As filed with the Securities and Exchange Commission on January 9, 2024.

Registration No. 333-274976

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

Amendment No. 3

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________

ORIENTAL RISE HOLDINGS LIMITED

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

__________________________

|

Cayman Islands |

100 |

Not Applicable |

||

|

(State or other jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

No. 48 Xianyu Road

Shuangcheng Town, Zherong County

Ningde City, Fujian Province

People’s Republic of China

+86 (0) 593 8386777

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

__________________________

The Crone Law Group P.C.

One East Liberty

Suite 600

Reno, Nevada 89501

Telephone: 646-861-7891

(Name, address, including zip code, and telephone number, including area code, of agent for service)

__________________________

Copies to:

|

Mark E. Crone, Esq. |

Fang Liu, Esq. |

__________________________

Approximate date of commencement of proposed sale to the public: as soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

|

Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

• Public Offering Prospectus. A prospectus to be used for the public offering of 3,000,000 Ordinary Shares of the Registrant (the “Public Offering Prospectus”) through the underwriter named on the cover page of the Public Offering Prospectus.

• Resale Prospectus. A prospectus to be used for the resale by the Selling Shareholders of up to 1,000,000 Ordinary Shares of the Registrant (the “Resale Prospectus”).

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

• they contain different outside and inside front covers and back covers;

• they contain different Offering sections in the Prospectus Summary section beginning on page 1;

• they contain different Use of Proceeds sections on page Alt-5;

• a Selling Shareholder section is included in the Resale Prospectus; and

• the Underwriting section from the Public Offering Prospectus on page 163 is deleted and replaced with a a Selling Shareholders Plan of Distribution section on Alt-3 is inserted in its place.

The Registrant has included in this Registration Statement a set of alternate pages after the back-cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant and the Selling Shareholders. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the Selling Shareholders.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 9, 2024

PRELIMINARY PROSPECTUS

ORIENTAL RISE HOLDINGS LIMITED

3,000,000 Ordinary Shares to be Sold by the Company

This is the initial public offering, or the “offering,” of 4,000,000 ordinary shares, par value US$0.0008 per share (each, an “Ordinary Share”, collectively, the “Ordinary Shares”) of Oriental Rise Holdings Limited, a Cayman Islands exempted company with limited liability. Up to 1,000,000 Ordinary Shares may be offered for resale or otherwise or otherwise disposed of by each shareholder named in the separate Resale Prospectus (the “Selling Shareholders”). In addition, 3,000,000 Ordinary Shares are being sold by the Company on a firm commitment underwritten basis.

Prior to this offering, there has been no public market for our Ordinary Shares. We expect that the initial public offering price will be $4.00 per Ordinary Share. We intend to list the Ordinary Shares on the Nasdaq Capital Market under the symbol “ORIS.” However, there is no assurance that such an application will be approved, that this offering will be completed, and that the Ordinary Shares of Oriental Rise will be trading on the Nasdaq Capital Market. If the Nasdaq Capital Market does not approve our application for listing on the Nasdaq Capital Market, this offering will not be completed.

The sale of the Ordinary Shares by the Selling Shareholders is conditioned upon the successful completion of the sale of the Ordinary Shares by the Company in the underwritten primary offering. The successful listing of our shares on the Nasdaq Capital Market is a condition to both the closing of our underwritten primary offering and to this secondary offering by our selling stockholders. Until such time as our ordinary shares are listed on the Nasdaq Capital Market, sales by the Selling Shareholders, if any, will be at a fixed price of $4.00 per Ordinary Share. Following the listing of our Ordinary Shares on the Nasdaq Capital Market, the per share public offering price of the Ordinary Shares to be sold by the Selling Shareholders will be the then-prevailing market price.

The registration of the Selling Shareholders’ Ordinary Shares does not mean that the Selling Shareholders will offer or sell any Ordinary Shares. We will not receive any proceeds from any sale or disposition of Ordinary Shares by the Selling Shareholders. In addition, we will pay all fees and expenses incident to the registration of the resale of Ordinary Shares by the Selling Shareholders. The Selling Shareholders may offer their Ordinary Shares from time to time directly or through one or more broker-dealers or agents at market prices prevailing at the time of sale. However, the Selling Shareholders will not sell any Ordinary Shares until after the closing of the underwritten primary offering. The offering by the Selling Shareholders will remain open for 180 days following the date of this prospectus. Following the expiration of such 180 period, we no longer intend to keep this registration statement effective. For additional information on the possible methods of sale that may be used by the Selling Shareholders, refer to the section of this prospectus entitled “Selling Shareholders Plan of Distribution”.

Unless otherwise stated, as used in this prospectus, references to “Oriental Rise” “the Company” or “our company,” “we,” “us,” and “our” are to Oriental Rise Holdings Limited, a Cayman Islands holding company. References to “PRC Operating Subsidiaries” refer to Fujian Min Dong Hong Tea Technology Co., Ltd. and Fujian Qingjing Agricultural Comprehensive Development Co., Ltd., Oriental Rise’s subsidiaries established under the laws of the People’s Republic of China. References to “our Group” and “the Group” refer to Oriental Rise together with its consolidated subsidiaries as a consolidated entity.

We are both an “emerging growth company” and a “foreign private issuer” under applicable U.S. federal securities laws and are eligible for reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company” and “Prospectus Summary — Implications of Being a Foreign Private Issuer.”

Upon the completion of this offering, we will have 23,000,000 Ordinary Shares issued and outstanding (assuming no underwriter exercise of the over-allotment option described below). Our founders Mr. Chun Sun Wong, Mr. Wai Kwong Fong, and Dr. Deming Zhou, will beneficially own 12,000,000 Ordinary Shares, representing approximately 52.2% of the total voting power of our issued and outstanding share capital immediately following the completing of this offering. Each Ordinary Share is entitled to one vote. We expect our founders and 5% of more beneficial owners will beneficially own in total 19,400,000 of our Ordinary Shares representing approximately 84.3% of the total voting power of our issued and outstanding share capital immediately following the completing of this offering.

We effected a subdivision of each of our the then issued and unissued ordinary shares of a par value of US$0.001 per share of the Company into 1.25 ordinary shares of a par value of US$0.0008 per share of the Company, effective on September 27, 2023 (the “Subdivision”). Unless expressly stated herein, all share and per-share information contained herein has been adjusted to account for the Subdivision.

INVESTING IN OUR ORDINARY SHARES INVOLVES A HIGH DEGREE OF RISK. See “RISK FACTORS” beginning on page 23 to read about factors you should consider before buying our ordinary shares.

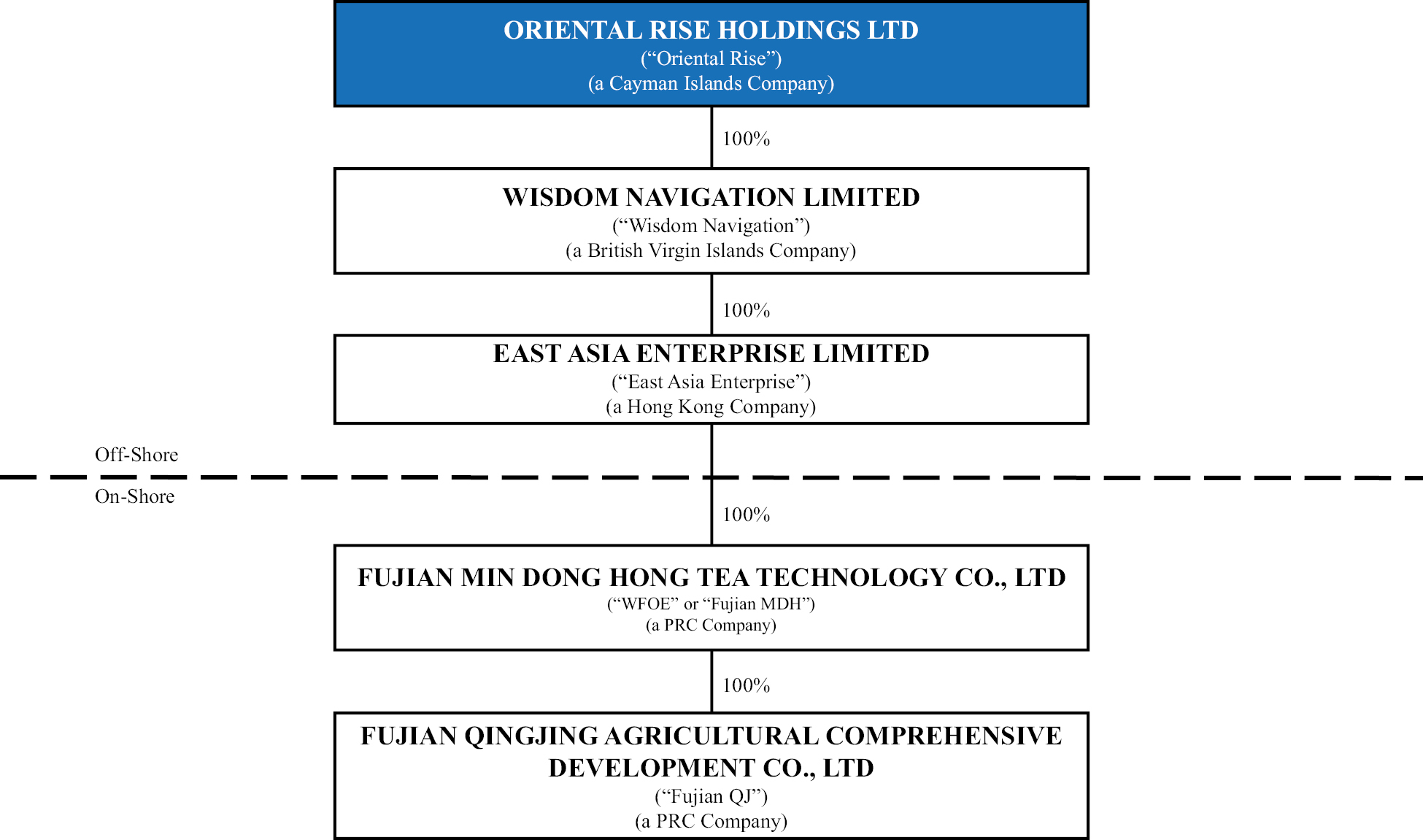

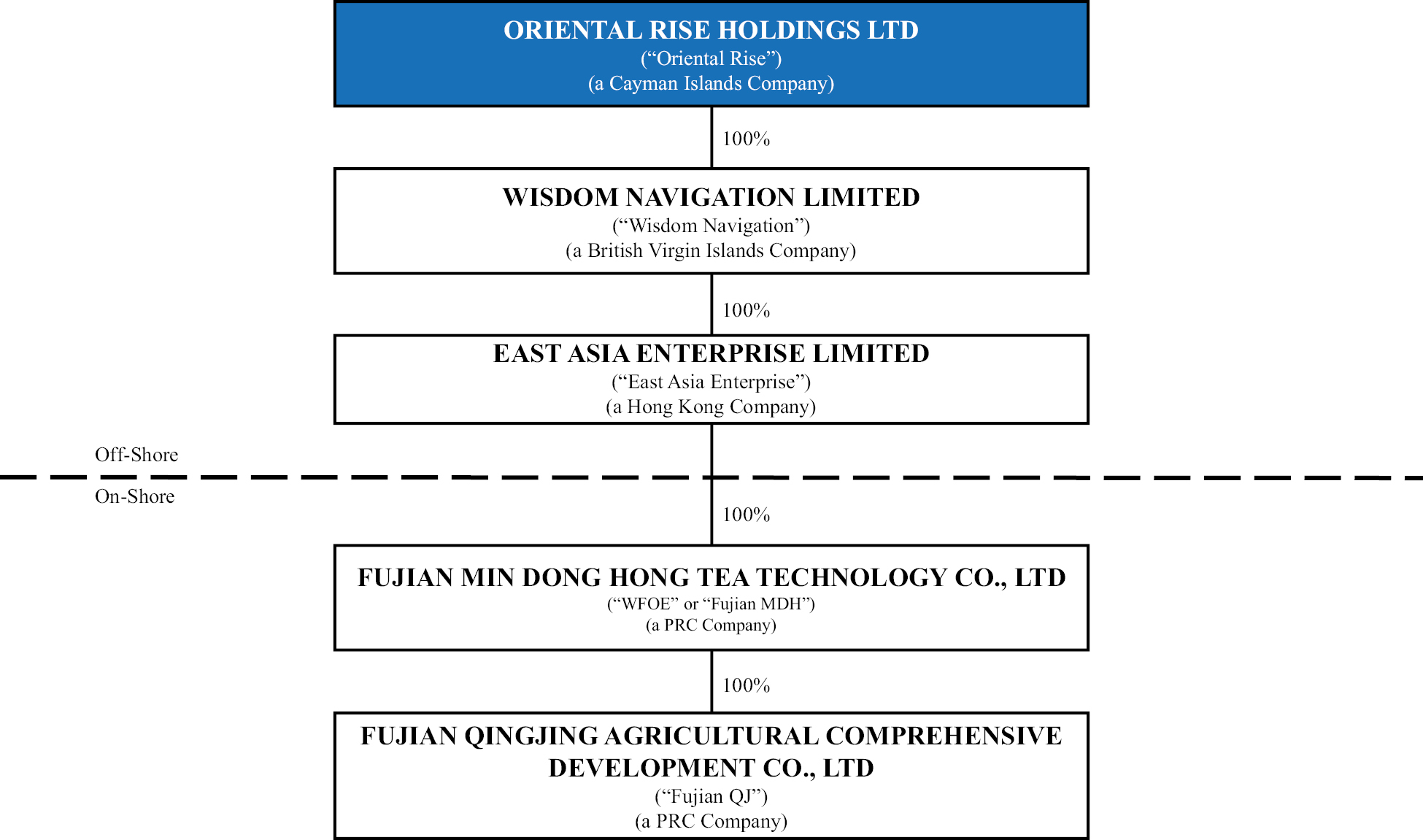

Oriental Rise is not a Chinese operating company but a Cayman Islands holding company. We conduct all of our operations through our subsidiaries established in mainland China. Oriental Rise indirectly holds equity interest in Fujian Min Dong Hong Tea Technology Co., Ltd. (the “WFOE”) and its domestic subsidiary Fujian Qingjing Agricultural Comprehensive Development Co., Ltd (“Fujian QJ”) through our intermediate British Virgin Islands subsidiary Wisdom Navigation Limited (“Wisdom Navigation”) and the Hong Kong company, East Asia Enterprise Limited (“East Asia Enterprise”). See “Corporate History and Structure” for additional details.

Our organizational structure involves unique risks to investors. The PRC regulatory authorities could disallow our operating structure, which would likely result in a material change in our operations and/or a material change in the value of our Ordinary Shares and could cause the value of our Ordinary Shares to significantly decline or become worthless. See “Prospectus Summary — Regulation Arising from Doing Business in China” on page 2, and “RISK FACTORS — Risks Related to Doing Business in China” beginning on page 42 of this prospectus.

We are exposed to legal and operations risks associated with having substantially all of our operations in China. The PRC government has significant authority to exert influence on the ability of a company with operations in China, including us, to conduct business. Changes in China’s as well as global economic, political or social conditions or government policies could materially and adversely affect our business and results of operations. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and as a result, these risks may result in material changes in the operations of our China operating entities, significant depreciation or a complete loss of the value of our Ordinary Shares, or a complete hindrance of our ability to offer or continue to offer, our shares to investors.

Recent statements by the Chinese government have indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investments in China based issuers. The PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement.

On February 17, 2023, the China Securities Regulatory Commission (the “CSRC”) released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Administrative Measures”) and relevant supporting guidelines (collectively, the “New Administrative Rules Regarding Overseas Listings”), which became effective on March 31, 2023. The New Administrative Rules Regarding Overseas Listings regulate both direct and indirect overseas offering and listing of PRC domestic companies’ securities by adopting a filing-based regulatory regime. Pursuant to the Trial Administrative Measures, where an issuer submits an application for initial public offering to competent overseas regulators, such issuer must file with the CSRC within three business days after such application is submitted. For more details regarding the Trial Administrative Measures, see “Regulations—Regulations Relating to Overseas Listing”. The Trial Administrative Measures also requires subsequent reports to be filed with the CSRC on material events, such as change of control or voluntary or forced delisting of the issuer(s) who have completed overseas offerings and listings. On February 17, 2023, the CSRC also issued the Notice on Administration for the Filing of Overseas Offering and Listing by Domestic Companies, or the Overseas Offering Administration Notice, pursuant to which, on or prior to the effective date of the Trial Administrative Measures, domestic companies that have already submitted valid applications for overseas securities offering and listing but our ability to pay dividends outside of China have not obtained approval from overseas regulatory authorities or stock exchanges may arrange the timing for submitting their filing applications with the CSRC in a reasonable manner, and must complete the filing before the completion of their overseas securities offering and listing. Pursuant to the Trial Administrative Measures and the Overseas Offering Administration Notice, we are required to complete the filing procedures with the CSRC before completion of this offering. We submitted the required filing to the CSRC on September 6, 2023. It is uncertain as to when we will, and whether we will be able to complete the filing procedures with the CSRC. According to the Trial Administrative Measures, the CSRC will conclude the filing procedures and publish the filing results on the CSRC website within 20 working days after receiving the filing materials if the filing materials are complete and comply with the stipulated requirements. However, during the filing process, the CSRC may request the Company to provide additional documents or may consult with competent authorities, the time for which will not be counted in the 20 working days. Since the New Administrative Rules Regarding Overseas Listings are newly promulgated, and the implementation and implementation thereof involve uncertainties, we cannot assure you that we will be able to complete the relevant filings in a timely manner or fulfil all the regulatory requirements thereunder. Any failure of us to fully comply with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our Ordinary Shares. In addition to

the CSRC filing under the Trial Administrative Measures, if it is determined that we are subject to any other CSRC approval, filing, other governmental authorization or requirements for this Offering, we cannot assure you that we could obtain such approval, complete such filing or meet other requirements in a timely manner or at all. If we fail to obtain such approval, complete such filing or meet other requirements in a timely manner, the Chinese regulatory authorities may impose fines and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operations in China, delay or restrict the repatriation of the proceeds from this Offering into China, force a delisting of our Ordinary Shares even after they are listed on Nasdaq, or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our securities. The CSRC, the CAC, or other PRC regulatory agencies also may take actions requiring us, or making it advisable for us, to halt this Offering before settlement and delivery of our Ordinary Shares. In addition, competent Chinese authorities could change the rules and regulations regarding foreign ownership in the industry in which we operate, which would likely result in a material change in our operations and/or a material change in the value of the securities we are registering for sale. New regulations restricting or forbidding foreign ownership in our industry could cause the value of our securities to significantly decline or to become worthless.

On February 24, 2023, the CSRC, together with Ministry of Finance of the PRC, National Administration of State Secrets Protection and National Archives Administration of mainland China, revised the Provisions on Strengthening Confidentiality and Archives Administration for Overseas Securities Offering and Listing which was issued by the CSRC, National Administration of State Secrets Protection and National Archives Administration of mainland China in 2009, or the Provisions. The revised Provisions is issued under the title the Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies, and came into effect on March 31, 2023. One of the major revisions to the revised Provisions is expanding its application to cover indirect overseas offering and listing to be consistent with the Trial Administrative Measures. The revised Provisions provide, among others, that (a) a domestic company that plans to, either directly or indirectly through its overseas listed entity, publicly disclose or provide to relevant individuals or entities including securities companies, securities service providers and overseas regulators, any documents and materials that contain state secrets or working secrets of government agencies, shall first obtain approval from competent authorities according to law, and file with the secrecy administrative department at the same level; and (b) domestic company that plans to, either directly or indirectly through its overseas listed entity, publicly disclose or provide to relevant individuals and entities including securities companies, securities service providers and overseas regulators, any other documents and materials that, if leaked, will be detrimental to national security or public interest, shall strictly fulfill relevant procedures stipulated by applicable national regulations.

As of March 31, 2023, any failure or perceived failure by the Company or PRC subsidiaries to comply with the above confidentiality and archives administration requirements under the revised Provisions and other PRC laws and regulations may result in that the relevant entities would be held legally liable by competent authorities, and referred to the judicial organ to be investigated for criminal liability if suspected of committing a crime.

The recently enacted Holding Foreign Companies Accountable Act (“HFCAA”), together with a recent joint statement by the United States Securities and Exchange Commission (the “Commission”) and the PCAOB call for additional stringent criteria to be applied to emerging market companies by assessing the qualification of non-U.S. auditors who are not inspected by the PCAOB. Under the HFCAA, our securities may be prohibited from trading on the Nasdaq or other U.S. stock exchanges if our auditor is not subject to inspection by the PCAOB for three consecutive years, and this ultimately could result in our Ordinary Shares being delisted from trading on any U.S. stock exchange. On December 29, 2022, President Biden signed the Consolidated Appropriations Act, 2023, which, among other things, amended the HFCAA to reduce the time period under the HFCAA to two consecutive years instead of three consecutive years. The termination in or any restriction on the trading of our securities will significantly limit or completely hinder our ability to offer securities to investors or cause such securities to significantly decline in value or become worthless.

Pursuant to the HFCAA, the PCAOB issued a Determination Report on December 16, 2021 (the “2021 Determination Report”) which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in China because of a position taken by one or more authorities in China. Our registered public accounting firm, located in the United Kingdom, is not subject to the 2021 Determination Report. On August 26, 2022, the CSRC, the Ministry of Finance of China, and the PCAOB signed a protocol governing inspections and investigations of audit firms based in mainland China and Hong Kong. On December 15, 2022, the PCAOB issued a new Determination Report (the “2022 Determination Report”) which: (1) vacated the 2021 Determination Report and (2) concluded that the PCAOB has been able to conduct inspections and investigations completely in the PRC in 2022. As required by the HFCAA, if in the future the PCAOB determines it no longer can inspect or investigate completely because of a position taken by an authority in the PRC, the PCAOB will act expeditiously to consider whether it should issue a new determination.

Upon the listing of our Ordinary Shares on the Nasdaq Stock Market, we will be considered a “controlled company” within the meaning of Nasdaq Rule 5615(c). A “controlled company” is a company of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company. Under Nasdaq Rule 5615(c), a “controlled company” may be exempted from the requirements of Nasdaq Rules 5605(b)(1) (requiring that the board consist of a majority of independent directors), (d) (requiring a compensation committee of the board

consisting of independent directors) and (e) (requiring independent director oversight of director nominations). Should we determine to rely on the “controlled company” exemptions, our board and its decision-making processes would lack the independent oversight typically required of Nasdaq-listed issuers. We do not intend, however, to take advantage of the “controlled company” exemption from Nasdaq corporate governance standards. As disclosed in this prospectus, we will have a majority independent board upon listing and have adopted board committee charters and policies consistent with Nasdaq’s regular listing and governance rules.

Our registered public accounting firm, PKF Littlejohn LLP, is not headquartered in mainland China or Hong Kong and was not identified in the 2021 Determination Report as a firm that the PCAOB is unable to inspect or investigate. Notwithstanding the foregoing, if the PCAOB is not able to fully conduct inspections of our auditor’s work papers in China, you may be deprived of the benefits of such inspection which could result in limitation or restriction to our access to the U.S. capital markets and trading of our securities may be prohibited under the HFCAA. See Risk Factor — “Although the audit report included in this prospectus was issued by PCAOB-registered auditors who are currently inspected by the PCAOB, if it is later determined that the PCAOB is unable to inspect or investigate our auditor completely, investors would be deprived of the benefits of such inspection and our Ordinary Shares may be delisted or prohibited from trading.” Under the AHFCAA, our securities may be prohibited from trading on the Nasdaq Capital Market or other U.S. stock exchanges if our auditor is not inspected by the PCAOB for three consecutive years, and this ultimately could result in our Ordinary Shares being delisted.

The structure of cash flows within our organization, as well as a summary of the applicable regulations, is as follows:

1. Our equity structure is a direct holding structure, that is, the overseas entity to be listed in the U.S., Oriental Rise Holdings Limited (“Oriental Rise”), directly controls Fujian Min Dong Hong Tea Technology Co., Ltd. (the “WFOE”) and other domestic operating entities through our intermediate British Virgin Islands subsidiary Wisdom Navigation Limited (“Wisdom Navigation”) and the Hong Kong company, East Asia Enterprise Limited (“East Asia Enterprise”). The Company has no operations, and does not intend to begin operations, in the special administrative region of Macau and Hong Kong. See “Corporate History and Structure” for additional details.

2. Within our direct holding structure, the cross-border transfer of funds within our corporate group shall be in compliance with the laws and regulations of the PRC. After foreign investors’ funds enter Oriental Rise at the close of this offering, the funds will be directly transferred to East Asia Enterprise, and then transferred to subordinate operating entities through the WFOE.

If Oriental Rise intends to distribute dividends, then Oriental Rise will cause to be transferred cash in support of such dividends from our PRC operating subsidiaries to East Asia Enterprise in accordance with the laws and regulations of the PRC, and then Oriental Rise will cause East Asia Enterprise to transfer the dividends to Wisdom Navigation and then to Oriental Rise and then from Oriental Rise to all shareholders respectively in proportion to the shares they hold, regardless of whether the shareholders are U.S. investors or investors in other countries or regions.

3. In the reporting periods presented and as of the date of this prospectus, no cash and other asset transfers have occurred among the Company and its subsidiaries; and no dividends or distributions of a subsidiary has been made to the Company. In addition, no transfers, dividends, or distributions have been made to investors to date. For the foreseeable future, the Company intends to use the earnings for research and development, to develop new products and to expand its production capacity. As a result, we do not expect to pay any cash dividends. See our consolidated financial statements starting on page F-1 of this prospectus.

4. Our PRC subsidiaries’ ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of our PRC subsidiaries is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of each of their registered capitals. These reserves are not distributable as cash dividends. See “Regulations Relating to Dividend Distributions” for more information.

To address persistent capital outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China and the State Administration of Foreign Exchange, or SAFE, have implemented a series of capital control measures in the subsequent months, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder loan repayments. The PRC government may continue to strengthen its capital controls, and our PRC subsidiaries’ dividends and other distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments.

In addition, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC central government and the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant to the tax agreement between mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10%. However, if the relevant tax authorities determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment, the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced 5% withholding rate will apply to dividends received by our Hong Kong subsidiary from our PRC subsidiaries. This withholding tax will reduce the amount of dividends we may receive from our PRC subsidiaries.

Please see “Risk Factors” beginning on page 23 of this prospectus for additional information.

This prospectus does not constitute, and there will not be, an offering of securities to the public in the Cayman Islands.

The underwriters are selling 3,000,000 Ordinary Shares (or 3,450,000 Ordinary Shares if the underwriters exercise their over-allotment option in full) in this Offering on a firm commitment basis.

We have granted the underwriters an option, exercisable for 45 days following the effective date of this prospectus, to purchase up to an additional 450,000 of the Ordinary Shares representing 15% of the Ordinary Shares offered in this offering on the same terms to cover over-allotments.

|

Per Share |

Total(3) |

|||||

|

Initial Public offering price |

$ |

|

$ |

|

||

|

Underwriting discounts and commissions(1)(2) |

$ |

|

$ |

|

||

|

Proceeds to us, before expenses |

$ |

|

$ |

|

||

____________

(1) An underwriting discount or spread equal to six percent (6.0%) of the offering price will also be provided to underwriters.

(2) Does not include a non-accountable expense allowance equal to one percent (1%) of the gross proceeds of this offering, payable to the underwriter(s), or the reimbursement of certain accountable expenses of the underwriter(s). We have also agreed to issue to US Tiger Securities, Inc. warrants to purchase up to an aggregate of 150,000 shares of our Ordinary Shares at an exercise price equal to one hundred and twenty percent (120%) of the public offering price of the shares sold in this offering for nominal consideration. The Registration Statement of which this prospectus is a part also covers the Ordinary Shares issuable upon the exercise thereof. See “Underwriting” beginning on page 163 for additional information regarding these warrants and underwriting compensation generally.

(3) Assumes that the underwriters do not exercise any portion of their over-allotment option.

The underwriters expect to deliver the Ordinary Shares against payment in U.S. dollars to purchasers on or about , 2023.

Neither the United States Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

US TIGER SECURITIES, INC.

Prospectus dated , 2023

|

Page |

||

|

1 |

||

|

18 |

||

|

23 |

||

|

63 |

||

|

67 |

||

|

68 |

||

|

69 |

||

|

70 |

||

|

71 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

73 |

|

|

96 |

||

|

105 |

||

|

126 |

||

|

137 |

||

|

139 |

||

|

143 |

||

|

145 |

||

|

146 |

||

|

147 |

||

|

155 |

||

|

157 |

||

|

161 |

||

|

163 |

||

|

168 |

||

|

169 |

||

|

169 |

||

|

169 |

||

|

F-1 |

You should rely only on the information contained in this prospectus or in any related free-writing prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus or in any related free-writing prospectus. We are offering to sell, and seeking offers to buy, the Ordinary Shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is current only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Ordinary Shares.

We have not taken any action to permit a public offering of the Ordinary Shares outside the United States or to permit the possession or distribution of this prospectus or any filed free writing prospectus outside the United States. Persons outside the United States who come into possession of this prospectus or any filed free writing prospectus must inform themselves about and observe any restrictions relating to the offering of the Ordinary Shares and the distribution of this prospectus or any filed free writing prospectus outside the United States.

Until , 2023 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

COMMONLY USED DEFINED TERMS

• “China” or the “PRC” refers to the People’s Republic of China, in which the Hong Kong Special Administrative Region of the PRC and the Macau Special Administrative Region of the PRC are included.

• “CIC Report” refers to the analysis and report on the mainland China’s tea market commissioned by us from China Insights Consultancy (“CIC”), a market research and consulting company and independent third party;

• “Dr. Zhou” refers to Dr. Deming Zhou, one of the founders of Oriental Rise;

• “East Asia Enterprise” refers to East Asia Enterprise Limited, a Hong Kong company and wholly owned subsidiary of Wisdom Navigation;

• “Fujian QJ” refers to Fujian Qingjing Agricultural Comprehensive Development Co., Ltd., a mainland China limited company and wholly owned subsidiary of the WFOE;

• “HKD” or “HK$” refers to Hong Kong dollars, the official currency of Hong Kong;

• “Hong Kong” refers to Hong Kong Special Administrative Region of PRC;

• “Macau” refers to Macau Special Administrative Region of PRC;

• “mainland China” is to the mainland of the People’s Republic of China;

• “PRC laws and regulations” refers to the laws and regulations of the PRC, without reference to the laws and regulations of Hong Kong and Macao Special Administrative Regions of the People’s Republic of China, and the relevant regulations of Taiwan region;

• “Mr. Wong” refers to Mr. Chun Sun Wong, one of the founders of Oriental Rise;

• “Mr. Fong” refers to Mr. Wai Kwong Fong, one of the founders of Oriental Rise;

• “RMB” or “Chinese Yuan” refers to the legal currency of mainland China;

• “shares”, “Shares” or “Ordinary Shares” refer to the Ordinary Shares of Oriental Rise, par value US$0.0008 per share;

• “U.S. dollars,” “dollars,” “USD” or “$” refers to the legal currency of the United States;

• “We,” “us,” “our company,” “our,” “the Company” and “Oriental Rise” refer to Oriental Rise Holdings Limited, a Cayman Islands holding company;

• “WFOE” or “Fujian MDH” refers to Fujian Min Dong Hong Tea Technology Co., Ltd., a mainland China limited company and wholly owned subsidiary of East Asia Enterprise;

• “Wisdom Navigation” refers to Wisdom Navigation Limited, a British Virgin Islands company and wholly owned subsidiary of Oriental Rise;

We have made statements in this prospectus, including under “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and elsewhere that constitute forward-looking statements. Forward-looking statements involve risks and uncertainties, such as statements about our plans, objectives, expectations, assumptions or future events. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “should,” “will,” “could” and similar expressions denoting uncertainty or an action that may, will or is expected to occur in the future. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements.

Examples of forward-looking statements include:

• the timing of the development of future products;

• projections of revenue, earnings, capital structure and other financial items;

ii

• the development of future company-owned branches;

• statements regarding the capabilities of our business operations;

• statements of expected future economic performance;

• statements regarding competition in our market; and

• assumptions underlying statements regarding us or our business.

The ultimate correctness of these forward-looking statements depends upon a number of known and unknown risks and events. We discuss our known material risks under the heading “Risk Factors” below. Many factors could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Consequently, you should not place undue reliance on these forward-looking statements. The forward-looking statements speak only as of the date on which they are made, and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

CURRENCY CONVERSION

This disclosure contains translations of certain HK$ amounts into US$ amounts at specified rates solely for the convenience of the reader. The relevant exchange rates are listed below:

|

For the |

For the |

|||

|

Period Ended RMB: USD exchange rate |

0.157 |

0.144 |

||

|

Period Average RMB: USD exchange rate |

0.155 |

0.149 |

CAUTIONARY NOTE REGARDING INDUSTRY DATA

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, you are cautioned not to give undue weight to this information.

We commissioned China Insights Consultancy (“CIC”), a market research and consulting company and an independent third party, to conduct an analysis of, and to report on the mainland China’s tea market. The CIC Report has been prepared by CIC independent of our influence. The fee payable to CIC for preparing the CIC Report was HK$162,082 (or approximately US$20,650), which we consider reflects market rates for similar services. CIC is a consulting firm founded in Hong Kong. It provides professional industry consulting across multiple industries. CIC’s services include industry consulting service, commercial due diligence, and strategic consulting.

The information and data collected by CIC have been analyzed, assessed, and validated using CIC’s in-house analysis models and techniques. The primary research was conducted via interviews with key industry experts and leading industry participants. The secondary research involved analysis of market data obtained from several publicly available data sources, such as the National Bureau of Statistics of China and industry associations. The methodology used by CIC is based on information gathered from multiple levels and allows such information to be cross-referenced for reliability and accuracy. On such basis we consider the data and statistics extracted from the CIC Report to be reliable.

The CIC Report contains a variety of market projections which were produced with the following key assumptions: (i) mainland China’s economic and industrial development is likely to continue to maintain a steady growth trend during the next decade; (ii) mainland China’s economy is also likely continue to grow steadily during the forecast period; (iii) related industry key drivers are likely to drive mainland China’s tea market in the forecast period, including strong governmental support, enhancement of consumers’ health awareness, increase in middle-class urban households,

iii

consumption upgrade, increasing market size of the fresh-made tea beverage industry, and growing varieties of tea products; (iv) there is no extreme force majeure or industry regulations in which the markets may be affected either dramatically or fundamentally.

The reliability of the CIC Report may be affected by the accuracy of the foregoing assumption and factors. The CIC Report mainly focuses on the mainland China market, being the main jurisdiction in which our business is located. We believe that there is no material adverse change in the market information since the date of the relevant data contained in the CIC Report which may qualify, contradict, or have an impact on the information in this section.

Except as otherwise noted, all the data and forecasts contained in this section are derived from the CIC Report.

iv

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements appearing elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in our Ordinary Shares discussed under “Risk Factors,” before deciding whether to buy our Ordinary Shares.

Our Business

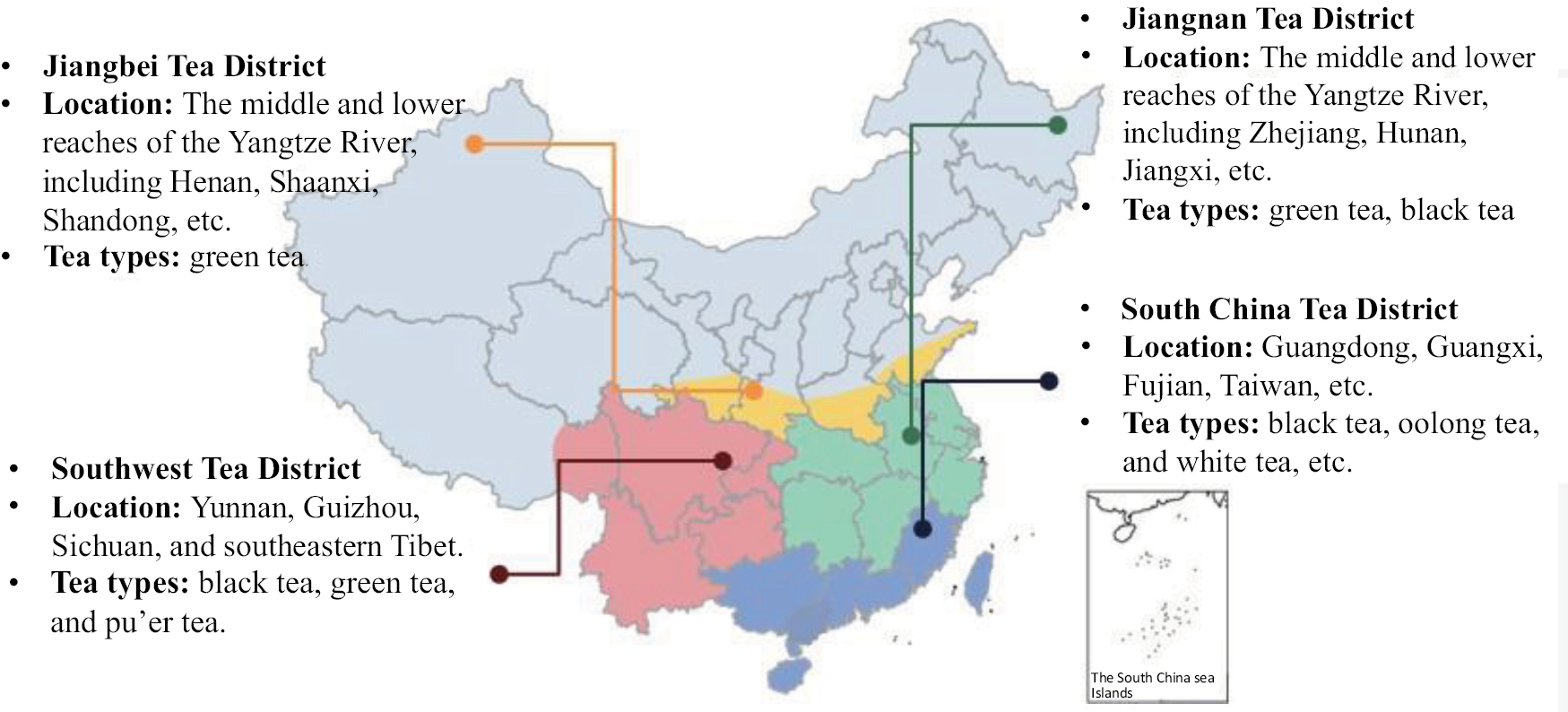

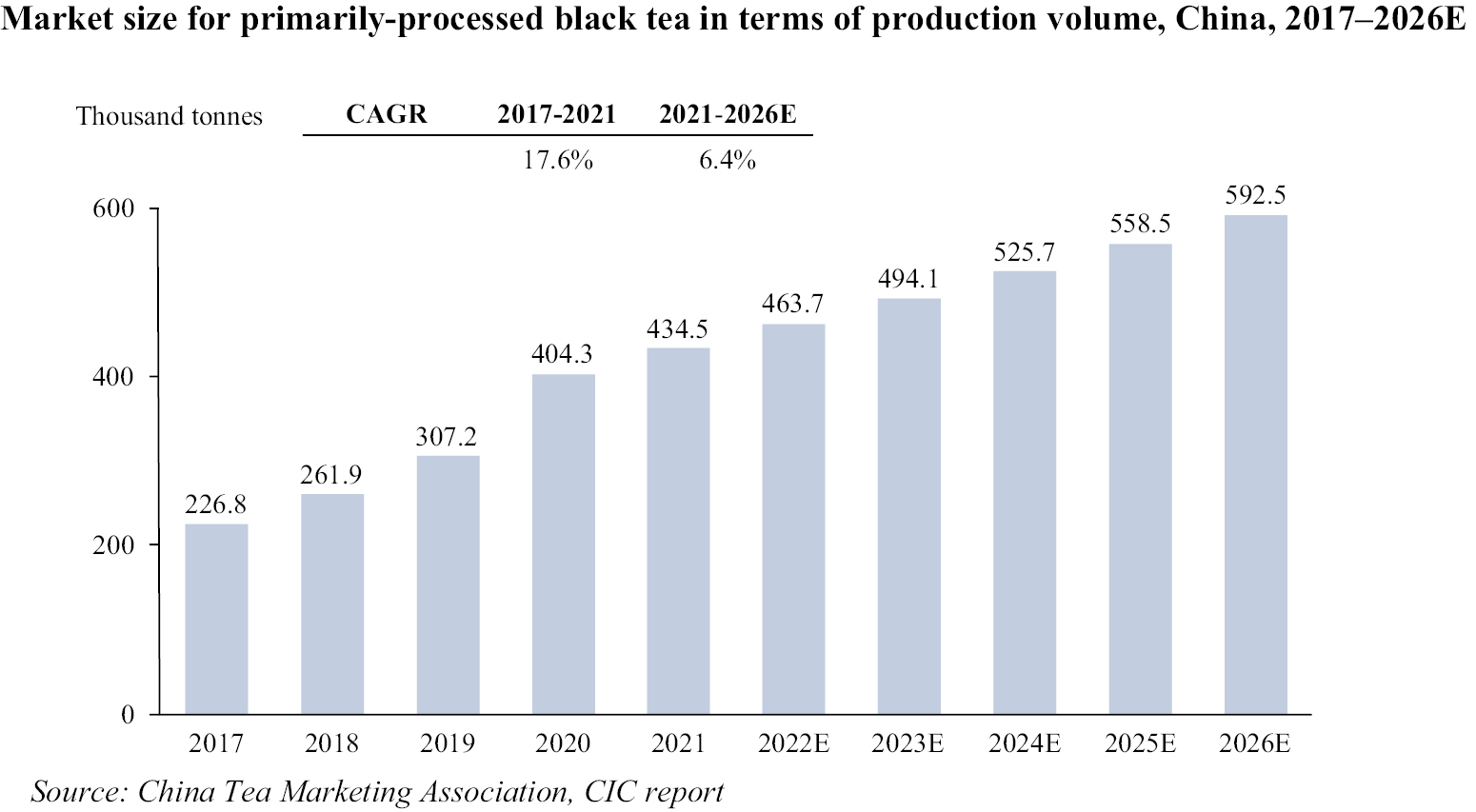

We are an integrated supplier of tea products in mainland China. Our major tea products include (i) primarily-processed tea consisting of white tea and black tea, and (ii) refined white tea and black tea. “Primarily-processed tea” refers to fresh tea leaves that have been roughly processed by initial steps including picking, wilting, drying, and grading. “Refined tea” refers to primarily-processed tea that is subjected to additional processing including sifting, removal of branches and stalks, compressing, drying, and packaging.

Our business operations are vertically integrated, covering cultivation, processing of tea leaves and the sale of tea products to tea business operators (such as wholesale distributors) and end-user retail customers in mainland China. We believe our vertically integrated business model distinguishes us from other primarily-processed tea and refined tea suppliers in mainland China, most of which are mainly engaged in only distinct parts of the value chain of cultivation, processing and sales of primarily-processed tea and refined tea.

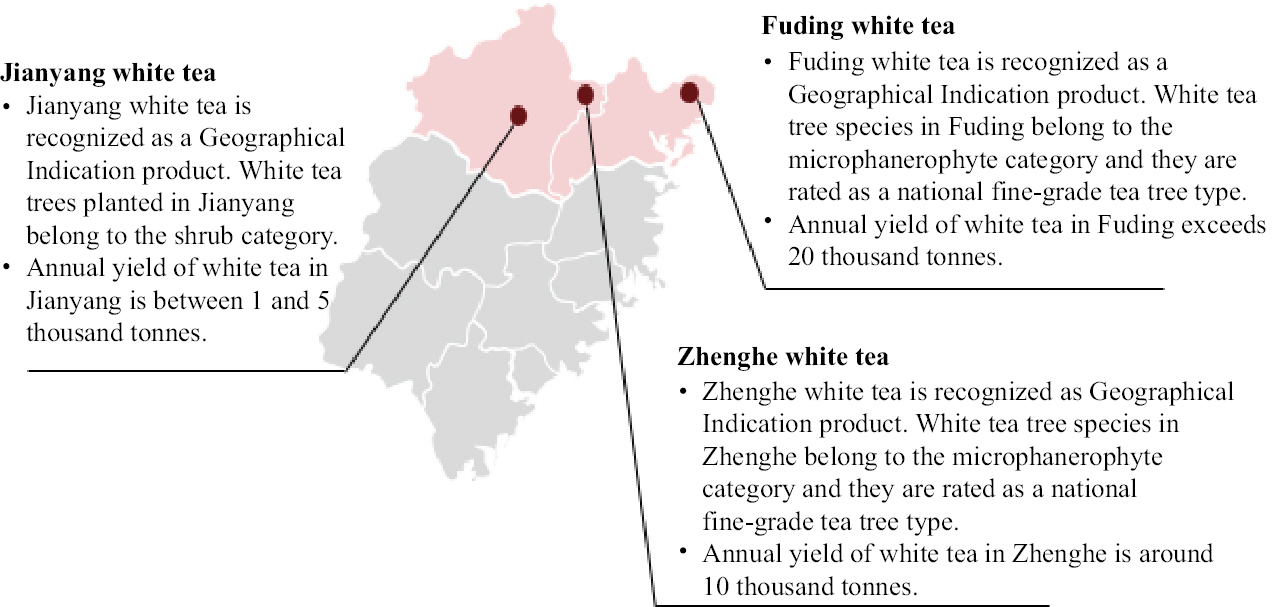

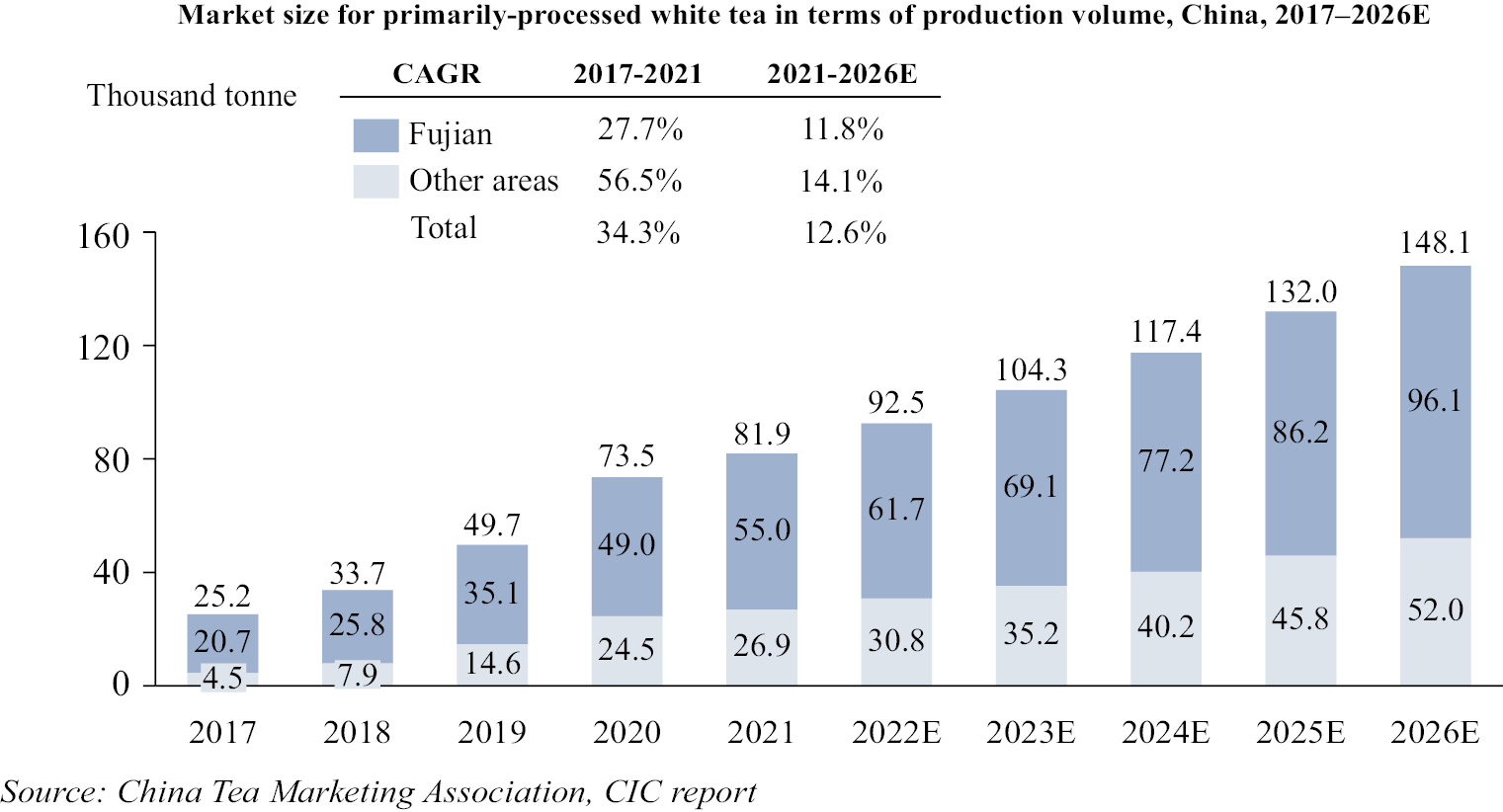

We operate tea gardens located in Zherong County, Ningde City in Fujian Province of mainland China. As of the date of this prospectus, we have entered into contractual management agreements with relevant villages with respect to approximately 7,212,000 square meters of tea gardens in Fujian Province. According to the CIC Report, Fujian accounts for approximately 67.2% of the total production volume of white tea in mainland China in 2021. In 2021, the white tea production volume of the Company is 424.8 tons, accounting for 0.8% and 0.5% of the total white tea production volume in Fujian Province and mainland China, respectively.

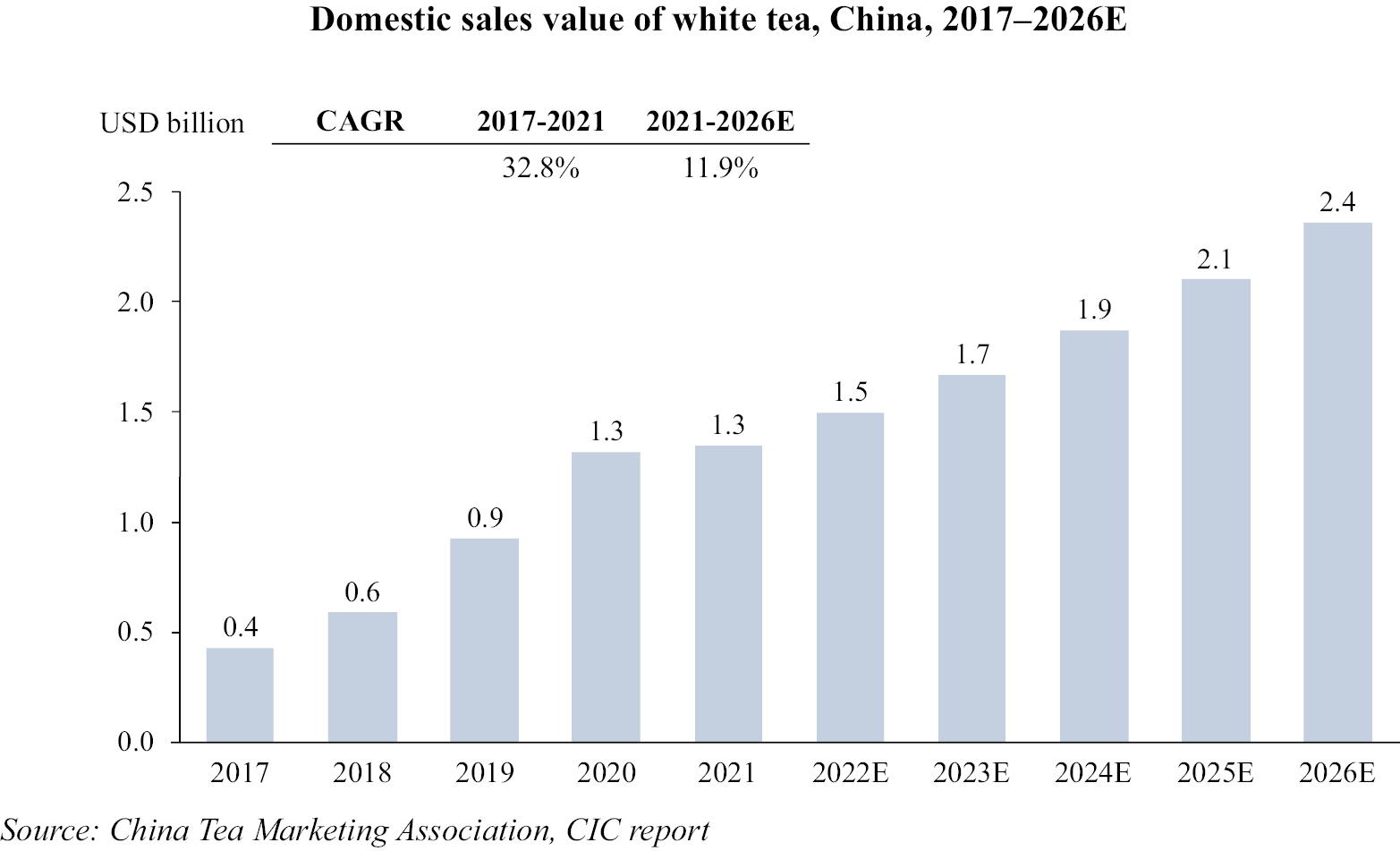

We commenced production and sales of tea in March 2014. Primarily-processed white tea is our leading product, accounting for approximately 81.3%, 83.2% and 83.7% of our total revenue for the years ended December 31, 2021 and 2022 and for the six-month period ended June 30, 2023, respectively. Our internal observations indicate increasing consumption demand for white tea and favorable future prospects of the white tea industry. According to CIC report, domestic sales value of white tea in Mainland China have experienced a strong growth between 2017 and 2021, increasing from approximately US$400 million (RMB 2.9 billion) to approximately US$1.3 billion (RMB 9.1 billion), representing a compound annual growth rate of approximately 32.80%. The CIC Report estimates Mainland China domestic sales value of white tea to approximately US$2.4 billion (RMB 16.0 billion) by 2026. Such figures indicate increasing consumption demand for white tea and favorable future prospects of the white tea industry.

We believe the size and scale of the tea gardens we operate, quality of our white tea product and quality control systems provide an exciting opportunity to service the blooming white tea market in mainland China.

Awards and Recognition

Our company has been recognized in mainland China as a “Leading Enterprise in City-level Agricultural Industrialization” in Ningde City in Fujian Province from 2015 through 2020. In November 2020, we received the Zherong High Mountain White Tea Industry Demonstration Award by the Fujian Tea China Organizing Committee. In 2020, our Shou Mei refined white teas received the golden prize in the 8th China Tea Industry Expo National Tea Recommendation and Selection Activity.

Ecological Advantages

We believe we are able to cultivate our tea leaves in an optimal ecological environment which greatly contributes to the quality of our tea. Zherong County, where the tea gardens we operate are located, has been recognized in mainland China as a “National-level Ecology and Civilization Construction Demonstration County” because of its high altitude and the mid-subtropical monsoon climate with year-round mild weather and abundant rainfall. As a result of these beneficial natural features, we believe our tea leaves to exhibit superior taste, smell, and visual appearances. In addition, the soil in Zherong County is suitable for both white tea and black tea plantation as it has a rich content of organic matters and moderate hydrogen ion concentration. We believe the tea gardens we operate provide a significant competitive advantage given the limited geographic and ecological areas otherwise available for high quality tea cultivation in mainland China.

1

Health Advantages

We believe there is rising awareness in the mainland China consumer market of the health and nutritional benefits of drinking white tea, including anti-bacterial and anti-oxidation properties, maintenance or improvement of blood pressure, blood sugar and blood fat levels, and improvement of the immune system. We also note strong support from the local government which has actively promoted the cultivation of white tea, including establishing demonstration sites for white tea gardens and the promotion of white tea cultural festivals.

Overall, domestic sales value of white tea in mainland China have experienced a strong growth between 2017 and 2021, increasing from approximately US$400 million (RMB 2.9 billion) to approximately US$1.3 billion (RMB 9.1 billion), representing a compound annual growth rate of approximately 32.80%. The CIC Report estimates mainland China domestic sales value of white tea to approximately US$2.4 billion (RMB 16.0 billion) by 2026.

Regulation Arising from Doing Business in China

Approvals from PRC Authorities to Conduct Our Operations and Issue Ordinary Shares to Foreign Investors

Our operations in China are governed by PRC laws and regulations, pursuant to which, for purposes of production and sale of our refined tea, we are required to obtain the food production license and food operation license from competent PRC authorities. As of the date of this prospectus, we have received all material requisite permissions and approvals from the PRC government authorities for our business operations currently conducted in China, and we have not received any denial of permissions for our China business operations.

On February 17, 2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Administrative Measures”) and relevant supporting guidelines (collectively, the “New Administrative Rules Regarding Overseas Listings”), which came into force on March 31, 2023. The New Administrative Rules Regarding Overseas Listings regulate both direct and indirect overseas offering and listing of mainland China domestic companies’ securities by adopting a filing-based regulatory regime. Pursuant to the Trial Administrative Measures, where an issuer submits an application for initial public offering to competent overseas regulators, such issuer must file with the CSRC within three business days after such application is submitted. For more details regarding the Trial Administrative Measures, see “Regulations — Regulations Relating to Overseas Listing.” Pursuant to the Trial Administrative Measures and the Overseas Offering Administration Notice, we are required to complete the filing procedures with the CSRC before completion of this offering. We submitted the required filing to the CSRC on September 6, 2023. It is uncertain as to when we will, and whether we will be able to complete the filing procedures with the CSRC. According to the Trial Administrative Measures, the CSRC will conclude the filing procedures and publish the filing results on the CSRC website within 20 working days after receiving the filing materials if the filing materials are complete and comply with the stipulated requirements. However, during the filing process, the CSRC may request the Company to provide additional documents or may consult with competent authorities, the time for which will not be counted in the 20 working days. Since the New Administrative Rules Regarding Overseas Listings are newly promulgated, and the interpretation and implementation thereof involve uncertainties, we cannot assure you that we will be able to complete the relevant filings in a timely manner or fulfil all the regulatory requirements thereunder. Any failure of us to fully comply with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our Ordinary Shares.

On February 24, 2023, the CSRC promulgated the Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies (the “Confidentiality and Archives Administration Provisions”), which also became effective on March 31, 2023. The Confidentiality and Archives Administration Provisions set out rules, requirements and procedures relating to provision of documents, materials and accounting archives for securities companies, securities service providers, overseas regulators and other entities and individuals in connection with overseas offering and listing, including without limitation to, domestic companies that carry out overseas offering and listing (either in direct or indirect means) and the securities companies and securities service providers (either incorporated domestically or overseas) that undertake relevant businesses shall not leak any state secret and working secret of government agencies, or harm national security and public interest, and a domestic company shall first obtain approval from competent authorities according to law, and file with the secrecy administrative department at the same level, if it plans to, either directly or through its overseas listed entity, publicly disclose or provide any documents and materials that contain state secrets or working secrets of government agencies. Working papers produced in the Chinese mainland by securities companies and securities service providers in the process of undertaking businesses related to overseas offerings and listing by domestic companies shall be retained in

2

the Chinese mainland. Where such documents need to be transferred or transmitted to outside the Chinese mainland, relevant approval procedures stipulated by regulations shall be followed. We believe we do not involve leaking any state secret and working secret of government agencies or harming national security and public interest in connection with provision of documents, materials and accounting archives and therefore we do not need to obtain approval from competent PRC authorities in this regard.

On December 28, 2021, the CAC, jointly with the relevant authorities, formally published Measures for Cybersecurity Review (2021) which took effect on February 15, 2022. Measures for Cybersecurity Review (2021) stipulates that operators of critical information infrastructure purchasing network products and services and online platform operators carrying out data processing activities that affect or may affect national security, shall conduct a cybersecurity review. Any online platform operator who controls more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if it seeks to be listed in a foreign country. Since our business does not rely on the collection of user data or implicate cybersecurity, we are not operators of critical information infrastructure or platform operators, and we do not possess more than one million users’ individual information, we believe that we are not subject to a cybersecurity review to issue our Ordinary Shares or list and trade of our Ordinary Shares on Nasdaq in connection with this offering under the Measures for Cybersecurity Review (2021). There remains uncertainty, however, as to how the Cybersecurity Review Measures will be interpreted or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation related to the Cybersecurity Review Measures. For further details, see “Risk Factors — Risks Related to Doing Business in China — The New Administrative Rules regarding Overseas Listings may significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless” on page 45 of this prospectus.

On August 8, 2006, six Chinese regulatory agencies, including the Ministry of Commerce of China (the “MOFCOM”), jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “M&A Rules”), which became effective on September 8, 2006, and amended on June 22, 2009. The M&A Rules contain provisions that require that an offshore special purpose vehicle (“SPV”) formed for listing purposes and controlled directly or indirectly by China’s companies or individuals shall obtain the approval of the CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange. On September 21, 2006, the CSRC published procedures specifying documents and materials required to be submitted to it by an SPV seeking CSRC approval of overseas listings. Given that the Company is not a SPV controlled directly or indirectly by Chinese companies or individuals under the M&A Rules, as of the date of this prospectus, the CSRC’s approval under the M&A Rules is not required for the listing and trading of our Ordinary Shares on Nasdaq in the context of this offering. However, there remains some uncertainty as to how the M&A Rules will be interpreted or implemented by the relevant PRC authorities in the context of an overseas offering, and the opinions summarized above will be subject to any new PRC laws, rules and regulations or detailed implementations and interpretations in any form relating to overseas listing of SPVs like the Company. We cannot assure you that relevant PRC government agencies, including the CSRC, would reach the same conclusion as we do.

While we believe that save for the filling requirements we shall fulfil under the Trial Administrative Measures, we are currently not required to obtain other permission from the CSRC, CAC or any other PRC authorities to issue our Ordinary Shares to foreign investors, or list and trade of our Ordinary Shares on Nasdaq in connection with this offering, there is uncertainty as to how the applicable PRC laws and regulations will be interpreted and implemented in the future, and we may be required to perform additional procedures or obtain such permissions or approvals in the future. Further, we are subject to the risks of uncertainty of any future actions of the PRC government in this regard including the risk that we inadvertently conclude that the permissions or approvals discussed here are not required, that applicable laws, regulations or interpretations change such that we are required to obtain approvals in the future, or that the PRC government could disallow our holding company structure, which would likely result in a material change in our operations, including our ability to continue our existing holding company structure, carry on our current business, accept foreign investments, and offer or continue to offer securities to our investors. These adverse actions could cause the value of our Ordinary Shares to significantly decline or become worthless. We may also be subject to penalties and sanctions imposed by the PRC regulatory agencies, including the CSRC, if we fail to comply with such rules and regulations, which would likely adversely affect the ability of our securities to be listed on a U.S. exchange and would likely cause the value of our securities to significantly decline or become worthless.

3

Competitive Strengths

We believe the following competitive strengths are essential to our success and differentiate us from our competitors:

• Vertically integrated business model with cost effective operations. Our tea business operations are vertically integrated, covering cultivation, processing of tea leaves and the sale of primarily-processed tea and refined tea. Such vertically integrated business model distinguishes us from other tea product suppliers in mainland China, most of which are mainly engaged in part or parts of the value chain of cultivation, processing and sales of primarily-processed tea and refined tea. In addition to the cultivation and sale of primarily-processed tea, we also use our primarily-processed tea as raw materials to produce refined tea for sale in mainland China. We can ensure a stable supply of raw materials for our refined tea without relying on third-party suppliers. We believe that our vertically integrated operations allow us to reduce our business and operational risks and better monitor our cost to further enhance our anticipated profit margin.

• Large scale, geographically focused production. As one of the top ten tea suppliers in Ningde City in terms of area of tea gardens, and in contrast to other competitors in the mainland China tea industry, we are able to conduct large-scale production. We therefore enjoy the benefits of economies of scale and reduced operational costs. Our cost-effectiveness has been further improved by our introduction of mechanized operations to improve the efficiency of our production and save labor costs.

• Strong internal quality control systems. We put strong emphasis on the quality of our primarily-processed tea and refined tea and have established stringent quality control system to ensure the safety and quality of our tea products. We inspect our fresh tea leaves before and during the harvest seasons to ensure the quality. Any unqualified fresh tea leaves will not be processed. We have a patrol team to monitor the tea gardens on a daily basis to check the status of the tea gardens. We also have a tea garden management team to supervise and monitor tea planting work conducted by tea garden managers and their workers during tea harvest seasons to ensure the quality of the tea leaves harvested from the tea gardens. For primarily-processed tea, we have experienced staff to check their appearance, moisture, and fragrance before the sale of our products to customers. For refined tea, our designated staff would check the appearance, moisture, color of tea soup, tastes, and fragrance before sales. We also send samples of our refined tea products to local inspection organizations annually to monitor their quality, including the appearance, taste, fragrance, color of tea soup, contaminants, and pesticide residue to guarantee the safety and the quality of our tea products.

• Favorable location with preferred production climate and soil. We believe we cultivate tea leaves under optimal ecological environment conditions which helps to ensure the quality of our tea. The 7,212,000 square meters of tea gardens we operate are located in Zherong County, Ningde City in Fujian. Located at an altitude ranging from 650 to 1,000 meters with a mid-subtropical monsoon climate, the weather in Zherong County is generally humid with abundant rainfall, which historically has been favorable for commercial tea cultivation. In addition, the soil in Zherong County has a rich content of organic matters and moderate hydrogen ion concentration which is desirable for white tea and black tea production in mainland China. Considering the limited tea production area in mainland China, we believe the preferred location, climate, and the soil of the tea gardens we operate give us a competitive edge in producing satisfactory tea products. With a conducive natural environment for tea plantation, we are able to cultivate fine-grade tea leaves, which can then be processed into high quality primarily-processed tea, especially white tea, with superior taste, smell and visual appearances which in turn generates greater retail prices.

• Competent management team with experience and expertise in the tea industry in mainland China. Our success is attributable to the extensive experience and the commitment of our executive directors and senior management team. In particular, Mr. Dezhi Liu, who is our Chief Executive Officer and Chairman of the Board of Directors, has over seven years of experience in the tea industry. As our directors and senior management team have accumulated years of experiences and industry know-how on cultivation of white tea and black tea and the processing techniques and skills, we are able to produce primarily-processed tea and refined tea products with high quality and maintain our competitiveness in the industry.

4

The Tea Gardens We Operate

The map below shows the location of Zherong County where we operate tea gardens as of the date of this prospectus:

As of the date of this prospectus, we operate tea gardens of approximately 7,212,000 square meters in Zherong County, Ningde City in Fujian Province in mainland China. Located at an altitude ranging from 650 to 1,000 meters with a mid-subtropical monsoon climate, the weather in Zherong County generally humid with abundant rainfall, which is favorable for tea cultivation. In addition, the soil in Zherong County has a rich content of organic matters and moderate hydrogen ion concentration which provides suitable conditions for tea plantation.

In selecting tea gardens, the first criteria are to look for tea gardens of suitable size and area. Our experienced operation team will also investigate the health of the trees planted in the tea gardens including density, color, and appearance of tea leaves, to assess whether they would remain healthy and productive in future.

For the six-month period ended June 30, 2023 and the years ended December 31, 2021 and 2022, we operated tea gardens occupying an area of approximately 7,212,000 square meters, 6,002,697 square meters and 6,002,697 square meters, respectively, which are all situated in Zhaizhong Township and Huangbai Township in Zherong County. The tea gardens we operate situated in Zhaizhong Township produce both white tea leaves and black tea leaves while the tea gardens situated in Huangbai Township produce white tea leaves only. In 2021, the white tea production volume of the Company is 424.8 tons, accounting for 0.8% and 0.5% of the total white tea production volume in Fujian Province and mainland China, respectively.

All of the tea gardens we operate are situated on parcels of land which are collectively owned by villagers in the relevant villages and were managed by the respective Zhaizhong and Huangbai village committees. Before entering into the contractual management rights agreement with us, the relevant village committees have obtained the consent of more than two-thirds of the members in villagers’ meetings or more than two-thirds of the villagers’ representatives

5

in advance and have submitted the same to the people’s government at township level for approval. Based on the advice of our PRC legal advisers, we believe that the village committees of Zhaizhong and Huangbai Village had been properly authorized to act on behalf of all of the farmer-households in the relevant villages.

We are in the process of carrying out a series of tea garden improvement works to boost agricultural capacity, which include improving irrigation system, construction of walking path within the tea garden area and increasing soil fertility. See “Business — The Tea Gardens We Operate” for additional information.

Our Business Strategy

Our business objectives are to maintain sustainable growth in our business and strengthen our market position in the tea industry. We intend to achieve these by implementing the following strategies:

Expand tea gardens through acquisitions and increase our production volume. In recent years, we were unable to accommodate all purchase orders placed by our customers. We received but did not undertake purchase orders which amounted to approximately US$6.88 million (RMB 47.363 million), US$14.26 million (RMB 92.30 million) and US$12.69 million (RMB 81.86 million) for the six-month period ended June 30, 2023 and each of the years ended December 31, 2022 and December 31, 2021, respectively. We believe the availability of additional capital to purchase and upgrade supplemental tea gardens will be an effective and efficient strategy to increase production, sales, revenue, and profit.

In addition, in recent years, we have elected to give order fulfillment priority to larger customers, which prevented us from undertaking purchase orders from some other customers. Accordingly, not only did we lose business opportunities, but our customers may also elect to purchase from our competitors who have more cultivation capacity.

Such insufficiency in cultivation capacity is intensified by the rapid growth in demand for tea in mainland China. According to the CIC Report, the domestic sales volume of tea in mainland China increased from approximately 1.8 million tons in 2017 to approximately 2.3 million tons in 2021, representing a compound annual growth rate of 6.1%. Industry observer, CIC, expects the projected domestic sales volume of tea in mainland China to reach approximately 2.8 million tons in 2026, as driven by increases in downstream tea consumption, The above numbers are mainly predicted based on the following assumptions: (1) tea has long been associated with various health benefits, and there is a growing awareness and appreciation for its positive impacts on well-being. With an increasing focus on health and wellness, more people in mainland China are likely to turn to tea as a healthy beverage; (2) the tea industry in mainland China is undergoing innovation and diversification, offering a wide range of tea products and flavors to cater to evolving consumer preferences. From traditional tea to herbal infusions and specialty teas, there is a growing market for unique and premium tea experiences. This expanding variety of tea options is likely to attract more consumers and contribute to increased tea sales volume; (3) fresh-made tea beverage (such as milk tea) is becoming exceedingly popular in mainland China. Fresh-made milk tea beverages are made from tea. A group of emerging brands launched innovative tea beverages in order to further attract consumers. The market size of fresh-made tea beverage industry in mainland China is estimated to continue growing with a compound annual growth rate of more than 20% between 2021 and 2026. In particular, the domestic sales volume of white tea in mainland China rose from approximately 21.8 thousand tons in 2017 to approximately 70.5 thousand tons in 2021, with a compound annual growth rate of 34.1% mainly due to (i) continuous promotion of cultivation of white tea by local governments in mainland China, (ii) enhanced customers’ awareness of the nutritional benefits of white tea, and (iii) growing demand for high-value white tea from middle-class households in mainland China which have increasing disposable income.

Disciplined acquisition of management rights for tea gardens. When selecting tea gardens to be acquired, we adopt the following selection criteria to ensure the quality of the tea leaves to be planted in our new tea gardens:

1) altitude of and climate at the location;

2) soil conditions of the tea gardens;

3) proximity to our existing operating tea gardens;

4) variety and growth potential of the tea leaves to be harvested; and

5) labor availability and costs.

6

As of the date of this prospectus, we operate tea gardens of approximately 7,212,000 square meters. The volumes of fresh tea leaves that were harvested from such tea gardens were approximately 1,192.18 tons, 2,529.98 tons and 2,304.69 tons for the six-month period ended June 30, 2023 and the years ended December 31, 2022 and 2021, respectively. As part of our expansion plan to increase our cultivation capacity, we have entered into, among others, agreements or letters of intent with two (2) village committees in Huangbai Township, Zherong County, covering approximately additional 3,533,351 square meters of tea garden. In 2021, the white tea production volume of the Company is 424.8 tons, accounting for 0.8% and 0.5% of the total white tea production volume in Fujian Province and mainland China, respectively.

The total consideration for such acquisitions is approximately US$13.1 million (RMB87.6 million), which we intend to finance by ordinary cash flow from operations and a portion of the net proceeds from this offering identified as “General corporate purposes and working capital” under the caption, “Use of Proceeds”.

We believe that, after the anticipated acquisition of additional tea gardens, we will have an additional total estimated maximum annual cultivation capacity of:

• approximately 3,362.5 tons of fresh tea leaves in 2025;

• an average estimated cultivation capacity of approximately 0.125 tons of fresh tea leaves per Mu for the spring harvest in 2025; and

• an average estimated cultivation capacity of approximately 0.125 tons of fresh leaves per Mu for the autumn harvest in 2025.

We further expect that the above tea gardens and addition land lots will attain a total estimated maximum annual cultivation capacity of approximately 4,370 tons of fresh tea leaves, after the completion of tea garden improvement works.

The tea garden improvement works include soil improvement work to transform the sloped land-area into terraced-area to prevent erosion and increase the absorbing capacity of the soil; and construction of improvements in the tea gardens to facilitate irrigation, daily operation as well as transportation.

Construction of new production plant. The utilization rates of our production facilities for primarily-processed white tea had reached maximum capacity for each of the preceding two years. To maintain quality, fresh tea leaves need to be processed within a short period of time after they are harvested; when our processing facilities reach full capacity, valuable raw material tea leaves are not processed efficiently leading to lost sales and revenue opportunities. To ensure that we have the capacity to process our harvested tea, we intend to expand our production facilities by establishing a new production plant in the Zherong Tea Industrial Zone, the initial phase of which is expected to have a gross floor area of approximately 9,783.0 square meters. The initial phase of the new production plant will be used for the production of primarily-processed white tea and refined tea and storage of our products. We have signed a letter of intent with the Management Committee of the Zherong Tea Industrial Zone, in which we indicated our intention to bid for the intended site for the new production plant. We estimate that the bidding price would be approximately US$5.0 million (RMB 33.70 million).

When assessing the options of the proposed location of the new production plant, we have taken into account the following factors:

• The Zherong Tea Industrial Zone has comprehensive ancillary facilities, including housing for workers, transportation and utility supplies, which will facilitate the daily operation of the new production plant;

• Being located near the urban area and highway, the Zherong Tea Industrial Zone can be easily accessed by our potential customers; and

• Relative ease of recruitment of potential workers from the urban area of Zherong County.

We expect that, after the establishment and construction of the new production plant, an estimated annual processing capacity of approximately 1,456 tons of fresh tea leaves for primarily-processed white tea and an estimated annual production capacity of approximately 1,248 tons of refined tea will be added to our production capacity. With the expanded cultivation and production capacity, we are confident that we can take advantage of incremental additional business opportunities and the anticipated growth in the demand for tea in mainland China.

7

Purchase of four automatic production lines for production of primarily-processed white tea. We have historically used machines and equipment which are manually operated by our employees for the production of primarily processed white tea. We intend to acquire four automatic production lines for production of primarily processed white tea at a total anticipated cost of approximately US$0.73 million (RMB 4.90 million) using expected net proceeds from this offering. The Company expects to utilize the additional four automatic production lines to operate concurrently with the manually operated machines that currently in use.

Each of the automatic production lines for the production of primarily processed white tea consist of a stainless-steel storage tank, a conveyor, a layer spreader, wilting light, drying machine and temperature and humidity control systems.

Since we intend to emphasize the quality of our tea products, we believe that the acquisition of the four production lines is crucial to the development of the Company, as (i) the increase in production efficiency brought by the automation, and (ii) the enhancement of quality of our tea products owing to the new functions of the advanced production lines will improve our competitiveness against other market participants.