UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year

ended

OR

OR

Date of event requiring this shell company report

For the transition period from to

Commission File

Number:

(Exact name of Registrant as specified in its charter)

Not

Applicable

(Translation of Registrant’s Name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

+

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name

of each exchange on which |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2023, the registrant had Ordinary Shares outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes x

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ¨ Large accelerated filer | ¨ Accelerated filer | x

|

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

¨

| ¨ U.S. GAAP | x |

¨ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

¨ Item 17 Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

¨ Yes ¨ No

| Auditor Name | Auditor Location | Auditor Firm ID | ||

EXPLANATORY NOTE

Metals Acquisition Limited (the “Company”) is filing this Amendment No. 1 (“Amendment No. 1”) to its Annual Report on Form 20-F for the fiscal year ended December 31, 2023, as filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 28, 2024 (the “Original Form 20-F”), to amend Item 4 of the Original Form 20-F to include:

| · | a report of the Company’s mineral resources and reserves as at December 31, 2023, |

| · | a reconciliation comparing the Company’s resources and reserves as of December 31, 2023 and December 31, 2022 and a related discussion which addresses each instruction as required by Item 1304(e) of Regulation S-K, and |

| · | certain updates to the descriptions of the Company’s existing infrastructure, previous operations and significant encumbrances, along with disclosure of the total cost of the Company’s property. |

This Amendment No. 1 also amends Item 19 of the Original 20-F to include as Exhibit 96.1 the technical report summary effective as of April 22, 2024 (the “Technical Report”) that was previously furnished on a Form 6-K to the SEC on April 26, 2024, and to file new certifications from the Company’s Principal Executive Officer and Principal Financial Officer as Exhibits 12.1 and 12.2.

Except as described above, this Amendment No. 1 does not amend, update or change any other items or disclosures contained in the Original Filing, and accordingly, this Amendment No. 1 does not reflect or purport to reflect any information or events occurring after the date of the Original Filing or modify or update those disclosures affected by subsequent events. Accordingly, this Amendment No. 1 should be read in conjunction with the Original Filing and the Company’s other filings with the SEC. Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Original Filing.

i

TABLE OF CONTENTS

Page

| Part I | 3 | |

| Item 4. | INFORMATION ON THE COMPANY | 3 |

| Part III | 25 | |

| Item 19. | EXHIBITS | 25 |

ii

Part I

| ITEM 4. | INFORMATION ON THE COMPANY |

| A. | History and Development of the Company |

Metals Acquisition Limited was incorporated under the laws of Jersey, Channel Islands on July 29, 2022. Our registered office is 3rd Floor, 44 Esplanade, St Helier, Jersey, JE4 9WG and our place of business is 1 Louth Rd, Cobar, NSW, 2835 (which is the address of the CSA Copper Mine). Our telephone number is +44 1534 514 000 and our agent for service of process in the United States is Puglisi & Associates, 850 Library Avenue, Suite 204, Newark, Delaware 19711.

Our website address is https://www.metalsacquisition.com/. The information on our website is not incorporated by reference into this Annual Report, and you should not consider information contained on our website to be a part of this Annual Report. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers, such as us, that file electronically, with the SEC at www.sec.gov.

On June 15, 2023, we consummated our Business Combination pursuant to the Share Sale Agreement, pursuant to which MAC-Sub acquired from Glencore 100% of the issued share capital of CMPL, which owns and operates the CSA Copper Mine near Cobar, New South Wales, Australia. Immediately prior to the Business Combination, MAC merged with and into us. Following the Business Combination, we continued as the surviving company, and CMPL became an indirect subsidiary of us.

As part of the Business Combination: (i) each issued and outstanding MAC Class A Ordinary Share and MAC Class B Ordinary Share was converted into one Ordinary Share, and (ii) each issued and outstanding whole warrant to purchase MAC Class A Ordinary Shares was converted into one Warrant at an exercise price of $11.50 per share, subject to the same terms and conditions existing prior to such conversion.

In connection with the execution and delivery of the Share Sale Agreement, MAC entered into Subscription Agreements with the Initial PIPE Investors, pursuant to which the Initial PIPE Investors agreed to subscribe for and purchase, and MAC agreed to issue and sell to the Initial PIPE Investors an aggregate of 22,951,747 Ordinary Shares at a price of $10.00 per share, for aggregate gross proceeds of $229,517,470. Four of the Initial PIPE Investors were officers and directors of MAC and one of the Initial PIPE Investors was also an affiliate of the Sponsor and they agreed to subscribe for 230,000 Ordinary Shares in the aggregate, at a purchase price of $10.00 per share, for aggregate gross proceeds of $2,300,000 all pursuant to the Subscription Agreements on the same terms and conditions as all other Initial PIPE Investors. Such subscribed shares were converted into Ordinary Shares in connection with the Business Combination. The Initial PIPE Investors were also granted customary registration rights in connection with the Initial PIPE Financing.

In connection with the Subscription Agreements, the Sponsor agreed to transfer an aggregate of 988,333 shares of Class B common stock of MAC that it held and agreed to sell 500,000 MAC private placement warrants at a price of $1.50 for each MAC private placement warrant to certain investors who agreed to subscribe for a significant number of Ordinary Shares.

MAC-Sub (as borrower), we and MAC (as guarantors) and Sprott (as lender) entered into a Mezzanine Loan Note Facility Agreement dated March 10, 2023 pursuant to which Sprott made available a US$135 million loan facility agreement available to MAC-Sub, for funding purposes in connection with the Business Combination (the “Mezz Facility”). In connection with the Mezz Facility, we, MAC, Sprott Private Resource Lending II (Collector), LP (the “Equity Subscriber”) and Sprott Private Resource Lending II (Collector-2), LP (the “Warrant Subscriber”), entered into a subscription agreement (the “Sprott Subscription Agreement”) pursuant to which the Equity Subscriber committed to purchase 1,500,000 Ordinary Shares at a purchase price of $10.00 per share and an aggregate purchase price of $15,000,000. In addition, in accordance with the terms of the Mezz Facility, the Warrant Subscriber received 3,187,500 warrants to purchase Ordinary Shares (the “Financing Warrants”) once the Mezz Facility began. Each Financing Warrant entitles the holder to purchase one Ordinary Share.

3

In accordance with ASX Listing Rule 4.10.3, we disclose the following information in relation to the stock exchanges which the Company’s securities are quoted. The Business Combination was consummated on June 15, 2023 and on June 16, 2023, the Ordinary Shares and Public Warrants commenced trading on the NYSE under the symbols “MTAL” and “MTAL.WS,” respectively. On February 20, 2024, we commenced trading CDIs on the ASX under the symbol “MAC.”

Australian Disclosure Requirements

Registered Australian office

Our Australian registered office is 1 Louth Rd, Cobar, NSW, 2835 (which is the address of the CSA Copper Mine). Our Australian registered office telephone number is +61 (02) 6836 5100.

Register of securities

Our statutory register of securities is kept and maintained at our registered office, 44 Esplanade, St. Helier, Jersey, JE4 9WG.

Sub registers are maintained in relation to:

| · | Ordinary Shares quoted on NYSE, by Continental Stock Transfer & Trust Company in the US; and |

| · | CDI’s quoted on ASX, by Computershare Investor Services Pty Limited in Australia. |

| B. | Business Overview |

Overview

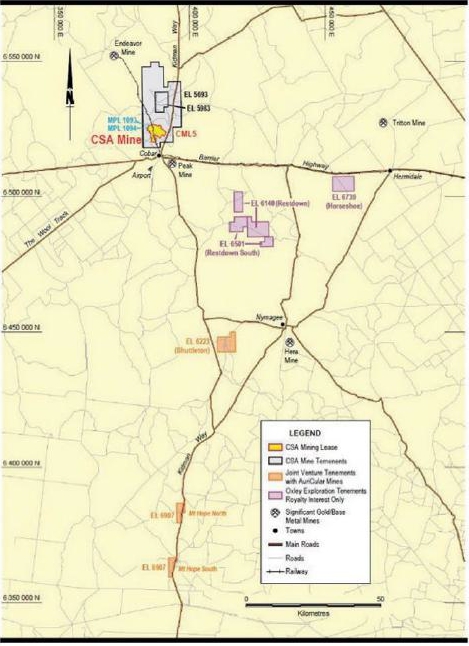

We operate the CSA Copper Mine, which is located less than 1,000 kilometers west-northwest of Sydney near the town of Cobar in western New South Wales, Australia. Sealed highways and public roads provide all-weather access to the CSA Copper Mine, and the CSA Copper Mine is linked by rail to the ports of Newcastle and Port Kembla, New South Wales, from which the copper concentrate product is exported. Road access to the mine site from Sydney is via National Highway No. A32, the Barrier Highway, a high-quality sealed rural highway to Cobar and from there to the mine site on sealed urban roads.

The CSA Copper Mine has a long operating history, with copper mineralization first discovered in 1871. Development commenced in the early 1900s, focusing on near surface mineralization. In 1965, Broken Hill South Limited developed a new mechanized underground mining and processing operation, with new shafts, winders, concentrator, and infrastructure. First underground production was in 1967. The mine was acquired by Conzinc RioTinto Australia Pty Ltd in 1980 and sold to Golden Shamrock Mines Pty Ltd (“GSM”) in 1993. GSM was subsequently acquired by Ashanti Gold Fields in the same year and the mine continued to operate until 1997. Glencore acquired the property in 1999. CMPL, a wholly owned Australian subsidiary of Glencore Operations Australia Pty Ltd, itself a wholly owned subsidiary of Glencore, was the direct owner and operator of the mine (and is the entity acquired by Metals Acquisition Corporation (“MAC”)). As part of its acquisition in 1999, Glencore received a number of concessions from the New South Wales government whereby several components of the previous mining operations were excised from the mining lease such that no liability arising from these components transferred to CMPL. The excised components included the Northern Tailings Storage Facility, a mine subsidence area and adjacent waste rock dumps.

Underground operations were resumed, and the mine was operated under Glencore management for over 20 years until being acquired by the Company on June 16, 2023.

The underground mine is serviced by two hoisting shafts and a decline from surface to the base of the mine. Ore is produced principally from two steeply dipping underground mineralized systems, QTS North (“QTSN”) and QTS Central (“QTSC”), from depths currently between 1,500 to 1,900 meters below the surface. The current depth of the decline is around 1,900 meters. The ore is crushed underground, hoisted to surface, and milled and processed through the CSA concentrator. In 2023, the CSA Copper Mine produced 142.1 kilotons (“kt”) of concentrate grading 25.43% copper containing 36.1kt of copper.

4

The currently estimated Ore Reserves (December 2023) support operations until 2034. The CSA Copper Mine has a long history of resource renewal and exploration success, and there is reasonable geological evidence of continuity down dip.

The town of Cobar is serviced by a sealed airstrip, with commercial flights five times per week to and from Sydney. The project is well-served by existing infrastructure, which includes power supply, water supply, site buildings, and service facilities. Power is supplied to the site from the state energy network via a 132 kV transmission line. A 22kV line is also connected to the site and is available for limited supply in emergencies. The state energy network is supplied by a mix of conventional and renewable power generation, including the 102 megawatt (“MW”) and 132MW solar farms in the nearby towns of Nyngan and Nevertire. Further diesel power generators are available to supply minimal backup power capable of supporting emergency room facilities and functions.

The majority of the water supply for the operation is provided by the Cobar Water Board from Lake Burrendong via a weir on the Bogan River at Nyngan through a network of pumps and pipelines. During times of significant drought, the CSA Copper Mine may not be able to rely on this water supply. Additional water is available from tailings water recycling, surface water capture, and an installed borefield, and can also be secured by replacing the pipeline from the Cobar Water Board system to the mine site that currently has approximately 20% transmission losses. The borefield has capacity for up to 1.3ML/day. The Cobar Water Board system is adequate to supply the operation up to around 1.4Mtpa; the borefield is only required during periods of drought or should a plant feed rate in excess of 1.4Mtpa be considered for extended periods. Although the CSA Copper Mine has water allocations provided under water licenses, there is no certainty of supply in times of significant drought. The supplementary water supply listed is not sufficient to maintain mining and processing operations at full production.

Competitive Strengths

For the following reasons, we believe that we and the CSA Copper Mine are well positioned to compete in the global copper market:

Attractive Location: The CSA Copper Mine is a well-established copper mine located in a low political risk jurisdiction. Much of the world’s copper is produced in higher risk jurisdictions in Africa and Latin America and as such is subject to potential supply and cost issues associated with resource nationalism, corruption, uncertain and materially changing fiscal regimes and political and civil disruption. While no certainty can exist that some or all of these factors would not impact us in the future, since the CSA Copper Mine opened in its modern format in 1967, the operation has not been significantly negatively impacted by these factors.

Established Operating History: As the CSA Copper Mine is already in production and is in the process of completing a significant capital reinvestment program, we believe the CSA Copper Mine is well positioned to supply copper at a competitive position on the global cost curve for copper. The CSA Copper Mine is also one of the highest-grade copper mines globally, which also provides a competitive advantage compared to many other copper mines. Cost inflation pressures are significant in the mining industry at the current time, especially so in the capital cost area of a new build mine (“Greenfield Build”). The risks associated with building a new mine are significant given the lack of historical operating data and the inflationary pressures in the mining industry at present. The CSA Copper Mine has a substantial competitive strength relative to Greenfield Build projects given its long-established operating track record and the major historical capital investments that have been made over the past 56 years.

Business Strategy

With only a single primary asset, our business strategy focuses on the safe, environmentally compliant operation of the CSA Copper Mine to produce copper and minor amounts of silver in concentrate. Recently, our business strategy has increased focus on performance in Environmental, Social, Governance (“ESG”) requirements. The business is well established and the current strategy has been in place for many years.

5

The mine has historically operated with a relatively short reserve life, with infill drilling of known orebodies occurring replacing mined reserves over the long-term and gradually expanding the total reserves. This has typically been accomplished through near mine exploration drilling, which has historically been targeted at a relatively low level sufficient to replace each year of mined production. In parallel to this, exploration activities target new lenses on the mining lease in close proximity to the existing known orebodies with the intention of finding new lenses or orebodies.

In the last few years, the CSA Copper Mine has consistently invested in exploration to identify additional resources and reserves, with the intent to develop a more robust pipeline of works through geophysics and geochemistry for drilling, that commenced in 2022. We plan to continue and expand on this strategy to provide a better ability for long-term planning and capital deployment decisions to be made.

Summary of Mineral Resources and Mineral Reserves

The deposit in the CSA Copper Mine is located within the Cobar mineral field in the Cobar Basin, a north-south mineralized belt containing copper, gold and lead-zinc mineralization, with four currently operating mines within 80 kilometers of Cobar. Mineralization is associated with north-south faulting and northwest cross cutting structures.

The CSA Copper Mine mineralization occurs in five known systems: Eastern, Western, QTSN, QTSC and QTS South. Within these systems multiple lenses occur; lenses are typically five and thirty meters wide, with relatively short strike lengths (less than 300 meters), but significant down plunge extent of up to 1,000 meters. Not all the systems extend to surface; QTSN which accounts for the bulk of the current production tons is developed from 600m depth, while QTSC is developed from a depth of around 1,200m.

The dominant copper sulphide is chalcopyrite (CuFeS2); silver is also present as acanthite (Ag2S).

BDA considers that the CSA Copper Mine has exploration potential both in the immediate vicinity of the CSA Copper Mine and within the broader tenement package. The QTSN and QTSC lodes remain open down dip, with the deepest drill intersection currently at around 2,200 meters. Magnetic and electromagnetic surveys have identified a number of targets along strike of the known CSA Copper Mine lodes, both within the Mining Lease and the surrounding Exploration Licenses.

We are subject to the reporting requirements of the Exchange Act and applicable Australian securities laws, and as a result, we have separately reported our mineral reserves and mineral resources according to the standards applicable to those requirements. U.S. reporting requirements are governed by S-K 1300, as issued by the SEC. Australian reporting requirements are governed by the JORC Code. Both sets of reporting standards have similar goals in terms of conveying an appropriate level of consistency and confidence in the disclosures being reported, but the standards embody slightly different approaches and definitions. All disclosure of mineral resources and mineral reserves in this report is reported in accordance with S-K 1300. For JORC compliant disclosure of mineral resources and mineral reserves, please see the Company’s annual report filed with the ASX on March 28, 2024.

Mineral Resources

The Mineral Resources presented in this section are not Mineral Reserves and do not reflect demonstrated economic viability. The reported Inferred Mineral Resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that all or any part of this Mineral Resource will be converted into Mineral Reserve. All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly. Mineral Resource estimates are exclusive of Mineral Reserves on a 100% ownership basis.

6

The table below sets forth the Mineral Resource estimate for the CSA Copper Mine as of December 31, 2023:

Copper and Silver Mineral Resources Exclusive of Mineral Reserves as at December 31, 2023, Based on a Copper Price of US$8,279/t at 1.5% Cu Cut-Off Grade

| Resource | Tonnes | Cu | Cu Metal | Ag | Ag Metal | ||||||||||||

| System | Category | Mt | % | kt | g/t | Moz | |||||||||||

| All Systems | Measured | 2.8 | 5.3 | 150.3 | 18.1 | 1.6 | |||||||||||

| Indicated | 1.6 | 4.7 | 74.4 | 11.8 | 0.6 | ||||||||||||

| Meas + Ind | 4.4 | 5.1 | 224.8 | 15.8 | 2.2 | ||||||||||||

| Inferred | 3.4 | 5.2 | 178.4 | 19.6 | 2.1 | ||||||||||||

| Total | 7.8 | 5.2 | 403.2 | 17.5 | 4.4 |

Notes:

| · | Mt = million tonnes, kt = thousand tonnes, g/t = grams per tonne, Moz = million ounces |

| · | Mineral Resources are reported as at December 31, 2023 and are reported using the definitions in Item 1300 of Regulation S-K (17 CFR Part 229) (SK1300) |

| · | Mineral Resources are reported excluding Mineral Reserves |

| · | The Qualified Person for the estimate is Mike Job, of Cube Consulting Pty Ltd |

| · | Price assumptions used in the estimation include US$8,279/t of copper and US$22.60/troy ounce (“oz”) of silver; in line with long term Broker Consensus forecast copper pricing as at August 8, 2023. This is explained further in Sections 16.4 and 16.7 of the Technical Report Summary - CSA Copper Mine - New South Wales - Australia, prepared by Behre Dolbear Australia Minerals Industry Consultants and other qualified persons effective as of April 22, 2024 (the “Technical Report Summary”). The copper price used for the fiscal 2023 cut-off grade, compared to US$7,400/t for the fiscal 2022 cut-off grade, is based on the higher consensus copper price in 2023 compared to 2022 |

| · | Geological mineralization boundaries defined at a nominal 2.5% Cu cut off for high grade lenses, and 1.5% Cu for the lower-grade halo; Mineral Resources reported above a 1.5% Cu cut-off grade |

| · | Costs assumptions underlying cut-off grade calculation include US$78 per ore tonne mined, US$20 per ore tonne milled and US$21 G&A per ore tonne milled. This is explained further in Section 12.5 of the Technical Report Summary |

| · | Metallurgical recovery assumptions used in the estimation were 97.5% copper recovery and 80% silver recovery |

| · | Mineral Resources reported as dry, raw, undiluted, in-situ tonnes |

| · | Figures are subject to rounding |

The table below sets forth the Mineral Resource estimate for the CSA Copper Mine as of December 31, 2022:

Copper and Silver Mineral Resources Exclusive of Mineral Reserves as of December 31, 2022, Based on a Copper Price of US$7,400/t

| System | Resource Category | Tons Mt | Cu % | Cu Metal Kt | Ag g/t | Ag Metal Moz | |||||||||||

| All Systems | Measured Mineral Resources | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |||||||||||

| Indicated Mineral Resources | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||||||||||||

| Meas + Ind Mineral Resources | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||||||||||||

| Inferred Mineral Resources | 3.5 | 5.6 | 193 | 20 | 2.2 | ||||||||||||

| Total Mineral Resources | 3.5 | 5.6 | 193 | 20 | 2.2 |

7

Notes:

| · | Mineral Resources are reported as of December 31, 2022 and are reported using the definitions in Item 1300 of Regulation S-K (17 CFR Part 229)(SK1300) |

| · | Mineral Resources are reported excluding Mineral Reserves |

| · | The Qualified Person for the estimate is Mike Job, of Cube Consulting Pty Ltd (“Cube”) |

| · | Price assumptions used in the estimation include US$7,400/t of Copper and US$21.7/ounce of silver. The Copper price is an approximate 9% discount to consensus copper pricing as at February 1, 2023 |

| · | Cost assumptions for the cut-off grade calculation were A$98 per ore tonne mined, A$20 per tonne milled and A$19 per tonne G+A |

| · | Geological mineralization boundaries defined at a nominal 2.5% Cu cut off |

| · | Metallurgical recovery assumptions used in the estimation were 97.5% Copper recovery and 80% Silver recovery |

| · | Mineral Resources reported as dry, raw, undiluted, in-situ tons |

| · | Figures are subject to rounding |

Difference in Resources 2022 to 2023

| Description | Estimated Date | Cut-Off Grade | Tonnes Mt | Cu % | Cu Metal kt | Ag g/t | Ag Metal Moz | |||||||||||||||||||

| Measured Mineral Resource | 31-December-2022 | 2.5 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |||||||||||||||||||

| Measured Mineral Resource | 31-December-2023 | 1.5 | 2.8 | 5.3 | 150.3 | 18.1 | 1.6 | |||||||||||||||||||

| Difference - Total Measured | 2.8 | 5.3 | 150.3 | 18.1 | 1.6 | |||||||||||||||||||||

| % Difference - Total Measured | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||||||

| Indicated Mineral Resource | 31-December-2022 | 2.5 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |||||||||||||||||||

| Indicated Mineral Resource | 31-December-2023 | 1.5 | 1.6 | 4.7 | 74.4 | 11.8 | 0.6 | |||||||||||||||||||

| Difference - Total Indicated | 1.6 | 4.7 | 74.4 | 11.8 | 0.6 | |||||||||||||||||||||

| % Difference - Total Indicated | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||||||

| Inferred Mineral Resource | 31-December-2022 | 2.5 | 3.5 | 5.6 | 193.0 | 20.0 | 2.2 | |||||||||||||||||||

| Inferred Mineral Resource | 31-December-2023 | 1.5 | 3.4 | 5.2 | 178.4 | 19.6 | 2.1 | |||||||||||||||||||

| Difference - Total Inferred | -0.1 | -0.4 | -14.6 | -0.4 | -0.1 | |||||||||||||||||||||

| % Difference - Total Inferred | (2.86 | )% | (7.14 | )% | (7.56 | )% | (2.00 | )% | (4.55 | )% | ||||||||||||||||

8

The average cut-off grade set out above reduced between December 31, 2023 and December 31, 2022 as a result primarily of the Offtake Agreement entered into concurrently with the Closing that provides significant additional revenue for the cut-off grade calculation, with use of a lower cut-off grade reducing the overall resource grade. Further, an additional 17,000m of back log drilling was logged and assayed and used in the fiscal 2023 resource estimate that had the impact of increasing the Measured and Indicated classifications of the overall resource which was then available for conversion to reserves.

The difference between the fiscal 2022 and fiscal 2023 resource estimates was also impacted by the higher consensus copper price in 2023, as compared to 2022.

Mineral Reserves

We produced a Mineral Reserve estimate for the CSA Copper Mine, based on actual stope designs incorporating mining losses, mining dilution and other modifying factors. The Mineral Reserve is based on Measured and Indicated resources only.

The table below sets forth the Mineral Reserve for the CSA Copper Mine as of December 31, 2023:

Copper and Silver Mineral Reserves as at December 31, 2023, Based on a Copper Price of US$8,279/t

| Reserve | Tonnes | Cu | Cu Metal | Ag | Ag Metal | ||||||||||||

| System | Category | Mt | % | kt | g/t | Moz | |||||||||||

| All Systems | Proven | 8.4 | 3.4 | 281.1 | 14 | 3.7 | |||||||||||

| Probable | 6.2 | 3.0 | 187.3 | 11 | 2.2 | ||||||||||||

| Total | 14.6 | 3.2 | 468.4 | 12 | 5.8 |

Notes:

| · | Mineral Reserves are reported as at December 31, 2023 and are reported using the definitions in Item 1300 of Regulation S-K (17 CFR Part 229)(SK1300) |

| · | The Qualified Person for the estimate is Jan Coetzee, an officer of the Registrant’s Australian subsidiary |

| · | Price assumptions used in the estimation include US$8,279/t of copper and US$22.60/troy ounce of silver; in line with long term Broker Consensus forecast copper pricing as at August 8, 2023. This is explained further in Sections 16.4 and 16.7 of the Technical Report Summary. The copper price used for the fiscal 2023 cut-off grade, compared to US$7,400/t for the fiscal 2022 cut-off grade, is based on the higher consensus copper price in 2023 compared to 2022 |

| · | Mineral Reserves are reported as dry, diluted, in-situ tonnes using a Stope breakeven cut-off grade of 2.2% Cu for 2024 to 2026, a Stope breakeven cut-off grade of 1.65% for the remaining periods and a Development breakeven cut-off grade of 1.0% Cu |

| · | Cost assumptions underlying the cut-off grade calculation include US$78 per ore tonne mined, US$20 per ore tonne milled and US$21 G&A per ore tonne milled. This is explained further in Section 12.5 of the Technical Report Summary |

| · | Metallurgical recovery assumptions used in the estimation were 97.5% copper recovery and 80% silver recovery |

9

| · | Figures are subject to rounding |

The table below sets forth the Mineral Reserve for the CSA Copper Mine as of December 31, 2022:

Summary of Copper and Silver Mineral Reserves as of December 31, 2022, Based on a Copper Price of US$7,400/t

| System | Reserve Category | Tons Mt | Cu % | Cu Metal Kt | Ag g/t | Ag Metal Moz | ||||||||||||||||

| All Systems | Proven Mineral Reserve | 4.8 | 4.3 | 208.8 | 17.8 | 2.8 | ||||||||||||||||

| Probable Mineral Reserve | 3.1 | 3.5 | 105.3 | 13.5 | 1.3 | |||||||||||||||||

| Total Mineral Reserve | 7.9 | 4.0 | 314.1 | 16.1 | 4.1 | |||||||||||||||||

Notes:

| · | Mineral Reserves are reported as of December 31, 2022 and are reported using the definitions in Item 1300 of Regulation S-K |

| · | The Qualified Person for the estimate is Jan Coetzee, an officer of the Registrant |

| · | Price assumptions used in the estimation include US$7,400/tonne of Copper and US$21.7/ounce of silver. The Copper price is an approximate 9% discount to consensus copper pricing as at February 1, 2023 |

| · | Cost assumptions for the cut-off grade calculation were A$98 per ore tonne mined, A$20 per tonne milled and A$19 per tonne G+A |

| · | Geological mineralization boundaries defined at a nominal 2.5% Cu cut off |

| · | Mineral Reserves reported as dry, diluted, in-situ tons using a Stope breakeven cut off grade of 2.2% Cu and a Development breakeven cut off grade of 1.0% Cu |

| · | Metallurgical recovery assumptions use in the estimation were 97.5% Copper recovery and 80% Silver recovery |

| · | Figures are subject to rounding |

Difference in Reserves 2022 to 2023

| Description | Estimated Date | Cut-Off Grade | Tonnes

Mt | Cu % | Cu Metal kt | Ag g/t | Ag Metal Moz | |||||||||||||||||||

| Proven | 31-December-2022 | 2.2 | 4.8 | 4.3 | 208.8 | 17.8 | 2.8 | |||||||||||||||||||

| Proven | 31-December-2023 | 2.2 / 1.67 | 8.4 | 3.4 | 281.1 | 13.6 | 3.7 | |||||||||||||||||||

| Difference - Total Proven | 3.6 | -0.9 | 72.3 | -4.2 | 0.9 | |||||||||||||||||||||

| % Difference - Total Proven | 75.00 | % | (20.93 | )% | 34.63 | % | (23.60 | )% | 32.14 | % | ||||||||||||||||

| Probable | 31-December-2022 | 2.2 | 3.1 | 3.5 | 105.3 | 13.5 | 1.3 | |||||||||||||||||||

| Probable | 31-December-2023 | 2.2 / 1.67 | 6.2 | 3.0 | 187.3 | 10.9 | 2.2 | |||||||||||||||||||

| Difference - Total Probable | 3.1 | -0.5 | 82.0 | -2.6 | 0.9 | |||||||||||||||||||||

| % Difference - Total Probable | 100.00 | % | (14.29 | )% | 77.87 | % | (19.26 | )% | 69.23 | % | ||||||||||||||||

10

The average cut-off grade set out above reduced between December 31, 2023 and December 31, 2022 as a result primarily of the Offtake Agreement entered into concurrently with the Closing that provides significant additional revenue for the cut-off grade calculation, with use of a lower cut-off grade reducing the overall reserve grade. The reserve modifying factors were also adjusted in 2023 based on actual reconciliation data that indicated higher actual mining dilution than used in the fiscal 2022 reserve estimate, with the net effect of increasing the dilution modifying factor in the fiscal 2023 reserve and thus reducing the average grades of the Proven and Probable reserves.

The difference between the fiscal 2022 and fiscal 2023 reserve estimates was also impacted by the higher consensus copper price in 2023, as compared to 2022, as well as the operating costs used for the fiscal 2023 cut-off grade (US$78 per ore tonne for mining , US$20 per ore tonne for milling and US$21 per ore tonne for G+A) being higher than those used for the fiscal 2022 cut-off grade calculation (A$98 per ore tonne for mining, A$20 per ore tonne for milling and A$19 per ore tonne for G+A).

Internal Controls over the Mineral Reserves and Mineral Resources Estimation Process

Assay Sample Preparation and Analysis

Core processing follows the standard sequence of meter mark-up, quantification of recovery, RQD determination, geological logging, sample mark-up, core photography, bulk density determination and sampling.

The sampling procedure includes interval checks, cutting intervals, sampling intervals, inserting standards, sampling duplicates, weighing samples and dispatching samples. All parts of the core processing cycle are tracked and recorded electronically.

Core yard technicians review the core and check the sample intervals as identified on the sampling sheet, including checking to ensure that the sample intervals satisfy length requirements (0.4 – 1.1m for NQ). The geologist corrects errors or discrepancies.

Core is cut according to the core cutting procedure with a CoreWise diamond coresaw. Where sample intervals start or end part of the way through a stick of core, the core is broken with a hammer.

Once the entire hole is cut, trays are laid out in order on the racks or on pallets. Sample intervals are marked onto the tray before sampling, allowing the correct sample intervals to be written onto the remaining half core. The core is cut in half with one half submitted to the laboratory for analysis and the other half returned to the tray. The half core to be analyzed is sampled into pre-numbered calico bags with sample numbers from the bags written on the sample sheet before sampling. Half core is collected from the end of the split back towards the start in order to minimize sampling errors. Sticks of half core longer than approximately 8cm are broken in order to reduce the risk of sample bags tearing during transport.

Sample preparation and assaying is carried out by independent laboratory, Australian Laboratory Services (“ALS”), in Orange, NSW, using an aqua regia digest and the Inductively Coupled Plasma Atomic Emission Spectrometry analytical method, with analysis for a standard suite of elements including copper, zinc, lead and silver. Quality Assurance/Quality Control (“QA/QC”) protocols have been comprehensive since 2004 and include insertion of standards (supplied by Ore Research and Exploration Pty Limited), blanks and duplicate samples at a frequency of approximately 1 in 30 samples. We monitor QA/QC data; the sampling and assaying data for the main elements are considered reliable and without material bias and sample security arrangements are appropriate and satisfactory. Our relational drillhole database is an AcQuire database which is a site-managed system.

By the beginning of 2023, due primarily to COVID-19 impacts on our geological and core sampling staff during 2020 – 2022, a backlog of over 13,000m of un-logged and/or un-assayed drill core had developed.

11

Specific Gravity Sampling

We compiled a database of around 16,000 bulk density values by testing one sample from each core tray (approximately one sample per 6.5m of core) and determining density using the water immersion method. A regression formula based on the copper assay of the samples tested was derived from this data. Since 2017, we have used ALS to carry out density measurements; we advise that the ALS data aligns well with the site-developed regression formula.

Quality Assurance and Quality Control

Regular analysis of our mine standards, inserted with each batch sent to the laboratory, commenced in 2007. These are in addition to normal laboratory standards inserted in the process by ALS. All QA/QC data are stored in our acQuire database.

Sample weights are measured both, before the samples leave CSA Copper Mine site, and before the samples are prepared for analysis at the ALS laboratory. Currently only the ALS sample weights are loaded into the acQuire database. All weights measured prior to leaving the CSA Copper Mine are loaded into a weight tracker spreadsheet. This spreadsheet is used to compare our and ALS sample weights as part of the QAQC process. It is rare for weights to differ by more than 2.5%. Such cases are usually due typographical error.

Standards and Blanks

External standards and blanks are inserted into the sampling sequence for each drill hole assay submission. One blank and eleven standards derived from CSA Copper Mine ore were prepared, supplied and certified by Ore Research and Exploration Pty Ltd for use at the CSA Copper Mine.

Standards to be inserted are specified by the logging geologist on the sampling sheet. The procedure requires a minimum of one standard for every 30 samples, with the selected standard representing a copper grade similar to the copper grade in the surrounding samples. The core yard technician removes the label from the standard so that it cannot be identified by the laboratory. It is placed in the appropriately numbered sample bag and secured. Blanks are inserted periodically, and following high grade samples, to check for contamination in the laboratory processing stream.

Field Duplicates

Duplicate intervals are specified by the geologist on the sampling sheet and are collected approximately every 30 samples. Duplicate samples are also inserted at the end of the hole. The core yard technician removes the remaining half of the core for the selected interval and places it in the appropriately numbered sample bag. For those intervals with duplicate samples, no core remains in the tray.

A separate dispatch is completed for each drill hole to enable the assay results of the entire hole to be received from the laboratory at the same time.

Comparison of original and duplicate (second half of drill core) assay results for the period 2002 to 2021 indicate very good performance for copper, with a correlation co-efficient of 0.98. Silver field duplicates are more erratic than copper with a correlation co-efficient of 0.79.

Laboratory QA/QC

ALS inserts standards into the sample stream as part of their internal QA/QC procedure. Assay results for these standards are supplied with results for samples submitted for analysis. Assay results for laboratory standards are also stored in the acQuire database. Again, laboratory standards are checked on receipt using QA/QC reports generated within the acQuire database and any issues are reported immediately to the laboratory for resolution.

12

Security and Storage

Geological records and assay data are stored in an acQuire database. Drill hole information is stored as collar, down hole survey, assay, geology, specific gravity and geotechnical data.

Drill hole location data are entered manually, survey and assay data are uploaded from the survey tool and laboratory downloads respectively. Geology data is entered manually from paper logs or logged directly into acQuire via a laptop computer. A significant proportion of drill data in the database is derived from historic hardcopy drill logs.

All data entered is tracked via various registers, including Diamond Drill Hole Register, Diamond Drilling Spreadsheet, Core Processing Checklist and UG Sampling Register.

There are four levels of access to the database. ‘Read only’ access is permitted for “public” users, ‘restricted data entry’ access for “data entry” users and ‘write access’ to data tables for “acQuire user” users. This hierarchical security structure allows only the database manager full access and the right to delete data.

Internal Data Verification

Basic database validation checks are carried out by the CSA Copper Mine personnel. These included sample from and to depths, geology depths, record duplication and missing collar duplication checks, as well as collar survey and down hole survey checks. Assay certificates were verified against acQuire dispatch and laboratory job numbers. Extensive random checks of the digital database were made against hardcopy/pdf format assay certificates and geology logs.

Core recovery data has only been collected consistently at the CSA Copper Mine since 2004. 99.8% of the core interval has a recovery greater than 95%. Poor core recoveries are not considered to have a significant impact on the CSA Copper Mine’s resource.

Review of Company’s QA/QC

Cube has undertaken a desktop review of historic (2020, 2021 and 2022) and current 2023 mineral resource reports containing control charts detailing the results of the CSA Copper Mine QA/QC. The process of systematic QA/QC monitoring has been in place since 2007. The Cube review of charted standards, laboratory and field duplicate results has identified no material issues indicating the assay data used by us is without material bias due to laboratory processes and a repeatable representable result overall. Cube is satisfied that the current practices undertaken by us are to industry standard and provide assay data which are sufficient to support the estimation of a mineral resource.

Operations

Mining

Copper production at the CSA Copper Mine is currently mine-constrained. Considerable effort in recent years, and many of the current capital expenditure programs underway, are primarily aimed at maximizing ore production as the mine gets deeper.

The CSA Copper Mine uses mechanized long-hole open stoping with cemented paste fill as the preferred mining method. A modified Avoca stoping method has been used successfully in the narrower lenses (principally QTSC and QTSW).

Over recent years, there has been a trend towards falling head grade delivered to surface. Undiluted grade reconciliation appears reasonable, but overbreak/underbreak performance and the resulting dilution and ore recovery appear to be worsening. This is related to more difficult ground conditions, poor stope/level design (and spacing), commencement of mining new narrower lenses (QTSC and QTSW) and quality of mining practices. We consider that all these factors can be better managed. Additionally, steps have been taken to reduce the level interval which should have a positive impact on grade and dilution over time.

13

Following completion of the replacement program for underground trucks and loaders, the mine has excess fleet and the utilization rate for all underground equipment was low. Excess fleet is being parked up and utilization rates are improving. This results in additional costs to keep extra equipment maintained and available; we believe that with improved utilization, fewer pieces of equipment will needed. Given the increasing ventilation and temperature constraints, consideration is being given to replacing the fleet with battery/electric production trucks and loaders whose lack of exhausts would help to reduce ventilation requirements.

We are committed to managing our operations’ associated carbon emissions and energy usage, by (i) supporting renewable energy initiatives in surrounding regions, (ii) focusing on improving and continually reviewing our mining operations to lower energy consumption and improve overall operational efficiency, and (iii) exploring the use and implementation of sustainable drivetrains such as battery electric vehicles to replace the diesel-powered mining fleet.

Planning, sequencing of stoping operations and general mine planning and supervision are areas needing improvement. We consider that all these factors can be better managed and steps have already been taken to reduce the level interval which should have a positive impact on grade and dilution over time. The lag in capital development accrued in 2021 and early 2022 will require a concerted effort to catch up in the coming years and is an area of high focus for us.

Processing

The metallurgical performance at the CSA Copper Mine is generally good, particularly in the main orebody, with consistently high copper recoveries and reasonable copper concentrate grades, and payable silver grades.

The change out of the Semi Autogenous Grinding (“SAG”) mill 2 in the third quarter of 2022 with a new Metso 1.6kW motor (completed) and SAG mill 1 in the second half of 2023 (completed) has increased mill reliability and throughput. However, mill throughput is still likely to be constrained by the ability of the mining operation to increase the mined ore tonnage.

Utilization of availability in the existing plant is poor. However, ore delivery from underground has been inconsistent, and the low plant utilization is typically related to delays in underground ore delivery.

A program of ongoing refurbishment of the flotation cells is underway and there are few problems with the flotation circuit. Reagent supply is steady, air delivery is good, and the process control system is performing satisfactorily.

Production Schedule and Life-of-Mine Plan

Recent ore production at the CSA Copper Mine has averaged around 1.1 million tons per annum (“Mtpa”); 2021 mine production was approximately 1.06Mtpa at 3.9% Cu, 2022 production was 1.03Mtpa at 3.70% Cu and 2023 production was 1.05Mtpa at 3.48% Cu. Over the last two years, COVID-19 labor restrictions, poor ventilation in the lower levels of the mine, and low equipment utilization rates have all impacted performance.

The improvements to mine ventilation and cooling recently completed, underground truck and loader replacements, and a renewed focus on geotechnically-driven mine sequencing and productivity improvements, could allow for some expansion of the annual ore production rates, while potentially maintaining head grades. For the remainder of the Mineral Reserve life, we are targeting annual production rates ramping back up to around 1.2Mtpa. These forecasts are from the Technical Report and not of Glencore. Glencore has not validated nor reviewed any of the underlying technical or macro assumptions used in defining the production schedules.

14

The following table shows the CSA Copper Mine Reserve mine plan:

| Description | Unit | Total/Avg | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |||||||||||||

| Ore Mined | kt | 14,569 | 1,068 | 1,286 | 1,400 | 1,400 | 1,400 | 1,398 | 1,395 | 1,396 | 1,400 | 1,391 | 1,035 | |||||||||||||

| Waste Mined | kt | 2,479 | 580 | 652 | 558 | 236 | 186 | 54 | 74 | 92 | 38 | 6 | 2 | |||||||||||||

| Total Material Moved | kt | 17,048 | 1,649 | 1,939 | 1,958 | 1,636 | 1,586 | 1,451 | 1,468 | 1,488 | 1,438 | 1,397 | 1,037 | |||||||||||||

| Cu Feed Grade | % | 3.29 | % | 3.64 | % | 3.34 | % | 3.58 | % | 3.52 | % | 3.46 | % | 3.43 | % | 3.09 | % | 3.04 | % | 3.06 | % | 2.85 | % | 3.20 | ||

| Ag Feed Grade | g/t | 12.86 | 15.65 | 12.07 | 14.22 | 13.07 | 12.57 | 12.77 | 11.65 | 12.08 | 12.63 | 11.29 | 14.46 | |||||||||||||

| Cu Contained in Feed | kt | 478.8 | 38.9 | 43.0 | 50.1 | 49.3 | 48.4 | 47.9 | 43.1 | 42.5 | 42.8 | 39.7 | 33.1 | |||||||||||||

| Ag Contained in Feed | koz | 6,023.1 | 537.5 | 499.0 | 640.0 | 588.2 | 565.6 | 573.9 | 522.3 | 542.3 | 568.4 | 505.0 | 481.1 | |||||||||||||

| Cu Concentrate Produced | dmkt | 1,795.4 | 145.8 | 161.3 | 187.8 | 185.0 | 181.4 | 179.7 | 161.7 | 159.4 | 160.6 | 148.7 | 124.0 | |||||||||||||

| Concentrate Cu Grade | % | 26.0 | % | 26.0 | % | 26.0 | % | 26.0 | % | 26.0 | % | 26.0 | % | 26.0 | % | 26.0 | % | 26.0 | % | 26.0 | % | 26.0 | % | 26.0 | ||

| Concentrate Ag Grade | g/t | 83.5 | 91.8 | 77.0 | 84.8 | 79.1 | 77.6 | 79.5 | 80.4 | 84.7 | 88.1 | 84.5 | 96.6 | |||||||||||||

| Cu Recovery | % | 97.5 | 97.5 | 97.5 | 97.5 | 97.5 | 97.5 | 97.5 | 97.5 | 97.5 | 97.5 | 97.5 | 97.5 | |||||||||||||

| Ag Recovery | % | 80.0 | 80.0 | 80.0 | 80.0 | 80.0 | 80.0 | 80.0 | 80.0 | 80.0 | 80.0 | 80.0 | 80.0 |

As mining progresses in any production year, the mine will adjust the mine sequences to respond to variations in delivery that occur throughout the year.

Any lowering of the mined head grade, either through the general trend to lower copper grades over time or potentially through a lowering of the cut-off grade, will need to be offset with higher ore production rates to maintain or increase copper metal delivered to the process plant. Hoisting and processing facilities have excess capacity to support the proposed throughputs of 1.3Mtpa provided the mining schedule can be achieved.

We plan to supplement ore production from the lower levels with production from mineralized lodes at shallower depths, plus upper-level remnant ore.

The completion of a second mill replacement, originally scheduled in 2022, was completed in May 2023. While this delay may have potentially displaced some production capacity in 2023, this should not be significant going forward if the mine produces at scheduled rates.

Key Commercial Arrangements

Offtake Agreement

Concurrently with the Closing, we entered into a new Offtake Agreement with GIAG to replace the existing offtake agreement and settle all amounts owing or receivable under the historical agreement. The Offtake Agreement is a LOM obligation, pursuant to which we are committed to selling all Material to GIAG, and GIAG is committed to buying all Material.

The Offtake Agreement is governed by the laws of England and Wales and contains customary terms and conditions, including in relation to (i) quantity, (ii) quality, (iii) shipment and delivery terms, (iv) pricing, (v) payments, (vi) weighting and sampling, (vii) assaying, (viii) Incoterms and insurance, (ix) loss, and (x) force majeure.

Other

A significant portion of costs at the CSA Copper Mine relate to labor and other employment costs. We have other operating contracting in place for goods and services that are in the normal course of business.

Customers

All sales by us are made to a single customer, GIAG. Concurrently with the Closing, we entered into the Offtake Agreement with GIAG.

15

Competition

We operate in the global copper industry and face competition from other copper producers for our main product. The copper market is a deep, liquid market where copper is traded globally in both cathode and concentrate formats.

The cost of turning copper and silver in concentrate into final usable copper and silver is expressed in the smelter charges set annually between the major copper producers and major Asian and European smelters. These charges rise and fall depending on the global supply and demand for copper as well as the freight costs relative to other producers.

Much of the world’s copper is produced in Latin American in large open pits that have a relatively low copper grade. In these mines, significantly more tons of earth have to be mined to produce a ton of copper relative to the CSA Copper Mine. We believe that the carbon footprint of these mines is significantly higher than the CSA Copper Mine and, given investor focus on ESG metrics, the CSA Copper Mine is at a significant competitive advantage.

Employees

The CSA Copper Mine operates with a workforce of mostly residential or “drive in drive out” workers sourced from the surrounding district. The majority of the workforce is accommodated in Cobar. No workforce accommodation is provided at the mine site itself, however, the Company owns and leases various properties in Cobar. The typical staffing levels are approximately 500 permanent employees with a workforce of contractors that are used for larger construction and maintenance projects. The CSA Copper Mine has a portion of its workforce who are members of the Australian Workers Union. As of December 31 2023, we employed approximately 500 individuals, all of whom work at the CSA Copper Mine. Employee rights and entitlements are governed, in addition to the general employment law framework of Australia and New South Wales, by the Cobar Management Pty Ltd Operations Enterprise Agreement 2020 (the “CMPL EA”), which provides for various leave, salary, overtime and related conditions. The CMPL EA contains a number of conditions more favorable than the minimum terms of employment applicable at law in Australia.

Intellectual Property

We do not possess any material intellectual property.

Seasonality

We have no properties that are subject to material restrictions on our operations due to seasonality.

Regulatory Overview

Government Regulation

We are subject to numerous and extensive federal, state and local laws, regulations, permits and other legal requirements applicable to the mining and mineral processing industry, including those pertaining to the environment, employee health and safety, Native Title, Indigenous heritage, plant and wildlife protection, water usage, land use, land access, rehabilitation, air emissions, wastewater discharges, air quality standards, greenhouse gas emissions, waste management, handling and disposal of hazardous and radioactive substances, remediation of soil and groundwater contamination, the discharge of materials into the environment and groundwater quality and availability. Our business may be affected in varying degrees by government regulation such as restrictions on production, export or sale controls, tax increases, royalties, environmental and pollution controls or changes in conditions under which minerals may be extracted, processed or marketed. These laws, regulations, permits and legal requirements may have a significant effect on the company’s results of operations, earnings and competitive position.

16

Our mining and explorations obligations are managed and conducted in compliance with the Mining Act 1992 (NSW) (the “Mining Act”), the Mining Regulations 2016 (NSW) and the title conditions applicable to our mining leases and exploration licences. All exploration and mining activity in New South Wales must be conducted in accordance with an authority issued under the Mining Act. The Mining Act, related laws and title conditions guide and restrict how we mine, process and export minerals, how we operate the CSA Copper Mine, how we rehabilitate our operations, our land access rights (and compensation payable for those rights), how we conduct exploration activities and our ongoing fee and reporting obligations. Our mining infrastructure and related developments at the CSA Copper Mine are subject to state and local planning laws, including the Environmental Planning and Assessment Act 1979 (NSW) (“EP&A Act”), State Environmental Planning Policy (Resources and Energy) 2021 (NSW) and the Cobar Local Environmental Plan 2012 (NSW). These planning laws may require us to obtain other permits or consents and comply with conditions in connection with the operation and maintenance of the CSA Copper Mine and mining infrastructure.

Our royalty liabilities in respect of any minerals recovered under the Mining Lease are regulated by State legislation, specifically the aforementioned Mining Act and Mining Regulations. Under the Mining Act, we will be liable for the payment of royalties to the State of New South Wales for any publicly owned minerals which are recovered under the Mining Lease, with each mineral having a different prescribed rate of royalty. For copper and silver mined at the CSA mine, an ad valorem royalty is calculated at 4 per cent of the value of production less allowable deductions. The liability to pay a royalty fee arises on or before July 31 annually, unless an amount of royalty greater than $50,000.00 was payable in the preceding 12-month period, ending on June 30. If an amount of royalty greater than $50,000.00 was payable for that period, the requirement to lodge a royalty return arises on a quarterly basis. We may also be liable to pay royalties to the State of New South Wales for any privately owned minerals and 7/8th of the royalty paid is owed to be paid to the private mineral owner. All royalty returns must be facilitated and lodged through the Revenue NSW portal by the relevant due date, as specified above.

The table provided below summarizes the rates of royalty payable for each of the minerals to which our Mining Lease relates to at the time of writing.

| (i) | Mineral | (ii) | Prescribed Royalty Rate (as a percentage of the value of the mineral recovered) | |

| (iii) | Antimony | (iv) | 4% | |

| (v) | Arsenic | (vi) | 4% | |

| (vii) | Bismuth | (viii) | 4% | |

| (ix) | Cadmium | (x) | 4% | |

| (xi) | Cobalt | (xii) | 4% | |

| (xiii) | Copper | (xiv) | 4% | |

| (xv) | Germanium | (xvi) | 4% | |

| (xvii) | Gold | (xviii) | 4% | |

| (xix) | Indium | (xx) | 4% | |

| (xxi) | Iron Minerals | (xxii) | 4% | |

| (xxiii) | Lead | (xxiv) | 4% | |

| (xxv) | Nickel | (xxvi) | 4% | |

| (xxvii) | Selenium | (xxviii) | 4% | |

| (xxix) | Silver | (xxx) | 4% | |

| (xxxi) | Sulphur | (xxxii) | 4% | |

| (xxxiii) | Zinc | (xxxiv) | 4% |

As part of the sale consideration, MAC entered into a copper Net Smelter Royalty (“NSR”) in favour of Glencore. This is at rate of 1.5% for copper only based on the NSR received by CMPL for the life of the mine.

Further, CMPL converted its former Restdown, Restdown South and Horseshoe Joint Venture (EL6140, EL6739 and EL6501) interest into a 1% NSR royalty-only interest as of February 8, 2022. There is no current or planned production from these mineral interests.

17

Federal environmental laws are established under the Environment Protection and Biodiversity Conservation Act 1999 (Cth), as amended (the “EPBC Act”) which provides a legal framework to protect and manage matters of national environmental significance. The EPBC Act applies to any activity that is likely to have a significant impact on identified matters of national significance. EPBC Act approval may be required for certain actions or activities that affect Australia’s environment, for example when our mining or exploration activities may impact water resources or endangered flora or fauna. In addition to federal laws, our operations are also subject to New South Wales environmental law including the EP&A Act, the Protection of the Environment Operations Act 1997 (NSW) (“POEO Act”), the Water Act 1912 (NSW), Water Management Act 2000 (NSW), Biodiversity Conservation Act 2016 (NSW) and associated regulations, as amended. Our environmental impact is also governed by an Environment Protection Licence held under the POEO Act which includes conditions that restrict CSA Copper Mine operations. Together, this regulatory framework and authorities govern our environmental performance within our operational footprint including impacts on existing landforms, Australian biodiversity, the quality of ecosystems, Aboriginal heritage matters, water usage, environmental rehabilitation obligations, air emissions, wastewater discharges, air quality standards, greenhouse gas emissions, waste management, handling and disposal of hazardous and radioactive substances, remediation of soil and groundwater contamination, land use, the discharge of materials into the environment, groundwater quality and availability and the public’s interest in any of the aforementioned items.

The CSA Copper Mine is operated in accordance with work health and safety regulations imposed under federal and state work health and safety legislation, the Work Health and Safety Act 2011 (Cth) and Work Health and Safety Act 2011 (NSW), the Work Health and Safety (Mines and Petroleum Sites) Act 2013 (NSW) and associated regulations, as amended. These laws impose minimum working and safety conditions that we must impose at the CSA Copper Mine and to ensure its operations are generally maintained at a competent level to protect our employees and contractors.

Our dams and tailings dams are operated in accordance with the Dam Safety Act 2015 (NSW) which requires it to have emergency and operation plans in place to mitigate any potential risks, and to report on incidents and annual operations.

Our use of land for mining and other operations activities is subject to the Native Title Act 1993 (Cth), as amended (“NT Act”), which may limit our operations in areas that native title is found to persist. Where native title interests are identified, exploration and mining activities may be limited until a right to negotiate process is completed between us and the native title claimants and, in certain circumstances, an Indigenous Land Use Agreement may be entered into. Native Title Determination Application NC2012/001 in favor of the Ngemba, Ngiyampaa, Wangaaypuwa and Wayilwan people is currently being determined in the Federal Court of Australia. In the event the NNWW Application is resolved, we may need to comply with the NT Act with respect to future operations or expansions, which may include entering into an Indigenous Land Use Agreement or paying compensation in connection with future mining activities.

In addition to the NT Act, we have obligations under the National Parks and Wildlife Act 1974 (NSW) to refrain from harming Aboriginal objects and heritage places. We have in place policies and procedures to ensure our mining activities do not damage Aboriginal heritage sites.

Environmental, mining, safety and other laws and regulations continue to evolve, which may require us to meet stricter standards and give rise to greater enforcement, which may result in increased fines and penalties for non-compliance or may result in a heightened degree of responsibility for companies and their officers, directors and employees. Future laws, regulations, permits or legal requirements, as well as the interpretation or enforcement of existing requirements, may require substantial increases in capital or operating costs to achieve and maintain compliance or may otherwise delay, limit or prohibit our development plans and future operations, or place other restrictions upon, our development plans or future operations or result in the imposition of fines and penalties for failure to comply.

Complying with these regulations is complicated and requires significant attention and resources. We have an extensive history of operations and our employees have a significant amount of experience working with various federal, state and local authorities to address compliance with such laws, regulations and permits. However, we cannot be sure that we will be in compliance with such requirements. We expect to continue to incur significant sums for ongoing regulatory expenditures, including salaries, and the costs for monitoring, compliance, remediation, reporting, pollution control equipment and permitting.

18

We are not aware of any probable government regulations that would materially impact us at this time, however there can be no assurance that regulations may not arise in the future that may have a negative effect on the company’s results of operations, earnings and competitive position.

Environment and Community

We have obligations to comply with national and state based environmental, work health and safety and community laws in operating and developing the CSA Copper Mine and its related assets. These include, among others, the EPBC Act, the NT Act, the Environmental Planning and Assessment Act 1979 (NSW), the Protection of the Environment Operations Act 1997 (NSW), the Work Health and Safety Act 2011 (NSW), the Mining Act 1992 (NSW), subsidiary legislation, local planning laws and the conditions of our material mining tenements and licenses.

We operate under a documented Environmental Management System which forms the basis of environmental management at the CSA Copper Mine and includes appropriate procedures, standards, and Environmental Management Plans that are designed to ensure all legal and regulatory requirements are met.

We identified potential environmental impacts likely to be associated with the CSA Copper Mine operations and has in-place appropriate design and operational measures that are designed to offset these potential impacts.

The STSF has been operating consistently, storing approximately 55kt of tailings per month. At this rate, the STSF has capacity to store tailings up to December 2024. The next STSF embankment raise, stage 10, has received permitting approval. CSA has also initiated early phase planning for the subsequent embankment raise, stage 11, to provide additional storage capacity beyond 2028. Regulatory standards that currently apply to the STSF are Dam Safety NSW and Australian National Committee on Large Dams. Independent reports confirm that the STSF is well operated with some observed issues in relation to the facility’s integrity. A tailings storage facility stability assessment, conducted by Golder Associates Pty Ltd, has indicated some sections of the dam where the Factor of Safety (“FOS”) is below the target for Post Seismic Liquified Strength. However, the Static FOS (Undrained Strength) remains within target for these areas. Designs are in place to add buttressing to sections of the stage 9 STSF wall to improve the FOS against slope failure at a cost of A$11.5 million and is expected to be completed in early 2024.

The decommissioned NTSF adjacent to the northern boundary of the STSF, is excised from the CSA Copper Mine lease (CML5) and is owned by the New South Wales government, but its recommissioning is one of the options under consideration for future additional tailings storage capacity.

Our 2021 estimate of closure costs to rehabilitate the existing disturbance area at the CSA Copper Mine, if the mine closed today, totals approximately A$69 million (US$46 million). However, in practice progressive rehabilitation is typically undertaken over the life of the mine, significantly reducing the final closure cost. We have a current rehabilitation bond required to be posted with the Department of Regional New South Wales for closure obligations in the amount of A$44.03 million (US$30.12 million).

Permitting and Development Consents

The CSA Copper Mine operates under several authorizations, including:

| · | Mining tenements issued under the Mining Act 1992 (NSW), including Consolidated Mining Lease No. 5 and Mining Purposes Leases No. 1093 and 1094; |

| · | Landowner’s Consent authorized by NSW Department of Planning Infrastructure and Environment (“DPIE”) |

19

| · | Development Consents authorized by the Cobar Shire Council (“CSC”), under referral from other government departments; Rehabilitation Management Plan (“RMP”), with the Forward Program and Rehabilitation Objectives authorized by the NSW Resources Regulator; |

| · | Environmental Protection License (EPL1864) authorized by the NSW Environmental Protection Agency (“EPA”); |

| · | Water Licenses issued under the Water Management Act 2000 (NSW); responsibilities for authorizing and managing water licenses are shared between the Natural Resources Access Regulator and Water NSW; and |

| · | NSW Western Lands Leases granted under the Western Lands Act of 1901 (NSW) and the Western Lands Act 1901. |

Mining projects in NSW (including expansions or modifications of existing projects) require development consent under the NSW Environmental Planning and Assessment Act 1979 (“EP&A Act”).

The earliest statutory development consent held by CMPL for the CSA mine is Local Development Consent No. 31/95 and Amendment 97/98:33 approved by CSC in 1995 and 1998 which permits use of the CSA mine site by CMPL. Subsequent expansions and amendments of mining development at CSA mine have all been assessed and administered by the CSC.

Rehabilitation Management Plan

Environmental aspects of mineral exploration and mining (including mine rehabilitation and closure) in New South Wales are administered under the NSW Mining Act 1992. Following the recent introduction of the Mining Amendment (Standard Conditions of Mining Leases — Rehabilitation) Regulation 2021, the MOP for large mines has been replaced by a targeted Rehabilitation Management Plan. This has replaced the current requirement for an Annual Environmental Management Report.

As a condition of compliance with a mining lease, a mine is required to prepare and implement a Rehabilitation Management Plan which includes a risk assessment, a Forward Program that covers three years and an annual report. The CSA Mine has completed a Rehabilitation Management Plan and has had its Rehabilitation Objectives Statement approved by the NSW Resources Regulator. CSA, as the lease holder, will provide annual reporting and scheduling of rehabilitation via an Annual Report and Forward Programme (three-year period).

Environmental Protection License

The Protection of the Environment Operations Act (“POEO Act”) is the statutory instrument through which certain specified activities are regulated by the NSW EPA. Activities are administered by means of Environment Protection Licenses (“EPLs”) issued to operators of the premises on which the activities occur. CSA currently holds EPL1864 authorizing mining of minerals to a maximum annual production capacity of 2Mtpa. The EPL1864 has a current Environmental Risk Level of 1, with Level 1 being the lowest risk score.

The most recent EPL review was completed on April 21, 2021, with the next review due on April 21, 2026. There are no additional required activities by CSA and given the historical operations of the mine and long-standing, regular interactions with the regulator, no material changes are expected to occur as a result of these reviews.

Water Licenses

At present, we hold an entitlement of 1,356 megalitres per annum (“MLpa”) of high security water, as measured from the origin, under the Water Sharing Plan for the Macquarie and Cudgegong Regulated Rivers Water Source via a number of water licenses. These water licenses are issued under the Water Management Act 2000 (NSW). A portion of our entitlement is lost in transit to the CSA Copper Mine due to factors such as evaporation and seepage along the Albert Priest Chanel and pipeline. As a result, the amount of water available for the CSA Copper Mine to utilize is approximately 950 MLpa (being equal to current site water demand). However, during periods of serious drought, we may not be able to access its full share of water under the water-sharing plan.

20

We also hold groundwater entitlements. However, river water is preferred due to the levels of sulphates and the hardness of the ground water, which renders it unsuitable for use unless treated via reverse osmosis.

Violation and Fines

We are not aware of any current material violations or fines imposed under the Regulations of the Mining Act 1992 that apply to the CSA Mine.

Encumbrances

We are not aware of any material encumbrances that would impact the current resource or reserve disclosures as presented herein.

Community Awareness, Benefits and Government Relations

There is strong community support for the CSA Copper Mine operation, and we have a positive working relationship with the CSC. The CSA Copper Mine is the largest employer in the Cobar region, with approximately 500 employees and contractors.

We are involved with a number of community projects including:

| · | assistance with the establishment of regular air services between Sydney and Cobar in 2015; |

| · | regular donations to local community initiatives; and |

| · | scholarships to students entering their final year of university. |

Overall, there is strong local and state government support for the continuation of mining within the Cobar region.

Climate Change and Carbon Emissions

The CSA Copper Mine ranks in the second quartile on the Carbon Emissions Intensity curve for Global Copper Mines with approximately 2.8 tons of CO2e per ton of copper equivalent produced. Scope 1 emissions represent about 14% of the total CO2e, whilst Scope 2 emissions represent 86%.

Scope 1 emissions predominantly relate to the diesel consumption from the mining fleet. Overall diesel consumption for the period of 30 June 2022 to 30 June 2023 (being the relevant regulatory reporting period under Australian law) was 4,516 kiloliters, with diesel usage fluctuations depending on construction projects related to the tailings dam. Scope 2 emissions predominantly relate to purchased electricity with the period of 30 June 2022 to 30 June 2023 (being the relevant regulatory reporting period under Australian law) consumption at 119,741 MWhrs and the average consumption per year estimated at 123,549 MWhrs over the next four years. The mine consumption of electricity relates mainly to ventilation and cooling in the mine, jaw crusher and sag mill, dewatering, press filter ventilation/chiller, paste fill and mine hosting and represent approximately 95% of the total electricity consumption. The region has substantial solar power generation with Nyngan and Nevertire power plants providing 102MW and 132MW, respectively. Currently, approximately 20% of our existing power supply for the CSA Copper Mine is received from the nearby Nyngan Solar Farm.

Given the depth, the CSA Copper Mine has a high demand for ventilation and cooling to provide a safe working environment for all underground personnel. Furthermore, the overall operations have latent capacity in the process plant, hoisting capacity and associated infrastructure.

21

We are committed to managing our operations’ associated carbon emissions and energy usage, by (i) supporting renewable energy initiatives in surrounding regions, (ii) focusing on improving and continually reviewing our mining operations to lower energy consumption and improve overall operational efficiency, and (iii) exploring the use and implementation of sustainable drivetrains such as battery electric vehicles to replace the diesel-powered mining fleet.

We are also engaging with several third parties in relation to various renewable energy opportunities for the supply of renewable energy to the mine site, including supply from potential thermal, solar and wind opportunities. We are also seeking to implement a more efficient and robust system of collecting and reporting on emissions data, including, for example, scoping work on our fuel management system.

Legal Proceedings

From time to time, we may be involved in various legal proceedings arising from the ordinary course of business activities. We are not presently a party to any litigation the outcome of which we believe, if determined adversely to us, would individually or taken together have a material adverse effect on our business, financial condition and results of operations.

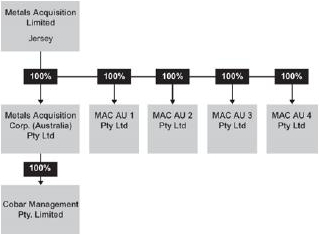

| C. | Organizational Structure |

The following diagram depicts a simplified organizational structure of the Company as of the date hereof.