Exhibit 99.1

_____, 2023

Dear Safe & Green Holdings Corp. Stockholder:

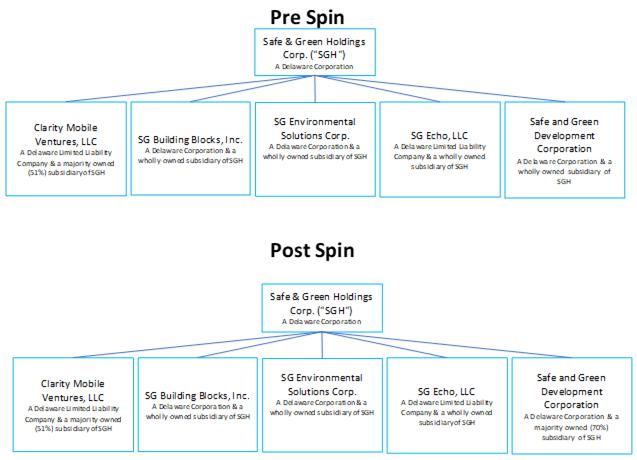

In December 2022, we announced our plan to separate

into two separate publicly traded companies. To implement the separation, we will distribute 30% of the outstanding shares of common

stock of Safe and Green Development Corporation (“SG DevCo”) to our stockholders on a pro rata basis as a distribution.

Each stockholder of Safe & Green Holdings

Corp. (“SG Holdings”) as of_____, 2023, the record date for the distribution, will receive 1.048 shares of SG DevCo common

stock for every five (5) shares of SG Holdings common stock held as of the close of business on the record date, as well as a cash payment

in lieu of any fractional shares. SG DevCo common stock will be issued in book-entry form only, which means that no physical share certificates

will be issued. You do not need to take any action to receive shares of SG DevCo to which you are entitled as a SG Holdings stockholder,

and you do not need to pay any consideration or surrender or exchange your SG Holdings common stock. Following the consummation

of the distribution, you will own common stock in both SG Holdings and SG DevCo.

The separation of SG DevCo from SG Holdings and

the distribution of SG DevCo common stock is intended, among other things, to enable the management of the two companies to pursue opportunities

for long-term growth and profitability unique to each company’s business and to allow each business to more effectively implement

its own distinct capital structure and capital allocation strategies. SG Holdings is expected to continue developing, designing and fabricating

modular structures. SG DevCo will focus on real estate development.

The SG Holdings Board of Directors believes that,

following the spin-off, the combined value of SG Holdings’ common stock and SG DevCo’s common stock could, over time and

assuming similar market conditions, be greater than the value of SG Holdings’ common stock had the spin-off not occurred. With

two separate public companies having distinct business models and investment characteristics, investors will have the opportunity to

value each against distinct sets of peers and investment metrics. This has the potential to increase the overall valuation of the companies,

thus unlocking stockholder value.

We encourage you to read the attached information

statement, which is being provided to all SG Holdings stockholders that held shares on the record date for the distribution. The information

statement describes the distribution in respect of SG DevCo in detail, material tax consequences and contains important business and

financial information about SG DevCo. The included financial statements of SG DevCo are prepared from SG Holdings’ historical accounting

records and contain certain allocations of SG Holdings’ costs as required, and we encourage you to read them together with the

pro forma financial information included in the attached information statement.

We believe the separation provides tremendous

opportunities for our businesses, as we work to continue to build long-term value. We appreciate your continuing support of SG Holdings.

|

Sincerely, |

| |

|

| |

Paul M. Galvin |

| |

Chief Executive Officer and Interim

Chief Financial Officer |

| |

Safe & Green Holdings Corp. |

_____, 2023

Dear Future Safe and Green Development Corporation Stockholder:

On behalf of Safe and Green Development Corporation

(“SG DevCo”) it is my great privilege to welcome you as a future stockholder of our company. Following our separation from

Safe & Green Holdings Corp. (“SG Holdings”), we will operate as a separate publicly traded company.

SG DevCo is a real estate developer which has

been and intends on continuing to engage primarily in the acquisition, development, management, sale and leasing of green single or multi-family

projects nationally. We plan to construct many of the developments using modular structures constructed by SG Holdings. In addition to

these development projects, we intend, subject to our ability to raise sufficient capital, to build strategically placed manufacturing

facilities. We expect to begin to break ground on several projects in 2023.

The separation will create two companies with

more focused, aligned businesses, which will allow each company to more effectively articulate a clear investment thesis to attract a

long-term investor base suited to its business and the industries in which it operates and serves. We believe that each company will

benefit from the investment community’s ability to value its businesses independently within the context of its particular industry

with the anticipation that, over time, the aggregate market value of the companies will be higher, assuming the same market conditions,

than if SG Holdings were to remain under its current configuration.

We invite you to learn more about our company

by reading the enclosed information statement, which details our strategy and plans for near and long-term growth to generate value for

our stockholders. We are excited about our future as a separate company, and we look forward to your support as a Safe and Green Development

Corporation stockholder as we begin this new and exciting chapter.

| |

Sincerely, |

| |

|

| |

David Villarreal |

| |

Chief Executive Officer |

| |

Safe and Green Development Corporation |

Information

contained herein is subject to completion or amendment. A registration statement on Form 10 relating to these securities has been filed

with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended.

Preliminary

and Subject to Completion, dated ____ XX, 2023

INFORMATION STATEMENT

Safe and Green Development

Corporation

This information statement is being furnished

in connection with the distribution by Safe & Green Holdings Corp. (“SG Holdings”), to its stockholders of 30% of the

outstanding shares of common stock of Safe and Green Development Corporation (“SG DevCo”), a wholly owned subsidiary of SG

Holdings, that holds the assets and liabilities associated with SG Holdings’ real estate development business.

We expect to apply to have our common stock listed

on the Nasdaq Capital Market as of the effective date of the distribution of our common stock to the stockholders of SG Holdings. For

every five (5) shares of common stock of SG Holdings held of record by you as of the close of business on [_______] 2023, the record date

for the distribution, you will receive 1.048 shares of our common stock. The distribution will generally be taxable to stockholders

for U.S. federal income tax purposes. See “Material U.S. Federal Income Tax Consequences.” The distribution is expected to

be completed on or about [_______], 2023, the distribution date. Immediately after SG Holdings completes the distribution, we will be

a separate publicly traded company.

No vote or other action is required by you to

receive shares of our common stock. You will not be required to pay anything for the new shares or to surrender any of your shares of

SG Holdings common stock. We are not asking you for a proxy, and you should not send us a proxy or your share certificates.

There currently is no trading market for our

common stock. Assuming the Nasdaq Capital Market authorizes our common stock for listing, we anticipate that a limited market, commonly

known as a “when-issued” trading market, for our common stock will commence on or shortly before the record date for the

distribution and will continue until the distribution of our common stock to SG Holdings stockholders. We expect the “regular-way”

trading of our common stock will begin on the first trading day following the completion of the distribution.

We are an “emerging growth company”

as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

See “Business—Emerging Growth Company.” In addition, we will be a “controlled company” within the

meaning of the corporate governance rules of the Nasdaq Stock Market due to SG Holding’s anticipated 70% ownership interest in

us immediately following the completion of the distribution.

In reviewing this information statement, you

should carefully consider the matters described under the caption “Risk Factors” beginning on page 13.

Neither the Securities and Exchange Commission,

nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful

or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute

an offer to sell or the solicitation of an offer to buy any securities.

The date of this information

statement is [ ] 2023.

This information statement was first made available

to SG Holdings stockholders on or about [ ] 2023.

Table

of Contents

ABOUT

THIS INFORMATION STATEMENT

This information statement forms part of a registration

statement on Form 10 (File No. 001- 41581) filed with the Securities and Exchange Commission (“SEC”), with respect to the

shares of our common stock to be distributed to SG Holdings stockholders in connection with the separation of SG Holdings and SG DevCo.

We and SG Holdings have supplied all information

contained in this information statement relating to our respective companies. We and SG Holdings have not authorized anyone to provide

you with information other than the information that is contained in this information statement. We and SG Holdings take no responsibility

for, and can provide no assurances as to the reliability of, any other information that others may give you. This information statement

is dated [ ], 2023, and you should not assume that the information contained in this information statement is accurate as of any date

other than such date.

Except as otherwise indicated or unless the

context otherwise requires, the information included in this information statement about SG Holdings assumes the completion of all of

the transactions referred to in this information statement in connection with the separation of SG Holdings and SG DevCo.

Unless otherwise indicated or as the context

otherwise requires, all references in this information statement to the following terms will have the meanings set forth below:

| |

● |

“SG DevCo,” “we,” “us,” “our,”

“our Company,” and “the Company” means Safe and Green Development Corporation; |

| |

|

|

| |

● |

“SG Holdings” means Safe & Green Holdings Corp. and,

when appropriate in the context, also includes the subsidiaries of this entity; |

| |

|

|

| |

● |

“Distribution” means the distribution of 30% of the shares

of our common stock, which are owned by SG Holdings, to stockholders of SG Holdings; |

| |

|

|

| |

● |

“Distribution

Date” means the date on which the Distribution is completed, which is expected to be on

or about [________], 2023; |

| |

|

|

| |

● |

“Separation” means the separation of the Spin-Off Business

from SG Holdings to SG DevCo; |

| |

|

|

| |

● |

“Nasdaq” means the Nasdaq Capital Market; |

| |

|

|

| |

● |

“Spin-Off Business” means SG Holdings’ real estate

development business currently conducted by SG DevCo, including the operations, properties, services, and activities of such business. |

| |

|

|

| |

● |

“Record Date” means _____, 2023, the record date for the Distribution. |

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

The statements contained in this information

statement that are not purely historical are forward-looking statements. All statements other than statements of historical facts contained

or incorporated herein by reference in this information statement, including statements regarding our future operating results, future

financial position, business strategy, objectives, goals, plans, prospects, markets, and plans and objectives for future operations,

are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,”

“believes,” “estimates,” “expects,” “intends,” “targets,” “contemplates,”

“projects,” “predicts,” “may,” “might,” “plan,” “will,” “would,”

“should,” “could,” “may,” “can,” “potential,” “continue,” “objective,”

or the negative of those terms, or similar expressions intended to identify forward-looking statements. However, not all forward-looking

statements contain these identifying words. Specific forward-looking statements in this information statement, include statements regarding

our strategies, outlook, business and prospects; and statements regarding potential share gains. Forward-looking statements are not guarantees

of future performance and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Although each

of SG Holdings and SG DevCo believes that the expectations reflected in any forward-looking statements it makes are based on reasonable

assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially

from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include,

but are not limited to:

| ● | Our

limited operating history makes it difficult for us to evaluate our future business prospects. |

| ● | Our

auditors have expressed substantial doubt about our ability to continue as a going concern. |

| ● | Our

financial condition and results of operations could be negatively affected if we fail to

grow or fail to manage our growth or investments effectively. |

| ● | The

long-term sustainability of our operations as well as future growth depends in part upon

our ability to acquire land parcels suitable for residential projects at reasonable prices. |

| ● | We

operate in a highly competitive market for investment opportunities, and we may be unable

to identify and complete acquisitions of real property assets. |

| ● | Our

property portfolio has a high concentration of properties located in certain states. |

| ● | There

can be no assurance that the properties in our development pipeline will be completed in

accordance with the anticipated timing or cost. |

| ● | Our

insurance coverage on our properties may be inadequate to cover any losses we may incur and

our insurance costs may increase. |

| | | |

| | ● | We

may not be able to secure sufficient modular units to complete our developments using modules

built by SG Echo. |

| ● | Our

operating results may be negatively affected by potential development and construction delays

and resultant increased costs and risks. |

| ● | We

rely on third-party suppliers and long supply chains, and if we fail to identify and develop

relationships with a sufficient number of qualified suppliers, or if there is a significant

interruption in our supply chains, our ability to timely and efficiently access raw materials

that meet our standards for quality could be adversely affected. |

| ● | The

construction of manufacturing facilities involves significant risks. |

| ● | Discovery

of previously undetected environmentally hazardous conditions may adversely affect our operating

results. |

| ● | Legislative,

regulatory, accounting or tax rules, and any changes to them or actions brought to enforce

them, could adversely affect us. |

| ● | Our

business, results of operations, cash flows and financial condition are greatly affected

by the performance of the real estate industry. |

| ● | Our

industry is cyclical and adverse changes in general and local economic conditions could reduce

the demand for housing and, as a result, could have a material adverse effect on us. |

| ● | Fluctuations

in real estate values may require us to write-down the book value of our real estate assets. |

| ● | We

may be required to take write-downs or write-offs, restructuring, and impairment or other

charges that could have a significant negative effect on our financial condition, results

of operations, and our stock price, which could cause you to lose some or all of your investment. |

| ● | Inflation

could adversely affect our business and financial results. |

| ● | We

could be impacted by our investments through joint ventures, which involve risks not present

in investments in which we are the sole owner. |

| ● | Risks

associated with our land and lot inventories could adversely affect our business or financial

results. |

| ● | We

may not be able to sell our real property assets when we desire. |

| ● | Access

to financing sources may not be available on favorable terms, or at all, which could adversely

affect our ability to maximize our returns. |

| ● | The

COVID-19 pandemic, or the future outbreak of any other highly infectious or contagious diseases,

could materially and adversely impact our performance, financial condition, results of operations

and cash flows. |

| ● | We

have no recent history of operating as an independent company, and our historical and pro forma

financial information is not necessarily representative of the results that we would have

achieved as a separate, publicly traded company and may not be a reliable indicator of our

future results. |

| ● | Following

the Separation and Distribution, our financial profile will change, and we will be a smaller,

less diversified company than SG Holdings prior to the Separation. |

| ● | We

may not achieve some or all of the expected benefits of the Separation and Distribution. |

| ● | SG

Holdings’ plan to separate into two publicly traded companies is subject to various

risks and uncertainties and may not be completed in accordance with the expected plans or

anticipated timeline, or at all, and will involve significant time and expense. |

| ● | Until

the Distribution occurs, SG Holdings’ Board of Directors has sole and absolute discretion

to change the terms of the Separation and Distribution in ways which may be unfavorable to

us. |

| ● | We

may have indemnification liabilities to SG Holdings under the separation and distribution

agreement. |

| ● | After

the Distribution, 70% of our common stock will be owned by a single stockholder, and it may

therefore be able to substantially control our management and affairs. |

| ● | After

the Distribution, we will be a “controlled company” within the meaning of the

Nasdaq listing standards and, as a result, will qualify for, and could rely on, exemptions

from certain corporate governance requirements. You may not have the same protections afforded

to stockholders of companies that are subject to such requirements. |

| ● | We

currently do not intend to pay dividends on our common stock. Consequently, our stockholders’

ability to achieve a return on their investment will depend on appreciation in the price

of our common stock. |

| ● | We

cannot be certain that an active trading market for our common stock will develop or be sustained

after the Distribution and, following the Distribution, our stock price may fluctuate significantly. |

| ● | The

combined post-Separation value of SG Holdings and SG DevCo shares may not equal or exceed

the pre-Separation value of SG Holdings shares. |

| ● | We

may issue shares of preferred or common stock in the future, which could dilute your percentage

ownership of the Company. |

| ● | Anti-takeover

provisions could enable SG DevCo to resist a takeover attempt by a third party and limit

the power of our stockholders. |

There can be no assurance that the Separation,

Distribution or any other transaction described above will in fact be consummated in the manner described or at all. The above list of

factors is not exhaustive or necessarily in order of importance. For additional information on identifying factors that may cause actual

results to vary materially from those stated in forward-looking statements, see the discussions under “Risk Factors” in this

information statement. Any forward-looking statement speaks only as of the date on which it is made, and each of SG Holdings and SG DevCo

assumes no obligation to update or revise such statement, whether as a result of new information, future events or otherwise, except

as required by applicable law.

QUESTIONS

AND ANSWERS ABOUT THE SEPARATION AND DISTRIBUTION

Please see “The Separation and Distribution”

for a more detailed description of the matters summarized below.

Why am I receiving this document?

You are receiving this document because you are

a SG Holdings stockholder as of the close of business on the record date and, as such, will be entitled to receive shares of our common

stock upon completion of the transactions described in this information statement. This document will help you understand how the Separation

and Distribution will affect your post-separation ownership in SG Holdings and SG DevCo.

How will SG Holdings accomplish the Separation

of the Spin-Off Business?

The Separation will be implemented by SG Holdings

distributing 30% the outstanding shares of common stock of SG DevCo to SG Holdings’ stockholders on a pro rata basis.

Why is SG Holdings separating the Spin-Off

Business from its current business operations?

The separation of SG DevCo from SG Holdings and

the distribution of SG DevCo common stock is intended, among other things, to enable the management of the two companies to pursue opportunities

for long-term growth and profitability unique to each company’s business and to allow each business to more effectively implement

its own distinct capital structure and capital allocation strategies.

The SG Holdings Board of Directors believes that,

following the spin-off, the combined value of SG Holdings’ common stock and SG DevCo’s common stock could, over time and

assuming similar market conditions, be greater than the value of SG Holdings’ common stock had the spin-off not occurred. As a

combined company, SG Holdings has no exact peers, which, the SG Holdings Board of Directors believes, causes the market to undervalue

the combined company. With two separate public companies having distinct business models and investment characteristics, investors will

have the opportunity to value each against distinct sets of peers and investment metrics. This has the potential to increase the overall

valuation of the companies, thus unlocking stockholder value. The increased market value of the common stock of each company should provide

additional flexibility for each company to pursue its business strategy. For additional information, see “The Separation and Distribution — Reasons

for the Separation.”

What is the record date for the Distribution?

The record date for the Distribution will be

[ ], 2023.

When will the Distribution occur?

The Distribution is expected to occur on or around

[ ], 2023.

What do I have to do to participate in the

Distribution?

Stockholders of SG Holdings as of the record

date for the Distribution will not be required to take any action to receive SG DevCo common stock in the Distribution, but you are urged

to read this entire information statement carefully. No stockholder approval of the Distribution is required. You are not being asked

for a proxy. You do not need to pay any consideration, exchange or surrender your existing shares of SG Holdings common stock or take

any other action to receive your shares of SG DevCo common stock. Please do not send in your SG Holdings stock certificates. The Distribution

will not affect the number of outstanding shares of SG Holdings common stock or any rights of SG Holdings stockholders, although it will

affect the market value of each outstanding share of SG Holdings common stock.

What will I receive in the Distribution?

In connection with the Distribution, you will

be entitled to receive 1.048 shares of our common stock for every five (5) shares of SG Holdings common stock held by you as of the close

of business on the record date, as well as a cash payment in lieu of any fractional shares, as discussed herein.

As a SG Holdings stockholder as of the record

date, how will shares of common stock be distributed to me?

At the effective time of the Distribution, we

will instruct our transfer agent and distribution agent to make book-entry credits for the shares of our common stock that you are entitled

to receive as a stockholder of SG Holdings as of the close of business on the record date. Since shares of our common stock will be in

uncertificated book-entry form, you will receive share ownership statements in place of physical share certificates.

What if I hold my shares through a broker,

bank, or other nominee?

SG Holdings stockholders that hold their shares

through a broker, bank, or other nominee will have their bank, brokerage, or other account credited with our common stock. For additional

information, those stockholders should contact their broker or bank directly.

How will fractional shares be treated in the

Distribution?

You will not receive fractional shares of our

common stock in connection with the Distribution. SG Holdings stockholders who would otherwise be entitled to a fraction of our common

stock (after aggregating all fractional shares of our common stock that otherwise would be received by such holder), will, in lieu of

such fraction of a share, be paid in cash the dollar amount (rounded to the nearest whole cent), without interest, determined by multiplying

such fraction by the volume weighted average closing trading price of a share of our common stock for the five consecutive trading days

ending five trading days immediately after the date the Distribution is effected Recipients of cash in lieu of fractional shares will

not be entitled to any interest on the amounts paid in lieu of fractional shares.

What are the conditions to the Separation

and Distribution?

The Separation and Distribution is subject to

the satisfaction or waiver of the following conditions, among other conditions described in this information statement:

| ● | The

SEC will have declared effective our registration statement on Form 10, of which this information

statement is a part, under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”); and no stop order suspending the effectiveness of our registration statement

on Form 10 will be in effect. |

| ● | This information

statement having been made available to SG Holdings’ stockholders. |

| ● | Nasdaq will have

approved the listing of SG DevCo common stock, subject to official notice of issuance. |

| ● | No events or developments

shall have occurred or exist that, in the sole and absolute judgment of the SG Holdings Board

of Directors, make it inadvisable to effect the Distribution or would result in the Distribution

and related transactions not being in the best interest of SG Holdings or its stockholders. |

SG Holdings and SG DevCo cannot assure you that

any or all of these conditions will be met, or that the Separation and Distribution will be consummated even if all of the conditions

are met. SG Holdings can decline at any time to go forward with the Separation and Distribution. In addition, SG Holdings may waive any

of the conditions to the Distribution. To the extent that the SG Holdings Board of Directors determines that any modifications by SG

Holdings, including any waivers of any conditions to the Distribution, materially change the terms of the Distribution, SG Holdings will

notify SG Holdings stockholders in a manner reasonably calculated to inform them about the modifications as may be required by law, by

publishing a press release, filing a current report on Form 8-K and/or circulating a supplement to this information statement. For a

complete discussion of all of the conditions to the distribution, see “The Separation and Distribution — Conditions

to the Distribution.”

What are the U.S. federal income tax consequences

to me of the Distribution?

The receipt by you of shares of SG DevCo common

stock in the Distribution and a cash payment in lieu of any fractional shares will generally be a taxable distribution in an amount equal

to the sum of the fair market value of such SG DevCo common stock and the amount of such cash you receive, which will be treated as a

taxable dividend to the extent of your ratable share of SG Holdings’ current and accumulated earnings and profits. The amount by

which the sum of the fair market value of such SG DevCo common stock and such cash you receive exceeds your ratable share of SG Holdings’

current and accumulated earnings and profits will be treated first as a non-taxable return of capital to the extent of (and in reduction

of) your tax basis in shares of SG Holdings common stock (but not below zero) and then as capital gain.

You should consult your own tax advisor as to

the particular consequences of the Distribution to you as well as your receipt of a cash payment in lieu of fractional shares, including

the applicability and effect of any U.S. federal, state and local tax laws, as well as any non-U.S. tax laws. For more information regarding

the material U.S. federal income tax consequences of the Distribution, see the section entitled “Material U.S. Federal Income Tax

Consequences.”

How will I determine the tax basis I will

have in the SG DevCo shares I receive in connection with the Distribution?

Your tax basis in the shares of SG DevCo common

stock received generally will equal the fair market value of such shares on the Distribution Date. For a more detailed discussion see

“Material U.S. Federal Income Tax Consequences.”

Can SG Holdings decide to cancel the Separation

and Distribution even if all the conditions have been met?

Yes. SG Holdings has the right to terminate,

or modify the terms of, the Separation and Distribution at any time prior to the Distribution Date, even if all of the conditions to

the Separation and Distribution are satisfied.

What if I want to sell my SG Holdings common

stock or my SG DevCo common stock?

You should consult with your financial advisors,

such as your stockbroker, bank or tax advisor. If you sell your shares of SG Holdings common stock in the “regular-way” market

after the record date and before the Distribution Date, you also will be selling your right to receive shares of SG DevCo common stock

in connection with the Distribution.

What is “regular-way” and “ex-distribution”

trading of SG Holdings common stock?

Beginning on or shortly before the record date

for the Distribution and continuing up to and through the Distribution Date, we expect that there will be two markets in SG Holdings

common stock: a “regular-way” market and an “ex-distribution” market. SG Holdings common stock that trades in

the “regular-way” market will trade with an entitlement to shares of SG DevCo common stock distributed pursuant to the Distribution.

Shares that trade in the “ex-distribution” market will trade without an entitlement to SG DevCo common stock distributed

pursuant to the Distribution. If you decide to sell any shares of SG Holdings common stock before the Distribution Date, you should make

sure your stockbroker, bank or other nominee understands whether you want to sell your SG Holdings common stock with or without your

entitlement to SG DevCo common stock pursuant to the Distribution. See “The Separation and Distribution — Trading

Between the Record Date and the Distribution Date” on page 31 of this information statement for a discussion of selling SG Holdings

common stock on or before the Distribution Date.

How will SG Holdings’ common stock and

SG DevCo’s common stock trade after the Distribution?

There is currently no public market for our common

stock. We plan to apply to have our common stock listed on Nasdaq under the ticker symbol “SGD.” SG Holdings common stock

will continue to trade on Nasdaq under the ticker symbol “SGBX.” SG DevCo anticipates that trading in shares of its

common stock will begin on a “when-issued” basis on or shortly before the record date for the distribution and will continue

up to and through the Distribution Date, and that “regular-way” trading in SG DevCo common stock will begin on the first

trading day following the completion of the Distribution. If trading begins on a “when-issued” basis, you may purchase or

sell SG DevCo common stock up to and through the Distribution Date, but your transaction will not settle until after the Distribution

Date. SG DevCo cannot predict the trading prices for its common stock before, on or after the Distribution Date.

Do I have appraisal rights?

No. SG Holdings stockholders do not have any

appraisal rights in connection with the Separation and Distribution.

Does SG DevCo intend to pay cash dividends

on its common stock?

No. We do not currently intend to pay cash dividends

on our common stock. See “Dividend Policy.”

Will the Separation and Distribution affect

the trading price of my SG Holdings stock?

The trading price of shares of SG Holdings common

stock immediately following the consummation of the Separation and Distribution may be expected to be lower than immediately prior to

that time because the trading price will no longer reflect the value of the Spin-Off Business (except to the extent of the shares of

our common stock retained by SG Holdings as described herein). There can be no assurance that, following the Separation and Distribution,

the combined trading prices of the SG Holdings common stock and our common stock will equal or exceed what the trading price of SG Holdings

common stock would have been in the absence of the Separation and Distribution. It is possible that after the Separation and Distribution,

our and SG Holdings’ combined equity value will be less than SG Holdings’ equity value before the Separation and Distribution.

What will the relationship between SG Holdings

and SG DevCo be following the Separation and Distribution?

In connection with the Separation and Distribution,

we will enter into a separation and distribution agreement and several other agreements with SG Holdings to provide a framework for our

relationship with SG Holdings after the Separation and Distribution. These agreements will provide for the allocation between SG Holdings

and SG DevCo of the assets, employees, liabilities and obligations (including, among others, investments, property, employee benefits

and tax-related assets and liabilities) of SG Holdings and its subsidiaries attributable to periods prior to, at and after the Separation

and will govern the relationship between us and SG Holdings subsequent to the completion of the Separation. In addition to the separation

and distribution agreement, the other principal agreements to be entered into with SG Holdings include a tax matters agreement and a

shared services agreement. See “The Separation and Distribution—Agreements with SG Holdings.”

Who is the Distribution Agent, Transfer Agent,

and Registrar for SG DevCo?

American Stock Transfer and Trust Company, LLC

will be the distribution agent for SG DevCo common stock and the transfer agent and registrar for SG DevCo common stock. For questions

relating to the transfer or mechanics of the stock distribution, you should contact:

American Stock Transfer and Trust Company, LLC

6201 15th Avenue

Brooklyn, New York 11219

Tel: [ ]

Who can I contact for more information?

If you have any questions relating to SG Holdings,

you should contact:

Safe & Green Holdings Corp.

990 Biscayne Blvd

#501, Office 12

Miami FL 33132

Tel: (646) 240-4235

Attn: Paul Galvin, Chairman & CEO

After the Separation, if you have questions relating

to SG DevCo, you should contact:

Safe and Green Development Corporation

990 Biscayne Blvd

#501, Office 12

Miami FL 33132

Tel: (904) 496-0027

Attn: David Villarreal, President

& CEO ]

INFORMATION

STATEMENT SUMMARY

This summary highlights information contained

in this information statement relating to us and shares of our common stock being distributed by SG Holdings in connection with the Distribution.

This summary may not contain all details concerning the Separation, Distribution or other information that may be important to you. To

better understand the Separation, Distribution and our business and financial position, you should carefully review this entire information

statement, including the risk factors, the material tax consequences discussion, our historical financial statements, our unaudited pro

forma financial statements, and the respective notes to those historical and pro forma financial statements.

Our historical financial statements have been

prepared on a “carve-out” basis to reflect the operations, financial condition, and cash flows of the Spin-Off Business during

all periods shown. Our unaudited pro forma financial statements adjust our historical financial statements to give effect to our Separation

from SG Holdings and our anticipated post-Separation capital structure.

Our Company

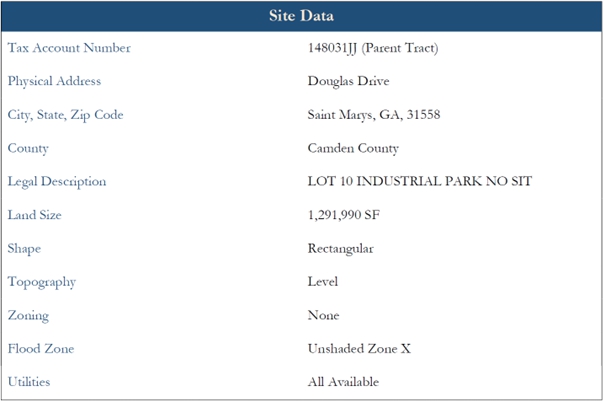

We were formed in 2021 for

the purpose of real property development utilizing SG Holdings’ proprietary technologies and SG Holdings’ manufacturing

facilities Our current business focus is primarily on the direct acquisition and indirect investment in properties nationally that

will be further developed in the future into green single or multi-family projects. To date, we have not generated any revenue and

our activities have consisted solely of the acquisition of three properties and an investment in two entities that have acquired two

properties to be further developed; however we have not yet commenced any development activities. We are focused on increasing our

presence in markets with favorable job formation and a favorable demand/supply ratio for multifamily housing. We intend to construct

many of the planned developments using modules built by SG Echo, LLC, a subsidiary of SG Holdings (“SG Echo”). In

addition to these development projects, we intend, subject to our ability to raise sufficient capital, to build additional,

strategically placed manufacturing facilities that will be sold or leased to third parties. We also intend to build manufacturing

sites for lease to SG Echo near our project sites in order to support SG Holdings $6,810,762 backlog of signed construction and

engineering contracts in existence at December 31, 2022 and take advantage of cost savings for transportation of modules from SG

Echo to our sites. We intend to build our first manufacturing facility on the land owned by us in St Mary’s, GA at a cost of approximately $16,000,000. We intend to fund the project

through a combination of debt, in the form of a construction loan, and equity from limited partners. We expect

that this facility will be fully operational by Q3 2024 and will fulfill the need for modular units at both our Norman Berry and

Cumberland Inlet projects. Our business model is flexible and we anticipate developing properties on our own and also through joint

ventures in which we partner with third-party equity investors or other developers.

We intend to develop the properties that we own

from the proceeds of future financings, both at the corporate and project level, and / or sale proceeds from properties that are sold.

However, our ability to develop any properties will be subject to our ability to raise capital either through the sale of equity or by

incurring debt. We have forecasted to invest approximately $1.6 million over the course of the next 12 months to start the development

of three different projects, subject to our ability to raise additional capital.

The projects we intend to develop over the next 12 months are:

| ● | Finley

Street Apartments (165 Units), the first phase of our Cumberland Inlet Site |

| ● | St

Mary’s Industrial, a 120,000 SF Manufacturing Facility to be leased by SG Echo |

| ● | Magnolia

Gardens I (100 Units), the first phase of our McLean Mixed Use Site |

Summary of Risk Factors

An investment in our Company is subject to a

number of risks, including risks relating to our business, risks related to the Separation and Distribution and risks related to our

common stock. Set forth below is a high-level summary of some, but not all, of these risks. Please read the information in the section

entitled “Risk Factors” of this information statement, for a more thorough description of these and other risks.

Risks Related to Our Business

Generally

| ● | Our

limited operating history makes it difficult for us to evaluate our future business prospects. |

| ● | Our

auditors have expressed substantial doubt about our ability to continue as a going concern. |

| ● | Our

financial condition and results of operations could be negatively affected if we fail to

grow or fail to manage our growth or investments effectively. |

| ● | The

long-term sustainability of our operations as well as future growth depends in part upon

our ability to acquire land parcels suitable for residential projects at reasonable prices. |

| ● | We

operate in a highly competitive market for investment opportunities, and we may be unable

to identify and complete acquisitions of real property assets. |

| ● | Our

property portfolio has a high concentration of properties located in certain states. |

| ● | There

can be no assurance that the properties in our development pipeline will be completed in

accordance with the anticipated timing or cost. |

| ● | Our

insurance coverage on our properties may be inadequate to cover any losses we may incur and

our insurance costs may increase. |

| | | |

| | ● | We may not be able to secure sufficient modular units to complete our

developments using modules built by SG Echo. |

| ● | Our

operating results may be negatively affected by potential development and construction delays

and resultant increased costs and risks. |

| ● | We

rely on third-party suppliers and long supply chains, and if we fail to identify and develop

relationships with a sufficient number of qualified suppliers, or if there is a significant

interruption in our supply chains, our ability to timely and efficiently access raw materials

that meet our standards for quality could be adversely affected. |

| ● | The

construction of manufacturing facilities involves significant risks. |

| ● | Discovery

of previously undetected environmentally hazardous conditions may adversely affect our operating

results. |

| ● | Legislative,

regulatory, accounting or tax rules, and any changes to them or actions brought to enforce

them, could adversely affect us. |

| ● | Our

business, results of operations, cash flows and financial condition are greatly affected

by the performance of the real estate industry. |

| ● | Our

industry is cyclical and adverse changes in general and local economic conditions could reduce

the demand for housing and, as a result, could have a material adverse effect on us. |

| ● | Fluctuations

in real estate values may require us to write-down the book value of our real estate assets. |

| ● | We

may be required to take write-downs or write-offs, restructuring, and impairment or other

charges that could have a significant negative effect on our financial condition, results

of operations, and our stock price, which could cause you to lose some or all of your investment. |

| ● | Inflation

could adversely affect our business and financial results. |

| ● | We

could be impacted by our investments through joint ventures, which involve risks not present

in investments in which we are the sole owner. |

| ● | Risks

associated with our land and lot inventories could adversely affect our business or financial

results. |

| ● | We

may not be able to sell our real property assets when we desire. |

| ● | Access

to financing sources may not be available on favorable terms, or at all, which could adversely

affect our ability to maximize our returns. |

| ● | The

COVID-19 pandemic, or the future outbreak of any other highly infectious or contagious diseases,

could materially and adversely impact our performance, financial condition, results of operations

and cash flows. |

Risks Related to the

Separation and Distribution

| ● | We

have no recent history of operating as an independent company, and our historical and pro forma

financial information is not necessarily representative of the results that we would have

achieved as a separate, publicly traded company and may not be a reliable indicator of our

future results. |

| ● | Following

the Separation and Distribution, our financial profile will change, and we will be a smaller,

less diversified company than SG Holdings prior to the Separation. |

| ● | We

may not achieve some or all of the expected benefits of the Separation and Distribution. |

| ● | SG

Holdings’ plan to separate into two publicly traded companies is subject to various

risks and uncertainties and may not be completed in accordance with the expected plans or

anticipated timeline, or at all, and will involve significant time and expense. |

| ● | Until

the Distribution occurs, SG Holdings’ Board of Directors has sole and absolute discretion

to change the terms of the Separation and Distribution in ways which may be unfavorable to

us. |

| ● | We

may have indemnification liabilities to SG Holdings under the separation and distribution

agreement. |

| ● | After

the Distribution, 70% of our common stock will be owned by a single stockholder, and it may

therefore be able to substantially control our management and affairs. |

| ● | After

the Distribution, we will be a “controlled company” within the meaning of the

Nasdaq listing standards and, as a result, will qualify for, and could rely on, exemptions

from certain corporate governance requirements. You may not have the same protections afforded

to stockholders of companies that are subject to such requirements. |

Risks Related to Our Common Stock

| ● | We

currently do not intend to pay dividends on our common stock. Consequently, our stockholders’

ability to achieve a return on their investment will depend on appreciation in the price

of our common stock. |

| ● | We

cannot be certain that an active trading market for our common stock will develop or be sustained

after the Distribution and, following the Distribution, our stock price may fluctuate significantly. |

| ● | The

combined post-Separation value of SG Holdings and SG DevCo shares may not equal or exceed

the pre-Separation value of SG Holdings shares. |

| ● | We

may issue shares of preferred or common stock in the future, which could dilute your percentage

ownership of the Company. |

| ● | Anti-takeover

provisions could enable SG DevCo to resist a takeover attempt by a third party and limit

the power of our stockholders. |

The Separation and Distribution

In December 2022, we announced our plan to separate

into two publicly traded companies. The Separation will occur through a pro rata distribution to SG Holdings’ stockholders

of 30% of the outstanding shares of common stock of SG DevCo. In connection with the Distribution, each SG Holdings stockholder will

receive 1.048 shares of SG DevCo common stock for every five (5) shares of SG Holdings common stock held as of the close of business

on [ ], 2023, the record date for the Distribution, as well as a cash payment in lieu of any fractional shares.

SG DevCo’s Post-Separation

Relationship with SG Holdings

After the Distribution, SG Holdings and SG DevCo

will be separate companies with separate management teams and separate boards of directors. Prior to the Distribution, SG Holdings and

SG DevCo will enter into a separation and distribution agreement. In connection with the Separation, we will also enter into various

other agreements to provide a framework for our relationship with SG Holdings after the Separation, including a tax matters agreement

and a shared services agreement. These agreements will provide for the allocation between SG Holdings and SG DevCo of the assets, employees,

liabilities and obligations (including, among others, investments, property, employee benefits and tax-related assets and liabilities)

of SG Holdings and its subsidiaries attributable to periods prior to, at and after the Separation and will govern the relationship between

us and SG Holdings subsequent to the completion of the Separation. For additional information regarding the separation agreement and

other transaction agreements, see “The Separation and Distribution—Agreements with SG Holdings.”

Reasons

for the Separation

SG Holdings previously announced that it was

proceeding with a plan to spin-off its real estate development business. We are currently a wholly owned subsidiary of SG Holdings and

expect to hold all of the assets, subject to any related liabilities, associated with the Spin-Off Business. Following a strategic review,

it was determined that separating the Spin-Off Business from SG Holdings’ current business operations would be in the best interests

of SG Holdings and its stockholders and that the Separation would create two companies with attributes that best position each company

for long-term success, including the following:

| ● | Distinct

Focus. Each company will benefit from a distinct strategic and management focus on

its specific operational and growth priorities. SG Holdings is expected to continue developing,

designing and fabricating modular structures. SG DevCo will focus on real estate development.

Because each company will have a smaller portfolio of businesses, management of each company

is expected to be able to better allocate time and resources to identifying and executing

operational and growth strategies. |

| ● | Allocation

of Financial Resources and Separate Capital Structures. The Separation will permit

each company to allocate its financial resources to meet the unique needs of its own business,

which will allow each company to intensify its focus on its distinct strategic priorities.

The Separation will also allow each business to more effectively pursue its own distinct

capital structures and capital allocation strategies. |

| ● | Targeted

Investment Opportunity. The Separation will create two companies with more focused,

aligned businesses, which will allow each company to more effectively articulate a clear

investment thesis to attract a long-term investor base suited to its businesses and the industries

in which it operates and serves, and will facilitate each company’s access to capital

by providing investors with two distinct and targeted investment opportunities. |

| ● | Employee

Incentives, Recruitment and Retention. The Separation will allow each company to

more effectively recruit, retain and motivate employees through the use of stock-based compensation

that more closely reflects and aligns management and employee incentives with specific growth

objectives, financial goals and business performance. In addition, the Separation will allow

incentive structures and targets at each company to be better aligned with each underlying

business. Similarly, recruitment and retention will be enhanced by more consistent talent

requirements across the businesses, allowing both recruiters and applicants greater clarity

and understanding of talent needs and opportunities associated with the core business activities,

principles and risks of each company. |

| ● | Direct

Access to Capital Markets. Each company will have its own equity structure that should

afford it direct access to the capital markets and allow it to capitalize on its unique growth

opportunities appropriate to its business. |

| ● | Incremental

Stockholder Value. We believe that each company will benefit from the investment

community’s ability to value its businesses independently within the context of its

particular industry with the anticipation that, over time, the aggregate market value of

the companies will be higher, assuming the same market conditions, than if SG Holdings were

to remain under its current configuration. |

Neither we, nor SG Holdings, can assure you that,

following the Separation, any of the benefits described above or otherwise in this information statement will be realized to the extent

anticipated or at all. For more information, see “Risk Factors.”

Regulatory Approvals and Appraisal Rights

We must complete the necessary registration under

the federal securities laws of our common stock to be issued in connection with the Distribution. We must also complete the applicable

listing requirements on Nasdaq for such shares. Other than these requirements, we do not believe that any other material governmental

or regulatory filings or approvals will be necessary to consummate the Distribution.

SG Holdings stockholders will not have any appraisal

rights in connection with the Separation and Distribution.

Corporate Information

We were incorporated

in Delaware in February 2021. We maintain our principal executive offices at 990 Biscayne Boulevard, #501, Office 12, Miami, Florida

33132. Our telephone number is (904) 496-0027. Our website will be located at www. [ ] and we expect to launch it prior the Distribution.

Our website and the information contained therein or connected thereto are not incorporated into this information statement or the registration

statement of which this information statement forms a part, or in any other filings with, or any information furnished or submitted to,

the SEC.

Reason for Furnishing this Information

Statement

This information statement is being furnished

solely to provide information to SG Holdings stockholders who will receive shares of SG DevCo common stock in the Distribution. It is

not, and is not to be construed as, an inducement or encouragement to buy or sell any of SG DevCo’s securities. The information

contained in this information statement is believed by SG DevCo to be accurate as of the date set forth on its cover. Changes may occur

after that date, and neither SG Holdings nor SG DevCo will update the information except as may be required in the normal course of their

respective disclosure obligations and practices.

RISK FACTORS

You should carefully consider the following

risks and other information in this information statement in evaluating SG DevCo and SG DevCo common stock. Any of the following risks

and uncertainties could materially adversely affect our business, financial condition or results of operations. The risks and uncertainties

described in this information statement are not the only risks and uncertainties that we face. Additional risks and uncertainties not

presently known to us or that we currently believe to be immaterial may become material and adversely affect our business, financial

condition and results of operations.

Risks Related to Our Business Generally

Our limited operating history makes it

difficult for us to evaluate our future business prospects.

We were incorporated in February 2021. We cannot

assure you that we will be able to operate our business successfully or profitably or find additional suitable investments. There can

be no assurance that we will be able to generate sufficient revenue from operations to pay our operating expenses. The results of our

operations and the execution on our business plan depends on the availability of additional land parcels, the performance of our currently

held properties, competition, the ability to obtain building permits, the availability of adequate equity and debt financing, and conditions

in the financial markets and economic conditions.

You should consider our business and prospects

in light of the risks and significant challenges we face as a new entrant into our industry. If we fail to adequately address any or

all of these risks and challenges, our business, prospects, financial condition, results of operations, and cash flows may be materially

and adversely affected.

Our auditors have expressed substantial

doubt about our ability to continue as a going concern.

We have never generated any revenue and have incurred

significant net losses in each year since inception. For the three months ended March 31, 2023, we incurred a net loss of $904,503 as

compared to a net loss of $468,736 for the three months ended March 31, 2022. For the year ended December 31, 2022 we incurred a net loss

of $2,444,259 as compared to a net loss of $485,747 for the period from February 17, 2021 through December 31, 2021 We expect to incur

increasing losses in the future when we commence development of the properties we own. We cannot offer any assurance as to our future

financial results. Also, we cannot provide any assurances that we will be able to secure additional funding from public or private offerings

on terms acceptable to us, or at all, if, and when needed. Our inability to achieve profitability from our current operating plans or

to raise capital to cover any potential shortfall would have a material adverse effect on our ability to meet our obligations as they

become due. If we are not able to secure additional funding, if, and when needed, we would be forced to curtail our operations or take

other action in order to continue to operate. We currently do not have any cash or cash equivalents on hand and since inception, we have

been funded by SG Holdings and have relied solely on SG Holdings to fund operations. These and other factors raise substantial doubt about

our ability to continue as a going concern. If we are unable to meet our obligations and are forced to curtail or cease our business operations,

our stockholders could suffer a complete loss of any investment made in our securities. Our independent registered public accounting firm

has indicated in their audit report that there is substantial doubt about our ability to continue as a going concern.

Our business strategy includes growth plans.

Our financial condition and results of operations could be negatively affected if we fail to grow or fail to manage our growth or investments

effectively.

Our prospects must be considered in light of

the risks, expenses and difficulties frequently encountered by companies in significant growth stages of development. We cannot assure

you that we will be able to successfully develop any of our properties or that we will have access to additional development opportunities.

Failure to manage potential transactions to successful conclusions, or failure more generally to manage our growth effectively, could

have a material adverse effect on our business, future prospects, financial condition or results of operations and could adversely affect

our ability to successfully implement our business strategy.

The long-term

sustainability of our operations as well as future growth depends in part upon our ability to acquire land parcels suitable for residential

projects at reasonable prices.

The long-term sustainability

of our operations, as well as future growth, depends in large part on the price at which we are able to obtain suitable land parcels

for development or homebuilding operations. Our ability to acquire land parcels for various residential projects may be adversely affected

by changes in the general availability of land parcels, the willingness of land sellers to sell land parcels at reasonable prices, competition

for available land parcels, availability of financing to acquire land parcels, zoning, regulations that limit housing density, the ability

to obtain building permits, environmental requirements and other market conditions and regulatory requirements. If suitable lots or land

at reasonable prices become less available, the number of units we may be able to build and sell could be reduced, and the cost of land

could be increased substantially, which could adversely impact us. As competition for suitable land increases, the cost of undeveloped

lots and the cost of developing owned land could also rise and the availability of suitable land at acceptable prices may decline, which

could adversely impact us. The availability of suitable land assets could also affect the success of our land acquisition strategy, which

may impact our ability to maintain or increase the number of our active communities, as well as to sustain and grow our revenues and

margins, and achieve or maintain profitability. Additionally, developing undeveloped land is capital intensive and time consuming and

we may develop land based upon forecasts and assumptions that prove to be inaccurate, resulting in projects that are not economically

viable.

We operate in a highly competitive market

for investment opportunities, and we may be unable to identify and complete acquisitions of real property assets.

The housing industry is highly competitive, and

we face competition from many sources, including from other housing communities both in the immediate vicinity and the geographic market

where our properties are and will be located. Furthermore, housing communities we invest in compete, or will compete, with numerous housing

alternatives in attracting residents, including owner occupied single and multifamily homes available to rent or purchase. Increased

competition may prevent us from acquiring attractive land parcels or make such acquisitions more expensive, hinder our market share expansion,

or lead to pricing pressures that may adversely impact our margins and revenues. Competitors may independently develop land and construct

housing units that are superior or substantially similar to our products and because they are or may be significantly larger, have a

longer operating history, and have greater resources or lower cost of capital than us, may be able to compete more effectively in one

or more of the markets in which we operate or plan to operate.

We will also compete with public and private

funds, commercial and investment banks, commercial financing companies and public and private REITs to make certain of the investments

that we plan to make. Many of such competitors are substantially larger and have considerably greater financial, technical and marketing

resources than us. In addition, some of our competitors may have higher risk tolerances or different risk assessments, allowing them

to pay higher consideration, consider a wider variety of investments and establish more effective relationships than us.

These competitive conditions could adversely

affect our ability to make investments. Moreover, our ability to close transactions will be subject to our ability to access financing

within stipulated contractual time frames, and there is no assurance that we will have access to such financing on terms that are favorable

to us, if at all.

Our property portfolio has a high concentration

of properties located in certain states.

To date, our properties are located in Georgia,

Texas and Oklahoma. Certain of our properties are located in areas that may experience catastrophic weather and other natural events

from time to time, including hurricanes or other severe weather, flooding fires, snow or ice storms, windstorms or earthquakes. These

adverse weather and natural events could cause substantial damages or losses to our properties which could exceed our insurance coverage.

In the event of a loss in excess of insured limits, we could lose our capital invested in the affected property, as well as anticipated

future revenue from that property. We could also continue to be obligated to repay any mortgage indebtedness or other obligations related

to the property. Any such loss could materially and adversely affect our business and our financial condition and results of operations.

To the extent that significant changes in the

climate occur, we may experience extreme weather and changes in precipitation and temperature and rising sea levels, all of which may

result in physical damage to or a decrease in demand for properties located in these areas or affected by these conditions. Should the

impact of climate change be material in nature, including destruction of our properties, or occur for lengthy periods of time, our financial

condition or results of operations may be adversely affected. In addition, changes in federal and state legislation and regulation on

climate change could result in increased capital expenditures to improve the energy efficiency of our existing properties or to protect

them from the consequence of climate change.

There can be no

assurance that the properties in our development pipeline will be completed in accordance with the anticipated timing or cost.

The development of the

projects in our pipeline is subject to numerous risks, many of which are outside of our control, including:

| ● | inability

to obtain entitlements; |

| ● | inability

to obtain financing on acceptable terms; |

| ● | default

by any of the contractors we engage to construct our projects; |

| ● | failure

to secure tenants or residents in the anticipated time frame, on acceptable terms, or at

all. |

We can provide no assurances

that we will complete any of the projects in our development pipeline on the anticipated schedule or within the budget, or that, once

completed, these properties will achieve the results that we expect. If the development of these projects is not completed in accordance

with our anticipated timing or cost, or the properties fail to achieve the financial results we expect, it could have a material adverse

effect on our business, financial condition, results of operations and cash flows and ability to repay our debt, including project-related

debt.

Our insurance

coverage on our properties may be inadequate to cover any losses we may incur and our insurance costs may increase.

We maintain insurance

on our properties. However, there are certain types of losses, generally of a catastrophic nature, such as floods or acts of war or terrorism

that may be uninsurable or not economical to insure. Further, insurance companies often increase premiums, require higher deductibles,

reduce limits, restrict coverage, and refuse to insure certain types of risks, which may result in increased costs or adversely affect

our business. We use our discretion when determining amounts, coverage limits and deductibles, for insurance, based on retaining an acceptable

level of risk at a reasonable cost. This may result in insurance coverage that, in the event of a substantial loss, would not be sufficient

to pay the full current market value or current replacement cost of our lost investment. In addition, we may become liable for injuries

and accidents at our properties that are underinsured. A significant uninsured loss or increase in insurance costs could materially and

adversely affect our business, liquidity, financial condition and results of operations.

We may not be able to secure sufficient

modular units to complete our developments using modules built by SG Echo

We intend to construct many of our planned developments

using modules built by SG Holdings subsidiary, SG Echo, and to rely on SG Holdings and SG Echo as the sole source of the modular units

used in our projects. SG Holdings has a $1,306,849 backlog of signed construction and engineering contracts in existence at March 31,

2023 on which work has not yet begun. Our ability to complete our modular developments will limited to the available capacity of the SG

Echo facility. If we are unable to secure sufficient modular units to complete our developments using modules built by SG Echo, our business,

prospects, financial condition, results of operations, and cash flows would be materially and adversely affected and the value of your

investment in our company may be materially adversely affected.

Our operating results may be negatively

affected by potential development and construction delays and resultant increased costs and risks.

We have acquired properties upon which we will

construct improvements. In connection with our development activities, we are subject to uncertainties associated with re-zoning for

development, environmental concerns of governmental entities or community groups and our contractor’s or partner’s ability

to build in conformity with plans, specifications, budgeted costs, and timetables. Performance also may be affected or delayed by conditions

beyond our control. We may incur additional risks when we make periodic progress payments or other advances to builders before they complete

construction. If a builder or development partner fails to perform, we may resort to legal action to rescind the purchase or the construction

contract or to compel performance, but there can be no assurance any legal action would be successful. These and other factors can result

in increased costs of a project or loss of our investment. In addition, we will be subject to normal lease-up risks relating to newly

constructed projects. We also must rely on rental income and expense projections and estimates of the fair market value of property upon

completion of construction when agreeing upon a price at the time we acquire the property. If our projections are inaccurate, we may

pay too much for a property, and our return on our investment could suffer.

We rely on third-party

suppliers and long supply chains, and if we fail to identify and develop relationships with a sufficient number of qualified suppliers,

or if there is a significant interruption in our supply chains, our ability to timely and efficiently access raw materials that meet

our standards for quality could be adversely affected.

Our ability to identify

and develop relationships with qualified suppliers who can satisfy our standards for quality and our need to access products and supplies

in a timely and efficient manner will be a significant challenge. We may be required to replace a supplier if their products do not meet

our quality or safety standards. In addition, our suppliers could discontinue selling products at any time for reasons that may or may

not be in our control or the suppliers’ control. Our operating results and inventory levels could suffer if we are unable to promptly

replace a supplier who is unwilling or unable to satisfy our requirements with a supplier providing similar products. Our suppliers’

ability to deliver products may also be affected by financing constraints caused by credit market conditions, which could negatively

impact our revenue and costs, at least until alternate sources of supply are arranged.

The construction of manufacturing facilities

involves significant risks.

We have limited experience constructing manufacturing

facilities and doing so is a complex and lengthy undertaking that requires sophisticated, multi-disciplinary planning and precise execution.

The construction of manufacturing facilities is subject to a number of risks. In particular, the construction costs may materially exceed

budgeted amounts, which could adversely affect our results of operations and financial condition. For example, we may suffer construction

delays or cost overruns as a result of a variety of factors, such as labor and material shortages, defects in materials and workmanship,

adverse weather conditions, transportation constraints, construction change orders, site changes, labor issues and other unforeseen difficulties,

any of which could delay or prevent the completion of our planned facilities. While our goal is to negotiate contracts with engineering,

procurement and construction firms that minimize risk, any delays or cost overruns we encounter may result in the renegotiation of our

construction contracts, which could increase our costs.

In addition, the construction of manufacturing

facilities may be subject to the receipt of approvals and permits from various regulatory agencies. Such agencies may not approve the

projects in a timely manner or may impose restrictions or conditions on a production facility that could potentially prevent construction

from proceeding, lengthen its expected completion schedule and/or increase its anticipated cost. If construction costs are higher than

we anticipate, we may be unable to achieve our expected investment return, which could adversely affect our business and results of operations.

Discovery of previously undetected environmentally

hazardous conditions may adversely affect our operating results.

We are subject to various federal, state and

local laws and regulations that (a) regulate certain activities and operations that may have environmental or health and safety effects,

such as the management, generation, release or disposal of regulated materials, substances or wastes, (b) impose liability for the costs

of cleaning up, and damages to natural resources from, past spills, waste disposals on and off-site, or other releases of hazardous materials

or regulated substances, and (c) regulate workplace safety. Compliance with these laws and regulations could increase our operational

costs. Violation of these laws may subject us to significant fines, penalties or disposal costs, which could negatively impact our results

of operations, financial position and cash flows. Under various federal, state and local environmental laws, a current or previous owner

or operator of currently or formerly owned, leased or operated real property may be liable for the cost of removal or remediation of

hazardous or toxic substances on, under or in such property. The costs of removal or remediation could be substantial. Such laws often

impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances.

Accordingly, we may incur significant costs to defend against claims of liability, to comply with environmental regulatory requirements,

to remediate any contaminated property, or to pay personal injury claims.

Moreover, environmental laws also may impose

liens on property or other restrictions on the manner in which property may be used or businesses may be operated, and these restrictions

may require substantial expenditures or prevent us or our lessees from operating such properties. Compliance with new or more stringent

laws or regulations or stricter interpretation of existing laws may require us to incur material expenditures. Future laws, ordinances

or regulations or the discovery of currently unknown conditions or non-compliances may impose material liability under environmental

laws.

Legislative, regulatory, accounting or

tax rules, and any changes to them or actions brought to enforce them, could adversely affect us.

We are subject to a wide range of legislative,