UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark one)

OR

For the fiscal year ended

OR

For the transition period from __________ to _________

OR

Date of event requiring this shell company report __________

Commission file number

(Exact name of the Registrant as specified in its charter)

| Not Applicable |

(Translation of Registrant’s name into English)

| Ireland |

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Tel:

Email:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| The |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| None |

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

| None |

(Title of Class)

Indicate the number of outstanding shares of each

of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| ☐ Yes | ☒ |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

| ☐ Yes | ☒ |

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| ☒ | ☐ No |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

| ☒ | ☐ No |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer ☐ | Accelerated filer ☐ | |

| Emerging Growth Company |

If an emerging growth

company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not

to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to

Section 13(a) of the Exchange Act.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark

whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal

control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting

firm that prepared or issued its audit report.

If securities are registered

pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing

reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP ☐ | Other ☐ | ||

| by the International Accounting Standards Board | ☒ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

| ☐ Item 17 | ☐ Item 18 |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| ☐ Yes |

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

| ☐ Yes | ☐ No |

Annual Report on Form 20-F

Year Ended December 31, 2023

TABLE OF CONTENTS

i

ii

CERTAIN INFORMATION

As used in this Annual Report on Form 20-F (the “Annual Report”), unless otherwise indicated or the context otherwise requires, references to:

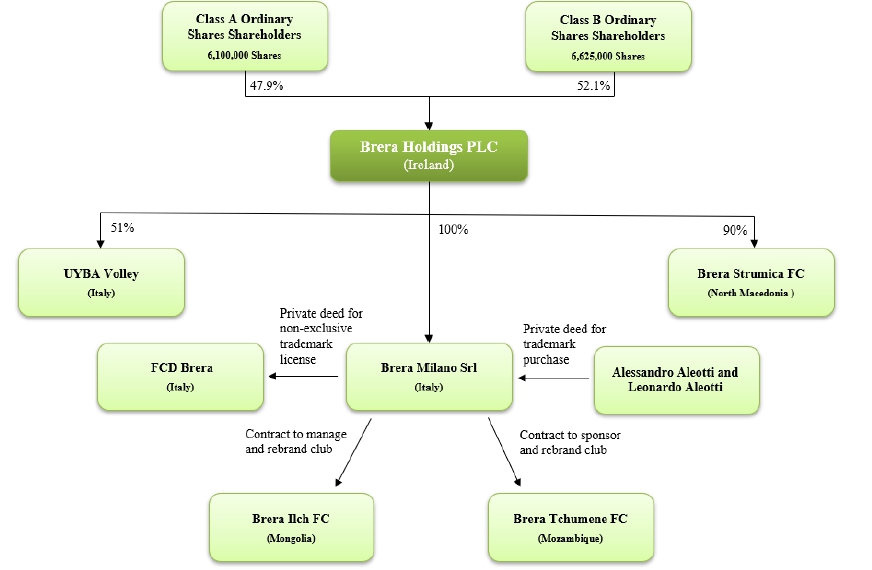

| ● | “Brera Holdings,” “we,” “us,” “our,” “the Company,” or “our company” are to Brera Holdings PLC, including its subsidiaries. |

| ● | “Brera Ilch FC” and “Bayanzurkh FC” are to Bayanzurkh Sporting Ilch FC, a sports association incorporated under the laws of Mongolia, with whom we have a contract to assume management control of the team and rebrand as Brera Ilch FC. |

| ● | “Brera Milano” and “KAP” are to Brera Milano S.r.l., formerly KAP S.r.l., an Italian limited liability company (società a responsabilità limitata), which is our wholly-owned subsidiary. |

| ● | “Brera Strumica FC,” “Fudbalski Klub Akademija Pandev” and “FKAP” are to Fudbalski Klub Akademija Pandev, a joint stock company organized under the laws of North Macedonia, which is our 90%-owned subsidiary. |

| ● | “Brera Tchumene FC” and “Tchumene FC” are to Tchumene FC Sports Association, a football club organized under the laws of Mozambique, with whom we have a contract to sponsor and rebrand the club as Brera Tchumene FC. |

| ● | “Class A Ordinary Shares” are to our Class A Ordinary Shares, $0.005 nominal value per share. |

| ● | “Class B Ordinary Shares” are to our Class B Ordinary Shares, $0.005 nominal value per share. |

| ● | “Commission” or “SEC” are to the Securities and Exchange Commission. |

| ● | “CONIFA” are to the Confederation of Independent Football Associations, the international governing body for association football teams that are not affiliated with FIFA. |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934, as amended. |

| ● | “FCD Brera,” “Brera FC,” “Brera Calcio” and “third team of Milan” are to the “Brera Football Club”. |

| ● | “FENIX Trophy” are to the FENIX Trophy, which is a non-professional pan-European football tournament recognized by UEFA, which inaugurally ran from September 2021 to June 2022, now in its third season, and was organized by Brera FC. “FENIX” is intended to be an acronym for “Friendly European Non-professional Innovative Xenial”. |

| ● | “FIFA” are to the Federation Internationale de Football Association, or International Federation of Association Football, the international governing body of association football. |

| ● | “FIGC” are to the Federazione Italiana Giuoco Calcio, or Italian Football Federation, the governing body of football in Italy and organizes the Italian football league. |

| ● | “first team” are to the players selected to play for the most senior team in a football club. |

| ● | “football” are to the sport commonly referred to as “soccer” in the United States. |

| ● | “Italian football” are to the Italian football league system, which consists of nine national and regional tournament levels, the first three being professional, while the remaining six are amateur, from highest level to lowest level are: Serie A, Serie B, Serie C, Serie D, Eccellenza, Promozione, Prima Categoria, Seconda Categoria, and Terza Categoria. |

| ● | “MCO” are to multi-club ownership, which is the practice of acquiring multiple sports clubs, typically football clubs, and building a network of related teams in the process. |

| ● | “Nasdaq” are to the Nasdaq Capital Market tier operated by The Nasdaq Stock Market LLC. |

| ● | “NOIF” are to the Norme organizzative interne della FIGC, or Internal Organizational Rules of the FIGC, the rules that govern all aspects of Italian football. |

| ● | “Securities Act” are to the Securities Act of 1933, as amended. |

| ● | “UEFA” are to the Union of European Football Associations, the governing body of European football and the umbrella organization for 55 national associations. |

iii

| ● | “UYBA” and “UYBA Volley” are to UYBA Volley S.s.d.a.r.l, an entity organized under the laws of Italy, which is our 51%-owned subsidiary. |

| ● | “2022 Plan” are to the Brera Holdings Limited 2022 Equity Incentive Plan approved by our board of directors on October 26, 2022. |

In this Annual Report, references to “U.S. dollars,” “dollars,” “USD” and “$” are to the legal currency of the United States, all references to “EUR euros”, “euros” and “€” are to the legal currency of the European Union, and all references to “MKD” or “denars” are to the legal currency of North Macedonia. Our reporting currency and our functional currency is EUR euros.

Solely for the convenience of the reader, this Annual Report contains translations of certain EUR euros into U.S. dollars at specified rates. Except as otherwise stated in this Annual Report, all translations from EUR euros into U.S. dollars in this Annual Report were made at a rate of €0.9040 per $1.00, the noon buying rate as set forth in the H.10 statistical release of the U.S. Federal Reserve Board in effect as of December 29, 2023. On July 5, 2024, the noon buying rate for EUR euros was €0.9235 per $1.00. No representation is made that the EUR euro or U.S. dollar amounts referred to in this Annual Report could have been or could be converted into U.S. dollars or EUR euros, as the case may be, at any particular rate or at all. Any discrepancies in any table between totals and sums of the amounts listed are due to rounding.

The audited consolidated financial statements and notes thereto as of and for fiscal years ended 2023, 2022 and 2021 included elsewhere in this Annual Report have been prepared in accordance with International Financial Reporting Standards, or IFRS. Our fiscal year end is December 31.

FORWARD-LOOKING STATEMENTS

This Annual Report contains many statements that are “forward-looking” and uses forward-looking terminology such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “ought to,” “plan,” “possible,” “potentially,” “predicts,” “project,” “should,” “will,” “would,” negatives of such terms or other similar statements. You should not place undue reliance on any forward-looking statement due to its inherent risk and uncertainties, both general and specific. Although we believe the assumptions on which the forward-looking statements are based are reasonable and within the bounds of our knowledge of our business and operations as of the date of this Annual Report, any or all of those assumptions could prove to be inaccurate. As a result, the forward-looking statements based on those assumptions could also be incorrect. The forward-looking statements in this Annual Report include, without limitation, statements relating to:

| ● | our goals and strategies; |

| ● | our future business development, financial condition and results of operations; |

| ● | our projected revenues, profits, earnings and other estimated financial information; |

| ● | our ability to secure additional funding necessary for the expansion of our business; |

| ● | the growth of and competition trends in our industry; |

| ● | our expectations regarding the popularity and competitive success of our sports clubs; |

| ● | our ability to maintain strong relationships with our fans, supporters and sponsors; |

| ● | fluctuations in general economic and business conditions in the markets in which we operate; and |

| ● | relevant government policies and regulations relating to our industry. |

The forward-looking statements included in this Annual Report are subject to known and unknown risks, uncertainties and assumptions about our businesses and business environments. These statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual results of our operations may differ materially from information contained in the forward-looking statements as a result of risk factors, some of which are described under the headings “Risk Factors”, “Operating and Financial Review and Prospects,” “Information on our Company” and elsewhere in this Annual Report. Such risks and uncertainties are not exhaustive. Other sections of this Annual Report include additional factors which could adversely impact our business and financial performance. The forward-looking statements contained in this Annual Report speak only as of the date of this Annual Report or, if obtained from third-party studies or reports, the date of the corresponding study or report, and are expressly qualified in their entirety by the cautionary statements in this Annual Report. Since we operate in an emerging and evolving environment and new risk factors and uncertainties emerge from time to time, you should not rely upon forward-looking statements as predictions of future events. Except as otherwise required by the securities laws of the United States, we undertake no obligation to update or revise any forward-looking statements to reflect events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events.

iv

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

3.A. [Reserved]

3.B. Capitalization and Indebtedness

Not applicable.

3.C. Reasons for the Offer and Use of Proceeds

Not applicable.

3.D. Risk Factors

You should carefully consider the following risk factors and all of the information contained in this Annual Report, including but not limited to, the matters addressed in the section titled “Forward-Looking Statements,” and our financial information before you decide whether to invest in our securities. One or more of a combination of these risks could materially impact our business, financial condition or results of operations. In any such case, the market price of our securities could decline, and you may lose all or part of your investment. Additional risks and uncertainties not currently known to us or that we currently do not consider to be material may also materially and adversely affect our business, financial condition or results of operations.

Summary Risk Factors

Risks Related to Our Business and Industry

| ● | Our business is substantially dependent on the popularity and/or competitive success of our acquired teams, which cannot be assured. |

| ● | We had a concentration of credit risk because we derived our revenue from a limited number of customers. |

| ● | We source our materials from a limited number of suppliers. If we lose one or more of the suppliers, our operation may be disrupted, and our results of operations may be adversely and materially impacted. |

| ● | If we are unable to maintain and enhance our brand and reputation, or if events occur that damage our brand and reputation, our ability to expand our fanbase, sponsors, and commercial partners or to sell significant quantities of our services may be impaired. |

| ● | Our business is dependent upon our ability to attract players and staff, including management, recruiters, and coaches for our acquired clubs. |

| ● | Injuries to, and illness of, players in our acquired clubs could hinder our success. |

| ● | We may pursue acquisitions and other strategic transactions to complement or expand our business that may not be successful. |

| ● | If we are unable to maintain, train and build an effective international sales and marketing infrastructure, we will not be able to commercialize and grow our brand successfully. |

| ● | It may not be possible to renew or replace key commercial and sponsorship agreements on similar or better terms or attract new sponsors. |

| ● | There could be a decline in the popularity of football. |

1

| ● | Our business is subject to seasonal fluctuations and our operating results and cash flow can vary substantially from period to period. |

| ● | We operate in a highly competitive market and there can be no assurance that we will be able to compete successfully. |

| ● | Our digital media strategy may not generate the revenue we anticipate. |

| ● | Our operations and operating results have been, and may continue to be, materially impacted by the COVID-19 pandemic and government and league actions taken in response. |

Risks Related to the Ownership of Our Class B Ordinary Shares

| ● | Our dual class voting structure has the effect of concentrating the voting control to holders of our Class A Ordinary Shares, which will limit or preclude your ability to influence corporate matters, and your interests may conflict with the interests of these shareholders. It may also adversely affect the trading market for our Class B Ordinary Shares due to exclusion from certain stock market indices. |

| ● | We may not be able to maintain a listing of our Class B Ordinary Shares on Nasdaq. |

| ● | Our operating results and share price may fluctuate, and you could lose all or part of your investment. |

| ● | We do not currently intend to pay dividends on our securities and, consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our Class B Ordinary Shares. In addition, any distribution of dividends must be in accordance with the rules and restrictions applying under Irish law. |

| ● | Changes to taxation or the interpretation or application of tax laws could have an adverse impact on our results of operations and financial condition. |

| ● | Shareholders could be diluted in the future if we increase our issued share capital because of the disapplication of statutory preemption rights. In addition, shareholders in certain jurisdictions, including the United States, may not be able to exercise their preemption rights even if those rights have not been disapplied. |

| ● | Irish law differs from the laws in effect in the United States and U.S. investors may have difficulty enforcing civil liabilities against us, our directors or members of senior management named in this Annual Report. |

| ● | Provisions of our constitution, as well as provisions of Irish law, could make an acquisition of us more difficult, limit attempts by our shareholders to replace or remove our current directors, and limit the market price of our ordinary shares. |

| ● | We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies. |

| ● | As a foreign private issuer, we are permitted to rely on exemptions from certain Nasdaq corporate governance standards applicable to domestic U.S. issuers. This may afford less protection to holders of our shares. |

| ● | We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses. |

| ● | As a “controlled company” under the rules of Nasdaq, we may choose to exempt our company from certain corporate governance requirements that could have an adverse effect on our public shareholders. |

| ● | There is a risk that we will be a passive foreign investment company for any taxable year, which could result in adverse U.S. federal income tax consequences to U.S. investors in our shares. |

| ● | We are subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not emerging growth companies, and our shareholders could receive less information than they might expect to receive from more mature public companies. |

| ● | We are a smaller reporting company within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available to smaller reporting companies, this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies. |

2

| ● | As a “smaller reporting company,” we may choose to exempt our company from certain corporate governance requirements that could have an adverse effect on our public shareholders. |

| ● | Future issuances of our Class B Ordinary Shares or securities convertible into, or exercisable or exchangeable for, our Class B Ordinary Shares, or the expiration of lock-up agreements that restrict the issuance of new ordinary shares or the trading of outstanding ordinary shares, could cause the market price of our Class B Ordinary Shares to decline and would result in the dilution of your holdings. |

| ● | Future issuances of debt securities, which would rank senior to our Class B Ordinary Shares upon our bankruptcy or liquidation, and future issuances of preferred shares, which could rank senior to our Class B Ordinary Shares for the purposes of dividends and liquidating distributions, may adversely affect the level of return you may be able to achieve from an investment in our Class B Ordinary Shares. |

| ● | If securities or industry analysts either do not publish research about us or publish inaccurate or unfavorable research about us, our business or our market, if they adversely change their recommendations regarding our Class B Ordinary Shares, or if our operating results do not meet their expectations or any financial guidance we may provide, the trading price or trading volume of our Class B Ordinary Shares could decline. |

| ● | If our Class B Ordinary Shares become subject to the penny stock rules, it would become more difficult to trade our shares. |

Risks Related to Our Business and Industry

Our business is substantially dependent on the popularity and/or competitive success of our acquired teams, which cannot be assured.

Our financial results are dependent on, and are expected to continue to depend in large part on, the football and other sports clubs we acquire remaining popular with their fanbases and, in varying degrees, on each club’s first team achieving competitive success, which can generate fan enthusiasm, resulting in sustained ticket, premium seating, suite, food and beverage and merchandise sales during the season. Competitive success can also lead to revenues related to access to continental (mainly European) competitions, the transfer market for the footballers we develop, and sponsorships. However, due to the sheer unpredictability of the on-the-pitch results, which do not strictly depend on the amount invested in the club, there can be no assurance that Brera-controlled clubs will achieve competitive success and ultimately thereby generate substantial increased revenues from related rights.

Our first team under management, Brera FC, is on a hiatus from football operations for the 2023-24 season and will resume in June 2024. Due to its status as an amateur club, we view Brera FC’s role in our business as one of supporting our primary revenue-generating initiatives, including promoting the FENIX Trophy, our non-professional pan-European football tournament recognized by UEFA, which inaugurally ran from September 2021 to June 2022 and was intended to allow Brera FC to connect with the local community, increase our fanbase, and develop important relationships with other football clubs. The FENIX Trophy is now in its third edition with the semifinal and final matches between the final four teams scheduled for May 10, 2024 and May 12, 2024. Even though this tournament has been successful, it is not guaranteed to continue to be in the future.

Our second team under management, Brera Tchumene FC, won its 2023 post-season tournament and in November 2023 was promoted to Mocambola, the First Division in Mozambique, for the 2024 season. Our third team under management, Brera Strumica FC, currently competes in the Macedonian First League and has since first being promoted in 2017. Brera Strumica FC has participated in the first qualifying round of two UEFA competitions, the Europa League during the 2019-20 season and the Europa Conference League during the 2022-23 season. Our fourth team under management, Brera Ilch FC, is currently competing in the Mongolia Premier League for the first time during the 2023-24 season which it earned the right to compete in after only being founded in 2020.

There can be no assurance that any of our acquired teams will maintain or increase in popularity and ultimately generate revenue. Without such revenues, our results of operations and financial condition will be severely impacted, and you may lose most or all of the value of your investment in our Class B Ordinary Shares.

If we are unable to raise substantial additional capital on acceptable terms, or at all, our financial situation may create doubt whether we will continue as a going concern.

For the years ended December 31, 2023 and 2022, the Company had a net loss of €4,911,655 and €1,226,855, respectively. There can be no assurances that we will be able to achieve a level of revenues adequate to generate sufficient cash flow from operations or obtain funding from additional financing through private placements, public offerings and/or bank financing necessary to support our working capital requirements and pursue our strategic goals. No assurance can be given that additional financing will be available, or if available, will be on acceptable terms. These conditions may impact our ability to continue as a going concern and the Company may need to pursue bankruptcy protection under the United States Bankruptcy Code.

We had a concentration of credit risk because we derived our revenue from a limited number of customers.

For the year ended December 31, 2022, we had 6 customers, among which 1 customer accounted for 74% of our revenue. For the year ended December 31, 2023, we had zero customers that made up 10% of revenue. As a result, our credit risk in respect of accounts receivable was concentrated in 1 customer and 0 customers accounting for at least 10% of revenue for each of the years ended December 31, 2022 and 2023, respectively. In order to minimize the credit risk, our management has created a team responsible for the determination of credit limits and credit approvals for our customers. We cannot assure you that we will not see concentration of accounts receivable from a small number of customers in the future. In such case, if any of these customers defaults on its payment obligations to us, we will not be able to recover the related accounts receivable, and our business, financial condition and results of operations may be materially and adversely affected.

3

We source our services from a limited number of service suppliers. If we lose one or more of these service suppliers, our operation may be disrupted, and our results of operations may be adversely and materially impacted.

One and four service suppliers each accounted for over 10% of our total cost of revenue, representing 125% and 88% of our cost of revenue for the years ended December 31, 2023 and 2022, respectively. For the amount due to our supplied as of December 31, 2023, this is a payment in kind supplier, and as a result, we anticipate that the balance will be zero by the end of the season. If we lose service suppliers and are unable to swiftly engage new service suppliers, our operations may be disrupted or suspended, and we may not be able to deliver products to our customers on time. We may also have to pay a higher price to source from a different service supplier on short notice. While we are actively searching for and negotiating with new service suppliers, there is no guarantee that we will be able to locate appropriate new service suppliers or service supplier merger targets in our desired timeline. As such, our results of operations may be adversely and materially impacted.

If we are unable to maintain and enhance our brand and reputation, or if events occur that damage our brand and reputation, our ability to expand our fanbase, sponsors, and commercial partners or to sell significant quantities of our services may be impaired.

The success of our business depends on the value and strength of our brand and reputation. Our brand and reputation are also integral to the implementation of our strategies for expanding our fanbase, sponsors and commercial partners. To be successful in the future, particularly outside of Europe, we believe we must preserve, grow and leverage the value of our brand across all of our revenue streams. For example, we must increase the amount of media coverage we receive in order to expand our fanbase and brand awareness. Unfavorable publicity regarding the competition performances of any of our acquired clubs or their behavior off the field, our ability to attract and retain certain players and coaching staff or actions by or changes in our ownership, could negatively affect our brand and reputation. Failure to respond effectively to negative publicity could also further erode our brand and reputation. Our brand may also be adversely affected if our public image or reputation is tarnished by negative social media campaigns or poor reviews of our services, events or fan experiences. In addition, events in the football industry as whole, even if unrelated to us, may negatively affect our brand or reputation. As a result, the size, engagement, and loyalty of our fanbase and related revenues may decline. Damage to our brand or reputation or loss of our fans’ commitment for any of these reasons could impair our ability to expand our fanbase, and increase crucial revenues from ticket, premium seating, suite, sponsorship, food and beverage and merchandise sales, which may have a material adverse effect on our business, results of operations, financial condition and cash flow, as well as require additional resources to rebuild our brand and reputation.

In addition, maintaining and enhancing our brand and reputation may require us to make substantial investments. We cannot assure you that such investments will be successful. Failure to successfully maintain and enhance the Brera brand or our reputation or excessive or unsuccessful expenses in connection with this effort could have a material adverse effect on our business, results of operations, financial condition and cash flow.

Our business is dependent upon our ability to attract players and staff, including management, recruiters, and coaches for our acquired clubs.

We are highly dependent on our players and members of our staff, such as our management, recruiters, and coaches. Competition for talented players and staff is, and will continue to be, intense. Our ability to attract and retain high quality staff, especially recruiters with local connections and networks, is critical to our success in attracting talented players for our acquired clubs, and, consequently, critical to our business, results of operations, financial condition and cash flow. If we fail to attract talented players for our acquired clubs and youth system, we will be unable to engage in the global transfer market and it will limit our ability to compete and potentially win significant revenue in UEFA and other regional competitions. In addition, our popularity in certain countries or regions may depend, at least in part, on fielding certain players from those countries or regions. Our failure to attract key personnel could have a negative impact on our ability to effectively manage and grow our business.

Injuries to, and illness of, players in our acquired clubs could hinder our success.

To the degree that our financial results are dependent on our acquired club’s popularity and/or competitive success, the likelihood of achieving such popularity or competitive success may be substantially impacted by serious and/or untimely injuries to or illness of key players. Our strategy is to maintain squads of first team players sufficient to mitigate the risk of player injuries or illnesses. However, this strategy may not be sufficient to mitigate all financial losses in the event of an injury or illness, and as a result such injury or illness may affect the performance of our acquired clubs. In addition, even with team and league-wide health and safety precautions in place and compliance with governmental guidance and other COVID-19 protocols we may adopt, our players may nevertheless contract COVID-19 and, as a result, our ability to participate in games may be substantially impacted. Replacement of an injured or ill player may result in an increase in our salary expenses.

4

We may pursue acquisitions and other strategic transactions to complement or expand our business that may not be successful.

We may explore opportunities to purchase or invest in other businesses, football clubs or assets that we believe will complement, enhance or expand our current business or that might otherwise offer us growth opportunities. In connection with our current and any future acquisitions of clubs outside Italy, different cultures, languages, and traditions, or political instability, could have material adverse effects on our business plans. As a result, our strategy of providing access to football talent from outside Western Europe could be unsuccessful.

Any transactions that we are able to identify and complete may involve risks, including the commitment of significant capital, the incurrence of indebtedness, the payment of advances, the diversion of management’s attention and resources, litigation or other claims in connection with acquisitions or against companies we invest in or acquire, our lack of control over certain joint venture companies and other minority investments, the inability to successfully integrate such business into our operations or even if successfully integrated, the risk of not achieving the intended results and the exposure to losses if the underlying transactions or ventures are not successful.

If we fail to properly manage our anticipated growth, our business could suffer.

The planned growth of our commercial operations may place a significant strain on our management and on our operational and financial resources and systems. To manage growth effectively, we will need to maintain a system of management controls, and attract and retain qualified personnel, as well as develop, train and manage management-level and other employees. Failure to manage our growth effectively could cause us to over-invest or under-invest in infrastructure, and result in losses or weaknesses in our infrastructure, which could have a material adverse effect on our business, results of operations, financial condition and cash flow. Any failure by us to manage our growth effectively could have a negative effect on our ability to achieve our development and commercialization goals and strategies.

If we are unable to maintain, train and build an effective international sales and marketing infrastructure, we will not be able to commercialize and grow our brand successfully.

As we grow, we may not be able to secure sales personnel or organizations that are adequate in number or expertise to successfully market and sell our brand and products on a global scale. If we are unable to expand our sales and marketing capability, train our sales force effectively or provide any other capabilities necessary to commercialize our brand internationally, we will need to contract with third parties to market and sell our brand. If we are unable to establish and maintain compliant and adequate sales and marketing capabilities, we may not be able to increase our revenue, may generate increased expenses, and may not continue to be profitable.

It may not be possible to renew or replace key commercial and sponsorship agreements on similar or better terms or attract new sponsors.

Our commercial revenue for each of the years ended 2023 and 2022 represented a major part of our total revenue. The substantial majority of our commercial revenue is generated from commercial agreements with our sponsors, and these agreements have finite terms. When these contracts do expire, we may not be able to renew or replace them with contracts on similar or better terms or at all.

If we fail to renew or replace these key commercial agreements on similar or better terms, we could experience a material reduction in our commercial and sponsorship revenue. Such a reduction could have a material adverse effect on our overall revenue and our ability to continue to compete with the other football clubs in Italy and Europe.

As part of our business plan, we intend to continue to grow our sponsorship portfolio by developing and expanding our geographic and service categorized approach, which will include partnering with additional global sponsors, regional sponsors, and mobile and media operators. We may not be able to successfully execute our business plan in promoting our brand to attract new sponsors. We cannot assure you that we will be successful in implementing our business plan or that our commercial and sponsorship revenue will continue to grow at the same rate as it has in the past or at all. Any of these events could negatively affect our ability to achieve our development and commercialization goals, which could have a material adverse effect on our business, results of operations, financial condition and cash flow.

The performance of the Company’s acquired professional football clubs in UEFA and other tournaments will be material to the Company’s results. Therefore, any failure for these teams to compete and earn sufficient prizes and sponsor interests as a result of any failure by us to supervise and manage these teams would have a material adverse effect on our business plans and results of operations.

An economic downturn and adverse economic conditions may harm our business.

The recent economic downturn and adverse conditions in Italy and global markets may negatively affect our operations in the future. Our revenue in part depends on personal disposable income and corporate marketing and hospitality budgets. Further, our sponsorship and commercial revenue are contingent upon the expenditures of businesses across a wide range of industries, and as these industries continue to cut costs in response to the economic downturn, our revenue may similarly decline. Continued weak economic conditions could cause a reduction in our commercial and sponsorship revenue, each of which could have a material adverse effect on our business, results of operations, financial condition and cash flow.

5

There could be a decline in the popularity of football.

There can be no assurance that football will retain its popularity as a sport around the world or its status in Italy as the most popular sport. Any decline in football’s popularity could result in lower ticket sales, sponsorship revenue, a reduction in the value of our players or our brand, or a decline in the value of our securities, including our Class B Ordinary Shares. Any one of these events or a combination of such events could have a material adverse effect on our business, results of operations, financial condition and cash flow.

Our business is subject to seasonal fluctuations and our operating results and cash flow can vary substantially from period to period.

Our revenues and expenses have been seasonal, and we expect they will continue to be seasonal. Due to the playing season, revenues from our business are typically concentrated in the third and fourth fiscal quarters of each fiscal year ended December 31. As a result, our operating results and cash flow reflect significant variation from period to period and will continue to do so in the future. Therefore, period-to-period comparisons of our operating results may not necessarily be meaningful and the operating results of one period are not indicative of our financial performance during a full fiscal year. This variability may adversely affect our business, results of operations and financial condition.

We operate in a highly competitive market and there can be no assurance that we will be able to compete successfully.

We face competition from other football clubs not only in Italy and Europe, but on a global scale. Many of those football clubs are larger, more experienced and better funded than us, which enables them to acquire top players and coaching staff and could result in improved performance from those teams in domestic and European competitions. In addition, from a commercial perspective, we actively compete across many different industries and within many different markets. We believe our primary sources of competition, both in Europe and internationally, include, but are not limited to:

| ● | other businesses seeking corporate sponsorships and commercial partners such as sports teams, other entertainment events and television and digital media outlets; |

| ● | providers of sports apparel and equipment seeking retail, merchandising, apparel and product licensing opportunities; |

| ● | digital content providers seeking consumer attention and leisure time, advertiser income and consumer e-commerce activity; and |

| ● | other types of television programming seeking access to broadcasters and advertiser income. |

All of the above forms of competition could have a material adverse effect on any of our revenue streams and our overall business, results of operations, financial condition and cash flow.

Our digital media strategy may not generate the revenue we anticipate.

We maintain contact with, and provide entertainment to, our global fanbase through a number of digital and other media channels, including the internet, mobile services and social media. While we have attracted a significant number of followers to our digital media assets, including our website, the future revenue and income potential of our new media business is uncertain. You should consider our business and prospects in light of the challenges, risks and difficulties we may encounter in this new and rapidly evolving market, including:

| ● | our digital media strategy will require us to provide offerings such as video on demand, highlights and international memberships that have not previously been a substantial part of our business; |

| ● | our ability to retain our current global fanbase, build our fanbase and increase engagement with our followers through our digital media assets; |

| ● | our ability to enhance the content offered through our digital media assets and increase our subscriber base; |

| ● | our ability to effectively generate revenue from interaction with our followers through our digital media assets; |

| ● | our ability to attract new sponsors and advertisers, retain existing sponsors and advertisers and demonstrate that our digital media assets will deliver value to them; |

| ● | our ability to develop our digital media assets in a cost effective manner and operate our digital media services profitably and securely; |

| ● | our ability to identify and capitalize on new digital media business opportunities; and |

| ● | our ability to compete with other sports and other media for users’ time. |

Failure to successfully address these risks and difficulties could affect our overall business, financial condition, results of operations, cash flow, liquidity and prospects.

6

Exchange rate fluctuations could negatively affect our financial condition.

Although we operate globally, our consolidated financial statements are presented in euros. In addition to conducting business in the European Union, we also operate in North America and the UK. Therefore, we have revenues and expenses denominated in euros, U.S. dollars, and British pound sterling, among others. As a result, our business and share price may be affected by fluctuations between, the euro and the U.S. dollar and the euro and the British pound sterling, which may have a significant impact on our reported results of operations and cash flows from period to period.

Failure to adequately protect our intellectual property and curb the sale of counterfeit merchandise could injure our brand.

Like other popular brands, we are susceptible to instances of brand infringement (such as counterfeiting and other unauthorized uses of our intellectual property rights). We seek to protect our brand assets by ensuring that we own and control certain intellectual property rights in and to those assets and, where appropriate, by enforcing those intellectual property rights. For example, we own the copyright in our logo, and our logo and trade name are registered as trademarks (or are the subject of applications for registration) in a number of jurisdictions in Europe, Asia Pacific, Africa, North America and South America. However, it is not possible to detect all instances of brand infringement. Additionally, where instances of brand infringement are detected, we cannot guarantee that such instances will be prevented as there may be legal or factual circumstances which give rise to uncertainty as to the validity, scope and enforceability of our intellectual property rights in the brand assets. Furthermore, the laws of certain countries in which we license our brand and conduct operations may not offer the same level of protection to intellectual property rights holders as those in Europe and the United States, or the time required to enforce our intellectual property rights under these legal regimes may be lengthy and delay recovery. If we were to fail or be unable to secure, protect, maintain and/or enforce the intellectual property rights which vest in our brand assets, then we could lose our exclusive right to exploit such brand assets. Infringement of our trademark, copyright and other intellectual property rights could have an adverse effect on our business. We also license our intellectual property rights to third parties. In an effort to protect our brand, we enter into licensing agreements with these third parties which govern the use of our intellectual property, and which require our licensees to abide by quality control standards with respect to such use. Although we make efforts to police our licensees’ use of our intellectual property, we cannot assure you that these efforts will be sufficient to ensure their compliance. The failure of our licensees to comply with the terms of their licenses could have a material adverse effect on our business, results of operations, financial condition and cash flow.

Our operations and operating results have been, and may continue to be, materially impacted by the COVID-19 pandemic and government and league actions taken in response.

As discussed in the “Business Overview” section of this Annual Report, our business depends on the activities of our acquired clubs. Due to the global COVID-19 pandemic, for our first acquired club Brera FC, the 2019-20 and 2020-21 season championships were suspended, and as a result, virtually all of our business operations were suspended.

While capacity limitations were eased for the end of 2021-22 season, a resurgence in the COVID-19 pandemic, such as the Omicron variant, or another major epidemic or pandemic could impact future seasons. Accordingly, no assurances can be made as to whether and when future seasons will occur, the number of games played for the future seasons, or if the games will be played with any in-arena audiences or without limited-capacity in-arena audiences. Additionally, it is unclear whether and to what extent COVID-19 and related concerns will impact the demand for attending those games and for our sponsorship, tickets and other premium inventory.

Given that our acquired clubs operate in various countries, with different levels of emergency and response to COVID-19, it is not predictable whether in the future a resurgence of the COVID-19 pandemic will have severe repercussions on the sports sector and alter our clubs’ season and course of business.

As a result of a resurgence in COVID-19, such as the Omicron variant, our business could be subject to additional governmental regulations and/or league determinations, including updated COVID-19 protocols for future seasons, which could have a material impact on our business.

Even with additional protective measures to provide for the health and safety of all of those in attendance, including compliance with governmental requirements, league restrictions, and other measures we may adopt, there can be no assurances that players, fans attending games or vendors and employees will not contract COVID-19. Any such occurrence could result in litigation, legal and other costs and reputational risk that could materially impact our business and results of operations. In addition, such additional measures will increase operating expenses.

In addition, the spread of the virus in many countries continues to adversely impact global economic activity and has contributed to significant volatility and negative pressure in financial markets and supply chains. The pandemic has had, and could have a significantly greater, material adverse effect on the Italian economy as a whole, as well as the local economy where we conduct our operations. The pandemic has resulted, and may continue to result for an extended period, in significant disruption of global financial markets, which may reduce our ability to access capital in the future, which could negatively affect our liquidity.

If the COVID-19 pandemic does not continue to slow and the spread of COVID-19 is not contained, our business operations, could be further delayed or interrupted. We expect that government and health authorities may announce new or extend existing restrictions, which could require us to make further adjustments to our operations in order to comply with any such restrictions. We may also experience limitations in employee or player resources. In addition, our operations could be disrupted if any of our employees or players were suspected of having COVID-19, which could require quarantine of some or all such employees or players or closure of our facilities for disinfection. The duration of any business disruption cannot be reasonably estimated at this time but may materially affect our ability to operate our business and result in additional costs.

7

The extent to which the pandemic may impact our results will depend on future developments, which are highly uncertain and cannot be predicted as of the date of this Annual Report, including the effectiveness of vaccines and other treatments for COVID-19, and other new information that may emerge concerning the severity of the pandemic and steps taken to contain the pandemic or treat its impact, among others. Nevertheless, the pandemic and the current financial, economic and capital markets environment, and future developments in the global supply chain and other areas present material uncertainty and risk with respect to our performance, financial condition, results of operations and cash flows.

Risks Related to the Ownership of Our Class B Ordinary Shares

Our dual class voting structure has the effect of concentrating the voting control to holders of our Class A Ordinary Shares, which will limit or preclude other shareholders’ ability to influence corporate matters, and their interests may conflict with the interests of the Class A Ordinary shareholders. It may also adversely affect the trading market for our Class B Ordinary Shares due to exclusion from certain stock market indices.

We adopted a dual class voting structure such that our ordinary shares consist of Class A Ordinary Shares and Class B Ordinary Shares, and we are authorized to issue any number of classes of preferred shares. Class A Ordinary Shares are entitled to ten votes per share on proposals requiring or requesting shareholder approval, and Class B Ordinary Shares are entitled to one vote on any such matter. Our Class B Ordinary Shares were listed and began trading on the Nasdaq Capital Market on January 27, 2023, under the symbol “BREA.” Prior to the listing, there was no public market for our ordinary shares.

As of the date of this Annual Report, the holders of our outstanding Class A Ordinary Shares, collectively held approximately 91.8% of the voting power of our outstanding share capital and collectively are therefore our controlling shareholders. The holders of our Class A Ordinary Shares are Leonardo Aleotti, the adult son of Alessandro Aleotti, our former Chief Strategy Officer and former director; Daniel Joseph McClory, our Executive Chairman and a director; Pinehurst Partners LLC, which is controlled by Daniel Joseph McClory; and BREA Holdings, LLC, which is controlled by Daniel Joseph McClory.

Daniel Joseph McClory, our Executive Chairman and a director, directly or indirectly controls approximately 88.1% of all voting rights as of the date of this Annual Report, and therefore has controlling voting power.

Our key officers and directors collectively beneficially own approximately 60.4% of our outstanding share capital as of the date of this Annual Report. In addition, our key officers and directors collectively have approximately 89.3% of voting power in the Company as of the date of this Annual Report. As a result, they have controlling voting power and the ability to approve all matters submitted to our shareholders for approval.

Our key officers and directors collectively have, and the Class A Ordinary Shareholders named above may have, the ability to control the outcome of most matters requiring shareholder approval, including:

| ● | the election of our board and, through our board, decision making with respect to our business direction and policies, including the appointment and removal of our officers; |

| ● | mergers, de-mergers and other significant corporate transactions; |

| ● | changes to our constitution; and |

| ● | our capital structure. |

This voting control and influence may discourage transactions involving a change of control of the Company, including transactions in which shareholders of our Class B Ordinary Shares might otherwise receive a premium for their shares.

S&P Dow Jones and FTSE Russell have implemented changes to their eligibility criteria for inclusion of shares of public companies on certain indices, including the S&P 500, namely, to exclude companies with multiple classes of shares of common stock from being added to such indices. In addition, several shareholder advisory firms have announced their opposition to the use of multiple class structures. As a result, the dual class structure of our ordinary shares may prevent the inclusion of the Class B Ordinary Shares in such indices and may cause shareholder advisory firms to publish negative commentary about our corporate governance practices or otherwise seek to cause us to change our capital structure. Any such exclusion from indices could result in a less active trading market for our Class B Ordinary Shares. Any actions or publications by shareholder advisory firms critical of our corporate governance practices or capital structure could also adversely affect the value of our Class B Ordinary Shares.

8

We may not be able to maintain a listing of our Class B Ordinary Shares on Nasdaq.

We must meet certain financial and liquidity criteria to maintain such listing. If we violate Nasdaq’s listing requirements, or if we fail to meet any of Nasdaq’s continued listing standards, our Class B Ordinary Shares may be delisted. In addition, our board of directors may determine that the cost of maintaining our listing on a national securities exchange outweighs the benefits of such listing. A delisting of our Class B Ordinary Shares from Nasdaq may materially impair our shareholders’ ability to buy and sell our Class B Ordinary Shares and could have an adverse effect on the market price of, and the efficiency of the trading market for, our Class B Ordinary Shares. The delisting of our Class B Ordinary Shares could significantly impair our ability to raise capital and the value of your investment.

Our operating results and share price may fluctuate, and you could lose all or part of your investment.

Our quarterly operating results are likely to fluctuate as a publicly traded company. In addition, securities markets worldwide have experienced, and are likely to continue to experience, significant price and volume fluctuations. This market volatility, as well as general economic, market, or political conditions, could subject the market price of our shares to wide price fluctuations regardless of our operating performance. You may not be able to resell your shares at or above price you paid or at all. Our operating results and the trading price of our Class B Ordinary Shares may fluctuate in response to various factors, including:

| ● | market conditions in the broader stock market; |

| ● | actual or anticipated fluctuations in our quarterly financial and operating results; |

| ● | introduction of new products or services by us or our competitors; |

| ● | issuance of new or changed securities analysts’ reports or recommendations; |

| ● | changes in debt ratings; |

| ● | results of operations that vary from expectations of securities analysts and investors; |

| ● | guidance, if any, that we provide to the public, any changes in this guidance or our failure to meet this guidance; |

| ● | strategic actions by us or our competitors; |

| ● | announcement by us, our competitors, or our vendors of significant contracts or acquisitions; |

| ● | sales, or anticipated sales, of large blocks of our Class B Ordinary Shares; |

| ● | additions or departures of key personnel; |

| ● | regulatory, legal, or political developments; |

| ● | public response to press releases or other public announcements by us or third parties, including our filings with the SEC; |

| ● | litigation and governmental investigations; |

| ● | changing economic conditions; |

| ● | changes in accounting principles; and |

| ● | other events or factors, including those from natural disasters, pandemic, pet disease, war, acts of terrorism, or responses to these events. |

These and other factors, many of which are beyond our control, may cause our operating results and the market price and demand for our Class B Ordinary Shares to fluctuate substantially. While we believe that operating results for any particular quarter are not necessarily a meaningful indication of future results, fluctuations in our quarterly operating results could limit or prevent investors from readily selling their shares and may otherwise negatively affect the market price and liquidity of our shares. In addition, in the past, when the market price of a stock has been volatile, holders of that stock have sometimes brought securities class action litigation against the company that issued the stock. If any of our shareholders brought a lawsuit against us, we could incur substantial costs defending the lawsuit. Such a lawsuit could also divert the time and attention of our management from our business, which could significantly harm our profitability and reputation.

9

We do not currently intend to pay dividends on our securities and, consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our Class B Ordinary Shares. In addition, any distribution of dividends must be in accordance with the rules and restrictions applying under Irish law.

We have not declared or paid any cash dividends on any class of our ordinary shares since our formation and do not currently intend to pay cash dividends in the foreseeable future. Any determination to pay dividends in the future will be at the sole discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual restrictions, general business conditions and other factors our board of directors deems relevant, and subject to compliance with applicable laws, including the Irish Companies Act 2014 (as amended), or the Irish Companies Act, which requires Irish companies to have distributable reserves available for distribution equal to or greater than the amount of the proposed dividend. Distributable reserves are the accumulated realized profits of the Company that have not previously been utilized in a distribution or capitalization less accumulated realized losses that have not previously been written off in a reduction or reorganization of capital. Unless the Company creates sufficient distributable reserves from its business activities, the creation of such distributable reserves would involve a reduction of the Company’s share premium account or other undenominated capital account, which would require the approval of (i) 75% of our shareholders present and voting at a shareholder meeting, and (ii) the Irish High Court. In the event that we do not undertake a reduction of capital to create distributable reserves, no distributions by way of dividends, share repurchases or otherwise will be permitted under Irish law until such time as the Company has created sufficient distributable reserves from its business activities. The determination as to whether or not the Company has sufficient distributable reserves to fund a dividend must be made by reference to “relevant financial statements” of the Company. The “relevant financial statements” are either the last set of unconsolidated annual audited financial statements or unaudited financial statements prepared in accordance with the Irish Companies Act, which give a “true and fair view” of the Company’s unconsolidated financial position in accordance with accepted accounting practice in Ireland.

Moreover, even if we are or become able to declare and pay dividends, we expect to retain all earnings, if any, generated by our operations for the development and growth of our business. Therefore, you are not likely to receive any dividends on your ordinary shares for the foreseeable future.

As a result, the success of an investment in our Class B Ordinary Shares will depend upon any future appreciation in our value and investors may need to sell all or part of their holdings of Class B Ordinary Shares after price appreciation, which may never occur, as the only way to realize any future gains on their investment. There is no guarantee that our Class B Ordinary Shares will appreciate in value or even maintain the price at which our shareholders have purchased our Class B Ordinary Shares. If the price of our Class B Ordinary Shares declines before we pay dividends, you will incur a loss on your investment, without the likelihood that this loss will be offset in part or at all by potential future cash dividends. Investors seeking cash dividends should not purchase Class B Ordinary Shares.

In addition, exchange rate fluctuations may affect the amount of euros that we are able to distribute, and the amount in dollars that our shareholders receive upon the payment of cash dividends or other distributions we declare and pay in euros, if any. These factors could harm the value of our Class B Ordinary Shares, and, in turn, the dollar proceeds that holders receive from the sale of our Class B Ordinary Shares.

Changes to taxation or the interpretation or application of tax laws could have an adverse impact on our results of operations and financial condition.

Our business is subject to various taxes in different jurisdictions (mainly Italy), which include, among others, the Italian corporate income tax (“IRES”), regional trade tax (“IRAP”), value added tax (“VAT”), excise duty, registration tax and other indirect taxes. We are exposed to the risk that our overall tax burden may increase in the future.

Changes in tax laws or regulations, or in the position of the relevant Italian and non-Italian authorities regarding the application, administration or interpretation of these laws or regulations, particularly if applied retrospectively, could have a material adverse effect on our business, results of operations and financial condition. These changes include the introduction of a global minimum tax at a rate of 15% under the Two-Pillar Solution to Address the Tax Challenges of the Digitalisation of the Economy, agreed upon by over 130 jurisdictions under the Organisation for Economic Co-operation and Development/G20 Inclusive Framework on Base Erosion and Profit Shifting and to be implemented as from January 1, 2024.

In addition, tax laws are complex and subject to subjective valuations and interpretive decisions, and we periodically may be subject to tax audits aimed at assessing our compliance with direct and indirect taxes. The tax authorities may not agree with our interpretations of, or the positions we have taken or intend to take on, tax laws applicable to our ordinary activities and extraordinary transactions. In case of challenges by the tax authorities to our interpretations, we could face long tax proceedings that could result in the payment of additional tax and penalties, with potential material adverse effects on our business, results of operations and financial condition.

Shareholders could be diluted in the future if we increase our issued share capital because of the disapplication of statutory preemption rights. In addition, shareholders in certain jurisdictions, including the United States, may not be able to exercise their preemption rights even if those rights have not been disapplied.

As a matter of Irish law, holders of our ordinary shares will have a preemption right with respect to any issuance of our ordinary shares for cash consideration or the granting of rights to subscribe for our ordinary shares for cash consideration, unless such preemption right is disapplied, in whole or in part, either in our constitution or by resolution of our shareholders at a general meeting of shareholders or otherwise. However, we have opted out of these preemption rights in our constitution as permitted under Irish company law (for a period of five years). Thus, our board of directors will be permitted to issue up to all of our authorized but unissued share capital on a non-preemptive basis for cash consideration at any stage during the period of five years after the date of adoption of our constitution. In addition, even if the disapplication of preemption rights contained in our constitution expires (and is not renewed by shareholders at a general meeting) or is terminated by our shareholders in a general meeting, due to laws and regulations in certain jurisdictions outside Ireland, shareholders in such jurisdictions may not be able to exercise their preemption rights unless we take action to register or otherwise qualify the rights offering under the laws of that jurisdiction. For example, in the United States, U.S. holders of our ordinary shares may not be able to exercise preemption rights unless a registration statement under the Securities Act is declared effective with respect to our ordinary shares issuable upon exercise of such rights or an exemption from the U.S. registration requirements is available. If shareholders in such jurisdictions are unable to exercise their preemption rights, their ownership interest would be diluted. Any future issuance of shares or debt instruments convertible into shares where preemption rights are not available or are excluded would result in the dilution of existing shareholders and reduce the earnings per share, which could have a material adverse effect on the price of shares.

10

Irish law differs from the laws in effect in the United States and U.S. investors may have difficulty enforcing civil liabilities against us, our directors or members of senior management.

Some of the members of our board of directors and senior management reside outside of the United States and all or a substantial portion of their assets are located outside the United States. As a result, it may not be possible to serve process on these directors, or us, in the United States or to enforce court judgments obtained in the United States against these individuals or us in Ireland based on the civil liability provisions of the U.S. federal or state securities laws. The United States currently does not have a treaty with Ireland providing for the reciprocal recognition and enforcement of judgments in civil and commercial matters. Therefore, a final judgment for the payment of money rendered by any U.S. federal or state court based on civil liability, whether or not based solely on U.S. federal or state securities laws, would not automatically be enforceable in Ireland. A judgment obtained against us will be enforced by the courts of Ireland if the following general requirements are met:

| ● | U.S. courts must have had jurisdiction in relation to the particular defendant according to Irish conflict of law rules (the submission to jurisdiction by the defendant would satisfy this rule); and |

| ● | the judgment must be final and conclusive and the decree must be final and unalterable in the court which pronounces it. |

A judgment can be final and conclusive even if it is subject to appeal or even if an appeal is pending. But where the effect of lodging an appeal under the applicable law is to stay execution of the judgment, it is possible that in the meantime the judgment may not be actionable in Ireland. It remains to be determined whether a final judgment given in default of appearance is final and conclusive. Irish courts may also refuse to enforce a judgment of the U.S. courts that meets the above requirements for one of the following reasons:

| ● | the judgment is not for a definite sum of money; |

| ● | the judgment was obtained by fraud; |

| ● | the enforcement of the judgment in Ireland would be contrary to natural or constitutional justice; |

| ● | the judgment is contrary to Irish public policy or involves certain U.S. laws that will not be enforced in Ireland; or |

| ● | jurisdiction cannot be obtained by the Irish courts over the judgment debtors in the enforcement proceedings by personal service in Ireland or outside Ireland under Order 11 of the Irish Superior Courts Rules. |

As an Irish company, we are principally governed by Irish law, which differs in some material respects from laws generally applicable to U.S. corporations and shareholders, including, among others, differences relating to interested director and officer transactions and shareholder lawsuits. Likewise, the duties of directors and officers of an Irish company generally are owed to the company only. Shareholders of Irish companies generally do not have a personal right of action against directors or other officers of the company and may exercise such rights of action on behalf of the company only in limited circumstances. Accordingly, holders of our ordinary shares may have more difficulty protecting their interests than would holders of shares of a corporation incorporated in a jurisdiction of the United States. You should also be aware that Irish law does not allow for any form of legal proceedings directly equivalent to the class action available in the United States.

Provisions of our constitution, as well as provisions of Irish law, could make an acquisition of us more difficult, limit attempts by our shareholders to replace or remove our current directors, and limit the market price of our ordinary shares.

Our constitution, together with certain provisions of the Irish Companies Act, could delay, defer or prevent a third party from acquiring us, even where such a transaction would be beneficial to the holders of ordinary shares, or could otherwise adversely affect the market price of our ordinary shares. For example, certain provisions of our constitution:

| ● | permit our board of directors to issue preferred shares with such rights and preferences as they may designate, subject to applicable law; |

| ● | permit our board of directors to adopt a shareholder rights plan upon such terms and conditions as it deems expedient and in our best interests; |

| ● | impose advance notice requirements for shareholder proposals and director nominations to be considered at annual shareholder meetings; and |

| ● | require the approval of 75% of the votes cast at a general meeting of shareholders to amend or repeal any provisions of our constitution. |

We believe these provisions, if implemented in compliance with applicable law, may provide some protection to holders of ordinary shares from coercive or otherwise unfair takeover tactics. These provisions are not intended to make us immune from takeovers. They will, however, apply even if some holders of ordinary shares consider an offer to be beneficial and could delay or prevent an acquisition that our board of directors determines is in the best interest of the holders of ordinary shares. Certain of these provisions may also prevent or discourage attempts to remove and replace incumbent directors.

11

In addition, mandatory provisions of Irish law could prevent or delay an acquisition of the Company by a third party. For example, Irish law does not permit shareholders of an Irish public limited company to take action by written consent with less than unanimous consent. Furthermore, an effort to acquire us may be subject to various provisions of Irish law relating to mandatory bids, voluntary bids, requirements to make a cash offer and minimum price requirements, as well as substantial acquisition rules and rules requiring the disclosure of interests in ordinary shares in certain circumstances.

Irish law differs from the laws in effect in the United States with respect to defending unwanted takeover proposals and may give our board of directors less ability to control negotiations with hostile offerors.

We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies.

Because we qualify as a foreign private issuer under the Exchange Act, we are exempt from certain provisions of the securities rules and regulations in the United States that are applicable to U.S. domestic issuers, including:

| ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q or current reports on Form 8-K; |

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| ● | the selective disclosure rules by issuers of material nonpublic information under Regulation FD. |

We are required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, we intend to publish our results on a semi-annual basis as press releases, distributed pursuant to the rules and regulations of Nasdaq press releases relating to financial results, and material events are also furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information that would be made available to you were you investing in a U.S. domestic issuer.

As a foreign private issuer, we are permitted to rely on exemptions from certain Nasdaq corporate governance standards applicable to domestic U.S. issuers. This may afford less protection to holders of our shares.

We are exempted from certain corporate governance requirements of Nasdaq by virtue of being a foreign private issuer. As a foreign private issuer, we are permitted to follow the governance practices of our home country in lieu of certain corporate governance requirements of Nasdaq. As result, the standards applicable to us are considerably different than the standards applied to domestic U.S. issuers. For instance, we are not required to:

| ● | have a majority of the board be independent (although all of the members of the audit committee must be independent under the Exchange Act); or |

| ● | have a compensation committee and a nominating committee to be comprised solely of “independent directors”. |

In the future, we may take advantage of these home country exemptions. As a result, our shareholders may not be provided with the benefits of certain corporate governance requirements of Nasdaq and may not have the same protections afforded to shareholders of other companies that are subject to these Nasdaq requirements.

We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses.