As filed with the Securities and Exchange Commission on February 27, 2023.

Registration No. 333-269470

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Ispire Technology Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 2111 | 84-5106049 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

19700 Magellan Drive

Los Angeles, CA 90502

(310) 742-9975

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Michael Wang, Chief Financial Officer

Ispire Technology Inc.

19700 Magellan Drive

Los Angeles, CA 90502

(310) 742-9975

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | |

|

Richard I. Anslow, Esq. Jonathan Deblinger, Esq. Asher S. Levitsky P.C. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas; Suite 1100 New York, New York 10105 Telephone: (212) 370-1300 |

Meng Ding, Esq. Sidley Austin 39/F, Two International Finance Centre Central, Hong Kong SAR Tel: +852.2509.7858 |

Approximate date of commencement of proposed sale to the public: as soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS (Subject to Completion) | Dated February 27, 2023 |

6,000,000 Shares

Ispire Technology Inc.

Common Stock

Offered by the Company

1,750,000 Shares of Common Stock Offered by Selling Stockholders

This is the initial public offering of 6,000,000 shares of common stock on a firm commitment basis. The estimated initial public offering price is expected to be in the range of $6.00 to $8.00 per share. Currently, no public market exists for our common stock. We intend to apply to have our common stock listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “ISPR.” The offering is contingent upon final approval of our Nasdaq listing, and we will not complete the offering if our common stock is not listed on Nasdaq.

In addition to the offering by us, two selling stockholders are offering an aggregate of 1,750,000 shares of common stock which they may sell at the initial public offering price of the underwritten offering until such time as our common stock is listed on the Nasdaq Capital Market, at which time they may sell such shares from time to time at prevailing market prices or at negotiated prices. The selling stockholders have not engaged any underwriter in connection with the sale of their shares, and we will not receive any proceeds from the sale by the Selling Stockholders of their shares. See “Selling Stockholders.”

We have granted the Underwriters the option, exercisable for 45 days from the date of this prospectus, to purchase up to an additional 900,000 from us at the initial public offering price less the underwriting discount and commissions to cover over-allotments.

We are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012, as amended, and will be subject to certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary — Emerging Growth Company Status.” We will be deemed to be a “controlled company” under the Nasdaq listing rules because Tuanfang Liu, our chief executive officer and a director, and his wife, Jiangyan Zhu, who is a director, will own 63.8% of our outstanding common stock upon completion of this offering (62.8 % if the underwriter’s over-allotment option is exercised in full). As a controlled company, we are not required to comply with certain of NASDAQ’s corporate governance requirements. We do not currently intend to take advantage of any of these exceptions except that Mr. Tuanfang Liu is chairman of the nominating and corporate governance committee. See “Prospectus Summary — Controlled Company.”

Investing in our common stock is highly speculative and involves a significant degree of risk. See “Risk Factors,” which begins on Page 12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discount and commissions (1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | The Underwriters will receive compensation in addition to the underwriting discount and commission, as set forth in the section entitled “Underwriting” beginning on page 78 upon the closing of this offering. We have also agreed to reimburse Underwriters for certain expenses incurred by it and to issue to the Underwriters upon closing of this offering, warrants (the “Underwriters’ Warrants”) to purchase the number of shares of common stock in the aggregate equal to 5% of the number of shares sold in the offering. See “Underwriting” for additional information. |

If the Underwriters exercise the over-allotment option in full, the total underwriting discounts and commissions payable will be $ , and the total proceeds to us, before expenses, will be $ .

This prospectus also relates to the public offering of an aggregate of 1,750,000 shares of common stock which may be sold from time to time by the selling stockholders named in this prospectus, which is separate and apart from our underwritten public offering, We will not receive any proceeds from the sale by the selling stockholders of their shares of common stock. The selling stockholders have not engaged any underwriter in connection with the sale of their common stock. The selling stockholders may sell common stock at the initial public offering price of the underwritten offering until such time as our common stock is listed on the Nasdaq Capital Market, at which time they may sell such shares in the public market based on the market price at the time of sale or at negotiated prices or in transactions that are not in the public market in the manner set forth under “Plan of Distribution.”

The Underwriters expect to deliver the common stock to purchasers in the offering on or about [●], 2023.

| US Tiger Securities, Inc. |

TFI Securities SPDB International

The date of this prospectus is , 2023.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any related free-writing prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, the common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is current only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Neither we nor the Underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any filed free writing prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus or any filed free writing prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus or any filed free writing prospectus outside of the United States.

Until , 2023 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the obligation of dealers to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

i

Introduction

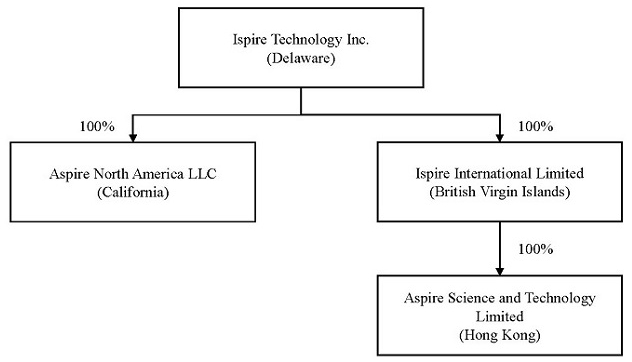

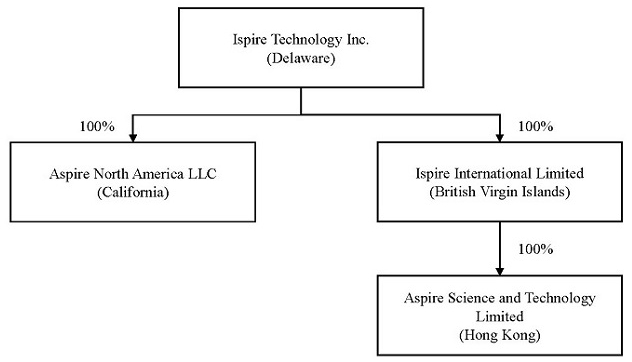

We were formed on June 13, 2022. We have two operating subsidiaries, Aspire North America LLC, a California limited liability company (“Aspire North America”), and Aspire Science and Technology Limited, a Hong Kong corporation (“Aspire Science”). On July 29, 2022, we acquired 100% of the equity interest in Aspire North America from Aspire Global Inc. (“Aspire Global”), and our wholly-owned subsidiary Ispire International Limited, a British Virgin Islands corporation (“Ispire International”), acquired 100% of the equity interest in Aspire Science from a wholly-owned subsidiary of Aspire Global in connection with a restructure by Aspire Global pursuant to which the equity in Aspire North America and Aspire Science was transferred to us, and, at the time of the transfer, we had the same stockholders as Aspire Global and our stockholders held the same percentage interest in us as they had in Aspire Global at the time of the transfer. See “Business – Acquisition of Our Business from a Related Party” and “Certain Relationships and Related Party Transactions.”

Unless the context indicates otherwise, all references to “we,” “us,” “our,” the “Company,” or similar terms used in this prospectus refer to (i) Ispire Technology Inc., including its subsidiaries, and (ii) for periods prior to July 29, 2022, the date we acquired our operating subsidiaries, the operations of our subsidiaries prior to our acquisition of the equity in the subsidiaries. Our consolidated financial statements reflect the consolidated operations of us and our subsidiaries as if the acquisition of the subsidiaries occurred on July 1, 2020. See Note 1 of Notes to Consolidated Financial Statements.

Our reporting currency is the U.S. dollar. The functional currency of Aspire Science, which is located in Hong Kong, is the Hong Kong Dollar (“HKD”). For Aspire Science, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. As a result, amounts relating to assets and liabilities reported on the statements of cash flows may not necessarily agree with the changes in the corresponding balances on the balance sheets. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income/loss. Transactions denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing on the transaction dates. Assets and liabilities denominated in foreign currencies are translated into the functional currencies at the exchange rates prevailing at the balance sheet date with any transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

The information presented in this prospectus that relates to the industry has been derived from industry reports prepared by Euromonitor International Limited. Euromonitor is an independent research firm. The tobacco report was commissioned by Aspire Global, and we commissioned the cannabis report. Investors are cautioned not to place any undue reliance on the information, including statistics and estimates, set forth in this section or similar information included elsewhere in this prospectus.

Overview

We are engaged in the research and development, design, commercialization, sales, marketing and distribution of branded e-cigarettes and cannabis vaping products. We sell our tobacco products worldwide except for the People’s Republic of China and Russia. Although we sold tobacco products in the United States in the years ended June 30, 2021 and 2022, we are limited in the product we may sell and, because the sales did not justify the marketing and regulatory costs, we have ceased marketing tobacco vaping products in the United States. Our tobacco products are marketed under the Aspire brand name and are sold primarily through our distribution network.

We currently sell our cannabis vaping hardware only in the United States, and we have recently commenced marketing activities in Canada and Europe, primarily in the European Union. All of our cannabis products are vaping hardware. Vaping refers to the practice of inhaling and exhaling the vapor produced by an electronic vaping device, and includes dabbing, which is the recreational inhalation of extremely concentrated tetrahydrocannabinol, the main psychotropic cannabinoid derived from the marijuana plant. Our cannabis products are marketed under the Ispire brand name, primarily on an ODM basis to other cannabis vapor companies. ODM generally involves the design and customization of core products to meet each brand’s unique image and needs, and our products are sold by our customers under their own brand names although they may also include our brand name on the products.

1

Our products use our BDC (bottom dual coil) coil technology which uses bottom dual coils to provide much higher temperature and an expanded heating that achieves much greater flavor and vapor production. We believe that the use of our dual-coil technology enhances the flavor performance of e-liquid, and the hidden wick cotton with special designed wick holes can both extend the tank e-liquid capacity and improve the speed of wicking to increase the coil life. Our BVC (bottom vertical coil) coil represents a big technological breakthrough for us in coil technology with a vertical heating wire surrounded by the cotton. This design can enable the coil heating to provide uniform temperature from the tank, together with more efficient wicking. This new technology, which Shenzhen Yi Jia introduced in 2014, enables the coil to last longer while still giving users what we believe is the purest and cleanest taste from e-liquids. The BVC coils are still very popular for MTL (mouth to lung) vapors today.

We bring a new coil technology to the tobacco vaping industry with the Cleito tank. The Cleito tank uses a revolutionary new coil design that replaces the standard chimney and, we believe, delivers maximized airflow. This design frees up even more restriction in the airflow by eliminating the need for a static chimney within the tank itself, which results in an expanded flavor profile and increased vapor production. Combined with a Clapton kanthal coil for maximum flavor, the Cleito tank delivers a rush of intense flavor and huge vapor with a broad profile. The simple top-fill design makes filling very easy, just unscrew the top cap to refill, more convenient, more enjoyable.

Our Ispire cannabis vapor products use our patented Ducore™ (Dual Coil) technology for cannabis vaporizers. This technology enables users to create massive plumes of vape without burning the cannabis oil. These products incorporate our patented dual coil technology for what we believe is best-in-class airflow and taste, and our technology for eliminating the leakage of the oil from the unit, which overcomes a major disadvantage with many existing products

At present, our products are manufactured and supplied by Shenzhen Yi Jia Technology Co., Limited, a Chinese company (“Shenzhen Yi Jia”), which is 95% owned by our chief executive officer and controlling stockholder, Tuanfang Liu. We are taking the initial steps toward the development of manufacturing operations in Vietnam and in California. Initially, our manufacturing operations will be primarily assembling from components that we purchase from other companies. Although we expect that we will commence these assembly operations in mid 2023, we cannot assure you that we will be able to meet this timetable or that we will be able to effectively and efficiently conduct such operations.

Through our global distributor network of more than 150 distributors, we sell the Aspire brand of tobacco vaporizer technology products in more than 30 countries. The main markets for our tobacco products are Europe and the Asia Pacific region, which does not include the PRC.

The following table sets forth our tobacco revenue and percentage for tobacco products by region for the years ended June 30, 2021 and 2022 and the six months ended December 31, 2021 and 2022 based on information provided to us by our distributors (dollars in thousands).

| Year Ended June 30, | Six Months Ended December 31, | |||||||||||||||||||||||||||||||

| 2021 | 2022 | 2021 | 2022 | |||||||||||||||||||||||||||||

| Revenues | % | Revenues | % | Revenues | % | Revenues | % | |||||||||||||||||||||||||

| Europe | $ | 45,568 | 74.4 | % | $ | 51,886 | 76.2 | % | $ | 29,946 | 63.4 | % | $ | 33,404 | 56.8 | % | ||||||||||||||||

| Asia Pacific (excluding China) | 11,915 | 19.4 | % | 13,213 | 19.4 | % | 7,322 | 15.5 | % | 8,117 | 13.8 | % | ||||||||||||||||||||

| North America | 3,757 | 6.1 | % | 2,849 | 4.2 | % | 9,904 | 21.0 | % | 17,163 | 29.2 | % | ||||||||||||||||||||

| Other | 30 | 0.1 | % | 169 | 0.2 | % | 61 | 0.1 | % | 156 | 0.2 | % | ||||||||||||||||||||

| $ | 61,270 | $ | 68,117 | $ | 47,233 | $ | 58,840 | |||||||||||||||||||||||||

For the years ended June 30, 2021 and 2022 and six months ended December 31, 2021 and 2022, our revenues from cannabis products was approximately $2.1 million, $20.0 million, $8.3 million and $15.8 million respectively. All sales of cannabis products to date have been in the United States, although we have recently commenced marketing efforts in Canada and Europe, primarily the European Union.

2

Industry Developments

Historically, combustible tobacco products, primarily cigarettes and cigars, have been, and continue to be, the principal tobacco products used by adult smokers. Diverse customer demands are driving the innovation in the tobacco industry. During the past few decades, a number of alternatives to combustible tobacco products have entered the market. These products can be classified in three categories – smokeless oral-use products (including moist snuff, snus, and nicotine pouches), e-vapor products and heated tobacco products.

Vapor devices are distinguished from traditional combustible tobacco products by their production of vapor through a process of heating rather than the burning associated with the consumption of cigarettes, cigars, cigarillos or smoking tobacco. In their current form, vapor devices usually include electronic circuitry and a power source supplying energy to the heating mechanism. Vapor products are not distinguished by the absence of tobacco. While the majority of current devices (e-cigarettes) are intended for use with a tobacco-derived or synthesized nicotine containing liquid the category includes tobacco products where it is heated and not combusted, such as heat-not-burn devices. Closed vaping systems designed to look like a cigarette are referred to as cigalikes.

Our products are vapor devices, a category which includes closed system vaping devices (non-cigalikes), vaping components, and open system vaping devices.

Over the past ten years, both technological advances and consumer demand resulting in large part from a desire to obtain the effects of smoking without the adverse health effects resulting from smoking cigarettes, have led to both an increase in the global popularity of vaping along with the application of anti-tobacco legislation and regulation to electronic products, including vaping. Innovation in battery and other component technologies have greatly improved product functionality and reliability. Many consumers are attracted to the discreetness that vaporizers provide in terms of size and ease of use, style/fashion, and the perception that vaping is less detrimental to health than cigarettes. The e-vapor market worldwide has experienced rapid growth through 2019. However, the growth rate decreased in 2020, in part, we believe, because of the steps taken by governments worldwide to address the COVID-19 pandemic, which was reflected in our decrease in revenue in the year ended June 30, 2020. However, government regulations, particularly in the United States, have materially impacted our revenue in the United States.

Cannabis has a long and entrenched history in the United States due to considerable popularity of medical and recreational use in addition to long-standing industrial production of hemp. While the 20th century saw the growth of increasingly negative attitudes towards cannabis from policy makers and the general public, recent decades have witnessed a significant shift in the perception of cannabis. In the late 1990s, acceptance of medical cannabis grew enough to allow for changes in regulation and the 2010s have seen rapid expansion of social acceptance for recreational use. Medical cannabis in particular has seen increasing approval as Americans seek alternatives to pharmaceutical products in the wake of a serious public health crisis related to prescription opioids. Legalization is also increasing thanks to growing movements seeking to reform the US criminal justice system. For example, on October 6, 2022, President Biden announced pardons of all prior federal convictions for simple marijuana possession, urged states to take a similar approach to state marijuana convictions, and ordered officials in his administration to revisit the Schedule I status of marijuana under the federal Controlled Substances Act. Increasing numbers of American political reformers see eliminating criminal penalties for use and sale of cannabis as a way to address various social and economic inequalities.

Adult-use cannabis has attracted mainly recreational consumers who use cannabis for relaxation and socialization. Former medical cannabis users have also been attracted to the adult-use space as it has expanded due to its lower barriers to entry (no requirement to get permission from a doctor to gain access) and significant overlap of products between medical and adult-use product line-ups. Nonetheless some medical patients do opt to continue using medical cannabis even after adult-use legalization due to preferential tax rates on medical products in some states, and social acceptance of cannabis is growing in the United States.

Cannabis vaping is the action of inhaling and exhaling vapor containing cannabis oil produced by a vaporizer technology device. We believe that vaping has become the preferred choice of many cannabis users due to its discreetness in both carrying and smell, ease of use, and perceived health benefits relative to smoking cannabis cigarettes or bowls which create smoke. Cannabis vaping products for adult recreational use is largely limited to the United States with modest use in Canada.

During the 117th Congress (which ended on January 3, 2023), legislators introduced a number of bills aimed at increasing opportunities for cannabis industry members and their service providers. The most comprehensive legislation introduced to date, the Cannabis Administration and Opportunity Act, would provide for federal regulation of cannabis products by the U.S. Food and Drug Administration (“FDA”) and taxation by the U.S. Alcohol Tobacco Tax and Trade Bureau (TTB) but would afford states continued authority to restrict and regulate such products. The States Reform Act would remove marijuana from Schedule I of the Controlled Substances Act and locate federal regulatory and taxation authority for cannabis products at the TTB while also affording states the ability to continue to restrict or prohibit such products. Passed by the House of Representatives, the Marijuana Opportunity, Reinvestment, and Expungement Act would also remove marijuana from the scope of the Controlled Substances Act and establish a federal excise and occupational tax framework for cannabis products. While none of these bills passed during the 117th Congress, we cannot predict whether or when any of these or other similar bills will be introduced in the new Congress or what specific provisions they will contain if so. However, we believe that the fact that various members of Congress in both houses have recently introduced cannabis reform bills—and that the House of Representatives has passed such legislation—suggests an openness to and momentum towards federal cannabis reform in the near term.

3

Our Strategy

We believe that we have the ability to evaluate the market need for both tobacco and cannabis vaping products and to develop products to meet the need. We believe that we have implemented systems of quality control that cover the key steps of supply chain management to provide high-quality products to adult smokers in a consistent manner.

Our strategy is to implement a multi-prong growth strategy directed at increasing our e-cigarette vaporizer technology products and developing our cannabis vaporizer technology products. Although we have ceased marketing tobacco vaping products in the United States as a result of regulator issues, we are actively marking our cannabis vaping products in the United States, primarily as ODM sales to other cannabis brands.

Historically, we have focused on building and growing our own branded business, with OEM and ODM sales accounting for a minor portion of our revenue for the years ended June 30, 2021 and 2022 and six months ended December 31, 2021 and 2022. We are looking to expand our OEM and ODM tobacco business, which accounted for approximately $1.1 million, $0.7 million, $0.6 million and $0.6 million of total revenue from tobacco products in the years ended June 30, 2021 and 2022 and six months ended December 31 2021 and 2022, respectively, and we believe that OEM/ODM will represent a key growth area for us in the future.

We plan to increase sales of our e-cigarette vaporizer technology products by increasing the number of distributors and regions as well as increasing sales to existing customers. We believe that our brands have a reputation for high quality products in the marketplace. We will seek to introduce new products to meet customer needs based on our assessment of the direction of the market. We do not market or sell nicotine vaping products in the United States and we have no plans to do so.

We will continue to expand our technology leadership by investing in vaporizer and similar technology research and development. Our research and development activities will be oriented to focus on both medical and recreational usages of cannabis products. We recognize that industry trends can change rapidly. We believe that our products must be at the forefront of technology if we are going to prosper. The cannabis vaping business is in its early stages and we will seek to develop a strong and leading position in this market. This market is currently largely in the United States, and we plan to be in the forefront as this market and other markets develop.

Through extensive research and development, our chief executive officer developed the patented Ducore technology, which is being assigned to us and which enables our cannabis vaporizer products to heat cannabis oil, which, we believe is the first leak-proof patented design, which enables the consumer to get the full flavor experience of the cannabis. Sales of our cannabis products to date are largely sales to cannabis brands on an ODM basis, and we anticipate that our cannabis sales will continue to be primarily ODM sales for the near future. It is the responsibility of our customers, cannabis brands, to manufacture the cannabis oil and load the oil into our vaping hardware product. We also sell some hardware products to end users, but our sales are primarily to ODM users. None of our products include cannabis oil or hemp oil.

Besides growing organically, we may consider strategic acquisitions, investments and business relationships if we believe it would help further our business strategy.

Effects of COVID-19 Pandemic

In December 2019, coronavirus disease 2019 (COVID-19) was first reported to have surfaced in Wuhan, China. During 2020, the disease spread to many parts of the world. The epidemic has resulted in quarantines, travel restrictions, and the temporary closure of stores and facilities in much of the world.

Measures taken by various governments to contain the virus have affected economic activity in all countries where the consumers of our product live. We took a number of measures to monitor and mitigate the effects of COVID-19, such as safety and health measures for our personnel, such as social distancing, in accordance with government policies and advice, securing the supply of materials that are essential to our production process. We will continue to follow the various government policies and advice and, in parallel, we may take further actions that we determine are in the best interests of our employees, customers, and business relationships.

Our products are manufactured in China by Shenzhen Yi Jia, which is 95% owned by our chief executive officer and controlling stockholder, Tuanfang Liu. From the middle of January 2020, the start of the Chinese New Year holiday, until the end of April 2020, its production was slowed due to the COVID-19 pandemic in China. This slowdown in production resulted in a near-total stoppage of Shenzhen Yi Jia’s supplier’s business during this nearly four-month period and our sales activities were substantially reduced. In addition, since our products are generally sold in stores such as grocery stores, convenience stores and tobacco stores, to the extent that either the stores are closed as a result of government actions or consumers are reluctant to go shopping because of the COVID-19 pandemic, retail sales of our products suffered. Following the temporary slowdown in production in the first half year of 2020, our supplier, Shenzhen Yi Jia, has recovered its production capacity, and we have not experienced significant supply chain constraints as a result of the pandemic.

4

From late 2020 to the middle of 2021, COVID-19 vaccination program had been greatly promoted around the globe, however several types of COVID-19 variants emerged in different parts of the world. Our sales in Europe and the United States continued to be affected by government actions relating to COVID-19 and COVID-19 variants, while the production was slightly reduced by the strict measures taken by the Government of China to address the small COVID-19 outbreaks in Guangdong province. China has recently ceased enforcing a zero-COVID policy. However, the COVID-19 risk in China is that deaths and hospitalizations from COVID-19 may affect the business in China and may affect Shenzhen Yi Jia’s operations as well as the operations of its suppliers. We cannot predict the effect the change from China’s zero-COVID policy will have on the business of Shenzhen Yi Jia or any of its suppliers. To the extent that the effects of the termination of China’s zero COVID policy result in closing or significantly reducing the operations of Shenzhen Yi Jia or any of its suppliers, our business will be impacted since we presently rely on Shenzhen Yi Jia for our products. We cannot predict the effect on our business, the business of Shenzhen Yi Jia and on business in the PRC in general as a result of the change in the PRC government’s zero-COVID rules, including the effect of increased infections, deaths and hospitalizations as well as the development of any new variants of COVID. To the extent that quarantine is required of any person entering mainland China, our business may be impacted. Although we do not have any operations or assets in mainland China, to the extent that any of our key personnel or any key personnel of Shenzhen Yi Jia or any of our or its suppliers are subject to quarantine on entering mainland China, our business may be impacted. Since January 8, 2023, no centralized quarantine or mass PCR testing will be undertaken on travelers entering mainland China. Travelers to mainland China are only required to take PCR test 48 hours prior to their departure and report the PCR test findings on their customs health declaration form. Only those whose test results are positive prior to departure will have to postpone their travel until the PCR results turn negative.

Supply Chain Risks

One of effects of the COVID-19 has been delays resulting from supply chain issues, which relate to the difficulty that companies have in having their products manufactured, shipped to the country of destination, and delivered from the port of entry to the customer’s location. As a result of the COVID-19 pandemic, during 2021 and early 2022, there were fewer longshoremen unloading ships and fewer truckers to deliver the products to market, which has resulted in significant delays in the delivery of products to markets. To the extent that products are shipped by sea, there are additional risks resulting from ports not being able to unload ships promptly, causing delays in getting into port, including potential damage from seawater and fire, product degradation and the possibility of containers being destroyed, damaged or falling off the ship into the water. The inability to deliver products to the ultimate vendor could impair our ability to generate revenue from our products. As the port delays have significantly decreased, we do not believe that the supply chain issues that affected our operations are currently affecting us. We cannot assure you that such delays will not affect our business in the future.

In 2021, Shenzhen Yi Jia suffered a chip shortage resulting in a slowdown in delivery of its products to us from April to August 2021. To secure the supply of chips, Shenzhen Yi Jia changed the payment terms to chip supplier from 30 days after delivery in the past to prepayment, and it engaged two new chip suppliers. Since September 2021, Shenzhen Yi Jia has obtained a supply of chips to meet its production need and a chip shortage no longer affect its production. During the six months ended December 31, 2022, a slowdown in the delivery of components to Shenzhen Yi Jia resulting from supply chain slowdowns as a result of the effects of China’s zero-COVID policy resulted in an increase in our cost of revenue during the period. We cannot assure you that we will not suffer from a chip shortage or that the effects of China’s COVID policy will not affect Shenzhen Yi Jia’s ability or the ability of its suppliers to delivery products in a timely manner.

With respect to sales to distributors other than in the United States, we are not involved in the shipping by the distributors, who arrange for shipping. However, to the extent that the distributors incur shipping delays in getting the product to market, their purchases of products from us may be delayed or reduced. We ship products for the United States market by air.

Controlled Company

A controlled company is a company of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company. We are a controlled company because Mr. Tuanfang Liu, our chief executive officer, holds more than 50% of our voting power, and we expect we will continue to be a controlled company upon completion of this offering. For so long as we remain a controlled company, we are exempt from the obligation to comply with certain Nasdaq corporate governance requirements, including:

| ● | our board of directors is not required to be comprised of a majority of independent directors. | |

| ● | our board of directors is not subject to the compensation committee requirement; and | |

| ● | we are not subject to the requirements that director nominees be selected either by the independent directors or a nomination committee comprised solely of independent directors. |

The controlled company exemptions do not apply to the audit committee requirement or the requirement for executive sessions of independent directors. We are required to disclose in our annual report that we are a controlled company and the basis for that determination. Although we do not plan to take advantage of the exemptions provided to controlled companies, other than including our chief executive officer and controlling stockholder as the chairman of the nominating and corporate governance committee, we may in the future take advantage of such exemptions.

5

Implications of Being an Emerging Growth Company

As a company with less than US$1.235 billion in revenue for the last fiscal year, we qualify as an “emerging growth company” pursuant to the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include exemption from the auditor attestation requirement under Section 404 of the Sarbanes-Oxley Act of 2002, or Section 404, in the assessment of the emerging growth company’s internal control over financial reporting. The JOBS Act also provides that an emerging growth company does not need to comply with any new or revised financial accounting standards until such date that a private company is otherwise required to comply with such new or revised accounting standards. We intend to take advantage of certain of these exemptions.

We will remain an emerging growth company until the earliest of (i) the last day of our fiscal year during which we have total annual gross revenues of at least US$1.235 billion; (ii) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (iii) the date on which we have, during the previous three year period, issued more than US$1.0 billion in non-convertible debt; or (iv) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which would occur if the market value of our common stock that are held by non-affiliates exceeds US$700 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

Matters Relating to PRC Laws

In this prospectus, “China” or the “PRC” refers to the People’s Republic of China; mainland China refers to the PRC, excluding Taiwan, the Hong Kong Special Administrative Region and the Macao Special Administrative Region, and PRC Laws refer to the laws, rules, regulations, statutes, notices, circulars and court judicial interpretation or the like of mainland China. Any PRC Laws refer to those currently in force, published for comments (if specifically stated) or being promulgated but have not come into effect (if specifically stated) and publicly available in mainland China as of the date of this prospectus. The majority of our operations are not in mainland China, and we do not believe we are subject to the PRC Laws applicable to those companies established in mainland China as of the date of this prospectus, based on advice from Han Kun Law Offices. We are mainly engaged in the research and development, design, commercialization, sales, marketing and distribution of branded e-cigarettes and cannabis vaping products. The sales of our tobacco products are conducted worldwide except for China and Russia. Through our global distributor network of more than 150 distributors, we sell the Aspire brand of tobacco vaporizer technology products in more than 30 countries and the main markets for such tobacco products are Europe and the Asia Pacific region, which does not include China.

We have two operating subsidiaries established, one in California and the other in Hong Kong. We do not conduct business and we do not have any employees, assets or funds in mainland China. Although most of our cash is in Hong Kong banks, a significant amount of these funds is to be paid to a related party. See “Certain Relationships and Related Party Transactions.” Our operations are primarily in the United States. Although our chief executive officer lives in mainland China, where Shenzhen Yi Jia is located, the services that he performs for us in his capacity as our chief executive officer are performed primarily in Hong Kong and the United States. In addition to serving as our chief executive officer, Tuanfang Liu is chairman of Shenzhen Yi Jia, and the services he provides in mainland China are performed in his capacity as chairman of Shenzhen Yi Jia. Our employees are largely in the United States, with 48 employees based in the United States and where our research and development activities are conducted, and eight employees in Hong Kong. Our facilities are located primarily in the United States, where we lease more than 83,600 square feet of office, manufacturing and storage space and where our research and development activities are conducted, as compared with 1,850 square feet of office space in Hong Kong. Hong Kong was established as a special administrative region of the PRC in accordance with Article 31 of the Constitution of the PRC. The Basic Law of the Hong Kong Special Administrative Region of the PRC (the “Basic Law”) was adopted and promulgated on April 4, 1990 and became effective on July 1, 1997, when the PRC resumed the exercise of sovereignty over Hong Kong. Pursuant to the Basic Law, Hong Kong is authorized by the National People’s Congress of the PRC to exercise a high degree of autonomy and the PRC Laws shall not be applied in Hong Kong, other than those relating to national defense, foreign affairs, and certain other matters that are not within the scope of autonomy of Hong Kong. While the National People’s Congress of the PRC has the power to amend the Basic Law, the Basic Law also expressly provides that no amendment to the Basic Law shall contravene the established basic policies of the PRC regarding Hong Kong. As a result, as of the date of this prospectus, national laws of the PRC that would be applicable to us if we were a corporation organized under PRC Laws or located in mainland China do not apply to our Hong Kong subsidiary. However, there is no assurance that certain PRC Laws, including existing laws and regulations and those enacted or promulgated in the future, will not be applicable to our Hong Kong subsidiary due to change in the current political arrangements between mainland China and Hong Kong or other reasons whether foreseeable or not presently foreseeable. The application of such laws and regulations may have a material adverse impact on us, as relevant PRC authorities may impose fines and penalties upon our Hong Kong subsidiary, delay or restrict the repatriation of the proceeds from this offering into Hong Kong, and any failure of us to fully comply with such new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our common stock, cause significant disruption to our business operations, and severely damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our common stock to significantly decline in value or in extreme cases, become worthless. See “Risk Factors – Risks Related to Our Business and Industry – Although we believe that our business is not subject to PRC Laws, our business could be materially impaired if it is determined that our business is subject to PRC Laws.” on page 27 and “Business -- Matters Relating to PRC Laws” on page 55.

At present, our products are manufactured and supplied by Shenzhen Yi Jia, a Chinese company under common control. However, we are also taking the initial steps toward the development of manufacturing operations in Vietnam and California, and our future operations will be diversified in different places of business, although we can give no assurance that we will be successful in developing and sustaining any manufacturing operations in Vietnam or California.

6

Our Organization

We are a Delaware corporation, organized on June 13, 2022. Aspire North America, LLC, a California limited liability company was formed on February 22, 2020, and 100% of its ownership was transferred to Aspire Global on September 23, 2020 and was transferred by Aspire Global to Ispire Technology on July 29, 2022. Aspire Science, a Hong Kong corporation, was incorporated on December 9, 2016 as a subsidiary of Aspire Global, and 100% of its equity was transferred to our subsidiary, Ispire International, on July 29, 2022. Ispire International was organized on July 6, 2022. Aspire North America and Aspire Science are our operating companies.

The following chart shows our corporate structure.

7

The Underwritten Offering

| Shares being offered by us: | 6,000,000 shares of common stock (or 6,900,000 shares of common stock if the Underwriters exercises their over-allotment option in full) on a firm commitment basis. |

| Initial offering price: | $6.00 to $8.00 per share. |

| Number of shares of common stock outstanding before the offering: | 50,000,0001 of our shares of common stock are outstanding as of the date of this prospectus. |

| Number of shares of common stock outstanding after the offering: | 56,000,0001 shares of common stock (or 56,900,0001 shares of common stock if the Underwriters exercise their over-allotment option in full). |

| Underwriter over-allotment option: | We have granted the Underwriters an option for a period of up to 45 days from the date of this prospectus to purchase up to 900,000 additional shares of common stock to cover over-allotments. |

| Use of proceeds: | We estimate that we will receive net proceeds from this offering of approximately $ 37.1 million (or approximately $43.0 million if the Underwriters exercise their over-allotment option in full), after deducting underwriting discounts, commissions and estimated offering expenses payable by us and assuming an initial offering price of $7.00 per share, the midpoint of the proposed offering price range.

We plan to use the net proceeds of this offering as follows: |

| ● | approximately 35% to develop manufacturing operations in both Vietnam and the United States; | |

| ● | approximately 25% for research and development activities, which include our efforts to develop new products and new vaping technology; | |

| ● | approximately 20% for the marketing and promotion of our branded products; | |

| ● | the balance of approximately 20%, together with any proceeds from the over-allotment option, for general administration and working capital. | |

| See “Use of Proceeds.” | ||

| Lock-up: | Our directors, officers and 5% or greater stockholders have agreed with the Underwriters not to sell, transfer or dispose of, directly or indirectly, any of our common stock or securities convertible into or exercisable or exchangeable for our common stock for a period of six months after the date of this prospectus. See “Shares Eligible for Future Sale” and “Underwriting” for more information. |

| Listing: | We intend to apply to have our common stock listed on the Nasdaq Capital Market, or Nasdaq. We cannot guarantee that we will be successful in listing our common stock on the Nasdaq; however, we will not complete this offering unless we are so listed. |

| Proposed Nasdaq symbol: | ISPR |

| Risk factors: | Investing in our common stock is highly speculative and involves a significant degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section. |

| 1 | Does not include up to 15,000,000 shares of common stock issuable pursuant to our 2022 Equity Incentive Plan. |

Offering by Selling Stockholders

Separate and apart from our underwritten public offering, two of our stockholders are offering an aggregate of 1,750,000 outstanding shares of common stock which they may sell at the initial public offering price of the underwritten offering until such time as our common stock is listed on the Nasdaq Capital Market, at which time they may sell such shares from time to time at prevailing market prices or at negotiated prices. The selling stockholders have not engaged any underwriter in connection with the sale of their shares, and we will not receive any proceeds from the sale by the Selling Stockholders of their shares. See “Selling Stockholders” and “Plan of Distribution.”

8

SUMMARY OF RISK FACTORS

Our business is subject to numerous risks described in the section titled “Risk Factors” and elsewhere in this prospectus. The main risks set forth below and others you should consider are discussed more fully in the section entitled “Risk Factors,” which you should read in its entirety.

| ● | Existing laws, regulations and policies as well as changes in existing laws, regulations and policies and the issuance of new laws, regulations, policies and any other entry barriers in relation to the e-vapor industry have materially and adversely affected and may further materially and adversely affect our business operations. | |

| ● | As a result of regulations in the United States, we are able to sell only one product line, the Nautilus Prime, in the United States. Our tobacco vaping sales in the United States were approximately $0.9 million the year ended June 30, 2022 and approximately $0.5 million for the six months ended December 31. 2022. Because the volume of sales did not justify the marketing and regulatory costs, we have ceased marketing tobacco vaping products in the United States. If any similar regulations are adopted with respect to cannabis products, our business will be severely impacted since all of our cannabis revenue for the year ended June 30, 2022 was generated from sales in the United States. | |

| ● | The recent amendments to the Prevent All Cigarette Trafficking (“PACT”) Act and regulations of the United States Postal Service extend the PACT Act to include e-cigarette and all vaping products, which include cannabis as well as tobacco products. These regulations place significant burdens on sellers of vaping products in the United States which may make it difficult to operate profitably in the United States. We use a combination of advanced accounting software and PACT Act compliant carriers to remain compliant with the tax and delivery restrictions of the PACT Act. To the extent that the carriers that we currently use change their policies and refuse to ship vaping products and we are not able to find other carriers that are PACT Act compliant, our business and prospects will be materially impaired, and we may not be able to continue in business. | |

| ● | We have no experience in the establishment and operation of manufacturing facilities in either Vietnam or the United States. In order to operate a manufacturing facility, even if it is limited to assembly from components manufactured by others, we will need to hire qualified personnel and comply with applicable laws, the failure of which could materially impair our business and operating results. | |

| ● | The market for cannabis vaping products has not developed, with the vast majority of sales being in the United States, with no assurance that a significant market will develop either in the United States or worldwide or that, if a market develops, we will be able to compete successfully with other companies that may enter the market as well as other legal and illegal forms of cannabis. | |

| ● | Because our chief executive officer and his wife will own 63.8% of our common stock after the offering ( 62.8% if the overallotment option is exercised in full) and he also owns 95% of the equity in the Chinese company that is presently our sole supplier and, as chief executive officer, he has significant authority over the conduct of our business, including the determination of price and other terms on which we purchase product from the supplier, he has a conflict of interest which may affect the development of our business and therefore the price of our common stock. | |

| ● | We sustained losses of approximately $2.0 million for the year ended June 30, 2022 and approximately $3.0 million for the six months ended December 31, 2022, and we cannot assure you that we can or will operate profitably in the future. | |

| ● | Because cannabis oil, unlike nicotine oil, is not of a uniform quality, products we design may not perform as intended, which could result in a loss of business |

| ● | If it is determined or perceived that the usage of e-vapor tobacco or cannabis products poses long-term health risks, the use of e-vapor products may decline significantly, which would materially and adversely affect our business, financial condition and results of operations. | |

| ● | Our business and the industry in which we operate are subject to inherent risks and uncertainties, including, among others, developments in regulatory landscape, medical discovery and market acceptance of vaping devices. | |

| ● | We are exposed to product liabilities and user complaints arising from the products we sell, which could have a material adverse impact on us. | |

| ● | Outbreaks of communicable diseases, natural disasters or other events may materially and adversely affect our business, results of operations and financial condition, including the effects of the COVID-19 pandemic and steps taken by governments to address the pandemic, which resulted in a four-month slowdown of our production during 2020 leading to a negative impact on our revenue and net income. | |

| ● | Misuse or abuse of our products may lead to potential adverse health effects, subjecting us to complaints, product liability claims and negative publicity. |

9

| ● | We face competition from companies in the e-vapor industry, including companies which are larger, better known and have a significantly larger market share than we do, and we may fail to compete effectively, as well as, with respect to cannabis, other legal and illegal forms of cannabis. | |

| ● | Misconduct, including illegal, fraudulent or collusive activities, by our employees, distributors, retailers or suppliers, may harm our brand and reputation and adversely affect our business and results of operations. |

| ● | We may be subject to liability if private information that we receive is not secure or if we violate privacy laws and regulations. | |

| ● | Our intellectual property rights, which were developed by our chief executive officer and Shenzhen Yi Jia and which we are acquiring from Shenzhen Yi Jia, Aspire Global and our chief executive officer with respect to cannabis and are licensing from Shenzhen Yi Jia, Aspire Global and our chief executive officer with respect to tobacco, are critical to our success. Infringement of our intellectual property rights by any third party or loss of our intellectual property rights may materially and adversely affect our business, financial condition and results of operations. | |

| ● | We and Shenzhen Yi Jia may not be able to prevent others from unauthorized use of our intellectual property, which could harm our business and competitive position. As the patents may expire and may not be extended, the patent applications may not be granted and the patent rights may be contested, circumvented, invalidated or limited in scope, our patent rights may not protect us effectively. | |

| ● | Our chief executive officer, who is also the chief executive officer and principal stockholder of Aspire Global and the 95% owner of Shenzhen Yi Jia, has potential conflicts of interest with us, which may materially and adversely affect our business and financial condition. | |

| ● | Because we are a controlled company, as defined by Nasdaq’s rules, we can take advantage of exemptions from certain Nasdaq corporate governance requirements, and, to the extent that we take advantage of these exemptions, you will not have the corporate governance protections normally provided to stockholders of a Nasdaq-listed company. | |

| ● | We may be liable for improper use or appropriation of personal information provided by our customers. | |

| ● | The sale or the anticipation of the sale by the selling stockholder may have an adverse effect upon the market price of our common stock and the Underwriters’ stabilization activities and the exercise of the Underwriters’ over-allotment option. | |

| ● | There has been no public market for our common stock prior to this offering, and you may not be able to resell our common stock at or above the price you paid, or at all. |

10

SELECTED CONSOLIDATED FINANCIAL DATA

(dollars in thousands, except per share amounts)

Consolidated Statement of Operations Data:

| Year Ended June 30, | Six Months Ended December 31, | |||||||||||||||

| 2021 | 2022 | 2021 | 2022 | |||||||||||||

| Revenue | $ | 63,415 | $ | 88,095 | $ | 47,233 | $ | 58,840 | ||||||||

| Cost of revenue | 52,999 | 74,789 | 39,921 | 48,910 | ||||||||||||

| Gross profit | 10,416 | 13,306 | 7,312 | 9,930 | ||||||||||||

| Operating expenses | 6,772 | 14,295 | 5,528 | 11,608 | ||||||||||||

| Income from operations | 3,644 | (989 | ) | 1,784 | (1,678 | ) | ||||||||||

| Other income(expense) | (20 | ) | 186 | 124 | (441 | ) | ||||||||||

| Income(loss) before income taxes | 3,624 | (803 | ) | 1,908 | (2,119 | ) | ||||||||||

| Net income(loss) | 2,938 | (1,874 | ) | 1,279 | (2,951 | ) | ||||||||||

| Net income(loss) per share | $ | 0.06 | $ | (0.04 | ) | $ | 0.03 | $ | (0.06 | ) | ||||||

| Average shares of common stock outstanding (basic and diluted) | 50,000,000 | 50,000,000 | 50,000,000 | 50,000,000 | ||||||||||||

Consolidated Balance Sheet Data

| As of June 30, | As of December 31, | |||||||||||

| 2021 | 2022 | 2022 | ||||||||||

| Assets | $ | 93,864 | $ | 100,735 | $ | 201,055 | ||||||

| Current assets | 93,421 | 99,449 | 122,808 | |||||||||

| Working capital | 13,585 | 10,481 | 7,800 | |||||||||

| Retained earnings | 13,821 | 11,946 | 8,995 | |||||||||

| Shareholders’ equity | 13,758 | 11,767 | 83,218 | |||||||||

Consolidated Cash Flows Data:

| Year Ended June 30, | Six Months

Ended December 31 | |||||||||||||||

| 2021 | 2022 | 2021 | 2022 | |||||||||||||

| Consolidated cash flow data: | ||||||||||||||||

| Net cash flows provided by (used in) operating activities | $ | 5,024 | $ | (7,558 | ) | $ | (8,484 | ) | $ | 8,825 | ||||||

| Net cash used in investing activities | (1 | ) | (122 | ) | (47 | ) | (478 | ) | ||||||||

| Net cash (used in) provided by financing activities | (228 | ) | (3,089 | ) | (2,234 | ) | 1,440 | |||||||||

| Net increase (decrease) in cash and cash equivalents | 4,795 | (10,769 | ) | (10,765 | ) | 9,787 | ||||||||||

11

An investment in our common stock involves a high degree of risks. You should carefully consider all of the information in this prospectus, including the risks and uncertainties described below, before making an investment in our common stock. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. In any such case, the market price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

Existing laws, regulations and policies and the issuance of new or more stringent laws, regulations, policies and any other restrictions or limitations in relation to the tobacco vaping industry have and can materially and adversely affect our business operations.

As vaping products have become more and more popular in recent years, government authorities worldwide have imposed laws, regulations and policies to regulate nicotine vaping products and the vaping industry and may impose more stringent controls either with changes in existing laws or regulations, with new laws or regulations, or with new interpretations of existing laws or regulations. Some governments have prohibited the usage of vaping products in certain areas, imposed specific taxes on vaping products or imposed restrictions, in certain areas such as product advertising, flavorings or nicotine concentration. Governments, primarily state and municipal, have imposed restrictions or prohibitions on smoking in public and on public transportation, such as on trains, airplanes and busses. Such prohibitions have been or may in the future be extended to e-cigarettes, including vaping products, and such restrictions may be imposed by local, regional or national governments. As a result of government laws and regulations affecting tobacco products, we ceased selling nicotine vaping products in the United States.

We cannot assure you that government authorities will not impose further restrictions on vaping nicotine products in the future, including but not limited to requirements to obtain and maintain licenses, approvals or permits for relevant business operation. Such restrictions, if any, may adversely affect supplies of raw materials, production and sales activities, taxation or other aspects of our business operation. We may not be able to comply with any or all changes in existing laws and regulations or any new laws and regulations and may incur significant compliance costs. All of the above may affect our production or market demand for vaping products and thus adversely affect our business, financial condition and results of operations. To the extent that we grow in scale and significance, we expect to face increased scrutiny, which may result in increased investment in compliance and related capabilities.

The World Health Organization (“WHO”) and the United State Centers for Disease Control and Prevention (“CDC”) have been clear in their view of the harmful effects of nicotine. Although they recognize that e-cigarettes may expose users to fewer harmful chemicals than burned cigarettes, which are considered very dangerous, and that any tobacco product, including e-cigarettes, is unsafe particularly for young people and pregnant women.

Countries have taken different steps to address the dangers of nicotine and to consider the difference between e-cigarettes and burned cigarettes. However, instances of death or serious illness resulting or perceived to result from the use of e-cigarettes as well as significant reported use by certain populations, including adolescents as well as nicotine-naïve individuals, may spur governments at all levels to increase restrictions on vaping products. We cannot assure you that the actions taken by municipal, state or provincial and national governments will not materially and adversely affect the market for vaping products generally and our business in particular.

Cannabis vapor products are subject to regulations and restrictions in the United States and are prohibited in many other countries.

Cannabis products are subject to federal and state regulation in the United States, and Western Europe generally prohibits the sale and use cannabis products, although some countries permit the use of approved cannabis products for medical purposes. Although an increasing number of states in the United States permit adult use of recreational marijuana, states have restriction as to where the products can be sold and many of the states that permit recreational use of marijuana require that sales be made only at licensed stores. The U.S. federal government still prohibits non-hemp cannabis products (unless approved by the FDA) but has generally not enforced against entities and individuals operating in compliance with state laws permitting such products. Likewise, under certain circumstances, devices intended for use in consuming federally prohibited cannabis products may also technically qualify as prohibited drug paraphernalia under federal law and the laws of certain states that continue to broadly restrict production and sale of non-hemp cannabis. However, the Federal Controlled Substances Act includes an exemption for “any person authorized by local, State, or Federal law to manufacture, possess, or distribute such items.”

No country in Western Europe has yet legalized recreational cannabis, but the region has some of the most developed cannabis cultures in the world, such as in the Netherlands and Spain. However, great differences persist among consumers, with older generations typically being more reluctant to allow cannabis use. Clear generational and social gaps still exist that make legalization and development of the market a slow process, although the potential legalization of adult-use cannabis in Germany is likely to accelerate the cannabis debate within the EU and promote the development of the industry at a regional level. Our ability to expand our marketing of cannabis products in the European market is dependent upon whether recreational cannabis will become legal in Western Europe, and we cannot give any assurance that we will be able to sell products in Western Europe. These restrictions on the sale and use of cannabis could impair our ability to market and sell our products.

12

While we believe that our business and sales do not violate the Federal Paraphernalia Law, legal proceedings alleging violations of such law or changes in such law or interpretations thereof could adversely affect our business, financial condition or results of operations.

Under U.S. Code Title 21 Section 863 (the “Federal Paraphernalia Law”), the term “drug paraphernalia” means “any equipment, product or material of any kind which is primarily intended or designed for use in manufacturing, compounding, converting, concealing, producing, processing, preparing, injecting, ingesting, inhaling, or otherwise introducing into the human body a controlled substance.” That law exempts “(1) any person authorized by local, State, or Federal law to manufacture, possess, or distribute such items” and “(2) any item that, in the normal lawful course of business, is imported, exported, transported, or sold through the mail or by any other means, and traditionally intended for use with tobacco products, including any pipe, paper, or accessory.” Any non-exempt drug paraphernalia offered or sold by any person in violation of the Federal Paraphernalia Law can be subject to seizure and forfeiture upon the conviction of such person for such violation, and a convicted person can be subject to fines under the Federal Paraphernalia Law and even imprisonment.

Several states with legal cannabis programs, including California, have enacted legislation invoking this exemption to shield state-legal businesses from federal enforcement on paraphernalia grounds. In addition, a recent court decision from the U.S. Court of International Trade applied this exemption in prohibiting U.S. Customs and Border Protection from refusing import entry of cannabis paraphernalia components that the importer could legally possess in the state of importation.

We believe our sales do not violate the Federal Paraphernalia Law in any material respect. We restrict the sale of products to comply with the Federal Paraphernalia Law’s exemption for sales authorized by state law. In particular, we (a) for our direct to customer products, we do not sell those products at all into the [__] states that have maintained complete or near complete cannabis prohibition, and have the distributers we work with covenant that they will not sell our products into these states, and (b) for our custom made and white label products, we limit the sale of those products to licensed dispensaries and entities, such as licensed cultivators or manufacturers.

While we believe that our business and sales are legally compliant with the Federal Paraphernalia Law in all material respects, any legal action commenced against us under such law could result in substantial costs and could have an adverse impact on our business, financial condition or results of operations. In addition, changes in cannabis laws or interpretations of such laws are difficult to predict, and could significantly affect our business.

Because Tuanfang Liu, our chief executive officer, who is also director, and his wife, Jiangyan Zhu, who is also a director, beneficially own 71.5% of our common stock and will own 63.8% of our common stock upon completion of this offering (62.8 % if the underwriters’ over-allotment is exercised in full), and Mr. Liu owns 95% of the equity of our sole supplier, Mr. Liu has a conflict of interest.

Because our chief executive officer and his wife own 66.5% and 5%, respectively, of our common stock, they have the power to elect all of our directors and to approve any matter which is subject to stockholder approval. Mr. Liu also own 95% of the equity in Shenzhen Yi Jia, which is currently our sole supplier. Mr. Liu is chairman of Shenzhen Yi Jia and his wife, Jiangyan Zhu, is its vice president of finance. The price and other terms at which Shenzhen Yi Jia sells product to us have been largely determined by Mr. Liu. In addition, as our chief executive officer he has significant authority in the implementation of our business plan, including the commencement of our proposed manufacturing operations in Vietnam and California. He has also historically been responsible for our product development and our present products have been the result of his research and development efforts. Mr. Liu’s interests may be different from our interests. Because of Mr. Liu’s conflict of interest, there is a risk that any actions he may take may have an adverse effect upon the success and development of our business and the price of our common stock.

As a result of the voting power of Mr. Liu and his wife, Ms. Zhu, investors will have little, if any, power to influence our business or to approve any action submitted to stockholders for their approval. The fact that they will continue to have a controlling interest in us may, by itself, serve as a deterrent to any person seeking to obtain control of us or to enter into any business relationship which might be beneficial to the minority stockholders.

13

Although our supply agreements with Shenzhen Yi Jia require Shenzhen Yi Jia to sell products to us at the most favorable market price that it sells similar products to third parties, because our products are designed for us and based on technology that was either developed by Mr. Liu prior to the date of the agreement or is developed by us, we cannot determine whether another supplier would be able to provide the products at the same or a better price. However, all pricing will be designed to enable us to sell the products at a price which enables us to generate a gross margin that we consider acceptable, and Mr. Liu will have significant input as to what is an acceptable gross margin. Our supply agreements also require Shenzhen to provide us with quality products and services in a timely manner, to provide to our customers the same warrant that we provide to our customer and to give first priority to the manufacture of our products over any other manufacturing obligations. However, as our chief executive officer, Mr. Liu has the ability to determine whether to pursuant any legal action to enforce our supply agreements. Thus, we will be relying on Mr. Liu taking actions that are in our best interests, and we run the risk that he may not do so.

The recent implementation of regulations relating to e-cigarettes has resulted in our decision not to market nicotine products in the United States.

The FDA has authority to regulate e-liquids, e-cigarettes, and other vaping products that contain (or are used to consume e-liquid containing) tobacco-derived ingredients and nicotine from any source as “tobacco products” under the federal Food, Drug and Cosmetic Act (the “Food, Drug and Cosmetic Act”), as amended by Family Smoking Prevention and Tobacco Control Act of 2009 (the “Tobacco Control Act”) and subsequent legislation. Through the issuance of the “Deeming Regulation” that became effective on August 8, 2016, the FDA began regulating e-liquids, e-cigarettes, and other vaping products that qualify as “tobacco products” under the Food, Drug and Cosmetic Act’s requirements added by the Tobacco Control Act. The Food, Drug and Cosmetic Act requires that any Deemed Tobacco Product that was not commercially marketed as of the “grandfather” date of February 15, 2007, obtain premarket authorization before it can be marketed in the United States. The compliance policy generally allowed companies to market Deemed Tobacco Products that qualify as “new tobacco products” but that were on the U.S. market on August 8, 2016, until September 9, 2020, and the continued marketing of such products without otherwise-required authorization for up to one year during the FDA’s review of a pending marketing application submitted by September 9, 2020. The compliance policy did not apply to otherwise-eligible products (i) for which the manufacturer has failed to take (or is failing to take) adequate measures to prevent minors’ access and (ii) that are targeted to minors or with marketing that is likely to promote use by minors. In the absence of this policy, we would have had to obtain prior authorization from the FDA to market any of our products after August 8, 2016. Accordingly, through September 9, 2020, Aspire North America marketed tobacco vaping products in the United States pursuant to the FDA’s compliance policy based on evidence that they were on the U.S. market on August 8, 2016, and had not been physically modified since.

FDA authorization to introduce a “new tobacco product” (or to continue marketing a “new tobacco product” covered by the current compliance policy for Deemed Tobacco Products that were on the U.S. market on August 8, 2016) could be obtained via any of the following three authorization pathways: (1) submission of a premarket tobacco product application (“PMTA”) and receipt of a marketing authorization order; (2) submission of a substantial equivalence report and receipt of a substantial equivalence order; or (3) submission of a request for an exemption from substantial equivalence requirements and receipt of a substantial equivalence exemption determination.

Since there were few, if any, e-liquid, e-cigarette, or other vaping products on the market as of February 15, 2007, there is no way to utilize the less onerous substantial equivalence or substantial equivalence exemption pathways that traditional tobacco companies can utilize for cigarettes, smokeless tobacco, and other traditional tobacco products. In order to obtain marketing authorizations, manufacturers of practically all e-liquid, e-cigarette, or other vaping products would have to use the PMTA pathway, which could potentially cost $1.0 million or more per application. Furthermore, the Deeming Regulation created a significant barrier to entry for any new e-liquid, e-cigarette, or other vaping product seeking to enter the market after August 8, 2016, since any such product would require an FDA marketing authorization through one of the aforementioned pathways.