Index supplement to the prospectus Registration Statement dated April 5, 2018, the prospectus Nos. 333-222672and 333-222672-01 supplement dated April 5, 2018 Dated April 4, 2019 and the underlying supplement dated April 5, 201S Rule 424(b)(3) INDEX BROCHURE 2019 S&P Economic Cycle Factor Rotator Index The S&P Economic Cycle Factor Rotator Index (the “Index”) attempts to provide a dynamic rules-based allocation to one of four equity indices (the “Equity Constituents”) and the (the “Bond Constituent”) while targeting a level volatility. Each month, the index determines the current phase of the business cycle based on the level and trend of the Chicago Fed National Activity Indicator (the “CFNAI”), and selects one of the four Equity Constituents below accordingly: • if the economy is in slowdown, the Index allocates to the S&P 500® Buyback FCF Excess Return Index (“Buyback”) • if the economy is in expansion, the Index allocates to the S&P Momentum United States LargeMidCap (USD) Excess Return Index (“Momentum”) • If the economy is in contraction, the Index allocates to the S&P 500® Low Volatility High Dividend Excess Return Index (“High Div Low Vol”) • If the economy is in recovery, the Index allocates to the S&P 500® Pure Value Excess Return Index (“Value”) The Equity Constituents do not reflect the reinvestment of dividends, and are subject to a notional financing cost based on 3-month cash rates. J.R Morgan Investing in the notes linked to the Index involves a number of risks. See “Selected risks associated with the Index” on page 8 of this document, “Risk Factors” in the relevant product supplement and underlying supplement and “Selected Risk Considerations” in the relevant pricing supplement. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of notes or passed upon the accuracy or the adequacy of this document or the accompanying product supplement, underlying supplement, prospectus supplement or prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits, are not insured by the Federal Deposit Insurance Corporation or any other governmental agency and are not obligations of. or guaranteed by. a bank.

IMPORTANT INFORMATION The information contained in this document is for discussion purposes only. Any information relating to performance contained in these materials is illustrative and no assurance is given that any indicative returns, performance or results, whether historical or hypothetical, will be achieved. All information herein is subject to change without notice, however, J.P. Morgan undertakes no duty to update this information. In the event of any inconsistency between the information presented herein and any other offering document, the other offering document shall govern. Each Equity Constituent is subject to a notional financing cost based on 3-month cash rates, which is calculated based on 2M and 3M USD LIBOR. However, from August 4, 2016 to May 1. 2017. in lieu of the actual levels of 2M and 3M USD LIBOR, the notional financing cost for each Equity Constituent was calculated using 0.6111% and 0.7776% respectively (the levels of 2M and 3M USD LIBOR as of August 4, 2016). As a result, the performance of the Index between August 4, 2016 and May 3, 2017 (the last date on which the stale LIBOR levels impacted the notional financing cost calculation) would have been cumulatively lower by -0.1131% had the notional financing cost applied to the Equity Constituents been calculated using actual LIBOR levels. Furthermore, effective February 1, 2017, the Index began rounding the CFNAI to the nearest basis point (0.01%) for purposes of determining the applicable monthly Equity Constituent, The performance of the index prior to February 1, 2017 does not reflect this change, and the Index has limited operating history based on the rounded CFNAI. USE OF HYPOTHETICAL BACKTESTED RETURNS Any backtested historical performance information included herein is hypothetical. The constituents may not have traded together in the manner shown in the hypothetical backtest of the Index included herein, and no representation is being made that the Index will achieve similar performance. There are frequently significant differences between hypothetical backtested performance and actual subsequent performance. The results obtained from backtesting information should not be considered indicative of the actual results that might be obtained from an investment or participation in a financial instrument or transaction referencing the Index. J.P. Morgan provides no assurance or guarantee that investments linked to the Index will operate or would have operated in the past in a manner consistent with these materials. The hypothetical historical levels presented herein have not been verified by an independent third party, and such hypothetical historical levels have inherent limitations. In addition, the selection methodologies of the SSP 500* Buyback FCF Excess Return Index and the S&P 500* Pure Value Excess Return Index reference financial information reported by the issuers of the securities that are eligible to be included in the relevant index, and the selection methodology applied with respect to any period of back-tested performance could reflect subsequent restatements or corrections of that financial information, even though those restatements or corrections would not have been available had the relevant index been calculated on a live basis. In addition, the monthly selection of the Equity Constituents reference the level and trend of the CFNAI, and the selection methodology applied with respect to any period of back-tested performance prior to 3/1/01 could reflect subsequent restatements or corrections of the CFNAi, even though those restatements or corrections would not have been available had the relevant index been calculated on a live basis. Finally, the selection methodologies of the S&P 500* Buyback FCF Excess Return Index and the SBP 50Q& Pure Value Excess Return Index reference financial information reported by the issuers of the securities that are eligible to be included in the relevant index, and the selection methodology applied with respect to any period of back-tested performance could reflect subsequent restatements or corrections of that financial information, even though those restatements or corrections would not have been available had the relevant index been calculated on a live basis. Alternative simulations, techniques, modeling or assumptions might produce significantly different results and prove to be more appropriate. Actual results will vary, perhaps materially, from the hypothetical backtested returns and allocations presented in this document. HISTORICAL AND BACKTESTED PERFORMANCE AND ALLOCATIONS ARE NOT INDICATIVE OF FUTURE RESULTS. Investment suitability must be determined individually for each investor, and investments linked to the Index may not be suitable for all investors. This material is not a product of J.P. Morgan Research Departments. Copyright (c) 2019 JPMorgan Chase & Co. All rights reserved. For additional regulatory disclosures, please consult: www.jpmorgan.com/disclosures. Information contained on this website is not incorporated by reference in, and should not be considered part of, this document.

Allocating based on the business cycle Each month, the Index determines the current phase of the business cycle based on the average level of the CFNAI over the past 3 months and its trend over the same 3 months, and selects one of the four Equity Co nstituents accordingly: if the average is positive but If the average is positive and the trend is down, the index the trend is up, the index allocates to Buyback allocates to Momentum If the average is negative and If the average is negative the trend is down*, the Index but the trend is up, the allocates to High Div Low Vol Index allocates to Value • If the CFNAI suggests the economy is currently moving from recovery to contraction, the Index waits one month to confirm the signal before rebalancing from Value into High Div Low Vol There is no assurance that the index methodology used to identify the current phase of the business cycle will be effective. THE CHICAGO FED NATIONAL ACTIVITY INDEX The CFNAI is a weighted average of 85 monthly indicators of national economic activity, drawn from four broad categories: production and income; employment, unemployment, and hours; personal consumption and housing; and sales, orders and inventories. The CFNAI is constructed to have: • an average value of zero when the U.S. economy is growing at the historical trend rate; • a negative value when growth is below-average; and • a positive value when growth is above-average. 3

Buyback S&P 500® BUYBACK FCF EXCESS RETURN INDEX Buyback generally provides exposure to large-cap U.S. stocks with relatively higher buybacks and free cash flows compared to the S&P 500* Index. !t rebalances quarterly (March. June. September and December) based on the following general approach: Begin with the S&P 500* Index Constituents \ Select the 100 with the highest buyback ratio as a percentage of their market cap (buybacks are measured over the 12 months ending a quarter earlier) \ Select the 30 with the highest free cash flow yield (excluding J.P. Morgan, Visa and any affiliates) Weight the stocks by free cash flow yield \ Apply the individual concentration limits (7.5% per stock) Momentum S&P MOMENTUM UNITED STATES LARGEMIDCAP (USD) EXCESS RETURN Momentum generally provides exposure to large- and mid-cap U.S. stocks with relatively higher recent performance compared to the SSP United States LargeMidCap Index. It rebalances semi-annually (March and September) based on the following general approach: Begin with the S&P United States LargeMidCap Index constituents \ Rank each stock by its risk-adjusted moment urn score (generally the return from the 14'“ prior month-end to the 2”“ prior month-end divided by volatility over the same period) \ Select the top 16%, then any stocks in the top 24% that are in the prior monthly portfolio, then any stocks in the top 20% until 20% are selectee! \ Weight the stocks by their float-adjusted market cap times their risk-adjusted momentum score Apply the individual concentration limits 4

High Div Low Vol S&P 500 LOW VOLATILITY HIGH DIVIDEND EXCESS RETURN High Div Low Vol/generally provides exposure to large-cap U.S. stocks with relatively higher dividends and lower volatility compared to the S&P 500® Index. It rebalances semi-annually (January and July) based on the following general approach: Begin with the S&P 500® Index Constituents S elect the 75 with the highest dividend yield (subject to a maximum of 10 per GICS1 industry} Select the 50 with the lowest realized volatility Weight the stocks by dividend yield \ Apply the individual and sector concentration limits (3% per stock and 25% per GIC5® industry) Value S&P 500® PURE VALUE EXCESS RETURN Value generally provides exposure to large-cap U.S. stocks with relatively cheaper prices (compared to fundamentals) and relatively lower growth compared to the S&P 500* Index. It rebalances annually in December based on the following general approach: Begin with the S&P 500* Index Constituents \ Calculate normalized scores for value (based on price/book, price/earnings and price/sales) and for growth (based on EPS growth, sales per share growth and momentum) \ Seiect the stocks that are most representative of high value/low growth stock \ Seiect the stocks that have substantially higher-than-average value scores Weight the stocks by capped value scores 5

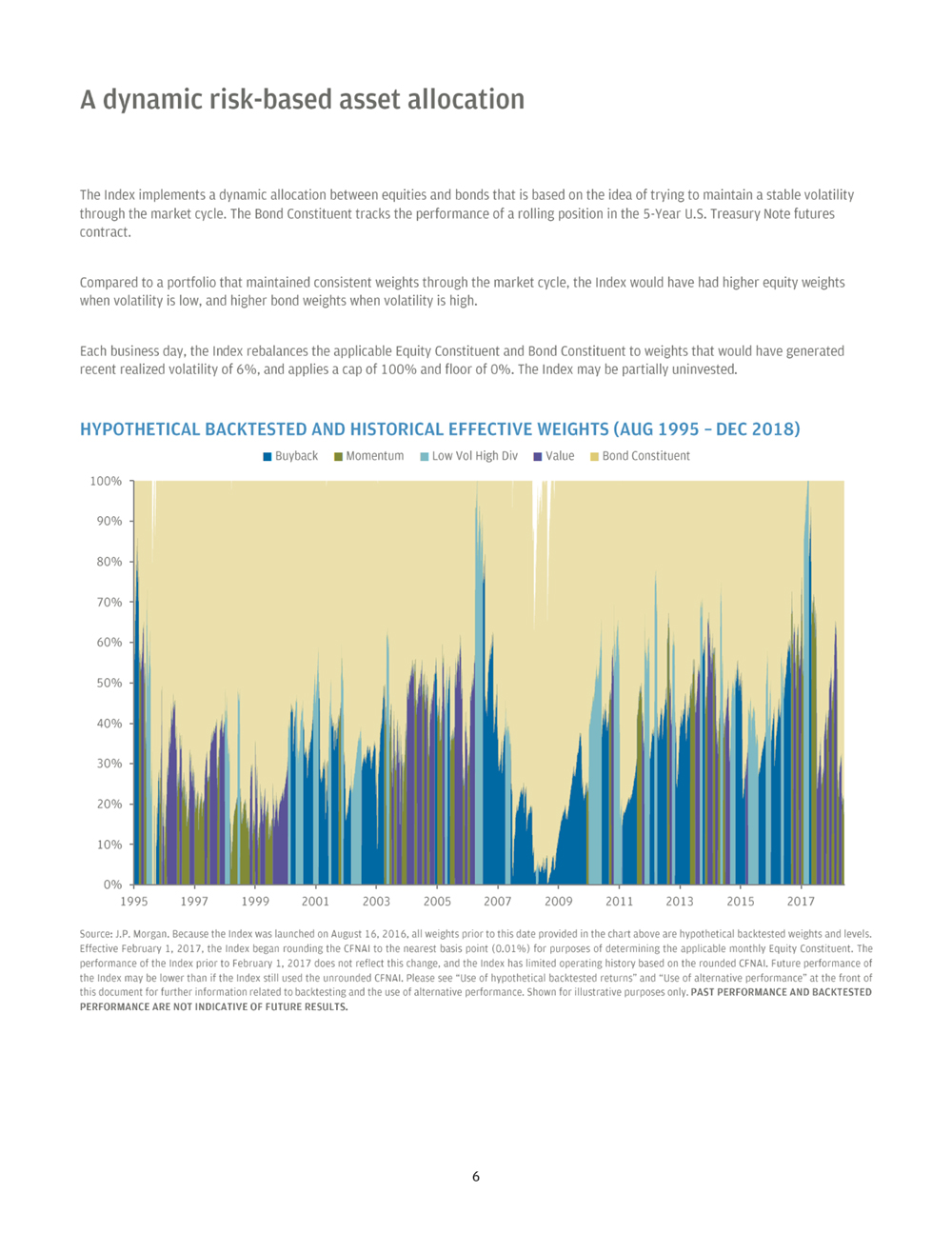

A dynamic risk-based asset allocation The Index implements a dynamic allocation between equities and bonds that is based on the idea of trying to maintain a stable volatility through the market cycle. The Bond Constituent tracks the performance of a rolling position in the 5-Year U.S. Treasury Note futures contract. Compared to a portfolio that maintained consistent weights through the market cycle, the Index would have had higher equity weights when volatility is low, and higher bond weights when volatility is high. Each business day, the Index rebalances the applicable Equity Constituent and Bond Constituent to weights that would have generated recent realized volatility of 6%, and applies a cap of 100% and floor of 0%. The Index may be partially uninvested. HYPOTHETICAL BACKTESTED AND HISTORICAL EFFECTIVE WEIGHTS (AUG 1995 - DEC 2018) • Buyback •Momentum • Low vol High Div lvalue Bond Constituent I 10 '. 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 5ource:J.P. Morgan. Because rtie I tides was launched on August 16, 2016, all weights priori d this date prav idefl in tne chart above are nvpotnet leal bach tested weigtitsand levels. Effective February 1, 2017. (Me Index began rou tiding tne CFNAI to tne nearest basis point (0,01%) for purposes of determining tne applicable mont my Equity Constituent. The pertofnianceofthelndespriortoFebruaryl.JOndoesnotreflectcniscnange.andthelndejhaslimiEedoperatingnistorvtaseiJoiitheroutidedCFNAl.Futureperromianceof tne Index may be lower ttian if ttie Index still used the unrounded CFNAi. Please see “Use of hypothetical bacfctested returns” and “Jse of alternative performance” at the (rant of tnis ddcument for further informatidn related td bachtesting anci tne use of alternative performance. Shown for illustrative purposes only. PAST PERFORMANCE AND BACKTESTED PERFORMANCE ARE NOT INDICATIVE OF FUTURE RESULTS.

S&P Economic Cycle Factor Rotator Index inception:Aug 16, 2016 HYPOTHETICAL AND HISTORICAL PERFORMANCE (AUG 1995 - DEC 2018) 440 i 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 Source: J.P. Morgan. Historical performance measures for the Index represent hypothetical backtested performance using the actual performance of each Equity Constituent and [He Bond Constituent (the “Jti deriving indices”) from August i, 1OT5 tnrougn August 15, 2016 (labeled “BacMested” in the en art above); and actual performance from AugLst 16, 2016 through December 31, 2018 (labeled “Actual' in tiie chart above). Each Equitv Constituent is subject to a notional financing cost based on 3-month cash rates, which is calculated based on 2M and 3M LSD LIBOR. However, from August 4, !016 to May 1, 2017, in lieu of the actual levels of 2M and 3M USD LIBOR. the notional financing cost far each Equitv Constituent was calculated using 0.6111% and 0.7776% respectively (me levels of 2M and 3M USD LIBOR as or August 4, 2016). As a result, the performance of the index between August 4, J016 and May 3,2017 (the last date on which the stale LIBOR levels impacted the notional financing cost calculation) would have been cumulatively lower by -0.1131 % nad th e notion al f in an c i ng cost ap pi led to th e Equ i ty Constituents been ca leu lated usi ng actual LI BOB level s. F urtti ermore, effect ive F ebrua ry 1, 2017, th e In d ex bega ti 2017 does not reflect this change, and the Index has limited operating history based on the rounded CFNAi. The “Domestic JO/60 Portlclio IER1” is a notional portfolio providing a monthly-rebalancing 40%/60lti weighted exposure to the S&P 500 Total Return index and the Bloomberg Barclays U.S. Aggregate Bond Total Return Index. The “Global 40/60 Portfolio IER)” is a notional portfolio providing a monthly-rebalancing 40%/60% weighted exposure to the MSCl ACWi Net Total Return index and the J.P. Morgan Global Aggregate Bond Index Total Return unhedged USD (a global investment-grade bond index). Each notional portfolio i; calculated on an excess return basis, i.e., net of a notional financing cost deduction equal to the return of the J.P. Morgan Cash Index JSD 3 Month, which tracks the return of a notional 3-month LJ.5. dollar time deposit. Weights within these notional assets that differ from those tracked by the Index and are not rebalanced on the same schedule as the Index. The notional portfolios are not rebalanced on the same schedule as the Index. All performance data for the Domestic 40/60 Portfolio (ER) and the Global 40/60 Portfolio (ER) is hypothetical and there is no guarantee that the index will outperform either one. or any other benchmark or index in the future. PAST PERFORMANCE AND EACKTESTED PERFORMANCE ARE NOT INDICATIVE OF FUTURE RESULTS, Please see “Use of hypothetical barttested returns” at the front of this document for further information related to backtesting. SSP Economic Cycle Factor Rotator is exclusively available in J.P. Morgan structured investments. 7

SELECTED RISKS ASSOCIATED WITH THE INDEX • Our affiliate, J.P. Morgan Securities LLC (“JPMS”), worked with S£P Dow Jones Indices LLC in developing the guidelines and policies governing the composition and calculation of the Index-The policies and judgments for which JPMS was responsible could have an impact, positive or negative, on the level of the Index. JPMS is under no obligation to consider your interests as an investor in notes linked to the Index. • The Equity Constituents are excess price return indices that include the deduction of a notional financing cost based on the relevant LI BOR rates-This notional financing cost will be ded ucted daily and, as a result, the level of the Index wil I trail the value of a hypothetical identically constituted synthetic portfolio from which no such cost is deducted. Vou will not receive dividends on the securities underlying the Equity Constituents. • Our parent company, JPMorgan Chase & Co, (“JPMC”), is one of the companies that make up the S&P SCO' Index and may be included in three Equity Constituents-JPMC will not, however, have any obligation to consider your interests in taking any corporate action that might affect the SSP BOO1* Index or any Equity Constituent, • The Index may not be successful or outperform any alternative strategy that might be employed in respect of the Underlying Indices and the CFNAI- No assurance can be given that the inferred stage of the U.S. business cycle will be reflective of the actual current stage of the U.S. business cycle. Because the CFM AI is a backward-looking measure thai reflects data from the preceding month, and because the Index references the 3-month average of the CFNAI, such inferred U.S. business cycle for purposes of the Index may lag behind the actual U.S. business cycle. In addition, no assurance can be given that the strategy the Index employs with respect to any U.S. business cycle stage is appropriate for that business cycle stage or will outperform any of the other strategies or any alternative investment strategy. • The index may not approximate its target volatility. • The Index may be significantly uninvested-lf the Index tracks a notional portfolio with an aggregate weight of less than 100%, the Index will not be fully invested, and any uninvested portion will earn no return. • The Index may be more heavily influenced by the performance of the relevant Equity Constituent than the performance of the Bond Constituent in general over time. • A significant portion of the index's exposure may be allocated to the Bond Constituent. • Changes in the value of the relevant Underlying Indices may offset each other or may become correlated in decline. • The investment strategy used to construct the Index involves daily adjustments to its notional exposure to the Underlying Indices. • There is no assurance that the strategies employed by the Equity Constituents will be successful. • The Equity Constituents are subject to concentration risk- The strategy employed by each Equity Constituent may result in significant concentration in a single industry or sector or a small number of industries or sectors. • The Bond Constituent is subject to significant risks associated with Futures contracts. • Uncertainty about the future of LIBOH may affect LIBOR rates-Uncertainty as to the nature of alternative reference rates and as to potential changes or other reforms to LIBOR may affect the LIBOR rates used to determine the notional financing cost, which may adversely affect the Index. • Other key risks: • The Index, which was established on August 16. 2016, and some of the Equity Constituents, which were established recently, have limited operating hi stories and may perform in unanticipated ways. • The Bond Component is an “excess return” index and not a “total return” index because it does not refiect interest that could be earned on funds notionally committed to the trading of futures contracts. • Negative roll returns associated with futures contracts may adversely affect the performance of the Bond Component. Suspension or disruptions of market trading in futures contracts may adversely affect the Index. • The Index is subject to significant risks associated with fixed-income securities, including interest rate-related risks. The Index may be influenced by unpredictable changes in the U.S. government and economy, and the Bond Component may be affected by changes in the perceived creditworthiness of the United States. • 2-month and 3-month USD LIBOR rates are affected by a number of factors and may be volatile, and the method by which LIBOR rates are determined may change, and any such change may adversely affect the Index. The risks identified above are not exhaustive. You should also carefully review the related “Risk Factors” section in the relevant product supplement and underlying supplement and the “Selected Risk Considerations” in the relevant pricing supplement.