As filed with the Securities and Exchange Commission on February 22, 2024

Registration No. 333-276945

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1 to

FORM

F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

JBDI Holdings Limited

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrants name into English)

| Cayman Islands | 3412 | Not Applicable | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

34 Gul Crescent

Singapore 629538

+65 6861 4150

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, New York 10168

800-221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Schlueter & Associates, P.C. 5290 DTC Parkway, Suite 150 Greenwood Village CO 80111 USA Telephone: (303) 292 3883 Attn: Mr. Henry F. Schlueter, Esq. Ms. Celia Velletri, Esq. |

Sichenzia Ross Ference Carmel LLP 1185 Avenue of the Americas, 31st Floor New York, NY 11036 Telephone: (212) 930 9700 Attn: Benjamin Tan, Esq. |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The term new or revised financial accounting standard refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| ● | Public Offering Prospectus. A prospectus to be used for the initial public offering of 1,750,000 ordinary shares (the “Ordinary Shares”) of the registrant and an aggregate of 500,000 Ordinary Shares of the Selling Shareholders, collectively, (the “Public Offering Prospectus”) through the underwriters named in the Underwriting section of the Public Offering Prospectus. | |

| ● | Resale Prospectus. A prospectus to be used for the potential resale by E U Holdings, Arc Development and Goldstein (collectively, the “Resale Shareholders”) of an aggregate of 2,980,216 Ordinary Shares of the registrant (the “Resale Prospectus”). |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| ● | they contain different outside and inside front covers; | |

| ● | the Offering section in the Prospectus Summary section on page 9 of the Public Offering Prospectus is removed and replaced with the Offering section on page Alt-2 of the Resale Prospectus; | |

| ● | they contain different Use of Proceeds sections on page 38 of the Public Offering Prospectus is removed and replaced with the Use of Proceeds section on page Alt-2 of the Resale Prospectus; | |

| ● | the Capitalization and Dilution sections on page 39 and page 40 of the Public Offering Prospectus are deleted from the Resale Prospectus respectively; | |

| ● | a selling shareholder section is included in the Resale Prospectus beginning on page 108 of the Resale Prospectus; | |

| ● | references in the Public Offering Prospectus to the Resale Prospectus will be deleted from the Resale Prospectus; | |

| ● | the Underwriting section on page 135 of the Public Offering Prospectus is removed and replaced with a Plan of Distribution section on page Alt-3 of the Resale Prospectus; | |

| ● | the Legal Matters section on page 139 of the Public Offering Prospectus is removed and replaced with the Legal Matters on page Alt-4 of in the Resale Prospectus; and | |

| ● | the outside back cover of the Public Offering Prospectus is deleted from the Resale Prospectus. |

The Registrant has included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Resale Prospectus as compared to the Public Offering Prospectus.

The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by Arc Development.

The information in this prospectus is not complete and may be changed or supplemented. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to Completion, dated February 22, 2024 |

JBDI Holdings Limited

1,750,000 Ordinary Shares

and

500,000 Ordinary Shares offered by the Selling Shareholders

This is an initial public offering of our ordinary shares, of par value at US$0.001 per share (the “Ordinary Shares”). We and the Selling Shareholders (as defined herein) are offering, on a firm commitment engagement basis, 1,750,000 Ordinary Shares and 500,000 Ordinary Shares, respectively, to be sold in this offering pursuant to this prospectus. We will not receive any proceeds from the sale of the Ordinary Shares to be sold by the Selling Shareholders. We anticipate that the initial public offering price of the Ordinary Shares will be between US$4.00 and US$5.00 per Ordinary Share.

Prior to this offering, there has been no public market for our Ordinary Shares. We intend to apply to list our Ordinary Shares on the Nasdaq Capital Market under the symbol “JBDI”. This offering is contingent upon the listing of our Ordinary Shares on the Nasdaq Capital Market. There can be no assurance that we will be successful in listing our Ordinary Shares on the Nasdaq Capital Market.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Investing in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See Risk Factors beginning on page 17 to read about factors you should consider before buying our Ordinary Shares.

We are an “Emerging Growth Company” and a “Foreign Private Issuer” under applicable U.S. federal securities laws and, as such, are eligible for reduced public company reporting requirements. Please see Implications of Being an Emerging Growth Company and Implications of Being a Foreign Private Issuer beginning on page 15 of this prospectus for more information.

The Resale Shareholders collectively own 2,980,216 Ordinary Shares that are being registered pursuant to a separate resale prospectus. Neither E U Holdings, Arc Development nor Goldstein are subject to a lock-up or leakage agreement and have the right to sell the shares being registered at any time after the Ordinary Shares begin trading on the Nasdaq Capital Market. No resale of the Ordinary Shares by the Resale Shareholders will occur until we complete the initial public offering of our Ordinary Shares and the Ordinary Shares begin trading on the Nasdaq Capital Market. The offering of Ordinary Shares pursuant to this prospectus is contingent upon listing on the Nasdaq Capital Market.

We are a holding company that is incorporated in the Cayman Islands as an exempted company. As a holding company with no operations, we conduct all of our operations through our wholly-owned subsidiaries in Singapore. The Ordinary Shares offered in this offering are shares of the holding company that is incorporated in the Cayman Islands as an exempted company. Investors of our Ordinary Shares should be aware that they may never directly hold equity interests in our subsidiaries.

Upon completion of this offering, our issued and outstanding shares will consist of 19,787,500 Ordinary Shares. We will be a controlled company as defined under the Nasdaq Capital Market Company Guide Section 801(a), immediately after the completion of this offering, E U Holdings, Mr. Lim CP, Ms. Siow KL, Mr. Lim KS and Mr. Lim TC, collectively known as our controlling shareholders, will own approximately 15,769,824 Ordinary Shares, or 79.7% of our total issued and outstanding Ordinary Shares, representing approximately 79.7% of the total voting power.

| Per Share | Total(4) | |||||||

| Initial public offering price(1) | US$ | 4.50 | US$ | 10,125,000 | (4) | |||

| Underwriting discounts and commissions(2) | US$ | 0.36 | US$ | 810,000 | ||||

| Proceeds to the Company before expenses(3) | US$ | 4.14 | US$ | 7,245,000 | ||||

| Proceeds to the Selling Shareholders | US$ | 4.14 | US$ | 2,070,000 | ||||

(1) Initial public offering price per share is assumed to be US$4.50 (being the mid-point of the offer price range).

(2) We have agreed to pay the underwriter a discount equal to 8% of the gross proceeds of the offering. This table does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to the underwriter. For a description of the other compensation to be received by the underwriter, see “Underwriting” beginning on page 135.

(3) Excludes fees and expenses payable to the underwriter. The total amount of underwriter expenses related to this offering is set forth in the section entitled “Expenses Relating to This Offering” on page 129.

(4) Includes US$7,875,000 gross proceeds from the sale of 1,750,000 Ordinary Shares offered by our Company and US$2,250,000 gross proceeds from the sale of 500,000 Ordinary Shares offered by the Selling Shareholders.

If we complete this offering, net proceeds will be delivered to us and the Selling Shareholders on the closing date.

The underwriter expects to deliver the Ordinary Shares to the purchasers against payment on or about [●], 2024.

You should not assume that the information contained in the registration statement to which this prospectus is a part is accurate as of any date other than the date hereof, regardless of the time of delivery of this prospectus or of any sale of the Ordinary Shares being registered in the registration statement of which this prospectus forms a part.

No dealer, salesperson or any other person is authorized to give any information or make any representations in connection with this offering other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction in which the offer or solicitation is not authorized or is unlawful.

SPARTAN CAPITAL SECURITIES, LLC

The date of this prospectus is [●], 2024.

TABLE OF CONTENTS

Until [●], 2024 (the 25th day after the date of this prospectus), all dealers that effect transactions in these Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

| i |

Neither we, the Selling Shareholders nor any of the underwriters have authorized anyone to provide you with any information or to make any representations other than as contained in this prospectus or in any related free writing prospectus. Neither we, the Selling Shareholders nor the underwriter take responsibility for, and provide no assurance about the reliability of, any information that others may give you. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we, the Selling Shareholders nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Ordinary Shares and the distribution of this prospectus outside the United States.

We obtained statistical data, market data and other industry data and forecasts used in this prospectus from market research, publicly available information and industry publications. While we believe that the statistical data, industry data, forecasts and market research are reliable, we have not independently verified the data.

| 1 |

PRESENTATION OF FINANCIAL INFORMATION

Basis of Presentation

Unless otherwise indicated, all financial information contained in this prospectus is prepared and presented in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP” or “GAAP”).

Certain amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, amounts, percentages and other figures shown as totals in certain tables or charts may not be the arithmetic aggregation of those that precede them, and amounts and figures expressed as percentages in the text may not total 100% or, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

Our financial year ends on May 31 of each year. References in this prospectus to a financial year, such as “financial year 2022”, relate to our financial year ended May 31 of that calendar year.

For the sake of undertaking a public offering of its Ordinary Shares, effective [●], 2024, the Company completed a series of reorganizing transactions resulting in [●] Ordinary Shares outstanding that have been retroactively restated to the beginning of the first period presented herein.

On February 7, 2024, for purposes of recapitalization in anticipation of the initial public offering, the Company’s shareholders passed resolutions to effect a 1:2 share sub-division (a “forward stock split”) and to change the Company’s authorized share capital to $500,000 divided into 1,000,000,000 ordinary shares, of a par value of $0.0005 each. Unless otherwise indicated, all references to Ordinary Shares, share data, per share data, and related information have been retroactively adjusted, where applicable, in this prospectus to reflect the 1:2 forward stock split of our Ordinary Shares on February 7, 2024 as if they had occurred at the beginning of the earlier period presented.

Financial Information in United States Dollars

Our reporting currency is the United States Dollar. This prospectus also contains translations of certain foreign currency amounts into United States Dollars for the convenience of the reader. Unless otherwise stated, all translations of Singapore Dollars into United States Dollars were made at S$1.3520 to US$1.00 for amounts relevant to the financial year ended May 31, 2023, S$1.3668 to US$1.00 for amounts relevant to the financial year ended May 31, 2022 and S$1.3222 to US$1.00 for amounts relevant to the financial year ended May 31, 2021, in accordance with our internal exchange rate. We make no representation that the Singapore Dollar or United States Dollar amounts referred to in this prospectus could have been or could be converted into United States Dollars or Singapore Dollars, as the case may be, at any particular rate or at all.

| 2 |

Certain market data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, reports of governmental and international agencies and industry publications and surveys. Industry publications and third-party research, surveys and reports generally indicate that their information has been obtained from sources believed to be reliable. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

| 3 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Industry Overview” and “Business.” These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “believe”, “plan”, “expect”, “intend”, “should”, “seek”, “estimate”, “will”, “aim” and “anticipate”, or other similar expressions, but these are not the exclusive means of identifying such statements. All statements other than statements of historical facts included in this document, including those regarding future financial position and results, business strategy, plans and objectives of management for future operations (including development plans and dividends) and statements on future industry growth are forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements which are forward-looking statements, including in our periodic reports that we will file with the SEC, other information sent to our shareholders and other written materials.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Risk Factors” and the following:

| ● | Our business is inherently susceptible to the cyclical fluctuations of the solvent, chemical, petroleum and edible product oil industries worldwide and regionally, which our customers are operating in | |

| ● | We are affected by regional and worldwide political, regulatory, social and economic conditions in the jurisdictions in which we and our customers and suppliers operate and in the jurisdiction which we intend to expand our business | |

| ● | Our business is dependent on the general economic conditions in Singapore | |

| ● | We are dependent on the need to continually maintain a wide range of Containers which are relevant to our customers’ needs | |

| ● | Escalating steel prices may increase our costs and affect our profit margins | |

| ● | Our continued success is dependent on our key management personnel and our experienced and skilled personnel and our business may be severely disrupted if we are unable to retain them or to attract suitable replacements | |

| ● | We are reliant on skilled labor | |

| ● | We are susceptible to fluctuations in the prices and quantity of available machineries and vehicles and their spare parts which are necessary for our operations | |

| ● | Our reputation and profitability may be adversely affected if there are major defects or failures in our products or services sold to our customers | |

| ● | Our reputation and financial performance may be adversely affected if there is prolonged machine or vehicle downtime | |

| ● | We are exposed to disputes and claims arising from accidents due to the usage of our products and services | |

| ● | Increased competition in the Reconditioned and new Containers sales business in Singapore and the Southeast Asian region may affect our ability to maintain our market share and growth | |

| ● | Our business is significantly dependent on our major customers’ needs and our relationships with them. We may be unsuccessful in attracting new customers |

| 4 |

| ● | We are exposed to the credit risks of our customers | |

| ● | We are dependent on our key suppliers for our supply of Containers | |

| ● | Our business is subject to supply chain interruptions | |

| ● | We may be affected if we are found to be in breach of any lease agreements entered into by us | |

| ● | Our business and operations may be materially and adversely affected in the event of a re-occurrence or a prolonged global pandemic outbreak of COVID-19 | |

| ● | We may be affected by an outbreak of other infectious diseases | |

| ● | We are exposed to risks arising from fluctuations of foreign currency exchange rates | |

| ● | We may be unable to obtain the necessary licenses, approvals or permits for our operations | |

| ● | We are subject to environmental, health and safety regulations, and may be adversely affected by new and changing laws and regulations | |

| ● | Our insurance policies may be inadequate to cover our assets, operations and any loss arising from business interruptions | |

| ● | We may require additional financing in the future to fund our operations and future growth | |

| ● | We may be harmed by negative publicity | |

| ● | If we are unable to maintain and protect our intellectual property, or if third parties assert that we infringe on their intellectual property rights, our business could suffer | |

| ● | We are exposed to risks in respect of acts of war, terrorist attacks, epidemics, political unrest, adverse weather conditions and other uncontrollable events | |

| ● | We may be unable to successfully implement our business strategies and future plans |

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

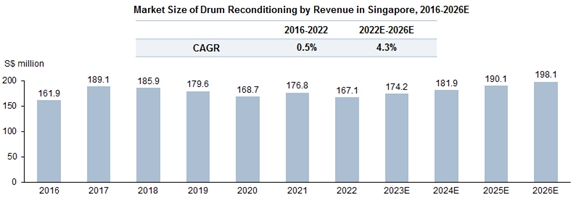

This prospectus contains certain data and information that we obtained from various government and private publications. Statistical data in these publications also include projections based on a number of assumptions. The markets for the supply of revitalized and Reconditioned drums and related businesses may not grow at the rate projected by such market data, or at all. Failure of this industry to grow at the projected rate may have a material and adverse effect on our business and the market price of our Ordinary Shares. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

| 5 |

“Amended and Restated Memorandum and Articles of Association” means the amended and restated memorandum and articles of association of our Company adopted on February 7, 2024 and as supplemented, amended or otherwise modified from time to time. A copy of the Amended and Restated Memorandum and Articles of Association are filed as Exhibit 3.1 to our Registration Statement of which this prospectus forms a part.

“Arc Development” means The Arc Development Company Limited, a company incorporated in Hong Kong and wholly-owned by Mr. Hinson Leung, and which owns 4.9% of our issued and outstanding Shares prior to this offering and one of the Selling Shareholders.

“bizSAFE” means a five-step programme that assists companies to build up their workplace safety and health capabilities in order to achieve quantum improvements in safety and health standards at the workplace, and organized under the WSH.

“Board” means the board of directors of our Company.

“Business Day” means a day (other than a Saturday, Sunday or public holiday in the U.S.) on which licensed banks in the U.S. are generally open for normal business to the public.

“BVI” means the British Virgin Islands.

“CAGR” means compound annual growth rate.

“Circuit Breaker Period” means the period from April 7, 2020 to June 1, 2020 (inclusive).

“Company” or “our Company” means JBDI Holdings Limited, an exempted company incorporated in the Cayman Islands with limited liability under the Companies Act on October 11, 2022.

“Companies Act” means the Companies Act (as revised) of the Cayman Islands.

“Containers” means plastic or metal industrial containers, whether they are new or used and whether they have covers, caps, valves, handles, external metal frames or not, including but not limited to IBCs, plastic drums, metal drums, open-top drums and plastic carboys with different capacities.

“COVID-19” means the Coronavirus Disease 2019.

“Directors” means the directors of our Company as at the date of this prospectus, unless otherwise stated.

“E U Holdings” means E U Holdings Pte. Ltd., a company incorporated in Singapore and owned by Mr. Neo Chin Heng and Mr. Ng Eng Guan as to 50% each.

“ESG” means environmental, social and governance.

“Exchange Act” means the United States Securities Exchange Act of 1934, as amended.

“Executive Directors” means the executive Directors of our Company as at the date of this prospectus, unless otherwise stated.

“Executive Officers” means the executive officers of our Company as at the date of this prospectus, unless otherwise stated.

| 6 |

“Frost & Sullivan” means Frost & Sullivan Limited, a business consulting firm involved in market research, analysis and growth strategy consulting and an Independent Third Party.

“Goldstein” means Goldstein Enterprises Limited, a company incorporated in the BVI and wholly-owned by Mr. Tan Kok Chuah, an Independent Third Party, and which holds 4.90% of our issued Ordinary Shares prior to this Offering and one of the Selling Shareholders.

“Group,” “our Group,” “we,” “us,” or “our” means our Company and its subsidiaries or any of them, or where the context so requires, in respect of the period before our Company becoming the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of our Company at the relevant time or the businesses which have since been acquired or carried on by them or, as the case may be, their predecessors.

“GST” means the goods and services tax chargeable pursuant to the Goods and Services Tax Act 1993 of Singapore.

“IBC” means intermediate bulk container.

“Independent Directors Nominees” means the independent non-Executive Directors of our Company as at the date of this prospectus, unless otherwise stated.

“Independent Third Party” means a person or company who or which is independent of and is not a 5% owner of, does not control and is not controlled by or under common control with any 5% owner and is not the spouse or descendant (by birth or adoption) of any 5% owner of our Company.

“ISO 9001” means an internationally recognized standard for a QMS which aims at the effectiveness of the QMS in meeting customer requirements and it prescribes requirements for ongoing improvement of quality assurance in design, development, production, installation and servicing.

“JBD Systems” means JBD Systems Pte. Ltd. (formerly known as Alpha Process Systems Pte. Ltd.), a company incorporated in Singapore on May 4, 2017 and a direct wholly-owned subsidiary of Jurong Barrels.

“JBDI” means JBDI Investments Limited, a business company incorporated in the BVI on October 10, 2022 and a direct wholly-owned subsidiary of our Company.

“JTC” means Jurong Town Corporation.

“Jurong Barrels” means Jurong Barrels & Drums Industries Pte. Ltd. (formerly known as Good Industries Pte. Ltd.), a company incorporated in Singapore on September 17, 1983 and a direct wholly-owned subsidiary of JBDI.

“KDS” means KDS Steel Pte Ltd, a company incorporated in Singapore and a direct wholly-owned subsidiary of E U Holdings.

“LTA” means the Land Transport Authority of Singapore.

“MOM” means the Ministry of Manpower of Singapore.

“Mr. Lim CP” means Mr. Lim Chwee Poh, one of our Executive Directors, a shareholder of our Company and the spouse of Ms. Siow KL, father of Mr. Lim TC and Mr. Lim TM and brother of Mr. Lim KS.

| 7 |

“Mr. Lim KS” means Mr. Lim Kim Seng, a shareholder of our Company, the brother of Mr. Lim CP, the brother-in-law of Ms. Siow KL and the uncle of Mr. Lim TC and Mr. Lim TM.

“Mr. Lim TC” means Mr. Lim Tze Chong, Patrick, a shareholder of our Company and the son of Mr. Lim CP and Ms. Siow KL, brother of Mr. Lim TM and nephew of Mr. Lim KS.

“Mr. Lim TM” means Mr. Lim Tze Ming, Kelvin, the son of Mr. Lim CP and Ms. Siow KL, brother of Mr. Lim TC and nephew of Mr. Lim KS.

“Ms. Siow KL” means Ms. Siow Kim Lian, a shareholder of our Company and the spouse of Mr. Lim CP, the mother of Mr. Lim TC and Mr. Lim TM and the sister-in-law of Mr. Lim KS.

“NEA” means National Environment Agency of Singapore.

“Nasdaq Capital Market” or “Nasdaq” means The Nasdaq Capital Market is an American stock exchange situated in New York City.

“Plant” means our plant at 34 Gul Crescent, Singapore 629538.

“PUB” means The Public Utilities Board, a statutory board under the Ministry of Sustainability and the Environment in Singapore.

“QMS” means our quality management system developed based on ISO 9001.

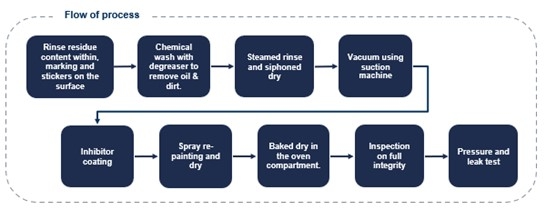

“Recondition” or “Reconditioning” means, with respect to used Containers, the process of (i) revitalizing used Containers through removing their residues and labels; (ii) cleaning their interior and exterior with vacuum suction, solvents (such as kerosene, Toluene and degreaser), scrubber machines, high pressure water jets/washing hose shoots and/or specialized machines; (iii) repainting their exterior; and/or (iv) restoring them through repairs.

“Recycle” means, with respect to used plastic Containers, the process of shredding pre-washed used plastic Containers that cannot be Reconditioned or resold into pellet form and selling them to end customers.

“Resale Shareholders” mean E U Holdings, Arc Development and Goldstein.

“S$” or “SGD” or “Singapore Dollars” means Singapore dollar(s), the lawful currency of Singapore.

“SCDF” means Singapore Civil Defence Force.

“SEC” or “Securities and Exchange Commission” means the United States Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Shares” or “Ordinary Shares” means ordinary shares of par value of US$0.0005 each in the share capital of our Company.

“Selling Shareholders” mean collectively (i) E U Holdings as to 300,000 Ordinary Shares, Mr. Lim TC as to 75,000 Ordinary Shares, Ms. Siow KL as to 75,000 Ordinary Shares, Mr. Lim CP as to 25,000 Ordinary Shares, Mr. Lim KS as to 25,000 Ordinary Shares; all being existing shareholders of our Company that are selling a portion of their Ordinary Shares pursuant to this prospectus.

“Singapore Companies Act” means the Companies Act 1967 of Singapore, as amended, supplemented or modified from time to time.

“SPF” means Singapore Police Force.

“Walkers (Hong Kong)” means Walkers (Hong Kong), our Cayman Islands and BVI legal advisers.

“Warehouse” means our warehouse at 16 Gul Crescent, Singapore 629526.

“WSH” means Workplace Safety and Health Council of Singapore, a statutory body under the MOM.

“US$”, “$” or “USD” or “United States Dollars” means United States dollar(s), the lawful currency of the United States of America.

| 8 |

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and notes to those statements, included elsewhere in this prospectus, before deciding to invest in our Ordinary Shares. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.”

Our Mission

Our mission is to offer environmentally friendly, efficient, innovative and reliable products and services primarily in Singapore and also for the Southeast Asia region to help our customers move towards a zero environmental impact footprint and to save costs and achieve a better allocation of resources in the process.

Overview

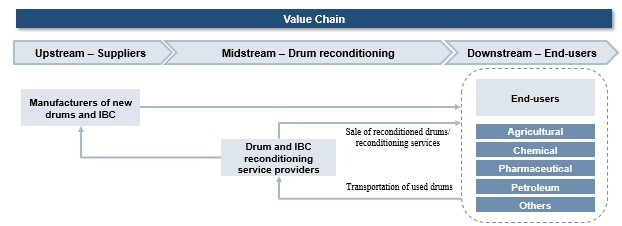

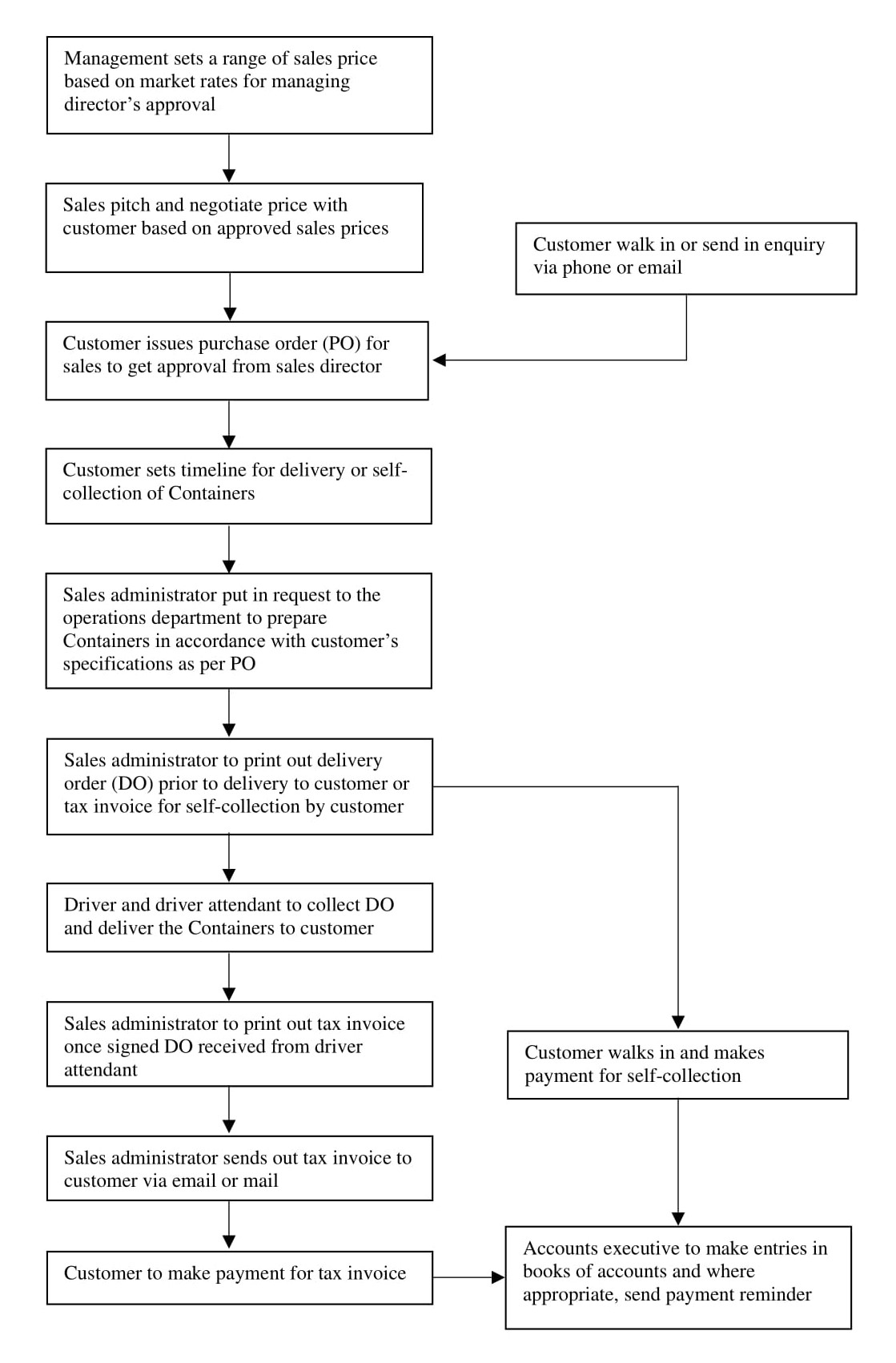

Our Group’s history began in 1983 when Mr. Lim CP set up Jurong Barrels with a business partner as an attempt to develop the business in the trading of Reconditioned Containers. Our Group’s business in trading of Reconditioned Containers officially commenced in 1984 when Mr. Lim CP’s two brothers acquired all his business partner’s shares in Jurong Barrels and Jurong Barrels acquired a plant to Recondition used Containers. Following in their father’s footsteps of trading in used Containers, they began trading in Reconditioned Containers as they believed that there is a bigger profit margin for these Containers than just used Containers. Over the nearly last four decades, we have grown from a small reconditioning and recycling business to a comprehensive revitalization, Reconditioning and recycling of drums business comprising a diversified range of drums including open top drums, metal drums, plastic drums, plastic carboys and intermediate bulk containers. We have also, over the years, diversified into the business lines of the sale of new drums and the collection of waste drums and related products. In becoming aware of the necessity of reducing the impact of businesses on the environment, we began the provision of waste water treatment through our direct wholly-owned subsidiary, JBD Systems.

Competitive Strengths

We have a long and proven track record in the supply of revitalized and Reconditioned steel and plastic drums in Singapore.

We have been supplying Reconditioned Containers to our customers for close to four decades and have accumulated industry experience in the Reconditioning of Used Containers. To better serve our customers, we also supply new Containers and offer a range of ancillary services to complement our business. We have been accredited with ISO 9001 (quality management) for Reconditioning of drums since October 2008. We believe our industry knowledge, reputation and consistent delivery of quality products and services have contributed to our success over the years.

We believe our track record in the supply of revitalized and Reconditioned steel and plastic drums and other products as well as our strategy to become environmentally friendly will facilitate the promotion and demand for our products with both existing and new customers, as well as the expansion of our business.

| 9 |

We maintain a sizeable and stable pool of skilled labor with our own facilities

Our main business is the sale of Reconditioned Containers and it is labor intensive to Recondition used Containers. We pride ourselves in having a team of stable and skilled workers, technicians, mechanics and drivers who have the relevant skills and expertise in Reconditioning of used Containers and the provision of other ancillary services which we offer to our customers. As at October 31, 2023, we had a team of 49 workers, nine technicians, three mechanics and 15 drivers in our operations department, which enable us to respond promptly to our customers’ requests, in terms of providing customization of Containers and other ancillary services to suit our customers’ needs and requirements. We believe that with the support of our Group’s stable pool of directly-hired skilled workforce and our own facilities (including all machines required for Reconditioning of used Containers, and as of October 31, 2023, a fleet of 13 delivery trucks and 15 forklifts and wastewater treatment facilities), we are self-contained and we are able to maintain the quality of our products and services in an efficient and coordinated manner as we do not have to rely on subcontractors to assist us in any production, service, logistic or maintenance process. Moreover, having our own pool of skilled direct labor and our own facilities will help us control and manage our costs more efficiently and effectively, which we believe helps to boost or stabilize our profit margins.

We have strong and stable relationships with our suppliers and customers

Due to the quality and range of our products and services, our capabilities as well as our market reputation, we have successfully established strong and stable relationships with our key suppliers and customers in Singapore and the Asian region during our close to 40 years of operations. We have identified and maintained good relationships with reliable suppliers, who will typically notify us of used Containers for sale. This enables us to source and purchase used Containers which are in good condition for Reconditioning prior to selling them to our customers. As we are able to keep up with industry trends and keep track of our customers’ changing needs, our customers regularly return to us for repeat business and from time to time, they also refer other prospective customers to us. We have a wide customer base comprising more than 300 customers from Singapore, Indonesia and Malaysia. Further, some of our customers are also our suppliers.

We have strived to maintain stable business relationships with our key customers. For the financial years ended May 31, 2023 and 2022, our top five customers accounted for approximately 31.6% and 34.9% of our total revenue, and our top five customers each have on average more than 18 years of business relationships with us. For the financial years ended May 31, 2022 and 2021, our top five customers accounted for approximately 34.9% and 29.8% of our total revenue, and our top five customers each have on average more than 18 years of business relationships with us. We believe that our Group’s strong and long-term relationships with these key customers provide us with a competitive advantage to secure future contracts, a steady flow of repeat business and revenue, and serve as a testament for us in marketing and business development with new customers.

We have an experienced and committed management team with a succession plan.

We are led by Mr. Lim CP, our Executive Director and Chief Executive Officer and one of the founding shareholders, who has been instrumental in spearheading the growth of our Group. Mr. Lim CP has over 40 years of experience in the trading of Reconditioned and new Containers in Singapore and is primarily responsible for planning and execution of our Group’s business strategies. He is supported by the other Executive Directors, Executive Officers and senior management (namely Mr. Liang Zhao Rong, Mr. Lim KS, Mr. Lim TC, Mr. Lim TM and Mr. Quek Che Wah) who collectively possess expertise in Reconditioning services, sales and marketing, operations, customer relationship management, human resources, operations and financial control and have been working with our Group for over 21 years on average. We believe that the collective knowledge, experience and expertise of our Executive Directors, Executive Officers and senior management will serve to respond to our customers’ needs in a timely manner which are essential for us to secure new business as well as maintain our existing customers.

| 10 |

Moreover, we recognize that effective succession planning is important in building a pipeline of leaders to ensure business continuity. As such, the second generation of Mr. Lim CP, namely Mr. Lim TM and Mr. Lim TC joined the Group in 1999 and 2003, respectively, to look after sales and operations. Our management team is conscientious in identifying, grooming and preparing our own staff for management roles. With all of our client-facing senior management being groomed internally, we are able to maintain a consistent management culture and our commitment towards personal development of our staff will in turn enable us to maintain our service quality as we continue to expand.

We have a fleet of 13 delivery trucks which enables us to efficiently coordinate and manage our logistic service

As of October 31, 2023, we had a fleet of 13 delivery trucks, which allows us to undertake efficient and coordinated logistic services for the delivery and collection of drums. Having our own fleet of trucks allow us to expediently deploy them to various locations as and when required as we do not need to rely on third parties. We also have an experienced in-house servicing team for our trucks to ensure that they are well maintained and operating efficiently.

Business strategies

Our principal objective is to sustain continuous growth in our business and strengthen our market position in the revitalization, Reconditioning and recycling of drums and related products industry in Singapore and elsewhere in Asia while reducing our environmental footprint with the following strategies:

| ● | Increasing our storage facilities and diversify the range of Containers | |

| ● | Strategic acquisitions, joint ventures and /or strategic alliances | |

| ● | Creating enterprise value through the strengthening of our ESG | |

| ● | Renewing and expanding our fleet of delivery trucks | |

| ● | Working towards Industry 5.0 through the three pillars of human-centricity, resilience and sustainability through automating certain aspects of our Reconditioning process | |

| ● | Increase marketing and brand building |

| 11 |

Risks and Challenges

Investing in our Ordinary Shares involves risks. The risks summarized below are qualified by reference to “Risk Factors” beginning on page 17 of this prospectus, which you should carefully consider before making a decision to purchase Ordinary Shares. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our Ordinary Shares would likely decline, and you may lose all or part of your investment.

These risks include but are not limited to the following:

Risks related to our business and industry (See “Risk Factors—Risks Related to our Business and Industry on page 17):

| ● | Our business is inherently susceptible to the cyclical fluctuations of the solvent, chemical, petroleum and edible oil product industries worldwide and regionally, which our customers are operating in | |

| ● | We are affected by regional and worldwide political, regulatory, social and economic conditions in the jurisdictions in which we and our customers and suppliers operate and in the jurisdictions which we intend to expand our business; | |

| ● | Our business is dependent on the general economic conditions in Singapore; | |

| ● | We are dependent on the need to continually maintain a wide range of Containers which are relevant to our customers’ needs; | |

| ● | Escalating steel process may increase our costs and affect our profit margin; | |

| ● | Our continued success is dependent on our key management personnel and our experienced and skilled personnel and our business may be severely disrupted if we are unable to retain them or to attract suitable replacements; | |

| ● | We are reliant on skilled labor; | |

| ● | We are susceptible to fluctuations in the prices and quantity of available machineries and vehicles and their spare parts which are necessary for our operation; | |

| ● | Our reputation and profitability may be adversely affected if there are major defects or failures in our products or services sold to our customers; | |

| ● | Our reputation and financial performance may be adversely affected if there is prolonged machine or vehicle downtime; | |

| ● | We are exposed to disputes and claims arising from accidents due to the usage of our products and services; | |

| ● | Increased competition in the Reconditioned and new Containers sales business in Singapore and the Southeast Asian region may affect our ability to maintain our market share and growth; | |

| ● | Our business is significantly dependent on our major customers’ needs and our relationships with them; | |

| ● | We are exposed to the credit risks of our customers; | |

| ● | We are dependent on our key suppliers for our supply of Containers; | |

| ● | Our business is subject to supply chain interruptions; | |

| ● | We may be affected if we are found to be in breach of any lease agreements entered into by us; | |

| ● | Our business and operations may be materially and adversely affected in the event of a re-occurrence or a prolonged global pandemic outbreak of COVID-19; | |

| ● | We may be affected by an outbreak of other infectious diseases; | |

| ● | We are exposed to risks arising from fluctuations of foreign currency exchange rates; | |

| ● | We may be unable to obtain the necessary licenses, approvals or permits for our operations; | |

| ● | We are subject to environmental, health and safety regulations and penalties, and may be adversely affected by new and changing laws and regulations; | |

| ● | Our insurance policies may be inadequate to cover our assets, operations and any loss arising from business interruptions; | |

| ● | We may require additional financing in the future to fund our operations and future growth; | |

| ● | We may be harmed by negative publicity; | |

| ● | If we are unable to maintain and protect our intellectual property, or if third parties assert that we infringe on their intellectual property rights, our business could suffer; | |

| ● | We are exposed to risks in respect of acts of war, terrorist attacks, epidemics, political unrest, adverse weather conditions and other uncontrollable events; | |

| ● | We may be unable to successfully implement our business strategies and future plans; |

| 12 |

Risks related to our Securities and this Offering (See “Risk Factors—Risks Related to Our Securities and This Offering on page 27):

| ● | An active trading market for our Ordinary Shares may not be established or, if established, may not continue and the trading price for our Ordinary Shares may fluctuate significantly; | |

| ● | We may not maintain the listing of our Ordinary Shares on the Nasdaq Capital Market which could limit investors’ ability to make transactions in our Ordinary Shares and subject us to additional trading restrictions; | |

| ● | The trading price of our Ordinary Shares may be volatile, which could result in substantial losses to investors; | |

| ● | Certain recent initial public offerings of companies with public floats comparable to our anticipated public float have experienced extreme volatility that was seemingly unrelated to the underlying performance of the respective company; | |

| ● | If securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding our Ordinary Shares, the market price for our Ordinary Shares and trading volume could decline; | |

| ● | The sale or availability for sale of substantial amounts of our Ordinary Shares, including the Ordinary Shares held by our Resale Shareholders that are being registered concurrently for resale in the Resale Prospectus, could adversely affect the market price; | |

| ● | Short selling may drive down the market price of our Ordinary Shares; | |

| ● | Because our public offering price per Ordinary Share is substantially higher than our net tangible book value per Ordinary Share, you will experience immediate and substantial dilution; | |

| ● | You must rely on the judgment of our management as to the uses of the net proceeds from this offering, and such uses may not produce income or increase our share price; | |

| ● | If we are classified as a passive foreign investment company, United States taxpayers who own our securities may have adverse United States federal income tax consequences; | |

| ● | As a “controlled company” within the meaning of the Nasdaq Capital Market Rules, we may rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies; | |

| ● | As a company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the Nasdaq Capital Market corporate governance listing standards. These practices may afford less protection to shareholders than they would enjoy if we complied fully with the Nasdaq Capital Market corporate governance listing standards; | |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law; | |

| ● | Recently introduced economic substance legislation of the Cayman Islands may impact us or our operations; | |

| ● | Certain judgments obtained against us by our shareholders may not be enforceable; | |

| ● | We are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirements; | |

| ● | We are a foreign private issuer within the meaning of the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies; | |

| ● | We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses to us; | |

| ● | We will incur significantly increased costs and devote substantial management time as a result of the listing of our Ordinary Shares on the Nasdaq Capital Market; | |

| ● | If we fail to meet applicable listing requirements, the Nasdaq Capital Market may delist our Ordinary Shares from trading, in which case the liquidity and market price of our Ordinary Shares could decline; and | |

| ● | The Ordinary Shares being delisted under the HFCAA if the PCAOB is unable to inspect auditors who are located in Singapore. |

| 13 |

Corporate Information

We were incorporated in the Cayman Islands as an exempted company on October 11, 2022. Our registered office in the Cayman Islands is at Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman, KY1-1111 Cayman Islands. Our principal executive office is at 34 Gul Crescent, Singapore 629538. Our telephone number at this location is +65 6861 4150. Our principal website address is https://www.barrels.com.sg. The information contained on our website does not form part of this prospectus. Our agent for service of process in the United States is Cogency Global Inc., 122 E. 42nd Street, 18th Floor, New York, New York 10168.

Because we are incorporated under the laws of the Cayman Islands, you may encounter difficulty protecting your interests as a shareholder, and your ability to protect your rights through the U.S. federal court system may be limited. Please refer to the sections entitled “Risk Factors” and “Enforceability of Civil Liabilities” for more information.

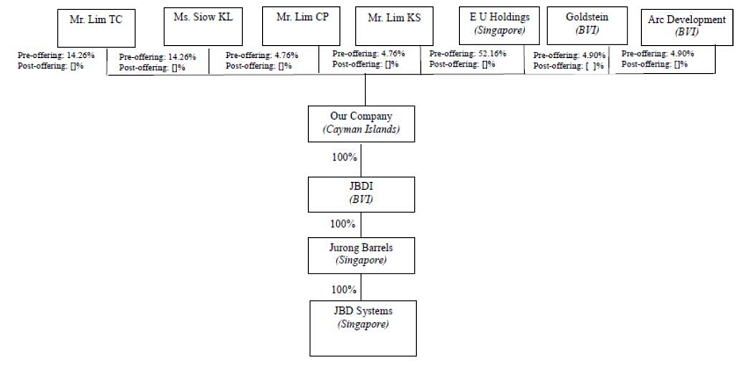

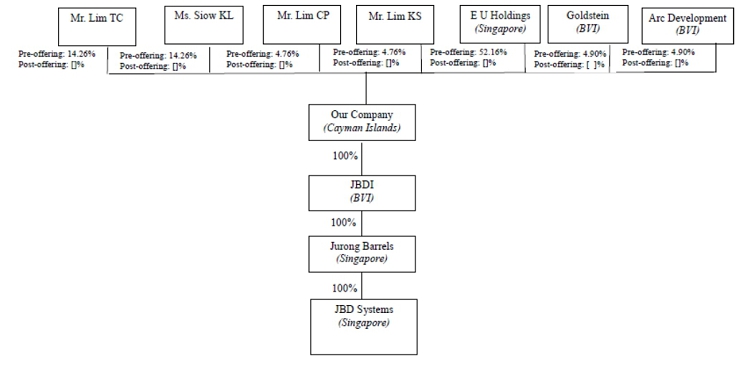

Since 2022, the Company completed several transactions for the purposes of a group reorganization, as below:

On October 10, 2022, E U Holdings, Mr. Lim CP, Ms. Siow KL, Mr. Lim KS, Mr. Lim TC (initial shareholders) and Arc Development entered into the Acquisition Agreement, pursuant to which Arc Development acquired 490 Ordinary Shares of JBDI (representing approximately 4.9% shareholding interest in JBDI) from E U Holdings, Mr. Lim CP, Ms. Siow KL, Mr. Lim KS and Mr. Lim TC for consideration of US$800,000. As a term of the acquisition, E U Holdings, Mr. Lim CP, Ms. Siow KL, Mr. Lim KS and Mr. Lim TC undertakes to transfer the entire issued share capital of Jurong Barrels to the JBDI. Following such transfer, E U Holdings owns 5,706 Ordinary Shares, Mr. Lim CP owns 475 Ordinary Shares, Ms. Siow KL owns 1,427 Ordinary Shares, Mr. Lim KS owns 475 Ordinary Shares, Mr. Lim TC 1,427 Ordinary Shares and Arc Development owns 490 Ordinary Shares, respectively.

On October 10, 2022, E U Holdings entered into a transfer agreement with Goldstein for the transfer of 4.90% of the issued share capital of JBDI.

On January 12, 2023, E U Holdings, Mr. Lim CP, Ms. Siow KL, Mr. Lim KS, Mr. Lim TC and JBDI entered into a sale and purchase agreement pursuant to which E U Holdings, Mr. Lim CP, Ms. Siow KL, Mr. Lim KS, Mr. Lim TC transferred its entire shareholding interest in Jurong Barrels to JBDI. The consideration is settled by JBDI allotting and issuing 1 Ordinary Share to each of E U Holdings, Mr. Lim CP, Ms. Siow KL, Mr. Lim KS, Mr. Lim TC credited as fully paid.

On May 30, 2023, E U Holdings, Mr. Lim CP, Ms. Siow KL, Mr. Lim KS, Mr. Lim TC, Goldstein, Arc Development and JBDI Holdings entered into a reorganization agreement, pursuant to which E U Holdings, Mr. Lim CP, Ms. Siow KL, Mr. Lim KS, Mr. Lim TC, Goldstein and Arc Development, transferred their respective 5,216 Ordinary Shares, 475 Ordinary Shares, 1,427 Ordinary Shares, 475 Ordinary Shares, 1,427 Ordinary Shares, 490 Ordinary Shares and 490 Ordinary Shares respectively into JBDI Holdings. The consideration is settled by JBDI Holdings issuing 4,704,179 Ordinary Shares, 429,292 Ordinary Shares, 1,286,074 Ordinary Shares, 429,292 Ordinary Shares, 1,286,074 Ordinary Shares, 441,919 Ordinary Shares and 441,919 Ordinary Shares to E U Holdings, Mr. Lim CP, Ms. Siow KL, Mr. Lim KS, Mr. Lim TC, Goldstein and Arc Development respectively, credited as fully paid.

Prior to a group reorganization, JBDI was the holding company of a group of companies comprised of Jurong Barrels and JBD Systems. JBDI held as to 52.16% by E U Holdings, 4.76% by Mr. Lim CP, 14.26% by Ms. Siow KL, 4.76% by Mr. Lim KS, 14.26% by Mr. Lim TC, 4.90% by Goldstein and 4.90% by Arc Development, the latter two of which are an independent third parties. Upon completion of the reorganization, E U Holdings owns 4,704,180 Ordinary Shares, Mr. Lim CP owns 429,292 Ordinary Shares, Ms. Siow KL owns 1,286,074 Ordinary Shares, Mr. Lim KS owns 429,292 Ordinary Shares, Mr. Lim TC owns 1,286,074 Ordinary Shares, Goldstein owns 441,919 Ordinary Shares and Arc Development owns 441,919 Ordinary Shares of the Company respectively, and JBDI, Jurong Barrels and JBD Systems become directly/indirectly owned subsidiaries.

The chart below sets out our corporate structure as at the date of this prospectus assuming an internal group reorganization has been completed with percentages held pre and post offering.

| (1) | E U Holdings, a company incorporated in Singapore and owned as to 50% by Mr. Neo Chin Heng and 50% by Mr. Ng Eng Guan. | |

| (2) | Arc Development, a company incorporated in Hong Kong and owned as to 100% by Mr. Hinson Leung. | |

| (3) | Goldstein, a company incorporated in the BVI and owned as to 100% by Mr. Tan Kok Chuan, an Independent Third Party. |

| 14 |

Implications of Being a “Controlled Company”

Upon completion of this offering, E U Holdings, Mr. Lim CP, Ms. Siow KL, Mr. Lim KS and Mr. Lim TC, collectively known as our controlling shareholders, will own approximately 79.7% of our total issued and outstanding Ordinary Shares, representing approximately 79.7% of the total voting power. As a result, we will be a “controlled company” within the meaning of the Nasdaq Capital Market Rules and therefore eligible for certain exemptions from the corporate governance requirements of the Nasdaq Capital Market listing rules. If we cease to be a foreign private issuer, we intend to rely on these exemptions. In addition, our controlling shareholders will be able to exert significant control over our management and affairs, including approval of significant corporate transactions.

Implications of Our Being an Emerging Growth Company

As a company with less than US$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include:

| ● | being permitted to provide only two years of selected financial information (rather than five years) and only two years of audited financial statements (rather than three years), in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; and | |

| ● | an exemption from compliance with the auditor attestation requirement of the Sarbanes-Oxley Act, on the effectiveness of our internal control over financial reporting. |

We may take advantage of these reporting exemptions until we are no longer an emerging growth company. We will remain an emerging growth company until the earliest of (1) the last day of the fiscal year in which the fifth anniversary of the completion of this offering occurs, (2) the last day of the fiscal year in which we have total annual gross revenue of at least US$1.235 billion, (3) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which means the market value of our Ordinary Shares that are held by non-affiliates exceeds US$700.0 million as of the prior December 31, and (4) the date on which we have issued more than US$1.0 billion in non-convertible debt during the prior three-year period. We may choose to take advantage of some, but not all, of the available exemptions. We have included two years of selected financial data in this prospectus in reliance on the first exemption described above. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold stock.

Implications of Our Being a Foreign Private Issuer

Upon completion of this offering, we will report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; | |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and | |

| ● | the rules under the Exchange Act requiring the filing with the Securities and Exchange Commission, or the SEC, of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither emerging growth companies nor foreign private issuers.

In addition, as a company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the corporate governance listing requirements of the Nasdaq Capital Market. These practices may afford less protection to shareholders than they would enjoy if we complied fully with corporate governance listing requirements of the Nasdaq Capital Market. Following this offering, we will rely on home country practice to be exempted from certain of the corporate governance requirements of the Nasdaq Capital Market, such that a majority of the Directors on our Board of Directors are not required to be independent directors.

| 15 |

The Offering

| Offering Price | The initial public offering price will be between US$4.00 and US$5.00 per Ordinary Share |

| Ordinary Shares offered by us | 1,750,000 Ordinary Shares |

| Ordinary Shares offered by the Selling Shareholders | 500,000 Ordinary Shares (of which E U Holdings is selling 300,000 Ordinary Shares, Mr. Lim TC is selling 75,000 Ordinary Shares, Ms. Siow KL is selling 75,000 Ordinary Shares, Mr. Lim CP is selling 25,000 Ordinary Shares and Mr. Lim KS is selling 25,000 Ordinary Shares. |

| Ordinary Shares issued and outstanding prior to this offering | 18,037,500 Ordinary Shares |

| Ordinary Shares to be issued and outstanding immediately after this offering | 19,787,500 Ordinary Shares |

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $6.0 million, based on an assumed initial public offering price of $4.50 per Ordinary Share (being the mid-point of the offer price range), which is the mid-point of the offer price range set forth on the cover of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any proceeds of sale from the Selling Shareholders’ Ordinary Shares.

We currently intend to use the net proceeds from this offering (i) to improve our automation process, upgrade our infrastructure and to improve our management efficiency in terms of level of technology, automation and precision; (ii) to increase our storage facilities; (iii) to expand through strategic targeted acquisitions; (iv) to expand our business into the trading of new drums; (v) to strengthen our ESG and work towards Industry 5.0; (vi) to market and brand build; (vii) to expand and renew our fleet of delivery trucks; (viii) to repay our shareholders for loans made to us in connection with costs and expenses incurred in connection with this offering and obtain a listing of our Ordinary Shares on the Nasdaq Capital Market; and (ix) for general working capital and corporate purposes. See “Use of Proceeds” |

| Lock-up | We, each of our Directors and Executive Officers and certain principal shareholders, except for the Selling Shareholders with respect to its Ordinary Shares sold in this offering, have agreed, subject to certain exceptions, for a period of 180 days after the date of this prospectus, not to, except in connection with this offering, offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of, directly or indirectly, any Ordinary Shares or any other securities convertible into or exercisable or exchangeable for Ordinary Shares, or enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of Ordinary Shares. See “Shares Eligible for Future Sale” and “Underwriting—Lock-Up Agreements” |

| Risk factors | Investing in our Ordinary Shares involves risks. See “Risk Factors” beginning on page 17 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Ordinary Shares |

| Listing | We plan to apply to list the Ordinary Shares on the Nasdaq Capital Market |

| Proposed trading symbol | JBDI |

| Transfer agent | VStock Transfer, LLC, 18 Lafayette Place, Woodmere, New York 11598; telephone: 212-828-8436, toll-free: 855-9VSTOCK |

| Payment and settlement | The underwriter expects to deliver the Ordinary Shares against payment therefor through the facilities of the Depository Trust Company on [●], 2024 |

| 16 |

Investing in our Ordinary Shares is highly speculative and involves a significant degree of risk. You should carefully consider the following risks, as well as other information contained in this prospectus, before making an investment in our Company. The risks discussed below could materially and adversely affect our business, prospects, financial condition, results of operations, cash flows, ability to pay dividends and the trading price of our Ordinary Shares. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, prospects, financial condition, results of operations, cash flows and ability to pay dividends, and you may lose all or part of your investment.

This prospectus also contains forward-looking statements having direct and/or indirect implications on our future performance. Our actual results may differ materially from those anticipated by these forward-looking statements due to certain factors, including the risks and uncertainties faced by us, as described below and elsewhere in this prospectus.

Risks Related to Our Business and Industry

Our business is inherently susceptible to the cyclical fluctuations of the solvent, chemical, petroleum and edible oil product industries worldwide and regionally, which our customers are operating in

Our customers mainly operate in the solvent, chemical, petroleum and edible product oil industries, respectively. These industries are largely cyclical in nature and economic downturns and resulting pricing pressures experienced by them have resulted in them reducing their capital and operating expenditures. A slowdown in these industries or the occurrence of any event that may adversely affect these industries such as changes in regulatory environment and economic conditions will result in a decrease in demand for our products and services, and accordingly our business, profitability and financial performance may be adversely affected. These industries are also subject to the impact of the industry cycle, general market and economic conditions and government policies and expenditures, which are factors beyond our control. A decline in the number of purchase orders or service contracts due to these factors may cause us to operate in a more competitive environment, and we may also be required to be more competitive in our pricing which, in turn, may adversely impact our business, financial condition, results of operations and prospects.

We are affected by regional and worldwide political, regulatory, social and economic conditions in the jurisdictions in which we and our customers and suppliers operate and in the jurisdictions which we intend to expand our business

We and our customers and suppliers are governed by the laws, regulations and government policies in each of the various jurisdictions in which we and our customers and suppliers operate or into which we intend to expand our business and operations. Our business and future growth are dependent on the political, regulatory, social and economic conditions in these jurisdictions, which are beyond our control. Any economic downturn, changes in policies, currency and interest rate fluctuations, capital controls or capital restrictions, labor laws, changes in environmental protection laws and regulations, duties and taxation and limitations on imports and exports in these countries may materially and adversely affect our business, financial condition, results of operations and prospects.

Generally, we fund our operations via our internal resources and short and long-term financing from banks and other financial institutions. Any disruption, uncertainty and volatility in the global credit markets may limit our ability to obtain the required working capital and financing for our business at reasonable terms and finance costs. If all or a substantial portion of our credit facilities are withdrawn and we are unable to secure alternative funding on acceptable commercial terms, our operations and financial position will be adversely affected. The interest rates for most of our credit facilities are subject to review from time to time by the relevant financial institutions. Given that we rely on these credit facilities to finance our operations and that interest expenses represent a significant percentage of our expenses, any increase in the interest rates of the credit facilities extended to us may have a material adverse impact on our profitability.

| 17 |

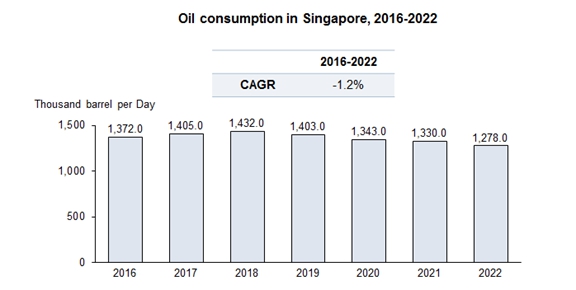

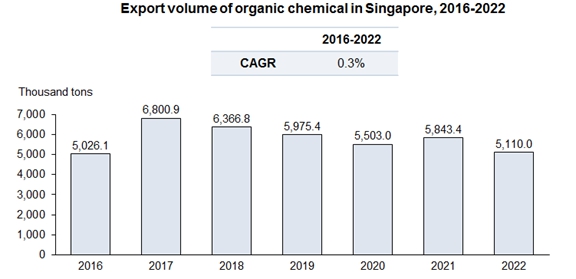

Our business is dependent on the general economic conditions in Singapore

Over 80% of our revenue was derived from our customers in Singapore during the financial years ended May 31, 2023 and 2022. As such, our business is subject to the uncertainties and cyclical nature of the solvent, chemical, petroleum and edible product oil industries in Singapore as the demand for our products and services is dependent, to a large extent, on the level of business activities in the solvent, chemical, petroleum and edible product oil industries in Singapore. In particular, our revenue and profitability may be adversely affected if the demand for solvent, chemical, petroleum and edible product oil products fall. In addition, an economic downturn in Singapore may lead to a reduction in a numerous range of business activities, thereby leading to a subsequent decline in demand for solvent, chemical, petroleum and edible product oil products, and this would have an adverse impact on our revenue and financial performance.

As our business is dependent on our customers’ demand for our products and services in Singapore and we do not enter into long-term contracts with our customers, it is critical that we maintain a good relationship with our customers. We cannot assure you that we will be able to do so. Accordingly, our historical performance may not be an indication of our future performance. In the event that we are not able to maintain our customers and that we are not able to identify new ones to replace them, there would be an adverse impact on our financial performance.

We are dependent on the need to continually maintain a wide range of Containers which are relevant to our customers’ needs

The needs and preferences of our customers in terms of types and specifications of Containers may change as a result of evolving needs. Our future success depends on our ability to obtain used and new Containers that meet evolving market demands of our customers. The preferences and purchasing patterns of our customers can change rapidly due to developments in their respective industries. There is no assurance that we will be able to respond to changes in the specifications of our customers in a timely manner. Our success depends on our ability to adapt our products to the requirements and specifications of our customers. There is also no assurance that we will be able to sufficiently and promptly respond to changes in customer preferences to make corresponding adjustments to our products or services, and failing to do so may have a material and adverse effect on our business, financial condition, results of operations and prospects.

As we want to ensure a quick turnaround time for our customers, we normally bid and tender for used Containers in bulk and Recondition them in anticipation of the needs of our customers. As of May 31, 2023 and 2022, we had inventories of approximately $0.3 million and approximately $0.3 million, respectively. Any change in customer demand for our products may have an adverse impact on our product sales, which may in turn lead to inventory obsolescence, decline in inventory value or inventory write-off. In that case, our business, financial condition, results of operations and prospects may be materially and adversely affected.

Escalating steel price may increase our costs and adversely affect our profit margin

Over 75% of our revenue during the financial years ended May 31, 2023 and 2022 was derived from the sale of Reconditioned and new Containers. The increase in the price of steel will generally lead to an increase in the price of new steel Containers. As the price of used steel Containers is generally pegged to the price of new steel Containers, the fluctuation in the price of steel (which is dependent on various factors such as the cost of raw materials, shipping cost, energy prices, demand and supply) will have a direct impact on our operating costs, which in turn will affect our profit margin. As such, escalating steel price may increase our costs and adversely affect our profit margin if we are unable to pass on the increase in costs to our customers, which would have an adverse impact on our revenue and financial performance.

| 18 |

Our continued success is dependent on our key management personnel and our experienced and skilled personnel and our business may be severely disrupted if we are unable to retain them or to attract suitable replacements

Since the commencement of our business, Mr. Lim CP, our Executive Director and Chief Executive Officer and one of our founding shareholders, has been instrumental in expanding our business and his brother, Mr. Lim KS, has been supporting in sales since inception. His two sons, namely and Mr. Lim TM and Mr. Lim TC also joined our Group in 1999 and 2003 to look after sales and operations, respectively. We rely on the wide network, contacts and experience of our Executive Directors, Executive Officers and senior management Mr. Lim CP, Mr. Lim KS, Mr. Lim TM, Mr. Lim TC, Mr. Liang Zhao Rong and Mr. Quek Che Wah, which was built collectively over four decades, in particular, sourcing for used and new Containers from new and existing suppliers and sales of Reconditioned and used Containers.

Our performance depends on the continued service and performance of our Executive Directors, Executive Officers and senior management, and in particular Mr. Lim CP because he plays an important role in guiding the implementation of our business strategies and future plans. The working and business relationships that our Executive Directors, Executive Officers and senior management have developed with our main suppliers and customers over the years is important for the future development of our business. If any of our Executive Directors, Executive Officers and senior management were to terminate their employment with our Group, there is no assurance that we would be able to find suitable replacements with such a vast network of contacts and experience in a timely manner. The loss of services of any of our Executive Directors, Executive Officers and senior management and/or the inability to identify, hire, train and retain other qualified technical, mechanical and operations personnel in the future may materially and adversely affect our business, financial condition, results of operations and prospects.