Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ☒ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: August 25, 2023

Commission File Number: 001-41789

noco-noco Inc.

(Exact name of Registrant as specified in its charter)

| Not applicable | Cayman Islands | |

| (Translation of Registrant’s name into English) |

(Jurisdiction of incorporation or organization) |

4 Shenton Way

#04-06 SGX Centre II

Singapore 068807

(Address of principal executive offices)

Masataka Matsumura

Chief Executive Officer

4 Shenton Way

#04-06 SGX Centre II

Singapore 068807

Telephone: +65 69709643

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of exchange on which registered | ||

| Ordinary shares, par value US$0.0001 | NCNC | The Nasdaq Capital Market LLC | ||

| Warrants, each whole warrant exercisable for one ordinary share | NCNCW | The Nasdaq Capital Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the shell company report: 132,436,440 ordinary shares, as of August 25, 2023.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Emerging growth company | ☒ | |||

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting over Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Table of Contents

Page

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 5 | ||||

| ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

5 | |||

| 5 | ||||

| 5 | ||||

| 37 | ||||

| 54 | ||||

| 55 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 66 | ||||

| ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

68 | |||

| ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

69 | |||

| II-1 | ||||

| III-1 | ||||

| III-1 | ||||

| III-1 | ||||

| III-1 | ||||

| III-1 | ||||

| III-3 |

i

Table of Contents

On August 25, 2023 (the “Closing Date”), noco-noco Inc. (formerly known as Prime Number Holding Limited), an exempted company with limited liability incorporated under the laws of the Cayman Islands (the “Company” or “PubCo”), consummated the previously announced Business Combination (defined below). The Business Combination was announced on December 29, 2022, where PubCo, Prime Number Acquisition I Corp. (“PNAC”), Prime Number Merger Sub Inc., a Delaware corporation and a direct wholly-owned subsidiary of PubCo (“Merger Sub”), Prime Number New Sub Pte. Ltd., a Singapore private company limited by shares and a direct wholly-owned subsidiary of PubCo (“New SubCo”), NOCO-NOCO PTE. LTD., a Singapore private company limited by shares (“noco-noco”), and certain shareholders of noco-noco collectively holding a controlling interest (together with other shareholders of noco-noco subsequently joining the transactions, the “Sellers”), entered into a business combination agreement (“Business Combination Agreement”), pursuant to which, PNAC proposed to enter into a business combination with noco-noco involving a merger and a share exchange, among which: (i) Merger Sub would merge with and into PNAC, with PNAC as the surviving entity and a wholly-owned subsidiary of PubCo (the “Merger”), (ii) New SubCo would acquire all of the issued and outstanding shares of noco-noco from the Sellers, and in exchange, PubCo would issue to the Sellers the ordinary shares of PubCo, with noco-noco becoming a subsidiary of New SubCo and an indirect subsidiary of PubCo (the “Share Exchange”, and together with the Merger and the other transactions contemplated by the Business Combination Agreement, the “Business Combination”). Upon the consummation of the Business Combination, each of PNAC and noco-noco would become a subsidiary of PubCo, and PNAC stockholders and the Sellers would receive ordinary shares, par value $0.0001 per share, of PubCo (“PubCo Ordinary Shares”) as consideration and become the shareholders of PubCo. The Merger was consummated on August 24, 2023, and the Share Exchange and Business Combination were consummated on the Closing Date.

Pursuant to the Business Combination Agreement, upon the consummation of the Business Combination: (i) each PNAC unit (“PNAC Units”) issued and outstanding immediately prior to the effective time of the Merger was automatically detached and the holder thereof was deemed to hold one share of PNAC Class A Common Stock (defined below), one half of PNAC Warrant (defined below), and one PNAC Right (defined below); (ii) each share of PNAC Class A common stock, par value $0.0001 per share (“PNAC Class A Common Stock”, together with PNAC Class B Common Stock, par value $0.0001 per share, the “PNAC Common Stock”) issued and outstanding immediately prior to the effective time of the Merger was canceled in exchange for the right to receive one PubCo Ordinary Share, (iii) each PNAC warrant (“PNAC Warrant”) outstanding immediately prior to the effective time of the Merger ceased to be a warrant with respect to PNAC Common Stock and was assumed by PubCo and converted into a warrant of PubCo (“PubCo Warrant”) to purchase one PubCo Ordinary Share subject to substantially the same terms and conditions prior to the effective time of the Merger; and (iv) each PNAC Right (“PNAC Right”) outstanding immediately prior to the effective time of the Merger was cancelled in exchange for the right to receive one-eighth (1/8) of one PubCo Ordinary Share. In addition, pursuant to the Business Combination Agreement, upon the consummation of the Share Exchange (i) New SubCo acquired all the outstanding shares of noco-noco (“noco-noco Shares”) from the Sellers, (ii) in exchange, each Seller received such number of newly issued PubCo Ordinary Share that was equal to the product of (a) the quotient of (i) $1,350,000,000 (the “noco-noco Valuation”), divided by (ii) the price per PubCo Ordinary Share that equals to the redemption price of each share of PNAC Class A Common Stock in connection with the Business Combination (the “PubCo Per Share Price”), multiplied by (b) such Seller’s Pro Rata Portion as set out in the Allocation Schedule of the Business Combination Agreement.

On August 28, 2023, the PubCo Ordinary Shares and PubCo Warrants commenced trading on the Nasdaq Capital Market (“Nasdaq”) under the symbols “NCNC” and “NCNCW”, respectively.

1

Table of Contents

Frequently Used Terms

In this shell company report on Form 20-F (including information incorporated by reference herein, this “Report”), unless the context otherwise requires, the “Company,” “noco-noco” and references to “we,” “us,” or similar such references should be understood to be references to noco-noco Inc. and its subsidiaries. When this Report refers to “noco-noco” “we,” “us,” or similar such references in the context of discussing noco-noco Pte. Ltd.’s business or other affairs prior to the consummation of the Business Combination on August 25, 2023, it refers to the business of noco-noco Pte. Ltd. and its subsidiaries. Following the date of consummation of the Business Combination, references to “noco-noco” “we,” “us,” or similar such references should be understood to refer to noco-noco Inc. and its subsidiaries. References to “PNAC” should be understood to refer to Prime Number Acquisition I Corp.

Certain amounts and percentages that appear in this Report may not sum due to rounding.

Unless otherwise stated or unless the context otherwise requires, in this Report:

“3DOM Alliance” means 3DOM Alliance Inc., a company incorporated under the laws of Japan, which is the majority shareholder of noco-noco;

“Business Combination” has the meaning ascribed to it in the section entitled “Explanatory Note.”;

“Business Combination Agreement” means the business combination agreement, dated December 29, 2022 (as may be amended, supplemented, or otherwise modified from time to time), by and among PubCo, PNAC, Merger Sub, New SubCo, noco-noco and certain shareholders of noco-noco;

“Closing” means the closing of the Business Combination;

“Closing Date” means the date of the Closing;

“ERF” means Emissions Reduction Fund, one of the schemes regulated by the CER;

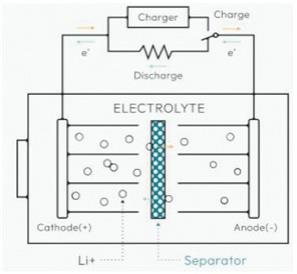

“ESS” means energy storage system, a device or group of devices assembled together, capable of storing energy in order to supply electrical energy at a later time;

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012; “LOI” means letter of intent;

“Merger” means the merger between PNAC and Merger Sub, with PNAC being the surviving company and a wholly-owned subsidiary of PubCo;

“Merger Closing” means the closing of the Merger;

“Merger Effective Time” means the effective time of the Merger, being the time of the Certificate of Merger (as defined in the Business Combination Agreement) being accepted by the Secretary of State of the State of Delaware, or such later time as may be specified in the Certificate of Merger;

“Merger Sub” means Prime Number Merger Sub Inc., a Delaware corporation; “MOU” means memorandum of understanding;

“Nasdaq” means the Nasdaq Capital Market;

“New SubCo” means Prime Number New Sub Pte. Ltd., a Singapore private company limited by shares;

“noco-noco” means NOCO-NOCO PTE. LTD., a Singapore private company limited by shares, or as the context requires, NOCO-NOCO PTE. LTD. and its subsidiaries and consolidated affiliated entities;

2

Table of Contents

“noco-noco Shares” means the outstanding ordinary shares of noco-noco;

“noco-noco Valuation” means $1,350,000,000;

“PNG” means Papua New Guinea;

“PubCo” means prior to the Closing, Prime Number Holding Limited, an exempted company limited by shares incorporated under the laws of the Cayman Islands; and upon and following the Closing, noco-noco Inc., an exempted company limited by shares incorporated under the laws of the Cayman Islands;

“PubCo Per Share Price” means the price per PubCo Ordinary Share that equal to the redemption price of each share of PNAC public share in connection with the Business Combination;

“Ordinary Shares” means the ordinary shares of the Company, having a par value of $0.0001 each;

“R&D” means research and development;

“Registration Rights Agreement” means the registration rights agreement to be entered between PubCo, the Sponsors and certain shareholders of noco-noco pursuant to the Business Combination Agreement upon closing;

“SEC” means the U.S. Securities and Exchange Commission;

“Sellers” means the shareholders of noco-noco (immediately prior to the Share Exchange) participating in the Share Exchange.

“shareholders” or “stockholders” means the holders of shares or stocks of a company;

“Share Exchange” means the transaction pursuant to which New SubCo will acquire issued and outstanding shares of noco-noco from the Sellers, in exchange, PubCo will issue to the Sellers the PubCo Ordinary Shares;

“Share Exchange Closing” means the closing of the Share Exchange;

“Singapore Dollars” and “S$” means Singapore dollars, the legal currency of Singapore;

“Transaction Financing” means equity financing that, pursuant to the Business Combination Agreement, PubCo, PNAC and the New SubCo shall use reasonable best efforts to obtain, on the terms mutually agreed to by noco-noco and PNAC, in an amount that is at least $20,000,000 prior to or upon the Share Exchange Closing; and

“U.S. Dollars,” “US$” and “$” means United States dollars, the legal currency of the United States; “U.S. GAAP” means United States generally accepted accounting principles.

Frequently Used Technical Terms

Unless otherwise stated or unless the context otherwise requires, in this Report:

“ACCUs” means Australian Carbon Credit Units, the national carbon credits issued by Australian regulators which can be obtained through establishing ERF projects;

“BEV” means battery electric vehicles, vehicles that exclusively use chemical energy stored in rechargeable battery packs; and “EV” means electric vehicles; and

“OEM” means original equipment manufacturer.

3

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains or may contain forward-looking statements as defined in Section 27A of the Securities Act, and Section 21E of the Exchange Act, that involve significant risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements include information about our possible or assumed future results of operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” and variations of such words and similar expressions are intended to identify the forward-looking statements, but absence of these words does not mean that a statement is not forward-looking. The risk factors and cautionary language referred to or incorporated by reference in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in our forward-looking statements, including among other things, the matters set forth in the section entitled “Item 3. Key Information — D. Risk Factors” of this Report and the section entitled “Risk Factors” of the Company’s Amendment No. 3 to the Registration Statement on Form F-4 (File No. 333-271994) filed with the SEC on July 21, 2023 (the “Form F-4”), which are incorporated by reference into this Report.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements contained in this Report, or the documents to which we refer readers in this Report, to reflect any change in our expectations with respect to such statements or any change in events, conditions or circumstances upon which any statement is based.

4

Table of Contents

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

| A. | Directors and Senior Management |

The directors and executive officers of the Company upon the consummation of the Business Combination are set forth in the Form F-4 in the section entitled “Management of PubCo Following The Business Combination,” which is incorporated herein by reference. The business address for each of the Company’s directors and executive officers is 4 Shenton Way, #04-06 SGX Centre II, Singapore 068807.

| B. | Adviser |

Sidley Austin will act as U.S. securities counsel to the Company upon and following the consummation of the Business Combination.

Ogier Global has and will continue to act as Cayman counsel to the Company upon and following the consummation of the Business Combination.

| C. | Auditors |

Marcum Asia CPAs LLP acted as the independent auditor for noco-noco Pte. Ltd., the predecessor of the Company, as of and for the years ended June 30, 2022 and 2021, and will continue to act as the independent auditor of the Company upon and following the consummation of the Business Combination. The current address of Marcum Asia CPAs LLP is 8 Marina View, Tower 1, #07-05 Asia Square, Singapore 018960.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

The following table sets forth our capitalization and indebtedness as of December 31, 2022 on:

| • | a historical basis; and |

| • | a pro forma, as adjusted basis, after giving effect to the Business Combination and the forward purchase agreement. |

| As of December 31, 2022 | ||||||||

| noco-noco | Pro Forma Combined |

|||||||

| Cash and cash equivalent |

$ | 214,449 | $ | 1,510,716 | ||||

| Liabilities |

2,002,521 | 7,293,111 | ||||||

| Equity |

||||||||

| Share capital |

2,348,091 | 28,193,855 | ||||||

| Retained earnings |

(3,506,393 | ) | 16,821,113 | |||||

| Reserves |

(6,720 | ) | (6,720 | ) | ||||

| Total equity |

(1,165,023 | ) | 11,366,022 | |||||

| Total capitalization |

$ | 837,498 | 18,659,133 | |||||

|

|

|

|

|

|||||

5

Table of Contents

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Our business and our industry are subject to significant risks. You should carefully consider all of the information set forth in this Report and in our other filings with the SEC, including the following risk factors, in evaluating our business. If any of the following risks actually occur, our business, financial condition, operating results, and growth prospects would likely be materially and adversely affected. This Report also contains forward-looking statements that involve risks and uncertainties. See the section entitled “Cautionary Note Regarding Forward-Looking Information.”

Summary of Risk Factors

The following summary description sets forth an overview of the material risks we are exposed to in the normal course of our business activities. The summary does not purport to be complete and is qualified in its entirety by reference to the full risk factor discussion immediately following this summary description. We encourage you to read the full risk factor discussion carefully.

Our business, results of operations and financial condition could be materially and adversely affected by any of the following material risks:

| • | We are an early stage company with a history of financial losses and our battery business expects to incur significant expenses and continuing losses for the foreseeable future. |

| • | Our business model has yet to be tested and any failure to commercialize our strategic plans would have an adverse effect on our operating results and business, harm our reputation and could result in substantial liabilities that exceed our resources. |

| • | Our business plan may not prove successful, is subject to legal and regulatory risks and our products may not be well-accepted by the markets, which could materially and adversely affect our prospects. |

| • | The success of our business significantly relies on our relationship with 3DOM Alliance. If 3DOM Alliance no longer exclusively licenses its intellectual property rights and technologies to us, our business, financial position, results of operations and prospect would be materially and adversely affected. |

| • | Our business and future growth depends on the growth in demand for BEVs, hybrid vehicles and alternative fuel. |

| • | The EV battery market continues to evolve and is highly competitive, and other battery manufacturers have significantly greater resources than we do. |

| • | Our future success depends on the needs and success of our clients, as well as the demand for our clients’ products or services. |

| • | Many of our target clients are large commercial transportation companies, renewable energy plants and power plants, and the failure to maintain existing clients and secure new clients, withdrawal of leasing services by such clients or failure to negotiate acceptable terms in contract renewal negotiations could have an adverse impact on our business. |

| • | We may not be able to engage target clients successfully and to convert such contacts into meaningful orders in the future. |

6

Table of Contents

| • | If we are unable to establish and maintain confidence in our long-term business prospects among clients and analysts and within our industry or are subject to negative publicity, then our financial condition, operating results, business prospects and access to capital may suffer materially. |

| • | If any of our battery products fails to perform as expected, our ability to develop, market and sell our products and services could be harmed. |

| • | Our battery products will require extensive safety testing prior to being offered to our lessees or installed in electric vehicles and power plants. |

| • | Any decline in the value of carbon credits or carbon offsets could materially adversely affect our business. |

| • | Changes in industry standards or practices for issuance or usage of carbon credits or carbon offsets could significantly adversely affect our business. |

| • | We cannot guarantee that the approvals of the carbon abatement projects and issuing of Australian Carbon Credit Units (“ACCUs”) will not be revoked, cancelled or otherwise. |

| • | Our operations and investments are located in Asia-Pacific and we are therefore exposed to various risks inherent in operating and investing in the region. |

Risks Related to Our Business and Industry

We are an early stage company with a history of financial losses and our battery business expects to incur significant expenses and continuing losses for the foreseeable future.

We are engaged in (i) leasing of battery products, including batteries, BEVs and ESS and (ii) carbon abatement solutions and carbon credit sales. Our battery business incurred a net loss of approximately $0.7 million and $1.1 million for the six months ended June 30, 2021 and 2022, respectively, and an accumulated deficit of approximately $1.3 million and $2.4 million as of June 30, 2021 and 2022, respectively. As our battery business currently does not have any operations to generate revenue, except revenue generated in 2021 for production of sample batteries used for a client’s internal testing for the purpose of providing the Public Utility Board of Singapore with a proof-of-concept ESS, we believe that our battery business will continue to incur operating and net losses each fiscal year until such time as we begin significant production and leasing of our battery products, which is not expected to occur until the second quarter of 2024, and may occur later.

We expect the rate at which we will incur losses to be higher in future periods as we, among other things, continue to expand our footprints in the Southeast Asian and South Asian region, increase our sales and marketing activities, develop our distribution infrastructure, and increase our general and administrative functions to support our growing operations. We may find that these efforts are more expensive than we currently anticipate or that these efforts may not result in revenues, which would further increase our losses or even prevent us from continuing as a going concern.

Further, the battery and EV industries are affected by market conditions that are outside our control. Our results of operations may fluctuate significantly from period to period due to a number of factors, including changes in market demand for batteries, BEVs and ESS, industry-wide technology changes, the loss of key clients and the postponement, rescheduling or cancellation of large orders by key clients. As a result of these factors and other risks discussed in this section, period-to-period comparisons should not be relied upon to predict our future performance.

7

Table of Contents

Our business model has yet to be tested and any failure to commercialize our strategic plans would have an adverse effect on our operating results and business, harm our reputation and could result in substantial liabilities that exceed our resources.

Our battery business has not commenced operations yet. Investors should be aware of the difficulties normally encountered by a new enterprise, many of which are beyond our control, including substantial risks and expenses in the course of developing or manufacturing new products or services, establishing or entering new markets, organizing operations, and undertaking marketing activities. The likelihood of our success must be considered in light of these risks, expenses, complications, delays and the competitive environment in which we operate. There is, therefore, nothing at this time upon which to base an assumption that our business plan will prove successful, and we may not be able to generate significant revenue, raise additional capital, or operate profitably. We will continue to encounter risks and difficulties frequently experienced by early commercial stage companies, including introducing products or services that are accepted by the markets, scaling up our infrastructure and headcount, and we may encounter unforeseen expenses, difficulties or delays in connection with our growth. In addition, as a result of the capital-intensive nature of our leasing business, we can be expected to face pressures to raise additional financings in order to sustain our operations of leasing projects to grow our business and achieve profitability. Any investment in our company is therefore highly speculative and could result in the loss of your entire investment.

It is difficult to predict our future revenues and appropriately budget for our expenses, and we have limited insight into potential changes in trends that may emerge and affect our business. In the event that actual results differ from our estimates or we adjust our estimates in future periods, our operating results, prospects and financial position could be materially affected. The projected financial information appearing elsewhere in these materials was prepared by management and reflects current estimates of future performance. The projected results depend on the successful implementation of management’s growth strategies and are based on assumptions and events over which we have only partial or no control. In particular, our projected results are heavily reliant on our ability to successfully develop, manufacture, market and lease our battery products. The assumptions underlying such projected information require the exercise of judgment and may not occur, and the projections are subject to uncertainty due to the effects of economic, business, competitive, regulatory, legislative, and political or other changes.

Our business plan may not prove successful, is subject to legal and regulatory risks and our products may not be well-accepted by the markets, which could materially and adversely affect our prospects.

Our businesses in Asia-Pacific, including Singapore, Thailand, the Philippines, Indonesia, India, Australia, and PNG, are relatively new, and there is no assurance that we will be able to achieve and maintain growth and profitability across all of our business segments. There is also no assurance that our offerings will be accepted by the market or that market acceptance of our offerings will grow. Further, technologies and industry standards in relation to batteries, BEVs and ESS are evolving. For example, many of our competitors are developing a variety of battery technologies, such as solid state batteries and fuel cells, which are expected to compete with our existing product lines. It is possible that our competitors will be able to introduce new products with more desirable features than ours and their new products will gain greater market acceptance. In addition, our business could be impacted by macro-economic conditions and their effect on discretionary consumer spending, which could impact the business of our prospective consumers and in turn could impact the demand of service offerings made available by us.

Furthermore, we plan to operate our leasing services and carbon abatement solutions in several countries in the large, diverse and complex Asia-Pacific region. Each of our segments is subject to various regulations in each of the jurisdictions in which we operate. Focus areas of regulatory risk that we are exposed to include, among others: (i) evolution of laws and regulations applicable to the leasing of batteries, BEVs and ESS as well as carbon abatement projects and carbon credit sales, (ii) various forms of data regulation such as data privacy, data localization, data portability, cybersecurity and advertising or marketing, (iii) economic regulations such as price, supply regulation, safety, health, environment regulations, (iv) foreign ownership restrictions, (v) vehicle regulation, (vi) land management, and (vii) native title of land. In addition, we may not be able to obtain all the licenses, permits and approvals that may be necessary to provide our product or service offerings. Because the relevant laws and regulations, as well as their interpretations, are often unclear and evolving in certain jurisdictions, this can make it difficult for us to assess whether we have complied with the relevant laws and regulations and which licenses and approvals are necessary for our business, or the processes for obtaining such licenses in certain jurisdictions. For these reasons, we also cannot be certain that we will be able to comply with all the material laws and regulations or maintain the licenses and approvals that we have previously obtained, or that once they expire we will be able to renew them. We cannot be sure that our interpretations of the rules and their exemptions have always been or will be consistent with those of the local regulators. As we expand our businesses, we may be required to obtain new licenses and will be subject to additional laws and regulations in the markets we plan to operate in.

8

Table of Contents

We also expect to expand our businesses in the Asia-Pacific region through acquisitions and strategic partnerships. Such expansion may increase the complexity of our business and may place significant strain on our management, personnel, operations, systems, technical performance, financial resources, and internal financial control and reporting functions. If our efforts of expansion through acquisitions or strategic partnerships fail, our business, results of operations, financial position, reputation, and prospects could be materially adversely affected.

The success of our business significantly relies on our relationship with 3DOM Alliance. If 3DOM Alliance no longer exclusively licenses its intellectual property rights and technologies to us, our business, financial position, results of operations and prospect would be materially and adversely affected.

All of our technologies are licensed from 3DOM Alliance, enabling us to utilize certain intellectual property rights and technologies owned or licensed in by 3DOM Alliance to manufacture and offer our own products. We also rely on 3DOM Alliance’s intellectual property rights and technologies to enable the development, operations and improvement of our battery products. Although our license-in agreement with 3DOM Alliance has a perpetual term, 3DOM Alliance can terminate the license-in agreement if we fail to pay any amounts when due with a thirty (30) days’ written notice, or when we fail to perform any obligation and fail to cure within the sixty (60) days notice period. If the license-in agreement is terminated or if we are unable to license future intellectual property rights and technologies from 3DOM Alliance, if we do so only on terms that are less favorable to us, our ability to continue to develop, maintain and improve our battery products and services could be harmed, which could in turn adversely affect our business, financial condition and results of operations. Additionally, some of the technology licensed under the 3DOM Alliance license are sublicensed to us by 3DOM (rather than licensed directly) and if 3DOM were to lose its rights to sublicense such technologies it is possible that we would not be able to use such technologies in the future.

Our business and future growth depends on the growth in demand for BEVs, hybrid vehicles and alternative fuel.

As the demand for our products is directly related to the market demand for BEVs, a fast-growing e-mobility market will be critical to the success of our business. In anticipation of an expected increase in the demand for BEVs in the next few years, we have sought long-term strategic partnerships, such as our strategic alliance with EV Dynamics and its Japanese subsidiary. However, the markets we have targeted, primarily those in Asia-Pacific region, may not achieve the level of growth we expect during the time frame projected. If any of these markets that we plan to expand into fails to achieve our expected level of growth, we may incur significant losses and not be able to generate enough revenue to achieve profitability. If the market for alternative fuel, hybrid vehicles and electric vehicles does not develop at the rate or in the manner or to the extent that we expect, or if critical assumptions that we have made regarding the efficiency of our energy solutions are incorrect or incomplete, our business, prospects, financial condition and operating results could be adversely affected.

The EV battery market continues to evolve and is highly competitive, and other battery manufacturers have significantly greater resources than we do.

The EV battery market, like the EV market it services, is fast-growing, extremely competitive and driven by the innovation of both large incumbents and emerging entrants like noco-noco. Lithium-ion battery technology has been widely adopted and our current competitors have, and future competitors may have, greater resources than we do and may also be able to devote greater resources to the development of their current and future technologies. These competitors also may have greater access to clients and may be able to establish cooperative or strategic relationships amongst themselves or with third parties that may further enhance their resources and competitive positioning. In addition, lithium-ion battery manufacturers may continue to reduce cost and expand supply of conventional batteries and, therefore reducing the prospects for our business or negatively impacting our ability to provide our products at a market-competitive price and with sufficient margins.

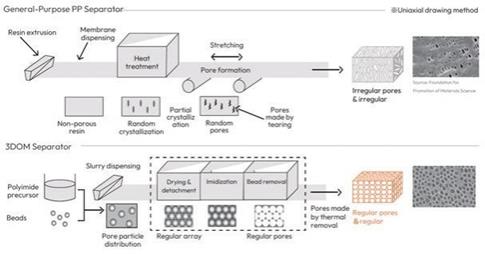

To date, we have focused our efforts on our state-of-the-art X-SEPA separator and lithium manganese iron phosphate (LMFP) cathode. However, a number of development-stage companies are also seeking to develop new technologies for lithium-metal batteries, such as new technologies for cathodes, anodes, electrolytes and additives. Some of these companies have established relationships with OEMs and are in varying stages of development. Additionally, many OEMs are researching and investing in conventional lithium-ion batteries and/or lithium-metal battery efforts and, in some cases, in battery development and production. Furthermore, other companies are developing alternative technologies such as advanced diesel, ethanol, fuel cells or compressed natural gas, as well as potential improvements in the fuel economy of the internal combustion engine. We expect competition in battery technology and BEVs to intensify due to increased demand for EVs. Competition may also be driven by a regulatory push for EVs, continuing globalization, and consolidation in the worldwide automotive industry. Developments in alternative technologies or improvements in battery technology made by competitors may materially adversely affect the sales, pricing and gross margins of our battery products. If a competing technology is developed that has superior operational or price performance, our business will be harmed. Similarly, if we fail to accurately predict and ensure that our battery technology can address clients’ changing needs or emerging technological trends, or if our clients fail to achieve the benefits expected from our battery products, our business will be harmed.

9

Table of Contents

Our future success depends on the needs and success of our clients, as well as the demand for our clients’ products or services.

The demand for our battery products, in particular the batteries and BEVs, will ultimately depend on our clients, consisting primarily of commercial transportation companies, renewable energy plants and power plants. Decisions to purchase or lease our batteries and BEVs may depend on the performance of the industries of our clients and if demand for output in those industries decreases, then the demand for our products may decrease as well. Demand in these industries is impacted by numerous factors, including, but not limited to, commodity prices, infrastructure spending, fuel costs, energy demands, municipal spending and government mandates and incentives. Increases or decreases in these variables may significantly impact the demand for our products.

Many of our target clients are large commercial transportation companies, renewable energy plants and power plants, and the failure to maintain existing clients and secure new clients, withdrawal of leasing services by such clients or failure to negotiate acceptable terms in contract renewal negotiations could have an adverse impact on our business.

Although we intend to lease predominantly to commercial transportation companies, renewable energy plants and power plants, we may not be able to establish or continue our relationships with such commercial transportation companies, renewable energy plants or power plants, if customer demand is not as high as we expect or if they face pressure or contractual obligations from their existing suppliers not to purchase our products or services. We may enter into long-term contracts with certain of these commercial transportation companies, renewable energy plants and power plants, who have substantial bargaining power with respect to price and other commercial terms, and any long-term contracts would be subject to renegotiation and renewal from time to time. Failure to maintain existing clients, obtain new clients, loss of all or a substantial portion of sales to any future clients for whatever reason (including, but not limited to, loss of contracts or failure to negotiate acceptable terms in contract renewal negotiations, loss of market share by these clients, insolvency of such clients, reduced or delayed client requirements, plant shutdowns, strikes or other work stoppages affecting production by such clients) or continued reduction of prices to these clients could have a significant adverse effect on our financial results and business prospects. There can be no assurance that we will be able to maintain existing clients, obtain new clients or secure new contracts.

The level of any future leasing to commercial transportation companies, renewable energy plants and power plants, including the realization of future leasing services from awarded business or obtaining new business or clients, is inherently subject to a number of risks and uncertainties, including the number of vehicles, energy storage or grid stabilization that these commercial transportation companies, renewable energy plants and power plants actually need. Further, to the extent that the financial condition, including bankruptcy or market share, of any of our largest clients deteriorates or their sales otherwise continue to decline, our business, prospects, financial condition and operating results could be adversely affected. Accordingly, we may not in fact realize all of the future sales represented by our awarded business. Any failure to realize these sales could have a material adverse effect on our business, prospects, financial condition and operating results.

We may not be able to engage target clients successfully and to convert such contacts into meaningful orders in the future.

Our success, and our ability to increase revenue and operate profitably, depends in part on our ability to identify target clients and convert target clients into meaningful orders or expand on client relationships. In some cases, certain clients will purchase our battery product samples on an early trial deployment basis, where such clients have the ability to test and evaluate whether our products meet their performance requirements before such clients commit to meaningful orders.

10

Table of Contents

Our future success depends on whether our target clients are willing to use our battery products as well as whether their product lines will incorporate our battery products. If our target clients expand their product lines, we hope to be the primary supplier for their BEVs. Competition in our industry is high. To secure acceptance of our products, we must constantly develop and introduce longer-range and more cost-effective batteries with enhanced functionality and performance to meet evolving industry standards. If we are unable to meet our clients’ performance requirements or industry specifications, retain or engage with target clients, or convert early trial deployments into meaningful orders, our business, prospects, financial condition and operating results could be materially adversely affected.

If we are unable to establish and maintain confidence in our long-term business prospects among clients and analysts and within our industry or are subject to negative publicity, then our financial condition, operating results, business prospects and access to capital may suffer materially.

Clients may be less likely to purchase our battery products if they are not convinced that our business will succeed or that our service and support and other operations will continue in the long term. Similarly, suppliers and other third parties will be less likely to invest time and resources in developing business relationships with us if they are not convinced that our business will succeed. Accordingly, in order to build and maintain our business, we must earn and maintain confidence among clients, suppliers, analysts, ratings agencies and other parties in our products, long-term financial viability and business prospects. Maintaining such confidence may be particularly complicated by certain factors including those that are largely outside of our control, such as our limited operating history, client unfamiliarity with our battery products, any delays in scaling production, delivery and service operations to meet demand, competition, future changes in the evolving hybrid electric and electric vehicle market or uncertainty regarding our production and sales performance compared with market expectations.

If any of our battery products fails to perform as expected, our ability to develop, market and sell our products and services could be harmed.

Our battery products, such as our batteries, BEVs, and ESS, could contain defects in design and production that may cause them not to perform as expected or may require repair. We currently have a limited frame of reference by which to evaluate the performance of our products upon which our business prospects depend. There can be no assurance that we will be able to detect and fix any defects in our battery products. We may experience recalls in the future, which could adversely affect our brand and could adversely affect our business, prospects, financial condition and operating results.

Further, our products may not perform consistent with clients’ expectations. Any product defects or any other failure of our battery products to perform as expected could harm our reputation and result in lost revenue, delivery delays, product recalls, negative publicity, product liability claims and significant warranty and other expenses and could have a material adverse impact on our business, prospects, financial condition and operating results. Additionally, problems and defects experienced by alternative fuel commercial vehicle companies or electric consumer vehicles could by association have a negative impact on public perception and customer demand for our products.

Our battery products will require extensive safety testing prior to being offered to our lessees or installed in electric vehicles and power plants.

To achieve acceptance by our clients, including lessees, and power producers, our anticipated batteries, BEVs and ESS will have to undergo extensive safety testing. We plan to conduct preliminary safety testing for design verification of our battery products at their prototype stage. We are also subject to safety tests for product validation to obtain various safety standard certifications before commencing mass production of our battery products. There can be no assurance that such tests will be successful, and we may identify different or new safety issues in our development or manufacturing of the batteries, BEVs and ESS that have not been present in our prototypes. If we have to make design changes to address any safety issues, we may have to delay or suspend commercialization, which could materially damage our business, prospects, financial condition, operating results and brand.

11

Table of Contents

Any decline in the value of carbon credits or carbon offsets could materially adversely affect our business.

The value of carbon credits and carbon offsets fluctuate based on market, standard-setting and regulatory forces outside our control. Although the value of carbon credits and carbon offsets has been rising in recent years, new technologies or easier carbon credit or carbon offset issuance rules, for example, may facilitate an increase in the supply of carbon credits and carbon offsets that outstrips demand, resulting in the value of carbon credits and carbon offsets to decline. Any such decline could mean demand and pricing for our carbon credit supply offerings would be adversely affected. Apart from supply and demand, the carbon credits prices may also be impacted by micro-and macro-economic conditions, general economic sentiment, international mandates, geopolitical tension, technology enhancements, inflation and currency exchange rates. Any decline in the value of carbon credits or carbon offsets could materially and adversely affect our business, results of operations and financial condition.

Changes in industry standards or practices for issuance or usage of carbon credits or carbon offsets could significantly adversely affect our business.

The issuance and verification procedures, and the recommended usage, for carbon credits or carbon offsets are evolving areas. Changes in these areas could materially and adversely impact our business. Should, for example, issuance standards change such that our carbon-focused projects are not able to issue as many carbon credits or carbon offsets as projected, our available carbon credit pool will decline which will materially negatively impact our business. The demand side of the carbon credit markets are driven by a combination of industry standards and generally accepted practices and regulations. Should industry practices or recommendations change, or the regulatory environment change, there could be a potentially material and adverse effect on our business.

If verified and available carbon sequestration or carbon credits or carbon offsets are lower than projected, our business could be materially adversely affected.

We may make estimates on future carbon potential for our carbon abatement projects, specifically including nature-based projects such as reforestation (or other similar projects such as changes in soil or land management). We may rely on these and other generally available estimates for making carbon neutrality calculations, tree planting commitments and/or carbon credits sales or carbon offsets. If the actual realized carbon sequestration differs from our estimates due to factors, such as differences in survival rates or measured carbon sequestration, or changes in verification methodologies, standards, or changes in required buffer pools (including by third-party verification organizations), fewer carbon sequestration, carbon credits or carbon offsets may be realized and available, which could negatively impact our business and profitability as carbon credits and carbon offsets earned by us may be reduced and we may be required to purchase carbon credits at prevailing market rates.

We cannot guarantee that the approvals of the carbon abatement projects and issuing of Australian Carbon Credit Units (“ACCUs”) will not be revoked, cancelled or otherwise.

We operate our carbon abatement solutions in a variety of Oceanian countries, including Australia and PNG. In Australia, the carbon abatement projects and the issuing of ACCUs are subject to the approvals and regulation of the Australian government and in particular, the Clean Energy Regulator (the “CER”). Prior to issuing ACCUs, the CER reviews and considers applications for approved projects. We cannot guarantee that such approvals and issuing of ACCUs will not be revoked, cancelled or otherwise negatively impacted, in which case our business could be materially adversely affected.

Furthermore, the regulatory bodies may impose further compliance procedures and protocols on our existing or future projects. Any such procedures or protocols will require us to adopt and incorporate any amendments to ensure full and complete compliance of law and regulations. This may result in the delay of carrying out our existing projects, and may also impact the development of our future business activities. The regulation of the ACCUs is subject to government policy changes, and we cannot guarantee that our current business activities will not be impacted by any future amendments to laws and regulations governing the carbon abatement industry.

12

Table of Contents

If we cannot acquire all interested parties’ consent for the carbon abatement projects, or if there is any deficiency in the ownership interests in the properties of the projects, our business could be materially adversely affected.

The carbon abatement project procurement stage may involve several parties with varying interests, which mainly includes landowners, but sometimes also a bank or a lending institution if there is a mortgage on the property to obtain consent or a “no objection certificate” from the lender to file and obtain carbon credits. For certain carbon abatement projects, we may not only need to obtain consent from a single landowner but multiple landowners to tie up contiguous land parcels for carrying out such projects. When we negotiate with the interested parties, we cannot guarantee that we are able to acquire the consent from all of them. If we are not able to do so, the projects will not be carried out according to the planned timetable, and our business could be materially adversely affected. In addition, if there is any deficiency or controversy in the title or ownership of any property which is the subject of a carbon abatement project, we will need to seek to ensure our legitimate business interests as protected, which may result in limiting the resources being applied to our business activities. Furthermore, if we are unsuccessful in protecting our legitimate business interests, our business operations could be materially adversely affected.

Any non-compliance of the landowners on their contractual obligations may affect our carbon abatement solutions business.

Due to the growth of our carbon abatement projects requiring large areas of land, access to land is an integral part of our business activities. In particular, unrestricted access to use and control the land is important to maintain and further our business activities. However, we are generally not the registered owner of any real property, and entirely rely on the licenses and/or agreements in place with the registered landowners and their compliance with their respective contractual obligations. If the landowners do not have valid licenses or approvals, or do not comply with legal requirements or contractual obligations, we may not be able to maintain the necessary rights required for our business activities and therefore it could affect our business operations.

We may not succeed in establishing, maintaining and strengthening our brand, which would materially and adversely affect client acceptance of our technologies and our business, revenues and prospects.

Our business and prospects depend on our ability to develop, maintain and strengthen our brand. If we are not able to establish, maintain and strengthen our brand, we may lose the opportunity to build a critical mass of clients. The battery and EV industry is intensely competitive, and we may not be successful in building, maintaining and strengthening our brand. Our potential competitors, including many battery manufacturers and automotive OEMs around the world, have greater name recognition, broader client relationships and substantially greater marketing resources than we do. If we do not develop and maintain a strong brand, our business, prospects, financial condition and operating results will be materially and adversely impacted.

We operate in an extremely competitive industry and are subject to pricing pressures. Further, many other battery manufacturers have significantly greater resources than we do.

We compete with a number of major international manufacturers and distributors, as well as a number of smaller, regional competitors. We expect competition to become more intense as zero-emission transportation is becoming the mainstream with an increasing number of participants in the industry. Increased competition may result in declines in average selling prices, causing a decrease in margins. Due to excess capacity in some sectors of our industry and consolidation among industrial battery purchasers, we may be subjected to significant pricing pressures.

Many of our competitors have greater financial, personnel, technical, manufacturing, marketing, sales and other resources than we do, which may place us at a competitive disadvantage. In addition, certain of our competitors may have a lower overall cost structure. As a result, these competitors may be in a stronger position to respond quickly to market opportunities, new or emerging technologies and evolving industry standards. Many of our competitors are developing a variety of battery technologies, such as solid state batteries and fuel cell, which are expected to compete with our existing product lines. It is possible that our competitors will be able to introduce new products with more desirable features than ours and their new products will gain greater market acceptance. If our competitors successfully do so, we may not be able to maintain our competitive position and our business and future success would be materially and adversely affected.

13

Table of Contents

We anticipate continued competitive pricing pressure as other producers may be able to employ labor at significantly lower costs, expand their export capacity and increase their marketing presence in our major end markets. Several of our competitors have strong technical, marketing, sales, manufacturing, distribution and other resources, as well as significant name recognition, established positions in the market and long-standing relationships with our industry’s potential client base. In addition, certain of our competitors may have long-standing relationships with suppliers, which may provide them with a competitive pricing advantage and reduce their exposure to volatile raw material costs. Our ability to maintain and improve our operating margins has depended, and continues to depend, on our ability to control and reduce our costs. We cannot assure you that we will be able to continue to control our operating expenses, to raise or maintain our prices or increase our unit volume, in order to maintain or improve our operating results.

The uncertainty in global economic conditions could negatively affect our operating results.

Our operating results are directly affected by the general global economic conditions of the industries in which our major client groups operate. Our business segments are highly dependent on the economic and market conditions in each of the geographic areas in which we operate. Leasing of our batteries, BEVs and ESS, for example, depend significantly on demand for new electric vehicle transportation or ride-sharing companies. The uncertainty in global economic conditions varies by geographic segment and can result in substantial volatility in global credit markets. These conditions affect our business by reducing prices that our clients may be able or willing to pay for our products or by reducing the demand for our products, which could in turn negatively impact our sales and result in a material adverse effect on our business, cash flow, results of operations and financial condition.

Substantial increases in the prices for our raw materials and components, some of which are obtained from a limited number of sources where demand may exceed supply, could materially and adversely affect our business.

We rely on third-party suppliers for components and equipment necessary to develop our products, including key supplies, such as polyimide substrate, organic beads, LMFP cathode material and separator manufacturing machine, for our battery products. We face risks relating to the availability of these materials and components, including that we will be subject to demand shortages and supply chain challenges, especially in the context of the current COVID-19 pandemic, and generally may not have sufficient purchasing power to eliminate the risk of price increases for the raw materials and tools we need. Further, certain components, including drying furnace, 3-layer die, charging and discharging equipment, IC chips and CPUs, have a long lead time which require us to order well in advance to support our proposed commercial operations. To mitigate the supply chain risks, we are adopting an all-round strategy of collaborating with many automaker partners and OEM suppliers. However, to the extent that we are unable to enter into commercial agreements with our prospective suppliers or our replacement suppliers on favorable terms, or these suppliers experience difficulties meeting our requirements, the development and commercial progression of our battery products and related technologies may be delayed.

Separately, we may be subject to various supply chain requirements regarding, among other things, conflict minerals and labor practices. We may be required to incur substantial costs to comply with these requirements, which may include locating new suppliers if certain issues are discovered. We may not be able to find any new suppliers for certain raw materials or components required for our operations, or such suppliers may be unwilling or unable to provide us with products.

Any disruption in the supply of components, equipment or materials could temporarily disrupt production of our battery product until an alternative supplier is able to supply the required material. Changes in business conditions, unforeseen circumstances, governmental changes, and other factors beyond our control or which we do not presently anticipate, could also affect our suppliers’ ability to deliver components or equipment to us on a timely basis. Any of the foregoing could materially and adversely affect our results of operations, financial condition and prospects.

Currency fluctuations, trade barriers, tariffs or shortages and other general economic or political conditions may limit our ability to obtain key components or equipment for our battery products or significantly increase freight charges, raw material costs and other expenses associated with our business, which could further materially and adversely affect our results of operations, financial condition and prospects.

14

Table of Contents

Entering into strategic alliances could expose us to risks.

We have entered into several memorandums of understanding (“MOUs”) for, and may in the future enter into additional, strategic alliances, including joint ventures or minority equity investments, with various third parties to further our business. For example, on November 14, 2022, we entered into a MOU with a view to joining forces with EV Dynamics to form a joint venture. Our strategic alliance with EV Dynamics will allow us to carry out a carbon-free bus leasing business to EV Dynamics’ existing clients as well as other new clients.

While offering potential benefits, these strategic alliances could subject us to a number of risks, including risks associated with sharing proprietary information, non-performance by the partners and increased expenses in establishing new strategic alliances, any of which may materially and adversely affect our business. We may have limited ability to monitor or control the actions of these partners and, to the extent any of these strategic partners suffers negative publicity or harm to their reputation from events relating to their business, we may also suffer negative publicity or harm to our reputation by virtue of our association with any such partner. For example, if we rely on certain strategic partner’s manufacturing facilities to produce our battery products, those operations would be outside of our control. We could experience delays if our partners do not meet agreed upon timelines, satisfy legal, industry or our client’s requirements, or experience capacity constraints, and in turn, we could lose clients and face reputational harm.

Further, there is risk of potential disputes with the strategic partners, and we could be affected by adverse publicity related to our partners whether or not such publicity is related to their collaboration with us. Our ability to successfully build a premium brand could also be adversely affected by perceptions about the quality of our partners’ products. Our OEM partners may also have economic, business, or legal interests or goals that are inconsistent with ours. As a result, it may be challenging for us to resolve issues that arise in respect of the performance of our agreements or MOUs with them, and such issues might impact development work underway under the agreements or MOUs.

Any significant disagreements with them, and especially if we become dependent on that OEM partner for our research and development efforts, may impede our ability to maximize the benefits of our partnerships and slow the commercial roll-out of our battery products. In addition, if our partners are unable or unwilling to meet their economic or other obligations under the agreements or MOUs, we may be required to fulfill those obligations alone, which could delay research and development progress and otherwise negatively impact our business and financial results. Furthermore, the relationships we have with our existing partners and the rights our partners have under their respective agreements or MOUs, may deter other OEMs from working with us. If we are not able to establish or expand our partnership with other OEMs, our business and prospects could be materially harmed.

We are dependent on our suppliers to fulfill our clients’ orders, and if we fail to manage our relationships effectively with, or lose the services of, these suppliers and cannot substitute suitable alternative suppliers, our operations would be materially adversely affected.

We rely on our suppliers for the provision of raw materials, automaker partners and OEM suppliers for the manufacturing of our battery products, including battery separators, cells and packs, BEVs and ESS. While we plan to engage multiple suppliers, automakers and OEMs whenever possible, the inability of our suppliers to deliver the raw materials and battery products manufactured by them at prices, volumes, performance and specifications acceptable to us could have a material adverse effect on our business, prospects, financial condition and operating results. In addition, because we rely on our suppliers and partners to provide raw materials or manufacture battery products that meet our quality standards, there can be no assurance that we can successfully receive quality materials or products from our suppliers and partners that satisfy our quality standards. Any of the foregoing could adversely affect our business, results of operations, financial condition and prospects.

15

Table of Contents

Our failure to keep up with rapid technological changes and evolving industry standards may cause our products to become obsolete and less marketable.

The battery market is characterized by changing technologies and evolving industry standards, which are difficult to predict. This, coupled with frequent introduction of new products and models, has shortened product life cycles and may render our products obsolete or unmarketable. Our ability to adapt to evolving industry standards and anticipate future standards and market trends will be a significant factor in maintaining and improving our prospects for growth. R&D activities, however, are inherently uncertain and require significant costs, and we might encounter practical difficulties in commercializing our new technologies licensed from 3DOM Alliance. On the other hand, our competitors may improve their technologies or even achieve technological breakthroughs that would render our products obsolete or less marketable. Therefore, our failure to effectively keep up with rapid technological changes and evolving industry standards by introducing new and enhanced products may cause us to lose our clients and to suffer a decrease in our revenue.

If we cannot continue to develop new products in a timely manner and at favorable margins, we may not be able to compete effectively.

The battery industry has been notable for the pace of innovations in product life, product design and applied technology. We and our competitors have made and continue to make, investments in innovating and improving our products. Our ability to create new products and line extensions and to sustain existing products is affected by whether we can, among other things:

| • | license-in on favorable terms and maintain innovative intellectual property and technologies from 3DOM Alliance and its licensors; |

| • | obtain governmental approvals and registrations; |

| • | comply with governmental regulations; and |

| • | anticipate client needs and preferences successfully. |

The failure to develop and launch successful new products and any delay in the development or launch of a new product could hinder the growth of our business. In addition, if competitors introduce new or enhanced products that significantly outperform ours, or if they develop or apply manufacturing technology that permits them to manufacture at a significantly lower cost relative to ours, we may be unable to compete successfully in the market segments affected by these changes.

We may obtain licenses on technology that has not been commercialized or has been commercialized only to a limited extent, and the success of our business may be adversely affected if such technology does not perform as expected.

From time to time, we may license from third parties, including 3DOM Alliance, technologies that have not been commercialized or which have been commercialized only to a limited extent. These technologies may not perform as expected within the markets for our battery products. If the cost, performance characteristics, manufacturing process or other specifications of these licensed technologies fall short of our targets, our projected sales, costs, time to market, future product pricing and potential operating margins may be adversely affected.

Developments in alternative technology may adversely affect the demand for our battery products.

Significant developments in alternative technologies, such as advanced diesel, ethanol or natural gas, or breathing batteries, may materially and adversely affect our business, prospects, financial condition and operating results in ways that we may not currently anticipate. Existing and other battery technologies, fuels or sources of energy may emerge as clients’ preferred alternatives to our battery products. Any failure by us to develop new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay our development and introduction of new and enhanced alternative products, which could result in decreased revenue and a loss of market share to our competitors.

We rely on 3DOM Alliance’s R&D efforts which may not be sufficient to adapt to changes in alternative fuel and electric vehicle technology. As technologies evolve, we will need to upgrade or adapt our clean energy solutions with the latest technology, in particular our licensed-in long-life battery technology, and developing intelligent battery systems with CPUs and Internet of Things (IoT) devices attached, in order to leverage on our own-and-lease model. However, we may not compete effectively with alternative systems if we are not able to source and integrate the latest technology into our battery products.

16

Table of Contents

Our products could have undetected defects, errors or bugs in hardware, firmware or software, which could reduce market adoption, damage our reputation with prospective clients, and/or expose us to product liability and other claims that could materially and adversely affect our business.

We may be subject to claims that our products have malfunctioned and persons were injured or purported to be injured due to latent defects. Any insurance that we carry may not be sufficient or it may not apply to all situations. Similarly, to the extent that such malfunctions are related to components obtained from third-party vendors, such vendors may not assume responsibility for such malfunctions. Any of these events could adversely affect our brand, reputation, financial condition or results of operations.

Any defects or errors in product or services offerings, or the perception of such defects or errors, or other performance problems could result in any of the following, each of which could adversely affect our business and results of operations:

| • | expenditure of significant financial and product development resources, including recalls, in efforts to analyze, correct, eliminate or work around errors or defects; |

| • | loss of existing or potential clients or partners; |

| • | interruptions or delays in sales; |

| • | equipment replacements; |

| • | delayed or lost revenue; |

| • | delay or failure to attain market acceptance; |

| • | delay in the development or release of new functionality or improvements; |

| • | negative publicity and reputational harm; |

| • | sales credits or refunds; |

| • | exposure of confidential or proprietary information; |

| • | diversion of development and client service resources; |

| • | breach of warranty claims; |

| • | legal claims under applicable laws, rules and regulations; and |

| • | the expense and risk of litigation. |

We also face the risk that any contractual protections we seek to include in our agreements with clients are rejected, not implemented uniformly or may not fully or effectively protect from claims by clients, business partners or other third parties. In addition, any insurance coverage or indemnification obligations of suppliers for our benefit may not adequately cover all such claims, or cover only a portion of such claims. A successful product liability, warranty, or other similar claim could have an adverse effect on our business, financial condition and results of operations. In addition, even claims that ultimately are unsuccessful could result in expenditure of funds in litigation, divert management’s time and other resources and cause reputational harm.

17

Table of Contents

We are subject to risks relating to production scale manufacturing of our battery products, including battery separators, cells and packs, BEVs and ESS through partners in the longer term.

Our business plan contemplates that automakers and OEMs will manufacture our battery products, including battery separators, cells and packs, BEVs, and ESS, using our unique pre-calculated and calibrated manufacturing process. However, modifying or constructing these lines for production of our products could be more complicated or present significant challenges to our manufacturing partners that we do not currently anticipate. As with any large-scale capital project, any modification or construction of this nature could be subject to delays, cost overruns or other complications. Any failure to commence commercial production on schedule likely would lead to additional costs and could delay our ability to generate meaningful revenues. In addition, any such delay could diminish any “first mover” advantage we aim to attain, prevent us from gaining the confidence of OEMs and open the door to increased competition. All of the foregoing could hinder our ability to successfully launch and grow our business and achieve a competitive position in the market.

Further, collaboration with third parties to manufacture our battery products reduces our level of control over the process. We could experience delays if our partners do not meet agreed upon timelines or experience capacity constraints. There is risk of potential disputes with partners, which could stop or slow production, and we could be affected by adverse publicity related to our partners, whether or not such publicity is related to such third parties’ collaboration with us. In addition, we cannot guarantee that our suppliers will not deviate from agreed-upon quality standards.

We may be unable to enter into agreements with manufacturers on terms and conditions acceptable to us and therefore we may need to contract with other third parties or create our own commercial production capacity. We may not be able to engage other third parties or establish or expand our own production capacity to meet our needs on acceptable terms, or at all. The expense and time required to adequately complete any transition may be greater than anticipated. Any of the foregoing could adversely affect our business, results of operations, financial condition and prospects.