0001944048DEF 14AFALSE00019440482023-01-022023-12-31iso4217:USD0001944048ecd:PeoMemberkvue:EquityAwardsReportedValueMember2023-01-022023-12-310001944048ecd:NonPeoNeoMemberkvue:EquityAwardsReportedValueMember2023-01-022023-12-310001944048kvue:ChangeInPensionValueMemberecd:PeoMember2023-01-022023-12-310001944048kvue:ChangeInPensionValueMemberecd:NonPeoNeoMember2023-01-022023-12-310001944048ecd:PeoMemberkvue:PensionServiceCostAndAssociatedPriorServiceCostMember2023-01-022023-12-310001944048kvue:PensionServiceCostAndAssociatedPriorServiceCostMemberecd:NonPeoNeoMember2023-01-022023-12-310001944048kvue:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2023-01-022023-12-310001944048kvue:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2023-01-022023-12-310001944048ecd:PeoMemberkvue:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-022023-12-310001944048ecd:NonPeoNeoMemberkvue:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-022023-12-310001944048ecd:PeoMemberkvue:EquityAwardsGrantedDuringTheYearVestedMember2023-01-022023-12-310001944048ecd:NonPeoNeoMemberkvue:EquityAwardsGrantedDuringTheYearVestedMember2023-01-022023-12-310001944048kvue:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2023-01-022023-12-310001944048kvue:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2023-01-022023-12-310001944048ecd:PeoMemberkvue:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-022023-12-310001944048kvue:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2023-01-022023-12-310001944048kvue:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMember2023-01-022023-12-310001944048kvue:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2023-01-022023-12-31000194404812023-01-022023-12-31000194404822023-01-022023-12-31000194404832023-01-022023-12-31

| | |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

|

|

SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 |

|

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| | | | | |

Check the appropriate box: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under Rule 14a-12 |

Kenvue Inc.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

| | | | | |

Payment of Filing Fee (Check all boxes that apply): |

☑ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| |

| | | | | |

| Message from our Chair of the Board Larry J. Merlo Chair, Board of Directors |

Kenvue Shareholders,

On behalf of the Kenvue Board of Directors, it is my pleasure to invite you to our first Annual Meeting of Shareholders — just over a year after Kenvue completed its initial public offering and launched as the world’s largest pure-play consumer health company by revenue.

While Kenvue is a new standalone business, the Company is leveraging its more than 135-year heritage of consumer insights and science-backed innovation as it lives into its Purpose: Realize the extraordinary power of everyday care. We are fortunate to have a foundation built on the Company’s differentiated portfolio of iconic brands that are recommended by healthcare professionals and trusted by generations of consumers around the world.

Looking back at 2023, it was a momentous year with the Company’s initial public offering in May and final separation from Johnson & Johnson in August. I am proud of the accomplishments of the Board, the Kenvue Leadership Team and the entire Kenvue team as they focused on establishing a strong operating infrastructure and achieved strong revenue growth, gross margin expansion and robust cash generation for the full year. In line with our commitment to return cash to shareholders, the Board was also pleased to initiate a quarterly cash dividend, underscoring our confidence in the strength of Kenvue’s iconic portfolio to drive sustainable, profitable growth and durable cash flow generation over the long term.

Building a Fit-for-Purpose Board of Directors

Kenvue combines the power of science with meaningful human insights and digital-first capabilities, empowering consumers to live healthier lives every day. As Kenvue was being formed, I had the opportunity to establish a strong group of directors, and I could not be more pleased with the other ten directors serving with me. They bring a diverse combination of experiences, skills and perspectives to oversee the execution of the Company's strategy and guide Kenvue forward. Working closely with Thibaut, we identified and recruited directors who not only have a proven track record in executive leadership and public company board experience but also bring to our Boardroom fit-for-purpose knowledge and expertise directly relevant to Kenvue’s business, including with respect to consumer goods and healthcare, global operations, finance, cyber and technology, marketing, supply chain, and human capital management. Over the course of the past year, each Board member has clearly demonstrated a deep commitment, passion, and ability to serve our business, shareholders, and all of our stakeholders.

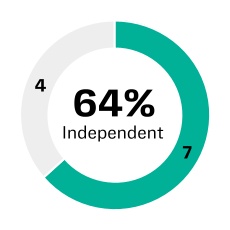

Our Corporate Governance Philosophies

My fellow directors and I take our role as stewards of your investment seriously, and we established a robust governance structure accordingly. We prioritized independent oversight with an independent Board Chair, a majority-independent Board, and only independent directors serving on each of our Audit, Compensation & Human Capital and Nominating, Governance & Sustainability Committees.

To more effectively enable Board oversight, the Committees leverage private sessions with Kenvue senior leaders, and the Board and Committees engage in executive sessions at every meeting. The Board also engages independent advisors where appropriate. Further, we adopted robust processes for overseeing enterprise risks that allow us to exercise rigorous oversight over the development and execution of the Company’s strategy.

As you will read in this proxy statement, we have carefully constructed a new executive compensation program for 2024 designed to drive long-term shareholder value, guided by the following principles: (i) incentivize executives to achieve strategic and financial objectives; (ii) design incentive programs to hold executives accountable for impact and align our executives’ financial interests with those of our shareholders; and (iii) provide competitive compensation considering our talent strategy, performance and external talent landscape.

Healthy Lives Mission

Early in our tenure as a Board, we oversaw the development of our Healthy Lives Mission, the Company's environmental, social, and governance strategy, and continue to oversee its implementation. Kenvue's Healthy Lives Mission strives to nurture healthy people, enrich a healthy planet, and maintain healthy practice, and our Board has supported the Company in setting goals and commitments to hold Kenvue accountable for the progress it aims to make.

We are proud to have a world-class and diverse team that truly reflects the consumers and customers we serve. The Kenvue Leadership Team counts nine different nationalities amongst its members and has a strong gender balance with 54% women representation. Additionally, six of our 11 directors are women and/or ethnically/racially diverse. In overseeing the Company’s human capital management strategy, the Board is committed to fostering a diverse, equitable, and inclusive atmosphere throughout the Company, where our people feel empowered and supported to contribute to Kenvue's performance and accelerate their own development.

Continuing to Deliver on Our Purpose

Looking ahead to 2024, Kenvue has a thoughtfully designed strategy that will enable the delivery of sustainable, profitable long-term growth. We look forward to continuing to work with Thibaut and the Kenvue Leadership Team as they focus on reaching more consumers, freeing up resources to invest further behind Kenvue’s brands, and fostering a culture of performance and impact.

Engaging with Our Shareholders

The Board is committed to maintaining meaningful shareholder engagement. Over the past year, under the Board’s oversight, Kenvue management has reached out to our largest institutional shareholders, held discussions with those who accepted our offer of a meeting, and relayed valuable feedback from these discussions to the Board on key matters, including corporate governance, executive compensation and sustainability.

We look forward to an ongoing dialogue as Kenvue continues its journey.

On behalf of the Board, I would like to thank you for your support and investment in Kenvue. With strong leadership focused on execution of the Company’s strategy, along with the talent and energy of the approximately 22,000 Kenvuers around the world, we see tremendous opportunities for the Company in 2024 and for many years to come.

Sincerely,

Larry J. Merlo

Chair, Board of Directors

Notice of 2024 Annual Meeting of Shareholders

Fellow Kenvue Shareholders:

You are cordially invited to the 2024 Annual Meeting of Shareholders of Kenvue Inc. (the “Annual Meeting”), where shareholders will vote on the matters below either by proxy or by voting online during the Annual Meeting.

| | | | | | | | |

Date and Time Thursday, May 23, 2024 9:00 a.m. Eastern Time | Location Online at www.virtualshareholdermeeting.com/KVUE2024 | Record Date March 25, 2024 |

| | | | | |

| Items of Business |

| 1 | Elect the 11 director nominees named in the proxy statement. |

| 2 | Approve, on a non-binding advisory basis, the compensation of our named executive officers. |

| 3 | Approve, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of our named executive officers. |

| 4 | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024. |

| 5 | Consider any other business as may properly come before the Annual Meeting. |

Your Vote is Important - Vote Right Away

Your vote is important. Ensure that your shares are represented at the meeting by voting in one of the following ways:

We encourage you to read the accompanying proxy statement with care and to vote and submit your proxy as soon as possible by using one of the methods described above, even if you intend to attend the Annual Meeting.

Edward J. Reed

Vice President, Corporate Secretary

Important Notice Regarding the Availability of Proxy Materials for the 2024 Annual Meeting of Shareholders to be Held on May 23, 2024: The proxy statement and our 2023 Annual Report to Shareholders are available at www.proxyvote.com. We mailed a Notice of Internet Availability to our shareholders (other than those who previously requested paper copies) on or about April 10, 2024.

| | | | | |

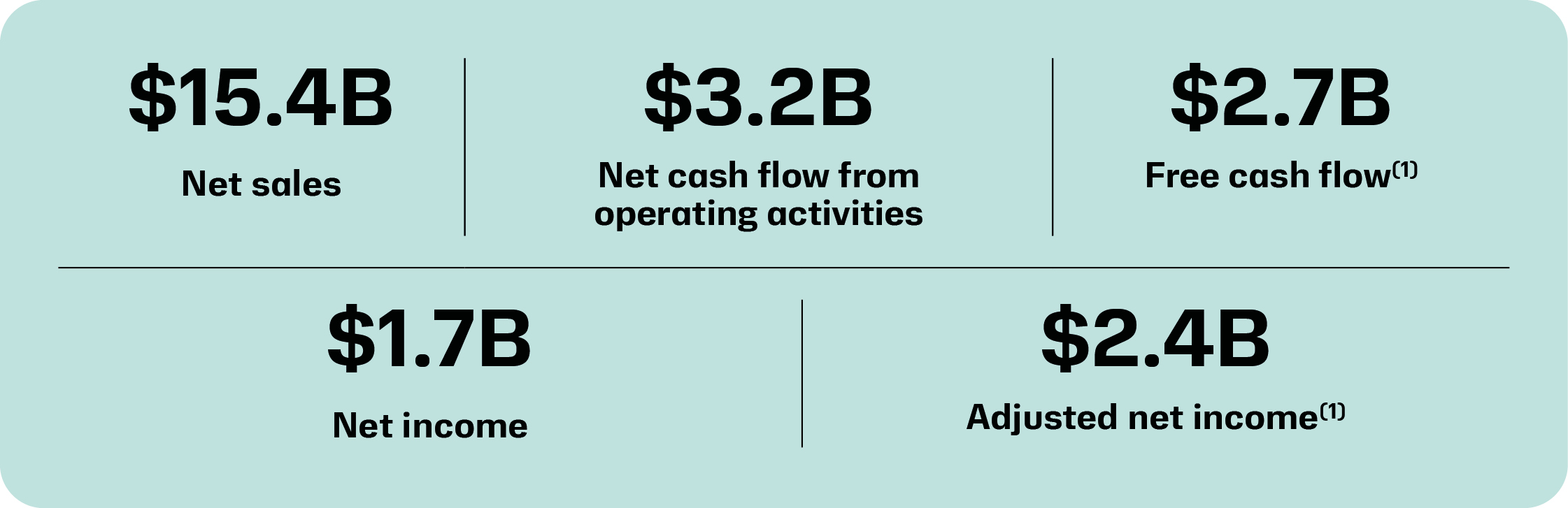

Realize the Extraordinary Power of Everyday Care About our Business With $15.4 billion in Net sales in 2023, Kenvue is the world’s largest pure-play consumer health company by revenue and holds a unique position at the intersection of healthcare and consumer goods. By combining the power of science with meaningful human insights and a digital-first approach, we empower consumers to live healthier lives every day. Built on more than a century of heritage and trusted by generations, our differentiated portfolio of iconic brands—including Tylenol®, Neutrogena®, Listerine®, Johnson’s®, BAND-AID® Brand Adhesive Bandages, Aveeno®, Zyrtec®, and Nicorette® —is backed by science and recommended by healthcare professionals, which further reinforces our consumers’ connections to our brands. We operate in three attractive segments: Self Care, Skin Health & Beauty, and Essential Health, allowing us to connect with consumers globally—in their daily rituals and the moments that matter most. Within these segments, our well-known portfolio represents a combination of global and regional brands, many of which hold leading positions in their respective categories. Since their inception, the goal of our brands has been to make a positive and enduring impact on the daily health of our consumers. We operate on a global scale with our broad product portfolio sold and distributed in more than 165 countries in 2023. Our global footprint is well balanced geographically, with approximately half of our 2023 Net sales generated outside North America. At Kenvue, we believe in the extraordinary power of everyday care, and our approximately 22,000 Kenvuers work every day to put that power in consumers’ hands and earn a place in their hearts and homes. | |

Our 15 priority brands

Table of Contents

Proxy Statement Roadmap

| | | | | | | | | | | | | | | | | |

Agenda Item | | Board

Recommendation |

| | | | | |

| | | | | |

Proposal 1 | | Election of Directors | | | For Each Nominee |

| | | | | |

Proposal 2 | | Approve, on a Non-Binding Advisory Basis, the Compensation of our Named Executive Officers | | | For |

| | | | | |

Proposal 3 | | Approve, on a Non-Binding Advisory Basis, the Frequency of Future Advisory Votes on the Compensation of our Named Executive Officers | | | One year |

| | | | | |

Proposal 4 | | Ratify the Appointment of the Company’s Independent Registered Public Accounting Firm | | | For |

Proxy Statement Summary

The accompanying proxy is solicited on behalf of the Board of Directors (the “Board”) for use at the 2024 Annual Meeting of Shareholders (the “Annual Meeting”) of Kenvue Inc. (“Kenvue”, “we”, “us”, “our” or the “Company”). Please review the entire proxy statement and our 2023 Annual Report to Shareholders before voting. The voting items expected to be proposed at the meeting are listed above, along with the Board’s voting recommendations.

2023 Performance Highlights & Separation from Johnson & Johnson

2023 was a transformational year for our business and we are proud of our accomplishments. We started the year as a wholly owned subsidiary of Johnson & Johnson (“J&J”) and by September we were the largest independent pure-play consumer health company by revenue. In May 2023, we completed the initial public offering (the “IPO”) of approximately 10.4% of our outstanding common stock and began trading on the New York Stock Exchange (“NYSE”) under the ticker symbol “KVUE”. In August 2023, J&J completed the disposition of an additional 80.1% of the outstanding common stock of Kenvue, completing our separation from J&J and our transition to being a fully independent, publicly traded company (the “Separation”). As of the date of this proxy statement, J&J continues to own approximately 9.5% of our outstanding common stock.

We achieved a tremendous amount in 2023 in addition to successfully standing up Kenvue as an independent, publicly traded company. We delivered on our long-term value creation algorithm, which is centered around profitable growth, durable cash flow generation and disciplined capital allocation. We also delivered on our commitment to return capital to our shareholders through the initiation of our quarterly dividend program.

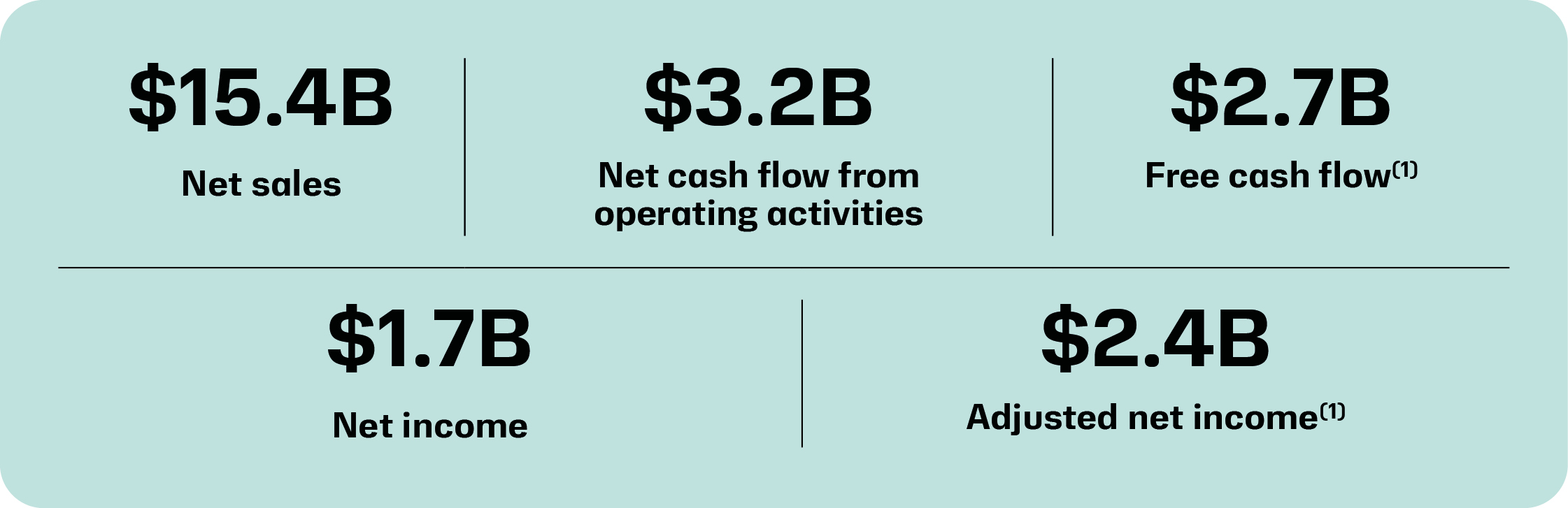

Highlights of our 2023 performance include:

(1)Free cash flow and Adjusted net income are non-GAAP financial measures; see the Appendix for definitions of non-GAAP financial measures and a reconciliation of such measures to the most directly comparable GAAP measures.

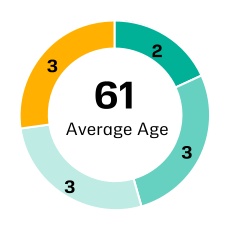

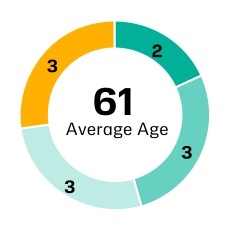

2024 Director Nominees Snapshot (Page 10) The following table provides summary information about each director nominee. Detailed information about each director’s background, skills and expertise can be found in “Proposal 1 - Election of Directors” beginning on page 10. | | | | | | | | | | | |

Richard E. Allison, Jr. Former CEO and Director of Domino’s Pizza, Inc. –Independent Director •Audit Committee •Compensation & Human Capital Committee | Peter M. Fasolo, Ph.D. EVP, Chief Human Resources Officer of Johnson & Johnson | Tamara S. Franklin Former Chief Digital, Data and Analytics Officer of Marsh LLC –Independent Director •Audit Committee •Nominating, Governance & Sustainability Committee | Seemantini Godbole EVP, Chief Digital and Information Officer of Lowe’s Companies Inc. –Independent Director •Audit Committee •Nominating, Governance & Sustainability Committee |

| | | |

Melanie L. Healey Former Group President of The Procter & Gamble Company –Independent Director •Nominating, Governance & Sustainability Committee (Chair) | Betsy D. Holden Former Co-CEO of Kraft Foods Inc. –Independent Director •Compensation & Human Capital Committee (Chair) | Larry J. Merlo Chair of the Board Former President and CEO of CVS Health –Independent Director •Compensation & Human Capital Committee •Nominating, Governance & Sustainability Committee | Thibaut Mongon Chief Executive Officer |

| | | |

Vasant Prabhu Former Vice Chairman and Chief Financial Officer of Visa Inc. –Independent Director •Audit Committee (Chair) | Michael E. Sneed Former EVP, Corporate Affairs & Chief Communications Officer of Johnson & Johnson | Joseph J. Wolk EVP, Chief Financial Officer of Johnson & Johnson | |

| | |

|

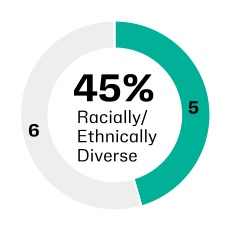

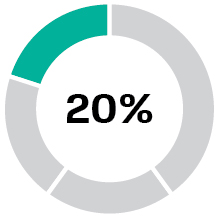

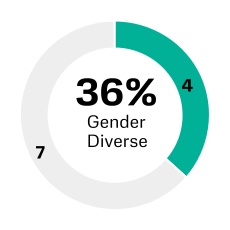

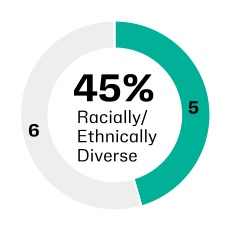

Racial and

Ethnic Diversity |

|

| | | | | |

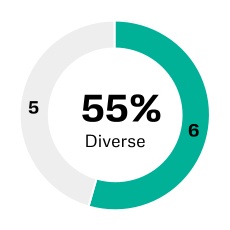

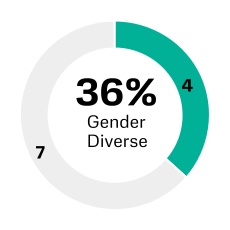

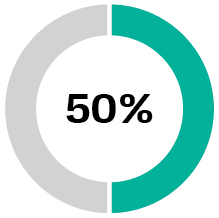

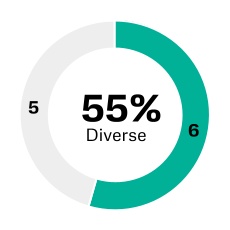

| Overall Diverse (Gender and/or Racial/Ethnic) |

| | | | | |

| Racially/Ethnically Diverse |

| | | | | |

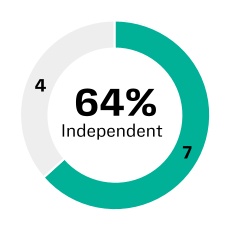

| Board Composition & Independence |

•Independent Board Chair with significant responsibilities •Majority independent Board with 7 of 11 directors being independent •Balanced Board with a large breadth of diverse skills, experiences, and areas of expertise •Independent Committees with only independent directors serving on our Audit, Compensation & Human Capital, and Nominating, Governance & Sustainability Committees •Independent Executive Sessions with only independent directors at every regularly scheduled Board and Committee meeting •Diverse Board with 6 of 11 directors identifying as women and/or ethnically/racially diverse |

|

|

Robust Board Oversight |

•Rigorous oversight of the development and execution of the Company’s strategic plans •Robust process for overseeing key enterprise risks, including cybersecurity and ESG-related risks •Strong Board and management succession planning process •Robust Board and Committee oversight of our sustainability strategy, policies, programs and commitments |

|

|

| Shareholder Rights & Engagement |

•Annual elections of all directors (no staggered board) •Simple majority voting standard for all uncontested elections •Single voting class •Active year-round shareholder engagement |

|

|

| Strong Governance Practices |

•Annual Board & Committee evaluations •Robust director and executive officer Code of Business Conduct & Ethics •Restrictions on overboarding •Mandatory retirement for directors •Significant stock ownership guidelines for directors (5x annual cash retainer) •Policy of no hedging, pledging or short-selling Kenvue stock for executives and directors |

Executive Compensation Highlights (page 35) Kenvue’s executive compensation program is designed to align behaviors with short- and long-term financial and operational results that drive long-term shareholder value. Our programs are built on the following principles:

•Incentivize executives to achieve our strategic and financial objectives;

•Design incentive programs to hold executives accountable for impact and align our executives' financial interests with our shareholders' long-term interests; and

•Provide competitive compensation considering Kenvue's talent strategy, performance, and external talent landscape.

Our 2024 annual incentive plan for executive officers will be based 70% on company performance and 30% on individual performance, with the following performance measures used to evaluate company performance:

| | | | | | | | |

Measure(1) | Weighting (% of Financial) | How it aligns with our strategic priorities |

Organic net sales | | Incentivizes the delivery of top-line growth, which is a key driver of value creation in the consumer staples industry |

| Adjusted gross profit margin | | Incentivizes margin-accretive top-line growth |

| Adjusted net income | | Incentivizes profit generation in support of robust free cash flows |

| Free cash flow | | Incentivizes robust free cash flow generation to enable execution of Kenvue's capital allocation strategy |

(1)These are non-GAAP financial measures. For purposes of measuring incentive performance, these measures exclude certain items affecting comparability, including the impact of changes in foreign currency exchange rates, acquisitions and divestitures, and other corporate adjustments. See the Appendix for a definition of each measure.

Annual long-term incentive awards granted to our executive officers in 2024 consist of 50% Performance Share Units ("PSUs"), 30% options and 20% Restricted Share Units ("RSUs"). PSUs will vest following the end of the three-year performance period, subject to continued service and achievement with respect to the following performance measures:

| | | | | | | | |

PSU Performance Measure(1) | Weighting | How it aligns with our strategic priorities |

Organic net sales(2) | | Incentivizes the delivery of top-line growth; given Net sales is a key driver of value creation in the consumer staples industry, we include it in both our 2024 annual incentive plan and 2024 PSU design |

Adjusted diluted earnings per share(2) | | Incentivizes profit generation in support of robust free cash flows |

Relative TSR | Modifier | Incentivizes market-leading long-term value creation, above that of our performance peers |

(1)Organic net sales and Adjusted diluted earnings per share are non-GAAP financial measures. For purposes of measuring incentive performance, these measures exclude certain items affecting comparability, including the impact of changes in foreign currency exchange rates, acquisitions and divestitures, and other corporate adjustments. See the Appendix for a definition each measure.

(2)Measured as a compound annual growth rate (“CAGR”).

In 2023, our executive compensation program prior to our Separation was determined by the Compensation and Benefits Committee of J&J's Board of Directors, while Kenvue's Compensation & Human Capital Committee determined our executive compensation program following the Separation. Both sets of determinations are necessary to understand our 2023 executive compensation program. Additional details about the decisions made by J&J's Compensation & Benefits Committee and by Kenvue's Compensation & Human Capital Committee are provided in the Compensation Discussion & Analysis and related disclosure.

Environmental, Social & Governance Highlights

Kenvue’s Healthy Lives Mission, our environmental, social and governance (“ESG”) strategy, strives to advance the well-being of people and our planet. In 2023, as a newly independent public company, we focused on developing an ESG strategy that was specific to Kenvue and that reflected Kenvue’s key ESG impacts, risks and opportunities. We conducted extensive peer and best-practice benchmarking, identified ESG trends and macro-economic forces that have the potential to impact our business, analyzed leading ESG reporting frameworks, engaged with internal and external stakeholders, conducted an ESG double materiality assessment, and worked cross-functionally with leaders across the organization to identify the key ESG-related impacts, risks and opportunities that underpin our Healthy Lives Mission.

Kenvue’s Healthy Lives Mission is our call for everyday care in action and is supported by three pillars: nurture Healthy People, enrich a Healthy Planet and maintain Healthy Practice. Within these three pillars, we are focused on nine priority areas for which we have established measurable goals and commitments to hold ourselves accountable and to demonstrate progress. We will provide more details about our progress against these goals and commitments when we publish our 2024 Healthy Lives Mission Report, which will be available on our website at Kenvue.com/our-commitments. References to our 2024 Healthy Lives Mission Report are for informational purposes only and neither the 2024 Healthy Lives Mission Report nor the other information on our website is incorporated by reference into this proxy statement.

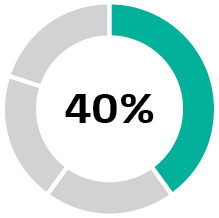

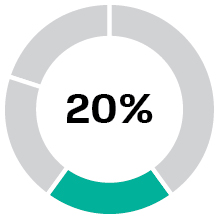

Shareholder Engagement Highlights (Page 28) We are committed to fostering ongoing, open and constructive communication with our shareholders. Following our Separation from J&J in August 2023, we launched an outreach program under our Board’s oversight to seek shareholder input and feedback on corporate governance, executive compensation, sustainability and other matters. We reached out to our largest institutional holders, representing approximately 40% of our common stock outstanding, and held discussions with all shareholders who accepted our offer of a meeting, representing approximately 25% of our common stock outstanding.

Proposal 1 - Election of Directors

Director Nomination Process

The Nominating, Governance & Sustainability Committee is responsible for recommending qualified candidates for nomination by the full Board, consistent with the criteria approved by the Board and set forth in our Principles of Corporate Governance. The Nominating, Governance & Sustainability Committee regularly, and at least annually, evaluates the composition of our Board to determine the current and future skills and experiences needed to effectively oversee the Company and its strategic direction. Each of our current Board members joined our public company Board in May 2023, in connection with our IPO and Separation from J&J.

The Board and Nominating, Governance & Sustainability Committee believe that all directors should display the attributes necessary to be effective directors: the highest ethical character, executive leadership experience, sound judgment, the time necessary to discharge their duties and a commitment to enhancing long-term shareholder value. In evaluating director candidates and considering incumbent directors for nomination to the Board, the Nominating, Governance & Sustainability Committee considers each nominee’s independence, professional accomplishments, and diversity, striving to ensure the Board is a diverse body reflecting differences in experience, background, skills, race, ethnicity, gender, and other unique characteristics. These criteria are articulated in the Principles of Corporate Governance available at investors.kenvue.com/governance. For incumbent directors, the Nominating Governance & Sustainability Committee also considers each director’s historic overall contributions to the Board, including level of attendance, level of participation, and contributions to the Board’s responsibilities.

In identifying prospective director candidates to serve on the Board, the Nominating, Governance & Sustainability Committee considers suggestions from many sources, including shareholders. All recommendations, together with appropriate biographical information, should be submitted to the Office of the Corporate Secretary at our principal office address as set forth in the section “Communications with our Board” below. Candidates proposed by shareholders are evaluated by the Nominating, Governance & Sustainability Committee in the same manner as other potential candidates.

| | | | | |

| 1 | Source candidate pool from |

| •Board members •Management •Shareholders •Third-party search firm |

| | | | | |

| 2 | In-depth review by the Nominating, Governance & Sustainability Committee guided by criteria in Principles of Corporate Governance |

| •Consider skills matrix •Screen qualifications •Consider diversity, including race, gender, experience and other characteristics •Review independence and potential conflicts •Meet with director candidates |

| | | | | |

| 3 | Nominating, Governance & Sustainability Committee recommends candidates to the Board |

| | | | | |

| 4 | Board reviews candidates and selects director nominees |

Proposal 1 - Election of Directors

Board Skills, Experience and Composition Highlights

Our Board believes that a well-rounded, diverse Board is essential for effective Board oversight and for driving long-term value for our shareholders. Collectively, our Board has deep knowledge of the consumer and healthcare industries, executive leadership and public company board experience, and a broad range of skills, including global operations, financial, cyber and technology, marketing, supply chain and human capital management expertise. Additionally, six out of eleven directors are women and/or ethnically/racially diverse. The following charts, along with our director biographies, highlight the key backgrounds, experiences, skills and diverse characteristics represented by our Board, collectively, and by each director nominee, individually. These attributes have been specifically identified by the Nominating, Governance & Sustainability Committee as being important in creating a diverse and well-rounded Board.

Board Skills & Experiences

| | | | | | | | | | | | | | | | | |

| Corporate Governance | | | | Human Capital Management & Sustainability |

| | | |

A deep understanding of corporate governance enhances independent Board oversight and supports our goals of accountability, transparency and protection of shareholder interests | | | Directors with experience relating to human capital management and sustainability support our culture, business and growth strategy and strengthen the Board’s oversight of these critical matters and related risks |

| | | | | |

| Cybersecurity & Data Privacy | | | | Industry (Consumer Packaged Goods, Healthcare or Complimentary field) |

| | | |

Expertise in cybersecurity and data privacy enables an understanding of the threat landscape, mitigation of cyber-risk and evaluation of preparedness to lead through a potential cyber crisis | | | Experience in the industry in which we operate is key to the Board's ability to understand consumer needs and identify potential changes in consumer trends and buying habits |

| | | | | |

| Digital Technology | | | | Marketing & Sales |

| | | |

Digital technology experience improves oversight of the selection and implementation of new technologies to enhance the Company’s efficiency and productivity | | | Marketing and sales experience—particularly in retail markets—helps the Board provide valuable insights on developing new markets and growing current markets and is critical to evaluating our strategy to drive growth |

| | | | | |

| Executive Leadership, Business Operations and Strategy | | | | R&D & Innovation |

| | | |

Experience as a CEO or senior executive empowers directors to provide impactful insights into our business growth strategies and business operating plans | | | Scientific knowledge and expertise in researching and developing innovative products enables Board oversight of our innovation pipeline and enables us to more effectively develop new products to meet the evolving needs of our consumers |

| | | | | |

| Finance | | | | Risk Management |

| | | |

A strong understanding of finance facilitates robust oversight of our financial reporting and evaluation of our performance | | | Deep experience in enterprise risk management empowers our Board to fulfill its critical risk oversight responsibilities |

| | | | | |

| Global & International | | | | Supply Chain |

| | | |

With approximately half of our Net sales generated outside of North America, international experience in global markets allows our Board to provide critical perspectives for our global growth strategy | | | Experience in supply chain enables our Board to contribute valuable insights into supply-chain strategy and execution and provide guidance and solutions to supply-chain challenges |

| | | | | |

| Government, Regulatory & Public Policy | | | | |

| | | |

Government, regulatory and public policy experience enhances our Board's oversight of our product portfolio in an ever-evolving regulatory landscape | | | |

Proposal 1 - Election of Directors

Director Snapshot

| | |

|

Racial and

Ethnic Diversity |

|

| | | | | |

| Overall Diverse (Gender and/or Racially/Ethnically Diverse) |

| | | | | |

| Racially/Ethnically Diverse |

Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Age: 57

Independent

Director since: May 2023 Committees: •Audit •Compensation & Human Capital | | | Richard E. Allison, Jr. Core Competencies Mr. Allison brings to our Board of Directors extensive experience in executive leadership and a deep understanding of global operations, business strategy, consumer businesses, operational management and market development that are crucial in steering global brands. Career Highlights Mr. Allison has served as director of Kenvue since May 2023. Mr. Allison served as Chief Executive Officer and as a board member of Domino’s Pizza, Inc., the largest pizza company in the world based on global retail sales, from 2018 to 2022. He joined Domino's in March 2011 as Executive Vice President of International and then served as President, Domino's International from October 2014 to July 2018. During the period that Mr. Allison led the international division and served as Chief Executive Officer, Domino's expanded by more than 20 countries and grew by more than 8,000 stores. Prior to joining Domino’s, Mr. Allison worked at Bain & Company, Inc. for more than 13 years, serving as a partner from 2004 to 2010, and as co-leader of Bain’s restaurant practice. He currently serves as a board member for Starbucks Corporation. Mr. Allison holds a B.S. in Business Administration from the University of North Carolina at Chapel Hill and an MBA from the University of North Carolina’s Kenan-Flagler Business School, where he serves as chair of the Board of Advisors. |

| | | | | | | |

| | Key Areas of Expertise | | | | |

| | | | | | | |

| | | Executive Leadership, Business Operations and Strategy | | Risk Management | | Finance |

| | | | | | | | |

| | | | Global & International | | Supply Chain | | Corporate Governance |

Proposal 1 - Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Age: 61

Director since: May 2023 | | | Peter M. Fasolo, Ph.D. Core Competencies Dr. Fasolo brings to Kenvue’s Board of Directors a deep understanding of the consumer health business through his senior leadership positions at Johnson & Johnson as well as extensive experience in business transformation and human capital management, including global talent, recruiting, diversity and inclusion, compensation, benefits and employee relations. Career Highlights Dr. Fasolo has served as a director of Kenvue since May 2023. Dr. Fasolo has served as Executive Vice President, Chief Human Resources Officer of Johnson & Johnson since 2016. Dr. Fasolo first joined Johnson & Johnson in 2004 as Worldwide Vice President, Human Resources in the MedTech segment and subsequently held numerous senior leadership roles, including as Vice President, Global Human Resources and Vice President, Global Talent Management. Dr. Fasolo also served as Chief Talent Officer for the North America portfolio companies of Kohlberg Kravis Roberts & Co and spent 13 years with Bristol-Myers Squibb in executive-level human resource roles in the pharmaceutical, medical devices and consumer segments. Dr. Fasolo currently serves on the boards of the Human Resources Policy Association, Tufts University and Save the Children and is a Fellow of the National Academy of Human Resources. He served as a board member for HireRight Holdings Corporation from 2018 to 2023. Dr. Fasolo holds a B.A. in Psychology from Providence College, an M.A. in Industrial Psychology from Fairleigh Dickinson University and a Ph.D. in Organizational Behavior from the University of Delaware. |

| | | | | | | | |

| | | Key Areas of Expertise | | | | |

| | | | | | | | |

| | | | Executive Leadership, Business Operations and Strategy | | Human Capital Management & Sustainability | | Industry |

| | | | | | | | |

| | | | Risk Management | | Corporate Governance | | Global & International |

| | | | | | | | |

| | | | | | | | |

Age: 57

Independent

Director since: May 2023 Committees: •Audit •Nominating, Governance & Sustainability | | | Tamara S. Franklin Core Competencies Ms. Franklin brings to Kenvue’s Board of Directors proven expertise in leading digital transformation initiatives across technology, data and analytics workstreams in large multinational organizations, complemented by her deep understanding of executive leadership and business strategy. Career Highlights Ms. Franklin has served as a director of Kenvue since May 2023. Ms. Franklin served as Chief Digital, Data and Analytics Officer of Marsh LLC from 2020 to 2023. She previously served as Chief Digital Officer and Vice President, Media and Entertainment, North America for International Business Machines Corporation and Executive Vice President, Digital for Scripps Networks Interactive, Inc. Ms. Franklin has significant experience leading digital businesses, including previous leadership roles at Motorola, Inc. and Turner Broadcasting System, Inc. She currently serves as a board member for Genpact Limited, a global professional services firm that specializes in digital-led business transformations. She also serves on the boards of Dream Academy and the Arts Council of Princeton. Ms. Franklin holds a B.A. in English from Yale University and an MBA from Harvard University. |

| | | | | | | |

| | Key Areas of Expertise | | | | |

| | | | | | | |

| | | Executive Leadership, Business Operations and Strategy | | Digital Technology | | Cybersecurity & Data Privacy |

| | | | | | | |

| | | Finance | | Human Capital Management & Sustainability | | Government, Regulation & Public Policy |

Proposal 1 - Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Age: 54

Independent

Director since: May 2023 Committees: •Audit •Nominating, Governance & Sustainability | | | Seemantini Godbole Core Competencies Ms. Godbole brings to Kenvue’s Board of Directors significant expertise in retail and consumer dynamics, as well as insights into global e-commerce, digital transformation, cybersecurity and technology strategies and has proven expertise in growing digital businesses through technology-enabled innovations. Career Highlights Ms. Godbole has served as a director of Kenvue since May 2023. Ms. Godbole serves as Executive Vice President, Chief Digital and Information Officer of Lowe’s Companies, Inc. where she leads the enterprise-wide global technology team focused on engineering, product, data and analytics, online, and innovation to enable technology transformation. She is responsible for technology strategy, product road maps and development, and technology operations across all channels, including digital, while also overseeing the overall business and the customer experience on Lowes.com. Ms. Godbole has more than 25 years of global technology experience. Before joining Lowe’s, she served as senior vice president, digital and marketing technology at Target Corp., where she oversaw the company’s global e-commerce, enterprise marketing and loyalty technology strategy and operations. Prior to Target, Ms. Godbole held multiple senior technology leadership roles at Sabre and Travelocity. Ms. Godbole serves on Apparo’s CXO Tech Council Ms. Godbole holds a Bachelor of Engineering in Electrical and Electronics Engineering from the National Institute of Technology in Nagpur, India and an M.S. in Computer Science from Texas Tech University. |

| | | | | | | |

| | Key Areas of Expertise | | | | |

| | | | | | | |

| | | Executive Leadership, Business Operations and Strategy | | Cybersecurity & Data Privacy | | R&D & Innovation |

| | | | | | | | |

| | | | Digital Technology | | Supply Chain | | Finance |

| | | | | | | | |

| | | | | | | | |

Age: 63

Independent

Director since: May 2023 Committees: •Nominating, Governance & Sustainability (Chair) | | | Melanie L. Healey Core Competencies Ms. Healey brings to Kenvue’s Board of Directors extensive experience in the consumer goods industry, valuable strategic insights, including with respect to trends in brand building, marketing, distribution and international operations, and significant corporate governance expertise, including through her service as a director for several large public companies. Career Highlights Ms. Healey has served as a director of Kenvue since May 2023. Ms. Healey served as a Group President of The Procter & Gamble Company from 2007 to 2015. In her 25 years at Procter & Gamble, she held several senior leadership positions, including Group President and Advisor to the Chairman and Chief Executive Officer, Group President of the North America Region, and Group President of the Global Health Care, Feminine Care and Adult Care Sector. Ms. Healey has more than 30 years of experience at multinational consumer goods companies, including Procter & Gamble, Johnson & Johnson and S.C. Johnson & Sons, and nearly two decades of experience outside the United States. She currently serves as a board member for Hilton Worldwide Holdings Inc., PPG Industries, Inc. and Verizon Communications Inc. She served as a board member for Target Corporation from 2015 to 2023. Ms. Healey holds a B.S. in Business Administration from the University of Richmond. |

| | | | | | | |

| | Key Areas of Expertise | | | |

| | | | | | | |

| | | Executive Leadership, Business Operations and Strategy | | Corporate Governance | | Global & International |

| | | | | | | | |

| | | | Human Capital Management & Sustainability | | Industry | | Risk Management |

Proposal 1 - Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Age: 68

Independent

Director since: May 2023 Committees: •Compensation & Human Capital (Chair) | | | Betsy D. Holden Core Competencies Ms. Holden brings to Kenvue’s Board of Directors a deep understanding of executive leadership, human capital management and corporate governance, including through her experiences as a chief executive officer, director and advisor for large public companies, complemented by an extensive knowledge of international business and strategy, including with respect to brand marketing, sales and digital development. Career Highlights Ms. Holden has served as a director of Kenvue since May 2023. Ms. Holden served as a Senior Advisor to McKinsey & Company from 2007 to 2020. She previously held several leadership roles at Kraft Foods, including Co-Chief Executive Officer of Kraft Foods Inc., President, Global Marketing and Category Development of Kraft Foods Inc. and President and Chief Executive Officer of Kraft Foods North America. Ms. Holden has served on ten public boards over the last 25 years, including Diageo Plc (2009 to 2018) and Time, Inc. (2014 to 2018). She currently serves as a board member for Dentsply Sirona Inc., NNN REIT, Inc., Western Union Company and several private portfolio companies of Paine Schwartz Partners, a private equity firm focused on sustainable agriculture and food products for which she sits on the Food Chain Advisory Board. She also serves on the Global Advisory Board of Northwestern University’s Kellogg School of Management. Ms. Holden served on Duke University’s Board of Trustees (2011-2023) and the Executive Committee (2015-2023). Ms. Holden holds a B.A. in Education from Duke University as well as an M.A. in Teaching and an MBA, each from Northwestern University. |

| | | | | | | | |

| | | Key Areas of Expertise | | | | |

| | | | | | | | |

| | | | Executive Leadership, Business Operations and Strategy | | Corporate Governance | | Human Capital Management & Sustainability |

| | | | | | | | |

| | | | Marketing & Sales | | Global & International | | Industry |

| | | | | | | | |

| | | | | | | | |

Independent Board Chair Age: 68

Director since: May 2023 Committees: •Compensation & Human Capital •Nominating, Governance & Sustainability •Executive (Chair) | | | Larry J. Merlo Core Competencies Mr. Merlo brings to Kenvue’s Board of Directors significant experience as a chief executive officer, director and advisor, with an in-depth knowledge of health and consumer trends, including in the areas of digital development, marketing, retail sales, science and technology. Career Highlights Mr. Merlo has served as Chair of Kenvue Board of Directors since May 2023. Mr. Merlo served as President and CEO of CVS Health from 2011 to 2021. Mr. Merlo previously held positions of increasing responsibility over his more than 40 years at CVS Health and its subsidiaries, including Chief Operating Officer of CVS Health, President of CVS Pharmacy and Executive Vice President–Stores. Mr. Merlo previously served as a Board member for CVS Health, America’s Health Insurance Plans (AHIP), National Association of Chain Drug Stores (NACDS), the Partnership for Rhode Island and Business Roundtable. He serves on the University of Pittsburgh Board of Trustees, where he is currently Chair of the Budget Committee, and a member of the Compensation Committee and was formerly Chair of the Research & Innovation Committee. He also serves as an advisor to Korn Ferry and Charlesbank Capital Partners. Mr. Merlo holds a B.S. from the University of Pittsburgh School of Pharmacy. |

| | | | | | | |

| | Key Areas of Expertise | | | | |

| | | | | | | |

| | | Executive Leadership, Business Operations and Strategy | | Corporate Governance | | Industry |

| | | | | | | |

| | | Marketing & Sales | | Human Capital Management & Sustainability | | Supply Chain |

Proposal 1 - Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Chief Executive Officer and Director Age: 54

Public Company Director since: May 2023 Committees: •Executive | | | Thibaut Mongon Core Competencies Mr. Mongon brings to Kenvue’s Board of Directors a deep understanding of the consumer health business and commitment to innovation, complemented by extensive international experience, a consumer-centric mindset and considerable expertise in business strategy. Career Highlights Mr. Mongon has served as Chief Executive Officer and director of Kenvue as a public company since May 2023. Mr. Mongon joined Johnson & Johnson in 2000 as Director of Marketing for the Vision Care group in France and subsequently held positions of increasing responsibility until he transitioned to the Pharmaceutical sector in 2012, as the Global Commercial Strategy Leader for the Neuroscience therapeutic area. Mr. Mongon joined the Consumer Health sector of Johnson & Johnson in 2014 as Company Group Chairman Asia-Pacific and was promoted to Executive Vice President and Worldwide Chairman, Consumer Health at Johnson & Johnson in 2019. Prior to joining Johnson & Johnson, Mr. Mongon worked for Bormioli in Italy and Danone in France. Mr. Mongon currently serves on the Board of Directors of The Consumer Goods Forum and is a member of the Business Roundtable. Mr. Mongon holds a degree in Marketing from KEDGE Business School and an MBA from INSEAD. |

| | | | | | | |

| Key Areas of Expertise | | | | |

| | | | | | | |

| | | Executive Leadership, Business Operations and Strategy | | Industry | | Marketing & Sales |

| | | | | | | | |

| | | | Global & International | | R&D & Innovation | | Risk Management |

| | | | | | | | |

| | | | | | | | |

Age: 64

Independent

Director since: May 2023 Committees: •Audit (Chair) | | | Vasant Prabhu Core Competencies Mr. Prabhu brings to Kenvue’s Board of Directors his vast experience as a chief financial officer of a number of large public companies and a sophisticated understanding of complex accounting principles and judgments, financial results, internal controls and financial reporting rules, regulations, processes and investor relations. Career Highlights Mr. Prabhu has served as a director of Kenvue since May 2023. Mr. Prabhu served as Vice Chairman of Visa Inc. from 2019 and as Chief Financial Officer from 2015, retiring in 2023. He previously served as Chief Financial Officer for NBCUniversal Media, LLC, Chief Financial Officer and Vice Chairman of Starwood Hotels and Resorts Worldwide, Inc. and Executive Vice President and Chief Financial Officer of Safeway, Inc. He has also held senior leadership roles at The McGraw-Hill Companies, Inc., PepsiCo, Inc. and Booz Allen Hamilton. Mr. Prabhu currently serves as a board member for Delta Air Lines, Inc. and a Trustee of the Brookings Institution, and he served as a board member for Mattel, Inc. from 2007 to 2020, where he was Chair of the Audit Committee. Mr. Prabhu holds a Bachelor of Technology in Mechanical Engineering from the Indian Institute of Technology and an MBA from the University of Chicago. |

| | | | | | | | |

| | | Key Areas of Expertise | | | | |

| | | | | | | | |

| | | | Executive Leadership, Business Operations and Strategy | | Finance | | Risk Management |

| | | | | | | | |

| | | | Global & International | | Corporate Governance | | Government, Regulation & Public Policy |

Proposal 1 - Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Age: 65

Director since: May 2023

| | | Michael E. Sneed Core Competencies Mr. Sneed brings to Kenvue’s Board of Directors a deep understanding of the consumer health business through his senior leadership positions at Johnson & Johnson as well as extensive strategic and operational expertise leading global marketing, communication, design and philanthropy functions. Career Highlights Mr. Sneed has served as a director of Kenvue since May 2023. Mr. Sneed served as Executive Vice President, Global Corporate Affairs and Chief Communication Officer of Johnson & Johnson from 2018 to 2022. He also served as a member of Johnson & Johnson’s Executive Committee during that time. Mr. Sneed originally joined Johnson & Johnson in 1983 and previously held a variety of senior leadership roles, including Vice President, Global Corporate Affairs and Chief Communications Officer, Company Group Chairman, Vision Care Franchise and Company Group Chairman, Consumer North America. He currently serves as a board member for Wayfair Inc. He also serves on the boards of Thomas Jefferson University, the Robert Wood Johnson Foundation and WHYY, a public media organization serving Philadelphia, Pennsylvania and the surrounding region. Mr. Sneed holds a B.A. in Economics and Psychology from Macalester College and an MBA from the Tuck School of Business at Dartmouth College. |

| | | | | | | | |

| | | Key Areas of Expertise | | | | |

| | | | | | | | |

| | | | Executive Leadership, Business Operations and Strategy | | Industry | | Government, Regulation & Public Policy |

| | | | | | | | |

| | | | Marketing & Sales | | Global & International | | Human Capital Management & Sustainability |

| | | | | | | | |

| | | | | | | | |

Age: 57

Director since: May 2023

| | | Joseph J. Wolk Core Competencies Mr. Wolk brings to Kenvue’s Board of Directors a deep understanding of the consumer health business through his senior leadership positions at Johnson & Johnson, broad expertise in management, strategy, finance and operations, substantial experience in the healthcare industry and a strong commitment to business innovation, talent development and purpose-based leadership. Career Highlights Mr. Wolk has served as a director of Kenvue since May 2023. Mr. Wolk has served as Executive Vice President, Chief Financial Officer of Johnson & Johnson since 2018. He also serves as a member of Johnson & Johnson’s Executive Committee. Mr. Wolk previously held a variety of senior leadership roles in several sectors and functions during his tenure at Johnson & Johnson, including Vice President of Investor Relations, Vice President of Finance for the Pharmaceuticals Group, Vice President of Finance for the Medical Devices Global Supply Chain and Chief Financial Officer of the North America Pharmaceuticals Group. He is also the executive sponsor of Johnson & Johnson’s Impact Venture Fund and Veterans Leadership Council and champions Johnson & Johnson’s Finance Leadership Development Program. He serves on the St. Joseph’s University Board of Trustees and is a member of the Stanford Medicine Board of Fellows, the CNBC Global CFO Council and the Wall Street Journal CFO Network. Mr. Wolk holds a B.S. in Finance from St. Joseph’s University and a J.D. from Temple University School of Law and is also a Certified Public Accountant (CPA). |

| | | | | | | | |

| | | Key Areas of Expertise | | | | |

| | | | | | | | |

| | | | Executive Leadership, Business Operations and Strategy | | Finance | | Industry |

| | | | | | | | |

| | | | Global & International | | Supply Chain | | Risk Management |

Corporate Governance

Board Culture & Governance Practices

Each of our directors joined our public company Board in May 2023 in connection with our IPO and Separation from J&J. As the Board was formed, our directors, guided by Kenvue’s Purpose and Values, aligned on our Board’s core purpose — to unleash short- and long-term value creation for Kenvue and all its stakeholders — and adopted a Board Culture Charter to define the role of our directors, the strategic priorities of the Board, operating norms for the Board and management, and general rules of engagement, in each case thoughtfully designed to further that core purpose. The Board Culture Charter was developed in collaboration with management, with input gathered from each individual director and from the Board as a whole. The Board Culture Charter helped our Board quickly establish a culture of open dialogue, enable effective information flow, and facilitate communication and constructive feedback among the members of the Board and management.

Additionally, our Board has adopted our Principles of Corporate Governance that, together with our Amended and Restated Certificate of Incorporation, Amended and Restated Bylaws, and Committee charters, provide a framework for the Board’s corporate governance practices. These governance documents are available on our website at investors.Kenvue.com/governance. The Principles of Corporate Governance cover a wide range of topics, including the duties and responsibilities of the Board; director qualifications; resignation and mandatory retirement policies; director compensation; share ownership guidelines; succession planning; evaluation of the CEO; director orientation and continuing education; Board and Committee performance evaluations; and Chair succession planning. The Principles of Corporate Governance are reviewed annually by the Nominating Governance & Sustainability Committee to ensure that our governance practices remain appropriate and continue to meet the needs of Kenvue and our shareholders.

Our Board is steadfast in its belief that the ethical character, integrity and values of our directors and senior management remain the most important safeguards to corporate governance. The Board has adopted a robust Code of Business Conduct & Ethics for Board members and executive officers, which is available on our website at investors.Kenvue.com/governance. This commitment to ethics and integrity is also reflected in Kenvue’s Purpose and Values.

Our Kenvue Purpose

Our Kenvue Values

| | | | | | | | | | | | | | | | | |

| Board Leadership Structure | | | Independent Board Leadership Structure | |

| | | |

Our Board has determined that having an independent director serve as Chair of the Board is in the best interests of our shareholders at this time and supports effective risk oversight. Larry J. Merlo has served as our independent Board Chair since the establishment of our public company Board in May 2023. Our Board believes that its leadership structure creates an appropriate balance between strong and consistent leadership and effective independent oversight of the Company. As a newly public company, the Board felt it was appropriate to separate the roles of Chair and CEO to give Mr. Mongon an opportunity to focus on the day-to-day management of the business and on executing our strategic priorities, while allowing Mr. Merlo to focus on leading the Board and facilitating the Board’s independent oversight. In his role as Chair, Mr. Merlo: •Monitors and provides feedback to management on the quality and quantity of information provided by management to the Board; •Participates in setting, and approves, the agenda for each Board meeting; •Calls meetings of the Board and independent directors and presides at all Board meetings and executive sessions of independent directors; •Presides at all shareholder meetings; •Communicates with the CEO after each executive session of the independent directors to provide feedback and effectuate the decisions and recommendations of the independent directors; •Acts as liaison between the independent directors and the CEO and management on a regular basis and on sensitive/critical issues; •Leads the annual performance evaluation of the CEO; •Oversees the annual evaluation of the Board; •Oversees CEO succession planning, in consultation with the Compensation & Human Capital Committee; and •Represents the Board in communications with shareholders or other stakeholders, including meeting with shareholders, as needed. | | |

| | | Larry J. Merlo Independent Chair of the Board | |

| | | | |

| | | | |

| | Independent Committee Chairs | |

| | | | |

| | | Melanie L. Healey Chair of the Nominating, Governance & Sustainability Committee | |

| | | | |

| | | Betsy D. Holden Chair of the Compensation & Human Capital Committee | |

| | | | |

| |

| Vasant Prabhu Chair of the Audit Committee | |

Considering the extensive duties of our Board Chair, under our Principles of Corporate Governance, our Chair may not serve as chair, lead director, or CEO at another public company, unless approved by the full Board. Our Amended and Restated Bylaws and Principles of Corporate Governance provide our Board with flexibility to separate or combine the roles of the CEO and Chair when and if it believes it is advisable and in the best interest of Kenvue shareholders to do so. Our fully independent Nominating, Governance & Sustainability Committee evaluates our leadership structure on an annual basis, including whether the roles of the CEO and Chair should be held by one individual or should be separated and whether the Chair of the Board should be an independent director. The annual review includes a discussion of the effectiveness of the current board leadership structure, the qualifications and experience of the Chair and any Board and shareholder feedback on the structure. The Nominating, Governance & Sustainability Committee and Board believe that our current leadership structure is in the best interest of the Company and its shareholders at this time. | |

Director Independence

Our Board assesses the independence of each director at least annually and has determined that all directors, with the exception of Messrs. Mongon, Sneed and Wolk and Dr. Fasolo, qualify as “independent” in accordance with the listing standards of NYSE and the heightened requirements under our “Standards of Independence” in our Principles of Corporate Governance. To be considered independent, the Board must determine that a director meets the independence requirements of the NYSE, does not have any appearance of a conflict, and does not have any direct or indirect material relationship with Kenvue.

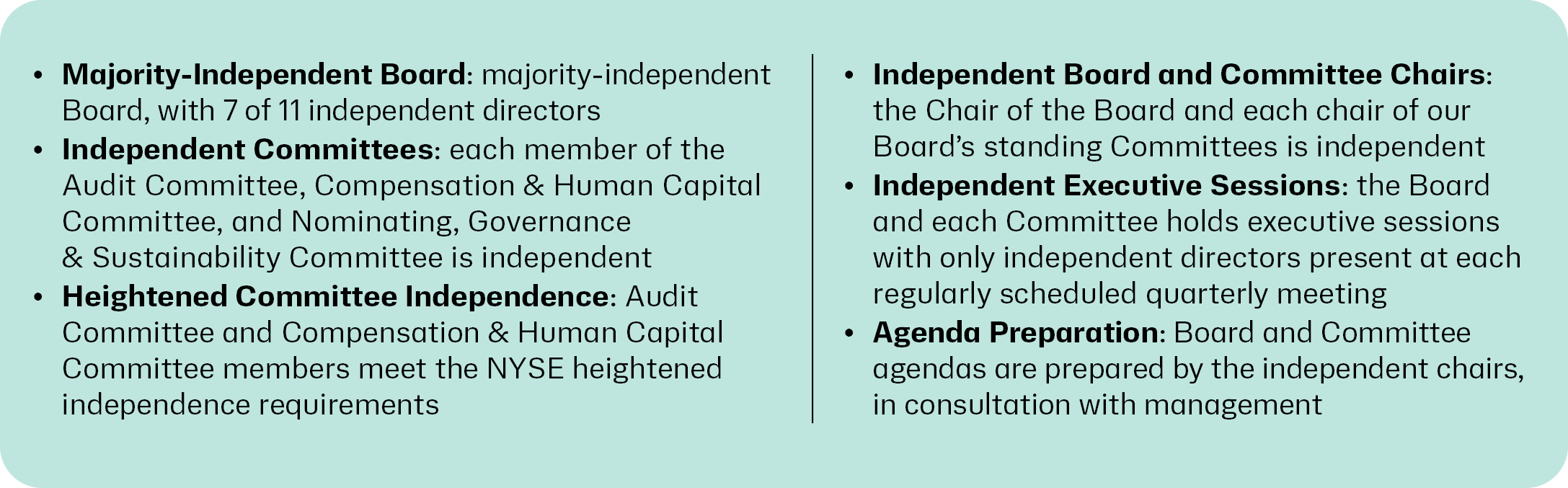

Highlights of our Board’s independence include:

Messrs. Sneed and Wolk and Dr. Fasolo are not independent in light of their relationship to our former parent, J&J. Dr. Fasolo and Mr. Wolk are executives of J&J and served in those roles at the time of Separation. Mr. Sneed was an executive officer of J&J until April 2022. Mr. Mongon is not independent because he serves as our Chief Executive Officer. In making these determinations, our Board considered the current and prior relationships that each non-employee director has with our Company and with J&J and all other facts and circumstances our Board deemed relevant.

Board Meeting Attendance

The Board held eight meetings in 2023 (from the date of our IPO in May 2023 through the end of fiscal year 2023). Each director attended at least 75% of the total number of 2023 meetings of the Board and of each Committee on which he or she served. We encourage, but do not require, all director nominees to attend our Annual Meeting.

Committees of the Board

The Board has a standing Audit Committee, Compensation & Human Capital Committee, Nominating, Governance & Sustainability Committee and Executive Committee. The Board has adopted a written charter for each Committee and these charters are available on Kenvue’s website at investors.kenvue.com/governance.

| | | | | | | | | | | |

| Audit Committee Vasant Prabhu (Chair)

Richard E. Allison, Jr.

Tamara S. Franklin

Seemantini Godbole Meetings Held in 2023: 9 | | Responsibilities: •Overseeing financial management, accounting and reporting processes and practices; •Appointing, retaining, compensating and evaluating our independent auditor; •Overseeing Kenvue’s internal audit organization, reviewing its annual plan and reviewing results of its audits; •Overseeing the quality and adequacy of Kenvue’s internal accounting controls over financial reporting; •Reviewing and monitoring Kenvue’s financial reporting compliance and practices, including Kenvue’s disclosure controls and procedures; and •Discussing with management the policies and processes used to assess and manage Kenvue’s exposure to risk, including assisting the Board in overseeing Kenvue’s policies and risk management programs related to financial management and disclosure, accounting, financials reporting and tax and treasury. The Board has determined that all Audit Committee members are considered independent under the heightened NYSE independence standards and that Mr. Prabhu is an “audit committee financial expert” as that term is defined under SEC rules. |

| |

| |

| |

| | | |

| | | | | | | | | | | |

| Compensation & Human Capital Committee Betsy D. Holden (Chair)

Richard E. Allison, Jr.

Larry J. Merlo Meetings Held in 2023: 6 | | Responsibilities: •Establishing Kenvue’s executive compensation philosophy and principles; •Reviewing and approving the compensation for the Chief Executive Officer and other executive officers; •Setting the composition of the group of peer companies used for comparison of executive compensation; •Overseeing Kenvue's long-term incentive plan; •Overseeing the design and management of the various savings as well as health and benefit plans that cover Kenvue’s employees; •Reviewing key talent metrics for Kenvue’s overall workforce, including metrics related to diversity, equity and inclusion; •Reviewing succession plans and talent development relating to the positions of the CEO and other positions on the Kenvue Leadership Team; and •Reviewing the compensation for Kenvue’s non-employee directors and recommending compensation for approval by the full Board. The Board has determined that all Compensation & Human Capital Committee members are considered independent under the heightened NYSE independence standards. |

| |

| |

| |

| | | |

| | | | | | | | | | | |

| Nominating, Governance & Sustainability Committee Melanie L. Healey (Chair)

Tamara S. Franklin

Seemantini Godbole

Larry J. Merlo Meetings Held in 2023: 4 | | Responsibilities: •Overseeing matters of corporate governance, including the evaluation of the policies and practices of the Board; •Reviewing potential candidates for the Board and recommending director nominees to the Board for approval; •Evaluating any questions of possible conflicts of interest for the Board members; •Overseeing compliance with applicable laws, regulations and the Company’s policies and risk management programs related to product safety, product quality, environmental regulations, privacy and cybersecurity; •Supporting and assisting the Kenvue Board in overseeing Kenvue’s sustainability strategy, policies, programs and commitments and receiving regular updates from management regarding such activities; •Reviewing and recommending director orientation and continuing education programs for the Board members; •Overseeing the process for performance evaluations of the Board and its Committees; •Overseeing compliance with Kenvue’s Code of Business Conduct & Ethics for Board members and executive officers; and •Evaluating the Board leadership structure on an annual basis. The Board has determined that each of the members of the Nominating, Governance & Sustainability Committee is independent under the rules of the NYSE. |

| |

| |

| |

| | | |

| | | | | | | | | | | |

| Executive Committee Larry J. Merlo (Chair)

Thibaut Mongon Meetings Held in 2023: 0 | | Responsibilities: •Empowered to exercise the authority of the Board between meetings in accordance with and subject to the limitations set forth in its written charter. |

| | | |

Board and Committee Evaluations

Our Board, Audit Committee, Compensation & Human Capital Committee, and Nominating, Governance & Sustainability Committee conduct self-evaluations annually to help ensure effective performance and to identify opportunities for improvement. In addition, our Executive Committee will conduct a self-evaluation as directed by the Board or in its discretion. As described in more detail above in “Board Culture & Governance Practices”, our Board has developed and adopted a framework for board operations, our Board Culture Charter, which helps inform our Board and Committee evaluations. The evaluations are intended to facilitate an examination and discussion by the entire Board and each Committee of its effectiveness as a group in fulfilling its requirements and other responsibilities and to assess if the Board and Committees are living into the values and principles of our Board Culture Charter. The Nominating, Governance & Sustainability Committee is responsible for developing and overseeing the process for conducting evaluations.

We conducted our first Board and Committee evaluations in late 2023, within eight months of our IPO and the establishment of our current Board, as follows:

| | | | | |

| 1 | Scope and format of evaluations |

As a first step, the Nominating, Governance & Sustainability Committee developed our evaluation process, including the questionnaires used by the Board and each Committee. The Nominating, Governance & Sustainability Committee recommended to the Board, and the Board approved, the 2023 Board and Committee self-evaluation process.

Once the format and content of the evaluation was approved, the self-evaluations were conducted under the oversight of the Nominating, Governance & Sustainability Committee, and for each Committee, led by the respective Committee Chair. As part of the evaluation, each director received questionnaires related to the full Board and their relevant Committees that asked them to consider various topics related to Board and Committee effectiveness and responsibilities, as well as satisfaction with the schedule, agendas, materials and discussion topics. Each director prepared responses to the questionnaires for discussion.

The directors discussed their responses to the questionnaires in executive sessions of each Committee, as well as in an executive session of the full Board. The discussions were led by the respective Chair of each Committee and the Chair of the Board. Directors discussed areas of strength and opportunities, with a view towards taking action to address any issues presented.

In addition to the annual self-evaluations, the Board evaluates its oversight of our business on an ongoing basis, and, in accordance with our Board Culture Charter, regularly provides feedback to management. During executive sessions, the independent directors raise and consider agenda topics that they believe deserve additional focus and topics to be addressed in future meetings. The Chair provides feedback to the CEO after each executive session of independent directors to effectuate the decisions and recommendations of the independent directors.

The Nominating, Governance & Sustainability Committee will continue to refine and oversee our processes for Board and Committee self-evaluations annually.

Board Oversight Responsibilities

Oversight of Strategy

Overseeing the Company’s short- and long-term corporate strategy is one of the Board’s primary areas of focus. Our directors’ expertise in strategy development and significant experience in the consumer packaged goods and healthcare industries are critical to the effective evaluation and oversight of our company strategy. The Board has developed robust practices to execute its oversight responsibilities.

•At the beginning of each fiscal year, the Board conducts an extensive review of the Company's annual and long-term strategic plans, financial targets, and plans for achieving those targets. Over the course of the year, the Board receives regular updates on the Company’s financial performance against the financial targets and its progress towards its strategic objectives.

•Board meeting agendas throughout the year include significant time allocated to review and discuss our long-term strategy, including risks, market trends, and key areas of opportunity. These discussions help the Board ensure that we are making progress toward our long-term strategic goals and gives the Board the opportunity to provide thoughtful and candid feedback about our strategic direction.

•The Board reviews and provides thoughtful insights on our capital allocation strategy, including any capital returns to shareholders through dividends or share repurchase plans and any significant capital investments.

•Independent directors hold regularly scheduled executive sessions without management present to discuss Company performance and review long-term strategy. These meetings are led by the independent Chair of the Board.

•The Board considers feedback from our shareholders to ensure that our short- and long-term strategies are appropriately designed to promote sustainable, profitable growth.

•The Board consults with external advisors to understand outside perspectives on the risks and opportunities facing our Company.

Oversight of Risk Management

The Board recognizes that sound risk management is integral to the achievement of our strategic objectives. The Board is responsible for the oversight of enterprise-level risk and for ensuring that management has processes in place to appropriately identify and manage risk. The Board exercises its risk oversight throughout the year, both at the full-Board level and through its Committees, which are comprised solely of independent directors. While the Board and its Committees oversee key risk areas, management is charged with the day-to-day management of risk.

We have developed internal processes that facilitate the identification and management of risks and regular communication with the Board. These processes include a robust enterprise risk management (“ERM”) framework that is designed to identify, assess and monitor risks that may have a significant impact on our business. The ERM framework informs our strategic planning activities through a collaborative risk management environment that proactively identifies and prioritizes our strategic, preventable, and external risks (including new or changing regulations). The ERM framework enables a clear understanding of the top risks and the exposure they have to our performance and strategic decisions. The ERM framework is reviewed annually as part of a risk assessment that is presented to our Board. The ERM framework is available on our website at investors.kenvue.com/governance.

Our ERM framework describes the roles and responsibilities of the Integrated Risk Management Council, a cross-functional group of senior enterprise risk leaders, which meets regularly to review and discuss significant risk facing our business. Our Integrated Risk Management Council proactively identifies, assesses and prioritizes key or emerging risks, which are then escalated to senior management as needed and reported to the relevant Committee or our Board. Our approach to risk management is integrated across all levels of the organization as follows:

Oversight of Cybersecurity

Given the importance of cybersecurity to our business and our stakeholders, our Board and Nominating, Governance & Sustainability Committee are actively engaged in the oversight of our cybersecurity program. Our process for assessing, identifying and managing material risks from cybersecurity threats is integrated into our broader ERM framework. The ERM framework is reviewed annually as part of a risk assessment that is presented to our Board. Our cybersecurity organization continually evaluates and addresses cybersecurity risk in alignment with our business objectives. We employ automation, and we also engage our internal audit function and a range of external consultants and other expert third parties in connection with the evaluation and management of cybersecurity risk and the maturation of our cybersecurity program.

The Nominating, Governance & Sustainability Committee is responsible for assisting the Board with respect to oversight of privacy and cybersecurity risks. The Nominating, Governance & Sustainability Committee receives reports from, and meets at least twice a year and as needed with, the Chief Information Security Officer (“CISO”) and the Chief Privacy Officer. The CISO and Chief Privacy Officer inform the Nominating, Governance & Sustainability Committee, which in turn informs our Board, of risks from cybersecurity threats during such meetings. The Nominating, Governance & Sustainability Committee reports to our full Board following each of its regularly scheduled meetings at a minimum and reviews with our Board significant issues or concerns that arise at Nominating, Governance & Sustainability Committee meetings.

Oversight of Human Capital and Succession Planning

The Board considers effective employee recruitment, development, engagement, and succession planning to be critical to executing on our strategy and ensuring our competitive success over the long-term. The Board reviews the Company’s human capital strategy, in support of its business strategy, at least annually and frequently discusses talent issues at its meetings.

The Compensation & Human Capital Committee provides oversight on a variety of human capital management topics, including diversity and inclusion and pay equity. Management regularly updates the Compensation & Human Capital Committee on key talent indicators for the overall workforce, including recruiting, talent development, and employee engagement metrics to ensure that Kenvue is appropriately mitigating the risk of loss or disengagement of critical talent. The Compensation & Human Capital Committee also regularly reviews employee surveys to assess our success in developing and fostering a culture that is aligned with our Purpose and Values and focused on driving performance, impact and accountability. The Compensation & Human Capital Committee reports to our full Board following each of its regularly scheduled meetings and reviews with our Board significant issues or concerns that arise at Compensation & Human Capital Committee meetings.

Additionally, the Board oversees CEO succession planning. Annually, the Board reviews succession plans for the CEO including an assessment of senior executives, their potential as successors to the CEO and any development plans for such executives. The Board also considers succession plans for other critical senior executive roles, such as the CEO’s direct reports. In support of our commitment to talent development, throughout the year, high-potential leaders are given exposure and visibility to Board members through formal presentations and at informal events. This engagement gives the Board insight into the Company’s talent pool and our leaders’ succession plans.

Oversight of our ESG Strategy

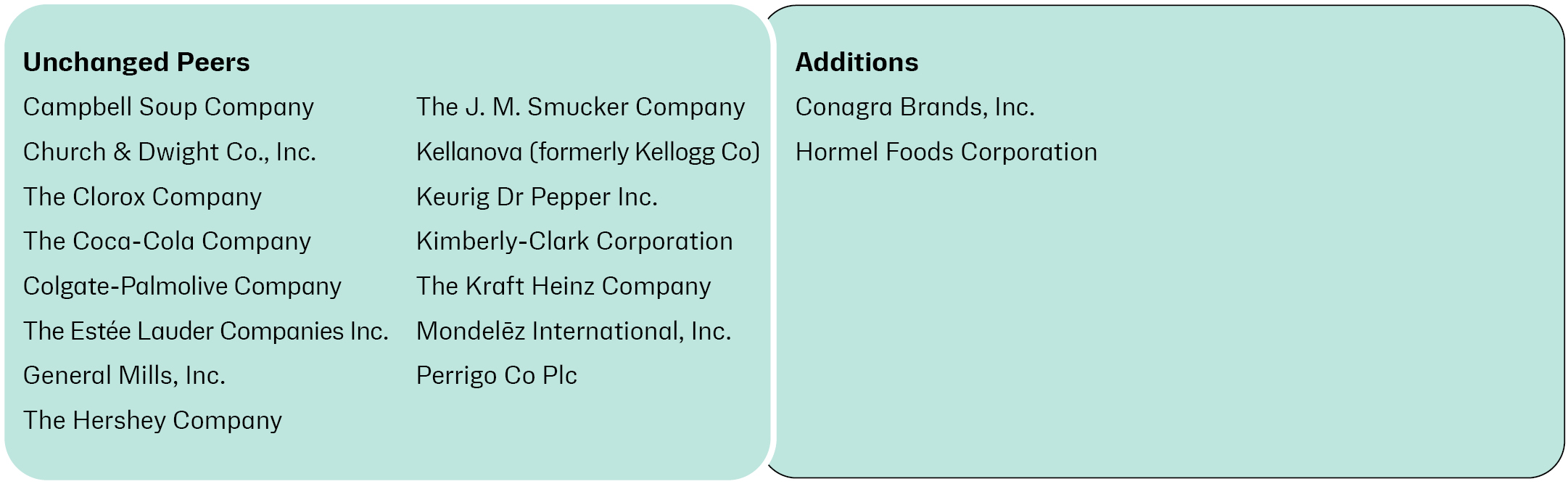

Our full Board is ultimately responsible for oversight of our ESG impacts, risks and opportunities and ensuring our ESG priorities and commitments are integrated into the Company’s long-term strategy. On an annual basis, the full Board receives an in-depth update on the Company’s ESG strategy, which we call our “Healthy Lives Mission”. After each regularly scheduled Committee meeting, the Committees report to the full Board with updates on their areas of designated ESG oversight responsibilities. For example, the Nominating, Governance and Sustainability Committee oversees and provides updates to the Board on governance and climate-related strategies and risks, and the Compensation & Human Capital Committee oversees and provides updates to the Board on human capital management and diversity, equity & inclusion strategies and risks.