As filed with the Securities and Exchange Commission on February 10, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________

SEALSQ Corp

(Exact name of registrant as specified in its charter)

__________________

| British Virgin Islands (State or other jurisdiction of incorporation or organization) |

3674 (Primary Standard Industrial

Avenue Louis-Casaï 58 |

N/A (I.R.S. Employer Identification No.) |

Peter Ward

Chief Financial Officer

SEALSQ Corp

Craigmuir Chambers, Road Town

Tortola, British Virgin Islands 1110

Tel: 011-41-22-594-3000

Fax: 011-41-22-594-3001

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

800-221-0102

(Name, address and telephone number of agent for service)

__________________

Copies to:

__________________

Herman H. Raspé, Esq. 1133 Avenue of the Americas |

George Y. Weston Harney Westwood & Riegels Craigmuir Chambers, PO Box 71, Road Town, Tortola, VG1110, British Virgin Islands Tel: (284) 852 4333 |

__________________

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective and the applicable shareholder approvals and the applicable conditions to the transaction have been satisfied or waived.

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company. ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

__________________

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION PRELIMINARY

PROSPECTUS DATED [DATE]

Distribution of 1,500,300 Ordinary Shares

of

SEALSQ Corp

to

Shareholders of WISeKey International Holding AG

as a

Partial Spin-Off

from WISeKey International Holding AG

_______________________

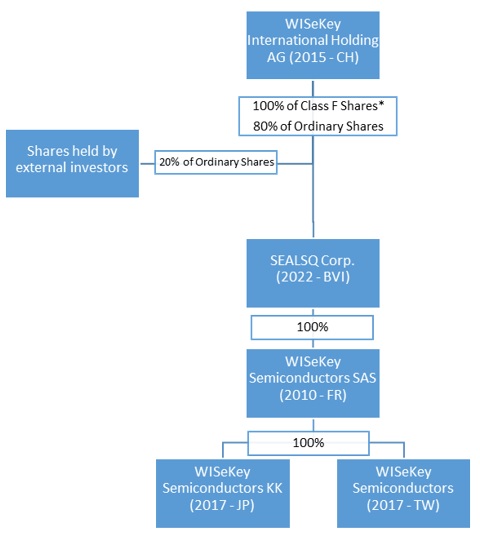

We are furnishing this prospectus to shareholders of WISeKey International Holding AG (“WISeKey”) and to holders of WISeKey American Depositary Shares (“ADSs”) representing Class B Shares of WISeKey (“Class B Shares”). SEALSQ Corp (“SEALSQ” or “we/us/our”) is currently a wholly-owned subsidiary of WISeKey. WISeKey proposes to distribute 20% of SEALSQ’s outstanding ordinary shares, US$0.01 par value per share (“Ordinary Shares”), to holders of WISeKey Class B Shares, including holders of WISeKey ADSs, and to holders of WISeKey Class A Shares (“Class A Shares”), in each case as a partial spin-off distribution as a dividend in kind to such holders (“Spin-Off Distribution”). WISeKey will initially retain 100% ownership of SEALSQ’s Class F Shares, par value of US$0.05 per share (“Class F Shares”) and 80% of SEALSQ’s Ordinary Shares. SEALSQ is reserving up to 5% of its Class F Shares for issuance pursuant to a Class F Share Option Plan (“F Share Option Plan”) for certain directors and senior management of SEALSQ, its subsidiaries and its parent. As a result, WISeKey’s initial ownership percentage of Class F Shares is subject to the grant and exercise of SEALSQ Class F Share options (“Options”) prior to the Spin-Off Distribution.

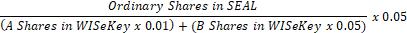

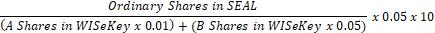

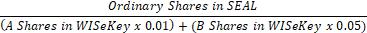

Based on the number of WISeKey shares outstanding as of December 31, 2022, holders of WISeKey Class B Shares will receive from WISeKey 0.011206165 SEALSQ Ordinary Share for every WISeKey 1 Class B Share owned at the applicable WISeKey share record date for the Spin-Off Distribution, holders of WISeKey ADSs will receive from WISeKey 0.11206165 Ordinary Share for every 1 WISeKey ADS owned at the close of business on the applicable WISeKey ADS record date for the Spin-Off Distribution, and holders of WISeKey Class A Shares will receive from WISeKey 0.002241233 SEALSQ Ordinary Share for every 1 WISeKey Class A Share owned on the applicable WISeKey share record date for the Spin-Off Distribution. WISeKey has informed us that WISeKey and the depositary bank for the ADSs will announce the applicable share record date, the applicable ADS record date and the applicable share distribution date, respectively, promptly after the Spin-Off Distribution is approved by the WISeKey shareholders at an Extraordinary General Meeting to be held on or about [·], 2023 and the applicable conditions for the Spin-Off Distribution have been satisfied or waived. WISeKey has informed us that it expects the Spin-Off Distribution to be completed in early 2023. To the extent WISeKey issues any additional shares or retires shares prior to the applicable share record date for the Spin-off Distribution, the number of SEALSQ Ordinary Shares to be distributed to holders of WISeKey Class B Shares, ADSs and Class A Shares will be adjusted proportionately using the formulae set forth in the subsection titled “Business—Mechanics of the Spin-Off Distribution”.

Fractional entitlements to SEALSQ Ordinary Shares will not be distributed. Instead, the distribution agent for the WISeKey Class A Shares and Class B Shares, and the depositary bank for the WISeKey ADSs, will aggregate all fractional entitlements to SEALSQ Ordinary Shares that WISeKey shareholders and ADS holders, respectively, would be entitled to receive into whole SEALSQ Ordinary Shares and sell such whole shares into the open market at prevailing rates promptly after SEALSQ Ordinary Shares commence trading on the Nasdaq Global Market, and distribute the net cash proceeds from the sales (after deduction of applicable fees, taxes and expenses) pro rata to each holder who would have otherwise been entitled to receive fractional entitlements to SEALSQ Ordinary Shares in the Spin-Off Distribution.

We have applied to list our Ordinary Shares on the Nasdaq Global Market under the symbol “LAES.” WISeKey ADSs (representing WISeKey Class B Shares) will continue to trade on the Nasdaq Global Market under the symbol “WKEY”. The Spin-Off Distribution is contingent upon the listing of our Ordinary Shares on the Nasdaq Global Market or another national securities exchange. There can be no assurance that we will be successful in our listing of our Ordinary Shares in the Nasdaq Global Market or another national securities exchange. However, we will not complete the Spin-Off Distribution unless we are so listed. This Spin-Off Distribution of our Ordinary Shares by WISeKey is the first public distribution of our Ordinary Shares, and prior to this distribution, there has been no public market for our Ordinary Shares. Accordingly, we can provide no assurance to you as to what the market price of our Ordinary Shares may be or how strong a secondary market for our Ordinary Shares will develop. There will be no public market for SEALSQ Class F Shares.

After the completion of the Spin-Off Distribution, WISeKey will continue to own a majority of the voting power of SEALSQ shares eligible to vote in the election of our directors. As a result, we will be a “controlled company” within the meaning of the corporate governance standards of Nasdaq. See the subsections titled “Risk Factors—We will be a ‘controlled company’ as defined under the Nasdaq Stock Market corporate governance rules. As a result, we will qualify for, and intend to rely on, exemptions from certain corporate governance requirements that would otherwise provide protection to shareholders of other companies” and “Prospectus Summary—Implications of Being a Controlled Company” for further information. We are also both an “emerging growth company” and a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, are subject to reduced public company disclosure requirements. See the subsections titled “Prospectus Summary—Implications of Being an Emerging Growth Company and a Foreign Private Issuer” and “Risk Factors— Risk Related to Our Corporate Structure—As a foreign private issuer we are entitled to claim exemptions from certain Nasdaq corporate governance standards, and if we elected to rely on these exemptions, you may not have the same protections afforded to shareholders of companies that are subject to all of the Nasdaq corporate governance requirements” and “Risk Factors—Risks Related to Our Ordinary Shares—We are an emerging growth company and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common shares less attractive to investors" for additional information.

__________________________

Investing in our Ordinary Shares involves risks. See “Risk Factors” beginning on page 29 of this prospectus for a discussion of information that should be considered in connection with an investment in our Ordinary Shares.

Neither the U.S. Securities and Exchange Commission (“SEC”) nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

WISeKey has informed us that it expects to make delivery of the SEALSQ Ordinary Shares in early 2023 to holders as of a record date to be announced by WISeKey's board of directors after the date of the WISeKey Extraordinary General Meeting, assuming all conditions for the Spin-off Distribution have been satisfied or waived.

__________________________

Prospectus dated , 2023.

TABLE OF CONTENTS

Page

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus and in any free writing prospectus filed with the SEC. We have not authorized anyone to provide you with different information or to make representations other than those contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer is not permitted.

Unless otherwise indicated, references to “SEALSQ,” the “Company,” “we,” “our,” “us” or similar terms refer to the registrant, SEALSQ Corp, and its subsidiaries, except where the context otherwise requires.

Unless otherwise indicated, all information contained in this prospectus regarding “WISeKey” has been provided by WISeKey to SEALSQ for purposes of inclusion in this prospectus. Any reference to “WISeKey” is to WISeKey International Holding AG and its subsidiaries, except where the context otherwise requires.

References to:

“BVI” are to the British Virgin Islands

“BVI Act” are to the BVI Business Companies Act 2004, as amended

“BVI Insolvency Act” are to the BVI Insolvency Act, 2003, as amended

“Code” are to U.S. Internal Revenue Code of 1986, as amended

“IRS” are to the U.S. Internal Revenue Service

“JOBS Act” are to U.S. Jumpstart Our Business Startups Act of 2012

“Sarbanes-Oxley Act” are to U.S. Sarbanes-Oxley Act of 2002

“SEC” or “Commission” are to the U.S. Securities and Exchange Commission

“Securities Act” are to the U.S. Securities Act of 1933, as amended

“Securities Exchange Act” are to the U.S. Securities Exchange Act of 1934, as amended

“$”, “US $”, “USD” and “U.S. dollars” are to the lawful currency of the United States of America

The following industry-specific acronyms are used in throughout the prospectus and have the meanings as set out below:

“ANSSI” is the Agence Nationale de la Sécurité des Systèmes d’Information, the French National Cybersecurity Agency

“Common Criteria EAL” refers to the Common Criteria Evaluation Assurance Level attributed to an IT product or system on a grade of 1 to 7 with 7 being the highest.

“FIDO” means Fast Identity Online

“FIPS140-2” refers to the Federal Information Processing Standard Publication 140-2 and is a US government computer security standard which is graded in levels from 1 to 4

“IC” is an Integrated Circuit

“IoT” is the Internet of Things

“IP” is Internet Protocol

“IPv6” is version six of the Internet Protocol

“NCCOE” is the U.S. National Cybersecurity Center of Excellence

“NIST” refers to the U.S. National Institute of Standards & Technology

“OEM” is an Original Equipment Manufacturer

“PQC” is Post-Quantum Cryptography

“USP” refers to Utility Service Providers

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. These forward-looking statements include information about possible or assumed future results of our operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” “projects,” “forecasts” and variations of such words and similar expressions, as they relate to us, WISeKey, our management or third parties, are intended to identify the forward-looking statements. Forward-looking statements include statements regarding our business strategy, financial performance, results of operations, market data, events or developments that SEALSQ expects or anticipates will occur in the future, as well as any other statements which are not historical facts. Although we believe that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements include, but are not limited to, statements we make regarding:

1

| · | Our anticipated goals, growth strategies and profitability; |

| · | Future operating or financial results; |

| · | Our forecast to be cash flow positive in 2023; |

| · | Our planned capital expenditure program for additional production lines to be added to our supply chain; |

| · | Our intention to make investments in sales and marketing operations including recruiting additional staff, and R&D of new products such as post-quantum cryptography; |

| · | Our intention to form new strategic partnerships to strengthen our position as an IoT cybersecurity provider; |

| · | Our belief that the products resulting from our R&D will create additional opportunities for growth; |

| · | Our belief that the recent market conditions and the shortage resulting from the COVID-19 pandemic has attracted more potential clients and that this trend will continue once the market conditions ease; |

| · | Our expectation about the development of the markets for SEALSQ, including expanding the role of Metaverse, increase in cyber threats and growth of secure hardware market, growing demand for IoT solutions, increase in cybersecurity spending based on the recent regulations and legislations; |

| · | Our estimation that IoT devices will require semiconductors connected to secure platforms, which could allow the semiconductor industry to maintain an average annual growth of 3% to 4% for the foreseeable future; |

| · | Our plans to upgrade our PKI offer to add new post-quantum features for the IoT market; |

| · | Our intent to invest heavily in the ongoing development of our products and technology; |

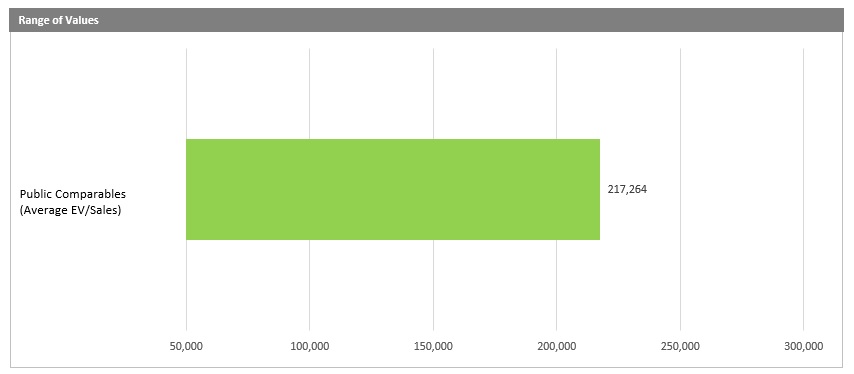

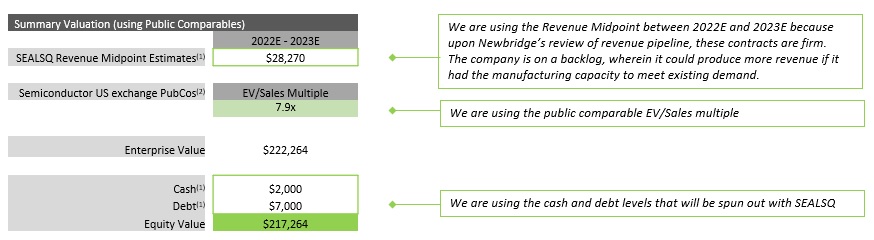

| · | Our belief that the value of SEALSQ is around $217 million, based on our valuation, using the Comparable Public Company Analysis’ valuation technique, supported by an independent valuation firm; |

| · | Our belief that a combination of our 2022 and 2023 revenue estimates is a reliable estimate upon which to base our valuation; |

| · | Our expectation that we will continue to gain several benefits from our parent company, WISeKey, including cash management via a loan agreement, and the financial reporting and legal support via the Separation Agreements; |

| · | Assumptions underlying or related to any of the foregoing. |

2

The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us and are only predictions based upon our current expectations and projections about future events. There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially from the results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Those factors include, in addition to those set forth in “Risk Factors" and those included elsewhere in this prospectus, among others, the following:

| · | The inability to realize estimated financial position, results of operations or cash flows; |

| · | The inherent uncertainty associated with financial projections and valuation techniques; |

| · | The valuation of SEALSQ based on 2022 and 2023 revenue estimates, which assumes a backlog of purchase orders received from clients and production schedules will be implemented as agreed; |

| · | Our ability to anticipate market needs and opportunities; |

| · | Our ability to attract new customers and retain existing customer base; |

| · | Our ability to foster innovation, to develop new products and enhancements to our existing products; |

| · | The demand for our products or for the goods into which our products are incorporated; |

| · | Our expectation that order commitments and non-cancellable orders we received are properly executed; |

| · | The sufficiency of our cash and cash equivalents to meet our liquidity needs; |

| · | The impact of any supply chain disruption that we may experience; |

| · | Our dependency on the timely supply of equipment and materials from our third-party suppliers; |

| · | Our ability to protect our intellectual property rights; |

| · | Our ability to keep pace with technical advances in cryptography and semiconductor design; |

| · | Our ability to raise funds for investment by cash flow from operating activities, advance payments from a key customer, and grants and other available subsidies from funding agencies; |

3

| · | Our ability to reducing its cost structure and its general and administrative costs; |

| · | Our ability to attract and retain qualified employees and key personnel; |

| · | Our ability to attract new customers and retain and expand within our existing customer base; |

| · | Our ability to foster innovation, to develop new products and enhancements to our existing products; |

| · | The potential impact of the COVID-19 pandemic affecting our clients’ ability and willingness to spend money in security applications and our supplier’s ability to source key components and material; |

| · | The future growth of the information technology and cybersecurity industry; |

| · | Risks relating to SEALSQ’s ability to implement its growth strategies and its Group’s restructuring; |

| · | Our ability to successfully hire and retain qualified employees and key personnel; |

| · | Our ability to successfully form new strategic partnerships with our alliance partners; |

| · | Our ability to continue beneficial transactions with material parties, including WISeKey and limited number of significant customers; |

| · | Our ability to prevent security breaches and unauthorized access to confidential customer information; |

| · | Our ability to comply with modified or new laws and regulations relating to our industries; |

| · | The activities of our competitors and the introduction of competing products by our competitors; |

| · | Market demand and semiconductor industry conditions; |

| · | Our ability to successfully introduce new technologies and products; |

| · | Uncertain negative effect of the COVID pandemic and its effect on the supply chain; |

| · | The cyclical nature of the semiconductor industry; |

| · | An economic downturn in the semiconductor industry; |

| · | Decreasing or diminishing an order backlog attributed to the change of customers’ positions and financial conditions; |

| · | Our ability to comply with U.S. and other applicable international laws and regulations; |

4

| · | Changes in our overall tax position as a result of changes in tax laws or tax rates, new or revised legislation, the outcome of tax audits or changes in international tax treaties which may impact our results of operations as well as our ability to accurately estimate tax credits, benefits, deductions and provisions and to realize deferred tax assets; |

| · | Fluctuations in the exchange rates between the U.S. dollar and the other major currencies we use for our operations; |

| · | Our ability to collect accounts receivable; |

| · | Changes in certain commodities used as raw material, which may affect our gross margin; |

| · | How long we will qualify as an emerging growth company or a foreign private issuer. |

Given these risks and uncertainties, you should not place undue reliance on forward-looking statements as a prediction of actual results.

WE UNDERTAKE NO OBLIGATION TO PUBLICLY UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENTS CONTAINED IN THIS PROSPECTUS OR THE DOCUMENTS TO WHICH WE REFER YOU IN THIS PROSPECTUS, TO REFLECT ANY CHANGE IN OUR EXPECTATIONS WITH RESPECT TO SUCH STATEMENTS OR ANY CHANGE IN EVENTS, CONDITIONS OR CIRCUMSTANCES ON WHICH ANY STATEMENT IS BASED, EXCEPT AS REQUIRED BY LAW.

ENFORCEABILITY OF CIVIL LIABILITIES

We are incorporated under the laws of the British Virgin Islands and our principal executive offices are located outside the United States. Most of our directors and officers and those of our subsidiaries are residents of countries other than the United States. Substantially all of our and our subsidiaries’ assets and a substantial portion of the assets of our directors and officers are located outside the United States. As a result, it may be difficult or impossible for United States investors to effect service of process within the United States upon us, our directors or officers, our subsidiaries or to realize against us or them judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States.

5

Furthermore, there is substantial doubt that courts in jurisdictions outside the U.S. (i) would enforce judgments of U.S. courts obtained in actions against us or our directors or officers based upon the civil liability provisions of applicable U.S. federal and state securities laws or (ii) would enforce, in original actions, liabilities against us or our directors or officers based on those laws.

MARKET DATA

The Company uses market data throughout this prospectus. The Company has obtained certain market data from publicly available information and industry publications. We believe such information are reasonable and reliable.

QUESTIONS AND ANSWERS ABOUT THE SPIN-OFF DISTRIBUTION

| Q: | Why am I receiving this Prospectus? |

| A: | You are receiving this prospectus because you are a holder of WISeKey shares and/or WISeKey American Depositary Shares and in connection with the proposed Spin-Off Distribution by WISeKey of 20% of SEALSQ’s outstanding Ordinary Shares. The Spin-Off Distribution is subject to approval by WISeKey shareholders, among others, at an Extraordinary General Meeting (“EGM”) of WISeKey shareholders to be held on or about [·], 2023. Details about the EGM and how holders of WISeKey shares may vote at the EGM will be distributed by WISeKey to its shareholders, as of a record date to be announced by WISeKey. |

| Q: | How many SEALSQ Ordinary Shares will I receive? |

| A: | Holders of Class B Shares of WISeKey will receive from WISeKey 0.011206165 SEALSQ Ordinary Share for every 1 Class B Share of WISeKey owned on the applicable share record date. Holders of WISeKey ADSs will receive from WISeKey 0.11206165 SEALSQ Ordinary Share for every 1 ADS of WISeKey owned on the applicable ADS record date. Holders of Class A Shares of WISeKey will receive from WISeKey 0.002241233 SEALSQ Ordinary Share for every 1 Class A Share of WISeKey owned at the applicable share record date. To the extent WISeKey issues any additional shares prior to the applicable share record date, the number of SEALSQ Ordinary Shares to be distributed to holders of WISeKey Class B Shares, ADSs and Class A Shares will be proportionately adjusted downward as set forth in the subsection titled “Business—Mechanics of the Spin-Off Distribution.” WISeKey has informed us that WISeKey and the depositary bank for the ADSs will announce the applicable share record date and the applicable ADS record date, respectively, and the share distribution date promptly after the Spin-Off Distribution is approved by the WISeKey shareholders at the EGM and the applicable conditions for the Spin-Off Distribution have been satisfied or waived. WISeKey expects to hold the EGM in early [·] 2023 and then expects to set a share record date of [●], 2023 for a distribution date of [●], 2023, however, these dates are provisional and are therefore subject to change. |

| Q: | What are the SEALSQ Ordinary Shares worth? |

| A: | The value of our Ordinary Shares will be determined by their trading price on Nasdaq after the Spin-Off Distribution. We do not know what the trading price of the Ordinary Shares will be and we can provide no assurance as to value. Our Class F Shares will not be listed. As a result, their value will need to be determined by reference to their voting rights and dividend rights in relation to the value of the Ordinary Shares. |

6

| Q: | What will the relationship between WISeKey and SEALSQ be after the Spin-Off Distribution? |

| A: | After the Spin-Off Distribution, SEALSQ will continue to be a subsidiary of WISeKey and WISeKey will initially own 80% of our Ordinary Shares and 100% of our Class F Shares. SEALSQ is reserving up to 5% of the Class F Shares for issuance pursuant to an F Share Option Plan for certain directors and senior management of SEALSQ, its subsidiaries and its parent. As a result, WISeKey’s initial ownership of SEALSQ Class F Shares is subject to the grant and exercise of Class F Share Options prior to the Spin-Off Distribution. Our Ordinary Shares, which are the shares that are being listed, have one (1) vote per share as against each other Ordinary Share but, as a class, the Ordinary Shares shall retain 50.01% of the Company’s voting power. Our Class F Shares will have a variable number of votes that ensure that the holders of Class F Shares as a class will retain 49.99% of the Company’s voting power, and WISeKey may, in certain circumstances, have voting power that, in the aggregate, exceeds 49.99% of the Company’s voting power. See the section titled “Description of Shares” for further discussion of the terms of the memorandum and articles of association (“Articles”) and voting power of the different classes of SEALSQ shares. WISeKey has informed us that it is considering whether to implement a mechanism by which holders of WISeKey Class B Shares would be able to exchange some of their WISeKey Class B Shares into WISeKey Class A Shares and then exchange some of their WISeKey Class A Shares for SEALSQ Class F Shares that WISeKey holds, subject to certain contractual and regulatory limitations (including compliance with applicable takeover laws and regulations), and to limitations that may be imposed by the WISeKey and SEALSQ boards of directors. The Class F Shares will be subject to a Class F Shareholders’ Agreement, a summary of the material terms of which can be found in the section titled “Description of Shares”. Our Articles provide that, in the event of a hostile takeover of WISeKey, as determined by SEALSQ’s board of directors, the Class F Shares owned by WISeKey will be subject to a mandatory redemption by SEALSQ in exchange for the issuance of new Ordinary Shares at a ratio of five (5) Ordinary Shares for each one (1) Class F Share redeemed. Upon completion of a mandatory redemption, the remaining Class F Shareholders, who are likely to be members of SEALSQ’s board of directors and senior management, would hold shares with 49.99% of the SEALSQ’s voting power. The mandatory redemption of Class F Shares, and the issuance of five (5) Ordinary Shares for each one (1) Class F Share redeemed, would result in a dilution of the per share voting power of the holders of our Ordinary Shares. See the section titled “Description of Shares” for a description of the mandatory redemption feature. |

| Q: | What are the reasons for the Spin-Off Distribution? |

| A: | It is the opinion of the board of directors of WISeKey that a partial spin-off of its global semiconductor business presents a significant market opportunity to investors in light of both the current market and the increased regulation discussed below. Based upon comparisons with our competitors, the WISeKey board of directors believes that the true value of SEALSQ is not fairly represented in the market valuation attributed to WISeKey. |

The coming years represent a significant opportunity for SEALSQ. Currently there are more than 12 billion IoT devices connected and this is expected to more than double by 2025.1 With new regulations being introduced by governments and supervisory bodies over the world concerning Connected Devices, Identity Verification, and the Internet of Things, SEALSQ is uniquely placed to deliver market ready, regulatory compliant products to the market. In particular, the EU Cybersecurity Act and the U.S. IoT Cybersecurity Improvement Act which are being supported and reinforced by additional legislation at state and country levels are forcing companies to address the Cybersecurity threat. At the same time, the EU General Data Protection Regulation is enforcing a much higher level of data protection for companies.

1 “State of IoT – Spring 2022”, IOT Analytics, May 2022

7

The IoT technology market is expected to grow from USD 300.3 billion in 2021 to USD 650.5 billion by 2026, at a CAGR of 16.7%.2 The market growth can be attributed to several factors, such as 5G communications technology, increasing necessity of data centers due to rising adoption of cloud platforms, growing use of wireless smart sensors and networks, and increased IP address space and better security solutions made available through IPv6.3

We believe SEALSQ is uniquely placed to take advantage of this significant opportunity as we combine secure hardware with a platform to manage its keys and to manage the physical/cyber pairing. This pairing associates the hardware chip inseparably with digital certificates and a digital record that reflects the lifecycle of the chip. Conversely, the digital security is anchored in hardware inside the device. It is this unique proposition that enables us to bring digital trust to the physical world. We offer provenance, proof of origin, and lifecycle management to devices and objects. Additionally, we enable data collection and data transmission to be protected against interference and eavesdropping, and we enable command execution and firmware updates to be reliable and trustworthy, and in a manner presently compliant with the regulations being introduced. Furthermore, as the connected world continues to evolve, SEALSQ intends to continue to invest heavily in the ongoing development of its products and its technology. We are already developing solutions intended to address the post-quantum technological age and the next generation hardware requirements.

We believe that the time is now to seize the opportunity and invest in the growth of SEALSQ. We believe in continuing to invest in the U.S. market, increasing the deployment of our products on U.S. soil, and supporting the move away from dependency on the Asian market that both the European and American governments are driving. It will also allow us to develop R&D activities in the U.S. leveraging the opportunity that, thanks to our IoT Post-Quantum technology, we have been selected as a collaborator by NIST for the NCCoE Trusted IoT Device Network-Layer Onboarding and Lifecycle Management Consortium project.4 For this project, SEALSQ is working with NIST and other industrial companies to define recommended practices for performing trusted network-layer onboarding, which will aid in the implementation and use of trusted onboarding solutions for IoT devices at scale. SEALSQ will implement the QUASARS (QUAntum resistant Secure ARchitectureS) project, a radical innovative solution, based upon the new WISeKey Secure RISC V based platform that is paving the way for the Post Quantum Cryptography era, with hybrid solutions compliant to ANSSI (“Agence Nationale de la Sécurité des Systèmes d’Information”, the National Cybersecurity Agency of France) recommendations. WISeKey Semiconductors has received a strong support from the French SCS Cluster for its QUASARS project.

We believe that the listing of SEALSQ on the Nasdaq Global Market represents an opportunity for WISeKey to realize the true value of SEALSQ’s technologies, supported by the independently prepared valuation that placed SEALSQ’s valuation at around USD 217M, to reward the loyal shareholders of WISeKey through the proposed distribution of shares in SEALSQ, and to enable SEALSQ to raise further funds on the market with which to invest in its expansion and its future strategy.

In determining whether to effect the Spin-Off Distribution, the board of directors of WISeKey considered the costs and risks associated with the transaction, including those associated with preparing SEALSQ to become a separate publicly traded company and the possibility that the trading value of the two separate entities after the Spin-Off Distribution may be less than the trading value of WISeKey’s Class B Shares and ADSs before the Spin-Off Distribution. Notwithstanding these costs and risks, the board of directors of WISeKey determined that a spin-off, in the form contemplated by the Spin-Off Distribution is in the best interests of WISeKey and its shareholders.

| Q: | Will SEALSQ Ordinary Shares be listed on a securities exchange? |

| A: | SEALSQ has applied to list its Ordinary Shares on the Nasdaq Global Market under the symbol “LAES”. |

2 “IoT Market with COVID-19 analysis by Component (Hardware, Software Solutions and Services), Organization Size, Focus Area (Smart Manufacturing, Smart Energy and Utilities, and Smart Retail) and Region – Global Forecast to 2026”, Markets and Markets, April 2022

3 "IoT Technology Market with COVID-19 Impact Analysis, by Node Component (Sensor, Memory Device, Connectivity IC), Solution (Remote Monitoring, Data Management), Platform, Service, End-use Application, Geography - Global Forecast to 2027", Markets and Markets, October 2021

4 http://www.nccoe.nist.gov/projects/trusted-iot-device-network-layer-onboarding-and-lifecycle-management.

8

| Q: | Will SEALSQ Class F Shares be listed on a securities exchange? |

| A: | SEALSQ Class F Shares will not be listed on a securities exchange. |

| Q: | Why does SEALSQ have two different classes of shares? |

| A: | SEALSQ has two different classes of share, Class F Shares and Ordinary Shares, due to the cybersecurity and geopolitical risks associated with the operations of SEALSQ’s business and its technology. |

The combined cybersecurity/geopolitical risks pose a challenge that we believe demands the implementation of a special share structure at SEALSQ which is developing cryptography-based microchips with quantum extension. We believe this technology must be appropriately protected from control by third parties that are deemed security risks to the technology.

The implementation of the dual share class structure which restricts control by third-parties stems from the fact that SEALSQ develops and sells highly secure technology to both the public and private sector that our clients and potential clients would not want or do not accept being owned or controlled by people, companies or governments that may be deemed security risks to their technology. As there currently do not exist any specific regulatory oversight of the secure device industry in many geographies, and in order to ensure that SEALSQ remains a neutral provider of security solutions, we believe that it is critical to the growth and ongoing competitiveness of SEALSQ that the board and SEALSQ’s Class F shareholders retain the ability to reject hostile approaches.

SEALSQ’s technology includes post-quantum features for the IoT market including Secure authentication, Brand protection, Network communications, future FIDO evolutions and additional general web-connected smart devices that obtain, analyze, and process the data collected from their surroundings.

The dual share class structure would also encourage long-term shareholders who hold Class F Shares by providing them a greater say in the Company. We believe that this dual class structure enables us to continue to focus on the research and development of new products and the inherent risk-taking that it requires, and allows us to focus on the long-term goals of SEALSQ. The structure also aims to promote stability in the membership of the SEALSQ board of directors and the strategic direction of SEALSQ, while aiming to discourage hostile takeovers and similar unfavorable transactions for the reasons previously set out. In the event of a hostile takeover of WISeKey, as determined by SEALSQ’s board of directors, the WISeKey-owned Class F shares would be redeemed and the remaining Class F shareholders would, as a class, retain 49.99% of the vote. Our Articles provide that, in the event of a change of control (being the acquisition by any person or entity, alone or jointly, of more than 50% of the voting rights of any Class F Shareholder which is a corporate entity), the Class F Shares owned by such Class F Shareholder will be subject to a mandatory redemption by SEALSQ in exchange for the issuance of new Ordinary Shares at a ratio of five (5) Ordinary Shares for each one (1) Class F Share redeemed. A change in the control of WISeKey would trigger this provision as they are the only corporate entity holding F Shares. Upon completion of a mandatory redemption, the remaining Class F Shareholders, who are likely to be members of SEALSQ’s board of directors and senior management, would hold shares with 49.99% of the Company’s voting power. The mandatory redemption of F Shares, and the issuance of five (5) Ordinary Shares for each one (1) Class F Share redeemed, would result in a dilution of the per share voting power of the holders of our Ordinary Shares. See the section titled “Description of Shares” for a description of the mandatory redemption feature.

9

See “Risk Factors – Risks Related to the dual class structure of our Shares” for more information.

| Q: | Will my WISeKey shares continue to be listed on a securities exchange? |

| A: | Yes. WISeKey’s Class B Shares will continue to be listed on the SIX Swiss Exchange under the symbol “WIHN” and WISeKey’s ADSs (which represent Class B Shares) will continue to trade on the Nasdaq Global Market under the symbol “WKEY”. The number of WISeKey shares you own, or your percentage of ownership in WISeKey, will not change as a result of the Spin-Off Distribution. |

| Q: | What conditions apply to the Spin-Off Distribution? |

| A: | At the EGM, WISeKey’s shareholders will need to approve the distribution of the SEALSQ Ordinary Shares in the form of a dividend in kind and, concurrently, a release of WISeKey capital contribution reserves to other WISeKey general reserves in an amount equal to the difference between the market value and the book value of the SEALSQ Ordinary Shares for statutory reporting purposes (these resolutions hereinafter referred to as the "Dividend Resolutions"). The market value of the SEALSQ Ordinary Shares will be determined based on the basis of the closing price of the SEALSQ Ordinary Shares on the first day of trading on Nasdaq. The resolutions to be adopted at WISeKey's EGM are included in Annex A of this prospectus. |

Other conditions that will need to be satisfied on or before the Spin-Off Distribution are:

1. The SEC shall have declared effective the registration statement containing this prospectus under the Securities Act, and no stop order suspending the effectiveness of the registration statement shall be in effect or threatened.

2. The SEALSQ Ordinary Shares shall have been accepted for listing on the Nasdaq, subject to official notice of issuance.

3. The ruling obtained from the Swiss Federal Tax Administration regarding the Swiss withholding tax consequences of the Spin-Off Distribution, substantially to the effect that the Spin-Off Distribution, including cash received in lieu of fractional entitlements to SEALSQ Ordinary Shares, is considered a distribution out of WISeKey qualifying capital contribution reserves, shall be in full force and effect at the time of the Spin-Off Distribution.

4. SEALSQ and WISeKey have entered into and completed a subscription agreement pursuant to which WISeKey will contribute 100% of the equity interest in WISeKey Semiconductors SAS (France) (together with WISeKey IoT Japan KK, a Japan-based sales subsidiary of WISeKey Semiconductors SAS, and WISeKey Semiconductors, Taiwan Branch, a Taiwan-based sales and support branch of WISeKey Semiconductors SAS) to SEALSQ against issuance by SEALSQ of 7,501,400 Ordinary Shares and 1,499,700 Class F Shares, and have executed the services agreement or agreements pursuant to which WISeKey will, post effectiveness of the Spin-Off Distribution, make available to SEALSQ certain resources, including skilled staff, external consultants and advisors with knowledge across multiple domains, and provide services including, but not limited to, sales and marketing, accounting, finance, legal, taxation, business and strategy consulting, public relations, marketing, risk management, information technology and general management. WISeKey will also make available funding to SEALSQ on the basis of an intra-group loan agreement (collectively referred to as the "Separation Agreements").

5. WISeKey shall have finalized the procedures, and entered into the applicable agreements with the distribution agent, for the distribution of the SEALSQ Ordinary Shares to its shareholders.

6. All permits, registrations and consents required under Swiss securities laws and the U.S. securities or blue sky laws in connection with the Spin-off Distribution and all other material governmental approvals and other consents necessary to consummate the Spin-Off Distribution shall have been received.

10

7. No order, injunction or decree issued by any governmental authority of competent jurisdiction or other legal restraint or prohibition preventing consummation of the Spin-Off Distribution shall be in effect, and no other event outside the control of WISeKey shall have occurred or failed to occur that prevents the consummation of the distribution of the Spin-Off Distribution; and

8. No other events or developments shall have occurred prior to the date on which the Spin-Off Distribution is to be effected that, in the reasonable judgment of the WISeKey's board of directors, would result in the Spin-Off Distribution having a material adverse effect on WISeKey or its shareholders (as a class), including on the prospects of SEALSQ and the prospective holders of its shares.

| Q: | What are the U.S. federal income tax consequences to me of the Spin-Off Distribution? |

| A: | It is not expected that the Spin-Off Distribution will satisfy all of the requirements of Section 355 of the Code, and as such the Spin-Off Distribution is not expected to be treated as a tax-free corporate division for U.S. federal income tax purposes. Rather, the distribution of SEALSQ Ordinary Shares to U.S. Holders of WISeKey Class B shares and ADSs is expected to be taxable as a distribution for U.S. federal income tax purposes. The tax treatment of the Spin-Off Distribution is discussed in the section “Material Tax Considerations – U.S. Federal Income Tax Considerations.” |

| Q: | What are the Swiss tax consequences to me of the Spin-Off Distribution? |

| A: | Holders of WISeKey shares who are not resident in Switzerland for tax purposes and who do not engage in a trade or business carried on through a permanent establishment or fixed place of business situated in Switzerland for tax purposes, and who are not subject to corporate or individual income taxation in Switzerland for any other reason, will not be subject to any Swiss federal, cantonal or communal income tax in connection with the Spin-Off Distribution. For Swiss holders of WISeKey shares, the Swiss income tax consequences depend on whether they hold their WISeKey shares as private assets or as business assets. The tax treatment of the Spin-Off Distribution is discussed in the section "Material Tax Considerations – Swiss Tax Considerations". |

| Q: | What are the BVI tax consequences to me of the Spin-Off Distribution? |

| A: | The BVI does not impose any corporate taxes, transfer taxes, withholding taxes or stamp taxes (except where a transfer will involve a direct or indirect transfer of an interest in BVI real property, which is not the case with the Spin-Off Distribution). As such there should not be any BVI tax consequences of the Spin-Off Distribution for the SEALSQ, WISeKey or any non-BVI resident shareholders of SEALSQ or WISeKey. |

| Q: | When will I receive SEALSQ Ordinary Shares? |

| A: | WISeKey expects to make delivery of the SEALSQ Ordinary Shares in early 2023 to holders of WISeKey shares as of a record date to be announced by WISeKey's board of directors after the date of the WISeKey EGM, assuming all conditions for the Spin-off Distribution have been satisfied or waived. If you sell your WISeKey shares before such record date, you will not receive SEALSQ Ordinary Shares in the Spin-Off Distribution. If you are a holder of WISeKey ADSs, the record date for the Spin-Off Distribution will be determined and announced by BNY Mellon, the depositary bank for the WISeKey ADSs. |

| Q: | How will I, and what do I have to do, receive SEALSQ Ordinary Shares? |

| A: | WISeKey will deliver the SEALSQ Ordinary Shares to the distribution agent. Computershare Inc. will serve as distribution agent in connection with the Spin-Off Distribution, and as transfer agent and registrar for SEALSQ Ordinary Shares. If your WISeKey shares are held in a bank or brokerage account, the SEALSQ Ordinary Shares distributed to you will initially be registered by our distribution agent in the name of your bank or broker for credit to your account. Our distribution agent will coordinate the further distribution of the SEALSQ Ordinary Shares with your bank or broker. If you hold shares of WISeKey in certificated form your ownership of SEALSQ Ordinary Shares will be recorded in the books of our transfer agent and a statement evidencing your ownership will be mailed to you. Certificates representing SEALSQ Ordinary Shares will not be issued in connection with the Spin-Off Distribution, but we may elect to issue certificates in the future. In order to avoid back-up withholding of U.S. taxes on the distribution of SEALSQ Ordinary Shares, you will need to provide a duly completed and signed Form W-8 or Form W-9 prior to the distribution date. It is anticipated that, promptly after the applicable record date for the Spin-Off Distribution, WISeKey (and/or the distribution agent) will send a notice of the distribution procedure for the SEALSQ Ordinary Shares to the applicable record date holders of WISeKey shares.

BNY Mellon, as depositary for the WISeKey ADS program, will distribute the SEALSQ Ordinary Shares to the WISeKey ADS holders pursuant to the terms of the Deposit Agreement for the WISeKey ADSs. If you hold shares of WISeKey in ADS form, you will receive a notice from BNY Mellon on the distribution procedure for the SEALSQ Ordinary Shares. |

11

| Q: | How will fractional entitlements to SEALSQ Ordinary Shares be treated in the Spin-Off Distribution? |

Fractional SEALSQ Ordinary Shares will not be distributed. Instead, the distribution agent (for the Class A Shares and Class B Shares) and BNY Mellon (the depositary bank for the WISeKey ADSs) will aggregate all fractional entitlements to SEALSQ Ordinary Shares that WISeKey shareholders and ADS holders, respectively, would be entitled to receive into whole SEALSQ Ordinary Shares and sell such whole Ordinary Shares into the open market at prevailing rates promptly after our Ordinary Shares commence trading on the Nasdaq Global Market, and distribute the net cash proceeds (after deduction of applicable fees, taxes and expenses) from the sales pro rata to each holder who would have otherwise been entitled to receive fractional entitlements to SEALSQ Ordinary Shares in the Spin-Off Distribution.

| Q: | Are Shareholders of WISeKey entitled to appraisal rights in connection with the Spin-Off Distribution? |

| A: | No. Shareholders of WISeKey are not entitled to appraisal rights in connection with the Spin-Off Distribution. WISeKey's shareholders of record who have voted against or abstained from voting on the Spin-Off Distribution at the EGM have a right to challenge the Dividend Resolutions. |

| Q: | Will my SEALSQ Ordinary Shares be freely transferable? |

| A: | Our Ordinary Shares being distributed in the Spin-Off Distribution will be freely transferable, except for Ordinary Shares held by persons that are our “affiliates” as defined in the rules under the Securities Act. |

12

| PROSPECTUS SUMMARY

This summary highlights information that appears later in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. This summary may not contain all of the information that may be important to you. As an investor or prospective investor, you should carefully review the entire prospectus, including the section of this prospectus entitled “Risk Factors” and the more detailed information that appears later in this prospectus before making an investment in our Ordinary Shares.

Unless otherwise indicated, references to “SEALSQ,” “SEAL Semiconductors,” the “Company,” “we,” “our,” “us” or similar terms refer to the registrant, SEALSQ Corp, and its subsidiaries, except where the context otherwise requires. Unless otherwise indicated, all references to “U.S. dollars,” “dollars,” “U.S. $” and “$” in this prospectus are to the lawful currency of the United States of America.

Explanatory Note

SEALSQ Corp (formerly known as SEAL (BVI) Corp.) was incorporated under the laws of the British Virgin Islands on April 1, 2022. SEALSQ was incorporated by WISeKey to serve as the holding company of 2 subsidiaries and 1 branch (which currently represent WISeKey’s global semiconductor business) that were transferred by WISeKey to SEALSQ (the “Subsidiaries” or “SEALSQ Corp Predecessor”) in connection with the Spin-Off Distribution. On January 1, 2023, WISeKey contributed these subsidiaries to SEALSQ, and, as the sole shareholder of SEALSQ, intends to distribute 20% of SEALSQ’s outstanding ordinary shares of US$0.01 par value per share (“Ordinary Shares”) to holders of WISeKey Class B Shares (“Class B Shares”), including to holders of WISeKey American Depositary Shares (“ADSs”) representing WISeKey Class B Shares, and to holders of WISeKey Class A Shares (“Class A Shares”), as a distribution by way of a dividend in kind to such holders as of a record date to be announced by WISeKey’s board of directors after the date of the WISeKey Extraordinary General Meeting, assuming all conditions for the Spin-Off Distribution have been satisfied or waived. WISeKey will initially retain 100% ownership of SEALSQ Class F Shares with a par value of US$0.05 per share (“Class F Shares”) and 80% of SEALSQ Ordinary Shares. SEALSQ is reserving up to 5% of its Class F Shares for issuance pursuant to an F Share Option Plan for certain directors and senior management of SEALSQ, its subsidiaries and its parent. As a result, WISeKey’s initial ownership percentage of Class F Shares is subject to the grant and exercise of SEALSQ Class F Share options (“Options”) prior to the Spin-Off Distribution. WISeKey has informed us that it is considering whether to implement a mechanism or process by which holders of WISeKey Class B Shares would be able to exchange some of their WISeKey Class B Shares into WISeKey Class A Shares and/or for SEALSQ Class F Shares that WISeKey holds, subject to applicable contractual and regulatory limitations (including compliance with applicable takeover laws and regulations) and limitations that may be imposed by the WISeKey and SEALSQ boards of directors. Any such conversions would reduce WISeKey’s percentage ownership of SEALSQ Class F Shares. Our Articles provide that, in the event of a change of control (being the acquisition by any person or entity, alone or jointly, of more than 50% of the voting rights of any Class F Shareholder which is a corporate entity), as determined by SEALSQ’s board of directors, the Class F Shares owned by such Class F Shareholder will be subject to a mandatory redemption by SEALSQ in exchange for the issuance of new Ordinary Shares at a ratio of five (5) Ordinary Shares for each one (1) Class F Share redeemed. A change in the control of WISeKey would trigger this provision as they are the only corporate entity holding F Shares. Upon completion of a mandatory redemption, the remaining Class F Shareholders, who are likely to be members of SEALSQ’s board of directors and senior management, would hold shares with 49.99% of the Company’s voting power. The mandatory redemption of Class F Shares in exchange for new Ordinary Shares would result in a dilution of the per share voting power of the holders of our Ordinary Shares. See the section titled “Description of Shares” for a description of the mandatory redemption feature.

Under the registration statement of which this prospectus forms a part, the Company is applying to register the Spin-Off Distribution by WISeKey of SEALSQ Ordinary Shares under the Securities Act. In addition, the Company has applied to have the Ordinary Shares listed on the Nasdaq Global Market under the ticker symbol “LAES”. Upon consummation of the Spin-Off Distribution and the successful listing of our Ordinary Shares on the Nasdaq Global Market, WISeKey and SEALSQ will be separate publicly traded companies, although WISeKey will initially retain 80% of SEALSQ’s Ordinary Shares and 100% of SEALSQ’s Class F Shares (subject to the grant and exercise of Class F Share Options as described above). WISeKey and SEALSQ will have separate boards of directors and management, although, at the time of the Spin-Off Distribution, some of the directors and officers of WISeKey will hold similar positions at SEALSQ.

|

13

| The financial statements in this prospectus include financial statements of the SEALSQ Corp Predecessor for the fiscal years ended December 31, 2020 and December 31, 2021 and the six months ended June 30, 2021 and 2022.

Unless otherwise indicated or required by the context in this prospectus, SEALSQ’s financial disclosure assumes that the consummation of the Spin-Off Distribution has occurred. Although WISeKey did not transfer the Subsidiaries constituting the WISeKey semiconductor business to SEALSQ until January 1, 2023, the operating and other statistical information with respect to SEALSQ’s business is presented as of June 30, 2022, unless otherwise indicated, as if SEALSQ owned such semiconductor business as of such date.

Overview

We are an OEM supplier of cybersecurity to manufacturers of IoT devices, branded appliances and precious objects. SEALSQ is uniquely placed in the IoT technology market as we combine secure hardware with a platform to manage its keys and to manage the physical/cyber pairing. This pairing associates the hardware chip inseparably with digital certificates and a digital record that reflects the lifecycle of the chip. Conversely, the digital security is anchored in hardware inside the device. It is this unique proposition that enables us to bring digital trust to the physical world. Our mission is to provide an unforgeable “passport” to a device or an object.

Our products bridge the physical and the digital world with a unique symbiosis between tamperproof semiconductors (physical) and managed cryptography (digital).

Once implemented into the target device or object, this “passport” carries 2 essential functions:

i) it makes the device unique, capable to identify and authenticate itself vis-à-vis a platform or another device with which it communicates,

ii) it makes the device or object impossible to copy and clone.

There currently is no existing public trading market for our Ordinary Shares. However, we are in the process of applying to have our Ordinary Shares listed on the Nasdaq Global Market under the symbol “LAES”. We make no representation that such application will be approved or that our Ordinary Shares will trade on such market, either now or at any time in the future. The successful listing of our Ordinary Shares on the Nasdaq Global Market is subject to our fulfilling all of the requirements of the Nasdaq Global Market and of approval by the shareholders of WISeKey at the Extraordinary General Meeting. We will not complete the Spin-Off Distribution unless we are so listed.

Our Solution

We are in the physical/cyber trust business. Every day, citizens, consumers and professionals rely on the trust we bring to the IoT devices around them. Our brand reflects digital comfort and a culture of trust, security, and protection.

For that, we offer to our customers:

|

| i) | “Secure Elements” implementing a mix of analog and digital countermeasures which are the DNA of our engineering teams, constantly monitoring and anticipating the new generation of attacks that the cyber hackers may develop. |

| ii) | A provisioning and personalization platform, which manages the creation of digital keys and certificates and their injection into our secure elements. |

| iii) | A Root Certificate Authority which guarantees the unicity and the authenticity of the digital identities which we are generating for

our customers. |

14

| Our products and infrastructures are certified with the highest grading of the industry by third party certification labs.

Our Competitive Strengths

We believe we have several competitive advantages that will enable us to maintain and extend our market position. Our key competitive strengths include:

|

| · | SEALSQ is unique because we combine secure hardware with a platform to manage its keys and to manage the physical/cyber pairing. This pairing associates the hardware chip inseparably with digital certificates and a digital record that reflects the lifecycle of the chip. Conversely, the digital security is anchored in hardware inside the device. It is this unique proposition that enables us to bring digital trust to the physical world.

|

| · | Customer dedication is in our DNA and we deliver to customers ordering hundreds of millions of units, as well as to customers ordering a few thousand custom units.

|

| · | Ongoing product innovation. We constantly innovate on our products to enhance and expand capabilities. Our agentless technology differentiates us in the market and positions us to capitalize on the proliferation of new device types entering the enterprise that cannot be supported by agent-based technologies.

|

| · | Proven Supply Chain Management processes with a track record of timely delivery.

|

| · | Standardized technology and compliance with industry-driven standards, to ease the integration by our direct customers and by end customers.

|

| · | Top-level certifications (Common Criteria EAL5+ and FIPS140-2 Level 3) that address the current and future requirements of IoT deployments in health care and critical infrastructure.

|

| · | The digital certificates are rooted at the OISTE Foundation, a not-for-profit organization based in Geneva, Switzerland, regulated by article 80 et seq. of the Swiss Civil Code and neutral vis-à-vis any dominant vendor, country or other market player.

|

| · | Broad appeal of our products across a diverse end customer base. We serve end customers of all sizes across diverse industries. We are deeply integrated into our customers’ security infrastructure, demonstrating immediate and ongoing value. We have a long-term, loyal base of end customers with many relationships spanning over 10 years.

|

| · | Recognized market leadership. We participate in standardization efforts by Wi-SUN Alliance, a global association to drive interoperability in smart cities and smart grids. SEALSQ is also currently working with NIST’s National Cybersecurity Center of Excellence (NCCoE) on a reference design for securely onboarding IoT devices.

|

| · | Global market reach driven by direct and indirect sales strategy. We have recruited top sales talents from leading security organizations and retain the highest quality sales representatives with demonstrated success. We are one of the only vendors in our market solely focused on security and control and, as such, our sales representatives are wholly focused on selling the standalone value of our products.

|

| · | Strong leadership team of security experts. We have a deep bench of talent at the executive level, with years of industry experience at secure semiconductor manufacturers and cryptography labs. |

|

Key Challenges | ||

Following the Spin-Off Distribution, we may face a number of challenges, both pre-existing and as a result of the Spin-Off Distribution, including: | ||

| · | We face competition from companies that are larger than us. Our semiconductor offer is limited to Secure Element, whereas our competition can offer a larger spectrum of microcontrollers components. It gives them the possibility to propose to their customers larger deals, thus to be potentially more flexible during price negotiation. | |

| · | Our competition benefits of their size to lower their manufacturing costs, which gives them as well more flexibility in price negotiation. | |

| · | We face competition from companies that are larger and better known, and we may lack sufficient financial or other resources to maintain or improve our competitive position. | |

| · | Our historical financial information may not be representative of the results we would have achieved as a stand-alone public company and may not be a reliable indicator of our future results. | |

| · | We may have difficulty operating as an independent, publicly traded company. | |

| · | We derive a significant amount of our revenues each year from a limited number of significant customers. | |

| · | The market price of our Ordinary Shares may be subject to significant fluctuations. | |

See the section entitled “Risk Factors” for more information on each of these key challenges. | ||

15

| Our Business

Our mission is to bring digital trust to the physical world.

Our products bridge the physical and the digital world with a unique symbiosis between tamperproof semiconductors (physical) and managed cryptography (digital). We are an OEM supplier of cybersecurity to manufacturers of IoT devices, branded appliances and precious objects.

Current customers use our products to bolt trust onto objects and devices ranging from pieces of art, medical consumables, and plastic access tokens to high-end appliances such as personal health monitors, industrial controllers, IT servers, home connected appliances, portable Hard Drive, authentication tokens, drones, and satellites. Brands count on our products to fight counterfeit, grey import, and theft. Industry and society count on our products to protect connected devices, which are often placed in unmanned and uncontrolled environments, against manipulation, disruption, spoofing, and data leakage.

Our vision is to go beyond individual devices and objects, and to enable a trusted metaverse. SEALSQ uses WISeID as a Universal Communications Identifier (UCID). Through the implementation of several practical applications such as UCID, a unique identifier for an IoT device on a network with blockchain, a distributed ledger shared with the nodes of a computer network to guarantee security, and Non-Fungible Tokens (NFTs), cryptographic assets on a blockchain that cannot be replicated, SEALSQ ensures that the device on the Metaverse is authenticated and cannot be corrupted or duplicated

SEALSQ will implement the QUASARS (QUAntum resistant Secure ARchitectureS) project, a radical innovative solution, based upon the new WISeKey Secure RISC V based platform that is paving the way for the Post Quantum Cryptography era, with hybrid solutions compliant to ANSSI (“Agence Nationale de la Sécurité des Systèmes d’Information”, the National Cybersecurity Agency of France) recommendations. WISeKey Semiconductors has received a strong support from the French SCS Cluster for its QUASARS project.

The Metaverse will present entirely new ways, for example, to create employment, impart education, deliver healthcare, and plan urban spaces. We believe it will be the next major labor organizing platform and that new organizations, products, and services will handle everything from payment processing to identity verification, hiring, ad delivery, content generation, and security. The Metaverse is based on Web 3.0, also known as the decentralized web, and is an evolution of the Internet that allows users to interact with each other in a more secure and private way. It does this by using blockchain technology to create a peer-to-peer network where users can transact without relying on intermediaries. This makes it ideal for developing virtual worlds as it provides a platform for users to interact without fear of censorship or data theft.

SEALSQ provides Digital Identities for Objects in the Metaverse, using an identification module that is built into the protocol, while supplementary applications will be developed. Users will have autonomy over their identity, meaning that they are in full control of their personal identification information and hence need not to rely on any central entity or third party for identity verification. With a true NFT identity, users can create, sign, and verify claims, while parties who interact with a user will be able to prove their identity.

Market Opportunity

The addressable market for IoT cybersecurity is massive: more than 12 billion IoT devices were connected in 2021 and this number is expected to grow to 27 billion units in 2025 with CAGR of 22% according to IoTAnalytics.5 McKinsey predict an annual US$12.6 trillion in economic value by 2030.6

As it stands, many of the currently deployed IoT devices lack any serious form of security: the devices contain weaknesses that can easily be exploited, and the vast majority of data transmission is left unprotected. Regulatory and legislative pressure in combination with the rising danger of ransomware and other types of attacks, however, will force IoT customers to adopt solid cybersecurity practices and techniques.

5 “State of IoT – Spring 2022”, IOT Analytics, May 2022

6 “The Internet of Things: Catching up to an accelerating Opportunity”, McKinsey & Company, November 2021

|

16

| An increase in cyber threats targeting critical infrastructure systems is one reason ABI Research forecasts that Authentication IC (Integrated Circuit), our core market, will be at the center of IoT cybersecurity. ABI Research also anticipates that the global market size of the Authentication IC will grow from 0.3 billion in 2022 to 1 billion in 2026 at a CAGR of 57.1%.7

Our Business Strategy

A large part of our business relies on the one-time-sale of hardware. We also, however, created our own post-market for provisioning, onboarding, and life cycle management offering an additional and recurring monetization opportunity. Those post-market services also fortify customer stickiness.

We intend to execute on the following growth strategies:

|

| · | Introduce new products to create additional opportunities in upgrade markets, in different sectors, and in new applications of our technology in innovating markets. For this purpose, SEALSQ is developing a brand-new generation of Secure Elements implementing new technologies in order to optimize its footprint and thus its costs, a Flash memory providing more customization flexibility, and a new generation of Crypto Processor capable of running Post-Quantum algorithms selected by the NIST. | |

| · | Grow global customer base. We invested significantly, and plan to continue to invest, in our sales organization to drive new customer adoption and to introduce our products to new markets. We believe these investments will allow us to pursue new large enterprise opportunities as well as opportunities outside of the United States.

|

| · | Expand our presence in the market by leveraging our ecosystem of partners. We believe there is a significant opportunity to grow sales through our technology and channel partners, particularly to mid-market enterprises.

|

| · | Expand within our existing customers as they grab their market opportunities. Our product revenue is directly tied to the number of devices they sell.

|

| · | Expand within our existing customers as we expand to new parts of their network, or as we displace a competitor. We expect to grow as our customers broaden their use of our products in different IoT markets.

|

Risk Factors Summary

An investment in our securities is subject to a number of risks, including risks related to our industry, business and corporate structure. The following summarizes some, but not all, of these risks. Please carefully consider all of the information discussed in “Risk Factors” in this prospectus for a more thorough description of these and other risks. | ||

| · | The semiconductor industry is highly cyclical and highly competitive. If we fail to introduce new technologies and products in a timely manner, this could adversely affect our business.

|

| · | Significantly increased volatility and instability and unfavorable economic conditions may adversely affect our business.

|

| · | The demand for our products depends to a significant degree on the demand for our customers’ end products.

|

| · | The semiconductor industry is characterized by continued price erosion, especially after a product has been on the market.

|

| · | Failure to protect our intellectual property could substantially harm our business, operating results, and financial condition. |

|

|

7 “Embedded Security for the IoT”, ABI Research, January March 2020

| ||

17

| · | We face competition from companies that are larger and better known, and we may lack sufficient financial or other resources to maintain or improve our competitive position. |

|

| · | Our research and development efforts may not produce successful products or enhancements to our security solutions that result in significant revenue or other benefits in the near future, if at all. | |

| · | We are dependent on the timely supply of equipment and materials from various sub-contractors and if any one of these suppliers fails to meet or delays their committed delivery schedules, we can suffer with lower or lost revenues.

|

| · | Changes in regulations or citizen concerns regarding privacy and protection of citizen data, or any failure or appearance of failure to comply with such laws, could diminish the value of our services and cause us to lose customers and revenue.

|

| · | If our security systems are breached, we may face civil liability, and public perception of our security measures could be diminished, either of which would negatively affect our ability to attract and retain customers.

|

| · | Our business model consists in promoting trust and security, and it depends on trust in our brand. Negative media coverage could adversely affect our brand and any failure to maintain, protect, and enhance our brand would hurt our ability to retain or expand our customer base.

|

| · | We depend on our customers’ ability to sell their products, which may pose challenges for our ability to forecast or optimize our inventory and sales.

|

| · | We may need to discontinue products and services. During the ramp-down of such products and services, we may experience a negative impact on our sales.

|

| · | We are a holding company with no direct cash generating operations and rely on our subsidiaries to provide us with funds necessary to pay dividends to shareholders.

|

| · | The Spin-Off Distribution is expected to be a taxable transaction to U.S. holders of WISeKey common stock and ADSs.

|

| · | Following the Spin-Off Distribution, the aggregate trading value of SEALSQ Ordinary Shares and WISeKey Class B Shares and ADSs may be less than the trading value of WISeKey Class B Shares and ADSs before the Spin-Off Distribution.

|

| · | We derive a significant amount of our revenues each year from a limited number of significant customers.

|

| · | The dual class structure of our shares has the effect of concentrating voting power with certain shareholders, in particular, WISeKey, which will effectively eliminate your ability to influence the outcome of important transactions, including a change in control.

|

| · | Our governance structure and our Articles may negatively affect the decision by certain institutional investors to purchase or hold our Ordinary Shares.

|

| · | Provisions in our Articles are intended to discourage certain types of transactions that may involve an actual or threatened hostile acquisition of control of SEALSQ, which will likely depress the trading price of our Ordinary Shares.

|

18

| · | The Shareholders’ Agreement has the effect of concentrating voting power with WISeKey and the other Class F shareholders, which will effectively eliminate your ability to influence the outcome of important transactions, including a change in control.

|

| · | WISeKey and other Class F shareholders could have voting power that exceeds 49.99% of the voting power of our outstanding capital stock.

|

| · | As a result of future issuances of our Ordinary Shares or the disposal of Ordinary Shares by WISeKey and other Class F shareholders, WISeKey and other Class F shareholders could have voting power that is substantially greater than, and outsized in comparison to, their economic interests and the percentage of our Ordinary Shares that they hold.

|

| · | Future issuances of our Ordinary Shares will dilute the voting power of our holders of Ordinary Shares, but may not result in further dilution of the voting power of Class F shareholders.

|

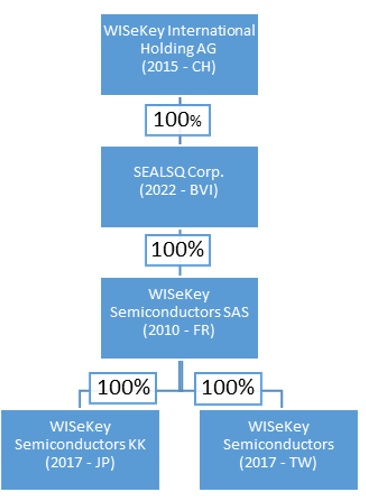

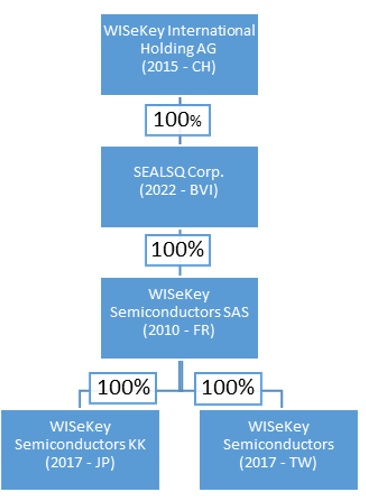

Corporate Structure

SEALSQ Corp is a wholly-owned subsidiary of WISeKey and will be the sole owner of all outstanding shares of the subsidiaries listed below. After the completion of the Spin-Off Distribution, we will continue to be a subsidiary of WISeKey.

Pursuant to an internal restructuring of WISeKey on January 1, 2023 (the “Internal Restructuring”), WISeKey transferred the ownership of WISeKey Semiconductors SAS (formerly known as “VaultIC SAS”), a French semiconductor manufacturer and distributor, WISeKey IoT Japan KK, a Japan-based sales subsidiary of WISeKey Semiconductors SAS, and WISeKey Semiconductors, Taiwan Branch, a Taiwan- based sales and support branch of WISeKey Semiconductors SAS, to SEALSQ in a share exchange.

For a discussion of the history and development of SEALSQ, see the section titled “Business”.