UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| OR | |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For

the fiscal year ended | |

| OR | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| OR | |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission

file number

(Exact name of registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

Hiroo,

Telephone: +81 3-4560-0650

(Address of principal executive offices)

Chief Executive Officer

Hiroo,

Telephone:

+

Email:

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| The Stock Market LLC | ||||

| The Stock Market LLC |

* Not for trading, but only in connection with the listing of the American Depositary Shares on The Nasdaq Stock Market LLC.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: Common Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large

accelerated filer ☐ Accelerated filer ☐

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes

☐ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ☐ No ☐

TABLE OF CONTENTS

| i |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained in this annual report, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, business strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In some cases, you can identify forward-looking statements by terms such as “may”, “will”, “should”, “believe”, “expect”, “could”, “intend”, “plan”, “anticipate”, “estimate”, “continue”, “predict”, “project”, “potential”, “target,” “goal” or other words that convey the uncertainty of future events or outcomes. You can also identify forward-looking statements by discussions of strategy, plans or intentions. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, because forward-looking statements relate to matters that have not yet occurred, they are inherently subject to significant business, competitive, economic, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including, among others, those discussed in this annual report under the headings “Risk Factors”, “Operating and Financial Review and Prospects”, and “Business Overview” may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements in this annual report. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements in this annual report include:

| ● | the size and growth potential of the markets for our services, and our ability to serve those markets; | |

| ● | the rate and degree of market acceptance of our services; | |

| ● | our ability to expand our sales organization to address effectively existing and new markets that we intend to target; | |

| ● | impact from future regulatory, judicial, and legislative changes or developments in the U.S. and foreign countries; | |

| ● | our ability to compete effectively in a competitive industry; | |

| ● | our ability to obtain funding for our operations; | |

| ● | our ability to attract collaborators and strategic partnerships; | |

| ● | our ability to continue to meet the Nasdaq requirements; | |

| ● | our ability to meet our other financial operating objectives; | |

| ● | the availability of qualified employees for our business operations; | |

| ● | general business and economic conditions (including, without limitation, risks associated construction plans and labor-related matters); | |

| ● | our ability to meet our financial obligations as they become due; | |

| ● | positive cash flows and financial viability of our operations and new business opportunities; | |

| ● | ability to secure intellectual property rights over our proprietary services; | |

| ● | our ability to be successful in new markets; | |

| ● | our ability to avoid infringement of intellectual property rights; and | |

| ● | the positive cash flows and financial viability of our operations and new business opportunities |

We describe certain material risks, uncertainties, and assumptions that could affect our business, including our financial condition and results of operations, under “Risk Factors.” We base our forward-looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that actual outcomes and results may, and are likely to, differ materially from what is expressed, implied or forecast by our forward-looking statements. Accordingly, potential investors should be careful about relying on any forward-looking statements. Except as required under the federal securities laws, we do not have any intention or obligation to update publicly any forward-looking statements after the date of this annual report, whether as a result of new information, future events, changes in assumptions, or otherwise.

Any forward-looking statement that we make in this annual report speaks only as of the date of this annual report. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements in this annual report, whether as a result of new information, future events or otherwise, after the date of this annual report.

| ii |

PART I.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

RISK FACTORS

An investment in the ADSs is highly speculative and involves a high degree of risk. We operate in a dynamic and rapidly changing industry that involves numerous risks and uncertainties. You should carefully consider the factors described below, together with all of the other information contained in this annual report, including the audited financial statements and the related notes included in this annual report, before deciding whether to invest in the ADSs. These risk factors are not presented in the order of importance or probability of occurrence. If any of the following risks actually occurs, our business, financial condition and results of operations could be materially and adversely affected. In that event, the market price of the ADSs could decline, and you could lose part or all of your investment. Some statements in this annual report, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

We operate in a dynamic and rapidly changing industry that involves numerous risks and uncertainties. You should carefully consider the factors described below, together with all of the other information contained in this annual report, including the audited financial statements and the related notes included in this annual report. These risk factors are not presented in the order of importance or probability of occurrence. If any of the following risks actually occurs, our business, financial condition and results of operations could be materially and adversely affected. Some statements in this annual report, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

As used in this annual report, the terms “the Company”, “SYLA Technologies”, “we”, “our” or “us” may, depending upon the context, refer solely to the Company, to one or more of the Company’s consolidated subsidiaries or to all of them taken as a whole.

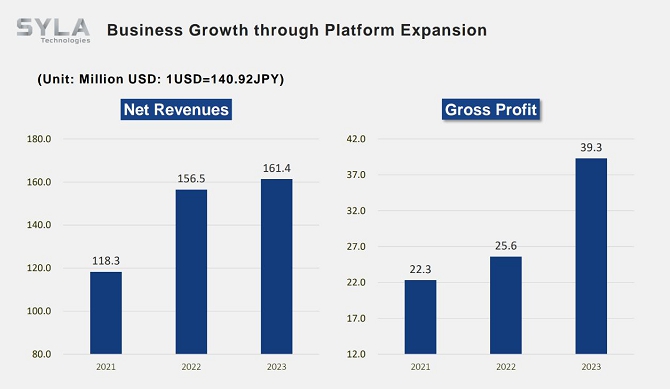

Our functional currency and reporting currency is the Japanese yen (which we refer to as “JPY” or “¥”). The terms “dollar,” “USD,” “US$” or “$” refer to U.S. dollars, the legal currency of the United States. Convenience translations included in this annual report of Japanese yen into U.S. dollars have been made at the exchange rate of ¥140.92= US$1.00, which was the foreign exchange rate on December 29, 2023 as reported by the Board of Governors of the Federal Reserve System (which we refer to as the “U.S. Federal Reserve”) in weekly release on January 2, 2024. Historical and current exchange rate information may be found at www.federalreserve.gov/releases/h10/.

| 1 |

Summary Risk Factors

Investing in our company involves significant risks. You should carefully consider all of the information in this annual report before making an investment in our company. These risks include the following:

| ● | Our ability to raise capital in the future may be limited, and our failure to raise capital when needed could prevent us from growing. | |

| ● | There is a risk that we will be a passive foreign investment company (which we refer to as “PFIC”) for the current or any future taxable year, which could result in material adverse U.S. federal income tax consequences if you are a U.S. holder. | |

| ● | It may not be possible for investors to effect service of process within the United States upon most our directors, corporate auditors and executive officers, or to enforce against us or those persons judgments obtained in U.S. courts predicated upon the civil liability provisions of the federal securities laws of the United States. | |

| ● | Rights of shareholders under Japanese law may be different from rights of shareholders in other jurisdictions. | |

| ● | Substantially all of our revenues are generated in Japan, but an increase of our international presence could expose us to fluctuations in foreign currency exchange rates, or a change in monetary policy may harm our financial results. | |

| ● | As a “foreign private issuer” we are permitted, and intend, to follow certain home country corporate governance and other practices instead of otherwise applicable SEC and Nasdaq requirements, which may result in less protection than is accorded to investors under rules applicable to domestic U.S. issuers. | |

| ● | As an “emerging growth company” under the JOBS Act, we are permitted to rely on exemptions from certain disclosure requirements. | |

| ● | If we are unable to implement and maintain effective internal control over financial reporting in the future, investors may lose confidence in the accuracy and completeness of our financial reports and have an adverse effect on the value of our securities. | |

| ● | As an emerging growth company, our auditor will not be required to attest to the effectiveness of our internal controls. | |

| ● | We incur significant costs as a result of operating as a public company, and our management is required to devote substantial time to new compliance initiatives. | |

| ● | We depend on certain officers of the Company, the loss of whom could materially harm our business. | |

| ● | Real estate development projects are subject to numerous risks outside the Company’s control such as governmental regulations and associated legal concerns, delays in permitting and other governmental approvals, potential delays in project initiation or completion, increased expenses, restrictions on construction or other activities, increased costs, and labor shortages. | |

| ● | Commercial and residential property building is subject to warranty and construction defect claims in the ordinary course of business that can be significant. | |

| ● | We rely on subcontractors, which can expose us to various liability risks. | |

| ● | We rely on our ability and the ability of our customers to obtain bank loans. | |

| ● | Failure to manage land acquisitions, inventory and construction and development processes could result in significant cost overruns or errors in valuing sites. | |

| ● | If land is not available at competitive prices, our sales and results of operations could be adversely affected. | |

| ● | If the value of our land inventory decreases, our results of operations could be adversely affected by impairments and write-downs. | |

| ● | A material amount of our revenues may be concentrated in one or more large customers. If we lose or experience a significant reduction in sales to such key customers, our revenues may decrease substantially and our results of operations and financial condition may be harmed. | |

| ● | Historically, we have relied to a material extent on certain suppliers. If we encounter delays or difficulties in securing the required materials from such suppliers and are unable to find replacements or immediately transition to alternative suppliers, the lack of supplies delaying the production of our products could have a material adverse effect on our financial condition, results of operations and reputation. | |

| ● | If we experience shortages in labor supply, increased labor costs or labor disruptions, there could be delays or increased costs in developing our real estate, which could adversely affect our operating results. | |

| ● | Failure to recruit, retain and develop highly skilled, competent people at all levels may have a material adverse effect on our standards of service. |

| 2 |

| ● | Regulations regarding environmental matters and climate change may affect us by substantially increasing our costs and exposing us to potentially liability. | |

| ● | Raw materials and building supply shortages and price fluctuations could delay or increase the cost of commercial and residential property construction and adversely affect our operating results. | |

| ● | We intend to have significant operations in certain geographic areas, which will subject us to an increased risk of loss of revenue or decreases in the market value of our land and commercial and residential properties in these regions from factors which may affect any of these regions. | |

| ● | We participate in certain unconsolidated joint ventures, including those where we do not have a controlling interest, where we may be adversely impacted by the failure of the unconsolidated joint venture or the other partners in the unconsolidated joint venture to fulfill their obligations. | |

| ● | A major health and safety incident relating to our business could be costly in terms of potential liabilities and reputational damage. | |

| ● | Ownership or occupation of land and the use of hazardous materials carries potential environmental risks and liabilities. | |

| ● | Shortages of utilities and resources and fluctuations in rates could adversely affect our business. | |

| ● | The illiquidity of real estate investments could significantly impede our ability to respond to adverse changes in the performance of our properties. | |

| ● | We may not make a profit if we sell a property. | |

| ● | Competition for acquisitions may result in fewer acquisition opportunities and increased prices for properties, which may impede our growth and materially and adversely affect us. | |

| ● | The consideration paid for our target acquisition may exceed fair market value, which may harm our financial condition and operating results. We may also be unable to lease vacant space or renegotiate existing leases at market rates, which would adversely affect our returns on a target acquisition. | |

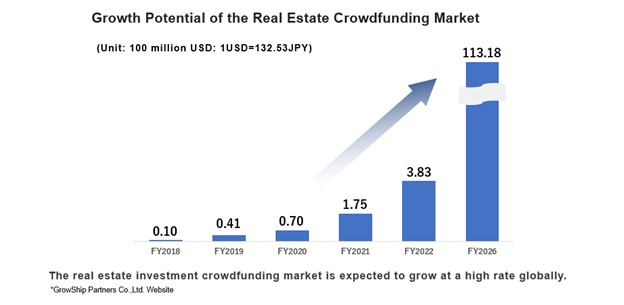

| ● | The real estate crowdfunding platforms may not operate as we anticipate. | |

| ● | If the security of our investors’ confidential information stored on the real estate crowdfunding platforms is breached or otherwise subjected to unauthorized access, their secure information may be stolen. | |

| ● | Any significant disruption in service on the real estate crowdfunding platforms or in their computer or communications systems could reduce their attractiveness and result in a loss of users. | |

| ● | If we were to enter bankruptcy proceedings, the operation of the real estate crowdfunding platforms and the activities with respect to our operations and business would be interrupted. | |

| ● | Inappropriate business behavior of entrepreneurs raising funds via our platforms could result in reputational or financial damages to our business. | |

| ● | Our crowdfunding platform operates on an online distribution model and is, therefore, subject to internet cyber risk. | |

| ● | Increasing competition within our emerging industry could have an impact on our business prospects. | |

| ● | Our level of indebtedness could materially and adversely affect our business, financial condition and results of operations. | |

| ● | Our outstanding debt agreements may limit our flexibility in operating and expanding our business. | |

| ● | We might obtain lines of credit and other borrowings, which increases our risk of loss due to potential foreclosure. | |

| ● | We have broad authority to incur debt. | |

| ● | Investors will not receive the benefit of the regulations provided to real estate investment trusts or investment companies. | |

| ● | If we are deemed to be an investment company, we may be required to institute burdensome compliance requirements and our activities may be restricted. | |

| ● | The exemption from the Investment Company Act of 1940 may restrict our operating flexibility. Failure to maintain this exemption may adversely affect our profitability. | |

| ● | We may suffer losses that are not covered by insurance. | |

| ● | Solar power generation is weather-dependent, and power production fluctuates depending on weather conditions such as clouds and rain. This can make power generation inconsistent and difficult to predict. | |

| ● | AI-related businesses are subject to risks such as slow market growth, competition, inability to secure development personnel, leakage of confidential information, procurement of semiconductors, and dependence on certain individuals (Tianqi Li, Chief AI Officer of SYLA Technologies Co., Ltd, and the Representative Director of SYLA Brain Co., Ltd.), which could affect our business and earnings if the AI-related market growth slows significantly. | |

| ● | Failure to protect our intellectual property could substantially harm our business and operating results. | |

| ● | Assertions by third parties of infringement or other violation by us of their intellectual property rights could result in significant costs and substantially harm our business and operating results. | |

| ● | If our cost efficiency measures are not successful, we may become less competitive. | |

| ● | Failure to deliver high-quality products, software, and services could lead to loss of customers and diminished profitability. |

| 3 |

| ● | Cyber-attacks and other security incidents that disrupt our operations or result in the breach or other compromise of proprietary or confidential information about us or our workforce, customers, or other third parties could disrupt our business, harm our reputation, cause us to lose clients and expose us to costly regulatory enforcement and litigation. | |

| ● | We may not successfully implement our acquisition strategy, which could result in unforeseen operating difficulties and increased costs. | |

| ● | Our ability to generate substantial non-U.S. net revenue is subject to additional risks and uncertainties. | |

| ● | Compliance requirements of current or future environmental and safety laws, or other laws, may increase costs, expose us to potential liability and otherwise harm our business. | |

| ● | Natural disasters, terrorism, armed hostilities, pandemics or other public health issues could harm our business. | |

| ● | Global climate change, and legal, regulatory, or market measures to address climate change, may negatively affect or business, operations, and financial results. | |

| ● | We may face substantial damages or be enjoined from pursuing important activities as a result of future litigation, arbitration or other claims. | |

| ● | Constriction of the capital markets could limit our ability to access capital and increase our costs of capital. | |

| ● | We anticipate having a substantial amount of debt which could adversely affect our business, financial condition or results of operations and prevent us from fulfilling our debt-related obligations. | |

| ● | Markets in which the Company is anticipated to invest are subject to a high degree of volatility and, therefore, the Company’s performance may be volatile. | |

| ● | The volatile credit and capital markets could have a material adverse effect on our financial condition. | |

| ● | A prolonged economic downturn could materially affect us in the future. | |

| ● | The Company is subject to changes in the Labor Standards Law and other regulations, and violations of such laws and regulations may adversely affect the Company’s business performance and reputation. | |

| ● | Failure to strengthen our internal controls could have a significant adverse impact on the Company and its business performance and reputation. | |

| ● | The ADSs are listed on Nasdaq, and there can be no assurance that we will be able to comply with Nasdaq’s continued listing standards. | |

| ● | The price of ADSs could be subject to rapid and substantial volatility. | |

| ● | The price of the ADSs may fluctuate substantially. | |

| ● | If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, the price of the ADSs and trading volume could decline. | |

| ● | If the voting power of our capital stock continues to be highly concentrated, it may prevent you and other minority shareholders from influencing significant corporate decisions and may result in conflicts of interest. | |

| ● | If the benefits of any proposed acquisition do not meet the expectations of investors, stockholders or financial analysts, the market price of the ADSs may decline. | |

| ● | The payment of future dividends on our common shares, if any, will be at the discretion of our board of directors and will depend on many factors on which the board of directors may determine not to do so. | |

| ● | Sales of a substantial number of common shares or ADSs in the public markets by our existing shareholders in the future could cause the price of the ADSs to fall. | |

| ● | The future issuance of additional common shares in connection with our stock options, convertible bonds, acquisitions or otherwise may adversely affect the market of the ADSs. | |

| ● | The right of holders of ADSs to participate in any future rights offerings may be limited, which may cause dilution to their holdings and holders of ADSs may not receive cash dividends if it is impractical to make them available to them. | |

| ● | Issuance of ADSs and surrender of ADSs for the purpose of withdrawal of shares may be suspended. | |

| ● | We may amend the deposit agreement without consent from holders of ADSs and, if such holders disagree with our amendments, their choices will be limited to selling the ADSs or withdrawing the underlying common shares. | |

| ● | Holders of ADSs may not receive distributions on our common shares or any value for them if it is illegal or impractical to make them available to such holders. | |

| ● | ADS holders may not be entitled to a jury trial with respect to claims arising under the deposit agreement, which could result in less favorable outcomes to the plaintiff(s) in any such action. |

Risks Related to our Business

Our ability to raise capital in the future may be limited, and our failure to raise capital when needed could prevent us from growing.

Our business and operations may consume resources faster than we anticipate. In the future, we may need to raise additional funds to invest in future growth opportunities. Additional financing may not be available on favorable terms, if at all. If adequate funds are not available on acceptable terms, we may be unable to invest in future growth opportunities, which could seriously harm our business and operating results. If we incur debt, the debt holders would have rights senior to equity holders to make claims on our assets, and the terms of any debt could restrict our operations, including our ability to pay dividends on our ADSs. Furthermore, if we issue equity securities, holders of our ADSs will experience dilution, and the new equity securities could have rights senior to those of our common shares and ADSs. Any additional equity or equity-linked financings would be dilutive to our holders of ADSs. Because our decision to issue securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. As a result, holders of our ADSs bear the risk of our future securities offerings reducing the market price of our ADSs and diluting their interest.

| 4 |

There is a risk that we will be a passive foreign investment company (which we refer to as “PFIC”) for the current or any future taxable year, which could result in material adverse U.S. federal income tax consequences if you are a U.S. holder.

A non-U.S. corporation, such as our Company, is classified as a PFIC for any taxable year in which, after applying relevant look-through rules with respect to the income and assets of its subsidiaries, either:

(i) 50% or more of the value of the corporation’s assets either produce passive income or are held for the production of passive income, based on the quarterly average of the fair market value of such assets; or

(ii) at least 75% of the corporation’s gross income is passive income. “Passive income” generally includes, for example, dividends, interest, certain rents and royalties, certain gains from the sale of stock and securities, and certain gains from commodities transactions. In determining the value and composition of our assets, the cash we raised in our initial public offering generally was considered to be held for the production of passive income and thus was considered a passive asset.

The determination of whether a corporation is a PFIC for a taxable year depends, in part, on the application of complex U.S. federal income tax rules that are subject to differing interpretations. In addition, the determination of whether a corporation will be a PFIC for any taxable year can only be made after the close of such taxable year. Our PFIC status depends, in part, on the amount of cash that we raise and how quickly we utilize the cash in our business. Furthermore, a decrease in the market price of the ADSs may also cause us to be classified as a PFIC for the current or any future taxable year. Based upon the foregoing, it is uncertain whether we will be a PFIC for our current taxable year or any future taxable year. We believe we were not a PFIC in prior taxable year 2023 because less than 75% of our gross income was passive income and less than 50% of the average value of our assets consisted of assets that would produce passive income in 2022.

| 5 |

If we are a PFIC for any taxable year during which a U.S. holder (as defined below) owns common shares or ADSs, certain adverse U.S. federal income tax consequences could apply to such U.S. holder. We have not determined, if we were to be classified as a PFIC for a taxable year, whether we will provide information necessary for a U.S. holder to make a “qualified electing fund” election which, if available, would result in tax treatment different from (and generally less adverse than) the general tax treatment for PFICs. Accordingly, U.S. holders should assume that they will not be able to make a qualified electing fund election with respect to the common shares or ADSs. The PFIC rules are complex, and each U.S. holder should consult its own tax advisor regarding the PFIC rules, the elections which may be available to it, and how the PFIC rules may affect the U.S. federal income tax consequences relating to the ownership and disposition of our common shares or ADSs.

It may not be possible for investors to effect service of process within the United States upon most our directors, corporate auditors and executive officers, or to enforce against us or those persons judgments obtained in U.S. courts predicated upon the civil liability provisions of the federal securities laws of the United States.

We are a joint stock corporation organized under Japanese law. Most of our directors, corporate auditors and executive officers reside in Japan, and significantly all of our assets and the assets of such persons are located outside of the United States. As a result, it may not be possible for investors to effect service of process within the United States upon these persons or us, or to enforce against them or us judgments obtained in U.S. courts, whether or not predicated upon the civil liability provisions of the federal securities laws of the United States or of the securities laws of any state of the United States. There is doubt as to the enforceability in Japan, either in original actions or in actions for enforcement of judgments of U.S. courts, of civil liabilities predicated solely on the federal securities laws of the United States or the securities laws of any state of the United States. A Japanese court may refuse to apply provisions of U.S. securities laws in original actions, or to enforce judgments of U.S. courts that are based on such provisions, if it considers such provisions to be contrary to the public policy of Japan. The United States and Japan do not currently have a treaty providing for reciprocal recognition and enforcement of judgments, other than arbitration awards, in civil and commercial matters, and a Japanese court may deem that there is not sufficient basis for the reciprocity on the enforcement of judgments. Therefore, if you obtain a civil judgment by a U.S. court, you may not be able to enforce it in Japan.

Rights of shareholders under Japanese law may be different from rights of shareholders in other jurisdictions.

Our articles of incorporation and the Companies Act of Japan (which we refer to as the “Companies Act”) govern our corporate affairs. Legal principles relating to matters such as the validity of corporate procedures, directors’ fiduciary duties and obligations, and shareholders’ rights under Japanese law may be different from, or less clearly defined than, those that would apply to a company incorporated in any other jurisdiction. Shareholders’ rights under Japanese law may not be as extensive as shareholders’ rights under the laws of other countries. For example, under the Companies Act, only holders of 3% or more of our total voting rights or our outstanding shares are entitled to examine our accounting books and records. Furthermore, there is a degree of uncertainty as to what duties the directors of a Japanese joint stock corporation may have in response to an unsolicited takeover bid, and such uncertainty may be more pronounced than that in other jurisdictions.

Substantially all of our revenues are generated in Japan, but an increase of our international presence could expose us to fluctuations in foreign currency exchange rates, or a change in monetary policy may harm our financial results.

Our functional currency and reporting currency is the Japanese yen. Substantially all of our revenues are generated in Japan, but an increase in our international presence could expose us to fluctuations in foreign currency exchange rates. We are subject to the effects of exchange rate fluctuations with respect to any of these currencies which, among other factors, may be influenced by governmental policies and domestic and international economic and political developments. If our non-Japanese revenues increase substantially in the future, any significant change in the value of the currencies of the countries in which we do business against the Japanese yen could adversely affect our financial condition and results of operations due to translational and transactional differences in exchange rates.

We cannot predict the effects of exchange rate fluctuations upon our future operating results because of the number of currencies involved, the amount of our revenues that will be generated in other countries, the variability of currency exposures, and the potential volatility of currency exchange rates. We do not take actions to manage our foreign currency exposure, such as entering into hedging transactions.

| 6 |

As a “foreign private issuer” we are permitted, and intend, to follow certain home country corporate governance and other practices instead of otherwise applicable SEC and Nasdaq requirements, which may result in less protection than is accorded to investors under rules applicable to domestic U.S. issuers.

Our status as a foreign private issuer exempts us from compliance with certain SEC laws and regulations and certain regulations of The Nasdaq Capital Market (which we refer to as “Nasdaq”), including certain governance requirements such as independent director oversight of the nomination of directors and executive compensation. Further, consistent with corporate governance practices in Japan, we do not have a standalone compensation committee or nomination and corporate governance committee under our board. In addition, we are not required under the Exchange Act to file current reports and financial statements with the U.S. Securities and Exchange Commission (which we refer to as the “SEC”) as frequently or as promptly as U.S. domestic companies whose securities are registered under the Exchange Act and we are generally exempt from filing quarterly reports with the SEC. Also, we are not required to provide the same executive compensation disclosures regarding the annual compensation of our five most highly compensated senior executives on an individual basis as are required of U.S. domestic issuers. As a foreign private issuer, we are permitted to disclose executive compensation on an aggregate basis and need not supply a Compensation Discussion & Analysis, as is required for domestic companies. Furthermore, as a foreign private issuer, we are also not subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. These exemptions and accommodations will reduce the frequency and scope of information and protections to which you are entitled as an investor.

As an “emerging growth company” under the JOBS Act, we are permitted to rely on exemptions from certain disclosure requirements.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| ● | have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| ● | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditors’ report providing additional information about the audit and the consolidated financial statements (i.e., an auditor discussion and analysis); |

| ● | submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay” and “say-on-frequency”; and |

| ● | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

In addition, Section 102 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our consolidated financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed US$1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our membership interests that is held by non-affiliates exceeds US$700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than US$1 billion in non-convertible debt during the preceding three year period.

| 7 |

Until such time, however, we cannot predict if investors will find our securities less attractive because we may rely on these exemptions. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the price of our securities may be more volatile.

If we are unable to implement and maintain effective internal control over financial reporting in the future, investors may lose confidence in the accuracy and completeness of our financial reports and have an adverse effect on the value of our securities.

As a public company, we would be required to maintain internal control over financial reporting and to report any material weaknesses in such internal control. Further, we will be required to report any changes in internal controls on annual basis. In addition, we would be required to furnish a report by management on the effectiveness of internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act. We will design, implement, and test the internal controls over financial reporting required to comply with these obligations. If we identify material weaknesses in our internal control over financial reporting, if we are unable to comply with the requirements of Section 404 in a timely manner, or assert that our internal control over financial reporting is effective, or if our independent registered public accounting firm is unable to express an opinion as to the effectiveness of its internal control over financial reporting when required, investors may lose confidence in the accuracy and completeness of our financial reports and the value of our securities could be negatively affected. We also could become subject to investigations by the Commission or other regulatory authorities, which could require additional financial and management resources.

As an emerging growth company, our auditor will not be required to attest to the effectiveness of our internal controls.

Our independent registered public accounting firm will not be required to attest to the effectiveness of our internal control over financial reporting while we are an emerging growth company. This means that the effectiveness of our financial operations may differ from our peer companies in that they may be required to obtain independent registered public accounting firm attestations as to the effectiveness of their internal controls over financial reporting and we are not. While our management is required to attest to internal control over financial reporting and we are required to detail changes to our internal controls in our annual reports on Form 20-F, we cannot provide assurance that the independent registered public accounting firm’s review process in assessing the effectiveness of our internal controls over financial reporting, if obtained, would not find one or more material weaknesses or significant deficiencies. Further, once we cease to be an emerging growth company (as described below), we will be subject to independent registered public accounting firm attestation regarding the effectiveness of our internal controls over financial reporting. Even if management finds such controls to be effective, our independent registered public accounting firm may decline to attest to the effectiveness of such internal controls and issue a qualified report.

We will incur significant costs as a result of operating as a public company, and our management is required to devote substantial time to new compliance initiatives.

We incur significant legal, accounting and other expenses as a public company. In addition, the Sarbanes-Oxley Act has imposed various requirements on public companies, including requiring establishment and maintenance of effective disclosure and financial controls. Our management and other personnel devote a substantial amount of time to these compliance initiatives. Moreover, these rules and regulations have increased and will continue to increase our legal and financial compliance costs and will make some activities more time-consuming and costly. For example, these rules and regulations can make it more difficult and more expensive for us to obtain directors’ and officers’ liability insurance, which could make it more difficult for us to attract and retain qualified members of our board of directors.

| 8 |

The Sarbanes-Oxley Act requires, among other things, that we maintain effective internal control over financial reporting and disclosure controls and procedures. In particular, we must perform system and process evaluation and testing of our internal control over financial reporting to allow management to report on the effectiveness of our internal control over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act. In addition, we will be required to have our independent registered public accounting firm attest to the effectiveness of our internal control over financial reporting the later of our second annual report on Form 20-F or the first annual report on Form 20-F following the date on which we are no longer an emerging growth company. Our compliance with Section 404 of the Sarbanes-Oxley Act will require that we incur substantial accounting expense and expend significant management efforts. We currently do not have an internal audit group, and we will need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. If we are not able to comply with the requirements of Section 404 in a timely manner, the value of our securities could decline and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

Our ability to successfully implement our business plan and comply with Section 404 requires us to be able to prepare timely and accurate financial statements. We expect that we will need to continue to improve existing, and implement new operational and financial systems, procedures and controls to manage our business effectively. Any delay in the implementation of, or disruption in the transition to, new or enhanced systems, procedures or controls, may cause our operations to suffer and we may be unable to conclude that our internal control over financial reporting is effective and to obtain an unqualified report on internal controls from our auditors as required under Section 404 of the Sarbanes-Oxley Act. This, in turn, could have an adverse impact on value of our securities, and could adversely affect our ability to access the capital markets.

We depend on certain officers of the Company, the loss of whom could materially harm our business.

We rely upon the accumulated knowledge, skills and experience of the officers and personnel of our Company and its affiliates. If Hiroyuki Sugimoto, our Chief Executive Officer, Yoshiyuki Yuto, our Chief Operating Officer, and Takahide Watanabe, our Chief Strategy Officer, or any of the other officers or personnel were to leave the Company or become incapacitated, we might suffer in our planning and execution of business strategy and operations, impacting our brand and financial results.

Risks Related to the Commercial and Residential Real Estate Construction and Development Business

Real estate development projects are subject to numerous risks outside the Company’s control such as governmental regulations and associated legal concerns, delays in permitting and other governmental approvals, potential delays in project initiation or completion, increased expenses, restrictions on construction or other activities, increased costs, and labor shortages.

Any properties in which the Company invests relating to real estate development projects are subject to a variety of risks that will be outside of the Company’s control, including governmental regulations and legal concerns, delays in obtaining entitlements, permits, and other governmental approvals. Development projects may also take longer than anticipated, increasing the time that part or all of the residential or commercial units are not available for rent or sale, and thus lowering the property’s cash flow or other income potential. Strong demand for skilled laborers and contractors may result in labor shortages and contractor unavailability, delaying project schedules and/or increasing costs. The costs of construction have increased dramatically during recent years and may continue to increase. The Company may enter into contracts to purchase properties before they are finished, and the foregoing risks could adversely impact the purchase prices, valuations, or closings dates of those properties. Although the Company will not undertake such transactions without reviewing detailed budgets, such budgets may understate the expense.

Commercial and residential property building is subject to warranty and construction defect claims in the ordinary course of business that can be significant.

We are subject to commercial and residential property warranty and construction defect claims arising in the ordinary course of business. There can be no assurance that any developments we undertake will be free from defects once completed. Construction defects may occur on projects and developments and may arise a significant period of time after completion. Defects arising on a development attributable to us may lead to significant contractual or other liabilities.

As a consequence, we maintain products and completed operations excess liability insurance, obtain indemnities and certificates of insurance from subcontractors generally covering claims related to damages resulting from faulty workmanship and materials and maintain warranty and other reserves for the commercial and residential properties we sell based on historical experience in our markets and our judgment of the risks associated with the types of commercial and residential properties built. Although we actively monitor our insurance reserves and coverage, because of the uncertainties inherent to these matters, we cannot provide assurance that our insurance coverage, our subcontractor’s indemnity and warranty arrangements and our reserves together will be adequate to address all of our warranty and construction defect claims in the future. In addition, contractual indemnities with our subcontractors can be difficult to enforce. We may also be responsible for applicable self-insured retentions and some types of claims may not be covered by insurance or may exceed applicable coverage limits. Additionally, the coverage offered by and the availability of products and completed operations excess liability insurance for construction defects is currently limited and costly. This coverage may be further restricted or become more costly in the future.

Unexpected expenditures attributable to defects or previously unknown sub-surface conditions arising on a development project may have a material adverse effect on our business, financial condition and operating results. In addition, severe or widespread incidents of defects giving rise to unexpected levels of expenditures, to the extent not covered by insurance or redress against subcontractors, may adversely affect our reputation, business, financial condition and operating results.

| 9 |

We rely on subcontractors, which can expose us to various liability risks.

We rely on subcontractors to perform approximately 85% of the construction of our commercial and residential properties and to select and obtain raw materials. In addition, orders are distributed among multiple companies so as not to rely on a specific subcontractor. In the case of in-house construction, we rely on subcontractors for approximately 85% of the total, and when the entire construction is outsourced to another construction company, the entire work will be done by the construction company or a subcontractor ordered by the construction company. We are exposed to various risks as a result of such reliance on these subcontractors and their suppliers, including, as described above, the possibility of defects in our commercial and residential properties due to improper workmanship or materials used by such parties, which may require us to comply with our warranty obligations and/or bring a claim under an insurance policy. The subcontractors we rely on to perform the actual construction of our commercial and residential properties are also subject to a significant and evolving number of local and national governments, including laws involving matters that are not within our control. If these subcontractors who construct our commercial and residential properties fail to comply with all applicable laws, we can suffer reputational damage and may be exposed to liability.

Subcontractors are independent of the commercial and residential property builders that contract with them under normal management practices and the terms of trade contracts and subcontracts within the commercial and residential property building industry. We do not have the ability to control what these independent subcontractors pay to or the work rules they impose on their employees. However, various federal and local governmental agencies have sought, and may in the future seek, to hold contracting parties like us responsible for our subcontractors’ violations of wage and hour laws, or workers’ compensation, collective bargaining and/or other employment-related obligations related to subcontractors’ workforces. Governmental agency determinations or attempts by others to make us responsible for our subcontractors’ labor practices or obligations, whether under “joint employer” theories, specific prefecture laws or regulations, or otherwise, could create substantial adverse exposure for us in situations that are not within our control and could be material to our business, financial condition and results of operations. We can also suffer damage to our reputation, and may be exposed to possible liability, if subcontractors fail to comply with applicable laws, including laws involving actions or matters that are not within our control. However, regardless of the steps we take after we learn of practices that do not comply with applicable laws, rules or regulations, we can in some instances be subject to fines or other governmental penalties, and our reputation can be injured, due to the practices having taken place.

We rely on our ability and the ability of our customers to obtain bank loans.

Our commercial and residential real estate construction is dependent on loans from financial institutions. We rely on bank loans for 20% of the financing that goes into construction of our development projects. Our commercial and residential real estate construction is dependent on our customers being able to obtain loans from financial institutions. The customers who purchase our properties rely on bank loans for the ability to make purchases. Additionally, more than 95% of our client purchasers use our affiliated bank loans to purchase condominiums. Affiliated loans are only offered to real estate agents that meet the standards set by financial institutions, such as sales and compliance. Therefore, in the event that a financial institution ceases to provide financing to a client who purchases a condominium, our business performance could be affected. If we are unable to obtain this funding at any time and for any reason, as we rely on bank loans for 65% of the financing for our construction and development projects, our business performance could be affected.

Failure to manage land acquisitions, inventory and construction and development processes could result in significant cost overruns or errors in valuing sites.

We intend on owning and purchasing indirectly through our acquisition of preferred equity interests in construction and development projects and managing the construction and development of such projects each year and are therefore dependent on our ability to process a number of transactions (which include, among other things, evaluating the site, designing the layout of the development, sourcing materials and subcontractors and managing contractual commitments) efficiently and accurately. Errors by employees, failure to comply with regulatory requirements and conduct of business rules, failings or inadequacies in internal control processes, equipment failures, natural disasters or the failure of external systems, including those of our suppliers or counterparties, could result in operational losses that could adversely affect our business, financial condition and operating results and our relationships with our customers.

| 10 |

In addition, we incur many costs even before we begin to build commercial and residential properties. Depending on the stage of development of a land parcel, these may include: costs of preparing land, finishing and entitling lots, installing roads, sewers, water systems and other utilities, taxes and other costs related to ownership of the land on which we plan to build commercial and residential properties; constructing model commercial and residential properties; and promotional and marketing expenses to prepare for the opening of new commercial and residential properties for sales. Moreover, local municipalities may impose development-related requirements resulting in additional costs. If the rate at which we sell and deliver commercial and residential properties slows or falls, or if our opening of new commercial and residential properties for sales is delayed, we may incur additional costs, which would adversely affect our gross profit margins, and it will take a longer period of time for us to recover our costs, including those we incurred in acquiring and developing land.

In certain circumstances, a grant of entitlements or development agreement with respect to a particular parcel of land may include restrictions on the transfer of such entitlements to a buyer of such land, which may increase our exposure to decreases in the price of such entitled land by restricting our ability to sell it for its full entitled value. In addition, inventory carrying costs can be significant and can result in reduced margins or losses in a poorly performing community or market. Further, if we were required to record a significant inventory impairment, it could negatively affect our earnings and negatively impact the market perception of our business.

If land is not available at competitive prices, our sales and results of operations could be adversely affected.

Our long-term profitability depends in large part on the price at which we are able to obtain suitable land for the development of our real estate. Increases in the price (or decreases in the availability) of suitable land could adversely affect our profitability. Moreover, changes in the general availability of desirable land, competition for available land, limited availability of financing to acquire land, zoning regulations that limit housing density, environmental requirements and other market conditions may hurt our ability to obtain land for real estate development at prices that will allow us to be profitable. If the supply of land that are appropriate for development of our real estate becomes more limited because of these factors, or for any other reason, the cost of land could increase and the number of buildings that we are able to build and sell could be reduced, which could adversely affect our results of operations and financial condition.

If the value of our land inventory decreases, our results of operations could be adversely affected by impairments and write-downs.

The value of our land and commercial and residential real estate is subject to market conditions. There is a significant time lag between the acquisition of land for development and the sale of residential and commercial real estate. Currently, it is difficult to acquire land that is in good shape and ready to begin construction. This is due to soaring land prices. Therefore, the Company is taking its time in acquiring smaller pieces of land. However, since it takes a considerable amount of time from development to sales, the Company may be affected by impairment or write-downs due to changes in social conditions or development in the neighborhood during that time.

There is an inherent risk that the value of the land owned by us may decline after purchase. The valuation of property is inherently subjective and based on the individual characteristics of each property. We may have acquired options on or bought and developed land at a cost we will not be able to recover fully or on which we cannot build and sell property profitably. In addition, our deposits for lots controlled under option or similar contracts may be put at risk, and depressed land values may cause us to abandon and forfeit deposits on land option contracts and other similar contracts if we cannot satisfactorily renegotiate the purchase price of the subject land. Factors such as changes in regulatory requirements and applicable laws (including in relation to building regulations, taxation and planning), political conditions, the condition of financial markets, both local and national economic conditions, the financial condition of customers, potentially adverse tax changes, and interest and inflation rate fluctuations subject valuations to uncertainty. Moreover, all valuations are made on the basis of assumptions that may not prove to reflect economic or demographic reality. If commercial or residential property demand decreases below what we anticipated when we acquired our inventory, our profitability may be adversely affected and we may not be able to recover our costs when we sell and build the commercial and residential properties. In addition, we may incur charges against our earnings for inventory impairments if the value of our owned inventory, including land we decide to sell, is reduced or for land option contract abandonments if we choose not to exercise land option contracts or other similar contracts, and these charges may be substantial.

| 11 |

We intend to regularly review the value of our land holdings and continue to review our holdings on a periodic basis. If material write-downs and impairments in the value of our inventory are required and, if in the future we are required to sell land or commercial and residential properties at a loss, our results of operations and financial condition would be adversely affected.

A material amount of our revenues may be concentrated in one or more large customers. If we lose or experience a significant reduction in sales to such key customers, our revenues may decrease substantially and our results of operations and financial condition may be harmed.

It is the nature of our business that a high concentration of our revenue is in the real estate division and therefore when we sell buildings and condominiums that we construct there is a tendency to have large customers who acquire such properties. Accordingly, in each year there may be a small number of customer purchasers from whom we generate our revenue. These customers may not be repeat customers and in each year it may be different single purchaser or small number of purchasers from which we generate a large percentage of our revenues. We rely on these purchasers and there is a risk that these purchasers may be unable to make payment under their obligations to us thereby affecting our revenues.

During the year ended December 31, 2022, we constructed and sold seven buildings, Kameido PJ (total units: 39), Nishi-koyama PJ (total units: 35), Asakusa II PJ (total units: 27), Edogawabashi PJ (total units: 27), Higashi-ikebukuro PJ (total units: 26), Kiba I (total units: 45), Kiba II (total units: 24) to a single customer, Mitsui & Co. Digital Asset Management. Three properties (Nishi-Koyama PJ, Asakusa II PJ, and Edogawabashi PJ) were paid in a lump sum during the third quarter of FY 2022. Sales of seven properties account for 34.59% of the total sales for the fiscal year. There are no long-term contracts or arrangements.

In 2023, Motomachi Chinatown PJ (95 units), Tabata PJ (51 units), and Oji II PJ (43 units) were constructed and sold to a private fund managed by BlackRock’s Real Estate Division, with the purchase price for each of these properties being a lump-sum payment at the time of property delivery. In connection with such sale, a business consignment agreement in respect of property management was finalized. Additionally, Meguro PJ (651.72m2) was sold to ES-CON Japan by land, with the purchase price being a lump-sum payment at the time of property delivery. However, for such sale there is no long-term contract or arrangement for property management after delivery.

Any payment issues encountered by these large customers would likely harm our financial condition and results of operations.

Historically, we have relied to a material extent on certain suppliers. If we encounter delays or difficulties in securing the required materials from such suppliers and are unable to find replacements or immediately transition to alternative suppliers, the lack of supplies delaying the production of our products could have a material adverse effect on our financial condition, results of operations and reputation.

Historically, we have relied to a material extent on certain suppliers. Although the Company has over 100 suppliers, certain suppliers are consistently supplying over 10% of the Company’s total construction costs per year.

As part of our real estate business, we resell buildings and land that have been constructed and developed by general contractors, general real estate companies or developers to third parties. In the case where we own the land, we engage a general contractor, general real estate company or developer to construct and develop the building or land and we make progress payments towards the construction and development of the building or land. In the case where we do not own the land (but rather the general contractor, general real estate company or developer owns the land), we purchase the constructed building with the land or developed land from the general contractor, general real estate company or developer upon completion. In Japan, we consider the general contractor, general real estate company or developer in these types of arrangements to be that of a supplier of buildings and land. In the past, we have routinely engaged Jyukyo Construction Co., Ltd., among several general contractors to construct condominiums under this type of supply arrangement for us.

During the year ended December 31, 2022, Sankoh Build. Inc. accounted for 19.35%, Fuetsu Construction Corp. for 16.69%, GODA KOUMUTEN CO., LTD. for 14.23%, and Jyukyo Construction Co., Ltd. for 13.48% of the supplies we received from our suppliers. Total sales prices for condominium buildings were paid by us within five months of the completion of such buildings. Thereafter, we resold such condominium buildings to our client. We have no long-term contract or arrangement with the aforementioned general contractors.

During the year ended December 31, 2023, Shinei Kogyo Ltd. accounted for 29.98%, Kazakoshi Kensetsu Co. for 21.80%, Mugishima Kensetsu for 11.39%, Misaki-gumi for 8.22%, and in-house construction for 7.68% of the supplies we received from our suppliers. Total construction costs were paid by the Company within 3 months after completion of construction. We have no long-term contract or arrangement with the aforementioned general contractors.

| 12 |

If we should encounter delays or difficulties in obtaining the building or land in these supply arrangements, our business related to these supplies and our financial condition, results of operations and reputation could be adversely affected.

If we experience shortages in labor supply, increased labor costs or labor disruptions, there could be delays or increased costs in developing our real estate, which could adversely affect our operating results.

We require a qualified labor force to develop our commercial and residential properties and build our commercial and residential properties. Access to qualified labor may be affected by circumstances beyond our control, including:

| ● | work stoppages resulting from labor disputes; | |

| ● | shortages of qualified trades people, such as carpenters, roofers, electricians and plumbers; | |

| ● | changes in laws relating to union organizing activity; |

| ● | changes in immigration laws and trends in labor force migration; and | |

| ● | increases in sub-contractor and professional services costs. |

Any of these circumstances could give rise to delays in the start or completion of, or could increase the cost of, developing one or more of our commercial or residential properties. We may not be able to recover these increased costs by raising our commercial or residential property prices because the prices for each commercial and residential properties are typically set months prior to its delivery pursuant to sales contracts with our buyers. In such circumstances, our operating results could be adversely affected. Additionally, market and competitive forces may also limit our ability to raise the sales prices of our commercial and residential properties.

Failure to recruit, retain and develop highly skilled, competent people at all levels may have a material adverse effect on our standards of service.

Key employees, including management team members, are fundamental to our ability to obtain, generate and manage opportunities. Key employees working in the real property building and construction industries are highly sought after. Failure to attract and retain such personnel or to ensure that their experience and knowledge are not lost when they leave the business through retirement, redundancy or otherwise may adversely affect the standards of our service and may have an adverse impact on our business, financial conditions and operating results. In addition, we do not maintain key person insurance in respect of any member of our senior management team. The loss of any of our management members or key personnel could adversely impact our business, financial condition and operating results.

The majority of work on site is performed by contractors. In addition, the number of young craftsmen has decreased due to the image of hard labor. At the same time, the number of skilled craftsmen is declining due to the retirement of baby boomers and other factors. In addition, if contractors are unable to secure sufficient human resources, delays in construction and development and quality problems may occur, leading to a decline in customer satisfaction. If salaries are raised to secure highly skilled craftsmen, this will also affect the price of construction.

| 13 |

Regulations regarding environmental matters and climate change may affect us by substantially increasing our costs and exposing us to potentially liability.

We are subject to various environmental laws and regulations, which may affect aspects of our operations such as how we manage stormwater runoff, wastewater discharges and dust; how we develop or operate on properties on or affecting resources such as cultural resources, or areas subject to preservation laws; and how we address contamination. Developers and commercial and residential property builders may become subject to more stringent requirements under such laws. It is unclear how these future developments and related matters, including at the prefectural or municipal level, will ultimately affect the regulated areas in which we may operate. While we cannot predict with certainty the extent to which developments in areas with stringent building requirements or legal restrictions or other environmental requirements that may become effective will affect us, they could require time-consuming and costly compliance programs or result in significant expenditures, which could lead to delays and increased operating costs. Our failure to comply with environmental laws could result in fines, penalties, restoration obligations, revocation of permits, and other sanctions. Pollution and other environmental conditions at or near our development sites could result in litigation against us for personal injury, property damage, or other losses. For example, if we conduct development activities in an area that has been developed with fill, even if we have obtained a development permit, we may conduct sloppy construction work or cause landslides due to downpours and other disasters. In such cases, people may die.

In addition, there is a variety of legislation being enacted, or considered for enactment, at the national, prefectural, and municipal government levels relating to energy and climate change. This legislation relates to items such as carbon dioxide emissions control and building codes that impose energy efficiency standards. New building code requirements that impose stricter energy efficiency standards could significantly increase our cost to construct commercial and residential properties. As climate change concerns continue to grow, legislation and regulations of this nature are expected to continue and become more costly to comply with. In addition, it is possible that some form of expanded energy efficiency legislation may be passed by the federal agencies and certain state legislatures, which may, despite being phased in over time, significantly increase our costs of building commercial and residential properties and the sale price to our buyers and adversely affect our sales volumes. We may be required to apply for additional approvals or modify our existing approvals because of changes in local circumstances or applicable law. Energy-related initiatives affect a wide variety of companies throughout Japan and the world and, because our operations are heavily dependent on significant amounts of raw materials, such as lumber, steel and concrete, they could have an indirect adverse impact on our operations and profitability to the extent the manufacturers and suppliers of our materials are burdened with expensive cap and trade and similar energy related taxes and regulations.

| 14 |

Raw materials and building supply shortages and price fluctuations could delay or increase the cost of commercial and residential property construction and adversely affect our operating results.

The commercial and residential real estate construction industry has experienced numerous difficulties in procuring raw materials and has been adversely affected by fluctuations in global commodity prices. In particular, shortages and price fluctuations in critical raw materials such as concrete, gypsum board, and lumber could delay the start or completion of one or more other commercial or residential real estate developments and increase development costs. Our needs for steel-related materials are particularly vulnerable to shortages. In addition, the delivery of raw materials and the transportation of workers to work sites and the cost of fuel oil used for heavy equipment are highly variable and may be subject to geopolitical events, major storms, other severe weather conditions, and the consequences of significant environmental incidents. Environmental laws and regulations may also negatively impact the availability and prices of raw materials such as lumber and concrete. These increased costs could adversely affect our operating margins and results of operations. In addition, we may not be able to pass on increased construction costs to customers with whom we have already entered into purchase contracts. In addition, such increased costs could adversely affect the economies of the regions in which we operate and reduce demand for our commercial and residential real estate.

We intend to have significant operations in certain geographic areas, which will subject us to an increased risk of loss of revenue or decreases in the market value of our land and commercial and residential properties in these regions from factors which may affect any of these regions.

We anticipate that our operations will be concentrated in 23 wards of Tokyo, Kanagawa, Kyoto, and Osaka. Some or all of these regions could be affected by:

| ● | severe weather; | |

| ● | natural disasters; | |

| ● | climate change; | |

| ● | shortages in the availability or increased costs in obtaining land, equipment, labor or building supplies; | |

| ● | unemployment; | |

| ● | changes to the population growth rates and therefore the demand for commercial and residential properties in these regions; and | |

| ● | changes in the regulatory and fiscal environment. |