As filed with the Securities and Exchange Commission on December 27, 2022.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

COURTSIDE GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 7370 | 35-2503373 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Courtside Group, Inc.

335 N. Maple Drive, Suite 127

Beverly Hills, California 90210

(310) 858-0888

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Kit Gray

President

Courtside Group, Inc.

335 N. Maple Drive, Suite 127

Beverly Hills, California 90210

(310) 858-0888

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Sasha Ablovatskiy Jonathan Shechter Foley Shechter Ablovatskiy LLP 1180 Avenue of the Americas, 8th Floor New York, NY 10036 (212) 335-0466 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated December 27, 2022.

7,443,664 Shares

Common Stock

This prospectus relates to the registration of the resale of up to 6,183,664 shares of our common stock, $0.00001 par value per share (the “common stock”), by our stockholders identified in this prospectus, or their permitted transferees (and together with LiveOne, Inc., (the “Registered Stockholders”) in connection with our direct listing on the Nasdaq Capital Market (the “Direct Listing”), consisting of (i) 3,069,664 shares of our common stock reserved for issuance upon the conversion of $8,838,500 aggregate principal amount of our Bridge Notes (as defined in this prospectus) purchased by certain Registered Stockholders, plus the amount of accrued and unpaid interest, if any, that is payable in shares of our common stock in connection with the conversion thereof, (ii) 2,946,167 shares of our common stock that may be issued upon exercise of the Bridge Warrants (as defined in this prospectus) that we issued to certain Registered Stockholders, and (iii) 167,833 shares of our common stock that may be issued upon exercise of the Bridge Warrants that we issued to the placement agent, a Registered Stockholder, in connection with the offering of the Bridge Notes and the Bridge Warrants.

This prospectus is also being furnished to you as a stockholder of LiveOne, Inc., a Delaware corporation and our parent (“LiveOne”), in connection with the planned distribution at a future date (the “Distribution”) by LiveOne, a Registered Stockholder, as a special dividend to its stockholders of up to 1,260,000 shares of our common stock (the “Distribution Shares”) out of the 20,000,000 shares of our common stock held by LiveOne immediately prior to the Distribution, consisting of (i) 1,240,000 Distribution Shares to be distributed as a special dividend in the Distribution and (ii) an additional 20,000 Distribution Shares to the extent that any Distribution Shares to be issued to LiveOne’s stockholders of record in the Distribution are required to be rounded up.

Unlike an initial public offering, the resale by the Registered Stockholders is not being underwritten by any investment bank. The Registered Stockholders may, or may not, elect to sell their shares of common stock covered by this prospectus, as and to the extent they may determine. Such sales, if any, will be made through brokerage transactions on the Nasdaq Capital Market at prevailing market prices. See “Plan of Distribution.” If the Registered Stockholders choose to sell or distribute, as applicable, their shares of common stock, we will not receive any proceeds from the sale or distribution, as applicable, of shares of our common stock by the Registered Stockholders.

We refer to the Direct Listing and the Distribution herein collectively as the “Spin-Out.” Immediately prior to the time of the Spin-Out, LiveOne will hold 100% of the outstanding shares of our common stock. At the time of the Spin-Out, LiveOne will distribute the Distribution Shares constituting approximately 6.2% of our outstanding shares of common stock held by LiveOne on a pro rata basis to holders of record of LiveOne’s common stock, $0.001 par value per share (“LiveOne common stock”), as of January 15, 2023, the record date set by LiveOne for purposes of such distribution (the “Record Date”), and in connection with the Distribution, we will complete the Direct Listing. Each ______ shares of LiveOne common stock outstanding as of 5:00pm New York City, on the Record Date will entitle the holder thereof to receive one share of our common stock (the “Distribution Ratio”), with any holder of less than ______ shares of LiveOne common stock receiving one share of our common stock as result of rounding up of any fractional shares of our common stock. The Distribution will be made in book-entry form by our transfer agent. Fractional shares of our common stock will be rounded up in the Distribution. After giving effect to the Spin-Out and conversion of the Bridge Notes (not including the exercise of the Bridge Warrants held by the holders of the Bridge Notes), LiveOne will own approximately 86.3% of the outstanding shares of our common stock, the holders of the Bridge Notes (other than LiveOne) will own approximately 8.3% of the outstanding shares of our common stock, and our directors and executive officers will own the remaining approximately ______% of outstanding shares of our common stock. Pursuant to the terms of the Bridge Notes, the Bridge Notes held by the Registered Stockholders (including LiveOne) will automatically convert into shares of our common stock as a result of the Direct Listing, subject to us satisfying the conditions set forth therein.

The Distribution will be effective as of ______, New York City time, on ______, 2023 in connection with the consummation of the Direct Listing. Immediately after the Spin-Out, we will become a publicly-traded company listed on the Nasdaq Capital Market and shall continue as a majority owned subsidiary of LiveOne.

No established public trading market for our common stock currently exists, and shares of our common stock do not have a history of trading in private transactions. The purchase prices of our common stock in any private transactions may have little or no relation to the opening public price of shares of our common stock on the Nasdaq Capital Market or the subsequent trading price of shares of our common stock on the Nasdaq Capital Market. See “Sale Price History of our Capital Stock.” Further, the listing of our common stock on the Nasdaq Capital Market without underwriters is a novel method for commencing public trading in shares of our common stock and, consequently, the trading volume and price of shares of our common stock may be more volatile than if shares of our common stock were initially listed in connection with an underwritten initial public offering. There can be no guarantee that we will successfully list our common stock on the Nasdaq Capital Market or be able to complete the Spin-Out.

On the day that shares of our common stock are initially listed on the Nasdaq Capital Market, the Nasdaq Stock Market LLC (“Nasdaq”) will begin accepting, but not executing, pre-opening buy and sell orders and will begin to continuously generate the indicative Current Reference Price (as defined below) on the basis of such accepted orders. During a 10-minute “Display Only” period, market participants may enter quotes and orders for shares of our common stock in Nasdaq’s systems and such information is disseminated, along with other indicative imbalance information, to Joseph Gunnar & Co., LLC (“Joseph Gunnar”) and other market participants by Nasdaq on its NOII and BookViewer tools. Following the “Display Only” period, a “Pre-Launch” period begins, during which Joseph Gunnar, in its capacity as our designated financial advisor to perform the functions under Nasdaq Rule 4120(c)(8), must notify Nasdaq that our shares are “ready to trade.” Once Joseph Gunnar has notified Nasdaq that shares of our common stock are ready to trade, Nasdaq will calculate the Current Reference Price for shares of our common stock, in accordance with Nasdaq rules. If Joseph Gunnar then approves proceeding at the Current Reference Price, Nasdaq will conduct a price validation test in accordance with Nasdaq Rule 4120(c)(8). As part of conducting such price validation test, Nasdaq may consult with Joseph Gunnar, if the price bands need to be modified, to select the new price bands for purposes of applying such test iteratively until the validation tests yield a price within such bands. Upon completion of such price validation checks, the applicable orders that have been entered will then be executed at such price and regular trading of shares of our common stock on the Nasdaq Capital Market will commence. Under the Nasdaq rules, the “Current Reference Price” means: (i) the single price at which the maximum number of orders to buy or sell shares of our common stock can be matched; (ii) if more than one price exists under clause (i), then the price that minimizes the number of shares of our common stock for which orders cannot be matched; (iii) if more than one price exists under clause (ii), then the entered price (i.e. the specified price entered in an order by a customer to buy or sell) at which shares of our common stock will remain unmatched (i.e. will not be bought or sold); and (iv) if more than one price exists under clause (iii), a price determined by Nasdaq after consultation with Joseph Gunnar in its capacity as financial advisor. Joseph Gunnar will exercise any consultation rights only to the extent that it may do so consistent with the anti-manipulation provisions of the federal securities laws, including Regulation M (to the extent applicable), or applicable relief granted thereunder. The Registered Stockholders will not be involved in Nasdaq’s price-setting mechanism, including any decision to delay or proceed with trading, nor will they control or influence Joseph Gunnar in carrying out its role as financial advisor. Joseph Gunnar will determine when shares of our common stock are ready to trade and approve proceeding at the Current Reference Price primarily based on consideration of volume, timing, and price. In particular, Joseph Gunnar will determine, based primarily on pre-opening buy and sell orders, when a reasonable amount of volume will cross on the opening trade such that sufficient price discovery has been made to open trading at the Current Reference Price. For more information, see “Plan of Distribution.”

We have applied to list our common stock on the Nasdaq Capital Market under the symbol “PODC.” We expect our common stock to begin trading on or about ______, 2023.

We are an “emerging growth company” as defined under the federal securities laws and have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company.”

Investing in shares of our shares of common stock involves risks. See “Risk Factors” beginning on page 23 to read about factors you should consider before buying shares of our common stock.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body or state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated ______, 2023.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the U.S. Securities and Exchange Commission (the “SEC”). Neither we nor any of the Registered Stockholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus we have prepared or that have been prepared on our behalf or to which we have referred you. Neither we nor any of the Registered Stockholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The Registered Stockholders are offering to sell, and seeking offers to buy, shares of their common stock but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, and results of operations may have changed since such date.

For investors outside the United States: Neither we nor any of the Registered Stockholders have done anything that would permit the use or possession or distribution of this prospectus or any related free writing prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock by the Registered Stockholders and the distribution of this prospectus outside the United States.

i

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC using a “shelf” registration or continuous offering process. Under this process, the Registered Stockholders may, from time to time, sell the common stock covered by this prospectus in the manner described in the section titled “Plan of Distribution.” Additionally, we may provide a prospectus supplement to add information to, or update or change information contained in, this prospectus, including the section titled “Plan of Distribution.” You may obtain this information without charge by following the instructions under the section titled “Where You Can Find Additional Information” appearing elsewhere in this prospectus. You should read this prospectus and any prospectus supplement before deciding to invest in our common stock.

Except as otherwise indicated, all information in this prospectus assumes:

| ● | Exclusion of the 2,000,000 shares of our common stock authorized for issuance under our 2022 Equity Incentive Plan (as amended, the “2022 Plan”), which was adopted by our sole stockholder and our board of directors on December 15, 2022, as well as any future increases in the number of shares of our common stock reserved for issuance under the 2022 Plan. As of ______, 2023, ______ shares of our common stock were reserved for issuance pursuant to awards made under our 2022 Plan, which awards will become effective on the day of the effectiveness of the registration statement of which this prospectus forms a part. See “Description of Capital Stock — 2022 Equity Incentive Plan”; |

| ● | the amendment of our Certificate of Incorporation to decrease the number of our shares of common stock and authorize the issuance of “blank check” preferred stock (the “Charter Amendments”); |

| ● | the conversion of our Bridge Notes into 3,069,664 shares of our common stock as of December 15, 2022, which will occur in connection with the effectiveness of the registration statement of which this prospectus forms a part, and automatically convert upon the effectiveness of the Direct Listing (the “Bridge Notes Conversion”); |

| ● | the exclusion of 2,946,167 shares of our common stock issuable upon exercise of our warrants outstanding as of the date of this prospectus, which warrants were issued to the holders of the Bridge Notes (the “Bridge Warrants”); |

| ● | the exclusion of 167,833 shares of our common stock issuable upon exercise of our placement agent warrants outstanding as of the date of this prospectus, which warrants were issued to the placement agent in connection with our sale of the Bridge Notes (the “Placement Agent Warrants”); and |

| ● | the filing and effectiveness of our Amended and Restated Certificate of Incorporation and the adoption of our Amended and Restated Bylaws, each of which will occur in connection with the effectiveness of the registration statement of which this prospectus forms a part. |

After giving effect to the Bridge Notes Conversion, as of December 15, 2022, we would have a total of 23,069,664 shares of our common stock issued and outstanding.

Certain amounts, percentages, and other figures presented in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals, dollars, or percentage amounts of changes may not represent the arithmetic summation or calculation of the figures that precede them.

ii

This summary highlights select information contained elsewhere in this prospectus and does not contain all the information you should consider before making an investment decision. You should read the entire prospectus carefully, including the sections entitled “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the accompanying notes included elsewhere in this prospectus before making an investment decision. Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “we,” “us,” “our,” the “Company,” “Courtside Group” and similar terms refer to Courtside Group, Inc. and its consolidated subsidiaries.

Overview

PodcastOne (the “Company,” “PodcastOne,” “we,” “us” or “our”) is a leading podcast platform and publisher that makes its content available to audiences via all podcasting distribution platforms, including PodcastOne’s website (www.podcastone.com), Apple Podcasts, Spotify, Amazon Music and more. We are a majority owned subsidiary of LiveOne, Inc., a Delaware corporation and a Nasdaq-listed company (“LiveOne”). We have recently been ranked #14 on the list of Top Podcast Publishers by the podcast metric company, Podtrac.

We also produce vodcasts (video podcasts), branded podcasts, merchandise and live events on behalf of our talent and clients. With a proven 360-degree advertiser solution for multiplatform integration opportunities and hyper-targeting, we deliver millions of monthly impressions, 14+ million monthly unique listeners, and 60+ million Interactive Advertising Bureau monthly downloads. With content covering all verticals (i.e., sports, entertainment, true-crime, business, society & culture, self-help, etc.), we provide a platform for brands to reach their most sought after targeted audiences.

Our operating model is focused on offering white glove service to our shows, talent and advertising clients. With an in-house sales, production, marketing and tech team, we believe PodcastOne delivers more to clients and talent than any other publisher in the marketplace. This allows us to scale our operations while attracting talent who in turn, will bring in additional brand advertisers and revenue. We earn revenue through the sale of embedded host-read ads, dynamic ads (host-read and otherwise), segment sponsorships and programmatic monetization channels. We also provide the opportunity for clients to have 100% share of voice with branded podcast episodes or series as well as live tours, merch and IP ownership for original programming.

In addition to our core business, we also built, own and operate a solution for the growing number of independent podcasters: LaunchPadOne. LaunchPadOne is our owned self-publishing podcast platform, created to provide a low or no cost tool for independent podcasters without access to parent podcasting networks or state of the art equipment to create and publish shows. LaunchPadOne serves as a talent pool for us to find new podcasts and talent.

For the fiscal years ended March 31, 2022 and 2021, we generated $32.3 million and $23.8 million in revenue, respectively, representing a compound annual growth rate (“CAGR”) of 36%. For the six months ended September 30, 2022 and 2021, we generated $17.2 million and $16.0 million in revenue, respectively, representing a CAGR of 8%. For the fiscal years ended March 31, 2022 and 2021, we incurred net losses $4.1 million and $4.6 million, respectively. For the six months ended September 30, 2022 and 2021, we had net income of $1.2 million and a net loss of $2.5 million, respectively.

We are more than a podcast company. We are in the relationship business. Every day, brands and creators partner with us to reach consumers who will purchase, listen and subscribe to their favorite PodcastOne podcasts across the audio landscape. We offer content across verticals so there is truly something for consumers who have varied preferences (reality TV, sports, true crime self-help, business, etc.). The power of our network and love of our brands is evident through our shows which consistently rank in the top 100 on the Apple Charts.

1

Recent Developments

| ● | Completed the $8.8 million Bridge Notes financing at a valuation of $68.1 million and announced LiveOne’s intention to spin-out our Company as a separate public company before year end. We agreed not to effect any Qualified Financing or Qualified Event (each as defined below), as applicable, unless our post-money valuation at the time of the Qualified Financing or Qualified Event, as applicable, is at least $150 million. |

| ● | Our President, Kit Gray, has been recently named one of the 22 most influential people in podcasting, and our Vice President of Brand and Talent Partnerships, Eli Dvorkin, has been named to this year’s Top 40 Under 40 in podcasting as chosen by Podcast Magazine. Our Head of Marketing, Ilana Susnow, was elected to The Podcast Academy’s Board of Governors, with her two-year term beginning May 1, 2022. |

| ● | We have an arrangement that allows us and our roster of top performing hosts to integrate unique visual elements into the podcasts they produce and distribute them via YouTube, becoming the first podcast network to utilize Adori, a pioneering interface technology. Adori’s unique YouTube integration technology allows podcast hosts and networks to seamlessly import episodes from RSS feeds, enhance them with visual elements and upload enriched assets directly to YouTube. Adori’s patented technology embeds contextual visuals, multi-format ads, AR experiences, buy buttons, polls, and other “call to action” features in the audio creating a more enhanced and richer listener experience. In creating visually enhanced podcasts, Adori’s YouTube product provides additional monetization avenues for our slate of original programming, increased discoverability and SEO presence. |

| ● | Several of our shows have hit recent milestones: Trust Me released its 100th episode in November 2022 and was featured in Harper’s BAZAAR’s “20 of the Best Podcasts to Download Now.” In October 2022, Coffee Convos was named by Edison Research as the top show delivering women listeners for advertisers. Co-Hosts Kailyn Lowry and Vee Rivera won the 2022 People’s Choice Podcast Award for Influencer of the Year and Podcast Listener Influencer of Year for their podcast, Baby Mama’s No Drama. The show also brought home the Rob Has a Podcast Entertainment award. Southern Tea, hosted by Lindsie Chrisley received a People’s Choice Award in the Kids & Family category. |

| ● | We recently expanded the Chrisley family vertical by introducing a new podcast featuring Savannah Chrisley to the network. Unlocked With Savannah Chrisley premiered with 40,000 listeners and instantly ranked on the Apple Charts at #17. This show is a complement to Chrisley Confessions with co-hosts Todd and Julie Chrisley, Southern Tea, with host Lindsie Chrisley and Coffee Convos with co-hosts Lindsie Chrisley and Kail Lowry. PodcastOne also has a very successful vertical featuring Kail Lowry’s shows Baby Mamas No Drama, Barely Famous and Vibin’ and Kinda’ Thrivin. |

| ● | We also partnered with Hyundai to produce live events with our hosts that provide multiple revenue streams for our Company and our talent while giving Hyundai a platform to promote their new vehicle launches. Two live shows, including one with The LadyGang and one with Jordan Harbinger, were be captured as vodcasts and later streamed on LiveOne’s streaming platform. As part of the branded content partnership, we are also developing an always-on audio plan to further drive promotion for Hyundai. In November 2022, we announced that Hyundai will have share of voice in the first four episodes of our new Friday Night Lights re-watch podcast It’s Not Only Football: Friday Night Lights and Beyond, starring Friday Night Lights stars Scott Porter and Zach Gilford and their celebrity friend, Mae Whitman. |

| ● | In the quarter ended September 30, 2022, we and Action Park Media (“APM”) forged a partnership that added 11 podcasts to the LiveOne portfolio, including shows from Emmy Award-Winning Entourage creator Doug Ellin, Emmy-nominated star Kevin Dillon, retired NHL star Sean Avery, former NFL quarterback Ryan Leaf, as well as Kelly Stafford, Ted Foxman and more. This partnership gave PodcastOne exclusive distribution and advertising sales rights for APM’s current slate of podcast and vodcast programming. In addition, it also allows for the two media companies to co-develop future podcast/vodcast based IP, produce advertiser-sponsored live streaming and touring opportunities for hosts/talent and create exclusive licensing for podcast-specific branded merchandise. |

| ● | In the fourth fiscal quarter ended March 31, 2022, we partnered with MotorTrend to produce a 12-part series around their InEVitable campaign, a new multi-platform initiative giving consumers a source for information, in-depth reporting, research/testing, predictions and entertainment devoted entirely to the future of mobility. The InEVitable is a podcast and vodcast series hosted by MotorTrend Head of Editorial, Ed Loh and MotorTrend editor and automotive personality Jonny Lieberman. The series provides in-depth discussion on the greatest challenges and changes coming for the future of transportation. Subsequently, we and MotorTrend have renewed this partnership for an extended 20+ episodes podcast and vodcast series. Production began in the first half of the fiscal year ending March 31, 2023. |

| ● | We further strengthened our relationship with Hubbard’s WTOP with the launch of American Nightmare Season 3: UNKNOWN SUBJECT. We have partnered with them for all three seasons and are looking forward to continued Apple rankings and download success. We continue to see success in the sale of this show and anticipate the relationship continuing for additional seasons. |

2

Industry Trends in Our Favor

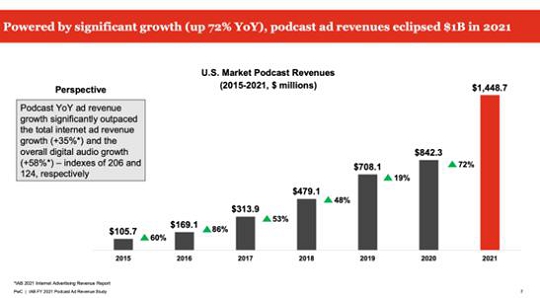

The Podcast Industry Keeps Growing While Radio is Shrinking ⸺ For the first time ever, the podcast advertising marketing grew beyond $1B in FY 2021 and are expected to exceed $2B in 2022 and reach $4B by 2024. The audio industry has shifted share of voice significantly from 74% radio/12% podcasts/14% other in 2014 to 39% radio/41% podcasts/20% other.

High Growth of Podcasts Audience ⸺ In the United States, podcasts have historically been and are expected to continue to develop as a high growth segment within the next five years. An estimated 177 million Americans have listened to a podcast at some point in their life, with “superfans” consuming over 11 hours of content per week in 2021. Driven by product innovations and content accessibility, the podcast market represents significant growth and monetization potential in the long-term.

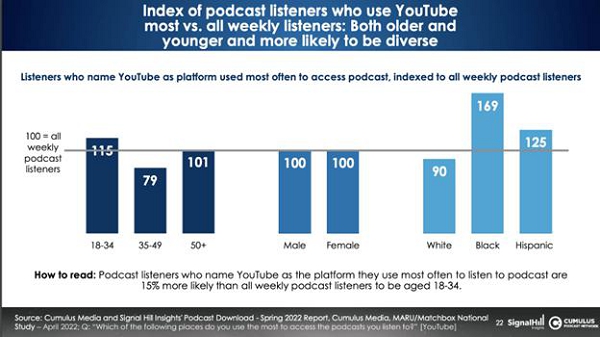

Launch of New Distribution Platforms ⸺ Being on the ground floor of a developing platform is another key to our growth strategy. This allows for more discoverability and exclusive feature opportunities. We are currently in beta with YouTube, which announced earlier this year that they are launching their own podcast platform. Approximately 18% of podcasts are consumed on YouTube and that number is quickly growing. When Facebook launched their audio platform, similarly, our shows were a part of their press plan, received exclusive boosting opportunities and were among the first podcasts to streaming on their platform.

Spoken Word is Increasing Among Gen Z ⸺ There has been a 214% increase in spoken word consumption since 2014 among the 13-24 year-old demographic, with 21% of that being podcast usage. We deliver content that spans various verticals, preferences and ages, positioning us to be part of that 21% and we expect to see that percentage grow as Gen Z continues to shift their listening habits to podcasts.

Increasing Penetration of Established Marketing ⸺ we have a strong opportunity for high growth, even in more in established markets. According to eMarketer, the number of podcast listeners is anticipated to grow to 126 million in 2022 and nearly 145 million listeners are expected to make podcasts a part of their media diet by 2026. Growth is projected to remain in double digits with an average podcast listening time per day topping 25 minutes by 2023.

Key Benefits to Our Listeners

Our Value Propositions

In addition to the highly favorable industry trends set forth above, the following elements denote the fundamental values of our PodcastOne community:

Easy audio making for everyone ⸺ We are one of the first online audio communities to provide a one-stop destination for creators to produce, edit, host and distribute audio content to consumer’s mobile and desktop devices. The turnkey production, sales and marketing services we offer make it possible for our partners to create high-quality, original podcasts. The monthly average number of podcasts downloaded from us increased from approximately 41.3 million in the second quarter of 2021 to approximately 58.4 million in the same period in 2022.

Reaching audience and getting paid ⸺ A host who makes such host’s podcasts, live streaming or interactive audio products available via PodcastOne gains access to one of the largest online audio communities. Our podcasts on publicly available platforms (Apple Podcasts, Spotify, Amazon Music, etc.) can be shared, further amplifying their reach. Leveraging our data-driven marketing strategies and best-in-class sales organization, we help increase the value of one’s original work, and motivate content creators to continue to create and share more content on our platform. Our data analytics also provide useful feedback to our hosts to help them create and distribute more unique and high-quality content that truly resonates with their audience and invites new listeners in.

3

“White Glove” Offerings ⸺ We differentiate ourselves from our competitors through deeply integrated sales, marketing, production and distribution services that are offered to creators once onboarded with PodcastOne. Our data driven marketing function range across in network cross promotion, social media best practices, video asset creation and off-network trade opportunities. As a result, we have cultivated a highly engaged listener community across a variety of verticals (true crime, Sports, TV & film, etc.). In the quarter ending September 30, 2022, we had recorded a total of 3.8 million average monthly listeners. We have an in-depth relationship with our creators on all levels as we are accessible and exude a work ethic incomparable to the other podcast networks in our industry.

Podcast Services ⸺ Listeners can access our podcasts on their mobile devices and desktops across all major distribution platforms (Apple Podcasts, Spotify, Amazon Music, etc.). We offer all of our podcasts for free to cultivate a broad and loyal user base and generate organic traffic to our audio entertainment which has attractive monetization potential. As we build and scale loyal listeners for our shows, we are also building listeners for our other shows, due to our internal cross promotional network. As shows increase in listenership, their value also increases to advertisers, often times resulting in higher cost per thousand impressions (“CPM”), in renewals and ultimately more revenue.

Our Market Opportunity

PodcastOne is a Leading Podcasting Company

PodcastOne is the leading advertiser-supported, on-demand digital audio network. With a 360-degree solution, including content creation, brand integration and distribution, PodcastOne sees more than 2.1 billion downloads annually, across 350 episodes produced weekly. Today, millions of people around the world have access to over 200 podcasts distributed by PodcastOne whenever and wherever they want. We were one of the first podcast companies and transformed the podcast industry by allowing users to stream audio content (podcasts) on demand. In contrast, traditional radio relies on a linear distribution model in which stations and channels are programmed to deliver a limited programming options with little freedom of choice.

We are one of the largest independent podcast publishers with deep routed relationships with our creators, advertisers and distribution platforms. With over 3.8M unique downloads a month in the US and 22.6M global streams and downloads, PodcastOne’s portfolio continues to grow with engaged listeners and top tier talent. As illustrated below, we have been recently ranked #14 on the list of Top Podcast Publishers by the podcast metric company, Podtrac, as a leading podcast publisher.

We are more than a podcast company. We are in the relationship business. Every day, brands and creators partner with us to reach consumers who will purchase, listen and subscribe to their favorite PodcastOne podcasts across the audio landscape. We offer content across verticals so there is truly something for consumers who have varied preferences (reality TV, sports, true crime self-help, business, etc.). The power of our network and love of our brands is evident through our shows which consistently rank in the top 100 on the Apple Charts. Furthermore, we have built a promotional strategy that enables discoverability of PodcastOne shows just by being a listener of a show in the same vertical. For example, if you are listening to a PodcastOne true crime show, you will likely hear a promo about another true crime show from PodcastOne.

PodcastOne wins and so do our listeners. Our brand reflects culture—and occasionally creates it—by turning vast and intriguing listening data into compelling stories that remind people of the role podcasts plays in their lives and encourages new fans to listen each week.

4

Podtrac Ranker October 2022

What Sets Us Apart

How is PodcastOne Different?

We are a leading US podcast network with nearly 270 podcasts/vodcasts, which have generated more than 2.381 billion downloads to date. We accomplish this through several unique approaches including:

Best In Class Content Portfolio with Deep Talent Relationships ⸺ PodcastOne publishes many of the biggest podcasts, including The Adam Carolla Show, Off the Vine with Kaitlyn Bristowe, Coffee Convos, The LadyGang, Nappy Boy Radio with T-Pain, and The Jordan Harbinger Show, spanning all major genres. We have personal relationships with each and every talent, which affords us the opportunity to build extensive multi-year agreements. These agreements provide exclusive rights to their podcasting content and derivative rights to new shows. Additionally, these value-added relationships with talent allow us to negotiate industry-leading participation splits.

5

Full Ownership of Technology Platform, with Proprietary Data and Insights ⸺ We are one of the few podcast networks with proprietary Content Management System (“CMS”)/Content Delivery Network (“CDN”) that allows for optimized programmatic capabilities and improved audience analytics. Our hosts/talent are also able to view their download numbers, trends and analytics on this proprietary software, something many competitors don’t provide. This fully owned and operated enterprise CMS rivals other paid platforms such as Megaphone (Spotify-owned), Art19 (Amazon-owned) and SimpleCast (SiriusXM/Pandora-owned). The CMS day to day operation and maintenance is managed by a vendor we contract with and is constantly being updated to be a best-in-class system. The CMS is the platform where podcast episodes are uploaded, RSS feeds are created and distributed to listening platforms, and the listening data is analyzed and displayed in a dashboard for the hosts / producers to see.

Blue Chip Advertiser Relationships with Targeted Measurable Campaigns and Value-Added Opportunities ⸺ We offer and book competitive campaigns with new and legacy brands by: (1) using measurement tools and partners to deploy leading podcast measurement solutions that are tailored to our clients key performance indicators, including brand impact and sales lift; (2) engaging with third party attribution partners to provide greater insight for our clients into the effectiveness of their campaigns across multiple publishers and hosting providers; and (3) conducting brand lift studies that allow the Company to demonstrate and validate campaign impacts.

In addition, because of our deep-rooted relationships with talent we are able to engage them in host-read embedded spots and coach them through voice-over delivery to increase direct response sales and advertiser satisfaction. Furthermore, these relationships allow us to create value-added opportunities with brands through talent socials, YouTube and other influencer marketing tools.

Advertisers also have the opportunity to brand entire podcast series, as executed by Microsoft and MotorTrend most recently. This would allow advertisers to enter into content development deals for their brand with us, where we would we produce and distribute an entire podcast series for the specific brand. Advertisers benefit from branding a podcast series by getting 100% share of voice ads, which in our experience significantly helps them launch a new product, service or offering. Two podcast series examples that we have recently put together in a similar format are The Inevitable podcast and On the Edge with Microsoft Edge podcast.

White Glove Services for Our Partners ⸺ PodcastOne is more than just a hosting platform. Our hands-on approach to launching original content and growing existing shows enables us to support our talent with production, editing, marketing and sales capabilities. We are a one-stop shop for everything creators need for their podcasts to be successful. When it comes to the sales and marketing, we are here to share best practices, allocate in-network promo inventory to their shows and engage in 360-degree sales efforts on their behalf.

LaunchPadOne ⸺ LaunchPadOne is a free innovative podcast hosting, distribution, and monetization platform that provides an end-to-end podcast solution. With over 1,000 available podcasts, LaunchPadOne offers creators a 360-degree podcasting ecosystem - a cutting-edge technology hosting platform, customizable design elements, a podcast player, distribution tools to publish on all major listening apps, including Apple Podcasts, Spotify, Google Podcasts, Overcast and Pocket Casts and others, and a deep network of shows. LaunchPadOne’s robust platform technology, promotion and monetization opportunities will allow podcast creators to leverage unique opportunities from PodcastOne, such as the ability to accumulate new listeners, get discovered, and collaborate with the established podcast network. PodcastOne will monetize the audience of the LaunchPadOne network through ad insertion technology platform, which generates revenue for PodcastOne. Simultaneously, LaunchPadOne creators will receive free hosting and also have the opportunity to generate revenue for their own podcasts by embedding any ads they sell on their own.

Best-In-Class Management Team with a Track Record of Execution and Growth ⸺ we have an unparalleled management team with expertise and resources to produce and manage our podcasts in a turnkey manner. Our list of services include Production studios, Producers, Editors, Social Media, Marketing, Public Relations, Guest Booking, Content Hosting, Nationwide Sales, Host Read Executions, Dynamic Ad Insertion, Programmatic Ads, Vodcasts, Live Events, and Merchandising.

6

Our best-in-class management team is comprised of the following executives who have scaled PodcastOne to position us as a competitive network in the industry that talent and advertisers want to be a part of:

Kit Gray: Co-Founder & President, PodcastOne ⸺ Mr. Gray founded PodcastOne in 2012 and attracted high impact podcast talent including Adam Carolla, The LadyGang and Kaitlyn Bristowe. Mr. Gray has been recently named a “Top Influencer in Podcasting” by Podcast Magazine.

Sue McNamara: Head of Sales ⸺ Ms. McNamara has 20 plus years of radio and podcast sales experience. Ms. McNamara is a former CBS radio sales management executive who was responsible for 35% PodcastOne revenue growth in fiscal year ended March 31, 2022.

Ilana Susnow: Head of Marketing and Audience Development ⸺ Ms. Susnow is a former NBCU marketing executive with 15+ years of experience in content marketing and audience development. Ms. Susnow built a marketing team that offers hosts swap and guest opportunities, public relations coverage, strategically paid, earned and owned media plans and event presence. Most recently, Ms. Susnow was elected to The Podcast Academy’s Board of Governors.

Eli Dvorkin: VP, Talent and Brand Partnerships ⸺ Mr. Dvorkin was our first outside hire. With over 15 years of audio experience, Mr. Dvorkin was recently named one of Podcast Magazine’s 40 Under 40 in podcasting for his ability to create profitable brand partnerships and his ability to grow new and existing talent.

Stacie Parra & Alistair Walford, Co-Heads of Production – with 20+ years of radio and podcast production experience, Ms. Parra has helped us scale a production team that provides a one-stop shop for talent that need production and editing resources for their podcasts.

Benefits for Creators

We provide a large but exclusive stage for creators to connect with existing fans and to be discovered by new fans. In addition to providing creators with access to a free, ad supported podcast marketplace. We also provide creators with a full stack of tools and services, enabling them to grow their podcasts in a turnkey manner.

Creator Services ⸺ Our in-house marketing and production teams are responsible for enhancing the growth and success of our talent/creators through various functions by focusing on brand building, audience development, strategy, talent, live events and sweepstakes. At the core of our shows are fundamental and trusted relationships with the hosts which collectively give us the ability to bring their vision to life. The multiple functions of creator services align cross-functionally and throughout PodcastOne to support creators on the platform while attracting new creators to our network.

Monetization ⸺ Between July 2020 and December 31, 2022, we have paid more than $30 million in MGs and advertiser revenue shares to creators. We do not pay to distribute our content and we monetize across all listener platforms.

Discovery ⸺ We not only help creators connect with existing fans, but we also support creators in connecting with the listeners who are most likely to become fans of their podcasts by running promos for all PodcastOne shows across respective verticals. From our data driven marketing approach that surface new podcasts to Users we offer creators the tools to reach their fans, new and old.

Distribution ⸺ A creator who makes their podcasts available on PodcastOne gains access to one of the largest publishing and distribution platforms based on our relationships with the top tier podcast apps and platforms. We enable creators to distribute their unique podcasts to this audience. We also pitch creator content for feature opportunities on Apple Podcasts, Spotify, Amazon Music, Stitcher, and iHeart to broaden their reach and discoverability. Additionally we promote our creator content across our social footprint and through email marketing to podcast fans.

Promotion ⸺ We empower creators and their managers to personalize and create unique profiles by providing them with best practices to develop their creator image, including featuring podcasts on their profiles and creating podcast playlists. On top of these standard services, we also offer creators specific promotional tools, designed to target specific Users and broad audiences in order to drive engagement.

7

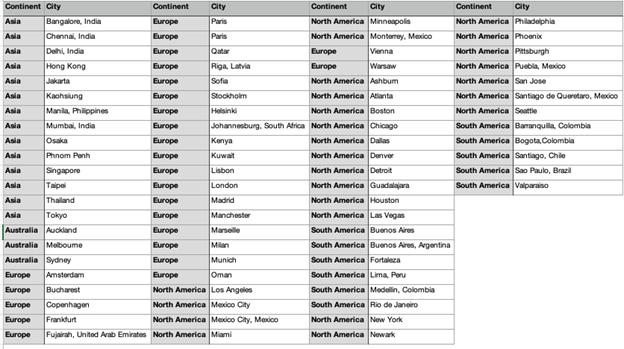

Analytics ⸺ We provide numerous analytics for creators through our service. Analytics that creators can access include the demographics of their audience, users’ anonymized geographical locations, top listening platforms, and podcast performance data such as number of downloads and weekly listening trends. We provide analytical support that creators need to optimize their performance and focus on doing what they do best—creating unique, entertaining experiences to share with fans around the world. For example, many creators have used our analytics to inform tour locations by citing the geographical audience insights provided in the CMS that would otherwise not have been known.

Our Business Model

We are an Ad-Supported Service that provides free content to listeners via their mobile and desktop devices. We generate revenue from the sale of audio, video and social advertising delivered through advertising impressions. We generally enter into arrangements with advertising agencies that purchase advertising on our platform on behalf of the agencies’ clients. These advertising arrangements typically specify the type of advertising product, pricing, insertion dates, and number of impressions in a stated period. Revenue for our Ad-Supported segment is affected primarily by the number of a show’s listeners and our ability to provide innovative advertising products that are relevant to our Ad-Supported Users and enhance returns for our advertising partners. Our advertising strategy centers on the belief that advertising products that are based on content and are relevant to the Ad-Supported User can enhance Ad-Supported Users’ experiences and provide even greater returns for advertisers through the strength of our host-read embedded promos. According to a Super Listener Survey in 2021, an estimated 49% of listeners believe the hosts actually use the products and services they recommend and 60% of podcast listeners say they have bought something from hearing a podcast ad. Offering advertisers additional ways to purchase advertising on a programmatic basis is another key way that we expand our portfolio of advertising products and enhance advertising revenue. Furthermore, we continue to focus on analytics and measurement tools to evaluate, demonstrate, and improve the effectiveness of advertising campaigns on our platform.

When we are onboard new talent both parties have the common interest of creating content that advertisers want to purchase. We craft our deals with a percentage split of the advertising revenue (host-read embedded ads, DAI and programmatic) which strengthens our partnerships because when advertisers spend, we all win.

Our Growth Strategies

We believe we are still in the early stages of realizing our goal to connect creators and audiences around the world. Our growth strategies are focused on continuously improving our technology and attracting more listeners in current and new markets in order to collect more behavioral data, which we use to offer our Users, advertisers, and creators to achieve more targeted results. The key elements of our growth strategy are:

Strategically Launch New Podcasts with Culturally Relevant Creators ⸺ A creator with an engaged fanbase can strengthen our network and along with it, the PodcastOne brand. There is a lot of strategy that comes from onboarding new creators. Most importantly is how they will impact audience growth across their vertical within the PodcastOne ecosystem. We have seen success in this manner with the Kail Lowry vertical and our Real Housewife-hosted shows.

8

Acquire Existing Podcasts that will Thrive on Our Network ⸺ With the data we collect on show performance and show growth through our in-network promotional strategy we know what shows we can grow on our network. Additionally, this data can guide what is missing and why we may want to acquire a show with large numbers that will provide us with a jumping off point for growing our other shows.

Continue to Invest In Our Advertising Business ⸺ We will continue to invest in our advertising products in order to create more value for advertisers and our Ad-Supported Users by enhancing our ability to make advertising content more relevant for our Ad-Supported Users. Our advertising strategy centers on the belief that advertising products that are based in podcasts and are relevant to the Ad-Supported User can enhance Ad-Supported Users’ experiences and provide even greater returns for advertisers. We have introduced a number of new advertising products, including sponsored playlists, a self-serve audio advertising platform, and are testing skippable audio advertising. Offering advertisers additional ways to purchase advertising on a programmatic basis is one example of how we continue to expand our portfolio of advertising products. We also are focused on third party agency relationships and their development of analytics and measurement tools to evaluate, demonstrate, and improve the effectiveness of advertising campaigns on our platform.

Partner with New Distribution Platforms from Day One ⸺ Being on the ground floor of a developing platform is another key to our growth strategy. This allows for more discoverability and exclusive feature opportunities. When Facebook launched their audio platform, PodcastOne shows were a part of the press plan, received exclusive boosting opportunities and were among the first podcasts to streaming on their platform. Similarly, we are currently in beta with YouTube, who announced earlier this year that they are launching a podcast platform of their own. Approximately 18% of podcasts are consumed on YouTube and that number is quickly growing.

Advertising Solutions for Partners ⸺ Our Ad-Supported Service has grown from $23.8 million in revenue for the year ended March 31, 2021 to $32.3 million in revenue for the year ended March 31, 2022, representing an increase of 36%. As more audio content is created and converting listeners to buyers, brands and advertisers are continuing to shift their marketing spends from traditional mediums to podcasting. A March 2022 survey by Advertiser Perceptions shows that “while 31% of agencies and brands have dedicated podcast ad budgets, more than half (54%) are taking the money out of their overall digital allocation including 49% that said it comes from their digital audio budget line.”

9

Technology innovation and data mining are at the heart of our Ad-Supported Service. From a technology perspective, we continue to adapt to what consumers want and the tools that agencies and partners are building to support these needs. We create content that resonates with listeners and that brands want to be aligned with.

PodcastOne has partnered with third party attribution companies to assist with attribution metrics, click-through data and ROI metrics. Such companies include: Podsights, Chartable, Claritas, Artsai, Podtrac and Extreme Reach.

Our ability to harness our data allows us to know our audiences. We believe we understand people through their mindset, activities, and tastes, and we can serve them relevant advertising catered specifically to them. Our advertising platform is continually moving toward a holistic people-based marketing approach that is better for both our listeners and our advertisers.

By offering advertisers customized opportunities within our programs we are able to deliver results for our brands and advertisers. Taking our podcast brands beyond an audio experience, we also give advertisers the opportunity to scale their buys across our video and social products when aligning with a PodcastOne podcast. We believe we will further strengthen our advertising business, since these are increasingly popular mediums for our advertising partners, the brands they represent and consumer behaviors.

Blue Chip Advertiser Relationships with Targeted Measurable Campaigns and Value-Added Opportunities ⸺ Our in-house marketing and production teams are responsible for enhancing the growth and success of our talent/creators through various functions by focusing on brand building, audience development, strategy, talent, live events and sweepstakes. At the core of our shows are fundamental and trusted relationships with the hosts which collectively give us the ability to bring their vision to life. The multiple functions of creator services align cross-functionally and throughout PodcastOne to support creators on the platform while attracting new creators to our network.

In addition, because of our deep-rooted relationships with talent we are able to engage them in host read embedded spots and coach them through voice-over delivery to increase direct response sales and advertiser satisfaction. Furthermore, these relationships allow us to create value-added opportunities with brands through talent socials, YouTube and other influencer marketing tools.

Advertisers also have the opportunity to brand entire podcast series, as executed by Microsoft and our MotorTrend podcast most recently. This would allow advertisers to enter into content development deals for their brand with us, where we would we produce and distribute an entire podcast series for the specific brand. Advertisers benefit from branding a podcast series by getting 100% share of voice ads, which in our experience significantly helps them launch a new product, service or offering. Two podcast series examples that we have recently put together in a similar format are The Inevitable podcast and On the Edge with Microsoft Edge podcast.

We also offer comprehensive sales opportunities for advertisers ranging from video, audio and social to live events and merchandise. By scaling across our talent’s networks we can offer exclusive branding opportunities to our clients including higher CPMs for us and value added opportunities for advertisers.

Our Content Strategy

At the core, our content strategy is about partnering with influencers and creators who will not only thrive in the audio space but who complement our current programming. Since July 2020 we have onboarded over 50 shows, increasing downloads by more than 50% for some (On Display with Melissa Gorga, Trust Me) and consistently ranking in the top 15 publishers according to Podtrac. We grow by continuing to identify what resonates with our listeners and delivering content consumers want to listen to.

There is also a surge in video podcasts (vodcasts), a product we have been delivering for some of our shows since 2020. We are encouraging all of our podcasters to create video content, a platform we can support (produce, edit, distribute) on their behalf via YouTube and various social platforms. With YouTube’s recent hyper focus on bringing podcast content to their platform, we expect to see considerable podcast listener growth and AdSense dollars (revenue) from the platform.

10

Our Technology

We have built an internal Content Management System (“CMS”) system that creators and producers can use to track metrics about shows on an episode-by-episode basis. CMS is the platform where podcast episodes are uploaded, RSS feeds are created and distributed to listening platforms, and the listening data is analyzed and displayed in a dashboard for the creators / producers to see. We are focused on continuously improving our technology so that it is user-friendly and sets us apart from other independent publishers.

We are one of the few podcast networks with a proprietary CMS that allows for a customizable internal system resulting in improved audience analytics. Our hosts/talent are also able to view their own download numbers, trends and analytics on this proprietary software, something many network competitors don’t provide. This fully owned and operated enterprise CMS rivals other paid platforms such as Megaphone (Spotify-owned), Art19 (Amazon-owned) and SimpleCast (SiriusXM/Pandora-owned). The CMS’ day-to-day operation and maintenance is managed by a vendor we contract with and is constantly being updated to be a best-in-class system.

Marketing

Since our inception, we have focused our marketing efforts on enhancing our brand’s authenticity and presence among consumers, creators and advertisers. Initially, our campaigns were designed to educate the market on the concept of on-demand podcast streaming and the navigation functionality we provided. As familiarity with the podcast access model spread, our promotional efforts shifted to promote the specific shows, talent and brands in our portfolio. We’ve found that consumers don’t particularly know or care who is producing the content they are listening to. They are listening because they like what a host or creator represents and has to say.

Our Competition

We compete for the time and attention of our users across different forms of media, including traditional broadcast, satellite, and internet radio (iHeartRadio, LastFM, Pandora, and SiriusXM), other providers of on-demand audio streaming services (Spotify, Amazon Prime, Apple Music, Deezer, Google Play Music, Joox, Pandora, and SoundCloud), and other providers of in-home and mobile entertainment such as cable television, video streaming services, and social media and networking websites. Additionally, we compete with midsized publishers creating and distributing ad-supported content for the aforementioned audio platforms (Dear Media, Kast Media, Barstool Sports, etc.). We compete to attract and engage listeners with our content accessibility, perceptions of advertising load in our shows, brand awareness and reputation. Many of our competitors enjoy competitive advantages such as greater name recognition, legacy operating histories, and larger marketing budgets, as well as greater financial, technical, human, and other resources.

Additionally, we compete to attract and retain advertisers and a share of their advertising spend for our Ad-Supported Service. We believe our ability to compete depends primarily on the reputation and strength of our brand as well as our reach and ability to deliver a strong return on investment to our advertisers, which is driven by the size of our show-specific audiences, our advertising products, our targeting, delivery and measurement capabilities, and third party/agency relationships.

We also compete to attract and retain highly talented individuals, including producers, editors, sales executives and marketers. Our ability to attract and retain personnel is driven by compensation, culture, and the reputation and strength of our brand. We believe we provide competitive compensation packages and foster a team-oriented culture where each employee is encouraged to have a meaningful contribution to PodcastOne. We also believe the reputation and strength of our brand helps us attract individuals that are passionate about our Service.

For information on competition-related risks, see “Risk Factors” on page 23.

11

History and Development of the Company

We are a Delaware corporation incorporated on February 5, 2014. On July 1, 2020, we were acquired by LiveOne and became its wholly owned subsidiary. On July 15, 2022, we completed a private placement offering (the “Notes Financing”) of our unsecured convertible notes to certain accredited investors and institutional investors for gross proceeds of $8,835,800. After the Direct Listing, we will become LiveOne’s majority owned subsidiary.

Intellectual Property

Our success depends in part upon our ability to protect our technologies and intellectual property. To accomplish this, we rely on a combination of intellectual property rights, including trade secrets, patents, copyrights, and trademarks, as well as contractual restrictions, technological measures, and other methods.

In addition to the forms of intellectual property listed above, we own rights to proprietary processes and trade secrets, including those underlying the PodcastOne platform. We use contractual and technological means to control the use and distribution of our proprietary software, trade secrets, and other confidential information, both internally and externally, including contractual protections with employees, contractors, customers, and partners. Finally, since 2019, PodcastOne has included passive participation in substantially all of its agreements, meaning if a podcast goes to derivative, PodcastOne has creative control but does accrue payment as a passive participant.

LaunchPadOne ⸺ LaunchPadOne is a free innovative podcast hosting, distribution, and monetization platform that provides an end-to-end podcast solution. With over 1,000 available podcasts, LaunchPadOne offers creators a 360 podcasting ecosystem - a cutting-edge technology hosting platform, customizable design elements, a podcast player, distribution tools to publish on all major listening apps, including Apple Podcasts, Spotify, Google Podcasts, Overcast and Pocket Casts and others, and a deep network of shows. LaunchPadOne’s robust platform technology, promotion and monetization opportunities will allow podcast creators to leverage unique opportunities from us, such as the ability to accumulate new listeners, get discovered, and collaborate with the established podcast network. We will monetize the audience of the LaunchPadOne network through ad insertion technology platform, which generates revenue for us. Simultaneously, LaunchPadOne creators receive free hosting and also have the opportunity to generate revenue for their own podcasts by embedding any ads they sell on their own.

Certain Relationships and Related Party Transactions

Please see section “Certain Relationships and Related Party Transactions ⸺ Various Agreements Entered into with LiveOne ⸺ Other Agreements” in this prospectus for a summary of material agreements, other than material agreements entered into in the ordinary course of business, to which we are or have been a party.

Summary Risk Factors

Our business is subject to a number of risks and uncertainties, as more fully described under “Risk Factors” in this prospectus. We have various categories of risks, including risks related to our business and industry; risks related to our intellectual property; risks related to regulatory compliance and legal matters; risks related to tax and accounting matters; risks related to ownership of our common stock; and general risk factors, which are discussed more fully in the section titled “Risk Factors.” These risks could materially and adversely impact our business, financial condition, and results of operations, which could cause the trading price of our common stock to decline and could result in a loss of all or part of your investment. Additional risks, beyond those summarized below or discussed elsewhere in this prospectus, may apply to our business, activities, or operations as currently conducted or as we may conduct them in the future or in the markets in which we operate or may in the future operate. Some of these risks include:

| ● | We have incurred significant operating and net losses since our inception and anticipate that we will continue to incur significant losses for the foreseeable future. |

| ● | We may require additional capital, including to fund our and/or LiveOne’s current debt obligations and to fund potential acquisitions and capital expenditures, which may not be available on terms acceptable to us or at all and which depends on many factors beyond our control. |

| ● | If LiveOne does not comply with the provisions of the senior credit facility and the Harvest Notes, its lenders may terminate their obligations to it and require LiveOne and/or us to repay all outstanding amounts owed thereunder. |

12

| ● | We may require additional capital, including to fund our current debt obligations and to fund potential acquisitions and capital expenditures, which may not be available on terms acceptable to us or at all and which depends on many factors beyond our control. |

| ● | We face and will continue to face competition for ad-supported listening time. |

| ● | Our business is dependent upon the performance of the podcasts and their talent. |

| ● | Significant up-front and/or minimum guarantees required under certain of our podcast license agreements may limit our operating flexibility and may adversely affect our business, operating results, and financial condition. |

| ● | If we fail to increase the number of listeners consuming our podcast content, our business, financial condition and results of operations may be adversely affected. |

| ● | Our revenue and operating results are highly dependent on the overall demand for advertising. Factors that affect the amount of advertising spending, such as economic downturns, can make it difficult to predict our revenue and could adversely affect our business. |

| ● | Expansion of our operations to deliver additional podcasts subjects us to increased business, legal, financial, reputational and competitive risks. |

| ● | Increases in the costs in relation to podcast content creators, such as higher podcast MGs and/or talent revenue share compensation and costs of discovering and cultivating a top podcast content creator, may have an adverse effect on our business, financial condition and results of operations. |

| ● | We use third-party services and technologies in connection with our business, and any disruption to the provision of these services and technologies to us could result in adverse publicity and a slowdown in the growth of our users, which could materially and adversely affect our business, financial condition and results of operations. |

| ● | We face competition for users’ attention and time. |

| ● | We face significant competition for advertiser and sponsorship spend. |

| ● | We cannot assure you that we will be able to meet Nasdaq’s initial listing requirements to consummate the Direct Listing, and Nasdaq may not permit our shares of common stock to be quoted on its exchange, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions. |

| ● | Our failure to meet the continued listing requirements of Nasdaq could result in a de-listing of our common stock and penny stock trading. |

| ● | We plan to expand into international markets in the 2024 fiscal year, which would subject us to risks associated with the legislative, judicial, accounting, regulatory, political and economic risks and conditions specific to such markets, which could adversely affect our business, financial condition and results of operations. |

| ● | Our success depends, in significant part, on discretionary consumer and corporate spending on entertainment and factors adversely affecting such spending could have a material adverse effect on our business, financial condition and results of operations. |

| ● | Unfavorable outcomes in legal proceedings may adversely affect our business, financial conditions and results of operations. |

| ● | LiveOne’s debt agreements contain restrictive and financial covenants that may limit our operating flexibility, and LiveOne’s substantial indebtedness may limit cash flow available to us to invest in the ongoing needs of our business. |

| ● | LiveOne may not have the ability to repay the amounts then due under the senior credit facility, Harvest Notes and/or convertible notes at maturity, which may have a material adverse effect on our business, financial condition and results of operations. |

| ● | The Distribution could result in significant tax liability to LiveOne and its stockholders. |

13

| ● | We may be unable to achieve some or all of the benefits that we expect to achieve from the Spin-Out. |

| ● | We have no operating history as an independent publicly-traded company, and our historical financial information is not necessarily representative of the results we would have achieved as an independent publicly-traded company and may not be a reliable indicator of our future results. |

| ● | We may not be able to access the credit and capital markets at the times and in the amounts needed on acceptable terms. |

| ● | Certain of LiveOne’s and our agreements contain provisions requiring the consent of third parties in connection with the Spin-Out. If these consents are not obtained, we may be unable to consummate the Spin-Out and/or enjoy the benefit of these agreements in the future. |

| ● | Our listing differs significantly from an underwritten initial public offering. |

| ● | Our stock price may be volatile, and could decline significantly and rapidly. |

| ● | The trading price of our common stock, upon listing on the Nasdaq Capital Market, may have little or no relationship to the historical sales prices of our capital stock in private transactions, and there have not been any private transactions in the recent past. |

| ● | An active, liquid, and orderly market for our common stock may not develop or be sustained. You may be unable to sell your shares of our common stock at or above the price at which you purchased them. |

| ● | LiveOne as our principal stockholders will have the ability to influence the outcome of director elections and other matters requiring stockholder approval. |

| ● | LiveOne’s majority ownership of our common stock will have the effect of concentrating voting control with it and its affiliates, which will limit your ability to influence the outcome of important transactions and to influence corporate governance matters, such as electing directors, and to approve material mergers, acquisitions, or other business combination transactions that may not be aligned with your interests. |

| ● | Other than our executive officers, none of LiveOne’s stockholders are party to any contractual lock-up agreement or other contractual restrictions on transfer. Following our listing, sales of substantial amounts of our common stock in the public markets, or the perception that sales might occur, could cause the trading price of our common stock to decline. |

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include that:

| ● | we are only required to include two years of audited consolidated financial statements in this prospectus in addition to any required interim financial statements, and correspondingly only required to provide reduced disclosure in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; |

| ● | we are not required to engage an auditor to report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”); |

| ● | we are not required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,”“say-on-frequency,” and “say-on-golden parachutes”; and |

| ● | we are not required to disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to our median employee compensation. |

We may take advantage of these provisions until the last day of the fiscal year during which the fifth anniversary of this listing occurs or such earlier time that we are no longer an emerging growth company. We will remain an emerging growth company until the earliest of: (i) the last day of the first fiscal year in which our annual gross revenue is $1.07 billion or more; (ii) the last day of the fiscal year during which the fifth anniversary of this listing occurs; (iii) the date on which we have issued more than $1.0 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC.

Under the JOBS Act, emerging growth companies also can delay adopting new or revised accounting standards until such time as those standards would otherwise apply to private companies. We currently intend to take advantage of this exemption.

For risks related to our status as an emerging growth company, see “Risk Factors — Risks Related to Ownership of Our Common Stock — We are an “emerging growth company,” and we cannot be certain if the reduced reporting and disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.”

14

Channels for Disclosure of Information

Investors, the media, and others should note that, following the effectiveness of the registration statement of which this prospectus forms a part, we intend to announce material information to the public through filings with the SEC, the investor relations page on our website (www.podcastone.com), blog posts on our website, press releases, public conference calls, webcasts, our Twitter feed (@PodcastOne), our Instagram page, our Facebook page and our LinkedIn page. Information contained on or accessible through our website is not incorporated by reference into this prospectus, and inclusion of our website address, Twitter feed, Instagram page, Facebook page and LinkedIn page in this prospectus are inactive textual references only. You should not consider information contained on our website or our social media pages to be part of this prospectus or in deciding whether to purchase shares of our common stock.

The information disclosed by the foregoing channels could be deemed to be material information. As such, we encourage investors, the media, and others to follow the channels listed above and to review the information disclosed through such channels.

Any updates to the list of disclosure channels through which we will announce information will be posted on the investor relations page on our website.

Corporate Information

We were incorporated in Delaware on February 5, 2014. On July 1, 2020, we were acquired by LiveOne and became its wholly owned subsidiary. As a result of the Direct Listing, we will become LiveOne’s majority owned subsidiary. Our principal executive offices are located at 335 North Maple Drive, Suite 127, Beverly Hills, CA 90210. Our main corporate website address is www.podcastone.com. We make available on or through our website our periodic reports that we file with the SEC. This information is available on our website free of charge as soon as reasonably practicable after we electronically file the information with or furnish it to the SEC. The contents of our website are not incorporated by reference into this document and shall not be deemed “filed” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

15

QUESTIONS AND ANSWERS ABOUT THE SPIN-OUT

The following questions and answers briefly address some commonly asked questions about the Spin-Out. They may not include all the information that is important to you. We encourage you to read carefully this entire prospectus and the other documents to which we have referred you. We have included references in certain parts of this section to direct you to a more detailed discussion of each topic presented in this section.

| Q: | What is the Spin-Out? |