UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year ended

OR

OR

Date of event requiring this shell company report________________

For the transition period from ___________________________ to ___________________________

Commission File Number:

(Exact name of Registrant as specified in its charter)

Not applicable |

|

|

(Translation of Registrant’s name into English) |

|

(Jurisdiction of incorporation or organization) |

All Seasons Place

(Address of principal executive offices)

All Seasons Place

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

|

|

|||

|

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

On September 30, 2023, the issuer had

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If the report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ |

Accelerated filer ☐ |

Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐

Other ☐

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

ZAPP ELECTRIC VEHICLES GROUP LIMITED

TABLE OF CONTENTS

ii |

||

iii |

||

iii |

||

iii |

||

|

1 |

|

Item 1. |

1 |

|

Item 2. |

1 |

|

Item 3. |

1 |

|

Item 4. |

27 |

|

Item 4A. |

36 |

|

Item 5. |

36 |

|

Item 6. |

40 |

|

Item 7. |

47 |

|

Item 8. |

48 |

|

Item 9. |

48 |

|

Item 10. |

49 |

|

Item 11. |

57 |

|

Item 12. |

57 |

|

|

57 |

|

Item 13. |

57 |

|

Item 14. |

Material Modifications to the Rights of Security Holders and Use of Proceeds |

57 |

Item 15. |

57 |

|

Item 16A. |

58 |

|

Item 16B. |

58 |

|

Item 16C. |

58 |

|

Item 16D. |

59 |

|

Item 16E. |

Purchase of Equity Securities by the Issuer and Affiliated Purchasers |

59 |

Item 16F. |

59 |

|

Item 16G. |

59 |

|

Item 16H. |

59 |

|

Item 16I. |

Disclosure Regarding Foreign Jurisdictions That Prevent Inspections |

59 |

|

60 |

|

Item 17. |

60 |

|

Item 18. |

60 |

|

Item 19. |

60 |

|

F-1 |

||

i

EXPLANATORY NOTE

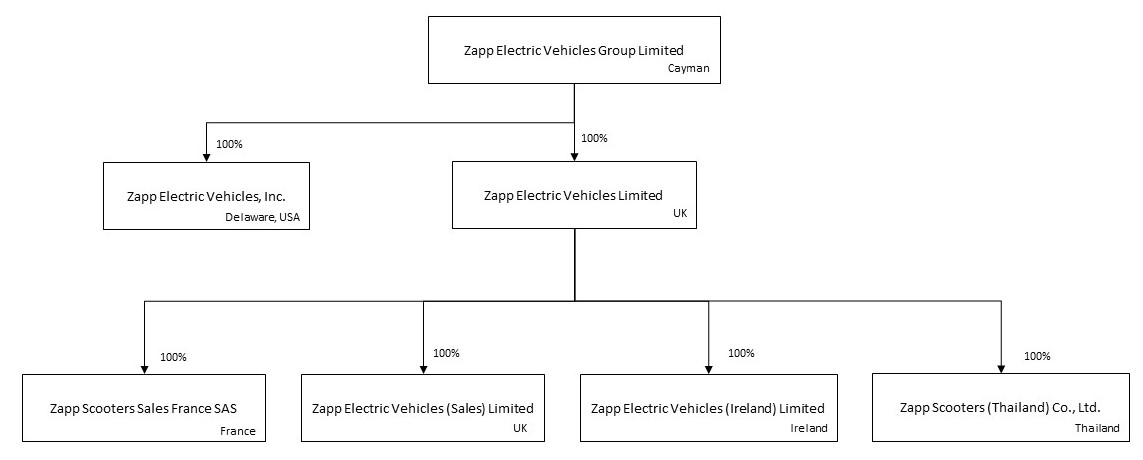

On April 28, 2023 , Zapp Electric Vehicles Group Limited, an exempted company incorporated with limited liability under the laws of the Cayman Islands (“Zapp EV”), consummated the business combination pursuant to the Agreement and Plan of Merger, dated as of November 22, 2022 (the “Merger Agreement”), by and among Zapp EV, CIIG Capital Partners II, Inc. (“CIIG II”), Zapp Electric Vehicles Limited, a private company limited by shares registered in England and Wales (“Zapp UK”) and Zapp Electric Vehicles, Inc., a Delaware corporation and direct, wholly owned subsidiary of Zapp EV (“Merger Sub”).

The Merger Agreement provided that the parties thereto would enter into a business combination transaction (the “Business Combination”) pursuant to which, among other things, (i) the shareholders of Zapp UK transferred their respective ordinary shares of Zapp UK to Zapp EV in exchange for ordinary shares of Zapp EV (“Ordinary Shares”, and such exchange, the “Company Exchange”); and (ii) immediately following the Company Exchange, Merger Sub merged with and into CIIG II, with CIIG II being the surviving corporation in the merger (the “Merger”), and each outstanding share of common stock of CIIG II (other than certain excluded shares) would convert into the right to receive one Zapp EV Ordinary Share.

Upon the consummation of the Business Combination: (i) the shareholders of Zapp UK transferred their respective shares of Zapp UK to Zapp EV in exchange for 41,296,259 Zapp EV Ordinary Shares pursuant to the Company Exchange, (ii) $6.1 million in aggregate principal amount of Zapp UK’s senior unsecured convertible loan notes due 2025 (the “Zapp UK Convertible Loan Notes”) were automatically redeemed at the principal amount by conversion into ordinary shares of Zapp UK, which were then transferred to Zapp EV in exchange for 871,428 Zapp EV Ordinary Shares; (iii) all Zapp UK options, whether vested or unvested, were released and cancelled by holders of Zapp UK options in exchange for 4,410,844 options to purchase Zapp EV Ordinary Shares (“Zapp EV Exchange Options”), of which 4,082,240 Zapp EV Exchange Options were fully vested upon the consummation of the Business Combination; (iv) the 6,000,000 Zapp UK warrants issued to Michael Joseph to purchase 6,000,000 ordinary shares of Zapp UK ceased to be warrants with respect to ordinary shares of Zapp UK and were assumed by Zapp EV and converted into 3,412,469 fully vested warrants to purchase Zapp EV Ordinary Shares (“Zapp EV Exchange Warrants”); (v) all shares of CIIG II Class A common stock, par value $0.0001 per share, and CIIG II Class B common stock, par value $0.0001 per share, were cancelled and automatically deemed to represent the right to receive 28,750,000 Zapp EV Ordinary Shares and 7,187,500 Zapp EV Ordinary Shares (of which 754,687 Zapp EV Ordinary Shares are unvested and subject to certain vesting conditions), respectively; and (vi) each CIIG II warrant was modified to provide that such warrant no longer entitles the holder thereof to purchase the number of shares of CIIG II’s common stock set forth therein and in substitution thereof such warrant would entitle the holder to acquire the same number of Zapp EV Ordinary Shares per warrant on the same terms (“Zapp EV Public Warrants”).

The Business Combination was consummated on April 28, 2023, whereupon Zapp UK became a direct wholly-owned subsidiary of Zapp EV, and CIIG II became a direct wholly-owned subsidiary of Zapp EV (changing its name to Zapp Electric Vehicles, Inc.). On May 1, 2023, Zapp EV Ordinary Shares and Zapp EV Public Warrants commenced trading on The Nasdaq Stock Market LLC, or “Nasdaq”, under the symbols “ZAPP” and “ZAPPW,” respectively.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report and the information incorporated by reference herein include certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (or the “Exchange Act”). These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this Report and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our future results of operations, financial condition, liquidity, prospects, growth, strategies, future market conditions or economic performance, developments in the capital and credit markets, and the evolution of the industry and markets in which we intend to operate.

The forward-looking statements contained in this Report are based on our current expectations and beliefs concerning future developments. There can be no assurance that future developments will be those that we have anticipated. All forward-looking statements herein involve risks, uncertainties and/or potentially incorrect assumptions, which may cause our actual results and financial condition to be materially different from those expressed or implied by the forward-looking statements.

Many factors could cause our actual future results of operations and financial condition to be materially different from (and more negative than) those expressed, anticipated or implied by the forward-looking statements in this Report, including without limitation: (i) our ability to raise sufficient additional capital to continue to operate as a Going Concern, (ii) the effect of the public listing of our securities on our business relationships, performance, financial condition and business generally, (iii) the outcome of any legal proceedings that may be instituted against the Company or its subsidiaries, (iv) our ability to maintain the listing of our securities on Nasdaq, (v) volatility in the price of our securities due to a variety of factors, including without limitation changes in the competitive and highly regulated industry in which we plan to operate, variations in competitors’ performance and success, and changes in laws and regulations affecting our business, (vi) our ability to implement business plans, meet forecasts and other expectations, and identify opportunities, (vii) the risk of slow growth and of downturns in the nascent and highly competitive electric vehicle industry, (viii) our ability to build the Zapp brand and consumers’ recognition, acceptance and adoption of the Zapp brand, (ix) the risk that we may be unable to develop and manufacture electric vehicles of sufficient quality, on schedule and at scale, that would appeal to a large customer base, (x) the risk that we have a limited operating history, have not yet released a commercially available electric vehicle and do not have experience manufacturing or selling a commercial product at scale, (xi) the risk that we may not be able to effectively manage our growth, including our design, research, development and maintenance capabilities and (xii) other factors discussed under “Item 3.D.—Key Information—Risk Factors” in this Annual Report, which section is incorporated herein by reference.

The foregoing list of risk factors described above and set forth in the “Risk Factors” section below is not exhaustive. Other sections of this annual report describe additional factors that could adversely affect our business, results of operations and financial condition. Should one or more of any such risks and/or uncertainties be adversely realized, or should any of our assumptions prove incorrect, actual results may vary in material negative respects from those expressed, anticipated or implied by the forward-looking statements herein. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. We undertake no obligation, except as required by law, to revise publicly any forward-looking statement to reflect circumstances or events after the date of this Report or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks described below and in the other periodic reports we file from time to time with the U.S. Securities and Exchange Commission (the “SEC”).

CURRENCY PRESENTATION

In this Annual Report, references to “$,” “USD” and “U.S. Dollars” are to the lawful currency of the United States of America, references to “EUR” and “€” are to the single currency adopted by participating member states of the European Union relating to Economic and Monetary Union, references to “GBP” and “£” are to the lawful currency of the United Kingdom, and references to “Thai Baht” or “THB” are to the lawful currency of the Kingdom of Thailand.

Unless otherwise specified or the context requires otherwise, all financial information for the Company provided in this annual report is denominated in U.S. Dollars.

DEFINITIONS

Definitions

Unless otherwise specified or the context otherwise requires in this Annual Report:

iii

iv

INFORMATION ABOUT IFRS AND NON-IFRS FINANCIAL MEASURES

Our financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. We do not refer to any non-IFRS measures in this Annual Report.

MARKET AND INDUSTRY DATA

Certain industry data and market data included in this Annual Report were obtained from independent third-party surveys, market research, publicly available information, reports of governmental agencies, and industry publications. Such data are based on and reflect a number of assumptions and limitations, and you are cautioned not to give undue weight to data and information obtained from these sources and referenced herein. We believe such data and information are helpful in gaining an understanding of the nascent electric vehicle industry and the markets in which we plan to operate, but caution you that investment in our Company’s securities is subject to a high degree of risk and uncertainty due to a variety of factors, including those described below in “Item 3.D—Key Information—Risk Factors.” These and other factors could cause results to differ materially from those expressed or implied by data and other information compiled by independent parties and referenced herein.

v

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Not applicable.

B. Advisers

Not applicable.

C. Auditors

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our securities carries a significant degree of risk. You should carefully consider the following risks and other information in this Annual Report, including our consolidated financial statements and related notes included herein, in connection with your ownership of our securities. If any of the negative outcomes or events described below occur, our business and financial results could be adversely affected in a material way. This could cause the trading price of our securities to decline, perhaps significantly, and you therefore may lose part or all of your investment. The risks set out below are not exhaustive and do not comprise all of the risks associated with an investment in the Company’s securities. Additional risks and uncertainties not currently known to us or which we currently deem immaterial may also have a material adverse effect on our business, results of operations, financial condition and prospects.

Risks Related to Zapp’s Business and Industry

We are an early-stage company with a history of losses and expect to incur significant expenses and losses for at least the near and medium term. We may not achieve or maintain profitability in the future.

We have not generated revenue and have incurred net losses since our inception, including losses of $222 million and $4 million for the years ended September 30, 2023, and 2022, respectively. We believe that we will continue to incur operating and net losses in the future until at least the time we begin significant deliveries of our vehicles which may occur later than we expect or not at all. We may not be profitable for at least the near and medium term as we invest in our business, build capacity and ramp-up operations, and we cannot assure you that we will ever achieve or be able to maintain profitability in the future. Even if we are able to successfully develop our vehicles and attract customers, there can be no assurance that we will be financially successful. For example, as we expand internationally and expand our vehicle portfolio, including the possible introduction of lower-priced vehicles, we will need to manage costs effectively to sell those products at our expected margins. Failure of the Company to become profitable could materially and adversely affect the value of your investment in our securities. Our ability to achieve profitability will depend on the successful development, commercial introduction and consumer acceptance of our vehicles including our first product, the i300 electric motorcycle, and our services, which may not occur. Our business also will at times require significant amounts of working capital to support the development of additional vehicle models and service platforms. An inability to generate positive cash flow in the near term may adversely affect our ability to raise needed capital for our business on reasonable terms, diminish supplier or customer willingness to enter into transactions with us, and have other adverse effects that may negatively impact our viability as a business in the medium and longer term. There can be no assurance that we will achieve positive cash flow in the near future or at all.

We continue to face significant liquidity constraints and require additional external sources of capital to fund our operations and for our debt service and other obligations.

Since inception, we have relied on a combination of debt and equity financing to fund our operations. Until the commercial launch and first customer deliveries of the i300, which we anticipate will allow us to begin generating cash from operations, we will continue to rely on external financing to fund our operations. There can be no assurance that we will be able to obtain such additional financing on commercially reasonable terms, or at all.

1

In order to minimize cash outflows, we have implemented strategies to conserve cash, such as delaying the settlement of payment obligations with a number of key suppliers, including professional services providers, and other payments related to the Business Combination, which has resulted in our trade and other payables increasing to $19.9 million at September 30, 2023 compared to $0.9 million at September 30, 2022. Despite our expectation that we will begin to generate revenues in 2024, the development of our business will result in increased operating cash outflows during 2024 compared to 2023. We expect that our cash flows from operating activities will continue to be insufficient to cover operating expenses and interest payments, and that we therefore will need other capital resources this year to fund our operations, debt service and other obligations as they become due, including the settlement of deferred payment obligations related to the Business Combination.

If we are unable to negotiate further extensions to our obligations to our suppliers or to generate sufficient revenues following our launch of the i300, we will need other external sources of capital to continue our operations, including through either debt or equity financing transactions, which may not be available on commercially reasonable terms, or at all. If these actions are not successful, and we are unable to continue to delay payments by agreement of certain major suppliers, we may not have sufficient liquidity to continue operations beyond the middle of calendar year 2024.

We may seek to obtain future financing through the issuance of debt or equity, and such financing may not be available on commercially reasonable terms or at all, which may have an adverse effect on our shareholders or may adversely affect our business and financial condition.

If we raise funds through the issuance of debt, including convertible debt or debt secured by some or all of our assets, holders of our debt securities will have rights, preferences and privileges senior to those of holders of our Shares in the event of liquidation. Moreover, whether we issue additional debt or not, it is possible, in the event of liquidation, that payment of creditor claims may leave no assets remaining to compensate holders of Shares. If we raise funds through the issuance of additional equity, whether through private placements or public offerings, such an issuance would dilute the ownership of any shareholders that do not participate in the issuance. There can be no assurance that we will be able to obtain debt or equity financing in a timely manner and on terms that are acceptable to us or at all. If we are unable to obtain any needed additional funding, we may be required to reduce the scope of, delay or eliminate some or all of our business plans, including without limitation our planned research, development, production and marketing activities and launch timing, any of which steps could materially harm our business.

Furthermore, the terms of any additional debt securities we may issue in the future may impose restrictions on our operations, which may include limiting our ability to incur additional indebtedness, pay dividends on or repurchase our share capital or make certain acquisitions or investments. In addition, we may be subject to covenants requiring us to satisfy certain financial tests and ratios, and our ability to satisfy such covenants may be affected over time by events outside of our control.

There is uncertainty regarding our ability to continue as a going concern.

We do not anticipate that our cash flows from operating activities will be sufficient to cover operating expenses and interest payments for the duration of the current fiscal year. While we recently concluded the Yorkville Transaction (see Note 24 to the consolidated financial statements included within this Annual Report), which will provide us with liquidity to facilitate the commercial launch of the i300, we will need other financing in the current fiscal year to fund our operations, debt service and other obligations as they become due, including the settlement of payment obligations relating to the Business Combination that were deferred until May 2024. There can be no assurance that we will be able to obtain such additional financing, or to obtain such additional financing on acceptable terms. As a result, the report of our independent registered public accounting firm for the year ended September 30, 2023 contains an explanatory paragraph relating to our ability to continue as a going concern. This uncertainty may materially and adversely affect our Share price and our ability to raise new capital.

We are a new entrant into an early-stage industry. As we scale and expand our business, we may not be able to adequately control the costs of our operations.

We have a short operating history in the electric powered two wheel vehicle (“EVP2W”) industry, which is continuously evolving. We have not yet delivered commercially available vehicles and do not yet have experience as an organization in high volume manufacturing, distribution and sales of vehicles. We intend to utilize business partners such as Summit and retailers with extensive experience in manufacturing and sale of vehicles at scale. Despite this experience, the EVP2W industry is in its early stages and there are no guarantees that this experience will result in sales of our vehicles at a comparable scale. We will require significant capital to develop and grow our business, including developing and producing our vehicles, establishing or expanding design, research and development, production and building our brand. We have incurred and expect to continue incurring significant expenses, including research and development expenses, selling and distribution expenses as we build our brand and market our vehicles, and general and administrative expenses as we scale our operations, identify and commit resources to investigate new areas of demand and incur costs as a public company, which will impact our profitability. Our ability to become profitable in the future is dependent on the design, development and marketability of our product portfolio, while also controlling costs to achieve expected margins. If we are unable to efficiently design, develop, market, deploy, distribute and service our vehicles while simultaneously controlling costs, our margins, profitability and prospects could be materially and adversely affected.

2

The global P2W market is highly competitive. Specifically, the EVP2W sector is rapidly growing and our products and services are and will be subject to strong competition from a growing list of established and new competitors.

Both the internal combustion engine (“ICE”) powered two wheel vehicle (“P2W”) and EVP2W industries generally are highly competitive, and we will be competing for sales with both ICE-focused companies and EV-focused companies. Several major P2W companies have EVP2Ws available today and other current and prospective motorcycle manufacturers are also developing EVP2Ws. Factors affecting competition include product performance and quality, technological innovation, customer experience, brand differentiation, product design, pricing and manufacturing scale and efficiency. Increased competition may lead to lower vehicle unit sales and downward price pressure and adversely affect our business, prospects, financial condition and operating results. We also expect competition for EVs to intensify due to increased demand and a regulatory push for alternative fuel vehicles, continuing globalization and consolidation in the worldwide automotive industry. Further, as a result of new entrants in the EV market, we may experience increased competition for components and other parts of our vehicles, which may have limited or possibly single-source supply.

Our future growth and success are highly dependent upon consumers’ adoption of, and their demand for, EVP2Ws and our battery solutions in a sector that is highly competitive, cyclical and volatile.

Our future growth is dependent on consumers’ willingness to adopt EVP2Ws and choose our products over those of other EVP2W manufacturers. Demand for EVP2Ws may be affected by factors directly impacting EVP2W prices or the cost of purchasing and operating EVP2Ws such as sales and financing incentives, prices of raw materials and parts and components, cost of fuel and governmental regulations, including tariffs, import regulation and other taxes. Volatility in demand may lead to lower vehicle unit sales, which may result in downward price pressure and adversely affect our business, operating results, financial condition and prospects.

In addition, demand for our vehicles will highly depend upon the adoption by consumers of alternative fuel vehicles in general and EVs in particular. The market for such vehicles is rapidly evolving and characterized by changing technologies, competitive pricing and competitive factors, evolving government regulation and industry standards, and changing consumer tastes and behaviors.

Other factors that may influence the adoption of alternative fuel vehicles, and specifically EVs, include:

Furthermore, our vehicles utilize portable battery packs which do not require dedicated charging infrastructure. While we believe that our portable battery packs differentiate our vehicles, there can be no assurance that consumers will adopt our battery solutions. If potential customers do not find our battery solutions attractive or are unwilling to adopt our battery solutions, it could impact the competitiveness of our vehicles and the rate of growth of our business and market penetration, and in turn, our business, prospects, financial condition and operating results.

Our business and prospects depend significantly on our ability to build the Zapp brand and consumers’ recognition, acceptance and adoption of the Zapp brand. We may not succeed in continuing to maintain and strengthen the Zapp brand.

Our business and prospects are heavily dependent on our ability to develop, maintain and strengthen the Zapp brand. If we do not continue to establish, maintain and strengthen our brand, we may lose the opportunity to build a critical mass of customers. Promoting

3

and positioning our brand will likely depend significantly on our ability to provide high-quality vehicles and engage with our customers as intended. In addition, our ability to develop, maintain and strengthen the Zapp brand will depend heavily on the success of our customer development and branding efforts. Such efforts mainly include building a community of customers engaged with our branding initiatives, including through our authorized resellers, at automotive shows and events, city pop-up stores and guerilla roadshows, as well as engaging celebrity talent, social media influencers or brand ambassadors or other brand partnerships. Such efforts may not achieve the desired results and we may be required to change our customer development and branding practices, which could result in substantially increased expenses. There is no assurance that such efforts would yield brand awareness or consumer adoption of our vehicles. If we do not develop and maintain a strong brand, our business, prospects, financial condition and operating results may be materially and adversely impacted.

In addition, if negative incidents occur or are perceived to have occurred, whether or not such incidents are our fault, we could be subject to adverse publicity. In particular, given the popularity of social media, any negative publicity, whether true or not, could quickly proliferate and harm consumer perceptions and confidence in the Zapp brand. Furthermore, there is the risk of potential adverse publicity related to our manufacturing partners or other partners whether or not such publicity is related to their collaboration with us. Our ability to successfully position our brand could also be adversely affected by perceptions about the quality of our competitors’ vehicles.

In addition, from time to time, our vehicles may be evaluated and reviewed by third parties. Any negative reviews, reviews which compare our vehicles unfavorably to competitors, or even negative opinions among reader comments following such reviews, could adversely affect consumer perception about our vehicles, no matter their accuracy.

We may experience delays in the design, manufacture, production, and launch of our vehicles, which could harm our business, prospects, financial condition and operating results.

Our future business depends in large part on our ability to execute on our plans to develop, produce, market and sell our vehicles. Many EV companies have experienced delays in the design, production and commercial release of new products. To the extent we delay the launch of our vehicles, our growth prospects could be adversely affected as we may fail to establish or grow our market share. Furthermore, we rely on contract manufacturers for the manufacturing of vehicles. We could experience delays if our contract manufacturers do not meet agreed upon timelines or experience capacity constraints. Additionally, we and our contract manufacturer rely on third-party suppliers for the provision and development of the key components and materials used in our vehicles. To the extent our suppliers experience any delays in providing us or our contract manufacturer with or developing necessary components, we could experience delays in delivering on our timelines. See “—Increases in costs, as a result of inflation or otherwise, disruption of supply or shortage of materials, in particular for lithium-ion battery cells and electronics subcomponents could harm our business.”

We may be unable to develop and manufacture vehicles of sufficient quality, and on schedule and scale, that would appeal to a large customer base.

Our business depends in large part on our ability to develop, market, produce and sell our vehicles. The continued development of and the ability to sell our vehicles at scale, including the i300 and future vehicles are and will be subject to risks, including with respect to:

4

Historically, P2W customers have expected manufacturers to periodically introduce new and improved vehicle models. To meet these expectations, we intend to introduce new vehicle models and enhanced versions of existing models. The EVP2W market is in its early stages and quickly evolving. As a new entrant in a young industry, we inherently have limited experience, as a company, designing, testing, manufacturing, marketing, selling and servicing vehicles and therefore cannot assure you that we will be able to meet customer expectations. Any of the foregoing could have a material adverse effect on our business, prospects, financial condition and operating results.

If we fail to achieve unit sales expectations, our business, prospects, financial condition and operating results could be adversely impacted.

While we have received interests and reservations for our vehicles, there is no guarantee that such interests will translate into unit sales. We have received only a limited number of reservations for our vehicles, all of which are subject to cancellation until delivery of the vehicle. The wait from the time a reservation is made until the time the vehicle is delivered could also impact user decisions on whether to ultimately make a purchase, due to potential changes in preferences, competitive developments and other factors. If we encounter delays in the delivery of our current or future vehicle models, we believe that a significant number of reservations may be cancelled. As a result, no assurance can be made that reservations will not be cancelled and will ultimately result in the final purchase, delivery, and sale of the vehicle.

Our ability to successfully achieve unit sales expectations will be fundamental to our future success in existing and new markets and our market share. We cannot assure you that we will be able to achieve unit sales expectations. If we are unable to achieve unit sales expectations our business, prospects, financial condition and operating results could be adversely impacted.

Our limited operating history makes evaluating our business and future prospects difficult and may increase the risk of your investment.

We are a company with an extremely limited operating history and have not generated revenue from sales of our vehicles or other products and services to date. As an entirely new product, there is no historical basis for making judgments on the demand for our vehicles, our ability to develop, produce and deliver vehicles, or our profitability in the future. It is difficult to predict our future revenues and appropriately budget for our expenses, and trends that may emerge in this quickly evolving industry that may be outside our visibility and may affect our business. You should consider our business and prospects in light of the risks and challenges we face as a new entrant in an early-stage industry, including with respect to our ability to continuously advance our vehicle technologies; develop safe, reliable and quality vehicles that appeal to customers; deliver and service a large volume of vehicles; turn profitable; build a globally recognized and respected brand cost-effectively; expand our vehicles lineup; navigate the evolving regulatory environment; improve and maintain our operational efficiency; manage supply chain effectively; adapt to changing market conditions, including technological developments and changes in competitive landscape; and manage our growth effectively.

While we are currently focusing on the i300, we expect our product roadmap to expand beyond the i300 and introduce new models in other categories or using other technologies that we have less experience in as we may adjust our strategies and plans from time to time to remain competitive.

If we fail to address any or all of these risks and challenges, our business may be materially and adversely affected.

As we continue to grow, we may not be able to effectively manage our growth, including with respect to our design, research, development and maintenance capabilities, which could negatively impact our brand and financial performance.

We intend to expand our operations significantly, which will require hiring, retaining and training new personnel, controlling expenses, establishing facilities, and implementing administrative infrastructure, systems, and processes. Our future operating results depend to a large extent on our ability to manage this expansion and growth successfully. Risks that we face in undertaking this expansion include, among others:

5

Furthermore, we have very limited experience to date in high volume production of our vehicles and we cannot be certain that we will be able to continue to partner with reliable contract manufacturers and reliable sources of component supply, that will enable us to meet the quality, price, engineering, design and production standards, as well as the production volumes, required to successfully market our vehicles as our operations expand. Any failure to effectively manage our growth could negatively impact our brand and financial performance.

The relationship of the UK and the EU could impact our ability to operate efficiently in certain jurisdictions or in certain markets.

On January 31, 2020, the UK exited the EU, an action referred to as Brexit. This was followed by an implementation period, during which EU law continued to apply in the UK and the UK maintained its EU single market access rights and EU customs union membership. The implementation period expired December 31, 2020. Consequently, the UK has become a third country vis-à-vis the EU, without access to the single market or membership of the EU customs union.

The UK and the EU have signed an EU-UK Trade and Cooperation Agreement, or TCA, which was formally approved by Parliament on April 28, 2021. This agreement provides details on how some aspects of the UK’s and EU’s relationship will operate going forward; however, there are still many uncertainties, and how the TCA will take effect in practice is still largely unknown. This lack of clarity on future UK laws and regulations and their interaction with the EU laws and regulations may negatively impact foreign direct investment in the UK, increase costs, depress economic activity, and restrict access to capital.

The uncertainty concerning the UK’s legal, political, and economic relationship with the EU after Brexit may be a source of instability in the international markets, create significant currency fluctuations, and/or otherwise adversely affect trading agreements or similar cross-border cooperation arrangements (whether economic, tax, fiscal, legal, regulatory, or otherwise) beyond the date of Brexit.

We have employees and intend to operate in the UK and other European countries. We cannot predict whether the UK will significantly alter its current laws and regulations in respect of the automotive and EVP2W industries and, if so, what impact any such alteration would have on our business. Moreover, we cannot predict the impact that Brexit will have on the marketing of our vehicles or the process to obtain regulatory approval in the UK for our vehicles. As a result of the developments in the relationship between the UK and the EU, we may experience adverse impacts on customer demand and profitability in the UK and other markets.

Additional Brexit-related impacts on our business could include potential inventory shortages in the UK, increased regulatory burdens and costs to comply with UK-specific regulations, and higher transportation costs for our products coming into and out of the UK. Any of these effects, among others, could materially and adversely affect our business, results of operations and financial condition.

Our receivables financing credit line with EXIM, which we will use to finance customer orders is cancellable by EXIM at any time, and we may be unable to secure financing at similar rates.

We have entered into a revolving loan agreement with EXIM (the “EXIM Facility”) providing for the issuance of short-term letters of credit and/or trust receipts for the purposes of purchase orders and production orders, and will depend on EXIM to finance our customer orders and the manufacturing of our vehicles. The EXIM Facility may be terminated by EXIM at any time. Termination of the EXIM Facility for any reason would have a material adverse effect on our business, delays in the production and delivery of our vehicles. We may have to obtain new financing, which may not be available on commercially reasonable terms or at all. If we cannot secure new financing arrangements if and when we need them, our business, operating results, financial condition and prospects could be materially adversely affected.

We depend on key suppliers to deliver components according to schedules, prices, quality, and volumes that are acceptable to us. We may be unable to effectively manage these suppliers. Uncertainties in the global economy may negatively impact suppliers and other business partners, which may interrupt the supply chain and require other changes to operations. These and other factors may adversely impact revenues and operating income.

Our success will be dependent upon our or our contract manufacturer’s ability to enter into supplier agreements and maintain our relationships with existing and future suppliers whose products are critical to the production of our vehicles. The supply agreements we may enter into with suppliers in the future may have provisions whereby such agreements can be terminated in various circumstances, including potentially without cause. If key suppliers terminate agreements and/or become unable to provide, or experience delays in providing, needed components, we may have difficulty finding replacement components. Additionally, our products contain parts that we purchase from limited-source suppliers, for which few or no immediate or readily available alternative exists. While we believe that we would be able in such case to establish alternate supply relationships and can obtain or engineer replacement components, we may be unable to do so quickly (or at all) at acceptable prices, volume and/or quality levels. In addition, unexpected changes in business conditions, supplier pricing and materials pricing, including due to inflation of raw material costs, labor issues, wars, trade policies, natural disasters, health epidemics such as the global COVID-19 pandemic, trade and shipping disruptions, port congestions and other factors beyond our or our suppliers’ control could affect current and future suppliers’ ability to remain solvent, operational and able to deliver the components we need. The unavailability of any supplier or component could result in production delays, product design changes and loss of access to important technology and tools for producing and supporting our products, as well as impact our capacity expansion and our ability to fulfill our obligations to customers. Moreover, significant increases in our production or product design changes by us may in the future require us to procure additional components in a short amount of time. Our suppliers may not be willing or able to sustainably meet our timelines or our cost, quality and volume needs, which may require us to replace them with other

6

sources. Any such disruptions could affect our ability to produce and deliver vehicles and negatively affect our business, results of operations and financial condition.

Also, if a supplied vehicle component becomes the subject of a product recall, we may be required to source an alternative component to remedy the issue(s) that led to such recall, which could increase our costs and divert management attention.

If we or our contract manufacturer do not enter into long-term supply agreements with guaranteed pricing for our parts or components, we and our contract manufacturer may be exposed to fluctuations in prices of components, materials and equipment. Agreements for the purchase of battery cells contain or are likely to contain pricing provisions that are subject to adjustments based on changes in market prices of key commodities. Substantial increases in the prices for such components, materials and equipment would increase our operating costs and could reduce our margins if we cannot recoup such increased costs. Any attempts to increase the announced or expected prices of our vehicles in response to increased costs could be viewed negatively by our potential customers and could adversely affect our business, operating results, financial condition and prospects.

Increases in costs or disruption of supply or shortages of materials could harm our business.

We and our suppliers may experience increases in the cost of or a sustained interruption in the supply of materials. Any such cost increase, supply interruption or shortage could materially and negatively impact our business, operating results, financial condition and prospects. We and our suppliers use various materials in our businesses and products, including, for example, lithium-ion battery cells, semiconductor chips, aluminum and steel, and the prices for these materials fluctuate. The available supply of these materials may be unstable, depending on market conditions and global demand. For example, recent conflicts in Ukraine and the Middle East may cause disruptions to and delays in our operations, including shortages and delays in the supply of certain parts, including materials and equipment necessary for the production of our vehicles, and the various internal designs and processes we may adopt in an effort to remedy or mitigate impacts of such disruptions and delays may result in higher costs. There have been very sizable increases in recent months in the cost of key metals, including lithium, nickel, aluminum and cobalt, with volatility in pricing expected to persist for the foreseeable future. In addition, our business also depends on the continued supply of battery cells for the battery packs used in our vehicles. We are exposed to multiple risks relating to lithium-ion battery cells. These risks include, but are not limited to:

We may have limited operational flexibility in the event of any disruption in the supply of battery cells, which could lead to disruptions in the production of our vehicles.

As in the case of batteries, semiconductors are an important component of the electrical architecture of our vehicles, controlling wide aspects of their operability and in turn subjecting us to a risk of shortages and long lead times in their supply. Many of the key semiconductors used in our vehicles come from limited-source suppliers, such that a disruption or shortage of production in respect of any such manufacturer or supplier may result in increased chip delivery lead times, delays in the production of our vehicles, and increased costs incurred to source alternative semiconductor suppliers. In addition, we may be required to incur additional costs and expenses in the event that new chip suppliers must be onboarded on an expedited basis.

Substantial increases in the prices of materials used in the production of our products, such as those charged by battery cell or semiconductor chip suppliers, would increase our operating costs and could reduce our margins. For example, due to the recent global semiconductor supply shortage, other supply chain issues, and the current inflationary environment in the United States and globally, the cost of input materials, components and processes required to produce our vehicles is expected to increase, and we may need to increase the prices of our vehicles in response to these cost pressures. Price increases and other measures taken by us to offset higher costs could materially and adversely affect our reputation and brand, result in negative publicity, a loss of customers and sales, and adversely affect our business, operating results, financial condition and prospects. In addition, a growth in popularity of EVs without a significant expansion in battery cell production capacity could result in shortages which would result in increased materials costs to us, and would impact our projected manufacturing and delivery timelines, and adversely affect our business, operating results, financial condition and prospects.

Engaging contract manufacturers, including Summit, to manufacture our vehicles is subject to risks, including in respect of costs and manufacturing capabilities. If we are unable to maintain a relationship with Summit to manufacture our vehicles, our manufacturing costs may be adversely affected.

A key financial benefit to our business is our asset-light operating model under which we will rely on a contract manufacturer to produce our vehicles. We have secured the experience and expertise of Summit to serve as our long-term contract manufacturing partner, providing manufacturing, procurement, logistics and distribution services for vehicles. If our contract manufacturing agreement terminates or expires, or if Summit fails to perform or meet our expected quality standards, timelines, capacity requirements, costs,

7

manufacturing capabilities or manufacturing footprint, we may need to engage another third-party contract manufacturer or build our own in-house manufacturing capabilities, which could cause us to incur significant cost, expense and production/delivery delays. As we do not currently have alternate manufacturing arrangements in place, it could if necessary take time to transition to another contract manufacturer and there is no guarantee that such alternative would meet our capacity, capability and/or quality requirements, or otherwise provide an effective and acceptable manufacturing solution. Any of the foregoing circumstances could adversely affect our business, operating results, financial condition and prospects.

We do not yet have a distribution network and do not have experience distributing directly to consumers. If we are unable to establish or maintain relationships with resellers or other retail partners or our authorized resellers or other retail partners are unable or ineffective in establishing or maintaining relationships with customers for our vehicles, our business may be adversely affected.

We employ a go-to-market business model whereby our revenue will be generated by sales through our online platform, authorized resellers and online resellers. We have received over 200 reseller applications by authorized resellers globally and have signed multiple letters of intent with certain authorized resellers as of the date of this annual report. However, all of these arrangements will require renegotiation at later stages as we begin our global product rollout, and some or all of these arrangements may be terminated or may not materialize into next-stage contracts or long-term contract arrangements. In addition, we do not currently have arrangements in place that will allow us to fully realize our global expansion plans. If we are unable to enter into acceptable contract arrangements with an adequate number of resellers in a timely manner, or at all, or if we fail to maintain such arrangements, our business, operating results, financial condition and prospects may be materially and adversely affected.

We will depend on the capability of such retail partners to develop and implement effective retail sales plans to help create demand among retail purchasers for our vehicles and related products and services that the retail partners may purchase from us. We intend to provide our retail partners with specific training and programs to assist them in selling our products, but there can be no assurance that these steps will be effective in building value adding commercial relationships. If our retail partners are not able to establish, maintain and strengthen our brand, we may lose the opportunity to build a critical mass of customers. Moreover, our retail partners’ ability to develop, maintain and strengthen their relationships with customers for vehicles will depend heavily on our ability to provide high-quality vehicles as well as the success of our customer development and marketing efforts. Our business and prospects depend significantly on our ability to build the Zapp brand and consumers’ recognition, acceptance, and adoption of the Zapp brand. We may not succeed in continuing to maintain and strengthen the Zapp brand.

Some of such retail partners may also market, sell and support product offerings that may be competitive with ours, may devote more resources to the marketing, sales and support of such competitive offerings or may have incentives to promote other offerings to the detriment of our own. Our retail partners’ actions could subject us to lawsuits, potential liability and reputational harm if, for example, any of our retail partners misrepresents the functionality of our vehicles to customers or violates applicable laws or our or their corporate policies. Even absent such issues, if our retail partners are unsuccessful in selling our EVs, or if we are unable to enter into arrangements with and retain a sufficient number of capable retail partners in each of the regions in which we plan to sell our vehicles, our business, operating results, financial condition and prospects could be adversely affected.

Furthermore, we intend to deliver our vehicles directly through “Zappers” who are franchised, independent delivery and service agents. We do not have experience in distributing directly to customers nor do we currently have franchisee arrangements in place. Our failure to enter into acceptable franchise arrangements in a timely manner, or at all, could result in delivery delays and adversely affect our business, operating results, financial condition and prospects.

Our ability to attract, train and retain executives and other qualified employees, including key members of management, is critical to our business, results of operations and future growth.

Our business and future success is substantially dependent on the continued services and performance of our key executives, senior management and other personnel, including personnel with relevant experience or expertise in the engineering and automotive sectors. Under our current employment arrangements, such persons may choose to terminate their employment with us at any time. The loss of the services of any of our key employees or any significant portion of our workforce could disrupt our operations and/or delay the development, introduction and rollout of our products and services. We cannot assure you that we will be able to retain these employees or find adequate replacements. When skilled personnel leave us, a lengthy period of time may be required to hire and train suitable replacement staff. Our ability to compete effectively depends on our ability to attract new employees and to retain and motivate our existing employees. We may be required to increase our levels of employee compensation more rapidly than in the past to remain competitive in attracting the quality of employees that our business requires. If we do not succeed in attracting well-qualified employees or retaining or motivating existing employees, our business, results of operations, financial condition and prospects could be adversely affected.

Employees may leave us or choose other employers over us due to various factors, such as a very competitive global labor market for talented individuals with automotive engineering or technology experience, or due to negative publicity related to us or our products. In regions where we have or will have operations, there is strong competition for individuals with skill sets needed for our business, including specialized knowledge of EVs, engineering, design and other expertise. We compete for talent with both mature and prosperous companies with greater financial resources as well as start-ups and emerging companies that promise short-term growth opportunities.

8

We expect to incur research and development costs and devote significant resources to developing new products, which may significantly reduce our profitability without leading to new revenue.

Our future growth depends on penetrating new markets, adapting existing products to customer requirements, and introducing new products that achieve market acceptance. If we are unable to do those things in a timely and cost-effective manner, we may lose our competitive position, our products may become dated, and our business, results of operations and financial condition could be adversely affected.

Our success in new markets will depend on a variety of factors, including but not limited to our ability to develop new products, new product features and services that address the customer requirements in such markets, attract a customer base and gain acceptance in such markets, and compete with new and existing competitors. Developing our products is expensive, and investments in product development may involve a long payback cycle. Our results of operations will be impacted by the timing and size of such investments, which may take several years to generate positive returns, if ever.

Additionally, future market share gains may take longer than planned and cause us to incur significant costs. Difficulties in any of our new product development efforts or our efforts to enter adjacent markets could adversely affect our business, operating results and financial condition.

We may face challenges in expanding our business and operations internationally and our ability to conduct business in markets may be adversely affected by legal, regulatory, political, and economic risks.

Our business plan includes operations in the UK, France and other countries in Europe, and subsequent expansion into other international markets including North America and the Asia Pacific. We will face risks associated with any potential international operations, including possible unfavorable legal, regulatory, political and economic risks, which could harm our business. We anticipate having international operations and subsidiaries that are subject to the legal, political, regulatory and social requirements and economic conditions in these jurisdictions. Furthermore, conducting and launching operations on an international scale requires close coordination of activities across multiple jurisdictions and time zones and consumes significant management resources. We will be subject to a number of risks associated with international business activities that may increase our costs, impact our ability to sell our vehicles and require significant management attention. These risks include:

If we fail to successfully address and manage these risks, our business, operating results, financial condition and prospects could be adversely affected.

9

If our vehicle owners modify our vehicles using third-party aftermarket products or otherwise, such vehicles may not operate properly, which may create negative publicity and could harm our business.

Automotive enthusiasts may seek to alter our vehicles to modify their performance in ways which could compromise vehicle safety and security systems. Also, customers may customize their vehicles with aftermarket parts that can compromise driver safety. We do not test, nor do we endorse, such changes or products. In addition, customers may attempt to modify our vehicles’ charging systems in ways that can compromise vehicle systems or expose our customers to injury. Such unauthorized modifications could reduce the safety and security of our vehicles, and any injuries resulting from such modifications could result in adverse publicity, which may negatively affect our brand and thus harm our business, operating results, financial condition and prospects.

If we are unable to establish and maintain confidence in our long-term business prospects among customers and analysts and within our industry, or are subject to negative publicity, then our business, operating results, financial condition and prospects may suffer materially.

Customers may be less likely to purchase our vehicles if they are not convinced that our business will succeed or that our service and support and other operations will continue in the long term. Similarly, suppliers and other third parties may be less likely to invest time and resources in developing business relationships with us if they are not convinced that our business will succeed. Accordingly, in order to build and maintain our business, we must maintain confidence among customers, suppliers, analysts, ratings agencies and other parties in our vehicles, long-term financial viability and business prospects. Maintaining such confidence may be complicated by certain factors, including many that are largely outside of our control, such as: our limited operating history; customer unfamiliarity with our vehicles and EVP2Ws in general; any delays in scaling production, delivery and service operations to meet demand; competition and uncertainty regarding the future of our vehicles and EVP2Ws in general; and our production and sales performance compared with market expectations.

Our financial results may vary significantly from period to period due to fluctuations in our operating costs, product demand, and other factors.

We expect our period-to-period financial results to vary based on our operating costs and product demand, which we anticipate will fluctuate as we continue to design, develop, produce and distribute new vehicles. Additionally, our revenue from period to period may fluctuate as we build our global distribution, add new derivative products based on market demand and margin opportunities, and introduce new or existing products in new markets.

Moreover, our revenue from period to period may fluctuate due to seasonality. As a seller of P2Ws, we expect to be impacted by seasonality, primarily by weather. During winter or colder months, sales of two wheeled vehicles tend to slow while during warmer months, sales increase. In Europe we expect revenue to be higher in the months of March through September, correlating with higher deliveries and when we plan to offer most of our potential customer ride experiences. During the months of October through February, we expect revenue to be lower as we focus on building the next season’s order bank. Such seasonality may cause our revenue to vary from quarter to quarter which can make forecasting more difficult and may adversely affect our ability to predict financial results accurately.

As a result of these factors, we believe that quarter-to-quarter comparisons of our financial results may not necessarily be meaningful and that such comparisons cannot be relied upon as indicators of future performance. Moreover, our varying financial results may not meet the expectations of equity research analysts, ratings agencies or investors, who may mainly focus on sequential quarterly financial results. If any of this occurs, the trading price of our Shares may experience significant volatility.

We collect and process certain information about our customers and their vehicles and are subject to various privacy and consumer protection laws.

We collect, receive, store, transmit and otherwise process different types of information about or related to a range of individuals, including our future customers, website visitors, our employees, job applicants and employees of other companies that we do business with (such as our vendors and suppliers). In addition to the information we will collect from our customers to complete a sale or transaction, we may in the future use our vehicles’ onboard electronic systems to capture information about each vehicle's use, such as location, charge time, battery usage, mileage and driving behavior, among other things, to aid us in providing services including EV diagnostics, repair, maintenance, insurance, roadside assistance and vehicle emergency services. Our customers may choose not to provide this data, which may harm our business and prospects. Possession and use of our customers’ vehicle use and other information may subject us to legislative and regulatory burdens and risks that could require notification of data breach, restrict our use of such information, and hinder our ability to acquire new customers or market to existing customers. If customers allege that we have improperly released or disclosed their sensitive personal data, we could face legal claims, lawsuits and reputational harm. If third parties improperly obtain and use sensitive personal data of our customers, we may be required to expend significant resources to resolve these problems.

As we expand our operations internationally, we will be required to comply with increasingly complex and rigorous regulatory standards enacted to protect business and personal information in the U.S., Europe, Asia-Pacific and elsewhere. Such regulations may impose additional regulatory obligations regarding the handling of personal information and further provide certain individual privacy rights to persons whose data is processed.

10

Data protection and privacy-related laws and regulations are evolving and may result in ever increasing regulatory and public scrutiny and escalating levels of enforcement and sanctions. For example, the EU adopted the GDPR. These laws (and other laws that have since been enacted) impose additional regulatory obligations regarding the handling of personal data and further provide certain individual privacy rights to persons whose data is processed by covered organizations.

We are subject to the GDPR and the UK data protection regime consisting primarily of the UK GDPR. The GDPR, the national implementing legislation in EU member states, and the UK GDPR impose stringent data protection requirements, some of which are different from requirements under existing data privacy laws in other jurisdictions.

The GDPR/UK GDPR also generally prohibits the transfer of personal data subject to those regimes outside of the EU/UK unless a lawful data transfer solution has been implemented or a data transfer derogation applies. Recent legal developments in Europe have created complexity and uncertainty regarding transfers of personal information from the EU and the UK to other countries. In addition, as supervisory authorities in the EEA and UK continue to issue further guidance relating to the processing of personal information, including the transfer of data, we could suffer additional costs or be subject to complaints or regulatory investigations or fines if there are allegations of non-compliance, and if we are otherwise unable to transfer personal data between and among countries and regions in which we operate, it could affect the manner in which we provide our services, the geographical location or segregation of our relevant systems and operations, and could adversely affect our financial results. Loss, retention or misuse of certain information and alleged violations of laws and regulations relating to privacy and data security, and any relevant claims, may expose us to potential liability and may require us to expend significant resources on data security and in responding to and defending such allegations and claims.

We may also become subject to evolving EU and UK privacy laws on cookies and e-marketing. In the EU and the UK, regulators are increasingly focusing on compliance with requirements in the online behavioral advertising ecosystem, and current national laws that implement the ePrivacy Directive may be replaced by an EU regulation known as the ePrivacy Regulation which will significantly increase fines for non-compliance. In the EU and the UK, informed consent is required for the placement of most cookies or similar technologies that store information, or access information stored, on a user’s device and for direct electronic marketing. The GDPR also imposes conditions on obtaining valid consent, such as a prohibition on pre-checked consents and a requirement to ensure separate consents are sought for each type of cookie or similar technology. While the text of the ePrivacy Regulation is still under development, a recent European court decision, regulators’ recent guidance and recent campaigns by a not-for-profit organization are driving increased attention to cookies and tracking technologies. There is also a general increasing awareness of how Internet user data is being used by companies, in particular, focused on the use of cookies to collect or aggregate information about Internet users’ online browsing activity. If regulators start to enforce the strict approach in recent guidance, this could lead to substantial costs, require significant systems changes, limit the effectiveness of our marketing activities, divert the attention of our technology personnel, adversely affect our margins, increase costs and subject us to additional liabilities. Regulation of cookies and similar technologies, and any decline of cookies or similar online tracking technologies as a means to identify and potentially target users, may lead to broader restrictions and impairments on our marketing and personalization activities, may require significant changes to our business and may negatively impact our efforts to understand users.

Additionally, other countries outside of Europe and the United States, including countries we either operate or may in the future operate within, are considering enacting legislation implementing data protection requirements or imposing cross-border data transfer restrictions or laws requiring local data residency. For example, on May 27, 2019, the PDPA was published in the Royal Gazette of Thailand. The PDPA came into effect on June 1, 2022. There are uncertainties as to how the PDPA will be implemented in practice and how compliance with the PDPA will affect our operations. Compliance with additional laws and regulations could be expensive and result in significant penalties (for example, fines for certain breaches of the GDPR or the UK GDPR are up to the greater of €20 million/£17.5 million or 4% of total global annual turnover), and may place restrictions on the conduct of our business and the manner in which we interact with our customers. Failure to comply with applicable laws and regulations could result in lawsuits, regulatory enforcement actions against us or other liability. For example, our misuse of or failure to secure personal information could result in violation of data privacy laws and regulations, proceedings against us by governmental entities or others, and/or result in significant liability and damage to our reputation and credibility. In addition, we may also face civil claims including representative actions and other class action type litigation (where individuals have alleged to suffered harm), potentially amounting to significant compensation or damages liabilities, as well as associated costs, diversion of internal resources, and reputational harm. These possibilities, if borne out, could have a negative impact on revenues and profits. If a third party alleges that we have violated applicable data privacy laws, we could face legal claims and damages as well as reputational harm among consumers, investors, and strategic partners.

Although we make reasonable efforts to comply with all applicable data protection laws and regulations, our interpretations and efforts may have been or may prove to be insufficient or incorrect. We also make public statements about our use and disclosure of personal information through our privacy policy, information provided on our website and other public statements. Although we endeavor to ensure that our public statements are complete, accurate and fully implemented, we may at times fail to do so or be alleged to have failed to do so. We may be subject to potential regulatory or other legal action if such policies or statements are found to be deceptive, unfair or misrepresentative of our actual practices. In addition, from time to time, concerns may be expressed about whether our products and services compromise the privacy of our customers and others. Any concerns about our data privacy and security practices (even if unfounded), or any failure, real or perceived, by us to comply with our posted privacy policies or with any legal or regulatory requirements, standards, certifications or orders or other privacy or consumer protection-related laws and regulations applicable to us, could cause our customers, riders and users to reduce their use of our products and services.

11

In addition, the regulatory framework for data privacy issues worldwide is currently evolving and is likely to remain uncertain for the foreseeable future, and it is possible that applicable laws and regulations may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules, or our practices. Any failure or perceived failure by us to comply with applicable privacy and data security laws and regulations, our privacy policies, or our privacy-related obligations to users or other third parties, or any compromise of security that results in the unauthorized access to or transfer of personal information or other customer data, may result in governmental enforcement actions, litigation or public statements against us by consumer advocacy groups or others and could cause our customers and users to lose trust in us, which would have an adverse effect on our reputation and business. We may also incur significant expenses to comply with privacy, consumer protection and security standards and controls imposed by laws, regulations, industry standards or contractual obligations.

Any significant change to applicable laws, regulations or industry practices regarding the use or disclosure of our users’ data, or regarding the manner in which the express or implied consent of users for the use and disclosure of such data is obtained-or in how these applicable laws, regulations or industry practices are interpreted and enforced by state, federal and international privacy regulators-could require us to modify our services and features, possibly in a material and costly manner, may subject us to legal claims, regulatory enforcement actions and fines, and may limit our ability to develop new services and features that make use of the data that our users voluntarily share with us.

If we fail to offer high-quality customer service covering the delivery and after-sales care of our vehicles, or fail to maintain a superior customer support experience, our business and reputation will suffer.

We aim to provide consumers with a high-quality customer service experience, including at-home delivery of orders and after-sales services. Our services may fail to meet our customers’ expectations, which could adversely affect our business, reputation and results of operations.