UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

For the fiscal year ending

For the transition period from __________ to __________.

Commission

file number:

(Exact name of registrant as specified in its charter)

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices, including ZIP Code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Smaller

reporting company | ||

| Emerging

growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

The registrant was not a public company as of the last business day of its most recently completed second fiscal quarter and, therefore, cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates as of such date.

As of January 16, 2024, there were shares of common stock, no par value, issued and outstanding.

Table of Contents

| Page | ||

| PART I | ||

| ITEM 1: | BUSINESS | 1 |

| ITEM 2: | PROPERTIES | 19 |

| ITEM 3: | LEGAL PROCEEDINGS | 19 |

| PART II | ||

| ITEM 5: | MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND PURCHASES OF EQUITY SECURITIES | 20 |

| ITEM 6: | [RESERVED] | 22 |

| ITEM 7: | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | 22 |

| ITEM 8: | FINANCIAL STATEMENTS | F-1 |

| ITEM 9A. | CONTROLS AND PROCEDURES | 35 |

| PART III | ||

| ITEM 10: | DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE | 36 |

| ITEM 11: | EXECUTIVE COMPENSATION | 42 |

| ITEM 12: | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 45 |

| ITEM 13: | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 46 |

| ITEM 14: | PRINCIPAL ACCOUNTING FEES AND SERVICES | 48 |

| PART IV | ||

| ITEM 15: | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 49 |

| SIGNATURES | 50 | |

| i |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may appear throughout this annual report, including in the following sections: “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that may cause actual results to differ materially. When used in this annual report, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements include, but are not limited to, statements contained in this annual report relating to our business strategy, our future operating results, and our liquidity and capital-resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you, therefore, against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation:

| ● | our ability to effectively operate our business segments; |

| ● | our ability to manage our research, development, expansion, growth, and operating expenses; |

| ● | our ability to evaluate and measure our business, prospects, and performance metrics; |

| ● | our ability to compete, directly and indirectly, and succeed in a highly competitive and evolving industry; |

| ● | our ability to respond and adapt to changes in technology and customer behavior; |

| ● | our ability to protect our intellectual property and to develop, maintain, and enhance a strong brand; and |

| ● | other factors relating to our industry, our operations, and results of operations. |

Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

USE OF CERTAIN DEFINED TERMS

Unless the context otherwise requires, in this annual report on Form 10-K references to:

| ● | the “Company,” “INNO,” the “registrant,” “we,” “our,” or “us” mean INNO HOLDINGS INC. and its subsidiaries; | |

| ● | “year” or “fiscal year” means the year ending September 30; | |

| ● | all dollar or $ references, when used in this prospectus, refer to United States dollars; | |

| ● | “framing” means the process of connecting building materials together to create a structure; | |

| ● | “stud” means a vertical framing member which forms part of a wall or partition, also known as a wall stud, a fundamental component of frame construction; | |

| ● | “truss” means a web-like roof design that uses tension and compression to create strong, light components that can span a long distance; | |

| ● | “joist” means a horizontal structural member used in framing to span an open space, often between beams that subsequently transfer loads to vertical members; | |

| ● | “cold-formed steel” or “CFS” or “light-gauge steel” or “LGS” means steel products shaped by cold-working processes carried out near room temperature, such as rolling, pressing, stamping, bending, etc.; | |

| ● | “turnkey cost” is the total cost that must be covered before a product or service is ready to be sold and used by consumers; | |

| ● | “prefab” means a building manufactured in sections to enable assembly on site. |

| ii |

PART I

ITEM 1. BUSINESS

Overview

INNO HOLDINGS INC. (“INNO,” “we,” “us,” or “Company”) is an innovative building-technology company with a mission to transform the construction industry with our proprietary cold-formed steel-framing technology and other building innovations. INNO recognized the inherent inefficiency and waste in traditional lumber-based construction techniques and sought to develop steel-based construction technologies to solve the problems. INNO takes its name from “innovation” and is committed to the research and development of steel studs/tracks/headers, providing higher performance and greater efficiencies in all aspects of construction, making better structural solutions for both commercial and residential buildings, resulting in substantial labor cost savings, in our view. The Company’s products are created using a combination of intelligent machines and cutting-edge techniques to provide an optimal design solution of framing for engineers, builders, and construction companies. We are currently a manufacturer of cold-formed-steel members and we offer a full range of services required to transform raw materials into precise steel framing products and prefabricated homes. We sell these finished products either to businesses or directly to customers. The finished products and cold-formed-steel members are used in a variety of building types, including residential, commercial, industrial, and infrastructure. We hope to transform the building industry by reducing construction times while providing more affordable, environmentally sustainable, and durable solutions compared to traditional construction materials and methods. We believe we are also well positioned to disrupt the construction industry, which now accounts for $10 trillion of the global economy.

We work with our customers to manufacture products in accordance with the customers’ drawings and specifications. Our work complies with specific national and international codes and standards applicable to the construction industry. We believe that we have earned our reputation through outstanding technical expertise, attention to detail, and a total commitment to excellence in customer service.

Our primary manufacturing operations are located on approximately five acres in Brookshire, Texas. Our facility houses state-of-the-art equipment that gives us the capability to manufacture 15,000 linear feet of product per day. We offer a full range of services such as structural designs, metal stud production, and preassembly of metal studs into steel wall panels, which are required to transform raw materials into finished products that are compliant with local building codes. Our manufacturing capabilities include fabrication operations, such as cutting, punching, forming and assembling, and machine operations, which includes computer numerical controlled (“CNC”) machine operations. We also provide support services for our manufacturing capabilities: manufacturing engineering (planning, fixture and tooling development, and manufacturing), quality control (inspection and testing), materials procurement, production control (scheduling, project management, and expediting), and final assembly.

All manufacturing at our facility is done in accordance with our written quality assurance program, which meets specific national codes as well as international codes, standards, and specifications. For example, we have ICC-ES evaluation reports (ESR-4641) that show that our cold-formed steel-framing members are compliant with the 2018 and 2015 International Building Code (“IBC”), 2019 California Building Code (“CBC”), and 2020 Florida Building Code. The standards used for each customer project are specific to each customer’s needs, and we have implemented those standards into our manufacturing operations.

Major Drivers of Our Business Opportunity

The traditional construction industry is labor intensive and suffers from a skilled labor shortage, which increases overall labor costs and contributes to inefficiencies in the construction process. Our steel-framing technology can decrease construction times by 50% or more by prefabricating panels and can reduce labor costs proportionately due to reduced construction timelines. Our intelligent CNC cold-formed roller machine automatically punches the holes for Mechanical, Electrical and Plumbing (MEP) channels eliminating many steps at the job site, compared to traditional onsite manual measurement and cutting procedures. INNO is dedicated to bringing automation to the construction industry to solve the overreliance on a declining supply of expensive, skilled labor.

Construction Site

Source: INNO

| 1 |

Reducing the need for on-site customization found in traditional construction processes is not only more profitable, it can decrease the risks associated with an inherently dangerous workplace. According to Frommer D’Amico, “10 Top Hazards In a Building Site”, nearly 6.5 million people go to work at approximately 252,000 construction sites across the U.S each day. On the job, these construction workers face a wide range of occupational safety hazards. Heavy equipment, bad weather and chaotic job site conditions can create dangerous situations. INNO typically manufactures metal studs and prefab wall panels, joists, and trusses within our indoor facility, unaffected by weather. The final products delivered to the jobsite are assembled wall panels, joists and trusses, which means almost 70% of structure framing work has been completed before it gets to the construction site where the remaining tasks are to erect and connect the pieces. A construction jobsite using INNO framing products is typically very clean and organized due to a lack of cuttings and debris, which reduces the risk of safety hazards. We anticipate that cold-formed steel-framing technology will ultimately replace wooden and traditional steel structures and we believe it is a big step forward in construction industry.

Construction site

Source: INNO

We are bringing sustainability to the market by replacing traditional wooden structures with cold-formed steel framing, allowing for the reduction of material waste — an average of 2% of steel scrap versus ~20% for wood waste. All steel scrap is 100% recyclable, which we support through our recycling operations. Many businesses are seeking actions that demonstrate sustainability, and steel is uniquely environmental-friendly in its reuse, giving us an edge in Leadership in Energy and Environmental Design (“LEED”) certifiable products and projects.

Scrap Metal Recycling Bin

Source: INNO

| 2 |

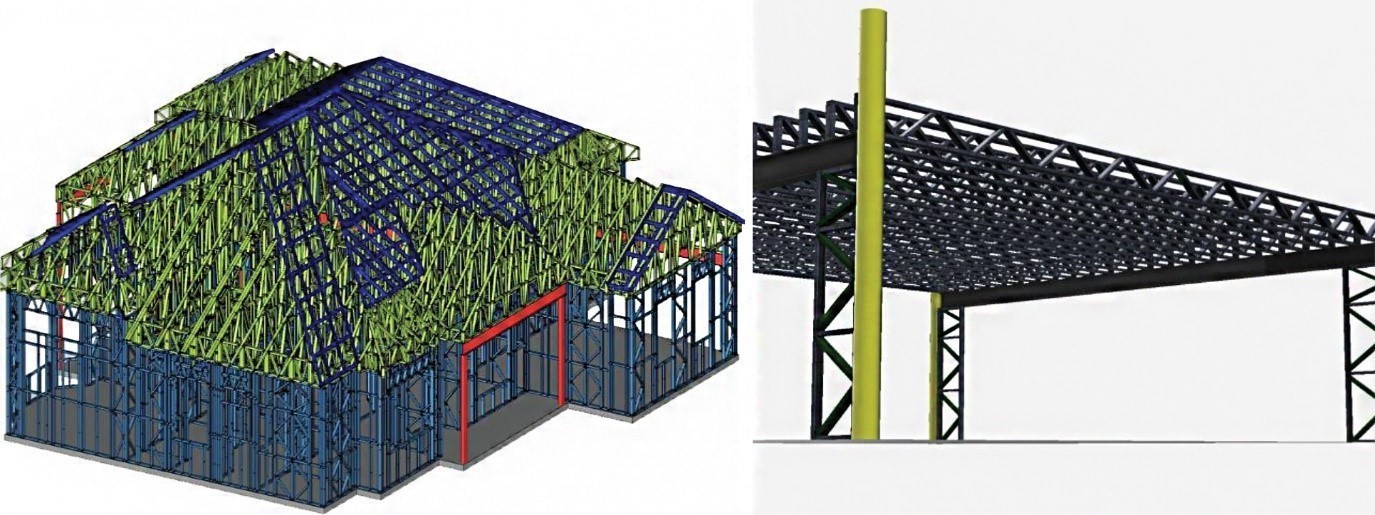

We are constantly striving to produce lasting results within the building technology sector. With increasingly evolving technological advancements in the industry, our objective is to continue staying ahead of the curve by focusing our ongoing research and development on cold-formed steel framing with an emphasis on architectural and engineering technologies. Our cold-formed steel-framing system increases building and labor savings by integrating each stage of the construction process with Building Information Modeling (“BIM”), which is a highly collaborative process that allows architects, engineers, real estate developers, contractors, manufacturers, and other construction professionals to plan, design, and construct a structure or building within one 3D model, to establish a common data environment, ensuring INNO delivers the final products with the minimum amount of rework needed.

BIM Model

Source: INNO

Off-site building is a technique in which a building or an infrastructure is planned and designed in a modular format. Those modules are fabricated offsite in a factory. Once fabricated, those modules are transported to the site and are installed together to finalize the structure. According to the Allied Market Research published report, titled “Offsite Construction Market by Material (Steel, Wood, Concrete, and Others) and Application (Residential, Commercial, and Industrial): Global Opportunity Analysis and Industry Forecast, 2021-2030”, the global Offsite Construction industry generated $130.4 billion in 2020, and is anticipated to generate $235.4 billion by 2030, representing a CAGR of 5.9% from 2021 to 2030. The rapid rise in urbanization and industrialization, increase in the pace of construction, high efficiency of offsite building is driving the growth of this market. The North America off-site construction market size was valued at $49.5 billion in 2021, and is projected to reach $80.9 billion by 2031, representing a CAGR of 4.9% from 2022 to 2031.

In its 2016 article titled, “Imagining Construction’s Digital Future,” McKinsey & Company noted that large construction projects typically take 20% longer to complete than projected and are up to 80% over budget. The article noted that developers are searching for “… off-site approaches that help them improve predictability, consistency, and repeatability.” The article also highlighted that developers can leverage off-site capabilities “… to transform the construction site into a manufacturing system. The result: greater efficiency, less waste, and improved safety.” Off-site construction is one of the five key trends discussed in the article in which we believe INNO participates, Due to our efficient production model, environmentally sustainable solutions, and superior product quality, believe we also participate the other four trends discussed, including green construction; cost efficiency; supply chain agility; and improved durability and strength).

We are leveraging the trend toward off-site and modular building techniques to increase productivity, reduce errors on-site, and decrease construction costs. As the market continues to move toward panelized building, we anticipate having an edge in the industry as a large-scale pioneer and building industry leader with our cost-reducing, time-saving, and quality solutions.

| 3 |

Our Products

Cold-Formed Steel Framing

Cold-formed steel is the material of choice to lower building costs and adapt to modular or off-site building. It is consistent in quality and form, and it can be shipped preassembled or it can be assembled on-site by workers with little training. Our steel roof trusses, wall panels, and joist systems are a cost-effective noncombustible alternative to

traditional building materials. They are now commonly used to build apartments, hotels, temporary housing, nursing homes, commercial buildings, industrial buildings, and single-family detached homes. These types of structures are expected to be the targets of our Company’s sales and marketing team.

Our proprietary cold-formed roller machines are equipped with proprietary software, which optimizes production efficiency and supports individual part customization to ensure each cold-formed-steel member is produced to the exact specifications of the plans. Our intelligent machines can precisely cut and punch out steel studs, leaving channels for the mechanical, electrical, and plumbing designs. We arrive at an accurate, comprehensive, and information-rich design model with the utilization of light-gauge steel-framing engineering software, which creates a digital model of the project that includes all functional systems, geometric features, and aesthetics, such as electrical wiring, air conditioning, doors, and windows. The light-gauge steel-framing engineering software is a shared multidisciplinary resource that allows collaborators to achieve maximum efficiency and effectiveness by compressing design lead time. We have created a full BIM solution that instructs our advanced cold-formed roller machines to produce each steel-framing piece to certain specifications.

After the design phase, our top-quality raw materials are processed on several production lines, each with made-to-order specific dimensions, screw holes, and cross-cut stitching. These customizations reduce the need for on-site manual calculations and simplify the assembling steps, both of which increase construction efficiency and reduce labor costs. All steel-framing products produced by our Company are International Code Council (ICC) certified. The International Code Council is the leading global source of model codes and standards and building safety solutions that include product evaluation, accreditation, technology, training, and certification. The Code Council’s codes, standards, and solutions are used to ensure safe, affordable, and sustainable communities and buildings worldwide.

Our modular steel building framing systems avoid construction delays caused by partial or unsynchronized delivery of different building components. By breaking away from the methods of traditional stick-built building, our customers report that their construction timelines have been reduced at least by 20%.

Castor Cube

Due to high housing prices, some are having difficulties purchasing a home. Housing market trends have shown a gradual preference for modular homes, which is a prefabricated building that consists of repeated sections called modules, and involves constructing sections away from the building site, then delivering them to the intended site where the installation is completed. We believe demand for prefab homes is on an upward growth trend in the United States. According to the Straits Research Institute, North America’s share of the global modular building market was valued at $28 billion in 2021 and is expected to grow to $53 billion by 2030, representing a CAGR of 7%. According to the summary of an IBISWorld report titled, “Prefabricated Home Manufacturing in the US — Market Size 2002-2029,” the prefabricated home manufacturing market size in the U.S. is expected to be $9.1 billion in 2023. We expect to capitalize on this trend by providing high-quality and affordable modular homes.

Most consumers are drawn to prefab homes because of their cost-effectiveness, efficiency, and permanent property characteristics. Castor Cube is a low-maintenance, single-story, 743-square-foot manufactured home with 4 color options that can resist earthquakes, withstand winds, and prevent pests. It is a cold-formed-steel building system equipped with honeycomb panels, and it is designed to maximize the strength-to-weight value. As a result, it yields high structural stability. Castor Cube can be built on a foundation or used as a mobile home.

The Castor Cube can be built on a foundation steel chassis, which can be single or used as a mobile multi-sectioned. We anticipate that this modular home product will be completely constructed within our facilities starting in the fourth quarter of 2023. Once built, it will be transported to permanent locations for installation. The timeline for product delivery is not affected by weather since it will be manufactured in our 100% climate-controlled factory. Furthermore, we expect that streamlined building process will shorten the completion time. We anticipate being able to produce up to one Castor Cube per day beginning in the year of 2024. We believe the Castor Cube demonstrates the effectiveness of our Company’s modular technique.

Castor Cube Rendering

Source: INNO

| 4 |

Mobile Factory: Off-site Equipment Rental, Sales, Service, and Support

We believe innovative technology can increase productivity in the building sector. Research and development of more efficient methods in the manufacturing and building space is at the forefront of our business model.

Our Mobile Factory is an all-in-one, secured production facility that will produce steel-framing members onsite. It can print wall panel, floor truss, and roof truss components. The size is customized for a trailer, which enables it to be transported anywhere, ranging from metropolitan suburbs to remote areas with little to no infrastructure. It is designed to enable immediate stud production on any site.

Our Mobile Factory is complete with metal stud production equipment and a diesel generator. This generator can supply continuous power to our cold-formed roller machine. The production capacity of our Mobile Factory is at least 1,000 linear feet per day. We believe this innovation is the good solution for urgent deployment in disaster areas or remote areas. It is designed to reduce the cost and time of transportation of metal studs, which we believe can drive a lower carbon footprint for larger projects.

Mobile Factory Illustration

Source: INNO

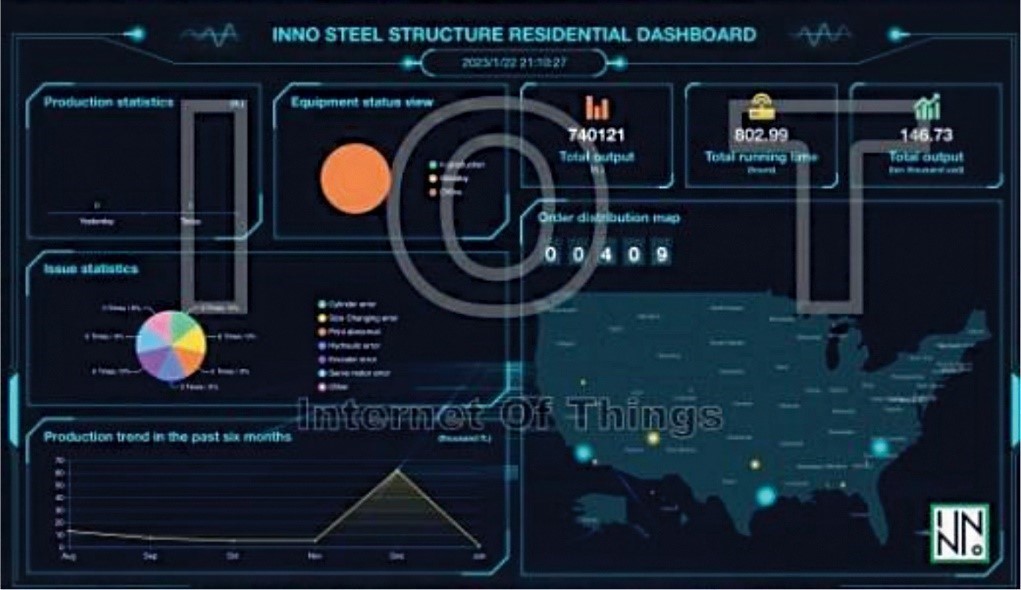

The Mobile Factory is operated and managed by Internet of Things (“IoT”) technology, a network of physical objects that are embedded with sensors, software and other technologies for the purpose of connecting and exchanging data with other devices and systems over the internet. INNO developed its proprietary IoT production management system independently. The system controls equipment and manages the Mobile Factory via a dashboard, allowing the user to gain a comparative understanding of production parameters, such as operation data, machinery breakdown data, uptime data and production efficiency.

IoT Production Management System

Source: INNO

| 5 |

Related Services

We may from time to time participate in land development and contractor services if an opportunity exists to leverage our products. Specifically, we have evaluated the development of apartment complexes, retirement communities, and remodels for projects that would incorporate our metal framing studs. For example, we have agreed to provide project development services for our contract with Vision Opportunity Fund LP, partially owned by a minority shareholder of the Company, related to the development of an approximately 110,000 sqft retirement community.

Our Customers

We can serve commercial, residential, and industrial projects. For the cold-formed steel-framing business, the sales model is business-to-business because the main customers are developers, builders, and contractors. For the Castor Cube prefab home products, the sales model is expected to be either business-to-business or business-to-customer.

On a year-to-year basis we are generally dependent on a small number of major customers that change year to year. Our written agreements with major customers normally terminate upon completion, and our major customers change from year to year. For fiscal year 2023, we had 24 customers, and for fiscal year 2022 we had 46 customers, of which only 10 were customers the prior fiscal year. For the years ended September 30, 2023 and 2022, three customers accounted for 53% and one customer accounted for 15% of the Company’s total revenues, respectively. As of September 30, 2023 and 2022, accounts receivable from one customer accounted for 100% and five customers accounted for 80% of the Company’s total accounts receivable, respectively.

These agreements contain standard construction and supplier agreement terms including payment schedules, performance schedules, the ability to subcontract, insurance obligations and indemnification provisions, and confidentiality provisions. Our written agreements with these customers generally terminate upon completion of the project or early terminate upon mutual agreement of the parties and contain provisions restricting our right to assign the agreement.

Our Suppliers

Historically we rely on a limited number of suppliers. For the years ended September 30, 2023 and 2022, three suppliers accounted for 57% and three suppliers accounted for 75% of the Company’s total purchases, respectively. As of September 30, 2023 and 2022, accounts payable to two suppliers accounted for 55% and three suppliers accounted for 94% of the Company’s total accounts payable, respectively. We currently do not have written agreements with these suppliers or, generally, with any of our suppliers. All of our purchases from these suppliers are made by way of individual orders.

Our Competitive Strengths

Technology Innovations

INNO recognizes that no technology or product is completely immune to being copied, and therefore the company is committed to being a pioneer in the industry by constantly researching and developing new technologies, and being ahead in various aspects of the industry such as regulations, equipment autonomy, design technology, production efficiency, new product birth, orderly management, coordinated transportation, remote production, etc. In this way, INNO aims to have the most advanced and comprehensive technology in the industry and be the true technological barrier for competitors to overcome.

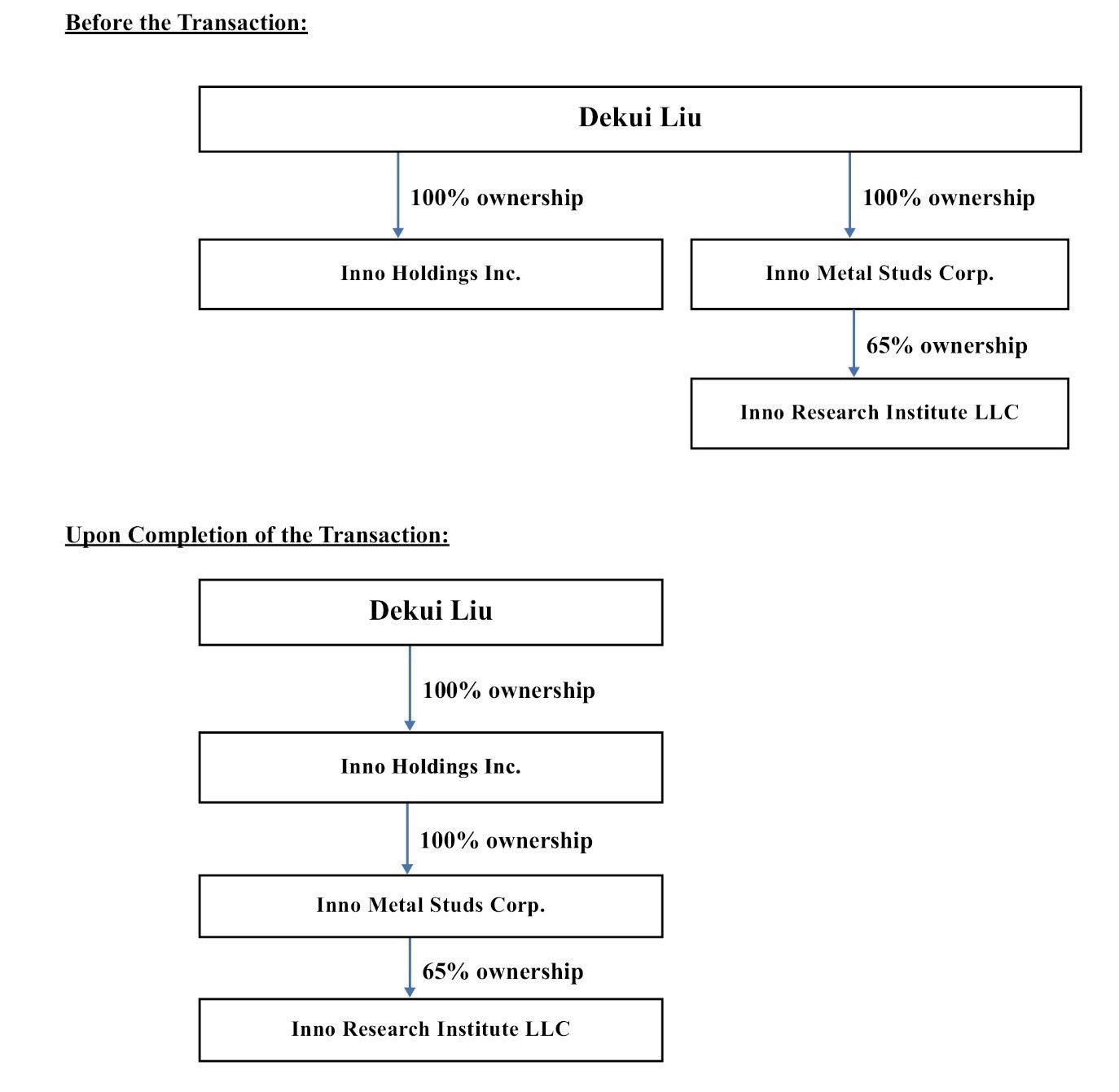

A significant competitive strength in our research and development capability is the Inno Research Institute, LLC, a subsidiary of INNO (“IRI”). IRI focuses on patentable innovative products and commercializing research discoveries in the cold-formed steel industry in the U.S. and committed to bringing innovation in the field of thin-walled structures, cold-formed steel building technology, and design methodology for resilient buildings.

| 6 |

Fully Integrated Manufacturing Process

Compared to other traditional metal stud manufacturers, INNO differentiates itself by integrating services from design to metal stud production to prefabrication, utilizing off-site building technology to reduce the need for on-site framing labor. This approach allows INNO to streamline the production process, increase efficiency, and reduce dependency on labor. By implementing off-site building technologies, INNO is able to prefabricate and assemble many components of the building in a factory setting, which can lead to improved quality control, faster construction times and reduced on-site labor costs. This approach allows INNO to be a leader in the metal studs manufacturing industry in the U.S. and set a new standard for the building industry.

Compared to other prefab home companies, INNO sets itself apart by making an innovation in the overall structure system and developing our own patent pending panel material for faster installation. Unlike other prefab home competitors who still use traditional wood-stick building methods or other unique liquid material (required by 3D printing), which are not as efficient and may not be able to guarantee delivery times, INNO’s patent pending panel material and overall structure system allows for faster installation, improved efficiency and guaranteed delivery times. This allows INNO to offer a more efficient and cost-effective solution for prefab home building and maintain a competitive edge in the market. Additionally, INNO’s patent pending material and system can guarantee the quality and safety of the building, which is a significant advantage over the other prefab home companies.

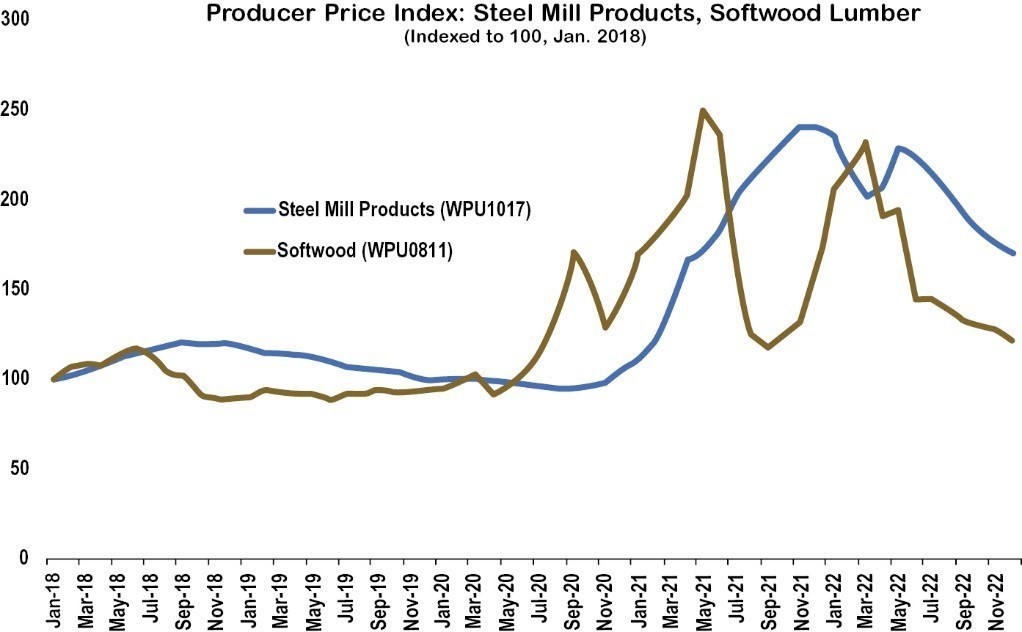

Rising Cost of Traditional Wood Construction Favors Transition to Steel

Utilizing INNO’s off-site building technology can significantly reduce overall construction costs, even when compared to wood building. The past several years of western wildfires in the United States have had a significant impact on lumber stocks and mills, leading to disruptions in supply and fluctuations in lumber prices. A study by the Steel Framing Industry Association (SFIA) indicates that the cost to build with cold-formed steel is relatively the same as building with wood when the cost comparison includes the construction insurance premiums associated with using the materials. As the price of wood no longer provides a cost advantage, alternative building materials like steel have become increasingly popular in the market. By leveraging its off-site building technology, INNO is able to offer a cost-effective solution that takes advantage of the cost benefits of steel building while also providing faster and more efficient construction.

We are keeping our prices at a competitive level with traditional wood framing solutions. In a recent internal case study, we found that INNO’s products delivered real-world cost-savings of 8-16% compared to wood framing. This study compared our solution against wood for a 2,2663 sqft. home built in 2022, for which we supplied materials. Based on fully quoted materials and estimated labor and insurance costs, we estimate the contractor saved 16% by using INNO products compared to wood framing. For the “low” scenario, we recently requested updated wood bids and used the lowest one; in this case, we estimate that INNO products would have provided the contractor with 8% savings.

Market Opportunity

We believe we compete in a $40 billion+ U.S.-based market opportunity in 2023.

Light-Gauge Steel-Framing Market

In concept, cold-formed-steel building structures are very similar to wooden structures. In steel buildings, the wooden structural elements are replaced by thin-walled steel components. The cold-forming process is the core technology used. By our estimates, the U.S. light-gauge steel framing market should be roughly $6 billion in 2023.

According to the report released by Grand View Research in 2020, titled “Light Gauge Steel Framing Market Size, Share & Trends Analysis Report By Type, By End-use, By Region, and Segment Forecasts, 2021-2028”, the global light-gauge steel-framing market was valued at $33.89 billion in 2020 and is expected to reach $48.21 billion by 2028, growing at a CAGR of 4.6% from 2021 to 2028. The substantial rise in construction spending and a shift in trend toward sustainable materials have contributed to higher energy efficiency at a lower cost, in turn driving the market demand for light-gauge steel frames. According to KBV Research’s report released in February 2022, titled “North America Light Gauge Steel Framing Market Size, Share and Industry Trend Analysis Report By Type, By End Use, By Country, Historical Data and Growth Forecast, 2021-2027,” the U. S. market has dominated the North American cold-formed steel-framing market, and it is expected to continue to be a dominant market player until 2027; thereby, achieving a market value of $7.2 billion by 2027.

| 7 |

According to the summary of an IBISWorld report titled, “Wood Framing in the US — Market Size 2005-2029,” the wood framing market size in the U.S. is expected to be $24.9 billion in 2023. Since the wood structures could be replaced by cold-formed-steel structures, INNO’s target market size includes the wood-framing market. If we combined the US light gauge steel (which we estimate to be currently at approximately $6 billion based on the projected market value of $7.2 billion by 2027) and wood framing market ($24.9 billion) opportunities in 2023, we estimate it would amount to a $29.9B market opportunity in which INNO competes.

Prefabricated Building Market

According to the summary of an IBISWorld report titled, “Prefabricated Home Manufacturing in the US — Market Size 2002-2029,” the prefabricated home manufacturing market size in the U.S. is expected to be $9.1 billion in 2023. According to the report released by Global Industry Analysts, Inc, titled “Prefabricated Building Global Market Trajectory & Analytics”, the global prefabricated building market, estimated at $106.1 billion in the year 2020, is projected to reach a revised size of $164.1 billion by 2027, growing at a CAGR of 6.4% over the analysis period of 2020 through 2027. According to Straits Research Institute, the U.S. modular home market is projected to be valued at $53 billion in 2030.

Prefabricated houses are those that are built with the help of prefabricated building materials. These building materials are prefabricated in an off-site facility and then transported to the desired location for assembly. The building materials used to develop prefabricated houses are divided into concrete-based and metal-based materials. The market is being driven by factors such as shorter construction times and cost savings. The market is also benefiting from increased customer interest in reducing CO2 emissions, green building, and waste reduction.

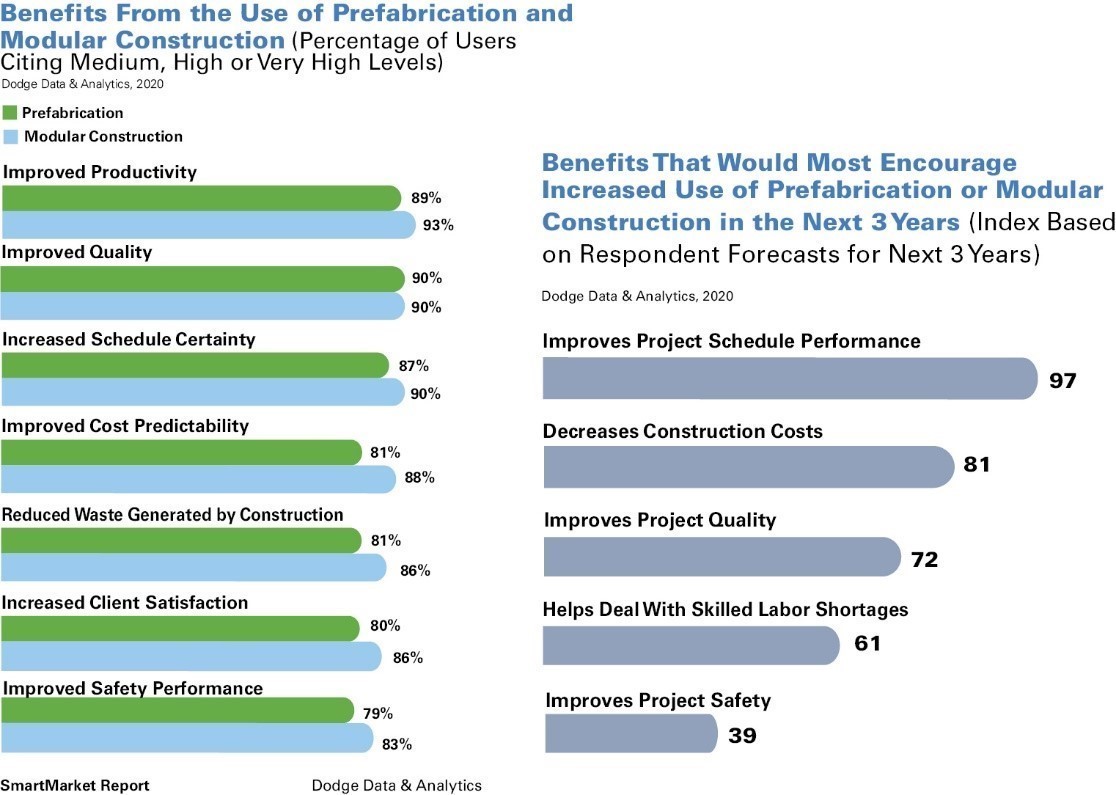

Due to the rise in labor wages and material costs, operators want to unlock greater efficiencies, reduce project costs and increase labor productivity in the face of a skilled labor shortage and low profit margin. Modeling technologies are impacting all aspects of the design and building industry. Studies from Dodge Data & Analytics report reveal a strong correlation between companies’ BIM use and the degree to which they enjoy improved schedule and budget performance from using prefabrication or modular building. The modular building market is gaining popularity among the construction giants owing to the various benefits that it possesses, including reduced waste, speedy building, cost-effectiveness, eco-friendliness, and flexibility. According to experts, modular building projects can be completed 30% to 50% more quickly than traditional building. Modular buildings are extremely flexible, owing to the custom-made fit that are created according to the specific requirements of customers.

Source: DDA’s new SmartMarket report, “Prefabrication and Modular Construction 2020.”

Design firms and contractors alike agree that both prefabrication and modular building are providing significant improvements to cost, schedule, quality and safety performance, productivity, client satisfaction and their ability to reduce waste. According to the McKinsey Global Institute (MGI’s) Reinventing construction: A route to higher productivity report, released in February 2017, parts of the construction industry are moving toward a manufacturing-like system of mass production, relying on prefabricated, standardized components that are produced off-site. Such system would include applications such as fully automated prefabrication processes that turn a 2D drawings or 3D model into a prefabricated building component, or fabrication directly off a 3D model or shop drawings, enabling the production of high-performing components and, ultimately, more efficient parts.

| 8 |

Regulatory and Governmental Pressures for Change

President Biden’s Executive Order 14057 on the adoption of the federal Sustainable Development Catalyst for America’s Clean Energy Industry and Jobs and the accompanying federal Sustainable Development Plan establish the ambitious goal of achieving zero emissions from building by 2045. The federal government will work on new construction, major renovations, and existing real estate to achieve linked electrification, reduced energy use, lower water consumption and waste reduction. The federal government will develop data-driven targets and annual indicators for energy and water reduction by 2030 based on leading performance benchmarks for building type categories and the composition of institutional building portfolios. As part of this journey, the federal government will use performance contracts to reduce emissions, improve efficiency, and modernize facilities while providing financial savings.

In 2021, the Los Angeles City Council Public Safety Committee approved a proposal to expand Fire District I, an anachronistic planning overlay that would effectively ban wood-frame building in much of the city. The motion currently winding its way through City Council would expand Fire District I to neighborhoods with a population density of 5,000 residents per square mile, among other areas. With nearly all of Los Angeles comfortably above 5,000 residents per square mile, this expansion would effectively ban timber and wood-frame building in much of the city, including many rapidly growing neighborhoods near transit.

Sustainability and Green Building

Manufacturing of materials for buildings and construction accounted for approximately 11% of global energy-related CO2 emissions in 2017 according to the Global Status Report 2018, Global Alliance for Buildings and Construction & International Energy Agency. Increased global awareness of green building has driven efforts among all levels of government. For example, local governments are beginning to regulate in favor of using alternatives to wood in building projects. To reduce the city’s vulnerability to wildfires, the Los Angeles City Council voted in early 2021 to explore a proposal that could prohibit the use of wood-frame building for larger developments in some of its most densely populated neighborhoods. Similarly, the Los Angeles City Council Public Safety Committee approval of a proposal in 2021 to expand Fire District 1, an anachronistic planning overlay that would effectively ban wood-frame building in much of the city. In most U.S. cities, fire safety is ensured by the International Building Code (IBC), which sets strict rules on allowable building materials and methods.

Cold-formed steel framing (“CFS”) is a highly sustainable, green building solution. Through technological advances and processing changes, steel has drastically reduced its carbon footprint. CFS boasts a high level of recyclability, energy savings and greenhouses gas reduction. Due to its inherent advantages such as fire-resistance, termite resistance, consistent material quality and sustainability, we believe cold-formed steel will be the optimal alternative building material.

Macroeconomic Factors

The past several years of western wildfires have had a devastating impact on lumber stock and mills that were in the path of these fires, plus the disruption of supply chain due to the COVID-19 pandemic, has resulted in rising lumber prices. The net result of the fall in steel prices and rise in lumber costs is a much stronger case for parity between the two raw materials.

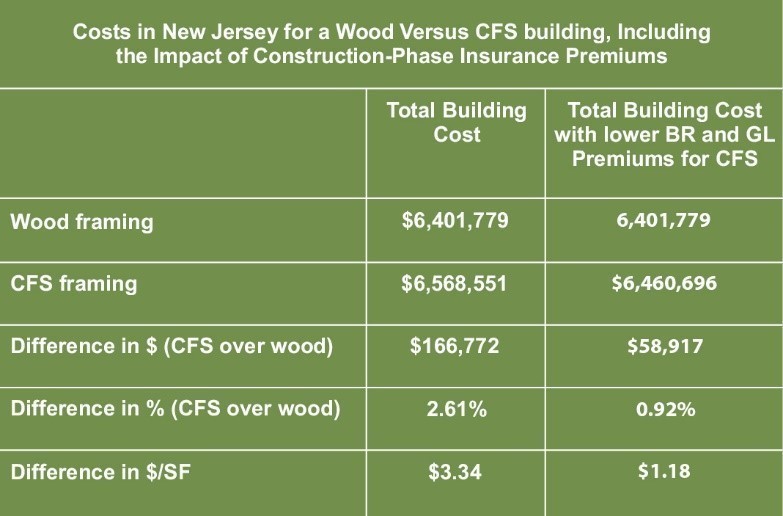

A new study conducted by R.A Smith, Inc., Brookfield, WI, and the SFIA addresses framing costs on behalf of architects, building owners, and general contractors. The study, “Costs to Build with Cold-formed Steel Versus a Wood-Framed Building,” established that CFS framing and wood framing cost relatively the same when the cost comparison included the construction insurance premiums associated with using the selected material. CFS is noncombustible, which reduces the risk of property loss during construction and over the life of the structure. It reduces the risk of property loss leads to lower insurance premiums for builders and owners. The true cost of CFS over wood is less than 1% when insurance is included in the comparison.

| 9 |

Marketing

We are an innovative building-technology company with a mission to transform the construction industry with our proprietary cold-formed steel-framing technology and other innovations. While we have significant customer concentrations, we endeavor to broaden our customer base as well as the industries we serve. Our marketing strategy is a long-term plan to achieve our Company’s mission by understanding the needs of customers and creating a distinct and sustainable competitive advantage. We position ourselves as the leader in intelligent steel-framing building systems. We intend to leverage our marketing and sales efforts to establish new potential customers. We also intend to leverage customer referrals, which in the past have been a source of new business. A significant portion of our business is the result of competitive bidding processes, and a significant portion of our business is from contract negotiation. We believe that the reputation we have developed with our current customers represents an important part of our marketing effort.

Quotation requests from customers are reviewed to determine the specific requirements and our ability to meet such requirements. Quotations are prepared by estimating the material and labor costs and assessing our current production schedule to determine our delivery commitments. Competitive bid quotations are submitted to the customer for review and award of the contract.

We have several strategic partners, including real estate companies, general contractors, builders and developers. Our strategic partners connect our Company with potential customers who are either potential homeowners or developers.

Through the several architecture, builder and contractor associations that we have joined, we share the advantages of cold-formed steel framing with others, and we educate and encourage construction industry practitioners to move out of their wood-framing comfort zone to embrace steel-framing technology.

We have a digital market channel and a social media presence. Also, we are actively conducting market research to determine the viability of our new products and new patents. We have increased our marketing budget and formed a professional sales team to increase our online marketing, which we believe can help us grow our revenue.

Research and Product Development/Innovations

We are a building technology company that is dedicated to research and product development innovation. Our scientists and engineers are committed to developing sturdier steel studs, tracks, headers, and other components, resulting in superior strength while maintaining the lowest costs possible. Our cold-formed roller machine is acquired from an original equipment manufacturer with certain modifications to the standard version of the machine that are unique and proprietary to INNO. When we refer to our “proprietary” cold-formed roller machines, we are referring to the modified machine with the intellectual property and process techniques we have developed. INNO uses CAD (Computer Aided Design) technology to arrive at the most accurate, comprehensive and information-rich design model within its parameters with the utilization of Vertex to ensure each member is produced to the exact specifications of called for in the design. The digital model of the project includes all functional systems and aesthetics, such as electrical wiring, air conditioning, doors, windows etc., as well as geometric features. It is a shared multi-disciplinary resource allowing all those working on a project to share information and working processes in order to achieve maximum efficiency and effectiveness, thus reducing all phases — design, pre-construction and construction — of the construction timeline. The platform gives us open communication, true collaboration, and aligned understanding. Taken all together, INNO has created a full BIM solution that works together to inform our state of the art light-gauge roll forming machines the instructions to automatically produce each steel framing member to exact specification.

We have continued making improvements to our cold-formed roller machines to optimally increase the printing speed. We are actively working on a list of 100 potential patentable products. Our goal is to commercialize patents and technologies that we own.

For example, the CFS portal frame system invented by our CEO could replace current shear wall systems to provide adequate lateral resistance against strong winds and severe earthquakes. The standard lateral force resisting systems in light frame cold-formed steel building are shear walls either sheathed by structural panels such as OSB, Plywood, and steel sheets or braced by steel straps. These systems require a large amount interior walls to be load bearing walls which limits flexibility for room layout and may not support large openings for windows and doors. The steel portal frame system is a novel long span framing system to replace the traditional hot-rolled structural steel frame. The new technologies in the portal frame system include optimized stiffened holes on cold-formed steel frame members to increase structural stability and span capacity and special moment joint technology using adhesive and rivet connections which enable superior energy dissipation capacity and fast fabrication.

| 10 |

This new CFS moment frame does not require any interior shear walls for the Castor Cube, our modular home product. It will allow the Cube to have various room layouts. The homeowners will also be able to change the room layout in the future. The new CFS moment frame can also be used for long-span residential and mid-rise commercial buildings. The new technology should improve the structural integrity of building structures, increase the lateral resistance, and lower the overall costs.

Another innovation, the cold-formed steel truss system, utilizes a strong axis of cold-formed steel stud members for both chords and webs which allow longer spans and lighter weight than the conventional type trusses. The steel truss system has wide applications in storage and education buildings.

We believe the steel truss system and steel portal framing system will also allow INNO to enter the high-rise commercial and large span industrial building markets (Type I and Type II buildings) and deliver more competitive and cost-effective building structures than the traditional structural steel frame and concrete masonry systems.

Honeycomb aluminum panel is a metal composite panel product series developed in combination with the composite honeycomb panel technology developed by the aviation industry. The panel is a box-type structure with surrounding edges, which has good airtightness and improves the safety and service life of the panel. The product adopts a “honeycomb sandwich” structure, that is, a composite plate made of high-strength alloy aluminum plate coated with a decorative coating with excellent weather resistance as the surface, bottom plate and aluminum honeycomb core through high temperature and high pressure. This product series has the advantages of excellent material selection, advanced technology, and reasonable structure. It not only has excellent performance in large scale and flatness, but also has many choices in terms of shape, surface treatment, color and installation system. This advanced technology enables the Company to manufacture high-strength and light-weight wall panel products. These siding products have very flat surfaces and tightly controlled seam widths, which allow architects to design very straight and beautiful walls with large panels. Except for certain technical restrictions, there is no standard size for honeycomb aluminum panels, and all wall panels are factory-made according to design drawings. Our production method allows the panels to be highly flexible in size and shape, such as curved panels and folded panels. This flexibility creates a complete and multi-functional highly competitive wall panel system that can be installed on almost any joist and are extremely simple to install.

Revenue Model

Our revenue model currently consists of sales of the following:

| ● | Light-gauged studs and tracks; | |

| ● | Prefabricated wall panels and trusses; | |

| ● | Structure framing work on site; | |

| ● | Engineering services; | |

| ● | Machine sales; and | |

| ● | Replicable Apartment product. |

Light-gauged studs and tracks

We supply metal studs from 12GA to 24GA depending on the structure engineering requirements and city building codes. The model for selling cold-formed steel studs and tracks is wholesale because it is business-to-business. Given the specific nature of our products, we do not sell retail. Unlike traditional metal stud suppliers, whose products are “made to stock” with no consideration for engineer design, our metal studs are typically made-to-order and customized for each project.

| 11 |

Prefabricated wall panels and trusses

Prefabricated wall panels and trusses are another option for customers. With these products, the customer can either choose to assemble the panels themselves or include this prefab service in their contract with us. Most customers typically choose prefab service because of our skilled team given that most wood framers are not familiar with steel framing.

INNO also has standardized modular wall products which could be used for all residential and commercial buildings. We design modular walls in 20 specifications to cover different building requirements. Modular walls are “made to stock” products and participate in both business-to-business and business-to-customer model channels.

Structure framing work on site

Steel structure installation on site is also an optional service. Depending on the project size and scope, we will provide on-site installation service if customers requested. With our full turnkey solution, all elements of the project construction are included, not just the cold-formed steel. This may include cabinetry and other items. In cases where the customer simply wants the framing, we bring our expertise in working with steel to that portion of the project. We are in the process of reducing our on-site work offerings.

Engineering services

Our engineering services provide stamped and sealed structure design services by our in-house engineer team. Because of the specific nature of our services, the rates vary case by case depending on the square footage and project complexity. Our engineer team will collaborate with customer’s architect, civil engineers, and MEP engineers to make sure the final structure design is city approved. To begin the metal stud production, our engineer team also generates the shop drawings which is a digital file and readable by our intelligent CNC machine. We also have another option where the customer may outsource the engineer service and contact INNO for metal stud production, where we do not provide continuous services until the design is city approved.

Machine sales

We may sell or lease our machines. We provide technical and design support at relatively low costs, including industry compliance license and permits, as well as shop drawings and structural design. We also offer administration, operation, and management consulting support, including directing and assisting factory set-up, operation procedures, equipment installation, machine maintenance, repairs, and efficiency improvement. The training for such operations and installations are also provided. We will recommend, select, and advise pricings for material suppliers and other vendors.

Replicable Apartment Product

Our flagship product within this series is Village 101, a smart senior living apartment comprising 155 units with a floor area of 110,000 square feet. The architectural plan package for Village 101 is complete and ready for implementation. Village 101 serves as a prototype building tech community, showcasing our innovative approach to senior living.

Our pipeline includes various apartment product options with different unit sizes, ranging from 15 to 150 units. These products are under active research and development, with the aim of creating replicable housing complexes across the United States. By leveraging our expertise in building technology and innovative design, we target to provide scalable and high-quality housing solutions that meet the evolving needs of residents including but not limited to senior citizen, college students and Gen Z etc.

Through our revenue model, we anticipate generating sustainable income by catering to the demand for replicable apartment products. By expanding our product line and continually advancing our research and development efforts, we aim to capture a significant market share in the housing industry while delivering superior value to our clients.

| 12 |

Cost of Sales

Cost of Sales primarily consist below components.

| ● | Materials — Rolled steel represents the single largest cost. We manage our relationship with suppliers (primarily US Steel) very adroitly by building in purchase orders and their associated costs to the customer to minimize our exposure to changes in steel prices for any specific project. We manage our purchases and deliveries as close to “just in time” as possible. | |

| ● | Labor — Labor is potentially the most variable component of cost of sales. We have a team of hourly workers who largely work onsite at the factory producing parts from raw steel and assembling them into prefabricated pieces to be delivered to job sites. Contractors are non-employee hourly workers who largely work in our turnkey projects. As-needed hourly labor is largely available in our markets. | |

| ● | Freight and Shipping — Our policy is to include any freight incurred to ship the product from our vendors to warehouses as a part of cost of goods sold. Outbound freight costs related to shipping costs to customers are considered periodic costs and are reflected in selling expenses. |

Other Expenses

Other expenses are typically comprised of payroll of salaried and hourly workers. We pride ourselves on running lean and efficiently. We operate in a business-friendly state with a large and available workforce. Rent, utilities, insurance, consulting service and other normal expenses are all competitive in the commercial area where we are based.

Our Growth Strategy

We seek to leverage the trend toward off-site and modular building techniques to increase productivity, reduce errors on-site, and decrease costs. With both Castor Cube and Mobile Factory as our featured products in the coming years, we seek to become leaders in the industry. As the market continues to move toward panelized construction, we seek to have an edge in the industry as a large-scale pioneer of the overall cost-reducing process.

INNO’s business growth strategy combines the following three parts: revenue growth strategy, profit growth strategy and technology growth strategy.

Revenue Growth Strategy

Our revenue growth strategy is composed of the following.

Capacity expansion and in-house research and development. We plan to expand factory operations and manufacturing capabilities in line with demand. We are also investing in R&D to ensure a pipeline of competitive and innovative building-technology products.

Multiple products. We are in the process of developing the Castor Cube, a 743-square-foot modular house product with the goal of mass producing. We are also working on developing Village 101, a smart senior living apartment comprising 155 units with a floor area of 110,000 square feet. The architectural plan package for Village 101 is complete and ready for implementation. Village 101 serves as a prototype building tech community, showcasing our innovative approach to senior living. Meanwhile, the new products extend to new building material composed of stainless steel, such as stainless-steel roof and panels with the vision of using such materials for seaside buildings.

Marketing investment. We are in the process of optimizing our online sales and marketing efforts by recruiting marketing talent and developing a marketing plan.

Potential Acquisitions. In accordance with our growth strategy, our company intends to pursue vertical integration by acquiring several companies operating within the construction industry in the United States. The objective of this vertical integration is to strengthen our position as a prominent building-technology developer and expand our capabilities within the market. We will position ourselves to offer a comprehensive range of solutions encompassing the entire building. The expanded scope of our offerings includes prefab structure systems, centralized MEP (mechanical, electrical, plumbing) systems, integrated wall systems, integrated floor systems, roofing systems, and prefab cabinets, sinks, and countertops. This integration allows us to deliver a single-cycle turnkey solution, streamlining the traditional linear process employed by traditional developers. To fortify our supply chain and augment our capabilities, we will consider the strategic acquisition of construction vendors/suppliers with the proceeds from IPO to pursue potential acquisitions. The targeted companies would include the ones that enjoy the popularities in the industry, including but not limited to the companies that can supply the interior finish, exterior wall panels, insulation materials and roof system etc. By incorporating the targeted companies into our operations, we will establish a comprehensive one-stop-shop solution for the multi-family apartments, thereby further solidifying our market position and value proposition. Consistent with our growth strategy, we are firmly committed to implementing a robust product life cycle management approach, encompassing all stages from procurement to delivery. Through our pursuit of vertical integration and strategic acquisitions, we are poised for substantial growth to assume a leadership role within the market. By expanding our product offerings, strengthening our supply chain, and cultivating key partnerships, we are well-positioned to provide comprehensive building solutions that effectively meet the evolving needs of our clients while concurrently driving revenue growth and delivering enhanced shareholder value.

| 13 |

Profit Growth Strategy

Our profit growth strategy is composed of the following.

Improving assembly automation. We plan to source and develop production robots and to expand automation where possible, to further increase our production efficiency.

Reducing transportation costs by utilizing Mobile Factory. Our Mobile Factory is equipped with our proprietary machines and can be transported to any jobsite. Mobile Factory utilizes Inno Statlink Data System which is ideal for remote production management. Mobile Factory saves significant transportation costs and as such, our goal is to increase the use of Mobile Factory.

Optimizing artificial intelligence design capabilities. We intend to optimize the artificial intelligence design capabilities by utilizing machine learning to get the wisest structure supporting data and running several models for all types of walls. The model we tested could reduce the raw materials used in different projects.

Technology Growth Strategy

Our technology growth strategy is composed of the following.

Develop EQ products to replace existing building materials with thinner and lighter products. We are developing technology in an effort to replace existing building materials with thinner materials. Once this technology matures, it is expected to save approximately 10% in raw materials.

Develop stainless steel as a building material for the high-end building market. We are developing technology to replace the current galvanized steel sheets with stainless steel. The new patent pending material could be used in extreme climate conditions for high-end customers.

Leverage module wall technology to increase the range of applications. We are in the process of developing different types of module wall products to expand our customer reach.

Strategic Partnerships

We have partnerships with at least 10 regional and national developers and builders. INNO’s customers include national real-estate developers and some local builders in both Texas and California. The regional/national developers and builders have a strong pipeline of projects coming each year. Their project types cover residential, commercial, and industrial. They either intend to use steel framing for structure or to develop land with Castor Cube and Village 101 projects, as their strategic partners, INNO will provide customized offer and have higher probability to bid and win projects. The cold-formed steel framing business is categorized as business-to-business model, and the Castor Cube as well as Village 101 projects will be either to business or to customers.

Competitive Outlook

Lumber-Based vs. Cold-Formed Steel

Our primary competitors (or segment with which we are most often compared) are traditional lumber-based building products solutions in certain categories, particularly buildings below six floors and residential. The accessibility and proficiency in assembling lumber-based structures can make practitioners in construction industry unwilling to move out of the wood framing comfort zone. Further, lumber prices were generally lower than the price of metal studs before the COVID-19 pandemic. The switch to cold-formed Steel is being driven by materials price and several market-based advantages of steel. Steel is strong, safe, durable, versatile, and cost-effective. Steel has the exceptional environmental advantage of being highly recycled and infinitely recyclable. Steel is tough and does not rot, spawl, split, or absorb moisture, and it is resistant to pests, unlike wood building materials.

| 14 |

Inherent Benefits of Steel Framing

| ● | Steel has the highest strength-to-weight ratio of any framing material. | |

| ● | Non-combustible. Steel will not contribute fuel to the spread of fire. | |

| ● | Steel is termite and rodent resistant. | |

| ● | Steel ensures dimensional stability. Will not rot, warp, crack or shrink. | |

| ● | Lower builder’s risk insurance. | |

| ● | Permanently straight walls. No call backs for nail pops. | |

| ● | No toxicity contribution. Free of resins, adhesives, and chemicals normally present in other framing material. | |

| ● | Consistent material quality. No regional variation. | |

| ● | Grounded against electrical storms. | |

| ● | Steel is inorganic. Unlike traditional framing products, steel is not vulnerable to mold. | |

| ● | Steel is the most recycled product in the world. Optimum sustainability. |

The SFIA has conducted studies of construction costs in two different locations using two identical buildings — one designed with wood and the other with cold-formed steel (CFS) framing. The mixed-use, 49,900 square foot building used in the studies is representative of many residential buildings constructed in the mid-rise market today and includes:

| ● | A first floor non-combustible (concrete) podium with parking and retail space | |

| ● | Residential dwellings on levels 2-5 | |

| ● | Roof-top/penthouse space atop level 5 housing building services. |

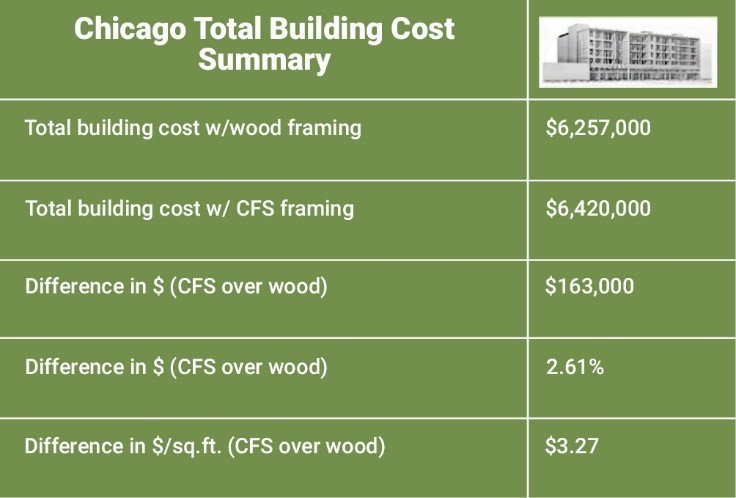

The first location for the study was a building constructed in Chicago in late 2017. Results include hard construction costs only. In this case, cold-formed steel cost 2.6% more than traditional wood construction.

SFIA Cost Analysis: Wood vs. Cold-Formed Steel, Location 1

Source: SFIA

| 15 |

The second location was in Morristown, New Jersey. It takes a deeper look at costs by including the impact of lower insurance premiums available for CFS construction compared to combustible framing (wood). The insurance costs from major insurers operating in New Jersey were converted to a cost per square foot and evaluated in terms of their impact on the overall building costs. In this case, cold-formed steel cost 0.9% more than traditional wood construction.

Cost Comparison Case Study 2

Source: SFIA

The two case studies mentioned above are taken from the official SFIA website. We believe INNO’s product cost is less than that of the preceding case studies, with the overall cost less than that of traditional wood.

Others Participating in Cold-formed Steel

The second category of competitors are divided into two groups: traditional manufacturers of metal studs and suppliers of cold-roller machines. Traditional manufacturers, such as Clark Dietrich and CEMCO, pre-punch their metal studs with punchouts at regular intervals for pipe installation, but the number of punchouts is fixed and not customized for each project. INNO employs proprietary software to calculate the minimum punchouts for MEP pipe installation that are consistent with the architectural plan set to ensure the structure’s load-bearing capability to the greatest extent possible. The load-bearing capability gradually decreases as the number of punchouts increases. Traditional steel framing manufacturers are unable to automatically make punchouts for screw holes, so manual drilling holes at the jobsite for metal stud connections are still required. The screw holes are precisely located and punched by the INNO CNC machines.

Screw hole punchouts are left for panel assembly, and the stud spacing should be building code compliant. The number of screw holes for each panel is calculated systematically, and the screws are included in the product package. We prefabricate the wall panels, joists, and trusses in the factory, eliminating the need for on-site manual labor to measure stud intervals and drill holes for metal stud connection. These two traditional metal studs profile manufacturers have a nationwide retail network that we cannot compete with. We are using the Internet to increase the marginal effect of sales, and our future strategy is to use Internet sales to undermine traditional store-based sales.

In the cold-formed roller machine market, FRAMECAD is a traditional LGS/CFS machine manufacturer. When compared to their LGS equipment, INNO CNC machines manufacturing cost is approximately 50% less, based on our estimates. INNO CNC machines currently have three pending patents, the CUBE 200 (Application number: 63437142), CUBE 300 (Application number: 63427583) and NEW OPTIMIZED DESIGN FOR ROLL FORMER CNC MACHINE (Application number: 63427583). CUBE 200 is able to form C& U type studs and tracks in the thickness of 16 gauge and 6 inches width studs. CUBE 300 is able to form C&U type studs in the thickness of 12 gauge and 12 inches width studs.

In addition, mobile factories are an important countermeasure to traditional equipment. We have developed a mobile factory for offsite production of steel pieces and structures that compete in the traditional prefab and modular building markets. INNO differentiates itself from other steel framing companies and cold-formed roller machine suppliers by integrating services ranging from metal stud manufacturing to prefabrication. In this context, we distinguish ourselves through the technologies and innovations we bring to our process and methods for producing structural components from rolled steel into useful pieces that assemble without error.

| 16 |

3D “Printing” Technology

Currently, 3D printing technology is widely used for prefab homes; however, cooling time is required for formation because the technical principle is to melt the material and then wait for it to cool before settling. In contrast to other prefab home companies, which use 3D printing technology, INNO uses our own cold-formed steel technology to ensure that there is no waiting time for structure formation. 3D printing necessitates the use of unique liquid raw materials such as LAVACRETE and Light Stone Material (LSM), neither of which are easily accessible. This could lead to supply chain disruptions and affect delivery time. Furthermore, the steel is still commonly used to support the structure of prefab homes, regardless of the manufacturing technology used.

Safety is an important factor to consider when choosing a prefab home. Since INNO’s CASTOR CUBE uses steel structure entirely, which has a high strength to weight ratio and good performance to resist disasters such as hurricanes and earthquakes. The foldable prefab home product manufactured by other company may not have the same level of disaster resistance as CASTOR CUBE.

Castor Cube plans to apply a patent for its utility hook-up system, which enable consumers to connect utility within one day. This is a unique feature that can make the process of setting up a prefab home more convenient for consumers. It is also worth noting that according to other prefab companies’ product introduction videos and their social media platforms, they all take around 48 hours to construct a 350 square feet prefab home.

With the usage of INNO’s patent pending honeycomb aluminum panels and Z-shaped pendant designed for replacing manual sheetrock installation, we can significantly reduce the number of manufacturing steps and minimize manual labor. INNO is planning to set up an automatic streamline to produce CASTOR CUBE. This will bring the significant increase in production capacity and it can help INNO to meet the growing demand for prefab homes more efficiently.

Government Regulations

Building Codes

Building codes are laws that set minimum requirements for how structural systems, plumbing, heating, ventilation and air conditioning, natural gas systems and other aspects of residential and commercial buildings should be designed and constructed. In the U.S., building codes mostly fall under the purview of state and local governments. All metal studs used for building structures are required to pass inspections in the jurisdiction they are located. We have ICC-ES evaluation reports (ESR-4641) that show that our cold-formed steel-framing members are compliant with the 2018 and 2015 International Building Code (“IBC”), 2019 California Building Code (“CBC”), and 2020 Florida Building Code (“FBC”). Because of the nature and use of our products, we need to be compliant with quality assurance programs.

Fire safety is one critical area of the building codes. As fire codes become stricter in some geographical areas or specific types of structures, our cold-formed steel materials are inherently non-combustible and therefore are advantaged over combustible alternatives.

Environmental Compliance

We are subject to U.S federal, state, and local environmental laws and regulations that involve the use, disposal and cleanup of substances regulated by those laws and subject to periodic inspections to monitor our compliance. We believe that we are currently in compliance with applicable environmental regulations. Expenditures for environmental compliance purposes during 2023 and 2022 were not material.

We were given awards by the U.S. Green Building Council (“USGBC”) in 2020. Our manufacturing processes minimizes waste, prevents pollution, and recycles wherever possible. Our manufacturing process manufactures special length products for all types of projects, has self-contained building system solutions that do not rely on third-party suppliers, and designs products to fulfill the BCA Energy Efficiency program. This compliance proves that we are a green company that meets basic environmental milestones and legal requirements.

| 17 |

Occupational Health and Safety Laws

Our business and operations are subject to numerous federal, state, and local laws and regulations intended to protect our employees. Due to the nature of manufacturing, we are subject to substantial regulations related to safety in the workplace. In addition to the requirements of local and state governments in Texas, we must comply with federal health and safety regulations, the most significant of which are enforced by the Occupational Safety and Health Administration.

Further, our operations and facilities are subject to additional federal, state, or local laws or regulations, such as the COVID-19 safety and prevention regulations. Our operations are also subject to federal, state, and local labor laws relating to employee privacy, wage and hour matters, overtime pay, discrimination and harassment, equal opportunity and employee leave and benefits.

It is our policy and practice to comply with all legal and regulatory requirements and our procedures and internal controls are designed to promote such compliance. Expenditures for compliance with occupational health and safety laws and regulations during 2023 and 2022 were not material.

Human Capital Resources

The success of our business depends in large part on our ability to attract, retain, and develop a workforce of skilled employees at all levels of our organization. We provide employees with base wages and salaries that we believe are competitive and consistent with each employee’s position. We also work with local, regional, and state-wide agencies to facilitate workforce hiring and development initiatives. We had 11 full-time employees at both of September 30, 2023 and 2022. We also utilize at-will contractors in our business. As of September 30, 2022, we had 10 at-will contractors employed. That number has since grown to 18 contractors as of September 30, 2023.

Intellectual Property Matters

Presently, we have no registered intellectual property rights and trademarks. The trademarks application status of our name and other marketing materials is pending. There are currently five pending patent applications and descriptions of each pending patent are as follows:

| ● | New optimized design for Roll Former CNC machine that efficiently produces C&U type studs and tracks to be used in building high quality, quick erection structures. (Application number: 63427583) | |

| ● | Cube 200, which is a new optimized design for a Roll Former CNC machine that efficiently produces C&U type studs and tracks to be used in building high quality, quick erection structures. (Application number: 63437142) | |

| ● | Z-shaped pendant for castor exterior wall to replace the Z-shaped pendant for sheetrock with honeycomb aluminum plate. (Application number: 63434155) | |

| ● | Cube 300, which is a new optimized design for a Roll Former CNC machine that efficiently produces C&U type studs and tracks to be used in building high quality, quick erection structures. (Application number: 63437143) | |

| ● | Aluminum honeycomb plate for interior wall construction. (Application number: 63367663) |