Exhibit 99.1

MasterBrand, Inc.

INFORMATION STATEMENT

Distribution of Common Stock of MasterBrand, Inc.

by

FORTUNE BRANDS HOME & SECURITY, INC.

to

FORTUNE BRANDS HOME & SECURITY, INC. STOCKHOLDERS

Fortune Brands Home & Security, Inc. (“Fortune Brands”) is furnishing this Information Statement to holders of Fortune Brands common stock in connection with the distribution by Fortune Brands of all of the issued and outstanding shares of common stock of MasterBrand, Inc. (“MasterBrand”). As of the date of this Information Statement, Fortune Brands owns all of the outstanding common stock of MasterBrand.

Fortune Brands expects that the distribution will be made on December 14, 2022 on a pro rata basis to the holders of record of Fortune Brands common stock as of 5:00 p.m., Central Time, on December 2, 2022, which is the record date. If you are a record holder of Fortune Brands common stock at 5:00 p.m., Central Time, on the record date, you will be entitled to receive one share of MasterBrand common stock for each share of Fortune Brands common stock you hold on that date. No fractional shares of MasterBrand common stock will be distributed in connection with the distribution. Instead, the Distribution Agent (as defined below) will aggregate all fractional shares into whole shares and sell the whole shares in the open market at prevailing market prices and distribute the aggregate cash proceeds of the sales, net of brokerage fees and other costs, pro rata to each Fortune Brands stockholder who would otherwise have been entitled to receive a fractional share in the distribution. As discussed under “The Separation,” if you sell your shares of Fortune Brands common stock in the “regular way” market after the close of business on the record date and up to and including the distribution date, you will be selling your right to receive shares of MasterBrand common stock in the distribution. Because MasterBrand shares will only be maintained in book-entry form, you will not receive a stock certificate representing your interest in MasterBrand.

The distribution is expected to be generally tax-free for U.S. federal income tax purposes to Fortune Brands, MasterBrand and Fortune Brands stockholders. You should consult your own tax advisor as to the particular consequences of the distribution to you, including the applicability and effect of any U.S. federal, state and local and non-U.S. tax laws.

You will not be required to make any payment for any shares of MasterBrand common stock that you will receive in the distribution, nor will you be required to surrender or exchange your shares of Fortune Brands common stock or take any other action in order to receive shares of MasterBrand common stock in the distribution. No vote or further action of Fortune Brands stockholders is required in connection with the distribution.

We are not asking you for a proxy, and you are requested not to send us a proxy.

There is no current trading market for MasterBrand common stock. However, we expect that a limited market, commonly known as a “when-issued” trading market, for MasterBrand common stock will develop three trading days prior to the Distribution Date (as defined below), and we expect that “regular way” trading of MasterBrand common stock will begin the first trading day following the Distribution Date. We have applied to have MasterBrand common stock authorized for listing on the New York Stock Exchange under the symbol “MBC”.

In reviewing this Information Statement, you should carefully consider the matters described in the section entitled “Risk Factors” beginning on page 27 of this Information Statement.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved these securities or determined if this Information Statement is truthful or complete. Any representation to the contrary is a criminal offense.

This Information Statement is not an offer to sell, or a solicitation of an offer to buy, any securities.

The date of this Information Statement is December 1, 2022

A Notice of Internet Availability of Information Statement Materials containing instructions describing how to access this Information Statement was first mailed to Fortune Brands stockholders on or about December 7, 2022.

| Page | ||||

| 1 | ||||

| 27 | ||||

| 49 | ||||

| 50 | ||||

| 61 | ||||

| UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

62 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

71 | |||

| 92 | ||||

| 104 | ||||

| 112 | ||||

| SECURITY OWNERSHIP OF MANAGEMENT, DIRECTORS AND PRINCIPAL STOCKHOLDERS |

135 | |||

| 137 | ||||

| 143 | ||||

| 147 | ||||

| 152 | ||||

| F-1 | ||||

i

NOTE REGARDING CERTAIN DEFINED TERMS

We use the following terms throughout this Information Statement:

Unless the context otherwise requires, “we,” “us,” “our,” the “Company,” “Cabinets,” the “Cabinets segment” and “MasterBrand” refer to MasterBrand, Inc., and its consolidated subsidiaries, which immediately before the Distribution (as defined below) holds, through its subsidiaries, all of the assets and liabilities of the Cabinets segment of Fortune Brands (as defined below). The Cabinets segment had historically been operated by MasterBrand Cabinets, Inc. (“MBCI”). In July 2022, Fortune Brands incorporated MasterBrand in the State of Delaware and subscribed to all of the shares of MasterBrand’s common stock upon its incorporation. Following the incorporation of MasterBrand, the following occurred: (1) Fortune Brands contributed all of the issued and outstanding shares of capital stock of MBCI to MasterBrand, resulting in MBCI becoming a subsidiary of MasterBrand through a transaction between entities under common control; and (2) MBCI was converted into a Delaware limited liability company, MasterBrand Cabinets LLC (“MBC LLC”).

“Fortune Brands” refers to Fortune Brands Home & Security, Inc. and its consolidated subsidiaries including the Cabinets segment prior to completion of the Separation and Distribution and excluding the Cabinets segment following the completion of the Separation and Distribution. It is anticipated that, following the Separation, Fortune Brands will change its name to “Fortune Brands Innovations, Inc.”

“Distribution” refers to the distribution of all of the shares of MasterBrand common stock owned by Fortune Brands to stockholders of Fortune Brands as of the Record Date (as defined below).

“Distribution Date” means the date on which the Distribution occurs.

“Record Date” means 5:00 p.m., Central Time, on December 2, 2022.

“Separation” refers to the spin-off of the MasterBrand business from Fortune Brands and the creation of an independent, publicly-traded company holding the MasterBrand business. The Separation will be effectuated through a pro rata distribution of shares of MasterBrand common stock to Fortune Brands stockholders as of the Record Date.

FINANCIAL STATEMENT PRESENTATION

This Information Statement includes certain historical consolidated financial statements and other data for MasterBrand and its subsidiaries. The Cabinets segment had historically been operated by MBCI. In July 2022, Fortune Brands incorporated MasterBrand in the State of Delaware and subscribed to all of the shares of MasterBrand’s common stock upon its incorporation. Following the incorporation of MasterBrand, the following occurred: (1) Fortune Brands contributed all of the issued and outstanding shares of capital stock of MBCI to MasterBrand, resulting in MBCI becoming a subsidiary of MasterBrand through a transaction between entities under common control; and (2) MBCI was converted into a Delaware limited liability company, MBC LLC (collectively, the “Reorganization”). As a result, the historical activity of the Company is that of MBCI prior to the Reorganization and the Company’s equity structure has been retroactively recast to reflect that of MasterBrand which includes 5,000 authorized and 100 issued shares of its common stock. Previously, the equity structure of MBCI included 1,000 authorized and issued shares of common stock. All share and per share amounts for all periods presented in our consolidated financial statements and our unaudited condensed consolidated financial statements reflect the effects of the change in equity structure resulting from the Reorganization.

Our consolidated financial statements are based on a 52- or 53-week fiscal year ending on the last Sunday in December in each calendar year. Unless the context otherwise requires, references to years and quarters contained in this Information Statement pertain to our fiscal years and fiscal quarters. Additionally, unless the context otherwise requires, references in this Information Statement to: (1) “2022,” “fiscal 2022” or our “2022 fiscal year” refers to our 2022 fiscal year that is a 52-week period that will end on December 25, 2022;

ii

(2) “2021,” “fiscal 2021” or our “2021 fiscal year” refers to our 2021 fiscal year that was a 52-week period that ended on December 26, 2021; (3) “2020,” “fiscal 2020” or our “2020 fiscal year” refers to our 2020 fiscal year that was a 52-week period that ended on December 27, 2020; and (4) “2019,” “fiscal 2019” or our “2019 fiscal year” refers to our 2019 fiscal year that was a 52-week period that ended on December 29, 2019. Furthermore, unless the context otherwise requires, reference in this Information Statement to: (1) “the first three quarters of 2022” refers to the thirty-nine weeks ended September 25, 2022; and (2) “the first three quarters of 2021” refers to the thirty-nine weeks ended September 26, 2021.

INDUSTRY AND MARKET DATA

This Information Statement contains estimates regarding market and industry data that were obtained from internal Company estimates as well as third-party sources, such as market research, consultant surveys, publicly available information and industry publications and surveys. We believe the information provided or made available by these third-party sources is generally reliable. However, market data is subject to change and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data-gathering process and other limitations and uncertainties inherent in any statistical survey, interpretation or presentation of market data. As a result, you should be aware that market data set forth herein, and estimates and beliefs based on that data presented herein, may not be reliable. Unless identified as a third-party source, market data is based on internal company estimates and data. Similarly, internal company estimates, which we believe to be reliable, are based upon management’s knowledge of the industry as of the date of those estimates and have not been verified by any independent sources. Accordingly, we cannot guarantee the accuracy or completeness of any such information, and you should not place undue reliance on that information.

iii

This summary highlights selected information contained elsewhere in this Information Statement and provides an overview of our Company, our Separation from Fortune Brands and the Distribution of our common stock by Fortune Brands to its stockholders, the means by which the Separation will be effected. For a more complete understanding of our business and the Separation and Distribution, you should read the entire Information Statement carefully, particularly the discussions set forth under “Risk Factors,” “Cautionary Statement Concerning Forward-Looking Statements,” “Unaudited Pro Forma Condensed Consolidated Financial Statements,” our audited consolidated financial statements and accompanying notes included elsewhere in this Information Statement, and our unaudited condensed consolidated financial statements and accompanying notes included elsewhere in this Information Statement.

Our Story

We are the largest residential cabinet manufacturer in North America. Our strong culture of continuous improvement, portfolio strength and our leading customer network drives our operational excellence and long-term value creation opportunities.

| ✓ | Long-standing relationships across a national network of 4,000+ dealers supported by strong service and unique multi-branded go-to-market proposition. |

| ✓ | Manufacturing scale, global supply chain, and operational agility to pivot with market demand. |

| ✓ | Clear path to value creation and growth through lean operational transformation, pricing excellence, new product introductions and emerging channels. |

Founded nearly 70 years ago, we are the largest manufacturer of residential cabinets in North America, based on 2021 net sales. Our superior product quality, innovative design and service excellence drives a compelling value proposition. We have insight into the fashion and features consumers desire, which we use to tailor our product lines across price points. Our volume leadership allows us to achieve an advantaged cost structure and service platform by standardizing product platforms and components to the greatest extent possible—resulting in an improved facility footprint and an efficient supply chain. Further, our decades of experience have informed how we use global geographies to optimize procurement and manufacturing costs. Finally, with the most extensive dealer network throughout the United States and Canada, we have an advantaged distribution model that cannot be easily replicated. We expect to further extend our competitive advantages by using technology and data to enhance the consumer’s experience from visualization to ordering to delivery and installation.

We believe our exceptional transformation over the last few years is only beginning to unlock the potential value of our unique combination of scale, operational agility, data-first operating model and strong continuous improvement culture. We will continue to distinguish this advantaged platform by capitalizing on the powerful demographic trends that we expect will drive repair & remodel (“R&R”) and new construction growth for years to come. We believe the combination of our leading market position and size, strategic vision, strong partnerships and commitment to continuous improvement will drive our future growth.

On April 28, 2022, Fortune Brands announced that its Board of Directors approved in principle a separation of its Cabinets segment into a standalone publicly-traded company. The Cabinets segment had historically been operated by MBCI. We were incorporated as a Delaware corporation in July 2022. We are a wholly-owned subsidiary of Fortune Brands that immediately before the Distribution holds, through its subsidiaries, all of the assets and liabilities of Fortune Brands’ Cabinets segment. In July 2022, following the incorporation of MasterBrand, MBCI became a wholly-owned subsidiary of MasterBrand and MBCI was converted into a Delaware limited liability company, MBC LLC. After the Distribution, we will be an independent, publicly-traded company.

1

Channels

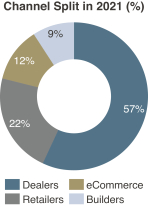

Our products are sold throughout the United States and Canada to the remodeling and new construction markets through three primary channels: dealers, retailers and builders.

| 1. | Dealers: We have built the industry’s largest and strongest network, with well-established relationships with over 4,000 cabinet dealers across the United States and Canada, many of whom we have worked with for decades. Our dealers cover a wide portion of the market, with some specializing in R&R, while others provide regional service to a variety of new construction home builders. Our extensive dealer network allows us to have exceptional market reach and the ability to target key growth areas. |

| 2. | Retailers: We serve the top retailers in North America and have developed strong and lasting partnerships with them as a result of our category management and commitment to best-in-class execution. |

| 3. | Builders: We strategically partner with the industry’s best and most profitable builders for single-family and multi-family construction. |

In addition, we are actively growing our presence in the emerging cabinets e-commerce channel, including through our channel partners’ on-line presence, and are actively partnering with leading players to develop continuing opportunities to penetrate and innovate in this exciting category.

Products

We offer a comprehensive portfolio of leading residential cabinetry products for the kitchen, bathroom and other parts of the home. Our products are available in a wide variety of designs, finishes and styles and span the most attractive categories of the cabinets market: stock, semi-custom and premium cabinetry. Our unique product portfolio allows homeowners to create the living spaces of their dreams, tailored to their price point and personalized for their individual style. While our product offerings may overlap in different categories, they generally follow the following characteristics: stock products provide consumers with a strong value proposition at entry level pricing, and these products benefit from low design complexity, standardized components and shorter lead times, while also offering exceptional quality and reliability; semi-custom products offer more styles and features than stock cabinets, allowing consumers to create a more personalized space at a lower price point compared to premium products; and finally premium products enable consumers to achieve their dream home by designing highly customized cabinets to meet their exact specifications—if they can dream it, we can make it.

Our Culture and Vision

We believe our strong culture differentiates us. The MasterBrand Way is our cultural foundation and drives our recent and ongoing transformation. Guided by foundational lean tools and process improvement principles of the MasterBrand Way, our associates across all our locations and at all levels work together under consistent lexicon

2

and frameworks to effectively develop cross-functional solutions. To various degrees and in various forms, the implementation of the MasterBrand Way has resulted in process improvements across our locations. This has allowed us to become more efficient, reduce costs and improve our margin profile during the currently challenging global operating environment.

Our Transformation

Our management team has decades of experience driving operational improvement, innovation, and growth. Since 2019 our management team, led by Dave Banyard, who will serve as our Chief Executive Officer, has been executing a purpose-driven strategic transformation of the business to create a more resilient and efficient operating platform, allowing us to remain agile irrespective of external market conditions. We have made strong progress toward achieving our operational initiatives and performance objectives, and we believe significant opportunity remains as we continue to execute our strategic transformation. Some of our notable initiatives launched since 2019 include:

| • | We have focused on strategically sizing, structuring and investing in our footprint to meet our customers’ delivery requirements and regional product demands, while minimizing transportation costs. For example, our recently opened facility in Jackson, Georgia optimally positions us to serve the retailer and value price point cabinetry markets in the high-growth area of the Southeast United States. This state-of-the-art facility enabled us to reduce our reliance on third party logistic providers while optimizing flow and flexibility in the plant. Using lean tools, we ramped this facility up to full capacity within four months of commencing operations. |

| • | We have implemented well-established tools, including process improvement tools recognized in our industry, to simplify our product portfolio and reduce complexity. This has allowed us to focus our commercial efforts on serving those markets and customers that we believe have the most attractive growth profiles. For example, our MANTRA brand sales grew at a 140% compounded annual growth rate (“CAGR”) from 2019 to 2021. We identified a specific market need, and then deployed our agile supply chain, efficient operations and broad channel coverage to deliver a product that offered the |

3

| value and style that the consumer was looking for, all while maintaining the quality standards for which we are known. |

| • | We seek to instill a lean culture across all aspects of our business, resulting in industry-leading employee safety levels, product quality improvements and incremental manufacturing capacity. For example, we recently used these tools to identify the most popular door styles and finishes, allowing us to significantly streamline the number of door styles and standard finishes offered in many of our products, while not sacrificing the flexibility or customization our customers desire. |

| • | We also use lean tools to standardize production and scale our internal manufacturing capability to increase our efficiency and reduce unit costs. For example, we recently made improvements in one of our facilities which significantly reduced the labor required to produce the same volume of cabinets. In another case, we staffed a factory expansion exclusively with existing associates, foregoing the need to hire and reducing the labor content of the product. |

Our commitment to the MasterBrand Way represents a commitment to our journey of continuous improvement and an acknowledgment that we can do better every day. While we continue to further optimize our platform, in 2021 alone we generated approximately $20 million in continuous improvement savings measured by direct and indirect cost reduction per unit through our initiatives versus 2020. We will continue driving our transformation to further simplify and standardize our business, and enhance our value proposition and customer experience through the use of data.

Our Results

Our ongoing strategic transformation has improved our manufacturing capacity and operational agility, allowing us to shift our production to service continuously evolving consumer trends and meet regional demands, even in the face of unprecedented disruptions and challenges. As a result, we have delivered above-market growth and increased market share while simultaneously simplifying the business and strengthening our culture of continuous improvement. Net sales increased from $2.4 billion in 2019, to $2.5 billion in 2020 and to $2.9 billion in 2021, a CAGR of approximately 9% from 2019 to 2021, and we maintained our margins despite the significant supply chain and inflationary pressures. We have outperformed our market peers by approximately 210 basis points in terms of net sales growth over the twelve months ended April 30, 2022 compared to the twelve months ended April 30, 2021 according to published data from the Kitchen Cabinet Manufacturers Association (“KCMA”). We believe we have significant opportunities to further expand our margins as we continue to execute our strategic growth initiatives.

Our Industry

Housing Market

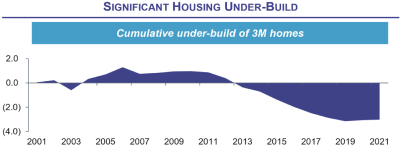

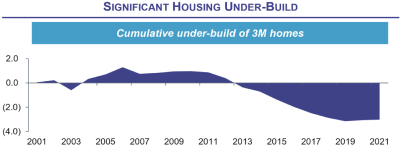

We expect continued, long-term expansion of housing and building products within both R&R and new construction. Several factors support long-term housing market strength, including the structural under-supply of new homes, aging housing stock, shifting demographics, and evolving consumer preferences. Given these factors, we expect the long-term expansion of housing and building products to continue, irrespective of short-term challenges. According to a 2021 study by FreddieMac, U.S. housing stock remains over three million homes underbuilt, and inventory continues to turn over rapidly. While rising interest rates may lead to a brief pause in activity while expectations are recalibrated, there are simply not enough homes to support pent-up demand. Additionally, R&R has been supported by tremendous home equity wealth, which hit a record high in 2022, according to a June 2022 report by the Federal Reserve. We believe these conditions will drive strong, long-term growth tailwinds for our market and that we are exceptionally well-positioned to capture potential upside in our markets, while also being able to navigate any short-term headwinds.

4

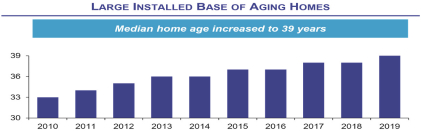

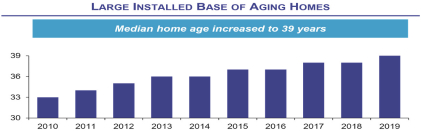

The U.S. has enjoyed long-term, sustained R&R growth; we estimate that U.S. R&R sales increased at a CAGR of 7% from 2018 to 2021. This growth is driven by aging U.S. housing stock, which has precipitated homeowners to upgrade outdated home spaces. In 2019, the median age of U.S. housing stock was approximately 40 years old according to the National Association of Home Builders, and homes built during the mid-2000’s housing boom are now becoming outdated, driving increased and sustained remodel volume.

According to the U.S. Census Bureau, U.S. new construction starts grew at a 9% CAGR from 2018 to 2021. This investment in new housing stock is to meet the U.S. single-family housing deficit and continuing low inventory levels of existing homes according to the National Association of Realtors.

Source: National Association of Home Builders (June 3, 2021)

Source: Fortune Brands internal estimates; reflects housing supply (single-family, multi-family, mobile completions) vs. demand (household formation and vacation/2nd homes, plus net depletions).

Cabinets Market

The kitchen plays an increasingly important role as the heart of the household and main entertainment center. According to a June 2021 study published by Houzz, investment on major remodels of large kitchens jumped 14% to $40,000 in 2020 from $35,000 in 2019. Kitchens have evolved from cooking spaces to living spaces, with families spending more time in the kitchen. Consumers want their kitchens to be a large, aesthetically beautiful, multifunctional space, with features like expandable seating and storage that enable the household to work, study and entertain.

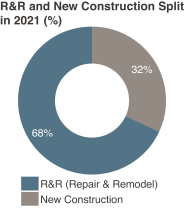

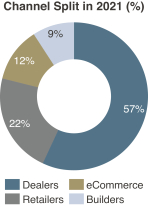

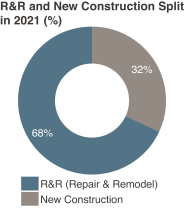

According to IBISWorld, the U.S. cabinet and vanity manufacturing market is estimated to have annual revenues of $18.4 billion in 2022. The two primary drivers of growth in the residential cabinets market are R&R and new construction, which accounted for 68% and 32%, respectively, of total U.S. residential cabinets sales according to our internal estimates.

The following charts reflect the percentage of net sales by channel in 2021 and R&R versus new construction in 2021 for the overall U.S. cabinet industry.

5

Cabinet Industry Channel and Market Split

|

|

Source: Fortune Brands internal estimates.

We believe our position as the largest residential cabinet manufacturer in North America offers us significant competitive advantages to capture this expected growth. We benefit from economies of scale, including a comprehensive global supply network, sophisticated shipping and logistics platforms, and tailored channel management strategies. Our size and cross-channel relationships allow us real-time insights into suppliers, manufacturing efficiencies, channel partners, consumer trends and market dynamics.

The U.S. and Canadian cabinet market comprises both a handful of large cabinet manufacturers, as well many smaller regional manufacturers and local cabinet craftspeople. In addition, over the past 10 years, the industry has experienced increased competition from low-cost imports. We have been able to effectively respond to these imports through our transformation efforts, our focus on value-priced cabinets, and our investments in low-cost country manufacturing and sourcing.

Our Unique Strengths

We are the industry leader, driving strategic transformation to consistently deliver top-tier performance.

We are the largest manufacturer of residential kitchen and bath cabinetry in North America with a proven track record of strong financial performance. Our leadership is driven by our product breadth, extensive distribution network, flexible manufacturing and superior customer service capabilities. Through our multi-product portfolio and innovation leadership, we provide our channels and customers with products that incorporate the latest style and design trends across the pricing continuum. Our flexible and agile supply chain, optimized manufacturing network and superior transportation capabilities ensure that we can deliver our products on-time and in the quantities demanded by our customers. Our scaled platform and industry-leading customer service position us as a preferred partner by national dealers, retailers and builders throughout North America, and we are growing our e-commerce presence. We have leveraged these capabilities to develop meaningful partnerships within each channel and expect that our leadership position will allow us to continue to drive enhanced growth and profitability. Our business primarily relies on U.S. and Canadian home improvement, R&R and new home construction activity levels, all of which are impacted by risks associated with fluctuations in the housing market. Moreover, because the barriers to entry in the cabinetry business are relatively low, we may be challenged to maintain our leading market share due to lower cost manufacturers taking share in a more cost-aware environment. For more information, see “Risk Factors—Risks Related to Our Business—Risks Related to Our Industry” in this Information Statement.

6

We have the most extensive dealer network, complemented by deep retailer and home-builder relationships, supporting full channel coverage.

We have long-established relationships with our customers throughout our end markets. We have built the industry’s largest and strongest network of cabinetry dealers, with over 4,000 dealer partners in the United States and Canada and have been a trusted partner to the most important retail customers for many decades. Our long-standing relationships are built on our commitment to the 4 Basics of the MasterBrand Way: safe and clean workplace, quality at or above expectations, complete and on-time delivery, and fashionable products at a fair price. Our dealer customers value our wide product selection, our tailored incentive programs and our customer support that enable them to meet a wide range of consumer needs. In addition, we offer a unique, unified sales and incentive program structure, making us the supplier of choice for the top dealers. Our retail customers value our differentiated category management expertise, comprehensive marketing programs, shorter lead times and lower transportation costs. Through our extensive coverage and longstanding partnerships with many of the largest and fastest growing dealers, retailers and builders, as well as our developing relationships with the major players in the e-commerce sector, including with our existing customers, we believe we are well-positioned to capture above market growth in each channel.

We have the global supply chain, manufacturing scale and operational agility to respond to any market conditions.

Our global supply chain and scalable manufacturing network enhance the flexibility and resilience of our business. In connection with our transformation over the past three years, we have made substantial investments in new facilities, more efficient equipment and system upgrades and improvements in our supply chain to improve material availability and reduce procurement costs. We are in the process of transforming our production platform to standardize product lines, scale our internal component manufacturing capability and increase capacity utilization. Finally, we have institutionalized our lean manufacturing capabilities to reduce waste, unlock additional capacity and increase labor productivity. Through a combination of plant reconfigurations, data utilization, equipment modernization and the opening of new facilities, including in Mexico, we have increased our manufacturing network’s capacity, agility and flexibility. More recently, we, like everyone in our industry, have been impacted by sustained levels of higher inflation, supply chain and transportation disruptions, as well as labor availability and high labor costs. However, we believe that our scale, organizational excellence and management expertise give us a competitive advantage over other manufacturers in our industry.

We have multiple levers for future value creation.

We believe we have significant opportunities for future value creation. First, we focus our efforts towards markets and customers throughout the industry with the most attractive growth profiles, leveraging our extensive channel breadth and supported by our product development, flexible supply chain strategy and operational agility. Next, as part of our continuing transformation, we will continue to employ the MasterBrand Way to drive simplification, waste reduction, and quality improvement, all of which have the potential to deliver higher margins and capital efficiency. Finally, we are continuing to use sophisticated data-first strategies to penetrate the emerging e-commerce category, further standardize and streamline processes and improve the customer and consumer experiences.

Industry leading environmental, social, and governance (“ESG”) is a key part of our strategy.

We have a culture of doing the right thing for our people and the planet. We consider ourselves a leader in sustainable wood sourcing practices; 80% of our hard wood spend in 2021 was derived from supply that originated in the United States and Canada, we have comprehensive wood auditing practices, and give preference to our suppliers who participate in sustainability programs. We believe there are opportunities to demonstrate our

7

commitment to sustainability through our best-in-class, ethical sourcing of wood products. Wood is an important natural resource, noted for its carbon sequestering abilities and, if sourced properly, it is an infinitely renewable resource. We are also a leader in employee safety. In 2021, we had an injury incident rate that was less than a third of the industry benchmark. We are also committed to an inclusive workplace where people are valued and respected with comprehensive health and benefit packages, numerous active employee resource groups and targeted Diversity, Equity and Inclusion (“DEI”) training to all people managers.

We have a proven management team driving ongoing strategic transformation.

We are led by a team of diverse and experienced executives from world-class organizations with a track record of driving manufacturing efficiency, growth strategies, product innovation, and profitable growth. Dave Banyard, who will serve as our Chief Executive Officer, is a proven leader with a history of success in leading global organizations and executing successful business transformations. Prior to joining our Company in 2019, Mr. Banyard held executive management roles with Roper Technologies, Inc. (NYSE: ROP) and Danaher Corporation (NYSE: DHR) and was most recently CEO and on the Board of Directors of Myers Industries, Inc. (NYSE: MYE).

Our management team includes an advantaged mix of cabinet industry veterans and experienced leaders from outside the cabinet industry. We believe this unique combination offers an ideal balance of industry insight and knowledge, together with the benefits of an outside perspective, allowing for the best potential opportunities for transformative, sustainable growth.

Our Growth Strategy

We seek to achieve exceptional financial performance and growth through the disciplined execution of a transformative strategy.

| • | Deploy the MasterBrand Way to improve efficiency and drive simplification and scale across a unified and agile manufacturing network. |

We believe we have ongoing opportunities to improve our operational performance and further differentiate ourselves by simplifying our product portfolio. We are transforming our business by deploying the MasterBrand Way to drive a culture of continuous improvement throughout the business. We expect that improving the efficiency of operations will drive improvements in our cost basis and increase operational resiliency. Further, we are simplifying our product lines to create a more unified manufacturing and supply chain network. In addition to leveraging scale across our network, we believe these initiatives will reduce our lead times, allow for more rapid reaction to changing customer needs and preferences and increase our ability to respond to any future disruptions. With the continued implementation of this strategy, our goal is to significantly improve profitability through lower overhead costs, by reducing input costs, increasing quality and efficiency, and eliminating waste. In connection with the Separation, we plan to incur indebtedness, and we expect to incur additional indebtedness in the future to manage our capital structure and drive our growth over the long term.

| • | Relentlessly focus on profitable organic sales growth and pricing excellence. |

Continuous product innovation is core to our culture and strategy. Over the past several years, we have launched new products and styles to address evolving customer and consumer needs, while also focusing on simplifying our business. We have responded to changing consumer preferences and price consciousness through our successful lower-price point lines like MANTRA, and we plan to continue to address consumer desire for fashionable, value-priced cabinets.

In addition, we believe there is ongoing potential in the e-commerce channel for cabinets and vanities. We believe there is opportunity for us to expand in this channel, through known large e-commerce players, our

8

existing retailers’ websites, digital native specialized e-tailors or direct-to-consumer opportunities. As a result of our scale, our streamlined product offerings and our existing relationships, we believe we are uniquely positioned to win in the e-commerce space, and we plan to be the market leader in this high-potential channel.

Finally, we have developed agile pricing strategies across our business, which we believe differentiates us. Our deep industry knowledge and data analysis capabilities allow us to successfully navigate cost challenges through strategic and thoughtful pricing actions, and we believe we have the tools and abilities to continue to do so in the future.

| • | Become the leader in the customer and consumer journey by providing a differentiated consumer experience. |

The consumer journey in residential kitchen and bath cabinets is evolving as new technologies become available to both consumers and manufacturers. Beyond a transactional process, the consumer journey is increasingly relationship-based, starting from the initial contact or touchpoint, continuing through the buying cycle and finishing at the end of installation. Customers prefer partners that can support them through this evolving landscape, and consumers are demanding a transformation of the buying process. We are utilizing data-first strategies like net promoter scores and web analytics to unlock insights into customer and consumer trends and to drive improvements in the consumer experience. We believe we can further differentiate ourselves as the leader in this space by continuing to invest in digital tools and sophisticated data analytics capabilities that will improve the overall experience, speed to market and access to information, allowing us to serve consumers’ evolving needs and capture additional sales growth.

| • | Execute strategic acquisitions that broaden our platform and capitalize on our proven strengths. |

Our Company was built through strategic, well-executed acquisitions, and we have proven to be a highly effective consolidation platform. We believe we will have opportunities to drive future value creation opportunities through thoughtful and strategic acquisitions. We regularly monitor the landscape for attractive opportunities that could allow us to leverage our operations and strong customer relationships, expand our portfolio of products and expand into new categories and geographies. We expect to drive long-term stockholder value by executing any strategic acquisitions by utilizing a disciplined process to identify, evaluate, execute and integrate acquired businesses.

Company Information

We were incorporated as a Delaware corporation in July 2022. Our principal executive offices are located at One MasterBrand Cabinets Drive, Jasper, Indiana 47546, and our telephone number is (812) 482-2527. Our website will be www.masterbrand.com. The information and other content contained in, or accessible through, our website are not part of, and are not incorporated into, this information statement, and investors should not rely on any such information in deciding whether to invest in our common stock.

The Separation

On April 28, 2022, Fortune Brands announced that its Board of Directors approved in principle a separation of its Cabinets segment into a standalone publicly-traded company. The Separation will occur through a Distribution of all of the shares of our common stock owned by Fortune Brands to Fortune Brands stockholders. Following the Distribution, Fortune Brands stockholders will own 100% of the shares of our common stock.

Fortune Brands believes that separating its Cabinets segment in current market conditions into a standalone publicly-traded company will significantly enhance the long-term growth and return prospects of Fortune Brands and our Company and offer substantially greater long-term value to stockholders, customers and employees of

9

each company. Moreover, separating the Cabinets segment into an independent, standalone company with publicly-traded stock will enable Fortune Brands to migrate those members of its stockholder base which are more aligned with the risk profile and market trends specific to the basic building products industry. In addition, the Separation will provide Fortune Brands and our Company with a number of benefits, including:

| • | Strategic and Management Focus: The Separation will enable the management teams of Fortune Brands and our Company to better focus on strengthening their respective market-leading businesses and pursue distinct and targeted opportunities for long-term growth, profitability, and value creation. Like many of its competitors and peers, our Company believes that it will be more effective in managing its capital structure with credit tied more specifically to its industry and business performance and achieving greater margin expansion by focusing on its operational effectiveness specific to basic building products. A dedicated management team and board of directors for each company will streamline operational and strategic decision-making, and ensure management incentives are optimized and aligned with their respective strategic priorities and financial objectives in line with its distinct industry. |

| • | Resource Allocation and Capital Deployment: The Separation will provide an opportunity for Fortune Brands and our Company to implement tailored capital structures tied specifically to its respective industry and business that provide greater financial and operational flexibility and increased agility. Each company will be better positioned to more effectively allocate resources to address their unique operating needs relating to their distinct manufacturing and marketing requirements that are specific to their respective markets, invest in distinct strategic priorities that will maximize long-term potential, and manage capital return strategies. Our Company’s unique operating needs are tailored towards enhancing the standardization of our processes, including with respect to our supply chain, and the specific manufacturing needs of our products, and strengthening our lean manufacturing capabilities. Fortune Brands’ unique operating needs will focus on enhancing brand awareness for its diverse set of products, developing innovative products across its set of businesses and optimizing its sales distribution channels for its many products, as well as to better align with key growth priorities within selected areas of the housing and consumer markets, including connected products, water management, material conversion and science and outdoor living spaces. The Separation will provide an opportunity for Fortune Brands and our Company to more effectively focus on these unique operating needs and markets. |

| • | Distinct Investment Opportunities and Investor Choice: The Separation will create two compelling investment opportunities for investors based on their unique operating models and financial profiles. It will also provide investors with enhanced insight into each company’s distinct value drivers and will allow for more targeted investment decisions. |

10

Questions and Answers about the Separation

The following is only a summary of the terms of the Separation. You should read the section entitled “The Separation” in this Information Statement for a more detailed description of the matters described below.

| Q: | What is the Separation? |

| A: | The Separation is the tax free spin-off of the Cabinets segment from Fortune Brands for U.S. Federal income tax purposes. Once the Separation is complete, MasterBrand will be an independent, publicly-traded company. Fortune Brands will continue as an independent, publicly-traded company focused on its Home, Security and Building products categories. |

| Q: | What is the Distribution? |

| A: | The Distribution is the method by which Fortune Brands will effectuate the Separation. In the Distribution, Fortune Brands will distribute all of the shares of MasterBrand common stock that it owns to its stockholders. Following the Distribution, we will be an independent, publicly-traded company, and Fortune Brands will not retain any ownership interest in MasterBrand. The number of shares of Fortune Brands common stock you own will not change as a result of the Distribution. |

| Q: | Why is Fortune Brands separating MasterBrand from Fortune Brands? |

| A: | Fortune Brands’ Board of Directors and management believe the Separation will provide the benefits set forth under the caption “The Separation—Reasons for the Separation” in this Information Statement. |

| Q: | Why am I receiving this document? |

| A: | Fortune Brands is delivering this document to you because you are a Fortune Brands stockholder and as such you will be entitled to receive a dividend of one share of MasterBrand common stock for each share of Fortune Brands common stock you hold on the Record Date. This document is intended to describe the Separation and Distribution and help you understand how the Separation and Distribution will affect your post-separation ownership in Fortune Brands and MasterBrand. |

| Q: | Why is the Separation of the two companies structured as a Distribution? |

| A: | Fortune Brands believes that a U.S. tax-free Distribution of our shares is the most efficient way to separate MasterBrand in a manner that is intended to enhance long-term value for Fortune Brands stockholders. |

| Q: | What will I receive in the Distribution? |

| A: | As a holder of Fortune Brands common stock, you will be entitled to receive a dividend of one share of MasterBrand common stock for each share of Fortune Brands common stock that you hold on the Record Date. If you sell your shares of Fortune Brands common stock in the “regular way” market after the close of business on the Record Date and up to and including the Distribution Date, you will be selling your right to receive shares of MasterBrand common stock in the Distribution. See “The Separation—Trading of Common Stock after the Record Date and Prior to the Distribution” in this Information Statement for more detail. Your proportionate interest in Fortune Brands will not change as a result of the Distribution. Each share of MasterBrand common stock will be entitled to vote, like holders in Fortune Brands common stock, on certain matters that require stockholder approval at annual and special stockholder meetings. There are no material differences in the voting rights that you will have as a MasterBrand common stockholder than you currently have as a Fortune Brands common stockholder. A description of the rights of MasterBrand common stockholders are set forth under “Description of Capital Stock—Common Stock” and “—Certain Provisions of Delaware Law, Our Charter and Our Bylaws.” For a more detailed description, see the section entitled “The Separation” in this Information Statement. |

11

| Q: | What is the record date for the Distribution, and when will the Distribution occur? |

| A: | The record date for the Distribution (the “Record Date”) is 5:00 p.m., Central Time, on December 2, 2022. We expect that Equiniti Trust Company (the “Distribution Agent”) will act as distribution agent and will distribute to Fortune Brands stockholders the shares of MasterBrand common stock on December 14, 2022, which we refer to as the Distribution Date. |

| Q: | What will be distributed in the Distribution? |

| A: | Approximately 128,020,187 shares of MasterBrand common stock will be distributed in the Distribution, based on the number of shares of Fortune Brands common stock outstanding as of October 31, 2022. The actual number of shares of MasterBrand common stock to be distributed will be calculated on the Record Date. The shares of MasterBrand common stock to be distributed by Fortune Brands will constitute all of the shares of MasterBrand common stock issued and outstanding immediately prior to the Distribution. |

| Q: | What are the conditions to the Distribution? |

| A: | The Distribution is subject to a number of conditions, including, among others, (1) the Board of Directors of Fortune Brands authorizing and approving the Distribution, (2) the receipt of an opinion of counsel confirming the tax-free status of the Distribution for U.S. federal income tax purposes and (3) the SEC declaring effective the registration statement of which this Information Statement forms a part. Fortune Brands and MasterBrand cannot assure you that any or all of these conditions and the additional conditions specified under “The Separation—Conditions to the Distribution” will be met, or that the Distribution and the related transactions will be consummated even if all of the conditions are met. Even if all of the conditions have been satisfied, the Board of Directors of Fortune Brands may terminate and abandon the Distribution and the related transactions at any time prior to the Distribution. The Board of Directors of Fortune Brands may choose to waive conditions, including the condition requiring the receipt of an opinion of counsel confirming the tax-free status of the Distribution for U.S. federal income tax purposes to consummate the Distribution. If the Distribution is not qualified to be tax-free, you may have adverse U.S. federal tax consequences with respect to your receipt of MasterBrand common stock and your gain or loss may be recognized, or be includible in your income, for U.S. federal income tax purposes. See “The Separation—Material U.S. Federal Income Tax Consequences of the Separation” and “Risk Factors—Risks Related to the Separation and Distribution” in this Information Statement for more information regarding the potential tax consequences to you of the Distribution. For a more detailed description of the conditions to the Distribution, see “The Separation—Conditions to the Distribution” in this Information Statement. |

| Q: | Can Fortune Brands decide to cancel the Distribution even if all of the conditions have been satisfied? |

| A: | Yes. The Board of Directors of Fortune Brands may, in its sole discretion and at any time prior to the Distribution, terminate the Distribution, even if all of the conditions to the Distribution have been satisfied. For a more detailed description, see “The Separation—Conditions to the Distribution” in this Information Statement. |

| Q: | What do I have to do to participate in the Distribution? |

| A: | No action is required on your part, but we urge you to read this document carefully. Stockholders who hold Fortune Brands common stock as of the Record Date will not be required to pay any cash or deliver any other consideration, including any shares of Fortune Brands common stock, to be entitled to receive the shares of MasterBrand common stock distributable to them in the Distribution. In addition, stockholder approval of the Distribution is not required or being sought. We are not asking you for a vote and are not requesting that you send a proxy card. |

12

| Q: | How will Fortune Brands distribute shares of MasterBrand common stock? |

| A: | If you are a registered stockholder (meaning you own your stock directly through an account with Fortune Brands’ transfer agent, Equiniti Trust Company (“Equiniti Trust Company” or the “Transfer Agent”)), Equiniti Trust Company will mail you a book-entry account statement that reflects the number of shares of MasterBrand common stock you own. If you own your Fortune Brands shares beneficially through a bank, broker or other nominee, your bank, broker or other nominee will credit your account with the MasterBrand shares you receive in the Distribution. We will not issue physical certificates, even if requested. For a more detailed description, see “The Separation—When and How You Will Receive MasterBrand Shares” in this Information Statement. |

| Q: | If I sell my shares of Fortune Brands common stock on or before the Distribution Date, will I still be entitled to receive shares of MasterBrand common stock in the Distribution? |

| A: | If you sell your shares of Fortune Brands common stock on or prior to the Distribution Date, you may also be selling your right to receive shares of MasterBrand common stock. For a more detailed description, see “The Separation—Trading of Common Stock after the Record Date and Prior to the Distribution” in this Information Statement. You are encouraged to consult with your financial advisor regarding the specific implications of selling your Fortune Brands common stock prior to or on the Distribution Date. |

| Q: | How will fractional shares be treated in the Distribution? |

| A: | No fractional shares of MasterBrand common stock will be distributed in connection with the Distribution. Instead, the Distribution Agent will aggregate all fractional shares into whole shares and sell the whole shares in the open market at prevailing market prices. The Distribution Agent will then distribute the aggregate cash proceeds of the sales, net of brokerage fees and other costs, pro rata to each Fortune Brands stockholder who would otherwise have been entitled to receive a fractional share in the Distribution. For a more detailed description, see “The Separation—Number of Shares You Will Receive” in this Information Statement. |

| Q: | Who will serve on MasterBrand’s Board of Directors? |

| A: | The individuals which we expect to serve on MasterBrand’s Board of Directors at the time of the Separation are identified in “Management—Our Board of Directors Following the Separation” in this Information Statement. |

| Q: | Who will manage MasterBrand following the Separation? |

| A: | The individuals we expect to serve as members of our management team are identified and discussed in “Management—Executive Officers Following the Separation” in this Information Statement. |

| Q: | What are the U.S. federal income tax consequences of the Distribution to U.S. stockholders? |

| A: | Fortune Brands has received a private letter ruling from the Internal Revenue Service (the “IRS” and the “IRS Ruling”) and expects to receive an opinion of its counsel, Sidley Austin, LLP, together, substantially to the effect that, for U.S. federal income tax purposes, the Distribution, except for cash received in lieu of any fractional shares of our common stock, will qualify as tax-free under Section 355 of the U.S. Internal Revenue Code of 1986 (the “Code”). The IRS Ruling relies, and the opinion will rely, on certain facts and assumptions, and certain representations from us and Fortune Brands regarding the past and future conduct of our respective businesses and other matters. |

13

Assuming that the Distribution qualifies under Section 355 of the Code, for U.S. federal income tax purposes no gain or loss will be recognized by, or be includible in the income of, Fortune Brands stockholders upon the receipt of our common stock pursuant to the Distribution. However, Fortune Brands stockholders that are subject to U.S. federal income tax will recognize gain or loss with respect to any cash received in lieu of any fractional shares.

See “The Separation—Material U.S. Federal Income Tax Consequences of the Separation” and “Risk Factors—Risks Related to the Separation and Distribution” in this Information Statement for more information regarding the potential tax consequences to you of the Distribution.

Each Fortune Brands stockholder is urged to consult its tax advisor as to the specific tax consequences of the Distribution to such stockholder, including the effect of any state, local or non-U.S. tax laws and of changes in applicable tax laws.

| Q: | How will the Distribution affect my tax basis in Fortune Brands common stock? |

| A: | Assuming that the Distribution is tax-free for U.S. federal income tax purposes to Fortune Brands stockholders (except with respect to cash received in lieu of fractional shares), your tax basis in Fortune Brands common stock held by you immediately prior to the Distribution will be adjusted to be allocated between your Fortune Brands common stock and the MasterBrand common stock that you will receive in the Distribution in proportion to the relative fair market values of each immediately following the Distribution. See “The Separation—Material U.S. Federal Income Tax Consequences of the Separation” in this Information Statement for a more detailed description of the effects of the Distribution on your tax basis in Fortune Brands common stock and MasterBrand common stock. |

| Q: | What if I want to sell my shares of Fortune Brands common stock or my shares of MasterBrand common stock? |

| A: | Neither Fortune Brands nor MasterBrand can make any recommendations on the purchase, retention or sale of shares. You should consult with your financial advisors, such as your stockbroker, bank or tax advisor. |

If you decide to sell any shares of Fortune Brands common stock after the Record Date, but before the Distribution Date, you should make sure your broker, bank or other nominee understands whether you want to sell your Fortune Brands common stock, the MasterBrand common stock you will be entitled to receive in the Distribution or both. If you sell your Fortune Brands common stock prior to the Record Date or sell your entitlement to receive shares of MasterBrand common stock in the Distribution on or prior to the Distribution Date, you will not receive any shares of MasterBrand common stock in the Distribution. For a more detailed description, see “The Separation—Trading of Common Stock after the Record Date and Prior to the Distribution” in this Information Statement.

| Q: | Will MasterBrand incur any debt prior to or at the time of the Distribution? |

| A: | Yes. We expect to incur approximately $950.0 million in aggregate principal amount of indebtedness in connection with the Separation and Distribution under our $1.25 billion secured credit facilities (the “Credit Facilities”), consisting of a $750.0 million term loan facility (the “Term Loan”) and a $500.0 million revolving credit facility (the “Revolving Facility” and collectively, the “Financing Arrangements”), the proceeds of which we intend to use to make a cash dividend payment in an amount equal to $940.0 million to Fortune Brands (the “Fortune Brands Cash Payment”) and to pay related fees and expenses. See “The Separation—Incurrence of Debt” and “Description of Certain Indebtedness.” We may also incur additional indebtedness in the future. Fortune Brands intends to use the Fortune Brands Cash Payment for general corporate purposes, which may include, among other things, investing in capacity expansion or capability improvements, repaying historical debt, making strategic acquisitions and making distributions with respect to, or repurchases of, Fortune Brands common stock. |

14

Following the Separation, our debt obligations, including the Financing Arrangements, could adversely affect our business and profitability and our ability to meet our other obligations. In addition, our indebtedness may limit our ability to borrow additional funds as needed or take advantage of business opportunities as they arise, pay cash dividends or repurchase shares of our common stock. See “Risk Factors—Risks Related to Our Operations—We intend to incur, and may in the future incur, additional debt obligations that could adversely affect our business and profitability and our ability to meet our other obligations.”

| Q: | Are there risks associated with owning shares of MasterBrand common stock? |

| A: | Yes. Our business is subject to both general and specific business risks relating to our operations. Our business is also subject to risks relating to the Separation, and, following the Distribution, we will be subject to risks relating to being an independent, publicly-traded company. Accordingly, you should read carefully the information set forth in the section entitled “Risk Factors” in this Information Statement. |

| Q: | Will the number of Fortune Brands shares I own change as a result of the Distribution? |

| A: | No, the number of shares of Fortune Brands common stock you own will not change as a result of the Distribution. |

| Q: | What will happen to the listing of Fortune Brands common stock? |

| A: | After the Distribution, it is anticipated that Fortune Brands will change its name to Fortune Brands Innovations, Inc., and its common stock will continue to be traded on the New York Stock Exchange (“NYSE”) under the symbol “FBIN”. |

| Q: | Does MasterBrand intend to pay cash dividends? |

| A: | We presently intend to retain future earnings, if any, to finance our business. As a result, we do not currently expect to pay any cash dividends, although we may do so in the future. The declaration and amount of future dividends will be determined from time to time by our Board of Directors and will depend on our financial condition, earnings, capital requirements, legal requirements, regulatory constraints, industry practice and any other factors that our Board of Directors believes are relevant. For a more detailed description, see “The Separation—Dividends” in this Information Statement. |

| Q: | Will MasterBrand common stock trade on a stock market? |

| A: | Currently, there is no public market for our common stock. Subject to the consummation of the Distribution, we have applied to have our common stock authorized for listing on the NYSE under the symbol “MBC”. We cannot predict the trading prices for our common stock when such trading begins. We anticipate that trading in shares of MasterBrand common stock will begin on a when-issued basis three trading days prior to the Distribution Date and will continue up to and including the Distribution Date. The term “when-issued” means that shares can be traded prior to the time shares are actually available or issued. On the Distribution Date, any when-issued trading in respect of our common stock will end, and regular way trading in shares of our common stock will begin on the first trading day following the Distribution Date. “Regular way” trading refers to trading after a security has been issued and typically involves a transaction that settles on the second full business day following the date of the transaction. |

If trading begins on a when-issued basis, you may purchase or sell MasterBrand common stock up to and including the Distribution Date, but your transaction will not settle until after the Distribution Date. For more information regarding regular way trading and when-issued trading, see “The Separation—Trading of Common Stock after the Record Date and Prior to the Distribution” in this Information Statement.

15

| Q: | What will happen to Fortune Brands outstanding stock options, restricted stock units and performance share awards previously granted to employees in connection with the Separation? |

| A: | We expect the treatment of Fortune Brands equity awards to depend on the status of the holder, as follows: |

Stock Options. We expect that stock options to purchase shares of Fortune Brands common stock (“Fortune Brands options”) that are outstanding as of the close of business on the Distribution Date and held by any individual who is employed by or providing services to MasterBrand (and in the case of a non-employee service provider, not providing services to Fortune Brands) immediately following the Separation, regardless of such individual’s employer or the entity to which such individual provided services immediately prior to the Separation (each, a “MasterBrand Holder”), will be converted into options to purchase shares of MasterBrand common stock (“MasterBrand options”), without any substantial changes to the original terms and conditions of the Fortune Brands options except as appropriate to preserve their intrinsic value following the Separation and to reflect their continuing employment or service with MasterBrand. We do not expect that any changes will be made with respect to Fortune Brands options held by any individual who is not a MasterBrand Holder (each individual who holds a Fortune Brands equity award immediately following the Separation and who is not a MasterBrand Holder immediately following the Separation, a “Fortune Brands Holder”) other than appropriate adjustments to preserve their intrinsic value following the Separation.

Restricted Stock Units. We expect that Fortune Brands restricted stock units (“Fortune Brands RSUs”) that are outstanding as of the close of business on the Distribution Date and held by MasterBrand Holders at such time will convert into MasterBrand restricted stock units (“MasterBrand RSUs”) in a manner that preserves the value of the award following the Separation and reflects the holder’s continuing employment or service with MasterBrand. Otherwise, such MasterBrand RSUs will be on substantially the same terms and conditions as the original Fortune Brands RSUs. We also expect that Fortune Brands RSUs held by Fortune Brands Holders on the Distribution Date will be adjusted to preserve the value of the award following the Separation but otherwise will remain unchanged.

Deferred Restricted Stock Units. Notwithstanding the above, with respect to any Fortune Brands RSUs which have been deferred under the Fortune Brands Home & Security, Inc. Deferred Compensation Plan (the “Fortune Brands DCP”) by a MasterBrand Holder, we expect that MasterBrand will adopt a nonqualified deferred compensation plan with substantially the same terms as the Fortune Brands DCP, and will credit to the account of such MasterBrand Holder under such plan the number of shares of MasterBrand common stock equal to the number of shares of MasterBrand common stock that would have been distributed to the MasterBrand Holder if the number of shares of Fortune Brands common stock subject to such deferred Fortune Brands RSUs had instead been issued and outstanding. Furthermore, the notional shares of Fortune Brands common stock credited to such MasterBrand Holder’s account will be deemed to have been sold as of the Distribution Date, based on the value of such shares as of the Distribution Date, and reinvested in the default investment fund maintained under MasterBrand’s nonqualified deferred compensation plan. We do not expect that any changes will be made with respect to Fortune Brands RSUs which have been deferred under the Fortune Brands DCP by a Fortune Brands Holder, other than appropriate adjustments to preserve their intrinsic value following the Separation.

With respect to any deferred shares of Fortune Brands common stock (“FBHS Deferred Shares”) notionally credited to the account of any Fortune Brands non-employee director under the Fortune Brands Home & Security, Inc. Directors’ Deferred Compensation Plan (the “Fortune Brands Director DCP”), such FBHS Deferred Shares will be adjusted so that any non-employee director that will become a MasterBrand Holder will be notionally credited with the number of deferred shares of MasterBrand common stock equal to the number of shares of MasterBrand common stock that would have been distributed to the MasterBrand Holder if the number of FBHS Deferred Shares had instead been issued and outstanding. We do not expect that any changes will be made with respect to FBHS Deferred Shares notionally credited to the account of a Fortune Brands Holder under the Fortune Brands Director DCP, other than appropriate adjustments to

16

preserve their intrinsic value following the Separation, except that if the non-employee director will serve on both the Fortune Brands’ Board of Directors and the MasterBrand’s Board of Directors, such non-employee director will receive the same treatment as holders of Fortune Brands common stock and will be notionally credited with deferred MasterBrand common stock equivalent to the dividend of one share of MasterBrand common stock for each FBHS Deferred Share held by the non-employee director as of the Record Date and the deferred MasterBrand common stock will be subject to the same terms and conditions applicable to the FBHS Deferred Shares.

Performance Share Awards. We expect that any performance share awards that are outstanding as of the close of business on the Distribution Date will be converted into (i) MasterBrand RSUs, to the extent such awards are held by MasterBrand Holders or (ii) Fortune Brands RSUs, to the extent such awards are held by Fortune Brands Holders. We expect that the number of restricted stock units will be determined by reference to each outstanding performance share award and will be determined based upon expected performance through the end of the performance period calculated based on actual Fortune Brands performance from the start of the performance period through the end of the fiscal quarter preceding the Distribution Date and expected performance for the remainder of the performance period had the Separation not occurred. We also expect that the restricted stock units will have a vesting period beginning on the Distribution Date and ending on the last day of the original performance period of the award.

| Q: | What will be the relationship between Fortune Brands and MasterBrand following the Distribution? |

| A: | After the Distribution, Fortune Brands will not own any shares of MasterBrand common stock, and each of MasterBrand and Fortune Brands will be independent, publicly-traded companies with their own management and boards of directors; however, we expect that two directors who currently serve on Fortune Brands’ Board of Directors will serve as directors on MasterBrand’s Board of Directors and continue to serve on Fortune Brands’ Board of Directors. |

In connection with the Separation, we are entering into a number of agreements with Fortune Brands that will govern the Distribution and allocate responsibilities for obligations arising before and after the Separation, including, among others, obligations relating to employees, taxes and certain liabilities. In addition, we will enter into a transition services agreement with Fortune Brands (the “Transition Services Agreement”) pursuant to which Fortune Brands and MasterBrand will provide certain transition services to each other on an interim basis. For a more detailed description, see “Certain Relationships and Related Party Transactions—Agreements with Fortune Brands” in this Information Statement.

| Q: | Will the Distribution of MasterBrand common stock affect the market price of Fortune Brands common stock? |

| A: | We expect the trading price of shares of Fortune Brands common stock immediately following the Distribution to be different than immediately prior to the Distribution because its trading price will no longer reflect the value of the MasterBrand business. Furthermore, until the market has fully analyzed the value of Fortune Brands without the MasterBrand business, the price of shares of Fortune Brands common stock may fluctuate. There can be no assurance that, following the Distribution, the combined value of the common stock of Fortune Brands and the common stock of MasterBrand will equal or exceed what the value of Fortune Brands common stock would have been in the absence of the Distribution. |

| Q: | Will I have appraisal rights in connection with the Distribution? |

| A: | No. Holders of Fortune Brands common stock are not entitled to appraisal rights in connection with the Distribution. |

17

| Q: | Whom can I contact for more information regarding MasterBrand and the Distribution? |

| A: | If you have questions relating to the mechanics of the Distribution, you should contact the Distribution Agent at: |

Equiniti Trust Company

1110 Centre Pointe Curve

Suite 101

Mendota Heights, MN 55120-4100

Phone: 800-468-9716

Before the Distribution, if you have questions relating to the Distribution, you should contact Fortune Brands at:

Investor Relations

Fortune Brands Home & Security, Inc.

520 Lake Cook Road

Deerfield, IL 60015

Phone: 847-484-4400

After the Distribution, if you have any questions relating to MasterBrand, you should contact us at:

Investor Relations

MasterBrand, Inc.

One MasterBrand Cabinets Drive

Jasper, Indiana 47546

Phone: 727-603-8630

After the Distribution, the transfer agent and registrar for our common stock will be:

Equiniti Trust Company

1110 Centre Pointe Curve

Suite 101

Mendota Heights, MN 55120-4100

Phone: 800-468-9716

18

Summary of the Separation

The following is a summary of the material terms of the Distribution and other related transactions. Please see “The Separation” for a more detailed description of the matters below.

| Distributing Company |

Fortune Brands Home & Security, Inc., a Delaware corporation. After the Separation, Fortune Brands will not own any shares of MasterBrand common stock, and it is anticipated that Fortune Brands will change its name to Fortune Brands Innovations, Inc. |

| Distributed Company |

MasterBrand, Inc., a Delaware corporation, is a wholly-owned subsidiary of Fortune Brands that immediately before the Distribution will hold, through its subsidiaries, all of the assets and liabilities of Fortune Brands’ Cabinets segment. After the Distribution, MasterBrand will be an independent, publicly-traded company. |

| Distributed Securities |

Fortune Brands will distribute all of the shares of MasterBrand common stock owned by Fortune Brands, which will be 100% of MasterBrand common stock issued and outstanding immediately prior to the Distribution. Based on the approximately 128,020,187 shares of Fortune Brands common stock outstanding on October 31, 2022, and applying the distribution ratio of one share of MasterBrand common stock for each share of Fortune Brands common stock, approximately 128,020,187 shares of MasterBrand common stock will be distributed in the Distribution. |

| Record Date |

The Record Date is 5:00 p.m., Central Time, on December 2, 2022. |

| Distribution Date |

The Distribution Date is December 14, 2022. |

| Distribution Ratio |

Each holder of Fortune Brands common stock will be entitled to receive one share of MasterBrand common stock for each share of Fortune Brands common stock held on the Record Date. Please note that if you sell your shares of Fortune Brands common stock on or before the Distribution Date, the buyer of those shares may, in certain circumstances, be entitled to receive the shares of MasterBrand common stock distributed on the Distribution Date. See “The Separation—Trading of Common Stock after the Record Date and Prior to the Distribution” in this Information Statement for more detail. |

| Fractional Shares |

The Distribution Agent will not distribute any fractional shares of MasterBrand common stock to Fortune Brands stockholders. Instead, the Distribution Agent will aggregate all fractional shares into whole shares, sell the whole shares in the open market at prevailing market prices and distribute the aggregate cash proceeds of the sales, net of brokerage fees and other costs, pro rata to each Fortune Brands stockholder who would otherwise have been entitled to receive a fractional share in the Distribution. Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts of |

19

| payments made in lieu of fractional shares. The receipt of cash in lieu of fractional shares will be taxable to the recipient stockholders as described in “The Separation—Material U.S. Federal Income Tax Consequences of the Separation” in this Information Statement. |

| Distribution Procedures |

On the Distribution Date, the Distribution Agent will distribute the shares of MasterBrand common stock by crediting those shares to book-entry accounts established by the Transfer Agent for persons who were stockholders of Fortune Brands as of the Record Date. Shares of MasterBrand common stock will be issued only in book-entry form. No paper stock certificates will be issued. You will not be required to make any payment or surrender or exchange your shares of Fortune Brands common stock or take any other action to receive your shares of MasterBrand common stock. However, as discussed below, if you sell shares of Fortune Brands common stock in the “regular way” market after the close of business on the Record Date and up to and including the Distribution Date, you will be selling your right to receive the associated shares of MasterBrand common stock in the Distribution. Registered stockholders will receive additional information from the Transfer Agent shortly after the Distribution Date. Beneficial stockholders will receive additional information from their brokers, banks or other nominees. |

| Trading Prior to or on the Distribution Date |