Bermuda | | | 4412 | | | N/A |

(State or other jurisdiction of incorporation or organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification Number) |

James A. McDonald Skadden, Arps, Slate, Meagher & Flom (UK) LLP 40 Bank Street, Canary Wharf London, E14 5DS United Kingdom +44 20 7519-7000 | | | John R. Vetterli Jessica Y. Chen White & Case LLP 1221 Avenue of the Americas New York, NY 10020 United States +1 (212) 819-8200 |

| | | Emerging growth company ☒ |

† | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

| | | Per Common Share | | | Total | |

Public offering price | | | $ | | | $ |

Underwriting discounts and commissions | | | $ | | | $ |

Proceeds, before expenses, to us(1) | | | $ | | | $ |

(1) | See “Underwriters” for additional information regarding the total underwriters’ compensation. |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

Vessel Name(1) | | | Hull No. | | | Type | | | Estimated Delivery Date | | | Size (dwt) | | | Intended Flag | | | Shipyard | | | Type of Employment(2) |

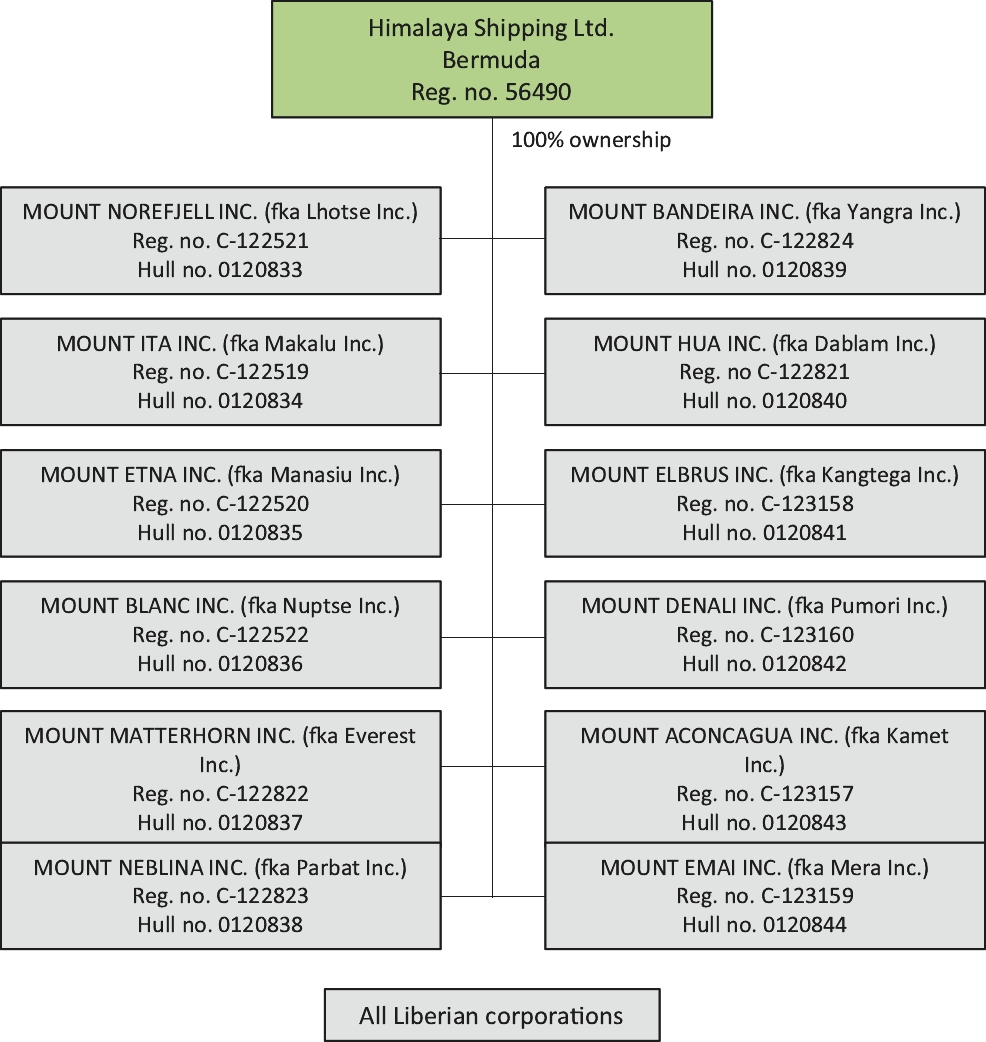

Mount Norefjell | | | 0120833 | | | Newcastlemax dry bulk carrier | | | March 2, 2023 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Ita | | | 0120834 | | | Newcastlemax dry bulk carrier | | | March 9, 2023 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Etna | | | 0120835 | | | Newcastlemax dry bulk carrier | | | March 25, 2023 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Blanc | | | 0120836 | | | Newcastlemax dry bulk carrier | | | June 4, 2023 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Matterhorn | | | 0120837 | | | Newcastlemax dry bulk carrier | | | July 24, 2023 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Neblina | | | 0120838 | | | Newcastlemax dry bulk carrier | | | September 7, 2023 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Bandeira | | | 0120839 | | | Newcastlemax dry bulk carrier | | | December 26, 2024 | | | 210,000 | | | Liberia | | | New Times | | |

Vessel Name(1) | | | Hull No. | | | Type | | | Estimated Delivery Date | | | Size (dwt) | | | Intended Flag | | | Shipyard | | | Type of Employment(2) |

Mount Hua | | | 0120840 | | | Newcastlemax dry bulk carrier | | | January 5, 2024 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Elbrus | | | 0120841 | | | Newcastlemax dry bulk carrier | | | February 19, 2024 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Denali | | | 0120842 | | | Newcastlemax dry bulk carrier | | | June 8, 2024 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Aconcagua | | | 0120843 | | | Newcastlemax dry bulk carrier | | | July 23, 2024 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Emai | | | 0120844 | | | Newcastlemax dry bulk carrier | | | August 2, 2024 | | | 210,000 | | | Liberia | | | New Times | | |

(1) | All our vessels are subject to Sale and Leaseback Agreements, effective upon delivery and effective transfer of ownership to the SPV owned by the Leasing Providers, as further described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Financing Arrangements”. |

(2) | We have agreed to charter six vessels on index-linked time charters for periods of between 24 to 28 months, plus certain extension options, and a seventh vessel for a two year charter at a fixed rate of $30 thousand per day, gross. These charters will be effective upon delivery and with respect to the first seven vessels to be delivered. |

• | changes in the international shipping industry, including charter hire rates and related volatility; |

• | the current state of the global financial markets and economic conditions; |

• | outbreaks of epidemic and pandemic diseases, including COVID-19, and governmental responses thereto; |

• | an over-supply of dry bulk vessel capacity which may lead to reductions in current charter rates, vessel values and profitability; |

• | high prices of fuel, or bunker, may adversely affect our profits; |

• | inherent operational risks of the shipping industry; |

• | risks with respect to our counterparties on contracts, and failure of such counterparties to meet their obligations; |

• | not being successful in finding employment for all of our vessels; |

• | dependency on the ability of our subsidiaries to distribute or loan funds to us in order to make dividend payments; |

• | potential conflicts of interests between us and 2020 Bulkers; |

• | a decrease in the level of China’s export of goods; |

• | our dependency upon a limited number of significant customers for a large part of our revenues and the loss of one or more of these customers; |

• | our inability to make required payment under certain of our Financing Arrangements if our vessel charters do not provide sufficient revenue to service our debt service obligations; |

• | restrictive covenants in our existing Credit Arrangements imposing financial and other restrictions on us; |

• | potential inability to comply with the financial covenants in our CCBFL Leasing; |

• | inability to successfully take delivery of and employ our newbuild dry bulk carriers; and |

• | other factors described under “Risk Factors” in this prospectus. |

• | Our bye-laws do not require shareholder approval for the issuance of shares (i) in connection with the acquisition of stock or assets of another company; (ii) when it would result in a change of control; (iii) when a share option or purchase plan is to be established or materially amended or other equity compensation arrangement made or materially amended, pursuant to which shares may be acquired by officers, directors, employees, or consultants; or (iv) in connection with a transaction (other than a public offering) involving the sale, issuance or potential issuance of shares at a price less than market value. |

• | The requirement to file quarterly reports on Form 10-Q, from filing proxy solicitation materials on Schedule 14A or 14C in connection with annual or special meetings of shareholders. |

• | The requirement to file reports on Form 8-K disclosing significant events within four business days of their occurrence. |

• | The disclosure requirements of Regulation FD. |

• | Section 16 rules regarding sales of common shares by insiders, which will provide less data in this regard than shareholders of U.S. companies that are subject to the Exchange Act. |

(in millions of U.S. dollars except share and per share data) | | | Year ended December 31, 2022 | | | Period from March 17 (Inception) to December 31, 2021 |

Operating expenses | | | | | ||

Total operating expenses | | | | | (1.0) | |

Operating loss | | | | | (1.0) | |

Net loss attributable to shareholders’ of Himalaya Shipping | | | | | (1.0) | |

Loss per share | | | | | ||

Basic and diluted loss per share | | | | | (0.06) | |

Weighted average shares outstanding | | | | | 18,316,970 |

(in millions of U.S.$) | | | As of December 31, 2022 | | | As of December 31, 2021 |

ASSETS | | | | | ||

| | | | | |||

Current Assets | | | | | ||

Cash and cash equivalents | | | | | 11.3 | |

Total current assets | | | | | 11.3 | |

| | | | | |||

Non-current assets | | | | | ||

Newbuildings | | | | | 83.5 | |

Other non-current assets | | | | | 0.4 | |

Total non-current assets | | | | | 83.9 | |

Total assets | | | | | 95.2 | |

| | | | | |||

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | ||

| | | | | |||

Current liabilities | | | | | ||

Trade payables | | | | | 0.8 | |

Total current liabilities | | | | | 0.8 | |

| | | | | |||

Non-current liabilities | | | | | ||

Related party liabilities | | | | | 2.5 | |

Total non-current liabilities | | | | | 2.5 | |

Total liabilities | | | | | 3.3 | |

Commitments and contingencies | | | | | ||

| | | | |

(in millions of U.S.$) | | | As of December 31, 2022 | | | As of December 31, 2021 |

Shareholders’ equity | | | | | ||

Common shares of par value $1.0 per share: authorized 140,010,000 shares, issued and outstanding 32,152,857 shares | | | | | 32.2 | |

Additional paid-in capital | | | | | 60.7 | |

Retained loss | | | | | (1.0) | |

Total shareholders’ equity | | | | | 91.9 | |

Total liabilities and shareholders’ equity | | | | | 95.2 |

(in millions of U.S.$) | | | Year ended December 31, 2022 | | | Period from March 17 (Inception) to December 31, 2021 |

Net loss | | | | | (1.0) | |

Other current and non-current liabilities | | | | | 0.5 | |

Net cash used in operating activities | | | | | (0.5) | |

Investing activities | | | | | ||

Additions to newbuildings | | | | | (68.8) | |

Net cash used in investing activities | | | | | (68.8) | |

Financing activities | | | | | ||

Proceeds from the issuance of common shares, net of issuance costs | | | | | 80.6 | |

Net cash provided by financing activities | | | | | 80.6 | |

Net increase (decrease) in cash and cash equivalents and restricted cash | | | | | 11.3 | |

Cash and cash equivalents and restricted cash at beginning of period | | | | | — | |

Cash and cash equivalents and restricted cash at end of period | | | | | 11.3 |

• | supply of and demand for, changes in the exploration or production of, and the location of consuming regions for energy resources, commodities, and semi-finished and finished consumer and industrial products; |

• | the location of regional and global exploration, production and manufacturing facilities; |

• | globalization and nationalization of production and manufacturing; |

• | global and regional economic and political conditions, armed conflicts, terrorist activities, embargoes, strikes, tariffs and “trade wars,” including the war in Ukraine, including developments in international trade and fluctuations in industrial and agricultural production; |

• | economic slowdowns caused by public health events such as the COVID-19 outbreak and other diseases and viruses, affecting livestock and humans; |

• | disruptions and developments in international trade; |

• | changes in seaborne and other transportation patterns, including the distance cargo is transported by sea and trade patterns; |

• | environmental and other regulatory developments; and |

• | currency exchange rates. |

• | the number of newbuilding orders and deliveries, including delays in deliveries; |

• | the number of shipyards and ability of shipyards to deliver vessels; |

• | the scrapping rate of older vessels; |

• | port and canal congestion; |

• | the degree of scrapping of older vessels, depending, among other things, on recycling rates and international recycling regulations; |

• | disruption of shipping routes due to accidents or political events; |

• | speed of vessel operation; |

• | vessel casualties; |

• | the number of vessels that are out of service, namely those that are laid-up, dry docked, awaiting repairs or otherwise not available for hire; |

• | sanctions (in particular, sanctions on Russia, Iran, and Venezuela, among others); |

• | availability of financing for new vessels and shipping activity; |

• | changes in national or international regulations that may limit the useful life of vessels or effectively cause reductions in the carrying capacity of vessels or early obsolescence of tonnage and encourage the construction of vessels; and |

• | changes in environmental and other regulations that may limit the useful lives of vessels. |

• | prevailing level of charter hire rates; |

• | general economic and market conditions affecting the shipping industry; |

• | types, sizes and ages of vessels; |

• | supply of and demand for vessels; |

• | the need to upgrade vessels as a result of charterer requirements; |

• | technological advances in vessel design or equipment or otherwise; |

• | cost of newbuildings; |

• | applicable governmental or other regulations; |

• | distressed asset sales, including the Shipbuilding Contract sales below acquisition costs due to lack of financing; and |

• | competition from other shipping companies and other modes of transportation. |

• | renew existing charters upon their expiration; |

• | obtain new charters; |

• | successfully interact with shipyards during periods of shipyard construction contracts; |

• | obtain financing on commercially acceptable terms; |

• | maintain satisfactory relationships with our charterers and suppliers; and |

• | successfully execute our business strategies. |

• | actual or anticipated variations in our operating results; |

• | whether or not financial analysts cover our common shares after this offering; |

• | changes in financial estimates by financial analysts, or any failure by us to meet or exceed any of these estimates, or changes in the recommendations of any financial analysts that elect to follow our common shares or the shares of our competitors; |

• | changes in market valuations of similar companies; |

• | announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships or joint ventures; |

• | future sales of our common shares by us or our shareholders; |

• | investor perceptions of us and the industry in which we operate; |

• | general economic, industry or market conditions; and |

• | the other factors described in this “Risk Factors” section. |

• | our board of directors to determine the powers, preferences and rights of our preference shares and to issue the preference shares without shareholder approval; |

• | an affirmative vote of 662∕3% of our voting shares for certain “business combination” transactions which have not been approved by our board of directors; |

• | our board of directors, with the sanction of a resolution passed by a simple majority of votes cast at a general meeting with the necessary quorum for such meeting of two persons at least holding or representing by proxy 331∕3% of our issued common shares (or the class, where applicable), to amalgamate or merge us with another company; and |

• | our board of directors to reduce the company’s issued share capital selectively with the authority of a resolution of the shareholders. |

• | plans to acquire newbuild vessels and any associated contracts thereof; |

• | expectations to maintain existing and secure additional charters; |

• | expected trends in our industry, including those discussed under “Industry Overview”; |

• | expected trends in the global fleet and demand of Newcastlemax vessels; |

• | expected market trends and expected impact of sanctions; |

• | our strategy and plans; |

• | our planned used of proceeds; |

• | our plans to meet our liquidity requirements; and |

• | our dividend policy. |

• | general economic, political and business conditions; |

• | our ability to complete the purchase of the vessels we have agreed to acquire; |

• | our ability to meet the conditions and covenants in our financing agreements; |

• | general dry bulk market conditions, including fluctuations in charter hire rates and vessel values; |

• | changes in demand in the dry bulk shipping industry, including the market for our vessels; |

• | changes in the supply of dry bulk vessels; |

• | our ability to successfully employ our dry bulk vessels; |

• | changes in our operating expenses, including fuel or bunker prices, dry docking and insurance costs; |

• | compliance with, and our liabilities under, governmental, tax environmental and safety laws and regulations; |

• | changes in governmental regulation, tax and trade matters and actions taken by regulatory authorities; |

• | potential disruption of shipping routes due to accidents or political events; |

• | our expectations regarding the availability of vessel acquisitions and our ability to complete acquisition transactions planned; |

• | our ability to procure or have access to financing and refinancing; |

• | our continued borrowing availability under our Sale and Leaseback Agreements and compliance with the financial covenants therein; |

• | fluctuations in foreign currency exchange rates; |

• | potential conflicts of interest involving members of our board and management and our significant shareholder; |

• | our ability to pay dividends; and |

• | other factors that may affect our financial condition, liquidity and results of operations. |

• | on an actual basis; and |

• | on as adjusted basis to give effect to our sale of the common shares in the offering, and the receipt of approximately $ million in estimated net proceeds from this offering, assuming an initial public offering price as set forth in the section entitled “Use of Proceeds” and assuming that the underwriters’ option to purchase additional common shares is not exercised. |

| | | As of December 31, 2022 | ||||

| | | Actual | | | As Adjusted(1) | |

| | | (in thousands of U.S. dollars) | ||||

Cash: | | | | | ||

Cash and cash equivalents | | | $ | | | $ |

Total current debt: | | | | | ||

Guaranteed | | | | | ||

Secured | | | | | ||

Unguaranteed and unsecured | | | | | ||

Total current debt | | | | | ||

Total non-current debt: | | | | | ||

Guaranteed | | | | | ||

Secured | | | | | ||

Unguaranteed and unsecured | | | | | ||

Total non-current debt | | | | | ||

Total indebtedness | | | | | ||

Shareholders’ equity: | | | | | ||

Share capital | | | | | ||

Additional paid-in capital | | | | | ||

Accumulated other comprehensive income | | | | | ||

Retained earnings (deficit) | | | | | ||

Total shareholders’ equity | | | | | ||

Total capitalization(2)(3) | | | $ | | | $ |

(1) | Reflects the net proceeds of this offering (assuming an offering price of $ per common share, assuming an initial public offering price of $ per common share, which is the closing price of our common shares on the Euronext Expand on , 2023). |

(2) | Each $1.00 increase (decrease) in the offering price per common share would increase (decrease) our total capitalization and shareholders’ equity by $ million. |

(3) | Total capitalization consists of total debt plus total shareholders’ equity. |

Assumed initial public offering price per share | | | $ |

Net tangible book value per share at December 31, 2022 | | | $ |

Increase in net tangible book value per share attributable to new investors | | | $ |

Pro forma net tangible book value per share after the offering | | | $ |

Dilution per common share to new investors | | | $ |

| | | Common Shares Purchased | | | Total Consideration | | | Average Price Per Share | |||||||

(in thousands, except percentages and per share amounts) | | | Number | | | Percent | | | Amount | | | Percent | | ||

Pre-IPO owners | | | | | | | | | | | |||||

Investors in this offering | | | | | | | | | | | |||||

Total | | | | | | | | | | | |||||

| | | (in millions of U.S. dollar) | |

2022 | | | $74.9 |

2023 | | | $363.3 |

2024 | | | $309.7 |

Total | | | $747.9 |

• | vessel operating expenses; |

• | chartering related expenses; |

• | technical and commercial management fees; |

• | voyage expenses and commissions; and |

• | depreciation. |

• | the earnings from our vessels; |

• | gains (losses) from any sale of vessels; |

• | vessel operating expenses, |

• | voyage commissions; |

• | administrative expenses; |

• | depreciation; and |

• | interest expense under our Sale and Leaseback Agreements. |

(in millions of U.S. dollars except per share data) | | | Year ended December 31, 2022 | | | Period from March 17 (Inception) to December 31, 2021 |

Operating expenses | | | | | ||

General and administrative expenses | | | | | (1.0) | |

Total operating expenses | | | | | (1.0) | |

Operating loss | | | | | (1.0) | |

Net loss attributable to shareholders’ of Himalaya Shipping Ltd. | | | | | (1.0) | |

| | | | | |||

Line items below: | | | | | ||

Basic and diluted loss per share | | | | | (0.06) | |

Weighted-average shares outstanding | | | | | 18,316,970 |

(in millions of U.S. dollars except per share data) | | | Year ended December 31, 2022 | | | Period from March 17 (Inception) to December 31, 2021 |

Consolidated statements of Comprehensive Income | | | | | ||

Net loss | | | | | (1.0) | |

Other comprehensive income | | | | | — | |

Total comprehensive income | | | | | (1.0) | |

Weighted average common shares outstanding | | | | | 18,316,970 | |

Earnings per share, basic and diluted | | | | | (0.06) |

(in millions of US$) | | | Year ended - December 31, 2022 | | | March 17 (Inception) to December 31, 2021 |

Net cash used in operating activities | | | | | (0.5) | |

Net cash used in investing activities | | | | | (68.8) | |

Net cash provided by financing activities | | | | | 80.6 | |

Net increase (decrease) in cash and cash equivalents and restricted cash | | | | | 11.3 | |

Cash and cash equivalents and restricted cash at beginning of period | | | | | — | |

Cash and cash equivalents and restricted cash at end of period | | | | | 11.3 |

Vessel Name | | | Hull No. | | | Third Anniversary | | | Fourth Anniversary | | | Fifth Anniversary | | | Sixth Anniversary | | | Seventh Anniversary |

Mount Norefjell | | | 0120833 | | | $56,934,360 | | | $54,492,480 | | | $52,050,600 | | | $49,608,720 | | | $47,166,840 |

Mount Ita | | | 0120834 | | | $56,934,360 | | | $54,492,480 | | | $52,050,600 | | | $49,608,720 | | | $47,166,840 |

Mount Etna | | | 0120835 | | | $56,934,360 | | | $54,492,480 | | | $52,050,600 | | | $49,608,720 | | | $47,166,840 |

Mount Blanc | | | 0120836 | | | $56,934,360 | | | $54,492,480 | | | $52,050,600 | | | $49,608,720 | | | $47,166,840 |

Mount Matterhorn | | | 0120837 | | | $56,000,000 | | | $54,000,000 | | | $51,000,000 | | | $48,000,000 | | | $46,000,000 |

Mount Neblina | | | 0120838 | | | $56,000,000 | | | $54,000,000 | | | $51,000,000 | | | $48,000,000 | | | $46,000,000 |

Mount Bandeira | | | 0120839 | | | $56,000,000 | | | $54,000,000 | | | $51,000,000 | | | $48,000,000 | | | $46,000,000 |

Mount Hua | | | 0120840 | | | $56,000,000 | | | $54,000,000 | | | $51,000,000 | | | $48,000,000 | | | $46,000,000 |

Mount Elbrus | | | 0120841 | | | $56,000,000 | | | $54,000,000 | | | $51,000,000 | | | $48,000,000 | | | $46,000,000 |

Mount Denali | | | 0120842 | | | $56,000,000 | | | $54,000,000 | | | $51,000,000 | | | $48,000,000 | | | $46,000,000 |

Mount Aconcagua | | | 0120843 | | | $56,000,000 | | | $54,000,000 | | | $51,000,000 | | | $48,000,000 | | | $46,000,000 |

Mount Emai | | | 0120844 | | | $56,000,000 | | | $54,000,000 | | | $51,000,000 | | | $48,000,000 | | | $46,000,000 |

Vessel Name | | | Hull No. | | | First Installment(1)(*) | | | Second Installment(1)(*) | | | Third Installment(*) | | | Fourth Installment(*) | | | Fifth Installment(*)(**) | | | Sixth Installment (Scrubbers) | | | Purchase Price(5) |

Mount Norefjell | | | 0120833 | | | $3,395,850 | | | $3,395,850 | | | $6,791,700(2) | | | $6,791,700(2) | | | $47,541,900(2) | | | $2,400,000 | | | $70,317,000 |

Mount Ita | | | 0120834 | | | $3,395,850 | | | $3,395,850 | | | $6,791,700(2) | | | $6,791,700(2) | | | $47,541,900(2) | | | $2,400,000 | | | $70,317,000 |

Mount Etna | | | 0120835 | | | $3,395,850 | | | $3,395,850 | | | $6,791,700(2) | | | $6,791,700(2) | | | $47,541,900(2) | | | $2,400,000 | | | $70,317,000 |

Mount Blanc | | | 0120836 | | | $3,395,850 | | | $3,395,850 | | | $6,791,700(2) | | | $6,791,700(2) | | | $47,541,900(2) | | | $2,400,000 | | | $70,317,000 |

Mount Matterhorn | | | 0120837 | | | $3,420,850 | | | $3,420,850 | | | $6,841,700(3) | | | $6,841,700(3) | | | $49,241,900(3) | | | $2,400,000 | | | $72,167,000 |

Mount Neblina | | | 0120838 | | | $3,420,850 | | | $3,420,850 | | | $6,841,700(3) | | | $6,841,700(3) | | | $49,241,900(3) | | | $2,400,000 | | | $72,167,000 |

Mount Bandeira | | | 0120839 | | | $3,420,850 | | | $3,420,850 | | | $6,841,700(4) | | | $6,841,700(4) | | | $49,241,900(4) | | | $2,400,000 | | | $72,167,000 |

Mount Hua | | | 0120840 | | | $3,420,850 | | | $3,420,850 | | | $6,841,700(4) | | | $6,841,700(4) | | | $49,241,900(4) | | | $2,400,000 | | | $72,167,000 |

Mount Elbrus | | | 0120841 | | | $3,445,850 | | | $3,445,850 | | | $6,891,700(3) | | | $6,891,700(3) | | | $49,591,900(3) | | | $2,400,000 | | | $72,667,000 |

Mount Denali | | | 0120842 | | | $3,445,850 | | | $3,445,850 | | | $6,891,700(3) | | | $6,891,700(3) | | | $49,591,900(3) | | | $2,400,000 | | | $72,667,000 |

Mount Aconcagua | | | 0120843 | | | $3,445,850 | | | $3,445,850 | | | $6,891,700(3) | | | $6,891,700(3) | | | $49,591,900(3) | | | $2,400,000 | | | $72,667,000 |

Mount Emai | | | 0120844 | | | $3,445,850 | | | $3,445,850 | | | $6,891,700(3) | | | $6,891,700(3) | | | $49,591,900(3) | | | $2,400,000 | | | $72,667,000 |

Total aggregate purchase price for the 12 vessels | | | $860,604,000(5) | |||||||||||||||||||||

(1) | Paid installments which have been financed with equity raised by the Company in 2021 (see “—Equity Issuances”). |

(2) | Installments to be paid substantially with proceeds from the financing available pursuant to the Avic Leasing. |

(3) | Installments to be paid substantially with proceeds from the financing available pursuant to the CCBFL Leasing. |

(4) | Installments to be paid substantially with proceeds from the financing available pursuant to the Jiangsu Leasing, effective in March 2023. |

(5) | Does not reflect the variation orders and the deductions of the Address Commission to be deducted from the purchase price. The average Address Commission for the vessels is $679,000; whereas the currently anticipated variation orders $532,000 per vessel as further described below. |

(*) | The table indicates the (i) installments that have been paid (in gray), (ii) installments to be paid which have financing (in green), and (iii) installment to be paid which are unfinanced (in white). |

(**) | The delivery installments are expected to be increased as a consequence of variation orders under the Shipbuilding Contracts, currently anticipated to be $532,000 per vessel, which related to an increase of the size of the Low Sulphur Fuel Oil (LSFO)/Marine Gas Oil (MGO) tanks on each vessel to 4,750 cbm, in order to offer maximum flexibility in trading of the ships. |

Vessel Name(1) | | | Hull No. | | | Type | | | Estimated Delivery Date | | | Size (dwt) | | | Intended Flag | | | Shipyard | | | Type of Employment(2) |

Mount Norefjell | | | 0120833 | | | Newcastlemax dry bulk carrier | | | March 2, 2023 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Ita | | | 0120834 | | | Newcastlemax dry bulk carrier | | | March 9, 2023 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Etna | | | 0120835 | | | Newcastlemax dry bulk carrier | | | March 25, 2023 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Blanc | | | 0120836 | | | Newcastlemax dry bulk carrier | | | June 4, 2023 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Matterhorn | | | 0120837 | | | Newcastlemax dry bulk carrier | | | July 24, 2023 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Neblina | | | 0120838 | | | Newcastlemax dry bulk carrier | | | September 7, 2023 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Bandeira | | | 0120839 | | | Newcastlemax dry bulk carrier | | | December 26, 2024 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Hua | | | 0120840 | | | Newcastlemax dry bulk carrier | | | January 5, 2024 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Elbrus | | | 0120841 | | | Newcastlemax dry bulk carrier | | | February 19, 2024 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Denali | | | 0120842 | | | Newcastlemax dry bulk carrier | | | June 8, 2024 | | | 210,000 | | | Liberia | | | New Times | | |

Vessel Name(1) | | | Hull No. | | | Type | | | Estimated Delivery Date | | | Size (dwt) | | | Intended Flag | | | Shipyard | | | Type of Employment(2) |

Mount Aconcagua | | | 0120843 | | | Newcastlemax dry bulk carrier | | | June 23, 2024 | | | 210,000 | | | Liberia | | | New Times | | | |

Mount Emai | | | 0120844 | | | Newcastlemax dry bulk carrier | | | August 2, 2024 | | | 210,000 | | | Liberia | | | New Times | | |

(1) | All our vessels are subject to Leaseback Agreements, effective upon delivery and effective transfer of ownership to the SPV owned by the Leasing Providers, as further described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Financing Arrangements”. |

(2) | We have agreed to charter six vessels on index-linked time charters for periods of between 24 to 28 months, plus certain extension options, and a seventh vessel for a two year charter at a fixed rate of $30 thousand per day, gross. These charters will be effective upon delivery and with respect to the first seven vessels to be delivered. |

Vessel Name | | | Hull No. | | | Contractual Delivery Date(3) | | | Estimated Delivery Date | | | Purchase Price(1)(2) |

Mount Norefjell | | | 0120833 | | | April 8, 2023 | | | March 2, 2023 | | | $70,317,000 |

Mount Ita | | | 0120834 | | | May 28, 2023 | | | March 9, 2023 | | | $70,317,000 |

Mount Etna | | | 0120835 | | | July 18, 2023 | | | March 25, 2023 | | | $70,317,000 |

Mount Blanc | | | 0120836 | | | September 8, 2023 | | | June 4, 2023 | | | $70,317,000 |

Mount Matterhorn | | | 0120837 | | | September 18, 2023 | | | July 24, 2023 | | | $72,167,000 |

Mount Neblina | | | 0120838 | | | October 31, 2023 | | | September 7, 2023 | | | $72,167,000 |

Mount Bandeira | | | 0120839 | | | February 8, 2024 | | | December 26, 2024 | | | $72,167,000 |

Mount Hua | | | 0120840 | | | February 28, 2024 | | | January 5, 2024 | | | $72,167,000 |

Mount Elbrus | | | 0120841 | | | April 22, 2024 | | | February 19, 2024 | | | $72,667,000 |

Mount Denali | | | 0120842 | | | July 8, 2024 | | | June 8, 2024 | | | $72,667,000 |

Mount Aconcagua | | | 0120843 | | | August 28, 2024 | | | July 23, 2024 | | | $72,667,000 |

Mount Emai | | | 0120844 | | | September 23, 2024 | | | August 2, 2024 | | | $72,667,000 |

(1) | Includes cost of scrubbers: $2.4 million per vessel. |

(2) | Does not reflect the variation orders and the deduction of the Address Commission to be deducted from the purchase price. The average Address Commission for the vessels is $679,000; whereas the currently anticipated variation orders $532,000 per vessel as further described below. |

(3) | In the event of delays in the construction of the vessels, or any performance required under the Shipbuilding Contracts due to certain causes which permit extension of the time for delivery, the contractual delivery dates shall be extended accordingly. |

Vessel Name | | | Hull No. | | | Address Commission |

Mount Norefjell | | | 0120833 | | | $674,000 |

Mount Ita | | | 0120834 | | | $674,000 |

Mount Etna | | | 0120835 | | | $674,000 |

Mount Blanc | | | 0120836 | | | $674,000 |

Mount Matterhorn | | | 0120837 | | | $679,000 |

Mount Neblina | | | 0120838 | | | $679,000 |

Mount Bandeira | | | 0120839 | | | $679,000 |

Mount Hua | | | 0120840 | | | $679,000 |

Mount Elbrus | | | 0120841 | | | $684,000 |

Mount Denali | | | 0120842 | | | $684,000 |

Mount Aconcagua | | | 0120843 | | | $684,000 |

Mount Emai | | | 0120844 | | | $684,000 |

• | injury to, destruction or loss of, or loss of use of, natural resources and the costs of assessment costs; |

• | injury to, or economic losses resulting from, the destruction of real and personal property; |

• | loss of subsistence use of natural resources that are injured, destroyed or lost; |

• | net loss of taxes, royalties, rents, fees or net profit revenues resulting from injury, destruction or loss of real or personal property, or natural resources; |

• | lost profits or impairment of earning capacity due to injury, destruction or loss of real or personal property or natural resources; and |

• | net cost of increased or additional public services necessitated by removal activities following a discharge of oil, such as protection from fire, safety or health hazards, and loss of subsistence use of natural resources. |

Directors and Executive Officers | | | Age | | | Position/Title |

Bjørn Isaksen | | | 38 | | | Director |

Jehan Mawjee | | | 34 | | | Director |

Georgina Sousa | | | 72 | | | Director |

Carl Steen | | | 73 | | | Director |

Mi Hong Yoon | | | 52 | | | Director and Company Secretary |

Herman Billung | | | 64 | | | Chief Executive Officer |

Vidar Hasund | | | 44 | | | Chief Financial Officer |

Olav Eikrem | | | 66 | | | Chief Technical Officer |

• | a duty to act in good faith in the best interests of the company; |

• | a duty not to make a personal profit from opportunities that arise from the office of director; |

• | a duty to avoid conflicts of interest; and |

• | a duty to exercise powers for the purpose for which such powers were intended. |

• | Our bye-laws do not require shareholder approval for the issuance of shares (i) in connection with the acquisition of stock or assets of another company; (ii) when it would result in a change of control; (iii) when |

• | The requirment to file quarterly reports on Form 10-Q, from filing proxy solicitation materials on Schedule 14A or 14C in connection with annual or special meetings of shareholders. |

• | The requirement to file reports on Form 8-K disclosing significant events within four business days of their occurrence. |

• | The disclosure requirements of Regulation FD. |

• | Section 16 rules regarding sales of common shares by insiders, which will provide less data in this regard than shareholders of U.S. companies that are subject to the Exchange Act. |

Common Shares Beneficially Owned | |||||||||||||||

| | | Prior to this offering | | | After Giving Effect to this offering Assuming Underwriters’ Option is Not Exercised | | | After Giving Effect to this offering Assuming Underwriters’ Option is Exercised in Full | |||||||

Name of Beneficial Owner | | | Number | | | Percent | | | Number | | | Percent | | | Percent |

Directors and Executive Officers | | | | | | | | | | | |||||

Herman Billung | | | * | | | * | | | | | | | |||

Vidar Hasund | | | * | | | * | | | | | | | |||

Olav Eikrem | | | * | | | * | | | | | | | |||

Bjørn Isaksen | | | * | | | * | | | | | | | |||

Jehan Mawjee | | | — | | | — | | | | | | | |||

Georgina Sousa | | | — | | | — | | | | | | | |||

Carl Steen | | | — | | | — | | | | | | | |||

Mi Hong Yoon | | | — | | | — | | | | | | | |||

All executive officers and directors as a group (eight persons)(1) | | | 380,000 | | | 1.2% | | | | | | | |||

5% Equity holders | | | | | | | | | | | |||||

Drew Holdings Ltd.(2) | | | 12,446,185 | | | 38.7% | | | | | | | |||

Affinity Shipholdings I LLP | | | 3,228,096 | | | 10.0% | | | | | | | |||

J.P. Morgan Securities LLC | | | 2,095,238 | | | 6.5% | | | | | | | |||

Citibank, N.A. | | | 1,952,380 | | | 6.1% | | | | | | | |||

* | Represents beneficial ownership of less than 1.0% of total outstanding shares, including share options granted under the LTI Plan. |

(1) | On December 8, 2021, our Board of Directors approved the award of 500,000 share options under the LTI Plan to our executive offices and directors to vest within a period of three years of the grant, all of which are not included for purposes of this table. |

(2) | On March 10, 2022, our Board of Directors approved the award of 120,000 share options under the LTI Plan to our executive offices and directors to vest within a period of three years of the grant, all of which are not included for purposed of this table. |

(3) | Drew Holdings Ltd. is wholly owned by Drew Trust, a trust established in Bermuda for the benefit of Mr. Trøim and his immediate family. |

• | Upon our incorporation on March 17, 2021, we issued 10,000 common shares at a subscription price of $1.00 per share. |

• | On June 15, 2021, we issued 15,000 common shares to Magni at a subscription price of $1.00 per share in exchange for (i) a contribution by Magni of receivables in the aggregate amount of $13.6 million, which related to receivables due an outstanding from our subsidiaries to Magni in connection with a loan made by Magni to pay the first installments under the 1-4 Shipbuilding Contract, and (ii) a capital contribution of $1.4 million in cash from Magni. |

• | On July 16, 2021, we completed a private placement of 10,000,000 shares at a subscription price of $3.00 per share, raising gross proceeds of $30 million, a significant portion of which was (together with the proceeds of equity financings) used to pay the first and second installments of the Shipbuilding Contracts totaling $82.1 million. |

• | On October 11, 2021, we completed a private placement of 7,142,857 common shares at a subscription price of $7.00 per share, raising gross proceeds of $50 million, a significant majority of which was to finance the first and second installments of the Shipbuilding Contracts totaling $82.1 million. |

Bermuda | | | Delaware | ||||||||||||

Shareholder meetings | |||||||||||||||

- | | | May be called by the Board of Directors and must be called upon the request of shareholders holding not less than 10% of the paid-up capital of the company carrying the right to vote at general meetings. | | | - | | | May be held at such time or place as designated in the certificate of incorporation or the bye-laws, or if not so designated, as determined by the board of directors. | ||||||

- | | | May be held in or outside Bermuda. | | | - | | | May be held in or outside of Delaware. | ||||||

- | | | Notice: | | | - | | | Notice: | ||||||

| | | - | | | Shareholders must be given at least seven clear days’ advance notice of a general meeting, but the accidental omission to give notice to any person does not invalidate the proceedings at a meeting. | | | | | - | | | Written notice shall be given not less than 10 nor more than 60 days before the meeting. | ||

| | | - | | | Notice of general meetings must specify the place, the day and time of the meeting and in the case of special general meetings, the general nature of the business to be considered. | | | | | - | | | Whenever stockholders are required to take any action at a meeting, a written notice of the meeting shall be given which shall state the place, if any, date and hour of the meeting, and the means of remote communication, if any. | ||

| | | | | | | | | | | ||||||

Shareholder’s voting rights | |||||||||||||||

- | | | Shareholders may act by written consent to elect directors or appoint an auditor. Shareholders may not act by written consent to remove a director or auditor. | | | - | | | With limited exceptions, stockholders may act by written consent to elect directors. | ||||||

- | | | Generally, except as otherwise provided in the bye-laws, or the Companies Act, any action or resolution requiring approval of the shareholders may be passed by a simple majority of the shareholders being all of the Shareholders who at the date of the resolution in writing represent the majority of votes that would be entitled to attend a meeting and vote on the resolution. Any person authorized to vote may authorize another person or persons to act for him or her by proxy, provided the instrument appointing the proxy is in any common form or such other form as the board of directors may determine. | | | - | | | Any person authorized to vote may authorize another person or persons to act for him or her by proxy | ||||||

- | | | The voting rights of shareholders are regulated by the company’s bye-laws and, in certain circumstances, by the Companies Act. The bye-laws may specify the number to constitute a quorum and if the bye-laws permit, a general meeting of the shareholders of a company may be held with only one individual present if the requirement for a quorum is satisfied. | | | - | | | For stock corporations, the certificate of incorporation or bye-laws may specify the number to constitute a quorum, but in no event shall a quorum consist of less than one-third of shares entitled to vote at a meeting. In the absence of such specifications, a majority of shares entitled to vote shall constitute a quorum. | ||||||

Bermuda | | | Delaware | ||||||||||||

| | | | | | | - | | | When a quorum is once present to organize a meeting, it is not broken by the subsequent withdrawal of any stockholders. | ||||||

- | | | The bye-laws may provide for cumulative voting, although our bye-laws do not. | | | - | | | The certificate of incorporation may provide for cumulative voting. | ||||||

- | | | The amalgamation or merger of a Bermuda company with another company or corporation (other than certain affiliated companies) requires the amalgamation or merger agreement to be approved by the company’s Board of Directors and by its shareholders. Unless the company’s bye-laws provide otherwise, the approval of 75% of the shareholders voting at such meeting is required to approve the amalgamation or merger agreement, and the quorum for such meeting must be two or more persons holding or representing more than one-third of the issued shares of the company. Our bye-laws provide that the Board may, with the sanction of a resolution passed by a simple majority of votes cast at a general meeting with the necessary quorum for such meeting of two persons at least holding or representing 331∕3% of our issued common shares (or the class, where applicable), amalgamate or merge us with another company. | | | - | | | Any two or more corporations existing under the laws of the state may merge into a single corporation pursuant to a board resolution and upon the majority vote by stockholders of each constituent corporation at an annual or special meeting. | ||||||

- | | | Subject to its bye-laws, a company may at any meeting of its Board of Directors sell, lease or exchange all or substantially all of its property and assets as its Board of Directors deems expedient and in the best interests of the company to do so. | | | - | | | Every corporation may at any meeting of the board sell, lease or exchange all or substantially all of its property and assets as its board deems expedient and for the best interests of the corporation when so authorized by a resolution adopted by the holders of a majority of the outstanding stock of a corporation entitled to vote. | ||||||

- | | | Any company which is the wholly owned subsidiary of a holding company, or one or more companies which are wholly owned subsidiaries of the same holding company, may amalgamate or merge without the vote or consent of shareholders in accordance with the Companies Act, provided that the approval of the Board of Directors is obtained and that a director or officer of each such company signs a statutory solvency declaration in respect of the relevant company. | | | - | | | Any corporation owning at least 90% of the outstanding shares of each class of another corporation may merge the other corporation into itself and assume all of its obligations without the vote or consent of stockholders; however, in case the parent corporation is not the surviving corporation, the proposed merger shall be approved by a majority of the outstanding stock of the parent corporation entitled to vote at a duly called stockholder meeting. | ||||||

- | | | Any mortgage, charge or pledge of a company’s property and assets may be authorized without the consent of shareholders subject to any restrictions under the bye-laws. | | | - | | | Any mortgage or pledge of a corporation’s property and assets may be authorized without the vote or consent of stockholders, except to the extent that the certificate of incorporation otherwise provides. | ||||||

| | | | | | | ||||||||||

Bermuda | | | Delaware | ||||||||||||

Transactions with Significant Shareholders | |||||||||||||||

- | | | A company may enter into certain business transactions with its significant shareholders, including asset sales, in which a significant shareholder receives, or could receive, a financial benefit that is greater than that received, or to be received, by other shareholders with prior approval from our board of directors but without obtaining prior approval from our shareholders. | | | - | | | Subject to certain exceptions and conditions, a corporation may not enter into a business combination with an interested shareholder for a period of three years from the time the person became an interested shareholder without prior approval from shareholders holding at least 662∕3% of the corporation’s outstanding voting stock which is not owned by such interested shareholder. | ||||||

| | | | | | | ||||||||||

Directors | |||||||||||||||

- | | | The Board of Directors must consist of at least one director. Our bye-laws provide that our Board of Directors shall consist of a minimum of two directors or such greater number as the Board of Directors may determine. | | | - | | | The board of directors must consist of at least one member. | ||||||

- | | | The number of directors is fixed by the bye-laws, and any changes to such number must be approved by the Board of Directors and/or the shareholders in accordance with the company’s bye-laws. | | | - | | | Number of board members shall be fixed by the bye-laws, unless the certificate of incorporation fixes the number of directors, in which case a change in the number shall be made only by amendment of the certificate of incorporation. | ||||||

- | | | Removal: | | | - | | | Removal: | ||||||

| | | - | | | Under our bye-laws, any or all directors may be removed by the holders of a majority of the shares entitled to vote at a special meeting convened and held in accordance with the bye-laws for the purpose of such removal. | | | | | - | | | Any or all of the directors may be removed, with or without cause, by the holders of a majority of the shares entitled to vote unless the certificate of incorporation otherwise provides. | ||

| | | | | | | - | | | In the case of a classified board, stockholders may effect removal of any or all directors only for cause. | ||||||

| | | | | | | ||||||||||

Bermuda | | | Delaware | ||||||||||||

Duties of directors | |||||||||||||||

- | | | The Companies Act authorizes the directors of a company, subject to its bye-laws, to exercise all powers of the company except those that are required by the Companies Act or the company’s bye-laws to be exercised by the shareholders of the company. Our bye-laws provide that our business is to be managed by our Board of Directors. At common law, members of a Board of Directors owe a fiduciary duty to the company to act in good faith in their dealings with or on behalf of the company and exercise their powers and fulfill the duties of their office honestly. This duty includes the following essential elements: | | | - | | | Under Delaware law, the business and affairs of a corporation are managed by or under the direction of its board of directors. In exercising their powers, directors are charged with a fiduciary duty of care to protect the interests of the corporation and a fiduciary duty of loyalty to act in the best interests of its stockholders. The duty of care requires that a director act in good faith, with the care that an ordinarily prudent person would exercise under similar circumstances. Under this duty, a director must inform himself of, and disclose to stockholders, all material information reasonably available regarding a significant transaction. The duty of loyalty requires that a director act in a manner he reasonably believes to be in the best interests of the corporation. He must not use his corporate position for personal gain or advantage. This duty prohibits self-dealing by a director and mandates that the best interest of the corporation and its stockholders take precedence over any interest possessed by a director, officer or controlling shareholder and not shared by the stockholders generally. | ||||||

| | | - | | | a duty to act in good faith in the best interests of the company; | | |||||||||

| | | - | | | a duty not to make a personal profit from opportunities that arise from the office of director; | | |||||||||

| | | - | | | a duty to avoid conflicts of interest; and | | |||||||||

| | | - | | | a duty to exercise powers for the purpose for which such powers were intended. | | |||||||||

- | | | The Companies Act imposes a duty on directors and officers of a Bermuda company: | | | - | | | In general, actions of a director are presumed to have been made on an informed basis, in good faith and in the honest belief that the action taken was in the best interests of the corporation. However, this presumption may be rebutted by evidence of a breach of one of the fiduciary duties. Should such evidence be presented concerning a transaction by a director, a director must prove the procedural fairness of the transaction, and that the transaction was of fair value to the corporation. | ||||||

| | | - | | | to act honestly and in good faith with a view to the best interests of the company; and | | |||||||||

| | | - | | | to exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances. | | |||||||||

- | | | The Companies Act also imposes various duties on directors and officers of a company with respect to certain matters of management and administration of the company. Under Bermuda law, directors and officers generally owe fiduciary duties to the company itself, not to the company’s individual shareholders, creditors or any class thereof. Our shareholders may not have a direct cause of action against our directors. | | |||||||||||

| | | | | | | ||||||||||

Bermuda | | | Delaware | ||||||||||||

Takeovers | |||||||||||||||

- | | | An acquiring party is generally able to acquire compulsorily the common shares of minority holders of a company in the following ways: | | | - | | | Delaware law provides that a parent corporation, by resolution of its board of directors and without any stockholder vote, may merge with any subsidiary of which it owns at least 90% of each class of its capital stock. Upon any such merger, and in the event the parent corporate does not own all of the stock of the subsidiary, dissenting stockholders of the subsidiary are entitled to certain appraisal rights. | ||||||

| | | - | | | by a procedure under the Companies Act known as a “scheme of arrangement.” A scheme of arrangement could be effected by obtaining the agreement of the company and of holders of common shares, representing in the aggregate a majority in number and at least 75% in value of the common shareholders present and voting at a court ordered meeting held to consider the scheme of arrangement. The scheme of arrangement must then be sanctioned by the Bermuda Supreme Court. If a scheme of arrangement receives all necessary agreements and sanctions, upon the filing of the court order with the Registrar, all holders of common shares could be compelled to sell their shares under the terms of the scheme of arrangement; | | |||||||||

| | | - | | | if the acquiring party is a company, it may compulsorily acquire all the shares of the target company by acquiring pursuant to a tender offer 90% of the shares or class of shares not already owned by, or by a nominee for, the acquiring party (the offeror), or any of its subsidiaries. If an offeror has, within four months after the making of an offer for all the shares or class of shares not owned by, or by a nominee for, the offeror, or any of its subsidiaries, obtained the approval of the holders of 90% or more of all the shares to which the offer relates, the offeror may, at any time within two months beginning with the date on which the approval was obtained, by notice compulsorily acquire the shares of any nontendering shareholder on the same terms as the original offer unless the Supreme Court of Bermuda (on application made within a one-month period from the date of the offeror’s notice of its intention to acquire such shares) orders otherwise. | | | - | | | Delaware law also provides, subject to certain exceptions, that if a person acquires 15% of voting stock of a company, the person is an “interested stockholder” and may not engage in “business combinations” with the company for a period of three years from the time the person acquired 15% or more of voting stock. | ||||

| | |||||||||||||||

Dissenter’s rights of appraisal | |||||||||||||||

- | | | A dissenting shareholder (that did not vote in favor of the amalgamation or merger and who is not satisfied that the fair value has been offered for his shares) of a Bermuda exempted company may, within one month of notice of the shareholders’ meeting, apply to the Bermuda Supreme Court to appraise the fair value of those shares. Note that each share of an amalgamating or merging company carries this right to vote in respect of the amalgamation or merger whether or not it otherwise | | | - | | | With limited exceptions, appraisal rights shall be available for the shares of any class or series of stock of a corporation in a merger or consolidation. | ||||||

Bermuda | | | Delaware | ||||||||||||

| | | carries the right to vote. | | | | | |||||||||

- | | | A dissenting shareholder (that did not vote in favor of the amalgamation or merger and who is not satisfied that the fair value has been offered for his shares) of a Bermuda exempted company may, within one month of notice of the shareholders’ meeting, apply to the Bermuda Supreme Court to appraise the fair value of those shares. Note that each share of an amalgamating or merging company carries this right to vote in respect of the amalgamation or merger whether or not it otherwise carries the right to vote. | | | - | | | The certificate of incorporation may provide that appraisal rights are available for shares as a result of an amendment to the certificate of incorporation, any merger or consolidation or the sale of all or substantially all of the assets. | ||||||

| | | | | - | | | The certificate of incorporation may provide that appraisal rights are available for shares as a result of an amendment to the certificate of incorporation, any merger or consolidation or the sale of all or substantially all of the assets. | ||||||||

| | | | | | | | | | | ||||||

Dissolution | |||||||||||||||

- | | | Under Bermuda law, a solvent company may be wound up by way of a shareholders’ voluntary liquidation. Prior to the company entering liquidation, a majority of the directors shall each make a statutory declaration, which states that the directors have made a full enquiry into the affairs of the company and have formed the opinion that the company will be able to pay its debts within a period of 12 months of the commencement of the winding up and must file the statutory declaration with the Registrar. The general meeting must be held within five weeks of the making of the declaration and will be convened primarily for the purposes of passing a resolution that the company be wound up voluntarily and appointing a liquidator. The winding up of the company is deemed to commence at the time of the passing of the resolution. | | | - | | | Under Delaware law, a corporation may voluntarily dissolve (i) if a majority of the board of directors adopts a resolution to that effect and the holders of a majority of the issued and outstanding shares entitled to vote thereon vote for such dissolution; or (ii) if all stockholders entitled to vote thereon consent in writing to such dissolution. | ||||||

| | | | | - | | | Under Delaware law, a corporation may voluntarily dissolve (i) if a majority of the board of directors adopts a resolution to that effect and the holders of a majority of the issued and outstanding shares entitled to vote thereon vote for such dissolution; or (ii) if all stockholders entitled to vote thereon consent in writing to such dissolution. | ||||||||

| | | | | | | | | | | ||||||

Bermuda | | | Delaware | ||||||||||||

Shareholder’s derivative actions | |||||||||||||||

- | | | Class actions and derivative actions are generally not available to shareholders under Bermuda law. Bermuda courts, however, would ordinarily be expected to permit a shareholder to commence an action in the name of a company to remedy a wrong to the company where the act complained of is alleged to be beyond the corporate power of the company or illegal, or would result in the violation of the company’s memorandum of association or bye-laws. Furthermore, consideration would be given by a Bermuda court to acts that are alleged to constitute a fraud against the minority shareholders or, for instance, where an act requires the approval of a greater percentage of the company’s shareholders than that which actually approved it. | | | - | | | In any derivative suit instituted by a stockholder of a corporation, it shall be averred in the complaint that the plaintiff was a stockholder of the corporation at the time of the transaction of which he complains or that such stockholder’s stock thereafter devolved upon such stockholder by operation of law. | ||||||

| | - | | | In any derivative suit instituted by a stockholder of a corporation, it shall be averred in the complaint that the plaintiff was a stockholder of the corporation at the time of the transaction of which he complains or that such stockholder’s stock thereafter devolved upon such stockholder by operation of law. | |||||||||||

| | | | | | | | | | | ||||||

Indemnification of Directors and Officers | |||||||||||||||

- | | | A company’s bye-laws may contain provisions excluding personal liability of a director, alternate director, officer, member of a committee authorized under the company’s bye-laws, resident representative or their respective heirs, executors or administrators to the company for any loss arising or liability attaching to him by virtue of any rule of law in respect of any negligence, default, breach of duty or breach of trust of which the officer or person may be guilty. Companies also have the power, generally, to indemnify directors, alternate directors and officers of a company and any member of a committee authorized under the company’s bye-laws, resident representatives or their respective heirs, executors or administrators if any such person was or is a party or threatened to be made a party to a threatened, pending or completed action, suit or proceeding by reason of the fact that he or she is or was a director, alternate director or officer of the company or member of a committee authorized under the company’s bye-laws, resident representative or their respective heirs, executors or administrators or was serving in a similar capacity for another entity at the company’s request. | | | - | | | A corporation may indemnify a director or officer of the corporation against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in defense of an action, suit or proceeding by reason of such position if (i) such director or officer acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation and (ii) with respect to any criminal action or proceeding, such director or officer had no reasonable cause to believe his conduct was unlawful. | ||||||

Number of Shares | | | Date |

32,152,857 | | | On the date of this prospectus. |

| | | After days from the date of this prospectus. |

• | offer, pledge, sell or contract to sell any common shares; |

• | sell any option or contract to purchase any common shares; |

• | purchase any option or contract to sell any common shares; |

• | grant any option, right or warrant for the sale of any common shares; |

• | lend or otherwise dispose of or transfer any common shares; |

• | request or demand that we file a registration statement related to the common shares; or |

• | enter into any swap or other agreement that transfers, in whole or in part, the economic consequence of ownership of any common shares whether any such swap or transaction is to be settled by delivery of shares or other securities, in cash or otherwise. |

• | 1% of the number of shares of our common shares then outstanding, which will equal approximately shares immediately after this offering, assuming no exercise of the underwriters’ option to purchase additional shares; or |

• | the average weekly trading volume of our common shares on the Stock Exchange during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale; |

• | banks and other financial institutions; |

• | real estate investment trusts; |

• | regulated investment companies; |

• | insurance companies; |

• | dealers in securities; |

• | traders in securities that elect to use a mark-to-market method of accounting; |

• | persons holding our common shares as part of a hedge, straddle, conversion, constructive sale or other integrated transaction; |

• | persons whose functional currency is not the U.S. dollar; |

• | tax-exempt entities; |

• | persons who acquire our common shares pursuant to any employee share option or otherwise as compensation; or |

• | persons who actually or constructively own ten percent or more of our common shares by vote or value. |

• | a citizen or individual resident of the United States.; |

• | a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) that is created or organized in or under the laws of United States, any state thereof of the District of Columbia; |

• | an estate the income of which is subject to U.S. federal income tax regardless of its source; or |

• | a trust if (i) a U.S. court is able to exercise primary supervision over its administration and one or more U.S. Persons have the authority to control all of its substantial decisions or (ii) it has a valid election in effect under applicable Regulations to be treated as a U.S. person. |

• | the excess distribution or gain will be allocated ratably over the U.S. Holder’s holding period for our common shares; |

• | amounts allocated to the current taxable year and any taxable years in the U.S. Holder’s holding period prior to the first taxable year in which we are classified as a PFIC (each, a “pre-PFIC year”), will be taxable as ordinary income; and |

• | amounts allocated to each prior taxable year, other than a pre-PFIC year, will be subject to tax at the highest marginal tax rate in effect for individuals or corporations, as appropriate, for that year, and such amounts will be increased by an additional tax equal interest on the resulting tax deemed deferred with respect to such years. |

Name | | | Number of Common Shares |

DNB Markets, Inc. | | | |

Total: | | |

| | | Per Common | | | Total | ||||

| | | Share | | | No Exercise | | | Full Exercise | |

Public offering price | | | $ | | | $ | | | $ |

Underwriting discounts and commissions to be paid by us: | | | $ | | | $ | | | $ |

Proceeds, before expenses, to us | | | $ | | | $ | | | $ |

• | offer, pledge, sell or contract to sell any common shares; |

• | sell any option or contract to purchase any common shares; |

• | purchase any option or contract to sell any common shares; |

• | grant any option, right or warrant for the sale of any common shares; |

• | lend or otherwise dispose of or transfer any common shares; |

• | request or demand that we file or make a confidential submission of a registration statement related to the common shares; or |

• | enter into any swap or other agreement that transfers, in whole or in part, the economic consequence of ownership of any common shares whether any such swap or transaction is to be settled by delivery of common shares or other securities, in cash or otherwise. |

a. | to any legal entity which is a qualified investor as defined under the Prospectus Regulation; |

b. | to fewer than 150 natural or legal persons (other than qualified investors as defined under the Prospectus Regulation), subject to obtaining the prior consent of the representative for any such offer; or |

c. | in any other circumstances falling within Article 1(4) of the Prospectus Regulation, |

a. | to any legal entity which is a qualified investor as defined under the UK Prospectus Regulation; |

b. | to fewer than 150 natural or legal persons (other than qualified investors as defined under the UK Prospectus Regulation), subject to obtaining the prior consent of the representative for any such offer; or |

c. | at any time in other circumstances falling within section 86 of the FSMA, |

(a) | a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or |

(b) | a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, |

(a) | to an institutional investor or to a relevant person, or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(i)(B) of the SFA; |

(b) | where no consideration is or will be given for the transfer; |

(c) | where the transfer is by operation of law; or |

(d) | as specified in Section 276(7) of the SFA. |

Expenses | | | Amount |

SEC registration fee | | | $ |

Stock Exchange listing fee | | | |

FINRA filing fee | | | |

Printing and engraving expenses | | | |

Legal fees and expenses | | | |

Accounting fees and expenses | | | |

Transfer agent and registrar fees and expenses | | | |

Miscellaneous costs | | | |

Total | | | $ |

| | | March 17 - December 31, 2021 | |

Operating expenses | | | |

General and administrative expenses | | | (1.0) |

Total operating expenses | | | (1.0) |

Operating loss | | | (1.0) |

Net loss attributable to shareholders’ of Himalaya Shipping Ltd. | | | (1.0) |

| | | ||

Loss per share: | | | |

Basic and diluted loss per share | | | (0.06) |

Weighted-average shares outstanding | | | 18,316,970 |

| | | December 31, 2021 | |

ASSETS | | | |

| | | ||

Current assets | | | |

Cash and cash equivalents | | | 11.3 |

Total current assets | | | 11.3 |

| | | ||

Non-current assets | | | |

Newbuildings | | | 83.5 |

Other non-current assets | | | 0.4 |

Total non-current assets | | | 83.9 |

Total assets | | | 95.2 |

| | | ||

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| | | ||

Current liabilities | | | |

Trade payables | | | 0.8 |

Total current liabilities | | | 0.8 |

| | | ||

Non-current liabilities | | | |

Related party liabilities | | | 2.5 |

Total non-current liabilities | | | 2.5 |

Total liabilities | | | 3.3 |

Commitments and contingencies | | | |

| | | ||

Shareholders’ equity | | | |

Common shares of par value $1.0 per share: authorized 140,010,000 shares, issued and outstanding 32,152,857 shares | | | 32.2 |

Additional paid-in capital | | | 60.7 |

Retained loss | | | (1.0) |

Total shareholders’ equity | | | 91.9 |

Total liabilities and shareholders’ equity | | | 95.2 |

| | | March 17 - December 31, 2021 | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| | | ||

Net loss for the period | | | (1.0) |

| | | ||

Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| | | ||

Changes in assets and liabilities: | | | |

Other current and non-current liabilities | | | 0.5 |

Net cash used in operating activities | | | (0.5) |

| | | ||

CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| | | ||

Additions to newbuildings | | | (68.8) |

Net cash used in investing activities | | | (68.8) |

| | | ||

CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| | | ||

Proceeds from the issuance of common shares, net of issuance costs | | | 80.6 |

Net cash provided by financing activities | | | 80.6 |

Net increase in cash and cash equivalents and restricted cash | | | 11.3 |

Cash and cash equivalents and restricted cash at the beginning of the period | | | — |

Cash and cash equivalents and restricted cash at the end of the period | | | 11.3 |

| | | ||

Supplemental disclosure of cash flow information | | | |

Non-cash settlement of debt | | | (13.6) |

Non-cash share issuance | | | 13.6 |

Non-cash payment in respect on newbuildings | | | (13.6) |

Issuance of debt as non-cash settlement for newbuilding delivery instalment | | | 13.6 |

Interest paid, net of capitalized interest | | | — |

| | | # of shares | | | Share capital | | | Additional paid-in capital | | | Retained earnings (deficit) | | | Total | |

Incorporation March 17, 2021 | | | 10,000 | | | — | | | — | | | — | | | — |

Issue of common shares | | | 32,142,857 | | | 32.2 | | | 62.8 | | | — | | | 95.0 |

Equity issuance costs | | | | | — | | | (2.1) | | | — | | | (2.1) | |

Total loss for the period | | | | | — | | | — | | | (1.0) | | | (1.0) | |

Balance as of December 31, 2021 | | | 32,152,857 | | | 32.2 | | | 60.7 | | | (1.0) | | | 91.9 |

| | | March 17 – December 31, 2021 | |

Net loss available to common shareholders | | | (1.0) |

Weighted average number of shares, basic and diluted | | | 18,316,970 |

Loss per share in U.S. Dollars, basic and diluted | | | (0.06) |

Cost: | | | |

Incorporation March 17, 2021 | | | — |

Installment payments(1) | | | 82.1 |

Other capitalized costs(2) | | | 1.4 |

Cost as of December 31, 2021 | | | 83.5 |

Net book value as of incorporation March 17, 2021 | | | — |

Net book value as of December 31, 2021 | | | 83.5 |

(1) | Installment payments include expenditures associated with the first and second installment payments to New Times Shipyard for the 12 dual fueled Newcastlemax dry bulk carriers including the non-cash payment of US$13.6 million paid by Magni on behalf of the Company, see note 10. |

(2) | Other capitalized costs include US$1.1 million in fees to Magni under the Corporate support agreement which was not paid as of December 31, 2021 (see note 10) and expenditures associated with supervision of the newbuilding program. |

| | | Hierarchy | | | December 31, 2021 | |

Assets | | | | | ||

Cash and cash equivalents(1) | | | 1 | | | 11.1 |

Liabilities | | | | | ||

Related party liabilities(2) | | | 1 | | | 2.5 |

(1) | The carrying value approximate the fair value due to their near term expected receipt of cash. |

(2) | The carrying value approximate the fair value due to their near term expected payment of cash, see description of Corporate Support Agreement in note 10. |

2022 | | | 74.9 |

2023 | | | 363.3 |

2024 | | | 309.7 |

Total | | | 747.9 |

| | | Outstanding share options | | | Weighted average remaining life | | | Weighted Average exercise price (in $) | | | Weighted Average grant Date fair value | |

Outstanding at incorporation 17.03.2021 – unvested | | | — | | | — | | | — | | | — |

Outstanding at incorporation 17.03.2021 – exercisable | | | — | | | | | — | | | — | |

Granted | | | 500,000 | | | 5.0 | | | 8.0 | | | 6.0 |

Exercisable | | | — | | | — | | | — | | | — |

Forfeited | | | — | | | — | | | — | | | — |

Outstanding at 31.12.2021 – unvested | | | 500,000 | | | 5.0 | | | 8.0 | | | 6.0 |

Outstanding at 31.12.2021 – exercisable | | | — | | | — | | | — | | | — |

| | | 2021 | |

Grant date | | | December 8 |

Risk-free rate | | | 1.52% |

Expected life | | | 4 years |

Expected future volatility | | | 57% |

• | Issuance of 10,000 common shares at inception at a purchase price of $1.00 per common share; |

• | Issuance of 15,000,000 common shares at $1.00 per share on June 15, 2021 in a conversion of debt of $13,583,400 and payment cash of $1,416,600; |

• | Issuance of 10,000,000 common shares at $3.00 per share on July 16, 2021 in a private placement, for gross proceeds of $30.0 million before issuance costs of $0.8 million. $0.4 million of the issuance costs relate to the Corporate support agreement and was not paid as of December 31, 2021, see note 10. |

• | Issuance of 7,142,857 common shares at $7.00 per share on October 11, 2021 in a private placement, for gross proceeds of $50.0 million before issuance costs of $1.3 million. $1.0 million of the issuance costs including $0.5 million relating to the Corporate support agreement (see note 10) was not paid as of December 31. 2021. |

Item 6. | Indemnification of Directors and Officers |

Item 7. | Recent Sales of Unregistered Securities |

• | After our incorporation on March 19, 2021, we issued 10,000 common shares at a subscription price of $1.00 per share. |

• | On June 15, 2021, we issued 15,000 common shares to Magni at a subscription price of $1.00 per share in exchange for (i) a contribution by Magni of receivables in the aggregate amount of $13.6 million, which related to receivables due an outstanding from our subsidiaries to Magni in connection with a loan made by Magni to pay the first installments under the 1-4 Shipbuilding Contract, and (ii) a capital contribution of $1.4 million in cash from Magni. |

• | On July 16, 2021, we completed a private placement of 10,000,000 shares at a subscription price of $3.00 per share, raising gross proceeds of $30 million, a significant portion of which was (together with the proceeds of equity financings) used to pay the first and second installments of the Shipbuilding Contracts totaling $82.1 million. |

• | On October 11, 2021, we completed a private placement of 7,142,857 common shares at a subscription price of $7.00 per share, raising gross proceeds of $50 million, a significant majority of which was to finance the first and second installments of the Shipbuilding Contracts totaling $82.1 million. |

Exhibits |

(a) | The following documents are filed as part of this registration statement: |

1.1 | | | Form of Underwriting Agreement* |

3.1 | | | Certificate of Incorporation* |

3.2 | | | Memorandum of Association of Himalaya Shipping* |

3.3 | | | Amended and Restated Bye-laws* |

5.1 | | | Opinion of MJM Limited as to the validity of the common shares* |

10.1 | | | Form of Registration Rights Agreement* |

10.2 | | | Shipbuilding Contract for Construction of One 210,000 dwt Bulk Carrier between New Times Shipbuilding Co. Ltd. and MOUNT NOREFJELL INC. (formerly known as LHOTSE INC.), for vessel with hull number 0120833, dated March 10, 2021, as amended on November 16, 2022*,** |

10.3 | | | Memorandum of Agreement and Bareboat Charter, dated February 25, 2022, between MOUNT NOREFJELL INC., a wholly owned subsidiary of Himalaya Shipping, and Great Lhotse Limited, providing for the sale and leaseback of the Mount Norefjell vessel, with hull number 0120833 (Avic Leasing)*,*** |

10.4 | | | Memorandum of Agreement and Bareboat Charter, dated April 20, 2022, between MOUNT MATTERHORN INC. (formerly known as EVEREST INC.), a wholly owned subsidiary of Himalaya Shipping, and Jianxin Jinjiushiwu Leasing (Tianjin) Co. Ltd., providing for the sale and leaseback of the Mount Matterhorn vessel, with hull number 0120837 (CCBFL Leasing)*,**** |

10.5 | | | Revolving Credit Facility Agreement between Himalaya Shipping Ltd. and Drew Holdings Limited. dated December 14, 2022* |

21.1 | | | List of subsidiaries of Himalaya Shipping* |

23.1 | | | Consent of PricewaterhouseCoopers AS* |

23.2 | | | Consent of MJM Limited (included in Exhibit 5.1)* |

24.1 | | | Powers of Attorney (included on signature page to the registration statement) |

107.1 | | | Filing Fee Table* |

* | To be filed by amendment. |

** | The other Shipbuilding Contracts with New Times are substantially the same as this one. |

*** | The other Sale and Leaseback Agreements with Avic are substantially the same as this one. |

**** | The other Sale and Leaseback Agreement with CCBFL are substantially the same as this one. |

(b) | Consolidated Financial Statements Schedules |

Item 9. | Undertakings |