Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended __________

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: March 29, 2023

Commission File Number: 001-41670

Apollomics Inc.

(Exact name of Registrant as specified in its charter)

| Not applicable | Cayman Islands | |

| (Translation of Registrant’s name into English) |

(Jurisdiction of incorporation or organization) |

989 E. Hillsdale Blvd., Suite 220

Foster City, California 94404

(Address of principal executive offices)

Copy to:

Sanjeev Redkar

President

989 E. Hillsdale Blvd., Suite 220

Foster City, California 94404

Telephone: (650) 209-4055

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Class A ordinary shares, par value $0.0001 per share | APLM | The Nasdaq Stock Market LLC | ||

| Warrants, each exercisable to purchase one Class A ordinary share at an exercise price of $11.50 per share | APLMW | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the shell company report:

On March 31, 2023, the issuer had 6,412,705 Class A ordinary shares, par value $0.0001 per share, and 80,383,133 Class B ordinary shares, par value $0.0001 per share, outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ | |||||

| Emerging growth company | ☒ | |||||||||

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issue by the International Accounting Standards Board | ☒ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☐

Table of Contents

i

Table of Contents

| C. |

Markets | 10 | ||||

| D. |

Selling Shareholders | 10 | ||||

| E. |

Dilution | 10 | ||||

| F. |

Expenses of the Issue | 10 | ||||

| ITEM 10. |

ADDITIONAL INFORMATION | 10 | ||||

| A. |

Share Capital | 10 | ||||

| B. |

Memorandum and Articles of Association | 10 | ||||

| C. |

Material Contracts | 10 | ||||

| D. |

Exchange Controls and Other Limitations Affecting Security Holders | 11 | ||||

| E. |

Taxation | 11 | ||||

| F. |

Dividends and Paying Agents | 11 | ||||

| G. |

Statement by Experts | 11 | ||||

| H. |

Documents on Display | 11 | ||||

| I. |

Subsidiary Information | 12 | ||||

| ITEM 11. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISKS | 12 | ||||

| ITEM 12. |

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 12 | ||||

| 12 | ||||||

| 12 | ||||||

| ITEM 17. |

FINANCIAL STATEMENTS | 12 | ||||

| ITEM 18. |

FINANCIAL STATEMENTS | 12 | ||||

ii

Table of Contents

On March 29, 2023 (the “Closing Date”), Apollomics Inc., a Cayman Islands exempted company (“Apollomics” or the “Company”), consummated the previously announced business combination pursuant to the Business Combination Agreement (as amended, the “BCA”), by and among the Company, Maxpro Capital Acquisition Corp., a Delaware Corporation (“Maxpro”), and Project Max SPAC Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Apollomics (“Merger Sub”).

The following transactions occurred pursuant to the terms of the BCA (collectively, the “Business Combination”):

| • | Immediately prior to the closing of the Business Combination (the “Closing”), Maxpro’s issued and outstanding shares of Class B common stock, par value $0.0001 per share (the “Maxpro Class B Common Stock”), converted on a one-for-one basis into shares of Maxpro’s Class A common stock, par value $0.0001 per share (the “Maxpro Class A Common Stock,” and, together with the Maxpro Class B Common Stock, the “Maxpro Common Stock”). |

| • | On the Closing Date, Merger Sub merged with and into Maxpro (the “Merger”), following which the separate existence of Merger Sub ceased and Maxpro continued, as a result of which: (A) Maxpro became a wholly-owned subsidiary of Apollomics; (B) each issued and outstanding unit of Maxpro, consisting of one share of Maxpro Class A Common Stock and one warrant (the “Maxpro Warrants”), became automatically detached; (C) in consideration for the acquisition of all of the issued and outstanding Maxpro Class A Common Stock (as a result of the Business Combination), Apollomics issued one Class A ordinary share, par value $0.0001 per share (“Apollomics Class A Ordinary Shares”) for each share of Maxpro Class A Common Stock acquired by virtue of the Business Combination; and (D) each issued and outstanding Maxpro Warrant to purchase a share of Maxpro Class A Common Stock was assumed by Apollomics (an “Apollomics Warrant,” which consists of “Apollomics Public Warrants” and “Apollomics Private Warrants,” corresponding to Maxpro’s Public Warrants and Private Warrants, respectively) and became exercisable for one Apollomics Class A Ordinary Share. |

| • | Immediately prior to the Closing, each Apollomics preferred share, par value $0.0001 per share (“Pre-Closing Apollomics Preferred Shares”) was converted (the “Pre-Closing Conversion”) into one ordinary share of Apollomics, par value $0.0001 per share (“Pre-Closing Apollomics Ordinary Shares”). |

| • | Immediately following the Pre-Closing Conversion, but prior to the Closing, each issued and outstanding Pre-Closing Apollomics Ordinary Share was converted (the “Share Split”) into a number of Class B ordinary shares, par value $0.0001 per share (“Apollomics Class B Shares” and, together with the Apollomics Class A Ordinary Shares, the “Post-Closing Apollomics Ordinary Shares”), equal to (as rounded down to the nearest whole number) the product of (A) the number of Apollomics Pre-Closing Ordinary Shares which the option had the right to acquire immediately prior to the Share Split, multiplied by (B) the Exchange Ratio. The “Exchange Ratio” was equal to 89.9 million Pre-Closing Apollomics Ordinary Shares divided by the aggregate number of fully-diluted Apollomics shares (as further described in the BCA) immediately prior to the Share Split. Pursuant to the BCA, the Apollomics board of directors (the “Apollomics Board”), determined to issue 3,099,990 Apollomics Class A Ordinary Shares in place of 3,099,990 Apollomics Class B Ordinary Shares to the legacy shareholders of Apollomics pursuant to this paragraph. |

| • | Each outstanding option to purchase a Pre-Closing Apollomics Ordinary Share, whether vested or unvested, immediately prior to the Merger, was also adjusted such that each option will (i) has the right to acquire a number of Apollomics Class B Ordinary Shares equal to (as rounded down to the nearest whole number) the product of (A) the number of Pre-Closing Apollomics Ordinary Shares which the option had the right to acquire immediately prior to the Share Split, multiplied by (B) the Exchange Ratio; and (ii) have an exercise price equal to (as rounded up to the nearest whole cent) the quotient of (A) the exercise price of the option immediately prior to the Share Split, divided by (B) the Exchange Ratio. |

iii

Table of Contents

On February 9, 2023, in connection with the Business Combination, Apollomics entered into Subscription Agreements (the “Subscription Agreements”) with certain accredited investors including Maxpro Investment Co., Ltd., an affiliate of MP One Investment LLC, a Delaware limited liability company, Maxpro’s sponsor (the “Sponsor”) (collectively, the “PIPE Investors”), pursuant to which the PIPE Investors subscribed to purchase an aggregate of (i) 230,000 Apollomics Class B Ordinary Shares at $10.00 per share (“PIPE Class B Shares”) and (ii) 2,135,000 Series A Preferred Shares of Apollomics (the “Apollomics Series A Preferred Shares” and, together with the PIPE Class B Shares, the “PIPE Shares”) at $10.00 per share, for gross proceeds to Apollomics of $23,650,000. Each Apollomics Series A Preferred Share is convertible, at any time at the option of the holder thereof, into Apollomics Class A Ordinary Shares at an initial conversion ratio of 1:1.25. Each PIPE Investor who subscribed for PIPE Class B Shares received one-fourth of one warrant of Apollomics (the “Penny Warrants” and, together with the PIPE Shares, the “PIPE Securities”) for every PIPE Class B Share purchased, each whole Penny Warrant exercisable to purchase one Apollomics Class A Ordinary Share for $0.01 per share (collectively, the “PIPE Financing”). Maxpro Investment Co., Ltd. has subscribed to purchase 2,100,000 of such Apollomics Series A Preferred Shares for an aggregate purchase price of $21,000,000. The PIPE Financing closed immediately prior to the Business Combination.

The Apollomics Class A Ordinary Shares and the Apollomics Warrants are traded on The Nasdaq Stock Market LLC (“Nasdaq”) under the symbols “APLM” and “APLMW”, respectively.

Except as otherwise indicated or required by context, references in this Shell Company Report on Form 20-F (the “Report”) to “we”, “us”, “our”, “Apollomics” or the “Company” refer to Apollomics Inc., a Cayman Islands exempted company.

iv

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report and the documents incorporated by reference herein include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements relate to, among others, our plans, objectives and expectations for our business, operations and financial performance and condition, and can be identified by terminology such as “may”, “should”, “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “continue” and similar expressions that do not relate solely to historical matters. Forward-looking statements are based on management’s belief and assumptions and on information currently available to management. Although we believe that the expectations reflected in forward-looking statements are reasonable, such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements.

Forward-looking statements in this Report and in any document incorporated by reference in this Report may include, but are not limited to, statements about:

| • | the ability of Apollomics to realize the benefits expected from the Business Combination and to maintain the listing of the Apollomics Class A Ordinary Shares on Nasdaq; |

| • | changes in global, regional or local business, market, financial, political and legal conditions, including the development, effects and enforcement of laws and regulations and the impact of any current or new government regulations in the United States and China affecting Apollomics’ operations and the continued listing of Apollomics’ securities; |

| • | Apollomics’ success in retaining or recruiting, or changes required in, its officers, key employees or directors; |

| • | factors relating to the business, operations and financial performance of Apollomics, including, but not limited to: |

| • | Apollomics’ ability to achieve successful clinical results; |

| • | Apollomics currently has no products approved for commercial sale; |

| • | Apollomics’ ability to obtain regulatory approval for its products, and any related restrictions or limitations of any approved products; |

| • | Apollomics’ ability to obtain licensing of third-party intellectual property rights for future discovery and development of Apollomics’ oncology projects; |

| • | Apollomics’ ability to commercialize product candidates and achieve market acceptance of such product candidates; |

| • | Apollomics’ success is dependent on drug candidates which it licenses from third parties; |

| • | Apollomics’ ability to respond to general economic conditions; |

| • | Apollomics has incurred significant losses since inception, and it expects to incur significant losses for the foreseeable future and may not be able to achieve or sustain profitability in the future; |

| • | Apollomics requires substantial additional capital to finance its operations, and if it is unable to raise such capital when needed or on acceptable terms, it may be forced to delay, reduce, and/or eliminate one or more of its development programs or future commercialization efforts; and |

| • | Apollomics’ ability to develop and maintain effective internal controls; |

| • | assumptions regarding interest rates and inflation; |

| • | competition and competitive pressures from other companies worldwide in the industries in which Apollomics operates; and |

| • | litigation and the ability to adequately protect Apollomics’ intellectual property rights. |

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors discussed under the “Risk Factors” section of the proxy statement/prospectus (the “Proxy Statement/Prospectus”) forming a part of the Registration Statement on Form F-4 of the Company (File No. 333-268525) (the “Registration Statement”) filed in connection with the Business Combination, which section is incorporated herein by reference. Accordingly, you should not rely on these forward-

1

Table of Contents

looking statements, which speak only as of the date of this Report. We undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this Report or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks described in the reports we will file from time to time with the SEC after the date of this Report.

Although we believe the expectations reflected in the forward-looking statements were reasonable at the time made, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy or completeness of any of these forward-looking statements. You should carefully consider the cautionary statements contained or referred to in this section in connection with the forward looking statements contained in this Report and any subsequent written or oral forward-looking statements that may be issued by the Company or persons acting on its behalf.

2

Table of Contents

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

| A. | Directors and Senior Management |

Information regarding the directors and executive officers of the Company after the closing of the Business Combination is included in the Proxy Statement/Prospectus under the section titled “Management of Apollomics Following the Business Combination” and is incorporated herein by reference.

The business address for each of the directors and executive officers of the Company is 989 E. Hillsdale Boulevard, Suite 220, Foster City, California 94404.

| B. | Advisers |

White & Case LLP, 555 South Flower Street, Suite 2700, Los Angeles, California, United States, has acted as U.S. securities counsel for the Company and will continue to act as U.S. securities counsel to the Company following the completion of the Business Combination.

Conyers Dill & Pearman LLP, Cricket Square, Hutchins Drive, PO Box 2681, Grand Cayman KY1-1111, Cayman Islands, has acted as counsel for the Company with respect to Cayman Islands law and will continue to act as counsel for the Company with respect to Cayman Islands law following the completion of the Business Combination.

| C. | Auditors |

For the years ended December 31, 2021 and 2020, Deloitte Touche Tohmatsu Certified Public Accountants LLP, has acted as the independent registered public accounting firm for the Company and is expected to continue to act as the Company’s independent registered public accounting firm for the year ended December 31, 2022.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

| A. | [Reserved.] |

| B. | Capitalization and Indebtedness |

The following table sets forth the capitalization of the Company on an unaudited pro forma combined basis as of June 30, 2022, after giving effect to the Business Combination and the PIPE Financing:

| As of June 30, 2022 |

||||

| Pro Forma | ||||

| (in thousands) |

||||

| Cash and cash equivalents |

$ | 61,696 | ||

|

|

|

|||

| Equity: |

||||

| Class A ordinary shares |

1 | |||

| Class B ordinary shares |

9 | |||

| Series A preferred shares |

20,126 | |||

| Share premium |

308,531 | |||

| Reserves |

48,529 | |||

| Accumulated loss |

(281,672 | ) | ||

|

|

|

|||

| Total equity: |

95,524 | |||

|

|

|

|||

| Total capitalization |

$ | 95,524 | ||

|

|

|

|||

3

Table of Contents

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

The risk factors related to the business and operations of Apollomics are described in the Proxy Statement/Prospectus under the section titled “Risk Factors”, which is incorporated herein by reference.

| ITEM 4. | INFORMATION ON THE COMPANY |

| A. | History and Development of the Company |

See “Explanatory Note” in this Report for additional information regarding the Company and the BCA. Certain additional information about the Company is included in the Proxy Statement/Prospectus under the section titled “Information About Apollomics” and is incorporated herein by reference. The material terms of the Business Combination are described in the Proxy Statement/Prospectus under the section titled “The Business Combination Agreement,” which is incorporated herein by reference.

The Company is subject to certain of the informational filing requirements of the Exchange Act. Since the Company is a “foreign private issuer,” it is exempt from the rules and regulations under the Exchange Act prescribing the furnishing and content of proxy statements, and the officers, directors and principal shareholders of the Company are exempt from the reporting and “short-swing” profit recovery provisions contained in Section 16 of the Exchange Act with respect to their purchase and sale of Apollomics Class A Ordinary Shares. In addition, the Company is not required to file reports and financial statements with the SEC as frequently or as promptly as U.S. public companies whose securities are registered under the Exchange Act. However, the Company is required to file with the SEC an Annual Report on Form 20-F containing financial statements audited by an independent accounting firm. The SEC also maintains a website at www.sec.gov that contains reports and other information that the Company files with or furnishes electronically to the SEC.

The website address of the Company is www.apollomicsinc.com. The information contained on the website does not form a part of, and is not incorporated by reference into, this Report.

| B. | Business Overview |

Information regarding the business of Apollomics is included in the Proxy Statement/Prospectus under the sections titled “Information About Apollomics” and “Apollomics’ Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which are incorporated herein by reference.

4

Table of Contents

| C. | Organizational Structure |

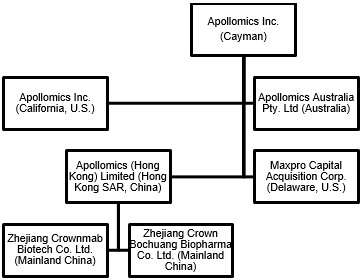

Apollomics was originally formed as CB Therapeutics Inc. as a result of a spin-off of Crown Bioscience International, which was completed on December 31, 2015. Apollomics conducts its operations through its subsidiaries based in California (headquarters), Australia, China and Hong Kong, which are listed below:

| Name |

Country of Incorporation and Place of Business |

Proportion of Ordinary Shares Held by Apollomics |

||||

| Apollomics Inc. |

California, United States | 100 | % | |||

| Maxpro Capital Acquisition Corp. |

Delaware, United States | 100 | % | |||

| Apollomics (Australia) Pty Ltd. |

Australia | 100 | % | |||

| Apollomics (Hong Kong) Limited |

Hong Kong SAR, China | 100 | % | |||

| Zhejiang Crownmab Biotech Co. Ltd. |

Mainland China | 100 | % | |||

| Zhejiang Crown Bochuang Biopharma Co. Ltd. |

Mainland China | 100 | % | |||

The diagram below depicts a simplified version of Apollomics immediately following the consummation of the Business Combination.

| D. | Property, Plants and Equipment |

Information regarding the facilities of Apollomics is included in the Proxy Statement/Prospectus under the section titled “Information About Apollomics— Facilities,” which is incorporated herein by reference.

5

Table of Contents

| ITEM 4A. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

The discussion and analysis of the financial condition and results of operations of Apollomics is included in the Proxy Statement/Prospectus under the section titled “Apollomics’ Management’s Discussion and Analysis of Financial Condition and Results of Operations”, which is incorporated herein by reference.

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

| A. | Directors and Senior Management |

Information regarding the directors and executive officers of the Company after the closing of the Business Combination is included in the Proxy Statement/Prospectus under the section titled “Management of Apollomics Following the Business Combination” and is incorporated herein by reference.

| B. | Compensation |

Information regarding the compensation of the directors and executive officers of the Company, including a summary of the Apollomics Inc. 2023 Incentive Plan, which was approved by the shareholders of the Company prior to the completion of the Business Combination, is included in the Proxy Statement/Prospectus under the section titled “Executive Compensation” and is incorporated herein by reference.

Indemnification

The Company has entered into indemnification agreements with its directors and executive officers. Information regarding such indemnification agreements is included in the Proxy Statement/Prospectus under the section titled “Management of Apollomics Following the Business Combination — Limitation on Liability and Indemnification of Officers and Directors” and is incorporated herein by reference.

| C. | Board Practices |

Information regarding the board of directors of the Company subsequent to the Business Combination is included in the Proxy Statement/Prospectus under the section titled “Management of Apollomics Following the Business Combination” and is incorporated herein by reference.

| D. | Employees |

Information regarding the employees of Apollomics is included in the Proxy Statement/Prospectus under the section titled “Information About Apollomics— Employees and Human Capital Resources” and is incorporated herein by reference.

| E. | Share Ownership |

Information regarding the ownership of the Post-Closing Apollomics Ordinary Shares by our directors and executive officers is set forth in Item 7.A of this Report.

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

| A. | Major Shareholders |

The following table sets forth information relating to the beneficial ownership of the Post-Closing Apollomics Ordinary Shares as of the Closing Date by:

| • | each person, or group of affiliated persons, known by us to beneficially own more than 5% of outstanding Apollomics Class A Ordinary Shares or Apollomics Class B Ordinary Shares; |

| • | each of our directors; |

| • | each of our executive officers; and |

6

Table of Contents

| • | all of our directors and executive officers as a group. |

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, and includes shares underlying options and warrants that are currently exercisable or exercisable within 60 days. In computing the number of shares beneficially owned by a person or entity and the percentage ownership of that person or entity in the table below, all shares subject to options or warrants held by such person or entity were deemed outstanding if such securities are currently exercisable, or exercisable within 60 days of the Closing Date. These shares were not deemed outstanding, however, for the purpose of computing the percentage ownership of any other person or entity.

The percentage of Apollomics Class A Ordinary Shares or Apollomics Class B Ordinary Shares beneficially owned is computed on the basis of 6,257,455 Apollomics Class A Ordinary Shares and 80,383,133 Apollomics Class B Ordinary Shares outstanding on the Closing Date, after giving effect to the Business Combination and the PIPE Financing.

7

Table of Contents

Unless otherwise indicated, we believe that all persons named in the table below have sole voting and investment power with respect to all Post-Closing Apollomics Ordinary Shares beneficially owned by them. To our knowledge, no Post-Closing Apollomics Ordinary Shares beneficially owned by any executive officer, director or director nominee have been pledged as security.

| Number of Apollomics Class A Ordinary Shares Beneficially Owned |

Percentage of Outstanding Apollomics Class A Ordinary Shares |

Number of Apollomics Class B Ordinary Shares Beneficially Owned |

Percentage of Outstanding Apollomics Class B Ordinary Shares |

Percentage of Total Voting Power |

||||||||||||||||

| 5% Holders: |

||||||||||||||||||||

| OrbiMed Advisors LLC(1)(2) |

662,561 | 10.5 | % | 17,331,074 | 21.6 | % | 20.8 | % | ||||||||||||

| Alpha Intelligence Enterprises Limited(1) |

288,598 | 4.6 | % | 7,461,932 | 9.3 | % | 8.9 | % | ||||||||||||

| Shanghai Chongmao Investment Center LP(1) |

275,441 | 4.4 | % | 7,121,771 | 8.9 | % | 8.5 | % | ||||||||||||

| MP One Investment LLC(3) |

3,721,300 | 54.1 | % | — | — | 10.8 | % | |||||||||||||

| Name and Address of Beneficial Owners Executive Officers and Directors |

||||||||||||||||||||

| Dr. Guo-Liang Yu(1) |

191,655 | 6.2 | % | 4,955,400 | 6.2 | % | 5.9 | % | ||||||||||||

| Dr. Sanjeev Redkar(1) |

142,379 | 4.6 | % | 3,681,321 | 4.6 | % | 4.4 | % | ||||||||||||

| Dr. Lijuan Jane Wang(1) |

— | — | — | — | — | |||||||||||||||

| Dr. Kin-Hung Peony Yu(1) |

— | — | — | — | — | |||||||||||||||

| Dr. Kenneth C. Carter(10) |

— | — | — | — | — | |||||||||||||||

| Dr. Hong-Jung (Moses) Chen(3)(4) |

6,420,050 | 67.3 | % | — | — | 7.1 | % | |||||||||||||

| Wendy Hayes(1) |

— | — | — | — | — | |||||||||||||||

| Glenn S. Vraniak(1) |

— | — | — | — | — | |||||||||||||||

| Dr. Jonathan Wang(1) |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| All Executive Officers and Directors as a Group |

6,754,084 | 78.1 | % | 8,636,721 | 10.8 | % | 17.4 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | The address of this securityholder is c/o Apollomics Inc., 989 E. Hillsdale Blvd., Suite 220, Foster City, California 94404. |

| (2) | 17,993,635 Post-Closing Apollomics Ordinary Shares, consisting of (i) 595,146 Apollomics Class A ordinary Shares and (ii) 15,588,012 Apollomics Class B Ordinary Shares (consisting of (i) 15,388,012 Apollomics Class B Ordinary Shares to be issued as part of the consideration issued to existing Apollomics shareholders as part of the Business Combination and (ii) 200,000 Apollomics Class B Ordinary Shares to be issued as part of the PIPE Financing) will be held of record by OrbiMed Asia Partners II, LP (“OAP2”) following the Closing. In addition, 1,810,477 Post-Closing Apollomics Ordinary Shares, consisting of 67,415 Apollomics Class A Ordinary Shares and 1,743,062 Apollomics Class B Ordinary Shares, will be held of record by OrbiMed Asia Partners, LP (“OAP” and, together with OAP2, the “OrbiMed Entities”) following the Closing. OrbiMed Advisors LLC (“OrbiMed Advisors”) is the advisory company to the OrbiMed Entities. OrbiMed Advisors may be deemed to have voting power and investment power over the securities held by the OrbiMed Entities and, as a result, may be deemed to have beneficial ownership over such securities. OrbiMed Advisors exercises voting and investment power through a management committee comprised of Carl L. Gordon, Sven H. Borho and W. Carter Neild, each of whom disclaims beneficial ownership of the securities held by the OrbiMed Entities, except to the extent of their pecuniary interest therein. |

| (3) | The address of this securityholder is c/o Maxpro Capital Acquisition Corp., 5/F-4, No. 89, Songren Road, Xinyi District, Taipei City 11073. Includes 619,400 Apollomics Class A Ordinary Shares issuable within 60 days of consummation of the Business Combination, consisting of (i) 464,150 Apollomics Class A Ordinary Shares underlying the Private Warrants and (ii) 155,250 Apollomics Class A Ordinary Shares underlying the warrants underlying the units issued to the securityholder pursuant to a convertible promissory note. MP One Investment LLC, Maxpro’s sponsor, is the record holder of the securities reported herein. MP One Investment LLC is controlled by Chen, Hong - Jung (Moses), Maxpro’s Chairman and Chief Executive Officer, and Song, Yung-Fong (Ron), Maxpro’s Chief Strategy Officer. By virtue of this relationship, Chen, Hong - Jung (Moses) and Song, Yung-Fong (Ron) may be deemed to share beneficial ownership of the securities held of record by the Sponsor. Chen, Hong - Jung (Moses) and Song, Yung-Fong (Ron) each disclaims any such beneficial ownership except to the extent of his pecuniary interest. |

8

Table of Contents

| (4) | Includes 2,668,750 Apollomics Class A Ordinary Shares issuable upon conversion of 2,135,000 Apollomics Series A Preferred Shares issued to Maxpro Investment Co., Ltd. in the PIPE Financing. Maxpro Investment Co., Ltd. is controlled by Chen, Hong - Jung (Moses), Maxpro’s Chief Executive Officer and Chairman, and Chen, Yi - Kuei (Alex), a member of the Maxpro Board. By virtue of this relationship, Chen, Hong - Jung (Moses) and Chen, Yi - Kuei (Alex) may be deemed to share beneficial ownership of the securities held of record by Maxpro Investment Co., Ltd. Chen, Hong - Jung (Moses) and Chen, Yi - Kuei (Alex) each disclaims any such beneficial ownership except to the extent of his pecuniary interest. |

| B. | Related Party Transactions |

Information regarding certain related party transactions is included in the Proxy Statement/Prospectus under the section titled “Certain Relationships and Related Person Transactions—Apollomics” and is incorporated herein by reference.

| C. | Interests of Experts and Counsel |

None.

| ITEM 8. | FINANCIAL INFORMATION |

| A. | Consolidated Statements and Other Financial Information |

See Item 18 of this Report for consolidated financial statements and other financial information.

| B. | Significant Changes |

A discussion of significant changes since December 31, 2021 and June 30, 2022, respectively, is provided under Item 4 of this Report and is incorporated herein by reference.

| ITEM 9. | THE OFFER AND LISTING |

| A. | Offer and Listing Details |

Nasdaq Listing of Apollomics Class A Ordinary Shares and Apollomics Warrants

The Apollomics Class A Ordinary Shares and Apollomics Warrants are listed on Nasdaq under the symbols “APLM” and “APLMW”, respectively. Holders of the Apollomics Class A Ordinary Shares and Apollomics Warrants should obtain current market quotations for their securities.

Lock-ups

Information regarding the lock-up restrictions applicable to the Class A Ordinary Shares is included in the Proxy Statement/Prospectus under the section titled “Related Agreements” and is incorporated herein by reference.

In addition, pursuant to the Company’s sixth Amended and Restated Memorandum & Articles of Association (the “MAA”), the Apollomics Class B Ordinary Shares are subject to a lock-up whereby such shareholders are prohibited from transferring such shares for a period of six months after the Closing Date. Upon the sixth month anniversary of the Closing Date, such shares will be converted to Apollomics Class A Ordinary Shares on a one-for-one basis, and will be listed on Nasdaq.

Further, pursuant to the MAA, the Apollomics Series A Preferred Shares or any Apollomics Class A Ordinary Shares into which such Apollomics Series A Preferred Shares may be converted, are not transferrable until six months after the Closing Date. At such time, such shares then converted into Apollomics Class A Ordinary Shares will be listed on Nasdaq. Upon the fifth anniversary of the Closing Date, the Apollomics Series A Preferred Shares will automatically convert into Apollomics Class A Ordinary Shares.

9

Table of Contents

Warrants

Upon the completion of the Business Combination, there were 10,969,400 Apollomics Warrants outstanding. The Warrants, which entitle the holder to purchase one Class A Ordinary Share at an exercise price of $11.50 per share, will become exercisable 30 days after the completion of the Business Combination. The Warrants will expire five years after the completion of the Business Combination or earlier upon redemption or liquidation in accordance with their terms.

In addition, the Penny Warrants are exercisable for Apollomics Class A Ordinary Shares beginning six months after the Closing Date and expire five years following the Closing Date, after which time the Penny Warrants shall automatically be cashlessly exercised. The Apollomics Class A Ordinary Shares issuable upon exercise of the Penny Warrants are expected to be listed on Nasdaq.

| B. | Plan of Distribution |

Not applicable.

| C. | Markets |

The Class A Ordinary Shares and Warrants are listed on Nasdaq under the symbols APLM and APLMW, respectively. There can be no assurance that the Ordinary Shares and/or Warrants will remain listed on Nasdaq.

| D. | Selling Shareholders |

Not applicable.

| E. | Dilution |

Not applicable.

| F. | Expenses of the Issue |

Not applicable.

| ITEM 10. | ADDITIONAL INFORMATION |

| A. | Share Capital |

The share capital of the Company is $65,000 divided into 650,000,000 shares of a par value of $0.0001 each, which comprise of (i) 500,000,000 Apollomics Class A Ordinary Shares, (ii) 100,000,000 Apollomics Class B Ordinary Shares and (iii) 50,000,000 preference shares, of which 3,100,000 preference shares are designated as Apollomics Series A Preferred Shares.

Information regarding our share capital is included in the Proxy Statement/Prospectus under the section titled “Description of Apollomics’ Share Capital and Articles of Association” and is incorporated herein by reference.

| B. | Memorandum and Articles of Association |

Information regarding certain material provisions of the MAA is included in the Proxy Statement/Prospectus under the section titled “Description of Apollomics’ Share Capital and Articles of Association” and is incorporated herein by reference.

| C. | Material Contracts |

Information regarding certain material contracts is included in the Proxy Statement/Prospectus under the sections titled “The Business Combination Agreement” and “Related Agreements” and is incorporated herein by reference.

10

Table of Contents

| D. | Exchange Controls and Other Limitations Affecting Security Holders |

There are no governmental laws, decrees, regulations or other legislation in the Cayman Islands that may affect the import or export of capital, including the availability of cash and cash equivalents for use by Apollomics, or that may affect the remittance of dividends, interest, or other payments by Apollomics to non-resident holders of its Post-Closing Apollomics Ordinary Shares. There is no limitation imposed by the laws of the Cayman Islands or in the MAA on the right of non-residents to hold or vote shares.

| E. | Taxation |

Information regarding certain tax consequences of owning and disposing of Apollomics Class A Ordinary Shares and Apollomics Warrants is included in the Proxy Statement/Prospectus under the section titled “Certain Material Tax Considerations” and “Material Cayman Islands Tax Considerations” and is incorporated herein by reference.

| F. | Dividends and Paying Agents |

Apollomics has not paid any dividends to its shareholders. Following the completion of the Business Combination, Apollomics’ board of directors will consider whether or not to institute a dividend policy. The determination to pay dividends will depend on many factors, including, among others, Apollomics’ financial condition, current and anticipated cash requirements, contractual restrictions and financing agreement covenants, solvency tests imposed by applicable corporate law and other factors that Apollomics’ board of directors may deem relevant.

| G. | Statement by Experts |

The financial statements of Maxpro Capital Acquisition Corp. as of December 31, 2021 and for the period from June 2, 2021 (inception) through December 31, 2021 appearing in the Proxy Statement/Prospectus have been audited by MaloneBailey, LLP, independent registered public accounting firm, as set forth in their report thereon, appearing elsewhere therein, and are included in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The consolidated financial statements of Apollomics Inc. as of December 31, 2020 and 2021, and for each of the two years in the period ended December 31, 2021, included in the Proxy Statement/Prospectus, have been audited by Deloitte Touche Tohmatsu Certified Public Accountants LLP, an independent registered public accounting firm, as stated in their report appearing elsewhere therein. Such consolidated financial statements are included in reliance upon the report of such firm given their authority as experts in accounting and auditing. The office of Deloitte Touche Tohmatsu Certified Public Accountants LLP is located at Shenzhen, People’s Republic of China.

| H. | Documents on Display |

We are subject to the informational requirements of the Exchange Act. Accordingly, we are required to file reports and other information with the SEC, including annual reports on Form 20-F and reports on Form 6-K. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information we have filed electronically with the SEC. As a foreign private issuer, we are exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements, and our executive officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we are not required under the Exchange Act to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

We also make available on our website, free of charge, our Annual Report and the text of our reports on Form 6-K, including any amendments to these reports, as well as certain other SEC filings, as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. Our website address is www.apollomicsinc.com. The reference to our website is an inactive textual reference only, and information contained therein or connected thereto is not incorporated into this Form 20-F.

11

Table of Contents

| I. | Subsidiary Information |

Not applicable.

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISKS |

Information regarding quantitative and qualitative disclosure about market risk is included in the Proxy Statement/Prospectus under the section titled “Apollomics’ Management’s Discussion and Analysis of Financial Condition and Results of Operations — Quantitative and Qualitative Disclosures about Market Risk” and is incorporated herein by reference.

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

Information pertaining to the Apollomics Warrants and the Penny Warrants is described in the Proxy Statement/Prospectus under the section titled “Description of Apollomics’ Share Capital and Articles of Association—Warrants.”

Not applicable.

| ITEM 17. | FINANCIAL STATEMENTS |

See Item 18.

| ITEM 18. | FINANCIAL STATEMENTS |

The audited consolidated financial statements of Apollomics Inc. and the audited financial statements of Maxpro Capital Acquisition Corp. are incorporated by reference to pages F-2 to F-111 of the Proxy Statement/Prospectus.

The unaudited pro forma condensed combined financial statements of Apollomics Inc. and Maxpro Capital Acquisition Corp. are attached as Exhibit 15.1 to this Report.

| ITEM 19. | EXHIBITS |

12

Table of Contents

| * | Filed herewith. |

13

Table of Contents

SIGNATURE

The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this report on its behalf.

| APOLLOMICS INC. | ||||||

| March 31, 2023 | By: | /s/ Guo-Liang Yu | ||||

| Name: Guo-Liang Yu | ||||||

| Title: Chief Executive Officer and Chairman of the Board of Directors | ||||||

14