UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For

the fiscal year ended

OR

OR

Date of event requiring this shell company report _________________________

For the transition period from ___________ to ___________

Commission

file number:

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant’s Name Into English)

(Jurisdiction of Incorporation or Organization)

(Address of Principal Executive Offices)

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange On Which Registered | ||

| * | * |

| * | Not for trading, but only in connection with the listing of the American Depositary Shares on |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate

the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered

by the annual report (December 31, 2023): There were

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | Emerging growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No

Annual Report on Form 20-F

Year Ended December 31, 2023

TABLE OF CONTENTS

i

| ITEM 9. | THE OFFER AND LISTING | 66 |

| A. Offer and Listing Details | 66 | |

| B. Plan of Distribution | 66 | |

| C. Markets | 66 | |

| D. Selling Shareholders | 67 | |

| E. Dilution | 67 | |

| F. Expenses of the Issue | 67 | |

| ITEM 10. | ADDITIONAL INFORMATION | 67 |

| A. Share Capital | 67 | |

| B. Bylaws | 67 | |

| C. Material Contracts | 75 | |

| D. Exchange Controls | 75 | |

| E. Taxation | 75 | |

| F. Dividends and Paying Agents | 81 | |

| G. Statement by Experts | 81 | |

| H. Documents on Display | 81 | |

| I. Subsidiary Information | 81 | |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 81 |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 82 |

| A. Debt Securities | 82 | |

| B. Warrants and Rights | 82 | |

| C. Other Securities | 82 | |

| D. American Depositary Shares | 82 | |

| PART II | ||

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 92 |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITIES HOLDERS AND USE OF PROCEEDS | 92 |

| ITEM 15. | CONTROLS AND PROCEDURES | 92 |

| ITEM 16 | [RESERVED] | 93 |

| ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | 94 |

| ITEM 16B. | CODE OF ETHICS | 94 |

| ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 94 |

| ITEM 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 94 |

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 95 |

| ITEM 16F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | 95 |

| ITEM 16G. | CORPORATE GOVERNANCE | 95 |

| ITEM 16H. | MINE SAFETY DISCLOSURE. | 95 |

| ITEM 16I. | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS. | 95 |

| PART III | ||

| ITEM 17. | FINANCIAL STATEMENTS | 96 |

| ITEM 18. | FINANCIAL STATEMENTS | 96 |

| ITEM 19. | EXHIBITS | 96 |

ii

INTRODUCTORY NOTES

Use of Certain Defined Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

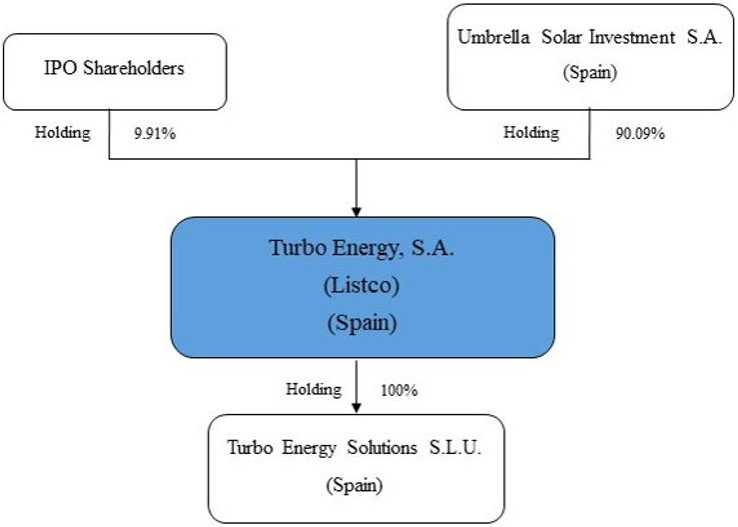

| ● | “we,” “us,” “the Company,” “our” or “our company” are to the combined business of Turbo Energy, S.A. (named before Turbo Energy S.L.), a Spanish corporation, and its consolidated subsidiary; |

| ● | “Umbrella Solar” is to Umbrella Solar Investment S.A. a company established under the laws of the Kingdom of Spain on March 23, 2018, our parent company. Mr. Enrique Selva Bellvis, our Chairman of the Board, owns 23.21% shares of Umbrella Solar. Crocodile Investment owns 54% shares of Umbrella Solar. Umbrella Solar is a public company listed in Spain on BME GROWTH; |

| ● | “Turbo Energy Solutions” is to Turbo Energy Solutions S.L.U. (named before IM2 Proyecto 35 S.L.U), a company established under the laws of the Kingdom of Spain on August 1, 2019, our wholly owned subsidiary; |

| ● | “Crocodile Investment” is to Crocodile Investment, S.L.U., a company established under the laws of the Kingdom of Spain on November 8, 2013. Crocodile Investment is Umbrella Solar’s 54% shareholder. Mr. Enrique Selva Bellvis, our Chairman of the Board, owns 100% shares of Crocodile Investment; |

| ● | “EUR euros”, “euros” and “€” are to the legal currency of the European Union; and |

| ● | “U.S. dollars,” “dollars,” “USD”, “US$”, or “$” are to the legal currency of the United States. |

Forward-Looking Information

In addition to historical information, this annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; and any statements regarding future economic conditions or performance, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements. Potential risks and uncertainties include, among other things, the possibility that third parties hold proprietary rights that preclude us from marketing our products, the emergence of additional competing technologies, changes in domestic and foreign laws, regulations and taxes, changes in economic conditions, uncertainties related to legal system and economic, political and social events in Spain, a general economic downturn, a downturn in the securities markets, and other risks and uncertainties which are generally set forth under Item 3 “Key information—D. Risk Factors” and elsewhere in this annual report.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

iii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable for annual reports on Form 20-F.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable for annual reports on Form 20-F.

ITEM 3. KEY INFORMATION

A. [RESERVED]

Not applicable.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our ADSs involves a high degree of risk. The following risk factors describe circumstances or events that could have a negative effect on our business, financial condition or operating results. You should carefully consider the risks described below, together with all of the other information included in this annual report, before making an investment decision. If any of the following risks actually occur, our business, financial condition or results of operations could suffer. In that case, the trading price of our ADSs could decline, and you may lose all or part of your investment. Additional risks and uncertainties not currently known to us or that we currently believe are not material could also impair our business, financial condition or operating results. Some statements in this annual report, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section titled “Cautionary Statement Regarding Forward-Looking Statements”.

Summary of Risk Factors

Investing in our company involves significant risks. These risks include the following:

| ● | Our products may experience quality problems from time to time that could result in negative publicity, litigation, product recalls and warranty claims, which could result in decreased revenues and harm to our brands. |

| ● | We expect to incur research and development costs and devote significant resources to developing new products, which could significantly reduce our profitability and may never result in revenue to the Company. |

1

| ● | Our success depends on our ability to develop new products and capabilities that respond to customer demand, industry trends or actions by our competitors and failure to do so may cause us to lose our competitiveness in the battery industry and may cause our profits to decline. |

| ● | We are dependent on a few customers for a significant amount of our net revenues. |

| ● | We currently report our financial results under IFRS, which differs in certain significant respect from U.S. generally accepted accounting principles. |

| ● | There has been no prior market for our ADSs and an active and liquid market for our ADSs may fail to develop, which could harm the market price of our ADSs. |

| ● | We are a Spanish corporation, and it may be difficult to enforce judgments against us in U.S. domestic courts. |

| ● | The deposit agreement provides that any legal action may only be instituted in a state or federal court in the city of New York, which may result in holders of our ADSs or ordinary shares having limited choice of forum and limited ability to obtain a favorable judicial forum for complaints against us or our respective directors, officers or employees. |

| ● | The deposit agreement waives holders of our ADSs’ right to jury trial in any legal proceeding arising out of the deposit agreement or the ADRs against us and/or the depository, which could result in less favorable outcomes to the plaintiffs in any of such actions. |

| ● | The form of Representative’s Warrant provides that any legal action may only be instituted in a state or federal court in the city of New York, New York, which may result in holders of the Representative’s Warrant having limited choice of forum and limited ability to obtain a favorable judicial forum for complaints against us or our respective directors, officers or employees. |

| ● | We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies. |

| ● | As a foreign private issuer, we are permitted to rely on exemptions from certain Nasdaq corporate governance standards applicable to domestic U.S. issuers. This may afford less protection to holders of our shares. |

| ● | Mr. Enrique Selva Bellvis, our Chairman of the Board, currently owns a majority of our outstanding ordinary shares. As a result, he has the ability to approve all matters submitted to our shareholders for approval. |

| ● | Future issuances of our ADSs or ordinary shares or securities convertible into, or exercisable or exchangeable for, our ordinary shares, or the expiration of lock-up agreements that restrict the issuance of new ADSs or ordinary shares or the trading of outstanding ADSs or ordinary shares, could cause the market price of our ADS to decline and would result in the dilution of your holdings. |

| ● | We have broad discretion in the use of our cash and cash equivalents, including the net proceeds we received in our initial public offering, and may not use them effectively. |

| ● | Holders of ADSs are not treated as holders of our ordinary shares. |

2

Risks Relating to Our Business and Industry

Our products may experience quality problems from time to time that could result in negative publicity, litigation, product recalls and warranty claims, which could result in decreased revenues and harm to our brands.

A catastrophic failure of our products could cause personal or property damages for which we would be potentially liable. Damage to or the failure of our products to perform to customer specifications could result in unexpected warranty expenses or result in a product recall, which would be time consuming and expensive. Any product recall in the future, whether it involves our or a competitor’s product, may result in negative publicity, damage our brand and materially and adversely affect our business, financial condition and results of operations. In the future, we may voluntarily or involuntarily initiate a recall if any of our products are proven to be or possibly could be defective or noncompliant with applicable environmental laws and regulations, including health and safety standards. Such recalls involve significant expense and diversion of management attention and other resources, which could adversely affect our brand image, as well as our business, financial condition and operating results.

Our solution, by making use of energy monitoring and management software, is susceptible to cyberattacks that could cause the management system to malfunction or even stop, without preventing the photovoltaic generation of the installation.

We may be subject to product liability claims.

If one of our products were to cause injury to someone or cause property damage, including as a result of product malfunctions, defects, or improper installation, then we could be exposed to product liability claims. We could incur significant costs and liabilities if we are sued and if damages are awarded against us. Further, any product liability claim we face could be expensive to defend and could divert management’s attention. The successful assertion of a product liability claim against us could result in potentially significant monetary damages, penalties or fines, subject us to adverse publicity, damage our reputation and competitive position, and adversely affect sales of our products. In addition, product liability claims, injuries, defects, or other problems experienced by other companies in similar industry could lead to unfavorable market conditions for the industry as a whole, and may have an adverse effect on our ability to attract new customers, thus harming our growth and financial performance.

We expect to incur research and development costs and devote significant resources to developing new products, which could significantly reduce our profitability and may never result in revenue to the Company.

Our future growth depends on penetrating new markets, adapting existing products to new applications and customer requirements, and introducing new products that achieve market acceptance. We plan to incur significant research and development costs in the future as part of our efforts to design, develop, manufacture and introduce new products and enhance existing products. Our research and development expenses were €361,420 (approximately $399,803), €169,435 and €106,786 during the fiscal year ended December 31, 2023, 2022 and 2021 and are likely to grow in the future. Further, our research and development program may not produce successful results, and our new products may not achieve market acceptance, create additional revenue or become profitable.

3

Our success depends on our ability to develop new products and capabilities that respond to customer demand, industry trends or actions by our competitors and failure to do so may cause us to lose our competitiveness in the battery industry and may cause our profits to decline.

Our success will depend on our ability to develop new products and capabilities that respond to customer demand, industry trends or actions by our competitors. There is no assurance that we will be able to successfully develop new products and capabilities that adequately respond to these forces. In addition, changes in legislative, regulatory or industry requirements or in competitive technologies may render certain of our products obsolete or less attractive. If we are unable to offer products and capabilities that satisfy customer demand, respond adequately to changes in industry trends or legislative changes and maintain our competitive position in our markets, our financial condition and results of operations would be materially and adversely affected.

The research and development of new products and technologies is costly and time consuming, and there are no assurances that our research and development of new products will be either successful or completed within anticipated timeframes, if at all. Our failure to technologically evolve and/or develop new or enhanced products may cause us to lose competitiveness in the renewable energy storage market. In addition, in order to compete effectively in the renewable energy storage industry, we must be able to launch new products to meet our customers’ demands in a timely manner. However, we cannot provide assurance that we will be able to install and certify any equipment needed to produce new products in a timely manner, or that the transitioning of our manufacturing facility and resources to full production under any new product programs will not impact production rates or other operational efficiency measures at our manufacturing facility. In addition, new product introductions and applications are risky, and may suffer from a lack of market acceptance, delays in related product development and failure of new products to operate properly. Any failure by us to successfully launch new products, or a failure by our customers to accept such products, could adversely affect our results.

The markets in which we operate are in their infancy and highly competitive, and we may not be successful in competing in these industries as the industry further develops. We currently face competition from new and established domestic and international competitors and expect to face competition from others in the future, including competition from companies with new technology.

The worldwide energy storage market is in its infancy, and we expect it will become more competitive in the future. We also expect more regulatory burden as customers adopt this new technology. There is no assurance that our energy storage systems will be successful in the respective markets in which they compete. A significant and growing number of established and new companies, as well as other companies, have entered or are reported to have plans to enter the energy storage market. Most of our current and potential competitors have significantly greater financial, technical, manufacturing, marketing, sales networks and other resources than we do and may be able to devote greater resources to the design, development, manufacturing, distribution, promotion, sale and support of their products. Increased competition could result in lower unit sales, price reductions, revenue shortfalls, loss of customers and loss of market share, which could harm our business, prospects, financial condition and operating results. The energy storage industry is highly competitive.

We face competition from other manufacturers, developers and installers of energy storage systems, as well as from large utilities. Decreases in the retail prices of electricity from utilities or other renewable energy sources could make our products less attractive to customers.

Events that negatively impact the growth of renewable energy will have a negative impact on our business and financial condition.

The growth and profitability of our business is dependent upon the future growth of renewable energy, such as wind and solar. The growth of renewable energy and an increase in the number of renewable energy projects are dependent upon a number of factors, including governmental policies offering incentives that encourage the building of renewable energy projects and offset the cost of alternative energy sources, including new technologies. Any events or change in the regulatory framework or electricity energy market that negatively impact the growth and development of renewable energy, particularly wind and solar energy, will have a negative impact on our business and financial condition.

4

If the estimates and assumptions we use to determine the size of our total addressable market are inaccurate, our future growth rate may be affected and the potential growth of our business may be limited.

Market estimates and growth forecasts are subject to significant uncertainty and are based on assumptions and estimates that may prove to be inaccurate. Even if the market in which we compete meets our size estimates and forecasted growth, our business could fail to grow at similar rates, if at all. Our market opportunity is also based on the assumption that our existing and future offerings will be more attractive to our customers and potential customers than competing products and services. If these assumptions prove inaccurate, our business, financial condition and results of operations could be adversely affected.

We are dependent on a few customers for a significant amount of our net revenues.

Historically a significant amount of our product sales has been generated from a small number of customers. For example, our top 10 customers, on an aggregate basis, accounted for approximately €5,004,061 (approximately $5,535,492) in revenue or 37.5% of our revenue for the fiscal year ended December 31, 2023. For the fiscal year ended December 31, 2022, revenues from our top 10 customers accounted for approximately €11,206,474 or 35.9% of our revenue. For the fiscal year ended December 31, 2021, Sonepar Iberica Spain accounted for 12% of our total revenue. The next largest client, Grupo Electro Stocks, accounted for 7.1% of our revenue for the fiscal year ended December 31, 2021.

There are inherent risks whenever a large percentage of total revenues are concentrated with a limited number of customers. It is not possible for us to predict the future level of demand for our services that will be generated by these customers. In addition, revenues from these larger customers may fluctuate from time to time based on the commencement and completion of projects, the timing of which may be affected by market conditions or other facts, some of which may be outside of our control. If any of these customers experience declining or delayed sales due to market, economic or competitive conditions, we could be pressured to reduce the prices we charge for our services and products which could have an adverse effect on our margins and financial position, and could negatively affect our revenues and results of operations and/or trading price of our ordinary shares. If any of these largest customers terminates our services, such termination would negatively affect our revenues and results of operations and/or trading price of our ordinary shares. There is no assurance that we will be successful in our efforts to convince customers to accept our products. Our failure to sell our products could have a material adverse effect on our financial condition and results of operations.

For most of our sales and customers, we do not have long-term contracts. Future agreements with respect to pricing, returns, promotions, among other things, are subject to periodic negotiation with such customers. No assurance can be given that our customers will continue to do business with us. The loss of any of our significant customers will have a material adverse effect on our business, results of operations, financial condition and liquidity. In addition, the uncertainty of product orders can make it difficult to forecast our sales and allocate our resources in a manner consistent with actual sales, and our expense levels are based in part on our expectations of future sales. If our expectations regarding future sales are inaccurate, we may be unable to reduce costs in a timely manner to adjust for sales shortfalls.

Real or perceived hazards associated with Lithium-ion battery technology may affect demand for our products.

Press reports have highlighted situations in which lithium-ion batteries have caught fire or exploded. For instance, in 2020, LG Chem recalled several residential solar battery storage products because of concerns about fire safety. Five fires involving these battery systems have been reported, including an explosion at an energy storage facility in Arizona that caused several injuries. Such publicity has resulted in a public perception that lithium-ion batteries are dangerous and unpredictable. Although we believe our battery packs are safe, these perceived hazards may result in customer reluctance to adopt our lithium-ion based technology.

5

Economic conditions may adversely affect consumer spending and the overall general health of our retail customers, which, in turn, may adversely affect our financial condition, results of operations and cash resources.

Uncertainty about the existing and future global economic conditions may cause our customers to defer purchases or cancel purchase orders for our products in response to tighter credit, decreased cash availability and weakened consumer confidence. Our financial success is sensitive to changes in general economic conditions, both globally and nationally. Recessionary economic cycles, higher interest borrowing rates, higher fuel and other energy costs, inflation, increases in commodity prices, higher levels of unemployment, higher consumer debt levels, higher tax rates and other changes in tax laws or other economic factors that may affect consumer spending or buying habits could continue to adversely affect the demand for our products. If credit pressures or other financial difficulties result in insolvency for our customers it could adversely impact our financial results. There can be no assurances that government and consumer responses to the disruptions in the financial markets will restore consumer confidence.

Spanish inflation has increased by 6.0% since 2020. However, recent inflationary pressures have not had a significant impact on our operations. While inflation is recognized as a potential risk, the company does not believe that the impact of inflation on their operations is material. It is possible, however, that future inflationary pressures could have a greater impact on our operations, and we will monitor this risk closely.

We are dependent on a limited number of suppliers for our batteries, inverters, and photovoltaic modules and the inability of these suppliers to continue to deliver, or their refusal to deliver, these products at prices and volumes acceptable to us would have a material adverse effect on our business, prospects and operating results.

We source batteries, inverters, and photovoltaic modules from a limited number of manufacturers located in China. For batteries, while we obtain components for our products and systems from multiple sources whenever possible, we have spent a great deal of time in developing and testing our batteries that we receive from our suppliers. We currently have five different battery suppliers who are all located in China. For our inverters, we import them from a single supplier based in China. The current reliance on suppliers from China for Turbo’s main products has not, to date, posed any drawbacks, despite the contraction in the worldwide supply of products caused by the COVID, which effects continued to be felt in 2023. Even in these circumstances, the constraint did not reduce supply but allowed for a 40% growth in purchases. The large number of suppliers in that country means that Turbo can change suppliers with some ease. A geopolitical conflict with China on a global level would be a potential supply problem, although the economic impact on a large scale in all sectors and in all markets would be even more serious than the lack of supplies.

As to the photovoltaic modules and the structures that support them, they are purchased from different suppliers in the market. We generally do not maintain long-term agreements with our source suppliers. While we believe that we will be able to establish additional supplier relationships, we may be unable to do so in the short term or at all at prices, quality or costs that are favorable to us.

In addition, for our star product, SunBox, the conception, design, manufacture of the exterior and structural part, and assembly of components, are all completed in Spain. While we are working on certifying a second supplier, the assembly of SunBox is provided by a single supplier located in Spain. Any disruption between our relationship with the supplier, or if the supplier is unable to meet our demands, our business and results of operations could be adversely affected.

Changes in business conditions, wars, regulatory requirements, economic conditions and cycles, governmental changes and other factors beyond our control could also affect our suppliers’ ability to deliver components to us on a timely basis or cause us to terminate our relationship with them and require us to find replacements, which we may have difficulty doing. Furthermore, if we experience significant increased demand, or need to replace our existing suppliers, there can be no assurance that additional supplies of component parts will be available when required on terms that are favorable to us, at all, or that any supplier would allocate sufficient supplies to us in order to meet our requirements or fill our orders in a timely manner. The loss of any limited source supplier or the disruption in the supply of components from these suppliers could lead to delays in the deliveries of our battery products and systems to our customers, which could hurt our relationships with our customers and also materially adversely affect our business, prospects and operating results.

6

Tariffs imposed on lithium-ion batteries by the United States government or a resulting trade war could have a material adverse effect on our results of operations.

In 2018, the United States government announced tariffs on certain steel and aluminum products imported into the United States, which has led to reciprocal tariffs being imposed by the European Union and other governments on products imported from the United States. The United States government has implemented tariffs on goods imported from China, and additional tariffs on goods imported from China are under consideration.

The lithium-ion battery industry has been subjected to tariffs implemented by the United States government on goods imported from China. Although we are currently not conducting business in the United States, we plan to enter the U.S. market in the near future. Given that all of our lithium-ion batteries are manufactured in China, potential tariffs on lithium-ion batteries imported from China would increase our costs, require us to increase prices to our customers or, if we are unable to do so, result in lower gross margins on the products sold by us.

The trade war could have a significant adverse effect on world trade and the world economy, as well as on our results of operations. If governments in the jurisdictions where we conduct business impose tariffs on components imported by us from China, such tariffs could have a material adverse effect on our business and results of operations.

Increases in costs, disruption of supply or shortage of raw materials, in particular lithium-ion phosphate cells, could harm our business.

We may experience increases in the costs or a sustained interruption in the supply or shortage of raw materials. Any such increase or supply interruption could materially negatively impact our business, prospects, financial condition and operating results. For instance, we are exposed to multiple risks relating to price fluctuations for lithium-iron phosphate cells.

These risks include:

| ● | the inability or unwillingness of battery manufacturers to supply the number of lithium-iron phosphate cells required to support our sales as demand for such rechargeable battery cells increases; |

| ● | disruption in the supply of cells due to quality issues or recalls by the battery cell manufacturers; and |

| ● | an increase in the cost of raw materials, such as iron and phosphate, used in lithium-iron phosphate cells. |

The economic benefit of our energy storage systems to our customers depends on the cost of electricity available from alternative sources, including local electric utility companies, which cost structure is subject to change.

The economic benefit of our energy storage systems to our customers includes, among other things, the benefit of reducing such customer’s payments to the local electric utility company. The rates at which electricity is available from a customer’s local electric utility company is subject to change and any changes in such rates may affect the relative benefits of our energy storage systems. Further, the local electric utility may impose “departing load,” “standby” or other charges on our customers in connection with their acquisition of our energy storage systems, the amounts of which are outside of our control and which may have a material impact on the economic benefit of our energy storage systems to our customers. Changes in the rates offered by local electric utilities and/or in the applicability or amounts of charges and other fees imposed by such utilities on customers acquiring our energy storage systems could adversely affect the demand for our energy storage systems.

Additionally, the electricity produced by our energy storage systems is currently not cost competitive in some geographic markets, and we may be unable to reduce our costs to a level at which our energy storage systems would be competitive in such markets. As such, unless the cost of electricity in these markets rises or we are able to generate demand for our energy storage systems based on benefits other than electricity cost savings, our potential for growth may be limited.

7

If we fail to scale our business operations and otherwise manage future growth and adapt to new conditions effectively as we grow our company, we may not be able to produce, market, sell and service our products successfully.

Any failure to manage our growth effectively could materially and adversely affect our business, prospects, operating results and financial condition. Our future operating results depend to a large extent on our ability to manage our expansion and growth successfully. We may not be successful in undertaking this expansion if we are unable to control expenses and avoid cost overruns and other unexpected operating costs; adapt our products and conduct our operations to meet local requirements; implement the required infrastructure, systems and processes; and find and hire the right skills to make our growth successful.

If we are unable to achieve our targeted manufacturing costs for our energy storage products, our financial condition and operating results will suffer.

There is no guarantee we will be able to achieve sufficient cost savings to reach our gross margin and profitability goals. We may also incur substantial costs or cost overruns in utilizing and increasing the production capability of our energy storage system facilities.

If we are unable to achieve production cost targets on our products pursuant to our plans, we may not be able to meet our gross margin and other financial targets. Many of the factors that impact our manufacturing costs are beyond our control, such as potential increases in the costs of our materials and components, such as lithium iron phosphate, nickel and other components of our battery cells. If we are unable to continue to control and reduce our manufacturing costs, our operating results, business and prospects will be harmed.

We may need to raise additional capital or financing after our initial public offering to continue to execute and expand our business.

While we expect that our available cash, credit facilities, and the expected net proceeds from our initial public offering will be sufficient to sustain our operations for the next twelve months from the date of this report, we may need to raise additional capital after our initial public offering to support our operations and execute on our business plan. We may be required to pursue sources of additional capital through various means, including joint venture projects, sale and leasing arrangements, and debt or equity financings. Any new securities that we may issue in the future may be sold on terms more favorable for our new investors than the terms of our initial public offering. Newly issued securities may include preferences, superior voting rights, and the issuance of warrants or other convertible securities that will have additional dilutive effects. We cannot assure that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition and results of operations. Our ability to obtain needed financing may be impaired by such factors as the weakness of capital markets, and the fact that we have not been profitable, which could impact the availability and cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, we may have to reduce our operations accordingly.

While we have not made material acquisitions to date, should we pursue acquisitions in the future, we would be subject to risks associated with acquisitions.

We may acquire additional assets, products, technologies or businesses that are complementary to our existing business. The process of identifying and consummating acquisitions and the subsequent integration of new assets and businesses into our own business would require attention from management and could result in a diversion of resources from our existing business, which in turn could have an adverse effect on its operations. Acquired assets or businesses may not generate the expected financial results. Acquisitions could also result in the use of cash, potentially dilutive issuances of equity securities, the occurrence of goodwill impairment charges, amortization expenses for other intangible assets and exposure to potential unknown liabilities of the acquired business.

8

Our business will be adversely affected if we are unable to protect our intellectual property rights from unauthorized use or infringement by third parties.

Any failure to protect our proprietary rights adequately could result in our competitors offering similar products, potentially resulting in the loss of some of our competitive advantage and a decrease in our revenue, which would adversely affect our business, prospects, financial condition and operating results. Our success depends, at least in part, on our ability to protect our core technology and intellectual property. To accomplish this, we rely on a combination of patents, patent applications, trade secrets, including know-how, employee and third-party nondisclosure agreements, copyright laws, trademarks, intellectual property licenses and other contractual rights to establish and protect our proprietary rights in our technology.

The protection provided by the patent laws is and will be important to our future opportunities. However, such patents and agreements and various other measures we take to protect our intellectual property from use by others may not be effective for various reasons, including the following:

| ● | the patents we have been granted may be challenged, invalidated or circumvented because of the pre-existence of similar patented or unpatented intellectual property rights or for other reasons; |

| ● | the costs associated with enforcing patents, confidentiality and invention agreements or other intellectual property rights may make aggressive enforcement impracticable; and |

| ● | existing and future competitors may independently develop similar technology and/or duplicate our systems in a way that circumvents our patents. |

Our patent application may not result in issued patents, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours.

Turbo Energy, was granted with a patent in October 2023, for one of its software developments that allows it to position its product, SunBox, among the most innovative residential photovoltaic equipment on the market. We have filed another two patent applications before the Spanish Patent and Trademark Office. Our patent applications may not result in issued patents, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours.

We cannot be certain that we are the first creator of inventions covered by pending patent applications or the first to file patent applications on these inventions, nor can we be certain that our pending patent applications will result in issued patents or that any of our issued patents will afford protection against a competitor. In addition, patent applications that we intend to file in different countries are subject to different laws, rules and procedures, and thus we cannot be certain that our patent applications will be issued. In addition, some countries provide significantly less effective patent enforcement than others, such as the United States.

The status of patents involves complex legal and factual questions and the breadth of claims allowed is uncertain. As a result, we cannot be certain that the patent applications that we file will result in patents being issued, or that our patents and any patents that may be issued to us in the near future will afford protection against competitors with similar technology. In addition, patents issued to us may be infringed upon or designed around by others and others may obtain patents that we need to license or design around, either of which would increase costs and may adversely affect our business, prospects, financial condition and operating results.

We rely on trade secret protections through confidentiality agreements with our employees, customers and other parties; the breach of such agreements could adversely affect our business and results of operations.

We rely on trade secrets, which we seek to protect, in part, through confidentiality and non-disclosure agreements with our employees, customers and other parties. There can be no assurance that these agreements will not be breached, that we would have adequate remedies for any such breach or that our trade secrets will not otherwise become known to or independently developed by competitors. To the extent that consultants, key employees or other third parties apply technological information independently developed by them or by others to our proposed projects, disputes may arise as to the proprietary rights to such information that may not be resolved in our favor. We may be involved from time to time in litigation to determine the enforceability, scope and validity of our proprietary rights. Any such litigation could result in substantial cost and diversion of effort by our management and technical personnel.

9

If we are unable to recruit and retain key management, technical and sales personnel, our business would be negatively affected.

For our business to be successful, we need to attract and retain highly qualified technical, management and sales personnel. The failure to recruit additional key personnel when needed with specific qualifications and on acceptable terms or to retain good relationships with our partners might impede our ability to continue to develop, commercialize and sell our products. To the extent the demand for skilled personnel exceeds supply, we could experience higher labor, recruiting and training costs in order to attract and retain such employees. We face competition for qualified personnel from other companies with significantly more resources available to them and thus may not be able to attract the level of personnel needed for our business to succeed.

We may be required to obtain the approval of various government agencies to market our products.

Our products are subject to product safety regulations by numerus governmental organizations. Accordingly, we may be required, or may voluntarily determine to, obtain approval of our products from one or more of the organizations engaged in regulating product safety. These approvals could require significant time and resources from our technical staff, and, if redesign were necessary, could result in a delay in the introduction of our products in various markets and applications. There can be no assurance that we will obtain any or all of the approvals that may be required to market our products.

We may face significant costs relating to environmental regulations for the storage and shipment of our lithium-ion batteries and inverters.

We operate our business globally. Various governmental regulations impose significant environmental requirements on the manufacture, storage, transportation, and disposal of various components of advanced energy storage systems. Although we believe that our operations are in material compliance with applicable environmental regulations, there can be no assurance that changes in such laws and regulations will not impose costly compliance requirements on us or otherwise subject us to future liabilities. Moreover, governments may enact additional regulations relating to the manufacture, storage, transportation, and disposal of components of advanced energy storage systems. Compliance with such additional regulations could require us to devote significant time and resources and could adversely affect demand for our products. There can be no assurance that additional or modified regulations relating to the manufacture, storage, transportation, and disposal of components of advanced energy systems will not be imposed.

Natural disasters, public health crises, political crises and other catastrophic events or other events outside of our control may adversely affect our business.

Any natural disaster related disruptions or other events outside of our control could affect our business negatively, harming our operating results. In addition, if our facilities, or the facilities of our suppliers, third-party service providers or customers, is affected by natural disasters, such as earthquakes, tsunamis, power shortages or outages, floods or monsoons, public health crises, such as pandemics and epidemics, political crises, such as terrorism, war, political instability or other conflict, or other events outside of our control, our business and operating results could suffer. Moreover, these types of events could negatively impact consumer spending in the impacted regions or, depending upon the severity, globally, which could adversely impact our operating results. Similar disasters occurring at our vendors’ manufacturing facilities could impact our reputation and our consumers’ perception of our brands.

If the current effective income tax rate payable by us in any country in which we operate is increased or if we lose any country-specific tax benefits, then our financial condition and results of operations may be adversely affected.

We conduct business in Andorra, Switzerland, Germany, Spain, France, UK, Greece, Croatia, Italy, Macau, Norway, Poland, Portugal, Romania, Slovakia, Uruguay and Morocco, and we file income tax returns in multiple jurisdictions. Our consolidated effective income tax rate could be materially adversely affected by several factors, including changes in the amount of income taxed by or allocated to the various jurisdictions in which we operate that have differing statutory tax rates; changing tax laws, regulations and interpretations of such tax laws in multiple jurisdictions; and the resolution of issues arising from tax audits or examinations and any related interest or penalties.

10

Any compromise of the cybersecurity of our platform could materially and adversely affect our business, operations and reputation.

Our products use cutting-edge technology through our proprietary software developments. Our existing software system and any new software systems we utilize may not perform as expected. If we experience a problem with the functioning of an important software system or a security breach of our information technology (IT) systems, including during system upgrades or new system implementations, the resulting disruptions could adversely affect the operation of our Turbo Energy App and our business,

Despite our implementation of reasonable security measures, our IT systems, like those of other companies, are vulnerable to damages from computer viruses, natural disasters, fire, power loss, telecommunications failures, personnel misconduct, human error, unauthorized access, physical or electronic security breaches, cyber-attacks (including malicious and destructive code, phishing attacks, ransomware, and denial of service attacks), and other similar disruptions. Such attacks or security breaches may be perpetrated by bad actors internally or externally (including computer hackers, persons involved with organized crime, or foreign state or foreign state-supported actors).

Cybersecurity is a risk that Umbrella Solar’s Board of Directors has identified as a key area to be addressed through collaboration with consulting firm at the group level. To this end, Turbo Energy has assigned responsibility for cybersecurity oversight to the IT manager, who works closely with an internal team and trusted local vendors. All parties with access to the management software suite have signed a corresponding confidentiality agreement, and information is not shared or accessible to any hardware supplier.

Furthermore, we are actively working to eliminate remote access to hardware data of suppliers involved in the manufacture of our products. We recognize the importance of ensuring the security and privacy of our systems and customer data, and we remain committed to implementing robust cybersecurity measures to mitigate potential risks.

Cybersecurity threat actors employ a wide variety of methods and techniques that are constantly evolving, increasingly sophisticated, and difficult to detect and successfully defend against. Any future incidents could expose us to claims, litigation, regulatory or other governmental investigations, administrative fines and potential liability. Any system failure, accident or security breach could result in disruptions to our operations. A material network breach in the security of our IT systems could include the theft of our trade secrets, customer information, human resources information or other confidential data, including but not limited to personally identifiable information. To the extent that any disruptions or security breach results in a loss or damage to our data, or an inappropriate disclosure of confidential, proprietary or customer information, it could cause significant damage to our reputation, affect our relationships with our customers and strategic partners, lead to claims against us from governments and private plaintiffs, and adversely affect our business. We cannot guarantee that future cyberattacks, if successful, will not have a material effect on our business or financial results.

11

Many governments have enacted laws requiring companies to provide notice of cyber incidents involving certain types of data, including personal data. If an actual or perceived cybersecurity breach of security measures, unauthorized access to our system or the systems of the third-party vendors that we rely upon, or any other cybersecurity threat occurs, we may incur liability, costs, or damages, contract termination, our reputation may be compromised, our ability to attract new customers could be negatively affected, and our business, financial condition, and results of operations could be materially and adversely affected. Any compromise of our security could also result in a violation of applicable security, privacy or data protection, consumer and other laws, regulatory or other governmental investigations, enforcement actions, and legal and financial exposure, including potential contractual liability. In addition, we may be required to incur significant costs to protect against and remediate damage caused by these disruptions or security breaches in the future.

The ongoing military conflict in Ukraine and geopolitical instability globally may negatively affect our business and financial condition.

We are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability due to the ongoing military conflict between Russia and Ukraine. Our business may be materially adversely affected by any negative impact on the global economy and capital markets resulting from the conflict in Ukraine or any other geopolitical tensions.

U.S. and global markets are experiencing volatility and disruption following the escalation of geopolitical tensions and the start of the military conflict between Russia and Ukraine. On February 24, 2022, a full-scale military invasion of Ukraine by Russian troops was reported. Although the length and impact of the ongoing military conflict is highly unpredictable, the conflict in Ukraine could lead to market disruptions, including significant volatility in commodity prices, credit and capital markets, as well as supply chain interruptions. We are continuing to monitor the situation in Ukraine and globally and assessing its potential impact on our business.

Governments in the United States and many other countries, or the Sanctioning Bodies, have imposed economic sanctions on certain Russian individuals, including politicians, and Russian corporate and banking entities. The Sanctioning Bodies, or others, could also institute broader sanctions on Russia. These sanctions, or even the threat of further sanctions, may result in the decline of the value and liquidity of Russian securities, a weakening of the ruble or other adverse consequences to the global economy.

The current war in Ukraine, and geopolitical events stemming from such conflicts, could cause consumer confidence and spending to decrease or result in increased volatility in the worldwide financial markets and economy. The extent and duration of the military action, resulting sanctions and resulting future market disruptions in the region are impossible to predict, but could be significant and have a severe adverse effect worldwide financial markets and economy.

Any of the abovementioned factors could adversely affect consumer demand, our business, financial condition, results of operations, liquidity and cash flows. The extent and duration of the military action, sanctions and resulting market disruptions are impossible to predict, but could be substantial. Any such disruptions may also magnify the impact of other risks described in this Item.

There has been no prior market for our ADSs and an active and liquid market for our ADSs may fail to develop, which could harm the market price of our ADSs.

Prior to our initial public offering, there has been no public market on a U.S. national securities exchange for our ADSs or ordinary shares. Although our ADSs have started trading on the Nasdaq Capital Market, a liquid public market for our ADSs may not develop. The initial public offering price for our ADSs has been determined by negotiation between us and the underwriters based upon several factors, including prevailing market conditions, our historical performance, estimates of our business potential and earnings prospects, and the market valuations of similar companies. The price at which the ADSs are traded after the initial public offering may decline below the initial public offering price, meaning that you may experience a decrease in the value of your ADSs regardless of our operating performance or prospects.

12

We are a Spanish corporation, and it may be difficult to enforce judgments against us in U.S. domestic courts.

We are a corporation organized under the laws of the Kingdom of Spain and substantially all of our assets are located outside the United States. Virtually all of our assets and a substantial portion of our current business operations are conducted in Spain. In addition, almost all of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons are located outside the United States. As a result, it may be difficult or impossible for U.S. shareholders to serve process within the United States upon us or to enforce judgment upon us for civil liabilities in U.S. courts. In addition, you should not assume that courts in the countries in which we are incorporated or where our assets are located (1) would enforce judgments of U.S. courts obtained in actions against us based upon the civil liability provisions of applicable U.S. federal and state securities laws or (2) would enforce, in original actions, liabilities against us based upon these laws.

The deposit agreement provides that any legal action may only be instituted in a state or federal court in the city of New York, which may result in holders of our ADSs or ordinary shares having limited choice of forum and limited ability to obtain a favorable judicial forum for complaints against us or our respective directors, officers or employees.

The deposit agreement, the ADRs and the ADSs will be interpreted in accordance with the laws of the State of New York. The rights of holders of ordinary shares (including ordinary shares represented by ADSs) are governed by the laws of the Kingdom of Spain. As an owner of ADSs, you irrevocably agree that any legal action arising out of the Deposit Agreement, the ADSs or the ADRs, involving the Company or the Depositary, may only be instituted in a state or federal court in the city of New York.

This choice of forum provision may increase cost for the holders of our ADSs or ordinary shares and limit their ability to bring a claim in a judicial forum that they find favorable for disputes with us, the depositary or the depositary’s respective directors, officers or employees, which may discourage such lawsuits against us, the depositary and the depositary’s respective directors, officers or employees. However, it is possible that a court could find either choice of forum provision to be inapplicable or unenforceable. The enforceability of similar choice of forum provisions has been challenged in legal proceedings. It is possible that a court could find this type of provision to be inapplicable or unenforceable.

To the extent that any such claims may be based upon federal law claims, Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Furthermore, Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. Accordingly, actions by holders of our ADSs or ordinary shares to enforce any duty or liability created by the Exchange Act, the Securities Act or the respective rules and regulations thereunder must be brought in a federal court in the city of New York. Holders of our ADSs or ordinary shares will not be deemed to have waived our compliance with the federal securities laws and the regulations promulgated thereunder. In addition, because substantially all of our assets are located outside the United States and almost all of our directors and officers are nationals and residents of countries other than the United States, courts in the countries in which we are incorporated or where our assets are located may not enforce judgments of U.S. courts obtained in actions against us based upon the civil liability provisions of applicable U.S. federal and state securities laws.

The deposit agreement waives holders of our ADSs’ right to jury trial in any legal proceeding arising out of the deposit agreement or the ADRs against us and/or the depository, which could result in less favorable outcomes to the plaintiffs in any of such actions.

The deposit agreement provides that, to the extent permitted by law, ADS holders waive the right to a jury trial of any claim they may have against us or the depositary arising out of or relating to our ordinary shares, the ADSs or the deposit agreement, including any claim under U.S. federal securities laws. If we or the depositary oppose a jury trial demand based on the waiver, the court would determine whether the waiver was enforceable on the facts and circumstances of that case in accordance with applicable case law. However, you will not be deemed, by agreeing to the terms of the deposit agreement, to have waived our or the depositary’s compliance with U.S. federal securities laws and the rules and regulations promulgated thereunder.

13

To our knowledge, we believe that a contractual pre-dispute jury trial waiver provision is generally enforceable, including under the laws of the State of New York, which govern the deposit agreement, by a federal or state court in the City of New York, which has exclusive jurisdiction over matters arising under the deposit agreement. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether a party knowingly, intelligently and voluntarily waived the right to a jury trial.

This jury trial waiver provision can discourage claims or limit shareholders’ ability to bring a claim in a judicial forum that they find favorable. If any holders or beneficial owners of ADSs bring a claim against us or the depositary in connection with matters arising under the deposit agreement or the ADSs, including claims under federal securities laws, such holder or beneficial owner may not be entitled to a jury trial with respect to such claims, which may have the effect of limiting and discouraging lawsuits against us and the depositary. If a lawsuit is brought against either or both of us and the depositary under the deposit agreement in New York, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in increasing costs of bringing a claim and having limited access to information and other imbalances of resources between us and the depositary and the claimant. A case that is only heard by a judge or justice of the applicable trial court may result in different outcomes than a trial heard by jury would have. Nevertheless, if this jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the deposit agreement with a jury trial. No condition, stipulation or provision of the deposit agreement or ADSs serves as a waiver by any holder or beneficial owner of ADSs or by us or the depositary of compliance with U.S. federal securities laws and the rules and regulations promulgated thereunder.

The form of Representative’s Warrant provides that any legal action may only be instituted in a state or federal court in the city of New York, New York, which may result in holders of the Representative’s Warrant having limited choice of forum and limited ability to obtain a favorable judicial forum for complaints against us or our respective directors, officers or employees.

The form of Representative’s Warrant will be interpreted in accordance with the laws of the State of New York. Holders of the Representative’s Warrant are irrevocably agreeing that any legal action arising out of the Representative’s Warrant involving the Company may only be instituted in a state or federal court in the city of New York.

This choice of forum provision may increase costs for the holders of the Representative’s Warrant and limit their ability to bring a claim in a judicial forum that they find favorable for disputes with us, which may discourage such lawsuits against us. However, it is possible that a court could find the choice of forum provision to be inapplicable or unenforceable. To the extent that any such claims may be based upon federal law claims, Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Furthermore, Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. Accordingly, actions by holders of the Representative’s Warrant to enforce any duty or liability created by the Exchange Act, the Securities Act or the respective rules and regulations thereunder must be brought in a federal court in the city of New York. Holders of the Representative’s Warrant will not be deemed to have waived our compliance with the federal securities laws and the regulations promulgated thereunder. In addition, because substantially all of our assets are located outside the United States and almost all of our directors and officers are nationals and residents of countries other than the United States, courts in the countries in which we are incorporated or where our assets are located may not enforce judgments of U.S. courts obtained in actions against us based upon the civil liability provisions of applicable U.S. federal and state securities laws.

14

We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies.

Because we qualify as a foreign private issuer under the Exchange Act, we are exempt from certain provisions of the securities rules and regulations in the United States that are applicable to U.S. domestic issuers, including:

| ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q or current reports on Form 8-K; |

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| ● | the selective disclosure rules by issuers of material nonpublic information under Regulation FD. |

We are required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, we intend to publish our financial results on a semi-annual basis as press releases, distributed pursuant to the rules and regulations of Nasdaq Press releases relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information that would be made available to you were you investing in a U.S. domestic issuer.

As a foreign private issuer, we are permitted to rely on exemptions from certain Nasdaq corporate governance standards applicable to domestic U.S. issuers. This may afford less protection to holders of our shares.

We are exempted from certain corporate governance requirements of Nasdaq by virtue of being a foreign private issuer. As a foreign private issuer, we are permitted to follow the governance practices of our home country in lieu of certain corporate governance requirements of Nasdaq. As result, the standards applicable to us are considerably different than the standards applied to domestic U.S. issuers. For instance, we are not required to:

| ● | have a majority of Independent Director. |

| ● | have an Audit Committee as we will not be considered a Public Entity under the Spanish law and in case Turbo would be listed in a Growth market in Spain equivalent to Nasdaq will have a majority of the board be independent (although all of the members of the Audit Committee must be independent under the Exchange Act); or |

| ● | have a Compensation Committee and a Nominating and Corporate Governance Committee to be comprised solely of “independent directors”. |

Although we do not currently intend to rely these “home country” exemptions, we may rely on some of these exemptions in the future. As a result, our shareholders may not be provided with the benefits of certain corporate governance requirements of Nasdaq.

Mr. Enrique Selva Bellvis, our Chairman of the Board, currently owns a majority of our outstanding ordinary shares. As a result, he has the ability to approve all matters submitted to our shareholders for approval.

Mr. Enrique Selva Bellvis, our Chairman of the Board, currently owns approximately 71.22% of our outstanding ordinary shares as date of this annual report. He therefore may have the ability to approve all matters submitted to our shareholders for approval including:

| ● | election of our board of directors; |

| ● | removal of any of our directors; |

15

| ● | any amendments to our certificate or articles of incorporation; and |

| ● | adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us. |

In addition, this concentration of ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our share price or prevent our shareholders from realizing a premium over our share price.

We qualify as a “controlled company” under Nasdaq corporate governance rules and we may be exempt from certain corporate governance requirements that could adversely affect our public shareholders.

Since Mr. Enrique Selva Bellvis, our Chairman of the Board, is the beneficial owner of a majority of the voting power of our issued and outstanding share capital following, we qualify as a “controlled company” under the Nasdaq Stock Market Rules. Under these rules a company of which more than 50% of the voting power is held by an individual, group or another company is a controlled company and may elect not to comply with certain corporate governance requirements, including the requirement that a majority of our directors be independent, as defined in the Nasdaq Stock Market Rules, and the requirement that our compensation and nominating and corporate governance committees consist entirely of independent directors. A “controlled company” may elect not to comply with certain corporate governance requirements, including, without limitation (i) the requirement that a majority of the board of directors consist of independent directors, (ii) the requirement that the compensation of our officers be determined or recommended to our board of directors by a Compensation Committee that is comprised solely of independent directors, and (iii) the requirement that director nominees be selected or recommended to the board of directors by a majority of independent directors or a Nominating and Corporate Governance Committee comprised solely of independent directors. Currently, we rely on the “controlled company” exemption. Since we elect to rely on the “controlled company” exemption, a majority of the members of our board of directors are not independent directors and our Nominating and Corporate Governance Committee and Compensation Committees do not consist entirely of independent directors. Our status as a controlled company could cause our Securities to look less attractive to certain investors or otherwise harm our trading price.

We will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not emerging growth companies and our shareholders could receive less information than they might expect to receive from more mature public companies.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we will be permitted to, and intend to, rely on exemptions from certain disclosure requirements. These provisions include exemption from the auditor attestation requirement under Section 404 of the Sarbanes-Oxley Act of 2002 in the assessment of the emerging growth company’s internal control over financial reporting. In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year during which we have total annual gross revenues of at least $1.235 billion; (ii) the last day of our fiscal year following the fifth anniversary of the completion of our initial public offering; (iii) the date on which we have, during the preceding three year period, issued more than $1.0 billion in non-convertible debt; or (iv) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which could occur if the market value of our securities that are held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.