Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23871

KKR Asset-Based Income Fund

(Exact name of registrant as specified in charter)

555 California Street, 50th Floor, San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

Lori Hoffman, Esq.

KKR Credit Advisors (US) LLC

555 California Street

50th Floor

San Francisco, California 94104

(Name and address of agent for service)

Copies to:

Kenneth E. Young, Esq.

William J. Bielefeld, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

Registrant’s telephone number, including area code: (415) 315-3620

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

KKR Asset-Based Income Fund

Annual Report

December 31, 2023

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

| 1 | ||||

| 4 | ||||

| 6 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 25 | ||||

| 26 | ||||

| 28 | ||||

| 29 |

KKR Asset-Based Income Fund (the “Fund”) publicly files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-PORT, and the reports for the last month in each quarter are made publicly available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent period ended June 30, will be available (i) without charge, upon request, by calling 855-862-6092; and (ii) on the Commission’s website at http://www.sec.gov.

INFORMATION ABOUT THE FUND’S TRUSTEES

The Fund’s Statement of Additional Information includes information about the Fund’s Trustees and is available without charge, upon request, by calling 855-844-8655 and by visiting the Commission’s website at www.sec.gov.

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

Management Discussion of Fund Performance (Unaudited)

Looking Back on the Markets – December 31, 2023

As we reflect on the past year, we have seen a continued trend of credit markets being in flux. Rising rates, geopolitical tensions, and deteriorating credit fundamentals have all posed headwinds for credit markets as investors navigate this volatile and opaque environment. Over the past year, syndicated markets saw increased volatility and have been effectively shut, forcing more issuers seeking financing solutions to pivot towards private lending. We believe that the flexibility and certainty of execution that private financing offers to borrowers will continue to be a tailwind for the asset class even after syndicated markets reopen. Private credit has become a more permanent allocation for large institutional investors, due to attractive overall returns driven by market volatility and uncertainty. In short, we think it will remain a good time to be a lender.

Even with inflation cooling and the U.S. Federal Reserve Board (“Fed”) approaching an easing campaign, we still think ‘higher for longer’ will remain in play. Structured products as part of this investment strategy often finance certain traditional infrastructure and real estate assets like aircraft, renewable power assets, and warehouses. These investments also have a degree of inflation linkage, given they are backed by hard assets that tend to rise in value with consumer prices and often have floating coupons that may benefit lenders during periods of higher rates. Within private credit, we think Asset-Based Finance is becoming more compelling. There is still a shortage of capital in sectors traditionally dominated by smaller banks, including asset-backed consumer loans and commercial real estate lending. This backdrop is a positive one for Asset-Based Finance. As such, owning collateral could prove to be fortuitous in the macroeconomic environment we envision.

Private Asset-Based Finance Market

Credit markets have changed in fundamental ways over the last 15 years—beginning with the shift of corporate borrowing away from syndicated markets and towards private credit. Banks began shrinking the scope of their lending activity in a more heavily regulated environment after the Global Financial Crisis, and the pullback has continued post-COVID and in the face of the U.S. regional banking scare in March 2023. As a result of the most recent retrenchment, the public capital markets machine broke down. What was left? Providers of private credit, which has steadily taken share from syndicated markets as a more reliable source of capital in times of uncertainty. Particularly recently, private Asset-Based Finance strategies have seen a growing number of attractive opportunities to lend against portfolios of high-quality assets as regional banks have started to look to shed portfolios of loans or exit from lending against certain assets. On the other side of the transaction, we think private credit is also a permanent option for borrowers. A growing number of financings that would have almost certainly taken place in syndicated markets in the past have instead been executed in private credit markets. A negotiation with one lender or, in a bigger transaction, a small group of like-minded lenders, offers a level of certainty and flexibility that syndicated markets often can’t, and we believe the potential benefits of that became obvious with syndicated markets shut in 2023.

On the demand side, we see a trend in which private credit is becoming a more permanent allocation for investors. Typically, we have seen the core allocations within private credit take on the role of corporate lending strategies with investors now turning to adding exposure to private strategies that are uncorrelated to corporate credit risk, such as Asset-Based Finance.

Asset-Based Finance offers the potential to invest in a wide variety of financial assets and hard assets that generate recurring or consistent cash flows. The collateral that underlies loans in this area can consist of consumer finance assets (mortgages, auto finance), hard assets (aircraft leasing), commercial finance (equipment leases), and contractual cash flows (royalties). As a result of the variety in the types of collateral available, as well

1

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

as the hundreds or even thousands of individual loans underlying every portfolio investment, correlations with other asset classes, including corporate credit, are relatively low. The Asset-Based Finance asset class could grow from $5.2 trillion to $7.7 trillion by 2027, by our estimates, in large part because of a pullback by banks in funding these kinds of collateralized loans. That pullback only accelerated as interest rates rose and questions about the asset-liability mismatch between short-term deposits and long-term debt obligations became more apparent with the collapse of Silicon Valley Bank, Signature Bank, and First Republic earlier this year.

In the United States, regional banks in particular are under pressure to sell loan portfolios due to more stringent capital requirements, but we are also seeing larger banks looking to shed these sorts of assets on attractive terms. Banks are struggling to attract deposits, with money market accounts paying higher interest rates. Given their long-duration books, which include unrealized losses, they cannot move fast enough to increase the yields they offer depositors. We expect banks to continue to optimize their balance sheets by selling high-quality assets, creating an opportunity for private Asset-Based Finance. As in other areas of our private credit business, we are focused primarily on high-quality borrowers and collateral. In the consumer segment, for example, our Asset-Based Finance team has drawn a sharp distinction between prime borrowers and lower-income borrowers, as the former has been far less affected by rising interest rates. Even something as simple as being a homeowner with a low mortgage rate locked in, compared to a renter who may have seen large increases in housing costs lately, can make a big difference in available cash. Our team has also been staying out of the segments that are most challenged by inflation and favoring investments with a high level of current income, rather than capital appreciation potential. We believe these loss-prevention measures are key to achieving strong risk-adjusted returns.

Fund Description & Performance

KKR Asset-Based Income Fund (“ABIF” or the “Fund”) invests in predominantly investment grade-rated Asset-Based Finance investments. The Fund launched on May 3, 2023, and is registered under the Investment Company Act of 1940, as amended, as a closed-end, non-diversified management investment company. The Fund’s investment objective is to seek to provide attractive risk-adjusted returns. ABIF seeks to invest at least 90% of its assets in either those rated investment grade, or investment grade like financings, as well as the purchase of whole loans which if securitized would largely be financed by investment grade bonds:

| • | Senior Investment Grade Financings are senior capital provided to a company or a portfolio backed by a pool of financial or hard assets, or private securitizations via pooling of financial assets. Examples include the securitization of a portfolio of music catalogues, a senior delayed draw financing facility for an auto lender, and a private securitization backed by residential solar or student loans. |

| • | Whole Loans involve the purchase of a pool of underlying loans directly from asset originators where approximately 85% of the capital structure is investment grade. Examples include consumer loans (home improvement loans, auto loans, student loans, etc.) and residential loans. |

ABIF targets investments in Senior Investment Grade Financings and Whole Loans, and focuses on investing in five key market segments with the following target exposures: Consumer (25-35%), Mortgage Finance (25-35%), Contractual Cash Flows (10-20%), Hard Assets (10-20%) and Small-Medium Enterprises (10-20%).

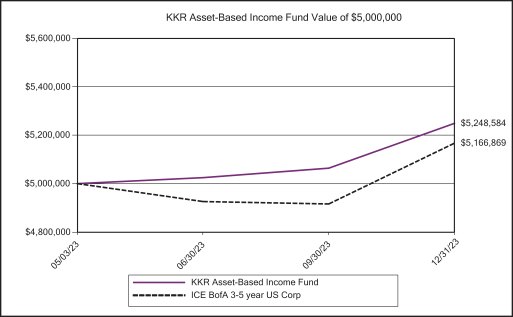

With respect to performance, since inception on May 3, 2023, the Fund has performed well both on an absolute basis and relative to broader IG Corporate markets. Since inception of the Fund through December 31, 2023, ABIF has achieved a total return gross of fees of 5.44% and 4.97% net of fees. By comparison, IG Corporates (as measured by the ICE Bank of America 3-5 US Corporate Index (C2A0)) returned 3.34%. The Fund outperformed its benchmark by 210 basis points (“bps”) on a gross of fees basis and 163 bps on a net of fees basis, at the high

2

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

end of its performance target. Additionally, the Fund has distributed $16.6 million of income since inception, or 6.4% on an annualized basis.

The Fund had a diversified portfolio of 58 assets, spread across target sectors of Mortgages, Consumer Finance, Small-Medium Sized Enterprises, Hard Assets, and Infrastructure, and yielded 7.38% as of December 31, 2023, compared to the corporate index of 4.95%. Additionally, the Fund’s risk composition included a substantial majority of A rated and BBB rated bonds, making up 88% of the portfolio’s market value. Further detail on this is below. Regarding the Fund’s performance drivers, the Fund’s Mortgage assets were the highest returning, followed by Infrastructure. Notably, performance was positive across all sectors and ratings.

We thank you for your partnership and continued investment in ABIF. We look forward to continued communications and will keep you apprised of the progress of ABIF specifically and the private credit marketplace generally.

Disclosures

Past performance is not an indication of future results. Returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, expense limitations and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when sold, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. An investment in the Fund involves risk, including the risk of loss of principal.

Must be preceded or accompanied by a prospectus.

An imbalance in supply and demand in the income market may result in valuation uncertainties and greater volatility, less liquidity, widening credit spreads and a lack of price transparency in the market. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non–payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. Borrowing to increase investments (leverage) will exaggerate the effect of any increase or decrease in the value of Fund investments. Investments rated below investment grade (typically referred to as “junk”) are generally subject to greater price volatility and illiquidity than higher rated investments. As interest rates rise, the value of certain income investments is likely to decline. Senior loans are subject to prepayment risk. Investments in foreign instruments or currencies can involve greater risk and volatility than US investments because of adverse market economic, political, regulatory, geopolitical or other conditions. Changes in the value of investments entered for hedging purposes may not match those of the position being hedged. The Fund may engage in other investment practices that may involve additional risks.

3

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

Performance Information (Unaudited)

Total Returns for the Period Ended December 31, 2023

| Since inception(1) |

||||||||

| KKR Asset-Based Income Fund |

4.97% | |||||||

| ICE BofA 3-5 year US Corp |

3.34% | |||||||

| (1) | The Fund commenced operations on May 3, 2023. |

Benchmark performance is from commencement date of common shares only and is not the commencement date of the benchmark itself.

The graph reflects the performance of a hypothetical $5,000,000 investment in common shares of the Fund for the period from inception through December 31, 2023. The performance shown in the table of average annual total returns is for common shares from the inception date through December 31, 2023. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance data shown represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that shares of the Fund when repurchased may be worth more or less than their original cost. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

4

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

Schedule of Investments Summary Table

As of December 31, 2023, the Fund’s portfolio composition, as a percentage of net assets, was as follows:

| % of Net Assets | ||||

| Asset-Backed Securities |

55.9% | |||

| Mortgage-Backed Securities |

31.2% | |||

| Senior Loans |

10.2% | |||

| Private Equity |

0.2% | |||

| Money Market Fund |

4.0% | |||

|

|

|

|||

| 101.5% | ||||

| Liabilities Exceeding Other Assets, Net |

(1.5)% | |||

|

|

|

|||

| Net Assets |

100.0% | |||

See accompanying notes to financial statements.

5

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

| Issuer | Asset | Effective Interest Rate |

Maturity Date |

Par | Fair Value | |||||||||||||||

| Asset-Backed Securities — 55.9% |

|

|||||||||||||||||||

| Auto — 7.1% |

||||||||||||||||||||

| Ally Auto Receivables Trust |

Class A3, Series 2022-3 | 5.07% | 4/15/2027 | 2,500,000 | $ | 2,499,884 | ||||||||||||||

| Exeter Automobile Receivables Trust |

Class C, Series 2022-1A | 2.56% | 6/15/2028 | 6,250,000 | 6,112,294 | |||||||||||||||

| Hyundai Auto Receivables Trust |

Class A3, Series 2022-A | 2.22% | 10/15/2026 | 2,427,732 | 2,373,058 | |||||||||||||||

| Octane Receivables Trust (a) |

Class D, Series 2022-2A | 7.70% | 2/20/2030 | 10,000,000 | 10,177,468 | |||||||||||||||

| Santander Drive Auto Receivables Trust (b) |

Class B, Series 2022-2 | 3.44% | 9/15/2027 | 3,000,000 | 2,943,985 | |||||||||||||||

| Westlake Automobile Receivables Trust (a) |

Class C, Series 2021-3A | 1.58% | 1/15/2027 | 6,250,000 | 6,063,568 | |||||||||||||||

| Infrastructure Credit — 9.6% |

|

|||||||||||||||||||

| Adams Outdoor Advertising LP (a) |

Class A2, Series 2023-1 | 6.97% | 7/15/2053 | 20,000,000 | 20,305,231 | |||||||||||||||

| ALLO Issuer LLC (a) |

Class A2, Series 2023-1A | 6.20% | 6/20/2053 | 17,069,000 | 16,727,081 | |||||||||||||||

| Hotwire Funding LLC (a) |

Class B, Series 2023-1A | 7.00% | 5/20/2053 | 4,500,000 | 4,438,647 | |||||||||||||||

| Single Family Rental — 12.7% |

|

|||||||||||||||||||

| AMSR Trust (a) |

Class E2, Series 2022-SFR3 | 4.00% | 10/17/2039 | 1,250,000 | 1,113,608 | |||||||||||||||

| AMSR Trust (a) |

Class E2, Series 2023-SFR1 | 4.00% | 4/17/2040 | 5,939,000 | 5,175,876 | |||||||||||||||

| Bridge Trust (a) |

Class E1, Series 2022-SFR1 | 6.30% | 11/17/2037 | 15,000,000 | 14,552,562 | |||||||||||||||

| FirstKey Homes Trust (a) |

Class E2, Series 2022-SFR1 | 5.00% | 5/19/2039 | 1,500,000 | 1,390,628 | |||||||||||||||

| FirstKey Homes Trust (a) |

Class E2, Series 2022-SFR3 | 3.50% | 7/17/2038 | 20,000,000 | 18,104,034 | |||||||||||||||

| FRTKL (a) |

Class E1, Series 2021-SFR1 | 2.37% | 9/17/2038 | 1,750,000 | 1,534,575 | |||||||||||||||

| FRTKL (a) |

Class E2, Series 2021-SFR1 | 2.52% | 9/17/2038 | 8,900,000 | 7,788,378 | |||||||||||||||

| Progress Residential Trust (a) |

Class E2, Series 2022-SFR3 | 5.60% | 4/17/2039 | 2,166,000 | 2,053,037 | |||||||||||||||

| Progress Residential Trust (a) |

Class E2, Series 2023-SFR1 | 6.60% | 3/17/2040 | 2,500,000 | 2,427,700 | |||||||||||||||

| Small Business Loans — 8.4% |

|

|||||||||||||||||||

| CPC Asset Securitization I LLC (a) |

Class A, Series 2021-1A | 3.58% | 11/16/2026 | 13,000,000 | 12,466,089 | |||||||||||||||

| CPC Asset Securitization II LLC (a) |

Class A, Series 2023-1A | 7.53% | 3/15/2029 | 11,930,000 | 12,117,819 | |||||||||||||||

| Libertas Asset Securitization LLC (a) |

Class A1, Series 2023-1A | 7.67% | 7/16/2029 | 11,500,000 | 11,646,508 | |||||||||||||||

| Solar Development Lending — 7.7% |

|

|||||||||||||||||||

| GoodLeap Sustainable Home Solutions Trust (a) |

Class A, Series 2023-2GS | 5.70% | 5/20/2055 | 9,642,613 | 9,496,702 | |||||||||||||||

| Mosaic Solar Loan Trust (a) |

Class B, Series 2023-3A | 7.37% | 11/20/2053 | 17,129,002 | 17,656,349 | |||||||||||||||

| Sunnova Helios XI Issuer LLC (a) |

Class B, Series 2023-A | 5.60% | 5/20/2050 | 6,313,882 | 6,094,741 | |||||||||||||||

| Student Loans — 3.3% |

|

|||||||||||||||||||

| College Ave Student Loans LLC (a) |

Class C, Series 2023-A | 6.06% | 5/25/2055 | 3,000,000 | 2,909,009 | |||||||||||||||

| College Ave Student Loans LLC (a) |

Class D, Series 2023-A | 6.89% | 5/25/2055 | 2,000,000 | 1,986,022 | |||||||||||||||

| College Ave Student Loans LLC (a) |

Class E, Series 2023-A | 8.49% | 5/25/2055 | 4,000,000 | 3,996,910 | |||||||||||||||

| SMB Private Education Loan Trust (a) |

Class C, Series 2023-B | 6.36% | 10/16/2056 | 5,000,000 | 5,003,156 | |||||||||||||||

| Unsecured Consumer — 7.1% |

|

|||||||||||||||||||

| Marlette Funding Trust (a) |

Class C, Series 2023-3A | 7.06% | 9/15/2033 | 13,670,000 | 13,863,234 | |||||||||||||||

| Marlette Funding Trust (a) |

Class D, Series 2023-2A | 7.92% | 6/15/2033 | 5,480,000 | 5,606,782 | |||||||||||||||

| Marlette Funding Trust (a) |

Class D, Series 2023-3A | 8.04% | 9/15/2033 | 3,500,000 | 3,594,415 | |||||||||||||||

| OneMain Financial Issuance Trust (a) |

Class C, Series 2023-1A | 6.38% | 6/14/2038 | 7,500,000 | 7,592,874 | |||||||||||||||

|

|

|

|||||||||||||||||||

| TOTAL ASSET-BACKED SECURITIES (Cost $236,733,205) |

|

$ | 239,812,224 | |||||||||||||||||

|

|

|

|||||||||||||||||||

See accompanying notes to financial statements.

6

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

| Issuer | Asset | Effective Interest Rate |

Maturity Date |

Par | Fair Value | |||||||||||

| Mortgage-Backed Securities — 31.2% |

|

|||||||||||||||

| Home Equity Investments — 3.7% |

|

|||||||||||||||

| Unison Trust (a)(c)(d) |

Class A, Series 2023-1 | 6.50% | 5/25/2033 | 14,199,316 | $ | 12,823,402 | ||||||||||

| Unison Trust (a)(d) |

Class A, Series 2023-2 | 6.50% | 11/25/2053 | 3,182,061 | 2,846,672 | |||||||||||

| Investor Loans — 4.3% |

|

|||||||||||||||

| Verus Securitization Trust (a)(e) |

Class M1, Series 2022-INV1 | 5.85% | 8/25/2067 | 10,927,000 | 10,523,045 | |||||||||||

| Verus Securitization Trust (a)(e) |

Class M1, Series 2022-INV2 | 6.80% | 10/25/2067 | 1,500,000 | 1,474,752 | |||||||||||

| Verus Securitization Trust (a)(e) |

Class M1, Series 2023-INV1 | 7.59% | 2/25/2068 | 6,300,000 | 6,375,480 | |||||||||||

| Non-Qualified Mortgage — 16.3% |

|

|||||||||||||||

| Credit Suisse Mortgage Trust (a)(e) |

Class M1, Series 2022-ATH3 | 7.10% | 8/25/2067 | 20,876,246 | 20,662,633 | |||||||||||

| GCAT Trust (a)(e) |

Class M1, Series 2022-NQM4 | 5.75% | 8/25/2067 | 7,500,000 | 7,093,820 | |||||||||||

| Imperial Fund Mortgage Trust (a)(c) |

Class M1, Series 2022-NQM5 | 6.25% | 8/25/2067 | 4,000,000 | 3,892,053 | |||||||||||

| Imperial Fund Mortgage Trust (a)(e) |

Class M1, Series 2022-NQM7 | 7.53% | 11/25/2067 | 16,788,000 | 16,814,607 | |||||||||||

| PRKCM Trust (a)(e) |

Class M1, Series 2022-AFC2 | 6.22% | 8/25/2057 | 2,420,000 | 2,344,431 | |||||||||||

| Verus Securitization Trust (a)(e) |

Class M1, Series 2022-8 | 6.15% | 9/25/2067 | 1,530,000 | 1,484,454 | |||||||||||

| Verus Securitization Trust (a)(e) |

Class M1, Series 2023-1 | 6.96% | 12/25/2067 | 2,000,000 | 1,974,917 | |||||||||||

| Verus Securitization Trust (a)(e) |

Class M1, Series 2023-2 | 7.62% | 3/25/2068 | 4,000,000 | 4,053,683 | |||||||||||

| Verus Securitization Trust (a)(e) |

Class M1, Series 2023-3 | 7.93% | 3/25/2068 | 2,000,000 | 2,032,991 | |||||||||||

| Verus Securitization Trust (a)(e) |

Class M1, Series 2023-4 | 7.40% | 5/25/2068 | 10,000,000 | 10,080,942 | |||||||||||

| Second Lien/HELOC — 6.9% |

|

|||||||||||||||

| FIGRE Trust (a)(e) |

Class A, Series 2023-HE2 | 6.51% | 5/25/2053 | 4,175,141 | 4,263,386 | |||||||||||

| FIGRE Trust (a)(e) |

Class B, Series 2023-HE2 | 7.69% | 5/25/2053 | 4,978,413 | 5,135,528 | |||||||||||

| Saluda Grade Alternative Mortgage |

Class A2, Series 2023-SEQ3 | 6.89% | 6/1/2053 | 5,829,000 | 5,876,359 | |||||||||||

| Saluda Grade Alternative Mortgage |

Class A3, Series 2023-SEQ3 | 7.12% | 6/1/2053 | 10,127,000 | 10,208,447 | |||||||||||

| Saluda Grade Alternative Mortgage |

Class M1, Series 2023-SEQ3 | 8.71% | 6/1/2053 | 3,722,000 | 3,808,758 | |||||||||||

|

|

|

|||||||||||||||

| TOTAL MORTGAGE-BACKED SECURITIES (Cost $132,472,267) |

$ | 133,770,360 | ||||||||||||||

|

|

|

|||||||||||||||

| Senior Loans — 10.2% |

||||||||||||||||

| Aviation Leasing — 3.3% |

||||||||||||||||

| Genesis Aircraft Services Ltd (d)(e)(f) |

TL 1L DD 08/23 | 8.22% - 8.69% | 7/31/2029 | 14,431,484 | 14,286,600 | |||||||||||

| Solar Development Lending — 0.9% |

|

|||||||||||||||

| SunPower Financial (b)(d)(e)(f) |

Revolver 1L 06/23 | 6.43% (SOFR + 2.50%) | 8/30/2054 | 1,630,862 | 1,630,862 | |||||||||||

| SunPower Financial (b)(d) |

TL 1L DD 11/23 | 6.65% | 8/30/2054 | 1,942,302 | 1,942,302 | |||||||||||

| Unsecured Consumer — 6.0% |

|

|||||||||||||||

| BHG Funding LLC (d) |

TL 1L A2 05/23 | 7.07% | 5/19/2036 | 22,851,031 | 22,535,686 | |||||||||||

| BHG Funding LLC (d) |

TL 2L B2 05/23 | 8.12% | 5/19/2036 | 1,694,412 | 1,669,504 | |||||||||||

| BHG Funding LLC (d)(e) |

TL 3L C2 05/23 | 13.96% | 5/19/2036 | 1,694,701 | 1,671,315 | |||||||||||

|

|

|

|||||||||||||||

| TOTAL SENIOR LOANS (Cost $44,244,792) |

$ | 43,736,269 | ||||||||||||||

|

|

|

|||||||||||||||

See accompanying notes to financial statements.

7

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

| Issuer | Asset | Effective Interest Rate |

Shares | Fair Value | ||||||||||||||||

| Private Equity — 0.2% |

||||||||||||||||||||

| Solar Development Lending — 0.2% |

||||||||||||||||||||

| SunPower Financial (b)(d) |

Private Equity (SPV) | 837,452 | $ | 1,018,199 | ||||||||||||||||

|

|

|

|||||||||||||||||||

| TOTAL PRIVATE EQUITY (Cost $837,452) |

|

$ | 1,018,199 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| TOTAL INVESTMENTS (Cost $414,287,716) — 97.5% |

|

$ | 418,337,052 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| Money Market Fund — 4.0% |

||||||||||||||||||||

| U.S. Government Securities — 4.0% |

||||||||||||||||||||

| Fidelity Investments Money Market Treasury Portfolio (g) |

Class I | 5.23% | 17,110,461 | 17,110,461 | ||||||||||||||||

|

|

|

|||||||||||||||||||

| TOTAL MONEY MARKET FUND (Cost $17,110,461) |

|

$ | 17,110,461 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| TOTAL INVESTMENTS INCLUDING MONEY MARKET FUND (Cost $431,398,177) — 101.5% |

|

$ | 435,447,513 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| LIABILITIES EXCEEDING OTHER ASSETS, NET — (1.5)% |

|

(6,483,636) | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| NET ASSETS — 100.0% |

|

$ | 428,963,877 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| DD | Delayed draw term loan |

| SOFR | Secured Overnight Financing Rate |

| SPV | Special Purpose Vehicle |

| TL | Term loan |

| 1L | First lien |

| 2L | Second lien |

| 3L | Third lien |

| (a) | Securities exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold to qualified institutional buyers in transactions exempt from registration. |

| (b) | Security considered restricted. |

| (c) | Debt obligation initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at December 31, 2023. |

| (d) | Value determined using significant unobservable inputs. |

| (e) | Variable rate securities. The effective rate shown is based on the latest available information as of December 31, 2023. Certain variable rate securities are based on a published reference rate and spread. Interest rates for certain variable rate securities are determined by the issuer, or agent and are based on current market conditions, and these securities do not indicate a reference rate and spread in their description. |

| (f) | Investment is a partially funded commitment. |

| (g) | Rate represents the money market fund’s average 7-day yield as of December 31, 2023. |

See accompanying notes to financial statements.

8

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

Statement of Assets and Liabilities

| Assets |

||||

| Investments, at fair value (cost $414,287,716) |

$ | 418,337,052 | ||

| Cash and cash equivalents |

17,110,461 | |||

| Dividend and interest receivable |

1,475,932 | |||

| Other assets |

382,816 | |||

| Prepaid expenses |

149,707 | |||

|

|

|

|||

| Total Assets |

437,455,968 | |||

|

|

|

|||

| Liabilities |

||||

| Distributions payable to Shareholders |

6,878,214 | |||

| Administration and custody fees payable |

336,194 | |||

| Due to Adviser |

173,858 | |||

| Investment advisory fees payable |

128,220 | |||

| Audit and tax fees payable |

120,668 | |||

| Trustees’ fees payable |

30,390 | |||

| Other accrued expenses |

423,307 | |||

|

|

|

|||

| Total Liabilities |

8,090,851 | |||

|

|

|

|||

| Series A Cumulative Preferred Shares, net (515 shares issued and outstanding) |

401,240 | |||

| Commitments and Contingencies (Note 8) |

||||

|

|

|

|||

| Net Assets |

$ | 428,963,877 | ||

|

|

|

|||

| Net Assets: |

||||

| Paid-in capital ($0.001 par value, unlimited shares authorized) |

$ | 424,981,656 | ||

| Total distributable earnings |

3,982,221 | |||

|

|

|

|||

| Total Net Assets |

$ | 428,963,877 | ||

|

|

|

|||

| Net Asset Value Per Share: |

||||

| 425,389 shares outstanding |

$ | 1,008.40 | ||

|

|

|

|||

See accompanying notes to financial statements.

9

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

For the Period from May 3, 2023 (commencement of operations) to December 31, 2023

| Investment Income |

||||

| Interest income |

$ | 16,218,779 | ||

| Dividend income |

1,857,265 | |||

| Other income |

477,782 | |||

|

|

|

|||

| Total Investment Income |

18,553,826 | |||

|

|

|

|||

| Expenses |

||||

| Investment advisory fees |

1,375,504 | |||

| Administration and custody fees |

460,043 | |||

| Legal fees |

200,000 | |||

| Audit and tax fees |

120,668 | |||

| Trustees’ fees |

104,363 | |||

| Insurance expenses |

97,099 | |||

| Transfer agent fees |

82,878 | |||

| Professional fees |

74,787 | |||

| Pricing fees |

49,726 | |||

| Other expenses |

145,914 | |||

|

|

|

|||

| Total Expenses |

2,710,982 | |||

|

|

|

|||

| Less: Fees waived by the Adviser |

(412,651) | |||

| Less: Expenses reimbursed by the Adviser |

(434,283) | |||

|

|

|

|||

| Net Expenses |

1,864,048 | |||

|

|

|

|||

| Net Investment Income |

16,689,778 | |||

|

|

|

|||

| Net Realized and Unrealized Gain (Loss) on Investments |

||||

| Net Realized Gain (Loss) From: |

||||

| Investments |

(96,186) | |||

|

|

|

|||

| Net Realized Loss |

(96,186) | |||

|

|

|

|||

| Net Change in Unrealized Appreciation (Depreciation) From: |

||||

| Investments |

4,049,336 | |||

|

|

|

|||

| Net Change in Unrealized Appreciation |

4,049,336 | |||

|

|

|

|||

| Net Realized and Unrealized Gain on Investments |

3,953,150 | |||

|

|

|

|||

| Distributions from net income paid to Series A Cumulative Preferred Shareholders |

(40,975) | |||

|

|

|

|||

| Increase in Net Assets resulting from operations |

$ | 20,601,953 | ||

|

|

|

|||

See accompanying notes to financial statements.

10

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

Statement of Changes in Net Assets

| For the Period from May 3, 2023 (commencement of operations) to December 31, 2023 |

||||

| Operations: |

||||

| Net investment income |

$ | 16,689,778 | ||

| Net realized loss |

(96,186) | |||

| Net change in unrealized appreciation |

4,049,336 | |||

| Distributions from net income paid to Series A Cumulative Preferred Shareholders |

(40,975) | |||

|

|

|

|||

| Increase in Net Assets resulting from Operations |

20,601,953 | |||

|

|

|

|||

| Distributions to Shareholders from: |

||||

| Total distributable earnings |

(16,638,076) | |||

|

|

|

|||

| Total Distributions to Shareholders |

(16,638,076) | |||

|

|

|

|||

| Shareholder Transactions (Note 7) |

||||

| Net proceeds from sale of shares |

425,000,000 | |||

|

|

|

|||

| Increase in Net Assets from Shareholder Transactions |

425,000,000 | |||

|

|

|

|||

| Net Increase in Net Assets |

$ | 428,963,877 | ||

|

|

|

|||

| Net Assets: |

||||

| Beginning of period |

— | |||

| End of period |

$ | 428,963,877 | ||

|

|

|

|||

See accompanying notes to financial statements.

11

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

For the Period from May 3, 2023 (commencement of operations) to December 31, 2023

| Cash Flows from Operating Activities: |

||||

| Net increase in net assets resulting from operations |

$ | 20,601,953 | ||

| Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | ||||

| Purchases of investments |

(435,514,748) | |||

| Proceeds from sales and paydowns of investments |

21,854,222 | |||

| Change in net unrealized appreciation on investments |

(4,049,336) | |||

| Net accretion of discounts and premiums |

(723,376) | |||

| Net realized loss on investment security transactions |

96,186 | |||

| Changes in assets and liabilities: |

||||

| Increase in dividend and interest receivable |

(1,475,932) | |||

| Increase in other assets |

(382,816) | |||

| Increase in prepaid expenses |

(149,707) | |||

| Increase in Trustees’ fees payable |

30,390 | |||

| Increase in audit and tax fees payable |

120,668 | |||

| Increase in investment advisory fees payable |

128,220 | |||

| Increase in due to Adviser |

173,858 | |||

| Increase in administration and custody fees payable |

336,194 | |||

| Increase in other expenses |

423,307 | |||

|

|

|

|||

| Net cash used in operating activities |

(398,530,917) | |||

|

|

|

|||

| Cash Flows from Financing Activities: |

||||

| Proceeds from sale of common shares |

425,000,000 | |||

| Proceeds from issuance of Series A Cumulative Preferred Shares |

401,240 | |||

| Payment of distributions to Common Stockholders |

(9,759,862) | |||

|

|

|

|||

| Net cash provided by financing activities |

415,641,378 | |||

|

|

|

|||

| Net Increase in Cash Equivalents |

17,110,461 | |||

|

|

|

|||

| Cash Equivalents: |

||||

| Beginning of period |

— | |||

|

|

|

|||

| End of period |

$ | 17,110,461 | ||

|

|

|

See accompanying notes to financial statements.

12

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

| For the Period from May 3, 2023(1) to December 31, 2023 |

||||

| Common Shares |

||||

| Per Share Operating Performance |

||||

| Net asset value, beginning of period |

$ | 1,000.00 | ||

| Income from operations: |

||||

| Net investment income(2) |

41.29 | |||

| Net realized and unrealized gain |

8.12 | |||

|

|

|

|||

| Total income from operations |

49.41 | |||

| Less distributions from: |

||||

| Net Investment Income |

(41.01) | |||

|

|

|

|||

| Net asset value, end of period |

$ | 1,008.40 | ||

|

|

|

|||

| Total return(3) |

4.97% | |||

| Ratio to average net assets |

||||

| Expenses, before waiver and reimbursement(4) |

0.99% | |||

| Expenses, after waiver and reimbursement(4) |

0.68% | |||

| Net investment income, before waiver and reimbursement(4) |

5.70% | |||

| Net investment income, after waiver and reimbursement(4) |

6.01% | |||

| Supplemental data |

||||

| Net assets, end of period |

$ | 428,963,877 | ||

| Portfolio turnover rate |

6.27% | |||

| (1) | Common Shares commenced operations on May 3, 2023. |

| (2) | Per share calculations were performed using the average shares outstanding for the period. |

| (3) | Total return and Portfolio turnover rate are for the period indicated and have not been annualized. Total return assumes a purchase of common share at the net asset value on the first day and a sale at the net asset value on the last day of each period reported on the table. Total return assumes reinvestment of dividends and distributions at prices obtained pursuant to the Fund’s dividend reinvestment plan. |

| (4) | Annualized. |

See accompanying notes to financial statements.

13

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

1. Organization

KKR Asset-Based Income Fund (the “Fund”) was organized on February 10, 2023 as a statutory trust under the laws of the State of Delaware. The Fund is a closed-end registered management investment company, which commenced operations on May 3, 2023. The Fund seeks to provide attractive risk-adjusted returns. The Fund is non-diversified for purposes of the Investment Company Act of 1940, as amended (the “1940 Act”). KKR Credit Advisors (US) LLC serves as the Fund’s investment adviser (the “Adviser”).

2. Summary of Significant Accounting Policies

Basis of Presentation — The accompanying financial statements are presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and are stated in United States (“U.S.”) dollars. The Fund is an investment company following accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services — Investment Companies. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in these financial statements. Actual results could differ from those estimates.

Valuation of Investments — The Board of Trustees (the “Board”) of the Fund has adopted valuation policies and procedures to ensure investments are valued in a manner consistent with GAAP as required by the 1940 Act. The Board designated the Adviser as the valuation designee to perform fair valuations pursuant to Rule 2a-5 under the 1940 Act (the “Valuation Designee”). The Valuation Designee has primary responsibility for implementing the Fund’s valuation policies and procedures.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where available, fair value is based on observable market prices or parameters, or derived from such prices or parameters. Where observable prices or inputs are not available, valuation models are applied. These valuation techniques involve some level of management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity for disclosure purposes.

Assets and liabilities recorded at fair value on the Statement of Assets and Liabilities are categorized based upon the level of judgment associated with the inputs used to measure their value. Hierarchical levels, as defined under GAAP, are directly related to the amount of subjectivity associated with the inputs to fair valuations of these assets and liabilities, and are as follows:

Level 1 — Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date.

Level 2 — Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs include quoted prices for similar instruments in active markets, and inputs other than quoted prices that are observable for the asset or liability.

Level 3 — Inputs are unobservable for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability.

14

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

A significant decrease in the volume and level of activity for the asset or liability is an indication that transactions or quoted prices may not be representative of fair value because in such market conditions there may be increased instances of transactions that are not orderly. In those circumstances, further analysis of transactions or quoted prices is needed, and a significant adjustment to the transactions or quoted prices may be necessary to estimate fair value.

The availability of observable inputs can vary depending on the financial asset or liability and is affected by a wide variety of factors, including, for example, the type of product, whether the product is new, whether the product is traded on an active exchange or in the secondary market, and the current market condition. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by the Fund in determining fair value is greatest for instruments categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement in its entirety falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The Fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and consideration of factors specific to the asset. The variability of the observable inputs affected by the factors described above may cause transfers between Levels 1, 2 and/or 3, which the Fund recognizes at the beginning of the period during which the inputs change.

Many financial assets and liabilities have bid and ask prices that can be observed in the marketplace. Bid prices reflect the highest price that the Fund and others are willing to pay for an asset. Ask prices represent the lowest price that the Fund and others are willing to accept for an asset. For financial assets and liabilities whose inputs are based on bid-ask prices, the Fund does not require that fair value always be a predetermined point in the bid-ask range. The Fund’s policy is to allow for mid-market pricing and adjust to the point within the bid-ask range that meets the Fund’s best estimate of fair value.

Depending on the relative liquidity in the markets for certain assets, the Fund may transfer assets to Level 3 if it determines that observable quoted prices, obtained directly or indirectly, are not available.

Investments are generally valued based on quotations from third party pricing services, unless such a quotation is unavailable or is determined to be unreliable or inadequately representing the fair value of the particular assets. In that case, valuations are based on either valuation data obtained from one or more other third party pricing sources, including broker dealers selected by the Adviser, or will reflect the Valuation Committee’s good faith determination of fair value based on other factors considered relevant. For assets classified as Level 3, valuations are based on various factors including financial and operating data of the company, company specific developments, market valuations of comparable companies and model projections.

For the period ended December 31, 2023, there have been no significant changes to the Fund’s fair value methodologies.

Reverse Repurchase Agreements — Reverse repurchase agreements are agreements that involve the sale of securities held by the Fund to financial institutions such as banks and broker-dealers, with an agreement that the Fund will repurchase the securities at an agreed upon price and date. During the reverse repurchase agreement period, the Fund continues to receive interest and principal payments on the securities sold. Transactions involving reverse repurchase agreements are treated as collateralized borrowings and are recorded at their contracted repurchase price, which approximates their fair value due to the short term nature of these transactions.

15

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

Senior Loans — Senior loans hold the most senior position in the capital structure of a borrower and in most circumstances are fully collateralized by assets of the borrower. They are generally repaid before unsecured bank loans, corporate bonds, subordinated debt, trade creditors and preferred or common shareholders. Substantial increases in interest rates could cause an increase in loan defaults as borrowers might lack resources to meet higher debt service requirements. The value of the Fund’s assets could also be affected by other uncertainties such as economic developments affecting the market for senior secured term loans or affecting borrowers generally.

Mortgage-Backed and Asset-Backed Securities — The Fund invests in mortgage-backed securities (“MBS”) and asset-backed securities (“ABS”). ABS represent interests in pools of underlying hard and financial assets. MBS are created from pools of residential or commercial mortgage loans. These securities typically provide a monthly payment that consists of principal and/or interest payments. Interest payments may be determined by fixed or adjustable rates.

Unfunded Loan Commitments — Unfunded loan commitments may be partially or wholly unfunded. During the contractual period, the Fund is obliged to provide funding to the borrower upon demand. The fair value of unfunded loan agreements may, at times, be priced at less than par value resulting in a financial liability in the Schedule of Investments. These values are temporary and the funding of the commitment will result in these investments valued as financial assets.

When-Issued Securities — The Fund may purchase and sell securities on a when-issued basis, including To Be Announced (“TBA”) securities. These transactions are made conditionally because a security, although authorized, has not yet been issued in the market. A commitment by the Fund is made regarding these transactions to purchase or sell securities for a predetermined price or yield, with payment and delivery taking place beyond the customary settlement period. The Fund may sell when-issued securities before they are delivered, which may result in a capital gain or loss. Risk may arise upon entering these contracts from the potential inability of a counterparty to meet the terms of their contracts, or if the issuer does not issue the securities due to political, economic, or other factors.

Investment Transactions — Investment transactions are accounted for on the trade date, the date the order to buy or sell is executed. Interest income is accrued as earned. Dividends are recorded on the ex-dividend date. Discounts are accreted and premiums are amortized using the effective interest method over the holding period of the investment. Paydown gains and losses on MBS and ABS are recorded as an adjustment to interest income. Realized gains and losses are calculated on the specific identified cost basis.

Cash and Cash Equivalents — Cash and cash equivalents include cash on hand, cash held in banks and highly liquid investments with original maturities of three or fewer months. Cash equivalents consist solely of money market funds with financial institutions. As of December 31, 2023, the Fund invested in Fidelity Investments Money Market Treasury Portfolio — Class I.

Distributions to Shareholders — Distributions of net investment income are declared and paid quarterly and distributable net realized capital gains, if any, are declared and distributed at least annually. Distributions to shareholders are recorded on the ex-dividend date.

Income Taxes — The Fund has elected to be treated and has qualified, and intends to continue to qualify in each taxable year, as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended, and in conformity with the Regulated Investment Company Modernization Act of 2010. The Fund will not be subject to federal income tax to the extent the Fund satisfies the requirements under Section 851 of the Internal Revenue Code, including distributing all of its gross investment company taxable income and capital gains to its shareholders based on the Fund’s fiscal year end of December 31.

16

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

To avoid imposition of a 4.0% excise tax on undistributed income applicable to regulated investment companies, the Fund intends to declare each year as dividends in each calendar year at least 98.0% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the one year period ended December 31) plus undistributed amounts, if any, from prior years.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is “more-likely-than-not” (i.e., greater than 50.0%) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions for the open tax year (2023). However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities, on-going analysis of and changes to tax laws, regulations and interpretations thereof.

As of December 31, 2023, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period ended December 31, 2023, the Fund did not incur any interest or penalties.

Recent Accounting Pronouncements — In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. ASU 2020-04 contains practical expedients for reference rate reform-related activities that impact debt, leases, derivatives, and other contracts. The guidance in ASU 2020-04 is optional and may be elected over time as reference rate reform activities occur. Management of the Fund has elected to adopt this accounting standard and apply it to contracts that are modified for the sole purpose of reference rate reform. In December 2022, the FASB issued ASU No. 2022-06, Reference Rate Reform (Topic 848): Deferral of the Sunset Date of Topic 848, which deferred the sunset day of this guidance to December 31, 2024. The adoption of these standards did not have a material impact to these financial statements.

3. Risk Considerations

The Fund invests mainly in ABS, MBS and senior loans. These investments may involve certain risks, including, but not limited to, those described below:

Global Economic and Market Conditions — The Fund is materially affected by market, economic and political conditions and events, such as natural disasters, epidemics and pandemics, wars, supply chain disruptions, economic sanctions, globally and in the jurisdictions and sectors in which it invests or operates, including factors affecting interest rates, the availability of credit, currency exchange rates and trade barriers. For example, the COVID-19 pandemic, the Russia-Ukraine war, rapid interest rate fluctuations, heightened inflation, supply chain disruptions, geopolitical risks, economic sanctions and volatility in the banking and financial sector have disrupted global economies and financial markets, and their prolonged economic impact is uncertain. Market, economic and political conditions and events are outside the Adviser’s control and could adversely affect the Fund’s operations and performance and the liquidity and value of the Fund’s investments and reduce the ability of the Fund to make attractive new investments.

Leverage Risk — Leverage is a speculative technique that may expose the Fund to greater risk and increased costs. When leverage is used, the net asset value of the Fund’s shares and the Fund’s investment return will likely be more volatile.

17

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

Market Risk — Bond markets rise and fall daily. As with any investment with performance tied to these markets, the value of an investment in the Fund will fluctuate, which means that shareholders could lose money.

Interest Rate Risk — Interest rates will rise and fall over time. During periods when interest rates are low, the Fund’s yield and total return also may be low. Changes in interest rates also may affect the Fund’s share price and a sharp rise in interest rates could cause the Fund’s share price to fall. The longer the Fund’s duration, the more sensitive to interest rate movements its share price is likely to be.

Credit Risk — The Fund is subject to the risk that a decline in the credit quality of an investment could cause the Fund to lose money or underperform. The Fund could lose money if the issuer or guarantor of an investment fails to make timely principal or interest payments or otherwise honor its obligations.

Liquidity Risk — A particular investment may be difficult to purchase or sell. The Fund may be unable to sell illiquid securities at an advantageous time or price.

Prepayment and Extension Risk — The Fund’s investments are subject to the risk that the investments may be paid off earlier or later than expected. Either situation could cause the Fund to hold investments paying lower than market rates of interest, which could hurt the Fund’s yield or share price.

Issuer Risk — The value of securities may decline for a number of reasons that directly relate to the issuer, such as its financial strength, management performance, financial leverage and reduced demand for the issuer’s goods and services, as well as the historical and prospective earnings of the issuer and the value of its assets.

For more information on these and other risks, refer to the Fund’s private placement memorandum.

4. Agreements

Investment Advisory Agreement — The Adviser provides day-to-day portfolio management services to the Fund and has discretion to purchase and sell investments in accordance with the Fund’s objectives, policies, and restrictions. For the services it provides to the Fund, the Adviser receives an annual fee, payable monthly in arrears by the Fund, in an amount equal to 0.50% of the Fund’s month end net assets (the “Management Fee”). The Adviser has agreed to temporarily reduce its Management Fee to an annual rate of 0.35% of the Fund’s month end net assets until the later of one year from the date of the Confidential Private Placement Memorandum, April 25, 2023, or until the Fund’s aggregate net assets are equal to or greater than $1.0 billion. Effective the later of one year from the date of the Confidential Private Placement Memorandum, April 25, 2023, or until the Fund’s aggregate net assets are equal to or greater than $1.0 billion, the Adviser’s agreement to temporarily reduce its Management Fee will terminate, and the Adviser will receive a Management Fee at an annual rate of 0.50% of the Fund’s month end net assets. The aforementioned limitation to the Management Fee may be extended, terminated or modified by the Adviser in its sole discretion and at any time, including prior to any such date listed above.

During the period ended December 31, 2023, the Adviser earned a Management Fee of $1.4 million and waived fees of $0.4 million.

Expense Limitation and Reimbursement Agreement — The Fund has entered into an Expense Limitation and Reimbursement Agreement (the “Expense Limitation Agreement”) with the Adviser pursuant to which the Adviser will agree to waive its monthly fee and pay, absorb or reimburse some or all of the Fund’s “Specified Expenses” (as defined below), an “Expense Limitation Payment,” for each month during the Limitation Period (as defined below) to the extent necessary so that, for any fiscal year, the Fund’s Specified Expenses do not exceed 0.30% of the Fund’s month end net assets.

18

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

“Specified Expenses” is defined to include all expenses incurred in the business of the Fund, including organization and offering expenses, with the exception of (i) the Management Fee; (ii) fees, costs and expenses of identifying, sourcing, investigating (and conducting diligence with respect to), evaluating, structuring, consummating, registering, holding, rating, monitoring or disposing potential and actual portfolio investments, including (a) brokerage commissions, clearing and settlement charges, investment banking fees, bank charges, custodial fees, placement, syndication and solicitation fees, arranger fees, expenses relating to short sales, sales commissions, and other investment, execution, closing and administrative fees, costs and expenses, (b) any travel-related costs and expenses incurred in connection therewith (including costs and expenses of accommodations and meals, costs and expenses related to attending trade association meetings, conferences or similar meetings for purposes of evaluating actual or potential investment opportunities, and with respect to travel on non-commercial aircraft, costs of travel at a comparable business class commercial airline rate) including any such expenses incurred in connection with attendance at meetings of relevant investment committees and portfolio management committees, (c) expenses associated with portfolio and risk management including hedging transactions and related costs, (d) fees, costs and expenses incurred in the organization, operation, administration, restructuring or dissolution, liquidation and termination of any entities through which the Fund makes investments (including costs associated with establishing and maintaining a permanent residence in certain jurisdictions, such as employee compensation and benefits, allocable rent and other overhead of entities established to manage or administer such entities including entities in which KKR or its affiliates have an interest), and (e) fees, costs and expenses of outside counsel, accountants, auditors, consultants and other similar advisors and service providers incurred in connection with designing, implementing and monitoring participation by portfolio companies or other issuers in compliance and operational “best practices” programs and initiatives; (iii) dividend/interest payments (including any dividend payments, interest expenses, commitment fees, or other expenses related to any leverage incurred by the Fund); (iv) taxes; and (v) extraordinary expenses (as determined in the sole discretion of the Adviser).

The “Limitation Period” commenced on April 25, 2023 through the later of two years or until the Fund’s aggregate net assets are equal to or greater than $1.5 billion. The Fund will agree to repay these amounts (“Reimbursement Payment”) on a monthly basis, but only if and to the extent that Specified Expenses plus the Reimbursement Payment are less than 0.30% of the Fund’s month end net assets during the year. The Fund’s obligation to make Reimbursement Payments expires 36 months from the month in which such fees are foregone or expense is incurred by the Adviser. The Expense Limitation Agreement terminates at the end of the Limitation Period, but may be renewed by the mutual agreement of the Adviser and the Fund for successive terms.

As of December 31, 2023, the amount of Expense Limitation Payments since the inception of the Fund provided by the Adviser was $0.4 million and no Reimbursement Payments have been made to the Adviser. The Fund’s management believes that Reimbursement Payments of the remaining Expense Limitation Payments were not probable as of December 31, 2023.

The following table reflects the Expense Limitation Payments that may become subject to reimbursement.

| For the period ended | Amount of Expense Limitation Payment |

Eligible for Reimbursement Payment through |

||||||

| December 31, 2023 |

$ | 434,283 | December 31, 2026 | |||||

Administrator, Custodian and Transfer Agent — KKR Credit Advisors (US) LLC also serves as the Fund’s administrator (the “Administrator”) pursuant to an administration agreement under which the Administrator is responsible for providing administrative and accounting services. The Administrator has also entered into a sub-administration agreement with The Bank of New York Mellon. The Fund has engaged The Bank of New York Mellon as the Fund’s custodian and has engaged BNY Mellon Investment Servicing (US) Inc. as the Fund’s transfer agent.

19

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

Distributor — Pursuant to a Distribution Agreement, KKR Capital Markets LLC (the “Distributor”), an affiliate of the Adviser, serves as distributor of the Fund’s shares. The Fund’s shares do not incur distribution or servicing fees.

Other — Certain officers of the Fund are also employees and officers of the Adviser. Such officers are paid no fees by the Fund for serving as officers of the Fund.

5. Fair Value

The following table presents information about the Fund’s assets measured on a recurring basis as of December 31, 2023, and indicates the fair value hierarchy of the inputs utilized by the Fund to determine such fair value:

| Description | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Investments: |

||||||||||||||||

| Asset-Backed Securities |

$ | — | $ | 239,812,224 | $ | — | $ | 239,812,224 | ||||||||

| Mortgage-Backed Securities |

— | 118,100,286 | 15,670,074 | 133,770,360 | ||||||||||||

| Senior Loans |

— | — | 43,736,269 | 43,736,269 | ||||||||||||

| Private Equity |

— | — | 1,018,199 | 1,018,199 | ||||||||||||

| Money Market Fund |

17,110,461 | — | — | 17,110,461 | ||||||||||||

|

|

|

|||||||||||||||

| Total Investments |

$ | 17,110,461 | $ | 357,912,510 | $ | 60,424,542 | $ | 435,447,513 | ||||||||

|

|

|

|||||||||||||||

The following are the details of the restricted securities of the Fund:

| Issuer(1) | Asset | Par/Shares | Cost | Value | Acquisition Date |

% of Net Assets |

||||||||||||||||||

| Asset-Backed Securities |

|

|||||||||||||||||||||||

| Santander Drive Auto Receivables Trust | Class B, Series 2022-2 | 3,000,000 | $ | 2,920,224 | $ | 2,943,985 | 10/17/2023 | 0.7 | % | |||||||||||||||

| Senior Loans |

||||||||||||||||||||||||

| SunPower Financial |

Revolver 1L 06/23 | 1,630,862 | 1,630,862 | 1,630,862 | 6/7/2023 | 0.4 | % | |||||||||||||||||

| SunPower Financial |

TL 1L DD 11/23 | 1,942,302 | 1,942,302 | 1,942,302 | 11/3/2023 | 0.5 | % | |||||||||||||||||

| Private Equity |

||||||||||||||||||||||||

| SunPower Financial |

Private Equity (SPV) | 837,452 | 837,452 | 1,018,199 | 6/7/2023 | 0.2 | % | |||||||||||||||||

|

|

|

|||||||||||||||||||||||

| $ | 7,330,840 | $ | 7,535,348 | |||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| (1) | Refer to the Schedule of Investments for more details on securities listed. |

20

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

The following is a reconciliation of the investments in which significant unobservable inputs (Level 3) were used in determining value:

| Mortgage-Backed Securities |

Senior Loans | Private Equity | Total | |||||||||||||

| Balance as of May 3, 2023 |

$ | — | $ | — | $ | — | $ | — | ||||||||

| Purchases and drawdowns |

16,138,121 | 51,684,404 | 837,452 | 68,659,977 | ||||||||||||

| Paydowns |

(868,236 | ) | (7,439,612 | ) | — | (8,307,848 | ) | |||||||||

| Paydown gain |

99,552 | — | — | 99,552 | ||||||||||||

| Accretion of discounts |

142,506 | — | — | 142,506 | ||||||||||||

| Net change in unrealized appreciation/(depreciation) | 158,131 | (508,523 | ) | 180,747 | (169,645 | ) | ||||||||||

|

|

|

|||||||||||||||

| Balance as of December 31, 2023 |

$ | 15,670,074 | $ | 43,736,269 | $ | 1,018,199 | $ | 60,424,542 | ||||||||

|

|

|

|||||||||||||||

| Net change in unrealized appreciation/(depreciation) on investments held at December 31, 2023 | $ | 158,131 | $ | (508,523 | ) | $ | 180,747 | $ | (169,645 | ) | ||||||

|

|

|

|||||||||||||||

The following table presents additional information about valuation techniques and inputs used for investments that are measured at fair value and categorized within Level 3 as of December 31, 2023:

| Financial Asset | Fair Value | Valuation Technique(1) |

Unobservable Inputs(2) |

Range (Weighted Average)(3) |

Impact to Valuation from an Increase in Input | |||||||

|

Mortgage-Backed Securities |

$ | 15,670,074 | Yield Analysis | Yield | 10.9% - 12.1% (11.9%) | Decrease | ||||||

| Senior Loans |

$ | 43,736,269 | Yield Analysis | Yield | 5.1% - 16.3% (8.7%) | Decrease | ||||||

| Private Equity |

$ | 1,018,199 | Discounted Cash Flows | WACC | 38.9% | Decrease | ||||||

| (1) | For the assets that have more than one valuation technique, the Fund may rely on the techniques individually or in aggregate based on a weight ascribed to each one ranging from 0.0%-100.0%. When determining the weighting ascribed to each valuation methodology, the Fund considers, among other factors, the availability of direct market comparables, the applicability of a discounted cash flow analysis and the expected hold period and manner of realization for the investment. These factors can result in different weightings among the investments and in certain instances, may result in up to a 100.0% weighting to a single methodology. |

| (2) | The significant unobservable inputs used in the fair value measurement of the Fund’s assets and liabilities may include the last twelve months (“LTM”) EBITDA multiple, weighted average cost of capital, discount margin, probability of default, loss severity and constant prepayment rate. In determining certain of these inputs, management evaluates a variety of factors including economic, industry and market trends and developments, market valuations of comparable companies, and company specific developments including potential exit strategies and realization opportunities. Significant increases or decreases in any of these inputs in isolation could result in significantly lower or higher fair value measurement. |

| (3) | Weighted average amounts are based on the estimated fair values. |

21

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

6. Investment Transactions

The cost of investments purchased and the proceeds from the sale of investments, other than short-term investments, for the period ended December 31, 2023 were as follows:

| Investments | ||||

| Purchases |

$ | 435,514,748 | ||

| Sales |

$ | 21,854,222 | ||

There were no purchases or sales of U.S. Government securities.

7. Shareholder Transactions

On April 25, 2023, the Fund issued 515 shares of Series A Cumulative Preferred Shares (“CPS”) at an issuance price and liquidation preference of $1,000 per share. The shares accrue dividends at a rate of 12.0% per annum, with interest paid semi-annually in arrears. Unless full cumulative dividends on all outstanding CPS are declared and paid, no dividends shall be declared or paid upon common shares of the Fund. Each holder of CPS is entitled to one vote for each unit of CPS held and are senior to all classes and series of the Fund’s common shares. In the event of any dissolution, liquidation or winding down of the Fund, the CPS holders will be entitled to receive a pro rata distribution, prior to any assets being made available to common shareholders, in an amount equal to the liquidation value of the CPS. At December 31, 2023, the Fund has issued 515 shares of the CPS for a total amount of $515,000.

At December 31, 2023, the Fund has unlimited common shares authorized with a par value of $0.001 per share. Shareholder transactions of the Fund’s common shares were as follows:

| Period Ended December 31, 2023 |

||||||||

| Shares | Amount | |||||||

|

|

|

|||||||

| Common Shares |

||||||||

| Shares sold |

425,389 | $ | 425,000,000 | |||||

|

|

|

|||||||

| Net increase |

425,389 | $ | 425,000,000 | |||||

|

|

|

|||||||

8. Commitments and Contingencies

The Fund may enter into certain credit agreements, of which all or a portion may be unfunded. The Fund will maintain sufficient liquidity to fund these commitments at the borrower’s discretion. As of December 31, 2023, total unfunded commitments on these credit agreements were $22.7 million.

Under the Fund’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In the normal course of business, the Fund enters into contracts that contain a variety of representations that provide general indemnifications. The Fund’s maximum liability exposure under these arrangements is unknown, as future claims that have not yet occurred may be made against the Fund. However, based on experience, management expects the risk of loss to be remote.

22

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

9. Federal Income Taxes

The timing and characterization of certain income, capital gains, and return of capital distributions are determined annually in accordance with federal tax regulations, which may differ from GAAP. As a result, the net investment income/loss and net realized gain/loss on investment transactions for a reporting period may differ significantly from distributions during such period. These book to tax differences may be temporary or permanent in nature. To the extent these differences are permanent, they are charged or credited to paid-in capital or distributable earnings, as appropriate, in the period in which the differences arise.

GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share.

As of December 31, 2023, the following permanent differences have been reclassified (to)/from the following accounts:

|

|

Distributable earnings | Paid-in Capital | ||||

| $18,344 | $ | (18,344 | ) | |||

The tax character of distributions declared for the year ended December 31, 2023 were as follows:

| Ordinary Income |

Total | |||||||

| December 31, 2023* |

$ | 16,679,051 | $ | 16,679,051 | ||||

| * | The final tax character of any distribution declared during the year ended December 31, 2023 will be determined in January 2024 and reported to shareholders on IRS Form 1099-DIV in accordance with federal income tax regulations. |

As of December 31, 2023 the components of total distributable earnings on a tax basis for the Fund are as follows:

| Undistributed Ordinary Income |

Net Unrealized Depreciation |

Other Temporary Differences |

Capital Loss Carryforward |

|||||||||

| $33,558 | $ | 4,049,336 | $ | (3,459 | ) | $ | (97,214 | ) | ||||

Net capital losses earned may be carried forward indefinitely and must retain the character of the original loss. During the year ended December 31, 2023, the Fund did not utilize any capital loss carryforwards. As of December 31, 2023, the Fund had non-expiring short-term capital loss carryforwards of $0.1 million.

As of December 31, 2023, the total cost of securities for federal income tax purposes and the aggregate gross unrealized appreciation and depreciation for securities held by the Fund are as follows:

| Federal Tax Cost |

Aggregate Gross |

Aggregate Gross |

Net Unrealized Appreciation |

|||||||||

| $414,287,716 | $ | 4,808,970 | $ | (759,634 | ) | $ | 4,049,336 | |||||

23

Table of Contents

|

Asset-Based Income Fund |

December 31, 2023 | |||||

|

|

|||||||

10. Borrowings