As filed with the Securities and Exchange Commission on March 12, 2024.

Registration No. 333-274606

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 7 to

FORM S-1

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

KINDLY MD, INC.

(Exact name of registrant as specified in its charter)

| Utah | 8049 | 84-3829824 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

5097 South 900 East

Suite 100

Salt Lake City, UT 84117

(385) 388-8220

(Address and telephone number of registrant’s principal executive offices)

Timothy Pickett

Chief Executive Officer

5097 South 900 East

Suite 100

Salt Lake City, UT 84117

(385)388-8220

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Callie T. Jones, Esq. | Richard A. Friedman, Esq. |

Lance Brunson, Esq. Brunson Chandler & Jones, PLLC |

Stephen Cohen, Esq. Sheppard, Mullin, Richter & Hampton LLP |

| 175 South Main Street, Suite 1410 | 30 Rockefeller Plaza |

| Salt Lake City, UT 84111 | New York, NY 10112-0015 |

| Tel.: (801) 303-5721 | Tel.: (212) 653-8700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement has been updated to include the audited financial statements and notes for the year ended December 31, 2023.

This Registration Statement contains two forms of prospectuses: one to be used in connection with the initial public offering of 1,272,727 Units of our common stock (including shares of common stock which may be issued on exercise of a 45-day option granted to the underwriters to cover over-allotments, if any) through the underwriters named on the cover page of this prospectus (the “IPO Prospectus”) and one to be used in connection with the potential resale by certain selling stockholders of an aggregate amount up to 1,712,057 shares of our common stock (the “Selling Stockholder Prospectus”). The IPO Prospectus and the Selling Stockholder Prospectus will be identical in all respects except for the alternate pages for the Selling Stockholder Prospectus included herein which are labeled “Alternate Pages for Selling Stockholder Prospectus.”

The Selling Stockholder Prospectus is substantively identical to the IPO Prospectus, except for the following principal points:

| ● | they contain different outside and inside front covers; | |

| ● | they contain different Offering sections in the Prospectus Summary section; | |

| ● | they contain different Use of Proceeds sections; | |

| ● | the Capitalization section is deleted from the Selling Stockholder Prospectus; | |

| ● | the Dilution section is deleted from the Selling Stockholder Prospectus; | |

| ● | a Selling Stockholder section is included in the Selling Stockholder Prospectus; | |

| ● | the Underwriting section from the IPO Prospectus is deleted from the Selling Stockholder Prospectus and a Plan of Distribution is inserted in its place; and | |

| ● | the Legal Matters section in the Selling Stockholder Prospectus deletes the reference to counsel for the underwriters. |

We have included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Selling Stockholder Prospectus as compared to the IPO Prospectus.

The sales of our common stock registered in the IPO Prospectus and the Selling Stockholder Prospectus may result in two offerings taking place concurrently, which could affect the price and liquidity of, and demand for, our common stock. This risk and other risks are included in “Risk Factors” beginning on page 11 of the IPO Prospectus.

The information in this preliminary prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED MARCH 12, 2024 |

KINDLY MD, INC.

1,272,727 Units

Each Unit Consisting of One Share of Common Stock

One Warrant to Purchase One Share of Common Stock and

One Non-tradeable Warrant to Purchase One-half of One Share of Common Stock

and the 1,909,091 Shares of Common Stock Underlying Such Warrants

This is the initial public offering of 1,272,727 units (each a “Unit” and collectively, the “Units”) of Kindly MD, Inc. (the “Company,” “KindlyMD,” “we,” “our,” or “us”). The initial public offering price of our Units is $5.50 per Unit. Each Unit consist of one share of our common stock with no par value (“Common Stock”), one tradeable warrant (each, a “Tradeable Warrant,” collectively, the “Tradeable Warrants”) to purchase one share of Common Stock at an exercise price of $6.33 per share, and one non-tradeable warrant to purchase one-half of one share of Common Stock (each, a “Non-tradeable Warrant,” collectively, the “Non-tradeable Warrants”; together with the Tradeable Warrants, each a “Warrant,” collectively, the “Warrants”) at an exercise price of $6.33 per share. The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of our Common Stock and the Warrants comprising the Units are immediately separable upon issuance and will be issued separately in this offering. Each Warrant offered as part of this offering is immediately exercisable upon issuance, and will expire five years from the date of issuance.

The Warrants will be issued in book-entry form pursuant to a warrant agency agreement (the “Warrant Agent Agreement”) between us and VStock Transfer, LLC, who will be acting as the warrant agent (the “Warrant Agent”).

Prior to this offering, there has been no public market for our Common Stock or Tradeable Warrants. In connection with this offering, we have applied to have our Common Stock and Tradeable Warrants listed on the Nasdaq Capital Market under the symbols “KDLY” and “KDLYW,” respectively. This offering is contingent upon final approval of our listing application with The Nasdaq Stock Market LLC (“Nasdaq”). There can be no assurance that we will be successful in listing our Common Stock and Tradeable Warrants on The Nasdaq Capital Market. We have not and do not intend to apply for listing of the Non-Tradeable Warrants on any exchange or market.

In addition, we have registered an aggregate of 1,712,057 shares of our common stock for resale by certain selling stockholders by means of the Selling Stockholder Prospectus. Sales of the shares of our common stock registered in this prospectus and the Selling Stockholder Prospectus may result in two offerings taking place concurrently which might affect price, demand, and liquidity of our common stock.

Additionally, we are, and following the completion of this offering, will continue to be a “controlled company” as defined under Nasdaq Marketplace Rules 5615(c), because Tim Pickett, our Chief Executive Officer and controlling stockholder will be able to exercise 48.7% of voting power of our issued and outstanding shares of Common Stock and will be able to determine all matters requiring approval by our stockholders, immediately after the consummation of this offering. For further information see “Security Ownership of Certain Beneficial Owners and Management.” However, even if we are deemed as a “controlled company,” we do not intend to avail ourselves of the corporate governance exemptions afforded to a “controlled company” under the Nasdaq Marketplace Rules. See “Risk Factors—Risks Related to Our Common Stock and this Offering.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus. You should carefully consider these risk factors, as well as the information contained in this prospectus, before purchasing any of the securities offered by this prospectus.

| Per Unit | Total Without Over-Allotment | Total With Over-Allotment | ||||||||||

| Initial public offering price | $ | 5.50 | $ | 6,999,999 | $ | 8,049,998 | ||||||

| Underwriting discounts and commissions (1) | $ | 0.50 | $ | 630,000 | $ | 724,500 | ||||||

| Proceeds, before expenses, to us | $ | 5.00 | $ | 6,369,999 | $ | 7,325,498 | ||||||

| (1) | Does not include a non-accountable allowance equal to 1.0% of the gross proceeds of this offering, payable to WallachBeth Capital LLC, as representative of the underwriters (the “Representative”), or the reimbursement of certain expenses of the underwriters. See “Underwriting” on page 60 for additional information regarding total underwriting compensation. |

In addition to the underwriting discounts listed above and the non-accountable expense allowance described in the footnote, we have agreed to issue upon the closing of this offering to the Representative, warrants that will expire on the fifth anniversary of the effective date of the registration statement of which this prospectus is a part, entitling the Representative to purchase 6% of the number of shares of Common Stock sold in this offering (excluding shares of common stock sold to cover over-allotments, if any) (the “Representative Warrants”). The registration statement of which this prospectus is a part also covers the Representative Warrants and the shares of Common Stock issuable upon the exercise thereof. For additional information regarding our arrangement with the underwriters, please see “Underwriting” beginning on page 60.

We have granted the Representative of the underwriters an option to purchase from us, at the public offering price, less the underwriting discounts and commissions, up to an additional 190,909 shares of Common Stock and/or 190,909 Tradeable Warrants, and 190,909 Non-Tradeable Warrants, in any combination thereof, less the underwriting discounts and commissions, within 45 days from the date of this prospectus to cover over-allotments, if any.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The underwriters expect to deliver the securities against payment in New York, New York on or about __________________, 2024.

Sole Book-Running Manager

WallachBeth Capital LLC

Prospectus dated , 2024

TABLE OF CONTENTS

Through and including , 2024 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriter and with respect to their unsold allotments or subscriptions.

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares of Common Stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

You should rely only on the information contained in this prospectus. Neither we nor the placement agent have authorized anyone to provide any information or to make any representations other than those contained in this prospectus we have prepared. We take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The selling stockholders are offering to sell and seeking offers to buy our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is current only as of its date. You should also read this prospectus together with the additional information described under “Where You Can Find More Information.”

Unless the context otherwise requires, we use the terms “we,” “us,” “Company,” “KindlyMD,” “Kindly,” and “our” to refer to Kindly MD, Inc. and its subsidiaries.

Solely for convenience, our trademarks and tradenames referred to in this prospectus, may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and tradenames. All other trademarks, service marks and trade names included or incorporated by reference into this prospectus, or the accompanying prospectus are the property of their respective owners.

| 3 |

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our Common Stock. You should read the entire prospectus carefully, including the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our combined financial statements and the related notes thereto that are included elsewhere in this prospectus, before making an investment decision. Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “KindlyMD,” the “Company,” “we,” “us,” “Kindly,” and “our” refer to Kindly MD, Inc., and its subsidiaries.

Overview

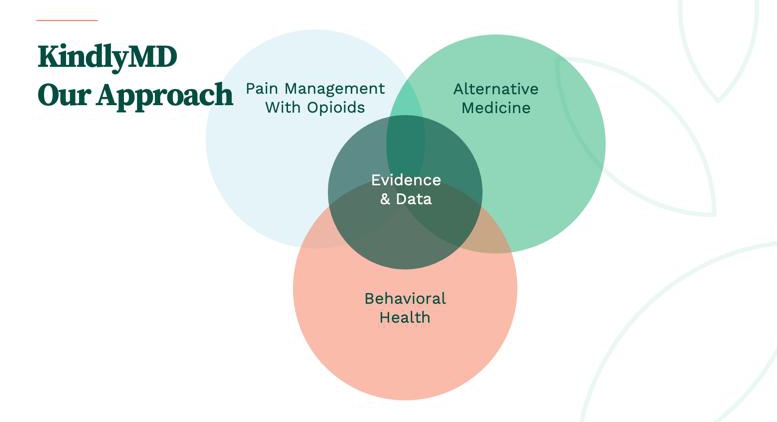

Kindly MD, Inc. (“We”, “Us”, “Company”, KindlyMD” or “Kindly”) is a Utah company formed in 2019. KindlyMD is a healthcare data company, focused on holistic pain management and reducing the impact of the opioid epidemic. KindlyMD offers direct health care to patients integrating prescription medicine and behavioral health services to reduce opioid use in the chronic pain patient population. Kindly believes these methods will help prevent and reduce addiction and dependency on opiates. Our specialty outpatient clinical services are offered on a fee-for-service basis. The Company offers evaluation and management, including, but not limited to chronic pain, functional medicine, cognitive behavioral therapy, trauma and addiction therapy, recovery support services, overdose education efforts, peer support, limited urgent care, preventative medicine, medically managed weight loss, and hormone therapy. Through its focus on an embedded model of prescriber and therapist teams, KindlyMD develops patient-specific care programs with a specific mission to reduce opioid use in the patient population while successfully treating patients with effective and evidence-based non-opioid alternatives in close conjunction with behavioral therapy.

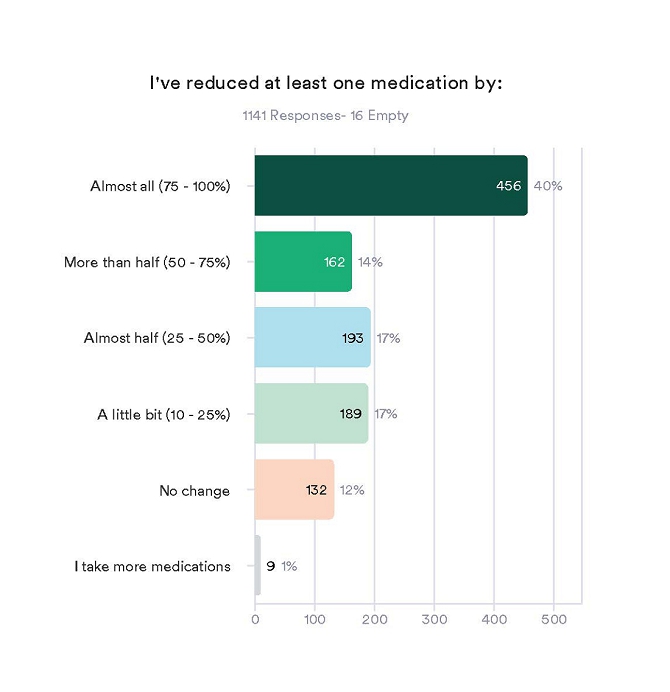

Beyond its treatment of patients, KindlyMD collects data focused on why and how patients turn to alternative treatments to reduce prescription medication use and addiction. The Company captures all relevant datapoints to assist and appropriately treat each individual patient. This also results in valuable data for the Company and the Company’s investors. We strive to become a source for evidence-based guidelines, data, treatment models, and education in the fight against the opioid crisis in America.

Business Revenue Streams

We currently earn revenue through (i) patient care services related to medical evaluation and treatment and (ii) product retail sales. Our forecasted plan is to operate across various revenue streams: (i) medical evaluation and treatment visits reimbursed by Medicare, Medicaid, and commercial insurance payers as well as self-pay services, (ii) data collection and research, (iii) education partnerships, (iv) service affiliate agreements, and (v) retail sales.

Further information about our revenue streams can be found in the “Business” section on page 37.

Market Opportunity

In the Utah market alone, KindlyMD has a unique opportunity for growth based on service line expansion into pain medicine management. Demand for both opioid and non-opioid pain treatment continues to increase due to the growing geriatric population, safe and effective access to non-opioid drugs, and increased prevalence of diagnoses such as osteoarthritis and migraines. Rising demand for surgeries, increasing awareness, availability of treatment options, and the willingness to seek treatment are expected to complement the growth of the population of patients seeking treatment for pain and/or chronic pain medication use. KindlyMD, already a large market share player in the Utah non-opioid treatment space, hopes to expand its reach with the inclusion of opioid medication management and behavioral therapy services.

| 4 |

Furthermore, the behavioral therapy industry is slated to grow with the integration of addiction and trauma based cognitive behavioral therapy (CBT) and inclusion of Ketamine and other infusion-based treatment options. Integration of these therapies with traditional pain management will provide a source of revenue as well as behavioral data and clinical research to develop valuable treatment programs, products, and further enhance legislative lobbying efforts toward wider acceptance of safe and effective non-opioid alternative therapies.

Growth Strategy

KindlyMD is leveraging healthcare standards and infrastructure to build a network of in-person clinics, telemedicine resources, and wholly-owned subsidiaries in the outpatient medical space. Our expansion approach considers metrics such as prescribing laws and regulations, rates of opioid prescriptions, inclusion of behavioral therapy outcomes, non-opioid alternative medicine access, including medical cannabis, and existing specialty clinic operations in each market.

Offering outpatient clinical services with integrated behavioral health is our central focus as we continue to expand into new Utah-based locations. KindlyMD may also expand upon its existing service lines. We are in the early stages of development. The Company has not taken concrete steps to expand into additional markets, nor have we identified any additional clinic locations or acquisitions or entered into any agreements or commitments for any material acquisitions or investments either in Utah or elsewhere.

KindlyMD will continue to leverage its growth potential as a leader in specialized data collection and healthcare in the opioid and alternative medicine space. We have not identified specific acquisition targets to disclose as of this offering. We intend to research and negotiate acquisitions as much as we are able. We will seek out specialty clinics focused on opioid or non-opioid evaluation and management of pain and other chronic illnesses. Clinics with large patient numbers that are and are not involved in state legal medical cannabis programs, where patients are not able to receive behavioral healthcare, addiction services, or prescription management and education. These programs will be evaluated by a small team led by the CEO, COO, and consultant evaluators in order to acquire them as wholly-owned subsidiaries or integrated healthcare clinics.

KindlyMD collects valuable data from interactions with people online, via telecommunication, in-person patient interactions, and through our products. Clients provide some of this data directly, as do clinicians, and staff by collecting data about interactions, product and medication use, experiences, and behavior. In collecting data from these interactions, we collect and collate data from different contexts and third parties to provide a more seamless, consistent, and uniquely personalized experience, to make informed business decisions, to make clinical decisions, and for other legitimate business purposes. We intend to further use and analyze such data to allow us to become a large and specialized healthcare data company working to reduce opioid use, track product use and sales data, which will be highly valuable to the healthcare industry, the alternative medicine industry, and the pharmaceutical industry.

Competitive Strengths

KindlyMD is one of the largest providers of medical evaluation and management services related to treatment recommendations within the medical cannabis program in Utah. We treated 18,930 visits under these programs in 2023 and have treated over 56,952 active patient visits as of the date of this filing. We operate with normative traditional medical standards and practices and set a high standard of care. Kindly MD has achieved year over year revenue growth to-date, including during the COVID-19 Pandemic. Our leadership team is highly skilled in healthcare technology, customer service, patient care, and high-touch interactions. We value a culture of service to the patient above all.

Our model of healthcare is unique, blending prescribers and licensed behavioral health clinicians into every patient care plan while leveraging non-opioid alternative medicine where indicated. Although there are several large healthcare networks using an integrated behavioral health medical model in low-income and high-risk population care, we know of no other large clinic in Utah or the US which uses this integration model combined with a willingness to incorporate non-traditional medicine. We are also one of a limited number of specialty providers who allow patients to utilize non-opioid alternative medications, such as medical cannabis, concomitantly with opioids with medical supervision by a licensed integration team.

Our competition, respectively, are traditional medication pain clinics as well as other non-opioid specialty alternative medicine clinics in Utah.

| 5 |

Recent Developments

Bridge Financings

From December 2023 to January 2024, we issued convertible promissory notes in the aggregate principal amount of $444,444 to certain investors. These amounts are due to be repaid, along with 10% interest per annum, upon the earlier of (i) the closing date of the Company’s IPO or (ii) one year from the date of execution of the promissory notes.

Risk Factors Summary

Investing in our Common Stock involves a high degree of risk because our business is subject to numerous risks and uncertainties, as more fully described in the section titled “Risk Factors” included elsewhere in this prospectus. You should carefully consider these risks before making an investment. These risks include, but are not limited to, the following:

| ● | Our business may suffer if we are unable to attract or retain talented personnel. | |

| ● | The lack of available and cost-effective directors and officer’s insurance coverage in our industry may cause us to be unable to attract and retain qualified executives, and this may result in our inability to further develop our business. | |

| ● | Management of growth will be necessary for us to be competitive. | |

| ● | Laws and regulations affecting the medical marijuana industry are constantly changing, which could detrimentally affect our operation. | |

| ● | If we expand into other states, we will have to ensure compliance with all of the regulations of those states, which may be different from the laws in the State of Utah. | |

| ● | There can be no assurance that our current and future strategic alliances or expansions of scope of existing relationships will have a beneficial impact on our business, financial condition and results of operations. | |

| ● | Our use, disclosure, and other processing of personal information, including health information, is subject to the Health Insurance Portability and Accountability Act (HIPAA), and other federal, state, and foreign data privacy and security laws and regulations, and our failure to comply with those laws and regulations or to appropriately secure the information we hold could result in significant liability or reputational harm and, in turn, a material adverse effect on our client base, customer base and revenue. |

| 6 |

| ● | Our business and financial performance may be adversely affected by downturns in the target markets that we serve or reduced demand for the types of services we offer. | |

| ● | Changes within the cannabis industry or the opioid industry may adversely affect our financial performance. | |

| ● | The Company’s industry is highly competitive, and we have less capital and resources than many of our competitors which may give them an advantage in marketing services similar to ours or make our services obsolete. | |

| ● | We may be unable to respond to the rapid technological change in the industry and such change may increase costs and competition that may adversely affect our business. | |

| ● | We may need additional capital that will dilute the ownership interest of investors. | |

| ● | We will be controlled by our existing majority shareholder. | |

| ● | Holders of the Warrants will have no rights as a holder of our Common Stock until they acquire our Common Stock. | |

| ● | Unless the Company becomes public and an active trading market develops for our securities, investors may not be able to sell their shares. | |

| ● | Costs and expenses of being a reporting company under the 1934 Securities Exchange Act may be burdensome and prevent us from achieving profitability. |

The risks summarized above or described in full below are not the only risks that we face. Additional risks and uncertainties not presently known to us, or that we currently deem to be immaterial, may also materially adversely affect our business, financial condition, results of operations, and future growth prospects.

Corporate Information

Our principal executive offices are located at 5097 S 900 E, Suite 100 Salt Lake City, UT 84117. Our telephone number is (385) 388-8220. Our corporate website address is located at www.kindlymd.com. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus.

Regulatory Landscape

Utah law requires that licensed medical providers who wish to recommend medical cannabis be licensed and registered with the Utah Department of Health every two years. Under the Utah Office of Health and Human Services, Center for Medical Cannabis, Rule R383-4 our providers to have an additional four hours of medical education than other providers and register with the state. Furthermore, any services offered to patients that are billed through health insurance payers require said providers to apply and contract with each insurance payer. The Company has contracted with Select Health, Medicare, and Utah Medicaid. There is no guarantee that all payers will contract with the company, or its providers.

Laws and regulations affecting the medical marijuana industry are constantly changing, which could affect our operation. Local, state, and federal medical marijuana laws and regulations are broad in scope and subject to evolving interpretations, which could require us to incur substantial costs associated with compliance or alter certain aspects of our business plan. In Utah, the Company complies with the Utah Medical Cannabis Act 26B-4-2, the Utah Controlled Substances Act 58-37 and under the rules established by the Utah Department of Health and Human Services, Center for Medical Cannabis. Our licensed providers are governed by the Utah Division of Professional licensing under the DOPL Licensing Act, 58-1. Federally, licensed medical providers are registered with the Drug Enforcement Administration (DEA) to prescribe scheduled medications in Utah.

| 7 |

Impact of COVID-19 Pandemic

The outbreak of COVID-19 has spread across the globe and is impacting worldwide economic activity. In response to the COVID-19 pandemic, during 2020 and 2021, the Company established policies and protocols to address safety considerations. The extent to which the COVID-19 pandemic will continue to affect the Company’s business, financial condition, liquidity, and the Company’s operating results will depend on future developments, which are highly uncertain and cannot be predicted. It will depend on various factors including the duration and severity of the outbreak, the severity, or variants of COVID-19, including the omicron variant and its subvariants, and the effectiveness, acceptance, and availability of vaccines in countries throughout the world, and new information which may emerge concerning the appropriate responses if and to the extent that the availability of vaccines reduces restrictions imposed during the pandemic.

Inflation Risk

We do not believe that inflation has had a material effect on our business, results of operations, or financial condition. Nonetheless, if our costs were to become subject to significant inflationary pressures, we may not be able to fully offset such higher costs. Our inability or failure to do so could harm our business, results of operations, or financial condition.

Implications of Being a Smaller Reporting Company

As a smaller reporting company, we are eligible for exemptions from various reporting requirements applicable to other public companies that are not smaller reporting companies, including, but not limited to:

| ● | Reduced disclosure obligations (e.g., matters regarding executive compensation) in our periodic reports, proxy statements and registration statements; and | |

| ● | Not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). |

We will remain a smaller reporting company until the end of the fiscal year in which (i) we have a public common equity float of more than $250 million, or (ii) we have annual revenues for the most recently completed fiscal year of more than $100 million plus we have a public common equity float or public float of more than $700 million. We also would not be eligible for status as smaller reporting company if we become an investment company, an asset-backed issuer or a majority-owned subsidiary of a parent company that is not a smaller reporting company.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our shareholders may be different from what you might receive from other public reporting companies in which you hold equity interests.

Uncertainty of Profitability

As of December 31, 2023, we had cash and cash equivalents of $525,500 and total working capital deficit of $214,906. For the year ended December 31, 2023, the Company incurred an operating loss of $1,620,220, and used cash flows in operating activities of $449,489. This history and our business strategy may result in meaningful volatility of revenues, losses and/or earnings. As we will only develop a limited number of business efforts, services and products at a time, our overall success will depend on a limited number of business initiatives, which may cause variability and unsteady profits and losses depending on the products and/or services offered and their market acceptance.

Our revenues and our profitability may be adversely affected by economic conditions and changes in the market for our products and/or services. Our business is also subject to general economic risks that could adversely impact the results of operations and financial condition.

We may not be able to continue our business as a going concern.

Because of the anticipated nature of the services that we offer and attempt to develop, it is difficult to accurately forecast revenues and operating results and these items could fluctuate in the future due to a number of factors. These factors may include, among other things, the following:

| ● | Our ability to raise sufficient capital to take advantage of opportunities and generate sufficient revenues to cover expenses. | |

| ● | Our ability to source strong opportunities with sufficient risk adjusted returns. | |

| ● | Our ability to manage our capital and liquidity requirements based on changing market conditions. | |

| ● | The amount and timing of operating and other costs and expenses. | |

| ● | The nature and extent of competition from other companies that may reduce market share and create pressure on pricing and investment return expectations. |

| 8 |

| Issuer: | Kindly MD, Inc. | |

| Securities offered(1): | 1,272,727 Units, at a public offering price of $5.50 per Unit, each consisting of (i) one share of Common Stock, (ii) one Tradeable Warrant to purchase one share of Common Stock and (iii) one Non-tradeable Warrant to purchase one-half of one share of Common Stock. The Units will not be certificated or issued in stand-alone form. The shares of our Common Stock and the Warrants comprising the Units are immediately separable upon issuance and will be issued separately; but will be purchased together in this offering. |

| Description of Warrants included in Units: | Each Unit consists of one share of Common Stock and two Warrants: one Tradeable Warrant to purchase one share of Common Stock and one Non-tradeable Warrant to purchase one-half of one share of Common Stock. The exercise price of the Tradeable Warrants is $6.33 per share (115% of the public offering price per Unit), and the exercise price of the Non-tradeable Warrant is $6.33 per share (115% of the public offering price per one Unit). Each Warrant will be exercisable immediately upon issuance and will expire five years after the initial issuance date. The terms of the Warrants will be governed by a warrant agency agreement, dated as of the effective date of this offering, between us and VStock Transfer, LLC as the warrant agent (the “Warrant Agent”). This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the Warrants. For more information regarding the Warrants, you should carefully read the section titled “Description of Our Securities—Warrants” in this prospectus. | |

| Over-allotment option | We have granted the underwriters an option for a period of up to 45 days to purchase, up to 190,909 additional shares of Common Stock, and 190,909 Tradeable Warrants and/or 190,909 Non-tradeable Warrants to purchase an additional shares of Common Stock, or any combination thereof, at the public offering price per share of Common Stock and per Warrant, respectively, less, in each case, underwriting discounts and commissions, on the same terms as set forth in this prospectus, solely to cover over-allotments, if any. | |

| Common Stock outstanding prior to the offering: | 4,617,798 shares | |

| Common Stock outstanding after the offering(2): | 5,971,333 shares (6,162,242 shares if the underwriters exercise their option to purchase additional shares in full). | |

| Use of proceeds: | We estimate that the net proceeds to us from this offering will be approximately $6,154,999, or approximately $7,099,998 if the underwriters exercise their over-allotment option in full, assuming an offering price of $5.50 per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds of this offering primarily for general corporate purposes, including capital expenditures, labor, real estate, marketing and sales, technology development, and other expenses. See “Use of Proceeds” for additional information. | |

| Underwriters’ compensation: | In connection with this offering, the underwriters will receive an underwriting discount equal to 9% of the gross proceeds from the sale of Units in the offering. We will also reimburse the underwriters for certain out-of-pocket actual expenses related to the offering in an amount not to exceed $145,000 and reimburse certain non-accountable expenses in the amount of 1.0% of the gross proceeds of this offering. For additional information regarding our arrangement with the underwriters, please see “Underwriting.” | |

| Representative Warrants: | Upon the closing of this offering, we have agreed to issue to WallachBeth warrants that will expire on the fifth anniversary of the commencement date of sales in this offering, entitling the Representative to purchase 6% of the number of shares of Common Stock sold in this offering will have an exercise price equal to 115% of the public offering price per Unit set forth on the cover page of this prospectus (or $6.33 per share, which is the price set forth on the cover page of this prospectus), will provide for a “cashless” exercise, and will contain certain antidilution adjustments (but excluding any price based antidilution). For additional information regarding the representative’s warrants, see “Underwriting—Representative’s Warrants”. |

| Proposed Nasdaq Capital Market trading symbol and listing: | We have applied to the Nasdaq Capital Market to list our Common Stock under the symbol “KDLY” and our Tradeable Warrants under the symbol “KDLYW.” No assurance can be given that our listing application will be approved and this offering will not be consummated unless Nasdaq has approved our Common Stock and Tradeable Warrants for listing. | |

| Dividend policy: | We have not historically paid dividends on our Common Stock and do not anticipate paying dividends on our Common Stock for the foreseeable future. | |

Transfer agent/Warrant Agent: |

VStock Transfer, LLC | |

| Risk factors: | See “Risk Factors” beginning on page 11 and the other information contained in this prospectus for a discussion of factors you should carefully consider before investing in our securities. | |

| Lock-ups | We and our directors, officers and holders of ten percent (10%) or more of our outstanding securities have agreed with the underwriters, subject to certain exceptions, not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock for a period of six months after the completion of this offering. See “Underwriting” on page 60. |

| (1) | The actual number of Units we will offer and the actual price per Unit will be determined based on the actual public offering. |

| (2) | The total number of shares of Common Stock that will be outstanding after this offering is based on 4,617,798 shares of Common Stock outstanding as of March 11, 2024. The total number of shares of Common Stock that will be outstanding after the offering include 80,808 shares that will be issued to certain lenders upon the IPO listing.

Unless otherwise indicated, the shares outstanding after this offering excludes the following: |

| ● | 1,909,091 shares of our Common Stock issuable upon the exercise of the Tradeable Warrants, and the exercise of Non-tradeable Warrants to be issued as part of the Units; | |

| ● | 87,818 shares of our Common Stock issuable upon exercise of the Representative Warrants. | |

| ● | 286,364 shares of our Common Stock issuable upon the exercise of the Tradeable Warrants and the exercise of Non-tradeable Warrants to be included as part of the Over-allotment Option |

Except as otherwise indicated herein, all information in this prospectus assumes, including the number of shares of common stock that will be outstanding after this offering, assumes or gives effect to

| ● | no shares of Common Stock have been issued pursuant to any warrants or options; | |

| ● | no exercise of outstanding options after; | |

| ● | no shares of Common Stock have been issued pursuant to the Representative’s over-allotment option; and | |

| ● | no shares of Common Stock have been issued pursuant to the Representative Warrants | |

| ● | The resale by the selling stockholders may cause the market price of our common stock to decline. |

| 9 |

SUMMARY OF FINANCIAL INFORMATION

The following table summarizes our financial data. The following summary statements of operations and balance sheet data for the fiscal years ended December 31, 2023 and 2022, and the balance sheet data as of December 31, 2023 have been derived from our audited financial statements included elsewhere in this prospectus. The historical financial data presented below is not necessarily indicative of our financial results in future periods. You should read the summary financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our financial statements are prepared and presented in accordance with United States generally accepted accounting principles, or U.S. GAAP. Our financial statements have been prepared on a basis consistent with our audited financial statements and include all adjustments, consisting of normal and recurring adjustments that we consider necessary for a fair presentation of the financial position and results of operations as of and for such periods.

Statement of Operations Data:

| For the Years Ended December 31, | ||||||||||||||||

| 2023 | 2022 | |||||||||||||||

| Amount | % of Revenues | Amount | % of Revenues | |||||||||||||

| Revenues | $ | 3,768,598 | 100.0 | % | $ | 3,787,077 | 100.0 | % | ||||||||

| Operating Expenses | ||||||||||||||||

| Cost of revenues | 226,166 | 6.0 | % | 152,385 | 4.0 | % | ||||||||||

| Salaries and wages | 3,700,967 | 98.2 | % | 4,176,542 | 110.3 | % | ||||||||||

| General and administrative | 1,356,048 | 36.0 | % | 2,098,118 | 55.4 | % | ||||||||||

| Depreciation | 105,637 | 2.8 | % | 53,445 | 1.4 | % | ||||||||||

| Total Operating Expenses | 5,388,818 | 143.0 | % | 6,480,490 | 171.1 | % | ||||||||||

| Loss from operations | (1,620,220 | ) | (43.0 | )% | (2,693,413 | ) | (71.1 | )% | ||||||||

| Other income (Expense) | ||||||||||||||||

| Other income | 58,603 | 1.6 | % | 152,820 | 4.1 | % | ||||||||||

| Interest expense | (55,844 | ) | (1.5 | )% | - | - | % | |||||||||

| Total Other Income | 2,759 | 0.1 | % | 152,820 | 4.1 | % | ||||||||||

| Net loss before income taxes | (1,617,461 | ) | (42.9 | )% | (2,540,593 | ) | (67.1 | )% | ||||||||

| Income tax benefit | - | - | % | - | - | % | ||||||||||

| Net loss | $ | (1,617,461 | ) | (42.9 | )% | $ | (2,540,593 | ) | (67.1 | )% | ||||||

Balance Sheet Data:

| December 31, 2023 | ||||||||||||

| Actual | Pro Forma(1) | Pro

Forma As Adjusted (2) (3) | ||||||||||

| Cash and cash equivalents | $ | 525,500 | $ | 81,056 | $ | 6,236,054 | ||||||

| Working capital | (214,906 | ) | (659,350 | ) | 5,495,648 | |||||||

| Total assets | 1,131,895 | 687,451 | 6,842,449 | |||||||||

| Total liabilities | 1,240,307 | 795,863 | 795,863 | |||||||||

| Accumulated deficit | (4,158,054 | ) | (4,158,054 | ) | (4,158,054 | ) | ||||||

| Total stockholders’ equity (deficit) | $ | (108,412 | ) | $ | (108,412 | ) | $ | 6,046,587 | ||||

1 On a pro forma as adjusted basis to give further effect to our to the conversion of an aggregate $444,444 in principal amount of outstanding convertible bridge notes, where note holders have agreed to convert their notes into shares of common stock, which will result in the additional 80,808 shares, calculated assuming an initial public offering price of $5.50 per share, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

2 Each $1.00 increase (decrease) in the assumed initial public offering price of $5.50 per share, would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders’ equity (deficit) by approximately $1,145,454, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1,000,000 shares in the number of shares offered by us at the assumed initial public offering price per share, would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders’ equity (deficit) by approximately $4,950,000.

3 On a pro forma as adjusted basis to give effect to (i) the sale of 1,272,727 Units by us in the offering (excluding any sale of Units pursuant to the underwriter’s over-allotment option), at an assumed public offering price of $5.50 per Unit, after deducting underwriting discounts and commissions and estimated offering expenses, assuming no exercise of any of the Representative’s Warrants issued pursuant to this offering.

| 10 |

An investment in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks that are described in this section You should also read the sections entitled “Cautionary Note Regarding Forward-Looking Statements” on page 26 of this prospectus. Additional risks not presently known or that we currently deem immaterial could also materially and adversely affect us. You should consult your own financial and legal advisors as to the risks entailed by an investment in our securities and the suitability of investing in our securities in light of your particular circumstances. If any of the risks contained in this prospectus develop into actual events, our assets, business, cash flows, condition (financial or otherwise), credit quality, financial performance, liquidity, long-term performance goals, prospects, and/or results of operations could be materially and adversely affected, the trading price of our Common Stock could decline and you may lose all or part of your investment. Some statements in this prospectus, including such statements in the following risk factors, constitute forward-looking statements.

The Company operates in an environment that involves many risks and uncertainties. The risks and uncertainties described in this section are not the only risks and uncertainties that we face. Additional risks and uncertainties that presently are not considered material or are not known to us, and therefore are not mentioned herein, may impair our business operations. If any of the risks described actually occur, our business, operating results, financial position, and value of our securities could be adversely affected.

RISKS RELATED TO OUR BUSINESS

The novel coronavirus (COVID-19) pandemic may have unexpected effects on our business, financial condition and results of operations.

In March 2020, the World Health Organization declared COVID-19 a global pandemic, and governmental authorities around the world have implemented measures to reduce the spread of COVID-19. These measures have adversely affected workforces, customers, supply chains, consumer sentiment, economies, and financial markets, and, along with decreased consumer spending, have led to an economic downturn across many global economies.

Numerous state and local jurisdictions have imposed, and others in the future may impose, shelter-in-place orders, quarantines, shut-downs of non-essential businesses, and similar government orders and restrictions on their residents to control the spread of COVID-19. Such orders or restrictions have resulted in temporary facility closures (including certain of our third-party VRCs), work stoppages, slowdowns and travel restrictions, among other effects, thereby adversely impacting our operations. In addition, we expect to be impacted by a downturn in the United States economy, which could have an adverse impact on discretionary consumer spending and may have a significant impact on our business operations and/or our ability to generate revenues and profits.

In response to the COVID-19 disruptions, we have implemented a number of measures designed to protect the health and safety of our staff and contractors. These measures include restrictions on non-essential business travel, the institution of work-from-home policies wherever feasible and the implementation of strategies for workplace safety at our facilities that remain open. We are following the guidance from public health officials and government agencies, including implementation of enhanced cleaning measures, social distancing guidelines and wearing of masks.

The extent to which COVID-19 ultimately impacts our business, financial condition and results of operations will depend on future developments, which are highly uncertain and unpredictable, including new information which may emerge concerning the severity and duration of the COVID-19 outbreak and the effectiveness of actions taken to contain the COVID-19 outbreak or treat its impact, among others. Additionally, while the extent to which COVID-19 ultimately impacts our operations will depend on a number of factors, many of which will be outside of our control. The COVID-19 outbreak is evolving and new information emerges daily; accordingly, the ultimate consequences of the COVID-19 outbreak cannot be predicted with certainty.

| 11 |

In addition to the COVID-19 disruptions possibility adversely impacting our business and financial results, they may also have the effect of heightening many of the other risks described in “Risk Factors,” including risks relating to changes due to our limited operating history; our ability to generate sufficient revenue, to generate positive cash flow; our relationships with third parties, and many other factors. We will endeavor to minimize these impacts, but there can be no assurance relative to the potential impacts that may be incurred.

Uncertainty of profitability.

Our business strategy may result in meaningful volatility of revenues, losses and/or earnings. As we will only develop a limited number of business efforts, services and products at a time, our overall success will depend on a limited number of business initiatives, which may cause variability and unsteady profits and losses depending on the products and/or services offered and their market acceptance.

Our revenues and our profitability may be adversely affected by economic conditions and changes in the market for our products and/or services. Our business is also subject to general economic risks that could adversely impact the results of operations and financial condition.

We may not be able to continue our business as a going concern.

Management plans to raise additional capital through the sale of shares of Common Stock to pursue business development activities, but there are no assurances of success relative to the efforts.

Because of the anticipated nature of the services that we offer and attempt to develop, it is difficult to accurately forecast revenues and operating results and these items could fluctuate in the future due to a number of factors. These factors may include, among other things, the following:

| ● | Our ability to raise sufficient capital to take advantage of opportunities and generate sufficient revenues to cover expenses. | |

| ● | Our ability to source strong opportunities with sufficient risk adjusted returns. | |

| ● | Our ability to manage our capital and liquidity requirements based on changing market conditions. | |

| ● | The amount and timing of operating and other costs and expenses. | |

| ● | The nature and extent of competition from other companies that may reduce market share and create pressure on pricing and investment return expectations. |

Our business may suffer if we are unable to attract or retain talented personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity, and good faith of Management, as well as other personnel. We have a small management team, and the loss of a key individual or our inability to attract suitably qualified replacements or additional staff could adversely affect our business. Our success also depends on the ability of Management to form and maintain key commercial relationships within the marketplace. No assurance can be given that key personnel will continue their association or employment with us or that replacement personnel with comparable skills will be found. If we are unable to attract and retain key personnel and additional employees, our business may be adversely affected. We do not maintain key-man life insurance on any of our executive employees.

Although we have entered into an employment agreement with our Chief Executive Officer, and do not believe our Chief Executive Officer is planning to leave or retire in the near term, we cannot assure you that he will remain with us. The loss or limitation of the services of any of our executives or members of our senior management team, or the inability to attract additional qualified management personnel, could have a material adverse effect on our business, financial condition, results of operations, or independent associate relations.

| 12 |

The lack of available and cost-effective directors and officer’s insurance coverage in our industry may cause us to be unable to attract and retain qualified executives, and this may result in our inability to further develop our business.

Our business depends on attracting independent directors, executives, and senior management to advance our business plans. We currently do not have directors and officer’s insurance to protect our directors, officers, and the company against the possible third-party claims. This is due to the significant lack of availability of such policies in the cannabis industry at reasonably competitive prices. As a result, the Company and our executive directors and officers are susceptible to liability claims arising by third parties, and as a result, we may be unable to attract and retain qualified independent directors and executive management causing the development of our business plans to be impeded as a result.

Management of growth will be necessary for us to be competitive.

Successful expansion of our business will depend on our ability to effectively attract and manage staff, strategic business relationships, and shareholders. Specifically, we will need to hire skilled management and technical personnel as well as manage partnerships to navigate shifts in the general economic environment. Expansion has the potential to place significant strains on financial, management, and operational resources, yet failure to expand will inhibit our profitability goals. We have no definitive plan for expansion into other states at this time.

The failure to enforce and maintain our intellectual property rights could adversely affect the value of the Company.

The success of our business will partially depend on our ability to protect our intellectual property. As of the date hereof, we do not own any federally registered patents or trademarks. The unauthorized use of our intellectual property could diminish the value of our business, which would have a material adverse effect on our financial condition and results of operation.

Laws and regulations affecting the medical marijuana industry are constantly changing, which could detrimentally affect our operation.

Local, state, and federal medical marijuana laws and regulations are broad in scope and subject to evolving interpretations, which could require us to incur substantial costs associated with compliance or alter certain aspects of our business plan. In addition, violations of these laws, or allegations of such violations, could disrupt certain aspects of our business plan and result in a material adverse effect on certain aspects of our planned operations. In addition, it is possible that regulations may be enacted in the future that will be directly applicable to certain aspects of our businesses. We cannot predict the nature of any future laws, regulations, interpretations, or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on our business.

Our operations, although compliant with Utah state law, are still subject to U.S. federal law which classifies cannabis as a Schedule I controlled substance. There is always a risk of federal enforcement action, and non-compliance could lead to significant legal penalties, including but not limited to fines, imprisonment, seizure of assets, and prohibition of business operations.

Our business operations in the medical marijuana industry expose us to specific risks. The conflict between federal and state laws regarding marijuana creates a complex legal environment, where compliance with state law does not exempt us from federal prosecution. Federal enforcement could disrupt our operations and expose us to substantial legal risk. The ongoing evolution of regulations and their enforcement adds a layer of uncertainty to our business.

The Cannabis industry also faces societal perceptions and stigma which can impact our market. Changes in laws, regulations, or societal perceptions can affect market conditions and the demand for our products and services.

If we expand into other states, we will have to ensure compliance with all of the regulations of those states, which may be different from the laws in the State of Utah.

We have no definitive plans to expand into other states. However, if we do choose to expand our operations to other states in the future, we will have to ensure full compliance with the laws of those states, which will necessitate significant investments in legal, operational, and administrative resources. Each expansion will come with its own set of unique challenges and potential risks, necessitating a thorough analysis of the specific state regulatory environments. Our business operations and expansion plans are in line with the current interpretation of the regulations in place. However, a change in regulatory interpretation, enforcement or law could adversely affect our operations. Consequently, the risks inherent in the cannabis industry and our business necessitate careful consideration by potential investors.

If we incur substantial liability from litigation, complaints, or enforcement actions, our financial condition could suffer.

Our participation adjacent to the medical marijuana industry may lead to litigation, formal or informal complaints, enforcement actions, and inquiries by various federal, state, or local governmental authorities against us. Litigation, complaints, and enforcement actions could consume considerable amounts of financial and other corporate resources, which could have a negative impact on our sales, revenue, profitability, and growth prospects.

There can be no assurance that our current and future strategic alliances or expansions of scope of existing relationships will have a beneficial impact on our business, financial condition and results of operations.

We may enter into strategic alliances and partnerships with third parties that we believe will complement or augment our existing business. Our ability to complete strategic alliances is dependent upon, and may be limited by, the availability of suitable candidates and capital. In addition, strategic alliances could present unforeseen integration obstacles or costs, may not enhance our business and may involve risks that could adversely affect us, including significant amounts of management time that may be diverted from operations in order to pursue and complete such transactions or maintain such strategic alliances. Future strategic alliances could result in the incurrence of additional debt, costs and contingent liabilities, and there can be no assurance that future strategic alliances will achieve, or that our existing strategic alliances will continue to achieve, the expected benefits to our business or that we will be able to consummate future strategic alliances on satisfactory terms, if at all. Any of the foregoing could have a material adverse effect on our business, financial condition and results of operations.

| 13 |

We may face unfavorable publicity or consumer perception.

Management believes the pain management, cannabis, and alternative medicine industry is highly dependent upon consumer perception regarding the safety, efficacy and quality of the treatment offered and outcomes produced. Consumer perception of our services may be significantly influenced by scientific research or findings, regulatory investigations, litigation, media attention and other publicity regarding opioids, cannabis, as well as alternative medicine services. There can be no assurance that future scientific research, findings, regulatory proceedings, litigation, media attention or other research findings or publicity will be favorable to the prescription medicine, behavioral therapy industry, cannabis, or alternative medicine market or any particular product, or consistent with earlier publicity. Future research reports, findings, regulatory proceedings, litigation, media attention or other publicity that is perceived as less favorable than, or questions earlier research reports, findings or publicity could have a material adverse effect on the demand for our services. Our dependence upon consumer perceptions means that such adverse reports, whether or not accurate or with merit, could ultimately have a material adverse effect on our business, results of operations, financial condition and cash flows. Further, adverse publicity reports or other media attention regarding the safety, efficacy and quality of treatments in general, or our services specifically, or associating the consumption of prescription or non-prescription medications, cannabis, or any other products with illness or other negative effects or events, could have such a material adverse effect.

We are subject to general economic risks.

Our operations could be affected by the economic context should the unemployment level, interest rates or inflation reach levels that influence consumer trends and spending and, consequently, impact our sales and profitability.

Provisions in our governing documents and Utah law may have an anti-takeover effect, and there are substitutional regulatory limitations on changes of control of bank holding companies.

Our corporate organizational documents and provisions of federal and state law to which we are subject contain certain provisions that could have an anti-takeover effect and may delay, make more difficult or prevent an attempted acquisition that you may favor or an attempted replacement of our board of directors or management.

Our brand is integral to our success. If we fail to effectively maintain, promote, and enhance our brand in a cost-effective manner, our business and competitive advantage may be harmed.

We believe that maintaining and enhancing our reputation and brand recognition is critical to our relationships with existing customers, providers, and strategic partners, and to our ability to attract new customers, providers, and strategic partners. The promotion of our brand may require us to make substantial investments, and we anticipate that, given the highly competitive nature of our market, these marketing initiatives may become increasingly difficult and expensive. Brand promotion and marketing activities may not be successful or yield increased revenue, and to the extent that these activities yield increased revenue, the increased revenue may not offset the expenses we incur and our results of operations could be harmed. In addition, any factor that diminishes our reputation or that of our management, including failing to meet the expectations of our customers, the providers, or partners, could harm our reputation and brand and make it substantially more difficult for us to attract new customers, providers, and partners. If we do not successfully maintain and enhance our reputation and brand recognition in a cost-effective manner, our business may not grow and we could lose our relationships with customers, providers, and partners, which could harm our business, financial condition, and results of operations.

| 14 |

The market for our model and services is new, rapidly evolving, and increasingly competitive, as the healthcare industry in the United States is undergoing significant structural change and consolidation, which makes it difficult to forecast demand for our solutions.

The market for our model is new, rapidly evolving and increasingly competitive. We are expanding our business by offering technology-driven access to consultation and treatment options for new conditions, including telehealth options, but it is uncertain whether our offerings will achieve and sustain high levels of demand and market adoption. Our future financial performance depends in part on growth in this market, our ability to market effectively and in a cost-efficient manner, and our ability to adapt to emerging demands of existing and potential customers and the evolving regulatory landscape. It is difficult to predict the future growth rate and size of our target market. Negative publicity concerning telehealth generally, our offerings, customer success on our platform, or our market as a whole could limit market acceptance of our business model and services. If our customers do not perceive the benefits of our offerings, or if our offerings do not drive customer use and enrollment, then our market and our customer base may not continue to develop, or they may develop more slowly than we expect. Negative publicity regarding customer confidentiality and privacy in the context of telehealth could limit market acceptance of our business model and services.

The healthcare industry in the United States is continually undergoing or threatened with significant structural change and is rapidly evolving. We believe demand for our offerings has been driven in part by rapidly growing costs in the traditional healthcare system, difficulties accessing the healthcare system, patient stigma associated with sensitive medical conditions, the movement toward patient-centricity and personalized healthcare, advances in technology, and general movement to telehealth accelerated by the COVID-19 pandemic. Widespread acceptance of personalized healthcare enabled by technology is critical to our future growth and success. A reduction in the growth of technology-enabled personalized healthcare could reduce the demand for our services and result in a lower revenue growth rate or decreased revenue.

Additionally, if healthcare or healthcare benefits trends shift or entirely new technologies are developed that replace existing offerings, our existing or future services could be rendered obsolete and require that we materially change our technology or business model. If we are unable to do so, our business could be adversely affected. In addition, we may experience difficulties with software development, industry standards, design or marketing that could delay or prevent our development, introduction, or implementation of new options on our platform and any enhancements thereto. Any such difficulties may have an adverse effect on our business, financial condition, and results of operations.

Competitive platforms or other technological breakthroughs for the monitoring, management, treatment, or prevention of medical conditions may adversely affect demand for our offerings.

Our ability to achieve our strategic objectives will depend, among other things, on our ability to enable fast and efficient telehealth consultations and maintain comprehensive and affordable offerings. Our competitors, as well as a number of other companies and providers, within and outside the healthcare industry, are pursuing new devices, delivery technologies, sensing technologies, procedures, treatments, drugs, and other therapies for the monitoring and treatment of medical conditions. Any technological breakthroughs in monitoring, treatment, or prevention of medical conditions that we could not similarly leverage could reduce the potential market for our offerings, which could significantly reduce our revenue and our potential to grow certain aspects of our business.

| 15 |

We operate in highly competitive markets and face competition from large, well-established healthcare providers, traditional retailers, pharmaceutical providers, and technology companies with significant resources, and, as a result, we may not be able to compete effectively.

The markets for healthcare and technology are intensely competitive, subject to rapid change, and significantly affected by new product and technological introductions and other market activities of industry participants. We compete directly not only with other established telehealth providers but also traditional healthcare providers, pharmacies and technology companies entering into the health and wellness industry. Our current competitors include traditional healthcare providers expanding into the telehealth market, incumbent telehealth providers, as well as new entrants into our market that are focused on direct-to-consumer healthcare or healthcare technology. Our competitors further include enterprise-focused companies that may enter the direct-to-consumer healthcare industry, as well as direct-to-consumer healthcare providers and technology companies.

New competitors or alliances may emerge that have greater market share, a larger customer base, more widely adopted proprietary technologies, greater marketing expertise, and greater financial resources, which could put us at a competitive disadvantage. For example, some state and federal regulatory authorities lowered certain barriers to the practice of telehealth in order to make remote healthcare services more accessible in response to the COVID-19 pandemic. Although it is unclear whether these regulatory changes will be permanent or that they will have a long-term impact on the adoption of telehealth services by the general public or legislative and regulatory authorities, these changes may result in greater competition for our business. The lower barriers to entry may allow various new competitors to enter the market more quickly and cost effectively than before the COVID-19 pandemic.

Additionally, we believe that the COVID-19 pandemic has introduced many new users to telehealth and further reinforced its benefits to potential competitors. We believe this may drive additional industry consolidation or cooperative relationships that may result in competitors with greater resources and access to potential customers. For example, we believe the COVID-19 pandemic may have caused various traditional healthcare providers to evaluate, and in some cases, pursue telehealth options that can be paired with their in-person capabilities. These industry changes could better position our competitors to serve certain segments of our current or future markets, which could create additional price pressure. In light of these factors, even if our offerings are more effective than those of our competitors, current or potential customers may accept competitive solutions in lieu of purchasing from us.

Our ability to compete effectively depends on our ability to distinguish our company and our offerings from our competitors and their products, and includes factors such as:

| ● | accessibility, ease of use and convenience; |

| ● | price and affordability; |

| ● | personalization; |

| ● | brand recognition; |

| ● | long-term outcomes; |

| ● | breadth and efficacy of offerings; |

| ● | market penetration; |

| ● | marketing resources and effectiveness; |

| ● | partnerships and alliances; |

| ● | relationships with providers, suppliers and partners; and |

| ● | regulatory compliance recourses. |

If we are unable to successfully compete with existing and potential competitors, our business, financial condition, and results of operations could be adversely affected.

| 16 |

Risks Of Government Action And Regulatory Uncertainty

Our use, disclosure, and other processing of personal information, including health information, is subject to the Health Insurance Portability and Accountability Act (HIPAA), and other federal, state, and foreign data privacy and security laws and regulations, and our failure to comply with those laws and regulations or to appropriately secure the information we hold could result in significant liability or reputational harm and, in turn, a material adverse effect on our client base, customer base and revenue.

In the course of offering personalized health and wellness recommendations, we collect a substantial amount of personalized health information. Numerous state and federal laws and regulations govern the collection, dissemination, use, privacy, confidentiality, security, availability, integrity and other processing of protected health information (PHI), and other types of personal information. For example, HIPAA establishes a set of national privacy and security standards for the protection PHI by health plans, healthcare clearinghouses and certain healthcare providers, referred to as covered entities, and the business associates with whom such covered entities contract for services, as well as their covered subcontractors. When we act in the capacity of a business associate under HIPAA, we execute business associate agreements with our clients.

HIPAA requires covered entities and business associates, such as us, to develop and maintain policies and procedures with respect to PHI that is used or disclosed, including the adoption of administrative, physical and technical safeguards to protect such information.

Violations of HIPAA may result in significant civil and criminal penalties. HIPAA also authorizes state attorneys general to file suit on behalf of their residents. Courts may award damages, costs and attorneys’ fees related to violations of HIPAA in such cases. While HIPAA does not create a private right of action allowing individuals to sue us in civil court for violations of HIPAA, its standards have been used as the basis for duty of care in state civil suits such as those for negligence or recklessness in the misuse or breach of duties related to PHI.

In addition, HIPAA mandates that the Secretary of HHS conduct periodic compliance audits of HIPAA covered entities and business associates for compliance with the HIPAA privacy and security rules.

HIPAA further requires that patients be notified of any unauthorized acquisition, access, use or disclosure of their unsecured PHI that compromises the privacy or security of such information, with certain exceptions related to unintentional or inadvertent use or disclosure by employees or authorized individuals. HIPAA requires such notifications to be made “without unreasonable delay and in no case later than 60 calendar days after discovery of the breach.” If a breach affects 500 patients or more, it must be reported to HHS without unreasonable delay, and HHS will post the name of the breaching entity on its public web site. Breaches affecting 500 patients or more in the same state or jurisdiction must also be reported to the local media. If a breach involves fewer than 500 people, the covered entity must record it in a log and notify HHS at least annually.