UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended _______

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: December 18, 2023

For the transition period from __________________________ to __________________________

Commission File Number: 001-41891

Vast Renewables

Limited

(Exact name of Registrant as specified in its charter)

| Not Applicable (Translation of Registrant’s name into English) |

Australia (Jurisdiction of incorporation or organization) |

226-230 Liverpool Street,

Darlinghurst, NSW 2010,

Australia

(Address of principal executive offices)

Alec Waugh, General Counsel

226-230 Liverpool Street,

Darlinghurst, NSW 2010,

Australia

+61 2 4072 2889

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading |

Name of each exchange on | ||

| Ordinary Shares, no par value | VSTE | The Nasdaq Stock Market LLC | ||

| Warrants, each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50 per share | VSTEW | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the shell company report: As of December 18, 2023, the issuer had 29,291,884 ordinary shares outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No ¨

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Emerging growth company | x |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

¨ U.S. GAAP

x International Financial Reporting Standards as issued by the International Accounting Standards Board

¨ Other

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ¨

table of contents

| 1 |

On December 18, 2023 (the “Closing Date”), Vast Renewables Limited, an Australian public company limited by shares (“Vast” or the “Company”), consummated the previously announced business combination pursuant to the Business Combination Agreement, dated as of February 14, 2023, as amended as of October 19, 2023 (the “Business Combination Agreement,” and the transactions contemplated thereby, the “Business Combination”), by and among the Company, Nabors Energy Transition Corp., a Delaware corporation (“NETC”), Neptune Merger Sub, Inc., a Delaware corporation and wholly owned direct subsidiary of Vast (“Merger Sub”), Nabors Energy Transition Sponsor LLC, a Delaware limited liability company (the “NETC Sponsor”) (solely with respect to Sections 5.20, 7.10(a) and 7.16 thereto), and Nabors Industries Ltd. (“Nabors”) (solely with respect to Sections 7.8(d) and 7.18 thereto), pursuant to which, among other things and subject to the terms and conditions contained therein, Merger Sub merged with and into NETC (the “Merger”), with NETC continuing as the surviving corporation and a wholly owned direct subsidiary of Vast (the “Surviving Corporation”).

Immediately prior to the effective time of the Merger (the “Effective Time”):

| ● | Vast caused all outstanding shares granted under its Management Equity Plan Deed dated on or around July 30, 2020, as amended on February 14, 2023 (the “MEP Deed” and, such shares, the “MEP Shares”), to be settled by way of a conversion and subdivision of those MEP Shares into ordinary shares in Vast (each, an “Ordinary Share”) in accordance with the MEP Deed and Vast’s Management Equity Plan De-SPAC Side Deed, dated on or around February 14, 2023 (the “MEP De-SPAC Side Deed” and such conversion and subdivision, the “MEP Share Conversion”), and after the MEP Share Conversion, all of the MEP Shares will no longer be outstanding and will cease to exist, and each holder of MEP Shares will thereafter cease to have any rights with respect to such MEP Shares; |

| ● | AgCentral Energy Pty Ltd. (“AgCentral”) caused (i) all of the outstanding convertible promissory notes issued by Vast held by AgCentral and (ii) all of the principal outstanding and accrued interest under each loan agreement between Vast and AgCentral to be converted into Ordinary Shares (collectively, the “Existing AgCentral Indebtedness Conversion”), in each case, pursuant to the terms of that certain Noteholder Support and Loan Termination Agreement, dated as of February 14, 2023, by and between Vast and AgCentral; and |

| ● | Vast caused a conversion of Ordinary Shares (whether by way of subdivision or consolidation) (the “Split Adjustment”), to occur immediately following the MEP Share Conversion and the Existing AgCentral Indebtedness Conversion, whereby the aggregate number of Ordinary Shares outstanding immediately following the Split Adjustment and immediately prior to the Effective Time was 20,500,000 Ordinary Shares. |

At the Effective Time, by virtue of the Merger and without any action on the part of NETC, Vast, Merger Sub or any of the holders of any of their securities, the following events took place simultaneously:

| ● | all shares of NETC Class A common stock, par value $0.0001 per share (the “NETC Class A Common Stock”), NETC Class B common stock, par value $0.0001 per share (the “NETC Class B Common Stock”), and NETC Class F common stock, par value $0.0001 per share (the “NETC Class F Common Stock” and together with the NETC Class B Common Stock and the NETC Class A Common Stock issued upon conversion of the NETC Class B Common Stock, the “Founder Shares”), held in the treasury of NETC were cancelled without any conversion thereof and no payment or distribution was made with respect thereof; |

| ● | (i) each share of NETC Class A Common Stock (other than the Redemption Shares (as defined below)) issued and outstanding immediately prior to the Effective Time were exchanged for a number of Ordinary Shares equal to the Exchange Ratio (as defined below), (ii) the shares of NETC Class F Common Stock and the shares of NETC Class B Common Stock issued and outstanding and held by NETC Sponsor or its transferees (based on a transfer following the date of the Business Combination Agreement) immediately prior to the Effective Time were collectively exchanged for 2,825,000 validly issued and fully paid Ordinary Shares, (iii) each share of NETC Class B Common Stock issued and outstanding and not held by NETC Sponsor or its transferees immediately prior to the Effective Time were exchanged for a number of Ordinary Shares equal to the Exchange Ratio, and (iv) each share of NETC Class F Common Stock issued and outstanding and not held by NETC Sponsor or its transferees immediately prior to the Effective Time were exchanged for a number of Ordinary Shares equal to the Exchange Ratio, in each case, after giving effect to the Split Adjustment (collectively, the “Per Share Merger Consideration”) and thereafter, each share of NETC Class A Common Stock, NETC Class F Common Stock and NETC Class B Common Stock was automatically cancelled and ceased to exist and each holder of NETC Class A Common Stock, NETC Class F Common Stock and NETC Class B Common Stock ceased to have any rights with respect thereto except the right to receive the Per Share Merger Consideration (other than pursuant to and in accordance with that certain letter agreement, dated as of February 14, 2023, by and among NETC, NETC Sponsor, Vast, Nabors Lux and NETC’s independent directors ( as amended on October 19, 2023, the “Support Agreement”)); |

| 2 |

| ● | each share of common stock, par value $0.0001 per share, of Merger Sub issued and outstanding immediately prior to the Effective Time was converted into one validly issued, fully paid and non-assessable share of common stock, par value $0.0001 per share, of the Surviving Corporation and constitutes the only outstanding shares of capital stock of the Surviving Corporation as of immediately after the Effective Time; and |

| ● | Vast assumed (i) the Private Warrant Agreement, dated as of November 16, 2021, by and between NETC and Continental Stock Transfer & Trust Company, as warrant agent (the “Original Private Warrant Agreement”) by virtue of the private warrant assignment, assumption and amendment agreement, dated as of December 18, 2023, by and among the Company, NETC and Continental Stock Transfer & Trust Company, as warrant agent (the Original Private Warrant Agreement, as amended by the private warrant assignment, assumption and amendment agreement, the “Private Warrant Agreement”) , and (ii) the Public Warrant Agreement, dated as of November 16, 2021, by and between NETC and Continental Stock Transfer & Trust Company, as warrant agent (the “Original Public Warrant Agreement,” and together with the Original Private Warrant Agreement, the “NETC Warrant Agreements”) by virtue of the public warrant assignment, assumption and amendment agreement, dated as of December 18, 2023, by and among the Company, NETC and Continental Stock Transfer & Trust Company, as warrant agent (the Original Public Warrant Agreement, as amended by the public warrant assignment, assumption and amendment agreement, the “Public Warrant Agreement”), and each warrant granted under the NETC Warrant Agreements (the “NETC Warrants”) then outstanding and unexercised automatically, without any action on the part of its holder, converted into a warrant to acquire Ordinary Shares (each such warrant issued under the Private Warrant Agreement, a “Vast Private Warrant,” each such warrant issued under the Public Warrant Agreement, a “Vast Public Warrant” and the Vast Private Warrants and the Vast Public Warrants collectively, the “Vast Warrants”). Each Vast Warrant is subject to the same terms and conditions (including exercisability terms) as were applicable to the corresponding NETC Warrant immediately prior to the Effective Time, except to the extent such terms or conditions are rendered inoperative by the Business Combination. |

“Exchange Ratio” means one (1).

Each share of NETC Class A Common Stock issued and outstanding immediately prior to the Effective Time with respect to which a NETC stockholder validly exercised its redemption rights (the “Redemption Shares”) was not entitled to receive the Per Share Merger Consideration and was converted immediately prior to the Effective Time into the right to receive from NETC, in cash, an amount per share calculated in accordance with such stockholder’s redemption rights.

Moreover, certain other related agreements were entered into in connection with the Business Combination, including the Notes Subscription Agreements, the Equity Subscription Agreements, the Nabors Backstop Agreement, the Shareholder and Registration Rights Agreement, the Support Agreement, the Noteholder Support and Loan Termination Agreement, the MEP Deed, MEP De-SPAC Side Deed, the Services Agreement, the Development Agreement and the October Notes Subscription Agreement, each as described in the Company’s Registration Statement on Form F-4 (333-272058), as amended, initially filed with the U.S. Securities and Exchange Commission (the “SEC”) on May 18, 2023 and declared effective on November 21, 2023 (the “Form F-4”), under the headings “Summary Term Sheet” and “The Business Combination Agreement and Related Agreements,” which are incorporated herein by reference, as well as the EDF Note Purchase Agreement, the JDA, the Parent Company Guarantee, the Nabors Backstop Agreement Amendment and the Nabors Backstop Loan each as described in the Company’s prospectus supplement to the Form F-4 filed on December 8, 2023 (the “Prospectus Supplement”) under the heading “Recent Developments,” which are incorporated herein by reference. See also “Item 10. Additional Information— Material Contracts,” elsewhere in this Report (as defined below).

| 3 |

The transaction was unanimously approved by the board of directors of NETC and was approved at the special meeting of NETC’s stockholders held on December 13, 2023 (the “Special Meeting”). NETC’s stockholders also voted to approve all other proposals presented at the Special Meeting. Also on December 13, 2023, Capital Airport Group (“CAG”), committed to invest an additional $2.0 million in Ordinary Shares. This was in addition to CAG’s previously announced $5.0 million commitment. CAG and Vast agreed that CAG’s purchase of Class A common stock of NETC from existing NETC stockholders who previously elected to redeem their shares in connection with the business combination and whose redemption election would be reversed would count towards satisfying CAG’s capital commitments. CAG satisfied its aggregate $7.0 million commitment by purchasing shares of Class A common stock of NETC from existing NETC stockholders who previously elected to redeem their shares in connection with the business combination and causing the redemption elections to be reversed. In connection with CAG’s investment, CAG also received an additional 129,911 Ordinary Shares of Vast at the closing of the Business Combination.

On December 18, 2023, Guggenheim Securities, LLC (“Guggenheim Securities”), financial advisor to NETC in the Business Combination, agreed to amend its engagement letter with NETC to provide that Guggenheim Securities would receive $1,750,000 in cash and 171,569 Ordinary Shares as consideration for its services pursuant to its engagement letter.

At the Effective Time, Vast issued:

| ● | An aggregate of 804,616 Ordinary Shares upon conversion of shares of NETC Class A Common Stock to the holders thereof; |

| ● | An aggregate of 3,000,000 Ordinary Shares upon conversion of Founder Shares to the holders thereof; |

| ● | An aggregate of 1,500,000 Ordinary Shares to former members of NETC Sponsor as acceleration of a portion of the Sponsor Earnback Shares, pursuant to the Nabors Backstop Agreement; |

| ● | 350,000 Ordinary Shares to Nabors Lux pursuant to the Nabors Backstop Agreement; |

| ● | An aggregate of 1,250,014 Ordinary Shares upon conversion of Senior Convertible Notes held by AgCentral and Nabors Lux; |

| ● | An aggregate of 1,715,686 Ordinary Shares to AgCentral and Nabors Lux pursuant to their respective Equity Subscription Agreements; and |

| ● | 171,569 Ordinary Shares to Guggenheim Securities pursuant to its amended engagement letter with NETC. |

As a result of the Business Combination, NETC became a wholly-owned direct subsidiary of the Company. On December 19, 2023, the Ordinary Shares and public Vast Warrants (as defined below) commenced trading on the Nasdaq Stock Market, or “Nasdaq,” under the symbols “VSTE” and “VSTEW,” respectively.

Except as otherwise indicated or required by context, references in this Shell Company Report on Form 20-F (including information incorporated by reference herein, this “Report”) to (i) “we,” “us,” “our,” “Company” or “Vast” refer to Vast Renewables Limited, an Australian public company limited by shares, and its consolidated subsidiaries, (ii) “$,” “US$,” “USD” and “dollars” mean U.S. dollars and (iii) “A$” and “AUD” mean Australian dollars.

Certain amounts that appear in this Report may not sum due to rounding.

| 4 |

Cautionary Note Regarding Forward-Looking Statements

This Report and the documents incorporated by reference herein include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Forward-looking statements reflect Vast’s or NETC’s views, as applicable, with respect to, among other things, their respective capital resources, portfolio performance and results of operations. Likewise, all of Vast’s statements regarding anticipated growth in its operations, anticipated market conditions, demographics and results of operations are forward-looking statements. In some cases, you can identify these forward-looking statements by the use of terminology such as “anticipates” “approximately,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “seeks,” “should,” “will” or the negative version of these words or other comparable words or phrases.

Forward-looking statements contained in this Report reflect Vast’s or NETC’s views, as applicable, about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause its actual results to differ significantly from those expressed in any forward-looking statement. Neither Vast nor NETC guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

| ● | risks relating to the lack of projected financial information with respect to Vast; |

| ● | Vast’s ability to successfully commercialize its operations; |

| ● | Vast’s ability to obtain new and maintain existing funding from government grants; |

| ● | general economic uncertainty; |

| ● | the effects of the COVID-19 pandemic; |

| ● | the volatility of currency exchange rates; |

| ● | Vast’s ability to obtain and maintain financing arrangements on attractive terms; |

| ● | Vast’s ability to manage growth; |

| ● | Vast’s ability to maintain the listing of Vast’s securities on Nasdaq or any other national exchange; |

| ● | risks related to the rollout of Vast’s business and expansion strategy; |

| ● | overall demand for solar energy and/or fuels and the potential for reduced demand if governmental rebates, tax credits and other financial incentives are reduced, modified or eliminated; |

| ● | the possibility that Vast’s technology and products could have undetected defects or errors; |

| ● | the effects of competition on Vast’s future business; |

| ● | potential disruption in Vast’s employee retention as a result of the Business Combination; |

| ● | the impact of and changes in governmental regulations or the enforcement thereof, tax laws and rates, accounting guidance and similar matters in regions in which Vast operates or will operate in the future; |

| ● | potential litigation, governmental or regulatory proceedings, investigations or inquiries involving Vast or NETC including in relation to the Business Combination; |

| ● | the effectiveness of Vast’s internal controls and its corporate policies and procedures; |

| ● | changes in personnel and availability of qualified personnel; |

| ● | environmental uncertainties and risks related to adverse weather conditions and natural disasters; |

| ● | potential write-downs, write-offs, restructuring and impairment or other charges required to be taken by Vast; |

| ● | the possibility that the NETC board’s valuation of Vast was inaccurate, including the failure of NETC’s diligence review to identify all material risks associated with the Business Combination; |

| ● | the limited experience of certain members of Vast’s management team in operating a public company in the United States; |

| 5 |

| ● | significant business disruptions resulting from natural or other disasters (including, but not limited to, health emergencies such as pandemics or epidemics, acts of war (including, but not limited to the war between Ukraine and Russia) or terrorism); |

| ● | the volatility of the market price and liquidity of Vast Ordinary Shares and other securities of Vast; and |

| ● | other risks and uncertainties, including those listed under the section titled “Risk Factors” |

While forward-looking statements reflect Vast’s and NETC’s good faith beliefs, as applicable, they are not guarantees of future performance. Vast and NETC disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes after the date of this Report, except as required by applicable law. For a further discussion of these and other factors that could cause Vast’s or NETC’s future results, performance or transactions to differ significantly from those expressed in any forward-looking statement, please see the section entitled “Risk Factors” of this Report and the section entitled “Risk Factors” of the Form F-4. You should not place undue reliance on any forward-looking statements, which are based only on information currently available to us (or to third parties making the forward-looking statements).

| 6 |

Item 1. Identity of Directors, Senior Management and Advisers

A. Directors and Senior Management

The directors and executive officers of the Company as of the date of this Report are set forth in Item 6.A of this Report. The business address for each of the Company’s directors and executive officers is 226-230 Liverpool Street, Darlinghurst, NSW 2010, Australia.

B. Advisers

White & Case LLP has acted as U.S. securities counsel for and continues to act as U.S. securities counsel for the Company following the completion of the Business Combination.

Gilbert + Tobin has acted as counsel for the Company with respect to Australian law and continues to act as counsel for the Company with respect to Australian law following the completion of the Business Combination.

C. Auditors

Ham, Langston & Brezina, LLP has acted as NETC’s independent registered public accounting firm as of September 30, 2023, December 31, 2022 and December 31, 2021, and for nine months ended September 30, 2023, the year ended December 31, 2022 and the period from March 31, 2021 (inception) through December 31, 2021.

PricewaterhouseCoopers has acted as Vast’s independent registered public accounting firm as of June 30, 2023 and June 30, 2022, and for the years then ended.

PricewaterhouseCoopers has acted as SiliconAurora Pty Ltd’s independent auditor as of June 30, 2023 and June 30, 2022, and for the years then ended.

Following the Business Combination, we intend to retain PricewaterhouseCoopers as the Company’s independent registered public accounting firm.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

A. [Reserved]

B. Capitalization and Indebtedness

The following table sets forth the capitalization of the Company on an unaudited pro forma combined basis as of June 30, 2023, after giving effect to the Business Combination:

| Pro Forma Combined | As

of June 30, | |||

| Cash and cash equivalents | $ | 19,847 | ||

| Total indebtedness | 17,875 | |||

| Equity | ||||

| Issued capital | 294,352 | |||

| Reserves | 3,285 | |||

| Accumulated losses | (300,710 | ) | ||

| Total equity | (3,073 | ) | ||

| Total capitalization | $ | 14,802 | ||

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

The risk factors associated with the Company are described in the Form F-4 under the heading “Risk Factors,” which information is incorporated herein by reference.

| 7 |

Item 4. Information on the Company

A. History and Development of the Company

Vast is an Australian public company limited by shares incorporated on March 27, 2009. For further information on the Business Combination, see “Explanatory Note” above. The history and development of the Company and the material terms of the Business Combination are described in the Form F-4 under the headings “Summary Term Sheet,” “The Business Combination,” “The Business Combination Agreement and Related Agreements,” “Business of Vast and Certain Information About Vast” and “Description of Vast Securities,” and in the Prospectus Supplement under the heading “Recent Developments,” each of which are incorporated herein by reference.

The Company’s registered office and principal executive office is 226-230 Liverpool Street, Darlinghurst, NSW 2010, Australia. The Company’s principal website address is https://www.vast.energy/. We do not incorporate the information contained on, or accessible through, the Company’s websites into this Report, and you should not consider it a part of this Report. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The SEC’s website is http://www.sec.gov.

B. Business Overview

A description of the Company’s business is included in the Form F-4 under the headings “Business of Vast and Certain Information About Vast” and “Vast’s Management’s Discussion and Analysis of Financial Condition and Results of Operation” and supplemented in the Prospectus Supplement under the heading “Recent Developments,” each of which are incorporated herein by reference. Also see “Explanatory Note” above, which is incorporated herein by reference.

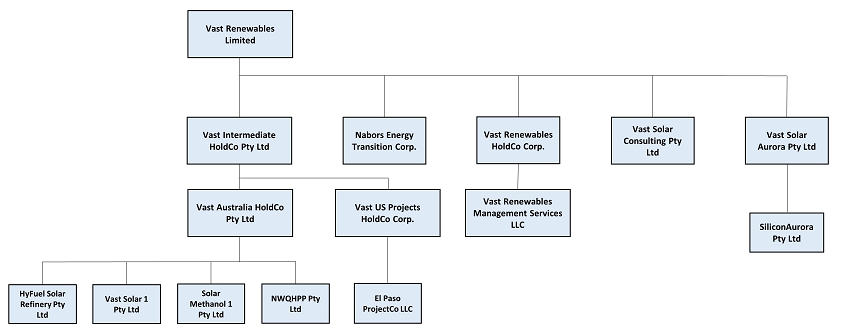

C. Organizational Structure

Upon consummation of the Business Combination, NETC became a wholly-owned direct subsidiary of the Company. The following diagram illustrates the structure of the Company immediately following the Business Combination;

D. Property, Plants and Equipment

Information regarding Vast’s property, plants and equipment is described in the Form F-4 under the heading “Business of Vast and Certain Information About Vast—Facilities,” which information is incorporated herein by reference.

Item 4A. Unresolved Staff Comments

None.

Item 5. Operating and Financial Review and Prospects

The discussion and analysis of the financial condition and results of operation of the Company is included in the Form F-4 under the heading “Vast’s Management’s Discussion and Analysis of Financial Condition and Results of Operation,” and supplemented in the Prospectus Supplement under the heading “Recent Developments,” which information are incorporated herein by reference. Also see “Explanatory Note” above, which is incorporated herein by reference.

| 8 |

Item 6. Directors, Senior Management and Employees

A. Directors and Senior Management

Directors and Executive Officers

The executive officers and directors of Vast are:

| Name | | Age | | Position |

| Craig Wood | | 46 | | Chief Executive Officer and Director |

| Marshall (Mark) D. Smith | | 63 | | Chief Financial Officer |

| Kurt Drewes | | 50 | | Chief Technology Officer |

| Alec Waugh | | 57 | | General Counsel |

| Sue Opie | | 56 | | Chief People Officer |

| Colleen Calhoun | | 57 | | Director |

| William Restrepo | | 63 | | Director |

| Colin Richardson | | 62 | | Director |

| John Yearwood | | 64 | | Director |

Executive Officers

Craig Wood, CEO, joined Vast in September 2015, after having worked at leading Australian private equity firm Archer Capital from May 2004 to August 2012 as an Investment Director before joining portfolio company Brownes Dairy in September 2012 as CFO and then Interim CEO until March 2015. Mr. Wood began his career in energy in Lehman Brothers’ New York Power and Utilities Group from September 2002 until February 2004 and, prior to that as an engineer in the oil and gas industry from November 1998 to September 1999. Mr. Wood graduated with BEng (Mechanical Hons) and BSc (IT) degrees from the University of Western Australia in 1998, a MA from Oxford University in 2001 where he studied as a Rhodes Scholar, and a MSc (Finance) from London Business School in 2002.

Marshall (Mark) D. Smith, Chief Financial Officer, joined Vast in September 2023, and is a highly accomplished senior executive with demonstrated performance in all aspects of the energy industry, including operations, capital allocation, strategic planning, business development, corporate finance, capital markets, M&A, IPOs, turnarounds, and restructuring. Most recently, Mark served as Chief Financial Officer for a Texas-based privately held oil and gas company, from September 2021 to September 2023. Prior to that, Mr. Smith served as Chief Financial Officer and Corporate Secretary of Guidon Energy, Blackstone’s largest energy-focused investment from September 2020 to May 2021. Prior to Guidon, from July 2014 to August 2020, he first served as Senior Executive Vice President and Chief Financial Officer, California Resources at Occidental Petroleum Corporation prior to its spin-off, where he was selected to serve as “second in command” for the spin-off/IPO of its California business in a tax-free distribution to shareholders, and following the spin-off, he served as Senior Executive Vice President and Chief Financial Officer at California Resources Corporation and served on the Executive Committee, Compliance Committee, Reserves Committee, and Disclosure Committee. Prior to Occidental Petroleum, Mr. Smith served as Senior Vice President and Chief Financial Officer for Ultra Petroleum Corporation and chairman of its international finance subsidiary. Before Ultra Petroleum, Mr. Smith was Vice President, Business Development at J.M. Huber Energy. Earlier in his career, Mark served as Managing Director, Investment Banking at Nesbitt Burns Securities Inc. (now BMO Capital Markets) and was appointed to the board of Nesbitt Burns Securities, and prior to that, he held various positions, including Director, Energy Group at Bank of Montreal. Mr. Smith holds an MBA, Finance (summa cum laude) from Oklahoma City University and a BS in Petroleum Engineering (Distinguished Scholar) from University of Oklahoma. He is member and past chairman, Advisory Board, University of Oklahoma Mewbourne School of Petroleum Engineering and a member of numerous boards, including the Muscular Dystrophy Association, where he serves on the Executive Committee and is chairman of the Audit Committee.

| 9 |

Kurt Drewes, Chief Technology Officer, is a seasoned CSP engineer with broad experience and joined Vast in July 2017. He has held positions in manufacturing, design, construction, operations and commercial management utilizing linear Fresnel, parabolic trough and central tower technologies and has worked in CSP in countries including Germany, Spain, South Africa, Morocco and Australia. Mr. Drewes joined Vast from ACWA Power where he was Project Director at the ACWA Solar Reserve Redstone CSP project in South Africa and Technical Advisor on the Noor 3 project in Morocco from November 2015 to June 2017. Prior to that, Mr. Drewes led the Owner’s Team of Abengoa Solar’s Khi Solar One project in South Africa from June 2013 to October 2015. Mr. Drewes was promoted to Global Head of Production at Novatec Solar in Germany, where he worked from July 2011 to May 2013, following his leadership as Operations Manager at Novatec’s CSP plant from June 2008 to June 2011, located in Murcia in Spain. Mr. Drewes earned his Mechanical Engineering degree from the University of Witwatersrand, South Africa in 1994 and an MBA from the University of Cape Town in 1999.

Alec Waugh, General Counsel, joined Vast in October 2015 and has over eleven years’ experience in working closely with private equity owned businesses and over 20 years total experience working with a range of multinational businesses. His extensive experience as a commercial and legal advisor has been across a wide range of food, agriculture, services and manufacturing businesses including seven years in his present role as General Counsel of Zip Water (a member of the Culligan Group) from, May 2015 to the current date (the last four years as General Counsel and Company Secretary) and General Counsel of Brownes Foods for four years, from March 2011 to September 2015. Prior to these roles he spent six years with the Fonterra Co-operative Group, from September 2003 to December 2009 and four years with Campbells/Arnott’s, from February 1998 to June 2002. Mr. Waugh has been working with Vast providing legal and strategic commercial support as the General Counsel and member of the executive leadership team. Mr. Waugh has a hands-on approach with providing his advice and counsel and is closely engaged with all members of Vast commercial team. While responsible for providing general legal support and commercial guidance to Vast, Mr. Waugh has played a critical role in the development of Vast’s IP strategy and portfolio, its commercial strategy and also its overall approach to risk management and compliance. Mr. Waugh has been admitted as a solicitor since 1998 and received a Diploma in Law (SAB), from Sydney University in 1997.

Sue Opie, Head of People, joined Vast in December 2019, and has 25 years HR strategic, project and operational experience. Before joining Vast, her career spanned across healthcare, pharmaceutical, manufacturing, hospitality, FMCG and Industrial sectors. From 2017, Ms. Opie was an HR advisor for small to medium sized companies, working with Executive and management teams to develop HR strategy, deliver HR operational services, be a facilitator for the Company's vision, lead transformational change, build leadership capability, drive a performance culture and enhance employee engagement. Prior to her consulting career, Ms Opie was Head of HR for HealthCare (2012 – 2017), an Australian private hospital group of 17 hospitals and HR Director for Inova Pharmaceuticals (2006 – 2012), providing HR leadership for the APAC and South Africa regions. Ms Opie's HR career commenced with 3M Australia (1993 – 2002). Ms. Opie has a career track record building a healthy company culture through the design and implementation of HR strategic plans aligned to the Company vision and business goals and leading transformational change in fast and agile business environments. Ms Opie holds a B. Science Psychology (Hons) from the University of NSW in 1988 and Masters of Management from Macquarie Graduate School of Management in 1996.

Directors

Colleen Calhoun was a member of the NETC Board. Ms. Calhoun has served as Operating Partner at The Engine, an investment firm focusing on climate change human health and advanced systems and infrastructure, since April 2023. Ms. Calhoun previously served as Vice President of Spruce Power (formerly known as XL Fleet) (NYSE: SPRU), a provider of fleet electrification solutions, and General Manager of XL Grid, a division of Spruce Power, from January 2021 to February 2023. Prior to this, Ms. Calhoun served as Founder and Principal Advisor at Helios Consulting, LLC from November 2019 to December 2020. Ms. Calhoun spent twenty-five years at GE across several roles at the company, including Chief Marketing Officer and Head of Business Development (August 2018 to October 2019) and Head of Business Development and Partnerships (January 2016 to August 2018) at GE Current, a leading provider of energy efficiency and digital productivity solutions for commercial buildings and cities, where she was instrumental in the divesture of the business from GE in 2019; Global Senior Director of Energy Ventures at GE Ventures (January 2013 to December 2015); Executive Director, Marketing, Strategy and Project Development at GE Power & Water (October 2010 to December 2012); and Managing Director, Global Growth Markets at GE Energy Financial Services (January 2006 to September 2010). Ms. Calhoun is presently a member of the board of directors at Nabors Energy Transition Corp. II (NYSE: NETD) and Quaise, Inc. and served on the board of directors of Evergreen Climate Innovations (formerly known as Clean Energy Trust) until February 2023. She also previously served on the Advisory Board at NYSERDA REV Connect.

| 10 |

William J. Restrepo was NETC’s Chief Financial Officer. Mr. Restrepo has served as Chief Financial Officer of Nabors Energy Transition Corp. II since April 2023. He has served as Chief Financial Officer of Nabors since March 2014. Mr. Restrepo previously served as Chief Financial Officer at Pacific Drilling S.A. from February 2011 to February 2014. He also previously served as Chief Financial Officer at Seitel from 2005 to 2009, and at Smith from 2009 to 2010 until its merger with Schlumberger Limited. Prior to that, from 1985 to 2005, Mr. Restrepo served in various senior strategic, financial and operational positions for Schlumberger Limited, including operational responsibility for all product lines in the Continental Europe and Arabian Gulf markets, as well as senior financial executive roles in Corporate Treasury and worldwide controller positions with international posts in Europe, South America and Asia. From 2018 to 2021, Mr. Restrepo served on the board of Reelwell AS, a Norwegian-based provider of advanced drilling technology. He served on the board of SANAD (Nabors’ joint venture with Saudi Aramco) from 2017 to 2020, and previously served on the boards of directors of C&J Energy Services Ltd. from 2015 to 2017, Probe Technology Services from 2008 to 2016, and Platinum Energy Solutions, Inc. from 2012 to 2013. Mr. Restrepo holds a B.A. in Economics and an M.B.A, both from Cornell University, as well as a B.S. in Civil Engineering from the University of Miami.

Colin Richardson, is a Managing Director at MA Financial Australia. Mr. Richardson has over three decades of investment banking experience advising clients on mergers and acquisitions and strategic advisory transactions across a variety of industries. Mr. Richardson was previously a Managing Director at Rothschild, a Managing Director and Head of M&A for Australia and New Zealand at Citigroup and a Managing Director in M&A at Deutsche Bank. Prior to joining Deutsche Bank, Mr. Richardson worked at SG Hambros, formerly known as Hambros Bank, in Australia and London. He served on the Board of Hockey NSW for three years, followed by three years on the Board of Hockey Australia. He was also the inaugural Chair of Hockey 1, which is Australia’s premier domestic hockey competition. Currently, Mr. Richardson serves as Managing Director at MA Financial Group and Chairman of MA Money, a residential mortgage origination company within the MA Financial Group. Mr. Richardson sits on various investment committees for funds manage by MA Financial Group. Mr. Richardson also holds positions on the boards of various Twynam Group Companies. Mr. Richardson holds a B.A. from Hull University.

John Yearwood was a member of the NETC Board. Mr. Yearwood currently serves on the board of directors of Nabors, TechnipFMC plc, Sheridan Production Partners, Foro Energy LLC, Bazean LLC, and Coil Tubing Partners LLC. He previously served on the boards of Sabine Oil & Gas, LLC until August 2016, Premium Oilfield Services, LLC until April 2017, and Dixie Electric LLC until November 2018. Until August 2010, he served as the Chief Executive Officer, President and Chief Operating Officer of Smith International, Inc. (“Smith”). He was first elected to Smith’s board of directors in 2006 and remained on the board until he successfully negotiated and completed the sale of Smith to Schlumberger Limited in August 2010. Mr. Yearwood has extensive experience in the energy industry, including throughout Latin America, Europe, North Africa and North America. Before joining Smith, Mr. Yearwood spent 27 years with Schlumberger Limited in numerous operations, management and staff positions throughout Latin America, Europe, North Africa and North America, including as President and in financial director positions. He also previously served as Financial Director of WesternGeco, a 70:30 joint venture between Schlumberger and Baker Hughes from 2000 to 2004. Mr. Yearwood received a B.S. Honors Degree in Geology and the Environment from Oxford Brookes University in England. Mr. Yearwood brings significant executive management experience and keen insight into strategic development initiatives, operations and Vast’s competitive environment to Vast’s board of directors.

| 11 |

B. Compensation

Decisions regarding the executive compensation program will be made by the compensation committee of the Company’s board of directors. The Company intends to develop an executive compensation program that is designed to align compensation with business objectives and the creation of shareholder value, while enabling the Company to attract, retain, incentivize and reward individuals who contribute to its long-term success.

Information pertaining to the compensation of the directors and executive officers of the Company is set forth in the Form F-4 under the heading “Executive Compensation” which information is incorporated herein by reference.

C. Board Practices

Board Composition

The business and affairs of the Company are organized under the direction of its board of directors. The primary responsibilities of the board of directors of the Company are to provide oversight, strategic guidance, counseling and direction to management. The board of directors of the Company will meet on a regular basis and additionally as required.

In accordance with the terms of the constitution of the Company (the “Constitution”), the board of directors of the Company may establish the authorized number of directors from time to time by resolution, provided however that such number shall not be less than three (3). At least two of the directors must ordinarily reside in Australia. The board of directors of the Company currently consists of five (5) members. Each of the directors will continue to serve as a director until the appointment and qualification of his or her successor or until his or her earlier death, resignation or removal. Vacancies on the board of directors can be filled by resolution of the board of directors. The board of directors is divided into three classes, each serving staggered, three-year terms:

| ● | the Class I directors are Colin Richardson, William Restrepo and Craig Wood and their terms will expire at the first annual general meeting; |

| ● | the Class II director is Colleen Calhoun and her term will expire at the second annual general meeting; and |

| ● | the Class III directors are John Yearwood and their terms will expire at the third annual general meeting. |

As a result of the staggered board, only one class of directors will be appointed at each annual general meeting, with the other classes continuing for the remainder of their respective terms.

Independence of Directors

Subject to applicable phase-in rules and exemptions for foreign private issuers, Vast adheres to the rules of Nasdaq in determining whether a director is independent. The Vast Board has consulted, and will consult, with its counsel to ensure that its determinations are consistent with those rules and all relevant securities and other laws and regulations regarding the independence of directors. The listing standards of Nasdaq generally define an “independent director” as a person, other than an executive officer or employee of a company or any other individual having a relationship which, in the opinion of the issuer’s board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The board of directors has determined that Colleen Calhoun and John Yearwood are be considered independent directors. Domestic issuers listed on Nasdaq are required to have a majority independent board no later than one year from the date on which it is first listed on Nasdaq and the independent directors are required to have regularly scheduled meetings at which only independent directors are present. However, as a foreign private issuer, Vast may elect to follow Australian practice, which does not require a majority independent board or that the independent directors have regularly scheduled meetings at which only independent directors are present. Vast currently relies on the “foreign private issuer exemption” from Nasdaq’s requirement that a majority of the Company board of directors be independent and only two of the five directors are considered to be independent directors

| 12 |

Board Committees

Vast has a separately standing audit committee, compensation committee and nominating and corporate governance committee, each of which operate under a written charter.

Subject to phase-in rules and a limited exception, Nasdaq Listing Rules and Rule 10A-3 of the Exchange Act require that the audit committee of a listed company be comprised solely of independent directors, and Nasdaq rules require that the compensation committee and nominating and corporate governance committee of a listed company be comprised solely of independent directors.

In addition, from time to time, special committees may be established under the direction of the Vast Board when the Vast Board deems it necessary or advisable to address specific issues. Copies of Vast’s committee charters are posted on Vast’s website, www.vast.energy, as required by applicable SEC and the Nasdaq Listing Rules. The information contained on, or that may be accessed through, NETC’s and Vast’s website is not part of, and is not incorporated into, this Report of which it forms a part.

Audit Committee

Vast has established an audit committee of the board of directors. Collen Calhoun, John Yearwood and Colin Richardson will serve as members and Colin Richardson is expected to serve as the chairperson of the audit committee. Under the Nasdaq Listing Rules and applicable SEC rules, Vast is required to have at least three members of the audit committee, all of whom must be independent, subject to the exception described below.

All members of Vast’s audit committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and the Nasdaq Listing Rules. The board of directors has determined that Colin Richardson is an audit committee financial expert as defined by the SEC rules and is financially sophisticated as defined by the Nasdaq Listing Rules.

The board of directors has determined that Ms. Calhoun and Mr. Yearwood each meet the independent director standard under Nasdaq Listing Rules and under Rule 10-A-3(b)(1) of the Exchange Act, but Mr. Richardson does not. Vast will have one year from the date of its listing on Nasdaq to have its audit committee be comprised solely of independent members. Vast intends to identify one additional independent director to serve on the audit committee within one year of the date of its listing on Nasdaq, at which time Mr. Richardson will resign from the committee.

Audit Committee Role

The board of directors adopted an audit committee charter setting forth the responsibilities of the audit committee, which are consistent with the SEC rules and the Nasdaq Listing Rules. These responsibilities include:

| ● | overseeing Vast’s accounting and financial reporting process; |

| ● | appointing, compensating, retaining, overseeing the work, and terminating the relationship with Vast’s independent registered public accounting firm and any other registered public accounting firm engaged for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attest services for Vast; |

| ● | setting clear hiring policies for employees or former employees of the independent registered public accounting firm, including but not limited to, as required by applicable laws and regulations; |

| ● | setting clear policies for audit partner rotation in compliance with applicable laws and regulations; |

| ● | discussing with Vast’s independent registered public accounting firm any audit problems or difficulties and management’s response; |

| ● | pre-approving all audit and non-audit services provided to Vast by its independent registered public accounting firm (other than those provided pursuant to appropriate preapproval policies established by the audit committee or exempt from such requirement under the rules of the SEC); |

| 13 |

| ● | reviewing and discussing Vast’s annual and quarterly financial statements with management and Vast’s independent registered public accounting firm; |

| ● | discussing Vast’s risk management policies; |

| ● | reviewing and approving or ratifying any related person transactions; |

| ● | reviewing management’s reports; |

| ● | discussing earnings press releases with management, as well as financial information and earnings guidance provided to analysts and rating agencies; |

| ● | reviewing the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on Vast’s financial statements; |

| ● | assessing and monitoring risk exposures, as well as the policies and guidelines to risk management process; |

| ● | establishing procedures for the receipt, retention and treatment of complaints received by Vast regarding accounting, internal accounting controls or auditing matters, and for the confidential and anonymous submission by Vast’s employees of concerns regarding questionable accounting or auditing matters; |

| ● | periodically reviewing and reassessing the adequacy of the audit committee charter; |

| ● | periodically meeting with management, the internal audit team and the independent auditors, separately; and |

| ● | preparing any audit committee report required by SEC rules. |

Compensation Committee

Vast has established a compensation committee of the board of directors. Colin Richardson and William Restrepo serve as members and William Restrepo serves as the chairperson of the compensation committee.

Domestic issuers listed on Nasdaq are required to have a compensation committee consisting of at least two members, each of whom must be independent. However, as a foreign private issuer, Vast is permitted, and has elected, to follow Australian practice, which does not require a compensation committee composed solely of independent directors.

Pursuant to the compensation committee charter, Vast’s compensation committee is responsible for, among other things:

| ● | reviewing and approving corporate goals and objectives with respect to the compensation of Vast’s Chief Executive Officer, evaluating Vast’s Chief Executive Officer’s performance in light of these goals and objectives and setting Vast’s Chief Executive Officer’s compensation; |

| ● | reviewing and setting or making recommendations to Vast’s board of directors regarding the compensation of Vast’s other executive officers; |

| ● | reviewing and making recommendations to the Vast’s board of directors regarding director compensation; |

| ● | reviewing and approving or making recommendations to Vast’s board of directors regarding Vast’s incentive compensation and equity-based plans and arrangements; and |

| ● | appointing and overseeing any compensation consultants. |

The compensation committee charter also provides that the compensation committee may, in its sole discretion, retain or obtain the advice of a compensation consultant, independent legal counsel or other adviser and will be directly responsible for the appointment, compensation and oversight of the work of any such adviser. However, before engaging or receiving advice from a compensation consultant, external legal counsel or any other adviser, the compensation committee will consider the independence of each such adviser, including the factors required by Nasdaq and the SEC.

| 14 |

Compensation Committee Interlocks and Insider Participation

No member of the compensation committee was at any time during fiscal year 2023, or at any other time, one of Vast’s officers or employees. None of Vast’s executive officers has served as a director or member of a compensation committee (or other committee serving an equivalent function) of any entity, one of whose executive officers served as a director of Vast’s board of directors or member of Vast’s compensation committee.

Nominating and Corporate Governance Committee

Vast has established a nominating and corporate governance committee of the board of directors. Colleen Calhoun, Colin Richardson and William Restrepo are members and Colleen Calhoun serves as the chairperson of the nominating and corporate governance committee.

Pursuant to the nominating and corporate governance committee charter, Vast’s nominating and corporate governance committee is responsible for, among other things:

| ● | identifying individuals qualified to become members of the Vast Board and ensure the Vast Board has the requisite expertise and consists of persons with sufficiently diverse and independent backgrounds; |

| ● | recommending to the Vast Board the persons to be nominated for election as directors and to each committee of the Vast Board; |

| ● | developing and recommending to the Vast Board corporate governance guidelines, and reviewing and recommending to the Vast Board proposed changes to our corporate governance guidelines from time to time; and |

| ● | overseeing the annual evaluations of the Vast Board, its committees and management. |

Domestic issuers listed on Nasdaq are required to have a nominating and corporate governance committee consisting solely of independent directors or adopt a board resolution providing that director nominations will be voted on solely by independent directors. However, as a foreign private issuer, Vast is permitted, and has elected, to follow Australian practice, which does not require a nominating and corporate governance committee composed solely of independent directors.

Risk Oversight

Vast’s board of directors oversees the risk management activities designed and implemented by its management. Vast’s board of directors executes its oversight responsibility both directly and through its committees. Vast’s board of directors also considers specific risk topics, including risks associated with its strategic initiatives, business plans and capital structure. Vast’s management, including its executive officers, are primarily responsible for managing the risks associated with the operation and business of Vast and provide appropriate updates to the board of directors and the audit committee. Vast’s board of directors has delegated to the audit committee oversight of its risk management process, and its other committees also consider risk as they perform their respective committee responsibilities. All committees report to Vast’s board of directors as appropriate, including when a matter rises to the level of material or enterprise risk.

Code of Business Conduct and Ethics

Vast has adopted a Code of Conduct and Ethics and posted its Code of Conduct and Ethics on its website. Vast intends to post any amendments to or any waivers from a provision of its Code of Conduct and Ethics on its website, and also intends to disclose any amendments to or waivers of certain provisions of its Code of Conduct and Ethics in a manner consistent with the applicable rules or regulations of the SEC and Nasdaq.

Shareholder Communication with the Board of Directors

Vast shareholders and interested parties may communicate with the board of directors, any committee chairperson or the independent directors as a group by writing to the board of directors or committee chairperson in care of Vast, 226-230 Liverpool Street, Darlinghurst, NSW 2010, Australia, Attn.: Alec Waugh, General Counsel.

| 15 |

Foreign Private Issuer Status

Vast is a “foreign private issuer,” as such term is defined in Rule 405 under the Securities Act. As a foreign private issuer Vast is permitted to comply with Australian corporate governance practices in lieu of the otherwise applicable Nasdaq Listing Rules, with limited exceptions, provided that it discloses the Nasdaq Listing Rules it does not follow and the equivalent Australian requirements with which it complies instead.

Vast relies on this “foreign private issuer exemption” with respect to the following requirements:

| ● | Third Party Director and Nominee Compensation — Nasdaq Listing Rule 5250(b)(3) requires listed companies to disclose third party director and nominee compensation. As a foreign private issuer, however, Vast is permitted to, and follows home country practice in lieu of this requirement. Australian law and corporate governance practice do not require Vast to disclose third party director and nominee compensation. |

| ● | Distribution of Annual and Interim Reports — Nasdaq Listing Rule 5250(d) requires that annual and interim reports be distributed or made available to shareholders within a reasonable period of time following filing with the SEC. As a foreign private issuer, however, Vast is permitted to, and follows home country practice in lieu of this requirement. Australian law and corporate governance practice require Vast to prepare an annual audited consolidated annual report that includes its financial statements. That annual report must be lodged with ASIC within four months of the end of the financial year and presented to shareholders at an annual general meeting within five months of the end of the financial year. There is no requirement to distribute or make available an interim report. |

| ● | Independent Directors — Nasdaq Listing Rule 5605(b)(1) requires that at least a majority of a listed company’s board of directors be independent directors, and Nasdaq Listing Rule 5605(b)(2) requires that independent directors regularly meet in executive session, where only independent directors are present. As a foreign private issuer, however, Vast is permitted to, and follows home country practice in lieu of these requirements. Australian law and corporate governance practice do not require a majority of Vast’s board to be independent directors and do not require the independent directors to regularly meet in executive sessions, where only the independent directors are present. |

| ● | Compensation Committee Composition — Nasdaq Listing Rule 5605(d)(2) requires that a listed company’s compensation committee be comprised of at least two members, each of whom is an independent director as defined under such rule. As a foreign private issuer, however, Vast is permitted to, and follows home country practice in lieu of these requirements. Australian law and corporate governance practice do not require that the compensation committee be composed solely of independent directors. |

| ● | Director Nominations — Nasdaq Listing Rule 5605(e) requires that director nominees be selected or recommended for selection by the full board either by (A) independent directors constituting a majority of the board’s independent directors in a vote in which only independent directors participate, or (B) a nominations committee comprised solely of independent directors. As a foreign private issuer, however, Vast is permitted to, and follows home country practice in lieu of these requirements. Australian law and corporate governance practice do not require that only independent directors participate in director nominations. |

| ● | Proxy Solicitation — Nasdaq Listing Rule 5620(b) requires companies that are not a limited partnership to solicit proxies and provide proxy statements for all meetings of shareholders and to provide copies of such proxy solicitation material to Nasdaq. As a foreign private issuer, however, Vast is permitted to, and follows home country practice in lieu of these requirements. Australian law and corporate governance practice do not require companies to solicit proxies or deliver proxy statements in connection with a meeting of shareholders. |

| ● | Quorum — Nasdaq Listing Rule 5620(c) sets out a quorum requirement of 33-1/3% of the outstanding shares of common voting stock. As a foreign private issuer, however, Vast is permitted to, and follows home country practice in lieu of these requirements. In accordance with Australian law and corporate governance practice, Vast’s Constitution provides that a quorum requires at least one-third of the voting power of the shares entitled to vote at a general meeting, which may not be in full compliance with Nasdaq Listing Rule 5620(c). |

| 16 |

| ● | Shareholder Approval — Nasdaq Listing Rule 5635 requires companies to obtain shareholder approval before undertaking any of the following transactions: |

| ● | acquiring the stock or assets of another company, where such acquisition results in the issuance of 20% or more of Vast’s outstanding share capital or voting power; |

| ● | entering into any change of control transaction; |

| ● | establishing or materially amending any equity compensation arrangement; and |

| ● | entering into any transaction other than a public offering involving the sale, issuance or potential issuance by Vast of shares (or securities convertible into or exercisable for shares) equal to 20% or more of Vast’s outstanding share capital or 20% or more of the voting power outstanding before the issuance for less than the greater of book or market value of the stock. |

As a foreign private issuer, however, Vast is permitted to, and follows home country practice in lieu of these requirements. In accordance with Australian law and corporate governance practice, shareholder approval is only necessary if a person, together with its associates, acquire a relevant interest in more than 20% of Vast’s shares at a time when Vast has more than 50 members.

Vast otherwise intends to comply with the rules generally applicable to U.S. domestic companies listed on Nasdaq. Vast may, however, in the future decide to rely upon the “foreign private issuer exemption” for purposes of opting out of some or all of the other corporate governance rules.

The comparison of the Australian and U.S. securities regulatory landscape set forth in the Form F-4 under the heading “Management of Vast After the Business Combination— Comparison of the Australian and U.S. Securities Regulatory Landscapes,” is incorporated herein by reference.

D. Employees

Information regarding Vast’s employees is described in the Form F-4 under the heading “Business of Vast and Certain Information About Vast—Human Capital,” which information is incorporated herein by reference.

E. Share Ownership

Ownership of the Company’s shares by its directors and executive officers upon consummation of the Business Combination is set forth in Item 7.A of this Report.

F. Disclosure of a registrant’s action to recover erroneously awarded compensation

None.

Item 7. Major Shareholders and Related Party Transactions

A. Major Shareholders

The following table sets forth information regarding the beneficial ownership of Ordinary Shares as of the date hereof by:

| ● | each person known by us to be the beneficial owner of more than 5% of outstanding Ordinary Shares; |

| ● | each of our directors and executive officers; and |

| ● | all our directors and executive officers as a group. |

| 17 |

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if that person possesses sole or shared voting or investment power over that security. A person is also deemed to be a beneficial owner of securities that person has a right to acquire within 60 days including, without limitation, through the exercise of any option, warrant or other right or the conversion of any other security. Such securities, however, are deemed to be outstanding only for the purpose of computing the percentage beneficial ownership of that person but are not deemed to be outstanding for the purpose of computing the percentage beneficial ownership of any other person. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities.

As of the date hereof, there are 29,291,884 Ordinary Shares issued and outstanding. This amount does not include 13,799,987 Ordinary Shares issuable upon the exercise of the public warrants of the Company, each exercisable at $11.50 for one Ordinary Share (the “Public Warrants”) or 13,730,000 private warrants of the Company, each exercisable at $11.50 for one Ordinary Share (the “Private Warrants” and, together with the Public Warrants, the “Warrants”), that remain outstanding following the Business Combination.

Unless otherwise indicated, we believe that all persons named in the table below have sole voting and investment power with respect to all Ordinary Shares beneficially owned by them.

| Beneficial Owners | Ordinary Shares | % of Total Ordinary Shares | ||||||

| Directors and Executive Officers(1) | ||||||||

| Craig Wood | 661,331 | 2.3 | % | |||||

| Marshall (Mark) D. Smith | — | — | ||||||

| Kurt Drewes | 396,799 | 1.4 | % | |||||

| Alec Waugh | — | — | ||||||

| Sue Opie | — | — | ||||||

| Colleen Calhoun(2) | 100,000 | * | ||||||

| William Restrepo(3) | 689,104 | 2.3 | % | |||||

| Colin Richardson | — | — | ||||||

| John Yearwood(4) | 923,762 | 3.1 | % | |||||

| All directors and executive officers as a group (9 individuals) | 2,770,996 | 9.1 | % | |||||

| Five Percent or More Shareholders | ||||||||

| AgCentral Energy Pty Limited(5) | 21,980,633 | 75.0 | % | |||||

| Anthony G. Petrello(6) | 15,324,556 | 30.6 | % | |||||

| Nabors Lux 2 S.a.r.l.(7) | 11,225,405 | 38.3 | % | |||||

| * | Less than 1%. |

| (1) Unless otherwise indicated, the address of each person named herein is c/o Vast, 226-230 Liverpool Street, Darlinghurst, NSW 2010, Australia. |

| (2) Consists of 50,000 Ordinary Shares and 50,000 Ordinary Shares underlying Vast Private Warrants. |

| (3) Consists of 114,104 Ordinary Shares and 575,000 Ordinary Shares underlying Vast Private Warrants. |

| (4) Consists of 223,762 Ordinary Shares and 700,000 Ordinary Shares underlying Vast Private Warrants. |

| (5) Consists of 19,679,200 Ordinary Shares owned of record by AgCentral Energy Pty Limited and 2,301,433 Ordinary Shares held by former MEP Participants who, pursuant to the MEP De-SPAC Side Deed, granted to AgCentral Energy Pty Limited a proxy to vote 100% of their Ordinary Shares for a period of two years following the Effective Date, (ii) 66.7% of their Vast Ordinary Shares for a period of three years following the Effective Date and (iii) 33.3% of their Vast Ordinary Shares for a period of four years following the Effective Date, provided that, on the date that is six months following the Closing, each MEP Participant may, with 10 business days’ prior written notice to Vast, elect to dispose of $350,000 worth of such MEP Participant’s Ordinary Shares, subject to a limit of $2,000,000, in the aggregate, of dispositions by all MEP Participants thereunder and any Ordinary Shares so disposed would be released from the voting arrangement described herein. |

| (6) Consists of (i) 3,783,905 Ordinary Shares held of record by Nabors Lux 2 S.a.r.l., (ii) 799,151 Ordinary Shares held of record by The Entrust Group Inc., FBO Anthony G. Petrello, (iii) 7,441,500 Ordinary Shares underlying Vast Private Warrants held of record by Nabors Lux 2 S.a.r.l., (iv) 801,000 Ordinary Shares underlying Vast Private Warrants held of record by Remington SPAC W, LLC and (v) 2,499,000 Ordinary Shares underlying Vast Private Warrants held of record by Cynthia A. Petrello Revocable Trust. Nabors Lux 2 S.a.r.l. is a wholly owned subsidiary of Nabors Industries Ltd. Anthony G. Petrello is the Chairman, President and Chief Executive Officer of Nabors Industries Ltd. Mr. Petrello is Manager of Remington SPAC W, LLC. Mr. Petrello may be deemed to have or share beneficial ownership of the securities held directly by Nabors Lux 2 S.a.r.l., Remington SPAC W, LLC and Cynthia A. Petrello Trust. Mr. Petrello disclaims beneficial ownership of such securities except to the extent of his direct ownership. The business address of Mr. Petrello, Nabors Lux 2 S.a.r.l., Remington SPAC W, LLC and Cynthia A. Petrello Trust is 515 West Greens Road, Suite 1200, Houston, Texas 77067. |

| (7) Consists of 3,783,905 Ordinary Shares and 7,441,500 Ordinary Shares underlying Vast Private Warrants. The business address of Nabors Lux 2 S.a.r.l. is 515 West Greens Road, Suite 1200, Houston, Texas 77067. |

B. Related Party Transactions

Information pertaining to the Company’s related party transactions is set forth in the Form F-4 under the headings “Certain Relationships and Related Transactions,” which information is incorporated by reference herein.

| 18 |

C. Interests of Experts and Counsel

Not applicable.

A. Consolidated Statements and Other Financial Information

Financial Statements

See Item 18 of this Report for financial statements and other financial information.

Legal Proceedings

From time to time, we may become involved in legal proceedings or be subject to claims arising in the ordinary course of our business. We are not currently a party to any legal proceedings, the outcome of which, if determined adversely to us, would individually or in the aggregate have a material adverse effect on our business, financial condition and/or operations.

Dividend Policy

Subject to the Corporations Act, the Constitution and any special terms and conditions of issue, the Vast Directors may, from time to time, resolve to pay a dividend or declare any interim, special or final dividend as, in their judgement, the financial position of Vast justifies.

The Vast Directors may fix the amount, time and method of payment of the dividends. The payment, resolution to pay, or declaration of a dividend does not require any confirmation by a general meeting.

The Company has not paid any cash dividends on Ordinary Shares since the Business Combination and currently has no plan to pay cash dividends on such securities in the foreseeable future. The Company has not identified a paying agent.

B. Significant Changes

None.

A. Offer and Listing Details

Nasdaq Listing of Ordinary Shares and Warrants

Ordinary Shares and Public Warrants are listed on Nasdaq under the symbols “VSTE” and “VSTEW,” respectively. Holders of Ordinary Shares and Public Warrants should obtain current market quotations for their securities. There can be no assurance that the Ordinary Shares and/or Public Warrants will remain listed on Nasdaq. If the Company fails to comply with the Nasdaq listing requirements, the Ordinary Shares and/or Public Warrants could be delisted from Nasdaq. In particular, Nasdaq requires us to have at least 400 total holders of Ordinary Shares. A delisting of the Ordinary Shares or Public Warrants will likely affect the liquidity of the Ordinary Shares or Public Warrants and could inhibit or restrict the ability of the Company to raise additional financing.

Lock-up Period

Information regarding the lock-up restrictions applicable to the Ordinary Shares and Vast Warrants held by the parties to the Shareholders and Registration Rights Agreement and the holders of Ordinary Shares received upon settlement of MEP Shares is included in the Form F-4 under the heading “NETC Special Meeting—Certain Information Relating to Vast—Restrictions on Resales” and is incorporated herein by reference.

| 19 |

Warrants

Upon the completion of the Business Combination, there were 27,529,987 Vast Warrants outstanding. The Vast Warrants, which entitle the holder to purchase one Ordinary Share at an exercise price of $11.50 per share, will become exercisable 30 days after the completion of the Business Combination. The Vast Warrants will expire five years after the completion of the Business Combination or earlier upon redemption or liquidation in accordance with their terms.

B. Plan of Distribution

Not applicable.

C. Markets

Ordinary Shares and Vast Public Warrants are listed on Nasdaq under the symbols “VSTE” and “VSTEW,” respectively. Holders of Ordinary Shares and Vast Public Warrants should obtain current market quotations for their securities. There can be no assurance that the Ordinary Shares and/or Vast Public Warrants will remain listed on Nasdaq. If the Company fails to comply with the Nasdaq listing requirements, the Ordinary Shares and/or Vast Public Warrants could be delisted from Nasdaq. In particular, Nasdaq requires us to have at least 400 total holders of Ordinary Shares. A delisting of the Ordinary Shares or Vast Public Warrants will likely affect the liquidity of the Ordinary Shares or Vast Public Warrants and could inhibit or restrict the ability of the Company to raise additional financing.

D. Selling Shareholders

Not applicable.

E. Dilution

Not applicable.

F. Expenses of the Issue

Not applicable.

Item 10. Additional Information

A. Share Capital

Information regarding our securities is included in the Form F-4 under the section titled “Description of Vast Securities” and is incorporated herein by reference.

As of the date hereof, and after closing of the Business Combination, there are 29,291,884 Ordinary Shares issued and outstanding. Upon the completion of the Business Combination, there were 27,529,987 Vast Warrants outstanding, of which 13,799,987 are Vast Public Warrants and 13,730,000 are Vast Private Warrants. The Vast Warrants, which entitle the holder to purchase one Ordinary Share at an exercise price of $11.50 per share, will become exercisable 30 days after the completion of the Business Combination. The Vast Warrants will expire five years after the completion of the Business Combination or earlier upon redemption or liquidation in accordance with their terms.

In addition, pursuant to the EDF Note Purchase Agreement, Vast Intermediate HoldCo Pty Ltd issued to EDF Australia Pacific Pty Ltd. a convertible note for Euro 10 million ($10,922,120 on December 18, 2023), the principal and interest of which is convertible into Ordinary Shares at a rate of $10.20, subject to certain conditions as outlined in the section of the Prospectus Supplement entitled “Recent Developments,” which information is incorporated by reference herein.

| 20 |

B. Memorandum and Articles of Association

The Constitution of the Company effective as of October 19, 2023 is filed as Exhibit 1.1 to this Report. The description of the Constitution is included in the Form F-4 under the heading “Description of Vast Securities,” which information is incorporated herein by reference.

C. Material Contracts