Exhibit 99.1

|

|

|

SITIO ROYALTIES AND BRIGHAM MINERALS ANNOUNCE COMPLETION OF MERGER

DENVER, Colorado—December 29, 2022—Sitio Royalties Corp. (NYSE: STR) (“Sitio” or the “Company”) and Brigham Minerals, Inc. (“Brigham”) today announced the successful completion of their merger, combining as Sitio Royalties Corp. The combination brings together two of the largest public companies in the mineral and royalty sector with complementary high-quality assets in the Permian Basin and other oil-focused regions, creating an industry leader with a proven track record of consolidating oil and gas mineral and royalty interests operated by a diverse set of E&P companies.

About Sitio Royalties Corp.

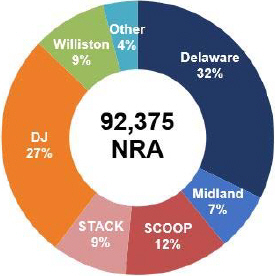

Sitio is a shareholder returns-driven company focused on large-scale consolidation of high-quality oil & gas mineral and royalty interests across premium basins, with a diversified set of top-tier operators. With a clear objective of generating cash flow from operations that can be returned to shareholders and reinvested, Sitio has accumulated over 260,000 NRAs through the consummation of over 185 acquisitions to date. More information about Sitio is available at www.sitio.com.

Forward-Looking Statements

This new release contains statements that may constitute “forward-looking statements” for purposes of federal securities laws. Forward-looking statements include, but are not limited to, statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “seeks,” “possible,” “potential,” “predict,” “project,” “prospects,” “guidance,” “outlook,” “should,” “would,” “will,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Except as otherwise required by applicable law, Sitio disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. These statements include, but are not limited to, statements about the Company’s expected benefits of the merger between Sitio and Brigham; future dividends; and future plans, expectations, and objectives for the Company’s operations, including statements about strategy, synergies, future operations, financial position, prospects, and plans. Forward-looking statements are not guarantees of performance. While forward-looking statements are based on assumptions and analyses made by us that we believe to be reasonable under the circumstances, whether actual results and developments will meet our expectations and predictions depend on a number of risks and uncertainties that could cause our actual results, performance, and financial condition to differ materially from our expectations and predictions. See “Risk Factors” in Sitio and Brigham’s joint consent solicitation statement/proxy statement/prospectus filed with the U.S. Securities and Exchange Commission (the “SEC”) on November 23, 2022 for a discussion of risk factors related to the merger between Sitio and Brigham. Additional information concerning these and other factors that may impact Brigham’s and Sitio’s expectations and projections can be found in Brigham’s periodic filings with the SEC, including Brigham’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and Sitio’s periodic filings with the SEC, including Sitio’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, Part II, Item 1A “Risk Factors” in Sitio’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Brigham’s and Sitio’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

IR contact:

Ross Wong

(720) 640–7647

IR@sitio.com