UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year ended

OR

OR

Date of event requiring this shell company report:

Commission File Number:

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Lifezone Metals Limited

Telephone number:

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| Ordinary Shares | ||||

| Warrants | 14,391,150 |

Indicate by check mark if

the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual

or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ☒ | |

| Emerging growth company |

If an emerging growth company

that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the

extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a)

of the Exchange Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether

the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control

over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that

prepared or issued its audit report.

If securities are registered

pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing

reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued | Other ☐ | |

| by the ☒ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

TABLE OF CONTENTS

i

ii

iii

INTRODUCTION

About this Annual Report

This Annual Report on Form 20-F contains the audited consolidated financial statements and the related notes for the year ended December 31, 2023 (“Annual Financial Statements”) of Lifezone Metals Limited (“Lifezone Metals” and the “Company”). The Annual Financial Statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”).

Discrepancies in any table between totals and sums of the amounts listed are due to rounding. Certain amounts and percentages have been rounded; consequently, certain figures may add up to be more or less than the total amount and certain percentages may add up to be more or less than 100% due to rounding.

Throughout this Annual Report, unless otherwise designated or the context otherwise requires, the terms “we,” “us,” “our,” “Lifezone” and “the Company” refer to Lifezone Metals and its subsidiaries.

Financial Statement Presentation

Lifezone Metals was incorporated on December 8, 2022, for the purpose of effectuating the Business Combination described herein. Prior to the consummation of the Business Combination, Lifezone Metals had no material assets and did not operate any businesses.

Lifezone Metals qualifies as a foreign private issuer as defined under Rule 405 under the Securities Act and prepares its financial statements denominated in U.S. dollars and in accordance with IFRS as issued by the IASB. Lifezone Metals’ audited financial statements for the year ended December 31, 2023, have been prepared in accordance with IFRS and audited in accordance with the standards of the Public Company Accounting Oversight Board (United States) (the “PCAOB”) and are reported in U.S. dollars.

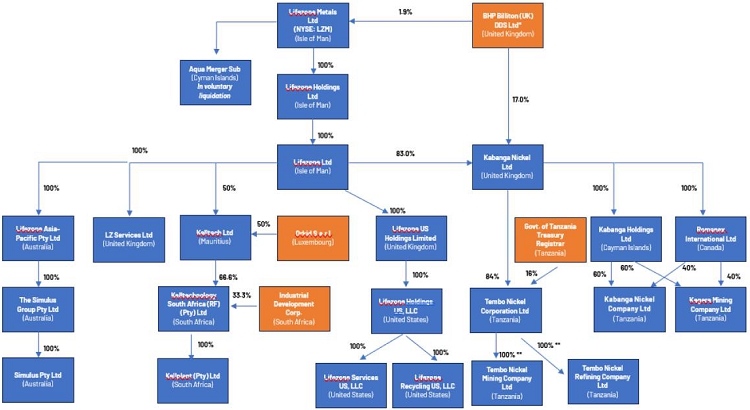

On December 13, 2022, Lifezone Metals, an Isle of Man company and GoGreen Investments Corporation (“GoGreen”), an exempted company incorporated under the laws of the Cayman Islands, entered into a Business Combination Agreement, with GoGreen Sponsor 1 LP, a Delaware limited partnership, Aqua Merger Sub, a Cayman Islands exempted company and wholly owned direct subsidiary of Lifezone Metals, and Lifezone Holdings Limited (“LHL”), an Isle of Man company.

On July 6, 2023, Lifezone, LHL and GoGreen consummated the SPAC transaction pursuant to the Business Combination Agreement (the “Business Combination”). The transaction was unanimously approved by GoGreen’s Board of Directors and was approved at the extraordinary general meeting of GoGreen’s shareholders held on June 29, 2023. GoGreen’s shareholders also voted to approve all the other proposals presented at the extraordinary general meeting of GoGreen’s shareholders held on June 29, 2023. As a result of the Business Combination, the Merger Sub, as the surviving entity after the Business Combination, and Lifezone Holdings each became wholly owned subsidiaries of Lifezone Metals.

Currency and Exchange Rates

In this Annual Report, unless otherwise specified, all monetary amounts are in U.S. dollars and all references to “$” mean U.S. dollars. Certain monetary amounts described herein have been expressed in U.S. dollars for convenience only and, when expressed in U.S. dollars in the future, such amounts may be different from those set forth herein due to intervening exchange rate fluctuations.

iv

CERTAIN DEFINED TERMS

In this document, unless the context otherwise requires:

“Acquisition date” means Business Combination on July 6, 2023.

“Amended and Restated Memorandum and Articles of Association of Lifezone Metals” or “A&R Articles of Association” means the memorandum and articles of association of Lifezone Metals.

“Ancillary Documents” means each agreement, instrument, certificate or document including the GoGreen disclosure schedules, LHL disclosure schedules, the Plan of Merger, Initial Lock-Up Agreements, the New Registration Rights Agreement, the Sponsor Support Agreement, the Warrant Assumption Agreement, any Joinder and the other agreements, instruments, certificates and documents executed or delivered by any of the parties to or in connection with the Business Combination Agreement.

“AUD” means Australian Dollars.

“Barrick” means Barrick Gold Corporation.

“BCA” means business combination agreement.

“BHP” means BHP Billiton (UK) DDS Limited, a UK based subsidiary of BHP Group Limited.

“Bushveld Complex” means a basin-shaped intrusion and geological region, internationally recognized for its PGM-bearing deposits, located in South Africa.

“Business Combination” means the Merger and the other transactions contemplated by the Business Combination Agreement, collectively.

“BCA” or “Business Combination Agreement” means the Business Combination Agreement, dated as of December 13, 2022, as it may be amended, supplemented or modified from time to time by and among GoGreen, Lifezone Metals, the Sponsor, Merger Sub, LHL, Keith Liddell, solely in his capacity as LHL Shareholders representative, and the shareholders of LHL party thereto.

“CGU” means cash generating unit.

“Committee” means a committee of at least two people appointed to Lifezone Metals’ board.

“Company” means Lifezone Metals.

“COVID-19” means the disease known as coronavirus disease or COVID-19, the virus known as severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) and any evolutions or mutations thereof.

“CTP” means concentrate treatment plant.

“Definitive Feasibility Study” / “DFS” means the definitive feasibility study for both the Kabanga underground mine and the base metals refinery to determine the development requirements of the project, including capital and operating costs, which is expected to be completed in the second half of 2024.

“DLSA” means the development, licensing and services agreement between Lifezone Limited and KNL, pursuant to which Lifezone Limited agreed to: (i) develop the Kabanga Hydromet Technology; (ii) once developed, license that technology to KNL for use by or on behalf of KNL initially in connection with a feasibility study and thereafter in connection with the Kabanga Project; and (iii) provide a variety of related services. Unless terminated earlier, the DLSA will remain in force until completion of the Kabanga Project and any related project, following which it shall automatically expire.

“D&O” means Directors and Officers.

“DGPS” means Differential Global Positioning System.

v

“DTC” means the Depository Trust Company.

“Dutwa Acquisition” means the potential acquisition of all the tangible assets and all registered and unregistered intellectual property relating to the Dutwa Nickel Project (excluding the Ngasamo deposit in the Dutwa Nickel Project area) from Harmony Minerals Limited and Dutwa Minerals Limited, pursuant to the non-binding term sheet dated September 5, 2022, between and among Harmony Minerals Limited and Dutwa Minerals Limited, which was subsequently amended and restated on April 27, 2023, by which we may acquire all the tangible assets and all registered and unregistered intellectual property related to the Dutwa Nickel Project in Tanzania (excluding the Ngasamo deposit in the Dutwa Nickel Project area).

“Dutwa Nickel Project” means the nickel laterite ore deposit at Dutwa in northern central Tanzania.

“Earnout Period” means the time period beginning on the Share Acquisition Closing Date and ending on the five-year anniversary of the Share Acquisition Closing Date.

“Earnout Shares” means the Lifezone Metals Ordinary Shares to be issued by Lifezone Metals to the eligible LHL Shareholders in connection with the Share Acquisition, within five business days after the occurrence of the Triggering Events described in this Annual Report, upon the terms and subject to the conditions set forth in the Business Combination Agreement, and subject to equitable adjustment for stock splits, reverse stock splits, stock dividends, reorganizations, recapitalizations, reclassifications, combination, exchange of shares or other like change or transaction with respect to Lifezone Metals Ordinary Shares.

“EBSP” means Economic Benefits Sharing Principle.

“EIA” means environmental impact assessment.

“EIS” means environmental impact statement.

“EGM” means Extraordinary general meeting.

“EGC” means emerging growth company.

“EMA” means the Environmental Management Act, 2004 of Tanzania.

“EMP” means the environmental management plan in relation to the Kabanga Project.

“ESG” means environmental, social and governance.

“EV” means electric vehicle.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“FCC” means the Fair Competition Commission of Tanzania.

“FCPA” means the Foreign Corrupt Practices Act of 1977, as amended.

“FID” means final investment decision.

“First Working Capital Note” means the promissory note dated January 19, 2023, issued by GoGreen to the Sponsor in the principal amount of up to $300,000 for working capital expenses.

“Flip-Up” means the KNL shareholders’ exchange of KNL shares for LHL shares on June 24, 2022.

“FPI” means Foreign Private Issuer.

“Framework Agreement” means the agreement entered into on January 19, 2021, between KNL and the GoT, pursuant to which TNCL, in which the GoT holds a 16% non-dilutable free-carried interest and KNL holds an 84% interest, was created.

“FVTOCI” means fair value through other comprehensive income.

“FVTPL” means fair value through profit and loss.

vi

“FY” means full year.

“GAAP” means generally accepted accounting principles.

“GBP” means Great British Pound.

“GDP” means Gross Domestic Product.

“GHGs” means greenhouse gases.

“Glencore” means Glencore Canada Corporation.

“GoGreen” means GoGreen Investments Corporation, a Cayman Islands exempted company.

“GoGreen Initial Shareholders” means the Sponsor and certain members of GoGreen’s board of directors and advisors.

“GoGreen PIPE Investors” means the investors that are affiliates of GoGreen that invested in the PIPE Financing and consists of John Dowd, Govind Friedland and Sergei Pokrovsky.

“GoT” means the Government of Tanzania.

“GST” means goods and services tax.

“Hydromet Technology” means the particular hydrometallurgical concentrate processing technology that has been developed, and intended to be developed further, based on Lifezone’s intellectual property which includes certain patents and proprietary information in relation to such technology, and which term includes the Kabanga Hydromet Technology and the Kell Process Technology.

“IASB” means the International Accounting Standards Board.

“ICA” means the U.S. Investment Company Act of 1940, as amended.

“IDC” means Industrial Development Corporation of South Africa, a South African national development finance institution.

“IDC-KTSA Shareholder Loan Agreement” means the shareholder loan agreement between IDC and KTSA dated March 31, 2022, in terms of which the IDC agreed to advance to KTSA a shareholder loan in the amount of R407,000,000.

“IFRS” means International Financial Reporting Standards as adopted by the IASB.

“Initial Lock-Up Agreements” means, collectively, the lock-up agreements entered into by the GoGreen Initial Shareholders and LHL Shareholders at the Share Acquisition Closing in connection with the Business Combination.

“IOM Companies Act” means the Companies Act 2006 of the Isle of Man.

“IP” means intellectual property.

“IPO” means GoGreen’s initial public offering of GoGreen units, consummated on October 25, 2021.

“IRS” means Internal Revenue Service.

“IT” means Information Technology.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended.

“TNCL Subsidiaries” means Tembo Refining and Tembo Mining, collectively.

“New VentureCo” or “VentureCo” means any joint venture entity formed by KNL and BHP pursuant to the Cooperation Deed.

“Kabanga Data” means the data and information acquired by KNL on April 30, 2021, relating to the Kabanga Project, including historical mineral resource estimation, all metallurgical test work and piloting data, analysis and studies in conjunction with the acquisition of Kabanga Holdings Limited from Barrick International (Barbados) Corporation and Glencore and all shares of Romanex International Limited from Glencore and Sutton.

“Kabanga Hydromet Technology” means the Hydromet Technology proposed to be developed for refining nickel, cobalt and copper at the Kahama refinery and licensed by Lifezone Limited to KNL, pursuant to the DLSA.

“Kabanga Nickel” means Kabanga Nickel Company Limited, a Tanzanian company.

vii

“Kabanga Nickel Project” means Lifezone Metals’ exploration project of the Kabanga deposit project area.

“Kagera Mining” means Kagera Mining Company Limited, a Tanzanian company.

“Kell Intellectual Property” means the IP rights with respect to the Kell Process Technology owned, licensed to or controlled by Lifezone Limited.

“Kell License” means the exclusive license granted by Lifezone Limited to its 50%- owned subsidiary, Kelltech, to use and sub-license the Kell Process Technology in the SADC License Area.

“Kellplant” means Kellplant Proprietary Limited, a limited liability private company, registered in and incorporated under the laws of South Africa.

“Kell Process Technology” means the Hydromet Technology licensed by Lifezone Limited to Kelltech pursuant to the Kelltech License Agreement for refining PGMs, gold and silver and associated base metals where the primary focus of the extraction process is a PGM, gold, or silver.

“Kelltech” means Kelltech Limited, a company registered and incorporated in Mauritius.

“Kelltech License Agreement” means a license agreement among Lifezone Limited, Keith Liddell and Kelltech, as amended.

“Kell-Sedibelo-Lifezone Refinery” means a potential refinery at SRL’s Pilanesberg Platinum Mine in South Africa that would process PGMs, gold, nickel, copper and cobalt, applying the Kell Process Technology.

“Key LHL Shareholders” means, collectively, Keith and Jane Shelagh Liddell (jointly), Varna Holdings Limited, BHP, Peter Smedvig, Keith Liddell, Kamberg Investments Limited, Duncan Bullivant, Hermetica Limited and Chris Showalter.

“KNL” means Kabanga Nickel Limited, a private limited company incorporated under the laws of England and Wales.

“KTSA” means Kelltechnology SA Proprietary Ltd.

“KTSA License” means the license granted to KTSA under the KTSA License Agreement.

“KTSA License Agreement” means a license agreement between Kelltech and KTSA, dated April 16, 2014, as amended, pursuant to which Kelltech Limited granted KTSA an exclusive sub-license to the Kell Intellectual Property under the Kelltech License Agreement to use the Kell Intellectual Property within the SADC License Area.

“LIBOR” means the London Inter-Bank Offered Rate.

“Lifezone Holdings” or “LHL” means Lifezone Holdings Limited, an Isle of Man company, and its consolidated subsidiaries and, following the Share Acquisition, a wholly owned subsidiary of Lifezone Metals.

“LHL Shareholders” means the shareholders of LHL immediately prior to the Share Acquisition Closing.

“Lifezone” means Lifezone Metals Limited (the Company, individually and together with its controlled subsidiaries.

“Lifezone Limited” means Lifezone Limited, a company limited by shares incorporated under the laws of the Isle of Man.

“Lifezone Metals” or “LML” means Lifezone Metals Limited, a company limited by shares incorporated under the laws of the Isle of Man.

“Lifezone Metals Ordinary Shares” means the ordinary shares, with $0.0001 par value per share, of Lifezone Metals.

“Lifezone Subscription Agreement” means the subscription agreement dated December 24, 2021, entered into between Lifezone Limited and BHP, pursuant to which BHP subscribed for ordinary shares of Lifezone Limited for an aggregate amount of $10 million.

viii

“LME” means London Metal Exchange.

“Lock-Up Agreements” means, collectively, the Initial Lock-Up Agreements and the lock-up agreements entered into by the limited partners of the Sponsor in connection with the distribution of Lifezone Metals Ordinary Shares and Warrants by the Sponsor to such limited partners.

“LSP” means loss per share.

“LZAP” means Lifezone Asia-Pacific Pty Ltd (formerly known as Metprotech Pacific Pty Ltd).

“LZL” means Lifezone Limited.

“LZSL” means LZ Services Limited.

“Merger” means the merger of GoGreen with and into Merger Sub, as a result of which the separate corporate existence of GoGreen ceased and Merger Sub continued as the surviving entity, and the shareholders of GoGreen (other than shareholders of GoGreen who elected to redeem their GoGreen ordinary shares and dissenting shareholders) became shareholders of Lifezone Metals.

“Merger Closing” means the closing of the Merger.

“Merger Closing Date” means the date of the Merger Closing, which was July 5, 2023.

“Merger Effective Time” means the time at which the Merger became effective, which occurred on July 5, 2023.

“Merger Sub” means Aqua Merger Sub.

“Mineral Resource Estimates” means the mineral resource estimates set out in the Technical Report Summary.

“MMPF” means Multi-purpose Mineral Processing Facility

“MRU” means mineral resource update.

“NCI” means non-controlling interest.

“New Registration Rights Agreement” means the Registration Rights Agreement entered into by and among Lifezone Metals, certain LHL Shareholders and the Sponsor in connection with the Business Combination.

“NiEq” means nickel equivalent.

“PAP” means project affected people.

“PFIC” means passive foreign investment company.

“PGM” means platinum group metals.

“Pilanesberg Platinum Mine” means the PGM-producing open pit mine complex located primarily within the farm Tuschenkomst 135JP, located in the Bushveld Complex, and which was operated by PPM until December 1, 2023, and indirectly owned by SRL.

“PIPE” means Private Investment in Public Equity.

“PIPE Financing” means the private placement of 7,017,317 Lifezone Metals Ordinary Shares to the PIPE Investors for gross proceeds of $70,173,170, pursuant to the Subscription Agreements.

“PIPE Investors” means the investors (including the GoGreen PIPE Investors) in the PIPE Financing pursuant to the Subscription Agreements.

“PPM” means Pilanesberg Platinum Mines Proprietary Limited, a limited liability private company, registered in and incorporated under the laws of South Africa. PPM is an indirect wholly owned subsidiary of SRL.

“Private Placement Warrants” means the 667,500 warrants issued to the Sponsor in a private placement concurrently with the IPO that were assumed by Lifezone Metals pursuant to the Warrant Assumption Agreement.

ix

“Promissory Note” means the promissory note dated March 17, 2021, as amended by the amended and restated promissory note dated September 21, 2021, whereby the Sponsor agreed to loan GoGreen up to $500,000 to be used for the payment of costs relating to the IPO.

“Public Warrants” means the public warrants that were previously registered and originally issued in the initial public offering of GoGreen Units at a price of $10.00 per GoGreen Unit, with each GoGreen Unit consisting of one Class A ordinary share of GoGreen and one-half of one GoGreen public warrant, and that were assumed by Lifezone Metals pursuant to the Warrant Assumption Agreement.

“QA” means quality assurance.

“QC” means quality control.

“OCI” means other comprehensive income.

“RAP” means Resettlement Action Plan

“Registration and Shareholder Rights Agreement” means the registration and shareholder rights agreement dated as of October 20, 2021, among GoGreen, the Sponsor and the other “Holders” named therein.

“Reorganization” means Capital reorganization.

“SADC License Area” means the countries (Angola, Botswana, the Democratic Republic of Congo, Lesotho, Malawi, Madagascar, Mozambique, Namibia, Swaziland, Tanzania, Zambia, Zimbabwe, South Africa and the Seychelles) where Kelltech can use and/or exercise the Kell Process Technology, under the exclusive license granted by Lifezone Limited.

“Sarbanes-Oxley Act” or “SOX” means the Sarbanes-Oxley Act of 2002.

“Second Extension” means the extension requested by the Sponsor, on April 10, 2023, that GoGreen extend the date by which GoGreen has to consummate a business combination from April 25, 2023, to July 25, 2023, as the second of two three-month extensions permitted under GoGreen’s existing governing documents.

“Section 404” means Section 404 of the Sarbanes-Oxley Act.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“SGPL” means The Simulus Group Pty Limited.

“Share Acquisition” means the acquisition by Lifezone Metals of all of the issued share capital of LHL in exchange for the issue to LHL Shareholders of Lifezone Metals Ordinary Shares and, if applicable, Earnout Shares, such that LHL became a direct wholly owned subsidiary of Lifezone Metals.

“Share Acquisition Closing” means the closing of the Share Acquisition.

“Share Acquisition Closing Date” means the date of the Share Acquisition Closing, which was July 6, 2023.

“Simulus” means Simulus Group Pty Ltd.

“Simulus SSA” means the Share Sale Agreement, dated July 3, 2023, among Metprotech Pacific Pty Ltd, the persons set out in Schedule 1 thereto as vendors, Simon Walsh, as Management Vendors Representative, the Simulus Group Pty Ltd and Lifezone Limited.

“SML” means the Special Mining Licence for the Kabanga deposit project area issued by the GoT to TNCL on October 25, 2021.

“SOFR” means Secured Overnight Financing Rate.

“SONIA” means Sterling overnight indexed average.

“SPAC” means special purpose acquisition company.

“SPAC transaction” means a transaction or series of related transactions by merger, consolidation, share exchange or otherwise of the Company with a publicly traded “special purpose acquisition company” or its subsidiary (collectively, a “SPAC”), immediately following the consummation of which the common stock or share capital of the SPAC or its successor entity is listed on the Nasdaq Stock Market, the New York Stock Exchange or another exchange or marketplace approved by the Board of Directors, including a majority of the Preferred Directors.

x

“Sponsor” means GoGreen Sponsor 1 LP, a Delaware limited partnership.

“Sponsor Earnout Shares” means the 1,725,000 Lifezone Metals Ordinary Shares to be issued to the Sponsor that are subject to vesting upon the occurrence of the triggering events described in this Annual Report, upon the terms and subject to the conditions set forth in the Business Combination Agreement and the Sponsor Support Agreement.

“Sponsor Support Agreement” means the letter agreement entered into concurrently with the Business Combination Agreement by the Sponsor, GoGreen, Lifezone Metals and LHL, pursuant to which, among other things, the Sponsor agreed to (a) waive the anti-dilution and certain other rights set forth in the organizational documents of GoGreen and (b) subject the Lifezone Metals Ordinary Shares to an earn-out subject to certain conditions.

“Sedibelo” means Sedibelo Resources Limited.

“Subscription Agreements” means those certain subscription agreements entered into on December 13, 2022, among GoGreen, Lifezone Metals and the PIPE Investors named therein relating to the PIPE Financing.

“Sutton” means Sutton Resources Limited.

“Technical Report Summary” means Kabanga 2023 Mineral Resource Update Technical Report Summary prepared by Sharron Sylvester, BSc (Geol), RPGeo AIG (10125) and Bernard Peters, BEng (Mining), FAusIMM (201743) (each, a “Qualified Person” and collectively, the “Qualified Persons”) with an effective date of November 30, 2023.

“Tembo Mining” means Tembo Nickel Mining Company Limited, a subsidiary of Tembo Nickel Corporation Limited.

“Tembo Refining” means Tembo Nickel Refining Company Limited, a subsidiary of Tembo Nickel Corporation Limited.

“TNCL” means Tembo Nickel Corporation Limited.

“TRA” means Tanzanian Revenue Authority.

“Trading Day” means any day on which the Lifezone Metals Ordinary Shares are actually traded on the NYSE (or the exchange on which the Lifezone Metals Ordinary Shares are then listed).

“Tranche 1 Investment” means the investment of $40 million received by KNL from BHP by way of a convertible loan, pursuant to the Tranche 1 Loan Agreement.

“Tranche 1 Loan Agreement” means the loan agreement dated December 24, 2021, between KNL and BHP pursuant to which KNL received investment of $40 million from BHP by way of a convertible loan forming the Tranche 1 Investment.

“Tranche 2 Investment” means BHP’s investment of $50 million in KNL in the form of equity under the Tranche 2 Subscription Agreement.

“Tranche 2 Subscription Agreement” means the equity subscription agreement dated October 14, 2022, between KNL and BHP, pursuant to which KNL received investment of $50 million from BHP by way of an equity subscription forming the Tranche 2 Investment.

“Tranche 3 Investment” means BHP’s potential investment in KNL in form of equity under the Tranche 3 Option Agreement, the completion of which is subject to certain conditions and pursuant to which BHP would, in aggregate, hold indirectly 51% of the total voting and economic equity rights in TNCL on a fully diluted basis.

“Tranche 3 Option Agreement” means the equity option agreement dated October 14, 2022, as amended on February 8, 2023, entered into between BHP, Lifezone Limited and KNL, pursuant to which BHP has the option to consummate a further investment in KNL, subject to certain conditions being satisfied, including the satisfactory completion of, and agreement on, the Definitive Feasibility Study, agreement on the joint financial model in respect of the Kabanga Project, the amendment of the articles of association and share capital of the TNCL Subsidiaries to remove the free-carried interest rights of the GoT in the TNCL Subsidiaries and receipt of any necessary regulatory and tax approvals.

xi

“Tranche 3 Shareholders’ Agreement” means the shareholders’ agreement that KNL and Lifezone Limited would enter into with BHP upon closing of the Tranche 3 Investment in respect of KNL and its subsidiaries.

“Triggering Event I” means if at any time during the Earnout Period, the daily VWAP of the Lifezone Metals Ordinary Shares during such period is equal to or exceeds $14.00 per share for any 20 Trading Days (which may or may not be consecutive) during a 30-consecutive Trading Day period.

“Triggering Event II” means if at any time during the Earnout Period, the daily VWAP of the Lifezone Metals Ordinary Shares during such period is equal to or exceeds $16.00 per share for any 20 Trading Days (which may or may not be consecutive) during a 30-consecutive Trading Day period.

“Triggering Events” means, collectively, Triggering Event I and Triggering Event II.

“Trust Account” means the trust account that held proceeds of the IPO and the concurrent sale of the GoGreen placement warrants established by GoGreen for the benefit of its shareholders.

“TZS” Tanzanian Shillings.

“U.S. dollar” or “$” means the legal currency of the United States.

“U.S. GAAP” means accounting principles generally accepted in the United States of America.

“VAT” means value added tax.

“VWAP” means, for any security as of any date(s), the dollar volume-weighted average price for such security on the principal securities exchange on which such security is then traded during normal trading hours of such exchange or market, as reported by Bloomberg through its “HP” function (set to weighted average) or, if the foregoing does not apply, the dollar volume-weighted average price of such security in the over-the-counter market on the electronic bulletin board for such security during normal trading hours of such market, as reported by Bloomberg, or, if no dollar volume-weighted average price is reported for such security by Bloomberg for such hours, the average of the highest closing bid price and the lowest closing ask price of any of the market makers for such security as reported by OTC Markets Group Inc. If the VWAP cannot be calculated for such security on such date(s) on any of the foregoing bases, the VWAP of such security on such date(s) shall be the fair market value as determined reasonably and in good faith by a majority of the disinterested directors of the board of directors (or equivalent governing body) of the applicable issuer. All such determinations shall be appropriately adjusted for any stock or share dividend, stock split or share subdivision, stock combination or share consolidation, recapitalization or other similar transaction during such period.

“WACC” means weighted average cost of capital.

“Warrants” means, collectively, the Private Placement Warrants and the Public Warrants.

“ZAR” means South African Rand.

xii

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

Some of the statements contained in this Annual Report (including information incorporated by reference herein, this Annual Report) constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act of 1934, as amended (the “Exchange Act”), regarding, among other things, the plans, strategies and prospects, both business and financial, of the Company. These statements are based on the beliefs and assumptions of the management of the Company. Although the Company believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot assure you that it will achieve or realize these plans, intentions or expectations.

Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, and any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “predicts,” “projects,” “forecasts,” “may,” “might,” “will,” “could,” “should,” “would,” “seeks,” “plans,” “scheduled,” “possible,” “continue,” “potential,” “anticipates” or “intends” or similar expressions; provided that the absence of these does not means that a statement is not forward-looking.

Forward-looking statements contained in this Report include, but are not limited to, statements regarding future events, the estimated or anticipated future results of Lifezone Metals, future opportunities for Lifezone Metals, including the efficacy of the Hydromet Technology and the development of, and processing of mineral resources at, the Kabanga Project, and other statements that are not historical facts.

These statements are based on the current expectations of Lifezone Metals’ management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on, by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Lifezone Metals. These statements are subject to a number of risks and uncertainties regarding Lifezone Metals’ business, and actual results may differ materially. These risks and uncertainties include, but are not limited to: general economic, political and business conditions, including but not limited to the economic and operational disruptions; the outcome of any legal proceedings that may be instituted against the Lifezone Metals; the risks related to the rollout of Lifezone Metals’ business, the efficacy of the Hydromet Technology, and the timing of expected business milestones; the acquisition of, maintenance of and protection of intellectual property; Lifezone’s ability to achieve projections and anticipate uncertainties relating to our business, operations and financial performance, including: expectations with respect to financial and business performance, and future operating results; financial projections and business metrics and any underlying assumptions; expectations regarding product and technology development and pipeline; expectations regarding future acquisitions, partnerships or other relationships with third parties; maintain key strategic relationships with partners and customers; anticipate the timing and/or significance of contractual relationships; Lifezone Metals’ development of, and processing of mineral resources at the Kabanga Project; the effects of competition on Lifezone Metals’ business; obtain additional capital, including use of the debt market, future capital requirements and sources and uses of cash; the ability of Lifezone Metals to execute its growth strategy, manage growth profitably and retain its key employees; upgrade, maintain and secure information technology systems; the ability of Lifezone Metals to maintain the listing of its securities on a U.S. national securities exchange; comply with applicable laws and regulations; stay abreast of modified or new laws and regulations applying to its business, including privacy regulation; and other risks that will be detailed from time to time in filings with the U.S. Securities and Exchange Commission (the “SEC”).

While forward-looking statements reflect the Company’s good faith beliefs, they are not guarantees of future performance. Except as otherwise required by applicable law, the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes after the date of this Annual Report, except as required by applicable law. For a further discussion of these and other factors that could cause the Company’s future results, performance or transactions to differ significantly from those expressed in any forward-looking statement, please see the section “Risk Factors”. You should not place undue reliance on any forward-looking statements, which are based only on information currently available to the Company.

xiii

PART I

ITEM 1: A, B, C: IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable

ITEM 2: A, B: OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable

ITEM 3: A, B, C: KEY INFORMATION

Not Applicable

ITEM 3: D: RISK FACTORS

Investing in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks and uncertainties described below. Our business, operating results, financial condition or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material. If any of the risks actually occurs, our business, operating results, financial condition and prospects could be adversely affected. In that event, the market price of the Lifezone Metals Ordinary Shares could decline, and you could lose part or all of your investment. The risks discussed below may not prove to be exhaustive and are based on certain assumptions that later may prove to be incorrect or incomplete. Lifezone Metals and its subsidiaries may face additional risks and uncertainties that are not presently known to such entity, or that are currently deemed immaterial, which may also impair our business or financial condition.

The following discussion should be read in conjunction with the sections entitled “Cautionary Note Regarding Forward-Looking Statements,” “Item 5 - Operations and Financial Review and Prospect” and the financial statements of Lifezone Metals and the notes thereto included herein, as applicable.

Summary of Risk Factors

An investment in our securities involves substantial risks and uncertainties that may adversely affect our business, financial condition and results of operations and cash flows. Some of the more significant challenges and risks relating to an investment in Lifezone Metals include, among other things, the following:

Risks Related to Operational Factors

| ● | The ability to obtain the significant additional capital required to fund Lifezone’s business, including the proposed Tranche 3 Investment from BHP. |

| ● | The impact on Lifezone’s business of geopolitical conditions and social, economic and political stability in the areas in which it operates, including in Tanzania and South Africa. |

| ● | The absence of any operating history at Lifezone on which to evaluate Lifezone’s business and prospects. |

| ● | The significant governmental regulations to which Lifezone is subject. |

| ● | Risks related to Lifezone’s acquisitions, partnerships and joint ventures, including the potential Kell-Sedibelo-Lifezone Refinery. |

| ● | Changes in consumer demand and preference for metals relevant to Lifezone’s business. |

| ● | The ability to compete for employees, exploration, resources, capital funding, equipment and contract exploration, development and construction services. |

| ● | Risks related to increased costs as the result of inflation or otherwise and changes in interest rates and exchange rates. |

| ● | The ability to implement Lifezone’s business strategies. |

| ● | Risks related to litigation and tax and other regulatory actions. |

| ● | Lifezone’s reliance on third-party operators, providers and contractors. |

1

| ● | Risks related to Lifezone Metals’ holding company structure. |

| ● | Risks related to global resource nationalism trends. |

| ● | The impact of accidents, natural disasters, public health or political crises or other catastrophic events. |

| ● | Inaccuracies in Lifezone’s assumptions and analyses on which projections or forecasts are based. |

Risks Related to the Hydromet Technology and Intellectual Property

| ● | Lifezone’s ability to obtain, maintain, protect or enforce its intellectual property rights. |

| ● | Risks related to the lack of prior deployment of Lifezone’s proprietary technology at a commercial scale and the ongoing development of its technology. |

| ● | The ability to find licensees for Lifezone’s Hydromet Technology and professional services. |

Risks Related to the Potential Kell-Sedibelo-Lifezone Refinery which may license our Hydromet Technology

| ● | Risks related to the construction of the potential Kell-Sedibelo-Lifezone Refinery, including SRL’s discontinuation of its mine plan and the recent suspension of the Pilanesberg Platinum Mine. |

| ● | Increases in capital costs for development of mineral processing projects. |

Risks Related to the Metals Extraction Operations

| ● | Changes in the market price of nickel, cobalt and copper. |

| ● | The ability to replace the mineral resource base on the area covered by the SML as it depletes. |

| ● | Lifezone’s concentration of metals extraction operations in one location. |

| ● | Differences in Lifezone’s Mineral Resource Estimates from mineral reserves and final quantities recovered, inaccuracies in estimates of life-of-mine and market price fluctuations and changes in operating and capital costs, which may render mineral extraction uneconomic. |

| ● | The highly speculative nature of Lifezone’s exploration activities. |

| ● | Lifezone’s reliance on governmental approvals and permits for its metals extraction business and the risk of alterations, suspension or cancellation thereof. |

Risks Relating to Lifezone Metals Operating as a Public Company

| ● | Failure of an active and liquid market to develop for Lifezone Metals Ordinary Shares and fluctuations in the market price thereof. |

| ● | KNL identifying a material weakness in its internal control over financial reporting. |

| ● | The expected lack of dividend payments for the foreseeable future. |

| ● | Lifezone Metals’ broad discretion over the use of its cash balances. |

| ● | Risks related to Lifezone Metals’ status as a public company, including increased costs and compliance with corporate governance and internal control requirements and its limited experience therewith. |

| ● | Risks related to Lifezone Metals’ status as an “emerging growth company” and the reduced disclosure requirements applicable thereto. |

| ● | Risks related to Lifezone Metals’ status as a “foreign private issuer”, including Exchange Act reporting obligations and NYSE corporate governance rules that, to some extent, are more lenient and less frequent than those of a U.S. domestic public company. |

| ● | Anti-takeover provisions in the Amended and Restated Memorandum and Articles of Association of Lifezone Metals. |

| ● | The potential classification of Lifezone Metals as an inadvertent investment company for the purposes of the ICA. |

2

Risks Related to ESG and Doing Business in Tanzania and South Africa

| ● | Exposure to ESG related risks, including failure to operate in a responsible, transparent and sustainable manner, overstatements of the ESG benefits of certain products or technology and costs related to compliance with climate-change and water use regulations. |

| ● | Perceptions of risks in developing countries or emerging markets, such as Tanzania and South Africa. |

| ● | The potential impact of currency controls. |

Risks Related to Ownership of Lifezone Metals’ Securities

| ● | The ability of Lifezone Metals to continue to list its securities on the NYSE and comply with the NYSE’s continued listing standards. |

| ● | The securities being offered in this prospectus represent a substantial percentage of our outstanding Lifezone Metals Ordinary Shares, and the sales of such securities could cause the market price of our Lifezone Metals Ordinary Shares to decline significantly. |

| ● | The potential dilution of shareholders from Lifezone Metals issuing additional equity in the future. |

Risks Related to Operational Factors Affecting Lifezone Metals

We will require significant additional capital to fund our business, and no assurance can be given that such capital will be available at all or available on terms acceptable to us.

For our IP licensing business, subject to completion of the pilot program, feasibility study, legal agreements and FID for both parties, the partnership with Glencore for recycling PGMs in the US could require a total estimated shared capital expenditures of $15 million to $20 million to construct the first recycling facility. The accuracy of this estimate will be increased following the completion of the feasibility study.

We require a substantial amount of capital to progress and develop our metals extraction business, substantially being the Kabanga Nickel Project. Developing a metals extraction project requires a substantial amount of capital in order to identify and delineate mineral resources through geological mapping and drilling, identify geological features that may prevent or restrict the extraction of ore, conduct evaluation, testing and study activities and ultimately construct extraction, processing facilities and related infrastructure, expand production capacity (including by sinking or deepening existing shafts), replenish reserves, purchase, maintain and improve assets, equipment and infrastructure, comply with legal or regulatory requirements or industry standards and meet unexpected liabilities. Large amounts of capital are required to implement projects, and long-term production and processing require both significant capital expenditures and ongoing maintenance and working capital expenditures.

We expect to materially increase our capital expenditures to support the growth in our business and operations at Kabanga in Tanzania, including funding the Definitive Feasibility Study which will provide capital expenditures estimate in accordance with the Australian Institute of Mining and Metallurgy (Cost Estimation Handbook, Second Edition, Monograph 27, 2012) with an expected accuracy range of capital cost of not more than plus (or minus) 15% and an expected estimate contingency range of not more than 15%, building out the required infrastructure, procuring equipment and commencing commercial operations.

We received an initial investment on December 24, 2021, from BHP of $10 million in Lifezone Limited and $40 million in KNL, and a further investment of $50 million by BHP in KNL on February 15, 2023, with such investment proceeds into KNL to be used for the ongoing funding requirements of the Kabanga Project in accordance with a budget agreed between KNL and BHP.

3

However, our ability to develop the Kabanga Project requires significant further funding. Pursuant to the Tranche 3 Option Agreement entered into between BHP, Lifezone Limited and KNL, BHP has the option to consummate a further investment in KNL, subject to certain conditions being satisfied, including the satisfactory completion of, and agreement on, the Definitive Feasibility Study, agreement on the joint financial model in respect of the Kabanga Project, the amendment of the articles of association of the TNCL Subsidiaries to remove the free-carried interest rights of the GoT in the TNCL Subsidiaries and receipt of any necessary regulatory and tax approvals. BHP is under no obligation to make such an additional investment regardless of the outcome of the ongoing Definitive Feasibility Study. We cannot assure you that the conditions for such investment by BHP will be met or that the investment will ultimately materialize. For more information see “— Extraction of minerals from identified nickel deposits may not be economically viable and the development of our mineral project into a commercially viable operation cannot be assured.”. Our base case is for BHP to develop the Kabanga Project and operate the mine. If the Tranche 3 Investment is not made by BHP, we expect that we would continue developing the Kabanga Project with additional funding through debt or equity financing, and monetizing the offtake from the project and/or royalty streams, and we may also explore other strategic partners for the project. However, there can be no assurance that we will be able to raise such additional funds on favorable terms or at all. As we will require significant additional capital to fund our business, our management regularly evaluates potential sources of liquidity; however, the development stage nature of our business may make any potential equity or debt investors unwilling to provide us with the necessary funds. Any additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our operations. We may also have to sell existing assets, such as rights to our Hydromet Technology or interests in the Kabanga Project or other projects, which would dilute our interests in such assets and any returns therefrom. If we are unable to exercise sufficient control over the operations of KNL or if the operations of KNL are not as successful as expected, the trading price of Lifezone Metals could be adversely affected. In addition, even if we are able to raise such funds, this may take considerably more time than the timeline under the Tranche 3 Option Agreement. If Lifezone Metals raises such funds in the form of equity financing, the Lifezone Metals’ shareholders at the time may be further diluted. Further, under the A&R Articles of Association, the holders of Lifezone Metals Ordinary Shares will not be entitled to any pre-emptive rights or anti-dilution rights. Any failure to raise the necessary funds or delay in any fundraising could have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity.

The Kabanga mining and refining operations will also require significant ongoing maintenance expenditures. For further details, see “Item 5 - Operations and Financial Review and Prospect.”

We may also require additional capital to fund acquisitions going forward. On September 5, 2022, Lifezone Limited entered into a non-binding term sheet with Harmony Minerals Limited and Dutwa Minerals Limited, which was subsequently amended and restated on April 27, 2023, pursuant to which we may acquire all the tangible assets and all registered and unregistered intellectual property related to the Dutwa Nickel Project in Tanzania (excluding the Ngasamo deposit in the Dutwa Nickel Project area). The Dutwa Acquisition is subject to the parties completing negotiations and agreeing commercial terms, entering into definitive documentation and, completing various other conditions, including Lifezone entering into a framework agreement with the GoT in respect of the Dutwa Nickel Project, similar to the Framework Agreement entered into in respect of the Kabanga Project. In the event we proceed with the Dutwa Acquisition, pursuant to the terms of the amended and restated term sheet, which is non-binding, we may have to make further payments, in addition to the non-refundable deposit amounting to $400,000 we have paid in September 12, 2022. Exclusivity in relation to the Dutwa Acquisition expired on July 27, 2023, negotiations are on-going and there can be no assurance that the Dutwa Acquisition will be completed.

In addition to the proposed capital expenditures set out above, we have existing payment obligations, contingent liabilities and commitments which require capital. KNL completed the KNL Acquisitions for a cumulative amount of $13,520,763, of which $8 million was released from escrow in 2021 and an additional $2 million payment of contingent consideration relating to the acquisition of the relevant subsidiaries was made on December 15, 2022, with the remaining $4 million due to the sellers at the earlier of the completion of the Definitive Feasibility Study and the fifth anniversary of the contract from the date of signing, being December 9, 2024.

4

Finally, we may have additional capital requirements to the extent we identify and decide to proceed or accelerate exploration activities, develop future metals extraction operations, or take advantage of opportunities for acquisitions, joint ventures or other business opportunities. We may also incur major unanticipated liabilities or expenses or our cost estimates could prove to be inaccurate. There can be no assurance that we will be able to obtain necessary financing in a timely manner, on acceptable terms, if at all.

Our business is based on, among other things, expectations as to future capital expenditures, and if we are unable to fund those capital expenditures, as a result of our operations being unable to generate sufficient cash flow or as a result of difficulties in raising debt or equity funding, we will not be able to commence operations, expand our IP licensing business or generate revenue or be able to develop future capital projects or undertake investments, and this may have a material adverse impact on the carrying value of our exploration assets and the investment of Lifezone Metals in its subsidiaries. In addition, we may be unable to develop new capital projects so as to continue production at cost-effective levels. Furthermore, any such reduction in capital expenditures may cause us to forgo some of the benefits of any future increases in commodity prices, as it is generally costly or impossible to resume production immediately or complete a deferred expansionary capital expenditure project, and we may not be able to follow our rights we may have in equity and debt participation in subsidiary companies, all of which may adversely affect our longer-term results of operations or financial condition.

It is possible that we will borrow money to finance future capital expenditures or for other uses. Our capital expenditures financed by borrowing may increase our leverage and make it more difficult for us to satisfy our obligations, limit our ability to obtain additional financing to operate our business or require us to dedicate a substantial portion of our cash flow to make payments on our debt. This may reduce our ability to use our cash flow to fund working capital, capital expenditures and other general corporate requirements, and place us at a competitive disadvantage relative to some of our competitors that have less debt.

Any future debt we incur and other agreements we enter into may contain, among other provisions, covenants that restrict our ability to finance future operations or capital needs or to engage in other business activities. Given the long-term nature of such agreements, these covenants and restrictions may present a material constraint on our operational and strategic flexibility and may preclude us from entering into strategic transactions that would be beneficial to us. A breach of any of these covenants could result in an event of default under the relevant agreement, and any such event of default or resulting acceleration under such agreements could result in an event of default under other agreements. Further, the lenders in respect of such debt may require hedging of some or all of the future metal output which may impose additional restrictions on us.

Our development, growth, future profitability and ability to continue our operations may be impacted by geopolitical conditions, including in Tanzania.

Our proposed metals extraction operations are planned to be located in Tanzania and, to date, the only projects proposed to license our Hydromet Technology are in Tanzania. Changes to, or increased instability in, the economic, political or social environment in Tanzania as a result of regional elections in 2024 or the general election in 2025 could create uncertainty that discourages investment in the region and may adversely affect future investments in Lifezone Metals and increase pressure from PAPs, especially those with little entitlement increases prompting the Government to in turn put pressure on the company which may delay the process. In addition, socio-political instability and unrest may also disrupt our or our licensees’ and potential licensees’ businesses and operations, compromise safety and security, increase costs, affect employee morale, impact our ability to deliver our operational plans, create uncertainty regarding mining licenses and cause reputational damage, any of which could have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity.

5

Further, we may face additional regulatory hurdles or an increase in taxation due to changes in the political regime. For instance, under the previous government in Tanzania, taxes were increased on companies in certain industries, including the mining, telecom and shipping industries.

Similarly, in South Africa, there were contradictory statements made by government officials beginning in 2019 in relation to the nationalization of the South African Reserve Bank, which created uncertainty around this issue. Any economic or political instability caused by any nationalization process, whether or not fully or partially completed, may create issues with the movement of funds into or out of South Africa and impact the general business environment in South Africa.

The development and operation of the potential Kell-Sedibelo-Lifezone Refinery in South Africa would be dependent on sufficient electricity supplied by Eskom, a state-owned electricity utility company that historically held a monopoly in the South African market, including ventilation and hoisting in the underground environment. Prolonged power outages, disruption, or shortage in supply in South Africa would have a material adverse impact on the development and operation of the potential Kell-Sedibelo-Lifezone Refinery. Over the past decade, electricity supply in South Africa has been constrained, with multiple power disruptions and load shedding constraints. After a strike at Eskom in June 2018, Eskom commenced load shedding (i.e., a controlled process that responds to unplanned events) in order to protect the electricity power system from a total blackout. Load shedding is expected to increase in the short to medium term.

There is no assurance that Eskom’s efforts to protect the national power grid will prevent a complete nationwide blackout. Power tariff increases may increase the costs of the development and operation of the potential Kell-Sedibelo-Lifezone Refinery. There can be no assurance that there will be sufficient power supply for the needs of the country or for our development or operation of the potential Kell-Sedibelo-Lifezone Refinery. Community disruptions could result in access to our metals extraction operations, or the potential Kell-Sedibelo-Lifezone Refinery being obstructed, our property being damaged and production being interrupted. In addition, any threats, or actual proceedings, to nationalize any of our assets could cause a cessation or curtailment of our operations.

High levels of unemployment and a shortage of critical skills in Tanzania and South Africa remain issues that impact the local economies. In particular, the effects of COVID-19 have, and continue to impact, stability in Tanzania and South Africa. Several other political and economic factors have led, and may continue to lead, to further downgrades in national credit ratings, and may adversely affect the Tanzanian and South African metals extraction industries as a whole, as well as our operations. Any negative impact on the Tanzanian or South African economies could adversely affect our business, operating results and financial condition. More specifically, there have been instances in the past where Tanzanian and South African metals extraction companies have experienced violence and vandalism towards mines and employees, breaches of perimeter security, robbery, the annexation of waste rock dumps and mining areas, and clashes between local villagers and the security forces of the mines.

In addition, economic and political instability and geopolitical events in regions outside of Tanzania and South Africa, including the United Kingdom’s exit from the EU, the emergence of a trade dispute between the United States and China, the invasion of Ukraine by Russia in February 2022 (and the retaliatory measures that have been taken, or could be taken in the future), recent instability in the financial services industry and rising inflation risks may result in unavoidable uncertainties and events that could negatively affect the risk appetite for investments in the equity markets and in Tanzania and South Africa and metals extraction companies in particular; cause volatility in currency exchange rates, commodity prices, interest rates and worldwide political, regulatory, economic or market conditions; and contribute to instability in political institutions, regulatory agencies and financial markets. Any of these factors could have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity.

6

We have no operating history on which to base an evaluation of our business and prospects and an evolving business model, which raise doubts about our ability to achieve profitability.

We have no operating history upon which an investor can evaluate our prospects. While Lifezone Limited was established in 2008 and KNL was incorporated in 2019, no active refinery has licensed our Hydromet Technology and KNL has no metals-producing properties. As of the date of this Annual Report, the only source of revenue for Lifezone Limited has been consulting fees received from affiliates and third parties and fees from third-party customers following the Simulus Acquisition. As a young business, we are unable to give potential investors any historical basis on which they can evaluate a potential investment.

Production from the Kabanga Project has yet to begin, and our activities at Kabanga as of the date of this Annual Report have been largely focused on raising capital, organizational matters, staffing, studies, development of the project and setting up the required infrastructure to begin production. Further, once the Kabanga Project is commissioned, production is expected to be ramped-up to its maximum capacity in a phased manner. As an organization, we have not yet demonstrated an ability to successfully mine the mineral resources necessary for successful commercialization, or enter into offtake agreements with third parties. Consequently, any predictions about our future success or viability may not be as accurate as they could be had we had an operating history. Our operations are subject to the risks inherent in the establishment of a new business enterprise, including access to capital, successful implementation of our business plan and limited revenue from operations. We cannot assure you that our intended activities or plan of operation will be successful or result in revenue or profit to us and any failure to implement our business plan may have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity. We have encountered, and may continue to encounter, unforeseen expenses, difficulties, complications, delays and other known or unknown factors in achieving our business objectives. See “— Our proprietary Kell Process Technology has not been deployed at a commercial scale and we may encounter operational difficulties at that scale, and the Kabanga Hydromet Technology is yet to be developed and may not be commercially viable, each of which may in turn have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity.”

We are subject to significant governmental regulations that affect our operations and costs of conducting our business and may not be able to obtain all required permits and licenses to place our properties into production.

Our exploration, development and refining activities are subject to laws and regulations governing various matters. These include laws and regulations relating to environmental protection, including emissions, the management of natural resources, management and use of hazardous substances and explosives, exploration and development of mines, production and post-closure reclamation and rehabilitation, exports, price controls, repatriation of capital and exchange controls, taxation, mining royalties, labor standards and occupational health and safety, including mine safety and historic and cultural preservation.

The costs associated with compliance with these laws and regulations are substantial. Possible future laws and regulations, and potential changes to existing laws and regulations, could cause additional expense, capital expenditures, restrictions on or suspensions of our operations and delays in the development of our metals extraction assets and those of other companies using our Hydromet Technology. Our operations require licenses and permits from various governmental authorities related to the establishment of our planned facilities, to the production, storage and distribution of our mined products, and to the disposal and storage of wastes and rehabilitation of worked-out and abandoned sites. Such licenses and permits are subject to change in various circumstances at any time and there can be no guarantee that we will be able to obtain or maintain all necessary licenses and permits. For instance, KNL’s subsidiary, TNCL, was issued the SML in October 30, 2021, by the GoT, which provides TNCL with legal tenure over the Kabanga deposit project area for the existence of the nickel orebody, and is required to pay an annual fee to maintain the SML with the GoT. Additionally, in case of breach the SML can be canceled, suspended or surrendered in accordance with Tanzanian law and shall lapse if, among other things, KNL ceases mining operations or abandons the area of mining operations without prior permission of the Mining Commission of Tanzania (the “Mining Commission”). Similarly, we would need to obtain certain permits and licenses to construct and operate the potential Kell-Sedibelo-Lifezone Refinery. Once the Kabanga Project is commissioned, production is expected to be ramped up to its maximum capacity in a phased manner and renewed or updated licenses may be required based on the size of the project during each such phase. See “Description of the Kabanga Project” and “— Risks Related to the Potential Kell-Sedibelo-Lifezone Refinery which may license our Hydromet Technology — The regulatory approval, permitting, development, startup and/or operation of sustainable power generation facilities at SRL and its use at the potential Kell-Sedibelo-Lifezone Refinery may involve unanticipated events resulting in delays that could negatively impact our business and our results of operations and cash flows.”

7

Moreover, certain laws and regulations may allow governmental authorities and private parties who have a substantial and direct interest in the metals extraction operations or the consequences of the metals extraction operations to bring lawsuits based upon damages to property, the environment and injury to persons (for example, resulting from the environmental and health and safety impacts of our operations), and could lead to the imposition of substantial damages awards, fines, penalties or other civil or criminal sanctions. Further, non-governmental organizations or local community organizations could direct adverse publicity against us or disrupt our operations.

Environmental, health and safety laws and regulations change frequently (due to general amendments or amendments brought about as a result of case law) and are generally becoming more stringent across the global metals extraction industry. If our environmental compliance obligations were to change as a result of changes to the legislation or in certain assumptions we make to estimate liabilities, or if unanticipated conditions were to arise in connection with our operations, our expenses and provisions and timelines would increase to reflect these changes. If material, these expenses and provisions could adversely affect our business, operating results and financial condition.

The regulatory approval and permitting of our Kabanga Nickel Project may take longer than expected and involve unanticipated events resulting in delays that could negatively impact our business and the results of our operations and cash flows.

The regulatory landscape governing environmental approvals is complex and dynamic. Changes in environmental regulations or the imposition of stricter standards may necessitate modifications to our projects, including the Kabanga Nickel Project, leading to increased compliance costs. A failure to adapt swiftly and adequately to evolving regulatory requirements poses a risk of delays, fines, or legal actions. In addition, it is critical that we secure appropriate environmental and operating approvals and permits as a prerequisite for commencement of our projects. Any delays in the permitting process, whether due to regulatory complexities or stakeholder opposition, could hinder our project timelines. Extended approval timelines could result in increased project costs, interest expenses, and missed market opportunities.

There is the risk that relevant regulators may impose fines and work stoppages for non-compliant operating procedures and activities, which could reduce or halt construction or production until lifted. The occurrence of any of these events could delay or halt construction or production, increase production costs and result in financial and regulatory liability for us, which could have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity.

An environmental and social impact assessment (“ESIA”) process is integral to obtaining approvals, and challenges in preparing a comprehensive and compliant ESIA may lead to delays or denials. In addition, the relevant authorities may issue administrative directives and compliance notices in the future to enforce the provisions of the relevant statutes to take specific mitigating measures, continue with those measures and/or complete those measures. The authorities may also order the suspension of part, or all of, our operations if there is non-compliance with legislation. Contravention of some of these statutes may also constitute a criminal offense and an offender may be liable for a fine or imprisonment, or both, in addition to administrative penalties. Local communities and stakeholders may express concerns or opposition to resource projects on environmental grounds. Opposition may lead to legal challenges, delays in approvals, or reputational damage. Effectively managing relationships with local communities and stakeholders is imperative to mitigate the risk of project disruptions. As a result, the occurrence of any of these events may have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity.

8

Acquisitions, strategic partnerships, joint ventures and other partnerships, including offtake agreements, may not perform in accordance with expectations, may fail to receive required regulatory approvals or may disrupt our operations and adversely affect our credit ratings and profitability.

We have entered, and in the future expect to enter, into joint ventures, strategic partnerships, partnership arrangements, acquisition agreements or offtake agreements with other parties in relation to our metals extraction business and our IP licensing business. Any failure of other parties to meet their obligations to us or to third parties, or any disputes with respect to the parties’ respective rights and obligations, could have a material adverse effect on us, the development and operations of our metals extraction business, including the Kabanga Project, and the IP licensing business, including the potential Kell-Sedibelo-Lifezone Refinery, and future joint ventures, if any, or their properties, and therefore could have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity.

In the event the partnership with Sedibelo and IDC regarding the development of the potential Kell-Sedibelo-Lifezone Refinery in South Africa is dissolved or our joint strategy changes, we may not receive any returns in relation to the development of the Kell Process Technology. This may have an adverse effect on our IP licensing business and for future licensing opportunities at refineries, which in turn may have a material adverse effect on our business, operations and profits as a whole. Sedibelo may also determine to fund an alternative refinery itself and may no longer support and select Kellplant, in which we have a look-through ownership interest, to lead the construction, operation and ownership of the potential Kell-Sedibelo-Lifezone Refinery.

For our IP licensing business, subject to completion of the pilot program, feasibility study, legal agreements and FID for both parties, the partnership with Glencore for recycling PGMs in the US could require a total estimated shared capital expenditures of $15 million to $20 million to construct the first recycling facility. The accuracy of this estimate will be increased following the completion of the feasibility study at Phase 1.