As filed with the Securities and Exchange Commission on December 22, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

Under

The Securities Act of 1933

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Jersey, Channel Islands (State or Other Jurisdiction of | 1000 (Primary Standard Industrial | Not Applicable (I.R.S. Employer |

Michael James McMullen

3rd Floor, 44 Esplanade,

St. Helier, Jersey, JE4 9WG

+44 1534 514 000

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

John Rhett Miles Bennett

425 Houston Street, Suite 400,

Fort Worth, Texas 76102

(817) 698-9901

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Ryan J. Dzierniejko

Skadden, Arps, Slate, Meagher & Flom LLP

One Manhattan West

New York, NY 10001

(212) 735-3000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (as amended, the “Securities Act”), check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

† | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

EXPLANATORY NOTE

Pursuant to Rule 429 under the Securities Act of 1933, as amended (the “Securities Act”), the prospectus included in this Registration Statement on Form F-1 (the “Registration Statement”) is a combined prospectus (the “Combined Prospectus”) relating to the following securities of Metals Acquisition Limited (the “Registrant”) being registered on this Registration Statement and previously registered on the Registrant’s Registration Statement on Form F-1 (File No. 333-273088), which was declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on August 22, 2023 (as amended, the “Prior Form F-1”) and the Registrant’s Registration Statement on Form F-4 (File No. 333-269007), which was declared effective by the SEC on May 11, 2023 (as amended, the “Prior Form F-4,” and together with Prior Form F-1, the “Prior Registration Statements”):

| (i) | 836,819 ordinary shares, par value $0.0001 per share (the “Ordinary Shares”) being newly registered for resale by the selling securityholders under this Registration Statement, as described in the Combined Prospectus; |

| (ii) | up to 8,838,260 Ordinary Shares previously registered for issuance upon the exercise of warrants to purchase Ordinary Shares of the Registrant pursuant to the Prior Form F-4; and |

| (iii) | up to 54,653,386 Ordinary Shares and 6,535,304 Private Warrants previously registered for resale pursuant to the Prior Form F-1 which were previously issued to certain of the selling securityholders, of which 6,535,304 represents Ordinary Shares underlying Private Warrants. |

The listing of the Selling Securityholders and the Ordinary Shares and Private Warrants registered for resale on behalf of the Selling Securityholders under the heading “Selling Securityholders” in the Combined Prospectus reflects the prior sale (following the effective date of the Prior Form F-1) by the Selling Securityholders of an aggregate of 149,860 Ordinary Shares.

In addition to registering 836,819 Ordinary Shares, this Registration Statement constitutes a Post-Effective Amendment No. 1 to each of the Prior Registration Statements and is being filed to update the Prior Registration Statements to (i) include consolidated financial statements as of June 30, 2023 and for the six months ended June 30, 2023 for MAL and its controlled subsidiaries and financial statements as of June 15, 2023 and for the period from January 1, 2023 to June 15, 2023, for CMPL and (ii) update certain other information contained in the Prior Registration Statements. Such Post-Effective Amendment No. 1 to each of the Prior Registration Statements shall hereafter become effective concurrently with the effectiveness of this Registration Statement in accordance with Section 8(c) of the Securities Act.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission, or “SEC,” is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 22, 2023

PRELIMINARY PROSPECTUS

Metals Acquisition Limited

64,478,325 ORDINARY SHARES

6,535,304 PRIVATE WARRANTS

This prospectus relates to the following: (i) the issuance by us of 8,838,260 ordinary shares, par value $0.0001 per share (the “Ordinary Shares”) issuable upon the exercise of 8,838,260 outstanding Public Warrants (as defined herein); and (ii) the offer and resale, from time to time, by the selling securityholders named herein (the “Selling Securityholders”), or their pledgees, donees, transferees, or other successors in interest, of up to an aggregate of 55,640,065 Ordinary Shares and 6,535,304 Private Warrants (as defined herein) issued to certain Selling Securityholders in connection with the Business Combination (as defined herein), consisting of: (a) up to 10,000,000 Ordinary Shares issued as part of the consideration in the Business Combination valued at $10.00 per share, (b) up to 5,640,362 Ordinary Shares distributed to the members of the Sponsor, originally issued to the Sponsor for an aggregate purchase price of approximately $0.004 per share, (c) up to 2,500,000 Ordinary Shares issued to Osisko Bermuda Limited pursuant to a subscription agreement (the “Copper Stream Subscription Agreement”) at $10.00 per share, (d) (x) up to 1,500,000 Ordinary Shares issued to Sprott Private Resource Lending II (“Sprott”) pursuant to a subscription agreement (the “Sprott Subscription Agreement”) at $10.00 per share in connection with the Mezz Facility (as defined herein) and (y) up to 3,187,500 Ordinary Shares issuable upon exercise of 3,187,500 warrants held by Sprott originally issued in connection with the Mezz Facility and Sprott Subscription Agreement, which are exercisable at a price per share of $12.50 (the “Financing Warrants”), (e) up to 1,500,000 Ordinary Shares issued to Osisko Bermuda Limited pursuant to a subscription agreement (the “Silver Stream Subscription Agreement”) at $10.00 per share, (f) up to 9,451,747 Ordinary Shares issued to certain Selling Securityholders under the Initial PIPE Financing (as defined herein) consummated in connection with the Business Combination at $10.00 per share, (g) up to 4,500,000 Ordinary Shares issued to BlackRock Funds in connection with the Initial PIPE Financing at $10.00 per share (plus 315,000 Founder Shares which the Sponsor transferred in connection therewith), (h) up to 2,000,000 Ordinary Shares issued to SailingStone Funds in connection with the Initial PIPE Financing at $10.00 per share (plus 90,000 Founder Shares which the Sponsor transferred in connection therewith), (i) up to 2,000,000 Ordinary Shares issued to BEP Special Situations VI LLC in connection with the Initial PIPE Financing at $10.00 per share (plus 83,333 Founder Shares which the Sponsor transferred in connection therewith), (j) (x) up to 5,000,000 Ordinary Shares issued to Fourth Sail Funds in connection with the Initial PIPE Financing at $10.00 per share (plus 500,000 Founder Shares which the Sponsor transferred in connection therewith) and (z) up to 500,000 Ordinary Shares issuable upon exercise of 500,000 Private Warrants (as defined herein) (which the Sponsor transferred in connection with the Initial PIPE Financing), (k) up to 6,035,304 Ordinary Shares issuable upon the exercise of 6,035,304 outstanding private placement warrants, which have been distributed to members of the Sponsor, originally issued in a private placement in connection with the initial public offering of Metals Acquisition Corp (“MAC”) at a price of $1.50 per warrant, which are exercisable at a price per share of $11.50 (the “Private Warrants”), and (l) up to 836,819 Ordinary Shares issued to certain Selling Securityholders under the October PIPE Financing (as defined herein) at $11.00 per share. Although certain of our shareholders are subject to restrictions regarding the transfer of their securities, these Ordinary Shares may be sold after the expiration of the applicable lock-up periods. The market price of our Ordinary Shares could decline if the Selling Securityholders sell a significant portion of our Ordinary Shares or are perceived by the market as intending to sell them.

We are registering the offer and resale of these securities to satisfy certain registration rights we have granted. The Selling Securityholders may offer all or part of the securities for resale from time to time through public or private transactions, in amounts, at prices and on terms determined at the time of offering. The Selling Securityholders may offer and sell these securities directly to purchasers, through agents in ordinary brokerage transactions, directly to market makers of our shares or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of securities offered hereunder, the Selling Securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”).

We will not receive any proceeds from the sale of the Ordinary Shares or Private Warrants by the Selling Securityholders pursuant to this prospectus or of the Ordinary Shares issued by us pursuant to this prospectus, except with respect to amounts received by us upon exercise of the Public Warrants, Private Warrants and Financing Warrants (together, the “Warrants”) to the extent such Warrants are exercised for cash, which amount of aggregate proceeds, assuming the exercise of all Warrants for cash, could be up to approximately $216.6 million. We believe the likelihood that warrant holders will exercise their Warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the market price of our Ordinary Shares. If the market price for our Ordinary Shares is less than $11.50 per share, we believe the holders of Public Warrants and Private Warrants will be less likely to exercise their Public Warrants and Private Warrants. If the market price for our Ordinary Shares is less than $12.50 per share, we believe the holders of Financing Warrants will be less likely to exercise their Financing Warrants. On December 19, 2023, the closing price of our Ordinary Shares on the New York Stock Exchange (“NYSE”) was $10.50 per share. In the event the market price of our Ordinary Shares is below the exercise price of our Warrants, we are unlikely to receive any proceeds from the exercise of our Warrants in the near future, if at all. See “Risk Factors—Risks Relating to Ownership of our Securities—The Warrants may never be in the money, and may expire worthless.”

Given the significant number of our Ordinary Shares that were redeemed in connection with the Business Combination, the number of Ordinary Shares that the Selling Securityholders can sell into the public markets and that are issued pursuant to this prospectus exceeds our current free float. As a result, significant near-term resales and/or issuances of our Ordinary Shares pursuant to this prospectus could have a significant, negative impact on the trading price of our Ordinary Shares since the number of Ordinary Shares that can be resold and/or issued, as the case may be, pursuant to this prospectus would constitute a considerable increase to our current free float. This impact may be heightened by the fact that, as described above, certain of the Selling Securityholders purchased shares of our Ordinary Shares at prices that are below the current trading price of our Ordinary Shares. The 64,478,325 Ordinary Shares registered for resale and/or issuance represent approximately 93.7% of the shares of our Ordinary Shares outstanding as of December 14, 2023 (assuming the exercise of all derivative securities for which underlying shares have been registered for resale and/or issuance).

We will pay the expenses, other than underwriting discounts and commissions and expenses incurred by the Selling Securityholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Securityholders in disposing of the securities, associated with the sale of securities pursuant to this prospectus.

Our Ordinary Shares and Public Warrants are listed on NYSE under the trading symbols “MTAL” and “MTAL.WS.” On December 19, 2023, the closing price for our Ordinary Shares on NYSE was $10.50 per share and the closing price for our Public Warrants on NYSE was $1.63 per unit.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are an “emerging growth company” and a “foreign private issuer” as those terms are defined under the U.S. federal securities laws and, as such, are subject to certain reduced public company disclosure and reporting requirements. See “Prospectus Summary—Emerging Growth Company” and “Prospectus Summary—Foreign Private Issuer.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 9 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PROSPECTUS DATED , 2023

TABLE OF CONTENTS

| ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

ENFORCEABILITY OF CIVIL LIABILITIES AND AGENT FOR SERVICE OF PROCESS IN THE UNITED STATES | ||

You should rely only on the information contained or incorporated by reference in this prospectus or any supplement. Neither we nor the Selling Securityholders have authorized anyone else to provide you with different information. The securities offered by this prospectus are being offered only in jurisdictions where the offer is permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any date other than the date on the front of each document. Our business, financial condition, results of operations and prospects may have changed since that date.

Except as otherwise set forth in this prospectus, neither we nor the Selling Securityholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-1 filed with the SEC by Metals Acquisition Limited. The Selling Securityholders named in this prospectus may, from time to time, sell the securities described in this prospectus in one or more offerings. We believe the likelihood that warrant holders will exercise their warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the trading price of our Ordinary Shares. If the market price for our Ordinary Shares is less than $11.50 per share, we believe the holders of Public Warrants and Private Warrants will be less likely to exercise their Public Warrants and Private Warrants. If the market price for our Ordinary Shares is less than $12.50 per share, we believe the holders of Financing Warrants will be less likely to exercise their Financing Warrants. See “Risk Factors—Risks Relating to Ownership of our Securities—The Warrants may never be in the money, and may expire worthless.” This prospectus includes important information about us, the securities being offered by the Selling Securityholders and other information you should know before investing. Any prospectus supplement may also add, update, or change information in this prospectus. If there is any inconsistency between the information contained in this prospectus and any prospectus supplement, you should rely on the information contained in that particular prospectus supplement. This prospectus does not contain all of the information provided in the registration statement that we filed with the SEC. You should read this prospectus together with the additional information about us described in the section below entitled “Where You Can Find Additional Information.” You should rely only on information contained in this prospectus, any prospectus supplement and any related free writing prospectus. We have not, and the Selling Securityholders have not, authorized anyone to provide you with information different from that contained in this prospectus, any prospectus supplement and any related free writing prospectus. The information contained in this prospectus is accurate only as of the date on the front cover of the prospectus. You should not assume that the information contained in this prospectus is accurate as of any other date.

The Selling Securityholders may offer and sell the securities directly to purchasers, through agents selected by the Selling Securityholders, to or through underwriters or dealers, or through any other means described in “Plan of Distribution.” A prospectus supplement, if required, may describe the terms of the plan of distribution and set forth the names of any agents, underwriters or dealers involved in the sale of securities.

References to “A$” or “AU$” in this prospectus refer to the Australian dollar, the official currency of Australia, and references to “U.S. dollars,” “US$” and “$” in this prospectus are to United States dollars, the legal currency of the United States. Discrepancies in any table between totals and sums of the amounts listed are due to rounding. Certain amounts and percentages have been rounded; consequently, certain figures may add up to be more or less than the total amount and certain percentages may add up to be more or less than 100%. In particular and without limitation, amounts expressed in millions contained in this prospectus have been rounded to a single decimal place for the convenience of readers.

Throughout this prospectus, unless otherwise designated or the context requires otherwise, the terms “we,” “us,” “our,” “the Company” and “our company” refer to Metals Acquisition Limited and its subsidiaries. References to “CMPL” mean Cobar Management Pty. Limited.

This document does not constitute a prospectus for the purposes of the Companies (Jersey) law 1991 (as amended) and the consent of the Registrar of Companies in Jersey to the circulation of this document is therefore not required.

ii

FINANCIAL STATEMENT PRESENTATION

Prior to the Business Combination, we had no material assets and did not conduct any material activities other than those incident to our formation via the initial public offering on NYSE and certain matters related to the Business Combination, such as the making of certain required securities law filings. On June 15, 2023, we completed the Business Combination, and we became the holding entity of CMPL.

The historical operations of CMPL are deemed to be those of the Company. Thus, the financial statements included in this prospectus reflect (i) the historical operating results of CMPL prior to the Closing of the Business Combination, (ii) the results of Metals Acquisition Limited prior to the Closing of the Business Combination and (iii) the consolidated results of the Company and CMPL for the period following the Closing of the Business Combination. The audited consolidated financial statements of CMPL as of June 15, 2023, December 31, 2022 and December 31, 2021, and for the period from January 1, 2023 to June 15, 2023 and the years ended December 31, 2022 and December 31, 2021 included in this prospectus have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”), which we refer to as our financial statements. The unaudited interim financial statements of CMPL as of June 30, 2022 have been prepared in accordance with IAS 34 and the period ended June 30, 2022.

We refer in various places in this prospectus to non-GAAP financial measures (i) Cash Cost, After By- product Credits, (ii) AISC, After By-product Credits, and (iii) free cash flow which are more fully explained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Significant Factors Affecting our Results of Operations—Non-GAAP Financial Measures”. The presentation of non-GAAP information is not meant to be considered in isolation or as a substitute for our financial results prepared in accordance with IFRS.

iii

INDUSTRY AND MARKET DATA

Market, ranking and industry data used throughout this prospectus is based on the good faith estimates of our management, which in turn are based upon our management’s review of internal surveys, independent industry surveys and publications and other third-party research and publicly available information, as indicated. Industry reports, publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In some cases, we do not expressly refer to the sources from which this data is derived. While we have compiled, extracted, and reproduced industry data from these sources, we have not independently verified the data. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

iv

FORWARD-LOOKING STATEMENTS

This prospectus and any prospectus supplement contain a number of forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this prospectus, including statements regarding our future financial position, results of operations, business strategy and plans and objectives of management for future operations, are forward-looking statements. Any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are also forward-looking statements. In some cases, you can identify forward-looking statements by words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “strategy,” “future,” “opportunity,” “may,” “target,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters.

Forward-looking statements include, without limitation, our expectations concerning the outlook for our business, productivity, plans and goals for future operational improvements and capital investments, operational performance, future market conditions or economic performance and developments in the capital and credit markets and expected future financial performance, as well as any information concerning possible or assumed future results of operations of the Company. Forward-looking statements also include statements regarding the expected benefits of the Business Combination.

The forward-looking statements are based on the current expectations of our management and are inherently subject to uncertainties and changes in circumstance and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors,” those discussed and identified in public filings we made with the SEC and the following important factors:

| ● | the effect of any future pandemic; |

| ● | the benefits of the Business Combination; |

| ● | expansion plans and opportunities; |

| ● | our public securities’ potential liquidity and trading; |

| ● | the lack of a market for our securities; |

| ● | our financial performance following the Business Combination; |

| ● | adverse variances in the actual resources, reserves and life-of-mine inventories at CMPL from those contained in the Technical Report; |

| ● | adverse operating conditions and geotechnical risks applicable to our operations; |

| ● | our substantial capital expenditure requirements; |

| ● | our inability to effectively manage growth; |

| ● | the ability to maintain the listing of our Ordinary Shares and Public Warrants on the NYSE; |

| ● | our success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| ● | the risks associated with cyclical demand for our products and vulnerability to industry downturns and regional, national or global downturns; |

| ● | fluctuations in our revenue and operating results; |

v

| ● | fluctuations and volatility in commodity prices and foreign exchange rates; |

| ● | unfavorable conditions or further disruptions in the capital and credit markets and our ability to obtain additional capital on commercially reasonable terms; |

| ● | competition from existing and new competitors; |

| ● | our ability to integrate any businesses we acquire; |

| ● | our dependence on third-party contractors to provide various services; |

| ● | compliance with and liabilities related to environmental, health and safety laws, regulations and other regulations, including those related to climate change, including changes to such laws, regulations and other requirements; |

| ● | climate change; |

| ● | changes in U.S., Australian or other foreign tax laws; |

| ● | increases in costs, disruption of supply, or shortages of materials; |

| ● | general economic or political conditions; and |

| ● | other factors detailed under the section entitled “Risk Factors” herein. |

Should one or more of these risks or uncertainties materialize, or should any of the assumptions made by our management prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

We caution you against placing undue reliance on forward-looking statements, which reflect current beliefs and are based on information currently available as of the date a forward-looking statement is made. Forward-looking statements set forth herein speak only as of the date of this prospectus. We do not undertake any obligation to revise forward-looking statements to reflect future events, changes in circumstances, or changes in beliefs. In the event that any forward-looking statement is updated, no inference should be made that we will make additional updates with respect to that statement, related matters, or any other forward-looking statements. Any corrections or revisions and other important assumptions and factors that could cause actual results to differ materially from forward-looking statements, including discussions of significant risk factors, may appear in our public filings with the SEC, which will be accessible at www.sec.gov, and which you are advised to consult.

vi

FREQUENTLY USED TERMS

Unless otherwise stated or unless the context otherwise requires in this document:

“2023 Plans” means the Incentive Plan, ESPP and DSU Plan, collectively.

“A&R Registration Rights Agreement” means the Amended and Restated Registration Rights Agreement we entered into with the Sponsor, Glencore and certain owners of equity interests in MAC concurrently with the Closing, pursuant to which that certain Registration Rights Agreement, dated as of July 28, 2021, was amended and restated in its entirety, as of the Closing.

“Ag” means silver.

“Articles” means our amended and restated memorandum and articles of association.

“ASX” means the Australian Securities Exchange operated by ASX Limited.

“Board” means the board of directors of the Company.

“Business Combination” means the Merger and the other transactions contemplated by the Share Sale Agreement, collectively.

“Citi Debt” means Citibank, N.A., Sydney Branch.

“Closing” means the consummation of the Business Combination on June 15, 2023, including the transactions contemplated by the Share Sale Agreement.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“Continental” refers to Continental Stock Transfer & Trust Company.

“Copper Stream” means the copper purchase agreement dated March 20, 2023 entered into by and among MAC-Sub, MAC and us in connection with the Redemptions Backstop Facility.

“COVID-19” or the “COVID-19 pandemic” means SARS-CoV-2 or COVID-19, and any evolutions or mutations thereof or other epidemics, pandemics or disease outbreaks.

“CSA Mine” means the Cornish, Scottish and Australian underground copper mine near Cobar, New South Wales, Australia.

“Cu” means copper.

“DSU Plan” means the 2023 Non-Employee Directors Deferred Unit Plan.

“EBITDA” means earnings before interest, taxes, depreciation and amortization.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“ESPP” means the 2023 Employee Stock Purchase Plan.

“Financing Warrants” means the warrants to purchase Ordinary Shares issued to Sprott under the Mezz Facility.

“Founder Shares” means the MAC Class B Ordinary Shares.

“GAH” means Glenore Australia Holdings Pty Limited (Australian Treasury).

“GIAG” means Glencore International AG.

vii

“IFRS” means International Financial Reporting Standards, as issued by the International Accounting Standards Board.

“Incentive Plan” means the 2023 Long-Term Incentive Plan.

“Indicated Mineral Resources” means that part of a Mineral Resource for which quantity, grade (or quality), densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. The nature, quality, amount and distribution of data are such as to allow confident interpretation of the geological framework and to assume continuity of mineralization. An Indicated Mineral Resource may be converted to a probable Ore Reserve.

“Inferred Mineral Resources” means that part of a Mineral Resource for which quantity and grade (or quality), are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply, but not to verify, geological and grade (or quality) continuity. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. Confidence in the estimate of Inferred Mineral Resources is not sufficient to allow the application of technical and economic parameters to be used for detailed planning studies. An Inferred Mineral Resource must not be converted to an Ore Reserve. While it is reasonably expected that the majority of an Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with further drilling or exploration data, there is no certainty that this will be the case.

“Initial PIPE Financing” means the private placement of Ordinary Shares to fund a portion of the consideration for the Business Combination.

“Initial PIPE Investors” means the investors that participated in the Initial PIPE Financing, collectively.

“initial shareholders” means certain of MAC’s officers and directors that are principals of the Sponsor and which indirectly held the Founder Shares through their holdings of Class B units in the Sponsor, which entitled them to an equivalent number of Ordinary Shares upon distribution.

“IPO” means MAC’s initial public offering of units, consummated on August 2, 2021.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended.

“JORC Code” means the Australasian Joint Ore Reserve Committee Code, 2012 edition.

“LME” means the London Metal Exchange.

“MAC Class A Ordinary Shares” means MAC’s Class A ordinary shares, par value $0.0001 per share.

“MAC Class B Ordinary Shares” means MAC’s Class B ordinary shares, par value $0.0001 per share.

“management” or our “management team” means the officers of the Company.

“Material” means all copper concentrate produced by the CSA Mine that is derived from minerals within the mining Tenements, produced by the operations or produced or derived from any ore, minerals or concentrates which are inputted to and/or processed through the plant (including any ore, minerals or concentrate produced or derived from any mining lease that is not the Mining Tenements) or as further set out in Clause 4 of the Offtake Agreement.

“Measured Mineral Resources” means that part of a Mineral Resource for which quantity, grade (or quality), densities, shape and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. The nature, quality, amount and distribution of data are such as to leave no reasonable doubt that the tonnage and grade of mineralization can be estimated to within close limits and that any variations from the estimate would be unlikely to significantly affect potential economic viability. A Measured Mineral Resource may be converted to a proven Ore Reserve (or to a probable Ore Reserve where circumstances other than geological confidence suggest that a lower confidence level is appropriate).

viii

“Merger” means the merger of MAC with and into the Company, with the Company continuing as the surviving company pursuant to the Plan of Merger.

“Mezz Facility” means the US$135 million mezzanine debt facility provided by Sprott to MAC-Sub.

“Mineral Resource” means a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such a form, grade (or quality) and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade (or quality), continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

“Modifying Factors” has the meaning given to it in the JORC Code.

“mt” means metric tonne.

“NSW” means New South Wales, Australia.

“NYSE” means The New York Stock Exchange.

“October PIPE Financing” means the private placement of Ordinary Shares made on October 13, 2023, in accordance with the terms of the Subscription Agreements.

“October PIPE Investors” means the investors that participated in the October PIPE Financing, collectively.

“Offtake Agreement” means a life-of-mine offtake obligation committing us to sell to GIAG all Material, and committing GIAG to buy all Material.

“Ordinary Shares” means our ordinary shares, par value $0.0001 per share, and having the rights and being subject to the restrictions specified in the Articles.

“Ore Reserve” means the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses which may occur when the material is mined or extracted and is defined by studies at Pre-Feasibility or Feasibility level that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified.

“PCAOB” means the Public Company Accounting Oversight Board.

“Private Warrants” means the 6,535,304 private placement warrants issued by us in exchange for MAC private placement warrants originally issued in a private placement in connection with MAC’s IPO at a price of $1.50 per warrant, which are exercisable at a price per share of $11.50.

“public shares” means MAC Class A Ordinary Shares included in the units sold by MAC in its IPO.

“public shareholders” means the holders of MAC Class A Ordinary Shares.

“Public Warrants” means the warrants included in the units sold in MAC’s IPO, each of which was exercisable for one MAC Class A Ordinary Share, in accordance with its terms.

“redemption” means the redemption of public shares for cash pursuant to the Articles.

“Redemptions Backstop Facility” means the up to US$100 million backstop facility provided by Osisko, US$75 million Copper Stream and US$25 million equity subscription following completion of redemptions on a pro-rata basis between the Copper Stream and equity subscription.

ix

“registrable securities” means, collectively, (a) the Founder Shares, (b) the private placement warrants (including any Ordinary Shares issued or issuable upon the exercise of the private placement warrants), (c) any outstanding Ordinary Shares or any other equity security (including the Ordinary Shares issued or issuable upon the exercise of any other equity security) of the Company held by a party to the A&R Rights Agreement, (d) any equity securities (including the Ordinary Shares issued or issuable upon the exercise of any such equity security) of the Company issuable upon conversion of any working capital loans in an amount up to $1,500,000 made to the Company by a party to the A&R Rights Agreement (including the Working Capital Warrants and any Ordinary Shares issued or issuable upon the exercise of the Working Capital Warrants) and (e) any other equity security of the Company issued or issuable with respect to any such Ordinary Share by way of a share capitalization or share split or in connection with a combination of shares, recapitalization, merger, consolidation or reorganization.

“Reserve” means an estimate of tonnage and grade or quality of Indicated and Measured Mineral Resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or Indicated Mineral Resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted.

“Royalty Area” means the area within the boundaries of the Tenements, meaning (a) the mining and exploration tenements (being the leases, licenses, claims, permits, and other authorities) and mining and exploration tenement applications listed in Schedule 1 to the Royalty Deed (whether registered or applied for) in each case as may be renewed, extended, substituted, replaced (including where an exploration license is replaced by a mining or other tenement with production rights) or consolidated; and (b) any other mining tenement, lease, license, claim, permit or authority applied for or granted wholly or partly in respect of the whole or any part of the area which is the subject, as at the Effective Date, of any of the mining or exploration tenements listed in Schedule 1 to the Royalty Deed that is at any time held, or an interest in which is at any time held, by the Grantor or any of its Related Bodies Corporate at the date on which the completion of the sale and purchase of the Shares in accordance with clause 8 of the Share Sale Agreement.

“Royalty Deed” means the deed between the Company, Glencore and CMPL, under which CMPL is required, on a quarterly basis, to pay to Glencore a royalty equal to 1.5% of Net Smelter Returns and grant security interests created as a result of the Royalty Deed. Net Smelter Returns are equal to the gross revenue minus permitted deductions for all marketable and metal-bearing copper material, in whatever form or state, that is mined, produced, extracted or otherwise recovered from the Royalty Area. Glencore has the right to transfer its interest in the Royalty Deed (subject to limited restrictions, and subject to a right of last refusal granted to CMPL) and the security created as a result of the Royalty Deed.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Senior Facilities” means the senior secured debt facility that MAC-Sub can draw down on for various purposes provided for in the SFA as part of the Debt Facilities.

“SFA” means the syndicated facilities agreement dated as of February 28, 2023, by and between MAC- Sub and the Senior Lenders, which sets forth the terms of the Senior Facilities.

“Senior Lenders” means Citi Debt, Bank of Montreal, Harris Bank, N.A., National Bank of Canada and The Bank of Nova Scotia, Australian Branch, collectively.

“Share Sale Agreement” means the Share Sale Agreement, entered into on March 17, 2022, by and among the Company, MAC, MAC-Sub and Glencore, as amended by the Deed of Consent and Covenant, dated as of November 22, 2022, as supplemented by the CMPL Share Sale Agreement Side Letter, dated as of April 21, 2023, as supplemented by the CMPL Share Sale Agreement Side Letter, dated May 31, 2023, and as further supplemented by the CMPL Share Sale Agreement Side Letter, dated June 2, 2023, as may be amended, supplemented, or otherwise modified from time to time.

“Silver Stream” means the up to US$90 million silver purchase agreement dated March 20, 2023 entered into by and among MAC-Sub, MAC, the Company and Osisko.

“Sponsor” means Green Mountain Metals LLC, a Cayman Islands limited liability company.

x

“Sponsor Letter Agreement” means the letter agreement, dated as of July 28, 2021, by and among Sponsor, the initial shareholders and MAC pursuant to which the parties agreed to vote all of their Founder Shares in favor of the Business Combination and related transactions and to take certain other actions in support of the Share Sale Agreement and related transactions.

“Subscription Agreements” means the subscription agreements, entered into or to be entered into by us and each of the October PIPE Investors in connection with the October PIPE Financing.

“Technical Report” means an independent technical review and independent technical report summary in accordance with SEC Regulation S-K Technical Report Summary requirements, which was prepared to accompany the SEC filing for the information of MAC’s shareholders.

“transfer agent” means Continental, our transfer agent.

“Trust Account” means the Trust Account that held a portion of the proceeds of the IPO and the concurrent sale of the private placement warrants.

“U.S. GAAP” means United States generally accepted accounting principles.

“VWAP” means volume-weighted average price.

“Warrants” means the Public Warrants, Private Warrants and Financing Warrants.

xi

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. You should read the following summary together with the more detailed information in this prospectus, any related prospectus supplement and any related free writing prospectus, including the information set forth in the sections titled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” in this prospectus, any related prospectus supplement and any related free writing prospectus in their entirety, and our financial statements and related notes thereto, before making an investment decision.

Overview

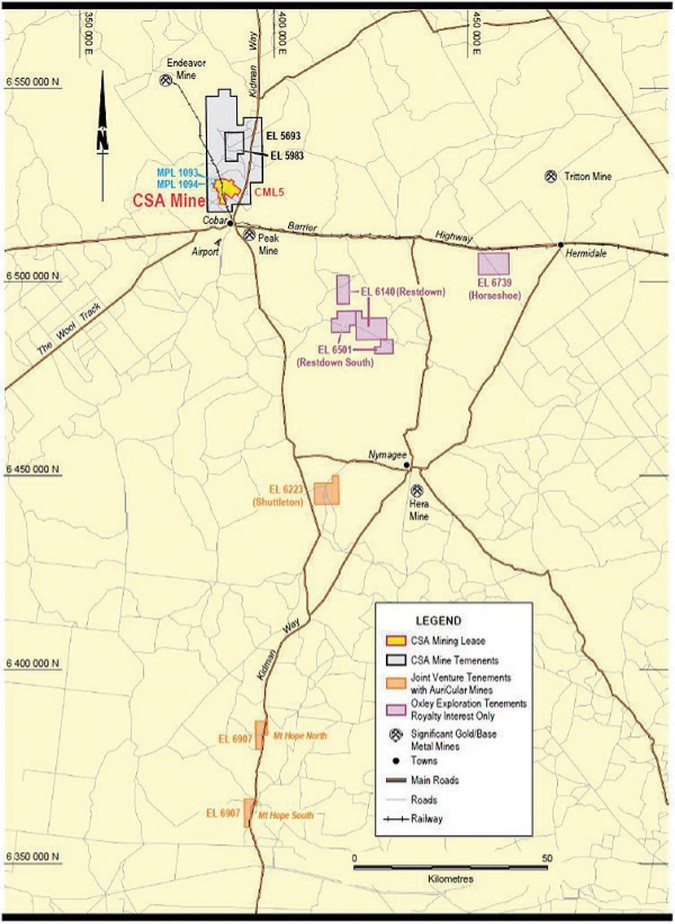

We operate the CSA Mine, which is located less than 1,000 kilometers west-northwest of Sydney near the town of Cobar in western New South Wales, Australia. Sealed highways and public roads provide all-weather access to the CSA Mine, and the CSA Mine is linked by rail to the ports of Newcastle and Port Kembla, New South Wales, from which the copper concentrate product is exported.

The CSA Mine has a long operating history, with copper mineralization first discovered in 1871. Development commenced in the early 1900s, focusing on near surface mineralization. In 1965, Broken Hill South Limited developed a new mechanized underground mining and processing operation, with new shafts, winders, concentrator, and infrastructure. Subsequently, it operated under several different owners, until Glencore acquired the property in 1999.

The underground mine is serviced by two hoisting shafts and a decline from surface to the base of the mine. Ore is produced principally from two steeply dipping underground mineralized systems, QTS North (“QTSN”) and QTS Central (“QTSC”), from depths currently between 1,500 to 1,900 meters below the surface. The current depth of the decline is around 1,900 meters. The ore is crushed underground, hoisted to surface, and milled and processed through the CSA concentrator. In 2022, the CSA Mine produced 144 kilotons (“kt”) of concentrate grading 26% copper containing 38kt of copper.

The currently estimated Ore Reserves support six and a half years of operation. The CSA Mine has a long history of resource renewal and exploration success, and there is reasonable geological evidence of continuity down dip.

The town of Cobar is serviced by a sealed airstrip, with commercial flights to and from Sydney. The project is well-served by existing infrastructure, which includes power supply, water supply, site buildings, and service facilities. Power is supplied to the site from the state energy network via a 132 kilovolt (“kV”) transmission line. A 22kV line is also connected to the site and is available for limited supply in emergencies. The state energy network is supplied by a mix of conventional and renewable power generation. Further diesel power generators are available to supply minimal backup power capable of supporting emergency room facilities and functions.

The majority of the water supply for the operation is provided by the Cobar Water Board from Lake Burrendong via a weir on the Bogan River at Nyngan through a network of pumps and pipelines. During times of significant drought, the CSA Mine may not be able to rely on this water supply. Additional water is available from tailings water recycling, surface water capture, and an installed borefield. Although the CSA Mine has water allocations provided under water licenses, there is no certainty of supply in times of significant drought. The supplementary water supply listed is not sufficient to maintain mining and processing operations at full production.

We believe that the CSA Mine has the potential to allow us to participate in the decarbonization of the world through the production and sale of copper, which is used in electrification production and supply. The copper concentrate produced by the CSA Mine is a well-known product in the global copper smelting market and is a quality product sought after for blending opportunities. By being in production already, the CSA Mine gives us the ability to participate in this opportunity as it evolves without the need for a major capital investment.

1

Recent Developments

Business Combination

On June 15, 2023 (the “Closing Date”), we consummated our Business Combination pursuant to the Share Sale Agreement, pursuant to which MAC-Sub acquired from Glencore 100% of the issued share capital of CMPL, which owns and operates the CSA Mine near Cobar, New South Wales, Australia. Immediately prior to the Business Combination, MAC merged with and into us. Following the Business Combination, we continued as the surviving company, and CMPL became an indirect subsidiary of us.

As part of the Business Combination: (i) each issued and outstanding MAC Class A Ordinary Share and MAC Class B Ordinary Share was converted into one Ordinary Share, and (ii) each issued and outstanding whole warrant to purchase MAC Class A Ordinary Shares was converted into one Warrant at an exercise price of $11.50 per share, subject to the same terms and conditions existing prior to such conversion.

Prior to the consummation of the Business Combination, MAC entered into Subscription Agreements with the Initial PIPE Investors, pursuant to which the Initial PIPE Investors agreed to subscribe for and purchase, and MAC agreed to issue and sell to the Initial PIPE Investors an aggregate of 22,951,747 Ordinary Shares at a price of $10.00 per share, for aggregate gross proceeds of $229,517,470. Four of the Initial PIPE Investors were officers and directors of MAC and one of the Initial PIPE Investors is also an affiliate of the Sponsor and they agreed to subscribe for 230,000 Ordinary Shares in the aggregate, at a purchase price of $10.00 per share, for aggregate gross proceeds of $2,300,000 all pursuant to the Subscription Agreements on the same terms and conditions as all other Initial PIPE Investors. Such subscribed shares were converted into Ordinary Shares in connection with the Business Combination. The Initial PIPE Investors were also granted customary registration rights in connection with the Initial PIPE Financing.

In connection with the Subscription Agreements, the Sponsor agreed to transfer an aggregate of 988,333 shares of Class B common stock of MAC that it held and agreed to sell 500,000 MAC private placement warrants at a price of $1.50 for each MAC private placement warrant to certain investors who agreed to subscribe for a significant number of Ordinary Shares.

MAC-Sub (as borrower), we and MAC (as guarantors) and Sprott (as lender) entered into a Mezzanine Loan Note Facility Agreement dated March 10, 2023 pursuant to which Sprott made available a US$135 million loan facility agreement available to MAC-Sub, for funding purposes in connection with the Business Combination (the “Mezz Facility”). In connection with the Mezz Facility, we, MAC, Sprott Private Resource Lending II (Collector), LP (the “Equity Subscriber”) and Sprott Private Resource Lending II (Collector-2), LP (the “Warrant Subscriber”), entered into a subscription agreement (the “Sprott Subscription Agreement”) pursuant to which the Equity Subscriber committed to purchase 1,500,000 Ordinary Shares at a purchase price of $10.00 per share and an aggregate purchase price of $15,000,000. In addition, in accordance with the terms of the Mezz Facility, the Warrant Subscriber received 3,187,500 warrants to purchase Ordinary Shares (the “Financing Warrants”) once the Mezz Facility began. Each Financing Warrant entitles the holder to purchase one Ordinary Share.

Moreover, certain other related agreements were executed in connection with the Business Combination, each as described under the heading “Certain Relationships and Related Person Transactions—Transactions Related to the Business Combination.”

The Business Combination was consummated on June 15, 2023 and on June 16, 2023, the Ordinary Shares and Public Warrants commenced trading on the NYSE under the symbols “MTAL” and “MTAL.WS,” respectively.

October 2023 PIPE Financing

On October 13, 2023, we entered into Subscription Agreements with the October PIPE Investors, pursuant to which the October PIPE Investors agreed to subscribe for and purchase, and we agreed to issue and sell to the October PIPE Investors, an aggregate of 1,827,096 Ordinary Shares at a price of $11.00 per share, for aggregate gross proceeds of $20,098,056. We also agreed to grant certain customary registration rights to certain October PIPE Investors in connection with the October PIPE Financing.

2

Appointment of Chief Financial Officer

On December 20, 2023, we announced the appointment of Mr. Morné Engelbrecht as Chief Financial Officer with an expected commencement date of February 10, 2024.

Emerging Growth Company

We qualify as an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the JOBS Act. As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies”, and may not be required to, among other things, (i) provide an auditor’s attestation report on our system of internal controls over financial reporting pursuant to Section 404; (ii) provide all of the compensation disclosure that may be required of non-emerging growth public companies under the Dodd-Frank Wall Street Reform and Consumer Protection Act; (iii) comply with any requirement that may be adopted by the PCAOB regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (auditor discussion and analysis); and (iv) disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year (x) following the fifth anniversary of the Closing or (y) in which we have total annual gross revenue of at least $1.235 billion (as adjusted for inflation pursuant to SEC rules from time to time), and (ii) the date on which (x) we are deemed to be a large accelerated filer, which means that the market value of our Ordinary Shares held by non-affiliates exceeds $700 million as of the prior June 30, or (y) the date on which we have issued more than $1.0 billion in nonconvertible debt during the prior three-year period.

Foreign Private Issuer

We are subject to the information reporting requirements of the Exchange Act that are applicable to “foreign private issuers,” and under those requirements we file reports with the SEC. As a foreign private issuer, we are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, we are not required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We also have four months after the end of each fiscal year to file our annual reports with the SEC and are not required to file current reports as frequently or promptly as U.S. domestic reporting companies. Furthermore, our officers, directors and principal shareholders are exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we are also not subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. These exemptions and leniencies reduce the frequency and scope of information and protections available to you in comparison to those applicable to shareholders of U.S. domestic reporting companies.

Our Corporate Information

We are a private limited company incorporated under the laws of Jersey, Channel Islands with limited liability. Prior to the Closing, we did not conduct any material activities other than those incident to our formation and certain matters related to the Business Combination, such as the making of certain required securities law filings.

The mailing address of our registered office is 3rd Floor, 44 Esplanade, St. Helier, Jersey, JE4 9WG and our telephone number is +44 1534 514 000. Our website is https://www.metalsacquisition.com/. The information contained in, or accessible through, our website does not constitute a part of this prospectus.

The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers, such as us, that file electronically, with the SEC at www.sec.gov.

Our agent for service of process in the United States is John Rhett Miles Bennett, 425 Houston Street, Suite 400, Fort Worth, TX 76102.

3

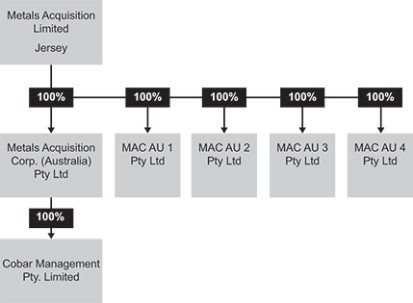

Our Organizational Structure

The following diagram depicts a simplified organizational structure of the Company as of the date hereof.

Summary Risk Factors

Investing in our securities entails a high degree of risk as more fully described under “Risk Factors.” You should carefully consider such risks before deciding to invest in our securities. These risks include, among others:

| ● | Estimates of Reserves are uncertain and the volume and grade of ore actually recovered may vary from our estimates. |

| ● | Our mining activities are subject to adverse operating conditions and geotechnical risks, which could adversely impact our ore recoveries and mining efficiencies. |

| ● | Our mining activities are subject to ongoing cost and resourcing requirements that may not always be met. |

| ● | To maintain our business, we will be required to make substantial capital expenditures. If we are unable to obtain needed capital or financing on satisfactory terms, it could have an adverse impact on our results of operations. |

| ● | Interruption or other disruptions and delays to our operations could have a material adverse effect on our cash flow, results of operations and financial condition. |

| ● | Our expected reduction in total direct site operating costs and increase in mined tonnages may not be realized in the short term or at all. |

| ● | All production from the CSA Mine is sold to a single customer, GIAG, and such reliance on GIAG as a key customer may have significant consequences for our cash flow and broader financial position. |

| ● | Future project expansion and exploration success may not be achieved. |

| ● | Maintenance of mining tenement title and approvals is essential to the ongoing conduct of our operations. |

| ● | Land access to current or future mining tenements may not always be guaranteed. |

| ● | General labor market tightness in the mining sector may lead to higher costs than planned or the inability to secure the skilled workforce necessary to optimize the mine. |

| ● | Rehabilitation liabilities may increase or otherwise impact our operating margins. |

| ● | Equipment failure at the CSA Mine could have an adverse impact on our ability to continue operations. |

4

| ● | General cost inflation across Australia, including, but not limited to, energy prices may increase the costs of production more than anticipated. |

| ● | We are subject to complex laws and regulations, which could have a material adverse effect on our operations and financial results. |

| ● | The cost, outcome or impact of existing or future litigation could materially and adversely affect our business, financial condition and reputation. |

| ● | Our current and future operations require permits and licenses, and failure to comply with or obtain such permits and licenses could have a material impact on our business. |

| ● | Premature mine closure or placement into care and maintenance could subject us to significant additional costs and could have a detrimental effect on our financial condition. |

| ● | We may be adversely affected by fluctuations in demand for, and prices of, copper. |

| ● | Appreciation of the Australian dollar against the U.S. dollar could have the effect of increasing the CSA Mine’s cost of production, thus reducing our margins. |

| ● | Our management of workplace health and safety matters may expose the company to significant risk. |

| ● | Risks regarding international conflict and related market pressures may impact our business operations. |

| ● | Information technology security breaches could harm our business activities and reputation. |

| ● | Changes in accounting standards may have an adverse effect on the reported financial performance of our business. |

| ● | Application of existing tax laws, rules or regulations are subject to interpretation by taxing authorities. |

| ● | Any new tax legislation introduced by governments may change the current tax treatment, which could adversely impact our cash flow from the CSA Mine. |

| ● | We may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on our financial condition, results of operations and share price, which could cause you to lose some or all of your investment. |

| ● | We incurred a significant amount of debt in connection with the Business Combination that is secured by substantially all of our assets, and may in the future incur additional indebtedness. Our payment obligations under such indebtedness may limit the funds available to us, and the terms of our debt agreements may restrict our flexibility in operating our business. |

| ● | The prices of our securities may be volatile and there is no guarantee of a positive return on the Ordinary Shares. |

| ● | There is no certainty that we will pay dividends. |

| ● | The securities offered in this prospectus represent a substantial percentage of our outstanding Ordinary Shares. The Selling Securityholders purchased the securities covered by this prospectus at different prices, some below the current trading price of such securities, and may therefore make substantial profits upon resales. |

| ● | If we do not satisfy our deferred consideration obligations to Glencore in cash under the Share Sale Agreement, holders of our Ordinary Shares may experience substantial dilution. |

| ● | The Warrants may never be in the money, and may expire worthless. |

5

| ● | The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain executive management and qualified board members. |

| ● | We have identified a material weakness in our internal control over financial reporting and if we fail to remediate such material weakness or establish and maintain effective internal controls over financial reporting, our ability to report our results of operations and financial condition accurately and in a timely manner may continue to be adversely affected. |

| ● | As a foreign private issuer, we are exempt from a number of rules under the U.S. securities laws and are permitted to file less information with the SEC than a U.S. company. This may limit the information available to holders of the Ordinary Shares. |

| ● | You may face difficulties in protecting your interests as a shareholder, as Jersey law provides substantially less protection when compared to the laws of the United States. |

| ● | Because the CSA Mine’s operations are located outside of the United States, we may be subject to a variety of additional risks that may negatively impact our operations. |

6

THE OFFERING

The summary below describes the principal terms of the offering. The “Description of Share Capital” section of this prospectus contains a more detailed description of our Ordinary Shares and Warrants.

Issuance of Ordinary Shares

The following information is as of December 14, 2023 and does not give effect to issuances of our Ordinary Shares or the exercise of Warrants after such date.

Ordinary Shares to be issued upon exercise of all Public Warrants |

| 8,838,260 Ordinary Shares. |

Resale of Ordinary Shares and Private Warrants

Ordinary Shares offered by the Selling Securityholders |

| Up to 55,640,065 Ordinary Shares, comprising: · up to 22,128,695 Ordinary Shares issued to certain Selling Securityholders in connection with the Business Combination, · up to 22,951,747 Ordinary Shares issued to certain Selling Securityholders under the Initial PIPE Financing consummated in connection with the Business Combination, · up to 6,535,304 Ordinary Shares issuable to certain Selling Securityholders following exercise of Private Warrants held by them, · up to 3,187,500 Ordinary Shares issuable upon exercise of Financing Warrants, and · up to 836,819 Ordinary Shares issued to certain Selling Securityholders under the October PIPE Financing. |

Private Warrants offered by the Selling Securityholders | Up to 6,535,304 Private Warrants that were issued in connection with the Business Combination. | |

Offering prices | The exercise price of the Public Warrants and the Private Warrants is $11.50 per Ordinary Share, subject to adjustment as described herein. The exercise price of the Financing Warrants is $12.50 per Ordinary Share. The Ordinary Shares offered by the Selling Securityholders under this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the Selling Securityholders may determine. See “Plan of Distribution.” | |

Ordinary Shares issued and outstanding prior to any exercise of the Warrants | 50,236,544 Ordinary Shares. | |

Ordinary Shares issued and outstanding assuming the exercise of all of the Warrants | 68,797,608 Ordinary Shares. | |

Warrants issued and outstanding | 18,561,064 Warrants, consisting of (i) 6,535,304 Private Warrants, (ii) 8,838,260 Public Warrants and (iii) 3,187,500 Financing Warrants, the exercise of which will result in the issuance of 18,561,064 Ordinary Shares. |

7

Use of proceeds | All of the Ordinary Shares and Private Warrants offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective accounts. We will not receive any of the proceeds from such sales. However, we could receive up to an aggregate of $216,639,736 from the exercise of all Warrants, assuming the exercise in full of such Warrants for cash. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes. We believe the likelihood that warrant holders will exercise their Warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the trading price of our Ordinary Shares. If the market price for our Ordinary Shares is less than $11.50 per share, we believe the holders of Public Warrants and Private Warrants will be less likely to exercise their Public Warrants and Private Warrants. If the market price for our Ordinary Shares is less than $12.50 per share, we believe the holders of Financing Warrants will be less likely to exercise their Financing Warrants. On December 19, 2023, the closing price of our Ordinary Shares on the NYSE was $10.50 per share. See “Use of Proceeds.” | |

Dividend policy | We have never declared or paid any cash dividend on our Ordinary Shares. The payment of cash dividends in the future will depend upon our revenues and earnings, if any, capital requirements and general financial condition. Any further determination to pay dividends on our Ordinary Shares would be at the discretion of our Board. | |

Market for our Ordinary Shares and Warrants | Our Ordinary Shares and Public Warrants are listed on the NYSE under the trading symbol “MTAL” and “MTAL.WS.” | |

Lock-Up Restrictions | Of the 55,490,205 Ordinary Shares that may be offered or sold by Selling Securityholders identified in this prospectus, 48,267,942 of those Ordinary Shares are subject to certain lock-up or other resale restrictions under the Securities Act as further described elsewhere in this prospectus. See “Shares Eligible for Future Sale.” | |

Risk Factors | Prospective investors should carefully consider the “Risk Factors” for a discussion of certain factors that should be considered before buying the securities offered hereby. |

8

RISK FACTORS

You should carefully consider the risks described below before making an investment decision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition or results of operations could be materially and adversely affected by any of these risks. The trading price and value of our securities could decline due to any of these risks, and you may lose all or part of your investment. This prospectus and any prospectus supplement or related free writing prospectus also contain forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus and any prospectus supplement or related free writing prospectus.

Risks Relating to Our Business and Industry

Estimates of Reserves are uncertain and the volume and grade of ore actually recovered may vary from our estimates.

The existing Ore Reserves will be depleted over time by production from our operations. The currently estimated Ore Reserves support approximately six and a half years of operation, with the additional mine life in the life-of-mine plan (“LOM Plan”) being based principally on estimated Inferred Mineral Resources or projections of mineralization down dip of Inferred Mineral Resources. While the CSA Mine has a long history of resource renewal and exploration success, and there is reasonable geological evidence of continuity down dip, our future estimates may not be realized. If we are unable to replace or increase Ore Reserves to maintain or grow our current level of Ore Reserves, this would adversely impact the long-term economic viability of our business and operations.

We base our Ore Reserve information on our own interpretation of geological data and current and proposed mine plans in accordance with the JORC Code. CMPL’s Ore Reserve estimate as of December 31, 2021 does not incorporate the Indicated Mineral Resources identified in the Technical Report. Our estimates are periodically updated to reflect past ore production, new drilling information and other geological or mining data.

While such estimates are based on knowledge, experience and industry practice utilizing suitably certified competent persons employed or contracted by CMPL, there are considerable uncertainties inherent in estimating quantities and qualities of economically recoverable Ore Reserves, including many factors beyond our control. As a result, estimates of economically recoverable Ore Reserves are by their nature uncertain. Some of the factors and assumptions which impact economically recoverable Ore Reserve estimates include:

| ● | geological and mining conditions; |

| ● | historical production from the area compared with production from other producing areas; |

| ● | the assumed effects of regulations and taxes by governmental agencies; |

| ● | our ability to obtain, maintain and renew all required mining tenements and permits; |

| ● | future improvements in mining technology; |

| ● | assumptions governing future commodity prices; and |

| ● | future operating costs, including the cost of materials and capital expenditures. |

Each of the factors which impacts reserve estimation may be beyond our control, prove unreliable or incorrect and/or vary considerably from the assumptions used in estimating the reserves. For these reasons, estimates of Ore Reserves may vary substantially.

Given the above factors, Glencore and CMPL’s internal estimates vary from those estimates contained in the Technical Report prepared by Behre Dolbear Australia Pty Ltd, in consultation with Cube Consulting Pty Ltd. Glencore has not verified or independently tested the assumptions underlying any estimate of Ore Reserves or Indicated, Inferred and/or Measured Mineral

9

Resources and those estimates are not to be read in any way as representative or indicative of Glencore and/or CMPL’s internal views on these matters.

In addition, the grade and/or quantity of the metals ultimately recovered may differ from that interpreted from drilling results. There can be no assurance that metals recovered in small-scale tests will be duplicated in large-scale tests under on-site conditions or on a commercial production scale. Until actually mined and processed, no assurance can be given that the estimated tonnage, grades and recovery levels will be realized or that the Ore Reserves will be mined and processed economically. Material inaccuracies in, or changes to, Ore Reserves estimates may impact the LOM Plan and other projections as to the future economic viability of our business operations. Actual production, revenues and expenditures with respect to our Ore Reserves will likely vary from estimates, and these variances may be material. As a result, our estimates may not accurately reflect our actual Ore Reserves in the future.

Additionally, our estimates of Ore Reserves may be adversely affected in future fiscal periods by the SEC’s recent rule amendments revising property disclosure requirements for publicly-traded mining companies.

Our mining activities are subject to adverse operating conditions and geotechnical risks, which could adversely impact our ore recoveries and mining efficiencies.

Mining activities are subject to adverse operating conditions and geotechnical risks. Operational risks, accidents and other adverse incidents could include:

| ● | variations in mining and geological conditions from those anticipated, such as variations in geotechnical conclusions; |

| ● | operational and technical difficulties encountered in mining, including management of atmosphere and noise, equipment failure and maintenance or technical issues; |

| ● | adverse weather conditions or natural or man-made disasters, including floods, droughts, bushfires, seismic activities, ground failures, rock bursts, pit wall failures, structural cave-ins or slides and other catastrophic events; |

| ● | insufficient or unreliable infrastructure, such as power, water and transport; |

| ● | industrial and environmental accidents, such as releases of mine affected water and diesel spill; |

| ● | industrial disputes and labor shortages; |

| ● | transportation shortages impacting the timely transportation of labor, goods, products and service providers; |

| ● | mine safety accidents, including fatalities, fires and explosions from methane and other sources; |

| ● | competition and conflicts with other natural resource extraction and production activities within overlapping operating areas; |

| ● | shortages, or increases in the costs, of consumables, components, spare parts, plant and equipment; |

| ● | cyber-attacks that disrupt our operations or result in the dissemination of proprietary or confidential information about us to our customers or other third parties; |

| ● | security breaches or terrorist acts; and |

| ● | any or all of which may affect the ability to continue mining activities at the CSA Mine. |