falseFY0001943444

0001943444

2023-01-01

2023-12-31

0001943444

2023-12-31

0001943444

2022-12-31

0001943444

2021-01-01

2021-12-31

0001943444

2022-01-01

2022-12-31

0001943444

2021-12-31

0001943444

2022-06-01

0001943444

2022-09-29

0001943444

2023-01-01

0001943444

2020-12-31

0001943444

dei:BusinessContactMember

2023-01-01

2023-12-31

0001943444

tti:UnrestrictedReservesMember

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001943444

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-12-31

0001943444

tti:StatutoryReservesMember

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001943444

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-12-31

0001943444

us-gaap:ProductMember

2023-01-01

2023-12-31

0001943444

tti:RelatedPartiesMember

2023-01-01

2023-12-31

0001943444

srt:ParentCompanyMember

2023-01-01

2023-12-31

0001943444

tti:QingdaoMember

us-gaap:RelatedPartyMember

2023-01-01

2023-12-31

0001943444

tti:TongshengIntelligentEquipmentShenzhenCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:QingdaoTongriElectricMachinesCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:TongshengIntelligenceTechnologyDevelopmentShenzhenCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:TungrayTechnologyPteLtdMember

2023-01-01

2023-12-31

0001943444

tti:QingdaoTungrayIntelligentTechnologyCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:TungraySingaporePte.LtdMember

2023-01-01

2023-12-31

0001943444

tti:TungrayMotionLtdMember

2023-01-01

2023-12-31

0001943444

tti:TungrayElectronicsLtdMember

2023-01-01

2023-12-31

0001943444

tti:TungrayIntelligentTechnologyLtdMember

2023-01-01

2023-12-31

0001943444

tti:TungResourcePteLtdMember

2023-01-01

2023-12-31

0001943444

tti:TungrayIndustrialAutomationShenzhenCo.LtdMember

2023-01-01

2023-12-31

0001943444

country:SG

2023-01-01

2023-12-31

0001943444

tti:CustomerTwoMember

2023-01-01

2023-12-31

0001943444

tti:CustomerOneMember

2023-01-01

2023-12-31

0001943444

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

tti:CustomerTwoMember

2023-01-01

2023-12-31

0001943444

us-gaap:AccountsPayableMember

us-gaap:SupplierConcentrationRiskMember

tti:VendorMember

2023-01-01

2023-12-31

0001943444

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

tti:CustomerOneMember

2023-01-01

2023-12-31

0001943444

tti:PurchaseBenchmarkMember

us-gaap:SupplierConcentrationRiskMember

tti:VendorMember

2023-01-01

2023-12-31

0001943444

us-gaap:CustomerConcentrationRiskMember

tti:CustomerTwoMember

2023-01-01

2023-12-31

0001943444

tti:VendorMember

2023-01-01

2023-12-31

0001943444

country:CN

2023-01-01

2023-12-31

0001943444

tti:IndustrialAndCommercialBankOfChinaPingduBranchMember

us-gaap:LoansPayableMember

2023-01-01

2023-12-31

0001943444

tti:OtherReceivablesMember

tti:QingdaoTungrayBiologyTechnologyCo.Ltd.Member

2023-01-01

2023-12-31

0001943444

tti:OtherReceivablesMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:OtherReceivablesMember

tti:TungmoonInvestmentMember

2023-01-01

2023-12-31

0001943444

tti:OtherReceivablesMember

tti:HuiTangMember

2023-01-01

2023-12-31

0001943444

tti:OperatingLeaseLiabilitiesMember

tti:JinganTangMember

2023-01-01

2023-12-31

0001943444

tti:OperatingLeaseLiabilitiesMember

tti:TungrayQingdaoTechnologyDevelopmentCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:PrepaymentsMember

tti:QingdaoTungrayTechnologyDevelopmentCo.Ltd.Member

2023-01-01

2023-12-31

0001943444

tti:PrepaymentsMember

tti:TungrayKunshanIndustrialAutomationCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:AccountReceivableMember

tti:KunshanTungrayIntelligentTechnologyCo.Ltd.Member

2023-01-01

2023-12-31

0001943444

us-gaap:AccountsPayableMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2023-01-01

2023-12-31

0001943444

us-gaap:AccountsPayableMember

tti:QingdaoTungrayTechnologyDevelopmentCo.Ltd.Member

2023-01-01

2023-12-31

0001943444

us-gaap:AccountsPayableMember

tti:ShanghaiTongruiIndustrialAutomationEquipmentCo.LtdMember

2023-01-01

2023-12-31

0001943444

us-gaap:AccountsPayableMember

tti:ShanghaiTongruiInvestmentManagementCo.Ltd.Member

2023-01-01

2023-12-31

0001943444

us-gaap:AccountsPayableMember

tti:HefeiCasDihugeAutomationCo.Ltd.Member

2023-01-01

2023-12-31

0001943444

tti:AccountReceivableMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:AccountReceivableMember

tti:TungrayKunshanIndustrialAutomationCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:AccountReceivableMember

tti:TungrayKunshanRobotIntelligentTechnologyCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:OtherPayablesMember

tti:LeiYaoMember

2023-01-01

2023-12-31

0001943444

tti:OtherPayablesMember

tti:MingxingGaoMember

2023-01-01

2023-12-31

0001943444

tti:OtherPayablesMember

tti:TungrayKunshanIndustrialAutomationCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:OtherPayablesMember

tti:ShanghaiTongruiInvestmentManagementCo.Ltd.Member

2023-01-01

2023-12-31

0001943444

tti:OtherPayablesMember

tti:JinganTangMember

2023-01-01

2023-12-31

0001943444

tti:OtherPayablesMember

tti:LilingDuMember

2023-01-01

2023-12-31

0001943444

tti:OtherPayablesMember

tti:GangWangMember

2023-01-01

2023-12-31

0001943444

tti:OtherPayablesMember

tti:DeminHanMember

2023-01-01

2023-12-31

0001943444

us-gaap:LineOfCreditMember

tti:UnitedOverseasBankLimitedMember

2023-01-01

2023-12-31

0001943444

us-gaap:LineOfCreditMember

tti:DbsBankLimitedMember

2023-01-01

2023-12-31

0001943444

us-gaap:LineOfCreditMember

tti:StandardCharteredBankMember

2023-01-01

2023-12-31

0001943444

tti:WeBankMember

us-gaap:LoansPayableMember

2023-01-01

2023-12-31

0001943444

tti:ForeignInvestmentEnterprisesMember

tti:PeoplesRepublicOfChinaMember

2023-01-01

2023-12-31

0001943444

tti:HighAndNewTechnologyEnterprisesMember

tti:PeoplesRepublicOfChinaMember

2023-01-01

2023-12-31

0001943444

tti:PeoplesRepublicOfChinaMember

2023-01-01

2023-12-31

0001943444

tti:ShenzhenTongriMember

tti:PeoplesRepublicOfChinaMember

2023-01-01

2023-12-31

0001943444

tti:QingdaoIntelligentMember

tti:PeoplesRepublicOfChinaMember

2023-01-01

2023-12-31

0001943444

tti:IndustrialAndCommercialBankOfChinaPingduBranchMember

tti:FromOctoberTwentiethTwoThousandTwentyTwoToOctoberEighteenTwoThousandTwentyThreeMember

us-gaap:LoansPayableMember

2023-01-01

2023-12-31

0001943444

tti:IndustrialAndCommercialBankOfChinaPingduBranchMember

tti:FromDecemberThirtyOneTwoThousandTwentyOneToNovemberTwentyNineTwoThousandTwentyTwoMember

us-gaap:LoansPayableMember

2023-01-01

2023-12-31

0001943444

tti:RevenueMember

tti:KunshanTongriIntelligentManufacturingTechnologyResearchInstituteCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:RevenueMember

tti:KunshanTungrayIntelligentTechnologyCo.Ltd.Member

2023-01-01

2023-12-31

0001943444

tti:RevenueMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:RevenueMember

tti:TungrayKunshanRobotIntelligentTechnologyCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:RevenueMember

tti:TungrayKunshanIndustrialAutomationCo.LtdMember

2023-01-01

2023-12-31

0001943444

tti:CostOfRevenueMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2023-01-01

2023-12-31

0001943444

us-gaap:OtherOperatingIncomeExpenseMember

tti:QingdaoTungrayBiologyTechnologyCo.Ltd.Member

2023-01-01

2023-12-31

0001943444

us-gaap:OperatingExpenseMember

tti:QingdaoTungrayTechnologyDevelopmentCo.Ltd.Member

2023-01-01

2023-12-31

0001943444

us-gaap:OperatingExpenseMember

tti:JinganTangMember

2023-01-01

2023-12-31

0001943444

tti:RevenueMember

2023-01-01

2023-12-31

0001943444

us-gaap:OperatingExpenseMember

2023-01-01

2023-12-31

0001943444

tti:WeBankMember

us-gaap:LoansPayableMember

us-gaap:PrimeRateMember

2023-01-01

2023-12-31

0001943444

tti:ChinaSubsidiariesMember

2023-01-01

2023-12-31

0001943444

us-gaap:CommonClassAMember

2022-12-31

0001943444

us-gaap:CommonClassBMember

2022-12-31

0001943444

srt:ParentCompanyMember

2022-12-31

0001943444

srt:ParentCompanyMember

us-gaap:CommonClassAMember

2022-12-31

0001943444

srt:ParentCompanyMember

us-gaap:CommonClassBMember

2022-12-31

0001943444

us-gaap:UseRightsMember

2022-12-31

0001943444

us-gaap:TechnologyBasedIntangibleAssetsMember

2022-12-31

0001943444

us-gaap:ComputerSoftwareIntangibleAssetMember

2022-12-31

0001943444

us-gaap:EquipmentMember

2022-12-31

0001943444

us-gaap:BuildingMember

2022-12-31

0001943444

us-gaap:OfficeEquipmentMember

2022-12-31

0001943444

currency:SGD

2022-12-31

0001943444

currency:CNY

srt:ArithmeticAverageMember

2022-12-31

0001943444

currency:CNY

2022-12-31

0001943444

currency:SGD

srt:ArithmeticAverageMember

2022-12-31

0001943444

tti:AccountReceivableMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2022-12-31

0001943444

tti:AccountReceivableMember

tti:TungrayKunshanIndustrialAutomationCo.LtdMember

2022-12-31

0001943444

tti:AccountReceivableMember

tti:TungrayKunshanRobotIntelligentTechnologyCo.LtdMember

2022-12-31

0001943444

tti:AccountReceivableMember

tti:KunshanTungrayIntelligentTechnologyCo.Ltd.Member

2022-12-31

0001943444

tti:AccountReceivableMember

2022-12-31

0001943444

tti:QingdaoIntelligentMember

tti:HaitianhuinengMember

2022-12-31

0001943444

us-gaap:AccountsPayableMember

tti:ShanghaiTongruiInvestmentManagementCo.Ltd.Member

2022-12-31

0001943444

us-gaap:AccountsPayableMember

tti:HefeiCasDihugeAutomationCo.Ltd.Member

2022-12-31

0001943444

us-gaap:AccountsPayableMember

2022-12-31

0001943444

us-gaap:AccountsPayableMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2022-12-31

0001943444

us-gaap:AccountsPayableMember

tti:QingdaoTungrayTechnologyDevelopmentCo.Ltd.Member

2022-12-31

0001943444

us-gaap:AccountsPayableMember

tti:ShanghaiTongruiIndustrialAutomationEquipmentCo.LtdMember

2022-12-31

0001943444

tti:IndustrialAndCommercialBankOfChinaPingduBranchMember

us-gaap:LoansPayableMember

2022-12-31

0001943444

us-gaap:LineOfCreditMember

tti:UnitedOverseasBankLimitedMember

2022-12-31

0001943444

us-gaap:LineOfCreditMember

tti:DbsBankLimitedMember

2022-12-31

0001943444

us-gaap:LineOfCreditMember

tti:StandardCharteredBankMember

2022-12-31

0001943444

us-gaap:LineOfCreditMember

2022-12-31

0001943444

tti:OtherReceivablesMember

tti:HuiTangMember

2022-12-31

0001943444

tti:OtherReceivablesMember

tti:TungmoonInvestmentMember

2022-12-31

0001943444

tti:OtherReceivablesMember

2022-12-31

0001943444

tti:OtherReceivablesMember

tti:QingdaoTungrayBiologyTechnologyCo.Ltd.Member

2022-12-31

0001943444

tti:OtherReceivablesMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2022-12-31

0001943444

tti:WeBankMember

us-gaap:LoansPayableMember

2022-12-31

0001943444

tti:OtherPayablesMember

tti:TungrayKunshanIndustrialAutomationCo.LtdMember

2022-12-31

0001943444

tti:OtherPayablesMember

tti:ShanghaiTongruiInvestmentManagementCo.Ltd.Member

2022-12-31

0001943444

tti:OtherPayablesMember

tti:JinganTangMember

2022-12-31

0001943444

tti:OtherPayablesMember

tti:LilingDuMember

2022-12-31

0001943444

tti:OtherPayablesMember

tti:GangWangMember

2022-12-31

0001943444

tti:OtherPayablesMember

tti:LeiYaoMember

2022-12-31

0001943444

tti:OtherPayablesMember

tti:DeminHanMember

2022-12-31

0001943444

tti:OtherPayablesMember

tti:MingxingGaoMember

2022-12-31

0001943444

tti:OtherPayablesMember

2022-12-31

0001943444

tti:PeoplesRepublicOfChinaMember

2022-12-31

0001943444

tti:PrepaymentsMember

tti:QingdaoTungrayTechnologyDevelopmentCo.Ltd.Member

2022-12-31

0001943444

tti:PrepaymentsMember

tti:TungrayKunshanIndustrialAutomationCo.LtdMember

2022-12-31

0001943444

tti:PrepaymentsMember

2022-12-31

0001943444

tti:OperatingLeaseLiabilitiesMember

tti:TungrayQingdaoTechnologyDevelopmentCo.LtdMember

2022-12-31

0001943444

tti:OperatingLeaseLiabilitiesMember

tti:JinganTangMember

2022-12-31

0001943444

tti:OperatingLeaseLiabilitiesMember

2022-12-31

0001943444

tti:ChinaSubsidiariesMember

2022-12-31

0001943444

us-gaap:CommonClassAMember

2023-12-31

0001943444

us-gaap:CommonClassBMember

2023-12-31

0001943444

srt:ParentCompanyMember

2023-12-31

0001943444

srt:ParentCompanyMember

us-gaap:CommonClassAMember

2023-12-31

0001943444

srt:ParentCompanyMember

us-gaap:CommonClassBMember

2023-12-31

0001943444

tti:TungrayMotionLtdMember

2023-12-31

0001943444

tti:TungrayElectronicsLtdMember

2023-12-31

0001943444

tti:TungrayIntelligentTechnologyLtdMember

2023-12-31

0001943444

tti:TungraySingaporePte.LtdMember

2023-12-31

0001943444

tti:TungResourcePteLtdMember

2023-12-31

0001943444

tti:TungrayIndustrialAutomationShenzhenCo.LtdMember

2023-12-31

0001943444

tti:TongshengIntelligentEquipmentShenzhenCo.LtdMember

2023-12-31

0001943444

tti:QingdaoTongriElectricMachinesCo.LtdMember

2023-12-31

0001943444

tti:QingdaoTungrayIntelligentTechnologyCo.LtdMember

2023-12-31

0001943444

tti:TungrayTechnologyPteLtdMember

2023-12-31

0001943444

tti:TongshengIntelligenceTechnologyDevelopmentShenzhenCo.LtdMember

2023-12-31

0001943444

us-gaap:ComputerSoftwareIntangibleAssetMember

srt:MinimumMember

2023-12-31

0001943444

us-gaap:ComputerSoftwareIntangibleAssetMember

srt:MaximumMember

2023-12-31

0001943444

us-gaap:UseRightsMember

2023-12-31

0001943444

us-gaap:TechnologyBasedIntangibleAssetsMember

srt:MaximumMember

2023-12-31

0001943444

us-gaap:TechnologyBasedIntangibleAssetsMember

srt:MinimumMember

2023-12-31

0001943444

tti:TongshengIntelligenMember

2023-12-31

0001943444

country:CN

2023-12-31

0001943444

us-gaap:AssetsTotalMember

country:SG

2023-12-31

0001943444

country:SG

2023-12-31

0001943444

us-gaap:AssetsTotalMember

country:CN

2023-12-31

0001943444

us-gaap:TechnologyBasedIntangibleAssetsMember

2023-12-31

0001943444

us-gaap:ComputerSoftwareIntangibleAssetMember

2023-12-31

0001943444

us-gaap:EquipmentMember

2023-12-31

0001943444

us-gaap:BuildingMember

2023-12-31

0001943444

us-gaap:OfficeEquipmentMember

2023-12-31

0001943444

currency:SGD

2023-12-31

0001943444

currency:CNY

2023-12-31

0001943444

currency:SGD

srt:ArithmeticAverageMember

2023-12-31

0001943444

currency:CNY

srt:ArithmeticAverageMember

2023-12-31

0001943444

tti:TwelveMonthsEndingDecemberTwentyTwentySevenMember

2023-12-31

0001943444

tti:TwelveMonthsEndingDecemberTwentyTwentyEightMember

2023-12-31

0001943444

tti:TwelveMonthsEndingDecemberTwentyTwentyFourMember

2023-12-31

0001943444

tti:TwelveMonthsEndingDecemberTwentyTwentyFiveMember

2023-12-31

0001943444

tti:TwelveMonthsEndingDecemberTwentyTwentySixMember

2023-12-31

0001943444

us-gaap:OfficeEquipmentMember

srt:MinimumMember

2023-12-31

0001943444

us-gaap:OfficeEquipmentMember

srt:MaximumMember

2023-12-31

0001943444

us-gaap:EquipmentMember

srt:MinimumMember

2023-12-31

0001943444

us-gaap:EquipmentMember

srt:MaximumMember

2023-12-31

0001943444

tti:AccountReceivableMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2023-12-31

0001943444

tti:AccountReceivableMember

tti:TungrayKunshanIndustrialAutomationCo.LtdMember

2023-12-31

0001943444

tti:AccountReceivableMember

tti:TungrayKunshanRobotIntelligentTechnologyCo.LtdMember

2023-12-31

0001943444

tti:AccountReceivableMember

tti:KunshanTungrayIntelligentTechnologyCo.Ltd.Member

2023-12-31

0001943444

tti:AccountReceivableMember

2023-12-31

0001943444

tti:QingdaoIntelligentMember

tti:HaitianhuinengMember

2023-12-31

0001943444

us-gaap:AccountsPayableMember

tti:ShanghaiTongruiInvestmentManagementCo.Ltd.Member

2023-12-31

0001943444

us-gaap:AccountsPayableMember

tti:HefeiCasDihugeAutomationCo.Ltd.Member

2023-12-31

0001943444

us-gaap:AccountsPayableMember

2023-12-31

0001943444

us-gaap:AccountsPayableMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2023-12-31

0001943444

us-gaap:AccountsPayableMember

tti:QingdaoTungrayTechnologyDevelopmentCo.Ltd.Member

2023-12-31

0001943444

us-gaap:AccountsPayableMember

tti:ShanghaiTongruiIndustrialAutomationEquipmentCo.LtdMember

2023-12-31

0001943444

tti:IndustrialAndCommercialBankOfChinaPingduBranchMember

us-gaap:LoansPayableMember

2023-12-31

0001943444

us-gaap:LineOfCreditMember

tti:UnitedOverseasBankLimitedMember

2023-12-31

0001943444

us-gaap:LineOfCreditMember

tti:DbsBankLimitedMember

2023-12-31

0001943444

us-gaap:LineOfCreditMember

tti:StandardCharteredBankMember

2023-12-31

0001943444

us-gaap:LineOfCreditMember

2023-12-31

0001943444

tti:OtherReceivablesMember

tti:HuiTangMember

2023-12-31

0001943444

tti:OtherReceivablesMember

tti:QingdaoTungrayBiologyTechnologyCo.Ltd.Member

2023-12-31

0001943444

tti:OtherReceivablesMember

tti:TungmoonInvestmentMember

2023-12-31

0001943444

tti:OtherReceivablesMember

2023-12-31

0001943444

tti:OtherReceivablesMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2023-12-31

0001943444

tti:WeBankMember

us-gaap:LoansPayableMember

2023-12-31

0001943444

tti:OtherPayablesMember

tti:TungrayKunshanIndustrialAutomationCo.LtdMember

2023-12-31

0001943444

tti:OtherPayablesMember

tti:ShanghaiTongruiInvestmentManagementCo.Ltd.Member

2023-12-31

0001943444

tti:OtherPayablesMember

tti:JinganTangMember

2023-12-31

0001943444

tti:OtherPayablesMember

tti:LilingDuMember

2023-12-31

0001943444

tti:OtherPayablesMember

tti:GangWangMember

2023-12-31

0001943444

tti:OtherPayablesMember

tti:LeiYaoMember

2023-12-31

0001943444

tti:OtherPayablesMember

tti:DeminHanMember

2023-12-31

0001943444

tti:OtherPayablesMember

tti:MingxingGaoMember

2023-12-31

0001943444

tti:OtherPayablesMember

2023-12-31

0001943444

tti:PeoplesRepublicOfChinaMember

2023-12-31

0001943444

tti:PrepaymentsMember

tti:QingdaoTungrayTechnologyDevelopmentCo.Ltd.Member

2023-12-31

0001943444

tti:PrepaymentsMember

2023-12-31

0001943444

tti:PrepaymentsMember

tti:TungrayKunshanIndustrialAutomationCo.LtdMember

2023-12-31

0001943444

tti:OperatingLeaseLiabilitiesMember

tti:TungrayQingdaoTechnologyDevelopmentCo.LtdMember

2023-12-31

0001943444

tti:OperatingLeaseLiabilitiesMember

tti:JinganTangMember

2023-12-31

0001943444

tti:OperatingLeaseLiabilitiesMember

2023-12-31

0001943444

tti:ChinaSubsidiariesMember

2023-12-31

0001943444

tti:RelatedPartyAndNonRelatedPartyMember

2023-12-31

0001943444

tti:BuildingLeasesMember

us-gaap:RelatedPartyMember

tti:QuingdaoMember

2023-12-31

0001943444

tti:BuildingLeasesMember

us-gaap:RelatedPartyMember

tti:JinganTangMember

2023-12-31

0001943444

tti:DepositInsuranceSchemeMember

country:SG

2023-12-31

0001943444

tti:UnrestrictedReservesMember

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001943444

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-12-31

0001943444

tti:StatutoryReservesMember

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001943444

tti:LoansReceivableRelatedPartiesMember

2022-01-01

2022-12-31

0001943444

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0001943444

us-gaap:ProductMember

2022-01-01

2022-12-31

0001943444

tti:RelatedPartiesMember

2022-01-01

2022-12-31

0001943444

srt:ParentCompanyMember

2022-01-01

2022-12-31

0001943444

tti:QingdaoMember

us-gaap:RelatedPartyMember

2022-01-01

2022-12-31

0001943444

tti:CustomerOneMember

2022-01-01

2022-12-31

0001943444

tti:CustomerTwoMember

2022-01-01

2022-12-31

0001943444

us-gaap:AccountsPayableMember

us-gaap:SupplierConcentrationRiskMember

tti:VendorMember

2022-01-01

2022-12-31

0001943444

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

tti:CustomerTwoMember

2022-01-01

2022-12-31

0001943444

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

tti:CustomerOneMember

2022-01-01

2022-12-31

0001943444

us-gaap:CustomerConcentrationRiskMember

tti:CustomerTwoMember

2022-01-01

2022-12-31

0001943444

tti:PurchaseBenchmarkMember

us-gaap:SupplierConcentrationRiskMember

tti:VendorMember

2022-01-01

2022-12-31

0001943444

tti:VendorMember

2022-01-01

2022-12-31

0001943444

country:CN

2022-01-01

2022-12-31

0001943444

country:SG

2022-01-01

2022-12-31

0001943444

tti:PeoplesRepublicOfChinaMember

2022-01-01

2022-12-31

0001943444

tti:RevenueMember

tti:TungrayKunshanRobotIntelligentTechnologyCo.LtdMember

2022-01-01

2022-12-31

0001943444

tti:RevenueMember

tti:TungrayKunshanIndustrialAutomationCo.LtdMember

2022-01-01

2022-12-31

0001943444

tti:RevenueMember

tti:KunshanTungrayIntelligentTechnologyCo.Ltd.Member

2022-01-01

2022-12-31

0001943444

tti:RevenueMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2022-01-01

2022-12-31

0001943444

tti:RevenueMember

2022-01-01

2022-12-31

0001943444

tti:RevenueMember

tti:KunshanTongriIntelligentManufacturingTechnologyResearchInstituteCo.LtdMember

2022-01-01

2022-12-31

0001943444

tti:CostOfRevenueMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2022-01-01

2022-12-31

0001943444

us-gaap:OtherOperatingIncomeExpenseMember

tti:QingdaoTungrayBiologyTechnologyCo.Ltd.Member

2022-01-01

2022-12-31

0001943444

us-gaap:OperatingExpenseMember

tti:QingdaoTungrayTechnologyDevelopmentCo.Ltd.Member

2022-01-01

2022-12-31

0001943444

us-gaap:OperatingExpenseMember

tti:JinganTangMember

2022-01-01

2022-12-31

0001943444

us-gaap:OperatingExpenseMember

2022-01-01

2022-12-31

0001943444

tti:ChinaSubsidiariesMember

2022-01-01

2022-12-31

0001943444

tti:LoansReceivableRelatedPartiesMember

2021-01-01

2021-12-31

0001943444

tti:UnrestrictedReservesMember

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001943444

us-gaap:NoncontrollingInterestMember

2021-01-01

2021-12-31

0001943444

tti:StatutoryReservesMember

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001943444

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-01-01

2021-12-31

0001943444

us-gaap:ProductMember

2021-01-01

2021-12-31

0001943444

tti:RelatedPartiesMember

2021-01-01

2021-12-31

0001943444

srt:ParentCompanyMember

2021-01-01

2021-12-31

0001943444

tti:QingdaoMember

us-gaap:RelatedPartyMember

2021-01-01

2021-12-31

0001943444

tti:CustomerOneMember

2021-01-01

2021-12-31

0001943444

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

tti:CustomerOneMember

2021-01-01

2021-12-31

0001943444

tti:PurchaseBenchmarkMember

us-gaap:SupplierConcentrationRiskMember

tti:VendorMember

2021-01-01

2021-12-31

0001943444

country:CN

2021-01-01

2021-12-31

0001943444

country:SG

2021-01-01

2021-12-31

0001943444

tti:PeoplesRepublicOfChinaMember

2021-01-01

2021-12-31

0001943444

tti:RevenueMember

tti:TungrayKunshanRobotIntelligentTechnologyCo.LtdMember

2021-01-01

2021-12-31

0001943444

tti:RevenueMember

tti:TungrayKunshanIndustrialAutomationCo.LtdMember

2021-01-01

2021-12-31

0001943444

tti:RevenueMember

tti:KunshanTungrayIntelligentTechnologyCo.Ltd.Member

2021-01-01

2021-12-31

0001943444

tti:RevenueMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2021-01-01

2021-12-31

0001943444

tti:RevenueMember

2021-01-01

2021-12-31

0001943444

tti:RevenueMember

tti:KunshanTongriIntelligentManufacturingTechnologyResearchInstituteCo.LtdMember

2021-01-01

2021-12-31

0001943444

tti:CostOfRevenueMember

tti:FdtQingdaoIntellectualTechnologyCo.LtdMember

2021-01-01

2021-12-31

0001943444

us-gaap:OtherOperatingIncomeExpenseMember

tti:QingdaoTungrayBiologyTechnologyCo.Ltd.Member

2021-01-01

2021-12-31

0001943444

us-gaap:OperatingExpenseMember

tti:QingdaoTungrayTechnologyDevelopmentCo.Ltd.Member

2021-01-01

2021-12-31

0001943444

us-gaap:OperatingExpenseMember

tti:JinganTangMember

2021-01-01

2021-12-31

0001943444

us-gaap:OperatingExpenseMember

2021-01-01

2021-12-31

0001943444

tti:XiangTongriIntelligentIndustrialTechnologyMember

us-gaap:SubsequentEventMember

2024-01-09

0001943444

tti:XiangTongriIntelligentIndustrialTechnologyMember

us-gaap:SubsequentEventMember

2024-03-06

0001943444

tti:XiangTongriIntelligentIndustrialTechnologyMember

us-gaap:SubsequentEventMember

2024-03-07

0001943444

tti:XiangTongriIntelligentIndustrialTechnologyMember

us-gaap:SubsequentEventMember

2024-03-06

2024-03-06

0001943444

tti:QingdaoMember

us-gaap:RelatedPartyMember

2021-12-31

0001943444

currency:SGD

2021-12-31

0001943444

currency:CNY

srt:ArithmeticAverageMember

2021-12-31

0001943444

currency:CNY

2021-12-31

0001943444

currency:SGD

srt:ArithmeticAverageMember

2021-12-31

0001943444

tti:PeoplesRepublicOfChinaMember

2021-12-31

0001943444

country:SG

us-gaap:SubsequentEventMember

2024-01-01

2024-01-01

0001943444

us-gaap:CommonStockMember

2022-06-01

0001943444

us-gaap:CommonStockMember

2022-09-29

0001943444

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2022-09-29

0001943444

us-gaap:CommonClassBMember

us-gaap:CommonStockMember

2022-09-29

0001943444

tti:HaitianhuinengMember

2021-03-29

0001943444

us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember

2020-09-20

2023-09-20

0001943444

tti:BuildingLeasesMember

us-gaap:NonrelatedPartyMember

tti:QuingdaoMember

2023-01-01

0001943444

tti:BuildingLeasesMember

us-gaap:RelatedPartyMember

tti:QuingdaoMember

2023-01-01

0001943444

tti:BuildingLeasesMember

us-gaap:RelatedPartyMember

tti:ShenzenMember

2023-01-01

0001943444

tti:BuildingPurchaseAgreementMember

us-gaap:NonrelatedPartyMember

tti:ShenzenMember

2019-03-01

0001943444

tti:BuildingLeasesMember

us-gaap:NonrelatedPartyMember

tti:ShenzenMember

2023-06-01

0001943444

tti:TungraySingaporePte.LtdMember

2022-11-22

0001943444

tti:TungResourcePteLtdMember

2022-11-22

0001943444

tti:QingdaoTungrayIntelligentTechnologyCo.LtdMember

2022-09-28

0001943444

tti:HaitianhuinengMember

2022-03-01

2022-03-31

0001943444

tti:BuildingLeasesMember

us-gaap:RelatedPartyMember

tti:ShenzenMember

2020-01-01

0001943444

us-gaap:LineOfCreditMember

tti:UnitedOverseasBankLimitedMember

tti:ShortTermDebtInterestRateInYearOneMember

us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember

2022-09-20

2022-09-20

0001943444

us-gaap:LineOfCreditMember

tti:StandardCharteredBankMember

tti:ShortTermDebtInterestRateInYearTwoMember

us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember

2024-09-20

2024-09-20

0001943444

us-gaap:LineOfCreditMember

tti:UnitedOverseasBankLimitedMember

tti:ShortTermDebtInterestRateInYearThreeMember

us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember

2024-09-20

2024-09-20

0001943444

us-gaap:LineOfCreditMember

tti:DbsBankLimitedMember

tti:ShortTermDebtInterestRateInYearOneMember

2022-06-06

2022-06-06

0001943444

us-gaap:LineOfCreditMember

tti:DbsBankLimitedMember

tti:ShortTermDebtInterestRateInYearTwoMember

2023-06-06

2023-06-06

0001943444

us-gaap:LineOfCreditMember

tti:DbsBankLimitedMember

tti:ShortTermDebtInterestRateInYearThreeMember

us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember

2023-06-06

2023-06-06

0001943444

us-gaap:LineOfCreditMember

tti:StandardCharteredBankMember

tti:ShortTermDebtInterestRateInYearOneMember

us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember

2023-09-20

2023-09-20

0001943444

us-gaap:LineOfCreditMember

tti:UnitedOverseasBankLimitedMember

tti:ShortTermDebtInterestRateInYearTwoMember

us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember

2023-09-20

2023-09-20

0001943444

us-gaap:LineOfCreditMember

tti:StandardCharteredBankMember

tti:ShortTermDebtInterestRateInYearThreeMember

us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember

2025-09-20

2025-09-20

0001943444

us-gaap:CommonClassAMember

us-gaap:SubsequentEventMember

us-gaap:IPOMember

2024-04-18

2024-04-18

0001943444

us-gaap:CommonClassAMember

us-gaap:SubsequentEventMember

2024-04-18

2024-04-18

0001943444

us-gaap:CommonClassAMember

us-gaap:SubsequentEventMember

us-gaap:IPOMember

2024-04-18

0001943444

us-gaap:SubsequentEventMember

2024-04-18

0001943444

us-gaap:CommonClassAMember

us-gaap:SubsequentEventMember

2024-04-18

0001943444

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2023-12-31

0001943444

us-gaap:CommonClassBMember

us-gaap:CommonStockMember

2023-12-31

0001943444

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001943444

us-gaap:NoncontrollingInterestMember

2023-12-31

0001943444

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001943444

tti:LoansReceivableRelatedPartiesMember

2023-12-31

0001943444

tti:StatutoryReservesMember

us-gaap:RetainedEarningsMember

2023-12-31

0001943444

tti:UnrestrictedReservesMember

us-gaap:RetainedEarningsMember

2023-12-31

0001943444

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2022-12-31

0001943444

us-gaap:CommonClassBMember

us-gaap:CommonStockMember

2022-12-31

0001943444

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001943444

tti:LoansReceivableRelatedPartiesMember

2022-12-31

0001943444

tti:StatutoryReservesMember

us-gaap:RetainedEarningsMember

2022-12-31

0001943444

tti:UnrestrictedReservesMember

us-gaap:RetainedEarningsMember

2022-12-31

0001943444

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001943444

us-gaap:NoncontrollingInterestMember

2022-12-31

0001943444

srt:ParentCompanyMember

2021-12-31

0001943444

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2020-12-31

0001943444

us-gaap:CommonClassBMember

us-gaap:CommonStockMember

2020-12-31

0001943444

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001943444

tti:LoansReceivableRelatedPartiesMember

2020-12-31

0001943444

tti:StatutoryReservesMember

us-gaap:RetainedEarningsMember

2020-12-31

0001943444

tti:UnrestrictedReservesMember

us-gaap:RetainedEarningsMember

2020-12-31

0001943444

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-12-31

0001943444

us-gaap:NoncontrollingInterestMember

2020-12-31

0001943444

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2021-12-31

0001943444

us-gaap:CommonClassBMember

us-gaap:CommonStockMember

2021-12-31

0001943444

tti:UnrestrictedReservesMember

us-gaap:RetainedEarningsMember

2021-12-31

0001943444

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001943444

us-gaap:NoncontrollingInterestMember

2021-12-31

0001943444

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001943444

tti:LoansReceivableRelatedPartiesMember

2021-12-31

0001943444

tti:StatutoryReservesMember

us-gaap:RetainedEarningsMember

2021-12-31

0001943444

srt:ParentCompanyMember

2020-12-31

iso4217:USD

xbrli:shares

xbrli:pure

utr:Year

iso4217:CNY

iso4217:SGD

utr:Month

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

¨

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

¨

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report for the transition period from ____________to ____________

Commission file number: 001-41998

(Exact Name of Registrant as Specified in its Charter)

(Translation of Registrant’s Name into English)

(Jurisdiction of Incorporation or Organization)

#02-01, 31 Mandai Estate,

Innovation Place Tower 4,

(Address of principal executive offices)

Email: yao_lei@tungray.com.sg

#02-01, 31 Mandai Estate,

Innovation Place Tower 4,

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | Name of Each Exchange on Which

Registered |

Class A Ordinary Shares, par value $0.0001 per share | | | | The NASDAQ Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

As of December 31, 2023, the issuer had 10,440,000 Class A Ordinary Shares and 4,560,000 Class B Ordinary Shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

¨

No

x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes

¨

No

x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

x

No

¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

x

No

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

| The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b) by the registered public accounting fi rm that prepared or issued its audit report.

¨

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial

statements

included in this filing:

| | International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ | | |

| If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨ |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

☐

No

x

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes

¨

No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes

¨

No

¨

Unless otherwise indicated, numerical figures included in this Annual Report on Form 20-F (the “Annual Report”) have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

For the sake of clarity, this Annual Report follows the English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English. Numerical figures included in this Annual Report have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. This Annual Report includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, you are cautioned not to give undue weight to this information.

| | “AHFCAA” refers to the Accelerating Holding Foreign Companies Accountable Act. |

| | “CAC” refers to the Cyberspace Administration of China; |

| | “Class A Ordinary Shares” refer to our Class A ordinary shares, $0.0001 par value per share; |

| | “Class B Ordinary Shares” refer to our Class B ordinary shares, $0.0001 par value per share; |

| | “CSRC” refers to China Securities Regulatory Commission. |

| | “China” or the “PRC” are to the People’s Republic of China, and only in the context of describing PRC laws, regulations and other legal or tax matters in this Annual Report, excludes Hong Kong, Macau and Taiwan; |

| | Depending on the context, the terms “we,” “us,” “our company,” “our”, “Tungray” and “the Company” refer to Tungray Technologies Inc, an exempted company with limited liability incorporated under the laws of the Cayman Islands, and its subsidiaries and affiliated companies. |

| | “HFCA Act” refers to the Holding Foreign Companies Accountable Act. |

| | “M&A Rules” refers to the Regulations on the Mergers and Acquisitions of Domestic Enterprises by Foreign Investors of China. |

| | “MOFCOM” refers to the Ministry of Commerce of China. |

| | “PCAOB” refers to the Public Company Accounting Oversight Board. |

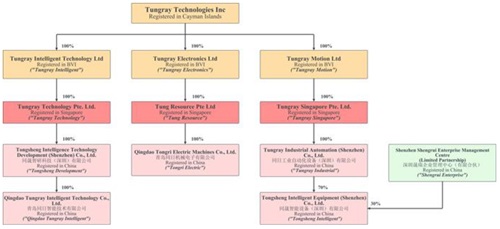

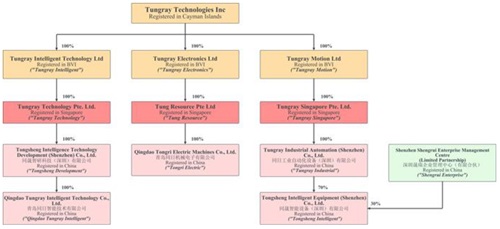

| | “PRC Subsidiaries” refers to Tongsheng Development, Qingdao Tungray Intelligent, Tongri Electric, Tungray Industrial and Tongsheng Intelligent. |

| | “Qingdao Tungray Intelligent” refer to Qingdao Tungray Intelligent Technology Co., Ltd., a PRC company. |

| | “RMB” or “Chinese Yuan” refers to the legal currency of China. |

| | “SAFE” refers to the State Administration of Foreign Exchange in China. |

| | “SAFE Circular 37” refers to the Circular on Relevant Issues Concerning Foreign Exchange Control on Domestic Residents’ Offshore Investment and Financing and Roundtrip Investment Through Special Purpose Vehicles. |

| | “SAT” refers to the PRC State Administration of Taxation. |

| | “SCNPC” refers to the Standing Committee of the National People’s Congress of China. |

| | “Tungray Intelligent” refers to Tungray Intelligent Technology Ltd., a British Virgin Islands company. |

| | “Tungray Motion” refers to Tungray Motion Ltd., a British Virgin Islands company. |

| | “Tungray Electronics” refers to Tungray Electronics Ltd., a British Virgin Islands company. |

| | “Tungray Technology” refer to TUNGRAY TECHNOLOGY PTE. LTD., a Singapore company. |

| | “Tung Resource” refer to TUNG RESOURCE PTE LTD, a Singapore company. |

| | “Tungray Singapore” refer to TUNGRAY SINGAPORE PTE. LTD., a Singapore company. |

| | “Tongsheng Development” refer to Tongsheng Intelligence Technology Development (Shenzhen) Co., Ltd., a PRC company. |

| | “Tongri Electric” refer to Qingdao Tongri Electric Machines Co., Ltd., a PRC company.

|

| | “Tungray Industrial” refer to Tungray Industrial Automation (Shenzhen) Co., Ltd., a PRC company. |

| | “Tongsheng Intelligent” refer to Tongsheng Intelligent Equipment (Shenzhen) Co., Ltd., a PRC company. |

| | “Shengrui Enterprise” refer to Shenzhen Shengrui Enterprise Management Centre (Limited Partnership), a PRC company. |

| | “Singapore Subsidiaries” refer to Tungray Technology, Tung Resource and Tungray Singapore. |

| | “U.S. GAAP” refer to generally accepted accounting principles in the United States. |

| | “VAT” refers to value added taxes. |

| | “Website” or “websites” refer to our website at www.tungray.tech. |

| | All references to “RMB,” “yuan” and “Renminbi” are to the legal currency of China. |

| | All references to “S Dollar,” “S$” are to Singapore dollars, the lawful currency of the Republic of Singapore. |

| | All references to “USD,” “US$” and “U.S. dollars” are to the legal currency of the United States, which is Tungray’s reporting currency. |

Our reporting currency is USD. However, substantially all of our consolidated revenues, costs, expenses and assets are denominated in S Dollar and RMB. This Annual Report contains translations of certain foreign currency amounts into USD for the convenience of the reader. All translations of S Dollar are calculated at the rate of US$1.00=S Dollar 1.3193 as of the year ended December 31, 2023 and US$1.00=S Dollar 1.3428 for the year ended December 31, 2023 representing the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on December 31, 2023. All translations of RMB are calculated at the rate of US$1.00=RMB 7.0999 as of the year ended December 31, 2023 and US$1.00=RMB 7.0809 for the year ended December 31, 2023 representing the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on December 31, 2023. All translations of S Dollar are calculated at the rate of US$1.00=S Dollar 1.3404 as of the year ended December 31, 2022 and US$1.00=S Dollar 1.3787 for the year ended December 31, 2022 representing the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on December 31, 2022. All translations of RMB are calculated at the rate of US$1.00=RMB 6.8972 as of the year ended December 31, 2022 and US$1.00=RMB 6.7290 for the year ended December 31, 2022 representing the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on December 31, 2022. All translations of S Dollar are calculated at the rate of US$1.00=S Dollar 1.3520 as of the year ended December 31, 2021 and US$1.00=S Dollar 1.3438 for the year ended December 31, 2021 representing the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on December 31, 2021. All translations of RMB are calculated at the rate of US$1.00=RMB 6.3726 as of the year ended December 31, 2021 and US$1.00=RMB 6.4508 for the year ended December 31, 2021 representing the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on December 31, 2021. No representation is made that the S Dollar or RMB amounts could have been, or could be, converted, realized or settled into USD at such rate, or at any other rate. Four of our operating entities’ functional currency are RMB, and two of our operating entities’ functional currency are S Dollar. As a result, we are exposed to foreign exchange risk as our results of operations may be affected by fluctuations in the exchange rate among, USD, S Dollar and RMB and we have not entered into any hedging transactions in an effort to reduce our exposure to foreign exchange risk.

FORWARD-LOOKING INFORMATION

This Annual Report contains forward-looking statements. These statements are made under the “safe harbor” provisions of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “may,” “intend,” “it is possible,” “subject to” and similar statements. Among other things, the sections titled “Item 3. Key Information—D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects” in this Annual Report, as well as our strategic and operational plans, contain forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements and are subject to change, and such change may be material and may have a material and adverse effect on our financial condition and results of operations for one or more prior periods. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained, either expressly or impliedly, in any of the forward-looking statements in this Annual Report. All information provided in this Annual Report and in the exhibits is as of the date of this Annual Report, and we do not undertake any obligation to update any such information, except as required under applicable law.

I

tem 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

I

tem 2. OFFER STATISTICS AND EXPECTED TIMETABLE

B.

Capitalization and Indebtedness

C.

Reasons for the Offer and Use of Proceeds

You should carefully consider the following risk factors, together with all of the other information included in this Annual Report. Investment in our securities involves a high degree of risk. You should carefully consider the risks described below together with all of the other information included in this Annual Report before making an investment decision. The risks and uncertainties described below represent our known material risks to our business. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, you may lose all or part of your investment.

Risks Related to Our Business and Industry. See “

Item 3. Key Information— Risk Factors — Risks Related to Our Business and Industry

” starting on page 4 of this Annual Report.

Risks and uncertainties related to our business and industry include, but are not limited to, the following:

| | Any adverse material changes to the Singapore and the PRC markets (whether localized or resulting from global economic or other conditions) such as the occurrence of an economic recession could have a material adverse effect on our business, results of operations and financial condition. See a more detailed discussion of this risk factor on page 4 of this Annual Report. |

| | Some of our subsidiaries have a limited operating history and are subject to the risks encountered by development-stage companies. See a more detailed discussion of this risk factor on page 6 of this Annual Report.

|

| | If our products do not respond to changes in technology, our products may become obsolete and we may experience a loss of customers and lower revenues. See a more detailed discussion of this risk factor on page 7 of this Annual Report. |

| | The manufacture of many of our products is a highly exacting and complex process, and if we directly or indirectly encounter problems in manufacturing products, business and financial results could suffer. See a more detailed discussion of this risk factor on page 7 of this Annual Report. |

| | We are dependent on our manufacturing facilities for the production of our highly engineered products and our suppliers’ factories, which subjects us to risks associated with disruptions and changing technology and manufacturing techniques that could place us at a competitive disadvantage. See a more detailed discussion of this risk factor on page 9 of this Annual Report. |

| | If we lose the services of any of our key executive officers and other key employees, or are unable to retain, recruit and hire experienced staff, our ability to effectively manage and execute our operations and meet our strategic objectives could be harmed. See a more detailed discussion of this risk factor on page 9 of this Annual Report. |

| | If we fail to protect our intellectual property rights, it could harm our business and competitive position. See a more detailed discussion of this risk factor on page 10 of this Annual Report. |

| | If we are unable to retain existing customers or attract new ones, or to attract sufficient spending from our customers, our business, results of operations and financial condition could be materially and adversely affected. See a more detailed discussion of this risk factor on page 13 of this Annual Report. |

| | Fluctuations in exchange rates could have a material adverse effect on our results of operations and the price of our Class A Ordinary Shares. See a more detailed discussion of this risk factor on page 15 of this Annual Report. |

Risks Related to Our Corporate Structure. See “

Item 3. Key Information— Risk Factors — Risks Related to Our Corporate Structure

” starting on page 15 of this Annual Report.

We are also subject to risks and uncertainties related to our corporate structure, including, but not limited to, the following:

| | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law. See a more detailed discussion of this risk factor on page 16 of this Annual Report.

|

| | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in Singapore and China against us or our management named in the Annual Report. See a more detailed discussion of this risk factor on page 16 of this Annual Report. |

| | The transfer of funds or assets between Tungray and its subsidiaries is subject to restrictions. See a more detailed discussion of this risk factor on page 17 of this Annual Report.

|

Risks Related to Doing Business in Singapore. See “

Item 3. Key Information— Risk Factors — Risks Related to Doing Business in Singapore

” starting on page 19 of this Annual Report.

The majority of our operations are in Singapore, so we face risks and uncertainties related to doing business in Singapore in general, including, but not limited to, the following:

| | We are subject to the laws of Singapore, which differ in certain material respects from the laws of the United States. See a more detailed discussion of this risk factor on page 19 of this Annual Report. |

| | Any adverse material changes to the Singapore market (whether localized or resulting from economic or other conditions) such as the occurrence of an economic recession, pandemic or widespread outbreak of an infectious disease (such as COVID-19), could have a material adverse effect on our business, results of operations and financial condition. See a more detailed discussion of this risk factor on page 20 of this Annual Report.

|

Risks Related to Doing Business in China. See “

Item 3. Key Information— Risk Factors — Risks Related to Doing Business in China

” starting on page 22 of this Annual Report.

A substantial portion of our operations are in China, so we face risks and uncertainties related to doing business in China in general, including, but not limited to, the following:

| | Because approximately 37 % of our operations are in China, our business is subject to the complex and rapidly evolving laws and regulations there, which are different in material aspects from the laws of the United States and may change and continue to evolve. The uncertainties with respect to the PRC legal system and with respect to the interpretation and enforcement of PRC laws and regulations could have a material adverse effect on us and the PRC government may exercise significant oversight over the conduct of our business, and may intervene in, influence or exert control over our operations at any time, which could result in a material change in our operations and/or the value of our Class A Ordinary Shares. See a more detailed discussion of this risk factor on page 22 of this Annual Report. |

| | The approval of and the filing with Cyberspace Administration of China or other PRC government authorities may be required in connection with offshore offerings under PRC laws, and, if required, we cannot predict whether or for how long we will be able to obtain such approval or complete such filing. See a more detailed discussion of this risk factor on page 22 of this Annual Report. |

| | Recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and an act passed by the US Senate all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our listings and offerings. See a more detailed discussion of this risk factor on page 25 of this Annual Report. |

| | PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident beneficial owners or our PRC Subsidiaries to liability or penalties, limit our ability to inject capital into our PRC Subsidiaries, limit our PRC Subsidiaries’ ability to increase their registered capital or distribute profits to us, or may otherwise adversely affect us. See a more detailed discussion of this risk factor on page 28 of this Annual Report. |

Risks Related to Our Class A Ordinary Shares. See “

Item 3. Key Information— Risk Factors — Risks Related to Our Class A Ordinary Shares

” starting on page 31 of this Annual Report.

In addition to the risks described above, we are subject to general risks and uncertainties related to our Class A Ordinary Shares, including, but not limited to, the following:

| | The market price for the Class A Ordinary Shares may be volatile. See a more detailed discussion of this risk factor on page 31 of this Annual Report. |

| | We may experience extreme stock price volatility unrelated to our actual or expected operating performance, financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Class A Ordinary Shares. See a more detailed discussion of this risk factor on page 32 of this Annual Report. |

| | We are a “foreign private issuer,” and our disclosure obligations differ from those of U.S. domestic reporting companies. As a result, we may not provide you the same information as U.S. domestic reporting companies or we may provide information at different times, which may make it more difficult for you to evaluate our performance and prospects. See a more detailed discussion of this risk factor on page 33 of this Annual Report. |

| | Our dual-class voting structure limits your ability to influence corporate matters and could discourage others from pursuing any change of control transactions that holders of our Class A Ordinary Shares may view as beneficial. See a more detailed discussion of this risk factor on page 37 of this Annual Report. |

| | Our dual-class voting structure may render our Class A Ordinary Shares ineligible for inclusion in certain stock market indices, and thus adversely affect the trading price and liquidity of our Class A Ordinary Shares. See a more detailed discussion of this risk factor on page 37 of this Annual Report. |

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

Any adverse material changes to the Singapore and the PRC markets (whether localized or resulting from global economic or other conditions) such as the occurrence of an economic recession could have a material adverse effect on our business, results of operations and financial condition.

During fiscal year ended December 31, 2023, approximately 63% and 37% of our revenue was derived from our operations in Singapore and mainland China, respectively. During fiscal year ended December 31, 2022, approximately 65% and 35% of our revenue was derived from our operations in Singapore and mainland China, respectively. During the fiscal year ended December 31, 2021, approximately 61% and 39% of our revenue was derived from our operations in Singapore and mainland China, respectively. Any adverse circumstances affecting the Singapore and the PRC markets, such as an economic recession, epidemic outbreak or natural disaster or other adverse incidents may adversely affect our business, financial condition, results of operations and prospects. Any downturn in the industry which we operate in resulting in the postponement, delay or cancellation of contracts and delay in recovery of receivables is likely to have an adverse impact on our business and profitability.

Uncertain global economic conditions have had and may continue to have an adverse impact on our business in the form of lower net sales due to weakened demand, unfavorable changes in product price/mix, or lower profit margins.

During economic downturns or recessions, there can be a heightened competition for sales and increased pressure to reduce selling prices as our customers may reduce their demand for our products. If we lose significant sales volume or reduce selling prices significantly, then there could be a negative impact on our combined financial condition or results of operations, profitability and cash flows.

Reduced availability of credit may also adversely affect the ability of some of our customers and suppliers to obtain funds for operations and capital expenditures. This could negatively impact our ability to obtain necessary supplies as well as our sales of products to affected customers. This could additionally result in reduced or delayed collections of outstanding accounts receivable.

The COVID-19 pandemic might adversely affect and continue to pose risks to our business, results of operations, financial condition and cash flows, and other epidemics or outbreaks of infectious diseases may have a similar impact.

In March 2020, the World Health Organization categorized COVID-19 as a pandemic. The spread of the outbreak has caused significant disruptions in global economies, including the U.S., Singapore and the PRC. We are subject to risks and uncertainties as a result of the COVID-19 pandemic. The effects of any new variants and subvariants of COVID-19, which may spread faster than the original Omicron variant, as well as any responsive actions taken by governments, may have the effect of slowing our sales. Further, policies of local governments effecting closures to avoid infections, including the recent lockdown in many provinces and municipalities in China, could affect our results of operations. We continue to evaluate the global risks and the slowdown in business activity related to COVID-19, including the potential impacts on our employees, customers, suppliers and financial results. The spread of COVID-19 did not have any material impact on the Company’s business during the fiscal years ended December 31, 2022 and 2021. However, during the fiscal year ended December 31, 2023, with the end of the COVID-19 pandemic, people’s work mode has changed from work from home during the pandemic to work at office, thus reducing the demand for office equipment such as printers, which had an impact on our business. The COVID-19 pandemic or other epidemics or outbreaks of infectious diseases could adversely impact our results of operations, financial condition and liquidity in several ways in the future. In particular, the continued spread of COVID-19 and efforts to contain the virus could:

| | impair the Company’s ability to manage day-to-day operations and product delivery; |

| | |

| | impact customers’ demand of our businesses’ products and services; |

| | |

| | cause disruptions in or closures of the Company’s operations or those of its customers;

|

| | |

| | impact global liquidity and the availability of capital; |

| | |

| | cause the Company to experience an increase in costs as a result of the Company’s emergency measures, delayed payments from customers and uncollectible accounts;

|

| | |

| | cause delays and disruptions in the supply chain resulting in disruptions in the commercial operation of our businesses;

|

| | |

| | cause limitations on our employees’ ability to work and travel;

|

| | |

| | impact availability of qualified personnel;

|

| | |

| | increase cybersecurity risks as remote working environments may be less secure and more susceptible to hacking attacks, including phishing and social engineering attempts that seek to exploit the COVID-19 pandemic; and |

| | |

| | cause other unpredictable events.

|

The severity of the impact on our business will depend on a number of factors, including, but not limited to, the duration and severity of the pandemic (including the advent of variants and the impact of vaccination on infection and hospitalization rates), the extent and severity of the impact on our customers and suppliers, the disruption to the manufacturing of and demand for our businesses’ products and services, the effect of federal, state or local regulations regarding safety measures to address the spread of COVID-19, and the impact of the global business and economic environment on liquidity and the availability of capital, all of which are uncertain and cannot be predicted. Due to the evolving and uncertain nature of this event, we cannot predict at this time the full extent to which the COVID-19 pandemic will adversely impact our business, results and financial condition, which will depend on many factors that are not known at this time. We are staying in close communication with our employees, customers and suppliers, and acting to mitigate the impact of this dynamic and evolving situation, but there is no guarantee we will be able to do so.

We operate in a competitive industry. If we are unable to compete successfully, we may lose market share to our competitors.

The domestic markets in both Singapore and mainland China for customized industrial manufacturing solutions of original equipment manufacturer (“OEMs”) and related products are highly competitive. Our current or potential competitors include major engineer-to-order (“ETO”) industrial manufactures in Singapore (such as Sigma Design & Engineering Pte Ltd), PRC (such as Xiamen Inker Induction Co., Ltd. and Xinchang Kechuang Automation Equipment Co., Ltd.) and other parts in the world. Some of our competitors may have greater brand recognition, larger group of customers or vendors, longer operating histories as well as marketing resources than we do. Customers may weigh their experience and resources over us in various ways, therefore increasing our competitor’s respective market shares.

You should not expect that we will be able to compete successfully against current or potential competitors, and such competitive pressures may have a material and adverse effect on our business, financial condition and results of operations. Failure to compete successfully against existing or new competitors may cause us to lose market share, customers and other business partners.

The cyclical nature and maturity of the precision engineering, manufacturing and consumer appliances industries in developed markets may adversely affect our performance.

The precision engineering, manufacturing and consumer appliances industries are generally cyclical in nature. Overall demand for our products is largely determined by the level of capital spending in manufacturing and other industrial sectors, and the precision engineering, manufacturing and consumer appliances industries have historically experienced contraction during periods of slowing industrial activity. If economic, business and industry conditions deteriorate, capital spending in those sectors may be substantially decreased, which could reduce demand for our products and have an adverse impact on our revenues and results of operations.

A significant or sustained decline in the levels of new capital investment and maintenance expenditures by certain of our customers could reduce the demand for our products and services and harm our operations and financial performance.

Demand for our products and services depends significantly on the level of new capital investment and planned maintenance expenditures by certain of our customers. The level of new capital expenditures by our customers is dependent upon many factors, including general economic conditions, availability of credit, economic conditions and investment activities within their respective industries and expectations of future market behavior. In addition, volatility in commodity prices can negatively affect the level of these new activities and can result in postponement of capital spending decisions or the delay or cancellation of existing orders. A reduction in

demand for our products and services has resulted in the past, and in the future could result in the delay or cancellation of existing orders or lead to excess manufacturing capacity, which unfavorably impacts our absorption of fixed manufacturing costs. Any reduced demand could have a material adverse effect on our business, financial condition and results of operations.

Some of our subsidiaries have a limited operating history and are subject to the risks encountered by development-stage companies.

Other than Tung Resource, Tungray Singapore, Tungray Industrial and Tongri Electric which have approximately 10-20 years of operation, our other subsidiaries have a limited operating history. Thus, the business strategies and model of these subsidiaries with a limited operating history are constantly being tested by the market and operating results, and we work to adjust our allocation of resources accordingly. As such, our business may be subject to significant fluctuations in operating results in terms of amounts of revenues and percentages of total with respect to the business segments.

We are, and expect for the foreseeable future to be, subject to all the risks and uncertainties, inherent in a development-stage business. As a result, we must establish many functions necessary to operate a business, including expanding our managerial and administrative structure, assessing and implementing our marketing program, implementing financial systems and controls and personnel recruitment. Accordingly, you should consider our prospects in light of the costs, uncertainties, delays and difficulties frequently encountered by companies with a limited operating history. These risks and challenges are, among other things:

| | we may require additional capital to develop and expand our operations which may not be available to us when we require it; |

| | |

| | our marketing and growth strategy may not be successful; |

| | |

| | our business may be subject to significant fluctuations in operating results; and |

| | we may not be able to attract, retain and motivate qualified professionals. |

Our future growth will depend substantially on our ability to address these and the other risks described in this Annual Report. If we do not successfully address these risks, our business would be significantly harmed.

Any disruption in the supply chain of raw materials and our products could adversely impact our ability to produce and deliver products.

As to the products we manufacture, we must manage our supply chain for raw materials and delivery of our products. Any supply chain fragmentation and local protectionism within Singapore and China may further complicate supply chain disruption risks. Local administrative bodies and physical infrastructure built to protect local interests pose transportation challenges for raw material transportation as well as product delivery. In addition, profitability and volume could be negatively impacted by limitations inherent within the supply chain, including competitive, governmental, legal, natural disasters, and other events that could impact both supply and price. Any of these occurrences could cause significant disruptions to our supply chain, manufacturing capability and distribution system that could adversely impact our ability to produce and deliver products.

Our business may be exposed to risks associated with a concentrated customer base.

Our top two customers, HP Inc. (“HP”) and Chengdu Innorev Industrial Co., Ltd. (“Chengdu Innorev”), accounted for 64.2% and 6.0% of revenues for the fiscal year ended December 31, 2023, respectively, and the amount due from these customers included in accounts receivable represented 20.4% and 8.6% of total accounts receivable as of December 31, 2023, respectively. Our top two customers, HP and Goertek Inc (“Goertek”), accounted for 60.7% and 8.8% of revenues for the year ended December 31, 2022, respectively, and the amount due from these customers included in accounts receivable represented 27.0% and 23.0% of total accounts receivable as of December 31, 2022, respectively. Our top two customers, HP and Goertek, accounted for 60.0% and 5.6% of revenues for the year ended December 31, 2021, respectively, and the amount due from these customers included in accounts receivable represented 20.9% and 10.8% of total accounts receivable for such year, respectively. Consistent with the industry practice, we have not entered into written agreements with our major customers. We have been providing services and products to such major customers based on purchase orders received from them from time to time, which mainly specify the product for purchase, quantity, unit price, and delivery date.