UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

For the Fiscal Year Ended

For the transition period from ______ until ______

Commission File Number:

(Exact name of Registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| |

| |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The | ||||

| The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes ☐ |

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Yes ☐ |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit post such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Yes ☐ No |

The aggregate market value of the Registrant’s

common stock, held by non-affiliates of the Registrant was approximately $

As of April 1, 2024, the Registrant had

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

In this Annual Report on Form 10-K, unless otherwise stated or as the context otherwise requires, references to “60 Degrees Pharmaceuticals, Inc.,” “60 Degrees Pharmaceuticals,” “60P,” the “Company,” “we,” “us,” “our” and similar references refer to 60 Degrees Pharmaceuticals, Inc., a Delaware corporation. Our logo and other trademarks or service marks of the Company appearing in this Annual Report on Form 10-K are the property of 60 Degrees Pharmaceuticals, Inc. This Annual Report on Form 10-K also contains registered marks, trademarks and trade names of other companies. All other trademarks, registered marks and trade names appearing in this Annual Report on Form 10-K are the property of their respective holders.

i

Cautionary Note Regarding Forward-Looking Statements and Industry Data

This Annual Report on Form 10-K, in particular, Part II Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements represent our expectations, beliefs, intentions or strategies concerning future events, including, but not limited to, any statements regarding our assumptions about financial performance; the continuation of historical trends; the sufficiency of our cash balances for future liquidity and capital resource needs; the expected impact of changes in accounting policies on our results of operations, financial condition or cash flows; anticipated problems and our plans for future operations; and the economy in general or the future of the industry in which we operate, all of which were subject to various risks and uncertainties.

When used in this Annual Report on Form 10-K and other reports, statements and information we have filed with the Securities and Exchange Commission (“SEC”), in our press releases, presentations to securities analysts or investors, in oral statements made by or with the approval of an executive officer, the words or phrases “believes,” “may,” “will,” “expects,” “should,” “continue,” “anticipates,” “intends,” “will likely result,” “estimates,” “projects” or similar expressions and variations thereof are intended to identify such forward-looking statements. However, any statements contained in this Annual Report on Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. These statements are only predictions. All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements. Any or all of our forward-looking statements in this document may turn out to be wrong. Actual events or results may differ materially. Our forward-looking statements can be affected by inaccurate assumptions we might make or by known or unknown risks, uncertainties and other factors.

This Annual Report on Form 10-K also contains estimates, projections and other information concerning our industry, our business and particular markets, including data regarding the estimated size of those markets. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, general publications, government data and similar sources.

ii

PART I

Item 1. Description of Business.

Overview

We are a specialty pharmaceutical company with a goal of using cutting-edge biological science and applied research to further develop and commercialize new therapies for the prevention and treatment of infectious diseases. We have successfully achieved regulatory approval of Arakoda, a malaria preventative treatment that has been on the market since late 2019. Currently, 60P’s pipeline under development covers development programs for vector-borne, fungal, and viral diseases utilizing three of the Company’s future products: (i) new products that contain the Arakoda regimen of Tafenoquine; (ii) new products that contain Tafenoquine; and (iii) Celgosivir. Additionally, we are conducting due diligence activities in relation to potential in-licensing of a product relevant to Lyme disease and an antimalarial combination partner for Tafenoquine for P. vivax malaria.

Corporate History

60 Degrees Pharmaceuticals, Inc. is a Delaware corporation that was incorporated on June 1, 2022. On June 1, 2022, 60 Degrees Pharmaceuticals, LLC, a District of Columbia limited liability company (“60P LLC”), entered into the Agreement and Plan of Merger with 60 Degrees Pharmaceuticals, Inc., pursuant to which 60P LLC merged into 60 Degrees Pharmaceuticals, Inc. The value of each outstanding member’s membership interest in 60P LLC was correspondingly converted into common stock of 60 Degrees Pharmaceuticals, Inc., par value $0.0001 per share, with a cost-basis equal to $5.00 per share.

We also operate one subsidiary. A summary of our majority-owned subsidiary is below.

We own 97% equity in 60P Australia Pty Ltd, a Sydney-Australia based subsidiary (“60P Australia”). 60P Australia holds sub-licensing rights for several ex-U.S. territories for our product.

60P Australia previously solely owned a Singaporean subsidiary company, 60P Singapore Pte. Ltd., which dissolved at our election in the second quarter of 2022.

Business Developments

The following highlights recent material developments in our business:

| ● | On January 22, 2024, we announced that we are planning a pivotal babesiosis study with tafenoquine following our January 17, 2024 FDA Meeting; and | |

| ● | On December 26, 2023, we announced IRB approval of a Phase IIA study to evaluate tafenoquine for babesiosis, an emerging tick-borne disease. |

Recent Developments

Monash University Agreement

On February 13, 2024, our majority-owned Australian subsidiary, 60P Australia Pty Ltd, and Monash University entered into the Research Services Agreement (the “Monash Agreement”) in which Monash University agreed to provide research services, including among other things, testing the efficacy of tafenoquine against candidemia, confirming suitable fungal infection dosage and determining the pharmacokinetics of tafenoquine following intraperitoneal drug administration (collectively, the “Monash Services”). The commencement date of the Monash Agreement was effective as of February 5, 2024, and the anticipated commencement of experiments and the completion date is in May 2024 and on November 30, 2024, respectively. The Company agreed to pay Monash University $90,167 AUD on April 1, 2024 and $90,167 AUD upon the completion of the Monash Services.

1

January 2024 Public Offering

On January 29, 2024, we entered into an Underwriting Agreement with WallachBeth Capital LLC, as representative of the underwriters listed on Schedule I thereto (the “Underwriting Agreement”), relating to our public offering (the “2024 Offering”) of 5,260,901 units (the “Units”) at an offering price of $0.385 per Unit and 999,076 pre-funded units (the “Pre-Funded Units”) at an offering price of $0.375 per Pre-Funded Unit. Each Unit consists of one share of common stock and one warrant exercisable for one share of common stock (the “Warrant”). Each Warrant has an exercise price of $0.4235 per share (110% of the offering price per Unit), is exercisable immediately upon issuance and expires five years from the date of issuance. Each Pre-Funded Unit consists of one pre-funded warrant exercisable for one share of common stock (the “Pre-Funded Warrant”) and one warrant identical to the Warrants included in the Units. The purchase price of each Pre-Funded Unit is equal to the price per Unit sold to the public in the offering, minus $0.01, and the exercise price of each Pre-Funded Warrant is $0.01 per share. The Pre-Funded Warrants are immediately exercisable and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full.

The underwriters were granted an option, exercisable within 45 days after the closing of the offering, to purchase up to 789,136 shares of our common stock at a price of $0.375 per share and/or 938,997 Warrants at a price of $0.01 per Warrant and/or 149,862 Pre-Funded Warrants at a price of $0.375 per Pre-Funded Warrant, or any combination of additional shares of common stock, Warrants and/or Pre-Funded Warrants, representing, in the aggregate, up to 15% of the number of Units sold in the offering, 15% of the Warrants underlying the Units and Pre-Funded Units sold in the offering and 15% of the Pre-Funded Warrants underlying the Pre-Funded Units sold in the offering, in all cases less the underwriting discount to cover over-allotments, if any. On January 31, 2024, WallachBeth Capital LLC partially exercised its over-allotment option with respect to 818,177 Warrants. On February 14, 2024, WallachBeth Capital LLC partially exercised its over-allotment option with respect to 50 shares of common stock and 50 Warrants.

The net proceeds to us from the 2024 Offering were approximately $1.9 million, after deducting underwriting discounts and commissions and the payment of other offering expenses associated with the 2024 Offering that were payable by us. We paid the Underwriter an underwriting discount equal to 8.0% of the gross proceeds of the 2024 Offering and a non-accountable expense fee equal to 1.5% of the gross proceeds of the 2024 Offering.

We also issued to WallachBeth Capital LLC warrants (the “Representative Warrants”) to purchase 375,599 shares of our common stock, which is equal to six percent (6%) of the common stock sold that were part of the Units and the pre-funded warrants sold that were part of the Pre-Funded Units in the 2024 Offering, at an exercise price of $0.4235 per share, which is equal to 110% of the offering price per Unit. The Representative Warrants may be exercised beginning on January 31, 2024 until January 31, 2029.

We intend to use the net proceeds from the 2024 Offering for increasing capitalization and financial flexibility, and relaunching our malaria prevention project in the U.S. later in 2024.

Our officers and directors have agreed, subject to certain exceptions, not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any shares of common stock or other securities convertible into or exercisable or exchangeable for shares of common stock until July 29, 2024 without the prior written consent of WallachBeth Capital LLC.

Mission

Our mission is to address the unmet medical need associated with infectious diseases through the development and commercialization of new small molecule therapeutics, focusing on synthetic drugs (made by chemists in labs, excluding biologics) with good safety profiles based on prior clinical studies, in order to reduce cost, risk, and capitalize on existing research. Our present focus is the expansion of Arakoda sales for malaria prevention and to demonstrate clinical benefit for other disease indications.

Market Opportunity

In 2018, the FDA approved Arakoda for malaria prevention in individuals 18 years and older, an indication for which there has historically been approximately 550,000 prescriptions combined (one prescription per three weeks of travel) in the United States each year for the current market-leading product (atovaquone-proguanil) and one of the legacy weekly administered antimalarials, mefloquine. Arakoda entered the U.S. supply chain in the third quarter of 2019, just prior to the COVID-19 pandemic. As the approved indication is for travel medicine, and international travel was substantially impacted by the pandemic, we did not undertake any active marketing efforts for Arakoda. For the calendar year 2023, our U.S. sales of Arakoda (not excluding returns) to pharmacies and other outlets was 1,632 boxes (a gross value of $383,520 at a WAC price of $235 per box), a substantial increase from the 570 boxes of Arakoda sold in 2022. We are currently assessing a targeted marketing strategy that will extract value from the current malaria prophylaxis indication and will continue our efforts to develop Arakoda for other applications.

2

We are repositioning the Arakoda regimen of Tafenoquine for new indications to address several therapeutic indications that have substantial U.S. caseloads, as further described below:

| ● |

Treatment of Tick-Borne Diseases. There are at least 38,000 cases of potentially treatable acute symptomatic babesiosis (red blood cell infections caused by deer tick bites) in the United States each year.1 Approximately 650 of these cases are hospitalizations.2 Symptomatic babesiosis is usually treated with a minimum ten day course of atovaquone and azithromycin which is extended to six weeks in the immunosuppressed, who may also experience relapses requiring multiple hospitalizations.3 This is much longer than equivalent serious parasitic diseases such as malaria where the goal is a three-day regimen. Separately, Babesia parasites are a common co-infection of patients experiencing chronic symptoms post-treatment Lyme disease syndrome (PTLDS). The size of this patient population is unclear, but it might be as high as 9,500 new cases and 190,000 cases cumulatively in the United States – this is based on the observation that Babesia parasites are a co-infection in Lyme patients about 10% of the time, and there may be up to 95,200 new cases of PTLDS each year, and a cumulative incidence in the U.S. of about 1,900,000.4 Arakoda has the potential to be added to the existing standard of care for treatment of acute babesiosis, making it more convenient and effective, and is already being used off-label to treat chronic babesiosis.

Separately from the clinical indication, based on estimates from industry experts, there may be somewhere between several hundred and several thousand cases of canine babesiosis each year in the United States, and thousands more globally. Currently, standard of care treatment for babesiosis in dogs is a ten-day course of atovaquone and azithromycin, which costs about $1,350 out of pocket. A treatment course of Tafenoquine mirroring the human prophylactic dose in dogs might cost < $300, offering a compelling alternative to standard of care. The additional resources required to generate enabling data for veterinary uses are much less expensive than human clinical trials.

| |

| ● |

Prevention of Tick-Borne Diseases. Post-exposure prophylaxis or early treatment with, respectively, a single dose or several week regimen of doxycycline following a tick-bite is a recognized indication to prevent the complications of Lyme disease. There may be more than 400,000 such tick bites in the United States requiring medical treatment each year. This estimate is based on the observation that approximately 50,000 tick bites are treated in U.S. hospital emergency rooms each year but this calculation represents only about 12% of actual treated tick bites based on observations from comparable ex-U.S health systems.5 Unlike Lyme disease, there is no characteristic rash associated with early infection, and no reliable diagnostic tests. Thus, an individual bitten by a tick cannot know whether they have also been infected with babesiosis. It is likely that a drug proven to be effective for this indication for babesiosis would also be used in conjunction with Lyme prophylaxis.

Babesiosis is a serious parasitic disease analogous to malaria and there are no vaccines relevant for the U.S. population for either. Although the risk of contracting malaria while exposed is low, the Centers for Diseases Control (CDC), nevertheless recommends, and the FDA approves drugs for, prevention of malaria. Every year, seasonally in the U.S. there is a population of individuals engaged in outdoor activities in the Northeast and Midwest who are at much greater risk of contracting babesiosis through a tick bite. While the number of prescriptions that might protect this population is not known, and requires refinement, it may be as high as 1.16 million per year, assuming that the number of potentially seasonally at-risk individuals (about 17.5 million U.S. individuals) who might consider taking chemoprophylaxis for babesiosis is similar to the proportion of at-risk U.S. travellers (about 8.2 million) to malaria-endemic countries who take malaria prophylaxis (about 6.7%).6 Arakoda has the potential to be added to the existing standard of care for treatment of babesiosis, and to be a market leading product for pre- and post-exposure prophylaxis of babesiosis. |

| 1 | This estimate is based on the observations of Krugeler et al (Emerg Infect Dis 2021;27:616-61) who reported that 476,000 cases of Lyme disease occur in U.S. states where babesiosis is endemic and Krause et. al. (JAMA 1996;275:1657-16602) who reported that 10% of Lyme disease patients are co-infected with babesiosis and the fact that according to Krause et al (AJTMH 2003;6:431-436) about 80% of cases are symptomatic (thus 476,000*10%*80% = 38,000 cases of babesiosis per year). |

| 2 | Bloch et al Open Forum Infect Dis 2022;9(11):ofac597. |

| 3 | According to IDSA guidelines. |

| 4 | The new case estimate for PTLDS is based on the observations of Krugeler (Emerg Infect Dis 2021;27:616-61) who reported that there are 476,000 cases of Lyme disease each year, multiplied by up to as 20% failure rate of primary antibiotic treatment regimens used as a modeling assumption by DeLong et al (BMC Public Health 2019;19(1):352). The cumulative prevalence data is from modeling work showing a cumulative prevalence of 1,900,000 PTLDS cases in 2020 (Delong et al. BMC Public Health 2019;19(1):352). The adjustments for babesiosis are based on the Krause et al. (JAMA 1996;275:1657-16602) who reported babesiosis as a coinfection in about 10% of Lyme patients. |

| 5 | Marx et. al., MMWR 2021;70:612-616. |

| 6 | According to the National Travel and Tourism Office, in 2015 there were approximately 8.2 million travelers, inclusively, to Africa, Latin America and countries in Asia (India, Philippines, other) with endemic malaria from the United States each year. According to Company estimates malaria prescriptions historically were 550,000 annually making the proportion of potentially at-risk travelers approximately 6.7% (550,000/8,200,000). According to CDC (see https:/www.cdc.gov/parasites/babesiosis/data-statistics/index.html), the following states have an annual incidence of babesiosis of at last 0.4 reported cases per 100,000 residents: ME, NH, VN, WI, MN, NY, PA, NJ, RI, CT, DE, MA, and 80+% of cases occur in June, July and August. The total population of these states is approximately 69 million, making the totally seasonally at-risk population about 17.3 million (69.3 million*0.25). Therefore, the potential number of prescriptions babesiosis prophylaxis each year might be 1.16 million (6.7%*17.34 million). |

3

| ● |

Treatment of Candida infections. According to the CDC, there are 50,000 cases of candidiasis (a type of fungal infection) each year in the United States and up to 1,900 clinical cases of C. auris, for which there are few available treatments, have been reported to date.7 Arakoda has the potential to be a market leading therapy for treatment/prevention of C. auris, and to be added to the standard of care regimens for other Candida infections. |

| ● | Prevention of fungal pneumonias. There are up to ~ 91-92,000 new medical conditions each year in the United States including acute lymphoblastic leukemia (up to 6.540 cases) and large B-cell lymphoma (up to 18,000 cases) patients receiving CAR-T therapy, solid organ transplant patients (up to 42,887 cases), allogeneic (~ 9,000 cases) and autologous (~ 15,000 cases) hematopoietic stem cell transplant patients for whom the use of antifungal prophylaxis is recommended.8 Despite the availability and use of antifungal prophylaxis, the risk of some patient groups contracting fungal pneumonia exceeds the risk of contracting malaria during travel to West Africa.9 Arakoda has the potential to be added to existing standard of care regimens for the prevention of fungal pneumonias. |

Celgosivir, a potential clinical candidate of 60P’s, has activity in a number of animal models of important viral diseases such as Dengue and RSV, both of which are associated with at least 4.1 million cases globally according to the European CDC (Dengue)10 and up to 240,000 hospitalizations (RSV) in children less than five years of age and adults greater than 65 years of age in the United States each year according to the CDC.11 As outlined in the “Strategy” section below, we expect to evaluate Celgosivir in additional non-clinical disease models before making a decision regarding clinical development.

| 7 | https://www.cdc.gov/fungal/diseases/candidiasis/invasive/statistics.html.; https://www.cdc.gov/fungal/candida-auris/tracking-c-auris.html. |

| 8 | See statistics for solid organ transplants at the Organ Transplant and Procurement Network at: National data - OPTN (hrsa.gov); See statistics for hematopoietic stem cell transplant in Dsouza et al Biology of Blood and Bone Marrow Transplantation 202;26: e177-e182; See statistics for acute lymphoblastic leukemia at: Key Statistics for Acute Lymphocytic Leukemia (ALL) (cancer.org); See statistics for large cell large B-cell lymphoma at; Diffuse Large B-Cell Lymphoma - Lymphoma Research Foundation; Treatment guidelines recommending antifungal prophylaxis for these diseases can be reviewed in (i) Fishman et al Clinical Transplantation. 2019;33:e13587, (ii) Hematopoietic Cell Transplantation (cancernetwork.com), (iii) Cooper et al Journal of the National Comprehensive Cancer Network 2016;14:882-913 and (iv) Los Arcos et al Infection (2021) 49:215–231. |

| 9 | Aguilar-Guisado et al Clin Transplant 2011;25:E629–38; Mace et al MMWR 202;70:1–35 |

| 10 |

https://www.ecdc.europa.eu/en/dengue- monthly#:~:text=This%20is%20an%20increase%20of%2032%20653%20cases%20and%2032,853%20deaths%20have% |

| 11 | https://www.cdc.gov/rsv/research/index.html#:~:text=Each%20year%20in%20the%20United,younger%20than%205% 20years%20old. &text=58%2C000-80%2C000%20hospitalizations%20among%20children%20younger%20than%205%20years% 20old.&text=60%2C000-120%2C000%20hospitalizations%20among%20adults%2065%20years%20and%20older. |

4

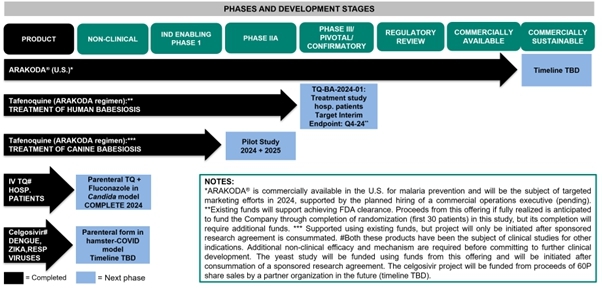

More information about our products is provided in the next section, and the status of various development efforts for the above-mentioned diseases is outlined in Figure A, below.

Figure A

Products

Arakoda (Tafenoquine) for malaria prevention

We entered into a cooperative research and development agreement with the United States Army in 2014 to complete development of Arakoda for prevention of malaria.12 With the U.S. Army, and other private sector entities as partners, we coordinated the execution of two clinical trials, development of a full manufacturing package, gap-filling non-clinical studies, compilation of a full regulatory dossier, successful defense of our program at an FDA advisory committee meeting, and submitted a new drug application (“NDA”) to the FDA in 2018. The history of that collaboration has been publicly communicated by the U.S. Army.13

The FDA and Australia’s medicinal regulatory agency, Therapeutic Goods Administration, subsequently approved Arakoda and Kodatef (brand name in Australia), respectively, for prevention of malaria in travelers in 2018. Prescribing information and guidance for patients can be found at www.arakoda.com. The features and benefits of Tafenoquine for malaria prophylaxis (marketed as Arakoda in the United States), some of which have been noted by third-party experts, include: convenient once weekly dosing following a three day load; the absence of reports of drug resistance during malaria prophylaxis; activity against liver and blood stages of malaria as well as both the major malaria species (Plasmodium vivax and Plasmodium falciparum); absence of any black-box safety warnings; good tolerability including in women and individuals with prior psychiatric medical history, and a comparable adverse event rate to placebo with up to 12 months continuous dosing.14 Tafenoquine entered the commercial supply chains in the U.S. (as Arakoda) and Australia (as Kodatef) in the third quarter of 2019.

| 12 | In 2014, we signed a cooperative research and development agreement with the United States Army Medical and Materiel Development Activity (Agreement W81XWH-14-0313). Under this agreement, we agreed to submit an NDA for Tafenoquine to the FDA (as Arakoda), while the US Army agreed to finance the bulk of the necessary development activities in support of that goal. |

| 13 | Zottig et al Military Medicine 2020; 185 (S1): 687. |

| 14 | Tan and Hwang Journal of Travel Medicine, 2018, 1–2; Baird Journal of Travel Medicine 2018:, 1–13; Schlagenhauf et al Travel Medicine and Infectious Disease 2022; 46:102268; See Arakoda prescribing information at www.arakoda.com; McCarthy et al CID 2019:69:480-486; Dow et al. Malar J (2015) 14:473; Dow et al. Malaria Journal 2014, 13:49; Novitt-Moreno et al Travel Med Infect Dis 2022 Jan-Feb;45:102211. |

5

The only limitation of Arakoda is the requirement for a G6PD test prior to administration.15 The G6PD test must be administered to a prospective patient prior to administration of Arakoda in order to prevent the potential occurrence of hemolytic anemia in individuals with G6PD deficiency.16 G6PD is one of the most common enzyme deficiencies and is implicated in hemolysis following administration/ingestion of a variety of oxidant drugs/food. G6PD must also be ruled out as a possible cause when diagnosing neonatal jaundice. As a consequence, G6PD testing is widely available in the United States through commercial pathology service providers (e.g., Labcorp, Quest Diagnostics, etc.). Although these tests have a turn-around time of up to 72 hours, the test needs only to be administered once. Thus, existing U.S. testing infrastructure is sufficient to support the FDA-approved use of the product (malaria prevention) by members of the armed forces (who automatically have a G6PD test when they enlist), civilian travelers with a long planning horizon or repeat travelers.

Tafenoquine for Other (Infectious) Diseases

During the pandemic, we also worked with NIH to evaluate the utility of Tafenoquine as an antifungal. We, and the NIH, found that Tafenoquine exhibits a Broad Spectrum of Activity in cell culture against Candida and other yeast strains via a different Mode of Action than traditional antifungals and also exhibits antifungal activity against some fungal strains at clinically relevant doses in animal models.17 Our work followed Legacy Studies that show Tafenoquine is effective for treatment and prevention of Pneumocystis pneumonia in animal models.18 We believe that if added to the standard of care for anti-fungal and yeast infection treatments for general use, Tafenoquine has the potential to improve patient outcomes in terms of recovery from yeast infections, and prevention of fungal pneumonias in immunosuppressed patients. There are limited treatment options available for these indications, and Tafenoquine’s novel mechanism of action might also mitigate problems of resistance. Clinical trial(s) to prove safety and efficacy, and approval by the FDA and other regulators, would be required before Tafenoquine could be marketed for these indications.

Tafenoquine is effective in animal models of babesiosis (tick borne red blood cell infections). In two of three recent clinical case studies, Tafenoquine administered after failure of conventional antibiotics in immunosuppressed babesiosis patients resulted in cures.19 Consequently, we believe that (i) if combined with standard of care products, Tafenoquine has the potential to reduce the duration of treatment with antibiotic therapy in immunosuppressed patients and the time to parasite clearance in non-immunosuppressed patients and (ii) that once appropriate clinical studies have been conducted, it is likely that Tafenoquine would be quickly embraced for post-exposure prophylaxis of babesiosis in patients with tick bites and suspected of being co-infected with Lyme disease. Clinical trial(s) to prove safety and efficacy, and approval by FDA and other regulators, would be required before Tafenoquine could be marketed for these indications.

Celgosivir

Celgosivir is a host targeted glucosidase inhibitor that was developed separately by other sponsors for HIV then for hepatitis C.20 The sponsors abandoned Celgosivir after completion of Phase II clinical trials involving 700+ patients, because other antivirals in development at the time had superior activity. The National University of Singapore initiated development of Celgosivir independently for Dengue fever. A clinical study, conducted in Singapore, the results of which were accepted for publication in the peer-reviewed journal Lancet Infectious Diseases, confirmed its safety but the observed reduction in viral load was lower than what the study was powered to detect.21 Celgosivir (as with other Dengue antivirals) exhibits greater capacity to cure Dengue infections in animal models when administered prior to symptom onset compared to post-symptom onset. In animal models, this problem can be addressed for Celgosivir, by administering the same dose of drug split into four doses per day rather than two doses per day (as was the case in the Singaporean clinical trial).22 This observation led to the filing and approval of a patent related to Dengue, which we licensed from the National University of Singapore.

| 15 | See prescribing information at www.arakoda.com. |

| 16 | See prescribing information at www.arakoda.com. |

| 17 | Dow and Smith, New Microbe and New Infect 2022; 45: 100964. |

| 18 | Queener et al Journal of Infectious Diseases 1992;165:764-8). |

| 19 | Liu et al. Antimicrobial Agents Chemo 2021;65:e00204-21, Marcos et al. IDCases 2022;27:e01460; Rogers et al. Clin Infect Dis. 2022 Jun 10:ciac473, Prasad and Wormsner. Pathogens 2022;11:1015. |

| 20 | Sorbera et al, Drugs of the Future 2005; 30:545-552. |

| 21 | Low et. al., Lancet ID 2014; 14:706-715. |

| 22 | Watanabe et al, Antiviral Research 2016; 10:e19. |

6

Additional clinical studies would be required to prove that such a 4x daily dosing regimen would be safe and effective in Dengue patients to regulators’ satisfaction. To that end, earlier in our history, we, in partnership with the National University of Singapore, and Singapore General Hospital, successfully secured a grant from the government of Singapore for a follow-on clinical trial, but were unable at that time to raise matching private sector funding. We concluded as a result that development of Repositioned Molecules for Dengue, solely and without simultaneous development for other therapeutic use, despite substantial morbidity and mortality in tropical countries, was an effort best suited for philanthropic entities. Accordingly, during the pandemic, we undertook an effort (in partnership with NIH’s Division of Microbiology and Infectious Diseases program and Florida State University) to determine whether Celgosivir might be more broadly useful for respiratory diseases that have impact in both tropical and temperate countries. Preliminary data suggest Celgosivir inhibits the replication of the virus that causes COVID-19 (SARS-CoV-2) in cell culture, and the RSV virus in cell culture and provides benefits in animals. We have filed and/or licensed patents in relation to Celgosivir for these other viruses as we believe there is potential applications to fight respiratory diseases that might have more commercial viability than historical development of Celgosivir to combat Dengue fever.

Competitive Strengths

Our main competitive strength has been our ability to achieve important clinical milestones inexpensively in therapeutic areas that other entities have found extremely challenging. With a small virtual management team, we have successfully built productive research partnerships with public and academic entities, and licensed products with well characterized safety profiles in prior clinical studies, thereby reducing the cost and risk of clinical development. This business and product model enabled Arakoda to be approved in 2018, with a total operating expense of < $10 million. We plan to focus in the future on generating proof of concept clinical data sets for the approved Arakoda regimen of Tafenoquine in other therapeutic areas, all of which is expected to foster and continue our existing tradition of inexpensive product development.

Strategy

Following our initial public offering in July 2023, our initial strategic priority was to conduct a Phase IIB that would have evaluated the potential of the Arakoda regimen of Tafenoquine to accelerate disease recovery in COVID-19 patients with low risk of disease progression. In October 2023, we made a decision to suspend this study. This was a consequence of advice previously received from the FDA, which we interpreted to mean that they would not have granted clearance for the study to proceed unless we redesigned it to (i) enroll a patient population in which receipt of Paxlovid or Lagevrio would be medically contraindicated or (ii) compare Tafenoquine to placebo in patients taking a “standard of care” regimen (defined by the FDA as Lagevrio or Paxlovid). The FDA’s position was somewhat surprising given that neither Paxlovid nor Lagevrio is indicated for treatment of COVID-19 in low-risk patients. We determined that conducting our study in an alternate population in the United States would be unfeasible, and conducting an add-on-to standard of care study might not be Phase III enabling. Accordingly, the Company made a decision to pivot back to continue commercialization of Arakoda for malaria, and further evaluation of the Arakoda regimen of Tafenoquine for babesiosis and other diseases. We believe such an approach is both less risky and less expensive.

Moving forward, our general strategy to achieve profitability and grow shareholder value has three facets: (i) increase sales of Arakoda; (ii) conduct clinical trials to expand the number of patients who can use Tafenoquine for new indications in the future; and (iii) reposition small molecule therapeutics with good clinical safety profiles for new indications.”

7

Expansion of U.S. Arakoda Sales

Hiring of Chief Commercial Officer. In February 2024, the Company hired a Chief Commercial Officer, Kristen Landon, to lead its activities relating to commercialization of Arakoda for malaria prevention. The Company’s planned activities for the first two quarters of 2024 are summarized below.

Acceptability and Demand of the Arakoda Product Profile. Market research will be conducted to understand current brand awareness and usage among prescribers and product acceptability among consumers, determine barriers to use, acceptability of differential price points, and demand of Arakoda relative to its main competitors. Generic atovaquone-proguanil is substantially cheaper than Arakoda for the average trip length (three weeks) and has superior formulary positioning (Tier 1 vs. Tier 3). However, generic-atovaquone proguanil does not provide the same level of confidence a traveler may experience from taking a product with a convenient weekly dosing regimen during travel, that works everywhere in the world against all malaria species and drug resistant strains, and which requires only a single dose for post-exposure prophylaxis upon return from a malarious area. The value those advantages confer needs to be quantified and communicated with stakeholders.

Market Segment Definition and Targeting. We plan to purchase additional sales data in order to define the list of top prescribers of atovaquone-proguanil, the main generic competitor to Arakoda for malaria prophylaxis Beginning in the third quarter of 2024, we plan to reach out to prescribers covering the top 80% of atovaquone-proguanil prescribers in order to educate them about the value proposition of Arakoda. We will also compile a list of the top institutions/organization that have ex-U.S. deployed workforces and internal occupational health and safety programs, and target these organizations with messaging regarding the convenience and global effectiveness of Arakoda. We do not initially plan to target U.S. government agencies as these organizations, such as the Department of Defense, are expected to be extremely price sensitive until operational considerations justify the use of superior products (the DOD used inexpensive doxycycline for malaria prevention in the low malaria risk setting of Afghanistan, but chose superior weekly mefloquine, despite safety concerns, for the Ebola mission to west Africa in 2014, where malaria rates were extremely high).

Digital Revamp and Collateral. We will work with an Agency of Record to test brand positioning and key marketing messages that we believe best highlight the features and benefits of Arakoda, namely the convenience of the travel and post-travel regimen and global effectiveness. Once these activities are completed, we will develop a marketing campaign that clearly articulates the brand’s value proposition including, key marketing messages and the development of promotional materials. The Arakoda website will be updated to reflect the aforementioned marketing messaging to support the relaunch of the product.

Revised Forecast. Once the above activities are completed (which we expect to be by the end of the second quarter of 2024), we will develop an internal three-year forecast for the malaria indication.

Arakoda Regimen of Tafenoquine for Babesiosis

In animal models, Tafenoquine monotherapy has been shown to suppress acute babesiosis infections to the point where the immune system can control them following single or multiple doses similar to those effective against malaria parasites, and combination of Tafenoquine with atovaquone leads to complete radical cure and to the conference of sterile immunity.23 In three case studies in individuals with immunosuppression and/or refractory parasites, Tafenoquine alone or combination with various standard of care antimalarials and antibiotics successfully cleared parasites leading to three consecutive negative PCR tests, and prevention of further relapses in two of three individuals.24 Collectively these data suggest Tafenoquine might have utility as monotherapy in patients with uncomplicated babesiosis and improve clinical outcomes in hospitalized/immunosuppressed patients already administered standard of care antibiotic regimens.

| 23 | Liu et al. Antimicrobial Agents Chemo 2021;65:e00204-21. Vydyam et al. J Infect Dis. 2024 Jan 3:jiad315. doi: 10.1093/infdis/jiad315 |

| 24 | Marcos et al. IDCases 2022;27:e01460; Rogers et al. Clin Infect Dis. 2022 Jun 10:ciac473, Prasad and Wormsner. Pathogens 2022;11:1015. |

8

In November 2023, we submitted a request for an advice (Type C) meeting to FDA to discuss our Tafenoquine babesiosis program. In that correspondence we proposed to the FDA that for a supplementary indication for Tafenoquine for babesiosis, it would be appropriate to conduct a single randomized placebo-controlled study in low-risk patients and a case series in high-risk patients. On January 17, 2024, during the requested regulatory advice meeting, the FDA stated that in principle, a single pivotal study could support a supplementary New Drug Application, provided that it included high-risk patients and incorporated a clinical endpoint as the primary endpoint. The clinical trial design that we discussed with FDA would have randomized symptomatic hospitalized patients diagnosed with babesiosis and at low risk of relapse who are taking azithromycin/atovaquone to receive four daily doses of Tafenoquine or placebo. This initial protocol had previously been approved by an ethics committee, and submitted to clinicaltrials.gov for public disclosure. We are now redrafting this protocol, per the FDA’s advice, as a pivotal study which will also include high risk patients, and be powered off a clinical endpoint. We remain on track to recruit patients in three hospitals in the North-Eastern United States, beginning in the summer of 2024, with a goal of reaching an interim analysis point by the end of 2024. If we do not achieve statistical significance, a sample re-estimation will be conducted, and additional subjects will be recruited during the 2025 tick season.

We will also be submitting a compassionate use IND to FDA so we can provide commercial Arakoda for use in immunosuppressed patients with babesiosis – the data collected under that future protocol will support data generated from the randomized study. We may, if resources permit, submit a similar compassionate use protocol to the FDA for the use of Tafenoquine for treatment of chronic babesiosis.

We have signed an agreement with North Carolina State University to support a pilot study of Tafenoquine for treatment of canine babesiosis in the United States under a sponsored research program. Should this collaboration be successful, we believe that the data from that study may provide supportive data for the clinical babesiosis development program, and could provide proof of concept for an expanded study to prove utility for veterinary indications.

From a commercial standpoint we are conducting market research and engaging with Key Opinion Leaders (KOLs) to further understand the commercial demand in acute and chronic babesiosis, including an assessment of the pre and post exposure prophylaxis opportunity. We will review current treatment regimens including diagnosis criteria and management of disease, understand the patient burden, and assess the competitive landscape.

Parenteral Tafenoquine for Fungal Infections

We plan to support a series of studies in animal models to determine whether single dose parenteral administration of Tafenoquine exhibits efficacy against Candida spp including C. auris. These studies will be conducted under a sponsored research agreement with Monash University in Melbourne, Australia.

Combination Partner for Tafenoquine for Malaria

Most new antimalarial treatment products are developed as drug combinations to proactively combat drug resistance. We believe that Tafenoquine, due to its long half-life and activity against all parasite species and strains, would be an ideal partner in a drug combination. Recently, Kentucky Technology Inc. (“KTI”), completed Phase IIA studies in P. vivax malaria, in which they evaluated the safety and efficacy of SJ733, their ATP4 inhibitor in combination with Tafenoquine as the combination partner drug. Recently it was announced the SJ733 development program would be partially supported by a grant from the Global Health Innovative Technology Fund (“GHIT”). As part of its shares for services agreement with KTI, The Company expects to receive a detailed feasibility assessment and business plan for the project in Q1 2024, including an assessment of potential PRV eligibility. The Company will utilize this information to make a business decision about whether it wishes to license commercial rights to SJ733.

Celgosivir for Antiviral Diseases

Reviewing prior studies of Celgosivir for Zika, Dengue, and RSV, it is evident that the drug protects against the pathological effects of viruses through a combination of anti-inflammatory and antiviral effects. These properties suggest it might have a beneficial effect in several viral diseases. Celgosivir is synthesized from castanospermine, which is obtained from botanical sources in low yield, making its inherent cost of goods potentially high. Castanospermine is also quite water soluble making it amenable to intravenous formulation. We plan to conduct a proof of concept study in an animal -COVID-19 model to evaluate whether parenterally administered castanospermine can ameliorate the pathological effects of SARS CoV-2 via modulation of cytokine response to infection. This project will be added to our statement of work for our services agreement with FSURF, and will commence when there are sufficient proceeds from the sale of FSURF’s 60P shares to support this research. The data generated from the study will allow us to assess whether to move forward with IND enabling studies of parenteral castanospermine (or Celgosivir) for viral indications.

9

Post-Marketing Requirements

We have an FDA post-marketing requirement to conduct a malaria prophylaxis study of Arakoda in pediatric and adolescent subjects. We proposed to the FDA, in late 2021, that this might not be safe to execute given that malaria prevention is administered to asymptomatic individuals and that methemoglobinemia (damage to the hemoglobin in blood that carries oxygen) occurred in 5% of patients, and exceeded a level of 10% in 3% of individuals in a study conducted by another sponsor in pediatric subjects with symptomatic vivax malaria.25 The FDA has asked us to propose an alternate design, for which we submitted a concept protocol in the fourth quarter of 2022, and submitted a full protocol in early 2024. We estimate the cost of conducting the study proposed by the FDA, if conducted in the manner suggested by the FDA, would be $2 million, and, due to the time periods required to secure protocol approvals from the FDA and Ethics Committees, could not be initiated any earlier than the third quarter of 2025. The funds from our January 2024 public offering to be expended on such a pediatric study will be limited to the minimum required to support protocol preparation and regulatory interactions with the FDA.

Potential In Licensing Activities

We may in the future engage a business development consultant to assist us with in-licensing additional late-stage development or early commercial stage infectious disease assets that complement our existing product portfolio and business plan. We are particularly interested in securing the rights to new products targeted at tick-borne diseases.

Capitalization and Future Financing

As outlined in "Liquidity and Capital Resources", following the recent public offering in which we netted approximately $1.9 million, our runway is through approximately October 31, 2024. To simplify the financing effort in August 2024, we expect that we will become shelf eligible and if we seek additional funding at that time, we will seek to file a shelf registration statement on Form S-3 to register our securities for sale to the public. Additionally, if we are able to develop a more robust forecast for Arakoda for the malaria indication, we may seek non-dilutive royalty-based funding or an equity line of credit to support further commercialization of Arakoda. There is no assurance that funds will be available on acceptable terms.

Competitors and Competitive Advantage

Arakoda is approved by the FDA for malaria prevention in travelers. The major (but not only) competing products are generic atovaquone-proguanil and doxycycline – these products have the benefit of being well established, not requiring a G6PD screen prior to travel (as is the case for Arakoda) and in the case of atovaquone-proguanil being generally recognized as well tolerated and safe. The major limitations of these two established products are the requirement for daily dosing including for up to 30 days post-travel in the case of doxycycline, the requirement to also take Primaquine (a medication used to treat and prevent malaria) for post-exposure prophylaxis to prevent relapse from P. vivax malaria, and the potential inconvenience for many patients of complying with a daily dosing regimen during travel. Doxycycline has the added disadvantages of a higher risk of vaginitis, sunburn following sun exposure, contraction of malaria due to missed daily doses, and esophageal necrosis. Drug resistance against the individual components of the atovaquone-proguanil is prevalent in some regions of the work, and the higher doses of atovaquone-proguanil used to treat malaria, are no longer effective in some parts of Southeast Asia.

Arakoda has the benefit of a convenient weekly dosing regimen following a three-day loading dose and a single day of dosing for post-exposure prophylaxis upon return from travel. It is effective against all species of malaria everywhere in the world, which simplifies prescribing decisions. It is the only FDA-approved antimalarial other than mefloquine with a safety profile demonstrated based on continuous dosing for 12 months, but unlike that product, it does not have a black-box safety warning. While G6PD testing is a potential limitation for first time travelers with short planning horizons, this is not the case for institutional occupation travel or repeat business travel, because a G6PD test need only be performed once and can be captured in electronic health records. G6PD testing is routinely available in the United States through commercial laboratory pathology services. Over time, Arakoda is expected to capture a significant share of the antimalarial prophylaxis market as a consequence of these advantages.

We are targeting additional indications for the Arakoda regimen of Tafenoquine, of which the priority is treatment of Babesiosis. In hospitalized patients, the Arakoda regimen will be partnered with the existing standard of care. For follow-on prevention indications for babesiosis there are no competing products.

| 25 | Velez et al 2021 - Lancet Child Adolesc Health 2022; 6: 86–95. |

10

Intellectual Property

We are co-owners, with the U.S. Army, of patents in the United States and certain foreign jurisdictions directed toward use of Tafenoquine for malaria and have obtained an exclusive worldwide license from the U.S. Army to practice these inventions. We also have an exclusive worldwide license to use manufacturing information and non-clinical and clinical data that the U.S. Army possesses relating to use of Tafenoquine for all therapeutic applications and uses excluding radical cure of symptomatic vivax malaria. We have submitted patent applications in the United States and certain foreign jurisdictions for use of Tafenoquine for COVID-19, fungal lung infections, tick-borne diseases, and other infectious and non-infectious diseases in which induction of host cytokines/inflammation is a component of the disease process. The United States Patent and Trademark Office (“USPTO”) recently allowed our first COVID-19 patent for Tafenoquine. We have optioned or licensed patents involving Celgosivir for the treatment and prevention of Dengue (from the National University of Singapore), COVID-19 & Zika (Florida State University), and have pending patent applications related to Celgosivir for RSV. We have optioned or own manufacturing methods related to Celgosivir. A detailed list of our intellectual property is as follows:

Patents

| Title | Patent No. | Country | Status | US Patent Date | Application No. | Estimated/ Anticipated Expiration Date | ||||||

| Dosing Regimen For Use Of Celgosivir As An Antiviral Therapeutic For Dengue Virus Infections | 2013203400 | Australia | 2013203400+ | 10-April-2033* | ||||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | 2014228035 | Australia | 2014228035 | 14-Mar-2034* | ||||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | MY-170991-A | Malaysia | PI2015002372 | 14-Mar-2034* | ||||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | 378015 | Mexico | MX/a/2015/013115 | 14-Mar-2034* | ||||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | 11201507254V | Singapore | 11201507254V | 14-Mar-2034* | ||||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | Pending | Singapore | Pending | 10201908089V | 14-Mar-2034* | |||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | 9763921 | US | 9/19/2017 | 14/772,873 | 14-Mar-2034^ | |||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | 10517854 | US | 12/31/2019 | 15/706,845 | 14-Mar-2034^ | |||||||

| Dosing Regimens Of Celgosivir For The Treatment Of Dengue | 11219616 | US | 1/11/2022 | 16/725,387 | 14-Mar-2034^ | |||||||

| Novel Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | 2015358566 | Australia | 2015358566 | 02-Dec-2035* | ||||||||

| Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | 2968694 | Canada | 2968694 | 02-Dec-2035* | ||||||||

| Novel Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | 10342791 | US | 7/9/2019 | 15/532,280 | 02-Dec-2035^ | |||||||

| Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naive Subjects | 10888558 | US | 1/12/2021 | 16/504,533 | 02-Dec-2035^ | |||||||

| Novel Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | Pending | Singapore | Pending | 10201904908Q | 02-Dec-2035* | |||||||

| Novel Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | Pending | EP | Pending | 15865264.4 | 02-Dec-2035* | |||||||

| Novel Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | Pending | Hong Kong | Pending | 18103081.4 | 02-Dec-2035* | |||||||

| Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naive Subjects | 11,744,828 | US | 9/5/2023 | 17/145,530 | 02-Dec-2035^ | |||||||

| Novel Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | Pending | New Zealand | Pending | 731813 | 02-Dec-2035* | |||||||

| Regimens of Tafenoquine for Prevention of Malaria in Malaria-Naive Subjects | Pending | US | Pending | 18/240,049 | 02-Dec-2035^ | |||||||

| Novel Dosing Regimens Of Celgosivir For The Prevention Of Dengue | 2016368580 | Australia | 2016368580 | 09-Dec-2036* | ||||||||

| Novel Dosing Regimens Of Celgosivir For The Prevention Of Dengue | Pending | Singapore | Pending | 10201912141Y | 09-Dec-2036* | |||||||

| Dosing Regimens Of Celgosivir For The Prevention Of Dengue | 11000516 | US | 5/11/2011 | 16/060,945 | 09-Dec-2036^ | |||||||

| Methods For The Treatment And Prevention Of Lung Infections By Administration Of Tafenoquine | Pending | EP | Pending | 21764438.4 | 02-Mar-2041* | |||||||

| Methods For The Treatment And Prevention Of Lung Infections By Administration Of Tafenoquine | Pending | China | Pending | 202180029643.7 | 02-Mar-2041* | |||||||

| Methods For The Treatment And Prevention Of Lung Infections By Administration Of Tafenoquine | Pending | Australia | Pending | 2021231743 | 02-Mar-2041* |

11

| Title | Patent No. | Country | Status | US Patent Date | Application No. | Estimated/ Anticipated Expiration Date | ||||||

| Methods For The Treatment And Prevention Of Lung Infections Caused By Gram-Positive Bacteria, Fungus, Or Virus By Administration Of Tafenoquine | Pending | Hong Kong | Pending | 62023078645.6 | 02-Mar-2041* | |||||||

| Methods For The Treatment And Prevention Of Lung Infections Caused By Gram-Positive Bacteria, Fungus, Or Virus By Administration Of Tafenoquine | 11,633,391 | US | 4/25/2023 | 17/189,544 | 05-May-2041^ | |||||||

| Methods For The Treatment And Prevention Of Lung Infections Caused By Gram-Positive Bacteria, Fungus, Or Virus By Administration Of Tafenoquine | Pending | US | Pending | 18/300,805 | 02-Mar-2041^ | |||||||

| Methods For The Treatment And Prevention Of Lung Infections Caused By Fungus By Administration Of Tafenoquine | Pending | US | Pending | 17/683,679 | 02-Mar-2041^ | |||||||

| Methods For The Treatment And Prevention Of Lung Infections Caused By Sars-Cov-2 Virus By Administration Of Tafenoquine | Pending | US | Pending | 17/683,718 | 02-Mar-2041^ | |||||||

| Treatment Of Human Coronavirus Infections Using Alpha-Glucosidase Glycoprotein Processing Inhibitors | 11369592 | US | 6/28/2022 | 17/180,140# | 19-Feb-2041^ | |||||||

| Treatment Of Human Coronavirus Infections Using Alpha-Glucosidase Glycoprotein Processing Inhibitors | Pending | US | Pending | 17/664,693# | 19-Feb-2041^ | |||||||

| Treatment Of Human Coronavirus Infections Using Alpha-Glucosidase Glycoprotein Processing Inhibitors | Pending | EP | Pending | 2021757552# | 19-Feb-2041* | |||||||

| Methods For The Treatment And Prevention Of Non-Viral Tick-Borne Diseases And Symptoms Thereof | Provisional | US | Provisional | 63/461,060 | ~21-Apr-2044& | |||||||

| Methods To Treat Respiratory Infection Utilizing Castanospermine Analogs | Pending | US | Pending | 18/218,202 | 05-Jul-2043^ | |||||||

| Methods To Treat Respiratory Infection Utilizing Castanospermine Analogs | Pending | PCT | Pending | PCT/US23/26884 | 05-Jul-2043* | |||||||

| Methods For The Treatment And Prevention Of Diseases Or Infections With MCP-1 Involvement By Administration Of Tafenoquine | Pending | US | Pending | 18/375,070 | 30-Sep-2043^ | |||||||

| Methods For The Treatment And Prevention Of Diseases Or Infections With MCP-1 Involvement By Administration Of Tafenoquine | Pending | PCT | Pending | PCT/US23/34169 | 30-Sep-2043 | |||||||

| Treatment Of Zika Virus Infections Using Alpha Glucosidase Inhibitors | 10,328,061+ | US | 6-25-2019 | 15/584,952+ | 2-May-37 | |||||||

| Treatment Of Zika Virus Infections Using Alpha Glucosidase Inhibitors | 10,561,642+ | US | 2-18-2020 | 15/856,377+ | 2-May-37 |

| * = | For foreign patents and applications, the estimated and/or anticipated patent expiration is the date that is twenty years from the PCT filing date. For all issued Australian patents, this estimated date was also confirmed through the Australian patent office web database. |

| ^ = | For issued U.S. patents, the estimated patent expiration was calculated using information from the front cover of the patent, i.e., 20 years from the date of the nonprovisional filing plus any listed Patent Term Adjustment less any time disclaimed through a Terminal Disclaimer. For pending U.S. applications, the anticipated patent expiration is the date twenty years from the earliest nonprovisional filing date and does not account for possible Patent Term Adjustment (PTA), Patent Term Extension (PTE), or Terminal Disclaimers. |

| & = | For U.S. provisional applications that are not yet the subject of a nonprovisional or PCT application, the anticipated patent expiration was determined using the assumption that a non-provisional application or PCT will be filed one year after filing the provisional application with a term lasting twenty years from the date of that nonprovisional or PCT filing. This does not account for possible Patent Term Adjustment (PTA), Patent Term Extension (PTE), or Terminal Disclaimers. |

| + = | 60 Degrees Pharmaceuticals, Inc. is not a listed Applicant and Geoffrey S. Dow, Ph.D. is not a listed inventor. |

| # = | 60 Degrees Pharmaceuticals, Inc. is not a listed Applicant, but Geoffrey S. Dow, Ph.D. is a listed inventor. |

12

All patents not designated with a “+” list Geoffrey S. Dow, Ph.D. as an inventor.

All patents not designated with a “+” or a “#” list 60 Degrees Pharmaceuticals, Inc. as an applicant.

All estimated patent expiration dates and anticipated patent expiration assume payment of any maintenance/annuity fees during the patent term.

Trademarks

| Country | Mark | Status | Application Number |

Date Filed |

Registration Date |

Registration Number |

BIR Ref Number |

Due Date | Due Date Description | |||||||||

| Australia | KODATEF | Registered | 1774631 | 2-Jun-16 | 6/2/2016 | 1774631 | 0081716-000029 | 2-Jun-26 | Renewal Due | |||||||||

| Canada | KODATEF | Registered | 1785098 | 1-Jun-16 | 11/26/2019 | TMA1,064,371 | 0081716-000028 | 26-Nov-29 | Renewal Due | |||||||||

| Canada | ARAKODA | Registered | 1899317 | 15-May-18 | 8/20/2020 | TMA1,081,180 | 0081716-000053 | 20-Aug-30 | Renewal Due | |||||||||

| China | KODATEF | Registered | 20842242 | 2-Aug-16 | 9/28/2017 | 20842242 | 0081716-000035 | 27-Sep-27 | Renewal Due | |||||||||

| European Union | KODATEF | Registered | 15508872 | 3-Jun-16 | 9/21/2016 | 15508872 | 0081716-000034 | 3-Jun-26 | Renewal Due | |||||||||

| European Union | ARAKODA | Registered | 17900852 | 16-May-18 | 9/20/2018 | 17900852 | 0081716-000054 | 16-May-28 | Renewal Due | |||||||||

| Israel | KODATEF | Registered | 285476 | 6-Jun-16 | 6/6/2016 | 285476 | 0081716-000033 | 6-Jun-26 | Renewal Due | |||||||||

| New Zealand | KODATEF | Registered | 1044407 | 7-Jun-16 | 12/8/2016 | 1044407 | 0081716-000031 | 6-May-26 | Renewal Due | |||||||||

| Russian Federation | KODATEF | Registered | 2016720181 | 6-Jun-16 | 7/10/2017 | 623174 | 0081716-000032 | 6-Jun-26 | Renewal Due | |||||||||

| Singapore | KODATEF | Registered | 40201707950V | 2-May-17 | 11/8/2017 | 40201707950V | 0081716-000040 | 2-May-27 | Renewal Due | |||||||||

| United Kingdom | ARAKODA | Registered | 17900852 | 16-May-18 | 9/20/2018 | UK00917900852 | 0081716-000054 | 16-May-28 | Renewal Due | |||||||||

| United Kingdom | KODATEF | Registered | 15508872 | 3-Jun-16 | 9/21/2016 | UK009015508872 | 0081716-000072 | 3-Jun-26 | Renewal Due | |||||||||

| United States of America | TQ 100 & TABLET DESIGN | Registered | 87608493 | 14-Sep-17 | 9/11/2018 | 5562900 | 0081716-000037 | 11-Sep-24 | Section 8 & 15 Due | |||||||||

| United States of America | ARAKODA | Registered | 87688137 | 16-Nov-17 | 12/31/2019 | 5950691 | 0081716-000050 | 31-Dec-25 | Section 8 & 15 Due | |||||||||

| United States of America | KODATEF | Allowed - 02/16/2021 | 90072885 | 24-Jul-20 | 0081716-000069 | 16-Aug-23 | Statement of Use/3rd Extension of Time Due |

13

Key Relationships & Licenses

On May 30, 2014, we entered into the Exclusive License Agreement (the “2014 NUS-SHS Agreement”) with National University of Singapore (“NUS”) and Singapore Health Services Pte Ltd (“SHS”) in which we were granted a license from NUS and SHS with respect to their share of patent rights regarding “Dosing Regimen for Use of Celgosivir as an Antiviral Therapeutic for Dengue Virus Infection” to develop, market and sell licensed products. The 2014 NUS-SHS Agreement continues in force until the expiration of the last to expire of any patents under the patent rights unless terminated earlier in accordance with the 2014 NUS-SHS Agreement. We are obligated to pay at the rate of 1.5% of gross sales.

On July 15, 2015, we entered into the Exclusive License Agreement with the U.S. Army Medical Materiel Development Activity (the “U.S. Army”), which was subsequently amended (the “U.S. Army Agreement”), in which we obtained a license to develop and commercialize the licensed technology with respect to all therapeutic applications and uses excluding radical cure of symptomatic vivax malaria. This exclusion does not impact our ability to market Arakoda for the FDA-approved use, which is the prevention of malaria utilizing the indicated dose in asymptomatic individuals traveling to malarious areas (whereas the license exclusion relates to its use to treat symptomatic vivax malaria in a patient already presenting with that disease). The term of the U.S. Army Agreement will continue until the expiration of the last to expire of the patent application or valid claim of the licensed technology, or 20 years from the start date of the U.S. Army Agreement, unless terminated earlier by the parties. We will be required to make a minimum annual royalty payment of 3% of net sales for net sales < $35 million, and 5% of net sales greater than $35 million, with US government sales excluded from the definition of net sales. In addition, we must pay a milestone fee of $75,000 once cumulative net sales from all sources exceeds $6 million, $100,000 if the company is acquired or merges, and regulatory approval milestone payments once marketing authorizations are achieved in Canada ($5,000) and Europe ($5,000). Also, we will be required to obtain the U.S. Army Medical Materiel Development Activity’s consent prior to a change of control of the Company, which consent was obtained on September 2, 2022.

On September 15, 2016, we entered into the Exclusive License Agreement (the “2016 NUS-SHS Agreement”) with National University of Singapore (“NUS”) and Singapore Health Services Pte Ltd (“SHS”) in which we were granted a license from NUS and SHS with respect to their share of patent rights regarding “Novel Dosing Regimens of Celgosivir for The Prevention of Dengue” to develop, market and sell licensed products. The 2016 NUS-SHS Agreement continues in force until the expiration of the last to expire of any patents under the patent rights unless terminated earlier in accordance with the 2016 NUS-SHS Agreement. We are obligated to pay at the rate of 1.5% of gross sales or minimum annual royalty ($5,000 in 2022 and $15,000 in 2023). In July 2022, the Company renegotiated the timing of a license fee of $85,000 Singapore Dollars, payable to the National University of Singapore, such that payment would be due at the earlier of (i) enrollment of a patient in a Phase II clinical trial involving Celgosivir, (ii) two years from the agreement date and (iii) an initial public offering.

On December 4, 2020, we entered into the Other Transaction Authority for Prototype Agreement (“OTAP Agreement”) with the Natick Contracting Division of the U.S. government in which we will, among other things, conduct activities for a Phase II clinical trial to assess the safety and efficacy of Tafenoquine for the treatment of mild to moderate COVID-19 disease, with the goal of delivering Tafenoquine with an FDA Emergency Use Authorization (“EUA”) approved as a countermeasure against COVID-19. The total amount of the OTAP Agreement is $4,999,814. The term of the OTAP Agreement commenced on December 4, 2020, and was completed in the third quarter of 2022. The U.S. government may terminate the OTAP Agreement for any or no reason by providing us with at least thirty (30) calendar days’ prior written notice. Pursuant to the OTAP Agreement, we will not offer, sell or otherwise provide the EUA or licensed version of the prototype (Tafenoquine) that is FDA approved for COVID-19 or any like product to any entity at a price lower than that offered to the DoD, which applies only to products sold in the U.S., European Union and Canada related to COVID-19.

14

On February 15, 2021, we entered into the Inter-Institutional Agreement with FSURF (the “FSURF Agreement”) in which FUSRF granted us the right to manage the licensing of intellectual property created at FSURF. The term of the FSURF Agreement expires five years from February 15, 2021. After deduction of a 5% administrative fee by FSURF, capped at $15,000 annually, and reimbursement of patent prosecution expenses, we will receive 20% of license income and FSURF will receive 80% of license income. Payments of license income shall be paid in U.S. dollars quarterly each year. On February 19, 2021, we entered into an agreement with FSURF, subsequently amended on February 15, 2023, that collectively granted an option, effective through August 19, 2023, to us to license methods for purifying castanospermine and its use for the treatment of COVID-19. On August 19, 2021, we entered into an agreement with FSURF, subsequently amended on February 15, 2023, that collectively granted an option, effective through August 19, 2023, to us to license a patent relating to the use of alpha glucosidase inhibitors (including Castanospermine and Celgosivir) for treatment of Zika infections.

Ending upon July 12, 2033 or the conversion or redemption in full of all of the shares of Series A Preferred Stock owned by Knight, we will pay Knight a royalty equal to 3.5% of our net sales, where “net sales” has the same meaning as in our license agreement with the U.S. Army for Tafenoquine. Due to the success of the qualified IPO, at the end of the quarter and each quarter thereafter the royalty will be calculated, and payment will be made within fifteen days.

On February 13, 2024, 60 Degrees Pharmaceuticals, Inc.’s (the “Company”) majority-owned Australian subsidiary, 60P Australia Pty Ltd, and Monash University entered into the Research Services Agreement (the “Agreement”) in which Monash University agreed to provide research services, including among other things, testing the efficacy of tafenoquine against candidemia, confirming suitable fungal infection dosage and determining the pharmacokinetics of tafenoquine following intraperitoneal drug administration (collectively, the “Services”). The commencement date of the Agreement was effective as of February 5, 2024, and the anticipated commencement of experiments and the completion date is in May 2024 and on November 30, 2024, respectively (each, a “Milestone”). The Company agreed to pay Monash University $90,167 AUD on April 1, 2024 and $90,167 AUD upon the completion of the Services.

Either 60P Australia Pty Ltd or Monash University may terminate the Agreement immediately by notice to the other if (i) the defaulting party is in breach of the Agreement and the defaulting party fails to remedy the breach within 20 business days of receiving written notice of the breach from the terminating party; (ii) an insolvency event occurs in relation to the defaulting party; or (iii) the parties agree that a Milestone will not be met by its anticipated completion date. Monash University may unilaterally terminate the Agreement if any of the Services contravene Australian Sanctions Law.

Sales and Marketing

Following our recent hire of a new Chief Commercial Officer, in 2024, we plan to evaluate our “relaunch” strategy for Arakoda for malaria prevention in the United States. As described in the “Strategy” section this will consist of i) conducting market research to understand HCP and consumer demand which will inform our sales forecast. A targeted marketing strategy will be developed and implemented in the second half of 2024 and we will evaluate the need to hire a small account team and /or Medical Science Liaisons (MSL) If so, we may utilize a contract services organization to ensure greater flexibility and limit overhead. We may also choose to develop an omnichannel approach utilizing digital, non-personal promotion and possibly a tele sales model if an in-person field force does not support a positive return on investment.

15

In 2023, we began to see named-patient sales in Europe, without any adjustments to pricing, triggering the purchase of another partial lot of Arakoda by our European distributor. Sales volume has increased in Australia in response to repricing of Kodatef by our local distributor to be more competitive with atovaquone-proguanil.

Manufacturing

We do not currently own or operate manufacturing facilities for the production of clinical or commercial quantities of our product candidates.

Australian Research Tax Credit and Overseas Finding Process

Under Section 27 of the Industry Research and Development Act 198626, the Australian government offers a research tax credit of 43.5% on registered research and development activities executed in Australia by eligible Australian domiciled entities. Companies are eligible to receive tax credits if they meet the following criteria: (i) are domiciled in Australia, (ii) have incurred at least $20,000 in eligible research and development expenses, (iii) have conducted at least one eligible research and development activity, (iv) beneficial owner(s) with > 40 % beneficial ownership when considered together do not have > $20 million AUD aggregated turnover on an annual basis. 60P Australia Pty Ltd meets all these criteria, and will continue to do so in the future unless, considered together with any of our shareholders who have > 40% beneficial ownership, have > $20 million AUD in aggregate annual turnover.

Under Section 28D of the Industry Research and Development Act 198627, research and development activities conducted outside Australia are also potentially eligible if they meet the following criteria: (i) they are approved in advance, (ii) they are linked to a core research and development activity conducted in Australia, (iii) cannot be conducted in Australia for various reasons and (iv) the value of activities conducted overseas is less than the value of activities conducted in Australia.

Government Regulation and Product Approvals

Government authorities in the United States, at the federal, state and local level, and in other countries and jurisdictions, including the European Union, extensively regulate, among other things, the research, development, testing, manufacture, quality control, approval, packaging, storage, recordkeeping, labeling, advertising, promotion, distribution, marketing, post-approval monitoring and reporting, and import and export of pharmaceutical products. The processes for obtaining regulatory approvals in the United States and in foreign countries and jurisdictions, along with subsequent compliance with applicable statutes and regulations and other regulatory authorities, require the expenditure of substantial time and financial resources.

| 26 | See Industry Research and Development Act 1986 (legislation.gov.au). |

| 27 | See Australian Government R&D Tax Incentive – Overseas R&D: Information Sheet. |

16

Review and Approval of Drugs in the United States