As filed with the Securities and Exchange Commission on August 20, 2024.

Registration No. 333-280240

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

AMENDMENT NO. 3

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_______________

(Exact name of registrant as specified in its charter)

_______________

| | 6770 | N/A | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

101 Roswell Drive, Nepean, Ontario,

K2J 0H5, Canada

Telephone: (+1) 403-561-7750

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

_______________

RAITI, PLLC

1345 Avenue of the Americas

New York, NY 10105

Tel.: (212) 590-2328

Facsimile: (646) 518-0135

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_______________

Copies to:

|

Warren A. Raiti, Esq. |

Richard Hall, Esq. |

William S. Rosenstadt, Esq. |

_______________

Approximate date of commencement of the proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||

| | ☒ | Smaller reporting company | | |||||

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

The information in this preliminary proxy statement/prospectus is not complete and may be changed. Oak Woods Acquisition Corporation may not issue the securities offered by this preliminary proxy statement/prospectus until the registration statement filed with the Securities and Exchange Commission, of which this preliminary proxy statement/prospectus is a part, is declared effective. This preliminary proxy statement/prospectus does not constitute an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale of these securities is not permitted.

PRELIMINARY — SUBJECT TO COMPLETION, DATED AUGUST 20, 2024

PROXY STATEMENT FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

OF OAK WOODS ACQUISITION CORPORATION AND PROSPECTUS FOR 3,125,571 ORDINARY SHARES OF THE COMPANY

(AT THE TIME OF THE CLOSE OF ITS PROPOSED BUSINESS COMBINATION)

Dear Shareholders of Oak Woods Acquisition Corporation,

The board of directors of Oak Woods Acquisition Corporation, a Cayman Islands exempted company (“we,” “us,” “our,” the “Company,” “OAKU” or “Oak Woods”) (which will change its name to Huajin Health Group Company Limited immediately upon the closing of the Business Combination as defined here below (the “Closing”)) has unanimously approved the transactions contemplated by that certain Merger Agreement and Plan of Reorganization, dated as of August 11, 2023 by and among OAKU, Huajin (China) Holdings Limited, a Cayman Islands exempted holding company (“Huajin”), Xuehong Li (as the “Shareholders’ Representative”) and Oak Woods Merger Sub Inc., a Cayman Islands exempted company and wholly-owned subsidiary of OAKU (the “Merger Sub”), as amended by the first amendment to the Merger Agreement entered into by OAKU, Huajin, Merger Sub, and the Shareholders’ Representative on June 26, 2024 (the “First Amendment”) (and as amended from time to time, collectively the “Merger Agreement”) and the other related proposals, pursuant to which the Merger Sub will merge with and into Huajin, with Huajin surviving the merger (hereinafter the “Business Combination” or “Merger”). Copies of the Merger Agreement and the First Amendment are attached to this proxy statement/prospectus as Annex A and Annex D, respectively. As described in this proxy statement/prospectus, OAKU’s shareholders are being asked to consider and vote upon the Business Combination, among other items. At Closing, OAKU intends to change its name from “Oak Woods Acquisition Corporation” to “Huajin Health Group Company Limited” and the post-combination company (being Huajin), together with its subsidiaries, will herein be referred to as the “Combined Company.” The Combined Company is not a Chinese operating company but a Cayman Islands holding company that, together with other shareholders own subsidiaries that ultimately operate within the Peoples Republic of China (PRC), as described further in this proxy statement/prospectus.

Further to the above, holders of the Class A and Class B Ordinary Shares of OAKU, which as of July [•], 2024 includes holders of 6,093,125 of Class A Ordinary Shares and holders of 1,437,500 of Class B Ordinary Shares, will be asked to approve the Merger Agreement and Plan of Reorganization, dated as of August 11, 2023 by and among OAKU, Huajin. Shareholders’ Representative and Oak Woods Merger Sub Inc., Merger Sub, as amended by the First Amendment entered into by OAKU, Huajin, Merger Sub, and the Shareholders’ Representative on June 26, 2024 (as amended from time to time) and the other related proposals, pursuant to which the Merger Sub will merge with and into Huajin, with Huajin surviving the merger. As a result, Huajin will become a wholly-owned subsidiary of OAKU. The former holders of the share capital of Huajin will be entitled to receive up to an aggregate of 23,761,410 Class A Ordinary Shares of OAKU (the “OAKU Class A Ordinary Shares” or the “OAKU Shares”), equal to the adjusted equity valuation of Huajin as of the closing of the Business Combination, divided by $10.00 per share. Effective as of immediately prior to the Closing, OAKU’s issued and outstanding Class B ordinary shares, par value $0.0001 per share (the “OAKU Class B Ordinary Shares”), will convert automatically on a one-for-one basis into OAKU’s Class A Ordinary Shares, par value $0.0001 per share. The “OAKU Class A Ordinary Shares,” and, together with the OAKU Class B Ordinary Shares, are referred to herein as the “OAKU Ordinary Shares”). Contemporaneously, upon the completion of the Business Combination, all of the currently authorized and issued and outstanding OAKU Class B Ordinary Shares will be reclassified and redesignated into OAKU Class A Ordinary Shares on a one-for-one basis, and contemporaneously with that, all of the authorized and issued and outstanding OAKU Class A Ordinary Shares will be reclassified and redesignated of into ordinary shares of OAKU on a one-for-one basis. Upon the completion of the Business Combination, the OAKU Ordinary Shares will refer to ordinary shares of OAKU.

Assuming that Huajin has a closing net debt of $12,385,903, we estimate that we will issue approximately 23,761,410 OAKU Shares to acquire Huajin. However, in accordance with the terms of the Merger Agreement, in the event that the closing net debt of Huajin is different from the assumption stated above, the allocation of the OAKU Shares issuable to the Huajin securityholders will change. Simultaneous with the Business Combination, OAKU will pass a special resolution to change its name to Huajin Health Group Company Limited upon completion of the Business Combination. The issuance of OAKU Class A Ordinary Shares to the securityholders of Huajin is being consummated on a private placement basis, pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), Regulation D and Regulation S, promulgated thereunder.

In connection with the Business Combination, on June 26, 2024, we entered into a backstop agreement with Fortune Woods Investment Holding Limited, a British Virgin Islands limited company (hereinafter “Backstop Investor”) reflecting our agreement to register herein for public resale 500,000 OAKU Class A Ordinary Shares in consideration for Backstop Investor’s agreement to purchase the equivalent of five million dollars ($5,000,000) worth of Class A Ordinary Shares of OAKU on terms and conditions mutually agreeable to OAKU and Huajin (the “Backstop Agreement”). Specifically, the Backstop Agreement requires us to complete a primary placement to the Backstop Investor, to occur concurrently with the closing of the Business Combination, pursuant to which the Company shall sell 500,000 OAKU Class A Ordinary Shares at $10.00 per share for a total drawdown of $5,000,000 (the “Backstop Shares”). Such proceeds will (i) offset certain capital used for shareholder redemptions; (ii) fund the cash portion of the consideration to certain shareholders of Huajin and transaction expenses in connection with the Business Combination; or (iii) be used for other corporate purposes, including satisfaction of its minimum cash requirements immediately following the Business Combination. Our agreement to sell and Backstop Investors’ agreement to purchase the Backstop Shares is referred to herein as the “Backstop Commitment”).

On [•], OAKU entered into subscription agreements (the “PIPE Subscription Agreements”) with the following institutional and accredited investors (the “PIPE Investors”): [•]. Pursuant to the PIPE Subscription Agreements, the PIPE Investors have agreed to purchase, immediately prior to the Closing, an aggregate of [•] Class A Ordinary Shares, par value $0.0001 per share, of OAKU at a purchase price of $10.00 per share (the “Initial PIPE Investment”), for aggregate proceeds of $[•]. The closing of the Initial PIPE Investment is conditioned on the concurrent closing of the Business Combination and other closing conditions as set forth in the Initial Subscription Agreements.

Certain registrable securities having “piggyback” registration rights, as well as the primary issuance of shares in conjunction with the terms of the Backstop Agreement and our agreement with AsianLegend are being registered herewith as described further in this prospectus/proxy statement. Specifically, Whale Bay International Company Limited, which is the sponsor of OAKU (the “Sponsor”), each of our initial shareholders, as well as Asian Legend International Investment Holding Limited (“AsianLegend”), our advisor in the Business Combination, have exercised their demand registration rights in connection with the closing of our Business Combination. Additionally, shares held by our Sponsor and other initial shareholders (which are subject to certain lock-up provision contained in their initial subscription agreements described further in our initial prospectus) shall form a part of our effective registration statement, together with shares issuable to AsianLegend pursuant to that certain advisory agreement entered by and between Oak Woods Acquisition Corporation and AsianLegend International Investment Holding Limited on March 23, 2023 (“AsianLegend Advisory Agreement”) whereby AsianLegend is entitled to receive shares equal to 5% of the total of the fair market value of the target of our business combination as defined in this registration statement, payable in Class A ordinary Shares (on a fully converted basis) into our Ordinary Shares at the time of closing of the Business Combination.

The 500,000 Class A Ordinary Shares to be issued pursuant to the Backstop Agreement and deliverable to the Backstop Investor, as well as 1,437,500 fully converted Ordinary Shares of our initial shareholders, which includes the Class B shares held by our sponsor and initials directors and our advisor Space Frontier Investment Holding Limited, as well as the 1,188,071 Class A Ordinary Shares shares payable to AsianLegend upon Closing of the Business Combination that are subject to “piggyback” registration rights as of the effective date of this registration statement, are hereinafter referred to as (the “Registration Shares”). The Asian Legend and the Backstop Investor shares are covered by this Registratin Statement, as an when deemed effective, and will be registered and fully issued in conjunction with the completion of our Business Combination, are not subject to a lock-up agreement with us, and thus may be freely sold, traded, or otherwise disposed of by AsianLegend or the Backstop Investor at any time after they are issued.

In total we are registering hereunder an aggregate of 3,125,571 ordinary shares of the Company under this Registration Statement, of which 1,688,071 shall be newly issued by us as and freely trading without restriction of any kind in conjunction with the closing of our Business Combination.

Upon the consummation of our Business Combination, we will be a “controlled company” as defined in Rule 5615(c)(1) of the Nasdaq Marketplace Rules because more than 50% of the voting power of the Company is controlled by Mr. Xuehong Li, as the primary beneficial owner of Huajin and its controlling person. Because we qualify as a controlled company, after our business combination we will not be required to have a majority of our Board be comprised of independent directors. Additionally, our Board will not be required to have an independent compensation or nominating committee or to have the independent directors exercise the nominating function.

We also will not be required to have the compensation of our executive officers be determined by a compensation committee of independent directors or a majority of the independent members of our Board. In addition, we will not be required to empower our Compensation Committee of the Board (the “Compensation Committee”) with the authority to engage the services of any compensation consultants, legal counsel, or other advisors or to have the Compensation Committee assess the independence of compensation consultants, legal counsel, or other advisors that it engages. Notwithstanding the above, the Company expects to operate under the corporate governance structure and with the initial post business combination directors disclosed herein.

It is a condition of the consummation of the Business Combination that OAKU receive confirmation from Nasdaq that the OAKU Class A Ordinary Shares to be issued in connection with the Business Combination have been approved for listing on Nasdaq, subject only to official notice of issuance thereof, but there can be no assurance such listing condition will be met or that OAKU will obtain such approval from Nasdaq. If such listing condition is not met or if such approval is not obtained, the Business Combination will not be consummated unless the stock exchange approval condition set forth in the Business Combination Agreement is waived by the applicable parties.

OAKU reserves the right to postpone or adjourn the Shareholder Meeting on one or more occasions as detailed in the Business Combination Agreement. In the event of an adjournment, the Shareholder Meeting will be reconvened as promptly as practicable.

Because the Combined Company will be a holding company with no material operations of its own, we will conduct our operations through an office in the PRC and our sponsor is predominantly controlled by a PRC national. Because the substantive operations of the Combined Company will be located and doing business in the PRC, we will be subject to certain legal and operational risks, including, without limitation, regulatory review of overseas listings of PRC companies. Like any company operating in a foreign country, we are also subject to risks and regulations relating to future actions of the PRC government in this regard. Furthermore, if one or more of the subsidiaries of our Combined Company fails to comply with PRC rules and regulations, existing now or promulgated in the future, it may have a materially adverse effect on the business operations, our financial performance, our results of operations of the Combined Company and/or the value of our ordinary shares we are registering for sale either before or after the business combination, which could cause the value of such securities to significantly decline or become worthless. It could also significantly limit or completely hinder the post-combination company’s ability to offer or continue to offer securities to investors. In recent years, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity, or VIE, structure, adopting new measures to extend the scope of data security and cybersecurity reviews, and expanding anti-monopoly enforcement activities. These actions and statements have impacted or may impact our ability to operate, and our ability to accept foreign investments or to list or remain listed on a U.S. or other foreign exchange. Since some of these statements and regulatory actions are new, it still needs to be further clarified how soon legislative or regulatory bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on the Combined Company’s business operations, our ability to accept foreign investments and our ability to list on a U.S. or other foreign exchange. Given the PRC government’s significant oversight over the conduct of business of any China-based company, the PRC government may regulate or influence the operations of our Combined Company, which could result in a material change in our operations and/or value of the securities we are registering for sale.

PRC laws and regulations that, in the opinion of Jingtian & Gongcheng according to its interpretation of the currently in-effect PRC laws and regulations, could be interpreted by the relevant PRC government authorities, namely, the China Securities Regulatory Commission (the “CSRC”), the Cyberspace Administration of China (the “CAC”) and their enforcement agencies, to require Huajin to obtain permission or approval in order to issue securities to foreign investors in connection with the Business Combination or offer securities to foreign investors. For more information about these and other risks relating to our prospective operations in PRC See — Risk Factors — Risks Related to Doing Business in Greater China of this prospectus and proxy statement.

As required under the Holding Foreign Companies Accountable Act (“HFCAA”), the U.S. Public Company Accounting Oversight Board (the “PCAOB”) issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China (the “PRC”) because of a position taken by one or more

authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. Our registered public accounting firm, Marcum Asia CPAs LLP (“MarcumAsia”), headquartered in New York City, New York, is an independent registered public accounting firm registered with the PCAOB and is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess MarcumAsia’s compliance with applicable professional standards. As such, MarcumAsia was not identified in this report as a firm subject to the PCAOB’s determination. The PCAOB currently has access to inspect the working papers of our auditor. Our auditor is not headquartered in China or Hong Kong and was not identified in this report as a firm subject to the PCAOB’s determinations. Notwithstanding the foregoing, in the event that we complete a business combination with a company with substantial operations in China or Hong Kong and the PCAOB is not able to fully conduct inspections of our auditor’s work papers in China or Hong Kong, it could cause us to fail to be in compliance with U.S. securities laws and regulations, we could cease to be listed on a U.S. securities exchange, and U.S. trading of our shares could be prohibited under the HFCAA. On August 26, 2022, the PCAOB signed a Statement of Protocol with the China Securities Regulatory Commission (the “CSRC”) and the Ministry of Finance of the People’s Republic of China, governing inspections and investigations of audit firms based in mainland China and Hong Kong. The Protocol remains unpublished and is subject to further explanation and implementation. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB announced in its 2022 HFCAA Determination Report (the “2022 Determination”) its determination that the PCAOB was able to secure complete access to inspect and investigate accounting firms headquartered in mainland China and Hong Kong, and the PCAOB Board voted to vacate previous determinations to the contrary. Should the PCAOB again encounter impediments to inspections and investigations in mainland China or Hong Kong as a result of positions taken by any authority in either jurisdiction, including by the CSRC or the Ministry of Finance (the “MOF”), the PCAOB will make determinations under the HFCAA as and when appropriate. On December 23, 2022 the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”) was enacted, which amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. On December 29, 2022 legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which contained, among other things, an identical provision to the AHFCAA and amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three years. As a result, the time period before an issuer’s securities may be prohibited from trading or delisted has been decreased accordingly. However, the HFCAA and related regulations currently do not affect the Company or the Combined Company as the Company’s auditor is subject to PCAOB’s inspections and investigations. See “Risk Factors — Risks Related to Doing Business in Greater China.

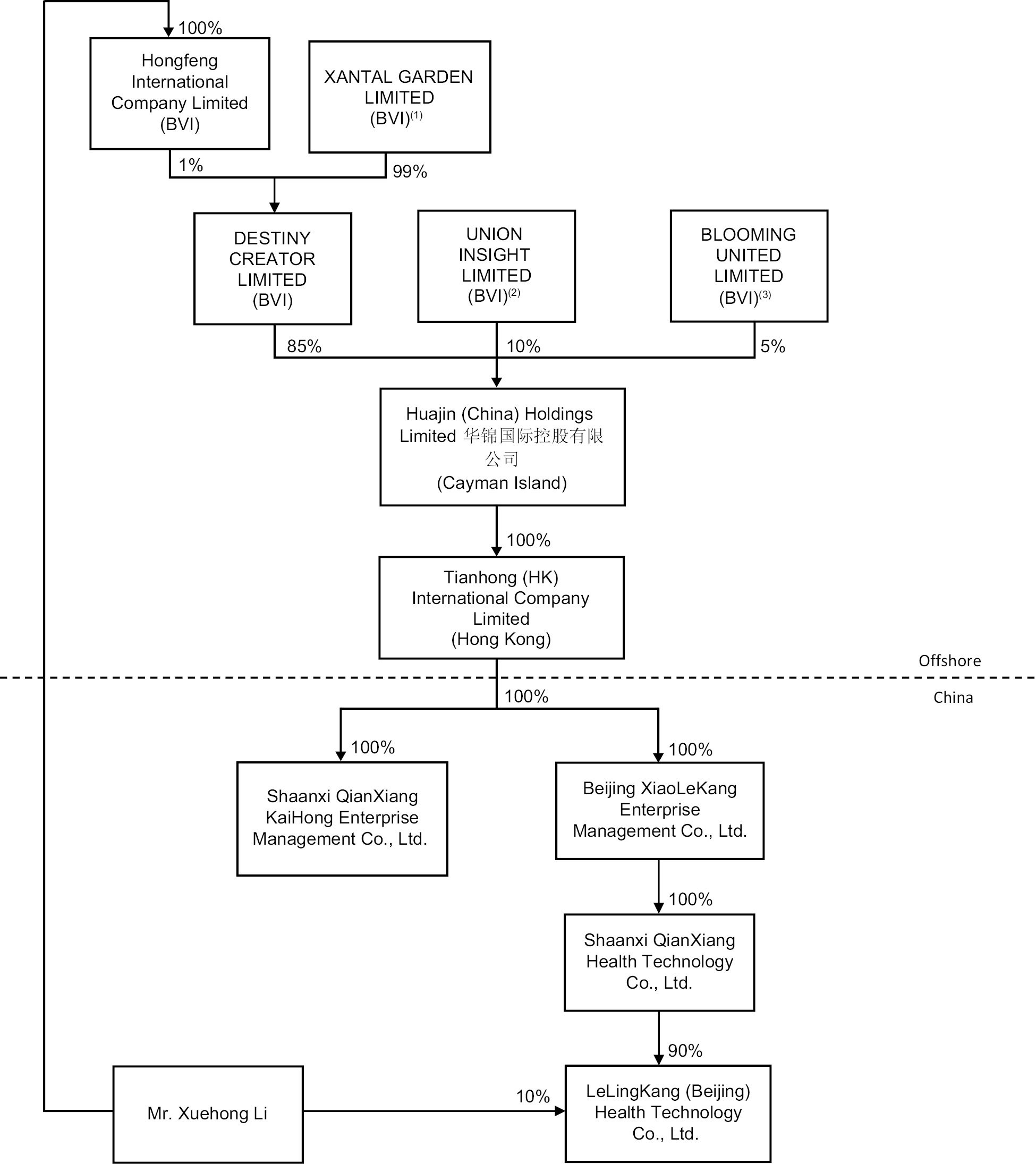

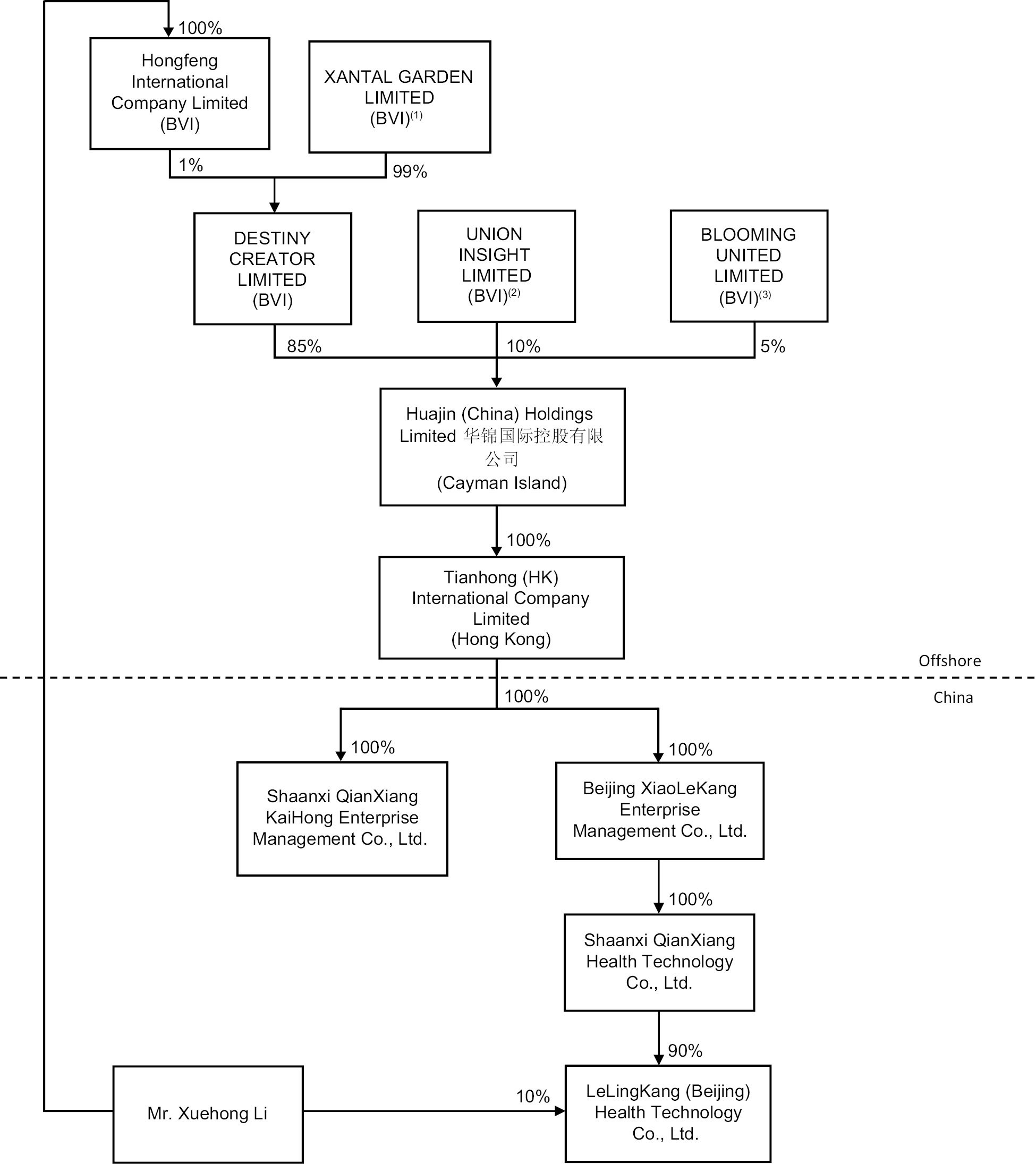

The following diagram sets forth the structure of Huajin and its subsidiaries immediately prior to the consummation of the Business Combination:

____________

(1) Xantal Garden Limited is a British Virgin Islands company 100% owned by Mr. Xuehong Li’s family trust, the Lee’s Trust.

(2) Union Insight Limited is a British Virgin Islands company 100% owned by Happiness Trust, a Hong Kong trust and an ESOP trust established by Mr. Xeuhong Li.

(3) Blooming United Limited is a British Virgin Islands company 100% owned by Sunshine Trust, a Hong Kong trust and an ESOP’ trust established by Mr. Xuehong Li.

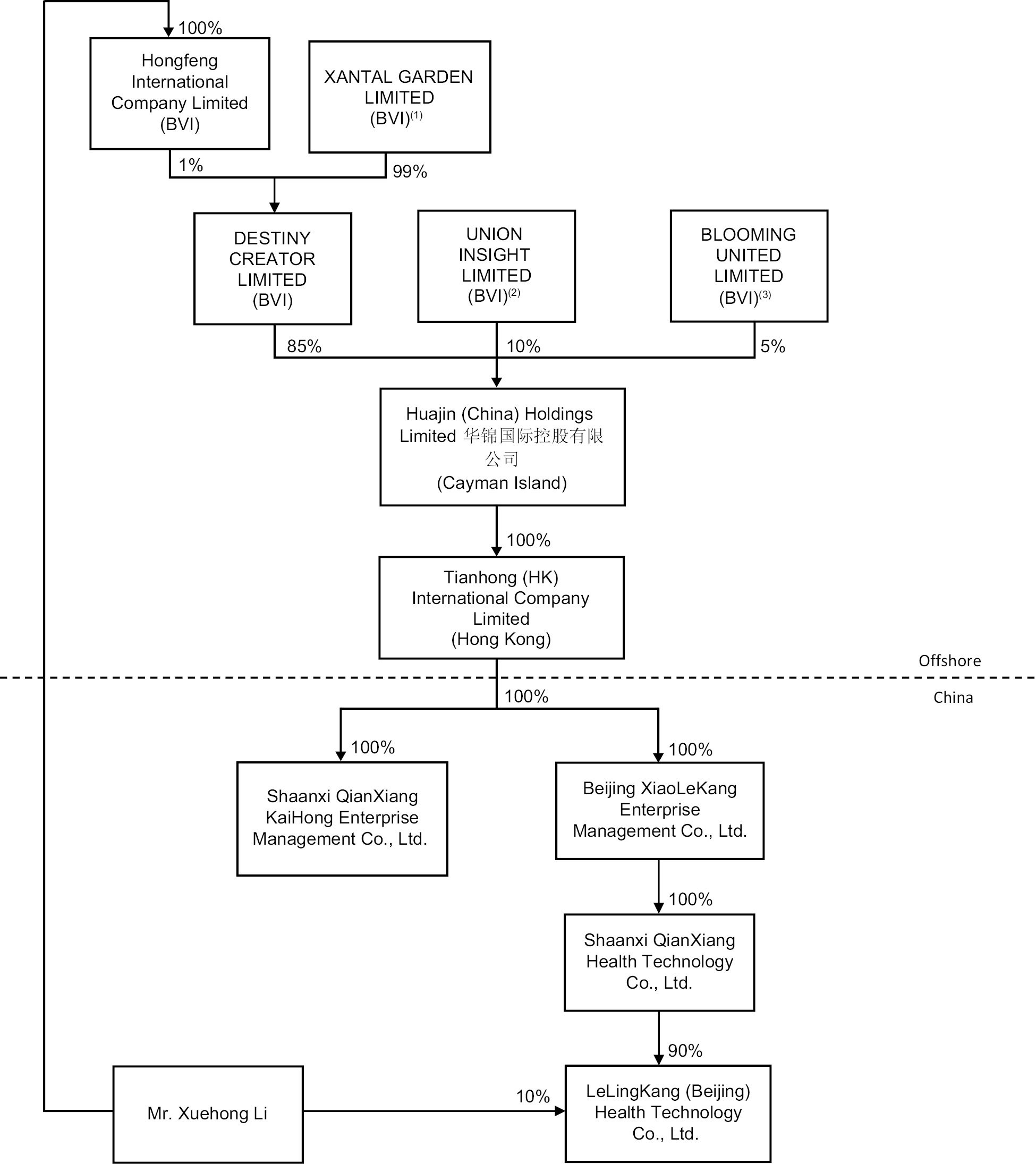

The following diagram sets forth the structure of the Company immediately following the consummation of the Business Combination:

Huajin (China) Holdings Limited 华锦 (中国) 控股有限公司, is a Cayman Islands exempted company incorporated on July 27, 2021. We conduct our business in China through our wholly owned subsidiaries. The consolidation of our Company and our wholly owned subsidiaries has been accounted for at historical cost and prepared on a basis as if the aforementioned transactions had become effective at the beginning of the first period presented in the accompanying consolidated financial statements.

As of the date of this proxy statement, Huajin has received from PRC authorities all requisite licenses, permissions or approvals needed to engage in the businesses currently conducted in China, and no permission or approval has been denied. The following table provides details on such licenses and permissions.

|

No. |

Company |

License/Permission |

Certificate Number |

Issuing Authority |

Validity |

|||||

|

1 |

Shaanxi QianXiang |

Certificate of Second-Class Medical Device Operation |

Shaan An Shi Yao Jian Xie Operation Cert. No. 20190123 |

Ankang City Administrative Approval Service Bureau |

Five years (From November 1, 2023 to October 30, 2028) |

|||||

|

2 |

Shaanxi QianXiang |

Commercial Franchise Enterprise Record Filing |

0610100412100106 |

Ministry of Commerce |

Long-term |

|||||

|

3 |

LeLingKang |

Food Operation License |

JY11105223325131 |

Beijing Chaoyang District Market Supervision and Administration Bureau |

Five years (From July 4, 2022 to July 3, 2027) |

Upon the completion of our initial business combination, our financial advisor Asian Legend International Investment Holding Limited (“AsianLegend”) will be entitled to a fee, payable in our fully converted Class A Ordinary Shares of 5% of the total share consideration payable to Huajin, which, subject to final net debt considerations of Huajin, is expected to equal 1,188,071 Class A Ordinary Shares. In the event of no redemption of Class A Ordinary Shares held by our public shareholders, this fee will result in AsianLegend owning 3.5%, and in the event of full redemption of Class A Ordinary Shares held by our public shareholders, 4.2% of our total issued and outstanding shares upon the closing of our business combination with Huajin. Because the shares payable to Huajin are conditioned on the success of an initial business combination, AsianLegend is incentivized to assist us in completing an initial business combination and their interests may thus conflict with ours.

This proxy statement/prospectus provides shareholders of OAKU with detailed information about the Business Combination and other matters to be considered at the extraordinary general meeting of OAKU. We encourage you to read the entire proxy statement/prospectus, including the annexes, exhibits and other documents referred to therein, carefully and in their entirety. You should also carefully consider the risk factors described in the section titled “Risk Factors” beginning on page 46 of this proxy statement/prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THE PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

The proxy statement/prospectus is dated , 2024 and is first being mailed to OAKU’s shareholders on or about , 2024.

Oak Woods Acquisition Corporation

101 Roswell Drive, Nepean, Ontario

K2J 0H5, Canada

Attn: Chief Financial Officer

Telephone: (+1) 403-561-7750

Dear Oak Woods Acquisitions Corporation Shareholders,

You are cordially invited to attend the extraordinary general meeting of the shareholders of Oak Woods Acquisition Corporation to be held on June __, 2024. OAKU is a Cayman Islands exempted company incorporated as a blank check company for the purpose of entering into a merger, share exchange, asset acquisition, share purchase, recapitalization, reorganization or similar business combination with one or more businesses or entities.

Holders of the Class A and Class B Ordinary Shares of OAKU will be asked to approve the Merger Agreement and Plan of Reorganization, dated as of August 11, 2023 by and among OAKU, Huajin, Shareholders’ Representative and Oak Woods Merger Sub Inc., Merger Sub, as amended by the First Amendment entered into by OAKU, Huajin, Merger Sub, and the Shareholders’ Representative on [•], 2024 (as amended from time to time) and the other related proposals, pursuant to which the Merger Sub will merge with and into Huajin, with Huajin surviving the merger. As a result, Huajin will become a wholly-owned subsidiary of OAKU. The former holders of the share capital of Huajin will be entitled to receive up to an aggregate of 23,761,410 Class A Ordinary Shares of OAKU (the “OAKU Class A Ordinary Shares” or the “OAKU Shares”), equal to the adjusted equity valuation of Huajin as of the closing of the Business Combination, divided by $10.00 per share. Effective as of immediately prior to the Closing, OAKU’s issued and outstanding Class B ordinary shares, par value $0.0001 per share (the “OAKU Class B Ordinary Shares”), will convert automatically on a one-for-one basis into OAKU’s Class A Ordinary Shares, par value $0.0001 per share. The “OAKU Class A Ordinary Shares,” and, together with the OAKU Class B Ordinary Shares, are referred to herein as the “OAKU Ordinary Shares”). Contemporaneously, upon the completion of the Business Combination, all of the currently authorized and issued and outstanding OAKU Class B Ordinary Shares will be reclassified and redesignated into OAKU Class A Ordinary Shares on a one-for-one basis, and contemporaneously with that, all of the authorized and issued and outstanding OAKU Class A Ordinary Shares will be reclassified and redesignated of into ordinary shares of OAKU on a one-for-one basis.

Upon the completion of the Business Combination, the OAKU Ordinary Shares will refer to ordinary shares of OAKU. Upon effectiveness of this registration statement all of the Registration Shares shall registered shares under the Securities Act of 1933, including in total 980,625 Ordinary Shares held by our Sponsor, Whale Bay International Company Limited, 420,000 Ordinary Shares held by our initial shareholder Space Frontier Investment Holding Limited, 350,000 shares held by our former CEO Fen Zhang, 10,000 shares held by our Director John O’Donnell, 10,000 shares held by our Director Mitchell Cariaga, 10,000 shares held by our Director Lauren Simmons, as well as 1,188,071 Ordinary Shares issuable upon closing of our Business Combination to Asian Legend, as well as those [___•___] Ordinary Shares issued pursuant to the PIPE Subscription Agreements. The shares issued to AsianLegend are contingent on the consummation of a Business Combination and not subject to the Lock-Up Agreements otherwise applicable to our initial shareholders (as that term is defined in our initial prospectus) or as described below in this proxy statement/prospectus with regard to the former shareholders of Huajin.

Our initial shareholders have agreed not to transfer, assign or sell any of their founder shares until the earlier to occur of (i) one year after the date of the consummation of our initial business combination or (ii) 30 days after we consummate a liquidation, merger, share exchange or other similar transaction which results in all of our shareholders having the right to exchange their Class A ordinary shares for cash, securities or other property (except as described herein under the section of our initial prospectus entitled “Restrictions on Transfers of Founder Shares and Private Placement Units”). Any permitted transferees will be subject to the same restrictions and other agreements of our initial shareholders with respect to any founder shares. Notwithstanding the foregoing, (x) if the closing price of our Class A ordinary shares equals or exceeds $12.00 per share (as adjusted for share sub-divisions, share dividends, reorganizations, recapitalizations and the like) for any 20 trading days within any 30-trading day period commencing at least 150 days after the consummation of our initial business combination or (y) following the our initial business combination, on the date on which we complete a liquidation, merger, share exchange or other similar transaction that results in all of our shareholders having the right to exchange their ordinary shares for cash, securities or other property, the founder shares will no longer be subject to such transfer restrictions. We refer to such transfer restrictions throughout this prospectus as the lock-up.

Assuming that Huajin has a closing net debt of $12,385,903, we estimate that we will issue approximately 23,761,410 OAKU Shares to acquire Huajin. However, in accordance with the terms of the Merger Agreement, in the event that the closing net debt of Huajin is different from the assumption stated above, the allocation of the OAKU Shares issuable to the Huajin securityholders will change. In all cases, the aggregate number of OAKU Share to be issued, shall be determined by subtracting the “Closing Net Debt” of Huajin (as defined in the Merger Agreement) from the agreed valuation of $250,000,000, and dividing such difference by $10.00, which represents the agreed valuation of one (1) OAKU Ordinary Share at the Closing of the Business Combination.

However, in accordance with the terms of the Merger Agreement, in the event that the Closing Net Debt of Huajin is greater or lesser than anticipated the number of OAKU Ordinary Shares payable to Huajin security holders at the time of the closing of the business combination will respectively decrease or increase proportionately.

Simultaneous with the Business Combination, OAKU will pass a special resolution to change its name to Huajin Health Group Company Limited upon completion of the Business Combination. The issuance of OAKU Class A Ordinary Shares to the securityholders of Huajin is being consummated on a private placement basis, pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), Regulation D and Regulation S, promulgated thereunder.

In connection with the Business Combination, on June 26, 2024, we entered into the Backstop Agreement with the Backstop Investor reflecting our agreement to register herein for public resale 500,000 OAKU Class A Ordinary Shares in consideration for Backstop Investor’s agreement to purchase the equivalent of five million dollars ($5,000,000) worth of Class A Ordinary Shares of OAKU on terms and conditions mutually agreeable to OAKU and Huajin. Specifically, the Backstop Agreement requires us to complete a primary placement of the Backstop Shares to the Backstop Investor, to occur concurrently with the closing of the Business Combination. The proceeds from the sale of the Backstop Shares are expected to (i) offset certain capital used for shareholder redemptions; (ii) fund the cash portion of the consideration to certain shareholders of Huajin and transaction expenses in connection with the Business Combination; or (iii) be used for other corporate purposes, including satisfaction of its minimum cash requirements immediately following the Business Combination.

In addition, Asian Legend International Investment Holding Limited (“AsianLegend”) acted as financial advisor to OAKU with respect to the Business Combination and will receive a fee from OAKU for its services, a substantial portion of which will become payable only if the Business Combination is consummated, with the consent of Huajin and OAKU, and subject to the terms and conditions set forth in the letter agreement dated March 23, 2023, as amended, between AsianLegend and OAKU. In addition, OAKU has agreed to indemnify AsianLegend for certain liabilities arising out of its engagement. Prior to the parties’ entry into the Merger Agreement, AsianLegend did not have any other financial advisory or other significant commercial or investment banking relationships with Huajin. The Agreement with AsianLegend, entered by and between contemplates that the Company will pay to AsianLegend USD $100,000 per calendar month during the term of this Agreement; and, as discussed above, an amount of paid shares equals to 5% of total value of the target company (in this case Huajin) in a successful business merger or acquisition by us as determined by a fair market value and stated in a definitive merger agreement between us and the prospective target, in Class A Ordinary Shares, together with piggyback registration rights and payable upon the of our consummation of our initial business combination. As such, 1,188,071 Class A Ordinary Shares will be issued to AsianLegend in exchange for its services rendered for the Business Combination, upon the Closing. The shares issuable to AsianLegend are contingent on the consummation of a Business Combination, and are not subject to any lock-up agreement. Because the Asian Legend shares will be registered together with those of our Initial Shareholders upon completion of our initial business combination, and are not subject to a lock-up agreement with us, they may be freely disposed of by AsianLegend at any time after they are issued. The applicable period to date of the agreement with AsianLegend has run from the effective date of our IPO through the earlier of the consummation of our initial business combination, or in the event that the Company fails to complete a Transaction within any applicable time period or selects not to complete a Transaction, the dissolution of the Company under applicable laws, unless extended by mutual written consent or earlier terminated. We have agreed to indemnify AsianLegend for claims, actions, suits, proceedings (including those of shareholders), damages, liabilities and expenses incurred in connection with, or generally arising out of, their advisory services to us. The shares issued to AsianLegend is contingent on the consummation of a Business Combination.

Certain registrable securities having “piggyback” registration rights, as well as the primary issuance of shares in conjunction with the terms of the Backstop Agreement and our agreement with AsianLegend are being registered herewith as described further in this prospectus/proxy statement. Specifically, Whale Bay International

Company Limited, which is the sponsor of OAKU (the “Sponsor”), each of our initial shareholders, as well as Asian Legend International Investment Holding Limited (“AsianLegend”), our advisor in the Business Combination, have exercised their demand registration rights in connection with the closing of our Business Combination. Additionally, shares held by our Sponsor and other initial shareholders (which are subject to certain lock-up provision contained in their initial subscription agreements described further in our initial prospectus) shall form a part of our effective registration statement, together with shares issuable to AsianLegend pursuant to that certain advisory agreement entered by and between Oak Woods Acquisition Corporation and AsianLegend International Investment Holding Limited on March 23, 2023 (“AsianLegend Advisory Agreement”) whereby AsianLegend is entitled to receive shares equal to 5% of the total of the fair market value of the target of our business combination as defined in this registration statement, payable in Class A ordinary Shares (on a fully converted basis) into our Ordinary Shares at the time of closing of the Business Combination. The 500,000 Class A Ordinary Shares to be issued pursuant to the Backstop Agreement and deliverable to the Backstop Investor, as well as 1,437,500 fully converted Ordinary Shares of our initial shareholders, which includes the Class B shares held by our sponsor and initials directors and our advisor Space Frontier Investment Holding Limited, as well as the 1,188,071 Class A ordinary Shares shares payable to AsianLegend upon Closing of the Business Combination that are subject to “piggyback” registration rights as of the effective date of this registration statement, are hereinafter referred to as (the “Registration Shares”). Because the Asian Legend and the Backstop Investor shares will be registered and fully issued in conjunction with the completion of our Business Combination, and are not subject to a lock-up agreement with us, they may be freely sold, traded, or otherwise disposed of by AsianLegend or the Backstop Investor at any time after they are issued.

In total we are registering hereunder an aggregate of 3,125,571 ordinary shares of the Company under this Registration Statement, of which 1,688,071 shall be newly issued by us as and freely trading without restriction in conjunction with the closing of our Business Combination.

The Combined Company is not a Chinese operating company but a Cayman Islands holding company that, together with other shareholders own subsidiaries that ultimately operate within the Peoples Republic of China (PRC). Specifically, the company that we are seeking to acquire is Huajin (China) Holdings Limited, a Cayman Islands exempted Company. Huajin (China) Holdings Limited owns 100% of Tianhong (HK) International Company Limited, a Hong Kong registered company. Tianhong (HK) International Company Limited owns 100% of bothShaanxi QianXiang KaiHong Enterprise Management Co., Ltd. and Beijing XiaoLeKang Enterprise Management Co., Ltd., each of which are operating companies registered in the Peoples Republic of China. Beijing XiaoLeKang Enterprise Management Co., Ltd. owns 100% of Shaanxi QianXiang Health Technology Co., Ltd., an operating company engaged in healthcare services as described further in this Registration Statement and registered in the Peoples Republic of China. Shaanxi QianXiang Health Technology Co., Ltd. owns 90% of LeLingKang (Beijing) Health Tehnology Co., Ltd., an operating company engaged in food processing services as described further in this Registration Statement and registered in the Peoples Republic of China. The remaining 10% of LeLingKang (Beijing) Health Technology Co., Ltd. is held directly by the Shareholder Representative, Mr. Xuehong Li. Upon the consummation of our Business Combination we will be a “controlled company” as defined in Rule 5615(c)(1) of the Nasdaq Marketplace Rules because more than 50% of the voting power of the Company is controlled by Mr. Xuehong Li, as the primary beneficial owner of Huajin and its controlling person. Because we qualify as a controlled company, after our business combination we will not be required to have a majority of our Board be comprised of independent directors. Additionally, our Board will not be required to have an independent compensation or nominating committee or to have the independent directors exercise the nominating function. We also will not be required to have the compensation of our executive officers be determined by a compensation committee of independent directors or a majority of the independent members of our Board. In addition, we will not be required to empower our Compensation Committee of the Board (the “Compensation Committee”) with the authority to engage the services of any compensation consultants, legal counsel, or other advisors or to have the Compensation Committee assess the independence of compensation consultants, legal counsel, or other advisors that it engages. Notwithstanding the above, the Company expects to operate under the corporate governance structure and with the initial post business combination directors disclosed herein.

Because the Combined Company will be a holding company with no material operations of its own, after our business combination we will conduct our operations through an office in the PRC. Our sponsor is also predominantly controlled by a PRC national. Because the substantive operations of the Combined Company after the business combination will be located and doing business in the PRC, we will be subject to certain legal and operational risks, including, without limitation, regulatory review of overseas listings of PRC companies. Like any company operating in a foreign country, we will be subject to risks and regulations relating to future actions

of the PRC government in this regard. Furthermore, if one or more of the subsidiaries of our Combined Company fails to comply with PRC rules and regulations, existing now or promulgated in the future, it may have a materially adverse effect on the business operations, our financial performance, our results of operations of the Combined Company and/or the value of our ordinary shares we are registering for sale either before or after the business combination, which could cause the value of such securities to significantly decline or become worthless. It could also significantly limit or completely hinder the post-combination company’s ability to offer or continue to offer securities to investors. In recent years, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity, or VIE, structure, adopting new measures to extend the scope of data security and cybersecurity reviews, and expanding anti-monopoly enforcement activities. These actions and statements have impacted or may impact the post business combination entity’s ability to operate, and ability to accept foreign investments or to list or remain listed on a U.S. or other foreign exchange. Since some of these statements and regulatory actions are new, it still needs to be further clarified how soon legislative or regulatory bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on the Combined Company’s business operations, our ability to accept foreign investments and our ability to list on a U.S. or other foreign exchange. Given the PRC government’s significant oversight over the conduct of business of any China-based company, the PRC government may regulate or influence the operations of our Combined Company, which could result in a material change in our operations and/or value of the securities we are registering for sale.

As required under the Holding Foreign Companies Accountable Act (“HFCAA”), the U.S. Public Company Accounting Oversight Board (the “PCAOB”) issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China (the “PRC”) because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. Our registered public accounting firm, Marcum Asia CPAs LLP (“MarcumAsia”), headquartered in New York City, New York, is an independent registered public accounting firm registered with the PCAOB and is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess MarcumAsia’s compliance with applicable professional standards. As such, MarcumAsia was not identified in this report as a firm subject to the PCAOB’s determination. The PCAOB currently has access to inspect the working papers of our auditor. Our auditor is not headquartered in China or Hong Kong and was not identified in this report as a firm subject to the PCAOB’s determinations. Notwithstanding the foregoing, in the event that we complete a business combination with a company with substantial operations in China or Hong Kong and the PCAOB is not able to fully conduct inspections of our auditor’s work papers in China or Hong Kong, it could cause us to fail to be in compliance with U.S. securities laws and regulations, we could cease to be listed on a U.S. securities exchange, and U.S. trading of our shares could be prohibited under the HFCAA. On August 26, 2022, the PCAOB signed a Statement of Protocol with the China Securities Regulatory Commission (the “CSRC”) and the Ministry of Finance of the People’s Republic of China, governing inspections and investigations of audit firms based in mainland China and Hong Kong. The Protocol remains unpublished and is subject to further explanation and implementation. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB announced in its 2022 HFCAA Determination Report (the “2022 Determination”) its determination that the PCAOB was able to secure complete access to inspect and investigate accounting firms headquartered in mainland China and Hong Kong, and the PCAOB Board voted to vacate previous determinations to the contrary. Should the PCAOB again encounter impediments to inspections and investigations in mainland China or Hong Kong as a result of positions taken by any authority in either jurisdiction, including by the CSRC or the Ministry of Finance (the “MOF”), the PCAOB will make determinations under the HFCAA as and when appropriate. On December 23, 2022 the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”) was enacted, which amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. On December 29, 2022 legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which contained, among other things, an identical provision to the AHFCAA and amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three years. As a result, the time period before an issuer’s securities may be prohibited from

trading or delisted has been decreased accordingly. However, the HFCAA and related regulations currently do not affect the Company or the Combined Company as the Company’s auditor is subject to PCAOB’s inspections and investigations. See “Risk Factors — Risks Related to Doing Business in Greater China.”

The Business Combination and the transactions contemplated by the Business Combination Agreement are not subject to any federal or state regulatory requirement or approval, except for (1) the filings and registration with the Cayman Islands Registrar of Companies and the payment of the applicable fees under the Cayman Companies Act necessary to effectuate the Business Combination, and (2) the PRC regulatory permission for the Business Combination as set forth below.

On July 6, 2021, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Severely Cracking Down on Illegal Securities Activities According to Law (the “Opinions”). The Opinions stressed the need to strengthen the administration over illegal securities activities and the supervision over overseas listings by Chinese companies. Effective measures, such as promoting the construction of relevant regulatory systems, will be taken to deal with the risks and incidents of China-related overseas listed companies.

On November 14, 2021, the CAC promulgated the draft Regulations on the Administration of Cyber Data Security (Draft for Comments) (the “Draft CAC Regulation”), which has not yet become effective. The Draft CAC Regulation provides that data processors that conduct the following activities must apply for cybersecurity review: (1) merger, reorganization or spin-off of Internet platform operators holding a large amount of data resources related to national security, economic development or public interests, which may have an adverse effect on national security; (2) data processors intending to list their securities on a foreign stock exchange that handle personal information of more than one million people; (3) data processors intending to list their securities on a stock exchange in Hong Kong which may have an adverse effect on national security; and (4) other data processing activities that may have an adverse effect on national security.

On December 28, 2021, the CAC, jointly with 12 other governmental authorities, promulgated the revised Cybersecurity Review Measures (2021), which became effective on February 15, 2022. According to the Cybersecurity Review Measures (2021), critical information infrastructure operators that intend to purchase internet products and services which may have an adverse effect on national security must apply for cybersecurity review. Meanwhile, online platform operators holding personal information of over one million users that intend to list their securities on a foreign stock exchange must apply for cybersecurity review. In the meantime, the governmental authorities have the discretion to initiate a cybersecurity review on any data processing activity if they deem such a data processing activity affects or may affect national security. The specific implementation rules on cybersecurity review are subject to further clarification by subsequent regulations.

On July 7, 2022, the CAC promulgated the Measures for the Security Assessment of Cross-Border Transfer of Data, which took effect on September 1, 2022. These measures aim to regulate cross-border transfers of data, requiring among other things, that data processors that provide data to overseas apply to CAC for security assessments if: (1) data processors provide important data to overseas parties; (2) critical information infrastructure operators and data processors process personal information of more than one million individuals provide personal information to overseas parties; (3) data processors that have cumulatively provided personal information of 100,000 people or sensitive personal information of 10,000 people to overseas parties since January 1 of the previous year, provide personal information to overseas parties; and (4) other scenarios required by the CAC to apply for security assessments are met. In addition, these measures require data processors to carry out self-assessments of risks of providing data to overseas parties before applying to the CAC for security assessments.

Given that the above-mentioned newly promulgated laws, regulations and policies were recently promulgated or issued, and have not yet taken effect (as applicable), their interpretation, application and enforcement are subject to the regulations in force at the time. The Combined Company will not be immediately subject to cybersecurity review with the Cyberspace Administration of China, or the “CAC,” after the Cybersecurity Review Measures became effective on February 15, 2022, since it will not have over one million users’ personal information, which or collect more than one million users’ information in the foreseeable future, which collection (if it were conducted) would subject the combined company to the Cybersecurity Review Measures; and also would not be subject to network data security review by the CAC if the Draft Regulations on the Network Data Security Administration are enacted as proposed, since the combined company will not have over one million users’ personal information

and do not collect data that affects or may affect national security and would not likely collect over one million users’ personal information or data that affects or may affect national security in the foreseeable future, that would otherwise subject us to the Network Data Security Administration Draft.

On February 17, 2023, the CSRC promulgated Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic Companies (the “Overseas Listing Trial Measures”) and circulated five supporting guidelines, which became effective on March 31, 2023. The Overseas Listing Trial Measures will comprehensively improve and reform the existing regulatory regime for overseas offering and listing of PRC domestic companies’ securities and will regulate both direct and indirect overseas offering and listing of PRC domestic companies’ securities by adopting a filing-based regulatory regime.

According to the Overseas Listing Trial Measures, PRC domestic companies that seek to offer and list securities in overseas markets, either in direct or indirect means, are required to fulfill the filing procedure with the CSRC and report relevant information. The Overseas Listing Trial Measures provides that an overseas listing or offering is explicitly prohibited, if any of the following: (1) such securities offering and listing is explicitly prohibited by provisions in laws, administrative regulations and relevant state rules; (2) the intended securities offering and listing may endanger national security as reviewed and determined by competent authorities under the State Council in accordance with law; (3) the domestic company intending to make the securities offering and listing, or its controlling shareholder(s) and the actual controller, have committed relevant crimes such as corruption, bribery, embezzlement, misappropriation of property or undermining the order of the socialist market economy during the latest three years; (4) the domestic company intending to make the securities offering and listing is currently under investigations for suspicion of criminal offenses or major violations of laws and regulations, and no conclusion has yet been made thereof; or (5) there are material ownership disputes over equity held by the domestic company’s controlling shareholder(s) or by other shareholder(s) that are controlled by the controlling shareholder(s) and/or actual controller.

The Overseas Listing Trial Measures also provides that if the issuer meets both the following criteria, the overseas securities offering and listing conducted by such issuer will be deemed as indirect overseas offering by PRC domestic companies: (1) 50% or more of any of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent fiscal year is accounted for by domestic companies; and (2) the main parts of the issuer’s business activities are conducted in mainland China, or its main place(s) of business are located in mainland China, or the majority of senior management staff in charge of its business operations and management are PRC citizens or have their usual place(s) of residence located in mainland China. Where an issuer submits an application for initial public offering to competent overseas regulators, such issuer must file with the CSRC within three business days after such application is submitted. In addition, the Overseas Listing Trial Measures provides that the direct or indirect overseas listings of the assets of domestic companies through one or more acquisitions, share swaps, transfers or other transaction arrangements shall be subject to filing procedures in accordance with the Overseas Listing Trial Measures, which filing shall be submitted within three business days after the issuer submits its application documents relating to the initial public offering and/or listing or after the first public announcement of the relevant transaction (if the submission of relevant application documents is not required). The Overseas Listing Trial Measures also requires subsequent reports to be filed with the CSRC on material events, such as change of control or voluntary or forced delisting of the issuer(s) who have completed overseas offerings and listings.

Guidance for Application of Regulatory Rules — Overseas Offering and Listing No. 1, promulgated by CSRC together with the Overseas Listing Trial Measures, provides that if a domestic enterprise completes an overseas offering through an overseas special purposes acquisition company, it shall submit the filing materials within three business days after such overseas special purposes acquisition company publicly announces such acquisition transaction. In addition, according to the Notice on Administration for the Filing of Overseas Offering and Listing by Domestic Enterprises published by CSRC on its official website on February 17, 2023, companies that have already been listed on overseas stock exchanges prior to March 31, 2023 or the companies that have obtained the approval from overseas supervision administrations or stock exchanges for its offering and listing prior to March 31, 2023 and will complete their overseas offering and listing prior to September 30, 2023 are not required to make immediate filings for its listing, but are required to make filings for subsequent offerings in accordance with the Overseas Listing Trial Measures. Companies that have already submitted an application for an initial public offering to overseas supervision administrations but have not yet obtained the approval from overseas supervision

administrations or stock exchanges for the offering and listing prior to March 31, 2023 may arrange for the filing within a reasonable time period and should complete the required CSRC filing procedure, the completion of which will be published on the CSRC website, before such companies’ overseas issuance and listing.

Because Combined Company had not obtained the approval from the SEC and Nasdaq for the Business Combination prior to March 31, 2023, Huajin believes that in accordance with the abovementioned guidance and rules, it shall complete the filing procedure under the Overseas Listing Trial Measures before the consummation of the Business Combination and the listing of Combined Company’s securities on Nasdaq. Huajin has submitted a filing with the CSRC with respect to the Business Combination. As of the date of this proxy statement/prospectus, Huajin has not completed the filing procedures with the CSRC. If Huajin fails to complete required filing procedures for the Business Combination and the listing of Combined Company’s securities on Nasdaq, the Business Combination may not be consummated. As of the date of this proxy statement/prospectus, other than correspondence with the CSRC in connection with the CSRC filing procedures, Huajin has not received any formal inquiry, notice, warning, sanction, or any regulatory objection from the CSRC with respect to this Business Combination. As the Overseas Listing Trial Measures was newly published and there is uncertainty with respect to the filing requirements and their implementation, Huajin cannot be sure that it will be able to complete such filing in a timely manner or at all. Any failure or perceived failure by Huajin to comply with such filing requirements under the Overseas Listing Trial Measures may result in forced rectification, warnings and fines against Huajin and could materially hinder its ability to consummate the Business Combination. OAKU, Merger Sub and Huajin will not consummate the Business Combination without first completing the CSRC filing and receiving the CSRC approval under the Overseas Listing Trial Measures, even if the securityholders of OAKU have approved the Business Combination in the extraordinary general meeting. See “Risk Factors — Risks Related to Doing Business in Greater China — As some of our operations are conducted in China, recent regulatory developments in China, including an intent indicated by the Chinese governmental authorities to exert more oversight over offerings that are conducted outside the PRC and/or foreign investment in PRC-based issuers, may subject Huajin to additional regulatory review or otherwise restrict or hinder Huajin’s ability to offer securities and raise capital outside the PRC, all of which could materially affect Huajin’s business and cause the value of Huajin’s securities to significantly decline or be worthless.”

On February 24, 2023, the CSRC, the Ministry of Finance, the National Administration of State Secrets Protection and the National Archives Administration released the revised Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies (the “Archives Rules”), which became effective on March 31, 2023. The Archives Rules regulate both overseas direct offerings and overseas indirect offerings, providing that, among other things:

• in relation to the overseas listing activities of PRC enterprises, the PRC enterprises are required to strictly comply with the relevant requirements on confidentiality and archives management, establish a sound confidentiality and archives system, and take necessary measures to implement their confidentiality and archives management responsibilities;

• during the course of an overseas offering and listing, if a PRC enterprise needs to publicly disclose or provide to securities companies or securities service providers and overseas regulators, any materials that contain relevant state secrets, government work secrets or information that has a sensitive impact (i.e. be detrimental to national security or the public interest if divulged), the PRC enterprise should complete the relevant approval/filing and other regulatory procedures; and

• working papers produced in the PRC by securities companies and securities service providers, which provide PRC enterprises with securities services during their overseas issuance and listing, should be stored in the PRC, and competent PRC authorities must approve the transmission of all such working papers to recipients outside the PRC.

Any failure or perceived failure by Huajin to comply with the Archives Rules and the confidentiality requirements and other PRC laws and regulations may result in Huajin being held legally liable by competent authorities.

Many aspects of Huajin’s business depend on obtaining and maintaining licenses, approvals, permits or qualifications from PRC regulators. Obtaining such approvals, licenses, permits or qualifications depends on Huajin’s compliance with regulatory requirements. PRC regulatory authorities also have relatively broad discretion to grant, renew and revoke licenses and approvals and to implement laws and regulations. Based on PRC laws and

regulations currently in effect and subject to different interpretations of these laws and regulations that may be adopted by PRC authorities, the PRC Subsidiaries have obtained the following licenses and approvals necessary to operate in China as of the date of this proxy statement/prospectus: (1) each of the PRC Subsidiaries has obtained a business license; (2) Shaanxi QianXiang has obtained the certificate of second-class medical device operation and commercial franchise enterprise record filing; (3) LeLingKang has obtained the food operation license. Apart from these licenses and approvals, the PRC Subsidiaries and the Affiliated Entities may not be able to maintain existing licenses, permits and approvals and the government authorities may subsequently require the PRC Subsidiaries and the Affiliated Entities to obtain any additional licenses, permits and approvals. If the PRC Subsidiaries fail to obtain the necessary licenses, permits and approvals or inadvertently conclude that any permissions or approvals are not required, or if applicable laws, regulations, or interpretations change and the PRC Subsidiaries are required to obtain such permissions or approvals in the future, the PRC Subsidiaries may be subject to fines, confiscation of revenues generated from incompliant operations or the suspension of relevant operations. The PRC Subsidiaries may also experience adverse publicity arising from such non-compliance with government regulations that negatively impact Huajin. See “Risk Factors — Risks Related to Doing Business in Greater China — Because some of our operations are in China, our business is subject to a certain degree of complex and rapidly evolving laws and regulations there. Regulatory or other governmental bodies may exercise significant oversight over the conduct of our business in People’s Republic of China (the “PRC”), which could result in a material change in our operations following the Business Combination and/or the value of our securities.”

Dividend Distribution and Taxation: In light of Huajin’s holding company structure, Huajin’s, and following the Business Combination, Combined Company’s ability to pay dividends to the shareholders, and to service any debt Huajin may incur, may depend upon dividends paid by Shaanxi WFOE and Beijing WFOE (“WFOEs”) to Huajin, despite that Huajin may obtain financing at the holding company level through other methods. However, the WFOEs in China are subject to certain statutory reserve and solvency conditions before they can distribute dividends or make payment to Huajin, which, if failed, may restrict their ability to pay dividends or make payment to Huajin and Combined Company following the Business Combination. Under PRC laws and regulations, WFOEs are permitted to pay dividends only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Furthermore, WFOEs are required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the companies. The statutory reserve fund requires that annual appropriations of 10% of net after-tax income should be set aside prior to payment of any dividends, until the aggregate amount of such fund reaches 50% of their registered capital. As a result of such restrictions under PRC laws and regulations, Huajin’s PRC Subsidiaries are restricted in their ability to transfer a portion of their net assets to Huajin either in the form of dividends, loans or advances. As of the date of this proxy statement/prospectus, none of Combined Company, Huajin and its subsidiaries has made any dividends or distributions to their respective shareholder(s), including any U.S. investors, nor do they have any present plan to pay any cash dividends in the foreseeable future. Any determination to pay dividends in the future will be at the discretion of the respective board of Combined Company and Huajin. As of the date of this proxy statement/prospectus, none of Huajin, Combined Company, and WFOEs intends to distribute earnings. Combined Company and Huajin are not subject to any restrictions under Cayman Islands law on dividend distribution to their shareholders.

Subject to the “passive foreign investment company” rules and following the Business Combination, the gross amount of any distribution that Combined Company makes to a U.S. Holder (as defined in “Certain Material U.S. Federal Income Tax Considerations”) with respect to the Class A Ordinary Shares (including any amounts withheld to reflect PRC withholding taxes) will be taxable as a dividend for United States federal income tax purposes, to the extent paid out of Combined Company’s current or accumulated earnings and profits, as determined under United States federal income tax principles.

Foreign Exchange Restriction: Huajin, and the PRC Subsidiaries are, and following the Business Combination, Combined Company will be subject to restrictions on foreign exchange and their ability to transfer cash between entities, across borders, and to U.S. investors. Under PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval of SAFE by complying with certain procedural requirements. However, approval from or registration with appropriate government authorities is required where Renminbi is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government imposes controls on the convertibility of RMB into foreign currencies and the remittance of funds out of China, which may restrict the

transfer of cash between Huajin and Combined Company following the Business Combination, its subsidiaries, or the investors. Under PRC laws and regulations, the PRC Subsidiaries are subject to certain restrictions with respect to payment of dividends or otherwise transfers of any of their net assets to Huajin and Combined Company. Remittance of dividends by the PRC Subsidiaries out of China is also subject to certain procedures with the banks designated by the PRC State Administration of Foreign Exchange. These restrictions are benchmarked against the paid-up capital and the statutory reserve funds of the PRC Subsidiaries in which neither Huajin nor Combined Company have legal ownership. While there are currently no such restrictions on foreign exchange and our ability to transfer cash or assets between Huajin and its Hong Kong subsidiary, if certain PRC laws and regulations, including existing laws and regulations and those enacted or promulgated in the future were to become applicable to the Hong Kong subsidiary in the future, and to the extent our cash or assets are in Hong Kong or a Hong Kong entity, such funds or assets may not be available due to interventions in or the imposition of restrictions and limitations on our ability to transfer funds or assets by the PRC government. Furthermore, there can be no assurance that the PRC government will not intervene or impose restrictions on Huajin and Combined Company following the Business Combination, and its subsidiaries to transfer or distribute cash within the organization, which could result in an inability of or prohibition on making transfers or distributions to entities outside of mainland China and Hong Kong. See “Risk Factors — Risks Related to Doing Business in China — Government regulation of currency conversion of and regulations on loans to, and direct investment in, PRC entities by offshore holding companies may delay us from making loans or additional contributions to our PRC subsidiaries, which could restrict our ability to utilize the proceeds from the Business Combination effectively and affect our ability to fund and expand our business.”

Transfer of Cash and Asset: Cash may be transferred within the group in the following manner: (1) Combined Company or Huajin may transfer funds to Combined Company’s or Huajin’s subsidiaries, including the PRC Subsidiaries, by way of capital contributions, inter-group advances or loans; (2) Combined Company’s or Huajin’s subsidiaries, including WFOEs, may make dividends or other distributions to Combined Company or Huajin; (3) Combined Company’s or Huajin’s PRC subsidiaries may lend to and borrow from each other from time to time for business operation purposes. Cash is transferred within the group to satisfy working capital requirement of the respective operating entities, and is managed by Huajin’s finance department based on fund control policy and procedure. As of the date of this proxy statement/prospectus, no transfers, dividends or distributions have been made among Combined Company, Huajin, and its subsidiaries, or to investors; and no other cash flows and transfers of other assets by type have occurred between Combined Company, Huajin, and its PRC Subsidiaries. As an offshore holding company, Huajin and Combined Company following the Business Combination may use the proceeds of its offshore fund-raising activities to provide loans or make capital contributions to the PRC Subsidiaries, in each case subject to the satisfaction of applicable regulatory requirements. See “— Dividend Distribution and Taxation” and “— Foreign Exchange Restriction.”

To vote its public shares or OAKU Ordinary Shares (as the case may be) at the special meeting on the Business Combination Proposal (as defined in Proposal No. 1 of this proxy statement), a shareholder must be entered in the register of members of the Company as a shareholder (hereinafter a “Member”) as of __________, 2024, the record date for the extraordinary general meeting (the “Record Date”). Accordingly, if you purchase public shares after the Record Date you will not be able to redeem your shares upon consummation of the Business Combination unless you either (i) have a written agreement from the seller/transferor of the public shares whereby the seller/transferor agrees to vote the shares in accordance with your instructions, or (ii) obtain a proxy from the seller/transferor which authorizes you to vote the public shares held in record name of the seller/transferor and must actually vote such public shares on the Business Combination Proposal.