UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For

the fiscal year ended

OR

OR

Date of event requiring this shell company report:

For the transition period from _________ to _____________.

Commission

file number:

(Exact name of Registrant as Specified in its Charter)

(Translation of Registrant’s name into English)

(Jurisdiction of Incorporation or Organization)

Shandong,

CN-37

People’s

Republic of

(Address of Principal Executive Offices)

Tel:

Shandong,

CN-37

People’s

Republic of

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: ordinary shares, par value $0.0001 per share issued and outstanding as of December 31, 2023.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☒ | Emerging growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ☒

|

☐ International Financial Reporting Standards as issued | ☐ Other |

| by the International Accounting Standards Board |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ☐ Item 18 ☐

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ☐ No

CHIJET MOTOR COMPANY, INC.

ANNUAL REPORT ON FORM 20-F

TABLE OF CONTENTS

| i |

CERTAIN TERMS AND CONVENSIONS

Unless otherwise indicated, in this annual report, the following terms shall have the meaning set out below:

“Business Combination” means the transactions contemplated by the Business Combination Agreement whereby, among other things, (a) Chijet Motor will acquire all of the issued and outstanding capital shares of Chijet held by the Sellers in exchange for Chijet Motor Ordinary Shares, and any shares Chijet holds in Chijet Motor shall be surrendered for no consideration, such that Chijet becomes a wholly-owned subsidiary of Chijet Motor and the Sellers become shareholders of Chijet Motor (referred to as the Share Exchange); and immediately thereafter (b) Merger Sub will merge with and into JWAC, with JWAC continuing as the surviving entity and wholly-owned subsidiary of Chijet Motor.

“Business Combination Agreement” or “BCA” means the Business Combination Agreement, dated as of October 25, 2022, by and among (i) JWAC, (ii) Chijet Motor, (iii) Merger Sub, (iv) Chijet Inc., (v) the Sellers and (vi) the Seller Representative.

“Charter” means the Amended and Restated Memorandum and Articles of Association of Chijet Motor, a copy of which is attached to this annual report as an exhibit.

“Chijet” means Chijet Inc., a Cayman Islands exempted company and its consolidated subsidiaries, prior to the consummation of the Business Combination and to Chijet Motor Company, Inc., or Chijet Motor, and its consolidated subsidiaries following the Business Combination, as the context requires.

“Chijet Holders” or “Sellers” means collectively, the holders of Chijet Ordinary Shares.

“Chijet Motor” means Chijet Motor Company, Inc., a Cayman Islands exempted company, and newly formed corporation in connection with the Business Combination, and upon consummation of the Business Combination each of JWAC and Chijet will be direct, wholly-owned subsidiaries of Chijet Motor.

“Chijet Motor Ordinary Shares” or “Ordinary Shares” means ordinary shares, par value $0.0001 per share, of Chijet Motor.

“Chijet Motor Preferred Shares” means preferred shares, par value $0.0001 per share, of Chijet Motor.

“Chijet Ordinary Shares” means the ordinary shares of Chijet Inc.

“China” or “PRC” refer to the People’s Republic of China, excluding, for the purpose of this annual report only, Taiwan, Hong Kong and Macau.

“Closing” means the closing of the Business Combination.

“Closing Date” means June 1, 2023.

“Code” means the Internal Revenue Code of 1986, as amended.

| “CSRC” refers to the China Securities Regulatory Commission. |

“Dollars” means U.S. Dollars.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“FINRA” refers to the Financial Industry Regulatory Authority, Inc.

“GT Warrant” means the warrant issued on February 15, 2022 to Greentree Financial Group Inc. by Shandong Baoya, for services rendered, to purchase 5,000,000 shares of Shandong Baoya’s common stock, exercisable at $2.00 per share for five years. GT Warrant will be replaced with an equivalent warrant exercisable into Chijet Motor Ordinary Shares pursuant to the GT Warrant Agreement.

| ii |

“GT Warrant Agreement” means that certain warrant agreement by and among Greentree Financial Group Inc. and Shandong Baoya and dated February 15, 2022.

“I-Bankers” means I-Bankers Securities, Inc., the representative of the underwriters in the JWAC IPO.

“JOBS Act” refers to the Jumpstart Our Business Startups Act, enacted in April 2012.

“JWAC” means Jupiter Wellness Acquisition Corp., a Delaware corporation.

“JWAC Certificate of Incorporation” means JWAC’s amended and restated certificate of incorporation, as may be amended from time to time.

“JWAC Common Stock” means the Class A common stock, par value $0.0001 per share, of JWAC.

“JWAC IPO” means JWAC’s initial public offering.

“JWAC Preferred Stock” means the shares of preferred stock, par value $0.0001 per share, of JWAC.

“JWAC representative warrants” or “Representative Warrant” means the warrants we issued to I-Bankers as Representative in connection with the JWAC IPO as representative of the underwriters, consisting in aggregate of Representative Warrants to purchase 414,000 shares of JWAC Common Stock, exercisable at $12.00 per share for five years after the first anniversary of the effective date of this registration statement. They are exercisable on a cash-less basis at the option of their holder or holders. The representative warrants are exercisable upon the Closing and terminate on December 9, 2026.

“JWAC representative shares” means the shares we issued to I-Bankers in connection with JWAC IPO as representative of the underwriters consisting of 276,000 shares of JWAC Common Stock following the exercise of the Representative’s overallotment option.

“JWAC Sponsor” or “Sponsor” means Jupiter Wellness Sponsor LLC, a Delaware limited liability company.

“Merger Sub” means Chijet Motor (USA) Company, Inc., a Delaware corporation and a wholly-owned subsidiary of Chijet Motor prior to the Closing of the Business Combination. Merger Sub is survived by JWAC as the surviving entity and wholly-owned subsidiary of Chijet Motor after the Business Combination.

“PCAOB” refers to the Public Company Accounting Oversight Board of the United States

“PFIC” refers to a passive foreign investment company

“Representative” means to I-Bankers Securities, Inc. as the representative of the several underwriters of JWAC in connection with the JWAC IPO.

“rights agent” means American Stock Transfer & Trust Company, the rights agent designed under the Rights Agreement.

“RMB” or “Renminbi” refer to the legal currency of the People’s Republic of China.

“SAFE” refers to China’s State Administration of Foreign Exchange.

“SAT” refers to China’s State Administration of Taxation.

“SEC” refers to the United States Securities and Exchange Commission.

“Securities Act” refers to the Securities Act of 1933, as amended.

“Sellers” means the Chijet Holders, which are described as Sellers in the Business Combination Agreement.

“Shandong Baoya” means Shandong Baoya New Energy Vehicle Co., Ltd., a PRC company.

“Share Exchange” means the transactions contemplated by the Business Combination Agreement whereby Chijet Motor will acquire all of the issued and outstanding capital shares of Chijet held by the Sellers in exchange for Chijet Motor Ordinary Shares, and any shares Chijet holds in Chijet Motor shall be surrendered for no consideration, such that Chijet becomes a wholly-owned subsidiary of Chijet Motor and the Sellers become shareholders of Chijet Motor.

“U.S. dollar,” “USD,” “US$” and “$” mean the legal currency of the United States.

“U.S. GAAP” means generally accepted accounting principles in the United States.

“U.S.” means the United States of America.

| iii |

Our reporting currency is the US$. The functional currency of our entities is RMB. Solely for the convenience of the reader, this annual report contains translations of some RMB amounts into U.S. dollars, at specified rates. The conversion of RMB into U.S. dollars in this annual report is based on the exchange rate set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System. Unless otherwise noted, all translations from RMB to U.S. dollars and from U.S. dollars to RMB in this annual report are made at the rate of RMB 7.0999 to US$1.00, the rate in effect as of December 31, 2023. We make no representation that any RMB or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or RMB, as the case may be, at any particular rate, or at all. The PRC government imposes control over its foreign currency reserves in part through direct regulation of the conversion of RMB into foreign exchange.

Our fiscal year end is December 31. References to a particular “fiscal year” are to our fiscal year ended December 31 of that calendar year. Our audited consolidated financial statements have been prepared in accordance with the generally accepted accounting principles in the United States (the “U.S. GAAP”).

We obtained the industry, market and competitive position data in this annual report from our own internal estimates, surveys, and research as well as from publicly available information, industry and general publications and research, surveys and studies conducted by third parties. None of the independent industry publications used in this annual report were prepared on our behalf. Industry publications, research, surveys, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this annual report, and to risks due to a variety of factors, including those described under “Item 3. Key Information - D. Risk Factors.” These and other factors could cause results to differ materially from those expressed in these forecasts and other forward-looking information.

We have proprietary rights to trademarks used in this annual report that are important to our business, many of which are registered under applicable intellectual property laws. Solely for convenience, the trademarks, service marks and trade names referred to in this annual report are without the ®, ™ and other similar symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

This annual report contains additional trademarks, service marks and trade names of others. All trademarks, service marks and trade names appearing in this annual report are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other person.

When used herein, the references to laws and regulations of “China” or the “PRC” are only to such laws and regulations of mainland China, excluding, for the purpose of this annual report only, Taiwan, Hong Kong and Macau.

| iv |

FORWARD-LOOKING STATEMENTS

This annual report contains “forward-looking statements” for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 that represent our beliefs, projections and predictions about future events. You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

| ● | changes in applicable laws or regulations; | |

| ● | the actual performance of our technology in full-scale operation at customer locations; | |

| ● | the timing of revenue and expenditures; | |

| ● | the ability of ours to access sufficient capital to run its business; | |

| ● | assumptions regarding, and changes in, energy, material and labor prices; | |

| ● | the possibility that we might be adversely affected by other economic, business or competitive factors; | |

| ● | the future financial and business performance of us and our subsidiaries; | |

| ● | the performance of our technology in full-scale operations at customer locations; | |

| ● | the potential market size and the assumptions and estimates related thereto; | |

| ● | changes in the market for our products and services; | |

| ● | the outcome of any legal proceedings that might be instituted against us; | |

| ● | expansion and other plans and opportunities; | |

| ● | other statements preceded by, followed by or that include the words “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek” or “target,” or similar expressions; and

| |

| ● | other factors in the “Item 3. Key Information - D. Risk Factors” section in this annual report. |

These forward-looking statements are subject to various and significant risks and uncertainties, including those which are beyond our control. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should thoroughly read this annual report and the documents that we refer to herein with the understanding that our actual future results may be materially different from and worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements. We disclaim any obligation to update our forward-looking statements, except as required by law.

This annual report contains certain data and information that we obtained from various Chinese government and private publications. Statistical data in these publications also include projections based on a number of assumptions.

In addition, the new and rapidly changing nature of the display panel industry results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our industry. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

| v |

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

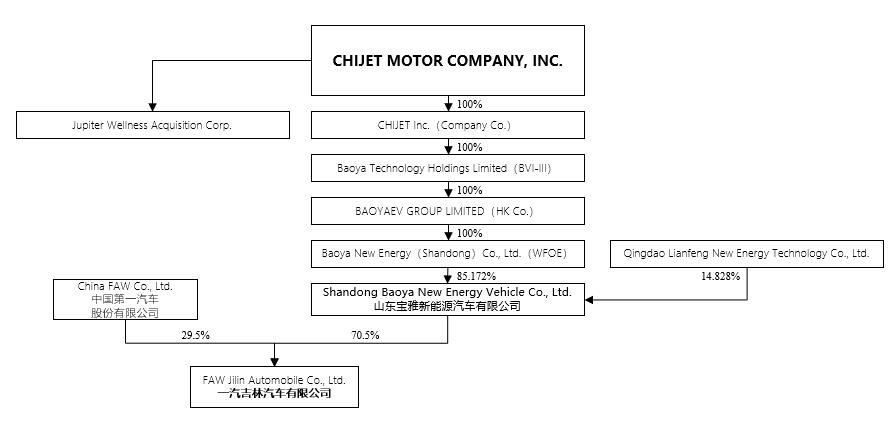

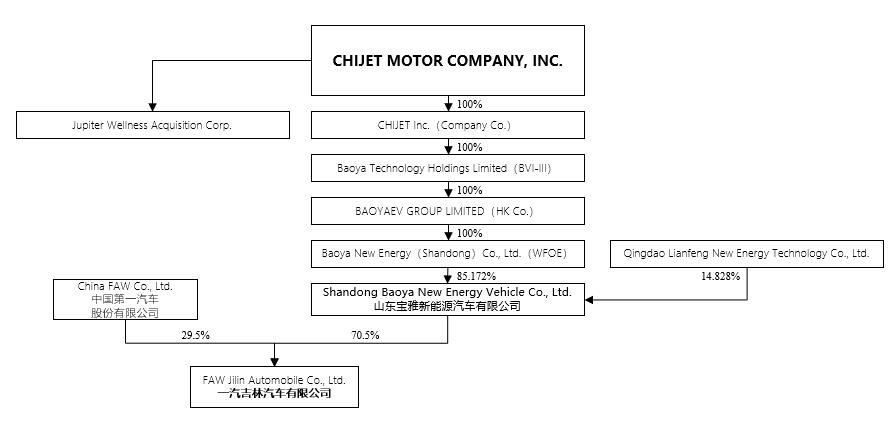

Our Holding Company Structure

Neither Chijet Inc. nor Chijet Motor is an operating company but a Cayman Islands holding company with operations primarily conducted by its subsidiaries based in China. We and our subsidiaries are subject to complex and evolving PRC laws and regulations and face various legal and operational risks and uncertainties relating to doing business in China. For example, we and our subsidiaries in the PRC face risks associated with regulatory approvals on offshore offerings, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy, as well as the lack of inspection on our auditors by the PCAOB, which may impact our ability to conduct certain businesses, accept foreign investments, or list and conduct offerings on a United States or other foreign exchange. These risks could result in a material adverse change in our operations and the value of our ordinary shares, significantly limit or completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline. For a detailed description of risk related to doing business in China, please refer to risks disclosed under “Item 3. Key Information-D. Risk Factors-Risks Related to Doing Business in China.”

PRC government’s significant authority in regulating our operations and its oversight and control over offerings conducted overseas by, and foreign investment in, China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. Implementation of industry-wide regulations, including data security or anti-monopoly related regulations, in this nature may cause the value of such securities to significantly decline. For more details, see “Item 3. Key Information-D. Risk Factors-Risks Related to Doing Business in China- The Chinese government may intervene in or influence our operations in China at any time, which could result in a material change in our operations and ability to produce vehicles.”

Risks arising from the legal system in China, including risks and changes regarding the enforcement of laws and quickly evolving rules and regulations in China, could result in a material adverse change in our operations and the value of our ordinary shares. For more details, see “Item 3. Key Information-D. Risk Factors-Risks Related to Doing Business in China- Changes in Chinese policies, regulations, and rules may be quick with little advance notice, and the enforcement of laws of the Chinese government is subject to change and could have a significant impact upon our ability to operate profitably.”

Permissions Required from the PRC Authorities for Our Operations

Our operations in China are governed by PRC laws and regulations. As of the date of this annual report, our PRC subsidiaries have obtained the requisite licenses and permits from the PRC government authorities that are material for the business operations of our holding company and our subsidiaries in China. Given the interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities are subject to change, we may be required to obtain additional licenses, permits, filings or approvals for the operations of our businesses in the future. For more detailed information, see “Item 3. Key Information-D. Risk Factors-Risk related to Our Business and Industry- Permissions required for our business from PRC Authorities which have been received to date, but there can be no assurance of future events relating to such permissions.”

The PRC governmental authorities have promulgated PRC laws and regulations relating to cybersecurity review and overseas listings. Under PRC laws and regulations effective as of the date of this annual report, none of us or our PRC subsidiaries (i) is required to obtain any prior permission from the China Securities Regulatory Commission, or the CSRC, (ii) is required to go through a cybersecurity review conducted by the Cyberspace Administration of China, or the CAC, or (iii) has received any notice from any PRC authority requiring us to obtain any prior permissions, in each case in connection with our previous issuance of securities to foreign investors. However, in certain circumstances, the relevant PRC governmental authorities may perform cybersecurity review on us. For more detailed information, see “Item 3. Key Information-D. Risk Factors-Risks Related to Doing Business in China -There may be changes from time to time in the interpretation and enforcement of PRC laws and regulations and changes in policies, rules, and regulations in China, which may be quick with little advance notice, could limit the legal protections available to you and us.”

Meanwhile, the PRC government has recently indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers. For more detailed information, see “Item 3. Key Information-D. Risk Factors-Risks Related to Doing Business in China- The CSRC has recently released the Trial Measures for China-based companies seeking to conduct overseas offering and listing in foreign markets. Actions by the PRC government to exert more oversight and control over offerings that are conducted overseas and foreign investment in China-based issuers may significantly limit or completely hinder our ability to offer or continue to offer our Ordinary Shares to investors and could cause the value of our Ordinary Shares to significantly decline or such shares to become worthless.”

The Holding Foreign Companies Accountable Act

The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020. The HFCA Act states that if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC will prohibit our ordinary shares from being traded on a national securities exchange or in the over-the-counter trading market in the United States.

On December 2, 2021, the SEC adopted final amendments to its rules implementing the HFCA Act. Such final rules establish procedures that the SEC will follow in (i) determining whether a registrant is a “Commission-Identified Issuer” (a registrant identified by the SEC as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in that jurisdiction) and (ii) prohibiting the trading of an issuer that is a Commission-Identified Issuer for three consecutive years under the HFCA Act. The SEC began identifying Commission-Identified Issuers for the fiscal years beginning after December 18, 2020. A Commission-Identified Issuer is required to comply with the submission and disclosure requirements in the annual report for each year in which it was identified.

As of the date of this annual report, we have not been, and do not expect to be identified by the SEC under the HFCA Act. However, whether the PCAOB will continue to conduct inspections and investigations completely to its satisfaction of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s control including positions taken by authorities of the PRC.

| 1 |

On December 16, 2021, the PCAOB issued its determination that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, because of positions taken by PRC authorities in those jurisdictions, and the PCAOB included in the report of its determination a list of the accounting firms that are headquartered in the PRC or Hong Kong. This list does not include our auditor, Assentsure PAC.

On August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “Statement of Protocol”) with the CSRC and the Ministry of Finance of China (“MOF”). The terms of the Statement of Protocol would grant the PCAOB complete access to audit work papers and other information so that it may inspect and investigate PCAOB-registered accounting firms headquartered in mainland China and Hong Kong.

On December 15, 2022, the PCAOB announced that it has secured complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate the previous 2021 determination report to the contrary. On December 29, 2022, a legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden. The Consolidated Appropriations Act contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act, which reduces the number of consecutive non-inspection years required for triggering the prohibitions under the Holding Foreign Companies Accountable Act from three years to two. As a result of the Consolidated Appropriations Act, the HFCA Act now also applies if the PCAOB’s inability to inspect or investigate the relevant accounting firm is due to a position taken by an authority in any foreign jurisdiction. The denying jurisdiction does not need to be where the accounting firm is located. Our current auditor, Assentsure PAC, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. Notwithstanding the foregoing, in the future, if there is any regulatory change or step taken by PRC regulators that does not permit our auditor to provide audit documentations located in China to the PCAOB for inspection or investigation, investors may be deprived of the benefits of such inspection. Any audit reports not issued by auditors that are completely inspected by the PCAOB, or a lack of PCAOB inspections of audit work undertaken in China that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control procedures, could result in a lack of assurance that our financial statements and disclosures are adequate and accurate, then such lack of inspection could cause our securities to be delisted from the stock exchange. See “Item 3. Key Information-D. Risk Factors-Risks Related to Doing Business in China - The Holding Foreign Companies Accountable Act (“HFCAA”), together with recent joint statement by the SEC and PCAOB, Nasdaq rule changes, a determination by the PCAOB that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments add uncertainties to our ability to be listed on U.S. stock exchanges.”

The PCAOB is required under the HFCA Act to make its determination on an annual basis with regards to its ability to inspect and investigate completely accounting firms based in the mainland China and Hong Kong, among other jurisdictions. The possibility of being a “Commission-Identified Issuer” and risk of delisting could continue to adversely affect the trading price of our securities. Should the PCAOB again encounter impediments to inspections and investigations in mainland China or Hong Kong as a result of positions taken by any authority in either jurisdiction, the PCAOB will make determinations under the HFCA Act as and when appropriate.

Cash and Asset Flows through Our Organization

Both Chijet Inc. and Chijet Motor are holding companies with no material operations of their own. We conduct a portion of our operations through our PRC subsidiaries. As a result, our ability to pay dividends depends significantly upon dividends paid by our PRC subsidiaries. If our existing PRC subsidiaries or any newly formed ones incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends to us. In addition, our wholly foreign-owned subsidiaries in China are permitted to pay dividends to us only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Under PRC law, each of our subsidiaries in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund certain statutory reserve funds until such reserve funds reach 50% of its registered capital. In addition, each of our subsidiaries in China may allocate a portion of its after-tax profits based on PRC accounting standards to enterprise expansion funds and staff bonus and welfare funds at its discretion. The statutory reserve funds and the discretionary funds are not distributable as cash dividends. Remittance of dividends by a wholly foreign-owned company out of China is subject to examination by the banks designated by SAFE. Our PRC subsidiaries have not paid dividends and will not be able to pay dividends until they generate accumulated profits and meet the requirements for statutory reserve funds. In the future we expect that our in-house vehicle manufacturing will be carried out primarily by Shandong Baoya and FAW Jilin. For more details, see “Item 5. Operating and Financial Review and Prospects-B. Liquidity and Capital Resources-Holding Company Structure.”

| 2 |

Under PRC laws and regulations, our PRC subsidiaries are subject to certain restrictions with respect to paying dividends or otherwise transferring any of their net assets to us. Remittance of dividends by a wholly foreign-owned enterprise out of China is also subject to examination by the banks designated by the State Administration of Foreign Exchange, or SAFE. The amounts restricted include the paid-up capital and the statutory reserve funds of our PRC subsidiaries, totaling $148,301 thousand, $170,956 thousand and $148,202 thousand as of December 31, 2023, 2022 and 2021, respectively.

Furthermore, cash transfers from our PRC subsidiaries to entities outside of China are subject to PRC government controls on currency conversion. To the extent cash in our business is in the PRC or a PRC entity, such cash may not be available to fund operations or for other use outside of the PRC due to restrictions and limitations imposed by the governmental authorities on the ability of us or our PRC subsidiaries to transfer cash outside of the PRC. Shortages in the availability of foreign currency may temporarily delay the ability of our PRC subsidiaries to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. In view of the foregoing, to the extent cash in our business is held in China or by a PRC entity, such cash may not be available to fund operations or for other use outside of the PRC. For risk related to the fund flows of our operations in China, see “Item 3. Key Information-D. Risk Factors-Risks Related to Doing Business in China- To the extent cash or assets in our business are in the PRC or Hong Kong or a PRC or Hong Kong entity, the funds or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of our company and our subsidiaries by the PRC government to transfer cash or assets, which may materially and adversely affect our business, financial condition and results of operations and may result in our inability to sustain our growth and expansion strategies” and “- PRC regulation on loans to, and direct investment in, our PRC subsidiary by offshore holding companies and governmental control in currency conversion may delay or prevent us from using the proceeds of the Business Combination to make loans to or make additional capital contributions to our PRC subsidiary, which could materially and adversely affect our liquidity and our ability to fund and expand our business.”

Under PRC law, we may provide funding to our PRC subsidiaries only through capital contributions or loans, subject to satisfaction of applicable government registration and approval requirements. For the fiscal years ended December 31, 2023, 2022, and 2021, we provided funding to our PRC subsidiaries of $7,150 thousand, nil and nil, respectively.

In addition, funds are transferred among our PRC subsidiaries for working capital purposes, primarily between Shandong Baoya, our main operating subsidiary and its subsidiaries. The following table provides a summary of the distributions and working capital funds transferred between Shandong Baoya and its subsidiaries:

| Fiscal

Years Ended December 31, | ||||||||||||

| In thousands USD $ | ||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Cash transferred to its subsidiaries from Shandong Baoya | $ | 3,917 | $ | 7,744 | $ | 3,484 | ||||||

| Cash transferred to Shandong Baoya from its subsidiaries | $ | 4,406 | $ | 9,612 | $ | 312 | ||||||

| 3 |

The transfer of funds among companies are subject to the Provisions of the Supreme People’s Court on Several Issues Concerning the Application of Law in the Trial of Private Lending Cases (2021 Revision, the “Provisions on Private Lending Cases”), which was implemented on January 1, 2021 to regulate the financing activities between natural persons, legal persons and unincorporated organizations. The Provisions on Private Lending Cases set forth that private lending contracts will be upheld as invalid under the circumstance that (i) the lender swindles loans from financial institutions for relending; (ii) the lender relends the funds obtained by means of a loan from another profit-making legal person, raising funds from its employees, illegally taking deposits from the public; (iii) the lender who has not obtained the lending qualification according to the law lends money to any unspecified object of the society for the purpose of making profits; (iv) the lender lends funds to a borrower when the lender knows or should have known that the borrower intended to use the borrowed funds for illegal or criminal purposes; (v) the lending is in violations of mandatory provisions of laws or administrative regulations or (vi) the lending is in violations of public orders or good morals. The aforementioned circumstances do not exist in our PRC subsidiaries’ operations. As advised by our PRC counsel, Han Kun Law Offices, the Provisions on Private Lending Cases does not prohibit using cash generated from one subsidiary to fund another subsidiary’s operations. We have not been notified of any other restriction which could limit our PRC subsidiaries’ ability to transfer cash between subsidiaries. See “Item 4. Information on the Company - B. Business Overview - Regulation - Regulations Relating to Private Lending.”

Our wholly owned subsidiary, Chijet Inc., has maintained cash management policies which dictate the purpose, amount and procedure of cash transfers between Chijet Inc. and its wholly-owned and holding subsidiaries. Cash transfers within Chijet Inc. and its subsidiaries are subject to approval thresholds: transfers below RMB 5 million (approximately US$780,000) require review by the initiating entity’s financial department, those between RMB 5 million and RMB 20 million (approximately US$3.12 million) mandate CEO and CFO approval, and transfers exceeding RMB 20 million (approximately US$3.12 million) require board approval. Matters not addressed by these regulations are governed by relevant laws and regulations.

3.A. [Reserved]

3.B. Capitalization and Indebtedness

Not Applicable.

3.C. Reasons for the Offer and Use of Proceeds

Not Applicable.

3.D. Risk Factors

Investing in our ordinary shares is highly speculative and involves a significant degree of risk. You should carefully consider the following risks as well as all other information contained in this annual report, including the matters discussed under the headings “Forward-Looking Statements” and “Item 5. Operating and Financial Review and Prospects” before you decide to make an investment in our ordinary shares. Chijet Motor is a holding company with substantial all of its operations in China and is subject to a legal and regulatory environment that in many respects differs from the United States. The risks discussed below could materially and adversely affect our business, prospects, financial condition, results of operations, cash flows, ability to pay dividends and the trading price of our ordinary shares. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, prospects, financial condition, results of operations, cash flows and ability to pay dividends, and you may lose all or part of your investment.

Such risks are not exhaustive. We may face additional risks that are presently unknown to us or that we believe to be immaterial as of the date of this annual report. Known and unknown risks and uncertainties may significantly impact and impair our business operations through our subsidiaries in China.

| 4 |

RISK FACTORS SUMMARY

Our business is subject to numerous risks described in the section titled “Risk Factors” and elsewhere in this annual report. The main risks set forth below and others you should consider are discussed more fully in the section entitled “Risk Factors”, which you should read in its entirety.

Risk Related to Our Business and Industry

Risks and uncertainties related to our business and industry include, but are not limited to, the following:

| ● | Our business model and technology have yet to be operated in a commercial setting and any failure to commercialize our strategic plans would have an adverse effect on our operating results and business. | |

| ● | We have a history of operating losses and expect to incur significant additional expenses and operating losses. | |

| ● | Our failure to secure new contracts may adversely affect our business operations and financial results. | |

| ● | If we are not able to successfully manage its growth strategy, our business operations and financial results may be adversely affected. | |

| ● | We have failed to meet certain conditions of our existing loans and may not be able to meet the conditions of other loans. This poses a material risk to our financial stability and may materially and adversely impact our business, financial results and future prospects. | |

| ● | We are in breach of certain loan agreements. If lenders enforce the pledge on certain of our properties, our business operation may be disrupted, and our business, financial condition, results of operations and prospects could be materially and adversely affected. | |

| ● | An increase in the prices of materials used in our business could adversely affect our business. | |

| ● | We may be unable to complete or operate its projects on a profitable basis or as we have committed to our customers. | |

| ● | Our revenue, expenses, and operating results may fluctuate significantly. | |

| ● | Failure of third parties to manufacture quality products or provide reliable services in a timely manner could cause delays in the delivery of our services and completion of its projects, which could damage our reputation, have a negative impact on our relationships with its customers and adversely affect our growth. | |

| ● | Our estimates of market opportunity and forecasts of market growth may prove to be inaccurate. | |

| ● | Our business will depend on experienced and skilled personnel and third-party engineering subcontractor resources, and if we lose key personnel or if we are unable to attract and integrate additional skilled personnel, it will be more difficult for us to manage our business and complete projects. | |

| ● | We expect to operate in a highly competitive industry, and our current or future competitors may be able to compete more effectively than we do, which could have a material adverse effect on our business, revenues, growth rates, and market share. | |

| ● | We expect that our business will benefit in part from government support for new energy vehicles and electric vehicles, and a decline in such support could harm our business. | |

| ● | Our patent applications may not issue as patents, which may have a material adverse effect on our ability to prevent others from commercially exploiting solutions similar to ours. | |

| ● | Certain of our facilities are or may be located in regions that may be affected by extreme weather conditions and natural disasters. | |

| ● | We are subject to various environmental laws and regulations that could impose substantial costs upon us and cause delays in manufacture and sale of our vehicles. | |

| ● | Our ability to produce vehicles and our future growth depend upon our ability to maintain relationships with our existing suppliers and strategic partners, to source new suppliers for our critical components, and to complete building out our supply chain while effectively managing the risks due to such relationships. | |

| ● | We may not be able to accurately estimate the supply and demand for our vehicles, which could result in inefficiencies in our business, hinder our ability to generate revenue, and create delays in the production of our vehicles. | |

| ● | We may in the future experience significant delays in the design, development, manufacture, launch, and financing of our vehicles, as well as delays in our constructions of factories, which could harm our business and prospects. |

| 5 |

| ● | Increases in costs, disruption of supply, or shortage of materials, especially for lithium-ion cells or semiconductors, could harm our business. | |

| ● | Our limited operating history of NEVs makes evaluating our business and future prospects difficult and may increase the risk of your investment. | |

| ● | If we are unable to maintain and enhance our brands, capture additional market share, or if our reputation and business are harmed, it could have a material and adverse impact on our business, financial condition, results of operations, and prospects. | |

| ● | Our sales will depend in part on our ability to establish and maintain confidence in our business prospects among consumers, analysts, and others within our industry. | |

| ● | The automotive industry has significant barriers to entry that we must overcome in order to manufacture and sell electric vehicles at scale. | |

| ● | We may be unable to adequately control the substantial costs associated with our operations. | |

| ● | We depend on revenue generated from a limited number of models and expect this to continue in the foreseeable future. | |

| ● | If our vehicles fail to perform as expected, our ability to develop, market, and sell our products could be harmed. | |

| ● | If vehicle owners customize our vehicles or change the infrastructure with aftermarket products, the vehicle may not operate properly, which may create negative publicity and could harm our business. |

Risks Related to Cybersecurity and Data Privacy

| ● | We rely on our IT systems, and any material disruption to our IT systems could have a material and adverse effect on us. | |

| ● | Any unauthorized control or manipulation of our products, digital sales tools, and systems could result in a loss of confidence in us and our products. | |

| ● | Data privacy concerns are generally increasing, which could result in new legislation, negative public perception of our data collection practices and certain of our services or technologies, and/or changing user behaviors that negatively affect our business and product development plans. | |

| ● | We are subject to evolving laws, regulations, standards, policies, and contractual obligations related to data privacy, security, and consumer protection, and any actual or perceived failure to comply with such obligations could harm our reputation and brand, subject us to significant fines and liability, or otherwise adversely affect our business. |

Risks Related to Our Employees and Human Resources

| ● | Our ability to effectively manage our growth relies on the performance of highly skilled personnel, including our Chief Executive Officer Mu Hongwei, our senior management team, and other key employees, and our ability to recruit and retain key employees. The loss of key personnel or an inability to attract, retain, and motivate qualified personnel may impair our ability to expand our business. | |

| ● | Misconduct by our employees and independent contractors during and before their employment with us could expose us to potentially significant legal liabilities, reputational harm, and/or other damages to our business. |

Risks Related to Litigation and Regulations

| ● | We are subject to evolving laws and regulations that could impose substantial costs, legal prohibitions, or unfavorable changes upon our operations or products, and any failure to comply with these laws and regulations, including as they evolve, could result in litigation and substantially harm our business and results of operations. | |

| ● | We or our subsidiaries may have undertaken, or in the future may choose to or be compelled to undertake, product recalls or to take other actions that could result in litigation and adversely affect our business, prospects, results of operations, reputation, and financial condition. |

| 6 |

| ● | We may in the future be subject to legal proceedings, regulatory disputes, and governmental inquiries that could cause us to incur significant expenses, divert our management’s attention, and materially harm our business, results of operations, cash flows, and financial condition. | |

| ● | We may become subject to product liability claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims. | |

| ● | Our suppliers and manufacturing partners may be exposed to delays, limitations, and risks related to the environmental permits and other operating permits required to operate manufacturing facilities for our vehicles. | |

| ● | If we fail to implement and maintain an effective system of internal controls over financial reporting, we may be unable to accurately report our results of operations, meet reporting obligations, or prevent fraud. As a result, our security holders could lose confidence in our financial and other public reporting, which would harm our business and trading price of our securities. | |

| ● | We are subject to various environmental, health, and safety laws and regulations that could impose substantial costs on us and cause delays in expanding our production capabilities. | |

| ● | The unavailability, reduction, elimination or the conditionality of certain government and economic programs could have a material and adverse effect on our business, prospects, financial condition, and results of operations. |

Risks Related to Intellectual Property

| ● | We may fail to adequately obtain, maintain, enforce, and protect our existing and future intellectual property and licensing rights, and we may not be able to prevent third parties from unauthorized use of our intellectual property and proprietary technology. If we are unsuccessful in any of the foregoing, our competitive position could be harmed, and we could be required to incur significant expenses to enforce our rights. | |

| ● | We use other parties’ software and other intellectual property in our proprietary software, including “open source” software. Any inability to continuously use such software or other intellectual property in the future could have a material adverse impact on our business, financial condition, results of operations, and prospects. | |

| ● | We may become subject to claims of intellectual property infringement by third parties which, regardless of merit, could be time-consuming and costly and result in significant legal liability, and could negatively impact our business, financial condition, results of operations, and prospects. |

Risks Related to Financing and Strategic Transactions

| ● | We will require additional capital to support business growth, and this capital might not be available on commercially reasonable terms, or at all. | |

| ● | Our financial results may vary significantly from period to period due to fluctuations in our operating costs, product demand, and other factors. |

Risks Related to Doing Business in China

| ● | We are also subject to risks and uncertainties relating to doing business in China in general, including, but are not limited to, the following: | |

| ● | We face uncertainties for U.S. stock exchange listings due to the HFCAA, SEC, PCAOB statements, Nasdaq rule changes, and PCAOB limitations. | |

| ● | Changes in the interpretation and application of PRC laws and evolving cybersecurity oversight may hinder our share offerings. | |

| ● | Changes in PRC policies or China-U.S. relations could adversely affect our expansion strategies. | |

| ● | Differences between private and state-owned enterprises may pose integration challenges for us. | |

| ● | Failure to meet vehicle standards or protect customer data could impact our business. | |

| ● | Labor law enforcement may increase costs and impose limitations on our operations. | |

| ● | Failure to comply with PRC regulations and tax laws may lead to fines and penalties for us. | |

| ● | Foreign exchange restrictions and taxation could limit our revenue utilization. | |

| ● | Challenges in conducting investigations and legal proceedings in China may arise for us. | |

| ● | PRC government interventions may limit our ability to transfer funds or assets outside the PRC. | |

| ● | International trade tensions and political risks may adversely impact our business. |

| 7 |

Risks Related to Ownership of Chijet Motor Ordinary Shares

In addition to the risks and uncertainties described above, we are subject to risk related to ordinary shares, including, but not limited to, the following:

| ● | We may not be able to timely and effectively implement controls and procedures required by Section 404 of the Sarbanes-Oxley Act of 2002. | |

| ● | If we are characterized as a passive foreign investment company for U.S. federal income tax purposes, our U.S. shareholders may suffer adverse tax consequences. | |

| ● | Code Section 7874 may increase our U.S. affiliates’ U.S. taxable income or have other adverse consequences to us and our shareholders. | |

| ● | We are an “emerging growth company” and it cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make its shares of common stock less attractive to investors. | |

| ● | The future exercise of registration rights may adversely affect the market price of Chijet Motor Ordinary Shares. | |

| ● | Future resales of our Ordinary Shares issued in connection with the Business Combination may cause the market price of our Ordinary Shares to drop significantly, even if Chijet Motor’s business is doing well. | |

| ● | The market price of our securities may decline. | |

| ● | Nasdaq may delist our securities from trading on its exchange. | |

| ● | Concentration of ownership among our existing executive officers, directors and their affiliates may prevent new investors from influencing significant corporate decisions. | |

| ● | We do not expect to declare any dividends in the foreseeable future. | |

| ● | Our business and stock price may suffer as a result of our lack of public company operating experience and if securities or industry analysts do not publish or cease publishing research or reports about us, our business, or our market, or if they change their recommendations regarding our Ordinary Shares in an adverse manner, the price and trading volume of our Ordinary Shares could decline. | |

| ● | Our issuance of additional capital stock in connection with financings, acquisitions, investments, stock incentive plans or otherwise will dilute all other shareholders. |

RISK FACTORS

An investment in our Ordinary Shares involves significant risks. You should carefully consider all of the information in this annual report, including the risks and uncertainties described below, before making an investment in our Ordinary Shares. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. In any such case, the market price of our Ordinary Shares could decline, and you may lose all or part of your investment.

The risks set out below are not exhaustive and do not comprise all of the risks associated with an investment in Chijet Motor. Additional risks and uncertainties not currently known to Chijet Motor or which Chijet Motor currently deems immaterial may also have a material adverse effect on Chijet Motor’s business, financial condition, results of operations, prospects and/or its share price.

Risk Related to Our Business and Industry

Our business model and technology have yet to be operated in a commercial setting and any failure to commercialize our strategic plans would have an adverse effect on our operating results and business, harm our reputation and could result in substantial liabilities that exceed our resources.

Investors should be aware of the difficulties normally encountered by a new enterprise, many of which are beyond our control, including substantial risks and expenses in the course of developing new, unproven technology, establishing or entering new markets, organizing operations and undertaking marketing activities. Our financial performance depends, in part, on our ability to design, develop, manufacture, assemble, test, commercialize, market and support our vehicles on a timely and cost-effective basis.

| 8 |

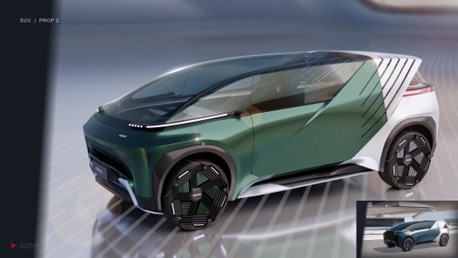

We plan to commercialize electric commercial vehicles for production and sales currently and will commercialize a large number of electric passenger cars in 2024. Reference to “commercialize” or “commercialization” in this context means that we have currently finalized the vehicle and prepared for the mass production. A SOP (“Start of Production”) refers to the last stage (or node) for which a new model can be marketed and sold, and means all our R&D phase is generally finished so that the whole vehicle can be mass-produced on the production line. We have currently finalized the SOP for manufacturing electric commercial vehicles. We similarly anticipate the completion of the SOP for electric passenger cars in 2024.

Our plan to reach the SOP stage for some electric passenger cars in 2024 means, for purposes of the large number, that electric passenger cars have entered the batch production category in internal manufacturing of “MP (Mass Production),” which is larger than the earlier manufacturing categories of engineering sample, pre-production or pilot production. As a practical matter, we currently anticipate that our FB77 electric vehicle is expected to be launched during November 2024, and it is expected that 17,000 units of FB77 will be sold in China in 2025.

Following the commencement of production of electric vehicles, we may reduce the production of conventional fuel vehicles. Our principal focus has been on research and development activities to improve our technology and make our vehicles attractive to potential customers. We have begun construction of our first electric vehicle manufacturing site for pure electric vehicles only, having started construction in the second half of 2022. Our electric vehicle manufacturing site in Yantai is expected to have its assembly workshop for electric vehicles completed in October 2024. Our production site in Jilin is currently in normal production status, focusing on conventional vehicles.

These activities are subject to various risks and uncertainties that we are not able to control, including changes in customer demand, competing energy prices or industry standards, and the introduction of new or superior technologies by others. Moreover, any failure by us in the future to develop new technologies or to timely react to changes in existing technologies could materially delay our development of new solutions, which could result in technology obsolescence, decreased revenues, and a loss of our market share to our competitors. In addition, solutions or technologies developed by others may render our solutions or technologies obsolete or non-competitive. Further, if our solutions are not in compliance with prevailing industry standards, such non-compliance could materially and adversely affect our financial condition, cash flows, and results of operations.

The likelihood of our success must be considered in light of these risks, expenses, complications, delays, and the competitive environment in which we operate. There is, therefore, nothing at this time upon which to base an assumption that our business plan will prove successful, or that our technology will work as intended or be scalable, and we may not be able to generate revenue, raise additional capital, or operate profitably. We will continue to encounter risks and difficulties frequently experienced by early commercial stage companies, including scaling up our infrastructure and headcount, and we may encounter unforeseen expenses, difficulties, or delays in connection with our growth. In addition, as a result of the capital-intensive nature of our business, we expect to continue to sustain substantial operating expenses without generating sufficient revenues to cover expenditures. Any investment in us is therefore highly speculative and could result in the loss of your entire investment.

We have a history of operating losses and expect to incur significant additional expenses and operating losses.

We are an early-stage company, have a history of operating losses and negative operating cash flows. We incurred a net loss of $98,501 thousand, $111,518 thousand, and $62,552 thousand for the years ended December 31, 2023, 2022, and 2021, respectively. We expect that we will continue to incur operating and net losses for the medium term. The amount of future losses and when, if ever, we will achieve profitability are uncertain. In addition, even if we achieve profitability, there can be no assurance that we will be able to maintain profitability in the future. Our potential profitability is particularly dependent upon the penetration and growth of the market for our vehicles, parts, and technology, including solid-state batteries, in-wheel motors, and intelligent driving solutions, which may not occur at the levels we currently anticipate or at all.

| 9 |

Although the COVID-19 pandemic has affected our business and operations, those risks may be diminishing.

The COVID-19 pandemic has also periodically disrupted the manufacturing operations of vehicle manufacturers and their suppliers, including us. The COVID-19 pandemic poses risks included its impact on general economic conditions; manufacturing and supply chain operations; stay-at-home orders; and local and global financial markets. Any such disruptions to us or to our suppliers could result in delays and could negatively affect our production volume.

Please also see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations” for more information. In addition, the COVID-19 pandemic has resulted in volatility in some global financial markets, which could increase our cost of capital or limit our ability to access financing when needed. Broader impacts of the pandemic also include inflationary pressure, which impacts the cost at which we can manufacture vehicles. The magnitude and duration of the COVID-19 pandemic and its economic and regulatory consequences are rapidly changing and uncertain. If the COVID-19 variants outbreak resurges, it could materially and adversely impact our business, financial condition, and results of operations.

Our failure to secure new contracts may adversely affect our business operations and financial results.

Our business depends in large part on our ability to secure contracts with customers. Contract proposals and negotiations are complex and frequently involve a lengthy negotiation and selection process, which is affected by a number of factors. These factors include market conditions, demonstrating to potential customers that our solutions can work for them, financing arrangements, and any required governmental approvals. If negative market conditions arise, and we cannot sell our vehicles, or if we fail to secure adequate financial arrangements or any required government approvals, we may not be able to pursue particular projects, which could adversely affect our ability to generate revenue. If we fail to complete a project in a timely manner, miss a required performance standard, or otherwise fail to adequately perform on a project, then we may incur a loss on that project, which may result in increased losses.

Our engagements will involve complex projects. The quality of our performance on such projects depends in large part upon our ability to manage the relationship with our clients and our ability to effectively manage the project and deploy appropriate resources, including third-party contractors and our own personnel, in a timely manner. If a project is not completed by the scheduled date or fails to meet required performance standards, we may either incur significant additional costs or be held responsible for the costs incurred by the client to rectify damages due to late completion or failure to achieve the required performance standards. The performance of projects can be affected by a number of factors, including unavoidable delays from suppliers and subcontractors, government inaction, public opposition, inability to obtain financing, weather conditions, unavailability of vendor materials, changes in the project scope of services requested by our clients, industrial accidents, environmental hazards, and labor disruptions. To the extent these events occur, the total costs of the project could exceed our estimates and we could incur a loss on a project, which would have an adverse effect on our business, results of operations, and financial condition. Further, any defects or errors, or failures to meet our clients’ expectations, could result in claims for damages against us.

If we are not able to successfully manage its growth strategy, our business operations and financial results may be adversely affected.

Our expected future growth presents numerous managerial, administrative, and operational challenges. Our ability to manage the growth of our operations will require us to continue to develop and improve our management information systems and our other internal systems and controls. In addition, our growth will increase our need to attract, develop, motivate, and retain both our management and employees. The inability of our management to effectively manage our growth or the inability of our employees to achieve anticipated performance could have a material adverse effect on our business.

| 10 |

The unavailability, reduction or elimination of government and economic incentives and other legislative or regulatory actions relating to renewable energy could have a material adverse effect on our business, prospects, financial condition and operating results.

Any reduction, elimination, or discriminatory application of government subsidies and economic incentives because of policy changes, the reduced need for such subsidies and incentives due to the perceived success of vehicles with carbon-free fuel solutions, or other reasons may result in the diminished competitiveness of the renewable energy industry generally or our vehicles. This could also materially and adversely affect the growth of the renewable energy markets and our business, prospects, financial condition, and operating results.

While we may seek to use certain tax credits and other incentives for electric vehicles, there is no guarantee these programs will be available in the future, or that we will be able to use them. If current tax incentives are not available in the future, our financial position could be harmed.

We may face significant challenges in securing on acceptable terms for a substantial part of the government grants, loans, and other incentives for which we apply. We have not been, and may continue to be, unable to convert any existing loans into government grants and subsidies we have applied for. We have failed to meet certain conditions of our existing loans and may not be able to meet the conditions of other loans. This poses a material risk to our financial stability and may materially and adversely impact our business, financial results and future prospects.

Our ability to obtain funds or incentives from government sources is subject to the availability of funds under applicable government programs and approval of our applications to participate in such programs. The application process for these funds and other incentives will likely be highly competitive. We cannot assure you that we will be successful in obtaining any of these additional grants, loans, and other incentives. If we are not successful in obtaining any of these additional incentives and we are unable to find alternative sources of funding to meet our planned capital needs, our business and prospects for certain projects could be materially adversely affected.

In May 2016, we secured two interest-free loans from non-financial institutions specifically for developing the Electric Vehicle industry in Xiangyang, PRC. The loans’ utilization was strictly limited to this purpose, with their maturity depending on the development’s progress. However, due to the COVID-19 pandemic and subsequent regulations, we were unable to meet the loan conditions or secure government subsidies to repay the loans by July 2022. Consequently, the loans were reclassified as current liabilities for the years 2021, 2022, and 2023, and we incurred a penalty of US$737 thousand (RMB5,232 thousand) for defaulting, which is 5% of the land use rights cost. The lender also reserved rights to demand compensation for losses, repurchase the land, and require repayment of any related government subsidies. As of April 30, 2024, no subsidies had been received. The principal amounts outstanding were approximately US$97,832 thousand (RMB 694,598 thousand) and US$100,697 thousand (RMB 694,598 thousand), respectively, as of December 31, 2023, and December 31, 2022. The variance primarily resulted from currency exchange rate fluctuations.

| 11 |

We are negotiating with the lender to extend the loan terms and are planning to expand production to fulfill the loan conditions. During the period ended December 31, 2023, we were unable to meet the conditions to apply for the government subsidies to repay the loans. As a result, in June 2023, the Company signed two pledge agreements with the lender. Pursuant to the pledge agreements, the Company pledged machinery and equipment, mold and tooling with a carrying amount of approximately US$12,766 thousand (RMB90,638 thousand), buildings with a carrying amount of approximately US$15,815 thousand (RMB11,282 thousand) and land use rights with a carrying amount of US$14,406 thousand (RMB102,280 thousand) to the government to secure the repayment of the principal and related interest on the aforementioned loans. See Note 17 of Notes to Consolidated Financial Statements, which are included in this annual report, for more details of the loan agreements.

Additionally, in December 2019, Shandong Baoya entered into loan agreements with Yantai Guofeng Investment Holding Group Co., Ltd. The loans bear an annual interest rate of 6.5%. Pursuant to the loan agreements, if Shandong Baoya met certain development conditions, part of the loan could be waived and converted to a government subsidy, including interest on such portion. For the year ended December 31, 2023, no principal amount has been converted to government subsidies. As of December 31, 2023, the outstanding principals were US$104,227 thousand. As of April 30, 2024, the outstanding principals and interests were US$133,794 thousand (RMB949,927 thousand).

We are in breach of certain loan agreements and may become in breach of other loan agreements in the future. If lenders enforce the pledge on certain of our properties, our business operation may be disrupted, and our business, financial condition, results of operations and prospects could be materially and adversely affected.

We obtained loans from certain related parties and other institutions to fund our business operations. FAW Jilin, China FAW Corporation Limited (the minority shareholder of FAW Jilin) and its affiliate, FAW Finance Co., Ltd have entered into a series of working capital loan agreements in the amount of RMB700 million (approximately US$98,593 thousand) on January 29, 2019, in the amount of RMB350 million (approximately US$49,296 thousand) on May 20, 2019, in the amount of RMB150 million (approximately US$21,127 thousand) on August 29, 2019, in the amount of approximately RMB270 million (approximately US$38,029) on October 29, 2019, in the amount of approximately RMB188 million (approximately US$26,479 thousand) on November 27, 2019, in the amount of approximately RMB87.4 million (approximately US$12,310 thousand) on December 13, 2019, each of the loans bears an annual interest rate of 3.915% with a term of one year. On January 23, 2020, the loan in the amount of RMB 700 million was extended for 12 months. On May 20, 2020, the parties have entered into a supplement agreement to the loan agreements, pursuant to which, FAW Jilin agreed to make four installment payments of US$41,732,628 (RMB 287,867,500), each for the remaining principal balance and pledged certain land use rights, buildings, machinery and equipment, mold and tooling and other logistic equipment of FAW Jilin. FAW Jilin failed to make the payments on November 1, 2022 and November 1, 2023. As of April 30, 2024, the aggregate outstanding principals and interests under such loans were US$185,746 thousand (RMB1,318,779 thousand). See “Item 7. Major Shareholders and Related Party Transactions” and “Item 13. Defaults, Dividend Arrearages and Delinquencies” for more details and current status of the loan agreements. If FAW Finance Co., Ltd. enforces the pledge, we will be unable to continue the use of such land, buildings, machinery and equipment, and our business operation may be disrupted. We may be forced to suspend manufacturing or look for alternative manufacturing facilities, which could be time-consuming, and the alternative facilities may not be available at commercially acceptable terms, or at all. Consequently, our business, financial condition, results of operations and prospects could be materially and adversely affected.

In May 2016, we secured two interest-free loans from non-financial institutions specifically for developing the Electric Vehicle industry in Xiangyang, PRC. The loans’ utilization was strictly limited to this purpose, with their maturity depending on the development’s progress. However, due to the COVID-19 pandemic and subsequent regulations, we were unable to meet the loan conditions or secure government subsidies to repay the loans by July 2022. Consequently, the loans were reclassified as current liabilities for the years 2021, 2022, and 2023, and we incurred a penalty of US$737 thousand (RMB5,232 thousand) for defaulting, which is 5% of the land use rights cost. The lender also reserved rights to demand compensation for losses, repurchase the land, and require repayment of any related government subsidies. As of April 30, 2024, no subsidies had been received. The principal amounts outstanding were approximately US$97,832 thousand (RMB 694,598 thousand) and US$100,697 thousand (RMB 694,598 thousand), respectively, as of December 31, 2023, and December 31, 2022. The variance primarily resulted from currency exchange rate fluctuations.

We are negotiating with the lender to extend the loan terms and are planning to expand production to fulfill the loan conditions. During the period ended December 31, 2023, we were unable to meet the conditions to apply for the government subsidies to repay the loans. As a result, in June 2023, the Company signed two pledge agreements with the lender. Pursuant to the pledge agreements, the Company pledged machinery and equipment, mold and tooling with a carrying amount of approximately US$12,766 thousand (RMB90,638 thousand), buildings with a carrying amount of approximately US$15,815 thousand (RMB11,282 thousand) and land use rights with a carrying amount of US$14,406 thousand (RMB102,280 thousand) to the government to secure the repayment of the principal and related interest on the aforementioned loans. See Note 17 of Notes to Consolidated Financial Statements, which are included in this annual report, for more details of the loan agreements. If the lenders enforce the pledge, we will be unable to continue the use of such land, buildings, machinery and equipment, and our business operation may be disrupted. We may be forced to suspend manufacturing or look for alternative manufacturing facilities, which could be time-consuming, and the alternative facilities may not be available at commercially acceptable terms, or at all. Consequently, our business, financial condition, results of operations and prospects could be materially and adversely affected.

An increase in the prices of materials used in our business could adversely affect our business.

Because we are vehicle manufacturers, we are exposed to market risk of increases in certain commodity prices of materials, such as nickel, steel, concrete, and adhesives, which are used as components of supplies or materials utilized in our operations. In particular, raw material costs have been extremely volatile during the pandemic, in some cases increasing by 30% to 100%. These prices could be materially impacted by general market conditions and other factors. Our prices with current customers are determined by the sale of our vehicles and there is limited ability for prices to be adjusted for price increases in materials, and while we believe we may be able to increase our prices under future sales to account for some price increases in materials, there can be no assurance that price increases of materials, if they were to occur, would be recoverable.