By Order of the Board of Directors,

Lawrence Bruno

Chairman

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☑ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

CORE LABORATORIES INC.

6316 Windfern Road

Houston, Texas 77040

|

|

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS |

|

|

To Be Held May 8, 2024 |

|

|

|

|

Dear Shareholder:

You are cordially invited to attend our 2024 annual meeting of shareholders (the “Meeting”) of Core Laboratories Inc. (the “Company”), which will be held at the Hotel Zaza, Memorial City, 9787 Katy Freeway, Houston, Texas 77024, on Wednesday, May 8, 2024 at 9:00 a.m. Central Daylight Time (“CDT”). The Meeting is being held for the following purposes as proposed by the Board:

The election of the Company's Board members as described in agenda item no. 1 and the topics covered by agenda item nos. 2 through 4 have largely been presented to and approved by our shareholders at our prior annual meetings.

A list of shareholders entitled to vote at the Meeting will be available for review by any shareholder at our offices in Houston Texas, located at 6316 Windfern Road, Houston, Texas 77040. Such list will be available for review beginning on the 10th calendar day preceding the Meeting through the close of the Meeting.

IF YOU PLAN TO ATTEND IN PERSON:

Attendance at the Meeting is limited to shareholders as of the close of business Eastern Daylight Time on March 14, 2024, Company management and Company advisors. Registration will begin at 8:00 a.m. CDT and the Meeting will begin at 9:00 a.m. CDT on May 8, 2024. Each shareholder desiring to attend MUST bring proof of share ownership as of March 14, 2024 with him/her to the Meeting along with a valid form of identification. Examples of proof of share ownership include voting instruction statements from a broker or bank. In addition, you should register with the Company beforehand to indicate your plan to attend. Such registration may be made by contacting the Company’s Secretary as described in the proxy statement. Failure to comply with these requirements may preclude you from being admitted to the Meeting.

It is important that your shares be represented at the Meeting regardless of whether you plan to attend. In order to be able to vote at the Meeting, you must be a record holder of shares (or otherwise a person with voting rights with respect to shares) at the close of business Eastern Daylight Time on March 14, 2024. Please mark, sign, date and return the accompanying proxy card accordingly, vote online or vote by phone, all as described in further detail in the proxy statement. If you are present at the Meeting and wish to do so, you may revoke your proxy and vote in person.

By Order of the Board of Directors, |

|

Lawrence Bruno |

Chairman |

Houston, Texas

March 18, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE 2024 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 8, 2024

The Notice of 2024 Annual Meeting of Shareholders and the Proxy Statement for the 2024 Annual Meeting of Shareholders, together with the Company’s Annual Report to Shareholders, are available free of charge at www.proxyvote.com.

TABLE OF CONTENTS

|

|

Page |

3 |

||

|

|

|

6 |

||

|

|

|

|

Security Ownership by Certain Beneficial Owners and Management |

6 |

|

7 |

|

|

7 |

|

|

8 |

|

|

|

|

9 |

||

|

|

|

|

9 |

|

|

16 |

|

|

17 |

|

|

18 |

|

|

18 |

|

|

18 |

|

|

20 |

|

|

20 |

|

|

21 |

|

|

21 |

|

|

Communications with Directors; Website Access to Our Corporate Documents |

22 |

|

22 |

|

|

|

|

23 |

||

|

|

|

24 |

||

|

|

|

|

24 |

|

|

24 |

|

|

26 |

|

|

30 |

|

|

34 |

|

|

36 |

|

|

|

|

EXECUTIVE COMPENSATION TABLES |

37 |

|

|

|

|

|

37 |

|

|

38 |

|

|

38 |

|

|

39 |

|

|

41 |

|

|

41 |

|

CORE LABORATORIES INC.

6316 Windfern Road

Houston, Texas 77040

PROXY STATEMENT |

WHY HAVE I RECEIVED THESE MATERIALS?

This proxy statement and the accompanying proxy card are first being made available to you on the Internet on March 18, 2024, and written notice has been sent to our shareholders in a manner consistent with applicable law. If you receive notice of the materials and wish to request a physical copy of the materials be sent to you, those materials will be mailed to you upon receipt of your request. These materials are being furnished in connection with the solicitation of proxies by and on behalf of the Board of Directors of Core Laboratories Inc. (the “Company”) for use at our 2024 annual meeting of shareholders (the “2024 Annual Meeting” or the “Meeting”), to be held at the Hotel Zaza, Memorial City, 9787 Katy Freeway, Houston, Texas 77024, on Wednesday, May 8, 2024 at 9:00 a.m. CDT for the purpose of voting on the proposals described in this proxy statement.

WHY DID I RECEIVE A ONE-PAGE NOTICE IN THE MAIL REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A FULL SET OF PROXY MATERIALS?

As permitted by rules adopted by the U.S. Securities and Exchange Commission (“SEC”), we are making this proxy statement and our Annual Report on Form 10-K (the “Annual Report”) available on the Internet. In order to be able to comply with applicable electronic notification deadlines, we will mail a notice to those persons who were shareholders as of the close of business Eastern Daylight Time on March 14, 2024, containing instructions on how to access the proxy statement and Annual Report and vote on-line or by phone. In addition, shareholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The proxy materials will be posted on www.proxyvote.com and on the Company’s website, www.corelab.com. See the Section below on “WHO IS ENTITLED TO VOTE” for the important dates related to voting the shares.

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

WHAT AM I VOTING ON?

You will be voting on the following matters proposed by the Board:

3

WHO IS ENTITLED TO VOTE?

We are sending notice of the 2024 Annual Meeting to those shareholders who hold shares of common stock at the close of business Eastern Daylight Time on March 14, 2024 in order to be able to comply with applicable electronic notification deadlines. As of March 14, 2024, there were 46,864,366 shares of common stock outstanding. Our shares of common stock are the only class of capital stock outstanding and entitled to notice of and to vote at the Meeting. Each outstanding share of common stock (issued shares excluding common stock held by the Company) is entitled to one vote. Holders of common stock do not have the right to cumulative voting in the election of directors.

HOW DO I VOTE BEFORE THE MEETING?

If you are a registered shareholder, meaning that you hold your shares through an account with our transfer agent, Computershare, as of March 14, 2024, you can vote by mail by completing, signing and returning the accompanying proxy card or you may vote online at www.proxyvote.com or by phone: +1-800-690-6903.

If you hold your shares, as of March 14, 2024, through an account with a bank or broker, you may vote by mail, online or by phone by following the directions that your bank or broker provides.

In order for your mailed or on-line vote or vote cast by phone to be counted, it must be received on or before 11:59 p.m. Eastern Daylight Time on Tuesday, May 7, 2024. The official electronic voting results will be those reported by our vote tabulator, Broadridge Financial Solutions, in its final report upon the close of business Eastern Daylight Time on Tuesday, May 7, 2024. Any other proxies that are actually received in hand by our Secretary before the polls close at the conclusion of voting at the meeting will be voted as indicated.

MAY I VOTE AT THE MEETING?

If you are a registered shareholder as of March 14, 2024, you may vote your shares at the meeting if you attend in person. If you hold your shares as of March 14, 2024 through an account with a bank or broker, you must obtain a legal proxy from the bank or broker in order to vote at the meeting. Even if you plan to attend the meeting, we encourage you to vote your shares by proxy.

IF YOU PLAN TO ATTEND IN PERSON:

Attendance at the Meeting is limited to shareholders as of the close of business Eastern Daylight Time on March 14, 2024, Company management and Company advisors. Registration will begin at 8:00 a.m. CDT and the Meeting will begin at 9:00 a.m. CDT on May 8, 2024. Each shareholder desiring to attend MUST bring proof of share ownership as of March 14, 2024 with him/her to the Meeting along with a valid form of identification. Examples of proof of share ownership include voting instruction statements from a broker or bank. In addition, you should register with the Company beforehand to indicate your plan to attend. Such registration may be made by contacting the Company’s Secretary as described further in the proxy statement. Failure to comply with these requirements may preclude you from being admitted to the Meeting.

CAN I CHANGE MY MIND AFTER I VOTE?

You may change your vote at any time before the polls close at the conclusion of voting at the meeting. You may revoke your proxy (1) by giving written notice to Mark D. Tattoli, Secretary, Core Laboratories Inc., 6316 Windfern Road, Houston,

4

Texas 77040, at any time before the proxy is voted, (2) by submitting a properly signed proxy card with a later date, or (3) by voting in person at the 2024 Annual Meeting.

If you hold your shares through an account with a bank or broker, you may revoke your proxy by following the instructions provided to you by your bank or broker, or by obtaining a legal proxy from your bank or broker and voting in person at the Meeting.

WHAT IF I RETURN MY PROXY CARD BUT DO NOT PROVIDE VOTING INSTRUCTIONS?

Proxies that are signed and returned but do not contain instructions will be voted “FOR” all proposals and in accordance with the best judgment of the named proxies on any other matters properly brought before the meeting.

WHAT VOTE IS REQUIRED?

The attendance in person or by proxy of holders of a majority of the shares of common stock entitled to vote at the Meeting will constitute a quorum to hold the Meeting. Under the Company’s Bylaws, Proposal 1 will require a plurality of votes cast in order to be adopted.

Our Bylaws provide that shares of common stock abstaining from voting will count as shares present for the purposes of determining the presence or absence of a quorum. The Bylaws also provide that broker non-votes will count as shares present at the Meeting or for the purpose of determining the presence or absence of a quorum. A “broker non-vote” occurs if you do not provide the record holder of your shares (usually a bank, broker, or other nominee) with voting instructions on a matter and the holder is not permitted to vote on the matter without instructions from you under applicable rules of the New York Stock Exchange (“NYSE”).

WHO WILL BEAR THE EXPENSE OF SOLICITING PROXIES?

We will bear the cost of preparing and mailing proxy materials as well as the cost of soliciting proxies and will reimburse banks, brokerage firms, custodians, nominees and fiduciaries for their expenses in sending proxy materials to the beneficial owners of our common stock. The solicitation of proxies by the Board will be conducted by mail and through the Internet. In addition, certain members of the Board, as well as our officers and regular employees may solicit proxies in person, by facsimile, by telephone or by other means of electronic communication. We have retained Okapi Partners LLC to assist in the solicitation of proxies for a fee of $9,500 plus out-of-pocket expenses, which fee and expenses will be paid by the Company. In addition to solicitation of proxies, Okapi Partners LLC may provide advisory services as requested pertaining to the solicitation of proxies.

5

OWNERSHIP OF SECURITIES

Security Ownership by Certain Beneficial Owners and Management |

The table below sets forth certain information, as of March 14, 2024, with respect to the common stock beneficially owned, or expected to be beneficially owned by:

Name of Beneficial Owner (1) |

|

Number of |

|

|

Percentage of |

|

Ariel Investment, LLC (3) |

|

|

8,988,399 |

|

|

19.18% |

BlackRock, Inc. (4) |

|

|

7,978,275 |

|

|

17.02% |

The Vanguard Group, Inc. (5) |

|

|

5,364,333 |

|

|

11.45% |

Earnest Partners LLC (6) |

|

|

3,727,668 |

|

|

7.95% |

Lawrence Bruno |

|

|

163,203 |

|

|

* |

Christopher S. Hill |

|

|

72,049 |

|

|

* |

Gwendolyn Y. Gresham |

|

|

23,960 |

|

|

* |

Mark D. Tattoli |

|

|

10,377 |

|

|

* |

Martha Z. Carnes |

|

|

30,592 |

|

|

* |

Michael Straughen |

|

|

16,467 |

|

|

* |

Harvey Klingensmith |

|

|

26,226 |

|

|

* |

Kwaku Temeng |

|

|

9,792 |

|

|

* |

Katherine Murray |

|

|

5,485 |

|

|

* |

Curtis Anastasio |

|

|

— |

|

|

* |

All current Directors and executive officers as a group (10 persons) |

|

|

358,151 |

|

|

* |

* Represents less than 1%. |

|

|

|

|

|

|

6

Delinquent Section 16(a) Reports |

Section 16(a) of the Securities Exchange Act of 1934 requires Directors, named executive officers and persons who own more than 10% of our shares, among others, to file initial reports of ownership and reports of changes in ownership (Forms 3, 4 and 5) of our shares with the SEC and the NYSE. Such filers are required by SEC regulations to furnish us with copies of all such forms that they file.

Based solely on its review of reports and written representations that the Company has received, the Company believes that all required Section 16 reports were timely filed during 2023, with the exception of five Form 4 filings for each of Lawrence Bruno, Christopher S. Hill, Gwendolyn Y. Gresham, Mark D. Tattoli, and Kevin Daniels which were due to be filed on February 20, 2023, but were filed one day late, on February 21, 2023.

Equity Compensation Plan Information |

We have two main incentive plans, our 2020 Long-Term Incentive Plan (“LTIP”), and our 2023 Non-Employee Director Stock Incentive Plan (“2023 Director Plan”), both of which have been approved by our shareholders. The following table shows the balance of shares in each plan that remain available for future issuance and the number of shares that have been awarded, but not yet vested, under each of the equity compensation plans as of December 31, 2023.

|

|

Number of Common |

|

|

Weighted Average |

|

|

Number of Common |

|

|||

Equity compensation plans approved by our shareholders |

|

|

|

|

|

|

|

|

|

|||

LTIP |

|

|

1,195,973 |

|

|

|

— |

|

|

|

651,651 |

|

2023 Director Plan |

|

|

38,514 |

|

|

|

— |

|

|

|

489,225 |

|

Equity compensation plans not approved by our shareholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Total |

|

|

1,234,487 |

|

|

|

— |

|

|

|

1,140,876 |

|

7

Performance Graph |

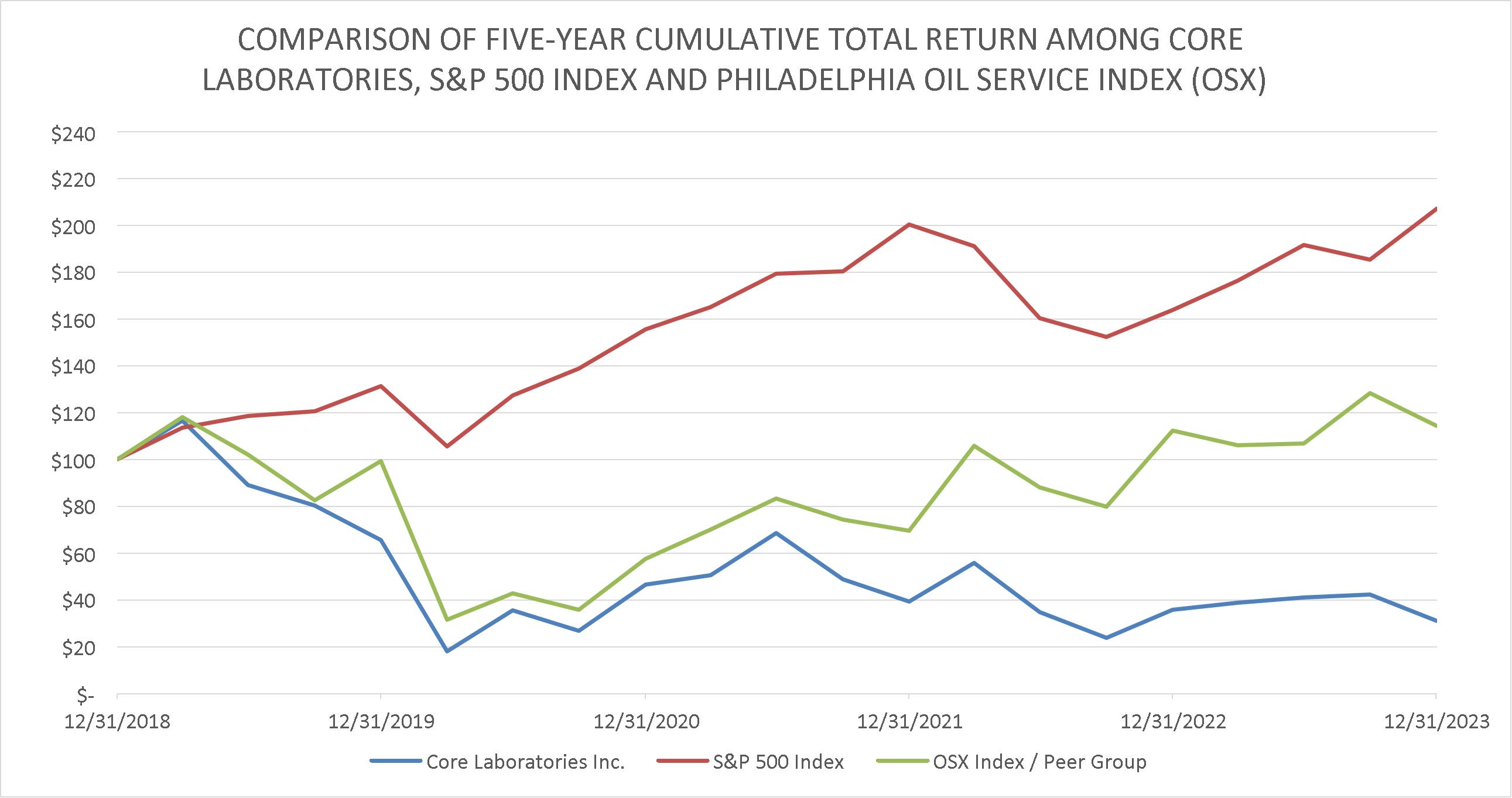

The following performance graph compares the performance of our common stock to the Standard & Poor’s 500 Index and the Philadelphia Oil Service Index (“OSX”) for the period beginning December 31, 2018 and ending December 31, 2023. Core Laboratories is an established member of the OSX, which includes a greater concentration of our most direct peers.

The graph assumes that the value of an investment in our common stock and each index was $100 at December 31, 2018 and that all dividends were reinvested. The shareholder return set forth below is not necessarily indicative of future performance. The following graph and related information is “furnished” and shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, as amended (the “Exchange Act”) except to the extent that the Company specifically incorporates it by reference into such filing.

8

INFORMATION ABOUT OUR DIRECTORS AND DIRECTOR COMPENSATION

Board of Directors |

Set forth below is the biographical information for our Directors who will serve following the 2024 Annual Meeting and their respective committee assignments, including individuals who have been nominated for election as Class III Directors. You may vote for one or both of the nominees, or none of the nominees.

Nominees for Class III Directors (Term to Expire 2027)

Lawrence Bruno

Mr. Bruno became President of the Company on February 1, 2018, and on January 1, 2019, he also assumed the position of Chief Operating Officer. On May 20, 2020, Mr. Bruno succeeded Mr. David Demshur as the Chairman of the Board and Chief Executive Officer and has led the Company’s global operations for both of its business segments, Reservoir Description and Production Enhancement. Over the last several years, Mr. Bruno has served as a technical spokesperson for many investor presentations and panels in the oil and gas industry and has been instrumental in driving the Company’s technology innovation that will continue to be a critical strength in the years to come. Mr. Bruno previously led the Company’s global reservoir-based laboratories within the Company’s Reservoir Description segment, from July 2015 through January 31, 2018. Mr. Bruno has been in the industry for more than 35 years and with the Company for more than 23 years. |

|

Prior to being named as President of the Petroleum Services division in July 2015, Mr. Bruno was the General Manager of U.S. Rocks from 1999 to July 2015. Prior to joining the Company, he was employed at an oil and gas service company for 14 years before it was acquired by the Company in 1999. Mr. Bruno received a Master’s of Science degree in Geology in 1987 from the University of Houston. Mr. Bruno’s extensive operations and management experience at the Company makes him well-suited to lead the Company as Chief Executive Officer and Chairman of the Board. |

9

Kwaku Temeng

Mr. Temeng retired from Aramco Services Company (“ASC”) in Houston, Texas in May of 2021, where he served as Director of Upstream since 2007. During his tenure, he was responsible for managing Saudi Aramco’s upstream technology and business programs in North America. These included cultivating business relationships, evaluating commercial opportunities, performing analyses of technology trends and best practices, and overseeing technical studies undertaken by commercial laboratories, universities, and technology centers. Prior to his final assignment, Mr. Temeng worked for 14 years with Saudi Aramco in Saudi Arabia where he held a variety of professional, managerial, and advisory positions. He oversaw managing the company’s drilling budget development, coordination of petroleum engineering studies and served as a special advisor to senior management. He was instrumental in developing the framework for Saudi Aramco’s upstream research and development program. In his assignments with Saudi Aramco and ASC, Mr. Temeng combined his knowledge of engineering and economics to direct production planning, budgeting, and technical studies for the world’s largest producing company. He also administered contracts and relationships with all the major oilfield services companies, and in the process has gained great insight from the client perspective into what drives successful relationships between producing companies and service providers. |

|

Before joining Saudi Aramco, Mr. Temeng worked in the U.S. as a petroleum engineer with Exxon Company USA and Mobil Oil Corporation. Mr. Temeng earned a Bachelor’s degree in Ocean Engineering from the Massachusetts Institute of Technology (MIT), a Master of Science, Master of Engineering and Doctorate degrees in Petroleum Engineering from Stanford University. He served as a member of the Stanford University Earth Sciences Advisory Board and the Society of Petroleum Engineers and is licensed as a professional petroleum engineer in the State of California. Mr. Temeng’s experience in the oil and gas industry and expertise in petroleum engineering allow him to provide valuable insight to the Company. |

10

Continuing Class II Directors (Term to Expire 2025)

Martha Z. Carnes

Ms. Carnes retired from PricewaterhouseCoopers LLP (“PwC”) in June 2016, where she had a 34-year career with the firm. She was an Assurance Partner serving large, publicly traded companies in the energy industry. Ms. Carnes held a number of leadership positions with PwC including the Houston office Managing Partner. She also served as PwC’s Energy and Mining leader for the United States where she led the firm’s energy and mining assurance, tax and advisory practices. In these roles, she was responsible for leading the design and execution of the market and sector strategies, business development, compensation, professional development, succession planning, and client satisfaction. As an Assurance Partner, Ms. Carnes had vast experience with capital markets activities and was the lead audit partner on some of the largest merger and acquisition transactions completed in the energy sector at that time. Ms. Carnes also served as one of PwC’s Risk Management Partners and was PwC’s United States representative on the firm’s Global Communities Board. She is a certified public accountant.

|

|

Since December 2019, she has served as a director of SunCoke Energy, Inc., whose principal businesses are cokemaking and logistics, and is the Chair of the Audit Committee. Since July 2017, Ms. Carnes has also served as a director of Matrix Service Company, a services company that provides engineering, fabrication, infrastructure, construction, and maintenance services primarily to the oil, gas, power, petrochemical, industrial, agricultural, mining and minerals markets, where she chairs the Audit Committee and is a member of the Compensation and Nominations and Governance Committees. She is also a Member Representative for Ohio Valley Midstream, a member managed limited liability corporation engaged in natural gas and natural gas liquids gathering and processing. She is a member of the Board of Trustees at Texas Children’s Hospital where she chairs the Operations, Planning and Philanthropy Committee and serves on the Executive Committee and Audit, Risk and Compliance Committee. Ms. Carnes is also a member of the Board of the Barbara Bush Houston Literacy Foundation where she chairs the Compensation Committee. Her financial expertise and experience in working with and auditing public companies in the energy industry, and her operational experience at PwC, a professional services firm, allow her to provide important insight to the Company. |

11

Michael Straughen

Following an extensive career in oilfield services, Mr. Straughen retired from executive office at the end of 2014 and has since held various non-executive positions. Most recently, he served on the board of the Glasgow-based Denholm Energy Services Group, from which he retired in June 2023. He was previously on the board of Glacier Energy Services, an Aberdeen-based offshore services company, until June 2020, on the board of ASCO, an Aberdeen-based logistics support group, until June 2019, and also on the board of GMS PLC, an Abu Dhabi-based, but London-listed, marine services company for three years until the end of 2016. Mr. Straughen’s last executive position was as an Executive Director of John Wood Group PLC, the UK’s leading oilfield services business, from 2007 to the end of 2014, where he served as Chief Executive of the Engineering Division, which had revenues of $1.8 billion and 10,000 employees. His responsibilities included P&L performance, HSSE, resourcing, customer relationships, strategy and growth. As an Executive Director of a publicly traded company, he also had responsibilities for corporate governance. |

|

From 1982 to 2007, he served in various roles, including as Group Managing Director, with AMEC PLC, an international project management and engineering services provider. Mr. Straughen is a Chartered Engineer, has served on various industry bodies and continues to be a mentor to small businesses. His extensive management experience in the oil and gas sector, as well as his diverse background, enable him to provide valuable insight on management, governance, and strategic issues. |

12

Katherine Murray

Following a 33-year career serving the energy sector as a senior finance executive to large global corporations and as a public accountant, Ms. Murray retired from executive office in 2018. From that time, she has worked as an independent financial consultant and, since January 2024 has served as Chief Financial Officer for The Coalition for the Homeless, a non-profit organization addressing homelessness in Houston and Harris County, Texas. From January 2021 to December 2023, she was Chairman of the Board and served as a member of the Finance and Communications Committees for the Foundation for the Women’s Energy Network, a non-profit organization serving women in energy. From January 2013 until May 2018, Ms. Murray held progressive financial leadership roles at McDermott International, Inc. (“McDermott”), a global provider of engineering, procurement, construction, and installation solutions to the energy industry. Most recently, from 2017 to 2018, she served as Vice President and Regional Chief Financial Officer, Worldwide Finance Operations for McDermott’s global assets and projects group. Her responsibilities included financial reporting, operational accounting, financial planning, tax, and strategic planning. Previously, from 2015 to 2017, she served as Vice President and Treasurer, where she was responsible for implementing strategies to optimize McDermott’s capital structure and cash flows. Through these roles, Ms. Murray gained extensive experience managing lender arrangements and relationships across the globe, including the U.S., Europe, and the Middle East. |

|

From 2016 to 2017, she also worked in Investor Relations for McDermott, and became responsible for optimizing shareholders’ and analysts’ relations and communications, including outreach programs in the U.S. and Europe. Prior to this time, from 1991 to 2012, Ms. Murray held progressive positions at El Paso Corporation (formerly Tenneco Gas, Inc.), a provider of natural gas and related energy products. As Senior Vice President, Tax from 2001 to 2012, she was responsible for over $600 million of annual taxes, and gained significant experience in financial reporting, internal controls, worldwide compliance, tax litigation, entity structuring and financial planning and analysis. She was also a key contributor to El Paso Corporation’s strategic initiatives, including mergers and acquisitions, dispositions and the ultimate $3 billion sale of the business to Kinder Morgan in 2012. Ms. Murray began her career with Arthur Andersen, serving in their energy tax practice, and is a member of the Texas Society of Certified Public Accountants. She earned a Bachelors in Business Administration with a minor in Accounting from the University of St. Thomas. Ms. Murray’s financial expertise and extensive experience working in senior finance roles in large global energy companies, as well as her public accounting experience, allow her to contribute key insights to the Company. |

13

Continuing Class I Directors (Term to Expire 2026)

Harvey Klingensmith

Mr. Klingensmith, a native of Denver, Colorado, retired from executive office at the end of January 2019 after numerous executive leadership positions in the oil and gas industry. Mr. Klingensmith co-founded and served as Chief Executive Officer and Board member of Ajax Resources LLC (“Ajax”), an exploration and production company focused on oil and gas development in the Permian Basin. He served as Chief Executive Officer from its founding in July 2015 until October 2017 and served on the Board until its sale in 2018. As Co-Founder and Chief Executive Officer of Ajax, Mr. Klingensmith was instrumental in successfully putting together the $425 million financing package necessary to start Ajax; recruited key personnel needed to build and run the business; and executed key business initiatives that resulted in production growth from 2,000 to 18,500 barrels of oil equivalent per day and Ajax’s sale to Diamondback Energy for $1.24 billion. Mr. Klingensmith was also President of Wyatt Energy LLC (“Wyatt”), a privately held, independent oil and gas exploration and production company based in Houston, Texas, focused on the identification of and investment in unique opportunities in the oil and gas space, from April 2014 through January 2018. He led this effort simultaneously with his roles at Ajax. |

|

Mr. Klingensmith also co-founded and served as Chief Executive Officer of Spoke Resources Ltd. (“Spoke”), including its predecessor entity Stone Mountain Resources Ltd (“Stone”), from April 2006 through August 2018. Spoke was a large natural gas production company headquartered in Calgary, Alberta, and had its primary producing asset in NE British Columbia before its sale to Surmont Oil and Gas in 2018. During his tenure at Spoke and Stone, Mr. Klingensmith led efforts to raise capital, headed operations and production growth as well as gained experience with financially distressed companies during Stone’s entry into receivership and exit as Spoke before its sale to Surmont Oil and Gas in 2018. Prior to entering the private space Mr. Klingensmith had served as President of El Paso Canada (2002-2004), Senior Vice President Worldwide Exploration for Coastal Oil and Gas (1994-2001), and Vice President of Worldwide Exploration of Maxus Energy (1986-1993). Mr. Klingensmith received dual Bachelor of Science degrees in Geological Engineering and Geophysical Engineering from the Colorado School of Mines in 1975. He is an active member of the Society of Petroleum Engineers, the American Association of Petroleum Geologists and the Society of Exploration Geophysicists. Mr. Klingensmith’s over 44 years of diverse experience in the upstream oil and gas business along with his proven leadership and executive oversight experience make him a valuable addition to our board. |

14

Curtis Anastasio

Mr. Anastasio retired from executive office in 2013, having spent over 35 years in various leadership positions in the upstream, midstream and downstream sectors of the oil and gas industry. At various stages over the course of his career, Mr. Anastasio has been responsible for supply, trading, transportation, marketing, business development and legal & regulatory affairs. He began his career in the industry in 1988 with Ultramar plc, an integrated oil and gas company with assets principally in the United States, Canada, Latin America, the United Kingdom and Asia Pacific. In a series of acquisitions, Ultramar’s midstream assets were ultimately acquired by NuStar Energy L.P., a publicly traded energy master limited partnership based in San Antonio, Texas. Mr. Anastasio was appointed President and Chief Executive Officer of NuStar in April 2001, leading the company’s initial public offering. He served in that role until his retirement on December 31, 2013. Under Mr. Anastasio’s leadership, NuStar grew from a small business to a Fortune 500 company. NuStar received many awards and recognition during his tenure, including being named by Fortune magazine as one of the 100 Best Companies to Work for in America every year since 2007 and Forbes Magazine’s 100 Most Trustworthy Companies. In 2013, Mr. Anastasio was elected to the San Antonio Business Hall of Fame. Mr. Anastasio presently serves on the boards of two publicly traded companies, both of which are listed on the New York Stock Exchange. From May 2014 until July 2023, he served as the Chairman of GasLog Partners L.P., an international owner, operator and manager of liquefied natural gas carriers, providing support to international energy companies as part of their LNG logistics chain. |

|

As Executive Chairman, he led the company’s initial public offering in May 2014. Mr. Anastasio also serves on the Board and as Chairman of the Audit Committee of Par Pacific Holdings, Inc., an energy company with primary interests in refining, retail and logistics, including a refining, marketing and logistics business in Hawaii, refining and logistics businesses in Washington, Montana and Wyoming and a retail distribution network in the Pacific Northwest. The company also owns an equity interest in a joint venture focused on natural gas production. Finally, Mr. Anastasio serves on the Board and as Chairman of the Audit Committee of The Chemours Company, which was spun out from DuPont in 2015. A multinational specialty chemicals company providing titanium technologies, fluoroproducts and chemical solutions, Chemours ingredients are found in plastics and coatings, refrigeration and air conditioning, mining and oil refining operations and general industrial manufacturing. Mr. Anastasio also served as a director of the Federal Reserve Bank of Dallas for six years from 2014 through 2019. In addition to participating in various volunteer activities, Mr. Anastasio has served as Chairman of the Board of Trustees of the United Way of San Antonio and Bexar County, Chairman of the Alamo Area Council of the Boy Scouts of America, and Chairman of the National Association of Publicly Traded Partnerships. Mr. Anastasio received a Juris Doctorate degree from Harvard Law School in 1981 and a Bachelor of Arts degree, magna cum laude, from Cornell University in 1978. Prior to focusing his career on the oil and gas industry, Mr. Anastasio worked in private practice as a corporate attorney in New York City. |

15

Non-Executive Director Compensation |

The following table sets forth a summary of the compensation we paid to our non-executive Directors in 2023. Directors who are our full-time employees receive no compensation for serving as Directors.

Director Compensation

for Year Ended December 31, 2023

Name (1) |

|

Fee Earned or Paid |

|

|

Stock Awards (2)(3) |

|

|

Total |

|

|||

Martha Z. Carnes |

|

|

127,500 |

|

|

|

141,288 |

|

|

|

268,788 |

|

Monique van Dijken Eeuwijk (4) |

|

|

43,750 |

|

|

|

— |

|

|

|

43,750 |

|

Harvey Klingensmith |

|

|

80,000 |

|

|

|

141,288 |

|

|

|

221,288 |

|

Katherine A. Murray |

|

|

77,500 |

|

|

|

141,288 |

|

|

|

218,788 |

|

Michael Straughen |

|

|

102,500 |

|

|

|

141,288 |

|

|

|

243,788 |

|

Kwaku Temeng |

|

|

86,250 |

|

|

|

141,288 |

|

|

|

227,538 |

|

Curtis Anastasio (5) |

|

|

37,500 |

|

|

|

153,289 |

|

|

|

190,789 |

|

Retainer/Fees

Each non-executive Director was paid the following amounts during fiscal year 2023:

Equity-Based Compensation

Effective as of April 1, 2022, we made a grant of restricted shares to the non-executive Directors serving in 2022 in the amount of $150,000, divided by the closing price of the Company’s stock on January 17, 2022, rounded upwards to the nearest

16

whole share for a total of 5,485 shares each. The restricted shares vested, without performance criteria, at the end of a one-year vesting period that began on April 1, 2022 and ended on April 1, 2023.

Effective as of April 1, 2023, we made a grant of restricted shares to the non-executive Directors serving in 2023 in the amount of $150,000, divided by the closing price of the Company’s stock on January 13, 2023, rounded upwards to the nearest whole share for a total of 6,419 shares each. The restricted shares will vest, without performance criteria, at the end of a one-year vesting period that began on April 1, 2023 and ends on April 1, 2024.

Outstanding awards granted to the current non-executive Directors require the recipient’s continued service as a director (other than termination of service due to death or disability) to the time of vesting for the recipient to receive the shares that would otherwise vest. In the event of an award recipient’s death or disability prior to the last day of these vesting periods, his or her restricted shares would vest in accordance with the aforementioned vesting schedules. If an award recipient’s service with us terminates (other than due to death or disability) prior to the last day of these vesting periods, his or her restricted shares would be immediately forfeited to the extent not then vested. In the event of a change in control (as defined in the 2023 Director Plan) prior to the last day of the aforementioned vesting periods and while the award recipient is in our service (or in the event of a termination of the award recipient’s service upon such change in control), all of the award recipient’s restricted shares will vest as of the effective date of such change in control.

Minimum Stock Ownership by Non-Executive Directors

The Compensation Committee has established a requirement that non-executive Directors must maintain equity ownership of Company stock, determined using the average price of the stock over the immediately preceding five years, in the minimum amount of five times the annual base retainer for the previous year. Non-executive Directors will be allowed five years to achieve that minimum equity ownership level. All current Directors are in compliance with the Compensation Committee’s requirements.

Policy against Insider Trading

The Company has a written policy against insider trading that is applicable to all Directors and other persons with access to material, non-public information about the Company. Such policy provides that entering into any derivative transaction which effectively shifts the economic risk of ownership to a third party (e.g., selling the stock short; entering into collars, floors, cap arrangements, or placing the stock on margin) is not allowed at any time.

2024 Non-Executive Director Compensation

Each non-executive Director serving in 2024 shall receive the same level of cash compensation in 2024 as received by Board members in 2023 and described above under “Retainer/Fees” on page 16 of this proxy statement.

In addition, effective as of April 1, 2024, we will award each of our non-executive Directors who will continue to serve on the Board after the conclusion of the 2024 Annual Meeting an amount of restricted shares equal to $150,000 based on the closing price of the Company’s stock on January 10, 2024, which was $16.10 rounded upwards to the nearest whole share, which amounts to 9,317 shares. The restricted shares will vest, without performance criteria, at the end of a one-year vesting period that will begin on April 1, 2024 and will end on April 1, 2025. This award will be subject to an agreement to be signed by each recipient.

Board Structure |

The Company has a single-tier board currently consisting of seven directors divided among three classes. Each class is elected for a three-year term such that the term of one class of directors expires at the annual meeting each year. Mr. Bruno currently serves as the Company’s Chief Executive Officer (the “CEO”) and as Chairman of the Board. Given the size of the Company, we believe our stakeholders are well served by having Mr. Bruno hold the Chief Executive Officer role along with being Chairman of the Board and that this is the most effective leadership structure for us at the present time. We also note that within our industry, the common practice is for the same person to hold both positions. We believe this structure has served us well for many years.

Ms. Carnes has served as our Lead Director since the 2020 annual meeting. The Lead Director has leadership authority and responsibilities and sets the agenda for, and leads all executive sessions of the independent directors, providing feedback, as

17

appropriate, from those meetings to the Chairman of the Board. Ms. Carnes has served on the Board since 2016. She is deemed to be independent from the Company (according to applicable regulatory standards, as well as by shareholder advisory services such as ISS and Glass-Lewis).

In its role providing risk oversight of the Company, the Board oversees our stakeholders’ interest in the long-term health and overall success of the Company and its financial strength, as well as the interests of the other stakeholders of the Company. The Board is actively involved in overseeing risk management for the Company, and each of our Board committees considers the risks within its areas of responsibility. The Board and each of our Board committees regularly discuss with management our major risk exposures, their potential financial impact on us and the steps we take to manage them.

Director Independence |

In connection with determining the independence of each Director of the Company, the Board inquired as to any transactions and relationships between each Director and his or her immediate family and the Company and its subsidiaries, and reviewed and discussed the results of such inquiry. The purpose of this review was to determine whether any such relationships or transactions were material and, therefore, inconsistent with a determination that a Director is independent under the standards set forth by the NYSE. With regard to Messrs. Straughen, Temeng, Klingensmith and Anastasio and Mmes. Carnes and Murray, none have ever held any position with the Company or any of its affiliates apart from their service on the Board and its committees and all qualify as independent under the NYSE Listed Company Manual section 303A.02.

As a result of this review, after finding no material transactions or relationships among the following Directors and the Company, the Board affirmatively determined that each of Messrs. Straughen, Temeng, Klingensmith and Anastasio and Mmes. Carnes and Murray, are independent under the applicable standards described above.

Board Meetings |

The Board held four meetings in 2023. All Directors participated in 100% of the 2023 Board meetings. All Directors participated in 100% of the meetings in 2023 of all committees on which he or she serves. Under our Corporate Governance Guidelines, Directors are expected to diligently fulfill their fiduciary duties to the Company, including preparing for, attending and participating in meetings of the Board and the committees of which the Director is a member. In 2023, all Directors participated in the 2023 annual meeting of shareholders. All current board members are expected to attend the 2024 Annual Meeting.

Our non-executive Directors meet separately in executive session without any members of management present. The Lead Director is the presiding Director at each such session. If any of our non-executive Directors were to fail to meet the applicable criteria for independence, then our independent Directors would meet separately at least once a year in accordance with the rules of the NYSE.

Committees of the Board |

The Board has three standing committees, the identities, memberships and functions of which are described below. Each Director who is at the time “independent” and who has never served as a director of any affiliate of the Company may be considered for committee assignment at any time during their term, as determined by the Board.

Audit Committee

The current members of the Audit Committee are Mmes. Carnes (Chairman) and Murray, and Mr. Straughen, each of whom will continue in their respective roles following the conclusion of the 2024 Annual Meeting. The Audit Committee’s principal functions, which are discussed in detail in its charter, include making recommendations concerning the engagement of the independent registered public accountants, reviewing with the independent registered public accountants the plan and results of the engagement, approving professional services provided by the independent registered public accountants and reviewing the

18

adequacy of our internal accounting controls. Additionally, the Audit Committee is responsible for overseeing the quality and effectiveness of the Company’s policies and procedures with respect to information technology systems, including enterprise cybersecurity and data privacy. Each member of the Audit Committee is independent, as defined by Section 10A of the Exchange Act and by the corporate governance standards set forth by the NYSE. Each member of the Audit Committee is financially literate, and Mmes. Carnes and Murray each qualify as an “audit committee financial expert” under the rules promulgated pursuant to the Exchange Act. The Audit Committee held five meetings in 2023. A copy of the Audit Committee’s written charter may be found on the Company’s website at https://www.corelab.com/corporate-business-executives. See “Audit Committee Report” below.

Compensation Committee

The current members of the Compensation Committee are Messrs. Straughen (Chairman), Klingensmith and Temeng, each of whom will continue in their respective roles following the conclusion of the 2024 Annual Meeting. The Board has determined that each of the members of the Compensation Committee is (i) independent under the NYSE’s rules governing Compensation Committee membership and (ii) a “non-employee director” under Rule 16b-3 of the Exchange Act.

The Compensation Committee’s principal functions, which are discussed in detail in its charter, include a general review of our compensation and benefit plans to ensure that they are properly designed to meet corporate objectives. The Compensation Committee reviews and approves the compensation of our Chief Executive Officer and our senior executive officers, granting of awards under our benefit plans and adopting and changing major compensation policies and practices. In addition to establishing the compensation for the Chief Executive Officer, the Compensation Committee reports its recommendations to the Board for review and approval of awards made pursuant to our LTIP. Pursuant to its charter, the Compensation Committee has the authority to delegate its responsibilities to other persons. The Compensation Committee held three meetings in 2023.

The Compensation Committee periodically retains a consultant to provide independent advice on executive compensation matters and to perform specific project-related work. The consultant reports directly to the committee, which pre-approves the scope of work and fees charged. The Compensation Committee communicates to the consultant the role that management has in the analysis of executive compensation, such as the verification of executive and Company information as required by the consultant.

The Compensation Committee operates under a written charter. A copy of the Compensation Committee charter may be found on the Company’s website at https://www.corelab.com/corporate-business-executives. See “Compensation Committee Report” below.

Nominating, Governance, Sustainability and Corporate Responsibility Committee

The current members of the NGSCR Committee are Messrs. Temeng (Chairman), Klingensmith and Anastasio, each of whom will continue in their respective roles following the conclusion of the 2024 Annual Meeting.

The NGSCR Committee’s principal functions, which are discussed in detail in its charter, include recommending candidates to the Board for election as Directors, recommending candidates to the Board for appointment to the Board’s committees, reviewing succession planning for the Chief Executive Officer and other senior executive management, reviewing the Company’s sustainability strategies and evaluating the Company’s performance and compliance with its sustainability, corporate governance and social responsibility policies, and leading the Board in its annual review of the performance of the Board, its committees and management. Each member of the NGSCR Committee is independent as defined by the corporate governance standards of the NYSE. The NGSCR Committee held two meetings in 2023.

The NGSCR Committee operates under a written charter. A copy of the NGSCR Committee Charter may be found on the Company’s website at https://www.corelab.com/corporate-business-executives.

19

Qualifications of Directors |

The NGSCR Committee has the responsibility to make recommendations to the Board of Directors of candidates for the Board that the NGSCR Committee believes will perform well in that role and maximize shareholder and stakeholder value. In considering suitable candidates for that position, the NGSCR Committee considers, among other factors, the person’s reputation, knowledge, experience, integrity, independence, skills, expertise, business and governmental acumen and time commitments. In addition to considering these factors on an individual basis, the NGSCR Committee considers how these factors contribute to the overall variety and mix of attributes of our Board as a whole so that the members of our Board collectively possess the diverse knowledge and complementary attributes necessary to oversee our business. Directors should be exemplary representatives of the Company and be able to provide a wide range of management and strategic advice and be someone that the Company can count on to devote the required time and attention needed from members of the Board. In the case of current Directors being considered for re-nomination, the NGSCR Committee will also take into account the Director’s tenure as a member of our Board; the Director’s history of attendance at meetings of the Board and committees thereof; the Director’s preparation for and participation in all meetings; and the Director’s contributions and performance as a member of the Board.

Six of the seven members of the Board who will serve following the 2024 Annual Meeting are considered independent under applicable SEC and NYSE standards. For this year’s Meeting and election, the NGSCR Committee believes the candidates possess the characteristics outlined above and bring to the Board valuable skills that enhance the Board’s ability to manage and guide the strategic affairs of the Company in the best interests of our shareholders and our other stakeholders.

A more complete description of the specific qualifications of each of our Board members and of this year’s nominees are contained in the biographical information section beginning on page 9 of this proxy statement.

Director Nomination Process |

The NGSCR Committee, the Chairman of the Board, the Chief Executive Officer, or a Director identifies a need to add a new Board member that meets specific criteria or to fill a vacancy on the Board. The NGSCR Committee also reviews the candidacy of existing members of the Board whose terms are expiring and who may be eligible for reelection to the Board. The NGSCR Committee also considers recommendations for nominees for directorships submitted by shareholders as provided below. The nomination process is outlined below:

20

Related person transactions have the potential to create actual or perceived conflicts of interest between the Company and its Directors and/or named executive officers or any of their respective immediate family members. Under its charter, the Audit Committee is charged with the responsibility of reviewing with management and the independent registered public accountants (together and/or separately, as appropriate) insider and affiliated party transactions and potential conflicts of interest. The Audit Committee has delegated authority to review transactions involving employees, other than our named executive officers, to our General Counsel. We identify such transactions by distributing questionnaires annually to each of our Directors, officers and employees.

In deciding whether to approve a related person transaction, the following factors may be considered:

To receive approval, the related person transaction must be on terms that are fair and reasonable to the Company, and which are on terms at least as favorable to the Company as would be available from non-related entities in comparable transactions. The Audit Committee requires that there is a Company business interest supporting the transaction and the transaction meets the same Company standards that apply to comparable transactions with unaffiliated entities. The Audit Committee has adopted a written policy that governs the approval of related person transactions.

There were no transactions that occurred during fiscal year 2023 in which, to our knowledge, the Company was or is a party, in which the amount involved exceeded $120,000, and in which any director, director nominee, named executive officer, holder of more than 5% of our common stock or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest.

Compensation Committee Interlocks and Insider Participation |

During 2023, no named executive officer served as:

21

Communications with Directors; Website Access to Our Corporate Documents |

Shareholders or other interested parties can contact any Director or committee of the Board of Directors by directing correspondence to Mark D. Tattoli, Secretary, Core Laboratories Inc., 6316 Windfern Road, Houston, Texas 77040. Comments or complaints relating to the Company’s accounting, internal accounting controls or auditing matters will be referred to members of the Audit Committee.

Our Internet address is www.corelab.com. Our Corporate Governance Guidelines, Code of Ethics and Corporate Responsibility and the charters of our Board committees are available on our website. We will also furnish printed copies of such information free of charge upon written request to our Investor Relations department (investor.relations@corelab.com).

We file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the SEC.

These reports are available free of charge through our website as soon as reasonably practicable after they are filed with the respective agency. We may from time to time provide important disclosures to investors by posting them in the investor relations section of our website, as allowed by SEC rules. The SEC maintains an Internet website at www.sec.gov that contains reports, proxy and information statements, and other information regarding our Company that we file electronically with the SEC.

Risk Assessment of Compensation Policies and Practices |

We have assessed our compensation policies and practices and found that the compensation policies and practices are not reasonably likely to have a material adverse effect on us. Our Compensation Committee and our Board are aware of the need to routinely assess our compensation policies and practices and will make a determination as to the necessity of this particular disclosure on an annual basis.

22

CORPORATE GOVERNANCE AND RESPONSIBILITY

Core Laboratories maintains a corporate governance page on its website that includes key information about corporate governance initiatives, including Corporate Governance Guidelines, a Code of Ethics and Corporate Responsibility, and committee charters for the Audit, Compensation, and NGSCR Committees of the Board. The corporate governance page can be found at https://www.corelab.com/sustainability/governance/.

The actions we are taking regarding corporate responsibility, are posted on our website, and in the form of our Annual Sustainability Reports that can be found at https://www.corelab.com/sustainability/.

23

COMPENSATION DISCUSSION AND ANALYSIS

Introduction |

This Compensation Discussion and Analysis (“CD&A”) describes our executive compensation program as it relates to our Named Executive Officers (“NEOs”). This CD&A also summarizes the Compensation Committee’s process for making pay decisions, as well as its rationale for specific decisions related to the 2023 performance year. Our NEOs for 2023 are listed below, along with the title that each NEO held in 2023:

Name of Executive |

|

Age |

|

Title |

Lawrence Bruno |

|

64 |

|

Chairman, President and Chief Executive Officer |

Christopher S. Hill |

|

54 |

|

Senior Vice President and Chief Financial Officer |

Gwendolyn Y. Gresham |

|

56 |

|

Senior Vice President, Corporate Development and Investor Relations |

Mark D. Tattoli |

|

52 |

|

Senior Vice President, Secretary and General Counsel |

Executive Summary |

Industry Conditions and Outlook

The Company’s outlook for continued growth in the demand for oil and natural gas remains constructive. The forecast provided in the International Energy Agency’s December 2023 report, projects global demand in 2024 to increase 1% and reach 102.7 million barrels per day. Activity associated with the expansion of international upstream projects is expected to grow in 2024. Particularly on long-cycle projects both onshore and offshore in the Middle East, South Atlantic Margin, and parts of Asia Pacific and West Africa. We continue to believe increased levels of investment will be required to maintain current production levels and satisfy growing global demand for hydrocarbons.

The United States Energy Information Administration (EIA) is forecasting that U.S. oil production will average 13.1 million barrels per day in 2024, also an increase of 1% when compared to 2023 oil production. As such, the Company anticipates that U.S. land drilling and completion activity will remain stable in the onshore oil plays. However, a decline in activity is expected in the onshore natural gas plays, due to weaker natural gas commodity prices, and potential caps on future takeaway capacity with the recent moratorium on LNG export terminal construction. Recent and continued consolidation of oil and gas operating companies in the U.S. shale market may also disrupt or slow down drilling and completion activity in the onshore plays impacted by those consolidations.

Although the Company’s outlook regarding the exploration and production of oil and gas remains constructive, the geopolitical conflicts between Russia and Ukraine and more recently in the Middle East have caused disruptions and instability in the movement and trading patterns of crude oil. These on-going conflicts may continue to cause disruptions, which could adversely impact our business in the affected regions. The Company’s volume of associated laboratory services is expected to be commensurate with the trading and movement of crude oil into Europe, the Middle East, Asia and across the globe.

The Company continues to invest in technology targeted to both solve client problems and capitalize on growth opportunities as part of our long-term growth strategy and execution of its strategic plan. We continue to broaden our market presence by opening or expanding facilities in strategic areas to align with client demand and market conditions, while also looking to capture synergies within our business lines. We continue to expand our capabilities in the Middle East and South America. We believe our market presence in strategic areas creates a unique opportunity to serve our clients who have global operations, whether they are international oil companies, national oil companies, or independent oil companies. Our development activities are guided by our clients. We routinely collaborate with our clients, who bring us problems to solve, and we leverage those solutions through protected intellectual property.

24

Carbon capture and sequestration (“CCS”) remains a focus for many of our oil and gas clients, with the onset of more stringent emissions control requirements and existing global accords to reduce greenhouse gas emissions. The Company’s activities on CCS projects have expanded and are expected to continue expanding in 2024 and beyond.

2023 Business Achievements

Over the course of our 28 years as a publicly traded company, we have posted an annualized compounded shareholder return of 7.25%, according to Bloomberg Financial, compared to 9.73% for the S&P 500, over that same time period. See “Ownership of Securities - Performance Graph” on page 8 for a graph comparing our five-year cumulative total shareholder return to the Standards & Poors 500 Index and the Philadelphia Oil Services Index.

During 2023, our key financial and operational performance results demonstrated year-over-year improvement and included top-quartile operating margin and return on invested capital (“ROIC”) performance:

Compensation Actions

Our executive compensation decisions included:

2023 “Say-on-Pay” / Shareholder Engagement

Each year, we carefully consider the results of our shareholder say-on-pay vote from the preceding year. We also consider the feedback we receive from our major shareholders, which we solicit in various ways, including face-to-face meetings during the year. At our 2023 Annual meeting, 96.6% of votes cast approved our executive compensation program.

Our Compensation Committee believes that shareholder feedback, including the most recent say-on-pay vote, supports their view that our compensation programs remain aligned with the best interests of our shareholders. The Committee continues to review the design of our programs to ensure they remain aligned with shareholder interests, with our industry peers, and with compensation governance best practices.

25

Best Compensation Governance Practices & Policies

Our executive compensation program is grounded in the following policies and practices, which promote sound compensation governance, enhance our pay-for-performance philosophy and further align our executives’ interests with those of our stakeholders:

WHAT WE DO |

|

WHAT WE DO NOT DO |

||

|

100% of NEO equity awards are performance-based and at-risk |

|

|

No hedging transactions by executive officers or directors |

|

Target performance for equity incentive awards set above the median of industry peers

|

|

|

No significant perquisites |

|

Incentive awards based on both absolute and relative performance results, with no guaranteed payouts |

|

|

No “single trigger” change in control cash severance benefits |

|

Equity award grants subject to three-year performance periods to promote retention |

|

|

Company stock may not be margined by executive officers or directors |

|

Clawback policy applies to performance-based cash and equity incentive compensation |

|

|

|

|

Compensation Committee advised by an independent compensation consultant |

|

|

|

What Guides Our Executive Compensation Program |

Compensation Philosophy and Objectives

Our executive compensation program is designed to create a strong financial incentive for our NEOs to maximize ROIC and other financial and operational metrics, which we believe leads to long-term sustainable growth in stakeholder value. Our compensation philosophy is driven by the following guiding principles and objectives:

Guiding Principle |

|

Objective |

Pay for Performance |

|

Drive performance relative to our financial goals, which are designed to achieve growth in shareholder returns and long-term value creation |

Competitiveness |

|

Provide compensation at levels that will attract, motivate, and retain highly qualified executives who are focused on the long-term best interests of our shareholders |

Shareholder Alignment |

|

Reinforce a culture of ownership and long-term commitment to shareholder interests through alignment of Corporate, Environmental and Social Governance |

26

The Core Elements of Compensation

The core elements of executive compensation are summarized in the table below:

Element |

|

Form |

|

What It Does |

|

How It Links to Performance |

Base Salary |

|

Cash (Fixed) |

|

Provides a competitive rate relative to similar positions in the oilfield services industry and other service-based industries, and enables the Company to attract and retain critical executive talent |

|

• Based on job scope, level of responsibilities, experience, tenure and market levels |

Annual Cash Incentive Plan |

|

Cash (Variable and At-Risk) |

|

Focuses executives on achieving annual financial and operational goals that drive long-term shareholder value |

|

• Payouts: zero to 2x target for Messers. Bruno and Hill and zero to 1.7x target for Ms. Gresham and Mr. Tattoli, based on annual performance • Combination of absolute and relative financial and non-financial goals |

Long-Term Incentive Plan (LTIP) |

|

Equity (Variable and At-Risk) |

|

Provides incentives for executives to execute on longer-term financial/strategic growth goals that drive value creation and support talent retention |

|

• Payouts: 0% to 175% of target, based on performance over a three-year period • Combination of relative (ROIC) and absolute (TSR) performance |

Pay Mix: Emphasis on Variable Performance-based Compensation

The charts below show the target compensation of our Chief Executive Officer and our other NEOs for fiscal year 2023. These charts illustrate that a majority of NEO compensation is performance-based and variable (84% for our Chief Executive Officer and an average of 73% for our other NEOs). The weighting of these compensation components puts a material, significant portion of the executives’ total direct compensation “at risk” if Company performance declines or underperforms relative to the Bloomberg Comp Group and/or the Compensation Peer Group described further below.

|

|

|

27

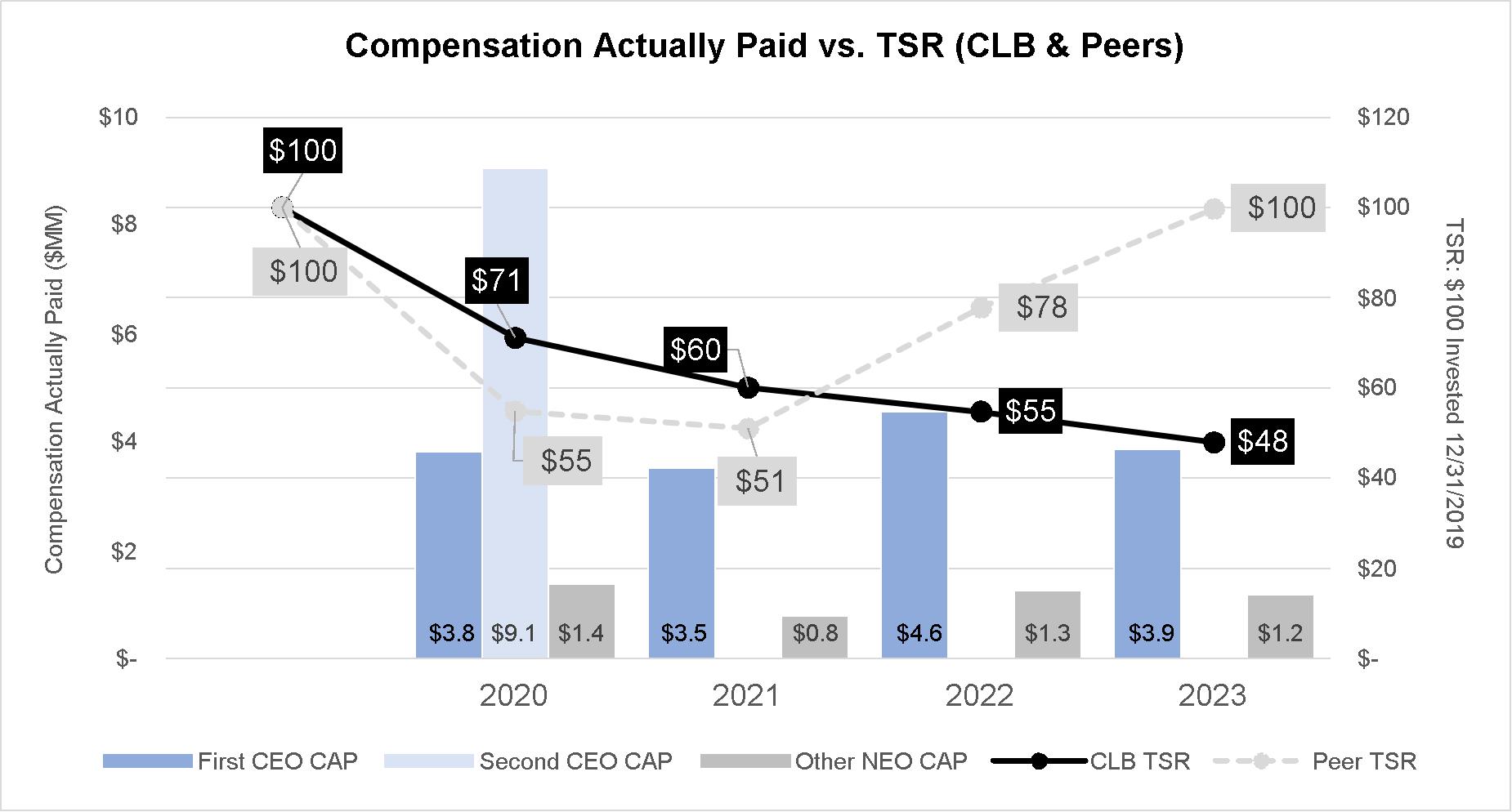

CEO Realizable Compensation: Aligned with Performance

Our emphasis on at-risk, variable and performance-based pay elements, particularly equity incentives, helps to ensure that the actual compensation realized by our NEOs aligns with returns to our shareholders. As shown in the charts below, the relationship between CEO realizable and target pay over the past five years has aligned with our total shareholder return performance.

CEO REALIZABLE PAY ALIGNED WITH PERFORMANCE(1) |

|

Target compensation includes base salary, target annual incentive award, and the grant-date value of performance share units. Realizable compensation includes base salary, actual annual cash incentive paid, and the value of performance share units determined by whether the awards are still outstanding as of the end of the year or have been settled during that year. Any performance share units settled within the five-year period have been adjusted for actual payout percent. Outstanding performance share unit awards have been valued assuming a target payout with the stock price that is applicable at the end of each year.

The Role of the Compensation Committee

Our Compensation Committee’s principal functions include conducting periodic reviews of the Company’s compensation and benefits programs to ensure that they are properly designed to meet corporate objectives, overseeing of the administration of the cash incentive and equity-based plans and developing the compensation program for the Directors.

The Compensation Committee generally focuses on compensation structures designed to reflect the middle range of the market. We believe that maintaining compensation opportunities in the middle range of our peer group supports recruitment and retention while ensuring that realized pay opportunities align appropriately with individual and Company performance. The Compensation Committee targets a market range rather than a specific percentile in order to respond better to changing business conditions, manage salaries and incentives more evenly over an individual’s career, and minimize potential for automatic

28

increases in salaries and incentives that could occur with inflexible and narrow competitive targets. The Compensation Committee links a significant portion of each executive’s total compensation to accomplishing specific, measurable results based on both Company and individual performance intended to create value for shareholders in both the short- and long-term. Only executives with performance exceeding established targets may exceed the market median in total compensation due to incentive compensation.

The Role of Management

Our CEO provides recommendations to the Compensation Committee in its evaluation of our other NEOs, including recommendations of individual cash and equity compensation levels for each of the remaining NEOs.

The Role of the Independent Compensation Consultant

Our Compensation Committee retains a consultant to provide independent advice on executive compensation matters and to perform specific project-related work. During 2023, the Compensation Committee engaged Meridian Compensation Partners (“Meridian”) to provide information on pay levels and program design for 2023. Meridian reported to and acted at the direction of the Compensation Committee. The Compensation Committee assessed the independence of the firm pursuant to applicable SEC and NYSE rules and concluded that the firm’s work for the Compensation Committee did not raise any conflict of interest for 2023.

The Role of Market Compensation Analysis

The Compensation Committee reviews several sources as a reference for determining competitive total compensation packages. For 2023 executive compensation recommendations, the Compensation Committee reviewed and considered Meridian’s evaluation and analysis of compensation survey data from multiple general industry and industry-specific sources.

In addition, the Compensation Committee reviews proxy statement data from the Company’s peer group (see below). This analysis was used to determine our NEOs’ base salary, annual incentive targets and long-term equity awards (100% performance-based) for 2023.

Selecting the Peer Group

The Compensation Committee, with the assistance of Meridian, developed a peer group of companies to be used for compensation comparison purposes (“Compensation Peer Group”). The Compensation Peer Group consists of publicly traded oilfield services companies comparable in size to our Company in terms of annual revenues and the value of ongoing operations. The following companies comprise our Compensation Peer Group used to evaluate the market for NEO compensation for 2023:

Baker Hughes Company |

|

Fugro N.V. |

|

RPC, Inc. |

Champion X Corporation |

|

Helix Energy Solutions Group |

|

TechnipFMC plc |

Dril-Quip Inc. |

|

John Wood Group PLC |

|

TGS-NOPEC Geophysical Company ASA |

Expro Group Holdings N.V. |

|

Oceaneering International |

|

|

Forum Energy Technologies |

|

Oil States International |

|

|

The Compensation Committee periodically reviews the composition of our Compensation Peer Group to ensure it remains appropriate. During 2023, the Compensation Committee approved several changes to better align with our current size and in light of our recently completed redomestication from the Netherlands to the U.S. The following companies were used to evaluate the market for NEO compensation for 2024.

29

Bristow Group Inc. |

|

Helix Energy Solutions Group |

|

TETRA Technologies Inc. |

Champion X Corporation |

|

Oceaneering International |

|

TechnipFMC plc |

Dril-Quip Inc. |

|

Oil States International |

|

Tidewater Inc. |

Expro Group Holdings N.V. |

|

Precision Drilling Corporation |

|

Weatherford International |

Forum Energy Technologies |

|

RPC, Inc. |

|

|

2023 Compensation Program Details |

Base Salary

Base salary is the fixed annual compensation we pay to an executive for performing specific job responsibilities. It represents the minimum income an executive may receive in any given year. We target annual base salaries in the middle range of our Compensation Peer Group for executives having similar responsibilities. The Compensation Committee may adjust salaries based on its annual review of the following factors:

As a result of these factors, a particular executive’s base salary may be above or below the median of our Compensation Peer Group for a given year. The table below shows base salaries for each of our NEOs for the years ending December 31, 2023 and 2022.

Name of Executive |

|

December 31, 2022 ($) |

|

May 12, 2023 (1) ($) |

|

October 13, 2023 (2) ($) |

|

December 31, 2023 ($) |

Lawrence Bruno |

|

820,000 |

|

852,800 |

|

886,912 |

|

886,912 |

Christopher S. Hill |

|

430,000 |

|

447,200 |

|

465,088 |

|

465,088 |

Gwendolyn Y. Gresham |

|

370,000 |

|

392,200 |

|

407,888 |

|

407,888 |

Mark D. Tattoli |

|

370,000 |

|

392,200 |

|

407,888 |

|

407,888 |

(1) NEO annual base salary adjusted for 2022 merit approved by the Compensation Committee on January 18, 2022 and deferred to the first half of 2023. |

(2) NEO annual base salary adjusted for 2023 merit cycle in second half of 2023, approved by the Compensation Committee on January 17, 2023. |

Annual Cash Incentives

All of our NEOs participate in our annual cash incentive plan. Under this plan, each NEO is assigned a target and a maximum bonus expressed as a percentage of his or her base salary. The target award opportunity is established as a percentage of the NEO’s salary based upon a review of the competitive data for that officer’s position, level of responsibility and ability to impact our financial success. The target bonus percentage and maximum bonus percentage for each NEO in 2023 is set forth in the table below.

|

|

|

|

Award Percentages |

||

Name of Executive |

|

Title |

|

Target |

|

Maximum |

Lawrence Bruno |

|

Chairman, President and Chief Executive Officer |

|

100% |

- |

200% |

Christopher S. Hill |

|

Senior Vice President and Chief Financial Officer |

|

75% |

- |

150% |

Gwendolyn Y. Gresham |

|

Senior Vice President, Corporate Development and |

|

75% |

- |

130% |

Mark D. Tattoli |

|

Senior Vice President, Secretary and General Counsel |

|

75% |

- |

130% |

30

The Compensation Committee has set performance goals that are consistent with the Company’s business strategy and focus on creating long-term shareholder value. Performance is assessed based on the achievement of specific financial measures, safety metrics, operating objectives, and environmental, social and governance goals. The Compensation Committee may also consider individual contributions to performance results.

Relative Performance