Table of Contents

As filed with the Securities and Exchange Commission on June 26, 2023

File No. 000-56540

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 1

to

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g)

OF THE SECURITIES EXCHANGE ACT OF 1934

KKR Private Equity Conglomerate LLC

(Exact name of registrant as specified in charter)

| Delaware | 88-4368033 | |

| (State or other jurisdiction of incorporation or registration) |

(I.R.S. Employer Identification No.) | |

| 30 Hudson Yards, New York, NY |

10001 | |

| (Address of principal executive offices) | (Zip Code) | |

(212) 750-8300

(Registrant’s telephone number, including area code)

with copies to:

| Rajib Chanda Jonathan Pacheco Simpson Thacher & Bartlett LLP 900 G Street, N.W. Washington, DC 20001 |

Joseph Kaufman Mark Brod Benjamin Wells Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, NY 10017 |

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Class S Shares

Class D Shares

Class U Shares

Class I Shares

Class R-S Shares

Class R-D Shares

Class R-U Shares

Class R-I Shares

Class F Shares

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Table of Contents

| Page | ||||||

| ii | ||||||

| iii | ||||||

| ITEM 1. | 1 | |||||

| ITEM 1A. | 45 | |||||

| ITEM 2. | 101 | |||||

| ITEM 3. | 107 | |||||

| ITEM 4. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

107 | ||||

| ITEM 5. | 107 | |||||

| ITEM 6. | 111 | |||||

| ITEM 7. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

112 | ||||

| ITEM 8. | 165 | |||||

| ITEM 9. | MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS |

165 | ||||

| ITEM 10. | 167 | |||||

| ITEM 11. | 168 | |||||

| ITEM 12. | 179 | |||||

| ITEM 13. | 180 | |||||

| ITEM 14. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

180 | ||||

| ITEM 15. | 180 | |||||

i

Table of Contents

KKR Private Equity Conglomerate LLC is filing this registration statement on Form 10 (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to provide current public information to the investment community in anticipation of being required to register under Section 12(g) of the Exchange Act in the future, to comply with applicable requirements thereunder.

In this Registration Statement, except where the context suggests otherwise:

| • | the terms “we,” “us,” “our,” “K-PEC” and the “Company,” refer to KKR Private Equity Conglomerate LLC; |

| • | the term “Manager” refers to KKR DAV Manager LLC, our manager and a wholly-owned subsidiary of KKR; |

| • | the term “KKR” refers collectively to Kohlberg Kravis Roberts & Co. L.P., its subsidiaries and, in the case of references to the holder of Class G Shares, KKR Group Assets Holdings III L.P., an affiliate of the Manager; |

| • | the term “shareholder” and “shareholders” refer to a holder or holders of our Shares (as defined below). There are eight classes of Shares available to investors through the Company: Class S Shares (“Class S Shares”), Class D Shares (“Class D Shares”), Class U Shares (“Class U Shares”), Class I Shares (“Class I Shares”), Class R-S Shares (“Class R-S Shares”), Class R-D Shares (“Class R-D Shares”), Class R-U Shares (“Class R-U Shares”) and Class R-I Shares (“Class R-I Shares,” together with Class S Shares, Class D Shares, Class U Shares, Class I Shares, Class R-S Shares, Class R-D Shares and Class R-U Shares, the “Investor Shares”); |

| • | Class E Shares (“Class E Shares”), Class F Shares (“Class F Shares”), Class G Shares (“Class G Shares”) and Class H Shares (“Class H Shares” and together with Class E Shares, Class F Shares and Class G Shares, the “KKR Shares” and together with the Investor Shares, the “Shares”) will be held only by KKR, certain of its affiliates and employees and the Company’s employees, officers and directors and are not being offered to other investors; and |

| • | the term “KKR Vehicles” collectively refers to the funds, investment vehicles and accounts managed, now or in the future, by KKR, the Manager, KKR Credit (defined herein) or any of their respective affiliates (excluding for this purpose, KKR proprietary entities), including funds, investment vehicles and accounts pursuing the following strategies: private equity (including growth equity, impact, and core strategies), credit (including (i) leveraged credit strategies, including leveraged loan, high-yield bond, opportunistic credit and revolving credit strategies, and (ii) alternative credit strategies, including special situations and private credit strategies such as direct lending and private opportunistic credit (or mezzanine) investment strategies), and real asset strategies (including real estate, energy and infrastructure strategies). |

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and we will take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”).

This Registration Statement does not constitute an offer of securities of KKR Private Equity Conglomerate LLC or any other entity. Once this Registration Statement has been deemed effective, we will be subject to the requirements of Section 13(a) of the Exchange Act, including the rules and regulations promulgated thereunder, which will require us, among other things, to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and we will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

ii

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this Registration Statement constitute forward-looking statements because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this Registration Statement may include statements as to:

| • | our future operating results; |

| • | our business prospects and the prospects of the portfolio companies we own and control; |

| • | the impact of the acquisitions that we expect to make; |

| • | our ability to raise sufficient capital to execute our acquisition strategies; |

| • | the ability of the Manager to source adequate acquisition opportunities to efficiently deploy capital; |

| • | the ability of our portfolio companies to achieve their objectives; |

| • | our current and expected financing arrangements; |

| • | changes in the general interest rate environment; |

| • | the adequacy of our cash resources, financing sources and working capital; |

| • | the timing and amount of cash flows, distributions and dividends, if any, from our portfolio companies; |

| • | our contractual arrangements and relationships with third parties; |

| • | actual and potential conflicts of interest with the Manager or any of its affiliates; |

| • | the dependence of our future success on the general economy and its effect on the industries in which we own and control portfolio companies; |

| • | our use of financial leverage; |

| • | the ability of the Manager to identify, acquire and support our portfolio companies; |

| • | the ability of the Manager or its affiliates to attract and retain highly talented professionals; |

| • | our ability to structure acquisitions and joint ventures in a tax-efficient manner and the effect of changes to tax legislation and our tax position; and |

| • | the tax status of the enterprises through which we own and control portfolio companies. |

In addition, words such as “anticipate,” “believe,” “expect” and “intend” indicate a forward-looking statement, although not all forward-looking statements include these words. The forward-looking statements contained in this Registration Statement involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth in “Item 1A. Risk Factors” and elsewhere in this Registration Statement. Other factors that could cause actual results to differ materially include:

| • | changes in the economy; |

| • | risks associated with possible disruption in our operations or the economy generally due to terrorism, natural disasters, epidemics or other events having a broad impact on the economy; and |

| • | future changes in laws or regulations and conditions in our operating areas. |

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this Registration Statement should not be regarded as a representation by us that our plans and objectives will be achieved. These forward-looking statements apply only as of the date of this Registration Statement. Moreover, we assume no duty and do not undertake to update the forward-looking statements.

iii

Table of Contents

The following is only a summary of the principal risks that may materially adversely affect our business, financial condition, results of operations and cash flows. The following should be read in conjunction with the complete discussion of risk factors we face, which are set forth in “Item 1A. Risk Factors.”

Risks Related to Our Business

| • | Difficult market and economic conditions can adversely affect our business in many ways. |

| • | We will have significant liquidity requirements, and adverse market and economic conditions may adversely affect our sources of liquidity, which could adversely affect our business operations in the future. |

| • | Uncertainty caused by bank closures and other developments in the global financial system may have a material adverse effect on our and our portfolio companies’ operations and overall performance. |

| • | Extensive regulation of our business affects our activities and creates the potential for significant liabilities and penalties, which could materially and adversely affect our business. |

| • | Misconduct of employees of KKR or by third-party service providers could cause significant losses to us. |

| • | Complex regulations may limit our ability to raise capital, increase the costs of our capital raising activities and may subject us to penalties. |

| • | Operational risks, including those relating to third parties who provide services to us, may disrupt our businesses, result in losses or limit our growth. |

| • | Federal, state and foreign anti-corruption and trade sanctions laws and restrictions on foreign direct investment applicable to us and our portfolio companies create the potential for significant liabilities and penalties, the inability to complete transactions, imposition of significant costs and burdens, and reputational harm. |

| • | We anticipate being subject to increasing focus by our investors, regulators and other stakeholders on environmental, social and governance (“ESG”) matters. |

| • | Public health crises, such as COVID-19, may continue to occur from time to time, which could directly and indirectly adversely impact us and our portfolio companies. |

| • | Conflicts between KKR or its affiliates and the Company regarding syndication of portfolio companies and warehousing may not be resolved in favor of the Company. |

Risks Related to Our Portfolio Companies and Industry Focus

| • | Our acquisitions and holdings may be subject to a number of inherent risks. |

| • | We may acquire interests in portfolio companies through arrangements with third parties, including a minority interest, to the extent consistent with maintaining our exclusion from the Investment Company Act. |

| • | We may enter into Joint Ventures with third parties to acquire portfolio companies, which could result in shared decision-making authority and conflicts of interest. |

| • | We may acquire portfolio companies involved in heavily regulated industries. |

| • | We may acquire portfolio companies subject to commodity price risk and energy industry market dislocation. |

| • | We may acquire portfolio companies that may be exposed to interest rate risk, meaning that changes in prevailing market interest rates could negatively affect the value of such portfolio companies. |

| • | If a portfolio company is unable to increase its revenue in times of higher inflation, its profitability might be adversely affected. |

iv

Table of Contents

| • | We may acquire portfolio companies involved in the health care sector, which is subject to risks of changes in government policies, regulatory approval and continual regulatory review. |

| • | We may acquire portfolio companies in the renewable energy industry, which is subject to risks of a rapidly evolving market. |

| • | We may acquire portfolio companies experiencing or expected to experience financial difficulties, or that otherwise may become distressed, which may ultimately cause such portfolio companies to become subject to bankruptcy proceedings. |

| • | We may acquire emerging and less established companies that are heavily dependent on new technologies, where success is less certain. |

| • | We may acquire companies that are heavily dependent on patents, trademarks and other intellectual property. |

| • | We may acquire portfolio companies involved in the technology industry, which is subject to risks of technological disruption and rapidly changing market conditions. |

| • | We may acquire portfolio companies in the technology sector, which may expose us to increased competitive risks and downward pressure on pricing. |

| • | We may acquire portfolio companies involved in the media industry, which is subject to risks of adverse government regulation. |

| • | We may acquire “middle market” portfolio companies, which involves certain risks that are not encountered in large-sized acquisitions. |

| • | We may acquire portfolio companies that are based outside of the United States, which may expose us to additional risks not typically associated with acquiring companies that are based in the United States. |

| • | We may be impacted by changes in trade policies. |

| • | Fluctuations in currency values could adversely affect the U.S. dollar value of portfolio companies, interest, dividends and other revenue streams received by us, gains and losses realized on the sale of portfolio companies and the amount of distributions, if any, to be made by us. |

| • | We may make a limited number of acquisitions, or acquisitions that are concentrated in certain portfolio companies or geographic regions, which could negatively affect our performance to the extent those concentrated holdings perform poorly. |

| • | We may acquire portfolio companies based in Asia, which may be dependent upon international trade. |

| • | Risk management activities may adversely affect our return. |

| • | We or our portfolio companies may need to incur financial leverage to be able to achieve our or their business objectives, resulting in additional risks. |

Risks Related to Our Structure

| • | We will depend on the Manager and KKR to achieve our business objectives. |

| • | In the event that the Company’s Management Agreement is terminated, the Company will be required to repurchase any KKR Shares. |

| • | Our ability to achieve our business objective depends on the ability of the Manager to identify, acquire and support our portfolio companies. |

| • | We will rely on the ability of the management teams of our portfolio companies to implement any agreed-upon business plans but cannot assure they will be able to do so in accordance with the Company’s expectations. |

v

Table of Contents

| • | There are various conflicts of interest in our relationship with KKR, including with our Manager and in the allocation of management resources to KKR Vehicles (as defined herein) and us, which could result in decisions that are not in the best interests of our shareholders. |

| • | We would not be able to operate our business according to our business plan if we are required to register as an investment company under the Investment Company Act. |

| • | If we are required to register as an investment company under the Investment Company Act, we would likely be treated as a publicly traded partnership that is subject to corporate income taxes. |

| • | Our LLC Agreement (as defined below) will contain provisions that reduce or eliminate duties (including fiduciary duties) of our Board and limit remedies available to shareholders for actions that might otherwise constitute a breach of duty. It will be difficult for shareholders to successfully challenge a resolution of a conflict of interest in accordance with the LLC Agreement. |

| • | Our LLC Agreement will include a jury trial waiver that could limit the ability of shareholders of the Company to bring or demand a jury trial in any claim or cause of action arising out of or relating to the LLC Agreement, or the business or affairs of the Company. |

| • | Our LLC Agreement will designate the Court of Chancery of the State of Delaware or, if such court lacks jurisdiction, the state or federal courts in the State of Delaware and any appellate court thereof, as applicable, as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by shareholders, which could limit our shareholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or other employees. |

| • | KKR, the Manager, their respective affiliates, our directors, officers and certain service providers will be entitled to exculpation and indemnification resulting in limited right of action for shareholders. |

| • | We will have certain reporting obligations not applicable to private companies. We will need to make significant capital expenditures to be in compliance with certain regulations not applicable to private companies. Failure to comply with such regulations may have an adverse effect on our business. |

| • | We could be subject to review and approval by the Committee on Foreign Investment in the United States (“CFIUS”) or other regulatory agencies resulting in limitations or restrictions on our acquisitions and joint ventures. |

| • | We could become subject to the fiduciary responsibility and prohibited transaction provisions of Title I of the U.S. Employee Retirement Income Security Act of 1974, as amended (“ERISA”) and/or the prohibited transaction provisions of Section 4975 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), and we could be subject to potential controlled group liability. |

| • | Failure to comply with Data Protection and Privacy Laws could lead to significant fines, sanctions and penalties. |

| • | Cybersecurity risks could result in the loss of data, interruptions in our business and damage to our reputation, and subject us to regulatory actions, increased costs and financial losses, each of which could have a material adverse effect on our business and results of operations. |

Risks Related to an Investment in Our Shares

| • | There is no market for the Shares and shareholders will bear the risks of owning Shares for an extended period of time due to limited repurchases. |

| • | We may amend the LLC Agreement without shareholder approval and shareholders will not be entitled to vote for the election of directors or have any right to influence or control the Company’s operations. |

| • | We do not expect to make distributions on a regular basis. |

| • | Valuations of our portfolio companies are estimates of fair value and may not necessarily correspond to realizable value. |

vi

Table of Contents

| • | Monthly NAV calculations are not governed by governmental or independent securities, financial or accounting rules or standards. |

| • | We are a new company and have a limited operating history. |

| • | Due to the nature of our holdings in portfolio companies, shareholders will have limited liquidity and may not receive a full return of their invested capital if they elect to have their Shares repurchased by the Company. |

| • | There is no public trading market for Shares of the Company; therefore, a shareholder’s ability to dispose of its shares will likely be limited to repurchase by us. If a shareholder sells its Shares to us, the shareholder may receive less than the price it paid. |

| • | A shareholder’s ability to have its Shares repurchased by us is limited. |

| • | Economic events that may cause our shareholders to request that we repurchase their shares may materially and adversely affect our cash flows, our results of operations and financial condition. |

| • | The Company may require a shareholder to have its Shares repurchased at any time in its sole discretion. |

| • | Holders of Class R-S Shares, Class R-D Shares, Class R-U Shares and Class R-I Shares may have their shares automatically converted to Class S Shares, Class D Shares, Class U Shares or Class I Shares, respectively. |

| • | Payment of the Management Fee or Performance Participation Allocation in Shares will dilute a shareholder’s interest in the Company. |

| • | Shareholders holding Shares through accounts regulated by ERISA, such as individual retirement accounts (“IRAs”) and 401(k) plans, may be subject to additional regulatory and tax risks. |

Risks Related to Our Liquidity Portfolio

| • | We may hold corporate bonds. |

| • | We may invest in loans. |

| • | We may invest in convertible securities. |

| • | We may be subject to the risk of commercial mortgage backed securities (“CMBS”). |

| • | We may be subject to residential mortgage-backed securities (“RMBS”) risk. |

| • | Our holdings of pass-through certificates, securitization vehicles or other special purpose entities (collectively, “asset-backed securities”) may involve risks that differ from or are greater than risks associated with other types of instruments. |

| • | Collateralized bond obligations, collateralized loan obligations and other collateralized debt obligations are subject to additional risk. |

Risks Related to Taxation

| • | The Company’s ability to make distributions depends on it receiving sufficient cash distributions from its underlying Operating Subsidiary, and we cannot assure our shareholders that our Company will be able to make cash distributions to them in amounts that are sufficient to fund their tax liabilities. |

| • | If the Company or the Operating Subsidiary were to be treated as a corporation for U.S. federal income tax purposes, the value of our Shares might be adversely affected. |

vii

Table of Contents

| ITEM 1. | BUSINESS |

General Development of Business

We are a holding company that seeks to acquire, own and control portfolio companies with the objective of generating attractive risk-adjusted returns and achieving medium-to-long-term capital appreciation through Joint Ventures (defined below). We have been established by KKR as the flagship conglomerate to own and control Joint Ventures that, directly or indirectly, own majority stakes in portfolio companies, and to a lesser extent, Joint Ventures that own influential yet non-majority stakes in portfolio companies. Our Joint Ventures will focus on acquiring geographically diversified portfolio companies that operate principally in business lines that are crucial to the global economy: Business & Financial Services; Consumer & Retail; Healthcare; Impact; Industrials; and Technology, Media & Telecommunications.

We are sponsored by KKR and expect to benefit from its industry leading institutional private equity sourcing and portfolio management platform pursuant to a management agreement with the Manager (the “Management Agreement”). We have appointed the Manager to assist us with certain management, administrative and advisory services related to identifying, acquiring, owning and controlling portfolio companies through Joint Ventures. KKR’s business activities, including those of the Manager, represent past activities of entities that are neither a parent nor subsidiary of the Company.

We anticipate owning and controlling portfolio companies through Joint Ventures in the geographies where KKR is active, including North America, Europe and Asia Pacific. Over time, we expect to acquire portfolio companies that generate attractive risk-adjusted returns, using proceeds raised from the continuous offering of our securities, distributions from portfolio companies, and opportunistically recycling capital generated from dispositions of portfolio companies.

A key part of our strategy is to form joint ventures (“Joint Ventures”) by pooling capital with KKR Vehicles that target acquisitions of portfolio companies that are compatible with our business strategy. We expect that we will own nearly all of our portfolio companies through Joint Ventures alongside one or more KKR Vehicles and that the Joint Ventures will be managed in a way that reflects the commonality of interests between the KKR Vehicles and the Company. The Company and the KKR Vehicles in a Joint Venture will both have a shared interest in maximizing value of the Joint Venture, and we believe that a joint acquisition and management strategy that pools the resources of the KKR Vehicles and the Company will lead to greater opportunities to gain sufficient influence or control over portfolio companies to deploy an operations-oriented management approach to value creation with the objective of achieving capital appreciation for all interest holders in the Joint Venture. We plan to own all or substantially all of our Joint Venture interests and other interests in portfolio companies directly or indirectly through our wholly-owned operating subsidiary, K-PEC Holdings LLC (the “Operating Subsidiary”). In turn, we expect our Operating Subsidiary to hold our interests in portfolio companies and Joint Ventures through one or more corporations, limited liability companies or limited partnerships. For a detailed description of the types of portfolio companies we intend to acquire, see “—Acquisition Strategies” below. We expect that most of our Joint Ventures will own a majority of, and/or have primary control over, the underlying portfolio company. The Company and the applicable KKR Vehicle will hold the interests in each portfolio company as co-general partners of the relevant Joint Venture, but the relative economic interests in such Joint Venture will vary from acquisition to acquisition.

We have a board of directors (the “Board”) whose corporate governance responsibilities are based on fiduciary duties applicable to Delaware limited liability companies, as will be modified by our amended and restated limited liability company agreement (the “LLC Agreement”). The Board consists of six directors, half of whom are independent. The Board oversees the management of the Company and the performance of the Manager. See “Item 5. Directors and Executive Officers.” Actual or potential conflicts of interest will arise from time to time between the Company, KKR and the KKR Vehicles. See “Item 7. Certain Relationships and Related Transactions, and Director Independence—Potential Conflicts of Interest” and “Item 11. Description of Registrant’s Securities to be Registered—Summary of the LLC Agreement.” Our independent directors are expected to approve protocols for handling actual and potential conflicts of interest and may be called upon from time to time to approve specific conflicts on behalf of our audit committee (the “Audit Committee”).

Table of Contents

Our executive committee (the “Executive Committee,” as described below under “—Our Executive Committee”) is ultimately responsible for making significant capital allocation decisions proposed by the Manager and the appointment of one or more Company officers to the governing bodies of Joint Ventures. Our Executive Committee and Company management team will be composed of Company employees as well as employees of KKR who will be assigned or seconded to the Company. We will pay for all expenses related to the services performed for the Company by such persons, including the compensation of our seconded officers, employees and other personnel. For Company employees, we expect they will spend substantially all of their time managing the Company and/or overseeing, managing and supporting Joint Ventures and portfolio companies. To the extent Company employees spend time supporting KKR Vehicles, then those KKR Vehicles will reimburse us for all expenses related to the services performed for such other vehicles by our employees, including compensation expenses.

There is no guarantee that we will achieve our business objectives. See “Item 1A. Risk Factors” and “Item 7. Certain Relationships and Related Transactions, and Director Independence—Potential Conflicts of Interest” of this Registration Statement for additional details on the risks associated with a purchase of our Shares.

We expect to conduct a continuous private offering of our Shares to (i) accredited investors (as defined in Regulation D under the Securities Act) and (ii) in the case of Shares sold outside the United States, to persons that are not “U.S. persons” (as defined in Regulation S under the Securities Act) in reliance on exemptions from the registration requirements of the Securities Act, including under Regulation D and Regulation S.

The Company

We were formed as a Delaware limited liability company on December 6, 2022. We have a limited operating history and were formed as the flagship conglomerate to own and control Joint Ventures that hold a portfolio of global companies and businesses. Our principal office is located at 30 Hudson Yards, New York, New York 10001 and our telephone number is (212) 750-8300. We have not yet commenced commercial activities and as a result, we currently (i) do not hold interests in any Joint Ventures or portfolio companies, (ii) do not have any employees and (iii) have not generated any revenues, as of the date of this Registration Statement. In connection with an initial capital contribution to the Company, KKR is the sole holder of the Company’s Class G Shares. See “Item 2. Financial Information—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” for additional information. As a result, KKR holds, directly and indirectly, all of the voting power of the Company and is able to control the appointment and removal of all members of the Board, including the Company’s independent directors, and, accordingly, exercises substantial influence over the Company and its portfolio companies. For the remainder of this fiscal year, we plan to acquire interests in Joint Ventures using proceeds of the Private Offering (as defined below) and/or contributions of such interests by KKR affiliates in exchange for Class E Shares. See “Item 1A. Risk Factors—Risks Related to Our Business—Conflicts between KKR or its affiliates and the Company regarding syndication of portfolio companies and warehousing may not be resolved in favor of the Company.” In identifying potential acquisition targets, the Company expects to rely on the Manager’s sourcing capabilities, which in turn will leverage KKR’s entire global platform to target opportunities behind identified themes where KKR has significant conviction and expertise with more than four decades of private equity acquisitions. The formation of KKR’s themes starts with concrete experience and is reinforced through accumulated domain knowledge and credentials in certain sectors and sub-sectors. As KKR originates new deal opportunities, KKR leans into opportunities where it has established expertise and can hope to achieve “repeat successes,” which are deals that are sometimes the product of expertise gleaned from prior investments. See “—Due Diligence.” We seek to form Joint Ventures with all current and future KKR Vehicles across KKR’s private equity strategies, which include traditional private equity (i.e., buy-and-build, M&A, public-to-private and corporate carveout/non-core divestitures), middle market, core equity, growth equity and global impact. In making acquisition recommendations to the Company, the Manager will also consider the resources made available to it across KKR’s extensive resource platform that supports the daily activities of KKR’s private equity business. This platform has a broad spectrum of capabilities spanning operational, financial-, macro- and stakeholder-related

2

Table of Contents

areas. The Manager will also seek insights for potential acquisition opportunities from KKR’s deep pool of investment professionals in groups like KKR Infrastructure and KKR Real Estate. See “—Acquisition Strategies.”

The Company’s acquisitions will also depend on how the KKR Group (defined below) allocates its opportunities between itself, the Company, and other KKR Vehicles. This approach is designed to help ensure allocations of opportunities are made over time on a fair and equitable basis. In determining allocations of opportunities, the KKR Group will take into account such factors as it deems appropriate, which could include, for example and without limitation: business strategies and focus; target investment size and target returns, available capital, the timing of capital inflows and outflows and anticipated capital commitments and subscriptions; timing of closing and speed of execution; liquidity profile, including during a ramp-up or wind-down period; applicable concentration limits and other investment restrictions and client instructions (including, without limitation, the need to resize positions to avoid breaches of applicable investment restrictions); mandatory minimum investment rights and other contractual obligations applicable to participating funds (as discussed further below), vehicles and accounts and/or to their investors; portfolio diversification; applicable investment periods and proximity to the end of the term of the relevant funds, vehicles and accounts; the management of actual or potential conflicts of interest; limitations on participants imposed by a portfolio company or other counterparty involved in making an opportunity available; whether an opportunity requires specific advisory committee or other consents on behalf of relevant funds, vehicles and accounts; lender covenants; tax efficiencies and potential adverse tax consequences; regulatory restrictions applicable to participating funds, vehicles and accounts and shareholders that could limit the Company’s ability to participate in a proposed investment; policies and restrictions (including internal policies and procedures) applicable to participating funds, vehicles and accounts; the avoidance of odd-lots or cases where a pro rata or other defined allocation methodology would result in a de minimis allocation to one or more participating funds, vehicles and accounts; the potential dilutive effect of a new position; the overall risk profile of a portfolio; the potential return available from a debt investment as compared to an equity investment; the potential effect of the Company’s performance (positive and negative); and any other considerations deemed relevant by the KKR Group. See “Item 7. Certain Relationships and Related Transactions, and Director Independence—Potential Conflicts of Interest—No Assurance of Ability to Participate in Acquisition Opportunities; Relationship with KKR, its Affiliates and KKR Vehicles; Allocation of Acquisition Opportunities.”

The Company expects to rely on the Manager’s portfolio monitoring process in owning and controlling portfolio companies. The Manager’s deal team will develop a 100-Day Plan, which is a strategy and detailed plan for the relevant portfolio company. This plan, which delineates the operational issues to be addressed immediately after the acquisition, is presented to the relevant Private Equity Portfolio Management Committee (“PMC”). After the first 100 days, the Manager’s deal team will return to the relevant PMC to present its progress against the plan and to outline its next set of goals. See “—Portfolio Monitoring.”

In connection with its plan of operation, the Company has entered into an Expense Limitation and Reimbursement Agreement with the Manager pursuant to which, through and including June 30, 2024, the Manager has agreed to forgo an amount of its monthly Management Fee (defined below) and/or pay, absorb or reimburse certain expenses of the Company, to the extent necessary so that, for any fiscal year, the Company’s annualized “Specified Expenses” (defined below) do not exceed 0.60% of the Company’s net assets as of the end of each calendar month. See “Item 2. Financial Information—Management’s Discussion and Analysis of Financial Condition and Results of Operation—Expenses—Expense Limitation and Reimbursement Agreement.” Accordingly, the Manager currently bears the expenses related to the Company’s operations and as the Company’s net asset value (“NAV”) grows, the manager intends to seek reimbursement pursuant to the Expense Limitation and Reimbursement Agreement.

Our business objective is to generate attractive risk-adjusted returns and achieve medium-to-long-term capital appreciation through Joint Ventures diversified by sector, industry and geography, by owning and controlling Joint Ventures through which we will hold a global portfolio of companies.

We expect that over the long term, Joint Ventures and portfolio companies will make up approximately 80% of our assets. Additionally, we expect that up to 20% of our assets will consist of cash and cash

3

Table of Contents

equivalents, U.S. Treasury securities, U.S. government agency securities, municipal securities, other sovereign debt, investment grade credit and other investments including high yield credit, asset backed securities, mortgage backed securities, collateralized loan obligations, leveraged loans and/or debt of companies or assets (which may include securities or loans of KKR portfolio companies) (collectively, the “Liquidity Portfolio”) in each case in order to provide us with income, to facilitate capital deployment and provide a potential source of liquidity. These types of liquid assets may exceed 20% of our assets at any given time due to the initial ramp-up period, distributions from, or dispositions of, portfolio companies or for other reasons as our Manager determines. Moreover, we will not acquire any cryptocurrency, and (a) no more than 5% of our assets will consist of interests in “blind pools” and (b) no more than 10% of our assets will consist of publicly traded equity securities (not including any portfolio company that becomes publicly traded during the term of our ownership).

We intend to operate our business in a manner permitting us to maintain an exclusion from registration under the Investment Company Act of 1940, as amended (the “Investment Company Act”). See “Item 1A. Risk Factors—Risks Related to Our Structure—We would not be able to operate our business according to our business plan if we are required to register as an investment company under the Investment Company Act.”

The Manager

We are managed by the Manager, a wholly owned subsidiary of KKR and an investment adviser registered under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Manager will manage the Company pursuant to the terms of the Management Agreement and support the Company in managing its portfolio companies with the objective of generating attractive risk-adjusted returns and achieving medium-to-long-term capital appreciation through Joint Ventures diversified by sector, industry and geography for shareholders.

Since 1976, KKR has established a process to successfully navigate the private and public markets and grow capital over a diverse set of market cycles. The Manager will apply KKR’s “all-weather” philosophy to the Company’s differentiated acquisition strategy, seeking to leverage KKR’s entire global platform, with the ultimate goal of building a balanced portfolio of companies with the potential to perform well throughout economic cycles. KKR’s business activities, including those of the Manager, represent past activities of entities that are neither a parent nor subsidiary of the Company. KKR’s successes do not guarantee similar outcomes for the Company, and as of the date of this Registration Statement, the Company has not yet commenced operations. KKR is a leading global investment firm that manages multiple alternative asset classes, including private equity, infrastructure, energy, real estate and credit. As of March 31, 2023, KKR had aggregate assets under management of over $510 billion.

The KKR private equity team has significant experience executing private equity and private equity-related transactions. KKR’s tenure and experience in private equity, as well as its deep relationships within individual regional markets, have enabled KKR to develop an extensive network of contacts and relationships that we view as a central component of KKR’s competitive advantage. As of March 31, 2023, KKR private equity had aggregate assets under management of approximately $165.8 billion.

Pursuant to the Management Agreement, the Manager will be entitled to receive a management fee (the “Management Fee”) and expense reimbursements. So long as the Management Agreement has not been terminated, KKR will also receive a performance participation allocation (the “Performance Participation Allocation”). See “Item 1. Business—Compensation of the Manager—Management Fee” and “Item 1. Business—Performance Participation Allocation” for additional information.

The Manager will delegate the portfolio management function for the Liquidity Portfolio to KKR Credit Advisors (US) LLC and KKR Credit Advisors (Ireland) Unlimited Company (the “Liquidity Managers”), each of which are affiliates of the Manager. The Executive Committee will have the ability to determine the portion of our assets that will be managed by each Liquidity Manager, but will not have investment-level discretion for the portion managed by each Liquidity Manager.

4

Table of Contents

In consideration for its services, each Liquidity Manager will be entitled to receive a fee payable by the Manager (out of its Management Fee) in an amount to be agreed between the Manager and each Liquidity Manager from time to time.

Acquisition Strategies

We seek to generate attractive risk-adjusted returns and achieve medium-to-long-term capital appreciation through Joint Ventures diversified by sector, industry and geography. Our business strategy is to buy good companies we can make great. We plan to enter in these types of Joint Ventures with a long term, hands-on operational perspective in mind. We seek to acquire businesses and form Joint Ventures across the spectrum in terms of size and stage of maturity and around the world through a thematic approach. These themes come from KKR’s industry teams and macro team—creating a top down and bottom up approach.

Through this approach, we provide investors access to KKR’s industry leading institutional private equity platform. We seek to form Joint Ventures with all current and future KKR Vehicles across its private equity strategies:

| • | Traditional Private Equity: KKR, established in 1976, pioneered the traditional private equity industry and has remained one of the world’s largest and most successful investment firms through the past four decades of economic cycles. KKR’s traditional private equity strategy seeks to acquire controlling stakes or positions of influence in high-quality companies with attractive growth prospects, overlaying KKR’s regional coverage model with teams of sector specialists. Investing globally, KKR focuses on opportunities where KKR believes the value of the business can be enhanced through its active involvement. KKR seeks to add value to those companies by helping them grow their top line and expand EBITDA margins through increased operational efficiency. The majority of traditional private equity deals correspond to one of these types: |

| • | Buy-and-Build: Buy a company with established businesses or capabilities. It then buys additional companies that managers believe can enhance the value of the first company, whether by expanding the scope of its operations, enhancing the product or service lineup, adding new expertise or other capabilities, or realizing synergies. KKR also often calls on these platform strategies to seek consolidation within a sector along a specific theme. |

| • | Transformative Mergers & Acquisitions (“M&A”): Acquisitions that fundamentally change the nature of the acquirer’s business model or operations. A manager may buy a company with an eye toward a transformative transaction down the road, or an opportunity for transformational M&A may arise for an existing portfolio company. |

| • | Public-to-Private: Buying a public company and taking it private, meaning that its shares no longer trade on a public exchange. |

| • | Corporate Carveouts/Non-Core Divestitures: Buying a single business unit from a larger company and operating it as a standalone business. |

| • | Middle Market: KKR’s middle market strategy seeks to marry KKR’s well-honed private equity investment process with a dedicated team to pursue established companies that are smaller than those targeted by KKR’s traditional private equity funds and exhibit strong potential for growth and operational improvement. |

| • | Core Equity: KKR’s core equity strategy seeks to invest in mature, industry-leading companies with a lower volatility profile, longer duration, and lower risk profile than those targeted by KKR’s traditional private equity funds. The core equity strategy focuses on opportunities with attractive risk-adjusted returns and significant expected net asset value appreciation and compounding over a long-term horizon. |

5

Table of Contents

| • | Growth Equity: KKR’s growth equity strategies seek to leverage KKR’s expertise to offer capital and strategic solutions to growing companies in the Technology, Media, and Telecom and Health Care sectors. These strategies seek to capitalize on attractive opportunities to invest in companies seeking equity checks which are too small to meet the investment strategies of KKR’s traditional private equity funds and primarily minority stakes in companies which feature commercial or operational risk rather than technological or scientific risk. KKR believes that digital transformation is creating significant tech growth opportunities and challenges across all industries and geographies. Moreover, KKR believes that the health sector is underpinned by strong fundamentals over time and through multiple cycles with continued rewards for medical innovation for new products, services, and care delivery models. |

Our growth equity strategy will represent a limited proportion of our acquisitions. For these types of deals, we will seek opportunities primarily in the U.S. and Europe (including Israel), and will have a flexible approach to transaction, ownership and corporate structures across companies in both the private and public markets.

| • | Global Impact (“Global Impact”): KKR’s global impact strategy seeks to acquire small- to medium-sized businesses across the Americas, Europe and Asia that contribute toward one or more of the United Nations Sustainable Development Goals. By leading with this commercial focus, KKR aims to generate private equity returns, while driving positive impact to the United Nations Sustainable Development Goals within four solutions-oriented themes: Climate Action, Lifelong Learning, Sustainable Living and Inclusive Growth. This strategy pursues traditional private-equity approaches for accessing the opportunity set including: change of control acquisitions, minority partnerships with influence, industry build-ups and growth equity. |

KKR has an extensive resource platform that supports the daily activities of KKR’s private equity business. This platform has a broad spectrum of capabilities spanning operational, financial-, macro- and stakeholder-related areas. These capabilities are outlined below.

| • | KKR Capstone (“KKR Capstone”): The KKR private equity team works closely with KKR Capstone, an affiliate of the Manager, and includes a team of global operational professionals that has been an integral part of portfolio operations at KKR since the early 2000s. KKR Capstone partners with the KKR private equity team and management teams of portfolio companies to help define strategic priorities for and drive operational improvement in portfolio companies. The Capstone team is comprised of experienced professionals with extensive general management and functional expertise, whose typical background is that of former general managers, operating executives and management consultants. References to “Capstone Executives,” operating executives, operating experts, or operating consultants are to such employees of KKR Capstone. |

| • | KKR Capital Markets LLC (“KCM”): In 2006, KKR began to build its KCM team. KCM, which is an affiliate of the Manager, was developed to provide KKR with a capital markets-oriented perspective on its deal financings and portfolio company capital structure management, as well as to give KKR the ability to draw on creative and differentiated capital sources. The global KCM team adds value by providing insight and direct access to financing sources that help KKR improve the capital structures of portfolio companies. The KCM team facilitates and adds expertise around investment structuring, financing and capital markets-related issues across the capital structure. |

| • | KKR Credit: Over the last 15 years, KKR has built out a base of investment professionals beyond its traditional private equity teams. In 2004, KKR formed KKR Credit (“KKR Credit”), which is divided between Leveraged Credit and Private Credit. KKR Credit will be involved in managing the KKR Vehicles. |

| • | Public Policy & Affairs: In 2008, KKR developed a dedicated public affairs team (“Global Public Affairs”) that made it possible to expand KKR’s engagement with stakeholders. The team has extensive expertise in public policy, media, government and regulatory affairs, as well as experience |

6

Table of Contents

| working with community groups, labor unions, industry and trade associations, and non-governmental organizations (“NGOs”). As such, it is a dedicated resource designed to enable KKR to better evaluate regulatory trends that impact the development of investment theses of portfolio companies and assist management teams of portfolio companies in engaging on ESG issues, both from a risk and increasingly from an opportunity perspective. This team further helps KKR to more effectively manage communications with its investors and relationships with all of the stakeholders in portfolio companies. |

| • | Global Macro and Asset Allocation: In 2011, KKR established a dedicated Global Macro and Asset Allocation (“GMAA”) team. The GMAA team works very closely with the different regional and sector teams, helping to provide a top-down perspective on countries, industries and individual companies, which KKR believes provides significant advantages to its investment processes. |

| • | KKR Global Institute: Established in 2013, the KKR Global Institute provides analysis and insights about geopolitical, technological, demographic and macroeconomic developments and long-term trends. Drawing on the GMAA team and the Global Public Affairs team, the KKR Global Institute is actively involved in KKR’s investment processes by serving as a resource for KKR’s deal teams, clients and investment partners and portfolio companies. |

| • | KKR Technology & Innovation Team: Recognizing the disruptive challenges and opportunities related to technology, KKR’s leadership formed a small and agile team of technology operators. The team supports KKR’s deal teams in the evaluation of opportunities from a technology perspective as well as supporting KKR’s portfolio companies with technology choices and technological transformations. |

| • | Senior Advisors, Executive Advisors & Industry Advisors: KKR has a large roster of Senior Advisors (“Senior Advisors”), Executive Advisors (“Executive Advisors”) and Industry Advisors (“Industry Advisors”) around the world who have held leading executive roles in major global corporations. KKR’s Senior, Executive and Industry Advisors provide it with additional operational and strategic insights, serve on the boards of KKR portfolio companies, help KKR evaluate individual opportunities and assist KKR portfolio companies with operational matters. KKR also has a roster of KKR advisors (“KKR Advisors”) who are former employees of KKR and are engaged as consultants for KKR. |

In addition to the resources described above, KKR’s private equity business also draws on the support of a deep pool of investment professionals across KKR, such as:

| • | KKR Infrastructure: Since establishing a dedicated infrastructure business in 2008, KKR has been an active infrastructure investor globally. KKR Infrastructure pursues global infrastructure opportunities with an emphasis on investments in existing assets and businesses located in OECD countries. KKR Infrastructure focuses on investments in critical infrastructure assets with low volatility and strong downside protection, where KKR believes it can leverage its firm-wide platform to tackle complexity in sourcing, structuring, operations, and execution and deliver attractive returns with a low risk profile. The KKR infrastructure team sits adjacent to the private equity business, and the two mutually benefit each other in sourcing, information sharing, operating expertise and structuring expertise, in particular, across common areas of interest such as the water and renewable energy sectors. |

| • | KKR Real Estate: Since 2012, KKR has expanded to include a dedicated real estate investment platform. KKR Real Estate is a global solutions provider across the capital structure in the real estate industry, and focuses on opportunities including property-level equity, debt and special situations transactions and businesses with significant real estate holdings that can benefit from KKR’s operational expertise. The real estate team sits adjacent to the private equity business, and the two mutually benefit each other in much the same manner as with the KKR infrastructure team. |

7

Table of Contents

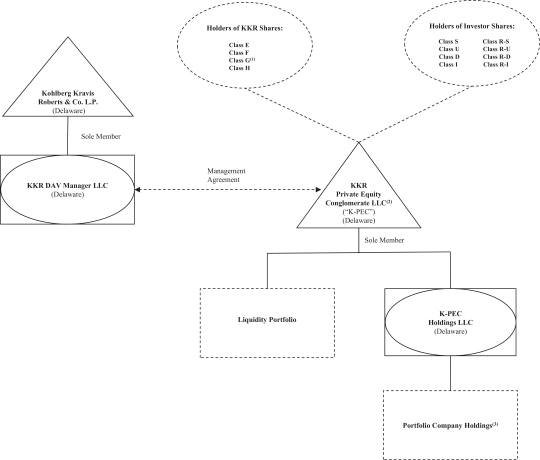

Organizational Chart of KKR Private Equity Conglomerate LLC

| (1) | As of the date of this Registration Statement, KKR, through its ownership of all of the Company’s outstanding Class G Shares, holds, directly and indirectly, all of the voting power of the Company. See “Item 1A. Risk Factors—Risks Related to Our Structure—We will depend on the Manager and KKR to achieve our business objectives.” |

| (2) | Represents the registrant entity. |

| (3) | We plan to own all or substantially all of our Joint Venture interests and other interests in portfolio companies directly or indirectly through our wholly-owned operating subsidiary, K-PEC Holdings LLC. See “—Business—General Development of Business.” |

8

Table of Contents

Key Trends in Private Equity

KKR’s decades of focus in its key industry verticals has helped it to recognize patterns in how to drive outcomes in each sector in which it operates. Through this experience, KKR has developed industry-specific playbooks for capturing upside, mitigating downside and driving step-changes in performance within its portfolio companies. KKR takes a consistent approach, creating a feedback loop that helps KKR to understand the outcomes it experiences and to continually fine-tune its processes. The private equity team also works closely

with the GMAA team for a global macro, top-down perspective on countries, individual industries and companies. This helps to consolidate the in-house macro view and facilitates improved investment decision-making as its input flows into the diligence work of the private equity teams as well as into Investment Committee discussions.

In terms of the market today, inflation is impacting global consumers, an increase in rates has contributed to a slowing global economy and equity and bond indices have been volatile.

This market environment has undoubtedly affected the private equity market and private equity controlling-stake M&A deal volume has come down given difficulty in securing financing for leveraged buyouts. However, with asset prices more dislocated and capital quite scarce, we anticipate continued challenges in the public markets to present a unique opportunity for private equity investors who have dry powder to deploy. With this market backdrop, there are a number of global megatrends across sectors that we are monitoring closely, including, but not limited to:

| • | Secular and cyclical forces are reshaping the financial landscape across the globe, creating opportunities to invest behind platforms that are well positioned to capitalize on these changes. There is disintermediation of the value chain with value shifting towards distribution. Leaders are consolidating shares with technology and talent accelerating the trend. Financial technology firms are scaling up rapidly in e-payment, e-lending and online asset management platforms in emerging Asia. Regulatory pressure is shifting focus to less regulated providers. |

| • | The current health care environment is characterized by secular growth and dynamic change, the combination of which creates attractive opportunities. The health care sector continues to be recession resilient, with key tailwinds including aging demographics and medical innovation. Sub-sectors/companies that can navigate and/or are less exposed to reimbursement complexity and regulatory scrutiny provide opportunities. |

| • | Within industrials, a late-cycle economy is presenting opportunities to invest through dislocation and we expect to favor businesses where we can leverage our operational toolkit. Opportunity exists to acquire businesses with strong competitive positioning and attractive financial characteristics in fundamentally attractive sectors. These companies can be further improved through supply chain optimization, innovation, commercial effectiveness and/or M&A. |

| • | Ongoing labor scarcity is pressuring the need for increased employee engagement and accelerating the trend towards automation/digitalization. With labor costs rising amidst sluggish demographics, a dearth of trained workers for key sectors, a lower participation rate and less immigration, we think that corporations will focus increasingly on technology-driven productivity gains. The pace of disruption will only accelerate, particularly as it relates to technological change across multiple industries faced with increasing labor costs. |

| • | Consumer landscape, facing disruption from changing consumer preferences, shopping habits, and e-commerce penetration is creating opportunities to acquire distinct brands and defensible business models. This quality-driven consumption is leading to growing demand for safe, healthy and high-quality food products with a focus on growing consumer demand for quality, sustainability, health and lifestyle. In terms of sub-sectors, a broad emphasis exists on consumer products, services, internet/eCommerce, hospitality/leisure, and thematic opportunities across health and wellness, digital acceleration, experiential and engaging concepts, value and premium brands. |

9

Table of Contents

| • | Demand for high-quality content and unique consumer experiences continues to rise on a global basis. The convergence of media and technology is creating opportunities across the gaming, entertainment, media and sports sectors. Category leaders with secular tailwinds that provide consolidated platforms are well positioned for this trend, with potential to bring together content, community and commerce in one disruptive scalable platform. In addition, the increasing pace of disruption is creating opportunities to support software companies that are navigating both the shift to subscription and paradigm shift to cloud. An emphasis exists on global, growth-oriented and scaled investments that embrace complexity to re-invent mature businesses and accelerate into new business models. |

| • | Data-driven decision making has become an integral global business practice, fueling increasing demand for rich data sets, actionable insights and predictive use cases. Value is also shifting to integrated solution providers in the services and education sectors. Disruptors are being innovative around data or software and de novo platform launches are targeting thematic areas. |

| • | Security of “everything.” The world has shifted from a period of benign globalization to one of great power competition. This shift means that countries, corporations, and even individuals will need to build out more redundancy across not only energy but also data, food, pharma, technology, water and transportation. These sectors and their supply chains will be subject to greater geopolitical oversight, in terms of both industrial policy intended to build national providers of these services and also scrutiny of foreign investment and resiliency of supply chains. Also, we believe almost all aspects of defense spending are poised to surge. All told, our “security of everything” concept represents hundreds of billions of dollars in potential operating and capital expenditures that may help to cushion the blow of the global economic slowdown we are experiencing. |

| • | The Energy Transition. This theme is probably as massive as the internet opportunity was around the turn of the century. There will be both winners and losers as this mega-theme unfolds, though we believe the generosity of the recent Inflation Reduction Act should lead to more winners than losers in the United States. Interestingly, though, while the internet was a deflationary global force, the energy transition is an inflationary one. The energy transition will need to address energy security and affordability as well as sustainability, which will impact its direction and speed. |

As KKR continues to navigate these trends and subsequent themes, KKR remains focused on opportunities with strong recurring revenue and earnings profiles, with pricing power and in fundamentally good businesses that it believes it can make great through its operational improvement capabilities. KKR is maintaining active dialogue with management teams at target public companies and exploring potential public-to-private buyout transactions as well as continuing to proactively diligence and watch private targets.

Our Board

The Board’s corporate governance responsibilities are based on fiduciary duties applicable to Delaware limited liability companies, as modified by our LLC Agreement. The Board consists of six directors, half of whom are independent. The Board oversees the management of the Company and the performance of the Manager. See “Item 5. Directors and Executive Officers.” Actual or potential conflicts of interest will arise from time to time between the Company and KKR and the KKR Vehicles. See “Item 7. Certain Relationships and Related Transactions, and Director Independence—Potential Conflicts of Interest.” Our independent directors will approve protocols for handling actual and potential conflicts of interest and may be called upon from time to time to approve specific conflicts on behalf of our Audit Committee. See “Item 11. Description of Registrant’s Securities to be Registered—Summary of the LLC Agreement.”

Management Agreement

The description below of the Management Agreement is only a summary and is not necessarily complete. The description set forth below is qualified in its entirety by reference to the Management Agreement which has been filed as an exhibit to this Registration Statement.

10

Table of Contents

The Manager will provide management services to us pursuant to the Management Agreement. Under the terms of the Management Agreement, the Manager is responsible for the following:

| • | originating and recommending opportunities to form Joint Ventures to acquire portfolio companies, consistent with the business objectives and strategy of the Company; |

| • | monitoring and evaluating our portfolio companies; |

| • | analyzing and investigating potential dispositions of portfolio companies, including identification of potential acquirers and evaluations of offers made by such potential acquirers; |

| • | structuring of Joint Ventures and acquisitions of portfolio companies; |

| • | identifying bank and institutional sources of financing, arrangement of appropriate introductions and marketing of financial proposals; |

| • | supervising the preparation and review of all documents required in connection with the acquisition, disposition or financing of each portfolio company; |

| • | administrative services for which we will reimburse KKR; |

| • | monitoring the performance of portfolio companies and, where appropriate, providing advice regarding the management of Joint Ventures and portfolio companies; |

| • | arranging and coordinating the services of other professionals and consultants, including KKR personnel; |

| • | making recommendations to the Company’s Repurchase Committee (as defined below) with respect to the Company’s share repurchases; and |

| • | providing us with such other services as the Board or the Executive Committee may, from time to time, appoint the Manager to be responsible for and perform, consistent with the terms of the Management Agreement. |

The Manager’s services under the Management Agreement will not be exclusive, and the Manager will be free to furnish similar services to other entities, and it intends to do so, so long as its services to us are not impaired. For the avoidance of doubt, the management, policies and operations of the Company shall be the ultimate responsibility of the Board acting pursuant to and in accordance with the LLC Agreement.

The term of the Management Agreement will continue indefinitely unless terminated as described below. The Management Agreement may be terminated upon the affirmative vote of all of our independent directors. We will need to provide the Manager 90 days’ written notice of any termination. Upon termination, the Manager will be paid a termination fee (the “Termination Fee”) equal to three times the sum of (i) the average annual Management Fee earned by the Manager and (ii) the average annual Performance Participation Allocation received by KKR during the 24-month period immediately preceding the most recently completed calendar quarter prior to the date of termination of the Management Agreement. We may terminate the Management Agreement for cause upon 30 days’ written notice and in such case, we would not be required to pay a Termination Fee.

The Manager may terminate the Management Agreement if we become required to register as an investment company under the Investment Company Act, with such termination deemed to occur immediately before such event, in which case we would not be required to pay a Termination Fee. The Manager may also terminate the Management Agreement by providing us with 180 days’ written notice, in which case we would not be required to pay a Termination Fee. In addition, if we default in the performance or observance of any material term, condition or covenant contained in the Management Agreement and the default continues for a period of 30 days after written notice to us requesting that the default be remedied within that period, the Manager may terminate the Management Agreement upon 60 days’ written notice, and we would be required to pay a Termination Fee.

11

Table of Contents

In addition, if our Management Agreement is terminated, we expect that the Management Agreement will obligate us to forfeit our controlling interest in any Joint Venture, which would likely require us to register as an investment company under the Investment Company Act and adversely affect an investment in our Shares. The Management Agreement will require us to repurchase any KKR Shares if the Management Agreement is terminated, which could require us to liquidate portfolio companies at unfavorable times or prices, which may adversely affect an investment in our Shares. See “Item 1A. Risk Factors—Risks Related to Our Structure—In the event that the Company’s Management Agreement is terminated, the Company will be required to repurchase any KKR Shares.”

Compensation of the Manager

Management Fee

Pursuant to the Management Agreement, the Manager is entitled to receive a Management Fee from the Company.

The Management Fee is payable monthly in arrears in an amount equal to (i) 1.25% per annum of the month-end NAV attributable to Class S Shares, Class D Shares, Class U Shares and Class I Shares, (ii) 1.0% per annum of the month-end NAV attributable to Class R-S Shares, Class R-D Shares, Class R-U Shares and Class R-I Shares for a 60-month period following the acceptance of the initial subscription for Shares of the Company in our Private Offering (as defined below) by persons that are not affiliates of the Manager (the “Initial Offering”) (provided that such shares are purchased by an investor as part of an intermediary’s aggregate subscription for at least $100 million during the 12-month period following the Initial Offering), and 1.25% per annum of the month-end NAV attributable to such shares thereafter, each before giving effect to any accruals for the Management Fee, the Distribution Fee (as defined below), the Servicing Fee (as defined below), the Performance Participation Allocation (as defined below), share repurchases for that month, any distributions and without taking into account any taxes (whether paid, payable, accrued or otherwise) of any intermediate entity through which the Company indirectly holds in a portfolio company, as determined in the good faith judgment of the Manager. This Registration Statement does not constitute an offer of securities of KKR Private Equity Conglomerate LLC or any other entity. We intend to conduct the Private Offering in reliance on exemptions from the registration requirements of the Securities Act, including under Regulation D and Regulation S. See “—Private Offering of Shares.”

In addition to the fees paid to the Manager, we will pay all other costs and expenses of our operations, including compensation of our employees and non-investment professional employees of the Manager or KKR, directors, custodial expenses, leveraging expenses, transfer agent expenses, legal fees, expenses of independent auditors, expenses of our periodic repurchases, expenses of preparing, printing and distributing offering documents, shareholder reports, notices, proxy statements and reports to governmental agencies and taxes, if any. See “Item 2. Financial Information—Management’s Discussion and Analysis of Financial Condition and Results of Operation—Expenses—Company Expenses” and “Item 7. Certain Relationships and Related Transactions, and Director Independence—Potential Conflicts of Interest—Applicable Employees” below. The Management Fee will be offset by certain fees and expenses. See “Item 7. Certain Relationships and Related Transactions, and Director Independence—Transactions with Related Persons, Promoters and Certain Control Persons—Management Fee Offset.”

Performance Participation Allocation

So long as the Management Agreement has not been terminated, KKR will be entitled to receive a Performance Participation Allocation equal to 15.0% of the Total Return attributable to Investor Shares, subject to a 5.0% Hurdle Amount and a High Water Mark, with a 100% Catch-Up (each term as defined in Item 2 below). The Performance Participation Allocation will be measured and paid on an annual basis and accrued monthly. For further information regarding the Performance Participation Allocation, see “Item 2. Financial Information—Management’s Discussion and Analysis of Financial Condition and Results of Operation—Expenses—Performance Participation Allocation” below.

12

Table of Contents

Our Administrator

We plan to enter into an administration agreement with an administrator (the “Administrator”) pursuant to which the Administrator will be responsible for generally performing administrative services of the Company. We anticipate that pursuant to the administration agreement, the Administrator will be entitled to receive a monthly fee based on the monthly value of the Company’s net assets, subject to a minimum annual fee, plus out-of-pocket expenses.

Acquisition Process Overview

The Company will engage the Manager to access the deal sourcing, diligence and portfolio monitoring capabilities of the KKR private equity team and the broader KKR platform.

KKR strives to maintain robust processes and accountability to improve investment decisions, allocate capital effectively, actively engage in key decisions impacting operational value creation, and rigorously monitor investments. KKR has instituted investment management practices that will govern how it sources transactions for us. These practices cover communication, investment methodologies from initial deal sourcing through long-term holding periods, including sophisticated deal tracking and accounting procedures and expansion and leveraging of internal and external resources.

KKR will be responsible for making acquisition recommendations to us. KKR’s private equity team professionals will be accountable to our Executive Committee through the life of our control and management of a portfolio company, including monitoring, building value and ongoing management.

Due Diligence Process

While the Company has not yet commenced operations, it expects to rely on the Manager’s due diligence process in identifying and considering potential acquisitions. Over more than four decades of private equity acquisitions, KKR’s Private Equity business has developed an “all-weather” philosophy, leveraging KKR’s entire global platform to target opportunities behind identified themes where KKR has significant conviction and expertise. The formation of KKR’s themes starts with concrete experience and is reinforced through accumulated domain knowledge and credentials in certain sectors and sub-sectors. As KKR originates new deal opportunities, KKR leans into opportunities where it has established expertise and can hope to achieve “repeat successes,” which are deals that are sometimes the product of expertise gleaned from prior investments. With respect to potential portfolio company acquisitions, the Company generally expects to rely on the methods and resources by which KKR identifies target companies as well as the determinations of the Manager on whether to acquire an interest in such companies.

KKR has focused on investing in fundamentally strong companies with defensible market positions seeking to drive returns through enhanced innovation, operational improvements, creative structuring and accretive M&A. KKR’s value orientation and ability to finance and execute complex investments have been central to its ability to acquire portfolio companies at purchase multiples below those prevailing in public markets.

Once KKR has identified a prospective opportunity that fits one of its high conviction themes and company profiles, KKR employs its rigorous due diligence process. As KKR starts to evaluate any new opportunity, it seeks to leverage the wide ranging skills and experiences of the deal team and supporting resources as far as possible, including the following:

| • | Deep understanding of the regional and local markets; |

| • | In-depth knowledge of industry sectors; |

| • | Understanding of accounting, legal, and regulatory issues across multiple jurisdictions; |

| • | Management and operational expertise; |

13

Table of Contents

| • | Understanding of stakeholder perspectives and ability to engage with key stakeholders, including governments, non-governmental organizations, community groups, environmental advocates, unions, and regulatory bodies; |

| • | In depth understanding of ESG and sustainability perspectives related to the sector and the asset; and |

| • | Ability to direct effective resources to grow portfolio companies. |