SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

UNDER

THE SECURITIES ACT OF 1933

| |

Cayman Islands

(State or other jurisdiction of

incorporation or organization) |

| |

3630

(Primary Standard Industrial

Classification Code Number) |

| |

98-1738011

(I.R.S. Employer

Identification Number) |

|

Needham, MA 02494

(617) 243-0235

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Chief Executive Officer

SharkNinja, Inc.

89 A Street

Needham, MA 02494

(617) 243-0235

| |

Pedro J. Lopez-Baldrich

Chief Legal Officer SharkNinja, Inc. 89 A Street Needham, MA 02494 (617) 243-0235 |

| |

Howard L. Ellin

Ryan J. Dzierniejko Skadden, Arps, Slate, Meagher & Flom LLP One Manhattan West New York, NY 10001 (212) 735-3000 |

|

| | | | | | ii | | | |

| | | | | | ii | | | |

| | | | | | ii | | | |

| | | | | | 1 | | | |

| | | | | | 22 | | | |

| | | | | | 67 | | | |

| | | | | | 69 | | | |

| | | | | | 70 | | | |

| | | | | | 71 | | | |

| | | | | | 73 | | | |

| | | | | | 84 | | | |

| | | | | | 108 | | | |

| | | | | | 139 | | | |

| | | | | | 146 | | | |

| | | | | | 154 | | | |

| | | | | | 156 | | | |

| | | | | | 170 | | | |

| | | | | | 171 | | | |

| | | | | | 176 | | | |

| | | | | | 176 | | | |

| | | | | | 176 | | | |

| | | | | | 176 | | | |

| | | | | | F-1 | | |

![[MISSING IMAGE: bc_netsales-4clr.jpg]](bc_netsales-4clr.jpg)

![[MISSING IMAGE: bc_market-4clr.jpg]](bc_market-4clr.jpg)

![[MISSING IMAGE: pc_global-4clr.jpg]](pc_global-4clr.jpg)

![[MISSING IMAGE: pc_addressable-4c.jpg]](pc_addressable-4c.jpg)

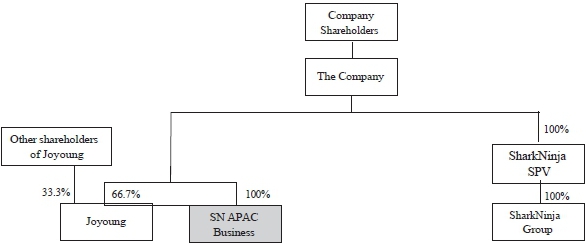

![[MISSING IMAGE: fc_immediatelyprior-4c.jpg]](fc_immediatelyprior-4c.jpg)

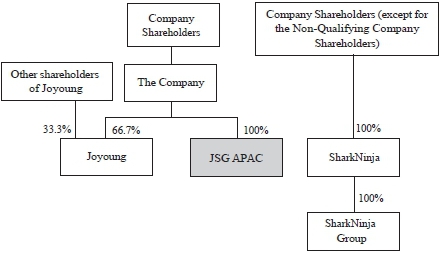

![[MISSING IMAGE: fc_immediatelyafter-4c.jpg]](fc_immediatelyafter-4c.jpg)

|

($ in thousands, except

share and per share data) |

| |

Years Ended

December 31, |

| |

Three Months Ended

March 31, |

| |

Pro Forma

Year Ended December 31, |

| |

Pro Forma

Three Months Ended March 31, |

| ||||||||||||||||||||||||||||||

| |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |

2022

|

| |

2023

|

| |||||||||||||||||||||||

|

Net Sales

|

| | | $ | 2,753,166 | | | | | $ | 3,726,994 | | | | | $ | 3,717,366 | | | | | $ | 809,626 | | | | | $ | 855,282 | | | | | $ | | | | | $ | | | ||

|

Cost of Sales

|

| | | | 1,499,724 | | | | | | 2,288,810 | | | | | | 2,307,172 | | | | | | 457,700 | | | | | | 454,739 | | | | | | | | | | | | | | |

|

Gross Profit

|

| | | | 1,253,442 | | | | | | 1,438,184 | | | | | | 1,410,194 | | | | | | 351,926 | | | | | | 400,543 | | | | | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||||

|

Research and Development(1)

|

| | | | 159,635 | | | | | | 200,641 | | | | | | 215,660 | | | | | | 51,971 | | | | | | 58,725 | | | | | | | | | | | | | | |

|

Sales and Marketing(1)

|

| | | | 445,084 | | | | | | 619,162 | | | | | | 621,953 | | | | | | 125,541 | | | | | | 152,120 | | | | | | | | | | | | | | |

|

General and Administrative(1)

|

| | | | 183,286 | | | | | | 180,124 | | | | | | 251,207 | | | | | | 52,025 | | | | | | 67,068 | | | | | | | | | | | | | | |

|

Total Operating Expenses

|

| | | | 788,005 | | | | | | 999,927 | | | | | | 1,088,820 | | | | | | 229,537 | | | | | | 277,913 | | | | | | | | | | | | | | |

|

Operating Income

|

| | | | 465,437 | | | | | | 438,257 | | | | | | 321,374 | | | | | | 122,389 | | | | | | 122,630 | | | | | | | | | | | | | | |

|

Interest Expense, Net

|

| | | | (40,279) | | | | | | (16,287) | | | | | | (27,021) | | | | | | (4,004) | | | | | | (8,489) | | | | | | | | | | |||||

|

Other Income (Expense),

Net |

| | | | (5,692) | | | | | | (7,644) | | | | | | 7,631 | | | | | | (3,909) | | | | | | (2,780) | | | | | | | | | | | | | | |

|

($ in thousands, except

share and per share data) |

| |

Years Ended

December 31, |

| |

Three Months Ended

March 31, |

| |

Pro Forma

Year Ended December 31, |

| |

Pro Forma

Three Months Ended March 31, |

| ||||||||||||||||||||||||||||||

| |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |

2022

|

| |

2023

|

| |||||||||||||||||||||||

|

Income Before Income

Taxes |

| | | | 419,466 | | | | | | 414,326 | | | | | | 301,984 | | | | | | 114,476 | | | | | | 111,361 | | | | | | | | | | | | | | |

|

Provision for Income

Taxes |

| | | | 92,268 | | | | | | 83,213 | | | | | | 69,630 | | | | | | 25,565 | | | | | | 24,265 | | | | | | | | | | | | | | |

|

Net Income

|

| | | $ | 327,198 | | | | | $ | 331,113 | | | | | $ | 232,354 | | | | | $ | 88,911 | | | | | $ | 87,096 | | | | | $ | | | | | $ | | | ||

| Net Income Per Share, basic and diluted | | | | $ | 6,544 | | | | | $ | 6,622 | | | | | $ | 4,647 | | | | | $ | 1,778 | | | | | $ | 1,742 | | | | | $ | | | | | $ | | | ||

|

Weighted-Average Number of

Shares Used in Computing Net Income Per Share, basic and diluted |

| | | | 50,000 | | | | | | 50,000 | | | | | | 50,000 | | | | | | 50,000 | | | | | | 50,000 | | | | | | | | | | | | | | |

| Pro Forma Net Income Per Share, basic and diluted | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||||

|

Pro Forma Weighted-Average

Number of Shares Used in Computing Net Income Per Share, basic and diluted |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||||

|

($ in thousands, except

share and per share data) |

| |

Years Ended

December 31, |

| |

Three Months Ended

March 31, |

| |

Pro Forma

Year Ended December 31, |

| |

Pro Forma

Three Months Ended March 31, |

| ||||||||||||||||||||||||||||||

| |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |

2022

|

| |

2023

|

| |||||||||||||||||||||||

|

Net Cash Provided by (Used in) Operating Activities

|

| | | $ | 293,435 | | | | | $ | 229,147 | | | | | $ | 204,964 | | | | | $ | (101,130) | | | | | $ | 89,762 | | | | | $ | | | | | $ | | | ||

|

Net Cash Used in Investing Activities

|

| | | | (81,434) | | | | | | (66,366) | | | | | | (52,384) | | | | | | (11,134) | | | | | | (7,799) | | | | | ||||||||||

|

Net Cash Provided by (Used in) Financing Activities

|

| | | | (120,668) | | | | | | (54,500) | | | | | | (160,170) | | | | | | 8,026 | | | | | | (98,631) | | | | | ||||||||||

| | | |

As of March 31, 2023

|

| |||||||||

|

($ in thousands)

|

| |

Actual

|

| |

Pro Forma

|

| ||||||

|

Cash and Cash Equivalents

|

| | | $ | 181,537 | | | | | $ | | | |

|

Total Assets

|

| | | | 3,166,828 | | | | | | | | |

|

Total Liabilities

|

| | | | 1,308,821 | | | | | | | | |

|

Total Shareholders’ Equity

|

| | | | 1,858,007 | | | | | | | | |

| | | |

Year Ended December 31,

|

| |

Three Months Ended

March 31, |

| ||||||||||||||||||||||||

|

($ in thousands)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |||||||||||||||

|

Research and Development

|

| | | $ | 1,713 | | | | | $ | 2,918 | | | | | $ | 1,741 | | | | | $ | 821 | | | | | $ | 230 | | |

|

Sales and Marketing

|

| | | | 1,866 | | | | | | 1,755 | | | | | | 459 | | | | | | 257 | | | | | | 101 | | |

|

General and Administrative

|

| | | | 6,455 | | | | | | 9,251 | | | | | | 3,309 | | | | | | 1,492 | | | | | | 517 | | |

|

Total Share-Based Compensation

|

| | | $ | 10,034 | | | | | $ | 13,924 | | | | | $ | 5,509 | | | | | $ | 2,570 | | | | | $ | 848 | | |

| | | |

Year Ended December 31,

|

| |

Three Months Ended March 31,

|

| ||||||||||||||||||||||||

|

($ in thousands, except % and per share data)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |||||||||||||||

|

Adjusted Net Sales(1)

|

| | | $ | 2,689,708 | | | | | $ | 3,625,299 | | | | | $ | 3,619,932 | | | | | $ | 789,546 | | | | | $ | 835,633 | | |

|

Adjusted Gross Profit(2)

|

| | | $ | 1,204,356 | | | | | $ | 1,476,062 | | | | | $ | 1,447,561 | | | | | $ | 359,210 | | | | | $ | 406,792 | | |

|

Adjusted Gross Margin(3)

|

| |

44.8%

|

| |

40.7%

|

| |

40.0%

|

| |

45.5%

|

| |

48.7%

|

| |||||||||||||||

|

Adjusted Net Income(4)

|

| | | $ | 349,490 | | | | | $ | 423,242 | | | | | $ | 330,365 | | | | | $ | 109,280 | | | | | $ | 118,999 | | |

| Adjusted Net Income Per Diluted Share(5) | | | | $ | 6,990 | | | | | $ | 8,465 | | | | | $ | 6,607 | | | | | $ | 2,186 | | | | | $ | 2,380 | | |

| EBITDA(6) | | | | $ | 537,825 | | | | | $ | 508,796 | | | | | $ | 415,713 | | | | | $ | 138,684 | | | | | $ | 142,604 | | |

|

Adjusted EBITDA(7)

|

| | | $ | 527,699 | | | | | $ | 603,129 | | | | | $ | 519,614 | | | | | $ | 159,235 | | | | | $ | 178,016 | | |

|

Adjusted EBITDA Margin(8)

|

| |

19.6%

|

| |

16.6%

|

| |

14.4%

|

| |

20.2%

|

| |

21.3%

|

| |||||||||||||||

| | | |

As of March 31, 2023

|

| |||||||||

|

($ in thousands, except share data)

|

| |

Actual

|

| |

Pro Forma

|

| ||||||

|

Cash and cash equivalents

|

| | | $ | 181,537 | | | | | $ | | | |

| Debt: | | | | | | | | | | | | | |

|

Term loan, due March 2025(1)

|

| | | | 400,000 | | | | | | | | |

|

Term loan, due (2)

|

| | | | — | | | | | | | | |

|

Total debt

|

| | | | 400,000 | | | | | | | | |

| Shareholders’ equity: | | | | | | | | | | | | | |

|

Ordinary shares, $0.20 par value per share; 250,000 shares authorized and

50,000 shares issued and outstanding on an actual basis; shares authorized and shares issued and outstanding on a pro forma basis |

| | | | 10 | | | | | | | | |

|

Preferred shares, $ par value per share; no shares authorized, issued

and outstanding on an actual basis; shares authorized; and no shares issued or outstanding on a pro forma basis |

| | | | — | | | | | | | | |

|

Additional paid-in capital

|

| | | | 941,210 | | | | | | | | |

|

Retained earnings

|

| | | | 923,551 | | | | | | | | |

|

Accumulated other comprehensive loss

|

| | | | (6,764) | | | | | | | | |

|

Total shareholders’ equity

|

| | | | 1,858,007 | | | | | | | | |

|

Total capitalization

|

| | | $ | 2,258,007 | | | | | $ | | | |

As of March 31, 2023

(in thousands, except par value amounts)

| | | |

SharkNinja

Global SPV, LTD. |

| |

Divestiture

Transactions Adjustments |

| | | | |

As Adjusted

Before Other Transaction Accounting Adjustments and Autonomous Entity Adjustments |

| |

Other

Transaction Accounting Adjustments |

| | | | |

Autonomous

Entity Adjustments |

| |

SharkNinja,

Inc. |

| ||||||||||||||||||

| Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||

| Current assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||

|

Cash and cash equivalents

|

| | | $ | 181,537 | | | | | $ | (2,961) | | | |

[a]

|

| | | $ | 178,576 | | | | | $ | 8,830 | | | |

[b]

|

| | | $ | — | | | | | $ | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | (48,812) | | | |

[c]

|

| | | | — | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

[d]

|

| | | | — | | | | |||||

|

Restricted cash

|

| | | | 25,914 | | | | | | — | | | | | | | | | 25,914 | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Accounts receivable, net

|

| | | | 780,558 | | | | | | (27,961) | | | |

[a]

|

| | | | 752,597 | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Inventories

|

| | | | 510,472 | | | | | | (10,771) | | | |

[a]

|

| | | | 499,701 | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Prepaid expenses and other current

assets |

| | | | 80,436 | | | | | | (113) | | | |

[a]

|

| | | | 80,323 | | | | | | (8,830) | | | |

[b]

|

| | | | — | | | | | | | | |

|

Total current assets

|

| | | | 1,578,917 | | | | | | (41,806) | | | | | | | | | 1,537,111 | | | | | | (48,812) | | | | | | | | | — | | | | | | | | |

|

Property and equipment, net

|

| | | | 144,942 | | | | | | (1,787) | | | |

[a]

|

| | | | 143,155 | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Operating lease right-of-use assets

|

| | | | 65,552 | | | | | | (590) | | | |

[a]

|

| | | | 64,962 | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Intangible assets, net

|

| | | | 488,518 | | | | | | — | | | | | | | | | 488,518 | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Goodwill

|

| | | | 840,183 | | | | | | — | | | | | | | | | 840,183 | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Deferred tax assets, noncurrent

|

| | | | 5,017 | | | | | | (3,062) | | | |

[a]

|

| | | | 1,955 | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Other assets, noncurrent

|

| | | | 43,699 | | | | | | (342) | | | |

[a]

|

| | | | 43,357 | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Total assets

|

| | | $ | 3,166,828 | | | | | $ | (47,587) | | | | | | | | $ | 3,119,241 | | | | | $ | (48,812) | | | | | | | | $ | — | | | | | $ | | | |

| Liabilities and Shareholders’ Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||

| Current liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||

|

Accounts payable

|

| | | $ | 275,955 | | | | | $ | (17,661) | | | |

[a]

|

| | | $ | 258,294 | | | | | $ | — | | | | | | | | $ | — | | | | | | | | |

|

Accrued expenses and other current

liabilities |

| | | | 483,643 | | | | | | (12,233) | | | |

[a]

|

| | | | 471,410 | | | | | | (5,355) | | | |

[c]

|

| | | | — | | | | | | | | |

|

Tax payable

|

| | | | 8,539 | | | | | | — | | | | | | | | | 8,539 | | | | | | | | | | | | | | | — | | | | | | | | |

|

Current portion of long-term debt

|

| | | | 99,503 | | | | | | — | | | | | | | | | 99,503 | | | | | | | | | |

[d]

|

| | | | — | | | | | | | | |

|

Total current liabilities

|

| | | | 867,640 | | | | | | (29,894) | | | | | | | | | 837,746 | | | | | | (5,355) | | | | | | | | | — | | | | | | | | |

|

Long-term debt

|

| | | | 299,340 | | | | | | — | | | | | | | | | 299,340 | | | | | | | | | |

[d]

|

| | | | — | | | | | | | | |

|

Operating lease liabilities, noncurrent

|

| | | | 61,242 | | | | | | (249) | | | |

[a]

|

| | | | 60,993 | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Deferred tax liabilities, noncurrent

|

| | | | 54,546 | | | | | | — | | | | | | | | | 54,546 | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Other liabilities, noncurrent

|

| | | | 26,053 | | | | | | — | | | | | | | | | 26,053 | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Total liabilities

|

| | | $ | 1,308,821 | | | | | $ | (30,143) | | | | | | | | $ | 1,278,678 | | | | | $ | (5,355) | | | | | | | | $ | — | | | | |||||

| Shareholders’ equity: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||

|

Ordinary shares, $0.20 par value

per share, 250,000 shares authorized, 50,000 shares issued and outstanding as of March 31, 2023 on a historical basis and $ par value per share, shares authorized, shares issued and outstanding as of March 31, 2023 on a pro forma basis |

| | | $ | 10 | | | | | $ | — | | | | | | | | $ | 10 | | | | | $ | — | | | |

[e]

|

| | | $ | — | | | | | $ | | | |

|

Additional paid-in capital

|

| | | | 941,210 | | | | | | — | | | | | | | | | 941,210 | | | | | | — | | | |

[e]

|

| | | | — | | | | | | | | |

|

Retained earnings

|

| | | | 923,551 | | | | | | (17,444) | | | |

[a]

|

| | | | 906,107 | | | | | | (43,457) | | | |

[c]

|

| | | | — | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

[d]

|

| | | | — | | | | | | | | |

|

Accumulated other comprehensive

loss |

| | | | (6,764) | | | | | | — | | | | | | | | | (6,764) | | | | | | — | | | | | | | | | — | | | | | | | | |

|

Total shareholder’s equity

|

| | | $ | 1,858,007 | | | | | | (17,444) | | | | | | | | | 1,840,563 | | | | | | (43,457) | | | | | | | | | — | | | | | | | | |

|

Total liabilities and shareholders’ equity

|

| | | $ | 3,166,828 | | | | | $ | (47,587) | | | | | | | | $ | 3,119,241 | | | | | $ | (48,812) | | | | | | | | $ | — | | | | | $ | | | |

For the Three Months Ended March 31, 2023

(in thousands, except share and per share amounts)

| | | |

SharkNinja

Global SPV, LTD. |

| |

Divestiture

Transactions Adjustments |

| | | | |

Before Other

Transaction Accounting Adjustments and Autonomous Entity Adjustments |

| |

Other

Transaction Accounting Adjustments |

| | | | |

Autonomous

Entity Adjustments |

| | | | |

SharkNinja,

Inc. |

| ||||||||||||||||||

|

Net sales

|

| | | $ | 855,282 | | | | | $ | (19,060) | | | |

[f]

|

| | | $ | 836,222 | | | | | $ | — | | | | | | | | $ | — | | | | | | | | $ | | | |

|

Cost of sales

|

| | | | 454,739 | | | | | | (25,898) | | | |

[f]

|

| | | | 428,841 | | | | | | — | | | | | | | | | 7,095 | | | |

[k]

|

| | | | | | |

|

Gross profit

|

| | | | 400,543 | | | | | | 6,838 | | | | | | | | | 407,381 | | | | | | — | | | | | | | | | (7,095) | | | | | | | | | | | |

|

Operating expenses:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Research and development

|

| | | $ | 58,725 | | | | | $ | (99) | | | |

[f]

|

| | | $ | 58,626 | | | | | $ | — | | | | | | | | $ | — | | | | | | | | $ | | | |

|

Sales and marketing

|

| | | | 152,120 | | | | | | (5,052) | | | |

[f]

|

| | | | 147,068 | | | | | | — | | | | | | | | | — | | | | | | | | | | | |

|

General and administrative

|

| | | | 67,068 | | | | | | (917) | | | |

[f]

|

| | | | 66,151 | | | | | | (18,468) | | | |

[h]

|

| | | | — | | | | | | | | | | | |

|

Total operating expenses

|

| | | | 277,913 | | | | | | (6,068) | | | | | | | | | 271,845 | | | | | | (18,468) | | | | | | | | | — | | | | | | | | | | | |

|

Operating income

|

| | | | 122,630 | | | | | | 12,906 | | | | | | | | | 135,536 | | | | | | — | | | | | | | | | (7,095) | | | | | | | | | | | |

|

Interest expense, net

|

| | | | (8,489) | | | | | | 2 | | | |

[f]

|

| | | | (8,487) | | | | | | | | | |

[i]

|

| | | | — | | | | | | | | | | | |

|

Other expense, net

|

| | | | (2,780) | | | | | | (5) | | | |

[f]

|

| | | | (2,785) | | | | | | — | | | | | | | | | | | | |

[l]

|

| | | | | | |

| Income before income taxes | | | | | 111,361 | | | | | | 12,903 | | | | | | | | | 124,264 | | | | | | 18,468 | | | | | | | | | (7,095) | | | | | | | | | | | |

| Provision for income taxes | | | | | 24,265 | | | | | | (162) | | | |

[f]

|

| | | | 27,082 | | | | | | 4,063 | | | |

[j]

|

| | | | (1,561) | | | |

[m]

|

| | | | | | |

| | | | | | | | | | | | 2,979 | | | |

[g]

|

| | | | | | | | | | — | | | | | | | | | | | | | | | | | | | | |

|

Net income

|

| | | $ | 87,096 | | | | | $ | 10,086 | | | | | | | | $ | 97,182 | | | | | $ | 14,405 | | | | | | | | $ | (5,534) | | | | | | | | $ | | | |

|

Net income per share, basic and diluted

|

| | | $ | 1,742 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Weighted-average number

of shares used in computing net income per share, basic and diluted |

| | | | 50,000 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Pro forma net income per

share: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Basic and diluted

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

[v]

|

| | | $ | | | |

|

Pro forma number of shares used in computing net income per share:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Basic and diluted

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

[v]

|

| | | | | | |

For the Year Ended December 31, 2022

(in thousands, except share and per share amounts)

| | | |

SharkNinja

Global SPV, LTD. |

| |

Divestiture

Transactions Adjustments |

| | | | |

As Adjusted

Before Other Transaction Accounting Adjustments and Autonomous Entity Adjustments |

| |

Other

Transaction Accounting Adjustments |

| | | | |

Autonomous

Entity Adjustments |

| | | | |

SharkNinja,

Inc. |

| ||||||||||||||||||

|

Net sales

|

| | | $ | 3,717,366 | | | | | $ | (94,510) | | | |

[n]

|

| | | $ | 3,622,856 | | | | | $ | — | | | | | | | | $ | — | | | | | | | | $ | | | |

|

Cost of sales

|

| | | | 2,307,172 | | | | | | (134,800) | | | |

[n]

|

| | | | 2,172,372 | | | | | | — | | | | | | | | | 75,622 | | | |

[s]

|

| | | | | | |

|

Gross profit

|

| | | | 1,410,194 | | | | | | 40,290 | | | | | | | | | 1,450,484 | | | | | | — | | | | | | | | | (75,622) | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||

|

Research and development

|

| | | $ | 215,660 | | | | | $ | (724) | | | |

[n]

|

| | | $ | 214,936 | | | | | $ | — | | | | | | | | $ | — | | | | | | | | $ | | | |

|

Sales and marketing

|

| | | | 621,953 | | | | | | (23,658) | | | |

[n]

|

| | | | 598,295 | | | | | | — | | | | | | | | | — | | | | | | | | | | | |

|

General and administrative

|

| | | | 251,207 | | | | | | (3,485) | | | |

[n]

|

| | | | 247,722 | | | | | | 61,925 | | | |

[p]

|

| | | | — | | | | | | | | | | | |

|

Total operating expenses

|

| | | | 1,088,820 | | | | | | (27,867) | | | | | | | | | 1,060,953 | | | | | | 61,925 | | | | | | | | | — | | | | | | | | | | | |

|

Operating income

|

| | | | 321,374 | | | | | | 68,157 | | | | | | | | | 389,531 | | | | | | (61,925) | | | | | | | | | (75,622) | | | | | | | |||||

|

Interest expense, net

|

| | | | (27,021) | | | | | | 2 | | | |

[n]

|

| | | | (27,019) | | | | | | | | | |

[q]

|

| | | | — | | | | | | | |||||

|

Other income, net

|

| | | | 7,631 | | | | | | 3,068 | | | |

[n]

|

| | | | 10,699 | | | | | | — | | | | | | | | | | | | |

[t]

|

| | |||||

| Income before income taxes | | | | | 301,984 | | | | | | 71,227 | | | | | | | | | 373,211 | | | | | | (61,925) | | | | | | | | | (75,622) | | | | | | | | | | | |

|

Provision for income taxes

|

| | | | 69,630 | | | | | | (1,842) | | | |

[n]

|

| | | | 85,293 | | | | | | (13,624) | | | |

[r]

|

| | | | (16,637) | | | |

[u]

|

| | | | | | |

| | | | | | | | | | | | 17,505 | | | |

[o]

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net income

|

| | | $ | 232,354 | | | | | $ | 55,564 | | | | | | | | $ | 287,918 | | | | | $ | (48,301) | | | | | | | | $ | (58,985) | | | | | | | | $ | | | |

|

Net income per share, basic

and diluted |

| | | $ | 4,647 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||

|

Weighted-average number

of shares used in computing net income per share, basic and diluted |

| | | | 50,000 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||

| Pro forma net income per share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||

|

Basic and diluted

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

[v]

|

| | | $ | | | |

|

Pro forma number of shares

used in computing net income per share: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||

|

Basic and diluted

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

[v]

|

| | | | | | |

|

(in thousands, except share and per share data)

|

| |

Three Months

Ended March 31, 2023 |

| |||

| Numerator: | | | | | | | |

|

Pro forma net income, basic and diluted

|

| | | $ | | | |

| Denominator: | | | | | | | |

|

Weighted-average shares used in computing pro forma net income per share—basic

and diluted(1) |

| | | | | | |

|

Pro forma net income per share—basic and diluted

|

| | | $ | | | |

|

(in thousands, except share and per share data)

|

| |

Year Ended

December 31, 2022 |

| |||

| Numerator: | | | | | | | |

|

Pro forma net income, basic and diluted

|

| | | $ | | | |

| Denominator: | | | | | | | |

|

Weighted-average shares used in computing pro forma net income per share—basic

and diluted(1) |

| |

|

| |||

|

Pro forma net income per share—basic and diluted

|

| | | $ | | | |

| | | |

Year Ended December 31,

|

| |

Three Months Ended

March 31, |

| ||||||||||||||||||||||||

|

($ in thousands)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |||||||||||||||

|

Net Sales

|

| | | $ | 2,753,166 | | | | | $ | 3,726,994 | | | | | $ | 3,717,366 | | | | | $ | 809,626 | | | | | $ | 855,282 | | |

|

Cost of Sales

|

| | | | 1,499,724 | | | | | | 2,288,810 | | | | | | 2,307,172 | | | | | | 457,700 | | | | | | 454,739 | | |

|

Gross Profit

|

| | | | 1,253,442 | | | | | | 1,438,184 | | | | | | 1,410,194 | | | | | | 351,926 | | | | | | 400,543 | | |

| Operating Expenses: | | | | | | | | | | | | | | | | | | | | | | ||||||||||

|

Research and Development(1)

|

| | | | 159,635 | | | | | | 200,641 | | | | | | 215,660 | | | | | | 51,971 | | | | | | 58,725 | | |

|

Sales and Marketing(1)

|

| | | | 445,084 | | | | | | 619,162 | | | | | | 621,953 | | | | | | 125,541 | | | | | | 152,120 | | |

|

General and Administrative(1)

|

| | | | 183,286 | | | | | | 180,124 | | | | | | 251,207 | | | | | | 52,025 | | | | | | 67,068 | | |

|

Total Operating Expenses

|

| | | | 788,005 | | | | | | 999,927 | | | | | | 1,088,820 | | | | | | 229,537 | | | | | | 277,913 | | |

|

Operating Income

|

| | | | 465,437 | | | | | | 438,257 | | | | | | 321,374 | | | | | | 122,389 | | | | | | 122,630 | | |

|

Interest Expense, Net

|

| | | | (40,279) | | | | | | (16,287) | | | | | | (27,021) | | | | | | (4,004) | | | | | | (8,489) | | |

|

Other Income (Expense), Net

|

| | | | (5,692) | | | | | | (7,644) | | | | | | 7,631 | | | | | | (3,909) | | | | | | (2,780) | | |

|

Income Before Income Taxes

|

| | | | 419,466 | | | | | | 414,326 | | | | | | 301,984 | | | | | | 114,476 | | | | | | 111,361 | | |

|

Provision for Income Taxes

|

| | | | 92,268 | | | | | | 83,213 | | | | | | 69,630 | | | | | | 25,565 | | | | | | 24,265 | | |

|

Net Income

|

| | | $ | 327,198 | | | | | $ | 331,113 | | | | | $ | 232,354 | | | | | $ | 88,911 | | | | | $ | 87,096 | | |

| | | |

Year Ended December 31,

|

| |

Three Months Ended

March 31, |

| ||||||||||||||||||||||||

|

($ in thousands)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |||||||||||||||

|

Research and Development

|

| | | $ | 1,713 | | | | | $ | 2,918 | | | | | $ | 1,741 | | | | | $ | 821 | | | | | $ | 230 | | |

|

Sales and Marketing

|

| | | | 1,866 | | | | | | 1,755 | | | | | | 459 | | | | | | 257 | | | | | | 101 | | |

|

General and Administrative

|

| | | | 6,455 | | | | | | 9,251 | | | | | | 3,309 | | | | | | 1,492 | | | | | | 517 | | |

|

Total Share-Based Compensation

|

| | | $ | 10,034 | | | | | $ | 13,924 | | | | | $ | 5,509 | | | | | $ | 2,570 | | | | | $ | 848 | | |

| | | |

Year Ended December 31,

|

| |

Three Months Ended

March 31, |

| ||||||||||||||||||||||||

| | | |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |||||||||||||||

|

Net Sales

|

| | | | 100.0% | | | | | | 100.0% | | | | | | 100.0% | | | | | | 100.0% | | | | | | 100.0% | | |

|

Cost of Sales

|

| | | | 54.5 | | | | | | 61.4 | | | | | | 62.1 | | | | | | 56.5 | | | | | | 53.2 | | |

|

Gross Profit

|

| | | | 45.5 | | | | | | 38.6 | | | | | | 37.9 | | | | | | 43.5 | | | | | | 46.8 | | |

| Operating Expenses: | | | | | | | | | | | | | | | | | | | | | | ||||||||||

|

Research and Development

|

| | | | 5.8 | | | | | | 5.4 | | | | | | 5.8 | | | | | | 6.4 | | | | | | 6.9 | | |

|

Sales and Marketing

|

| | | | 16.2 | | | | | | 16.6 | | | | | | 16.7 | | | | | | 15.5 | | | | | | 17.8 | | |

|

General and Administrative

|

| | | | 6.6 | | | | | | 4.8 | | | | | | 6.8 | | | | | | 6.4 | | | | | | 7.7 | | |

|

Total Operating Expenses

|

| | | | 28.6 | | | | | | 26.8 | | | | | | 29.3 | | | | | | 28.3 | | | | | | 32.4 | | |

|

Operating Income

|

| | | | 16.9 | | | | | | 11.8 | | | | | | 8.6 | | | | | | 15.2 | | | | | | 14.4 | | |

|

Interest Expense, Net

|

| | | | (1.5) | | | | | | (0.4) | | | | | | (0.7) | | | | | | (0.5) | | | | | | (1.0) | | |

|

Other Income (Expense), Net

|

| | | | (0.2) | | | | | | (0.2) | | | | | | 0.2 | | | | | | (0.5) | | | | | | (0.3) | | |

|

Income Before Income Taxes

|

| | | | 15.2 | | | | | | 11.2 | | | | | | 8.1 | | | | | | 14.2 | | | | | | 13.1 | | |

|

Provision for Income Taxes

|

| | | | 3.4 | | | | | | 2.2 | | | | | | 1.8 | | | | | | 3.2 | | | | | | 2.8 | | |

|

Net Income

|

| | | | 11.8% | | | | | | 9.0% | | | | | | 6.3% | | | | | | 11.0% | | | | | | 10.3% | | |

| | | |

Three Months Ended March 31,

|

| |||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2022

|

| |

2023

|

| |

$ Change

|

| |

% Change

|

| ||||||||||||

|

Net Sales

|

| | | $ | 809,626 | | | | | $ | 855,282 | | | | | $ | 45,656 | | | | | | 5.6% | | |

| | | |

Three Months Ended March 31,

|

| |||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2022

|

| |

2023

|

| |

$ Change

|

| |

% Change

|

| ||||||||||||

|

Gross Profit

|

| | | $ | 351,926 | | | | | $ | 400,543 | | | | | | 48,617 | | | | | | 13.8% | | |

|

Gross Margin

|

| | | | 43.5% | | | | | | 46.8% | | | | | | | | | | | | | | |

| | | |

Three Months Ended March 31,

|

| |||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2022

|

| |

2023

|

| |

$ Change

|

| |

% Change

|

| ||||||||||||

|

Research and Development

|

| | | $ | 51,971 | | | | | $ | 58,725 | | | | | $ | 6,754 | | | | | | 13.0% | | |

|

Percentage of Net Sales

|

| | | | 6.4% | | | | | | 6.9% | | | | | | | | | | | | | | |

|

Sales and Marketing

|

| | | $ | 125,541 | | | | | $ | 152,120 | | | | | $ | 26,579 | | | | | | 21.2% | | |

|

Percentage of Net Sales

|

| | | | 15.5% | | | | | | 17.8% | | | | | | | | | | | | | | |

|

General and Administrative

|

| | | $ | 52,025 | | | | | $ | 67,068 | | | | | $ | 15,043 | | | | | | 28.9% | | |

|

Percentage of Net Sales

|

| | | | 6.4% | | | | | | 7.7% | | | | | | | | | | | | | | |

|

Total Operating Expenses

|

| | | $ | 229,537 | | | | | $ | 277,913 | | | | | $ | 48,376 | | | | | | 21.1% | | |

|

Percentage of Net Sales

|

| | | | 28.3% | | | | | | 32.4% | | | | | | | | | | | | | | |

| | | |

Three Months Ended March 31,

|

| |||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2022

|

| |

2023

|

| |

$ Change

|

| |

% Change

|

| ||||||||||||

|

Interest Expense, Net

|

| | | $ | (4,004) | | | | | $ | (8,489) | | | | | $ | 4,485 | | | | | | 112.0% | | |

|

Percentage of Net Sales

|

| | | | (0.5)% | | | | | | (1.0)% | | | | | | | | | | | | | | |

| | | |

Three Months Ended March 31,

|

| |||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2022

|

| |

2023

|

| |

$ Change

|

| |

% Change

|

| ||||||||||||

|

Other Expense, Net

|

| | | $ | (3,909) | | | | | $ | (2,780) | | | | | $ | (1,129) | | | | | | (28.9)% | | |

|

Percentage of Net Sales

|

| | | | (0.5)% | | | | | | (0.3)% | | | | | | | | | | | | | | |

| | | |

Three Months Ended March 31,

|

| |||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2022

|

| |

2023

|

| |

$ Change

|

| |

% Change

|

| ||||||||||||

|

Provision for Income Taxes

|

| | | $ | 25,565 | | | | | $ | 24,265 | | | | | $ | 1,300 | | | | | | (5.1)% | | |

|

Percentage of Income Before Income Taxes

|

| | | | 22.3% | | | | | | 21.8% | | | | | | | | | | | | | | |

| | | |

Year Ended December 31,

|

| |

% Change

|

| ||||||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2020 to 2021

|

| |

2021 to 2022

|

| |||||||||||||||

|

Net Sales

|

| | | $ | 2,753,166 | | | | | $ | 3,726,994 | | | | | $ | 3,717,366 | | | | | | 35.4% | | | | | | (0.3)% | | |

| | | |

Year Ended December 31,

|

| |

% Change

|

| ||||||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2020 to 2021

|

| |

2021 to 2022

|

| |||||||||||||||

|

Gross Profit

|

| | | $ | 1,253,442 | | | | | $ | 1,438,184 | | | | | $ | 1,410,194 | | | | | | 14.7% | | | | | | (1.9)% | | |

|

Gross Margin

|

| | | | 45.5% | | | | | | 38.6% | | | | | | 37.9% | | | | | | | | | | | | | | |

| | | |

Year Ended December 31,

|

| |

% Change

|

| ||||||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2020 to 2021

|

| |

2021 to 2022

|

| |||||||||||||||

|

Research and Development

|

| | | $ | 159,635 | | | | | $ | 200,641 | | | | | $ | 215,660 | | | | | | 25.7% | | | | | | 7.5% | | |

|

Percentage of Net Sales

|

| | | | 5.8% | | | | | | 5.4% | | | | | | 5.8% | | | | | | | | | | | | | | |

|

Sales and Marketing

|

| | | $ | 445,084 | | | | | $ | 619,162 | | | | | $ | 621,953 | | | | | | 39.1% | | | | | | 0.5% | | |

|

Percentage of Net Sales

|

| | | | 16.2% | | | | | | 16.6% | | | | | | 16.7% | | | | | | | | | | | | | | |

|

General and Administrative

|

| | | $ | 183,286 | | | | | $ | 180,124 | | | | | $ | 251,207 | | | | | | (1.7)% | | | | | | 39.5% | | |

|

Percentage of Net Sales

|

| | | | 6.6% | | | | | | 4.8% | | | | | | 6.8% | | | | | | | | | | | | | | |

|

Total Operating Expenses

|

| | | $ | 788,005 | | | | | $ | 999,927 | | | | | $ | 1,088,820 | | | | | | 26.9% | | | | | | 8.9% | | |

|

Percentage of Net Sales

|

| | | | 28.6% | | | | | | 26.8% | | | | | | 29.3% | | | | | | | | | | | | | | |

| | | |

Year Ended December 31,

|

| |

% Change

|

| ||||||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2020 to 2021

|

| |

2021 to 2022

|

| |||||||||||||||

|

Interest Expense, Net

|

| | | $ | (40,279) | | | | | $ | (16,287) | | | | | $ | (27,021) | | | | | | (59.6)% | | | | | | 65.9% | | |

|

Percentage of Net Sales

|

| | | | (1.5)% | | | | | | (0.4)% | | | | | | (0.7)% | | | | | | | | | | | | | | |

| | | |

Year Ended December 31,

|

| |

% Change

|

| ||||||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2020 to 2021

|

| |

2021 to 2022

|

| |||||||||||||||

|

Other Income (Expense), Net

|

| | | $ | (5,692) | | | | | $ | (7,644) | | | | | $ | 7,631 | | | | | | 34.3% | | | | | | 199.8% | | |

|

Percentage of Net Sales

|

| | | | (0.2)% | | | | | | (0.2)% | | | | | | 0.2% | | | | | | | | | | | | | | |

| | | |

Year Ended December 31,

|

| |

% Change

|

| ||||||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2020 to 2021

|

| |

2021 to 2022

|

| |||||||||||||||

|

Provision for Income Taxes

|

| | | $ | 92,268 | | | | | $ | 83,213 | | | | | $ | 69,630 | | | | | | (9.8)% | | | | | | (16.3)% | | |

| Percentage of Income Before Income Taxes | | | | | 22.0% | | | | | | 20.1% | | | | | | 23.1% | | | | | | | | | | | | | | |

| | | |

Year Ended December 31,

|

| |

Three Months Ended

March 31, |

| ||||||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |||||||||||||||

|

Net Sales

|

| | | $ | 2,753,166 | | | | | $ | 3,726,994 | | | | | $ | 3,717,366 | | | | | $ | 809,626 | | | | | $ | 855,282 | | |

|

Divested Subsidiary Adjustment(1)

|

| | | | (63,458) | | | | | | (101,695) | | | | | | (97,434) | | | | | | (20,080) | | | | | | (19,649) | | |

|

Adjusted Net Sales

|

| | | $ | 2,689,708 | | | | | $ | 3,625,299 | | | | | $ | 3,619,932 | | | | | $ | 789,546 | | | | | $ | 835,633 | | |

| | | |

Year Ended December 31,

|

| |

Three Months Ended

March 31, |

| ||||||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |||||||||||||||

|

Net Sales

|

| | | $ | 2,753,166 | | | | | $ | 3,726,994 | | | | | $ | 3,717,366 | | | | | $ | 809,626 | | | | | $ | 855,282 | | |

|

Cost of Sales

|

| | | | (1,499,724) | | | | | | (2,288,810) | | | | | | (2,307,172) | | | | | | (457,700) | | | | | | (454,739) | | |

|

Gross Profit

|

| | | | 1,253,442 | | | | | | 1,438,184 | | | | | $ | 1,410,194 | | | | | $ | 351,926 | | | | | $ | 400,543 | | |

|

Gross Margin %

|

| |

45.5%

|

| |

38.6%

|

| |

37.9%

|

| |

43.5%

|

| |

46.8%

|

| |||||||||||||||

| Divested Subsidiary Net Sales Adjustment(1) | | | | | (63,458) | | | | | | (101,695) | | | | | | (97,434) | | | | | | (20,080) | | | | | | (19,649) | | |

| Divested Subsidiary Cost of Sales Adjustment(2) | | | | | 39,512 | | | | | | 63,931 | | | | | | 64,506 | | | | | | 11,945 | | | | | | 13,027 | | |

| Product Procurement Adjustment(3) | | | | | 12,960 | | | | | | 75,642 | | | | | | 70,295 | | | | | | 15,419 | | | | | | 12,871 | | |

|

Tariff Refunds(4)

|

| | | | (38,100) | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Adjusted Gross Profit

|

| | | $ | 1,204,356 | | | | | $ | 1,476,062 | | | | | $ | 1,447,561 | | | | | $ | 359,210 | | | | | $ | 406,792 | | |

|

Adjusted Net Sales

|

| | | | 2,689,708 | | | | | | 3,625,299 | | | | | | 3,619,932 | | | | | | 789,546 | | | | | | 835,633 | | |

|

Adjusted Gross Margin

|

| |

44.8%

|

| |

40.7%

|

| |

40.0%

|

| |

45.5%

|

| |

48.7%

|

| |||||||||||||||

| | | |

Year Ended December 31,

|

| |

Three Months Ended

March 31, |

| ||||||||||||||||||||||||

|

($ in thousands, except %, share and per share amounts)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |||||||||||||||

|

Net Income

|

| | | $ | 327,198 | | | | | $ | 331,113 | | | | | $ | 232,354 | | | | | $ | 88,911 | | | | | $ | 87,096 | | |

|

Share-Based Compensation(1)

|

| | | | 10,034 | | | | | | 13,924 | | | | | | 5,509 | | | | | | 2,570 | | | | | | 848 | | |

|

Tariff Refunds(2)

|

| | | | (38,100) | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Litigation Costs(3)

|

| | | | 5,304 | | | | | | 10,602 | | | | | | 4,513 | | | | | | 161 | | | | | | 174 | | |

|

Foreign Currency Losses (Gains), Net(4)

|

| | | | 2,643 | | | | | | 3,447 | | | | | | (9,275) | | | | | | 4,720 | | | | | | 4,149 | | |

|

Loss on Extinguishment of Debt(5)

|

| | | | 16,410 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Amortization of Acquired Intangible

Assets(6) |

| | | | 19,587 | | | | | | 19,587 | | | | | | 19,587 | | | | | | 4,897 | | | | | | 4,897 | | |

|

Separation and Distribution Related Costs(7)

|

| | | | — | | | | | | — | | | | | | 2,896 | | | | | | — | | | | | | 18,468 | | |

|

Executive Bonus(8)

|

| | | | — | | | | | | — | | | | | | 34,000 | | | | | | — | | | | | | — | | |

|

Product Procurement Adjustment(9)

|

| | | | 12,960 | | | | | | 75,642 | | | | | | 70,295 | | | | | | 15,419 | | | | | | 12,871 | | |

|

Tax Impact of Adjusting Items(10)

|

| | | | (6,344) | | | | | | (27,104) | | | | | | (28,056) | | | | | | (6,109) | | | | | | (9,109) | | |

| Divested Subsidiary Net Income Adjustment(11) | | | | | (202) | | | | | | (3,969) | | | | | | (1,458) | | | | | | (1,289) | | | | | | (395) | | |

|

Adjusted Net Income

|

| | | $ | 349,490 | | | | | $ | 423,242 | | | | | $ | 330,365 | | | | | $ | 109,280 | | | | | $ | 118,999 | | |

|

Net Income Per Share, diluted

|

| | | $ | 6,544 | | | | | $ | 6,622 | | | | | $ | 4,647 | | | | | $ | 1,778 | | | | | $ | 1,742 | | |

|

Adjusted Net Income Per Diluted Share

|

| | | $ | 6,990 | | | | | $ | 8,465 | | | | | $ | 6,607 | | | | | $ | 2,186 | | | | | $ | 2,380 | | |

| Diluted Weighted-Average Number of Shares Used in Computing Adjusted Net Income Per Diluted Share | | | | | 50,000 | | | | | | 50,000 | | | | | | 50,000 | | | | | | 50,000 | | | | | | 50,000 | | |

| | | |

Year Ended December 31,

|

| |

Three Months Ended

March 31, |

| ||||||||||||||||||||||||

|

($ in thousands, except %)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |||||||||||||||

|

Net Income

|

| | | $ | 327,198 | | | | | $ | 331,113 | | | | | $ | 232,354 | | | | | $ | 88,911 | | | | | $ | 87,096 | | |

|

Interest Expense, Net(1)

|

| | | | 40,279 | | | | | | 16,287 | | | | | | 27,021 | | | | | | 4,004 | | | | | | 8,489 | | |

|

Provision for Income Taxes

|

| | | | 92,268 | | | | | | 83,213 | | | | | | 69,630 | | | | | | 25,565 | | | | | | 24,265 | | |

|

Depreciation and Amortization

|

| | | | 78,080 | | | | | | 78,183 | | | | | | 86,708 | | | | | | 20,204 | | | | | | 22,754 | | |

|

EBITDA

|

| | | $ | 537,825 | | | | | $ | 508,796 | | | | | $ | 415,713 | | | | | $ | 138,684 | | | | | $ | 142,604 | | |

|

Share-Based Compensation(2)

|

| | | | 10,034 | | | | | | 13,924 | | | | | | 5,509 | | | | | | 2,570 | | | | | | 848 | | |

|

Tariff Refunds(3)

|

| | | | (38,100) | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Litigation Costs(4)

|

| | | | 5,304 | | | | | | 10,602 | | | | | | 4,513 | | | | | | 161 | | | | | | 174 | | |

| Foreign Currency Losses (Gains), Net(5) | | | | | 2,643 | | | | | | 3,447 | | | | | | (9,275) | | | | | | 4,720 | | | | | | 4,149 | | |

|

Separation and Distribution Related

Costs(6) |

| | | | — | | | | | | — | | | | | | 2,896 | | | | | | — | | | | | | 18,468 | | |

|

Executive Bonus(7)

|

| | | | — | | | | | | — | | | | | | 34,000 | | | | | | — | | | | | | — | | |

|

Product Procurement

Adjustment(8) |

| | | | 12,960 | | | | | | 75,642 | | | | | | 70,295 | | | | | | 15,419 | | | | | | 12,871 | | |

| Divested Subsidiary Adjusted EBITDA Adjustment(9) | | | | | (2,967) | | | | | | (9,282) | | | | | | (4,037) | | | | | | (2,319) | | | | | | (1,098) | | |

|

Adjusted EBITDA

|

| | | $ | 527,699 | | | | | $ | 603,129 | | | | | $ | 519,614 | | | | | $ | 159,235 | | | | | $ | 178,016 | | |

|

Adjusted Net Sales

|

| | | | 2,689,708 | | | | | | 3,625,299 | | | | | | 3,619,932 | | | | | $ | 789,546 | | | | | $ | 835,633 | | |

|

Adjusted EBITDA Margin

|

| |

19.6%

|

| |

16.6%

|

| |

14.4%

|

| |

20.2%

|

| |

21.3%

|

| |||||||||||||||

| | | |

Year Ended December 31,

|

| |

Three Months Ended

March 31, |

| ||||||||||||||||||||||||

|

($ in thousands)

|

| |

2020

|

| |

2021

|

| |

2022

|

| |

2022

|

| |

2023

|

| |||||||||||||||

| Net Cash Provided by (Used in) Operating Activities | | | | $ | 293,435 | | | | | $ | 229,147 | | | | | $ | 204,964 | | | | | $ | (101,130) | | | | | $ | 89,762 | | |

|

Net Cash Used in Investing Activities

|

| | | | (81,434) | | | | | | (66,366) | | | | | | (52,384) | | | | | | (11,134) | | | | | | (7,799) | | |

| Net Cash Provided by (Used in) Financing Activities | | | | | (120,668) | | | | | | (54,500) | | | | | | (160,170) | | | | | | 8,026 | | | | | | (98,631) | | |

![[MISSING IMAGE: bc_netsales-4clr.jpg]](bc_netsales-4clr.jpg)

![[MISSING IMAGE: bc_market-4clr.jpg]](bc_market-4clr.jpg)

![[MISSING IMAGE: pc_global-4clr.jpg]](pc_global-4clr.jpg)

![[MISSING IMAGE: pc_addressable-4c.jpg]](pc_addressable-4c.jpg)

![[MISSING IMAGE: lc_expansion-4c.jpg]](lc_expansion-4c.jpg)

![[MISSING IMAGE: ph_productoffering-4clr.jpg]](ph_productoffering-4clr.jpg)

![[MISSING IMAGE: ph_products-4clr.jpg]](ph_products-4clr.jpg)

![[MISSING IMAGE: ph_cordless-4clr.jpg]](ph_cordless-4clr.jpg)

![[MISSING IMAGE: ph_robotvac-4clr.jpg]](ph_robotvac-4clr.jpg)

![[MISSING IMAGE: ph_robotkey-4clr.jpg]](ph_robotkey-4clr.jpg)

![[MISSING IMAGE: ph_sharkclean-4clr.jpg]](ph_sharkclean-4clr.jpg)

![[MISSING IMAGE: ph_mopswet-4clr.jpg]](ph_mopswet-4clr.jpg)

![[MISSING IMAGE: ph_floorclean-4clr.jpg]](ph_floorclean-4clr.jpg)

![[MISSING IMAGE: ph_homeproducts-4clr.jpg]](ph_homeproducts-4clr.jpg)

![[MISSING IMAGE: ph_keytech-4clr.jpg]](ph_keytech-4clr.jpg)

![[MISSING IMAGE: ph_beauty-4clr.jpg]](ph_beauty-4clr.jpg)

![[MISSING IMAGE: ph_beautytech-4clr.jpg]](ph_beautytech-4clr.jpg)

![[MISSING IMAGE: ph_smallkitchen-4clr.jpg]](ph_smallkitchen-4clr.jpg)

![[MISSING IMAGE: ph_keyproducts-4clr.jpg]](ph_keyproducts-4clr.jpg)

![[MISSING IMAGE: ph_motorized-4clr.jpg]](ph_motorized-4clr.jpg)

![[MISSING IMAGE: ph_heatingproduct-4clr.jpg]](ph_heatingproduct-4clr.jpg)

![[MISSING IMAGE: ph_heatedcooking-4clr.jpg]](ph_heatedcooking-4clr.jpg)

![[MISSING IMAGE: ph_beverageprod-4clr.jpg]](ph_beverageprod-4clr.jpg)

![[MISSING IMAGE: ph_beveragetech-4clr.jpg]](ph_beveragetech-4clr.jpg)

![[MISSING IMAGE: ph_kitchenware-4clr.jpg]](ph_kitchenware-4clr.jpg)

![[MISSING IMAGE: ph_premium-4clr.jpg]](ph_premium-4clr.jpg)

![[MISSING IMAGE: ph_disruptingappliance-4clr.jpg]](ph_disruptingappliance-4clr.jpg)

![[MISSING IMAGE: ph_optimization-4clr.jpg]](ph_optimization-4clr.jpg)

|

Name

|

| |

Age

|

| |

Position

|

|

| Executive Officers | | | | | | | |

| Mark Barrocas | | |

51

|

| | Chief Executive Officer and Director | |

| Larry Flynn | | |

43

|

| | Interim Chief Financial Officer and Chief Accounting Officer | |

| Pedro J. Lopez-Baldrich | | |

51

|

| | Chief Legal Officer | |

| Neil Shah | | |

43

|

| | Chief Commercial Officer, EVP | |

| Non-Employee Directors | | | | | | | |

| Xuning Wang | | |

54

|

| | Chairperson | |

| Peter Feld | | |

58

|

| | Director Nominee | |

| Wendy Hayes | | |

53

|

| | Director Nominee | |

| Chi Kin Max Hui | | |

49

|

| | Director Nominee | |

| Dennis Paul | | |

50

|

| | Director Nominee | |

| Timothy R. Warner | | |

72

|

| | Director Nominee | |

|

Name of Beneficial Owner

|

| |

Number of

Ordinary Shares Beneficially Owned |

| |

Percentage of

Ordinary Shares |

|

| Directors, Director Nominees and Executive Officers | | | | | | | |

|

Mark Barrocas(1)

|

| | | | | | |

|

Larry Flynn

|

| | | | | | |

|

Pedro J. Lopez-Baldrich(2)

|

| | | | | | |

|

Neil Shah(3)

|

| | | | | | |

|

Xuning Wang(4)

|

| | | | | | |

|

Peter Feld

|

| | | | | | |

|

Wendy Hayes

|

| | | | | | |

|

Chi Kin Max Hui(5)

|

| | | | | | |

|

Dennis Paul

|

| | | | | | |

|

Timothy R. Warner

|

| | | | | | |

| All directors, director nominees and executive officers as a group (10 persons) | | | | | | | |

| 5% Shareholders | | | | | | | |

|

Entities affiliated with CDH(6)

|

| | | | | |

| | | |

Page

|

| |||

| Audited Consolidated Financial Statements | | | | | | | |

| | | | | F-2 | | | |

| | | | | F-4 | | | |

| | | | | F-5 | | | |

| | | | | F-6 | | | |

| | | | | F-7 | | | |

| | | | | F-8 | | | |

| | | | | F-9 | | | |

| Unaudited Condensed Consolidated Financial Statements | | | | | | | |

| | | | | F-38 | | | |

| | | | | F-39 | | | |

| | | | | F-40 | | | |

| | | | | F-41 | | | |

| | | | | F-42 | | | |

| | | | | F-43 | | | |

| | | | | Revenue Recognition—Variable Consideration for Sales Discounts and Rebates | |

| |

Description of the Matter

|

| | As described in Note 2 to the consolidated financial statements, the Company has contractual programs and practices with customers that can give rise to elements of variable consideration, including discount and rebate programs. The Company accounts for consideration payable to customers under these programs as a reduction of net sales and if the consideration payable to a customer includes a variable amount, the Company estimates the transaction price using the most likely amount method. As of December 31, 2022, the Company had accrued sales incentives of $230.2 million. | |

| | | | | Auditing the Company’s accounting for variable consideration for certain non-contractual discount and rebate programs was challenging and subjective due to the degree of estimation involved in measuring the variable consideration. Given the nature and significance of the reserves associated with these discount and rebate programs, subjective auditor judgment was required to evaluate completeness of the amounts accrued for sales incentives. | |

| |

How We

Addressed the Matter in Our Audit |

| | To test variable consideration related to sales discounts and rebates, our audit procedures included, among others, testing the completeness and accuracy of the underlying data used in the Company’s calculation. For a sample of customers, we agreed sales to underlying support and the terms of the rebate program to the underlying contract and tested the calculation of discount and rebate reserves. We tested management’s lookback analysis over historical reserves compared to actuals and a sample of credit memos issued to customers for sales discounts and rebates compared to the reserves. To test the completeness of the reserve we compared a sample of credit notes issued after December 31, 2022 to the Company’s estimate. | |

(in thousands, except share and per share data)

| | | |

As of December 31,

|

| |||||||||

| | | |

2021

|

| |

2022

|

| ||||||

| Assets | | | | | | | | | | | | | |

| Current assets: | | | | | | | | | | | | | |

|

Cash and cash equivalents

|

| | | $ | 225,362 | | | | | $ | 192,890 | | |

|

Restricted cash

|

| | | | 15,235 | | | | | | 25,880 | | |

|

Accounts receivable, net(1)

|

| | | | 841,547 | | | | | | 766,503 | | |

|

Inventories

|

| | | | 602,482 | | | | | | 548,588 | | |

|

Prepaid expenses and other current assets(2)

|

| | | | 86,426 | | | | | | 181,831 | | |

|

Total current assets

|

| | | | 1,771,052 | | | | | | 1,715,692 | | |

|

Property and equipment, net

|

| | | | 109,101 | | | | | | 137,341 | | |

|

Operating lease right-of-use assets

|

| | | | 73,277 | | | | | | 67,321 | | |

|

Intangible assets, net

|

| | | | 510,169 | | | | | | 492,709 | | |

|

Goodwill

|

| | | | 840,825 | | | | | | 840,148 | | |

|

Deferred tax assets, noncurrent

|

| | | | 7,892 | | | | | | 6,291 | | |

|

Other assets, noncurrent(3)

|

| | | | 44,040 | | | | | | 35,389 | | |

|

Total assets

|

| | | $ | 3,356,356 | | | | | $ | 3,294,891 | | |

| Liabilities and Shareholders’ Equity | | | | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | | | | |

|

Accounts payable(4)

|

| | | $ | 442,564 | | | | | $ | 328,122 | | |

|

Accrued expenses and other current liabilities(5)

|

| | | | 494,782 | | | | | | 552,023 | | |

|

Tax payable

|

| | | | 6,751 | | | | | | 1,581 | | |

|

Current portion of long-term debt

|

| | | | 49,402 | | | | | | 86,972 | | |

|

Total current liabilities

|

| | | | 993,499 | | | | | | 968,698 | | |

|

Long-term debt

|

| | | | 435,953 | | | | | | 349,169 | | |

|

Operating lease liabilities, noncurrent

|

| | | | 63,906 | | | | | | 61,779 | | |

|

Deferred tax liabilities, noncurrent

|

| | | | 81,828 | | | | | | 60,976 | | |

|

Other liabilities, noncurrent

|

| | | | 19,807 | | | | | | 25,980 | | |

|

Total liabilities

|

| | | $ | 1,594,993 | | | | | $ | 1,466,602 | | |

| Commitments and contingencies (Note 9) | | | | | | | | | | | | | |

| Shareholders’ equity: | | | | | | | | | | | | | |

|

Ordinary shares, $0.20 par value per share, 250,000 shares authorized, 50,000 shares issued and outstanding as of December 31, 2021 and 2022

|

| | | | 10 | | | | | | 10 | | |

|

Additional paid-in capital

|

| | | | 954,435 | | | | | | 941,210 | | |

|

Retained earnings

|

| | | | 797,970 | | | | | | 896,738 | | |

|

Accumulated other comprehensive income (loss)

|

| | | | 8,948 | | | | | | (9,669) | | |

|

Total shareholders’ equity

|

| | | | 1,761,363 | | | | | | 1,828,289 | | |

|

Total liabilities and shareholders’ equity

|

| | | $ | 3,356,356 | | | | | $ | 3,294,891 | | |

(in thousands, except share and per share data)

| | | |

Year Ended December 31,

|

| |||||||||||||||

| | | |

2020

|

| |

2021

|

| |

2022

|

| |||||||||

|

Net sales(1)

|

| | | $ | 2,753,166 | | | | | $ | 3,726,994 | | | | | $ | 3,717,366 | | |

|

Cost of sales(2)

|

| | | | 1,499,724 | | | | | | 2,288,810 | | | | | | 2,307,172 | | |

|

Gross profit

|

| | | | 1,253,442 | | | | | | 1,438,184 | | | | | | 1,410,194 | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | |

|

Research and development(3)

|

| | | | 159,635 | | | | | | 200,641 | | | | | | 215,660 | | |

|

Sales and marketing

|

| | | | 445,084 | | | | | | 619,162 | | | | | | 621,953 | | |

|

General and administrative

|

| | | | 183,286 | | | | | | 180,124 | | | | | | 251,207 | | |

|

Total operating expenses

|

| | | | 788,005 | | | | | | 999,927 | | | | | | 1,088,820 | | |

|

Operating income

|

| | | | 465,437 | | | | | | 438,257 | | | | | | 321,374 | | |

|

Interest expense, net

|

| | | | (40,279) | | | | | | (16,287) | | | | | | (27,021) | | |

|

Other income (expense), net

|

| | | | (5,692) | | | | | | (7,644) | | | | | | 7,631 | | |

|

Income before income taxes

|

| | | | 419,466 | | | | | | 414,326 | | | | | | 301,984 | | |

|

Provision for income taxes

|

| | | | 92,268 | | | | | | 83,213 | | | | | | 69,630 | | |

|

Net income

|

| | | $ | 327,198 | | | | | $ | 331,113 | | | | | $ | 232,354 | | |

|

Net income per share, basic and diluted

|

| | | $ | 6,544 | | | | | $ | 6,622 | | | | | $ | 4,647 | | |

| Weighted-average number of shares used in computing net income per share, basic and diluted | | | | | 50,000 | | | | | | 50,000 | | | | | | 50,000 | | |

(in thousands)

| | | |

Year Ended December 31,

|

| |||||||||||||||

| | | |

2020

|

| |

2021

|

| |

2022

|

| |||||||||

|

Net income

|

| | | $ | 327,198 | | | | | $ | 331,113 | | | | | $ | 232,354 | | |

| Other comprehensive income (loss), net of tax: | | | | | | | | | | | | | | | | | | | |

|

Foreign currency translation adjustments

|

| | | | 10,507 | | | | | | 541 | | | | | | (18,617) | | |

|

Comprehensive income

|

| | | $ | 337,705 | | | | | $ | 331,654 | | | | | $ | 213,737 | | |

(in thousands, except share data)

| | | |

Ordinary shares

|

| |

Additional

Paid-in Capital |

| |

Accumulated

Other Comprehensive Income (Loss) |

| |

Retained

Earnings |

| |

Total

Shareholder’s Equity |

| |||||||||||||||||||||

| | | |

Shares

|

| |

Amount

|

| ||||||||||||||||||||||||||||||

|

Balance as of December 31, 2019

|

| | | | 50,000 | | | | | $ | 10 | | | | | $ | 850,466 | | | | | $ | (2,100) | | | | | $ | 181,659 | | | | | $ | 1,030,035 | | |

|

Contribution from parent

|

| | | | — | | | | | | — | | | | | | 80,011 | | | | | | — | | | | | | — | | | | | | 80,011 | | |

|

Share-based compensation cost

|

| | | | — | | | | | | — | | | | | | 10,034 | | | | | | — | | | | | | — | | | | | | 10,034 | | |

|

Other comprehensive income, net of tax

|

| | | | — | | | | | | — | | | | | | — | | | | | | 10,507 | | | | | | — | | | | | | 10,507 | | |

|

Net income

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 327,198 | | | | | | 327,198 | | |

|

Balance as of December 31, 2020

|

| | | | 50,000 | | | | | $ | 10 | | | | | $ | 940,511 | | | | | $ | 8,407 | | | | | $ | 508,857 | | | | | $ | 1,457,785 | | |

|

Distribution paid to parent

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | (42,000) | | | | | | (42,000) | | |

|

Share-based compensation cost

|

| | | | — | | | | | | — | | | | | | 13,924 | | | | | | — | | | | | | — | | | | | | 13,924 | | |

|

Other comprehensive income, net of tax

|

| | | | — | | | | | | — | | | | | | — | | | | | | 541 | | | | | | — | | | | | | 541 | | |

|

Net income

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 331,113 | | | | | | 331,113 | | |

|

Balance as of December 31, 2021

|

| | | | 50,000 | | | | | $ | 10 | | | | | $ | 954,435 | | | | | $ | 8,948 | | | | | $ | 797,970 | | | | | $ | 1,761,363 | | |

|

Distribution paid to parent

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | (83,450) | | | | | | (83,450) | | |

|

Intercompany note to parent (Note 10)

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | (50,136) | | | | | | (50,136) | | |

|

Recharge from parent for share-based compensation

|

| | | | — | | | | | | — | | | | | | (18,734) | | | | | | — | | | | | | — | | | | | | (18,734) | | |

|

Share-based compensation cost

|

| | | | — | | | | | | — | | | | | | 5,509 | | | | | | — | | | | | | — | | | | | | 5,509 | | |

|

Other comprehensive loss, net of tax

|

| | | | — | | | | | | — | | | | | | — | | | | | | (18,617) | | | | | | — | | | | | | (18,617) | | |

|

Net income

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 232,354 | | | | | | 232,354 | | |

|

Balance as of December 31, 2022

|

| | | | 50,000 | | | | | $ | 10 | | | | | $ | 941,210 | | | | | $ | (9,669) | | | | | $ | 896,738 | | | | | $ | 1,828,289 | | |

(in thousands)

| | | |

Year Ended December 31,

|

| |||||||||||||||

| | | |

2020

|

| |

2021

|

| |

2022

|

| |||||||||

| Cash flows from operating activities: | | | | | | | | | | | | | | | | | | | |

|

Net income

|

| | | $ | 327,198 | | | | | $ | 331,113 | | | | | $ | 232,354 | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | | | | | | | | |

|

Depreciation and amortization

|

| | | | 78,080 | | | | | | 78,183 | | | | | | 86,708 | | |

|

Share-based compensation cost

|

| | | | 10,034 | | | | | | 13,924 | | | | | | 5,509 | | |

|

Provision for credit losses

|

| | | | 9,391 | | | | | | 7,913 | | | | | | 8,965 | | |

|

Non-cash lease expense

|

| | | | 11,441 | | | | | | 13,062 | | | | | | 15,475 | | |

|

Amortization of debt discount

|

| | | | 1,568 | | | | | | 906 | | | | | | 932 | | |

|

Loss on extinguishment of debt

|

| | | | 16,410 | | | | | | — | | | | | | — | | |

|

Deferred income taxes, net

|

| | | | (7,506) | | | | | | (15,127) | | | | | | (16,646) | | |

|

Loss (gain) from equity method investment

|

| | | | 3,495 | | | | | | 4,492 | | | | | | (141) | | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | | | | | | | | |

|

Accounts receivable(1)

|

| | | | (335,285) | | | | | | (77,444) | | | | | | 519 | | |

|

Inventories

|

| | | | (179,375) | | | | | | (185,474) | | | | | | 53,894 | | |

|

Prepaid expenses and other assets(2)

|

| | | | (29,755) | | | | | | (47,725) | | | | | | (114,163) | | |

|

Accounts payable(3)

|

| | | | 198,746 | | | | | | 74,850 | | | | | | (118,161) | | |

|

Tax payable

|

| | | | 14,414 | | | | | | (13,343) | | | | | | (5,170) | | |

|

Operating lease liability

|

| | | | (10,771) | | | | | | (12,629) | | | | | | (14,316) | | |

|

Accrued expenses and other liabilities(4)

|

| | | | 185,350 | | | | | | 56,446 | | | | | | 69,205 | | |

|

Net cash provided by operating activities

|

| | | | 293,435 | | | | | | 229,147 | | | | | | 204,964 | | |

| Cash flows from investing activities: | | | | | | | | | | | | | | | | | | | |

|

Purchase of property and equipment

|

| | | | (54,497) | | | | | | (47,992) | | | | | | (80,257) | | |

|

Purchase of intangible asset

|

| | | | (3,389) | | | | | | (5,068) | | | | | | (7,348) | | |

|

Capitalized internal-use software development

|

| | | | (3,193) | | | | | | (7,014) | | | | | | (6,829) | | |

|

Cash receipts on deferred payment in sold receivables

|

| | | | — | | | | | | — | | | | | | 42,416 | | |

|

Business acquisition of Qfeeltech, net of cash acquired

|

| | | | (16,860) | | | | | | — | | | | | | — | | |

|

Investment in equity method investment

|

| | | | (3,495) | | | | | | (4,492) | | | | | | (66) | | |

|

Other investing activities, net

|

| | | | — | | | | | | (1,800) | | | | | | (300) | | |

|

Net cash used in investing activities

|

| | | | (81,434) | | | | | | (66,366) | | | | | | (52,384) | | |

| Cash flows from financing activities: | | | | | | | | | | | | | | | | | | | |

|

Proceeds from issuance of debt, net of issuance cost

|

| | | | 727,263 | | | | | | 110,000 | | | | | | 259,854 | | |

|

Repayment of debt

|

| | | | (927,942) | | | | | | (122,500) | | | | | | (310,000) | | |

|

Contribution from parent

|

| | | | 80,011 | | | | | | — | | | | | | — | | |

|

Intercompany note to parent

|

| | | | — | | | | | | — | | | | | | (49,286) | | |

|

Distribution paid to parent

|

| | | | — | | | | | | (42,000) | | | | | | (45,438) | | |

|

Recharge from parent for share-based compensation

|

| | | | — | | | | | | — | | | | | | (15,300) | | |

|

Net cash used in financing activities

|

| | | | (120,668) | | | | | | (54,500) | | | | | | (160,170) | | |

|

Effect of exchange rates changes on cash

|

| | | | 8,433 | | | | | | (704) | | | | | | (14,237) | | |

|

Net increase (decrease) in cash, cash equivalents, and restricted cash

|

| | | | 99,766 | | | | | | 107,577 | | | | | | (21,827) | | |

|

Cash, cash equivalents, and restricted cash at beginning of year

|

| | | | 33,254 | | | | | | 133,020 | | | | | | 240,597 | | |

|

Cash, cash equivalents, and restricted cash at end of year

|

| | | $ | 133,020 | | | | | $ | 240,597 | | | | | $ | 218,770 | | |

| Supplemental disclosures of cash flow information: | | | | | | | | | | | | | | | | | | | |

|

Cash paid for income taxes

|

| | | $ | 74,513 | | | | | $ | 91,892 | | | | | $ | 90,027 | | |

|

Cash paid for interest

|

| | | | 17,828 | | | | | | 12,005 | | | | | | 16,322 | | |

| Supplemental disclosures of noncash investing and financing activities: | | | | | | | | | | | | | | | | | | | |

|

Purchase of property and equipment accrued and not yet paid

|

| | | $ | 731 | | | | | $ | 4,226 | | | | | $ | 1,235 | | |

|

Deferred payments related to business acquisition

|

| | | | — | | | | | | 600 | | | | | | — | | |

|

Share-based compensation recharge not yet paid

|

| | | | — | | | | | | — | | | | | | (3,434) | | |

|

Deferred payment received for sold receivables

|

| | | | — | | | | | | — | | | | | | (64,710) | | |

| Reconciliation of cash, cash equivalents and restricted cash within the Consolidated Balance Sheets to the amounts shown in the Statements of Cash Flows above: | | | | | | | | | | | | | | | | | | | |

|

Cash and cash equivalents

|

| | | $ | 129,928 | | | | | $ | 225,362 | | | | | $ | 192,890 | | |

|

Restricted cash

|

| | | | 3,092 | | | | | | 15,235 | | | | | | 25,880 | | |

|

Total cash, cash equivalents and restricted cash

|

| | | $ | 133,020 | | | | | $ | 240,597 | | | | | $ | 218,770 | | |

| | | |

Accounts Receivable, Net

|

| |

Net Sales

|

| ||||||||||||||||||||||||

| | | |

As of December 31,

|

| |

Year Ended December 31,

|

| ||||||||||||||||||||||||

| | | |

2021

|

| |

2022

|

| |

2020

|

| |

2021

|

| |

2022

|

| |||||||||||||||

|

Customer A

|

| | | | 16.1% | | | | | | 15.1% | | | | | | 14.5% | | | | | | 16.0% | | | | | | 17.0% | | |

|

Customer B

|

| | | | 10.0 | | | | | | * | | | | | | * | | | | | | * | | | | | | * | | |

|

Customer C

|

| | | | * | | | | | | 19.8 | | | | | | 16.6 | | | | | | 16.1 | | | | | | 15.7 | | |

|

Customer D

|

| | | | * | | | | | | * | | | | | | * | | | | | | * | | | | | | 10.2 | | |

| | | |

Year Ended

December 31, |

| |||

| | | |

2022

|

| |||

| | | |

(in thousands)

|

| |||

|

Beginning balance

|

| | | $ | — | | |

|

Non-cash addition to DPP receivable

|

| | | | 64,710 | | |

|

Cash collected on DPP receivable

|

| | | | (42,416) | | |

|

Ending balance

|

| | | $ | 22,294 | | |

| | Molds and tooling | | |

3 years

|

|

| | Computer and software | | |

3 years

|

|

| | Displays | | |

2 years

|

|

| | Equipment | | |

5 years

|

|

| | Furniture and fixtures | | |

7 years

|

|

| | Leasehold improvements | | |

Shorter of remaining lease

term or estimated useful life |

|

| | Developed technology | | |

12 years

|

|

| | Patents | | |

10 years

|

|

| | Customer relationships | | |

9 years

|

|

| | Trade name and trademarks | | |

Indefinite and assessed

annually for impairment |

|

| | | |

Year Ended December 31,

|

| |||||||||||||||||||||||||||||||||

| | | |

2020

|

| |

2021

|

| |

2022

|

| |||||||||||||||||||||||||||

| | | |

Amount

|

| |

Percentage of

Net Sales |

| |

Amount

|

| |

Percentage of

Net Sales |

| |

Amount

|

| |

Percentage of

Net Sales |

| ||||||||||||||||||

| | | |

(in thousands, except percentages)

|

| |||||||||||||||||||||||||||||||||

|

North America(1)

|