UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

OR

For the fiscal year ended

OR

OR

Date of event requiring this shell company report:

For the transition period from _________ to _____________.

Commission file number:

| (Exact name of Registrant as Specified in its Charter) |

| N/A |

(Translation of Registrant’s name into English)

| (Jurisdiction of Incorporation or Organization) |

| +86-13020144962 |

| (Address of Principal Executive Offices) |

|

Telephone: Email: |

| (Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

The number of shares of Class A ordinary shares, par value $0.005 outstanding

as of December 31, 2023 is

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check

mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal

control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting

firm that prepared or issued its audit report.

If securities are

registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in

the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ☐ Item 18 ☐

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ☐ No

TABLE OF CONTENTS

i

INTRODUCTION

ii

FORWARD-LOOKING INFORMATION

The discussion contained in this Annual Report on Form 20-F (“Annual Report”) contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the United States Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases like “anticipate,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “target,” “expects,” “management believes,” “we believe,” “we intend,” “we may,” “we will,” “we should,” “we seek,” “we plan,” the negative of those terms, and similar words or phrases. We base these forward-looking statements on our expectations, assumptions, estimates and projections about our business and the industry in which we operate as of the date of this Annual Report. These forward-looking statements are subject to a number of risks and uncertainties that cannot be predicted, quantified or controlled and that could cause actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Statements in this Annual Report describe factors, among others, that could contribute to or cause these differences. Actual results may vary materially from those anticipated, estimated, projected or expected should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect. Because the factors discussed in this Annual Report could cause actual results or outcomes to differ materially from those expressed in any forward-looking statement made by us or on our behalf, you should not place undue reliance on any such forward-looking statement. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the date of this Annual Report or the date of documents incorporated by reference herein that include forward-looking statements.

Currency, exchange rate, and other references

Unless otherwise noted, all currency figures in this filing are in U.S. dollars.

References to “US$,” “$”, “dollars” and “U.S. dollars” are to the legal currency of the United States.

References to “HK$” are to the Hong Kong dollars, the legal currency of Hong Kong.

Our reporting currency is U.S. Dollars. This Annual Report also contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations of HK$ into U.S. dollars were made at HK$7.8019 and HK$7.8015 to US$1.00, the exchange rates set forth in the H.10 statistical release of the Federal Reserve Board on December 31, 2023 and December 31, 2022, respectively. We make no representation that the HK$ or U.S. dollar amounts referred to in this Annual Report could have been or could be converted into U.S. dollars or HK$, as the case may be, at any particular rate or at all.

References to “Hong Kong” are to “Hong Kong, Special Administrative Region of the People’s Republic of China”.

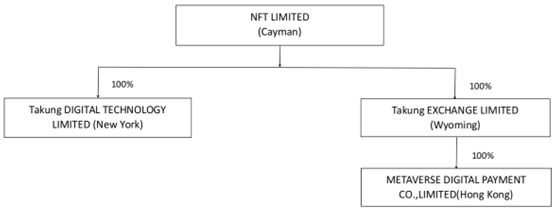

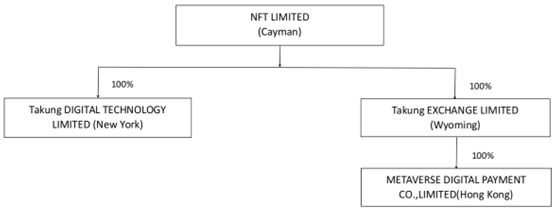

Unless otherwise specified or required by context, references to “we,” “the Company”, “NFT Limited”, “our” and “us” refer collectively to (i) NFT Limited, (ii) the subsidiaries of NFT Limited, Takung ART CO LIMITED, Takung DIGITAL TECHNOLOGY LIMITED (“NFT Digital”), Takung EXCHANGE LIMITED (“NFT Exchange ”) and its wholly owned Hong Kong subsidiary, METAVERSE DIGITAL PAYMENT CO., LIMITED (“Metaverse HK”), respectively.

iii

PART I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

Item 3. KEY INFORMATION

Not applicable

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Summary of Risk Factors

Investing in our Ordinary Shares involves significant risks. You should carefully consider all of the information in this annual report before making an investment in our Ordinary Shares. Below please find a summary of the principal risks we, our subsidiaries, the VIE and its subsidiaries face, organized under relevant headings. These risks are discussed more fully in the section titled “Item 3. Key Information—D. Risk Factors” in this annual report.

RISKS RELATED TO OUR BUSINESS AND FINANCIAL CONDITION

We are transitioning our business from PRC based business to internationally operated with a focus in U.S. Our business plan is at its early stage of development.

Starting from summer of 2021, we started to expand our business to provide block chain based consulting services to the companies engaged in releasing NFT and related businesses. In November 2021, the artwork unit trading platform operated by Tianjin Takung was suspended by the local authority as a result of the regulatory scrutiny by PRC governments on digital asset related business started. Since beginning of 2022, we made strategic decision to diversify our revenue stream while focusing on utilizing NFT related technologies. We are currently in an early development stage and may be subject to growth-related risks.

Although our management believes that our current business strategy has significant potential, our Company may never attain profitable operations and our management may not succeed in realizing its business objectives. If it is not able to execute our business strategy as anticipated, the Company may not be able to achieve profitability, and our business and financial condition may be adversely affected.

1

The global economy and the financial markets may negatively affect our business and clients, as well as the supply of and demand for works of art.

Our business is affected by global, national and local economic conditions since the services we provide are discretionary and we depend, to a significant extent, upon a number of factors relating to discretionary consumer spending in Hong Kong, mainland China and around the world. These factors include economic conditions and perceptions of such conditions by Traders, employment rates, the level of Traders’ disposable income, business conditions, interest rates, availability of credit and levels of taxation in regional and local markets. There can be no assurance that our services will not be adversely affected by changes in general economic conditions in Hong Kong, mainland China and globally.

The art market is influenced over time by the overall strength and stability of the global economy and the financial markets, although this correlation may not be immediately evident. In addition, political conditions and world events may affect our business through their effect on the economies, as well as on the willingness of potential buyers and sellers to invest and sell art in the wake of economic uncertainty.

A decline in trading volumes will decrease our trading revenues.

Trading volumes are directly affected by economic, political and market conditions, broad trends in business and finance, unforeseen market closures or other disruptions in trading, the level and volatility of interest rates, inflation, changes in price levels of artworks and the overall level of investor confidence. In recent years, trading volumes across our markets have fluctuated depending on market conditions and other factors beyond our control. Because a significant percentage of our revenues are tied directly to the trading volumes on our markets, a general decline in trading volumes would lower revenues and may adversely affect our operating results. Declines in trading volumes have also impacted our market share or pricing structures and adversely affected our business and financial condition.

Our NFT platform may not be successful and may expose us to legal, regulatory, and other risks. Given the nascent and evolving nature of cryptocurrencies, NFTs, and our NFT platform, we may unable to accurately anticipate or adequately address such risks or the potential impact of such risks. The occurrence of any such risks could materially and adversely affect our business, financial condition, results of operations, reputation, and prospects.

In July 2021, the Company focused on a new direction with three initiatives to develop blockchain and NFT related businesses, including consultancy service, NFT marketplace and blockchain-based online games. NFTs are digital assets recorded on a blockchain ledger for verification of authenticity and ownership of a unique digital asset, such as artwork. Given the increased scrutiny of digital assets as well as cryptocurrencies for regulatory and anti-money laundering purposes, it is possible that the United States and other jurisdictions will engage in increased scrutiny and regulation of NFTs and our business. While NFTs and cryptocurrencies are similar in that both are based on blockchain technology, unlike cryptocurrency units, which are fungible, NFTs have unique identification codes and represent content on the blockchain. The record of ownership of the NFT, which establishes authenticity and may also carry other rights, cannot be duplicated. As NFTs are a relatively new and emerging type of digital asset, the regulatory, commercial, and legal framework governing NFTs (as well as cryptocurrencies) is likely to evolve both in the United States and internationally and implicates issues regarding a range of matters, including, but not limited to, intellectual property rights, privacy and cybersecurity, fraud, anti-money laundering, sanctions, and currency, commodity, and securities law implications.

For example, NFTs raise various intellectual property law considerations, including adequacy and scope of assignment, licensing, transfer, copyright, and other right of use issues. The creator of an NFT will often have all rights to the content of the NFT and can determine what rights to assign to a buyer, such as the right to display, modify, or copy the content. To the extent we are directly or indirectly involved in a dispute between creators and buyers on our NFT trading platform, it could materially and adversely affect the success of our NFT platform and harm our business and reputation. NFTs, and our NFT platform, may also be an attractive target for cybersecurity attacks. For example, a perpetrator could seek to obtain the private key associated with a digital wallet holding an NFT to access and sell the NFT without valid authorization, and the owner of the NFT may have limited recourse due to the nature of blockchain transactions and of cybercrimes generally. NFT marketplaces, including our NFT platform, may also be vulnerable to attacks where an unauthorized party acquires the necessary credentials to access user accounts. The safeguards we have implemented or may implement in the future to protect against cybersecurity threats may be insufficient. If our NFT platform were to experience any cyberattacks, it could negatively impact our reputation and market acceptance of our platform.

2

NFTs, and our NFT platform, may also be subject to regulations of the Financial Crimes Enforcement Network (“FinCEN”) of the U.S. Department of Treasury and the Bank Secrecy Act. Further, the Office of Foreign Assets Controls (“OFAC”) has signaled sanctions could apply to digital transactions and has pursued enforcement actions involving cryptocurrencies and digital asset accounts. The nature of many NFT transactions also involve circumstances which present higher risks for potential violations, such as anonymity, subjective valuation, use of intermediaries, lack of transparency, and decentralization associated with blockchain technology. In addition, the Commodity Futures Trading Commission has stated that cryptocurrencies, with which NFTs have some similarities, fall within the definition of “commodities.” If NFTs were deemed to be a commodity, NFT transactions could be subject to prohibitions on deceptive and manipulative trading or restrictions on manner of trading (e.g., on a registered derivatives exchange), depending on how the transaction is conducted. Moreover, if NFTs were deemed to be a “security,” it could raise federal and state securities law implications, including exemption or registration requirements for marketplaces for NFT transactions, sellers of NFTs, and the NFT transactions themselves, as well as liability issues, such as insider trading or material omissions or misstatements, among others. NFT transactions may also be subject to laws governing virtual currency or money transmission. For example, New York has legislation regarding the operation of virtual currency businesses. NFT transactions also raise issues regarding compliance with laws of foreign jurisdictions, many of which present complex compliance issues and may conflict with one another. Our launch and operation of our NFT platform expose us to the foregoing risks, among others, any of which could materially and adversely affect the success of our NFT platform and harm our business, financial condition, results of operations, reputation, and prospects.

As the market for NFTs is relatively nascent, it is difficult to predict how the legal and regulatory framework around NFTs will develop and how such developments will impact our business and our NFT platform. Further, market acceptance of NFTs is uncertain as buyers may be unfamiliar or uncomfortable with digital assets generally, how to transact in digital assets, or how to assess the value of NFTs. The launch of our NFT platform also subjects us to risks similar to those associated with any new platform offering, including, but not limited to, our ability to accurately anticipate market demand and acceptance, our ability to successfully launch our new NFT platform offering, creator and buyer acceptance, technical issues with the operation of our new NFT platform, and legal and regulatory risks as discussed above. We believe these risks may be heightened with respect to our NFT platform, as NFTs are still considered a relatively novel concept. If we fail to accurately anticipate or manage the risks associated with our NFT platform or with our facilitation of cryptocurrency transactions, or if we directly or indirectly become subject to disputes, liability, or other legal or regulatory issues in connection with our NFT platform or cryptocurrency transactions, our NFT platform may not be successful and our business, financial condition, results of operations, reputation, and prospects could be materially harmed.

Our facilitation of transaction in digital works on our NFT platform exposes us to risks under U.S. and foreign tax laws.

Although under U.S. federal tax laws, cryptocurrencies are currently considered property versus currency, we are obligated to report transactions involving cryptocurrencies in U.S. dollars and must determine their fair market value on each transaction date. The U.S. federal taxing authorities have issued limited guidance on cryptocurrency transactions. The current guidance treats the use of cryptocurrency to purchase a NFT as a taxable disposition of the cryptocurrency, which subjects the holder to taxable gain that such holder must report for federal and state tax purposes. Similarly, a seller of a NFT is subject to tax on the sale of the NFT. Congress is currently proposing legislation that could require us to report such transactions to the IRS. Our failure to accurately record or report the cryptocurrency and NFT sales transacted through our NFT platform, or held by us, would expose us to adverse tax consequences, penalties, and interest. Moreover, the IRS, in connection with audits of cryptocurrency exchanges, has successfully sued to obtain account holder transaction and tax information. The applicability of tax laws in the United States and foreign jurisdictions with respect to cryptocurrency and NFTs will continue to evolve. This uncertainty increases the risk of non-compliance with tax laws, which in turn could result in adverse tax consequences, penalties, investigations or audits, litigation, account holder lawsuits, or the need to revise or restate our financial statements and associated consequences therewith, among other things. Any of the foregoing could materially and adversely affect our business, financial condition, results of operations, reputation, and prospects.

3

System limitations or failures could harm our business.

Our businesses depend on the integrity and performance of the technology, computer and communications systems supporting them. If our systems cannot expand to cope with increased demand or otherwise fail to perform, we could experience unanticipated disruptions in service, slower response times and delays in the introduction of new services. These consequences could result financial losses and decreased customer service and satisfaction. If trading volumes increase unexpectedly or other unanticipated events occur, we may need to expand and upgrade our technology, transaction processing systems and network infrastructure. We do not know whether we will be able to accurately project the rate, timing or cost of any increases, or expand and upgrade our systems and infrastructure to accommodate any increases in a timely manner.

We have insufficient insurance coverage.

We presently do not have any insurance to cover certain events such as physical damage to our office premises and resulting business interruption, certain injuries occurring on our property and liability for breach of legal responsibilities as we believe, based on our organization, business model and the remote possibility of the incurrence of substantial damages from such events, that the costs of such insurance greatly exceeds the benefits of having it. However, in the possible event of a significant loss from such an event, this may severely impact our performance or continue as a going concern.

The success of our business depends on our ability to market and advertise the services we provide effectively.

Our ability to establish effective marketing campaigns is the key to our success. Our advertisements promote our corporate image and our services. If we are unable to increase awareness of our brand, the benefits of using our trading platform to invest in artwork and that such investment is secure, we may not be able to attract new Traders. Our marketing activities may not be successful in promoting our services or in retaining and increasing our Trader base. We cannot assure you that our marketing programs will be adequate to support our future growth, which may result in a material adverse effect on our results of operations.

Our success is dependent on the receptiveness of traders of artwork to our platform.

We believe the demand for artwork listings will be generated by our Traders. We hope to educate our Traders on the merits of using our platform to invest in artwork. Not only in the subject artwork secure and insured, it requires less capital for our Traders to invest as they need only invest in artwork units and not purchase the entire piece of artwork. We hope that they will see their investment as less risky as they are presented with the opportunity to diversify their investments through various pieces of artwork. Our success would accordingly depend on the receptiveness of Traders to the merits of investments on our platform.

If we are unable to renew the lease of our property, our operations may be adversely affected.

We do not directly own the land over the property we lease. We may lose our leases or may not be able to renew it when it is due on terms that are reasonable or favorable to us. This may have adverse impact on our operations, including disrupting our operations or increasing our cost of operations.

The failure to manage growth effectively could have an adverse effect on our employee efficiency, working capital levels, and results of operations.

Any significant growth in the market for our services or our entry into new markets may require an expansion of our employee base for managerial, operational, financial, and other purposes. As of the date of this annual report, we have 27 full time employees. During any growth, we may face problems related to our operational and financial systems and controls. We would also need to continue to expand, train and manage our employee base. Continued future growth will impose significant added responsibilities upon the members of management to identify, recruit, maintain, integrate, and motivate new employees.

4

Aside from increased difficulties in the management of human resources, we may also encounter working capital issues, as we will need increased liquidity to finance the purchase of supplies, development of new services, and the hiring of additional employees. For effective growth management, we will be required to continue improving our operations, management, and financial systems and controls. Our failure to manage growth effectively may lead to operational and financial inefficiencies that will have a negative effect on our profitability. We cannot assure investors that we will be able to timely and effectively meet that demand and maintain the quality standards required by our existing and potential customers.

If we need additional capital to fund our growing operations, we may not be able to obtain sufficient capital and may be forced to limit the scope of our operations.

If adequate additional financing is not available on reasonable terms, we may not be able to undertake our expansion plan and we would have to modify our business plans accordingly. There is no assurance that additional financing will be available to us.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the competitive services by our competitors; (iii) the level of our investment in research and development; and (iv) the amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

If we cannot obtain additional funding, we may be required to: (i) limit our future investments in research and development; (ii) limit our marketing efforts; and (iii) decrease or eliminate capital expenditures. Such reductions could materially adversely affect our business and our ability to compete.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Our success is, to a certain extent, attributable to the management and operational and technical expertise of certain key personnel. In addition, we will require an increasing number of experienced and competent executives and other members of senior management to implement our growth plans. If we lose the services of any member of our senior management, we may not be able to locate suitable or qualified replacements, and may incur additional expenses to recruit and train new personnel, which could severely disrupt our business and prospects.

We are dependent on a trained workforce and any inability to retain or effectively recruit such employees, particularly distribution personnel and regional retail managers for our business, could have a material adverse effect on our business, financial condition and results of operations.

We must attract, recruit and retain a sizeable workforce of qualified and trained staff to operate our business. Our ability to implement effectively our business strategy and expand our operations will depend upon, among other factors, the successful recruitment and retention of highly skilled and experienced technical and marketing personnel. There is significant competition for qualified personnel in our business and we may not be successful in recruiting or retaining sufficient qualified personnel consistent with our current and future operational needs.

5

Our financial results may fluctuate because of many factors and, as a result, investors should not rely on our historical financial data as indicative of future results.

Fluctuations in operating results or the failure of operating results to meet the expectations of public market analysts and investors may negatively impact the market price of our securities. Operating results may fluctuate in the future due to a variety of factors that could affect revenues or expenses in any particular quarter. Fluctuations in operating results could cause the value of our securities to decline. Investors should not rely on comparisons of results of operations as an indication of future performance. As result of the factors listed below, it is possible that in future periods results of operations may be below the expectations of public market analysts and investors. This could cause the market price of our securities to decline. Factors that may affect our quarterly results include:

| ● | vulnerability of our business to a general economic downturn in Hong Kong and mainland China; |

| ● | fluctuation and unpredictability of the prices of the products we sell; |

| ● | changes in the laws and regulations of Hong Kong and mainland China that affect our operations; and |

| ● | our ability to obtain necessary government certifications and/or licenses to conduct our business. |

If we fail to establish and maintain effective internal control over financial reporting, our ability to accurately and timely report our financial results in accordance with U.S. GAAP could be materially and adversely affected. In addition, investor confidence in us and the market price of our equities could decline significantly if we conclude that our internal control over financial reporting is not effective.

We are consistently enhancing our internal controls over financial reporting by making the following changes: (i) we established a desired level of corporate governance with regard to identifying and measuring the risk of material misstatement, (ii) we set up a key monitoring mechanism including independent directors and audit committee to oversee and monitor our risk management, business strategies and financial reporting procedure, (iii) we have a Chief Financial Officer with SEC and US GAAP expertise and (iv) we have strengthened our financial team by employing more qualified accountant(s) to enhance the quality of our financial reporting function. We conducted out an evaluation using the framework set forth in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission with the participation of our management, including Kuangtao Wang, the Company’s Chief Executive Officer and Yaobin Wang, the Company’s Chief Financial Officer of the effectiveness of the Company’s disclosure controls and procedures (as defined under Rule 13a-15(e) under the Exchange Act) as of December 31, 2023. Based upon that evaluation, we concluded that our disclosure controls and procedures were effective to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act, is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to the Company’s management, including the Company’s CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure. However, we do not expect that our disclosure controls and procedures or our internal control over financial reporting will prevent or detect all error and fraud. Any control system, no matter how well designed and operated, is based upon certain assumptions and can provide only reasonable, not absolute, assurance that its objectives will be met. Further, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud, if any, within the Company have been detected. Accordingly, if in spite of such changes and improvements, our internal controls are still ineffective in our ability to accurately and timely report our financial results in accordance with U.S. GAAP, this could result in inaccuracies in our financial statements and could also impair our ability to comply with applicable financial reporting requirements and make related regulatory filings on a timely basis. This, in turn, could result in a material adverse impact on us and undermine investor confidence in us and the market price of our equities could decline significantly.

6

Security breaches and attacks against our systems and network, and any potentially resulting breach or failure to otherwise protect confidential and proprietary information, could damage our reputation and negatively impact our business, as well as materially and adversely affect our financial condition and results of operations.

Although we have employed significant resources to develop our security measures against breaches, our cybersecurity measures may not detect or prevent all attempts to compromise our systems, including distributed denial-of-service attacks, viruses, malicious software, break-ins, phishing attacks, social engineering, security breaches or other attacks and similar disruptions that may jeopardize the security of information stored in and transmitted by our systems or that we otherwise maintain. Breaches of our cybersecurity measures could result in unauthorized access to our systems, misappropriation of information or data, deletion or modification of client information, or a denial-of-service or other interruption to our business operations. As techniques used to obtain unauthorized access to or sabotage systems change frequently and may not be known until launched against us or our third-party service providers, we may be unable to anticipate, or implement adequate measures to protect against, these attacks.

If we are unable to avert these attacks and security breaches, we could be subject to significant legal and financial liability, our reputation would be harmed and we could sustain substantial revenue loss from lost sales and customer dissatisfaction. We may not have the resources or technical sophistication to anticipate or prevent rapidly evolving types of cyber-attacks. Cyber-attacks may target us, our Traders or other participants, the communication infrastructure, or the e-platform on which we depend. Actual or anticipated attacks and risks may cause us to incur significantly higher costs, including costs to deploy additional personnel and network protection technologies, train employees, and engage third-party experts and consultants. Cybersecurity breaches would not only harm our reputation and business, but also could materially decrease our revenue and net income.

Future inflation may inhibit our ability to conduct business profitably.

Recently, the US economy has experienced high rates of inflation. High inflation may in the future cause US governments to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in US, and thereby harm the market for our services.

The Company’s requirements could exceed the amount of time or level of experience that our officer and directors may have.

Our success largely depends on the continuing services of our chief executive officer and chairman of the board of directors, Kuangtao Wang, our chief financial officer, Yaobin Wang, and our directors, Guisuo Lu, Doug Buerger and Ronggang (Jonanthan) Zhang. Our continued success, also, depends on our ability to attract and retain qualified personnel. We believe that Messrs. Li, Wang, Qian, Lu, Buerger and Zhang possess valuable business development and marketing knowledge, experience and leadership abilities that would be difficult in the short term to replicate. The loss of their services could have an adverse effect on our business, results of operations and financial condition as our potential future revenues.

There can be no assurance that we will be able to attract and hire officers or directors with similar experience to operate our business, in the event that any one of them is otherwise unsuccessful in doing so.

Because our funds are held in banks which may not be covered by sufficient insurance, the failure of any bank in which we deposit our funds could affect our ability to continue our business.

Banks and other financial institutions in Hong Kong and China may not be covered by sufficient insurance for funds held on deposit. The Hong Kong Deposit Protection Board manages and supervises the operation of the Deposit Protection Scheme, which protects deposit amounts up to only $64,487 (HK$500,000).

The Central Bank of Djibouti (BCD) regulates the banking sector and has implemented measures to strengthen the financial system, such as increasing capital requirements and improving liquidity ratios. However, there is no specific mention of a formal deposit insurance system that protects depositors in case of bank failures.

As a result, in the event of a bank failure, we may not have access to funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to have access to our cash could impair our operations, and, if we are not able to access funds to pay our employees and other creditors, we may be unable to continue in business.

7

Our annual effective income tax rate can change significantly as a result of a combination of changes in our U.S. and foreign earnings and other factors, including changes in tax laws or changes made by regulatory authorities.

Our consolidated effective income tax rate is equal to our total income tax expense (benefit) as a percentage of total book income (loss) before tax. However, income tax expense and benefits are recognized on a jurisdictional or legal entity basis instead of worldwide or consolidated level basis. Losses in one jurisdiction may not be used to offset profits in other jurisdictions and may cause an increase in our tax rate. Changes in statutory income tax rates and laws, as well as initiation of tax audits by local and foreign authorities, could impact the amount of income tax liability and income taxes we are required to pay. In addition, any fluctuation in the earnings (or losses) of the jurisdictions and assumptions used in the calculation of income taxes could have a significant effect on our consolidated effective income tax rate. Furthermore, our effective tax rate could increase if we are unable to generate sufficient future taxable income in certain jurisdictions, or if we are otherwise required to increase our valuation allowances against our deferred tax assets.

We are subject to taxation in multiple jurisdictions. As a result, any adverse development in the tax laws of any of these jurisdictions or any disagreement with our tax positions could have a material adverse effect on our business, consolidated financial condition or results of operations.

We are subject to taxation in, and to the tax laws and regulations of, multiple jurisdictions particularly in the Cayman Island, United States, and Hong Kong SAR. In addition, tax authorities in any applicable jurisdiction, including the United States, may disagree with the positions we have taken or intend to take regarding the tax treatment or characterization of any of our transactions. In the event any applicable tax authorities effectively sustained their positions which are different from our tax treatment of any of our transactions, it could have a significant adverse impact on our business, consolidated results of our operations as well as consolidated financial condition.

Our financial position and results of operations may be significantly impacted by any unfavorable tax consequences due to the changes to the fiscal policies or tax regulations.

On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (the “Tax Act”) which includes significant changes to the U.S. corporate income tax system and U.S. international tax regime. The effect of the international provisions of the Tax Act resulted in a one-time deemed repatriation tax on unremitted foreign earnings and profits (a “transition tax”), a minimum tax on foreign earnings of U.S.-based multinationals with foreign subsidiaries, a base erosion tax on transactions between U.S. and non-U.S. affiliated corporations, in structures involving U.S. and non-US headquartered groups, a partial participation exemption for dividends from foreign subsidiaries and several other changes across the U.S. international tax provisions addressing the source of income, FTCs, deductibility of payments and other issues, including ownership and transfers of intangible property (Global Intangible Low-Taxed Income or GILTI).

The remaining international tax provisions will be effective for taxable years beginning after December 31, 2017. The Company has evaluated whether it has additional provision amount resulted by the GILTI inclusion on current earnings and profits of its foreign controlled corporations. See our discussion and analysis of income tax in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The growth of aging receivables and a deterioration in the collectability of these accounts could adversely affect our results of operations.

We provide for bad debts principally based upon the aging of accounts receivable, in addition to collectability of specific customer accounts, our history of bad debts, and the general condition of the industry. During December 31, 2023 and 2022, we recognized $nil and $8,484, respectively, in provision for doubtful accounts.

While the management exercised its caution in the entry into agreements with authorized agents, who in turn select Traders and the Company reviewed the Traders, certain Traders could pay arrears the monthly fee and owe debts to the Company for a long period. In the event the Company has to write off the amount of uncollectible receivables of the authorized agent subscription fee and commission fee from the selected Traders, and if such write-off is material, it may have adverse impact on our financial results.

8

RISKS RELATED TO DOING BUSINESS IN HONG KONG

Our operations are conducted by our subsidiaries in Hong Kong and the United States. Accordingly, the laws and regulations of the PRC do not currently have any material impact on our business, financial condition and results of operations. However, if certain PRC laws and regulations were to become applicable to a company such as us in the future, the application of such laws and regulations may have a material adverse impact on our business, financial condition and results of operations and our ability to offer or continue to offer securities to investors, any of which may cause the value of our common stock, to significantly decline or become worthless.

The Hong Kong legal system embodies uncertainties which could limit the legal protections available to you and us.

As one of the conditions for the handover of the sovereignty of Hong Kong to China, China had to accept some conditions such as Hong Kong’s Basic Law before its return. The Basic Law ensured Hong Kong will retain its own currency (the Hong Kong Dollar), legal system, parliamentary system and people’s rights and freedom for fifty years from 1997. This agreement had given Hong Kong the freedom to function in a high degree of autonomy. The Special Administrative Region (“SAR”) of Hong Kong is responsible for its own domestic affairs including, but not limited to, the judiciary and courts of last resort, immigration and customs, public finance, currencies and extradition. Hong Kong continues using the English common law system.

Some international observers and human rights organizations have expressed doubts about the future of the relative political freedoms enjoyed in Hong Kong, and about the PRC’s pledge to allow a high degree of autonomy in Hong Kong. They considered, for example, that the proposals in Article 23 of the Basic Law in 2003 (which was withdrawn due to mass opposition) might have undermined autonomy. On June 10, 2014, Beijing released a new report asserting its authority over the territory. This ignited criticism from many people in Hong Kong, who said that the Communist leadership was reneging on its pledges to abide by the “one country, two systems” policy that allows for a democratic, autonomous Hong Kong under Beijing’s rule.

If the PRC were to, in fact, renege on its agreement to allow Hong Kong to function autonomously, this could potentially impact Hong Kong’s common law legal system and may in turn bring about uncertainty in, for example, the enforcement of our contractual rights. This could, in turn, materially and adversely affect our business and operation. Additionally, intellectual property rights and confidentiality protections in Hong Kong may not be as effective as in the United States or other countries. Accordingly, we cannot predict the effect of future developments in the Hong Kong legal system, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. These uncertainties could limit the legal protections available to us, including our ability to enforce our agreements with our customers.

It will be difficult to acquire jurisdiction and enforce liabilities against our officers, directors and assets based in Hong Kong.

Substantially all of our assets will be located in Hong Kong and United States, and our officers and our present directors reside outside of the United States. As a result, it may not be possible for United States investors to enforce their legal rights, to effect service of process upon our directors or officers or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties of our directors and officers under Federal securities laws.

We may have difficulty establishing adequate management, legal and financial controls in Hong Kong, which could impair our planning processes and make it difficult to provide accurate reports of our operating results.

Although we will be required to implement internal controls, we may have difficulty in hiring and retaining a sufficient number of qualified employees to work in Hong Kong and mainland China in these areas. As a result of these factors, we may experience difficulty in establishing the required controls, making it difficult for management to forecast its needs and to present the results of our operations accurately at all times. If we are unable to establish the required controls, market makers may be reluctant to make a market in our stock and investors may be reluctant to purchase our stock, which would make it difficult for you to sell any shares of common stock that you may own or acquire.

9

Although we and our subsidiaries are not based in mainland China and we have no operations in mainland China, the PRC government may intervene or influence our current and future operations in Hong Kong at any time, or may exert more control over overseas offerings and listings and/or foreign investment in issuers like ourselves. It may result in a material adverse change in our Hong Kong subsidiaries’ operations, significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline or become worthless, which would materially affect the interests of the investors.

We and our subsidiaries are not based in mainland China and do not have operations in mainland China. We currently do not have or intend to set up any subsidiary in mainland China, or do not foresee the need to enter into any contractual arrangements with a VIE to establish a VIE structure in mainland China. Pursuant to the Basic Law, which is a national law of the PRC and the constitutional document for Hong Kong, national laws of the PRC shall not be applied in Hong Kong except for those listed in Annex III of the Basic Law and applied locally by promulgation or local legislation. The Basic Law expressly provides that the national laws of the PRC which may be listed in Annex III of the Basic Law shall be confined to those relating to defense and foreign affairs as well as other matters outside the autonomy of Hong Kong. The basic policies of the PRC regarding Hong Kong as a special administrative region of the PRC are reflected in the Basic Law, providing Hong Kong with a high degree of autonomy and executive, legislative and independent judicial powers, including that of final adjudication under the principle of “one country, two systems”.

However, in light of the PRC government’s recent expansion of authority in Hong Kong, we may be subject to uncertainty about any future actions of the PRC government or authorities in Hong Kong, and it is possible that all the legal and operational risks associated with being based in and having operations in the PRC may also apply to operations in Hong Kong in the future. There is no assurance that there will not be any changes in the economic, political and legal environment in Hong Kong. The PRC government may intervene or influence our current and future operations in Hong Kong at any time, or may exert more control over offerings conducted overseas and/or foreign investment in issuers like ourselves. Such governmental actions, if and when they occur: (i) could significantly limit or completely hinder our ability to continue our operations; (ii) could significantly limit or hinder our ability to offer or continue to offer our common stock to investors; and (iii) may cause the value of our common stock to significantly decline or become worthless.

There remain some uncertainties as to whether we will be required to obtain approvals from Chinese authorities to list on the U.S. exchanges and offer securities in the future, and if required, we cannot assure you that we will be able to obtain such approval.

The Regulations on Mergers and Acquisitions of Domestic Companies by Foreign Investors (the “M&A Rules”), adopted by six PRC regulatory agencies in 2006 and amended in 2009, requires an overseas special purpose vehicle formed for listing purposes through acquisitions of PRC domestic companies and controlled by PRC companies or individuals to obtain the approval of the CSRC prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange.

We are also aware that, recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in mainland China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over mainland-China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. For example, on July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued the Opinions on Strictly and Lawfully Cracking Down Illegal Securities Activities to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over mainland-China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws.

On December 28, 2021, the CAC and other PRC authorities promulgated the Cybersecurity Review Measures, which took effect on February 15, 2022. In addition, the Cybersecurity Law, which was adopted by the Standing Committee of the National People’s Congress on November 7, 2016 and came into force on June 1, 2017, and the Cybersecurity Review Measures, or the “Review Measures”, provide that personal information and important data collected and generated by a critical information infrastructure operator in the course of its operations in mainland China must be stored in mainland China, and if a critical information infrastructure operator purchases internet products and services that affect or may affect national security, it should be subject to national security review by the CAC together with competent departments of the State Council. In addition, for critical information infrastructure operators, or the “CIIOs”, that purchase network-related products and services, the CIIOs shall declare any network-related product or service that affects or may affect national security to the Office of Cybersecurity Review of the CAC for cybersecurity review. Due to the lack of further interpretations, the exact scope of what constitutes a “CIIO” remains unclear. Further, the PRC government authorities may have wide discretion in the interpretation and enforcement of these laws. In addition, the Review Measures stipulates that any online platform operators holding more than one million users/users’ individual information shall be subject to cybersecurity review before listing abroad. As of the date of this annual, neither we nor our subsidiaries received any notice from any authorities identifying us or our subsidiaries as a CIIO or requiring us or our subsidiaries to undertake a cybersecurity review by the CAC. Further, as of the date of this annual report, neither we nor our subsidiaries have been subject to any penalties, fines, suspensions, investigations from any competent authorities for violation of the regulations or policies that have been issued by the CAC.

10

On June 10, 2021, the Standing Committee of the National People’s Congress promulgated the Data Security Law which took effect on September 1, 2021. The Data Security Law requires that data shall not be collected by theft or other illegal means, and it also provides for a data classification and hierarchical protection system. The data classification and hierarchical protection system protects data according to its importance in economic and social development, and the damages it may cause to national security, public interests, or the legitimate rights and interests of individuals and organizations if the data is falsified, damaged, disclosed, illegally obtained or illegally used, which protection system is expected to be built by the state for data security in the near future. On November 14, 2021, the CAC published the Regulations on the Data Security Administration Draft, or the “Data Security Regulations Draft”, to solicit public opinion and comments. Under the Data Security Regulations Draft, an overseas initial public offering to be conducted by a data processor processing the personal information of more than one million individuals shall apply for a cybersecurity review. Data processor means an individual or organization that independently makes decisions on the purpose and manner of processing in data processing activities, and data processing activities refers to activities such as the collection, retention, use, processing, transmission, provision, disclosure, or deletion of data. Our Hong Kong subsidiary, Metaverse HK may collect and store certain data (including certain personal information) from our clients who may be PRC individuals. We do not currently expect the Review Measures to have an impact on our business, operations or this offering as we do not believe that Metaverse HK is deemed to be a “CIIO” or a “data processor” controlling personal information of no less than one million users, that are required to file for cybersecurity review for overseas listing, because (i) Metaverse HK is incorporated and operating in Hong Kong without any subsidiary or VIE structure in mainland China and the Review Measures remains unclear whether it shall be applied to a Hong Kong company; (ii) as of the date of this annual report, Metaverse HK did not collect or store any personal information of individual clients of mainland China; and (iii) as of the date of this annual report, Metaverse HK has not been informed by any PRC governmental authority of any requirement that it file for a cybersecurity review. Based on laws and regulations currently in effect in the PRC as of the date of this annual report, we believe our Hong Kong subsidiaries are not required to pass the cybersecurity review of the CAC in order to list our common stock in the U.S.

In addition, on February 17, 2023, the China Securities Regulatory Commission (the “CSRC”) promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the “Trial Measures,” and five supporting guidelines, which came into effect on March 31, 2023. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas, both directly and indirectly, shall complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three working days following its submission of initial public offerings or listing application. If a domestic company fails to complete required filing procedures or conceals any material fact or falsifies any major content in its filing documents, such domestic company may be subject to administrative penalties, such as an order to rectify, warnings, fines, and its controlling shareholders, actual controllers, the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines. According to the Notice on the Administrative Arrangements for the Filing of the Overseas Securities Offering and Listing by Domestic Companies from the CSRC, or “the CSRC Notice,” the domestic companies that have already been listed overseas before the effective date of the Trial Measures (namely, March 31, 2023) shall be deemed as existing issuers (the “Existing Issuers”). Existing Issuers are not required to complete the filing procedures immediately, and they shall be required to file with the CSRC for any subsequent offerings. Based on laws and regulations currently in effect in the PRC as of the date of this annual report, we believe our Hong Kong subsidiaries are not required to obtain regulatory approval from the CSRC in order to list our shares of common stock in the U.S.

Since these rules, statements and regulatory actions are new, it is highly uncertain how soon the legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any. Any failure of us to fully comply with new regulatory requirements may cause significant disruption to our business operations, materially and adversely affect our financial condition and results of operations, and cause our common stock to significantly decline in value or become worthless.

As of the date of this annual report, on the basis that we currently do not have any business operations in mainland China, we believe are not required to obtain approvals from the PRC authorities to operate our business or list on the U.S. exchanges and offer or continue to offer securities; specifically, we are currently not required to obtain any permission or approval from the CSRC, the CAC or any other PRC governmental authority to operate our business or to list our securities on a U.S. securities exchange or issue securities to foreign investors. However, if we and our Hong Kong subsidiaries (i) do not receive or maintain such approval, should the approval be required in the future by the PRC government, (ii) inadvertently conclude that such approval is not required, or (iii) applicable laws, regulations, or interpretations change and we are required to obtain such approval in the future, our operations and financial condition could be materially adversely affected, and our ability to offer or continue to offer securities to investors could be significantly limited or completely hindered and the securities currently being offered may substantially decline in value and become worthless.

11

Although the audit report included in this annual report is prepared by U.S. auditors who are currently not inspected by the Public Company Accounting Oversight Board (the “PCAOB”), there is no guarantee that future audit reports will be prepared by auditors inspected by the PCAOB and, as such, in the future investors may be deprived of the benefits of such inspection. Furthermore, trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act (the “HFCA Act”) if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely, and as a result, U.S. national securities exchanges, such as NYSE American, may determine to delist our securities. Furthermore, on December 29, 2022, the Consolidated Appropriations Act, was signed into law by President Biden. The Consolidated Appropriations Act contained, among other things, an identical provision to AHFCAA, which reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two.

As an auditor of companies that are registered with the SEC and publicly traded in the United States and a firm registered with the PCAOB, our auditor is required under the laws of the United States to undergo regular inspections by the PCAOB to assess their compliance with the laws of the United States and professional standards.

Our auditor, Assentsure PAC, the independent registered public accounting firm that issues the audit report included elsewhere in this annual report, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess our auditor’s compliance with the applicable professional standards. Inspections of other auditors conducted by the PCAOB outside mainland China and Hong Kong have at times identified deficiencies in those auditors’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. The lack of PCAOB inspections of audit work undertaken in mainland China and Hong Kong prevents the PCAOB from regularly evaluating auditors’ audits and their quality control procedures. As a result, if there is any component of our auditor’s work papers become located in mainland China and Hong Kong in the future, such work papers will not be subject to inspection by the PCAOB. As a result, investors would be deprived of such PCAOB inspections, which could result in limitations or restrictions to our access of the U.S. capital markets.

As part of a continued regulatory focus in the United States on access to audit and other information currently protected by national law, in particular mainland China’s, in June 2019, a bipartisan group of lawmakers introduced bills in both houses of the U.S. Congress which, if passed, would require the SEC to maintain a list of issuers for which PCAOB is not able to inspect or investigate the audit work performed by a foreign public accounting firm completely. The proposed Ensuring Quality Information and Transparency for Abroad-Based Listings on our Exchanges (“EQUITABLE”) Act prescribes increased disclosure requirements for these issuers and, beginning in 2025, the delisting from U.S. national securities exchanges such as NYSE American of issuers included on the SEC’s list for three consecutive years. It is unclear if this proposed legislation will be enacted. Furthermore, there have been recent deliberations within the U.S. government regarding potentially limiting or restricting China-based companies from accessing U.S. capital markets. On May 20, 2020, the U.S. Senate passed the Holding Foreign Companies Accountable Act (the “HFCA Act”), which includes requirements for the SEC to identify issuers whose audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely because of a restriction imposed by a non-U.S. authority in the auditor’s local jurisdiction. The U.S. House of Representatives passed the HFCA Act on December 2, 2020, and the HFCA Act was signed into law on December 18, 2020. Additionally, in July 2020, the U.S. President’s Working Group on Financial Markets issued recommendations for actions that can be taken by the executive branch, the SEC, the PCAOB or other federal agencies and department with respect to Chinese companies listed on U.S. stock exchanges and their audit firms, in an effort to protect investors in the United States. In response, on November 23, 2020, the SEC issued guidance highlighting certain risks (and their implications to U.S. investors) associated with investments in China-based issuers and summarizing enhanced disclosures the SEC recommends China-based issuers make regarding such risks. On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCA Act. We will be required to comply with these rules if the SEC identifies us as having a “non-inspection” year (as defined in the interim final rules) under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCA Act, including the listing and trading prohibition requirements described above. Under the HFCA Act, our securities may be prohibited from trading on NYSE American or other U.S. stock exchanges if our auditor is not inspected by the PCAOB for three consecutive years, and this ultimately could result in our common stock being delisted.

12

Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”), which, if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three and would reduce the time before our securities may be prohibited from trading or delisted. On September 22, 2021, the PCAOB adopted a final rule implementing the AHFCAA, which provides a framework for the PCAOB to use when determining, as contemplated under the AHFCAA, whether the Board is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction. On November 5, 2021, the SEC approved the PCAOB’s Rule 6100, Board Determinations Under the HFCA Act. On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions. On December 16, 2021, the PCAOB issued a Determination Report which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the PRC, and (2) Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. On December 29, 2022, the Consolidated Appropriations Act, was signed into law by President Biden. The Consolidated Appropriations Act contained, among other things, an identical provision to AHFCAA, which reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two. Our auditor is registered with the PCAOB and is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess our auditor’s compliance with the applicable professional standards. Our auditor, Assentsure PAC, is headquartered in Singapore. Therefore, our auditor is subject to the Determination announced by the PCAOB on December 16, 2021. Notwithstanding the foregoing, in the future, if there is any regulatory change or steps taken by the PRC regulators that do not permit Assentsure PAC to provide audit documentation located in China or Hong Kong to the PCAOB for inspection or investigation, or the PCAOB expands the scope of the Determination so that we are subject to the HFCA Act, as the same may be amended, you may be deprived of the benefits of such inspection which could result in limitation or restriction to our access to the U.S. capital markets and trading of our securities, including trading on the national exchange and trading on “over-the-counter” markets, may be prohibited under the HFCA Act. However, in the event the PRC authorities would further strengthen regulations over auditing work of Chinese companies listed on the U.S. stock exchanges, which would prohibit our current auditor to perform work in China, then we would need to change our auditor and the audit workpapers prepared by our new auditor may not be inspected by the PCAOB without the approval of the PRC authorities, in which case the PCAOB may not be able to fully evaluate the audit or the auditors’ quality control procedures. Furthermore, due to the recent developments in connection with the implementation of the Holding Foreign Companies Accountable Act, we cannot assure you whether the SEC, Nasdaq or other regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control. Our auditor, Assentsure PAC, is headquartered in Singapore, not mainland China or Hong Kong and was not identified in this report as a firm subject to the PCAOB’s determination. Therefore, our auditor is not currently subject to the determinations announced by the PCAOB on December 16, 2021, and it is currently subject to the PCAOB inspections.

While our auditor is based outside mainland China and Hong Kong, and is registered with the PCAOB and has been inspected by the PCAOB on a regular basis, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection could cause trading in the our securities to be prohibited under the HFCA Act, and ultimately result in a determination by a securities exchange to delist our securities. In addition, the recent developments would add uncertainties to the listing and trading of our shares of common stock and we cannot assure you whether NYSE American or regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of our financial statements. It remains unclear what the SEC’s implementation process related to the above rules will entail or what further actions the SEC, the PCAOB or NYSE American will take to address these issues and what impact those actions will have on U.S. companies that have significant operations in the PRC and have securities listed on a U.S. stock exchange (including a national securities exchange or over-the-counter stock market). In addition, the above amendments and any additional actions, proceedings, or new rules resulting from these efforts to increase U.S. regulatory access to audit information could create some uncertainty for investors, the market price of our common stock could be adversely affected, and we could be delisted if we and our auditor are unable to meet the PCAOB inspection requirement or being required to engage a new audit firm, which would require significant expense and management time.

13

On August 26, 2022, the PCAOB signed a Statement of Protocol (the “SOP”) Agreements with the CSRC and China’s Ministry of Finance. The SOP Agreement, together with two protocol agreements (collectively, “SOP Agreements”), governs inspections and investigations of audit firms based in mainland China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB Board will consider the need to issue a new determination. Delisting of our common stock would force holders of our common stock to sell their common stock. The market price of our common stock could be adversely affected as a result of anticipated negative impacts of these executive or legislative actions upon, as well as negative investor sentiment towards, companies with significant operations in China that are listed in the United States, regardless of whether these executive or legislative actions are implemented and regardless of our actual operating performance.

The enactment of Law of the PRC on Safeguarding National Security in the Hong Kong Special Administrative Region (the “Hong Kong National Security Law”) could impact our Hong Kong subsidiaries.

On June 30, 2020, the Standing Committee of the PRC National People’s Congress adopted the Hong Kong National Security Law. This law defines the duties and government bodies of the Hong Kong National Security Law for safeguarding national security and four categories of offences — secession, subversion, terrorist activities, and collusion with a foreign country or external elements to endanger national security — and their corresponding penalties. On July 14, 2020, the former U.S. President Donald Trump signed the Hong Kong Autonomy Act (the “HKAA”), into law, authorizing the U.S. administration to impose blocking sanctions against individuals and entities who are determined to have materially contributed to the erosion of Hong Kong’s autonomy. On August 7, 2020 the U.S. government imposed HKAA-authorized sanctions on eleven individuals, including HKSAR chief executive Carrie Lam. On October 14, 2020, the U.S. State Department submitted to relevant committees of Congress the report required under HKAA, identifying persons materially contributing to “the failure of the Government of China to meet its obligations under the Joint Declaration or the Basic Law.” The HKAA further authorizes secondary sanctions, including the imposition of blocking sanctions, against foreign financial institutions that knowingly conduct a significant transaction with foreign persons sanctioned under this authority. The imposition of sanctions may directly affect the foreign financial institutions as well as any third parties or customers dealing with any foreign financial institution that is targeted. It is difficult to predict the full impact of the Hong Kong National Security Law and HKAA on Hong Kong and companies located in Hong Kong. If our Hong Kong subsidiary is determined to be in violation of the Hong Kong National Security Law or the HKAA by competent authorities, our business operations, financial position and results of operations could be materially and adversely affected.

The PRC government may intervene or influence our operations at any time or may exert more control over overseas offerings and listings and foreign investment in China-based issuers, which may result in a material change in our operations and/or the value of our common stock. Additionally, the governmental and regulatory interference could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

There are political risks associated with conducting business in Hong Kong.