UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report __________

Commission

file number

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Telephone:

+

Email:

At the address of the Company set forth above

(Name, Telephone, E-mail and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The

|

* Not for trading, but only in connection with the listing of the American depositary shares on The Nasdaq Stock Market LLC

Securities registered or to be registered pursuant to Section 12(g): None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

ordinary shares were outstanding as of December 31, 2023

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒

Indicate

by check mark whether the registrant has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | |

| Non-accelerated filer | ☐ | Emerging growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registration has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which consolidated financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities

Exchange Act of 1934). ☐ Yes ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities

Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☒

Table of Contents

| i |

CONVENTIONS THAT APPLY TO THIS ANNUAL REPORT ON FORM 20-F

Unless we indicate otherwise, references in this report to:

| ● | “ADSs” are to American depositary shares, each of which represents eight ordinary shares; | |

| ● | “BVI” are to the British Virgin Islands; | |

| ● | “BVI Act” are to BVI Business Companies Act, 2004 as amended from time to time | |

| ● | “FSC” are to the Forest Stewardship Council; | |

| ● | “Hong Kong” are to the Hong Kong Special Administrative Region in the People’s Republic of China; | |

| ● | “IPO” are to the Company’s initial public offering which was consummated on September 14, 2023; | |

| ● | “Macau” are to the Macao Special Administrative Region in the People’s Republic of China; | |

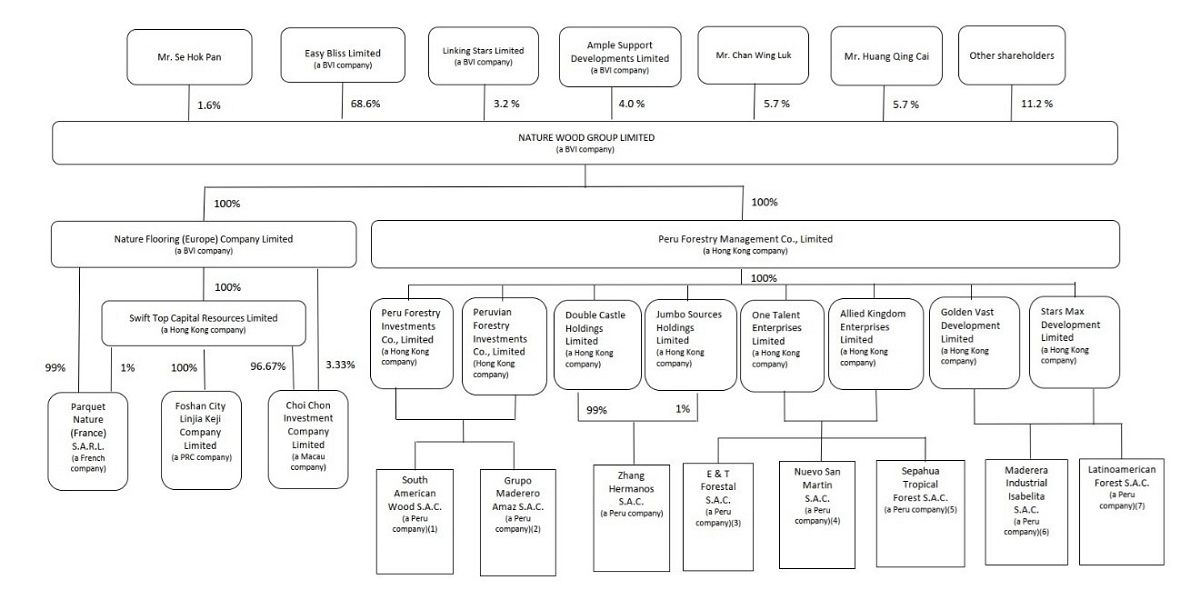

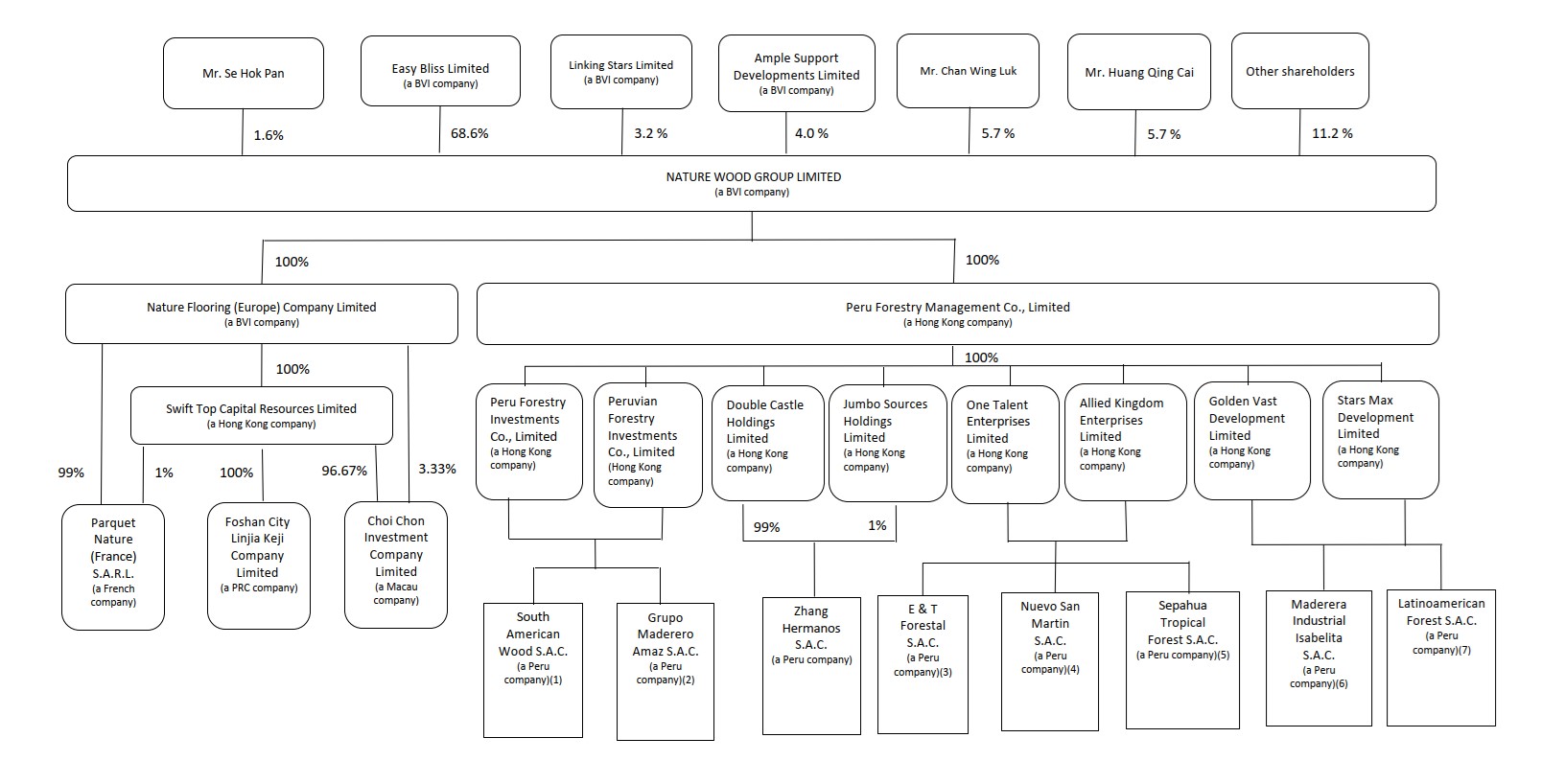

| ● | “Operating Subsidiaries” are to Swift Top Capital Resources Limited, Parquet Nature (France) S.A.R.L., Choi Chon Investment Company Limited, South American Wood S.A.C., Grupo Maderero Amaz S.A.C., E&T Forestal S.A.C., Nuevo San Martin S.A.C., Sepahua Tropical Forest S.A.C., Maderera Industrial Isabelita S.A.C. and Latinoamerican Forest S.A.C., each a subsidiary of our Company; | |

| ● | “Ordinary Shares” are to the ordinary shares of our Company, par value of $0.001 per share; | |

| ● | “Our Board” are to the board of Directors; | |

| ● | “our Company” are to Nature Wood Group Limited, the holding company incorporated in the BVI; | |

| ● | “our Forests” are to parcels of land in Peru with an aggregate area of approximately 615,333 hectares, of which our Group owned the natural forest concessions and cutting rights for the exploitation of timber, as at June 30, 2023 | |

| ● | “our Group”, “the Group”, “we”, “us” and “our” are to our Company and its subsidiaries; where the discussions in the context relate to business operations and/or financial performance, then the terms “Company”, “we”, “us”, “our”, “our Company”, “our Group”, “the Group” and “our business” refer to the business operations and/or financial performance of the Operating Subsidiaries; | |

| ● | “our Director(s)” are to the director(s) of our Company; | |

| ● | “PEFC” are to Programme for the Endorsement of Forest Certification; | |

| ● | “PRC” or “China” are to the People’s Republic of China, excluding Hong Kong, Macau and Taiwan for the purposes of this report only; | |

| ● | “RMB” or “Renminbi” are to the legal currency of China; | |

| ● | “sawn timber” are to square timber and commercial materials; | |

| ● | “$”, “USD”, “US$” or “U.S. dollars” are to the legal currency of the United States; | |

| ● | “HKD” or “HK$” are to the legal currency of Hong Kong; | |

| ● | “EUR” are to the legal currency of the European Union; | |

| ● | “MOP” are to the legal currency of Macau; | |

| ● | “SOL” or “S/” are to the legal currency of Peru. |

| ii |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that involve risks and uncertainties, including statements based on our current expectations, assumptions, estimates and projections about us and our industry. These forward-looking statements are made under the “safe harbor” provision under Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and as defined in the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. In some cases, these forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”, “anticipate”, “aim”, “estimate”, “intend”, “plan”, “believe”, “potential”, “continue”, “is/are likely to” or other similar expressions. The forward-looking statements included in this annual report relate to, among others:

| ● | timing of the development of future business; | |

| ● | capabilities of our business operations; | |

| ● | expected future economic performance; | |

| ● | competition in our market; | |

| ● | continued market acceptance of our services and products; | |

| ● | protection of our intellectual property rights; | |

| ● | changes in the laws that affect our operations; | |

| ● | inflation and fluctuations in foreign currency exchange rates; | |

| ● | our ability to obtain and maintain all necessary government certifications, approvals, and/or licenses to conduct our business; | |

| ● | continued development of a public trading market for our securities; | |

| ● | the cost of complying with current and future governmental regulations and the impact of any changes in the regulations on our operations; | |

| ● | managing our growth effectively; | |

| ● | projections of revenue, earnings, capital structure and other financial items; | |

| ● | fluctuations in operating results; and | |

| ● | health crisis, including due to pandemics such as the COVID-19 pandemic and government measures taken in response thereto. |

You should read these statements in conjunction with the risks disclosed in “Item 3. Key Information—3.D. Risk Factors” of this annual report and other risks outlined in our other filings with the Securities and Exchange Commission, or the SEC. Moreover, we operate in an evolving environment. New risks may emerge from time to time, and it is not possible for our management to predict all risks, nor can we assess the impact of such risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ materially from those contained in any forward-looking statements. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this annual report and the documents that we have referred to in this annual report, completely and with the understanding that our actual future results may be materially different from what we expect.

| iii |

PART I.

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not Applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not Applicable.

| ITEM 3. | KEY INFORMATION |

3.A. [Reserved]

3.B. Capitalization and Indebtedness

Not Applicable.

3.C. Reasons for the Offer and Use of Proceeds

Not Applicable.

3.D. Risk Factors

You should carefully consider each of the following risks and all the other information contained in this 2023 20-F Report in evaluating us and our common stock. Although the risks are organized by headings, and each risk is discussed separately, many are interrelated. Our business, financial condition, results of operations and cash flows could be materially and adversely affected by these risks, and, as a result, the trading price of our common stock could decline. We have in the past been adversely affected by certain of, and may in the future be affected by, these risks. You should not interpret the disclosure of any risk factor to imply that the risk has not already materialized.

Risks Related to Our Business and Industry

Our revenues are sensitive to fluctuations of log price and selling price of our products in the forestry industry.

Historically, prices for logs have been volatile and are affected by numerous factors that are not under control, including demand for wood and wood products, supply from illegal logging, changes in currency exchange rates, economic growth rates, foreign and domestic interest rates, trade policies, and prevailing fuel and transportation costs.

In addition, industry-wide increases in the supply of logs during a favorable price period can also lead to downward pressure on prices through oversupply. Increased production by us and our competitors could lead to oversupply and lower prices. Oversupply and lower prices may also result from illegal logging activity or decreased government enforcement of logging restrictions. Our revenues and profits are extremely sensitive to changes in log prices and selling prices of our products. Slight changes in log prices and selling prices of our products may cause a disproportionally large change in our revenues and our results of operation. If market prices for logs or our products were to decline, it could have a material adverse effect on our business, financial condition and results of operation.

We may face increased costs for new forest acquisitions.

As the forestry sector develops, sellers may become increasingly sophisticated about the valuation and prices of their forests and may demand higher premiums for high quality forests. There is no assurance that we will be able to negotiate favorably low prices for our new forest acquisitions. Rising acquisition costs and intensifying competition for new forests may hamper our expansion plans and have an adverse impact on the profitability and results of our operations.

Our Forests are subject to environmental regulations in the relevant jurisdictions.

The operations of our forestry business are subject to a wide range of environmental laws and regulations, which regulate, among other things, forestry activities, including harvesting, land clearing for forests and the emission, noise or discharge of pollutants, effluents, or solid waste, water or atmosphere.

Environmental laws and regulations have generally become more stringent in recent years and could become even more stringent in the future. We may be required to obtain certain licenses before we are permitted to occupy certain premises and/or carry out certain activities. They also protect endangered or threatened wildlife species which may live in our Forests. Some of these environmental laws and regulations could impose significant costs, expenses, penalties, administrative measures, and liabilities on us for violations of existing conditions attached to our licenses or commitments of environmental impact assessments, whether or not we caused or knew about them. Violations of such laws and regulations may result in civil penalties (such as fines and recovery of costs), remediation expenses, potential injunctions and prohibition orders and criminal penalties. Some environmental statutes impose strict liability, rendering a person liable for environmental damage without regard to the person’s negligence or fault.

| 1 |

Compliance with, or damages or penalties for violating, current and future environmental laws and regulations could result in a reduction in harvesting volume, suspension of our activities and may force us to incur significant expenses, which in turn could have a material adverse effect on our business, financial condition, and results of operations. Any tightening of the requirements prescribed by environmental laws and regulations in Peru or France, or changes in the manner of interpretation or enforcement of such existing laws or regulations, could adversely impact our operations by increasing our compliance costs and potential liabilities in connection with such laws and regulations, including additional capital or operating expenditures, which may place additional demands on our liquidity and adversely affect our results of operations.

We are dependent on the availability of large numbers of workers to perform manual labor.

We rely on large numbers of workers to harvest logs and perform manual labor. As many of our Forests are located in remote areas far from population centers, there is a risk that manpower for harvesting logs and for maintaining our Forests will not be available on a continuous basis due to factors such as rural-urban migration. We are also vulnerable to labor shortages due to strikes, labor stoppages and civil unrest. Any shortage of labor could increase our costs and reduce our production, which may have a material adverse effect on our business, financial condition and results of operations.

Our Forests may not grow in accordance with our expectations.

The success of our business depends in part upon the productivity of our existing and future forests. Growth in forests depends on a number of factors, many of which are beyond our control. These include, but are not limited to, damage by fire, diseases, pests, environmental pollution, and other natural or man-made disasters, as well as weather, climate, genetic factors and soil conditions. Our ability to improve the growth speed of our Forests will depend on the factors described above as well as our ability to improve our forest management practices. As a result, there can be no assurance that our Forest will grow as we expect. Our future business, financial condition and results of operations may be adversely affected if our Forests grow at a slower rate than we expect.

Our forest survey and knowledge of our Forests are subject to errors in the survey.

Our operating results depend on our knowledge of forests, especially in Peru and France. We regularly visit our Forests to monitor their growth and condition. In this process, we use a random sampling method for our survey of forests. We cannot guarantee the reliability of the results of our survey. In the event that the results of our survey are not reliable, our knowledge of our Forests and our ability to manage our Forests could be greatly hampered, which may have a material adverse effect on our business, financial condition and results of operations.

We depend on certain major customers.

For each of the years ended December 31, 2023, 2022 and 2021, we had a total of 143, 158 and 115 customers respectively, which had purchased our wood products. Our five largest customers during the respective periods accounted for approximately 53.2%, 55.3% and 55.1% of our total turnover respectively; whilst our largest customer accounted for approximately 28.2%, 19.5% and 22.6% of our total turnover respectively.

We may face increased operating costs and staff costs.

Our business may face increased operating costs as the forestry industry continues to develop. Our operating expenses for logging activities consist of our costs of harvesting, such as labor costs, and costs associated with applying for logging permits for our Forests. We expect labor costs to rise as workers who harvest our logs become more experienced and increase their wage demands. Logging permits for our Forests are subject to periodic revisions by the local forest bureaus and we expect them to increase as the industry develops. Increases in our operating expenses for logging activities and staff costs may have a material adverse effect on our business, financial condition and results of operations.

| 2 |

Our inability to obtain logging permits with sufficient logging amounts could reduce our future revenues.

A logging permit setting out, among other things, the quota (in terms of the maximum area and/or number of trees) allowable for logging and the period of logging must be obtained from the local forestry bureaus for harvesting in Peru.

Because the availability of logging permits is subject to the approval of the relevant local forestry bureau, there is no assurance that we will be able to continue obtaining logging permits, or that the logging amount given to us under the logging permits will be sufficient for our operations. Should we fail to obtain logging permits with logging amounts sufficient for our operations, our revenues in the future may be reduced and our business, financial condition and results of operations may be materially and adversely affected.

Our inability to obtain certificates from the FSC could reduce our future revenues.

During the years ended December 31, 2023, 2022 and 2021, revenue generated from FSC-certified decking amounted to approximately $4.7 million, $11.2 million and $9.9 million, representing approximately 18.4%, 20.3% and 20.7% of our total revenue. This, in turn, requires that we retain and renew our existing FSC Chain of Custody (CoC) certifications. Our retention and renewal of these certificates depend on our performance in forest management.

We cannot assure you that we will be able to retain or renew our existing certificates or obtain new certificates. If we are unable to renew or retain certificates, our business, results of operations and financial condition will be materially and adversely affected.

Our inability to acquire enough immediately harvestable forests may affect our ability to meet demand.

As at December 31, 2023, our Forests covered an area of approximately 615,333 hectares. We rely on acquisitions of new forests to increase our timber supply, particularly new forests which are immediately harvestable. There can be no assurance that we will be able to acquire sufficient immediately harvestable forests in the future to keep up with demand. If we cannot do so, our business, financial condition and results of operation may be materially adversely affected.

The current global market fluctuations and economic downturn could materially and adversely affect our business, financial condition and results of operations.

The global capital and credit markets have been experiencing extreme volatility and disruption in recent times. Concerns over inflation or deflation, energy costs, geopolitical issues, and the availability and cost of credit have contributed to unprecedented levels of market volatility and diminished expectations for the global economy and the capital and consumer markets in the future. These factors, combined with volatile oil prices, declining business activities and consumer confidence and increased unemployment, have precipitated an economic slowdown and a possible prolonged global recession. These events have led to a slowdown in the global economy which a number of economists predict could be significant and protracted. As a result, the demand for our wood products may significantly decrease, thereby materially and adversely affecting our business, financial condition and results of operations.

Social conflicts may disrupt our operations.

Despite Peru’s ongoing economic growth and stabilization, high levels of poverty and unemployment and social and political tensions continue to be pervasive problems in the country. Peru has, from time to time, experienced social and political turmoil, including riots, nationwide protests, strikes and street demonstrations. In the past, Peru has experienced periods of political instability that has included a succession of regimes with differing economic policies and programs. Recently, since December 2022, Peru has experienced unrelenting political turmoil. Part of our operations are conducted in Peru and depend on economic and political developments in the country. As a result, any social conflicts may disrupt our business operations, which could have a material adverse effect on our business and financial performance.

| 3 |

Security, political and economic instability in the Middle East may harm our business.

The escalating conflicts between Israel and its neighboring countries and Islamist militia and political groups since late 2023, particularly the Israel-Gaza Strip and attacks targeting vessels in the southern Red Sea, has introduced geopolitical tensions and security risks within the Middle East region. Such instability may affect the global markets and potentially cause disruptions to the international trade and financial systems. As such, the conflicts and heightened tensions in the Middle East could have an indirect, adverse impact on our business and financial condition and results of operations.

We are heavily dependent on key personnel and consultants.

We are heavily dependent on our Directors and management for the success of our operations. Our ability to negotiate successfully with the forest owners for our forest rights, and to acquire high quality forests, depends on the skills, relationships and reputation of our senior management. In particular, we rely on the management skills of our chairman, Mr. Hok Pan Se, for our business across borders. We also rely on the expertise and experience of our forest management staff, procurement and inventory staff, production staff, sales and marketing staff and consultants.

If we lose the services of any of our key personnel and/or if we cannot attract or retain quality consultants to advise us, we may lose our competitive advantage and our business could be adversely affected.

We face competition from other companies in the forestry industry.

We face many local and overseas competitors who also supply wood products to the market. Our primary competitors operate either domestically or within the Asia Pacific region. In particular, we face competition from a host of small logging firms, some of which may not comply with environmental and other industry standards to the same extent as we do, resulting in their potentially lower operating costs.

Competition in our industry is influenced by factors including the costs of new forest acquisitions, regulatory compliance, and forest insurance. Some of our competitors may have lower costs than we do, or, if their operations are located in less developed countries, may be subject to less stringent environmental and other governmental regulations than we are, because of different or regional laws and business practices. If we are unable to compete effectively, or if competition increases in the future, our revenues could decline, and there may be material adverse effects on our business, financial condition, results of operations and cash flows.

The forestry industry faces competition from solid wood substitutes.

In addition to competition within the forestry industry, the forest industry faces competition from solid wood substitutes. We face competition from companies that manufacture wood substitutes, such as imitation wood, fiber-cement wood, ceramic tile and other materials that are used as alternative materials mainly in construction and furniture production. The demand for wood products is also affected by changes in consumer trends and tastes. Preference for wood substitutes among manufacturers, construction companies and consumers could decrease demand for our products and have a material adverse effect on our revenue, financial condition and results of operations.

Abnormally high or prolonged levels of rain at our Forest locations may adversely impact our ability to harvest timber.

Our harvesting activity is dependent on, among other things, the weather conditions at our Forest locations. For safety reasons, we discontinue logging in our Forests during the rainy season, which is usually from late November to May. Abnormally prolonged periods of rainfall or unusually intense rainfall will reduce the volume of logs we are able to extract, which may have a material adverse effect on our business, financial condition and results of operations and revenues.

| 4 |

We are subject to certain risks relating to the delivery of our products.

We often rely on third-party logistics service providers for the delivery of our wood products to customers. Such delivery services could be suspended and thus interrupt the supply of our wood products if unforeseen events occur which are beyond our control, such as transportation bottlenecks, natural disasters, disease outbreaks or labor strikes. Any failure of this personnel to provide high-quality or timely delivery to our customers may negatively impact the purchase experience of our customers, damage our reputation and cause us to lose customers. Any negative publicity or poor feedback regarding our customer service overall may harm our brand and reputation and in turn cause us to lose customers and market share.

Disruption to the supply of raw materials or increase in raw material prices could materially and adversely affect our Group’s business, financial condition and results of operations.

The major raw materials used to produce our wood products are logs and floorings. The purchase of wood products and logs together accounted for approximately 92.0%, 97.8% and 93.9% of the total raw material purchase costs during the years ended December 31, 2023, 2022 and 2021 respectively. However, our Group has not entered into any long-term supply contracts with our suppliers. In the event that the ban on commercial logging is imposed by the French government or the places where our suppliers are located or natural disasters, the supply of timber for the production of our wood products and the hosting of timber auctions may be affected. It is therefore possible that our Group will not be able to purchase sufficient raw materials from our suppliers, in a timely manner and on commercially acceptable terms, or at all.

In addition, if we are unable to acquire raw materials from our existing suppliers for any reason, we cannot assure that our Group will be able to source the raw materials from alternative sources within a reasonable period of time, and at acceptable prices or at all. Our Group cannot assure that such shortages will not occur in the future. Any failure to obtain adequate supplies of raw materials on a timely basis may disrupt our Group’s operation, and may have a material adverse effect on the business, financial condition and results of operations of our Group.

Our networks and those of our third-party service providers may be vulnerable to cybersecurity risks.

Our network and those of our third-party service providers and our customers may be vulnerable to unauthorized access, computer attacks, viruses and other security problems. Persons who circumvent security measures could wrongfully access and obtain or use information on our network or cause service interruptions, delays or malfunctions in our devices, services or operations, any of which could harm our reputation, cause demand for our products and services to fall, and compromise our ability to pursue our business plans. Recently, there have been reported several significant, widespread security attacks and breaches that have compromised network integrity for many companies and governmental agencies, in some cases reportedly originating from outside the United States. In addition, there are reportedly private products available in the market today that may attempt to unlawfully intercept communications made using our network. We may be required to expend significant resources to respond to, contain, remediate, and protect against these attacks and threats, including compliance with applicable data breach and security laws and regulations, and to alleviate problems, including reputational harm and litigation, caused by these security incidents. Although we have implemented and intend to continue to implement security measures, these measures may prove to be inadequate. These security incidents could have a significant effect on our systems, devices and services, including system failures and delays that could limit network availability, which could harm our business and our reputation and result in substantial liability.

Risks Related to Doing Business in China

Our operations are based in Peru, France, Hong Kong and Macau. We have a subsidiary that is established in the PRC, namely Foshan City Linjia Technology Company Limited, which is engaged in IT consultancy and business consultancy. As of the date of this report, the PRC subsidiary has not (i) conducted any other business operation in the PRC, (ii) owned any material assets in the PRC, (iii) received loans or additional investments, (iv) distributed any dividends to shareholders, or (v) subjected to any administrative penalties in the PRC. The PRC subsidiary does not involve in the major part of our operations and we do not intend to conduct any major part of our operations through it in the future. Although we have equity ownership in our PRC, Hong Kong and Macau subsidiaries and currently do not have or intend to have any contractual arrangement to establish a variable interest entity structure with any entity in China, we may still be subject to unique risks due to uncertainty about any future actions of the Chinese government or authorities in Hong Kong and Macau in relation to business operations in the PRC, Hong Kong or Macau, or regulatory oversight of overseas listing of companies with operations in the PRC, Hong Kong or Macau.

| 5 |

Despite the fact that our operations in the PRC are insignificant, a major part of our operations is based in Hong Kong and Macau, each a Special Administrative Region of China. Although Hong Kong and Macau have their own governmental and legal system that is independent of the PRC, it is uncertain whether in the future the Hong Kong or Macau government will implement regulations and policies of the Chinese government, or adopt regulations and policies of its own that are substantially the same as those of the Chinese government. Moreover, given that policies, regulations, rules, and the enforcement of laws of the Chinese government may be changed or amended, it is also uncertain in the future whether our operations in Hong Kong or Macau will be subject to the oversight of the Chinese authorities.

We may be subject to the risks that are specific to doing business in the PRC. Nevertheless, we believe that the effect of the risks below on our Group would not be material.

Due to the long arm provisions under the current PRC laws and regulations, if the Chinese government exercises any significant oversight and discretion over the conduct of our business and intervenes in or influences our operations, our operations and/or the value of our ADSs could be affected. The policies, regulations, rules, and the enforcement of laws of the Chinese government may also be changed or amended with little advance notice and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system could be uncertain.

Our Company is a holding company and we conduct our operations through our Operating Subsidiaries in Peru, France, Hong Kong, Macau and China. As at the date of this report, we are not materially affected by recent statements by the Chinese Government indicating an extent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers. However, due to long arm provisions under the current PRC laws and regulations, there remains regulatory uncertainty with respect to the implementation and interpretation of laws in China. The PRC government may choose to exercise significant oversight and discretion, and the policies, regulations, rules, and enforcement of laws of the Chinese government to which we are subject may change from time to time. As a result, the application, interpretation, and enforcement of new and existing laws and regulations in the PRC and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system could also be uncertain. In addition, these laws and regulations may be interpreted and applied inconsistently by different agencies or authorities, and inconsistently with current policies and practices. New laws, regulations, and other government directives in the PRC may also be costly to comply with, and such compliance or any associated inquiries or investigations or any other government actions may:

| ● | delay or impede our development; | |

| ● | result in negative publicity or increase our operating costs; | |

| ● | require significant management time and attention; and | |

| ● | subject us to remedies, administrative penalties and even criminal liabilities that may harm our business, including fines assessed for our current or historical operations, or demands or orders that we modify or even cease our business practices. |

We are aware that since 2021, the PRC government has initiated a series of regulatory actions and statements to regulate business operations in certain areas in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation-making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on a U.S. or other foreign exchange.

| 6 |

The Chinese government may intervene or influence our operations at any time or may exert more control over offerings conducted overseas and foreign investment in China-based issuers, which may affect our operations and/or the value of our ADSs. The promulgation of new laws or regulations, or the new interpretation of existing laws and regulations, in each case that restricts or otherwise unfavorably impacts the ability or way we conduct our business and could require us to change certain aspects of our business to ensure compliance, which could decrease demand for our services, reduce revenues, increase costs, require us to obtain more licenses, permits, approvals or certificates, or subject us to additional liabilities. To the extent any new or more stringent measures are required to be implemented, our business, financial condition and results of operations could be adversely affected as well as materially decrease the value of our ADSs, potentially rendering them worthless.

If the Chinese government chooses to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, such action may significantly limit or completely hinder our ability to offer or continue to offer ADSs to investors and cause the value of our ADSs to significantly decline or be worthless.

Some statements by the Chinese government have indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investments in China-based issuers. On July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued a document to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws. On December 24, 2021, the CSRC published the drafts of the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies, and the Administrative Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies for public comment. On February 17, 2023, the CSRC published the formal Overseas Listing Measures to regulate overseas securities offering and listing activities by domestic companies.

Furthermore, on December 28, 2021, the CAC, the National Development and Reform Commission (“NDRC”), and several other administrations jointly issued the revised Measures for Cybersecurity Review, or the “Revised Review Measures”, which became effective on February 15, 2022 and replaced the existing Measures for Cybersecurity Review. According to the Revised Review Measures, if an “online platform operator” that is in possession of the personal data of more than one million users intends to list in a foreign country, it must apply for a cybersecurity review. Moreover, the CAC released the draft of the Regulations on Network Data Security Management in November 2021 for public consultation, which among other things, stipulates that a data processor listed overseas must conduct an annual data security review by itself or by engaging a data security service provider and submit the annual data security review report for a given year to the municipal cybersecurity department before January 31 of the following year. On July 7, 2022, the CAC released the Measures for the Security Assessment of Cross-Border Data, which becomes effective on September 1, 2022. According to the Measures for the Security Assessment of Cross-Border Data, where a data processor provides data abroad under any of the following circumstances, it shall apply for exit security assessment of data to the national cyberspace administration through the local provincial cyberspace administration: (1) the data processor provides important data abroad; (2) the operators of key information infrastructure and data processors that process the personal information of more than 1 million people provide personal information abroad; (3) data processors who have provided 100,000 personal information or 10,000 sensitive personal information abroad in aggregate since January 1 of last year provide personal information abroad; and (4) other situations required for security assessment as stipulated by the state cyberspace administration. Given the recency of the issuance of the Measures for the Security Assessment of Cross-Border Data, no guidance on the interpretation or implementation of such Measures has been published.

We sell a range of logs and flooring primarily in Hong Kong and Macau respectively, but not in mainland China. Our subsidiaries in Hong Kong and Macau have not collected or stored any data (including certain personal information) from PRC individuals. As a result, the likelihood of us being subject to the review of the CAC is remote.

| 7 |

In the event that we rely on dividends and other distributions on equity paid by our PRC or Hong Kong subsidiaries to fund any cash and financing requirements, we may have, any limitation on the ability of our PRC or Hong Kong subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business.

In general, our PRC subsidiary’s ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiary to pay dividends to its shareholders only out of its accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, our PRC subsidiary, as a Foreign Invested Enterprise, or FIE, is required to draw 10% of its after-tax profits each year, if any, to fund a common reserve, which may stop drawing its after-tax profits if the aggregate balance of the common reserve has already accounted for over 50 percent of its registered capital. These reserves are not distributable as cash dividends. If our PRC subsidiary incurs debt on its own in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments to us. Any limitation on the ability of our PRC subsidiary to distribute dividends or other payments to its shareholders could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends or otherwise fund and conduct our business.

The Enterprise Income Tax Law and its implementation rules provide that a withholding tax rate of up to 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless otherwise exempted or reduced according to treaties or arrangements between the PRC central government and governments of other countries or regions where the non-PRC resident enterprises are incorporated.

Under Hong Kong law, dividends could only be paid out of distributable profits (that is, accumulated realized profits less accumulated realized losses) or other distributable reserves. Dividends cannot be paid out of share capital. Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us.

Any limitation on the ability of our PRC or Hong Kong subsidiaries to pay dividends or make other distributions to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business.

To the extent cash or assets in our business is in the PRC or Hong Kong or in our PRC or Hong Kong subsidiaries, the funds or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on our ability or the ability of our subsidiaries by the PRC government to transfer cash or assets.

We may in the future depend on dividends and other distributions on equity paid by our PRC and Hong Kong subsidiaries or depend on our assets located in China or Hong Kong for our cash and financing requirements. The PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. Shortages in the availability of foreign currency may then restrict the ability of our PRC subsidiary to remit sufficient foreign currency to our offshore entities for our offshore entities to pay dividends or make other payments or otherwise to satisfy our foreign-currency-denominated obligations. Therefore, to the extent cash or assets in our business is in the PRC or Hong Kong or in our PRC or Hong Kong subsidiaries, the funds or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on our ability or the ability of our subsidiaries by the PRC government to transfer cash or assets.

The PRC government may continue to strengthen its capital controls, and more restrictions and substantial vetting processes may be put forward by the State Administration of Foreign Exchange of the PRC for cross-border transactions. Any limitation on the ability of our PRC and Hong Kong subsidiaries to pay dividends or make other kinds of payments to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends or otherwise fund and conduct our business.

Although the audit report included in this report is prepared by U.S. auditors who are currently inspected by the PCAOB, there is no guarantee that future audit reports will be prepared by auditors inspected by the PCAOB and, as such, in the future investors may be deprived of the benefits of such inspection. Furthermore, trading in our ADSs may be prohibited under the HFCA Act if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely, and as a result, U.S. national securities exchanges, such as the Nasdaq, may determine to delist our securities. Furthermore, on December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act was enacted, which amended the HFCA Act and requires the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, and thus reducing the time before our ADSs may be prohibited from trading or delisted.

As an auditor of companies that are registered with the SEC and publicly traded in the United States and a firm registered with the PCAOB, our auditor is required under the laws of the United States to undergo regular inspections by the PCAOB to assess their compliance with the laws of the United States and professional standards. The PCAOB is currently unable to conduct inspections without the approval of the Chinese government authorities. Inspections of other auditors conducted by the PCAOB outside mainland China have at times identified deficiencies in those auditors’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. The lack of PCAOB inspections of audit work undertaken in mainland China prevents the PCAOB from regularly evaluating auditors’ audits and their quality control procedures. As a result, if there is any component of our auditor’s work papers become located in mainland China in the future, such work papers will not be subject to inspection by the PCAOB. As a result, investors would be deprived of such PCAOB inspections, which could result in limitations or restrictions on our access to the U.S. capital markets.

| 8 |

On May 20, 2020, the U.S. Senate passed the HFCA Act, which includes requirements for the SEC to identify issuers whose audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely because of a restriction imposed by a non-U.S. authority in the auditor’s local jurisdiction. The U.S. House of Representatives passed the HFCA Act on December 2, 2020, and the HFCA Act was signed into law on December 18, 2020. Additionally, in July 2020, the U.S. President’s Working Group on Financial Markets issued recommendations for actions that can be taken by the executive branch, the SEC, the PCAOB or other federal agencies and departments with respect to Chinese companies listed on U.S. stock exchanges and their audit firms, in an effort to protect investors in the United States. In response, on November 23, 2020, the SEC issued guidance highlighting certain risks (and their implications to U.S. investors) associated with investments in China-based issuers and summarizing enhanced disclosures the SEC recommends China-based issuers make regarding such risks.

On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements in the HFCA Act. On December 2, 2021, the SEC adopted amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable to inspect or investigate. We will be required to comply with these rules if the SEC identifies us as having a “non-inspection” year under a process to be subsequently established by the SEC. The final amendments require any identified registrant to submit documentation to the SEC establishing that the registrant is not owned or controlled by a government entity in the public accounting firm’s foreign jurisdiction, and also require, among other things, disclosure in the registrant’s annual report regarding the audit arrangements of, and government influence on, such registrants. Under the HFCA Act (as amended by the Accelerating Holding Foreign Companies Accountable Act, which was enacted on December 29, 2022), our securities may be prohibited from trading on the Nasdaq or other U.S. stock exchanges if our auditor is not inspected by the PCAOB for two consecutive years, and this ultimately could result in our ADSs being delisted.

On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, and thus, would reduce the time before our ADSs may be prohibited from trading or delisted.

On September 22, 2021, the PCAOB adopted a final rule implementing the HFCA Act, which provides a framework for the PCAOB to use when determining, as contemplated under the HFCA Act, whether the Board is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction.

On November 5, 2021, the SEC approved the PCAOB’s Rule 6100, Board Determinations Under the Holding Foreign Companies Accountable Act. Rule 6100 provides a framework for the PCAOB to use when determining, as contemplated under the HFCA Act, whether it is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction.

On December 16, 2021, the PCAOB issued a report on its determinations that it was unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in Mainland China and in Hong Kong, because of positions taken by PRC authorities in those jurisdictions, which determinations were vacated on December 15, 2022. The PCAOB made its determinations pursuant to PCAOB Rule 6100, which provides a framework for how the PCAOB fulfills its responsibilities under the HFCA Act, which determinations were vacated on December 15, 2022. The report further listed in its Appendix A and Appendix B, the Registered Public Accounting Firms Subject to the Mainland China Determination and Registered Public Accounting Firms Subject to the Hong Kong Determination, respectively, which determinations were vacated on December 15, 2022. Our auditor, WWC, P.C. is headquartered in the United States, and did not appear as part of the report under the lists in its Appendix A or Appendix B.

| 9 |

On August 26, 2022, the PCAOB signed SOP Agreements with the China Securities Regulatory Commission (the “CSRC”) and China’s Ministry of Finance. The SOP Agreements established a specific, accountable framework to make possible complete inspections and investigations by the PCAOB of audit firms based in mainland China and Hong Kong, as required under U.S. law. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong completely in 2022. The PCAOB vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s control. However, if the PCAOB continues to be prohibited from conducting complete inspections and investigations of PCAOB-registered public accounting firms in mainland China and Hong Kong, the PCAOB is likely to determine by the end of 2023 that positions taken by authorities in the PRC obstructed its ability to inspect and investigate registered public accounting firms in mainland China and Hong Kong completely, then the companies audited by those registered public accounting firms would be subject to a trading prohibition on U.S. markets pursuant to the HFCA Act.

The SEC is assessing how to implement other requirements of the HFCA Act, including the listing and trading prohibition requirements described above. Future developments in respect of increasing U.S. regulatory access to audit information are uncertain, as the legislative developments are subject to the legislative process and the regulatory developments are subject to the rule-making process and other administrative procedures.

While we understand that there has been dialogue among the CSRC, the SEC and the PCAOB regarding the inspection of PCAOB-registered accounting firms in mainland China, there can be no assurance that we will be able to comply with requirements imposed by U.S. regulators if there is a significant change to current political arrangements between mainland China, Macau and Hong Kong, or if any component of our auditor’s work papers become located in mainland China in the future. Delisting of our ADSs would force holders of our ADSs to sell their ADSs. The market price of our ADSs could be adversely affected as a result of anticipated negative impacts of these executive or legislative actions, regardless of whether these executive or legislative actions are implemented and regardless of our actual operating performance.

If we fail to comply with work safety or environmental regulations, we could be exposed to penalties, fines, suspensions or action in other forms.

Our operations are subject to the work safety, fire safety and environmental protection laws and regulations promulgated by the PRC government. These laws and regulations require us to maintain safe working conditions and adopt effective measures to control and properly dispose of solid waste and other environmental pollutants. We could be exposed to penalties, fines, suspensions or actions in other forms if we fail to comply with these laws and regulations. The laws and regulations in China may be amended from time to time and changes in those laws and regulations may cause us to incur additional costs in order to comply with the more stringent rules. In the event that changes to existing laws and regulations require us to incur additional compliance costs or require costly changes to our production process, our costs could increase and we may suffer a decline in sales for certain products, as a result of which our business, results of operations and financial condition could be materially and adversely affected.

| 10 |

Increases in labor costs and enforcement of stricter labor laws and regulations in China and our additional payments of statutory employee benefits may adversely affect our business and profitability.

The average wage in China has increased in recent years and is expected to continue to grow. The average wage level for our employees has also increased in recent years. We expect that our labor costs, including wages and employee benefits, will continue to increase. Unless we are able to pass on these increased labor costs to our customers, our profitability and results of operations may be materially and adversely affected. In addition, we have been subject to stricter regulatory requirements in terms of entering into labor contracts with our employees and paying various statutory employee benefits, including pensions, housing funds, medical insurance, work related injury insurance, unemployment insurance and maternity insurance to designated government agencies for the benefit of our employees. Pursuant to the PRC Labor Contract Law and its implementation rules, employers are subject to stricter requirements in terms of signing labor contracts, paying remuneration, determining the term of employee’s probation and unilaterally terminating labor contracts. In the event that we decide to terminate some of our employees or otherwise change our employment or labor practices, the PRC Labor Contract Law and its implementation rules may limit our ability to effect those changes in a desirable or cost-effective manner, which could adversely affect our business and results of operations.

Pursuant to PRC laws and regulations, companies registered and operating in China are required to apply for social insurance registration and housing fund deposit registration within 30 days of their establishment and to pay for their employees various social insurance including pension insurance, medical insurance, work-related injury insurance, unemployment insurance and maternity insurance to the extent required by law. According to the Social Insurance Law, if an employing entity does not pay the full amount of social insurance premiums as scheduled or required, the social insurance premium collection institution shall order it to make the payment or make up the difference within the stipulated period and impose a daily fine equivalent to 0.05% of the overdue payment from the day on which the payment is overdue. If the payment is not made within the prescribed time ordered by the social insurance authority, the authority shall impose a fine ranging from one to three times of the overdue payment amount. According to the Regulations on Management of Housing Provident Funds, where an entity fails to deposit the housing provident fund in full within the prescribed deadline, it shall be ordered by the housing provident fund management center to deposit the fund within a time limit; if it still fails to deposit the fund within the time limit, the housing provident fund management center may apply to the People’s Court for enforcement. We have paid social insurance for all employees and housing provident fund for most of our employees in China. While our payment base of social insurance and housing provident fund meets the respective local government’s minimum requirements in respect of the locations of our PRC subsidiary, it is lower than the national legal standard. As of the date of this report, we have not received any notice of warning or been subject to any material administrative penalties or other material disciplinary actions from the relevant governmental authorities for our historical shortfall in social insurance and housing fund contribution. However, as the PRC government enhanced its enforcement measures relating to social insurance collection, we may be required to make up the contributions for our employees, and may be further subjected to late fees payment and administrative fines, which may adversely affect our financial condition and results of operations. As the interpretation and implementation of labor-related laws and regulations are still evolving, we cannot assure you that our current employment practices do not and will not violate other effective or future labor-related laws and regulations in China, which may subject us to labor disputes or government investigations. In addition, we may incur additional expenses in order to comply with such laws and regulations, which may adversely affect our business and profitability.

The enactment of the Law of the PRC on Safeguarding National Security in the Hong Kong Special Administrative Region (the “Hong Kong National Security Law”) could impact our Hong Kong subsidiaries.

On June 30, 2020, the Standing Committee of the PRC National People’s Congress adopted the Hong Kong National Security Law. This law defines the duties and government bodies of the Hong Kong National Security Law for safeguarding national security and four categories of offences — secession, subversion, terrorist activities, and collusion with a foreign country or external elements to endanger national security — and their corresponding penalties. On July 14, 2020, former U.S. President Donald Trump signed the Hong Kong Autonomy Act, or HKAA, into law, authorizing the U.S. administration to impose blocking sanctions against individuals and entities who are determined to have materially contributed to the erosion of Hong Kong’s autonomy. The spokesperson of the PRC government has issued statements that this document was grossly trampled on the international law and basic norms of international relations, seriously interfered in China’s internal affairs, and should have been repealed a long time ago. On August 7, 2020 the U.S. government imposed HKAA-authorized sanctions on eleven individuals, including HKSAR chief executive Carrie Lam. On October 14, 2020, the U.S. State Department submitted to relevant committees of Congress the report required under HKAA, identifying persons materially contributing to “the failure of the Government of China to meet its obligations under the Joint Declaration or the Basic Law.” The HKAA further authorizes secondary sanctions, including the imposition of blocking sanctions, against foreign financial institutions that knowingly conduct a significant transaction with foreign persons sanctioned under this authority. The imposition of sanctions may directly affect foreign financial institutions as well as any third parties or customers dealing with any foreign financial institution that is targeted. It is difficult to predict the full impact of the Hong Kong National Security Law and HKAA on Hong Kong and companies located in Hong Kong. Any such continued tension between the U.S. and the PRC may affect the economy of Hong Kong and in turn, materially and adversely affect our business and operation. If our subsidiaries in Hong Kong are determined to be in violation of the Hong Kong National Security Law or the HKAA by competent authorities, our business operations, financial position and results of operations could be materially and adversely affected.

| 11 |

A downturn in Hong Kong, China or the global economy, and the economic and political policies of China could materially and adversely affect our business and financial condition.

We conduct our operation through our Operating Subsidiaries in Europe, the U.S. and Asia, primarily in Hong Kong and China. Accordingly, our business, prospects, financial condition and results of operations may be influenced to a significant degree by political, economic and social conditions in Hong Kong and China generally and by continued economic growth in Hong Kong and China as a whole. The Chinese economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the Chinese economy has experienced significant growth over the past decades, growth has been uneven, both geographically and among various sectors of the economy. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall Chinese economy but may have a negative effect on us.

Economic conditions in Hong Kong and China are sensitive to global economic conditions. Any prolonged slowdown in the global or Chinese economy may affect potential clients’ confidence in the financial market as a whole and have a negative impact on our business, results of operations and financial condition. Additionally, continued turbulence in the international markets may adversely affect our ability to access the capital markets to meet liquidity needs.

The Hong Kong legal system embodies uncertainties which could limit the legal protections available to our Company.

Hong Kong is a Special Administrative Region of the PRC and enjoys a high degree of autonomy under the “one country, two systems” principle. The Hong Kong Special Administrative Region’s constitutional document, the Basic Law, ensures that the current political situation will remain in effect for 50 years. Hong Kong has enjoyed the freedom to function with a high degree of autonomy for its affairs, including currencies, immigration and custom, an independent judiciary system and a parliamentary system. The National People’s Congress of the PRC has the right to amend the Basic Law. We cannot assure you that there will not be any amendment to the Basic Law that may affect the judiciary and legal systems of Hong Kong and guarantee the implementation of the “one country, two systems” principle and the level of autonomy as currently in place at the moment. Any changes in the state of the political environment in Hong Kong may materially and adversely affect our business and operation. Additionally, intellectual property rights and confidentiality protections in Hong Kong may not be as effective as in the United States or other countries. These uncertainties could limit the legal protections available to us, including our ability to enforce our agreements with our clients.

Changes in international trade policies, trade disputes, barriers to trade, or the emergence of a trade war may dampen growth in China and other markets where the majority of our clients reside.

Political events, international trade disputes, and other business interruptions could harm or disrupt international commerce and the global economy, and could have a material adverse effect on us and our customers, service providers and other partners. International trade disputes could result in tariffs and other protectionist measures which may materially and adversely affect our business.

Tariffs could increase the cost of goods and products which could affect customers’ investment decisions. In addition, political uncertainty surrounding international trade disputes and the potential of the escalation to trade war and global recession could have a negative effect on customer confidence, which could materially and adversely affect our business. We may have also access to fewer business opportunities, and our operations may be negatively impacted as a result. In addition, the current and future actions or escalations by either the United States or China that affect trade relations may cause global economic turmoil and potentially have a negative impact on our markets, our business, or our results of operations, as well as the financial condition of our clients. and we cannot provide any assurances as to whether such actions will occur or the form that they may take.

| 12 |

Under the Basic Law of the Hong Kong Special Administrative Region of the People’s Republic of China, Hong Kong is exclusively in charge of its internal affairs and external relations, while the government of the PRC is responsible for its foreign affairs and defense. As a separate customs territory, Hong Kong maintains and develops relations with foreign states and regions. However, based on recent political development, the U.S. State Department has indicated that the United States no longer considers Hong Kong to have significant autonomy from China. Hong Kong’s preferential trade status was removed by the United States government and the United States may impose the same tariffs and other trade restrictions on exports from Hong Kong that it places on goods from mainland China. These and other recent actions may represent an escalation in political and trade tensions involving the U.S., China and Hong Kong, which could potentially harm our business.

Fluctuations in exchange rates could have a material and adverse effect on our results of operations and the value of your investment.

Our revenues and expenses will be denominated in Hong Kong dollars, EUR, Renminbi and U.S. dollars. Although the exchange rate between the Hong Kong dollar to the U.S. dollar has been pegged since 1983, we cannot assure you that the Hong Kong dollar will remain pegged to the U.S. dollar. Any significant fluctuations in the exchange rates between Hong Kong dollars to the U.S. dollars may have a material adverse effect on our revenue and financial condition. We have not used any forward contracts, futures, swaps or currency borrowings to hedge our exposure to foreign currency risk.

Risks Related to Our ADSs

An active trading market for the ADSs on Nasdaq might not develop or be sustained, their trading prices might fluctuate significantly and the liquidity of our ordinary shares would be materially affected.

We cannot assure you that an active trading market for the ADSs on Nasdaq will develop or be sustained. If an active trading market of our ADSs on Nasdaq does not develop or is not sustained, the market price and liquidity of our ADSs could be materially and adversely affected.

We incurred increased costs as a result of being a public company, and will continue to incur increased costs particularly after we cease to qualify as an “emerging growth company.”

We incurred significant legal, accounting and other expenses as a public company that we did not incur as a private company. The Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC, impose various requirements on the corporate governance practices of public companies. We are an “emerging growth company” as defined in the JOBS Act and will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a)following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.235 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our ADSs that are held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include exemption from the auditor attestation requirement under Section 404 in the assessment of the emerging growth company’s internal control over financial reporting and permission to delay adopting new or revised accounting standards until such time as those standards apply to private companies.

Compliance with these rules and regulations increases our legal and financial compliance costs and makes some corporate activities more time-consuming and costly. After we are no longer an “emerging growth company”, or until five years following the completion of our initial public offering, whichever is earlier, we expect to incur significant expenses and devote substantial management effort toward ensuring compliance with the requirements of Section 404 and the other rules and regulations of the SEC. For example, as a public company, we have been required to increase the number of independent directors and adopt policies regarding internal controls and disclosure controls and procedures. We have incurred additional costs in obtaining director and officer liability insurance. In addition, we incur additional costs associated with our public company reporting requirements. It may also be more difficult for us to find qualified persons to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these rules and regulations, and we cannot predict or estimate with any degree of certainty the amount of additional costs we may incur or the timing of such costs.

| 13 |

If we fail to meet applicable listing requirements, Nasdaq may delist our ADSs from trading, in which case the liquidity and market price of our ADSs could decline.

We cannot assure you that we will be able to meet the continued listing standards of Nasdaq in the future. If we fail to comply with the applicable listing standards and Nasdaq delists our ADSs, we and our shareholders could face significant material adverse consequences, including:

| ● | a limited availability of market quotations for our ADSs; | |

| ● | reduced liquidity for our ADSs; | |

| ● | a determination that our ADSs are “penny stock”, which would require brokers trading in our ADSs to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our ADSs; | |

| ● | a limited amount of news about us and analyst coverage of us; and | |

| ● | a decreased ability for us to issue additional equity securities or obtain additional equity or debt financing in the future. |

The National Securities Markets Improvement Act of 1996, which is a federal statute, prevents or preempts the states from regulating the sale of certain securities, which are referred to as “covered securities.” Because we expect that our ADSs will be listed on Nasdaq, such securities will be covered securities. Although the states are preempted from regulating the sale of our securities, the federal statute does allow the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar the sale of covered securities in a particular case. Further, if we were no longer listed on Nasdaq, our securities would not be covered securities and we would be subject to regulations in each state in which we offer our securities.

Volatility in our ADSs price may subject us to securities litigation.

The market for our ADSs may have, when compared to seasoned issuers, significant price volatility and we expect that our ADS price may continue to be more volatile than that of a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

The price and the trading volume of our ADSs may be volatile which could result in substantial losses for investors.