanding.

9

On July 15, 2024, we adopted the LZ Technology Holdings Limited 2024 Equity Incentive Plan (the “2024 Plan”). The purpose of the 2024 Plan is to grant share options, restricted share units and other forms of incentive compensation to our officers, employees, directors and consultants. The maximum number of Class B Ordinary Shares that may be issued pursuant to awards granted under the 2024 Plan is 15,000,000 shares. As of the date of this prospectus, all shares remain available for issuance under the 2024 Plan.

On July 15, 2024, in consideration for business consulting services to be provided by JW Investment Management Limited, a British Virgin Islands company (“JW”), commencing on July 15, 2024 and ending on the fourth (4th) anniversary of the date on which the Class B Ordinary Shares begin trading on the Nasdaq, LZ Technology issued JW a pre-funded warrant to purchase 7,500,000 Class B Ordinary Shares (the “JW Warrant”). The JW Warrant has an exercise price of $0.01 per share and provides for piggyback registration rights with respect to the Class B Ordinary Shares issuable upon exercise of the JW Warrant, excluding this registration in connection with the Company’s initial public offering. The JW Warrant will vest in five (5) equal annual installments over a four-year period with the first 20% vesting on the date the Class B Ordinary Shares begin trading on the Nasdaq. The JW Warrant is subject to a limitation on beneficial ownership to 4.99% of the Company’s Class B Ordinary Shares that would be outstanding immediately after exercise. The JW Warrant and the Class B Ordinary Shares issuable upon exercise thereof are subject to the 180-day lock-up required by the underwriters in connection with this offering. A copy of the JW Warrant is filed as an exhibit to this registration statement and the description above is qualified in its entirety by reference to the full text of such exhibit.

As of the date of this prospectus, the Company has the following consolidated subsidiaries:

| ● | Dongrun Technology Holdings Limited, a wholly owned direct subsidiary, formed on December 5, 2022 under the laws of British Virgin Islands, whose principal activity is investment holding; |

| ● | LZ Digital Technology Group Limited, a wholly owned indirect subsidiary, formed on November 21, 2022 under the laws of Hong Kong, whose principal activity is investment holding; |

| ● | Lianzhang Menhu (Zhejiang) Holding Co., Ltd. (联掌门户(浙江)控股有限公司), or LZ Menhu, the WFOE, a wholly owned indirect subsidiary, formed on May 10, 2023 under PRC laws, whose principal activity is investment holding; |

| ● | Lianzhang Portal Network Technology Co., Ltd (联掌门户网络科技有限公司), or Lianzhang Portal, a 96.85% owned indirect subsidiary, formed on September 10, 2014 under PRC laws, engaged in providing intelligent access control and safety management systems and advertising and promotional services. As of the date of this prospectus, Wuxi Jiangxi Technology Venture Capital Co., Ltd. owns approximately 3.15% of Lianzhang Portal. For more information, please see “Corporate History and Structure—Lianzhang Portal’s Minority Shareholder”; |

| ● | LianZhang Media Co., Ltd. (联掌传媒有限责任公司), a wholly owned subsidiary of Lianzhang Portal, formed on January 16, 2018 under PRC laws, engaged in providing advertising, information system integration service, and information technology consulting service; |

| ● | Xiamen LianZhang Culture Media Co., Ltd. (厦门联掌文化传媒有限责任公司), a wholly owned subsidiary of Lianzhang Portal, formed on October 15, 2014 under PRC laws, engaged in advertising, information system integration service, and information technology consulting service; |

| ● | LianZhang New Community Construction Development (Jiangsu) Co., Ltd. (联掌新型社区建设发展(江苏)有限责任公司), an 80% owned subsidiary of Lianzhang Portal, formed on June 21, 2018 under PRC laws, engaged in sales of access control devices and renovation of old residential areas; |

| ● | Xiamen Lianzhanghui Intelligent Technology Co., Ltd. (厦门联掌慧智能技术有限责任公司), a wholly owned subsidiary of Lianzhang Portal, formed on October 31, 2014 under PRC laws, engaged in sales of access control devices and renovation of old residential areas; |

10

| ● | Xiamen Infinity Network Technology Co., Ltd. (厦门无限主义网络科技有限公司), or Xiamen Infinity, a wholly owned subsidiary of Lianzhang Portal, formed on August 16, 2021 under PRC laws, engaged in social media advertising of experience and grocery products; |

| ● | Xiamen Limited E-commerce Co., Ltd. (厦门有限主义电子商务有限公司), a wholly owned subsidiary of Lianzhang Portal, formed on April 7, 2022 under PRC laws, whose principal activity is investment holding; | |

| ● | Lianzhang Life Services Co., Ltd.联掌生活服务有限责任公司,100% owned subsidiary of Lianzhang Portal, formed on September 14, 2023 under PRC laws, engaged in online sales of local experience and grocery products. |

| ● | Lianzhang Digital Technology (Xiamen) Co., Ltd. (联掌数字科技(厦门)有限公司), or Lianzhang Digital Technology, a wholly owned subsidiary of Lianzhang Portal, formed on May 6, 2023 under PRC laws, engaged in system operation and management; |

| ● | Lianzhang Life Services (Xiamen) Co., Ltd. (联掌生活服务(厦门)有限公司), a wholly owned subsidiary of Lianzhang Digital Technology, formed on May 9, 2023 under PRC laws, engaged in online sales of local experience and grocery products; |

| ● | Lianzhang Digital Marketing Planning (Xiamen) Co., Ltd. (联掌数字营销策划(厦门)有限公司), a wholly owned subsidiary of Lianzhang Digital Technology, formed on May 9, 2023 under PRC laws, engaged in advertising and promotional services; | |

| ● | Lianzhang (Xiamen) Audiovisual Technology Co., Ltd. 联掌(厦门)视听技术有限责任公司, a 100% owned subsidiary of Lianzhang Digital Technology, formed on May 23, 2024 under PRC laws, engaged in advertising information system integration services and information technology consulting services. |

| ● | Live Well (Xiamen) Network Technology Co., Ltd. (住得好(厦门)网络科技有限公司), a 70% owned subsidiary of Lianzhang Life Services (Xiamen) Co., Ltd., formed on May 12, 2023 under PRC laws, engaged in online sales of local experience and grocery products; |

| ● | Taizhou Quanxiang Network Technology Co., Ltd. (台州圈享网络科技有限公司), a 51% owned subsidiary of Xiamen Infinity, formed on February 23, 2023 under PRC laws, engaged in online sales of local experience and grocery products; |

| ● | Shanghai Lianxian Digital Technology Co., Ltd. (上海联限数字科技有限公司), a 65% owned subsidiary of Xiamen Limited E-commerce Co., Ltd., formed on April 11, 2023 under PRC laws, engaged in online sales of local experience and grocery products. |

You are specifically cautioned that in addition, as we conduct substantially all of our operations in China, there are significant subject to legal and operational risks associated with having substantially all of our operations in China, including risks related to the legal, political and economic policies of the Chinese government, the relations between China and the United States, and applicable PRC and United States regulations, which risks could result in a material change in our operations and/or cause the value of the Class B Ordinary Shares to significantly decline or become worthless and affect LZ Technology’s ability to offer or continue to offer its securities to investors.

Licenses and Permissions

We are not operating in an industry that prohibits or limits foreign investment in China. As a result, as advised by our PRC counsel, Beijing Hylands Law Firm, other than those requisite for a domestic company in China engaged in the same business, as of the date of this prospectus, we are not required to obtain any additional permission to conduct our business operations in China. However, if we do not receive or maintain our existing licenses, or we inadvertently conclude that governmental approvals are not required, or applicable laws, regulations, or interpretations change such that we are required to obtain approval in the future and we fail to obtain such approval on a timely basis, we may be subject to governmental investigations, fines, penalties, orders to suspend operations and rectify any non-compliance, or prohibitions from conducting certain business or any financing, which could result in a material adverse change in our operations, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause our securities to significantly decline in value or become worthless.

11

As of the date of this prospectus, our PRC subsidiaries have received from PRC authorities all requisite licenses, permissions or approvals needed to engage in the businesses currently conducted by them in China in all material aspects, and no permission or approval has been denied. The following table summarizes the licenses and permissions currently held by our PRC subsidiaries.

| Company | License/Permit | Issuing Authority | Issuance Date |

Term | ||||

| Lianzhang

Menhu (Zhejiang) Holding Co., Ltd. (联掌门户(浙江)控股有限公司) |

Business License | Huzhou

City Wuxing District Market Supervision Administration 湖州市吴兴区市场监督管理局 |

April 22, 2024 | No fixed term. | ||||

| Lianzhang

Portal Network Technology Co., Ltd (联掌门户网络科技有限公司) |

Business License | Huzhou

City Wuxing District Market Supervision Administration 湖州市吴兴区市场监督管理局 |

April 22, 2024 | No fixed term. | ||||

| LianZhang

Media Co., Ltd. 联掌传媒有限责任公司 |

Business License | Wuxi

National Technological Innovation District (Wuxi Xinwu District) Administrative Approval Bureau 无锡国家高新技术产业开发区(无锡市新吴区)行政审批局 |