As filed with the Securities and Exchange Commission on February 24, 2023

Registration Nos. 333- and 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

JPMORGAN CHASE & CO.

(Exact name of registrant as specified in its charter)

| Delaware | 13-2624428 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification Number) | |

| JPMorgan Chase & Co. 383 Madison Avenue New York, New York 10179 (212) 270-6000 |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

JPMORGAN CHASE FINANCIAL COMPANY LLC

(Exact name of registrant as specified in its charter)

| Delaware | 47-5462128 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification Number) | |

| JPMorgan Chase Financial Company LLC 383 Madison Avenue, Floor 5 New York, New York 10179 (212) 270-6000 |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

| John H. Tribolati Corporate Secretary JPMorgan Chase & Co. 277 Park Avenue New York, New York 10172-10003 (212) 270-6000 |

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Lee Meyerson, Esq. Hui Lin, Esq. Benjamin Heriaud, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 (212) 455-2000 |

Stephen B. Grant, Esq. Scott L. Nearing, Esq.

|

Yan Zhang, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

(Check one):

JPMorgan Chase & Co.

| Large accelerated filer ☒ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☐ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

THE REGISTRANTS HEREBY AMEND THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANTS SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 24, 2023

Prospectus

$100,000,000,000

JPMorgan Chase & Co.

Debt Securities

Warrants

Units

Purchase Contracts

Guarantees

JPMorgan Chase Financial Company LLC

Debt Securities

Warrants

We, JPMorgan Chase & Co., may from time to time offer and sell any of our securities listed above, in each case, in one or more series. Our subsidiary, JPMorgan Chase Financial Company LLC, which we refer to as “JPMorgan Financial,” also may from time to time offer and sell its securities listed above, in each case, in one or more series. We fully and unconditionally guarantee all payments of principal, interest and other amounts payable on any debt securities or warrants JPMorgan Financial issues. Up to $100,000,000,000, or the equivalent thereof in any other currency, of these securities may be offered from time to time, in amounts, on terms and at prices that will be determined at the time they are offered for sale. These terms and prices will be described in more detail in one or more supplements to this prospectus.

You should read this prospectus and the applicable supplement or supplements to this prospectus carefully before you invest. Investing in these securities involves a number of risks. See the section entitled “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Report on Form 10-Q, and any risk factors described in the applicable supplement or supplements to this prospectus, for a discussion of risks you should consider in connection with an investment in any of the securities offered under this prospectus.

These securities will not be listed on any securities exchange unless otherwise specified in one or more supplements to this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus or any supplement. Any representation to the contrary is a criminal offense.

These securities are not bank deposits, are not insured by the Federal Deposit Insurance Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank.

This prospectus is dated , 2023

ABOUT THIS PROSPECTUS

This prospectus is part of a Registration Statement that we and JPMorgan Financial filed with the Securities and Exchange Commission, which we refer to as the SEC, utilizing a “shelf” registration process. Under this shelf registration process, we may, from time to time, sell any combination of the relevant securities described in the prospectus in one or more offerings; and our subsidiary, JPMorgan Financial, may, from time to time, offer any combination of the relevant securities described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the securities we or JPMorgan Financial may offer. Each time we or JPMorgan Financial sell securities, we or JPMorgan Financial will provide one or more prospectus supplements, together with one or more pricing supplements, underlying supplements, product supplements and/or other types of offering documents or supplements (together referred to herein as a “prospectus supplement”) that will contain specific information about the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus. You should read both this prospectus and the accompanying prospectus supplement together with the additional information described under the heading “Where You Can Find More Information” beginning on page 1 of this prospectus.

Following the initial distribution of an offering of securities, J.P. Morgan Securities LLC and other affiliates of ours and, if applicable, other third-party broker dealers may offer and sell those securities in the course of their businesses as broker dealers. J.P. Morgan Securities LLC and other affiliates of ours and, if applicable, other third-party broker dealers may act as principal or agent in these transactions. This prospectus and the accompanying prospectus supplement will also be used in connection with those transactions. Sales in any of those transactions will be made at varying prices related to prevailing market prices and other circumstances at the time of sale.

We and JPMorgan Financial have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus or the accompanying prospectus supplement. We and JPMorgan Financial take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus and the accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in the accompanying prospectus supplement or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus or the accompanying prospectus supplement, nor any sale made hereunder and thereunder shall, under any circumstances, create any implication that there has been no change in the affairs of JPMorgan Chase & Co. or JPMorgan Financial since the date hereof or that the information contained or incorporated by reference herein or therein is correct as of any time subsequent to the date of such information.

In this prospectus, “JPMorgan Chase,” “we,” “us” and “our” refer to JPMorgan Chase & Co. and not to any of its subsidiaries, except where the context otherwise requires or as otherwise indicated. We use “JPMorgan Financial” to refer to JPMorgan Chase Financial Company LLC, our wholly owned subsidiary.

i

Table of Contents

Page

ii

Where You Can Find More Information

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet website that contains reports, proxy and information statements and other materials that are filed through the Commission’s Electronic Data Gathering, Analysis and Retrieval (EDGAR) System or any successor thereto. This website can currently be accessed at http://www.sec.gov. You can find information we have filed with the SEC by reference to file number 001-05805. Such documents, reports and information are also available on our website: http://www.jpmorgan.com. Websites that are cited or referred to in this prospectus do not constitute part of, and are not incorporated by reference in, this prospectus or any accompanying prospectus supplement.

This prospectus is part of a registration statement we and JPMorgan Financial filed with the SEC. This prospectus omits some information contained in the registration statement in accordance with SEC rules and regulations. You should review the information and exhibits in the registration statement for further information on us and our consolidated subsidiaries and the securities we and JPMorgan Financial are offering. Statements in this prospectus concerning any document we and JPMorgan Financial filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate these statements.

The SEC allows us to “incorporate by reference” into this prospectus the information in documents we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and later information that we file with the SEC will update and supersede this information.

We incorporate by reference (i) the documents listed below and (ii) any future filings we make with the SEC under Section 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934 during the period after the date of the initial registration statement and prior to the effectiveness of the registration statement and after the date of this prospectus until the termination of each offering of securities covered by this prospectus is completed, other than, in each case, those documents or the portions of those documents that are furnished and not filed:

| (a) | our Annual Report on Form 10-K for the year ended December 31, 2022; and |

| (b) | our Current Reports on Form 8-K filed on January 13, 2023, January 17, 2023, January 17, 2023 and January 19, 2023. |

You may request, at no cost to you, a copy of these documents by writing or telephoning us at: Office of the Secretary, JPMorgan Chase & Co., 277 Park Avenue, New York, New York 10172-10003 (Telephone: (212) 270-6000).

1

JPMorgan Chase, a financial holding company incorporated under Delaware law in 1968, is a leading financial services firm based in the United States, with operations worldwide. JPMorgan Chase had $3.7 trillion in assets and $292.3 billion in stockholders’ equity as of December 31, 2022. JPMorgan Chase is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, JPMorgan Chase serves millions of customers, predominantly in the United States, and many of the world’s most prominent corporate, institutional and government clients globally.

JPMorgan Chase’s principal bank subsidiary is JPMorgan Chase Bank, National Association, which we refer to as the “Bank,” a national banking association with U.S. branches in 48 states and Washington, D.C. JPMorgan Chase’s principal non-bank subsidiary is J.P. Morgan Securities LLC, a U.S. broker-dealer. The bank and non-bank subsidiaries of JPMorgan Chase operate nationally as well as through overseas branches and subsidiaries, representative offices and subsidiary foreign banks. JPMorgan Chase’s principal operating subsidiaries outside the United States are J.P. Morgan Securities plc and J.P. Morgan SE, which are subsidiaries of the Bank and are based in the United Kingdom and Germany, respectively.

The principal executive office of JPMorgan Chase is located at 383 Madison Avenue, New York, New York 10179, U.S.A., and its telephone number is (212) 270-6000.

JPMorgan Chase Financial Company LLC

JPMorgan Financial is a Delaware limited liability company and an indirect, wholly owned finance subsidiary of JPMorgan Chase, created for the purpose of providing JPMorgan Chase and/or its affiliates with financing for their operations by issuing securities designed to meet investor demand for products that reflect certain risk-return profiles and specific market exposure. Any securities issued by JPMorgan Financial will be fully and unconditionally guaranteed by JPMorgan Chase. JPMorgan Financial expects to lend the net proceeds from these offerings to JPMorgan Chase and/or its affiliates.

The principal executive offices of JPMorgan Financial are located at 383 Madison Avenue, Floor 5, New York, New York 10179 and its telephone number is (212) 270-6000.

We will contribute the net proceeds that we receive from the sale of our securities offered by this prospectus and the accompanying prospectus supplement to our “intermediate holding company” subsidiary, JPMorgan Chase Holdings LLC, which we refer to as the “IHC,” which will use those net proceeds for general corporate purposes, in connection with hedging our obligations under the securities or for any other purpose described in the applicable prospectus supplement. General corporate purposes may include investments in our subsidiaries, payments of dividends to us, extensions of credit to us or our subsidiaries or the financing of possible acquisitions or business expansion.

Net proceeds may be temporarily invested pending application for their stated purpose. Interest on our debt securities and dividends on our equity securities, as well as redemptions or repurchases of our outstanding securities, will be made using amounts we receive as dividends or extensions of credit from IHC or as dividends from the Bank.

JPMorgan Financial intends to lend the net proceeds from the sale of its securities offered by this prospectus and the accompanying prospectus supplement to us and/or our affiliates. We expect that we and/or our affiliates will use the proceeds from these loans to provide additional funds for our and/or their operations and for other general corporate purposes.

2

Important Factors That May Affect Future Results

From time to time, we and JPMorgan Financial have made and will make forward-looking statements. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipate,” “target,” “expect,” “estimate,” “intend,” “plan,” “goal,” “believe,” or other words of similar meaning. Forward-looking statements provide our current expectations or forecasts of future events, circumstances, results or aspirations. Our and JPMorgan Financial’s disclosures in this prospectus, any prospectus supplement and any documents incorporated by reference into this prospectus may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We also may make forward-looking statements in our other documents filed or furnished with the SEC. In addition, our senior management may make forward-looking statements orally to investors, analysts, representatives of the media and others.

All forward-looking statements are, by their nature, subject to risks and uncertainties, many of which are beyond our control. Our actual future results may differ materially from those set forth in our forward-looking statements. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors that could cause actual results to differ from those in the forward-looking statements:

| · | local, regional and global business, economic and political conditions and geopolitical events, including the war in Ukraine; |

| · | changes in laws, rules and regulatory requirements, including capital and liquidity requirements affecting our businesses, and our ability to address those requirements; |

| · | heightened regulatory and governmental oversight and scrutiny of our business practices, including dealings with retail customers; |

| · | changes in trade, monetary and fiscal policies and laws; |

| · | changes in the level of inflation; |

| · | changes in income tax laws, rules and regulations; |

| · | securities and capital markets behavior, including changes in market liquidity and volatility; |

| · | changes in investor sentiment or consumer spending or savings behavior; |

| · | our ability to manage effectively our capital and liquidity; |

| · | changes in credit ratings assigned to us or our subsidiaries; |

| · | damage to our reputation; |

| · | our ability to appropriately address social, environmental and sustainability concerns that may arise, including from our business activities; |

| · | our ability to deal effectively with an economic slowdown or other economic or market disruption, including, but not limited to, in the interest rate environment; |

| · | technology changes instituted by us, our counterparties or competitors; |

| · | the effectiveness of our control agenda; |

| · | our ability to develop or discontinue products and services, and the extent to which products or services previously sold by us require us to incur liabilities or absorb losses not contemplated at their initiation or origination; |

3

| · | acceptance of our new and existing products and services by the marketplace and our ability to innovate and to increase market share; |

| · | our ability to attract and retain qualified and diverse employees; |

| · | our ability to control expenses; |

| · | competitive pressures; |

| · | changes in the credit quality of our clients, customers and counterparties; |

| · | adequacy of our risk management framework, disclosure controls and procedures and internal control over financial reporting; |

| · | adverse judicial or regulatory proceedings; |

| · | changes in applicable accounting policies, including the introduction of new accounting standards; |

| · | our ability to determine accurate values of certain assets and liabilities; |

| · | occurrence of natural or man-made disasters or calamities, including health emergencies, the spread of infectious diseases, epidemics or pandemics, an outbreak or escalation of hostilities or other geopolitical instabilities, the effects of climate change or extraordinary events beyond our control, and our ability to deal effectively with disruptions caused by the foregoing; |

| · | our ability to maintain the security of our financial, accounting, technology, data processing and other operational systems and facilities; |

| · | our ability to withstand disruptions that may be caused by any failure of our operational systems or those of third parties; and |

| · | our ability to effectively defend ourselves against cyberattacks and other attempts by unauthorized parties to access our information or that of our customers or to disrupt our systems. |

Additional factors that may cause future results to differ materially from forward-looking statements can be found in portions of our periodic and current reports filed with the SEC and incorporated by reference in this prospectus. These factors include, for example, those discussed under the caption “Risk Factors” in our most recent annual and quarterly reports, to which reference is hereby made.

Any forward-looking statements made by or on behalf of us and JPMorgan Financial in this prospectus, any applicable prospectus supplement or in a document incorporated by reference in this prospectus speak only as of the date of this prospectus, the applicable prospectus supplement or the document incorporated by reference, as the case may be. We and JPMorgan Financial do not undertake to update any forward-looking statements, except as required by law. You should, however, consult any further disclosures of a forward-looking nature we may make in any subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

4

Description of Debt Securities of JPMorgan Chase & Co.

General

In this “Description of Debt Securities of JPMorgan Chase & Co.” section, all references to “debt securities” refer only to debt securities issued by JPMorgan Chase & Co. and not to any debt securities issued by JPMorgan Chase Financial Company LLC.

The following description of the terms of the debt securities contains certain general terms that may apply to the debt securities. The specific terms of any debt securities will be described in one or more prospectus supplements relating to those debt securities.

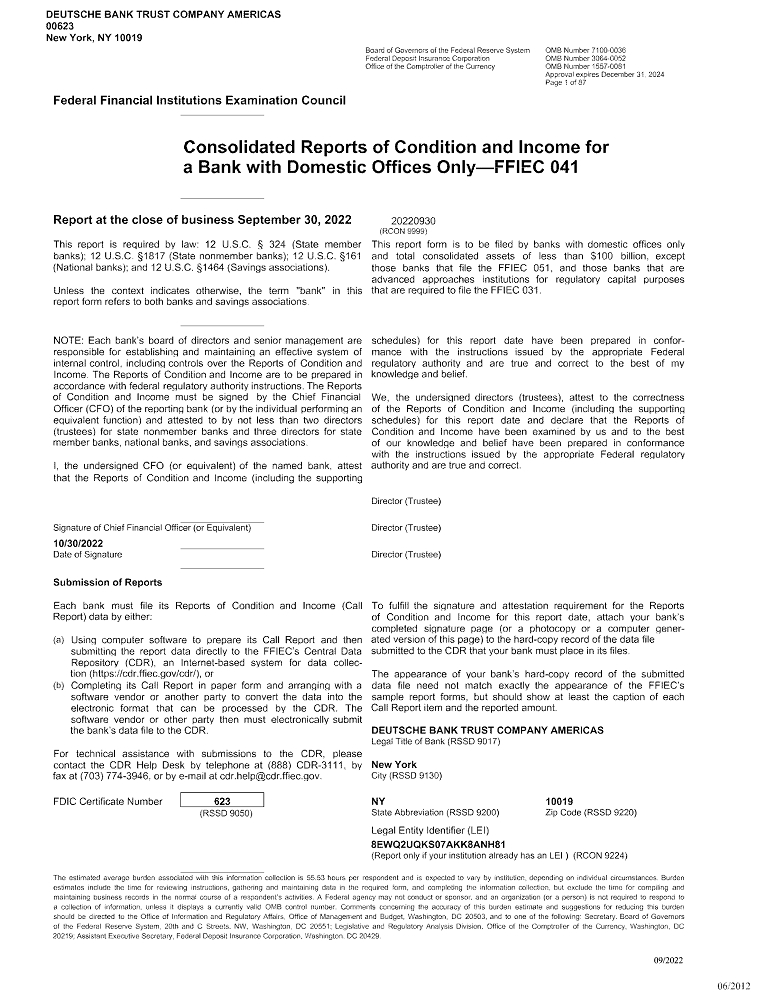

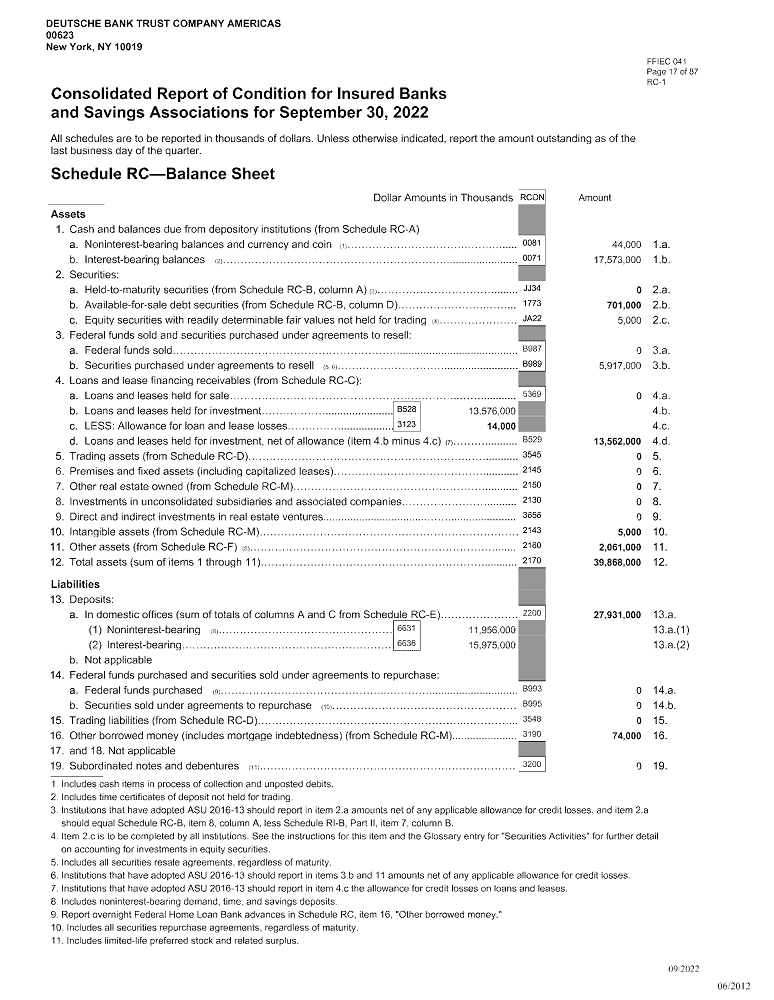

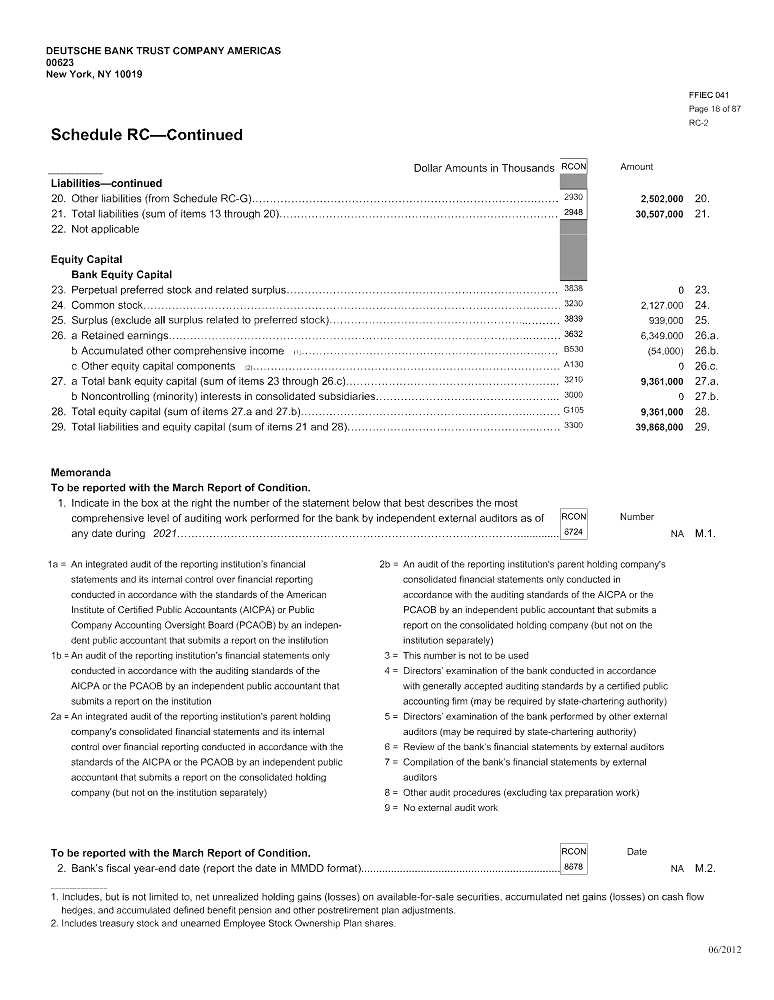

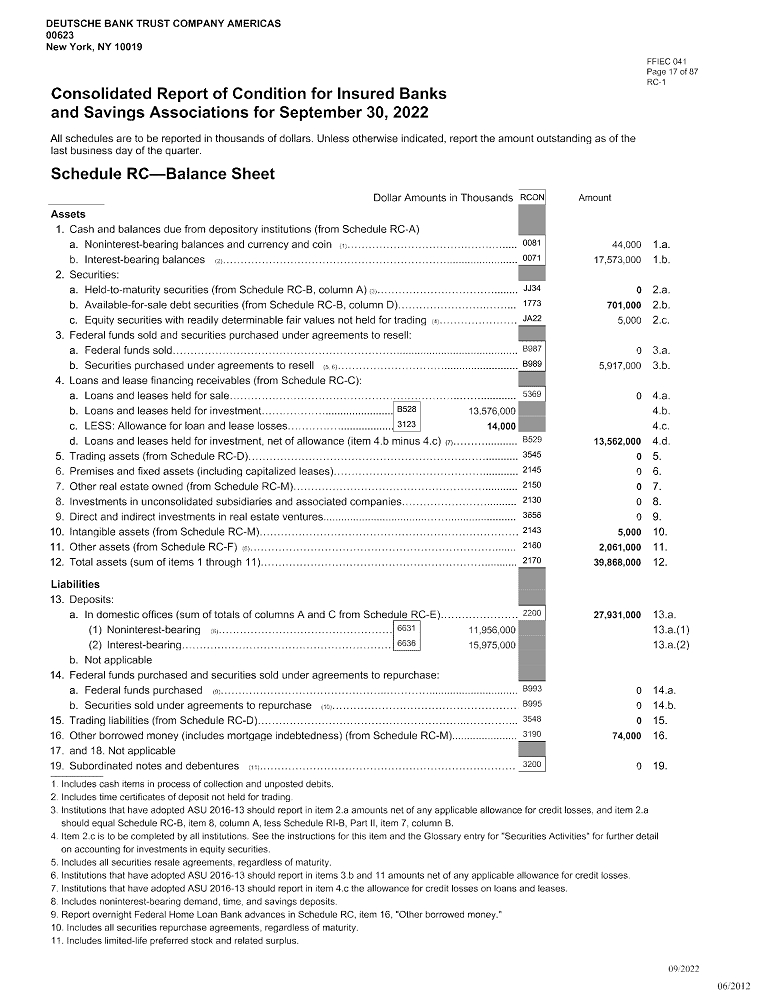

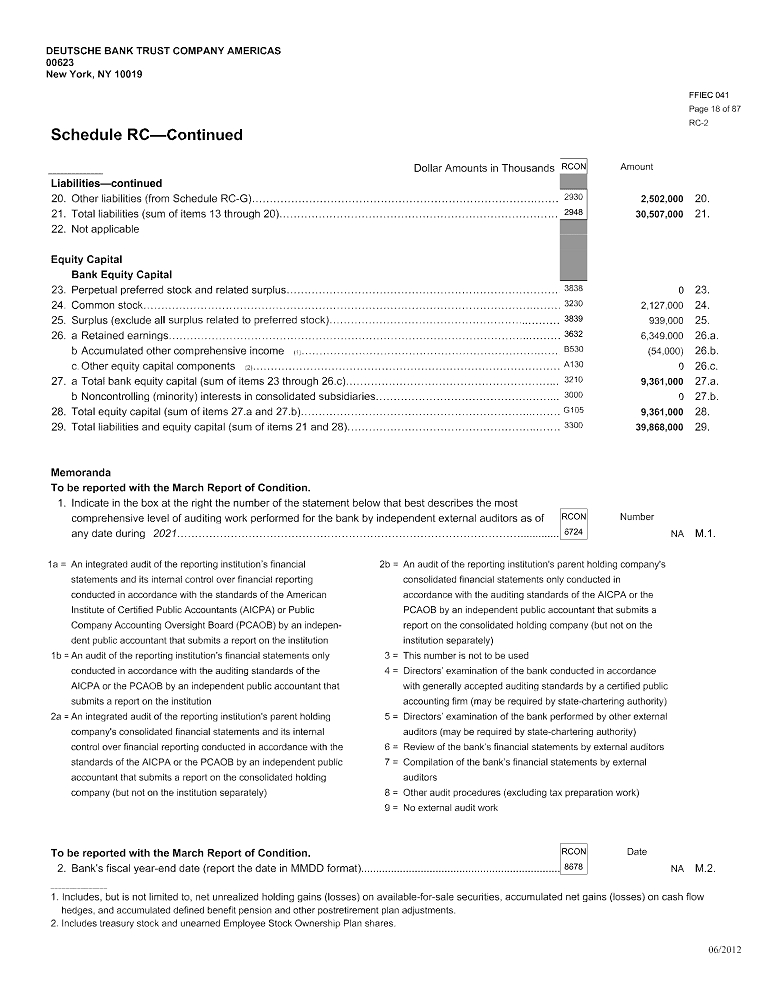

The debt securities will be issued under an Indenture dated May 25, 2001, between us and Deutsche Bank Trust Company Americas (formerly Bankers Trust Company), as trustee (as has been and as may be further supplemented from time to time, for purposes of this section entitled “Description of Debt Securities of JPMorgan Chase & Co.,” the “Indenture”).

We have summarized below the material provisions of the Indenture and the debt securities issued under the Indenture or indicated which material provisions will be described in the related prospectus supplement. These descriptions are only summaries, and each investor should refer to the Indenture, which describes completely the terms and definitions summarized below and contains additional information regarding the debt securities issued under it. Where appropriate, we use parentheses to refer you to the particular sections of the Indenture. Any reference to particular sections or defined terms of the Indenture in any statement under this heading qualifies the entire statement and incorporates by reference the applicable section or definition into that statement.

The debt securities will be our direct, unsecured general obligations and will have the same rank in liquidation as all of our other unsecured and unsubordinated debt.

The Indenture does not limit the aggregate principal amount of debt securities that may be issued under it. The Indenture provides that debt securities may be issued up to the principal amount authorized by us from time to time. (Section 2.03) We have previously established the Series E medium-term notes under the Indenture. As of December 31, 2022, we had approximately $5.0 billion aggregate principal amount of Series E medium-term notes outstanding under the Indenture. Our board of directors has authorized the issuance of securities under the registration statement to which this prospectus relates, including Series E medium-term notes, with an aggregate initial public offering price not to exceed $150 billion, to be issued on or after February 17, 2023.

The Indenture allows us to reopen a previous issue of a series of debt securities and issue additional debt securities of that issue. We have no obligation to take your interests into account when deciding whether to issue additional debt securities. In addition, we are under no obligation to reopen any series of debt securities or to issue any additional debt securities.

We are a holding company that holds the stock of the Bank and IHC. We conduct substantially all of our operations through subsidiaries, including the Bank and the IHC. As a result, claims of the holders of the debt securities will generally have a junior position to claims of creditors of our subsidiaries. Claims of our subsidiaries’ creditors other than JPMorgan Chase & Co. include substantial amounts of deposit liabilities, long-term debt and other liabilities. In addition, we are obligated to contribute to the IHC substantially all the net proceeds that we receive from the issuance of securities (including any securities offered by use of this prospectus), and the ability of the Bank and the IHC to make payments to us is limited. As a result of these arrangements, our ability to make various payments is dependent on our receiving dividends from the Bank and dividends and extensions of credit from the IHC. These limitations could affect our ability to pay interest on our debt securities, redeem or repurchase outstanding securities and fulfill our other payment obligations.

We may issue debt securities from time to time in one or more series. (Section 2.03) The debt securities may be denominated and payable in U.S. dollars or foreign currencies. (Section 2.03) We may also issue debt securities, from time to time, with the principal amount, interest or other amounts payable on any relevant payment date to be determined by reference to one or more currency exchange rates, interest rates, swap rates, securities or baskets of securities, commodity prices, indices, basket of indices,

5

or any other financial, economic or other measure or instrument, including the occurrence or non-occurrence of any event or circumstance. The debt securities may also be issued as original issue discount debt securities, which will bear no interest or bear interest at below market rates and will be sold at a discount to their stated principal amount. In addition, we may issue debt securities as part of units issued by us, as described in “— Description of Units” below. All references in this prospectus, or any prospectus supplement to other amounts will include premium, if any, other cash amounts payable under the Indenture, if any, and the delivery of securities or baskets of securities under the terms of the debt securities.

The debt securities may bear interest at a fixed rate, which may be zero, or a floating rate.

The prospectus supplement relating to a particular series of debt securities being offered will specify the particular terms of, and other information relating to, those debt securities.

Holders may present debt securities for exchange or transfer, in the manner, at the places and subject to the restrictions stated in the debt securities and described in the applicable prospectus supplement. We will provide these services without charge except for any tax or other governmental charge payable in connection with these services and subject to any limitations provided in the Indenture. (Section 2.08)

If any of the securities are held in global form, the procedures for transfer of interests in those securities will depend upon the procedures of the depositary for those global securities. See “Forms of Securities.”

We will generally have no obligation to repurchase, redeem, or change the terms of the debt securities upon any event (including a change in control) that might have an adverse effect on our credit quality.

Events of Default and Waivers

An “Event of Default” with respect to a series of debt securities issued under the Indenture is defined in the Indenture as:

| · | default in the payment of interest on any debt securities of that series and continuance of such default for 30 days; |

| · | default in the payment of principal or other amounts payable on any debt securities of that series when due, at maturity, upon redemption, by declaration or otherwise, and continuance of such default for 30 days; |

| · | specified events of our bankruptcy, insolvency, winding up or liquidation, whether voluntary or involuntary; or |

| · | any other event of default provided in the applicable supplemental indentures to the Indenture or form of security. (Section 5.01) |

Senior debt securities issued by us prior to December 31, 2016 (the “Pre-2017 Senior Debt Securities”) are subject to events of default that are different from those set forth above. In particular:

| · | the events of default applicable to the Pre-2017 Senior Debt Securities do not provide for a 30-day cure period with respect to any failure by us to pay the principal of those Pre-2017 Senior Debt Securities; |

| · | most series of Pre-2017 Senior Debt Securities contain an additional event of default that is applicable if we fail to perform any of the covenants contained in the terms and conditions of, or the governing instrument for, those Pre-2017 Senior Debt Securities and that failure continues for 90 days; and |

| · | the events of default applicable to certain series of Pre-2017 Senior Debt Securities provide that specified events of bankruptcy, insolvency or reorganization of the Bank. would constitute an event of default with respect to those Pre-2017 Senior Debt Securities. |

6

In addition, certain series of senior debt securities that we assumed in connection with our merger with The Bear Stearns Companies Inc. include additional events of default.

Accordingly, if we fail to pay the principal of any series of Pre-2017 Senior Debt Securities when due, the holders of those Pre-2017 Senior Debt Securities would be entitled to declare their Pre-2017 Senior Debt Securities due and payable immediately, whereas holders of the debt securities would not be entitled to accelerate the debt securities until 30 days after our failure to pay the principal of the debt securities. In addition, holders of the debt securities will not have the benefit of the additional events of default described above that are applicable to the Pre-2017 Senior Debt Securities.

If a default in the payment of principal, interest or other amounts payable on the debt securities, or any other Event of Default provided in the applicable supplemental indentures to the Indenture or form of security, with respect to one or more (but in the case of a default in a manner provided in a supplemental indenture or form of security, less than all) series of debt securities occurs and is continuing, either the trustee or the holders of not less than 25% in aggregate principal amount of the debt securities of such series then outstanding, treated as one class, by written notice, may declare the principal of all outstanding debt securities of such series and any interest accrued thereon, to be due and payable immediately. For this purpose, the debt securities will be deemed not to be in the same series as debt securities issued under the Indenture prior to January 13, 2017. If a default in a manner provided in a supplemental indenture or form of security with respect to all series of debt securities, or due to specified events of our bankruptcy, insolvency, winding up or liquidation, occurs and is continuing, either the trustee or the holders of not less than 25% in aggregate principal amount of all debt securities then outstanding, treated as one class, by written notice, may declare the principal of all outstanding debt securities and any interest accrued thereon, to be due and payable immediately. Subject to certain conditions such declarations may be annulled and past defaults may be waived by the holders of a majority in aggregate principal amount of the outstanding debt securities of the series affected. (Sections 5.01 and 5.10)

An Event of Default with respect to one series of debt securities does not necessarily constitute an Event of Default with respect to any other series of debt securities. The Indenture requires the trustee to provide notice of default with respect to the debt securities within 90 days, unless the default is cured, but provides that the trustee may withhold notice to the holders of the debt securities of any default if the board of directors, the executive committee, or a trust committee of directors or trustees and/or responsible officers of the trustee determines in good faith that it is in the interest of the holders of the debt securities of the applicable series to do so. The trustee may not withhold notice of a default in the payment of principal of, interest on or any other amounts due under, such debt securities. (Section 5.11)

The Indenture provides that the holders of a majority in aggregate principal amount of outstanding debt securities of each series affected, with all such series voting as a single class, may direct the time, method, and place of conducting any proceeding for any remedy available to the trustee, or exercising any trust or power conferred on the trustee. The trustee may decline to act if the direction is contrary to law and in certain other circumstances set forth in the Indenture. (Section 5.09) The trustee is not obligated to exercise any of its rights or powers under the Indenture at the request or direction of the holders of debt securities unless the holders offer the trustee security or indemnity satisfactory to it against the costs, expenses and liabilities incurred therein or thereby. (Section 6.02(d))

No holder of any debt security of any affected series has the right to institute any action for remedy unless such holder has previously given to the trustee written notice of default, the trustee has failed to take action for 60 days after the holders of not less than 25% in aggregate principal amount of the debt securities of each affected series make written request upon the trustee to institute such action and have offered reasonable indemnity in connection with the same and the holders of a majority in aggregate principal amount of the debt securities of each affected series (voting as a single class) have not given direction to the trustee that is inconsistent with the written request referred to above. (Section 5.06)

However, the right of any holder of a debt security or coupon to receive payment of the principal of and interest on that debt security or coupon on or after its due date, or to institute suit for the enforcement of any such payment, may not be impaired or affected without the consent of that holder. (Section 5.07)

The Indenture requires us to file annually with the trustee a written statement as to whether or not we have knowledge of a default. (Section 3.05)

7

Covenant Breach

Under the Indenture, a “Covenant Breach” would occur with respect to a series of debt securities if we fail to perform or breach any of the covenants contained in the Indenture (other than a failure to pay principal or interest on the debt securities) and that failure or breach continues for 90 days after the trustee or the holders of at least 25% in aggregate principal amount of the outstanding debt securities give written notice of that failure or breach. Neither the trustee nor the holders of the debt securities will be entitled to accelerate the maturity of the debt securities as a result of any Covenant Breach.

If a Covenant Breach or Event of Default with respect to the debt securities occurs and is continuing, the trustee may in its discretion proceed to protect and enforce its rights and the rights of the holders of the debt securities by such appropriate judicial proceedings as the trustee deems most effectual to protect and enforce any such rights, whether for the specific enforcement of any covenant or agreement in the Indenture or in aid of the exercise of any power granted in the Indenture, or to enforce any other proper remedy.

Discharge, Defeasance and Covenant Defeasance

Discharge of Indenture. The Indenture will cease to be of further effect with respect to debt securities of any series, except as to rights of registration of transfer and exchange, substitution of mutilated, defaced, lost or stolen debt securities, rights of holders to receive principal, interest or other amounts payable under the debt securities on the due date thereof (but not upon acceleration), rights and immunities of the trustee and rights of holders with respect to property deposited pursuant to the following provisions, and our obligation to maintain an office for payments, if at any time:

| · | we have paid the principal, interest and any other amounts payable under the debt securities of such series as and when due; |

| · | we have delivered to the trustee or the applicable paying agent for cancellation all debt securities of such series; or |

| · | the debt securities of such series not delivered to the trustee or the applicable paying agent for cancellation have become due and payable, or will become due and payable within one year, or are to be called for redemption within one year under arrangements satisfactory to the trustee or the applicable paying agent for the giving of notice of redemption, and we have irrevocably deposited with the trustee or the applicable paying agent as trust funds the entire amount in cash or, in the case of securities payable in dollars, U.S. government obligations sufficient to pay all amounts due with respect to such debt securities on or after the date of such deposit, including at maturity or upon redemption of all such debt securities, including principal, interest and other amounts, and any mandatory sinking fund payments, on the dates on which such payments are due and payable. (Section 10.01) |

The trustee, on our demand accompanied by an officers’ certificate and an opinion of counsel and at our cost and expense, will execute proper instruments acknowledging such satisfaction of and discharging the Indenture with respect to such series.

Defeasance of a Series of Securities at Any Time. We may also discharge all of our obligations, other than those obligations that survive as referred to under “— Discharge of Indenture” above, under any series of debt securities at any time, which we refer to as “defeasance.”

We may be released with respect to any outstanding series of debt securities from the obligations imposed by Article 9 of the Indenture, which contains the covenant described below limiting consolidations, mergers and asset sales, and elect not to comply with that provision without creating an Event of Default or Covenant Breach. Discharge under these procedures is called “covenant defeasance.”

Defeasance or covenant defeasance may be effected only if, among other things:

| · | we irrevocably deposit with the trustee or the applicable paying agent cash or, in the case of debt securities payable only in U.S. dollars, U.S. government obligations, as trust funds in an amount |

8

certified to be sufficient to pay on each date that they become due and payable, the principal of, interest on, other amounts due under, and any mandatory sinking fund payments for, all outstanding debt securities of the series being defeased; and

| · | we deliver to the trustee an opinion of counsel to the effect that the holders of the series of debt securities being defeased will not recognize income, gain or loss for United States federal income tax purposes as a result of the defeasance or covenant defeasance and will be subject to United States federal income tax on the same amount and in the same manner and at the same times as would have been the case if such deposit and defeasance or covenant defeasance, as the case may be, had not occurred (in the case of a defeasance, the opinion of counsel must be based on a ruling of the Internal Revenue Service or a change in United States federal income tax law); and |

| · | in the case of a covenant defeasance, no Event of Default or Covenant Breach or event which with notice or lapse of time or both would become an Event of Default or a Covenant Breach has occurred and is continuing on the date of our deposit with the trustee of cash or U.S. government obligations, as applicable, or, with respect to certain Events of Default, at any time during the period ending on the 91st day after the date of such deposit; and |

| · | in the case of a covenant defeasance, the covenant defeasance will not cause the trustee to have a conflicting interest for purposes of the Trust Indenture Act of 1939 with respect to any of our debt securities; and |

| · | in the case of a covenant defeasance, the covenant defeasance will not cause any debt securities then listed on a national securities exchange to be delisted; and |

| · | the defeasance or covenant defeasance will not result in a breach or violation of, or constitute a default under, the Indenture or any other agreement or instrument to which we are a party or by which we are bound. (Section 10.01) |

Modification of the Indenture

The Indenture contains provisions permitting us and the trustee to modify the Indenture or the rights of the holders of debt securities with the consent of the holders of not less than a majority in aggregate principal amount of each outstanding series of debt securities affected by the modification. Each holder of an affected debt security must consent to a modification that would:

| · | extend the final maturity date of the principal of, or of any interest on, or other amounts payable under any debt security; |

| · | reduce the principal amount of, rate of interest on, or any other amounts due under any debt security; |

| · | change the currency or currency unit of payment of any debt security or certain provisions of the Indenture applicable to debt securities in foreign currencies; |

| · | change the method in which amounts of payments of principal, interest or other amounts are determined on any debt security; |

| · | reduce any amount payable upon redemption of any debt security; |

| · | adversely affect the terms on which debt securities are convertible into or exchangeable or payable in other securities, instruments, contracts, currencies, commodities or other forms of property; |

| · | impair the right of a holder to institute suit for the payment of a debt security or, if the debt securities provide, any right of repurchase at the option of the holder of a debt security; or |

| · | reduce the percentage of debt securities of any series, the consent of the holders of which is required for any modification. (Section 8.02) |

9

The Indenture also permits us and the trustee to amend the Indenture in certain circumstances without the consent of the holders of debt securities to evidence our merger or the replacement of the trustee, to cure any ambiguity or to correct or supplement any defective or inconsistent provision, to make any change to the Indenture or our debt securities that we deem necessary or desirable and that does not materially and adversely affect the interests of holders of the debt securities and for certain other purposes. (Section 8.01)

Consolidations, Mergers and Sales of Assets

We may not merge or consolidate with any other entity or sell, convey or transfer all or substantially all of our assets to any other entity (other than the sale, conveyance or transfer of all or substantially all of our assets to one or more of our direct or indirect subsidiaries), unless:

| · | either we are the continuing corporation or the successor entity or the entity to whom those assets are sold, conveyed or transferred is a United States corporation or limited liability company that expressly assumes the due and punctual payment of the principal of, any interest on, or any other amounts due under the debt securities issued under the Indenture and the due and punctual performance and observance of all the covenants and conditions of the Indenture binding upon us, and |

| · | we or the successor entity will not, immediately after the merger or consolidation, sale, conveyance or transfer, be in default in the performance of any covenant or condition of the Indenture binding on us. (Section 9.01) |

There are no covenants or other provisions in the Indenture that would afford holders of debt securities additional protection in the event of a recapitalization transaction, a change of control of JPMorgan Chase & Co. or a highly leveraged transaction. The merger covenant described above would apply only if the recapitalization transaction, change of control or highly leveraged transaction were structured to include a merger or consolidation of JPMorgan Chase & Co. or a sale or conveyance of all or substantially all of our assets. However, we may provide specific protections, such as a put right or increased interest, for particular debt securities, which we would describe in the applicable prospectus supplement.

Concerning the Trustee, Paying Agent, Registrar and Transfer Agent

Our subsidiaries and we have a wide range of banking relationships with Deutsche Bank Trust Company Americas, The Bank of New York Mellon and The Bank of New York Mellon, London Branch. The Bank of New York Mellon and, for debt securities settled through Euroclear Bank SA/NV or Clearstream Banking, S.A., Luxembourg, The Bank of New York Mellon, London Branch, will be the paying agents, registrars, authenticating agents and transfer agents for debt securities issued under the Indenture.

Deutsche Bank Trust Company Americas is initially serving as the trustee for other securities issued by us or JPMorgan Financial, including the debt securities issued under our Indenture, the debt securities issued under JPMorgan Financial’s indenture for debt securities, to which we are a guarantor, and the warrants issued under JPMorgan Financial’s warrant indenture, to which we are a guarantor. Consequently, if an actual or potential event of default occurs with respect to any of these securities, the trustee may be considered to have a conflicting interest for purposes of the Trust Indenture Act of 1939, as amended. In that case, the trustee may be required to resign under the Indenture, and we would be required to appoint a successor trustee. For this purpose, a “potential” event of default means an event that would be an event of default if the requirements for giving us default notice or for the default having to exist for a specific period of time were disregarded.

Debt Securities in Foreign Currencies

Whenever the Indenture provides for an action by, or the determination of, any of the rights of, or any distribution to, holders of debt securities, in the absence of any provision to the contrary, any amount in respect of any debt security denominated in a currency or currency unit other than U.S. dollars may be treated for purposes of taking any such action or distribution as the amount of U.S. dollars that could reasonably be exchanged for such non-U.S. dollar amount. This amount will be calculated as of a date

10

that we specify to the paying agent or, if we fail to specify a date, on a date that the paying agent may determine. (Section 11.11)

Replacement of Debt Securities

At the expense of the holder, we may, in our discretion, replace any debt security that has been mutilated, destroyed, lost or stolen or that is apparently destroyed, lost or stolen. The mutilated debt security must be delivered to the paying agent and the registrar or satisfactory evidence of the destruction, loss or theft of the debt security must be delivered to us, the paying agent, the registrar and the trustee. At the expense of the holder, an indemnity that is satisfactory to us, the paying agent, the registrar and the trustee may be required before a replacement debt security will be issued. (Section 2.09)

Governing Law and Judgments

The debt securities and the Indenture will be governed by, and construed in accordance with, the laws of the State of New York. (Section 11.08) A judgment for money in an action based on debt securities payable in foreign currencies in a federal or state court in the United States ordinarily would be enforced in the United States only in U.S. dollars. The date used to determine the rate of conversion of the foreign currency in which a particular debt security is payable into U.S. dollars will depend upon various factors, including which court renders the judgment. However, if a judgment for money in an action based on the debt securities and the Indenture were entered by a New York court applying New York law, the court would render a judgment in that foreign currency, and the judgment would be converted into U.S. dollars at the rate of exchange prevailing on the date of entry of the judgment.

Insolvency and Resolution Considerations

Certain of the debt securities may constitute “loss-absorbing capacity” within the meaning of the rules issued by the Board of Governors of the Federal Reserve System (the “Federal Reserve”). Federal Reserve rules require that certain U.S. bank holding companies, including JPMorgan Chase & Co. (the “Parent Company”), maintain minimum levels of unsecured external long-term debt and other loss-absorbing capacity. Such debt must satisfy certain eligibility criteria under the Federal Reserve’s rules. Holders of the debt securities offered by use of this prospectus and other debt and equity securities of the Parent Company will absorb the losses of the Parent Company and its subsidiaries if the Parent Company were to enter into a resolution either:

| · | in a bankruptcy proceeding under Chapter 11 of the U.S. Bankruptcy Code, or |

| · | in a receivership administered by the Federal Deposit Insurance Corporation (“FDIC”) under Title II of the Dodd-Frank Act (“Title II”). |

The preferred “single point of entry” strategy under JPMorgan Chase & Co.’s resolution plan contemplates that only the Parent Company would enter bankruptcy proceedings. JPMorgan Chase’s subsidiaries would be recapitalized, as needed, so that they could continue normal operations or subsequently be divested or wound down in an orderly manner. As a result, the Parent Company’s losses and any losses incurred by its subsidiaries would be imposed first on holders of the Parent Company’s equity securities and thereafter on its unsecured creditors, including holders of the debt securities and other debt securities of the Parent Company. Claims of holders of those securities would have a junior position to the claims of creditors of JPMorgan Chase’s subsidiaries and to the claims of priority (as determined by statute) and secured creditors of the Parent Company.

Accordingly, in a resolution of the Parent Company in bankruptcy, holders of the debt securities offered by use of this prospectus and other debt securities of the Parent Company would realize value only to the extent available to the Parent Company as a shareholder of JPMorgan Chase Bank, N.A. and its other subsidiaries, and only after any claims of priority and secured creditors of the Parent Company have been fully repaid.

The FDIC has similarly indicated that a single-point-of-entry recapitalization model could be a desirable strategy to resolve a systemically important financial institution, such as the Parent Company,

11

under Title II. However, the FDIC has not formally adopted any specific resolution strategy in connection with its Title II authority.

If the Parent Company were to approach, or enter into, a resolution, none of the Parent Company, the Federal Reserve or the FDIC is obligated to follow JPMorgan Chase’s preferred resolution strategy, and losses to holders of the debt securities offered by use of this prospectus and other debt and equity securities of the Parent Company, under whatever strategy is ultimately followed, could be greater than they might have been under JPMorgan Chase’s preferred strategy.

12

Description of Warrants of JPMorgan Chase & Co.

Offered Warrants

In this “Description of Warrants of JPMorgan Chase & Co.” section, all references to “warrants” refer only to warrants issued by JPMorgan Chase & Co. and not to any warrants issued by JPMorgan Chase Financial Company LLC.

The warrants are options that are securities within the meaning of Section 2(a)(1) of the Securities Act of 1933, as amended.

We may issue warrants that are debt warrants, index warrants or universal warrants. We may offer any of these warrants separately or together with one or more other types of these warrants or purchase contracts, debt securities issued by us, debt obligations or other securities of an entity affiliated or not affiliated with us, other property or any combination of those securities in the form of units, as described in the applicable prospectus supplement. If we issue warrants as part of a unit, the accompanying prospectus supplement will specify whether those warrants may be separated from the other securities in the unit prior to the warrants’ expiration date. Universal warrants issued in the United States may not be so separated prior to the 91st day after the issuance of the unit, unless otherwise specified in the applicable prospectus supplement.

Debt Warrants. We may issue, together with debt securities or separately, warrants for the purchase of debt securities on terms to be determined at the time of sale. We refer to this type of warrant as a “debt warrant.”

Index Warrants. We may issue warrants entitling the holders thereof to receive from us, upon exercise, an amount in cash determined by reference to decreases or increases in the level of a specific index or in the levels (or relative levels) of two or more indices or combinations of indices, which index or indices may be based on one or more stocks, bonds or other securities, one or more currencies or currency units, or any combination of the foregoing, provided that any warrants that are based, in whole or in part, on one or more currency indices will be listed on a national securities exchange. We refer to this type of warrant as an “index warrant.”

Universal Warrants. We may also issue warrants to purchase or sell securities issued by us or another entity (other than our common stock), securities based on the performance of such entity, securities based on the performance of such entity but excluding the performance of a particular subsidiary or subsidiaries of such entity, a basket of securities, or any combination of the above.

We refer to the property in the above clauses as “warrant property.” We refer to this type of warrant as a “universal warrant.” We may satisfy our obligations, if any, with respect to any universal warrants by delivering the warrant property or the cash value of the securities, as described in the applicable prospectus supplement.

The prospectus supplement relating to the warrants being offered will specify the particular terms of, and other information relating to, those warrants.

Significant Provisions of the Warrant Agreements

We will issue the warrants under one or more warrant agreements to be entered into between us and a bank or trust company, as warrant agent, in one or more series, which will be described in the prospectus supplement for the warrants. The forms of warrant agreements are filed as exhibits to the registration statement. The following summarizes the significant provisions of the warrant agreements and the warrants and is not intended to be comprehensive. Holders of the warrants should review the detailed provisions of the relevant warrant agreement for a full description and for other information regarding the warrants. In addition, we will describe the specific terms that will apply to the warrants in an accompanying prospectus supplement, which will supplement and, if applicable, may modify or replace the general terms of the warrants described in the following section. If there are any differences between the accompanying prospectus supplement and this prospectus, the prospectus supplement will control.

13

Modifications without Consent of Warrantholders. We and the warrant agent may amend the terms of the warrants and the warrant certificates without the consent of the holders to:

| · | cure any ambiguity, |

| · | cure, correct or supplement any defective or inconsistent provision, or |

| · | amend the terms in any other manner which will not adversely affect the interests of the holders in any material respect. |

Modifications with Consent of Warrantholders. We and the warrant agent, with the consent of the holders of not less than a majority in number of the then outstanding warrants affected, may modify or amend the warrant agreement. However, we and the warrant agent may not, without the consent of each affected warrantholder:

| · | change the exercise price of the warrants; |

| · | reduce the amount receivable upon exercise, cancellation or expiration of the warrants other than in accordance with adjustment provisions included in the terms of the warrants; |

| · | shorten the period of time during which the warrants may be exercised; |

| · | materially and adversely affect the exercise rights of the owners of the warrants; or |

| · | reduce the percentage of outstanding warrants the consent of whose owners is required for the modification of the applicable warrant agreement. |

Merger, Consolidation, Sale or Other Disposition. If at any time there we merge or consolidate or transfer substantially all of our assets, the successor corporation will succeed to and assume all of our obligations under each warrant agreement and the warrant certificates. We will then be relieved of any further obligation under each of those warrant agreements and the warrants issued under those warrant agreements. See “Description of Debt Securities — Consolidations, Mergers and Sales of Assets.”

Enforceability of Rights of Warrantholders. The warrant agent will act solely as our agent in connection with the warrant certificates and will not assume any obligation or relationship of agency or trust for or with any holders of warrant certificates or beneficial owners of warrants. Any holder of warrant certificates and any beneficial owner of warrants may, without the consent of any other person, enforce its right, and may institute any proceeding, on its own behalf, to exercise the warrants evidenced by the warrant certificates in the manner provided for in that series of warrants or pursuant to the applicable warrant agreement. Prior to exercise, no holder of any warrant certificate or beneficial owner of any warrants will be entitled to any of the rights of a holder of the debt securities or any other warrant property that may be purchased upon exercise of the warrants, including, without limitation, the right to receive the payments on those debt securities or other warrant property or to enforce any of the covenants or rights in the Indenture or any other similar agreement.

Registration and Transfer of Warrants. Subject to the terms of the applicable warrant agreement, warrants in definitive form may be presented for exchange and for registration of transfer, at the corporate trust office of the warrant agent for that series of warrants, or at any other office indicated in the prospectus supplement relating to that series of warrants, without service charge. However, the holder will be required to pay any taxes and other governmental charges as described in the warrant agreement. The transfer or exchange will be effected only if the warrant agent for the series of warrants is satisfied with the documents of title and identity of the person making the request. See “Forms of Securities — Global Securities” for information regarding warrants in global form.

Replacement of Warrants. We will replace any mutilated certificate evidencing a definitive warrant at the expense of the holder upon surrender of that certificate to the warrant agent. We will replace certificates that have been destroyed, lost or stolen at the expense of the holder upon delivery to us and the warrant agent of evidence satisfactory to us and the warrant agent of the destruction, loss or theft of the certificates. In the case of a destroyed, lost or stolen certificate, an indemnity satisfactory to the

14

warrant agent and to us may be required at the expense of the holder of the warrant evidenced by that certificate before a replacement will be issued.

New York Law to Govern. The warrants and each warrant agreement will be governed by, and construed in accordance with, the laws of the State of New York.

15

Description of Units of JPMorgan Chase & Co.

General

Units will consist of any combination of warrants, purchase contracts, debt securities issued by us, debt obligations or other securities of an entity affiliated or not affiliated with us or any other property (which we refer collectively as the “unit property”). The units or units property may impose obligations on the holder, which may be secured by other items of unit property or other assets or security. The applicable prospectus supplement will also describe:

| · | the designation and the terms of the units and unit property may be traded separately or as other kinds of units; |

| · | whether holders of the units will be required to pledge any items to secure performance thereof, such as described in “— Description of Purchase Contracts of JPMorgan Chase & Co. —Purchase Contracts Issued as Part of Units — Pledge by Purchase Contract Holders to Secure Performance” below; |

| · | any additional terms of the applicable unit agreement; |

| · | any additional provisions for the issuance, payment, settlement, transfer or exchange of the units or of the unit property constituting the units; and |

| · | any applicable United States federal income tax consequences. |

The terms and conditions described under “— Description of Debt Securities of JPMorgan Chase & Co.,” “— Description of Warrants of JPMorgan Chase & Co.,” “— Description of Purchase Contracts of JPMorgan Chase & Co.,” and those described below under “— Significant Provisions of the Unit Agreement,” will apply to each unit and to any unit property consisting of warrants, purchase contracts, debt securities issued by us, debt obligations or other securities of an entity affiliated or not affiliated with us or other property, as applicable, unless otherwise specified in the applicable prospectus supplement.

Significant Provisions of the Unit Agreement

We will issue the units under one or more unit agreements, each referred to as a unit agreement, to be entered into between us and a bank or trust company, as unit agent. We may issue units in one or more series, which will be described in the applicable prospectus supplement for the units. The form of unit agreement is incorporated by reference as an exhibit to the registration statement. The following summarizes the significant provisions of the unit agreements and the units and is not intended to be comprehensive. Holders of the units should review the detailed provisions of the relevant unit agreement for a full description and for other information regarding the units. In addition, we will describe the specific terms that will apply to the units in an accompanying prospectus supplement, which will supplement and, if applicable, may modify or replace the general terms of the units described in the following section. If there are any differences between the accompanying prospectus supplement and this prospectus, the prospectus supplement will control.

Remedies. The unit agent will act solely as our agent in connection with the units governed by the unit agreement and will not assume any obligation or relationship of agency or trust for or with any holders of units or interests in those units. Any holder of units or interests in those units may, without the consent of the unit agent or any other holder or beneficial owner of units, enforce, and may institute any proceeding against us, on its own behalf, its rights under the unit agreement. However, the holders of units or interests in those units may only enforce their rights under the unit property underlying those units and the applicable purchase contract agreement in accordance with the terms of the Indenture, the applicable warrant agreement and the applicable purchase contract agreement.

Modification without Consent of Holders. We and the unit agent may amend or supplement the unit agreement and the terms of the purchase contracts and the purchase contract certificates without the consent of the holders to:

16

| · | cure any ambiguity; |

| · | cure, correct or supplement any defective or inconsistent provision in the agreement; or |

| · | amend the terms in any other manner which we may deem necessary or desirable and which will not adversely affect the interest of the affected holders of units in any material respect. |

Modification with Consent of Holders. We and the unit agent, with the consent of the holders of not less than a majority of units at the time outstanding, may modify or amend the rights of the affected holders of the affected units and the terms of the unit agreement. However, we and the unit agent may not, without the consent of each affected holder of units, make any modifications or amendments that would:

| · | materially and adversely affect the exercise rights of the affected holders, or |

| · | reduce the percentage of outstanding units the consent of whose owners is required to consent to a modification or amendment of the unit agreement. |

Modifications of any debt securities issued pursuant to the Indenture and included in units may only be made in accordance with the Indenture, as described under “— Description of Debt Securities of JPMorgan Chase & Co. — Modification of the Indenture” Modifications of any warrants included in units may only be made in accordance with the terms of the applicable warrant agreement as described under “— Description of Warrants of JPMorgan Chase & Co. — Significant Provisions of the Warrant Agreement.”

Merger, Consolidation, Sale or Conveyance. The unit agreement provides that we will not merge or consolidate with any other person and will not sell or convey all or substantially all of our assets to any person unless:

| · | we will be the continuing corporation, or the successor corporation or person that acquires all or substantially all of our assets: |

| · | will be a corporation organized under the laws of the United States, a state of the United States or the District of Columbia; and |

| · | will assume due and punctual performance of all of our obligations under the unit agreement; and |

| · | immediately after the merger, consolidation, sale or conveyance, we, that person or that successor corporation will not be in default in the performance of the covenants and conditions of the unit agreement applicable to us. |

Replacement of Unit Certificates. We will replace any mutilated certificate evidencing a definitive unit at the expense of the holder upon surrender of that certificate to the unit agent. We will replace certificates that have been destroyed, lost or stolen at the expense of the holder upon delivery to us and the unit agent of evidence satisfactory to us and the unit agent of the destruction, loss or theft of the certificates. In the case of a destroyed, lost or stolen certificate, an indemnity satisfactory to the unit agent and to us may be required at the expense of the holder of the units evidenced by that certificate before a replacement will be issued.

Title. We, the unit agent, the trustee, the warrant agent and any of their agents will treat the registered holder of any unit as its owner, notwithstanding any notice to the contrary, for all purposes.

New York Law to Govern. The unit agreement and the units will be governed by, and construed in accordance with, the laws of the State of New York.

17

Description of Purchase Contracts of JPMorgan Chase & Co.

We may issue purchase contracts, including purchase contracts issued as part of a unit with one or more items of unit property for the purchase or sale of, or settlement in cash based on the value of:

| · | securities issued by us or by an entity affiliated or not affiliated with us, a basket of those securities, an index or indices of those securities or any combination of the above; |

| · | currencies; |

| · | commodities; or |

| · | other property. |

We refer to the property in the above clauses as “purchase contract property.”

Each purchase contract will obligate the holder to purchase or sell, and obligate us to sell or purchase, on a specified date or dates, the purchase contract property at a specified price or prices, or cash in lieu of such purchase contract property, all as described in the applicable prospectus supplement. The applicable prospectus supplement will also specify the methods by which the holders may purchase or sell the purchase contract property and any acceleration, cancellation or termination provisions or other provisions relating to the settlement of a purchase contract.

Purchase Contracts Issued as Parts of Units

Purchase contracts issued as parts of units will be governed by the terms and provisions of a unit agreement. See “— Description of Units of JPMorgan Chase & Co. — Significant Provisions of the Unit Agreement.” The accompanying prospectus supplement will specify the following:

| · | whether the purchase contract obligates the holder to purchase or sell the purchase contract property; |

| · | whether and when a purchase contract issued as part of a unit may be separated from the other securities constituting part of that unit prior to the purchase contract’s settlement date; |

| · | the methods by which the holders may purchase or sell the purchase contract property; |

| · | any acceleration, cancellation or termination provisions or other provisions relating to the settlement of a purchase contract; |

| · | whether the purchase contracts will be issued in definitive or global form, although, in any case, the form of a purchase contract included in a unit will correspond to the form of the unit and of any debt security, warrant or other security included in that unit; and |

| · | any applicable United States federal income tax consequences. |

Holders of the purchase contracts should review the detailed provisions of the relevant unit agreement for a full description and for other information regarding the purchase contracts. In addition, we will describe the specific terms that will apply to the purchase contracts in an accompanying prospectus supplement, which will supplement and, if applicable, may modify or replace the general terms of the purchase contracts described in the following section. If there are any differences between the accompanying prospectus supplement and this prospectus, the prospectus supplement will control.

Settlement of Purchase Contracts. Where purchase contracts issued together with debt securities or debt obligations as part of a unit require the holders to buy purchase contract property, the unit agent may apply principal payments from the debt securities or debt obligations in satisfaction of the holders obligations under the related purchase contract as specified in the prospectus supplement. The unit agent will not so apply the principal payments if the holder has delivered cash to meet its obligations under the purchase contract. To settle the purchase contract and receive the purchase contract property, the holder must present and surrender the unit certificates at the office of the unit agent. If a holder settles its obligations under a purchase contract that is part of a unit in cash rather than by delivering the

18

debt security or debt obligation that is part of the unit, that debt security or debt obligation will remain outstanding, if the maturity extends beyond the relevant settlement date and, as more fully described in the applicable prospectus supplement, the holder will receive that debt security or debt obligation or an interest in the relevant global debt security.

Pledge by Purchase Contract Holders to Secure Performance. To secure the obligations of the purchase contract holders contained in the unit agreement and in the purchase contracts, the holders, acting through the unit agent, as their attorney-in-fact, will assign and pledge the items in the following sentence, which we refer to as the “pledge,” to JPMorgan Chase Bank, National Association, in its capacity as collateral agent, for our benefit. Except as otherwise described in the applicable prospectus supplement, the pledge is a security interest in, and a lien upon and right of set-off against, all of the holders’ right, title and interest in and to:

| · | all or any portion of the debt securities, debt obligations or other securities that are, or become, part of units that include the purchase contracts, or other property as may be specified in the applicable prospectus supplement, which we refer to as the “pledged items”; |

| · | all additions to and substitutions for the pledged items as may be permissible, if so specified in the applicable prospectus supplement; |

| · | all income, proceeds and collections received or to be received, or derived or to be derived, at any time from or in connection with the pledged items described in the two immediately preceding clauses above; and |

| · | all powers and rights owned or thereafter acquired under or with respect to the pledged items. |

The pledge constitutes collateral security for the performance when due by each holder of its obligations under the unit agreement and the applicable purchase contract. Except as otherwise described in the applicable prospectus supplement, the collateral agent will forward all payments from the pledged items to us, unless the payments have been released from the pledge in accordance with the unit agreement. If the terms of the unit so provide, we will use the payments received from the pledged items to satisfy the obligations of the holder of the unit under the related purchase contract.

Property Held in Trust by Unit Agent. If a holder fails to settle its obligations under a purchase contract that is part of a unit and fails to present and surrender its unit certificate to the unit agent when required, that holder will not receive the purchase contract property. Instead, the unit agent will hold that holder’s purchase contract property, together with any distributions, as the registered owner in trust for the benefit of the holder until the holder presents and surrenders the certificate or provides satisfactory evidence that the certificate has been destroyed, lost or stolen. The unit agent or JPMorgan Chase & Co. may require an indemnity from the holder for liabilities related to any destroyed, lost or stolen certificate. If the holder does not present the unit certificate, or provide the necessary evidence of destruction or loss and indemnity, on or before the second anniversary of the settlement date of the related purchase contract, the unit agent will pay to us the amounts it received in trust for that holder. Thereafter, the holder may recover those amounts only from us and not the unit agent. The unit agent will have no obligation to invest or to pay interest on any amount it holds in trust pending distribution.

19

Description of Debt Securities of JPMorgan Chase Financial Company LLC

General

In this “Description of Debt Securities of JPMorgan Chase Financial Company LLC” section, “we,” “us” and “our” refer only to JPMorgan Chase Financial Company LLC and not to any of its affiliates, including JPMorgan Chase & Co., references to the “Guarantor” refer only to JPMorgan Chase & Co. and not to any of its subsidiaries or affiliates, and all references to “debt securities” refer only to debt securities issued by JPMorgan Chase Financial Company LLC and not to any debt securities issued by JPMorgan Chase & Co.