As filed with the Commission on January 4, 2024

Commission File No. 333-271573

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 2

Registration Statement Under

THE SECURITIES ACT OF 1933

| ELEMENTS VENTURES GROUP INC. |

| (Exact name of registrant as specified in charter) |

| Wyoming | 7370 | N/A | ||

| (State or other jurisdiction | (Primary Standard Classi- | (IRS Employer | ||

| of incorporation) | fication Code Number) | I.D. Number) |

Elements Ventures Group Inc.

9980 Dufferin Street #20026

Vaughan, Ontario L6A 4M4

(647) 405-1054

elementsvg@protonmail.com

(Address and telephone number of principal executive offices)

Elements Ventures Group Inc.

9980 Dufferin Street #20026

Vaughan, Ontario L6A 4M4

(Address of principal place of business or intended principal place of business)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “ large accelerated filer,” “ accelerated filer,” “ smaller reporting company, ” and “ emerging growth company ” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| (Do not check if a smaller reporting company) | Emerging growth company | ☒ |

If an emerging growth company, indicate by checkmark if the registrant has not elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after the effective date of this Registration Statement

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(A), MAY DETERMINE.

| 1 |

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Dated January____, 2024

PRELIMINARY PROSPECTUS

ELEMENTS VENTURES GROUP INC.

6,000,000 SHARES OF COMMON STOCK

NO MINIMUM

AND

4,570,500 SHARES OF COMMON STOCK OFFERED BY THE SELLING STOCKHOLDERS

$0.35 PER SHARE

This is the initial public offering of the shares of common stock of Elements Ventures Group Inc., a Wyoming company (“we”, “us”, “our”, “Elements”, the “Company” or similar terms). We are offering for sale a total of 6,000,000 shares of our Common Stock at a price of $0.35 per share in a "self-underwritten", best effort, no minimum basis. Subscription funds that are accepted by us will be deposited directly into its operating account and will not be held in escrow. The funds will be available for our immediate use. In addition, the selling stockholders are selling 4,570,500 shares of common stock at a price of $0.35 per share. We will not receive proceeds from the sale of any shares by the selling stockholders Selling shareholders named herein may be deemed underwriters of the shares of common stock which they are offering. This offering will terminate 365 days from the date of this prospectus, unless extended by our Board of Directors for an additional 90 days or terminated. We have arbitrarily determined the offering price of $0.35 per share in relation to this offering. The offering price bears no relationship to our assets, book value, earnings or any other customary investment criteria. We are making this offering without the involvement of underwriters or broker-dealers.

Prior to this offering, there has been no public market for our common stock After the effective date of the registration statement, we intend to seek a market maker to file an application with the Financial Industry Regulatory Authority (“FINRA”) for a trading symbol and to have our common stock quoted on the OTC Pink Market. There is no assurance that an active trading market for our shares will develop or will be sustained if developed.

We qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (the “JOBS Act”).

Our sole officer and director Dmitry Kinslikh owns 60.5% of our currently outstanding common stock. As a result, we are a “controlled company”.

Purchase of our common stock involves a high degree of risk. You should carefully consider the factors described under the heading “Risk Factors” before investing in our shares of common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

THE DATE OF THIS PROSPECTUS IS JANUARY____, 2024

| 2 |

TABLE OF CONTENTS

| Prospectus Summary | 5 |

| Risk Factors | 8 |

| Risk Factors Related to Our Company | 8 |

| Risk Factors Relating to Our Common Stock | 11 |

| Use of Proceeds | 13 |

| Determination of Offering Price | 13 |

| Dilution | 14 |

| Selling Stockholders | 14 |

| Plan of Distribution | 15 |

| Description of Securities | 16 |

| Description of Business | 17 |

| Legal Proceedings | 32 |

| Market for Common Equity and Related Stockholder Matters | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 35 |

| Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | 36 |

| Directors, Executive Officers, Promoters and Control Persons | 37 |

| Executive Compensation | 38 |

| Security Ownership of Certain Beneficial Owners and Management | 38 |

| Certain Relationships and Related Transactions | 39 |

| Disclosure of Commission Position on Indemnification for Securities Act Liabilities | |

| Where You Can Find More Information | 39 |

| Interests of name experts and counsel | 39 |

| Financial Statements | 40 |

| 3 |

You should rely only on information contained in this prospectus. We have not authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date.

Until ____________, 2024 (90 business days after the effective date of this prospectus) all dealers that effect transactions in these securities whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

A CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors,” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

We cannot provide any assurance that we will be able to raise sufficient funds from this offering to proceed with our twelve months business plan.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

| 4 |

PROSPECTUS SUMMARY

Our Business

We are a development stage company and were incorporated in Wyoming on January 31, 2022. Dmitry Kinslikh is our founder. We are a technology led company focused on bringing healthcare technologies for people to help them live a healthier and better life.

Since inception we have generated no revenues and earned a net loss of $41,196. To implement our plan of operations we require a minimum funding of $80,000 for the next twelve months. Our independent auditor has issued an audit opinion for our Company, which includes a statement expressing a doubt as to our ability to continue as a going concern.

We are an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company. For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see “RISK FACTORS RISKS RELATED TO THIS OFFERING AND OUR COMMON STOCK - WE ARE AN “EMERGING GROWTH COMPANY” AND WE CANNOT BE CERTAIN IF THE REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO EMERGING GROWTH COMPANIES WILL MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS” on page 15 of this prospectus.

We contend that we are not a “shell company” within the meaning of Rule 405 or a blank check company because we have a defined business plan which we have begun executing and we no plans or intentions to engage in a merger or acquisition with an unidentified company, companies, entity or person.

We are developing a Health and Fitness as well as Diet and Nutrition app rolled into one called “FITLY”. FITLY is a cutting-edge health and wellness platform that aims to revolutionize the way individuals approach fitness, food, and nutrition.

| 5 |

The Offering

| Securities offered by the Company: | 6,000,000 shares of our common stock, par value $0.0001 per share. | |

| Securities Being Offered by the Selling Shareholders: | 4,570,500 shares of our common stock, par value $0.0001 per share. | |

| Offering price: | $0.35 | |

| Duration of offering: | The shares are being offered for a period not to exceed 365 days, unless extended by our Board of Directors for an additional 90 days. There is no minimum offering of the shares before the expiration date of the offering. | |

| Gross proceeds to us: | $2,100,000, assuming the maximum number of shares sold. For further information on the Use of Proceeds, see page 21 | |

| Market for the common stock: | There is no public market for our shares. After the effective date of the registration statement relating to this prospectus, we intend to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our common stock to eligible for trading on the OTC Pink Market. | |

| Shares outstanding prior to offering: | 11,570,500 | |

| Shares outstanding after offering: | 17,570,500 (assuming all the shares are sold) | |

| Risk Factors: | The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 14. |

| 6 |

EMERGING GROWTH COMPANY

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of:

| a. | The last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more; |

| b. | The last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title; |

| c. | The date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or |

| d. | The date on which such issuer is deemed to be a “large accelerated filer”, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto. |

As an emerging growth company, we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company, we are exempt from Section 14A and B of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

Smaller Reporting Company

Implications of being an emerging growth company - the JOBS Act

We qualify as an emerging growth company as that term is used in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| • | A requirement to have only two years of audited financial statements and only two years of related MD&A; | |

| • | Exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002; | |

| • | Reduced disclosure about the emerging growth company’s executive compensation arrangements; and | |

| • | No non-binding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of the reduced reporting requirements applicable to smaller reporting companies even if we no longer qualify as an “emerging growth company”.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

We could remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

| 7 |

RISK FACTORS

An investment in our common stock involves a high degree of risk. This section includes all of the known material risks in the offering. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock, when and if we trade at a later date, could decline due to any of these risks, and you may lose all or part of your investment.

RISKS ASSOCIATED TO OUR BUSINESS

WE HAVE NOT EARNED REVENUE AS OF AUGUST 31, 2023 AND OUR ABILITY CONTINUE OUR OPERATIONS IS DEPENDENT ON OUR ABILITY TO RAISE FINANCING. OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTANT HAS EXPRESSED SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

We have accrued net losses of $41,196 for the period since our inception on January 31, 2022 to August 31, 2023, and have no revenues as of this date. Our future is dependent upon our ability to obtain financing and upon future profitable operations in the technology business. Further, the finances required to fully develop our plan cannot be predicted with any certainty and may exceed any estimates we set forth. These factors raise a doubt that we will be able to continue as a going concern. BF Borgers CPA PC our independent registered public accounting firm has expressed a doubt about our ability to continue as a going concern. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital when needed, our director Dmitry Kinslikh has agreed to give us an interest-free loan to fund our operations. Otherwise, we will not be able to complete our business plan. As a result, we may have to liquidate our business and you may lose your investment. You should consider our independent registered public accountant’s comments when determining whether to make an investment.

WE ARE DEPENDENT UPON THE FUNDS TO BE RAISED IN THIS OFFERING TO CONTINUE OUR BUSINESS, THE PROCEEDS OF WHICH MAY BE INSUFFICIENT TO ACHIEVE REVENUES AND PROFITABLE OPERATIONS. WE MAY NEED TO OBTAIN ADDITIONAL FINANCING.

Our current operating funds are less than necessary to complete our intended operations in the technology business. We need the proceeds from this offering to start our operations as described in the “Plan of Operation” section of this prospectus. As of August 31, 2023, we had cash in the amount of $11,771 and liabilities of $49,380. The proceeds of this offering may not be sufficient for us to achieve additional revenues and profitable operations. We may need additional funds to achieve a sustainable sales level where ongoing operations can be funded out of revenues. Our director Dmitry Kinslikh has verbally agreed to give us an interest-free loan to fund our operations.

We require a minimum funding of approximately $80,000 to conduct our proposed operations for a period of one year. If we are not able to raise this amount, or if we experience a shortage of funds prior to funding we may utilize funds from Dmitry Kinslikh, our sole officer and director, who has informally agreed to advance funds to allow us to pay for professional fees, including fees payable in connection with the filing of this registration statement and operation expenses. However, Mr. Kinslikh has no formal commitment, arrangement or legal obligation to advance or loan funds to the company. After one year we may need additional financing. If we do not generate any revenue, we may need a minimum of $20,000 of additional funding to pay for ongoing SEC filing requirements. Even if we generate revenues, such revenues may be insufficient to cover our ongoing SEC filing requirements so we may need to seek additional financing to cover those costs. We do not currently have any arrangements for additional financing.

If we are successful in raising the funds from this offering, we plan to commence activities to continue our operations. We cannot provide investors with any assurance that we will be able to raise sufficient funds to continue our business plan according to our plan of operations.

| 8 |

WE REQUIRE ADDITIONAL CAPITAL AND FINANCING TO CONTINUE OUR BUSINESS AND FAILURE TO OBTAIN CAPITAL COULD CAUSE OUR BUSINESS TO FAIL.

The accompanying financial statements have been prepared assuming that we will continue as a going concern. As discussed in the Notes of our August 31, 2023 financial statements, we are in the development stage of operations, have had losses from operations since inception, no revenues and insufficient working capital available to implement our business plan and to meet ongoing financial obligations over the next fiscal year. Our Auditor has raised “substantial doubt regarding the Company's ability to continue as a going concern”, or in other words remain in business. We will require additional capital and financing in order to continue otherwise our business will fail. We have made no definitive arrangements for any additional capital or financing.

WE ARE A DEVELOPMENT STAGE COMPANY AND HAVE COMMENCED LIMITED OPERATIONS IN OUR BUSINESS. WE EXPECT TO INCUR SIGNIFICANT OPERATING LOSSES FOR THE FORESEEABLE FUTURE.

We were incorporated on January 31, 2022 and have commenced limited business operations. Accordingly, we have no way to evaluate the likelihood that our business will be successful. Potential investors should be aware of the difficulties normally encountered by new companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the operations that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to the ability to generate sufficient cash flow to operate our business, and additional costs and expenses that may exceed current estimates. We anticipate that we will incur increased operating expenses without realizing significant revenues. We expect to incur significant losses in the foreseeable future. We recognize that if the effectiveness of our business plan is not forthcoming, we will not be able to continue business operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful. If we are unsuccessful in addressing these risks, our business will most likely fail.

RISKS ASSOCIATED WITH LACK OF DEMAND FOR OUR SERVICES.

Although we are yet to begin selling our services, our business may be harmed if there is insufficient demand for our services. Our profits may not be enough if there will be a lack of customers who are interested in our services or turn to our competitors. We will have to use additional resources for marketing in social networks and others.

THE EFFECT OF THE RECENT ECONOMIC CRISIS MAY IMPACT OUR BUSINESS, OPERATING RESULTS OR FINANCIAL CONDITIONS.

The recent global crisis has caused disruption and extreme volatility in global financial markets and increased rates of default and bankruptcy and has impacted levels of consumer spending. These macroeconomic developments may affect our business, operating results or financial condition in a number of ways. For example, our potential customers may never start spending with us or may have difficulty paying us. A slow or uneven pace of economic recovery would negatively affect our ability to start our business and obtain financing.

BECAUSE WE ARE SMALL AND DO NOT HAVE MUCH CAPITAL, OUR MARKETING CAMPAIGN MAY NOT BE ENOUGH TO ATTRACT SUFFICIENT NUMBER OF CUSTOMERS TO OPERATE PROFITABLY. IF WE DO NOT MAKE A PROFIT, WE WILL SUSPEND OR CEASE OPERATIONS.

Although we are yet to begin selling our products, due to the fact we are small and do not have much capital, we must limit our marketing activities and may not be able to make our products/services known to potential customers. Because we will be limiting our marketing activities, we may not be able to attract enough customers to operate profitably. If we cannot operate profitably, we may have to suspend or cease operations.

BECAUSE OUR SOLE OFFICER AND DIRECTOR OWN S MORE THAN 50% OF OUR OUTSTANDING COMMON STOCK, IF ONLY 25% OF THE SHARES BEING OFFERED ARE SOLD, HE WILL MAKE AND CONTROL CORPORATE DECISIONS THAT MAY BE DISADVANTAGEOUS TO MINORITY SHAREHOLDERS.

If only 25% of our offering shares are sold, Mr. Dmitry Kinslikh, our sole officer and director, will own more than 50% of the outstanding shares of our common stock. Accordingly, he will have significant influence in determining the outcome of all corporate transactions or other matters, including the election of directors, mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. The interests of Mr. Dmitry Kinslikh may differ from the interests of the other stockholders and may result in corporate decisions that are disadvantageous to other shareholders.

| 9 |

MR. DMITRY KINSLIKH, OUR SOLE DIRECTOR, WILL BE ABLE TO DETERMINE HIS OWN SALARY AND PERQUISITES, WHICH COULD ADVERSELY AFFECT OUR INCOME.

Because our sole executive officer occupies all corporate positions, it may not be possible to have adequate internal controls. As the sole director, Mr. Dmitry Kinslikh has the sole authority to appoint our officers and determine their compensation. Accordingly, Mr. Dmitry Kinslikh could determine, as our sole director that his salary and perquisites are equal to or exceed our net income, if we ever have an income. In the event that Mr. Dmitry Kinslikh does determine that he is entitled to a salary and/or perquisites, investors will have no mechanism by which to revise his salary and perquisites since he controls a majority of the voting securities of the Company and will continue to do so even after the offering.

OUR INTERNAL CONTROLS MAY BE INADEQUATE, WHICH COULD CAUSE OUR FINANCIAL REPORTING TO BE UNRELIABLE AND LEAD TO MISINFORMATION BEING DISSEMINATED TO THE PUBLIC. AS A RESULT, OUR STOCKHOLDERS COULD LOSE CONFIDENCE IN OUR FINANCIAL RESULTS, WHICH COULD HARM OUR BUSINESS AND THE MARKET VALUE OF OUR COMMON SHARES.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. We may in the future discover areas of our internal controls that need improvement. Section 404 of the Sarbanes-Oxley Act of 2002 will require us to continue to evaluate and to report on our internal controls over financial reporting. We cannot be certain that we will be successful in continuing to maintain adequate control over our financial reporting and financial processes. Furthermore, if our business grows, our internal controls will become more complex, and we will require significantly more resources to ensure our internal controls remain effective. Additionally, the existence of any material weakness or significant deficiency would require management to devote significant time and incur significant expense to remediate any such material weaknesses or significant deficiencies and management may not be able to remediate any such material weaknesses or significant deficiencies in a timely manner.

KEY MANAGEMENT PERSONNEL MAY LEAVE THE COMPANY, WHICH COULD ADVERSELY AFFECT THE ABILITY OF THE COMPANY TO CONTINUE OPERATIONS.

The Company is entirely dependent on the efforts of its sole officer and director Dmitry Kinslikh. The Company does not have an employment agreement in place with its sole officer and director. His departure or the loss of any other key personnel in the future could have a material adverse effect on the business. There is no guarantee that replacement personnel, if any, will help the Company to operate profitably. The Company does not maintain key person life insurance on its sole officer and director.

WE DO NOT MAINTAIN ANY INSURANCE AND DO NOT INTEND TO MAINTAIN INSURANCE IN THE FUTURE.

We do not maintain any insurance and do not intend to maintain insurance in the foreseeable future. Because we do not have any insurance, if we are made a part of a products liability action, we may not have sufficient funds to defend the litigation. If that occurs a judgment could be rendered against us that could cause us to cease operations.

OUR SOLE OFFICER AND DIRECTOR HAS NO EXPERIENCE MANAGING A PUBLIC COMPANY THAT IS REQUIRED TO ESTABLISH AND MAINTAIN DISCLOSURE CONTROL AND PROCEDURES AND INTERNAL CONTROL OVER FINANCIAL REPORTING.

We have never operated as a public company. Dmitry Kinslikh, our sole officer and director has no experience managing a public company that is required to establish and maintain disclosure controls and procedures and internal control over financial reporting. As a result, we may not be able to operate successfully as a public company, even if our operations are successful. We plan to comply with all of the various rules and regulations, which are required for a public company that is reporting company with the Securities and Exchange Commission. However, if we cannot operate successfully as a public company, your investment may be materially adversely affected.

OUR PRESIDENT, MR. DMITRY KINSLIKH DOES NOT HAVE ANY PRIOR EXPERIENCE IN SELLING STOCKS, AND OUR BEST EFFORT OFFERING DOES NOT REQUIRE A MINIMUM AMOUNT TO BE RAISED. AS A RESULT OF THIS WE MAY NOT BE ABLE TO RAISE ENOUGH FUNDS TO START OUR BUSINESS AND INVESTORS MAY LOSE THEIR ENTIRE INVESTMENT.

Mr. Dmitry Kinslikh does not have any experience in selling stocks. Consequently, we may not be able to raise any funds successfully. Also, the best effort offering does not require a minimum amount to be raised. Our director Dmitry Kinslikh has agreed to give us an interest-free loan to help fund our operations. The loan will be repaid to Mr. Kinslikh when and if the Company receives sufficient amount of revenues and its operation grows. If we are not able to raise sufficient funds, we may not be able to fund our operations as planned, and our business will suffer and your investment may be materially adversely affected. Our inability to successfully conduct a best-effort offering could be the basis of your losing your entire investment in us.

| 10 |

RISK FACTORS RELATING TO OUR COMMON STOCK

ANY ADDITIONAL FUNDING WE ARRANGE THROUGH THE SALE OF OUR COMMON STOCK WILL RESULT IN DILUTION TO EXISTING SHAREHOLDERS.

We must raise additional capital in order for our business plan to succeed. Our most likely source of additional capital will be through the sale of additional shares of common stock. Such stock issuances will cause stockholders’ interests in our company to be diluted. Such dilution will negatively affect the value of an investor's shares. We have additional source of additional capital: our director Dmitry Kinslikh has agreed to give us an interest-free loan in case if the Company needs more funds to continue its operation. The Company does not have any written agreement on this point, only a verbal agreement.

IF WE DECIDE TO SUSPEND OUR OBLIGATIONS TO FILE REPORTS UNDER SECTION 15(D), THEN OUR SHAREHOLDERS WILL NOT RECEIVE PUBLICLY DISSEMINATED INFORMATION AND WILL BE A PRIVATE COMPANY.

Under Rule 12h-3 of the Securities Exchange Act of 1934, as amended, “Suspension of Duty to File Reports under Section 15(d)”, an issuer is eligible for the suspension to file reports pursuant to section 15(d) of the Securities Exchange Act of 1934, as amended, if the shares of common stock are held by fewer than 300 persons, or by fewer than 500 persons, where the total assets of the issuer have not be exceeded $10 million on the last day of each of the issuer's three most recent fiscal years. If we decide to suspend our obligations to file reports, then our shareholders will not receive publicly disseminated information, and their investment would not be liquid and would be a private company.

Once our Registration Statement is effective, management intends to file a Form 8-A which registers our class of common stock under Section 12 of the Exchange Act and. to file reports pursuant to Section 13(a)of the Securities Exchange Act of 1934, as amended.

IF WE DO NOT REGISTER A CLASS OF SECURITIES UNDER SECTION 12 OF THE EXCHANGE ACT, WE WILL BE SUBJECT TO SECTION 15(D) OF THE SECURITIES EXCHANGE ACT AND INVESTORS MAY NOT BE ABLE TO OBTAIN SUFFICIENT INFORMATION REGARDING THE COMPANY AND WILL MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS.

If we do not register a class of securities under Section 12 of the Exchange Act, we will be subject to Section 15(d) of the Securities Exchange Act and, accordingly, will not be subject to the proxy rules, Section 16 short-swing profit provisions, beneficial ownership reporting, and the bulk of the tender offer rules, therefore, investors may not be able to obtain sufficient information regarding the company and will make our common stock less attractive to investors.

RISKS ASSOCIATED WITH PURCHASE OF OUR SHARES

OUR OFFERING IS BEING MADE ON A BEST EFFORTS BASIS WITH NO MINIMUM AMOUNT OF SHARES ARE REQUIRED TO BE SOLD FOR THE OFFERING TO PROCEED.

In order to implement our business plan, we require funds from this offering. We require a minimum of $80,000 from the offering to implement your business plan. However, our offering is being made on a best efforts basis with no minimum amount of shares required to be sold in the offering to proceed. If we raise only a nominal amount of the proceeds we may be unable to implement our business plan and we will have to suspend or cease operations and you may lose your investment in our company. In addition, because there is no minimum offering amount, our ability to close the offering early poses a risk of loss of your investment in our company.

| 11 |

BECAUSE THE COMPANY HAS ARBITRARILY SET THE OFFERING PRICE, YOU MAY NOT REALIZE A RETURN ON YOUR INVESTMENT UPON RESALE OF YOUR SHARES.

The offering price and other terms and conditions relative to the Company’s shares have been arbitrarily determined by us and do not bear any relationship to assets, earnings, book value or any other objective criteria of value. Additionally, as the Company was formed on January 31, 2022 and has only a limited operating history and no earnings, the price of the offered shares is not based on its past earnings and no investment banker, appraiser or other independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares, as such our stockholders may not be able to receive a return on their investment when they sell their shares of common stock.

MONEY RAISED IN THIS OFFERING WILL BE IMMEDIATELY AVAILABLE TO THE COMPANY AND INVESTORS CANNOT WITHDRAW FUNDS ONCE INVESTED AND WILL NOT RECEIVE A REFUND.

Money raised in this offering will be immediately available to the company and our sole officer and director. Investors do not have the right to withdraw invested funds. Subscription payments will be paid directly to us and held on our corporate bank account if the Subscription Agreements are in good order and the Company accepts the subscription. Therefore, once an investment is made, investors will not have the use or right to return of such funds.

THERE IS NO GUARANTEE ALL OF THE FUNDS RAISED IN THE OFFERING WILL BE USED AS OUTLINED IN THIS PROSPECTUS.

We have committed to use the proceeds raised in this offering for the uses set forth in the “Use of Proceeds” section. However, certain factors beyond our control, such as increases in certain costs, could result in the Company being forced to reduce the proceeds allocated for other uses in order to accommodate these unforeseen changes. The failure of our management to use these funds effectively could result in unfavorable returns. This could have a significant adverse effect on our financial condition and could cause the price of our common stock to decline.

WE ARE SELLING THIS OFFERING WITHOUT AN UNDERWRITER AND MAY BE UNABLE TO SELL ANY SHARES.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell our shares through our President, who will receive no commissions. There is no guarantee that he will be able to sell any of the shares. Unless he is successful in selling at 40% of the shares and we receive the proceeds in the amount of $4,570,500 of this offering, we may have to seek alternative financing to implement our business plan.

THE TRADING IN OUR SHARES WILL BE REGULATED BY THE SECURITIES AND EXCHANGE COMMISSION RULE 15G-9 WHICH ESTABLISHED THE DEFINITION OF A “PENNY STOCK.”

The shares being offered are defined as a penny stock under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and rules of the Commission. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $3,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $4,570,500 ($300,000 jointly with spouse), or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the Commission. Consequently, the penny stock rules may make it difficult for you to resell any shares you may purchase, if at all.

| 12 |

DUE TO THE LACK OF A TRADING MARKET FOR OUR SECURITIES, YOU MAY HAVE DIFFICULTY SELLING ANY SHARES YOU PURCHASE IN THIS OFFERING.

We are not registered on any market or public stock exchange. There is presently no demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following the completion of the offering and apply to have the shares quoted on the OTC Pink Sheets (“OTC”) or other quotation service. The OTC is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter securities. The OTC is not an issuer listing service, market or exchange. Although the OTC does not have any listing requirements, to be eligible for quotation on the OTC, issuers must remain current in their filings with the SEC or applicable regulatory authority. If we are not able to pay the expenses associated with our reporting obligations we will not be able to apply for quotation on the OTC Pink Sheets or other quotation service. Market makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTC that become delinquent in their required filings will be removed following a 30 to 60 day grace period if they do not make their required filing during that time. We cannot guarantee that our application will be accepted or approved and our stock listed and quoted for sale. As of the date of this filing, there have been no discussions or understandings between Elements Ventures Group Inc. and anyone acting on our behalf, with any market maker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, or we do not sell sufficient shares or have sufficient shareholders to be quoted on the OTC, it will be difficult for you to sell any shares you purchase in this offering. In such a case, you may find that you are unable to achieve any benefit from your investment or liquidate, your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

WE WILL INCUR ONGOING COSTS AND EXPENSES FOR SEC REPORTING AND COMPLIANCE. WITHOUT REVENUE WE MAY NOT BE ABLE TO REMAIN IN COMPLIANCE, MAKING IT DIFFICULT FOR INVESTORS TO SELL THEIR SHARES, IF AT ALL.

The estimated cost of this registration statement is $25,000. We will have to utilize funds from Dmitry Kinslikh, our sole officer and director, who has verbally agreed to loan the company funds to complete the registration process. However, Mr. Dmitry Kinslikh has no obligation to loan such funds to us and there is a verbal guarantee that he will loan such funds to us. After the effective date of this prospectus, we will be required to file annual, quarterly and current reports, or other information with the SEC as provided by the Securities Exchange Act. We plan to contact a market maker immediately following the close of the offering and apply to have the shares quoted on the OTC Pink Sheets or other quotation service. To be eligible for quotation, issuers must remain current in their filings with the SEC. In order for us to remain in compliance we will require future revenues to cover the cost of these filings, which could comprise a substantial portion of our available cash resources. If we are unable to generate sufficient revenues to remain in compliance it may be difficult for you to resell any shares you may purchase, if at all. Also, if we are not able to pay the expenses associated with our reporting obligations we will not be able to apply for quotation on the OTC Pink Sheets or other quotation service.

USE OF PROCEEDS

Our public offering of 6,000,000 shares is being made at a price per share is $0.35 with net proceeds of $2,075,000 after estimated offering expenses of $25,000. The following table sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100%, respectively, of the securities offered for sale by the Company. There is no assurance that we will raise the full $2,100,000 as anticipated.

| 25% of Offering Sold | 50% of Offering Sold | 75% of Offering Sold | 100% of Offering Sold | |||||||||||||

| Gross Proceeds from this Offering (1) | $ | 525,000 | $ | 1,050,000 | $ | 1,575,000 | $ | 2,100,000 | ||||||||

| Shares Sold | 1,500,000 | 3,000,000 | 4,500,000 | 6,000,000 | ||||||||||||

| Gross Proceeds | $ | 525,000 | $ | 1,050,000 | $ | 1,575,000 | $ | 2,100,000 | ||||||||

| Total Before Expenses | $ | 525,000 | $ | 1,050,000 | $ | 1,575,000 | $ | 2,100,000 | ||||||||

| Administrative Offering Expenses | ||||||||||||||||

| Legal & Accounting | $ | 20,000 | $ | 20,000 | $ | 20,000 | $ | 20,000 | ||||||||

| Publishing/EDGAR | $ | 2,000 | $ | 2,000 | $ | 2,000 | $ | 2,000 | ||||||||

| Transfer Agent | $ | 2,000 | $ | 2,000 | $ | 2,000 | $ | 2,000 | ||||||||

| SEC Filing Fee | $ | 406.55 | $ | 406.55 | $ | 406.55 | $ | 406.55 | ||||||||

| Miscellaneous | $ | 593.45 | $ | 593.45 | $ | 593.45 | $ | 593.45 | ||||||||

| Total Administrative Operating Expenses | $ | 25,000 | $ | 25,000 | $ | 25,000 | $ | 25,000 | ||||||||

| Net Offering Proceeds | $ | 500,000 | $ | 1,025,000 | $ | 1,550,000 | $ | 2,075,000 | ||||||||

| Operating Offering Expenses | ||||||||||||||||

| Website Development | $ | 30,000 | $ | 30,000 | $ | 40,000 | $ | 40,000 | ||||||||

| Software/ Product development | $ | 362,500 | $ | 730,000 | $ | 1,097,500 | $ | 1,470,000 | ||||||||

| Marketing & Advertising | $ | 7,500 | $ | 165,000 | $ | 152,500 | $ | 248,838 | ||||||||

| Salaries | $ | 80,000 | $ | 80,000 | $ | 200,000 | $ | 256,163 | ||||||||

| Other operating expenses | $ | 20,000 | $ | 20,000 | $ | 60,000 | $ | 60,000 | ||||||||

| Total Operating Expenses | $ | 500,000 | $ | 1,025,000 | $ | 1,550,000 | $ | 2,075,000 | ||||||||

We believe the net proceeds from the sale of all the shares we are offering, assuming all the shares are sold (of which you have no assurance), will be sufficient to fund our operational expansion goals assuming application of the proceeds as outlined above. See “Plan of Operations”. The board of directors reserves the right to reallocate the use of net proceeds, if, in its judgment, such reallocation will best serve its needs in meeting changes, developments and unforeseen delays and difficulties. Pending use, the net proceeds shall be invested in certificates of deposit, money market accounts, treasury bills, and similar short term, liquid investments with substantial safety of principal.

| 13 |

DILUTION

The price of the current offering is fixed at $0.35 per share. This price is significantly higher than the valuation of the shares issued to our sole officer and director, Dmitry Kinslikh, which was $0.0001 per share for the 7,000,000 shares of common stock he earned from the Company. In addition, we have issued 4,570,000 shares to a number of shareholders at varying prices.

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders. The following tables compare the differences of your investment in our shares with the investment of our existing stockholders.

| % sold | Total outstanding | Net tangible book value/share | Increase/share to existing stockholders | %owned by existing stockholders | Dilution/share to new stockholders | %owned by new stockholders | ||||||||||||||||||||

| 25 | % | 15,320,000 | $ | 0.03362 | $ | 0.083 | 75.5 | % | $ | 0.316 | 9.8 | % | ||||||||||||||

| 50 | % | 19,070,000 | $ | 0.05454 | $ | 0.054 | 60.7 | % | $ | 0.295 | 15.7 | % | ||||||||||||||

| 75 | % | 22,820,000 | $ | 0.06858 | $ | 0.068 | 50.7 | % | $ | 0.281 | 19.7 | % | ||||||||||||||

| 100 | % | 26,570,000 | $ | 0.07866 | $ | 0.078 | 43.5 | % | $ | 0.271 | 22.6 | % | ||||||||||||||

As of August 31, 2023, the net tangible book value was $(12,181) or $(0.011) based upon 11,540,500 shares outstanding.

SELLING SHAREHOLDERS

The selling shareholders named in this prospectus are offering all of the 4,570,500 shares of common stock offered for resale through this prospectus and it also covers the registration of the 6,000,000 shares of our common stock in a primary offering. The 4,570,500 shares that were previously issued were acquired from us in private placements that were exempt from registration provided under Regulation S of the Securities Act of 1933. All of the sales/issuances of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

The following table provides as of the date of this prospectus, information regarding the beneficial ownership of our common stock held by each of the selling shareholders, including:

| • | the number of shares owned by each prior to this offering; |

| • | the total number of shares that are to be offered for each; |

| • | the total number of shares that will be owned by each upon completion of the offering; and |

| • | the percentage owned by each upon completion of the offering. |

| Name Of Selling Shareholder | Shares Owned Prior To This Offering | Total Number Of Shares To Be Offered For Selling Shareholders Account | Total Shares to Be Owned Upon Completion Of This Offering | Percentage of Shares owned Upon Completion of This Offering | ||||||||

| Lana Adamson | 350,500 | 500 | Nil | Nil | ||||||||

| Deepti Agarwal | 500 | 500 | Nil | Nil | ||||||||

| Rajeev Agarwal | 500 | 500 | Nil | Nil | ||||||||

| Muhammed Ajram | 500 | 500 | Nil | Nil | ||||||||

| Bhupinder Brar | 500 | 500 | Nil | Nil | ||||||||

| Komaljit Brar | 500 | 500 | Nil | Nil | ||||||||

| Amrit Singh Chahal | 10,000 | 10,000 | Nil | Nil | ||||||||

| Jasmeet Chahal | 10,000 | 10,000 | Nil | Nil | ||||||||

| Sergey Fedotov | 500 | 500 | Nil | Nil | ||||||||

| Jagdeep Gill | 500 | 500 | Nil | Nil | ||||||||

| Jasbir Gill | 500,000 | 500,000 | Nil | Nil | ||||||||

| Jaswinder Gill | 500,000 | 500,000 | Nil | Nil | ||||||||

| Tejpal Gill | 500,000 | 500,000 | Nil | Nil | ||||||||

| Manjinder Kalirai | 500 | 500 | Nil | Nil | ||||||||

| Navdeep Kalirai | 500 | 500 | Nil | Nil | ||||||||

| Parlad Kalirai | 500 | 500 | Nil | Nil | ||||||||

| Ramandeep Kalirai | 500 | 500 | Nil | Nil | ||||||||

| Balwinder Kooner | 500 | 500 | Nil | Nil | ||||||||

| Gurjeet Kooner | 500,000 | 500,000 | Nil | Nil | ||||||||

| Daniel Kostin | 500 | 500 | Nil | Nil | ||||||||

| Sergey Kuzhlev | 200,000 | 200,000 | Nil | Nil | ||||||||

| Yuliya Kuzhleva | 50,000 | 50,000 | Nil | Nil | ||||||||

| Rahul Maingi | 500 | 500 | Nil | Nil | ||||||||

| Julia Milter | 500 | 500 | Nil | Nil | ||||||||

| Sergey Milter | 500 | 500 | Nil | Nil | ||||||||

| Jaskarn Rai | 500,000 | 500,000 | Nil | Nil | ||||||||

| Teresa Safarian | 10,000 | 10,000 | Nil | Nil | ||||||||

| Mehnoor Sandhu | 500 | 500 | Nil | Nil | ||||||||

| Neeti Prabhjot Sandhu | 500 | 500 | Nil | Nil | ||||||||

| Jaspreet Saran | 500 | 500 | Nil | Nil | ||||||||

| Grace Sharma | 500,000 | 500,000 | Nil | Nil | ||||||||

| Vladimir Sidelnikov | 350,500 | 500 | Nil | Nil | ||||||||

| Simarpreet Singh | 10,000 | 10,000 | Nil | Nil | ||||||||

| Sergejs Suhanovs | 10,000 | 10,000 | Nil | Nil | ||||||||

| Vladimir Yevdokimov | 10,000 | 10,000 | Nil | Nil | ||||||||

| Elena Znamenskaya | 500,0,000 | 1,200,000 | Nil | Nil | ||||||||

| Roman Znamenski | 50,000 | 50,000 | Nil | Nil | ||||||||

| 14 |

PLAN OF DISTRIBUTION

By Selling Stockholders

In connection with the sale of the common shares, agents may receive compensation from the selling stockholders or from purchasers of common shares for whom they may act as agents in the form of discounts, concessions or commissions. The selling shareholders named herein may be deemed underwriters of the shares of common stock which they are offering and any profit on the resale of the common shares by them may be deemed to be underwriting discounts or commissions under such Act. We will not receive any proceeds from sale of shares by selling stockholders.

Upon our being notified by a selling stockholder that any material arrangement has been entered into with a broker or dealer for the sale of any common shares otherwise than through a stockholders brokerage account a Prospectus supplement or post-effective amendment will be filed, if required, pursuant to Rule 424(b) under the Securities Act of 1933

By Us

We are offering up to 6,000,000 shares of common stock on a dirre at a fixed price for the duration of the offering. This prospectus will permit our sole officer and director to sell the shares directly to the public, with no commission or other remuneration payable to him for any shares that they may sell. Our officer and director will sell the shares and intends to offer them to friends, family members and business acquaintances. In offering the securities on our behalf, they will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. The shares will be offered at a fixed price of $0.35 per share for a period of one hundred and eighty (180) days from the effective date of this prospectus, unless extended by our board of directors for an additional 90 days. Our board may choose to extend the offering for an additional 90 days if all of the shares are not sold at the end of 180 days from the effective date of this prospectus.

Our subscription agreement allows purchasers to purchase shares from us and requires that we promptly deliver a certificate representing the Shares, registered in the name of the Purchaser. As well, it grants the Purchaser a two-day cancellation right to cancel the subscription by sending notice to the Company by midnight on the 2nd business day after you the Purchaser signs the subscription agreement.

We have 11,570,500 shares of common stock issued and outstanding as of the date of this prospectus. The Company is registering 6,000,000 shares of its common stock for sale at the price of $0.35 per share. There is no arrangement to address the possible effect of the offering on the price of the stock. In connection with the Company’s selling efforts in the offering, Dmitry Kinslikh will not register as a broker-dealer pursuant to Section 15 of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an offering of the issuer’s securities.

Dmitry Kinslikh is not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act. Dmitry Kinslikh will not be compensated in connection with his participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Dmitry Kinslikh is not, and has not been within the past 12 months, a broker or dealer, and he has not been within the past 12 months, an associated person of a broker or dealer. At the end of the offering, Dmitry Kinslikh will continue to primarily perform substantial duties for the Company or on its behalf otherwise than in connection with transactions in securities. Dmitry Kinslikh will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

We will receive all proceeds from the sale of the 6,000,000 shares being offered. The price per share is fixed at $0.35 for the duration of this offering. Although our common stock is not listed on a public exchange or other quotation service, we intend to seek to have our shares of common stock quoted on the OTC Pink Sheets or other quotation service. In order to be quoted on the OTC Pink Sheets or other quotation service, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, nor can there be any assurance that such an application for quotation will be approved.

| 15 |

The Company’s shares may be sold to purchasers from time to time directly by and subject to the discretion of the Company. Further, the Company will not offer its shares for sale through underwriters, dealers, agents or anyone who may receive compensation in the form of underwriting discounts, concessions or commissions from the Company and/or the purchasers of the shares for whom they may act as agents. The shares of common stock sold by the Company may be occasionally sold in one or more transactions; all shares sold under this prospectus will be sold at a fixed price of $0.35 per share.

In order to comply with the applicable securities laws of certain states, the securities will be offered or sold in those only if they have been registered or qualified for sale; an exemption from such registration or if qualification requirement is available and with which we have complied. In addition, and without limiting the foregoing, we will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the period of time when this Registration Statement is effective. We will pay all expenses incidental to the registration of the shares (including registration pursuant to the securities laws of certain states).

DESCRIPTION OF SECURITIES

General

There is no established public trading market for our common stock. Our authorized capital stock consists of 500,000,000 shares of common stock, $0.0001 par value per share and 20,000,000 shares of preferred stock, par value $0.0001 per share. As of August 31, 2023 there were 11,570,500 shares of our common stock issued and outstanding that are held by our shareholders, and no shares of preferred stock are issued and outstanding.

Common Stock

The holders of our common stock currently have (i) equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board of Director of the Company; (ii) are entitled to share ratably in all of the assets of the Company available for distribution to holders of common stock upon liquidation, dissolution or winding up of the affairs of the Company (iii) do not have pre-emptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights applicable thereto; and (iv) are entitled to one non- cumulative vote per share on all matters on which stock holders may vote.

Holders

As of January 3, 2024 , we had had 38 holders of record.

Dividend Policy

We have not declared or paid dividends on our common stock since our formation, and we do not anticipate paying dividends in the foreseeable future. Declaration or payment of dividends, if any, in the future, will be at the discretion of our Board of Directors and will depend on our then current financial condition, results of operations, capital requirements and other factors deemed relevant by the Board of Directors. There are no contractual restrictions on our ability to declare or pay dividends.

Transfer Agent

We have not retained a transfer agent to serve as transfer agent for shares of our common stock. Until we engage such a transfer agent, we will be responsible for all record-keeping and administrative functions in connection with the shares of our common stock.

Penny Stock Rules

The Securities Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in “penny stocks” as such term is defined by Rule 15g-9. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or provided that current price and volume information with respect to transactions in such securities is provided by the exchange).

| 16 |

The shares offered by this prospectus constitute penny stock under the Securities and Exchange Act. The shares will remain penny stock for the foreseeable future. The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in our company will be subject to the penny stock rules.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the Commission, which: (i) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (ii) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities’ laws; (iii) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and significance of the spread between the bid and ask price; (iv) contains a toll-free telephone number for inquiries on disciplinary actions; (v) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (vi) contains such other information and is in such form as the Commission shall require by rule or regulation. The broker-dealer also must provide to the customer, prior to effecting any transaction in a penny stock, (i) bid and offer quotations for the penny stock; (ii) the compensation of the broker-dealer and its salesperson in the transaction; (iii) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (iv) monthly account statements showing the market value of each penny stock held in the customer’s account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those securities.

DESCRIPTION OF BUSINESS

We are a technology led company focused on bringing the healthcare technologies for the people to help them live a healthier and better life.

We are developing a Health and Fitness as well as Diet and Nutrition app rolled into one called “FITLY”. FITLY is a cutting-edge health and wellness platform that aims to revolutionize the way individuals approach fitness, food, and nutrition.

| 17 |

GENERAL DESCRIPTION OF OUR ACTIVITY

As an early-stage technology development enterprise, we are driven by great user experience and value addition of our customers, with full transparency and time-honored efficiency, matching top talent and creativity with global experience. Whether it’s a Health and Fitness App, with Diet and Nutrition App, or any planned enhancements and additions in the future, Elements FITLY delivers elegant, effective solutions to help our clients drive their business forward in the most brazen and protected manner. Monetizing a health tracking app with recipe features and the sale of wearable devices can be approached through several strategies. FITLY will have following potential monetization options:

| • | Freemium Model: Offer the FITLY app for free with basic health tracking features, including a limited recipe database. Provide premium subscriptions that unlock advanced features, such as personalized meal plans, exclusive recipes, or access to a larger recipe library. Premium subscribers can also receive discounts on wearable device purchases. |

| • | In-App Purchases: Offer in-app purchases for additional recipe packs, specialized diet plans, or advanced nutritional insights. Users can buy these digital products within the app to enhance their diet and improve their health tracking experience. |

| • | Recipe Marketplace: Create a marketplace within the app where users can purchase recipe collections from renowned chefs, nutritionists, or popular brands. Take a commission on each recipe pack sale or charge a listing fee for participating sellers. |

| • | Affiliate Partnerships: Collaborate with wearable device manufacturers and earn a commission for every sale made through the app. Promote specific wearable devices that seamlessly integrate with the app's tracking capabilities and offer users a comprehensive health monitoring experience. |

| • | Sponsored Content and Advertising: Partner with health and wellness brands, food companies, or fitness influencers to feature sponsored content, such as sponsored recipes or health-related articles, within the app. Display targeted advertisements that align with the app's focus and the users' interests. |

| • | Wearable Device Bundles: Offer bundled packages that combine the app's premium subscription with the purchase of a wearable device. Users can enjoy a discounted price for the combined package, enhancing their overall health tracking experience. |

| • | Data Analytics and Insights: Aggregate anonymized user data and provide aggregated analytics and insights to health researchers, food companies, or wellness organizations. Offer subscription-based access or data licensing options to interested parties. |

| • | Partner Discounts and Rewards: Forge partnerships with health-related businesses, such as gyms, fitness studios, or health food stores, to provide exclusive discounts or rewards for app users. Users can redeem these offers by achieving specific health goals or engaging with the app's features. |

| 18 |

This is a direct participation offering since we are offering the stock directly to the public without the participation of an underwriter. Our sole officer and director will be responsible for selling shares under this offering and no commission will be paid on any sales. He will utilize this prospectus to offer the shares to friends, family and business associates.

We are a newly created company that has not realized any revenues through August 31, 2023 with a net loss of $51,549 for the period from inception to August 31, 2023. To date our operations have been funded by loans from our sole officer and director, Dmitry Kinslikh and share subscriptions from our shareholders. Our independent auditor, BF Borgers CPA PC has issued an audit opinion, which includes a statement expressing a doubt as to our ability to continue as a going concern. Our address is 9980 Dufferin Street #20026, Vaughan, Ontario L6A 4M4 . Our telephone number is (647) 405-1054.

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or other quotation service. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our common stock to be eligible for trading on the OTC Pink Sheets. We do not yet have a market maker who has agreed to file such quotation service or that any market for our stock will develop.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

FITLY Overview

FITLY is comprised of 2 main categories:

| 1. | Fitness – Workout, physical activity monitoring; and, |

| 2. | Diet & Nutrition – focused on diet, food, calories tracking. |

Elements FITLY will be an all fitness and nutrition related tracking, training and guidance app. Elements Fitly app will be highly docile and will be available for a number of devices like smartphones, web, pads smartwatches, fitness bands and many more.

It broadly categorizes its segments as follows:

| • | Personal Trainer: FITLY will incorporate personal trainer app which has the pre-arranged workout and exercise routines, one best thing about this is that the user can choose the format of his/her routine exercise. For example, the workout can be in video format, illustrations format, three dimensional formats. It will also have the option to choose the level of difficulty based on their body and fitness goals. This is designed to make people feel more comfortable compared to the gym. |

| • | Diet and Nutrition: It covers entire aspects of the nutrition and the calorie amount of each food item is defined. Simultaneously, we can also get other information related to the daily diet chart. This will help those who are in must need of balancing their diet in order to maintain the healthy body state. |

| • | Yoga and Meditation: FITLY will have the separate section on Yoga & meditation which is the best way to be healthy is to maintain both psychological and physical health. This yoga and meditation app is for the users who want to keep their mind and body in a healthy mood without the following the heavy workout routine. |

| • | Activity Trainer: These are the most widely used apps, which actively tracks and monitors the user’s activities. These include the jogging, running, swimming, cycling, hiking and many more. The activity tracking will use various kinds of sensors to monitor and record the user’s activity information. |

| 19 |

Below is the list of some of the most prominent features of the FITLY application:

| • | Simple Registration Process: For a simple registration process, a user can add the login through the social media option for the end-users. It also adds another security layer by adding the facility of OTP or verification code with the user’s contact number. |

| • | Interactive User Profile: After the registration process, the user will fill up his/her details and other personal information such as name, date of birth, contact number and many more. Every user pleads to have a creative profile that’s highly interactive, to make the app more fun for them to use. Added functionalities will be implemented to keep up with the trend. |

| • | Social Media Integration: Social Media integration has now become a most wanted feature for not only the health and fitness applications but for all types of apps. All this is because the users like to update their whereabouts on their various social media platforms to maintain a constant number of followers. Integrating various social media platforms to FITLY application will also provide an increase in the online search for the brand. |

| • | Wearable Device Support: Smartwatches are the ones that most of the people are opting for. The community of wearable devices is growing at a significant rate so it won’t be a smart move to left out such a big part of the population. FITLY app will be user-friendly by giving support and adaptable for the wearable devices. |

| • | An option of Tracking: The field of fitness and health is the one where user likes to see the graph of progress, which is intended to check the previous state with the present state. So FITLY will provide its users with the option of tracking the data as well as the recording of their activity information. For example, provide the real-time data as per the activity or notify the users the number of calories they have burned in their recent activity. |

| • | GPS Support: The Geolocation feature or GPS support is the most essential to add to the app if there are physical activities like jogging, cycling, hiking, trekking running etc. while performing any physical activities the user can share the location with their friends or family. This feature is added to other functionalities of the app. |

| • | Push Notifications: Push Notifications is vital and if you are a regular reader of Mobile App Daily you may come to know the importance of push notifications especially in driving retention on your app. In a similar manner, the push notifications will remind the user of the daily health and fitness activities that App perform. |

| • | Video Format Tutorials: It is a fact that users prefer a video format when they want to learn new things. A video will convey the exact way to do the activity. A workout session cannot be explained entirely on the pictorial representation of the exercises included. So, to make exact use of the health and fitness apps the users do need the video tutorials for various fitness and health routines. |

| • | IAP Services: The IAP services also known as in-app purchases is one of the most known methods to earn revenue through your mobile or web application. Even with these apps, Fitly App offer the option of buying the special workout courses, specialized fitness gear and apparel with your brand logo over it. This feature also adds value from a revenue perspective for the application. |

| • | Various Payment Options: In general, many people may think that payment feature is an optional thing, but if we look at the current state of mobile commerce, adding this feature is now equally important. Because if the app consists of the IAP feature, then you need to have the payment gateway feature to integrate with it. To make this feature more adaptable, instead of adding just a payment option include various payment options to provide the user with a better experience. |

| 20 |

Here is some further description of some features elements of the FITLY app:

| • | User Profile: Users will be able to save information about their health and body condition from the first training day. |

| • | Activity Tracker: Adds the ability to set goals so users can see progress. Goals are about competing with yourself. Striving to become better every day needs to be encouraged. Make sure that for each new record or completed goal the status of the user is increased, or they receive virtual or real prizes. |

| 21 |

| • | Gamification: Progress indicators and leaderboards are powerful motivators. The ability to compete with each other even at home boosts performance. Nike Run Club has an excellent option – you can share a goal with your friends. Choose a distance, date, invite friends and whoever does the best gets a gold medal. |

| • | Personal Mentor: Guidance of a highly qualified specialist always helps in sports, so users will appreciate it if your fitness app has access to expert advice. Consider adding online tutor-supervised training – you can hire a specialist to help your users create a training program, teach tracking progress, and set the right direction for physical development. |

| • | Synchronization with Wearable Devices: Most users have several devices that help them track physical activity during sports. Smart devices have become very popular and today everyone tracks health metrics with their help. The user who has a smartwatch most likely bought them for a reason – they will want to use them in training, therefore, will prefer an application that will work in conjunction with their device. |

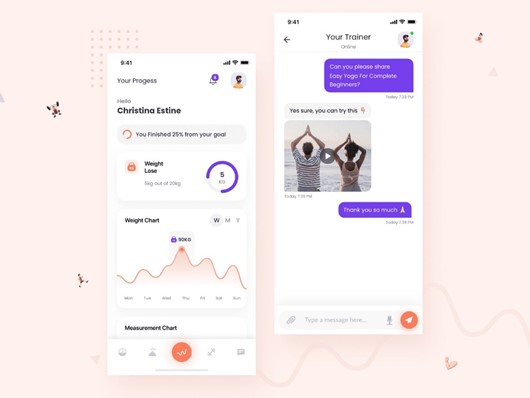

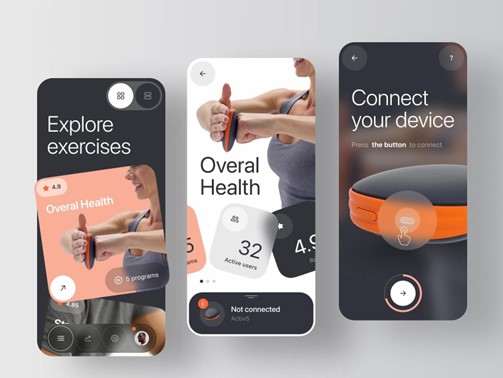

*The above graphic represents screenshots from our FITLY app.

| 22 |

Features that are implemented in FITLY diet & nutrition app:

| • | Nutrition: |

o Calendar: A built-in calendar can track eating habits.

o Meal Data: By entering information about every meal, users can analyze how well they eat every day.

o Photos: The app can recognize food in photos.

o Calorie Counter: This is the basic function of a food control app.

o Diet Tips: This feature will be useful for those who not only monitor nutrition but also want to lose weight.

| • | Weight Loss Record: |

o Dashboard: The app shows graph of calories consumed and burned and display the user’s progress.

o Diet Plan Based on User Goals: This feature allows the user to make his personal diet plan or set goals for weight loss proceeding from his physical indicators.

o Diet Suggestions:

| • | Calorie Counter & Log: |

o Calorie Counter: The app shows how many calories are in different foods.

o Food Log: Users are able to upload photos and descriptions of food consumed.

o Diet Suggesting: The app suggests ways to adjust the diet to achieve normal calorie intake.

o Barcode Scanner: Users are able to immediately calculate the number of calories by scanning product barcodes.

| • | Healthy Recipes: |