false

FY

0001957538

0001957538

2023-01-01

2023-12-31

0001957538

dei:BusinessContactMember

2023-01-01

2023-12-31

0001957538

ESGL:OrdinarySharesParValue0.0001PerShareMember

2023-01-01

2023-12-31

0001957538

ESGL:WarrantsToPurchaseOrdinarySharesMember

2023-01-01

2023-12-31

0001957538

2023-12-31

0001957538

2022-12-31

0001957538

2022-01-01

2022-12-31

0001957538

ifrs-full:IssuedCapitalMember

2021-12-31

0001957538

ESGL:RevaluationReserveMember

2021-12-31

0001957538

ESGL:ExchangeReserveMember

2021-12-31

0001957538

ifrs-full:SharePremiumMember

2021-12-31

0001957538

ifrs-full:OtherReservesMember

2021-12-31

0001957538

ESGL:ShareSubscriptionMember

2021-12-31

0001957538

ifrs-full:RetainedEarningsMember

2021-12-31

0001957538

2021-12-31

0001957538

ifrs-full:IssuedCapitalMember

2022-12-31

0001957538

ESGL:RevaluationReserveMember

2022-12-31

0001957538

ESGL:ExchangeReserveMember

2022-12-31

0001957538

ifrs-full:SharePremiumMember

2022-12-31

0001957538

ifrs-full:OtherReservesMember

2022-12-31

0001957538

ESGL:ShareSubscriptionMember

2022-12-31

0001957538

ifrs-full:RetainedEarningsMember

2022-12-31

0001957538

ifrs-full:IssuedCapitalMember

2022-01-01

2022-12-31

0001957538

ESGL:RevaluationReserveMember

2022-01-01

2022-12-31

0001957538

ESGL:ExchangeReserveMember

2022-01-01

2022-12-31

0001957538

ifrs-full:SharePremiumMember

2022-01-01

2022-12-31

0001957538

ifrs-full:OtherReservesMember

2022-01-01

2022-12-31

0001957538

ESGL:ShareSubscriptionMember

2022-01-01

2022-12-31

0001957538

ifrs-full:RetainedEarningsMember

2022-01-01

2022-12-31

0001957538

ifrs-full:IssuedCapitalMember

2023-01-01

2023-12-31

0001957538

ESGL:RevaluationReserveMember

2023-01-01

2023-12-31

0001957538

ESGL:ExchangeReserveMember

2023-01-01

2023-12-31

0001957538

ifrs-full:SharePremiumMember

2023-01-01

2023-12-31

0001957538

ifrs-full:OtherReservesMember

2023-01-01

2023-12-31

0001957538

ESGL:ShareSubscriptionMember

2023-01-01

2023-12-31

0001957538

ifrs-full:RetainedEarningsMember

2023-01-01

2023-12-31

0001957538

ifrs-full:IssuedCapitalMember

2023-12-31

0001957538

ESGL:RevaluationReserveMember

2023-12-31

0001957538

ESGL:ExchangeReserveMember

2023-12-31

0001957538

ifrs-full:SharePremiumMember

2023-12-31

0001957538

ifrs-full:OtherReservesMember

2023-12-31

0001957538

ESGL:ShareSubscriptionMember

2023-12-31

0001957538

ifrs-full:RetainedEarningsMember

2023-12-31

0001957538

ifrs-full:LeaseLiabilitiesMember

2021-12-31

0001957538

ifrs-full:LongtermBorrowingsMember

2021-12-31

0001957538

ifrs-full:LeaseLiabilitiesMember

2022-01-01

2022-12-31

0001957538

ifrs-full:LongtermBorrowingsMember

2022-01-01

2022-12-31

0001957538

ifrs-full:LeaseLiabilitiesMember

2022-12-31

0001957538

ifrs-full:LongtermBorrowingsMember

2022-12-31

0001957538

ifrs-full:LeaseLiabilitiesMember

2023-01-01

2023-12-31

0001957538

ifrs-full:LongtermBorrowingsMember

2023-01-01

2023-12-31

0001957538

ifrs-full:LeaseLiabilitiesMember

2023-12-31

0001957538

ifrs-full:LongtermBorrowingsMember

2023-12-31

0001957538

ifrs-full:LandAndBuildingsMember

2023-01-01

2023-12-31

0001957538

ESGL:PropertyAndEquipmentMember

ifrs-full:BottomOfRangeMember

2023-01-01

2023-12-31

0001957538

ESGL:PropertyAndEquipmentMember

ifrs-full:TopOfRangeMember

2023-01-01

2023-12-31

0001957538

ifrs-full:MachineryMember

ifrs-full:BottomOfRangeMember

2023-01-01

2023-12-31

0001957538

ifrs-full:MachineryMember

ifrs-full:TopOfRangeMember

2023-01-01

2023-12-31

0001957538

ESGL:RenovationMember

2023-01-01

2023-12-31

0001957538

ifrs-full:MotorVehiclesMember

2023-01-01

2023-12-31

0001957538

ifrs-full:FixturesAndFittingsMember

2023-01-01

2023-12-31

0001957538

ifrs-full:ComputerSoftwareMember

2023-01-01

2023-12-31

0001957538

ESGL:ForwardPurchaseAgreementMember

2023-07-27

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:VellarOpportunitiesFundMasterLtdMember

2023-07-27

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:ACMARRTKLLCMember

ESGL:ClassACommonStockMember

2023-07-27

0001957538

ESGL:SalesOfCircularProductsMember

2023-01-01

2023-12-31

0001957538

ESGL:SalesOfCircularProductsMember

2022-01-01

2022-12-31

0001957538

ESGL:WasteDisposalServicesMember

2023-01-01

2023-12-31

0001957538

ESGL:WasteDisposalServicesMember

2022-01-01

2022-12-31

0001957538

ifrs-full:ShorttermBorrowingsMember

2023-01-01

2023-12-31

0001957538

ifrs-full:ShorttermBorrowingsMember

2022-01-01

2022-12-31

0001957538

ESGL:LoansFromDirectorsMember

2023-01-01

2023-12-31

0001957538

ESGL:LoansFromDirectorsMember

2022-01-01

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:LeaseholdLandAndBuildingsMember

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:PropertyAndEquipmentMember

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:MachineryMember

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:RenovationMember

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:MotorVehiclesMember

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:FixturesAndFittingsMember

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:LeaseholdLandAndBuildingsMember

2023-01-01

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:PropertyAndEquipmentMember

2023-01-01

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:MachineryMember

2023-01-01

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:RenovationMember

2023-01-01

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:MotorVehiclesMember

2023-01-01

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:FixturesAndFittingsMember

2023-01-01

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

2023-01-01

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:LeaseholdLandAndBuildingsMember

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:PropertyAndEquipmentMember

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:MachineryMember

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:RenovationMember

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:MotorVehiclesMember

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:FixturesAndFittingsMember

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:LeaseholdLandAndBuildingsMember

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:PropertyAndEquipmentMember

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:MachineryMember

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:RenovationMember

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:MotorVehiclesMember

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:FixturesAndFittingsMember

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:LeaseholdLandAndBuildingsMember

2023-01-01

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:PropertyAndEquipmentMember

2023-01-01

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:MachineryMember

2023-01-01

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:RenovationMember

2023-01-01

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:MotorVehiclesMember

2023-01-01

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:FixturesAndFittingsMember

2023-01-01

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

2023-01-01

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:LeaseholdLandAndBuildingsMember

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:PropertyAndEquipmentMember

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:MachineryMember

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:RenovationMember

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:MotorVehiclesMember

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:FixturesAndFittingsMember

2023-12-31

0001957538

ESGL:AccumulatedDepreciationMember

2023-12-31

0001957538

ESGL:LeaseholdLandAndBuildingsMember

2023-12-31

0001957538

ESGL:PropertyAndEquipmentMember

2023-12-31

0001957538

ifrs-full:MachineryMember

2023-12-31

0001957538

ESGL:RenovationMember

2023-12-31

0001957538

ifrs-full:MotorVehiclesMember

2023-12-31

0001957538

ifrs-full:FixturesAndFittingsMember

2023-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:LeaseholdLandAndBuildingsMember

2021-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:PropertyAndEquipmentMember

2021-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:MachineryMember

2021-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:RenovationMember

2021-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:MotorVehiclesMember

2021-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:FixturesAndFittingsMember

2021-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

2021-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:LeaseholdLandAndBuildingsMember

2022-01-01

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:PropertyAndEquipmentMember

2022-01-01

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:MachineryMember

2022-01-01

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ESGL:RenovationMember

2022-01-01

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:MotorVehiclesMember

2022-01-01

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

ifrs-full:FixturesAndFittingsMember

2022-01-01

2022-12-31

0001957538

ifrs-full:GrossCarryingAmountMember

2022-01-01

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:LeaseholdLandAndBuildingsMember

2022-01-01

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:PropertyAndEquipmentMember

2022-01-01

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:MachineryMember

2022-01-01

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:RenovationMember

2022-01-01

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:MotorVehiclesMember

2022-01-01

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:FixturesAndFittingsMember

2022-01-01

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

2022-01-01

2022-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:LeaseholdLandAndBuildingsMember

2021-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:PropertyAndEquipmentMember

2021-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:MachineryMember

2021-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ESGL:RenovationMember

2021-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:MotorVehiclesMember

2021-12-31

0001957538

ESGL:AccumulatedDepreciationMember

ifrs-full:FixturesAndFittingsMember

2021-12-31

0001957538

ESGL:AccumulatedDepreciationMember

2021-12-31

0001957538

ESGL:LeaseholdLandAndBuildingsMember

2022-12-31

0001957538

ESGL:PropertyAndEquipmentMember

2022-12-31

0001957538

ifrs-full:MachineryMember

2022-12-31

0001957538

ESGL:RenovationMember

2022-12-31

0001957538

ifrs-full:MotorVehiclesMember

2022-12-31

0001957538

ifrs-full:FixturesAndFittingsMember

2022-12-31

0001957538

ifrs-full:RecurringFairValueMeasurementMember

ESGL:LeaseholdLandAndBuildingsMember

ESGL:IndustrialMember

country:SG

2023-12-31

0001957538

ifrs-full:Level1OfFairValueHierarchyMember

ifrs-full:RecurringFairValueMeasurementMember

ESGL:LeaseholdLandAndBuildingsMember

ESGL:IndustrialMember

country:SG

2023-12-31

0001957538

ifrs-full:Level2OfFairValueHierarchyMember

ifrs-full:RecurringFairValueMeasurementMember

ESGL:LeaseholdLandAndBuildingsMember

ESGL:IndustrialMember

country:SG

2023-12-31

0001957538

ifrs-full:Level3OfFairValueHierarchyMember

ifrs-full:RecurringFairValueMeasurementMember

ESGL:LeaseholdLandAndBuildingsMember

ESGL:IndustrialMember

country:SG

2023-12-31

0001957538

ifrs-full:RecurringFairValueMeasurementMember

ESGL:LeaseholdLandAndBuildingsMember

ESGL:IndustrialMember

country:SG

2022-12-31

0001957538

ifrs-full:Level1OfFairValueHierarchyMember

ifrs-full:RecurringFairValueMeasurementMember

ESGL:LeaseholdLandAndBuildingsMember

ESGL:IndustrialMember

country:SG

2022-12-31

0001957538

ifrs-full:Level2OfFairValueHierarchyMember

ifrs-full:RecurringFairValueMeasurementMember

ESGL:LeaseholdLandAndBuildingsMember

ESGL:IndustrialMember

country:SG

2022-12-31

0001957538

ifrs-full:Level3OfFairValueHierarchyMember

ifrs-full:RecurringFairValueMeasurementMember

ESGL:LeaseholdLandAndBuildingsMember

ESGL:IndustrialMember

country:SG

2022-12-31

0001957538

ifrs-full:Level3OfFairValueHierarchyMember

ESGL:LeaseholdLandAndBuildingsMember

2022-12-31

0001957538

ifrs-full:Level3OfFairValueHierarchyMember

ESGL:LeaseholdLandAndBuildingsMember

2023-01-01

2023-12-31

0001957538

ifrs-full:Level3OfFairValueHierarchyMember

ESGL:LeaseholdLandAndBuildingsMember

2023-12-31

0001957538

country:SG

2023-01-01

2023-12-31

0001957538

country:SG

ifrs-full:BottomOfRangeMember

2023-12-31

0001957538

country:SG

ifrs-full:TopOfRangeMember

2023-12-31

0001957538

country:SG

ifrs-full:BottomOfRangeMember

2022-12-31

0001957538

country:SG

ifrs-full:TopOfRangeMember

2022-12-31

0001957538

ESGL:AccumulatedAmortisationMember

2022-12-31

0001957538

ESGL:AccumulatedAmortisationMember

2021-12-31

0001957538

ESGL:AccumulatedAmortisationMember

2023-01-01

2023-12-31

0001957538

ESGL:AccumulatedAmortisationMember

2022-01-01

2022-12-31

0001957538

ESGL:AccumulatedAmortisationMember

2023-12-31

0001957538

ifrs-full:CurrentMember

2023-12-31

0001957538

ifrs-full:CurrentMember

2022-12-31

0001957538

ESGL:LessThanOneMonthMember

2023-12-31

0001957538

ESGL:LessThanOneMonthMember

2022-12-31

0001957538

ifrs-full:LaterThanTwoMonthsAndNotLaterThanThreeMonthsMember

2023-12-31

0001957538

ifrs-full:LaterThanTwoMonthsAndNotLaterThanThreeMonthsMember

2022-12-31

0001957538

ifrs-full:LaterThanThreeMonthsMember

2023-12-31

0001957538

ifrs-full:LaterThanThreeMonthsMember

2022-12-31

0001957538

ifrs-full:LandAndBuildingsMember

2023-12-31

0001957538

ifrs-full:LandAndBuildingsMember

2022-12-31

0001957538

ESGL:PlantAndEquipmentMember

2023-12-31

0001957538

ESGL:PlantAndEquipmentMember

2022-12-31

0001957538

ifrs-full:MotorVehiclesMember

2023-12-31

0001957538

ifrs-full:MotorVehiclesMember

2022-12-31

0001957538

ifrs-full:LandAndBuildingsMember

2023-01-01

2023-12-31

0001957538

ifrs-full:LandAndBuildingsMember

2022-01-01

2022-12-31

0001957538

ESGL:PlantAndEquipmentMember

2023-01-01

2023-12-31

0001957538

ESGL:PlantAndEquipmentMember

2022-01-01

2022-12-31

0001957538

ifrs-full:MotorVehiclesMember

2023-01-01

2023-12-31

0001957538

ifrs-full:MotorVehiclesMember

2022-01-01

2022-12-31

0001957538

ESGL:TermLoanOneMember

2023-12-31

0001957538

ESGL:TermLoanOneMember

2022-12-31

0001957538

ESGL:TermLoanTwoMember

2023-12-31

0001957538

ESGL:TermLoanTwoMember

2022-12-31

0001957538

ESGL:TermLoanFourMember

2023-12-31

0001957538

ESGL:TermLoanFourMember

2022-12-31

0001957538

ESGL:TermLoanFiveMember

2023-12-31

0001957538

ESGL:TermLoanFiveMember

2022-12-31

0001957538

ESGL:TermLoanSixMember

2023-12-31

0001957538

ESGL:TermLoanSixMember

2022-12-31

0001957538

ESGL:TermLoanSevenMember

2023-12-31

0001957538

ESGL:TermLoanSevenMember

2022-12-31

0001957538

ESGL:TradeReceivablesFinancingMember

2023-12-31

0001957538

ESGL:TradeReceivablesFinancingMember

2022-12-31

0001957538

ESGL:RevolvingCreditMember

2023-12-31

0001957538

ESGL:RevolvingCreditMember

2022-12-31

0001957538

ifrs-full:OnDemandMember

2023-12-31

0001957538

ifrs-full:OnDemandMember

2022-12-31

0001957538

ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember

2023-12-31

0001957538

ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember

2022-12-31

0001957538

ESGL:TermLoanOneMember

2023-01-01

2023-12-31

0001957538

ESGL:TermLoanOneMember

ifrs-full:BottomOfRangeMember

2023-12-31

0001957538

ESGL:TermLoanOneMember

ifrs-full:TopOfRangeMember

2023-12-31

0001957538

ESGL:TermLoanTwoMember

2023-01-01

2023-12-31

0001957538

ESGL:TermLoanTwoMember

ifrs-full:BottomOfRangeMember

2023-12-31

0001957538

ESGL:TermLoanTwoMember

ifrs-full:TopOfRangeMember

2023-12-31

0001957538

ESGL:TermLoanTwoMember

2023-12-31

0001957538

ESGL:TermLoanFourMember

2023-01-01

2023-12-31

0001957538

ESGL:TermLoanFourMember

2023-12-31

0001957538

ESGL:TermLoanFiveMember

2023-01-01

2023-12-31

0001957538

ESGL:TermLoanFiveMember

2023-12-31

0001957538

ESGL:TermLoanSixMember

2023-01-01

2023-12-31

0001957538

ESGL:TermLoanSixMember

2023-12-31

0001957538

ESGL:TermLoanSevenMember

2023-01-01

2023-12-31

0001957538

ESGL:TermLoanSevenMember

2023-12-31

0001957538

ESGL:RevolvingCreditMember

ifrs-full:BottomOfRangeMember

2023-01-01

2023-12-31

0001957538

ESGL:RevolvingCreditMember

ifrs-full:TopOfRangeMember

2023-01-01

2023-12-31

0001957538

ESGL:RevolvingCreditMember

2023-12-31

0001957538

ESGL:BusinessCombinationMergerAgreementMember

2023-12-31

0001957538

ESGL:BusinessCombinationMergerAgreementMember

2023-01-01

2023-12-31

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:ACMARRTKLLCMember

2023-07-27

0001957538

ESGL:SalariesAndBonusesMember

2023-01-01

2023-12-31

0001957538

ESGL:SalariesAndBonusesMember

2022-01-01

2022-12-31

0001957538

ESGL:DirectorsFeesMember

2023-01-01

2023-12-31

0001957538

ESGL:DirectorsFeesMember

2022-01-01

2022-12-31

0001957538

ESGL:PersonalGuaranteeFeeMember

2023-01-01

2023-12-31

0001957538

ESGL:PersonalGuaranteeFeeMember

2022-01-01

2022-12-31

0001957538

ESGL:EmployerContributionToTheCentralProvidentFundMember

2023-01-01

2023-12-31

0001957538

ESGL:EmployerContributionToTheCentralProvidentFundMember

2022-01-01

2022-12-31

0001957538

ifrs-full:CapitalisedDevelopmentExpenditureMember

2023-12-31

0001957538

ifrs-full:CapitalisedDevelopmentExpenditureMember

2022-12-31

0001957538

ifrs-full:ParentMember

2023-01-01

2023-12-31

0001957538

ifrs-full:ParentMember

2022-01-01

2022-12-31

0001957538

ifrs-full:SubsidiariesMember

2023-01-01

2023-12-31

0001957538

ifrs-full:SubsidiariesMember

2022-01-01

2022-12-31

0001957538

ESGL:EnvironmentalSolutionsPteLtdMember

2023-01-01

2023-12-31

0001957538

ESGL:EnvironmentalSolutionsPteLtdMember

2022-01-01

2022-12-31

0001957538

country:SG

2023-12-31

0001957538

country:US

2023-12-31

0001957538

country:SG

2022-12-31

0001957538

country:US

2022-12-31

0001957538

ESGL:PublicWarrantsMember

2023-01-01

2023-12-31

0001957538

ESGL:PrivateWarrantsMember

2023-01-01

2023-12-31

0001957538

ifrs-full:WarrantsMember

2023-12-31

0001957538

ESGL:StrengthenedMember

ifrs-full:CurrencyRiskMember

2023-01-01

2023-12-31

0001957538

ESGL:StrengthenedMember

ifrs-full:CurrencyRiskMember

2022-01-01

2022-12-31

0001957538

ESGL:WeekenedMember

ifrs-full:CurrencyRiskMember

2023-01-01

2023-12-31

0001957538

ESGL:WeekenedMember

ifrs-full:CurrencyRiskMember

2022-01-01

2022-12-31

0001957538

ifrs-full:CurrentMember

2023-12-31

0001957538

ifrs-full:CurrentMember

2023-01-01

2023-12-31

0001957538

ifrs-full:LaterThanOneMonthAndNotLaterThanThreeMonthsMember

2023-12-31

0001957538

ifrs-full:LaterThanOneMonthAndNotLaterThanThreeMonthsMember

2023-01-01

2023-12-31

0001957538

ifrs-full:LaterThanThreeMonthsAndNotLaterThanSixMonthsMember

2023-12-31

0001957538

ifrs-full:LaterThanThreeMonthsAndNotLaterThanSixMonthsMember

2023-01-01

2023-12-31

0001957538

ifrs-full:LaterThanSixMonthsMember

2023-12-31

0001957538

ifrs-full:LaterThanSixMonthsMember

2023-01-01

2023-12-31

0001957538

ifrs-full:CurrentMember

2022-12-31

0001957538

ifrs-full:CurrentMember

2022-01-01

2022-12-31

0001957538

ifrs-full:LaterThanOneMonthAndNotLaterThanThreeMonthsMember

2022-12-31

0001957538

ifrs-full:LaterThanOneMonthAndNotLaterThanThreeMonthsMember

2022-01-01

2022-12-31

0001957538

ifrs-full:LaterThanThreeMonthsAndNotLaterThanSixMonthsMember

2022-12-31

0001957538

ifrs-full:LaterThanThreeMonthsAndNotLaterThanSixMonthsMember

2022-01-01

2022-12-31

0001957538

ifrs-full:LaterThanSixMonthsMember

2022-12-31

0001957538

ifrs-full:LaterThanSixMonthsMember

2022-01-01

2022-12-31

0001957538

ifrs-full:TradeReceivablesMember

2022-12-31

0001957538

ifrs-full:TradeReceivablesMember

2021-12-31

0001957538

ifrs-full:TradeReceivablesMember

2023-01-01

2023-12-31

0001957538

ifrs-full:TradeReceivablesMember

2022-01-01

2022-12-31

0001957538

ifrs-full:TradeReceivablesMember

2023-12-31

0001957538

ifrs-full:NotLaterThanOneYearMember

2023-12-31

0001957538

ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember

2023-12-31

0001957538

ifrs-full:LaterThanFiveYearsMember

2023-12-31

0001957538

ifrs-full:NotLaterThanOneYearMember

2022-12-31

0001957538

ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember

2022-12-31

0001957538

ifrs-full:LaterThanFiveYearsMember

2022-12-31

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:VellarOpportunitiesFundMasterLtdMember

2023-07-26

2023-07-27

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:VellarOpportunitiesFundMasterLtdMember

ESGL:ClassACommonStockMember

ifrs-full:TopOfRangeMember

2023-07-27

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:VellarOpportunitiesFundMasterLtdMember

ESGL:ClassACommonStockMember

2023-07-27

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:VellarOpportunitiesFundMasterLtdMember

ifrs-full:TopOfRangeMember

2023-07-27

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:ACMARRTKLLCMember

ifrs-full:TopOfRangeMember

2023-07-27

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:VellarOpportunitiesFundMasterLtdMember

2023-08-14

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:ACMARRTKLLCMember

2023-08-04

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:VellarOpportunitiesFundMasterLtdMember

2023-08-04

2023-08-04

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:SellersMember

ifrs-full:TopOfRangeMember

2023-07-27

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:VellarOpportunitiesFundMasterLtdMember

2023-09-15

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:VellarOpportunitiesFundMasterLtdMember

2023-09-20

0001957538

ESGL:ForwardPurchaseAgreementMember

ESGL:ACMARRTKLLCMember

2023-12-04

0001957538

ESGL:ValuationPeriodAgreementMember

ESGL:VellarOpportunitiesFundMasterLtdMember

ifrs-full:MajorOrdinaryShareTransactionsMember

2024-03-21

0001957538

ESGL:ValuationPeriodAgreementMember

ESGL:VellarOpportunitiesFundMasterLtdMember

ifrs-full:WeightedAverageMember

ifrs-full:MajorOrdinaryShareTransactionsMember

2024-03-21

2024-03-21

0001957538

ESGL:ValuationPeriodAgreementMember

ESGL:VellarOpportunitiesFundMasterLtdMember

ifrs-full:MajorOrdinaryShareTransactionsMember

2024-03-21

2024-03-21

0001957538

ifrs-full:MajorOrdinaryShareTransactionsMember

ESGL:SharePurchaseAgreementMember

ESGL:AccreditedInvestorMember

ifrs-full:TopOfRangeMember

2024-03-27

0001957538

ifrs-full:MajorOrdinaryShareTransactionsMember

ESGL:SharePurchaseAgreementMember

ESGL:AccreditedInvestorMember

2024-03-27

0001957538

ifrs-full:MajorOrdinaryShareTransactionsMember

ESGL:SharePurchaseAgreementMember

ESGL:AccreditedInvestorMember

2024-03-28

0001957538

ifrs-full:MajorOrdinaryShareTransactionsMember

ESGL:SharePurchaseAgreementMember

ESGL:AccreditedInvestorMember

2024-04-03

0001957538

ifrs-full:MajorOrdinaryShareTransactionsMember

ESGL:SharePurchaseAgreementMember

ESGL:AccreditedInvestorMember

2024-04-03

2024-04-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

20-F

(Mark

One)

☐

REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

Date

of event requiring this shell company report……………….

Commission

File Number: 001-41772

ESGL

HOLDINGS LIMITED

(Exact

name of Registrant as specified in its charter)

| Not

applicable |

|

Cayman

Islands |

| (Translation

of Registrant’s name into English) |

|

(Jurisdiction

of incorporation or organization) |

101

Tuas South Avenue 2

Singapore

637226

(Address

of Principal Executive Offices)

Mr.

Quek Leng Chuang, Chief Executive Officer

101

Tuas South Avenue 2

Singapore

637226

Tel:

+65 6653 2299

Email:

queklc@env-solutions.com

(Name,

Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities

registered or to be registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Ordinary

shares, par value $0.0001 per share |

|

ESGL |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase ordinary shares |

|

ESGLW |

|

The

Nasdaq Stock Market LLC |

Securities

registered or to be registered pursuant to Section 12(g) of the Act: None

Securities

for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate

the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered

by the annual report: 22,998,039 ordinary shares and 9,002,331 warrants.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☐

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth

company. See definition of “large accelerated filer”, “accelerated filer,” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

Non-accelerated

filer ☒ |

| |

|

Emerging

growth company ☒ |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

Indicate

by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S.

GAAP ☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

Other

☐ |

If

“Other” has been checked in response to the previous question, indicate by check mark which financial statement item the

registrant has elected to follow. Item 17 ☐ Item 18 ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ☐ No ☒

(APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities

Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

annual report on Form 20-F (including information incorporated by reference herein, the “Report”) is being filed by ESGL

Holdings Limited, a Cayman Islands business company. Unless otherwise indicated, “we,” “us,” “our,”

“ESGL,” the “Group” and similar terminology refer to ESGL Holdings Limited and its subsidiaries. References to

“ESGH” and “Environmental Solutions Group Holdings Limited” refer to Environmental Solutions Group Holdings Limited,

a Cayman Islands exempted company. References to “S$” refers to the legal currency of Singapore.

Forward-looking

statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,”

“intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,”

“could,” “may,” “might,” “possible,” “potential,” “predict,”

“should,” “would” and other similar words and expressions, but the absence of these words does not mean that

a statement is not forward- looking. Forward-looking statements in this Report may include, for example, statements about:

| |

● |

Our

business strategies and outcomes; |

| |

|

|

| |

● |

our

financial performance following the Business Combination (defined below); |

| |

|

|

| |

● |

government

regulations governing business operations, and in particular those governing the environmental industry; |

| |

|

|

| |

● |

macro-economic

conditions in Singapore; |

| |

|

|

| |

● |

the

impact of the COVID-19 pandemic on our business and the actions we may take in response thereto; and |

| |

|

|

| |

● |

the

outcome of any known and unknown litigation and regulatory proceedings. |

These

forward-looking statements are based on information available as of the date of this Report, and current expectations, forecasts and

assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied

upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements

to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise,

except as may be required under applicable securities laws.

You

should not place undue reliance on these forward-looking statements. New risk factors and uncertainties emerge from time to time and

it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our

business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained

in any forward-looking statements. As a result of a number of known and unknown risks and uncertainties, our actual results or performance

may be materially different from those expressed or implied by these forward-looking statements.

This

Report also contains statistical data and estimates that we obtained from industry publications and reports generated by third-party

providers of market intelligence. These industry publications and reports generally indicate that the information contained therein was

obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information.

INTRODUCTION

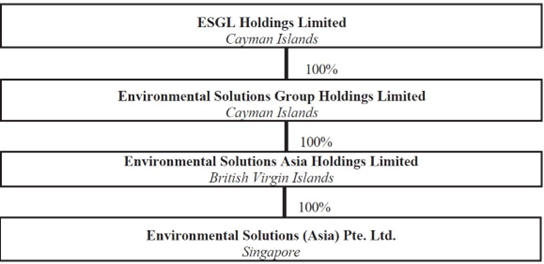

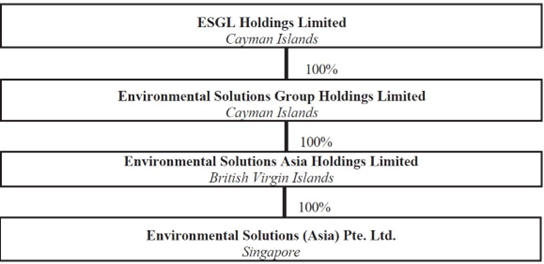

We

are a holding company primarily operating in Singapore through our subsidiary, Environmental Solutions (Asia) Pte. Ltd. (“ESA”).

Unless otherwise stated or unless the context otherwise requires, the terms “Company,” “the registrant,” “our

company,” “the company,” “we,” “us,” “our,” “ours” and “ESGL”

refer to ESGL Holdings Limited, a Cayman Islands business company, and its subsidiaries.

Our

consolidated financial statements are presented in U.S. dollars. All references in this annual report to “$,” “U.S.

$,” “U.S. dollars” and “dollars” mean U.S. dollars, unless otherwise noted.

We

completed a merger with Genesis Unicorn Capital Corp., a Delaware corporation (“GUCC”), on August 2, 2023 and ESGL’s

ordinary shares and warrants began trading on the Nasdaq Stock Exchange on August 4, 2023. The Company, Genesis Unicorn Capital Corp.,

a Delaware corporation (“GUCC”), ESGH Merger Sub Corp, a Cayman Islands exempted company and wholly-owned

subsidiary of the Company (the “Merger Sub”), and Environmental Solutions Group Holdings Limited, a Cayman Islands exempted

company (“Legacy ESGL”), entered into a Merger Agreement dated as of November 29, 2022 (the “Merger Agreement”).

The Merger Agreement provided for a business combination which was effected in two steps: (i) GUCC reincorporated to Cayman Islands by

merging with and into the Company, with the Company remaining as the surviving publicly traded entity (the “Reincorporation Merger”);

and (ii) following the Reincorporation Merger, Merger Sub merged with and into Legacy ESGL, resulting in Legacy ESGL being a wholly owned

subsidiary of the Company (the “Acquisition Merger,” together with Reincorporation Merger, the “Business Combination”).

Further,

in this annual report:

| |

● |

“$”

or “US$” or “U.S. dollars” or “USD” refers to the legal currency of the United States. |

| |

|

|

| |

● |

“Amended

and Restated Memorandum and Articles of Association” means ESGL’s amended and restated memorandum and articles of association

adopted by special resolutions dated July 28, 2023 and effective on August 2, 2023. |

| |

|

|

| |

● |

“Amended

and Restated Articles of Association” means ESGL’s amended and restated articles of association adopted by special resolutions

dated July 28, 2023 and effective on August 2, 2023. |

| |

|

|

| |

● |

“Amended

and Restated Memorandum of Association” means ESGL’s amended and restated memorandum of association adopted by special

resolutions dated July 28, 2023 and effective on August 2, 2023. |

| |

|

|

| |

● |

“Board”

means the board of directors of the Company. |

| |

|

|

| |

● |

“Business

Combination” means the Merger contemplated by the Merger Agreement. |

| |

|

|

| |

● |

“Code”

means the Internal Revenue Code of 1986, as amended. |

| |

|

|

| |

● |

“Company”

means ESGL Holdings Limited. |

| |

|

|

| |

● |

“Closing”

means the closing of the Business Combination. |

| |

|

|

| |

● |

“ESA”

means Environmental Solutions (Asia) Pte. Ltd., which was incorporated under the laws of Singapore on May 8, 1999. |

| |

|

|

| |

● |

“ESGH”

means Environmental Solutions Group Holdings Limited, a holding company incorporated under the laws of the Cayman Islands as an exempted

company with limited liability on November 18, 2022. |

| |

|

|

| |

● |

“ESGL”

means ESGL Holdings Limited, a Cayman Islands exempt company. |

| |

● |

“Exchange

Act” means the Securities Exchange Act of 1934, as amended. |

| |

|

|

| |

● |

“founder

shares” means the 2,156,250 Ordinary Shares issued to the Initial Stockholders at Closing in exchange for the 2,156,250 shares

of GUCC Class B common stock issued for an aggregate purchase price of $25,000 in March 2021. |

| |

|

|

| |

● |

“GAAP”

means accounting principles generally accepted in the United States of America. |

| |

|

|

| |

● |

“Group”

means ESGL and its subsidiaries, including ESGH, ES BVI and ESA. |

| |

|

|

| |

● |

“GUCC”

means Genesis Unicorn Capital Corp., a Delaware corporation. |

| |

|

|

| |

● |

“GUCC

Class A common stock” or “Class A common stock” means the Class A common stock, $0.0001 par value per share, of

Genesis Unicorn Capital Corp. |

| |

|

|

| |

● |

“GUCC

Class B common stock” or “Class B common stock” means the Class B common stock, $0.0001 par value per share, of

Genesis Unicorn Capital Corp. |

| |

|

|

| |

● |

“GUCC

common stock” or “common stock” means shares of GUCC Class A common stock and GUCC Class B common stock, collectively. |

| |

|

|

| |

● |

“IASB”

means International Accounting Standards Board. |

| |

|

|

| |

● |

“IFRS”

means International Financial Reporting Standards as issued by the IASB. |

| |

|

|

| |

● |

“Initial

Stockholders” means the Sponsor and other initial holders of founder shares. |

| |

|

|

| |

● |

“IPO”

refers to the initial public offering of 8,625,000 units (including 1,125,000 units as a result of the underwriters’ exercise

of its over-allotment option) of GUCC consummated on February 17, 2022. |

| |

|

|

| |

● |

“IRS”

means the United States Internal Revenue Service. |

| |

|

|

| |

● |

“Merger”

means the transactions contemplated by the Merger Agreement. |

| |

● |

“Merger

Agreement” means that certain Agreement and Plan of Merger, dated as of November 29, 2022, as may be amended from time to time,

by and among ESGL, GUCC, ESGH, and the other parties named therein. |

| |

|

|

| |

● |

“Ordinary

Shares” means the ordinary shares, $0.0001 par value per share, of ESGL. |

| |

|

|

| |

● |

“Private

Units” means the units issued to the Sponsor in a private placement simultaneously with the closing of IPO, with each unit

included one Ordinary Share and one Private Warrant. |

| |

|

|

| |

● |

“Private

Warrants” means the warrants included in the Private Units issued to the Sponsor in a private placement simultaneously with

the closing of IPO, with each Private Warrant entitling the holder to purchase one Ordinary Share. |

| |

|

|

| |

● |

“Public

Warrants” means the public warrants issued in the IPO, with each Public Warrant entitling the holder to purchase one Ordinary

Share. |

| |

|

|

| |

● |

“SEC”

means the U.S. Securities and Exchange Commission. |

| |

|

|

| |

● |

“Securities

Act” means the Securities Act of 1933, as amended. |

| |

|

|

| |

● |

“Sellers”

means ACM ARRT K LLC and Vellar Opportunities Fund Master, Ltd. |

| |

|

|

| |

● |

“Sponsor”

means Genesis Unicorn Capital, LLC, a Delaware limited liability company. |

PART

I

ITEM

1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not

applicable.

ITEM

2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not

applicable.

ITEM

3. KEY INFORMATION

| B. |

Capitalization

and Indebtedness |

Not

applicable.

| C. |

Reasons

for the Offer and Use of Proceeds |

Not

applicable.

Risks

Relating to the Group’s Business and Industry

For

the two years ended December 31, 2023 and 2022, the Group has incurred operating losses and may incur significant losses for the foreseeable

future. The Group may not generate sufficient revenue or become profitable or, if it achieves profitability, it may not be able to sustain

it.

For

the two years ended December 31, 2023 and 2022, the Group’s net losses were US$94,979,338 and US$2,391,812, respectively. As of

December 31, 2023, the Group had an accumulated deficit of US$99,985,928.

Substantially

all of the Group’s losses have resulted from approximately US$93.1 million of listing expenses which are

non-operational and non-recurring. In the financial year ended December 31, 2022, the Group incurred approximately US$981,000 of

Listing Expenses. The Group’s Listing Expenses in the year ended December 31, 2023 mainly arose from the accounting treatment

of its share based consideration for the Business Combination and the revaluation of the Forward Purchase Agreement

“FPA”. In the previous financial year, the Listing Expenses were mainly professional fees incurred for the Business

Combination.

The

other major contributor to the net loss were expenses incurred in connection with the depreciation of property, plant and equipment,

the purchase of raw materials, employee benefits expenses and its other operating expenses. The Group may continue to incur losses for

the foreseeable future as it continues its research and development activities, pursues potential mergers and acquisitions, seeks product

certification approvals in the territories it has identified, hires additional personnel, obtains and protects its intellectual property

and incurs additional costs for commercialization or to expand its pipeline of waste materials it collects and the circular products

it generates from the recycled waste collected from its customers with respect to its waste collection and disposal services.

To

become and remain profitable, the Group must increase its operating capacity to treat higher volumes of wastes and succeed in developing

and eventually commercializing circular products that can generate sufficient revenue. In that regard, the Group has commenced sales

of Fluorspar and Kao Lin, materials generated from the wastes the Group collected.

In

addition, the Group has not yet demonstrated an ability to successfully overcome many of the risks and uncertainties frequently encountered

by companies in new and rapidly evolving fields, particularly in the environmental services industry. Because of these numerous risks

and uncertainties, the Group is unable to accurately predict the timing or amount of increased expenses or when, or if, it will be able

to achieve profitability. Even if the Group achieves profitability, it may not be able to sustain or increase profitability on a quarterly

or annual basis. Its failure to become and remain profitable would depress the value of the Company and could impair the ability of the

Company to raise capital, expand its business, maintain its research and development efforts, diversify its products, or even continue

its operations. A decline in the value of the Company could also cause you to lose all or part of your investment.

The

environmental services industry is highly competitive and includes competitors that may have greater financial and operational resources,

flexibility to reduce prices or other competitive advantages that could make it difficult for the Group to compete effectively.

The

Group principally competes with waste management companies who collect and dispose the waste the Group needs for its waste management

and treatment processes. Competition for waste collection is typically based on factors such as geographic location, quality of services,

ease of doing business and/or price. the Group ‘s competitors may have greater financial and operational resources than we do.

They could also seek to gain market share by reducing the prices they charge customers, introducing products and solutions that are similar

to the Group’s or introducing new technology tools. If the Group were to lose market share or if it were to lower prices to address

competitive issues, it could negatively impact the Group’s consolidated financial condition, results of operations and cash flows.

The

Group requires a significant amount of capital to fund its operations and growth. If the Group cannot obtain sufficient capital on acceptable

terms, its business, financial condition, and prospects may be materially and adversely affected.

The

Group requires a significant amount of capital and resources for its operations and continued growth. The Group expects to make significant

investments to develop new operating capabilities and technology, which are fundamental to the Group’s business operations and

future growth. However, the Group cannot assure you that these investments will generate the optimal returns, if at all. To date, the

Group has historically funded its cash requirements primarily through the issuance of ordinary shares, cash generated by operations and

borrowings from banks. If these resources are insufficient to satisfy the Group’s cash requirements, the Group may seek to raise

funds through additional equity offering or debt financing or additional bank facilities. The Group’s ability to obtain additional

capital in the future, however, is subject to a number of uncertainties, including those relating to its future business development,

financial condition, and results of operations, general market conditions for financing activities by companies in its industry, and

macro-economic and other conditions. If the Group cannot obtain sufficient capital on acceptable terms to meet its capital needs, the

Group may not be able to execute its growth strategies, and the Group’s business, financial condition, and prospects may be materially

and adversely affected.

The

Group did not meet its original revenue projection for the fiscal year ended 2023.

The

projected revenues of the Group for fiscal year 2023 was $11.0 million. The revenues of the Group for the fiscal year ended 2023 was approximately

US$6.2 million. The Group did not meet its original 2023 revenue projection mainly due to a combination of several factors. Firstly,

the merger with Genesis Unicorn Capital Corp, expected to strengthen the Group’s financial standing, resulted in lower-than-expected

proceeds due to unprecedented high redemptions. This unexpected outcome had a notable impact on the Group’s revenue trajectory.

Secondly, the Group faced challenges in meeting its funding requirement to enhance technologies and capacity, essential for effectively

serving market needs. This limitation hindered the Group’s ability to capitalize on growth and innovation opportunities, consequently

affecting revenue generation. Furthermore, geopolitical tensions and market volatility presented additional obstacles to revenue generation

efforts. Lower manufacturing activity, potentially influenced by these external factors, led to reduced waste from customers, impacting

revenue streams. Lastly, unexpected waste management regulatory changes in Singapore posed operational challenges, particularly in the

final quarter of the financial year. Adapting to these regulatory shifts proved to be a complex task, affecting operational efficiency.

Therefore, there can be no assurance that the Group’s actual financial results would meet the financial projections and there is

a significant likelihood that the Group’s actual financial results over the time periods and under the scenarios covered by the

projections would be materially different. At this time, the Group’s management estimates that the impact of the lack of funds

for capital investments may continue in the near future and therefore, the Group may not be able to meet its original revenue projections

for 2024, 2025 and/or 2026. The Group has not updated its projections due to uncertainties surrounding recent developments, their future

outcomes, and their impact on the Group’s projections.

Fluctuations

in prices for recyclable waste materials the Group collects from its customers and the circular products that it sells to local and international

end users, traders or overseas refiners may adversely affect the Group’s revenue, operating income, and cash flows.

The

Group collects a variety of recyclable waste materials from its customers and processes and transforms them into circular products for

sale to local and international end users, traders or overseas refiners, and the Group may directly or indirectly receive proceeds from

its waste collection services and the sale of circular products. The Group’s results of operations may be affected

by changing prices or market requirements for the recyclable waste materials and the circular products. The resale and purchase prices

of, and market demand for, the circular products can be volatile because of changes in economic conditions and numerous other factors

beyond the Group’s control. These fluctuations may affect the cost of and demand for the Group’s services and the Group’s

future revenue, operating income, and cash flows. For example, a decline in oil prices would have an adverse effect on the Company’s

revenue.

The

Group is also exposed to inflationary pressures and rising interest rates which may adversely affect the selling price of its circular

products. If this causes purchasing demand from the Group’s customers for its circular products to reduce, the selling price of

certain of the Group’s circular products such as copper and zinc could drop and reduce its revenue. Inflation has also resulted

in higher costs for the maintenance of the Group’s equipment, higher electricity and fuel costs and freight and payroll costs,

which had an adverse impact on the Group’s operating profit and operating profit margin. Moreover, certain suppliers who are affected

by supply chain inflationary pressures may decide to reduce their production and as a result the volume of industrial waste that is generated

and supplied to the Group may be reduced. Similarly, following the general decline in the spending power of consumers, the Group’s

waste disposal customers which are mainly semi-conductor companies with products that are used in mobile devices to cars may also decide

to reduce their production which in turn would lead to lower volumes of waste being disposed to the Group. Although increasing the selling

price of the Group’s circular products could mitigate the impact of inflation, competitive pressures may constrain the Group’s

ability to fully recover any increased costs in this way. In addition, efforts to mitigate the effect of inflation through continuous

investments in waste treatment processes and software developments to automate, streamline and improve the productivity of the Group’s

business operations may not be sufficient.

The

Group may not be able to enhance its existing recycling, reuse, disposal and waste treatment solutions and develop new solutions in a

timely manner.

The

Group’s future operating results will depend, to a significant extent, on its ability to continue to provide efficient and innovative

recycling, reuse, disposal and waste treatment services that compare favorably with alternative services on the basis of cost, performance,

and customer preferences. The Group’s success in maintaining and growing with its existing customers and attracting new customers

depends on various factors, including the following:

| |

● |

innovative

development of new services for customers; |

| |

|

|

| |

● |

maintenance

of quality standards; |

| |

|

|

| |

● |

efficient

and cost-effective services; and |

| |

|

|

| |

● |

utilization

of advances in technology. |

The

Group’s inability to enhance its existing services and develop new services on a timely basis could harm its operating results

and impede its growth.

The

Group’s revenues, earnings and cash flows will fluctuate based on changes in commodity prices, and commodity prices for circular

products are particularly susceptible to volatility based on regulations and tariffs that affect its ability to export products.

Enforcement

or implementation of foreign and domestic regulations can affect the Group’s ability to export its circular products. In 2017,

the Chinese government announced bans on certain scrap materials and begun to enforce extremely restrictive quality and other requirements,

which significantly reduced China’s import of recyclables. As of January 1, 2021, China ceased importing virtually all recyclables,

including those exported by the Group. Many other markets, both domestic and foreign, have also tightened their quality expectations

and limited or restricted the import of certain circular products.

Such

trade restrictions have disrupted the global trade of recyclables, creating excess supply and decreasing recyclable commodity prices.

The Group has been actively working to identify alternative markets for recycling commodities, but there may not be demand for all of

the circular products it produces. The heightened quality requirements have been difficult for the industry to achieve and have driven

up operating costs. As prices of circular products have fallen and operating costs have increased, the Group and other recyclers are

passing cost increases through to waste collection customers.

Fluctuation

in energy prices also affects the Group’s business, including recycling of plastics manufactured from petroleum products. Significant

variations in the price of methane gas, electricity and other energy- related products can result in a corresponding significant impact

to the Group’s revenue from yield from such operations. Any of the commodity prices to which the Group is subject may fluctuate

substantially and without notice in the future.

Acute

and chronic weather events, including those brought about by climate change, may limit the Group’s operations and increase the

costs of collection, transfer, disposal, and other environmental services it provides.

The

Group’s operations could be adversely impacted by extreme weather events, changing weather patterns, and rising mean temperature

and sea levels, some of which the Group is already experiencing. The Intergovernmental Panel on Climate Change (“IPCC”),

which includes more than 1,300 scientists from the United States and other countries, forecasts a temperature rise of 2.5° to 10°

Fahrenheit over the next century. Changing weather patterns and rising temperatures are expected to result in more severe

heat waves, fires, storms, and other extreme weather events. Any of these extreme weather events such as flash flooding in Singapore

could significantly decrease the volume of waste material the Group collects from its waste disposal customers and suppliers of industrial

waste as they may be required to temporarily cease or suspend their business activities, thereby reducing the volume of waste they generate.

Other than the Group’s customers and suppliers, such adverse weather conditions may also result in the temporary suspension of

the Group’s business operations, ability to utilize the Group’s normal commercial channels and supply chain, and the incursion

of significant costs to repair its fixtures, equipment and property, all of which could significantly affect the Company’s operating

results during those periods.

The

Group’s businesses are subject to operational and safety risks.

Providing

waste management, treatment and recycling services to the Group’s customers involves risks such as equipment defects, malfunctions

and failures and natural disasters, which could potentially result in releases of hazardous materials, damage to or total loss of the

Group’s property or assets, injury or death of the Group’s employees or a need to shut down or reduce operations of the Group’s

facilities while remedial actions are undertaken. The Group’s employees and logistics providers, when necessary, often work under

potentially hazardous conditions. These risks expose the Group to potential liability for pollution and other environmental damages,

personal injury, loss of life, business interruption and property damage or destruction. The Group must also maintain a solid safety

record in order to remain a preferred supplier to its major customers. While the Group seeks to minimize its exposure to such risks primarily

through entering and maintaining various insurance policies in relation to the business, operations, employees and assets of ESA, such

actions and insurance may not be adequate to cover all of the Group’s potential liabilities which could negatively impact its results

of operations and cash flows.

The

Group’s insurance coverage and self-insurance reserves may be inadequate to cover all significant risk exposures, and increasing

costs to maintain adequate coverage may significantly impact the Group’s financial condition and results of operations.

The

Group carries a range of insurance policies intended to protect its assets and operations, including general liability insurance, property

damage, business interruption and environmental risk insurance. While the Group endeavors to purchase insurance coverage appropriate

to its risk assessment, it is unable to predict with certainty the frequency, nature or magnitude of claims for direct or consequential

damages, and as a result the Group’s insurance program may not fully cover itself for losses it may incur.

As

a result of a number of catastrophic weather and other events, insurance companies have incurred substantial losses and in many cases

they have substantially reduced the nature and amount of insurance coverage available to the market, have broadened exclusions and/or

have substantially increased the cost of such coverage. If this trend continues, the Group may not be able to maintain insurance of the

types and coverage it desires at reasonable rates. A partially or completely uninsured claim against the Group (including liabilities

associated with cleanup or remediation), if successful and of sufficient magnitude, could have a material adverse effect on the Group’s

business, financial condition and results of operations. Any future difficulty in obtaining insurance could also impair the Group’s

ability to secure future contracts, which may be conditional upon the availability of adequate insurance coverage. In addition, claims

associated with risks for which the Group is to some extent self-insured (property, workers’ compensation, employee medical, comprehensive

general liability and vehicle liability) may exceed the Group’s recorded reserves, which could negatively impact future earnings.

The

Group may have environmental liabilities that are not covered by its insurance. Changes in insurance markets also may impact its financial

results.

The

Group may incur environmental liabilities arising from its operations or properties. The Group maintains high deductibles for its environmental

liability insurance coverage. If the Group was to incur substantial liability for environmental damage, its insurance coverage may be

inadequate to cover such liability. This could have a material adverse effect on the Group’s consolidated financial condition,

results of operations and cash flows.

Also,

due to the variable condition of the insurance market, the Group has experienced, and may experience in the future, increased insurance

retention levels and increased premiums or unavailability of insurance. As the Group assumes more risk for insurance through higher retention

levels, the Group may experience more variability in its insurance reserves and expense.

The

Group depends on key personnel who would be difficult to replace, and its business will likely be harmed if it loses their services or

cannot hire additional qualified personnel.

The

Group’s success depends, to a significant extent, upon the continued services of its current management team and key personnel.

The loss of one or more of its key executives or employees could have a material adverse effect on its business. The Group does not maintain

“key person” insurance policies on the lives of any of its executives or any of its other employees. The Group employs all

of its executives and key employees on an at-will basis, and their employment can be terminated by the Group or them at any time, for

any reason, and without notice, subject, in certain cases, to severance payment rights.

The

Group’s success also depends on its ability to attract, retain, and motivate additional skilled management personnel. The Group

plans to continue to expand its work force to continue to enhance its business and operating results. The Group believes that there is

significant competition for qualified personnel with the skills and knowledge that it requires. Many of the other companies with which

the Group competes for qualified personnel have substantially greater financial and other resources than the Group does. They also may

provide more diverse opportunities and better chances for career advancement. Some of these characteristics may be more appealing to

high-quality candidates than those which the Group has to offer. If the Group is not able to retain its current key personnel or attract

the necessary qualified key personnel to accomplish its business objectives, it may experience constraints that will significantly impede

the achievement of its business objectives and its ability to pursue its business strategy. New hires require significant training and,

in most cases, take significant time before they achieve full productivity. New employees may not become as productive as the Group expects,

and the Group may be unable to hire or retain sufficient numbers of qualified individuals. If the Group’s recruiting, training,

and retention efforts are not successful or do not generate a corresponding increase in revenue, the Group’s business will be harmed.

General

economic conditions can directly and adversely affect revenues for environmental services and the Group’s income from operations

margins.

The

Group’s business is directly affected by changes in national and general economic factors that are outside of the Group’s

control, including consumer confidence, interest rates and access to global markets. A weak economy generally results in decreases in

volumes of waste generated, which negatively impacts the ability to grow through new business or service upgrades, and may result in

customer turnover and reduction in the waste service needs of the Group’s customers and the demand for circular products from end

users, traders or overseas refiners. Consumer uncertainty and the loss of consumer confidence may also reduce the number and variety

of services and/or circular products requested by customers. This decrease in demand can negatively impact commodity prices and the Group’s

operating income and cash flows.

The

Group could become involved in litigation matters that may be expensive and time consuming, and, if resolved adversely, could harm its

business, financial condition, or results of operations.

Although

the Group is not currently involved in any litigation matters, any such litigation to which it is a party may result in an onerous or

unfavorable judgment that may not be reversed upon appeal, or the Group may decide to settle lawsuits on similarly unfavorable terms.

Any negative outcome could result in payments of substantial monetary damages or fines, or changes to the Group’s products or business

practices, and accordingly the Group’s business, financial condition, or results of operations could be materially and adversely

affected.

The

Group could be required to make immediate repayment of certain of its outstanding debt with financial institutions.

As

of December 31, 2023, the Group has certain borrowings with outstanding balances of approximately US$5.7 million classified as

current liabilities, as the relevant loan agreements the Group entered into with the lenders provide them discretion to demand

immediate repayment of the outstanding balances from us. In addition, as of the date of this annual report, the Group had obtained

waivers from the relevant lenders in relation to certain terms and conditions under the relevant loan agreements in connection with

the closing of the Business Combination, except for Term Loan IV with an outstanding balance of approximately S$499,000 (US$378,000)

as of December 31, 2023 from the relevant bank (the “Relevant Bank”). On July 20, 2022, the Group had obtained a written

consent from the Relevant Bank for, among other things, the undertaking of a proposed restructuring of the Group. Subsequently on

January 17, 2023, the Group had requested a waiver from the Relevant Bank for the closing of the Business Combination. As of the

date of this annual report, the Group had not obtained the waiver or any notice from the Relevant Bank objecting, disagreeing to the

matter or demanding any immediate repayment of Term Loan IV in connection with the closing of the Business Combination.

Notwithstanding

the above, the lenders could demand immediate repayment of the outstanding balances from the Group for the borrowings classified as current

liabilities and it may be unable to repay, negotiate, extend or refinance the bank borrowings on favorable terms or at all, which may

have a material adverse effect on its business, results of operations and financial position. If the Group fails to repay certain of

the bank borrowings, some lenders could enforce their security interests under the relevant loan agreements and take possession of the

Group’s leasehold land and buildings where it operates its business, thereby resulting in a material adverse effect on the Group’s

business, results of operations and financial condition. See Note 17 to the Group’s financial statements for further information

on the Group’s outstanding debt with financial institutions.

The

Group’s strategy includes an increasing dependence on technology in its operations. If any of its key technology fails, its business

could be adversely affected.

The

Group’s operations are increasingly dependent on technology. The Group’s information technology systems are critical to its

ability to drive profitable growth, implement standardized processes and deliver a consistent customer experience. Problems with the

operation of the information or communication technology systems it uses could adversely affect, or temporarily disable, all or a portion

of the Group’s operations. Inabilities and delays in implementing new systems can also affect its ability to realize projected

or expected revenue or cost savings. Further, any systems failures could impede its ability to timely collect and report financial results

in accordance with applicable laws.

Emerging

technologies represent risks, as well as opportunities, to the Group’s current business model. The costs associated with developing

or investing in emerging technologies could require substantial capital and adversely affect the Group’s results of operations

and cash flows. Delays in the development or implementation of such emerging technologies and difficulties in marketing new products

or services based on emerging technologies could have similar negative impacts. The Group’s financial results may suffer if it

is not able to develop or license emerging technologies, or if a competitor obtains exclusive rights to an emerging technology that disrupts

the current methods used in the environmental services industry.

A

cyber security incident could negatively impact the Group’s business and its relationships with customers.

The

Group uses information technology, including computer and information networks, in substantially all aspects of its business operations.

The Group also use mobile devices, social networking and other online activities to connect with its employees and its customers. Such

uses give rise to cyber security risks, including security breach, espionage, system disruption, theft and inadvertent release of information.

The Group’s business involves the storage and transmission of numerous classes of sensitive and/or confidential information and

intellectual property, including customers’ personal information, private information about employees, and financial and strategic

information about the Group and its business partners. In connection with its strategy to grow through acquisitions and to pursue new