crane driving breakthrough performance 2024 notice of annual meeting and proxy statement.

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

crane driving breakthrough performance 2024 notice of annual meeting and proxy statement.

|

||||

|

CRANE COMPANY

100 FIRST STAMFORD PLACE

STAMFORD, CONNECTICUT 06902

Dear Fellow Stockholders: |

This Proxy Statement and the 2023 Annual Report to Stockholders are available at www.investors.craneco.com

| |||

Crane Company cordially invites you to attend its virtual Annual Meeting of Stockholders, which will be held online via live webcast at 10:00 a.m., Eastern Daylight Time, on Monday, April 22, 2024. There will be no physical location for the Annual Meeting. Crane Company stockholders will be able to attend the Annual Meeting online, and, with a control number appearing on your proxy card, vote shares electronically and submit questions during the Annual Meeting by visiting meetnow.global/MK7ZLCR at the meeting date and time.

The Notice of Annual Meeting and Proxy Statement on the following pages describe the matters to be presented at the meeting. Management will report on current operations, and there will be an opportunity to ask questions regarding Crane Company and its activities.

It is important that your shares be represented at the meeting, regardless of the size of your holdings. If you are unable to attend, I urge you to participate by voting your shares by proxy. You may do so by using the internet address or the toll-free telephone number set forth in this Proxy Statement, or by requesting a printed copy of the proxy materials and completing and returning by mail the proxy card you receive in response to your request.

Also, I have the pleasure and privilege of informing you that the Board of Directors has unanimously decided to appoint Crane Company’s current President and Chief Executive Officer, Max H. Mitchell, as Chairman of the Board effective as of the annual meeting on April 22, 2024. Max has skillfully led Crane Company over the past 10 years to new heights, achieving record results across every metric, creating substantial value for our stockholders, and actively reshaping the portfolio to position us for continued growth in the years to come.

It has been my honor to serve as the Company’s Chairman over the past several years and I could not be more confident in Max’s ability to succeed me as Chairman of the Board.

Sincerely,

|

| |

| James L.L. Tullis Chairman of the Board |

Max H. Mitchell Incoming Chairman of the Board, and current President and Chief Executive Officer |

March 7, 2024

1

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS APRIL 22, 2024 |

||||||||

To the Stockholders of Crane Company:

The 2024 ANNUAL MEETING OF STOCKHOLDERS OF CRANE COMPANY will be held virtually for the following purposes:

|

|

WHEN: |

April 22, 2024

Monday 10:00 a.m.

Eastern Daylight Time

|

WHERE: |

Online via live webcast at meetnow.global/MK7ZLCR

HOW TO VOTE:

|

By Phone |

800-652-VOTE (8683)

in the United States,

United States territories,

and Canada.

|

By Mail |

Complete, sign, and return

the proxy card.

|

By Internet |

www.envisionreports.com/cr

|

Live Webcast |

Stockholders at the close of

business on February 26,

2024, are entitled to vote at

the Annual Meeting

virtually.

|

By Scanning |

You can vote your shares

online by scanning the QR

code on your proxy card.

| Proposal |

Board Recommendation | |||

| Item 1 |

To elect nine directors to serve for one-year terms until the annual meeting of stockholders in 2025 | FOR each director u Page 10 | ||

| Item 2 |

To consider and vote on a proposal to ratify the selection of Deloitte & Touche LLP as independent auditors for Crane Company for 2024 | FOR u Page 36 | ||

| Item 3 |

To consider and vote on a proposal to approve, by a non-binding advisory vote, the compensation paid by the Company to certain executive officers | FOR u Page 40 | ||

| Item 4 |

To consider and vote on a proposal to approve, by a non-binding advisory vote, the frequency with which we will ask stockholders to approve the compensation paid by the Company to certain executive officers | EVERY YEAR u Page 86 | ||

In addition, any other business properly presented may be acted upon at the meeting.

In order to assure a quorum at the virtual 2024 Annual Meeting of Stockholders of Crane Company (the “Annual Meeting”), it is important that stockholders who do not expect to attend virtually vote by using the internet address or the toll-free telephone number listed in this Proxy Statement. If you have requested paper copies of the proxy materials, you can vote by completing and returning the proxy card enclosed in those materials.

The Board of Directors has fixed the close of business on February 26, 2024, as the record date for the meeting. Stockholders at that date and time are entitled to notice of and to vote at the Annual Meeting or any postponement or adjournment of the Annual Meeting. Each share is entitled to one vote. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: meetnow.global/MK7ZLCR at the meeting date and time described in this Proxy Statement. There is no physical location for the Annual Meeting.

This Notice of Annual Meeting of Stockholders and related Proxy Statement are first being distributed or made available to stockholders on or about March 7, 2024.

We previously mailed a Notice of Internet Availability of Proxy Materials to all Crane Company stockholders as of the record date. The notice advised such stockholders that they could view the Proxy Statement and Annual Report online at www.envisionreports.com/cr, or request in writing a paper or e-mail copy of the proxy materials at no cost.

A complete list of stockholders as of the record date will be open to examination by any stockholder during regular business hours at the offices of Crane Company, 100 First Stamford Place, Stamford, CT 06902, for a period of 10 days prior to the meeting.

By Order of the Board of Directors,

Anthony M. D’Iorio

Secretary

March 7, 2024

2

| PROXY SUMMARY | ||||||||

Director Nominees

| Name and Profession |

Age | Crane Director Since |

Crane Company Committees | |||||||||||||

|

|

AC | NGC | EC | MOCC | ||||||||||||

|

|

Martin R. Benante Retired Chairman of the Board and Chief Executive Officer, Curtiss-Wright Corporation |

71 | 2023 |

|

|

|

| |||||||||

|

|

Sanjay Kapoor Retired Executive Vice President and CFO, Spirit AeroSystems, Inc. |

63 | 2023 |

|

|

|

| |||||||||

|

|

Ronald C. Lindsay Retired Chief Operating Officer, |

65 | 2023 |

|

|

|

| |||||||||

|

|

Ellen McClain Chief Executive Officer and President, Year Up |

59 | 2023 |

|

|

|

| |||||||||

|

|

Charles G. McClure, Jr. Managing Partner, Michigan Capital Advisors |

70 | 2023 |

|

|

|

| |||||||||

|

|

Max H. Mitchell President and Chief Executive Officer, Crane Company |

60 | 2023 |

|

|

|

| |||||||||

|

|

Jennifer M. Pollino Executive Coach and Consultant, JM Pollino LLC |

59 | 2023 |

|

|

|

| |||||||||

|

|

John S. Stroup Operating Advisor, Clayton, Dubilier & Rice |

57 | 2023 |

|

|

|

| |||||||||

|

|

James L. L. Tullis Chairman, Tullis Health Investors, Inc. |

76 | 2023 |

|

|

|

| |||||||||

| AC | Audit Committee | NGC | Nominating and Governance Committee |

Chair

Chair

Member

Member | ||||

| EC | Executive Committee | MOCC | Management Organization and Compensation Committee | |||||

3

Proxy Summary

Corporate Governance Highlights

Basis of Presentation

On April 3, 2023, we completed our previously announced separation from Crane Holdings, Co. (“Crane Holdings”), and were launched as an independent, publicly traded company. Upon separation we continued to hold and to operate Crane Holdings’ former Aerospace & Electronics and Process Flow Technologies global growth platforms, as well as its Engineered Materials segment, under the leadership of our Chief Executive Officer, Max H. Mitchell, who served as the Chief Executive Officer of Crane Holdings since 2014.

Recent Governance Enhancements

As stated in our Corporate Governance Guidelines, the Board is responsible for helping to create a culture of high ethical standards and is committed to continually improving its corporate governance process, practices, and procedures. Accordingly, the Board has adopted the following best practices in corporate governance:

Board renewal and composition: In connection with the separation transaction, the members of the Crane Company Board were chosen with the intention of providing an optimal balance between continuity (by including a number of Crane Holdings, Co. directors), with independence and relevant market focused experience to drive organic and inorganic growth. The Board, specifically through the Nominating and Governance Committee, continually evaluates the skills, expertise, integrity, diversity, and other qualities believed to enhance the Board’s ability to manage and direct the affairs and business of the Company.

Lead Independent Director role: At a regular Board meeting in January 2024, the Board unanimously determined that it would be in the best interests of the Company and its stockholders to combine the Chairman and CEO roles and to appoint a Lead Independent Director, both effective at the Annual Meeting. In making this determination, the Board considered the Company’s recent separation from Crane Holdings, and the benefit of Board leadership under Mr. Mitchell, who has served as the Company’s Chief Executive Officer since 2014 (inclusive of his time as Chief Executive Officer of Crane Holdings), accumulated extensive day-to-day knowledge of the Company’s operations and long term needs, and driven its successful portfolio reshaping, strategic plan, and growth initiatives during his tenure.

|

|

Ongoing Board Governance Practices |

| ||||

|

• Establishment of Lead Independent Director role to ensure independent oversight under a combined Chairman/CEO structure

• 100% independent Audit, Nominating and Governance, and Management Organization and Compensation committees

• Regular executive sessions of non-management directors

• Annual Board and committee performance self-evaluations

• 100% Board and committee attendance in 2023

• Offer of resignation upon significant change in primary job responsibilities

• Directors are elected annually

|

• Majority voting and director resignation policy for directors in uncontested elections

• Stringent conflict of interest policies

• Directors subject to stock ownership guidelines and anti-hedging and pledging policies

• Director retirement policy

• Strict over-boarding policy for directors

• Diverse Board with the appropriate mix of skills, experience, and perspective

• Comprehensive director nomination and Board refreshment process

• Oversight of cybersecurity, sustainability and human capital matters impacting our business |

|||||

4

Proxy Summary

2023 Performance Highlights

Mr. Mitchell, along with the Board of Directors, executed on a series of major strategic actions over the last three years which, combined with the strong operating performance that Mr. Mitchell drove in the Company’s businesses, have created significant value for equity investors in Crane Company and its predecessor company. Specifically, these actions generated approximately $5.5 billion in equity value (market capitalization) comparing Crane Holdings’ equity value on December 31, 2020, to the combined equity value of both post-separation companies (Crane Company and Crane NXT, Co.) on December 31, 2023, an increase of 120%.

Crane Company Market Capitalization

We believe this equity value creation is attributable, primarily, to five strategic actions from 2021 through 2023:

| • | On May 24, 2021, Crane announced an agreement to divest its Engineered Materials segment (although the divestiture process was subsequently terminated following objections from the Department of Justice). |

| • | On March 30, 2022, Crane Holdings announced its intention to separate into two independent, publicly traded companies to optimize investment and capital allocation in order to accelerate growth. Crane Holdings’ board of directors and management believe that the creation of two market focused companies with distinct product and service offerings and strong balance sheets better positions each business to deliver long-term growth and create value for all stakeholders, including customers, investors and our associates. The separation was completed on April 3, 2023. |

| • | On April 25, 2022, Crane announced an agreement to divest Crane Supply, its Canadian distribution business. |

| • | On August 15, 2022, Crane announced the sale of a subsidiary holding all asbestos liabilities and related insurance assets to permanently remove all asbestos related liabilities and obligations from the Company’s balance sheet. |

| • | On October 23, 2023, Crane Company announced the acquisition of Baum lined piping GmbH for approximately $91 million as a strategic bolt-on for the company’s Chemical business within the Process Flow Technologies Segment. |

In addition to these strategic actions, the three business segments that now comprise Crane Company delivered very strong financial results in 2023.

5

Proxy Summary

Strong Financial Results Despite Ongoing Market Challenges

Final 2023 financial and operational results, adjusted for strategic actions, were substantially above our original financial targets for the year, driven by a combination of a better-than-expected recovery in certain end markets, consistent and strong operational execution, and substantial benefits from strategic growth investments. Specifically:

| • | At Aerospace & Electronics, 2023 sales increased 18% compared to 2022, with segment operating margins up 210 basis points to 20.1% in 2023. Adjusted segment operating margins increased 180 basis points to 20.1% in 2023. These results reflect strong performance, particularly given persistent supply chain challenges in the Aerospace, Defense and Electronics markets. |

| • | At Process Flow Technologies, sales declined 3% compared to 2022, with core sales growth of 5%, and a 1% contribution from the Baum acquisition, more than offset by the impact from the May 2022 divestiture of Crane Supply. Segment operating margins reached a record level of 19.4%, up 420 basis points compared to 2022, and adjusted segment operating margins reached a record 19.9%, up 370 basis points compared to 2022. These results reflect record performance for the segment despite unusually high inflation for commodities, components and labor. |

| • | At Engineered Materials, sales declined 13% reflecting the market decline for Recreational Vehicles. However, despite the significant decline in sales, segment operating margins increased 230 basis points to 14.9%, reflecting strong execution and disciplined pricing. Adjusted segment operating margins increased 60 basis points to 14.8%. |

| * | See “Non-GAAP Reconciliation” beginning on page 89 for more detail regarding Special Items impacting adjusted segment operating margins, as well as a reconciliation of the non-GAAP measures used herein. |

2023 Compensation Highlights

Compensation Best Practices

The Management Organization and Compensation Committee is firmly committed to implementing an executive compensation program that aligns management and stockholder interests, encourages executives to drive sustainable stockholder value creation, and helps retain key personnel. Key elements of our pay practices are as follows:

|

• Pay for performance, aligning executive pay with Company results and stockholder returns

• Require significant stock ownership by executives, including an above-market 6x base salary requirement for the CEO and 5x base salary requirement for the CFO

• Majority of executive variable pay is delivered in long-term equity-based awards

• Appropriate mix of fixed and variable pay to balance employee retention with Company goals, both annual and long-term

• Incentive compensation subject to “no-fault” clawback

• Management Organization and Compensation Committee advised by independent compensation consultant

|

• No excise tax gross-ups upon change in control

• No multi-year guaranteed incentive awards

• No fixed-duration employment contracts with executive officers

• No hedging or pledging of Company stock permitted

• No excessive perquisites for executives

• No supplemental executive retirement plan (SERP) benefits, and no further pension benefit accruals for executives

• No repricing of options

• No discounted stock options |

6

Proxy Summary

Aspects of Compensation Unique to the Separation Transaction

This Proxy Statement summarizes the compensation decisions made by Crane Holdings in 2023 through the completion of the separation of Crane Company from Crane Holdings on April 3, 2023, and the compensation decisions made by Crane Company after the separation transaction. These compensation decisions reflect the relative performance period of the respective companies, and the compensation paid to the respective NEOs during that fiscal year period for the intensive effort to prepare for and complete the separation. See “Impact of the Separation Transaction on NEO Compensation Disclosures” on page 41. In light of the then pending separation of Crane Holdings, the Crane Holdings’ board of directors determined in January 2023 to hold Mr. Mitchell’s compensation flat for 2023, to be reassessed by the Board of Crane Company following separation. Mr. Mitchell successfully led Crane Company through the separation integration, which created substantial equity value for our stockholders.

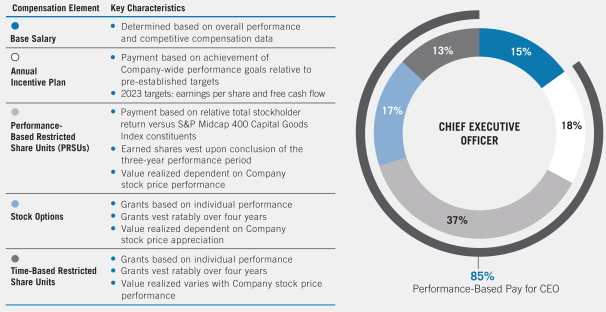

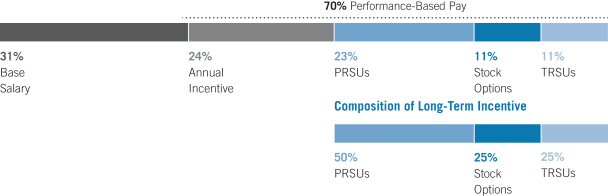

Pay for Performance Alignment

85% of CEO Target Pay is Performance-Based

The following table summarizes the major elements of our CEO compensation program, which is designed to link pay and performance (based on 2023 pay to Crane Company’s CEO by Crane Holdings, Co. prior to, and by Crane Company following, the separation).

Totals may not sum due to rounding.

7

Proxy Summary

Our Philanthropy, Sustainability and Equality Highlights

See additional details on the Company’s efforts and performance with respect to philanthropy, sustainability, and equality, at www.craneco.com/pse.

8

| PROXY STATEMENT | ||||||||

Table of Contents

9

| ITEM 1: ELECTION OF DIRECTORS | ||||||||

|

|

PROPOSAL 1 The Board recommends voting FOR each of the Director Nominees | |

Crane Company Board Composition

Our Corporate Governance Guidelines provide that the Board should generally have from nine to twelve directors, a substantial majority of whom must qualify as independent directors under the listing standards of the New York Stock Exchange (“NYSE”). In addition, the Guidelines provide that any director who has attained the age of 75 as of the record date for the annual meeting of stockholders shall tender his/her resignation from the Board.

The Board currently consists of nine members, eight of whom are independent, and eight were previously directors of Crane Holdings, Co. (“Crane Holdings”). James L.L. Tullis, who was a member of the Crane Holdings’ board of directors from 1998 and Chairman since 2020, and a member and Chairman of the Crane Company Board since the separation transaction completed on April 3, 2023, has attained the age of 75 as of the record date and, in accordance with the Company’s Director retirement policy, indicated his intention to retire from the Board effective as of the Annual Meeting. The Board reviewed Mr. Tullis’ proposed resignation giving due consideration to Mr. Tullis’ skills, leadership and governance expertise, his significant contributions and experience, and the significant benefits to the Company of leadership stability and continuity following the Company’s recently completed separation transaction. In addition, and very importantly, given the Board’s decision to consolidate the Chairman and CEO roles (See “Board Leadership Structure” on page 27 for a discussion of that decision) the Board felt it would be beneficial to have Mr. Tullis remain on the Board for another year in the capacity of Lead Independent Director, to provide continued independent oversight of management and the CEO, and to assist Mr. Mitchell in transitioning to the Chairman role. Accordingly, the Board requested that Mr. Tullis stand for re-election as a director for a one-year term at the Annual Meeting.

The Company believes a board with between nine to twelve directors is appropriate to generate a manageable diversity of thought, perspective, and insight in a cost-efficient manner.

The nine directors whose terms will expire at the time of the Annual Meeting but will serve until their successors are duly elected and qualified, are Martin R. Benante, Sanjay Kapoor, Ronald C. Lindsay, Ellen McClain, Charles G. McClure, Jr., Max H. Mitchell, Jennifer M. Pollino, John S. Stroup, and James L. L. Tullis.

The Board has nominated each of the nine directors for re-election by the stockholders for a one-year term to expire at the 2025 annual meeting of stockholders. The Board has determined that all directors other than Mr. Mitchell are independent directors.

Director Nominating Procedures

The Board believes that a company’s directors should possess and demonstrate, individually and as a group, an effective and diverse combination of skills and experience to guide the management and direction of the Company’s business and affairs and to align with our long-term strategic vision. The Board has charged the Nominating and Governance Committee with responsibility for evaluating the mix of skills, experience and diversity of background of the Company’s directors and director nominees, as well as leading the evaluation process for the Board and its committees.

Criteria for Board membership take into account skills, expertise, integrity, diversity in thought, ethnicity, and gender, and other qualities which are expected to enhance the Board’s ability to manage and direct Crane Company’s business and affairs. In general, nominees for director should have an understanding of the workings of large business organizations such as Crane Company and senior level executive leadership experience. In addition, nominees should have the ability to make independent, analytical judgments, and they should be effective communicators with the ability and willingness to devote the time and effort required to be an effective and contributing member of the Board.

10

Item 1: Election of Directors

Overboarding Policy

A director who serves as a chief executive officer may not serve on more than two public company boards in addition to our Board, and other directors should not sit on more than four public company boards in addition to our Board. The members of the Audit Committee may not serve on more than two other audit committees of public companies. All of the director nominees are in compliance with these requirements.

Board Composition

Our Board takes an active and thoughtful approach to board composition and is focused on building and maintaining a diverse board. In conducting its annual review of director skills and Board composition, the Nominating and Governance Committee determined and reported to the Board its judgment that the Board as a whole demonstrates a diversity of organizational and professional experience, education, skills, and other personal qualities and attributes that enable the Board to perform its duties in a highly effective manner. Following separation, the Board determined that it was in the best interests of the Company to fill a vacant director seat with someone who had substantial experience in driving inorganic growth in the aerospace and defense markets, and appointed Sanjay Kapoor for that seat. The Company is committed to continuing to grow its gender and ethnic diversity membership on the Board. The Company is proud to have such a diverse Board, including with respect to gender and ethnicity.

Board Snapshot

| Age

|

Tenure*

|

Diversity

|

| * | Includes service with Crane Holdings, Co. |

Board Skills and Experience

Our individual Board members have a wide range of skills and experience from within and outside our industry, giving them diverse perspectives from which to oversee the Company’s strategy of being a manufacturer of highly engineered industrial products in a broad range of markets where we have competitive differentiation and scale, and growing the business globally organically and through acquisitions. Our Board members possess expertise in, among other things, mergers and acquisitions and other business combinations, diversified industrial operations and manufacturing, international business, corporate finance, human capital management, cybersecurity, and organizational leadership.

11

Item 1: Election of Directors

Summary of Board Skills and Experience

|

|

|

|

|

|

|

|

|

|

| |||||||||

| Public company multinational CEO experience |

● |

|

|

|

● | ● |

|

● |

| |||||||||

| Public company multinational CFO experience |

|

● |

|

|

|

|

|

|

| |||||||||

| General finance acumen |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

| Corporate governance/board experience |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

| Mergers & Acquisitions |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

| Manufacturing operations |

● | ● | ● |

|

● | ● | ● | ● |

| |||||||||

| Expertise with one or more of Crane Company’s end markets |

● | ● | ● |

|

● | ● | ● |

|

| |||||||||

| Intellectual capital development (human capital) |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

| Cyber/Information Security skills |

● | ● |

|

● |

|

● | ● | ● |

| |||||||||

| Independent |

|

|

|

|

|

|

|

|

| |||||||||

| Self-Identified Race/Ethnicity |

|

|

|

|

|

|

|

|

| |||||||||

| African American |

|

|

|

● |

|

|

|

|

| |||||||||

| Indian/South Asian |

|

● |

|

|

|

|

|

|

| |||||||||

| White Caucasian |

● |

|

● |

|

● | ● | ● | ● | ● | |||||||||

| Self-Identified Gender |

|

|

|

|

|

|

|

|

| |||||||||

| Male |

● | ● | ● |

|

● | ● |

|

● | ● | |||||||||

| Female |

|

|

|

● |

|

|

● |

|

| |||||||||

The Board Composition and Board Skills and Experience sections above reflect the Board’s nine director nominees.

The Nominating and Governance Committee has proposed, and the Board recommends, that each of the nine nominees be elected to the Board. If, before the Annual Meeting, any nominee becomes unavailable for election as a director, the elected directors may make an interim vacancy appointment to the Board after the Annual Meeting, or the Board may reduce the number of directors to eliminate the vacancy.

12

Item 1: Election of Directors

Board of Directors Nominees

Nominees to be Elected for Terms to Expire in 2025

|

|

|

MARTIN R. BENANTE

Age: 71

Director Since: 2023

Crane Holdings, Co. Director Since: 2015* |

Crane Company Committees: Audit (Chair); Nominating and Governance |

|||||

|

Retired Chairman of the Board and Chief Executive Officer of Curtiss-Wright Corporation, Charlotte, NC (supplier of highly engineered products and services to commercial, industrial, aerospace, defense, and energy markets), having served from 2000 to 2015.

Other Directorships:

• Curtiss-Wright Corporation from 1999 to 2015

|

||||||||

| Relevant Skills and Experience:

• Strategic, operational, and managerial expertise gained through a more than 35-year career with a leading industrial manufacturer of highly engineered products in critical service applications, serving aerospace and process flow markets similar to those of the Company.

• CEO of a publicly traded company with international operations.

• Substantial expertise in driving growth through domestic and international mergers and acquisitions, and in the global integration of acquired companies. |

||||||||

|

|

|

SANJAY KAPOOR

Age: 63

Director Since: 2023 |

Crane Company Committees: Audit |

|||||

|

Retired Executive Vice President and CFO of Spirit AeroSystems, Inc., Wichita, KS (manufacturer of aerostructures for commercial airplanes, defense platforms and business/regional jets) having served in that role from 2016 to 2019. Prior to joining Spirit AeroSystems, Kapoor spent more than two decades with industry-leading defense and aviation sector companies Raytheon (2004-2013) and United Technologies (1990-2004), holding senior management positions overseeing significant aerospace and defense related programs.

Other Directorships:

• Saab, Inc. (US subsidiary of SAAB, AB) since 2021

• Black & Veatch (an EPC company under an ESOP) since 2018

|

||||||||

| Relevant Skills and Experience:

• Financial and operational expertise gained by extensive senior executive experience with publicly-traded manufacturing companies.

• Substantial experience driving inorganic growth in the aerospace and defense markets, and successfully integrating acquired companies. |

||||||||

13

Item 1: Election of Directors

|

|

|

RONALD C. LINDSAY

Age: 65

Director Since: 2023

Crane Holdings, Co. Director Since: 2013* |

Crane Company Committees: Audit; Nominating and Governance (Chair) |

|||||

|

Retired Chief Operating Officer of Eastman Chemical Company, Kingsport, TN (manufacturer of specialty chemicals, plastics, and fibers). Chief Operating Officer from 2013 to 2016, and Executive Vice President, Specialty Fluids and Intermediates, Fibers, Adhesives and Plasticizers Worldwide Engineering, Construction and Manufacturing Support, from 2011 to 2013. Positions of increasing responsibility with Eastman Chemical Company from 1980, including Senior Vice President from 2006 to 2009 and Executive Vice President from 2009 to 2013.

|

||||||||

| Relevant Skills and Experience:

• Corporate strategy, operations, sales, and manufacturing expertise gained by extensive senior executive experience with Eastman Chemical Company, a leading chemical manufacturer served by the Company’s Process Flow Technologies segment. |

||||||||

|

|

|

ELLEN MCCLAIN

Age: 59

Director Since: 2023

Crane Holdings, Co. Director Since: 2013* |

Crane Company Committees: Audit; Management Organization and Compensation |

|||||

|

Chief Executive Officer and President beginning in December 2023, President since 2022, Chief Operating Officer since 2021, and Chief Financial Officer from 2015 to 2021, Year Up, Boston, MA (not-for-profit provider of job training services). Senior management and financial positions with New York Racing Association, Inc., Ozone Park, NY (operator of thoroughbred racetracks), including President from 2012 to 2013. Vice President, Finance of Hearst-Argyle Television, Inc., New York, NY (operator of local television stations) from 2004 to 2009.

Other Directorships:

• Crane NXT, Co.(formerly known as Crane Holdings, Co.) since 2013

• Horseracing Integrity and Safety Authority from 2021 to 2023

|

||||||||

| Relevant Skills and Experience:

• Financial, operational and organizational expertise gained as chief executive officer, chief financial officer, chief operating officer, and president of public and private enterprises.

• Broad experience as a senior executive with responsibility for organizational direction and development, financial expertise, and intellectual capital (human capital). |

||||||||

14

Item 1: Election of Directors

|

|

|

CHARLES G. MCCLURE, JR.

Age: 70

Director Since: 2023

Crane Holdings, Co. Director Since: 2017* |

Crane Company Committees: Management Organization and Compensation; Nominating and Governance |

|||||

|

Managing Partner of Michigan Capital Advisors, Bloomfield, MI (private equity firm investing in Tier 2 and 3 global automotive and transportation suppliers). Prior to co-founding Michigan Capital Advisors in 2014, served from 2004 to 2013 as Chairman of the Board, CEO and President of Meritor, Inc., Troy, MI (leading global supplier of drivetrain, mobility, braking, and aftermarket solutions for commercial vehicle and industrial markets).

Other Directorships:

• 3D Systems since 2017; Chairman since 2018

• Penske Corporation since 2013

• DTE Energy Company since 2012

|

||||||||

| Relevant Skills and Experience:

• More than 35 years of experience in corporate strategy, manufacturing, sales, operations, and intellectual capital (human capital) expertise in various industries, including transportation.

• Proven leadership skills and corporate governance expertise with over 20 years of experience as chief executive officer, president, and director of major domestic and international public corporations, as well as a member of the boards of various industry organizations. |

||||||||

15

Item 1: Election of Directors

|

|

|

MAX H. MITCHELL

Age: 60

Director Since: 2023

Crane Holdings, Co. Director Since: 2014* |

Crane Company Committees: Executive |

|||||

|

President and Chief Executive Officer of Crane Company (a global manufacturer of highly engineered products in the Aerospace and Electronics, Process Flow Technologies, and Engineered Materials markets) and its former parent company, Crane Holdings, Co. since 2014; President and Chief Operating Officer of Crane Co. (prior to its reorganization into Crane Holdings, Co.) from 2013 to 2014; Executive Vice President and Chief Operating Officer of Crane Co. (prior to its reorganization into Crane Holdings, Co.) from 2011 to 2013; Group President, Process Flow Technologies segment of Crane Co., (prior to its reorganization into Crane Holdings, Co.) from 2005 to 2012.

Other Directorships:

• Crane NXT, Co. (formerly known as Crane Holdings, Co.) since 2014 (ending in April 2024)

• Goodyear Tire & Rubber Company since 2023

• Lennox International, Inc. from 2016 to 2022

• Manufacturers Alliance for Productivity and Innovation

|

||||||||

| Relevant Skills and Experience:

• Chief Executive Officer of a global publicly-traded company.

• Comprehensive knowledge of the Company’s culture and operations gained from successive leadership positions of increasing responsibility.

• Demonstrated expertise in developing and driving corporate strategy and optimizing portfolio results, including extensive portfolio reshaping.

• Extensive knowledge of, and experience with, the global end markets in which the Company trades.

• Broad international and domestic Mergers & Acquisitions expertise, including driving growth through M&A, and successful integration of acquired companies.

• Extensive experience with intellectual/human capital management processes to drive a performance-based culture.

• Substantial experience managing cyber and information technology personnel and programs. |

||||||||

16

Item 1: Election of Directors

|

|

|

JENNIFER M. POLLINO

Age: 59

Director Since: 2023

Crane Holdings, Co. Director Since: 2013* |

Crane Company Committees: Executive; Management Organization and Compensation (Chair); Nominating and Governance |

|||||

|

Executive Coach and Consultant, JM Pollino LLC, Charlotte, NC since 2012. Executive Vice President, Human Resources and Communications, Goodrich Corporation, Charlotte, NC (aerospace products manufacturer) from 2005 to 2012. Prior positions at Goodrich included President and General Manager of Goodrich Aerospace’s Aircraft Wheels & Brakes Division and of its Turbomachinery Products Division, and Vice President and General Manager of Goodrich Aerospace, Aircraft Seating Products.

Other Directorships:

• Hubbell Incorporated since 2020

• Kaman Corporation since 2015; Lead Independent Director since 2021

• Wesco Aircraft Holdings, Inc. from 2014 to 2020

• National Association of Corporate Directors since 2021

|

||||||||

| Relevant Skills and Experience:

• Broad experience as an aerospace industry senior executive with responsibility for corporate governance, intellectual capital (human capital), and organizational issues, as well as financial and operational expertise, gained in over 20 years as senior executive and general manager with a leading aerospace products company.

• Financial expertise gained as controller of savings and loan association and field accounting officer at Resolution Trust Corporation.

• Certified Public Accountant |

||||||||

17

Item 1: Election of Directors

|

|

|

JOHN S. STROUP

Age: 57

Director Since: 2023

Crane Holdings, Co. Director Since: 2020* |

Crane Company Committees: Audit; Management Organization and Compensation |

|||||

|

Operating Advisor, Clayton, Dubilier & Rice (a global private equity manager that invests in and builds businesses) since 2020. Former President, Chief Executive Officer, and member of the board of directors from 2005 to May 2020, Chairman from 2016, and Executive Chairman from 2020 to May 2021, of Belden Inc. (a global leader in signal transmission and security solutions).

Other Directorships:

• Crane NXT, Co. (formerly known as Crane Holdings, Co.) since 2020 (Chairman since 2023)

• Zurn Elkay Water Solutions Corporation from 2008 to 2023

• Tenneco from 2020 to 2022

• Belden, Inc. from 2005 to May 2021; Chairman from 2016 to 2020; Executive Chairman from 2020 to May 2021

|

||||||||

| Relevant Skills and Experience:

• More than 30 years of experience in industrial manufacturing of highly engineered products and business strategy development

• Proven leadership skills with over 15 years of experience as president, chief executive officer and director of a global leader in signal transmission and security solutions

• Significant experience in driving growth through M&A and strategic portfolio development |

||||||||

18

Item 1: Election of Directors

|

|

|

JAMES L. L. TULLIS

Age: 76

Director Since: 2023

Crane Holdings, Co. Director Since: 1998* |

Crane Company Committees: Executive (Chair); Management Organization and Compensation |

|||||

|

Chairman, Tullis Health Investors, LLC, Palm Beach Gardens, FL (venture capital investments in the health care industry) from 1988 to the present.

Other Directorships:

• Crane NXT, Co. (formerly known as Crane Holdings, Co.) since 1998

• Alphatec Holdings, Inc. since 2018

• Exagen Diagnostics, Inc. from 2015 to 2023

• Lord Abbett & Co. Mutual Funds since 2006; Chairman (from 2017 to 2023)

|

||||||||

| Relevant Skills and Experience:

• Executive leadership, financial and organizational expertise gained as chief executive officer of venture capital investment group, driving growth through M&A and strategic portfolio development

• Significant experience and expertise in management, strategy and governance matters gained as director of several public and private companies, including serving as chairman and on the compensation, nominating and governance, audit and executive committees of public companies |

||||||||

| Age calculations for all directors are as of the record date.

* Denotes period of beginning service on the Crane Holdings, Co. (now Crane NXT, Co.) Board of Directors, from which Crane Company was separated in a separation transaction on April 3, 2023. |

||||||||

VOTE REQUIRED

Our by-laws provide that nominees for director and directors running for re-election to the Board without opposition must receive the affirmative vote of a majority of votes cast. Any director who fails to receive the required number of votes for re-election is required by Crane Company policy to tender his or her written resignation to the Chairman of the Board for consideration by the Nominating and Governance Committee.

|

|

||||

|

|

||||

|

|

19

Item 1: Election of Directors

Independent Status of Directors

Standards for Director Independence

The listing standards of the NYSE, as well as Crane Company’s Corporate Governance Guidelines, require that a majority of the Board be comprised of independent directors. In order for a director to qualify as independent, the Board must affirmatively determine that the director has no material relationship with Crane Company. The Board has adopted the standards set forth below in order to assist the Nominating and Governance Committee and the Board itself in making determinations of director independence. Any of the following relationships would preclude a director from qualifying as an independent director:

| • | The director is or was an employee, or the director’s immediate family member is or was an executive officer, of Crane Company other than as an interim Chairman or interim CEO, unless at least three years have passed since the end of such employment relationship. |

| • | The director is an employee, or the director’s immediate family member is an executive officer, of an organization (other than a charitable organization) that in any of the last three completed fiscal years made payments to, or received payments from, Crane Company for property or services, if the amount of such payments exceeded the greater of $1 million or 2% of the other organization’s consolidated gross revenues. |

| • | The director has received, or the director’s immediate family member has received, direct compensation from Crane Company, if the director is a member of the Audit Committee or the amount of such direct compensation received during any twelve-month period within the preceding three years has exceeded $120,000 per year, excluding (i) director and committee fees and pension and other forms of deferred compensation for prior services (so long as such compensation is not contingent in any way on continued service); (ii) compensation received as interim Chairman or CEO; or (iii) compensation received by an immediate family member for service as a non-executive employee of Crane Company. |

| • | The director is a current partner of or employed by, or the director’s immediate family member is a current partner of, or an employee who personally works on the financial audit of Crane at a firm that is the internal or external auditor of Crane Company, or the director was, or the director’s immediate family member was, within the last three years a partner or employee of such a firm and personally worked on the Crane Company audit at that time. |

| • | The director is or was employed, or the director’s immediate family member is or was employed, as an executive officer of another organization, and any of Crane Company’s present executive officers serves or served on that other organization’s compensation committee, unless at least three years have passed since the end of such service or the employment relationship. |

| • | The director is a member of a law firm, or a partner or executive officer of any investment banking firm, that has provided services to Crane Company, if the director is a member of the Audit Committee or the fees paid in any of the last three completed fiscal years or anticipated for the current fiscal year exceed the greater of $1 million or 2% of such firm’s consolidated gross revenues. |

The existence of any relationship of the type referred to above, but at a level lower than the thresholds referred to, does not, if entered into in the ordinary course of business, preclude a director from being independent. The Nominating and Governance Committee and the Board review all relevant facts and circumstances before concluding that a relationship is not material or that a director is independent. Specifically, the Crane Company Management Organization and Compensation Committee’s evaluation process includes the annual review of (i) direct and indirect relationships between directors and the Company, (ii) a report of transactions with director affiliated entities, (iii) director responses to annual questionnaires, and (iv) Code of Business Conduct and Ethics compliance certifications. In addition, the Nominating and Governance Committee reviews and must approve all charitable contributions in excess of $10,000 made by the Company or through one of the following three independent charitable funds: Crane Fund, Crane Fund for Widows and Children, or Crane Foundation, to any organization for which a director or his or her spouse or other immediate family member serves as a trustee, director, or officer or in any similar capacity. There were no such contributions in 2023.

Crane Company’s Standards for Director Independence, along with its Corporate Governance Guidelines and Code of Business Conduct and Ethics, which apply to Crane Company’s directors and to all officers and other employees, including our Chief Executive Officer, Chief Financial Officer and Controller, are available on our website at www.investors.craneco.com/investors/corporate-governance. See “Code of Business Conduct and Ethics” on page 30.

20

Item 1: Election of Directors

Independence of Directors

The Nominating and Governance Committee has reviewed whether any of the directors other than Mr. Mitchell, who is the current Chief Executive Officer and Chairman designee of Crane Company, and who served as Chief Executive Officer of Crane Holdings, Co. until the completion of the separation transaction on April 3, 2023, has any relationship that, in the opinion of the Committee, (i) is material (either directly or as a partner, stockholder, director, or officer of an organization that has a relationship with Crane Company) and, as such, would be reasonably likely to interfere with the exercise by such person of independent judgment in carrying out the responsibilities of a director or (ii) would otherwise cause such person not to qualify as an “independent” director under the rules of the NYSE and, in the case of members of the Audit Committee and the Management Organization and Compensation Committee, the additional requirements under Sections 10A and 10C, respectively, of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the associated rules. The Nominating and Governance Committee determined that, other than Mr. Mitchell, all of Crane Company’s current directors and all persons who served as a director of Crane Company at any time from and after the closing of the separation transaction on April 3, 2023 are independent in accordance with the foregoing standards, and the Board has reviewed and accepted the determinations of the Nominating and Governance Committee.

In evaluating the independence of all directors, the Board considered all transactions in which the Company and any director had an interest, including all purchases and sales with other companies on which a director served on that company’s board. The Board determined in each case that such purchases and sales were de minimis, comprising less than 0.01% of the Company’s revenues. The Board evaluated these transactions and determined that they arose in the ordinary course of business and on the same terms and conditions available to other customers and suppliers. With regard to our directors also serving as directors of Crane NXT, Co., the Board considered the payments made to the Company by, and the payments made by the Company to, Crane NXT, Co. for transition services, repayment for third party invoices paid by the other party and tax-related obligations under agreements entered into in connection with the separation transaction. Among other things, the Board concluded that those individuals do not exert influence on the transition services or indemnification processes and that that such payments were on standard, previously negotiated terms that are consistent with terms involved in similar spin-off transactions. Furthermore, in reaching their determinations regarding the independence of the directors (other than Mr. Mitchell), the Committee and the Board applied the Standards for Director Independence described above and determined that there were no transactions that were likely to affect the independence of any director’s judgment.

Board Refreshment

Under the Corporate Governance Guidelines, each director who has attained the age of 75 as of the record date for an annual meeting of stockholders is required to tender his or her resignation from the Board. The Corporate Governance Guidelines also require a director to tender his or her resignation from the Board if there is a significant change in his or her primary job responsibilities that could impact the skills or perspectives they bring to the Board. The Nominating and Governance Committee then makes a recommendation to the Board, based on a review of all relevant circumstances, whether the Board should accept the resignation or ask the director to continue on the Board.

Mr. Tullis, who was a member of the Crane Holdings, Co. Board from 1998 and Chairman since 2020, and a member and Chairman of the Crane Company Board since the separation transaction completed on April 3, 2023, has attained the age of 75 as of the record date and, in accordance with the Company’s director retirement policy, indicated his intention to retire from the Board effective as of the Annual Meeting. The Board reviewed Mr. Tullis’ proposed resignation giving due consideration to Mr. Tullis’ skills, leadership and governance expertise, his significant contributions and experience, and the significant benefits to the Company of leadership stability and continuity following the Company’s recently completed separation transaction. In addition, and very importantly, given the Board’s decision to consolidate the Chairman and CEO roles (See “Board Leadership Structure” on page 27 for a discussion of that decision), the Board felt it would be beneficial to have Mr. Tullis remain on the Board for another year in the capacity of Lead Independent Director, to provide continued independent oversight of management and the CEO, and to assist Mr. Mitchell in transitioning to the Chairman role, the Board requested that Mr. Tullis stand for re-election for a one-year term at the Annual Meeting.

The Nominating and Governance Committee will, from time to time, seek to identify potential candidates for director to sustain and enhance the composition of the Board with an appropriate balance of knowledge, experience, skills, expertise, and diversity of thought, ethnicity, and gender, to enable Crane to formulate and implement its strategic plan.

21

Item 1: Election of Directors

In this process, the Committee will consider potential candidates proposed by other members of the Board, by management, or by stockholders, and the Committee has the sole authority to retain a search firm to assist in this process, at Crane Company’s expense.

Once a person has been identified by the Nominating and Governance Committee as a potential candidate, the Committee, as an initial matter, may collect and review publicly available information regarding the person to assess whether the person should be considered further. Generally, if the person expresses a willingness to be considered and to serve on the Board, and the Committee believes that the person has the potential to be a good candidate, the Committee would seek to gather additional information from or about the person, review the person’s accomplishments and qualifications in light of any other candidates that the Committee might be considering, and, as appropriate, conduct one or more interviews with the person. In certain instances, Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s background, skills and accomplishments. The Committee’s evaluation process does not vary based on whether or not a prospective candidate is recommended by a stockholder.

Board Effectiveness

Our Board, led by our Nominating and Governance Committee, evaluates the size and composition of our Board at least annually, giving consideration to evolving skills, diversity, perspective, and experience needed on our Board to perform its governance and oversight role as the business grows and evolves and the underlying risks change over time. Below are steps our Board has recently taken to proactively improve our Board effectiveness.

|

STEPS TO IMPROVE BOARD EFFECTIVENESS

• Identify director candidates with diverse backgrounds and experiences

• Annual Board and committee performance self-evaluations

• Alignment of director strengths with the Company’s strategic goals and objectives

• Director retirement policy

• Strict over-boarding policy for directors

• Adjust the size of the Board as appropriate to meet the governance needs of the Company

|

||||||||

|

||||||||

|

OUTCOMES

• Significant international Mergers & Acquisitions experience in the Company’s core markets

• Public company CEO experience

• Public company CFO experience

• Experience in the aerospace/defense sector

• Cyber/Information security skills and experience

• Intellectual capital (human capital) development

|

||||||||

Nominations by Stockholders

In considering candidates submitted by stockholders, the Nominating and Governance Committee will take into consideration the needs of the Board and the qualifications of the candidate. A stockholder proposing to nominate a director must provide certain information about the nominating stockholder and the director nominee, including the following information and must update such information as of the record date for the meeting:

| • | the number of shares of Company stock, including details regarding any derivative securities, held by the nominating stockholder and the director nominee and any of their respective affiliates or associates; |

22

Item 1: Election of Directors

| • | a description of any agreement regarding how the director nominee would vote, if elected, on a particular matter, including a representation that there are no other understandings, obligations or commitments; |

| • | a description of any agreement with respect to compensation as a director from any person other than the Company, including a representation that there are no other understandings, obligations or commitments; |

| • | a representation that the director nominee will comply with all publicly disclosed Board policies, including those relating to confidentiality; |

| • | a completed questionnaire similar to the one required of existing directors, a copy of which the Corporate Secretary will provide upon request; |

| • | a description of any material interest the nominating stockholder has in any such nomination; and |

| • | any other information about the proposed candidate that would, under the proxy rules of the Securities and Exchange Commission (the “SEC”), be required to be included in our proxy statement if the person were a nominee. |

Such notice must also be accompanied by a written consent of each proposed nominee to being named as a nominee and to serve as a director, if elected. A complete description of the requirements relating to a stockholder nomination is set forth in our by-laws.

Any stockholder recommendation for next year’s annual meeting, together with the information described above, must be sent to the Corporate Secretary at 100 First Stamford Place, 4th Floor, Stamford, CT 06902 and, in order to allow for timely consideration, must be received by the Corporate Secretary not less than 90 days, and not more than 120 days prior to April 22, 2025.

Majority Voting for Directors and Resignation Policy

Our by-laws provide that nominees for director and directors running for re-election to the Board without opposition must receive a majority of votes cast. Any director who fails to receive the required number of votes for re-election is required by Crane Company policy to tender his or her written resignation to the Chairman of the Board for consideration by the Nominating and Governance Committee. The Committee will consider such tendered resignation and make a recommendation to the Board concerning the acceptance or rejection of the resignation. In determining its recommendation to the Board, the Committee will consider all factors deemed relevant by the members of the Committee including, without limitation, the stated reason or reasons why stockholders voted against such director’s re-election, the qualifications of the director, and whether the director’s resignation from the Board would be in the best interests of the Company and its stockholders.

Board’s Role and Responsibilities

The Board is responsible for, and is committed to, overseeing the business and affairs of the Company and providing guidance for sound decision making, accountability and ethical professional conduct. It reviews the performance of our management and establishes guidelines and performance targets for our executive compensation program. The Board has adopted a comprehensive set of Corporate Governance Guidelines that set forth the Company’s governance philosophy, policies, and practices, and provide a framework for the conduct of the Board’s business.

Strategic Oversight

Our Board takes an active role in overseeing management’s formulation and implementation of its strategic plan. It receives a comprehensive overview of management’s strategic plan for all of the Company’s businesses at least annually, receives regular updates from consultants, financial advisors, and other experts on the global capital markets and industrial manufacturing environment, and receives periodic updates from individual businesses on their strategic plans at other regularly scheduled Board meetings throughout the year. The Board provides insight and feedback to senior management, and, if necessary, challenges management on the Company’s strategic direction. The Board also monitors and evaluates, with the assistance of the Chief Executive Officer, the Company’s strategic results, and approves all material capital allocation decisions.

23

Item 1: Election of Directors

Environmental, Social and Governance (“ESG”) Oversight

ESG strategies and initiatives are overseen by the Board. Our Board takes an active role in its oversight by reviewing ESG matters relevant to the Company’s business, including environmental, sustainability, corporate governance and diversity, equity, and inclusion. At least annually, the Board receives a comprehensive review of management’s plan for the Company with respect to philanthropy, sustainability, and equality initiatives and reviews the Company’s prior year initiatives and performance on these important issues. (See “Corporate Governance and Sustainability” on page 32). Our Board also receives periodic reports from management regarding the Company’s efforts, initiatives, and performance with respect to these metrics and is not only responsible for the oversight of the Company’s ESG commitments, but for periodically reviewing the Company’s policies and practices regarding ESG matters.

Cyber and Information Security Risk Oversight

Tone at the Top

Our approach to cybersecurity begins with our desire to maintain strong governance and controls to effectively manage and reduce security risks. Security begins with our “tone at the top”, where Company leadership consistently communicates the requirements for vigilance and compliance throughout the organization, and then leads by example. The cybersecurity program is led by Crane’s Chief Information Security Officer, who provides periodic updates to the Audit Committee of our Board of Directors, annual updates to the full Board of Directors, and regular reports to the executive management team about the program, including information about cyber risk management governance and the status of ongoing efforts to strengthen cybersecurity effectiveness. The entire Board of Directors ultimately is responsible for overseeing management’s risk assessment and risk management processes designed to monitor and mitigate information security risks, including cyber risks. The Company maintains cyber risk and related insurance policies as a measure of added protection.

Our Team and Capabilities

Our cybersecurity program is staffed by a team of highly skilled cybersecurity professionals, including over 24 dedicated internal cybersecurity resources. Four members of the security team currently have Certified Information Systems Security Professional (CISSP) credentials, many hold one or more Global Information Assurance Certification (GIAC)/The Sans Institute (SANS) cybersecurity certificates, and in total the team has over 70 security and network certifications. Our response team members are in various global locations to ensure 24/7 monitoring and response capabilities and are backed by a 24/7 Managed Security Services Provider (MSSP) who monitors cybersecurity alerts. The program incorporates industry standard frameworks, policies and practices designed to protect the privacy and security of our sensitive information, backed by a suite of best-in-class security technologies and tools to implement and automate security protections for our networks, employees, and customers.

Our Program and Results

We utilize a risk-based, multi-layered information security approach following the National Institute of Standards and Technology (NIST) Cybersecurity Framework (CSF) and the Center for Internet Security (CIS) critical security controls. We have adopted and implemented an approach to identify and mitigate information security risks that we believe is commercially reasonable for manufacturing companies of our size and scope and commensurate with the risks we face. From the completion of the Company’s separation from Crane Holdings on April 3, 2023, and during the past five years (as Crane Holdings), no attempted cyber-attack or other attempted intrusion on our information technology networks has resulted in a material adverse impact on our operations or financial results, in any penalties or settlements, or in the loss or exfiltration of Company data. In the event an attack or other intrusion were to be successful, we have a response team of internal and external resources engaged and prepared to respond.

Crane has not experienced a material third-party security breach, but recognizes the inherent cyber risks associated with relying on third-party vendors such as cloud service providers, software vendors, data processors, and IT service providers with access to company information, systems, or processes. Crane is committed to managing these risks responsibly and transparently and has an active process in place to assess and reduce that risk, including performing due diligence on third-party vendors before onboarding and evaluating and assessing their cybersecurity policies,

24

Item 1: Election of Directors

procedures, incident response plans, and relevant certifications (e.g., SOC 2, ISO 27001, etc.). We continuously monitor publicly available information about our third-party vendors for reports of security incidents and fully investigate any reports for impact to Crane systems or information and take appropriate measures to limit the impact to Crane in the event of a third-party security incident.

Education and Awareness

We educate and share best practices globally with our employees to raise awareness of cybersecurity threats. As part of our internal training process, we maintain an annual training for all employees on cybersecurity standards and provide monthly training on how to recognize and properly respond to phishing, social engineering schemes and other cyber threats. The Company uses advanced systems to block and analyze all email for threats, as well as equip our employees with an intuitive mechanism to easily report suspicious emails which are analyzed by our security systems and dedicated incident response team. Monthly “test” phishing emails are sent to our associates. Any failures trigger a retraining exercise if not properly reported and a monthly training vignette on cybersecurity awareness. To round out our robust awareness program, we have specific and regular training for our IT professionals, and we periodically engage independent third parties to test our information security processes and systems as part of our overall enterprise risk management program.

Risk Oversight

The Board recognizes its duty to assure itself that the Company has effective procedures for assessing and managing risks to the Company’s operations, financial position, and reputation, including compliance with applicable laws and regulations. The Board has charged the Audit Committee with responsibility for monitoring the Company’s processes and procedures for risk assessment, risk management, and compliance, which includes receiving regular reports on material litigation, environmental remediation activities, and on any violations of law or Company policies and resultant corrective action. The Audit Committee receives regular reports regarding these matters from management (at least quarterly). The Company’s Director of Compliance and Ethics, as well as the Chief Audit Executive, have regular independent communications with the Audit Committee. The Chair of the Audit Committee reports any significant matters to the Board as part of his briefing on the Committee’s meetings and activities.

The Board receives an annual presentation by management on the Company’s risk management practices. The Board also receives reports from management at each meeting regarding operating results, pending and proposed acquisition and divestiture transactions (each of which must be approved by the Board before completion), capital expenditures (material capital expenditures above $5 million require Board approval), and other matters.

In addition, the Management Organization and Compensation Committee of the Board has established a process for assessing the potential that the Company’s compensation plans and practices may encourage executives to take risks that are reasonably likely to have a material adverse effect on the Company. The conclusions of this assessment are set forth in the Compensation Discussion and Analysis section under the heading “Compensation Risk Assessment” on page 60.

25

Item 1: Election of Directors

Coordination Among Board Committees Regarding Risk Oversight

| AUDIT COMMITTEE | MANAGEMENT ORGANIZATION AND COMPENSATION COMMITTEE | NOMINATING AND GOVERNANCE COMMITTEE | ||

| • Financial reporting risk

• Legal and compliance risk

• Selection, performance assessment and compensation of the independent auditor

• Cyber/Information security risk

• Fraud risk

• Environmental risk |

• Performance assessment and compensation of the CEO and other executive officers

• Management succession planning and intellectual capital (human capital) development

• Risk review of incentive compensation arrangements |

• Governance risk

• Independence of directors

• Board succession planning

• Board and committee performance evaluation | ||

Management Succession Planning and Intellectual Capital

We have a comprehensive Intellectual Capital (“IC”) process at Crane Company that encompasses careful and rigorous talent selection, systematic training and personalized development, and an annual assessment of performance and potential. Our Board and the Management Organization and Compensation Committee take an important role in our human capital management and the IC process. The Management Organization and Compensation Committee has the primary responsibilities for (i) assuring that the Company’s management development and succession planning policies and procedures are sound and effective, (ii) evaluating the performance of the Chief Executive Officer and other members of senior management, and (iii) regularly reporting its findings and recommendations to the Board. A key element of the IC process is the identification of management succession needs and opportunities, whether arising from natural career growth and development, voluntary turnover, retirements, or other causes. Such management succession planning forms part of our annual strategy review process for each of our businesses, and the senior management levels are reviewed with the Board at least annually. The Board’s oversight and involvement in the annual review of senior management level succession needs and opportunities promotes the identification and development of a pipeline of strong performance-focused senior leaders that possess diverse skills and talents.

Stockholder Engagement

Crane Company regularly meets with current and potential stockholders, both to provide transparency about its operations and results, and to better understand the investment community’s perception of the Company’s performance and corporate strategy. Crane Company typically hosts an annual investor day event to provide a thorough review of the prior year’s results, to discuss the Company’s outlook for the current year, and to review the Company’s portfolio and capital allocation strategies. In 2023, our investor day event was held on March 9, the same day as Crane NXT, Co’s investor day event so that potential investors could learn about both post-separation entities.

During 2023, the Company also participated in meetings, phone calls and video conference calls with approximately 330 different investors at conferences, during investor roadshows, and in response to direct investor inquiries, an increase of approximately 69% from the prior year. The substantial increase in investor interaction during 2023, following a similar increase in the prior year, reflected our continued efforts to ensure thorough and transparent communications about the separation transaction, and to educate investors about post-separation Crane.

Our Vice President of Investor Relations and/or our Chief Financial Officer provide feedback from the investor and analyst meetings formally to the Board on a quarterly basis. Additional viewpoints and commentary from investors and

26

Item 1: Election of Directors

analysts are incorporated into our comprehensive strategic review which is presented to the Board at least annually, and on an ad hoc basis as appropriate.

Stockholder Communications with Directors

The Board has established a process to receive communications from stockholders and other interested parties. Stockholders and other interested parties may contact any member (or all members) of the Board, any Board committee, or any Chair of any such committee by mail or electronically. To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Board or any individual director or group or committee of directors by either name or title. All such correspondence should be sent to Crane Company c/o Corporate Secretary,100 First Stamford Place, 4th Floor, Stamford, CT 06902. To communicate with any of our directors electronically, stockholders should use the following e-mail address: corpsec@craneco.com.

All communications received as set forth in the preceding paragraph will be opened by the office of the Corporate Secretary for the sole purpose of determining whether they contain a message to our directors. Any contents will be forwarded promptly to the addressee unless they are in the nature of advertising or promotion of a product or service or are patently offensive or irrelevant. To the extent that the communication involves a request for information, such as an inquiry about the Company or stock-related matters, the Corporate Secretary’s office may handle the inquiry directly. In the case of communications to the Board or any group or committee of directors, the Corporate Secretary’s office will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the communication is addressed.

Board Structure

Board Leadership Structure

Our by-laws do not require that the roles of Chairman of the Board and Chief Executive Officer be held by different individuals, as the Board believes that effective board leadership structure can be highly dependent on the experience, skills, and personal interaction between persons in leadership roles and the needs of the Company at the time. Following the completion of the separation transaction these leadership roles were filled separately by our non-employee Chairman of the Board, James L. L. Tullis, who possesses extensive experience with the Company and with Crane Holdings, Co. prior to the separation, and by our Chief Executive Officer, Max H. Mitchell. At a regular Board meeting in January 2024, the Board unanimously determined that it would be in the best interests of the Company and its stockholders to combine the Chairman and CEO roles and to ensure continued good governance and independent oversight, appoint annually a director to serve in the newly created role of Lead Independent Director, both effective at the Annual Meeting. In making this determination, the Board considered the Company’s recent separation from Crane Holdings, Co., and the benefit of Board leadership under Mr. Mitchell, who has served as the Company’s Chief Executive Officer since 2014 (inclusive of his time as Chief Executive Officer of Crane Holdings, Co.), accumulated extensive day-to-day knowledge of the Company’s operations and long term needs, and driven its successful portfolio reshaping, strategic plan, and growth initiatives during his tenure. The Board also considered its current composition of diverse, experienced, skilled professionals all of whom have been determined to be independent directors (other than Mr. Mitchell). Furthermore, to assist in transitioning to this leadership structure change and to provide for the continued independent oversight of management and the CEO/Chairman, the Board established the position of Lead Independent Director. To facilitate this transition, and to assist Mr. Mitchell in assuming the duties of Chairman, the Company’s former Chairman, James L.L. Tullis was appointed to serve as Lead Independent Director, effective at the Annual Meeting.

The Board will continue to monitor and assess its leadership structure to ensure it best serves the needs of the Company and its stockholders.

27

Item 1: Election of Directors

Committees of the Board

The Board has established an Audit Committee, a Management Organization and Compensation Committee, and a Nominating and Governance Committee. The Board also established an Executive Committee, which meets when a quorum of the full Board cannot be readily convened. The memberships of these committees are as follows:

|

Roles and Responsibilities The Audit Committee is the Board’s principal agent in fulfilling legal and fiduciary obligations with respect to matters involving the Company’s accounting, auditing, financial reporting, internal control, legal compliance functions, risk management and conflicts of interest. The Audit Committee has the authority and responsibility for the appointment, retention, compensation, and oversight of our independent auditors.

Independence All members of the Audit Committee meet the independence and expertise requirements of the NYSE, and all qualify as “independent” under the provisions of SEC Rule 10A-3. In addition, the Board has determined that all the members of the Committee are an “audit committee financial expert” as defined in regulations of the SEC. The Crane Holdings, Co. Audit Committee met two times prior to the separation and the Crane Company Audit Committee met two times in 2023. The Audit Committee’s report appears beginning on page 38. | ||||||

| Audit Committee

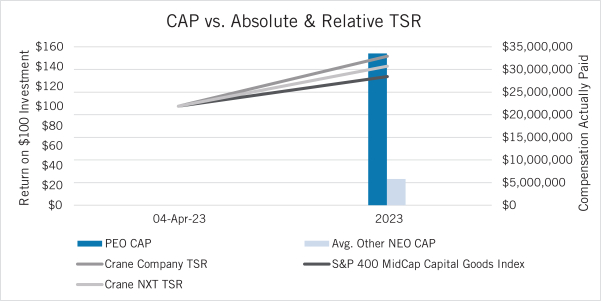

Chair M. Benante