As filed with the U.S. Securities and Exchange Commission on January 22, 2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________

________________________

| | 6770 | Not Applicable | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

Telephone:

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

________________________

New York,

Telephone:

(Name, address, including zip code, and telephone number, including area code, of agent for service)

________________________

With a Copy to:

Joan Wu, Esq.

Hunter Taubman Fischer & Li LLC

950 Third Avenue, 19th Floor

New York, NY 10022

(212) 530-2206

________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

• Primary Prospectus. A prospectus to be used for the primary offering by the Company of up to 370,000,000 ordinary shares of the Company (the “Primary Prospectus”).

• Resale Prospectus. A prospectus to be used for the resale by a selling shareholder of up to 16,987,652 ordinary shares of the Company (the “Resale Prospectus”).

The Resale Prospectus is substantively identical to the Primary Prospectus, except for the following principal points:

• they contain different outside and inside front covers;

• the Offering section in the Prospectus Summary section on page 23 of the Primary Prospectus is removed and replaced with the Offering section on page Alt-1 of the Resale Prospectus;

• the Use of Proceeds section on page 27 of the Primary Prospectus is removed and replaced with the Use of Proceeds section on page Alt-2 of the Resale Prospectus;

• a Dilution section is included in the Resale Prospectus beginning on page Alt-[ ] of the Resale Prospectus

• a selling shareholder section is included in the Resale Prospectus beginning on page Alt-3 of the Resale Prospectus;

• references in the Primary Prospectus to the Resale Prospectus will be deleted from the Resale Prospectus;

• the Plan of Distribution section on page 66 of the Primary Prospectus is removed and replaced with a Plan of Distribution section on page Alt-4 of the Resale Prospectus;

• the outside back cover of the Primary Prospectus is deleted from the Resale Prospectus.

The Registrant has included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Resale Prospectus as compared to the Primary Prospectus.

The information in this prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED JANUARY 22, 2024

370,000,000 Ordinary Shares

ETAO INTERNATIONAL CO., LTD.

We have entered into certain equity line of credit agreement dated December 4, 2023 (the “ELOC”), with Generating Alpha Ltd. (the “Investor”), relating to the sale of our ordinary shares, par value US$0.0001 per share (the “ordinary shares”), offered pursuant to this prospectus. In accordance with the terms of the ELOC, under this prospectus, we may offer and sell our ordinary shares having an aggregate offering price of up to $150,000,000 (the “Commitment Amount”) from time to time, solely at our request at anytime until the occurrence of (i) the first day of the month following the 24-month anniversary of the date of the effectiveness of this registration statement, of which the prospectus forms a part; (ii) the Investor have made payment pursuant to the ELOC in the aggregate amount of the Commitment Amount, or (iii) at such time that the there is no effective registration statement covering the ordinary shares issued or issuable pursuant to the ELOC. The ordinary shares would be purchased at a price per share that is equal to (ii) 90% of the lowest daily traded price of the ordinary shares during the ten (10) trading days immediately preceding the date when the ordinary shares are accepted and cleared by Investor’s brokerage firm.

The investors are not buying shares of a China-based operating company but instead are buying shares of a Cayman Islands holding company with operations conducted by the VIEs and their subsidiaries based in China and that this structure involves unique risks to investors.

This is an offering of the ordinary shares of the Cayman Islands holding company. We conduct our business through the VIEs and their subsidiaries based in China. You will not and may never have direct ownership in the operating entity based in China.

EF Hutton will be entitled to compensation at a commission rate equal to 7% of the aggregate gross sales price of ordinary shares sold through the ELOC. In connection with the sale of our ordinary shares on our behalf, the EF Hutton will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of EF Hutton will be deemed to be underwriting commissions or discounts. See “Plan of Distribution” beginning on page 66 regarding the compensation to be paid to EF Hutton.

Our ordinary shares are listed on the Nasdaq Capital Market, or “Nasdaq,” under the symbol “ETAO.” On December 21, 2023, the last reported sale price of our ordinary shares on Nasdaq was $0.49 per share.

Sales of our ordinary shares, if any, under this prospectus may be made by any method permitted that is deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and are therefore eligible to take advantage of certain reduced reporting requirements otherwise applicable to other public companies.

We are also a “foreign private issuer,” as defined in the Exchange Act and are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Investing in our ordinary shares involves a high degree of risk. Before buying any ordinary shares you should carefully read the discussion of material risks of investing in such securities in “Risk Factors” beginning on page 24 of this prospectus.

We face various risks and uncertainties relating to doing business in China. Our business operations are primarily conducted in China, and we are subject to complex and evolving PRC laws and regulations. For example, we face risks associated with regulatory requirements on overseas offerings, anti-monopoly regulatory actions, and oversight on cybersecurity and data

privacy, which may impact our ability to conduct certain businesses, accept foreign investments, or list and conduct offerings on a stock exchange in the United States or other foreign jurisdiction, and we are required to make filings with the China Securities Regulatory Commission (the “CSRC”) for applicable securities offerings, including this offering. These risks could materially and adversely impact our operations and the value of our ordinary shares, significantly limit or completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline or become worthless.

We are subject to certain legal and operational risks associated with being based in China. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and as a result these risks may result in material changes in the operations of the VIEs and their subsidiaries, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer or continue to offer our securities to investors. Recently, the PRC government adopted a series of regulatory actions and issued statements to regulate business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. As of the date of this prospectus, our Company, the VIEs and their subsidiaries have not been involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor has any of them received any inquiry, notice or sanction. As of the date of this prospectus, there are currently no relevant laws or regulations in the PRC that prohibit companies whose entity interests are within the PRC from listing on overseas stock exchanges. However, since these statements and regulatory actions are newly published, official guidance and related implementation rules have not been issued. It is highly uncertain what the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and our ability to continue our listing on an U.S. exchange. See “Item 3. Key Information — D. Risk Factors — Risks Related to Government Regulations — The approval of the CSRC or other PRC government authorities may be required in connection with this offering under PRC law, and, if required, we cannot predict whether or for how long we will be able to obtain such approval. ” and other risk factors disclosed in “Item 3. Key Information — D. Risk Factors — Risks Related to Doing Business in China” as set forth in our most recent annual report on Form 20-F for the fiscal year ended December 31, 2022 filed on September 1, 2023 (the “latest annual report”).

Our ordinary shares may be delisted and prohibited from being traded under the Holding Foreign Companies Accountable Act if the Public Company Accounting Oversight Board (the “PCAOB”) is unable to inspect our auditor. On May 20, 2020, the Senate passed the Holding Foreign Companies Accountable Act prohibiting an issuer’s securities from being traded on a national exchange if the PCAOB is unable to inspect the issuer’s auditors for three consecutive years. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act which, if passed by the U.S. House of Representatives and signed into law, would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the Holding Foreign Companies Accountable Act from three years to two, thus reducing the time before our securities may be delisted or prohibited from trading. On December 16, 2021, the PCAOB issued a report on its determinations that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong and identified the registered public accounting firms in China and Hong Kong that are subject to such determinations. This list does not include our auditor, WWC, P.C. However, the recent developments would add uncertainties to our offering and we cannot assure you whether Nasdaq or regulatory authorities would apply additional and more stringent criteria to us because the majority of our operations are conducted in China. On August 26, 2022, the PCAOB signed SOP Agreements with the China Securities Regulatory Commission (the “CSRC”) and China’s Ministry of Finance. The SOP Agreements established a specific, accountable framework to make possible complete inspections and investigations by the PCAOB of audit firms based in mainland China and Hong Kong, as required under U.S. law. However, if the PCAOB continues to be prohibited from conducting complete inspections and investigations of PCAOB-registered public accounting firms in mainland China and Hong Kong, the PCAOB is likely to determine by the end of 2022 that positions taken by authorities in the PRC obstructed its ability to inspect and investigate registered public accounting firms in mainland China and Hong Kong completely, then the companies audited by those registered public accounting firms would be subject to a trading prohibition on U.S. markets pursuant to the Holding Foreign Companies Accountable Act. See “Item 3. Key Information — D. Risk

Factors — Risks Related to Doing Business in China — The newly enacted “Holding Foreign Companies Accountable Act” and proposed “Accelerating Holding Foreign Companies Accountable Act” both call for additional and more stringent criteria to be applied to restrictive market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our ordinary shares and if our auditors fail to permit the Public Company Accounting Oversight Board (“PCAOB”) to inspect the auditing firm, our ordinary shares may be subject to delisting” as set forth in our latest annual report. Our ability to pay dividends depends upon dividends paid by our subsidiaries, the VIEs and their subsidiaries. If the PRC subsidiaries or any newly formed PRC subsidiaries incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends to us. In addition, the PRC subsidiaries are permitted to pay dividends to us only out of their respective retained earnings, if any, as determined in accordance with Chinese accounting standards and regulations. Under the applicable PRC laws and regulations, the PRC subsidiaries are required to set aside a portion of their after tax profits each year to fund certain statutory reserves, and funds from such reserves may not be distributed to us as cash dividends except in the event of liquidation of such subsidiaries. These statutory limitations affect, and future covenant debt limitations might affect, the PRC subsidiaries’ ability to pay dividends to us. We have not declared or paid dividends in the past, nor any dividends or distributions were made by a subsidiary or VIE to our holding company. We do not intend to distribute dividends in the foreseeable future, but we do not have a fixed dividend policy. Our board of directors have complete discretion on whether to distribute dividends, subject to applicable laws. See “Prospectus Summary — Our Corporate Structure — Cash Transfers and Dividend Distribution” commencing on page 13 of this prospectus.

EF HUTTON LLC

The date of this prospectus is , 2024.

TABLE OF CONTENTS

|

Page |

||

|

ii |

||

|

1 |

||

|

23 |

||

|

24 |

||

|

26 |

||

|

27 |

||

|

28 |

||

|

29 |

||

|

30 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

31 |

|

|

32 |

||

|

REGULATIONS |

||

|

56 |

||

|

57 |

||

|

58 |

||

|

66 |

||

|

67 |

||

|

68 |

||

|

68 |

||

|

68 |

||

|

69 |

i

ABOUT THIS PROSPECTUS

We and the Placement Agent have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you and which we have filed with the U.S. Securities and Exchange Commission (the “SEC”). We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the ordinary shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. For the avoidance of doubt, no offer or invitation to subscribe for our ordinary shares is made to the public in the Cayman Islands. The information contained in this prospectus is current only as of the date on the front cover of the prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated herein by reference as exhibits to the registration statement, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More Information.”

Our financial statements are prepared and presented in accordance with U.S. GAAP. Our historical results do not necessarily indicate our expected results for any future periods.

We have not taken any action to permit a public offering of the securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the securities and the distribution of this prospectus outside of the United States.

ii

COMMONLY USED DEFINED TERMS

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

• “Aaliance” means Aaliance Insurance Brokers Co., Ltd.

• “Biohelix” means Baihui (Beijing) Biotech Co., Ltd.

• “Chainworks” means Chain Workshop (Beijing) Co., Ltd.

• “Changsha Zhenghe” means Changsha Zhenghe Orthopedics Hospital Co., Ltd.

• “Changxing” means Changxing Zhizhou Hospital Co., Ltd.

• “Qianhu” means Qianhu (Jiangxi) Co., Ltd.

• “Consolidating VIEs” or “Consoldiated VIEs” refers to Aaliance, Biohelix, Chainworks, Changxing, DNurse, DTalks, Giuyang, Kangning, Mengzhou, Qianhu, and 6D Dental.

• “Code” means the Internal Revenue Code of 1986, as amended.

• “DILE” means Beijing Dile Technology Co., Ltd.

• “DNurse” means Beijing Dnurse Technology Co., Ltd., a PRC company and one of the eleven Consolidating VIEs.

• “DNurse Cayman” means Dnurse Investment Co. Ltd.

• “DTalks” means Zhichao Medical Technology (Hunan) Co., Ltd.

• “ETAO,” “we,” “us,”, “company”, “our company,” or “our” refers to ETAO International Co., Ltd., its subsidiaries and its contractually controlled entities consolidated in the financial statements, including the Consolidated VIEs and their respective consolidated subsidiaries.

• “ETAO China” refers to ETAO International Medical Technology Ltd.

• “ETAO Global” means ETAO Global Holdings Ltd.

• “ETAO Hong Kong” means ETAO International Group Co., Ltd.

• “Guiyang” means Tianlun (Giuyang) Buyun Buyu Hospital Co., Ltd.

• “Kangning” means Kang Ning (Heng Yang) Healthcare Management Co., Ltd.

• “Mengzhou” means Civil Hospital (Mengzhou City) Co., Ltd.

• “ETAO Ordinary Shares” means the ordinary shares of ETAO International Co., Ltd. a Cayman Islands exempted company.

• “Subsidiaries” and “subsidiaries” shall refer to the subsidiaries of ETAO, including ETAO BVI, ETAO Hong Kong, ETAO Healthcare, Dnurse Cayman, Dnurse Holdings Co., Limited and DILE.

• “VIEs” refers to Aaliance, Biohelix, Chainworks, Changsha Zhenghe, Changxing, DNurse, DTalks, Giuyang, Kangning, Mengzhou, Qianhu, and 6D Dental.

• “ETAO Healthcare” refers to ETAO International Healthcare Technology Co., Ltd.

• “WFOEs” shall refer to both ETAO Healthcare and DILE collectively.

• “6D Dental” means Hangzhou Six Dimension Dental Medical Technology Co. Ltd.

• “Ordinary shares” refer to our ordinary shares, par value US$0.0001 per share

iii

• “CSRC” shall refer to the China Securities Regulatory Commission.

• “China” or the “PRC” refers to the mainland of the People’s Republic of China, excluding, for the purpose of this prospectus only and references to the specific laws and regulations, Hong Kong, Macau and Taiwan

• “Renminbi” or “RMB” refers to the legal currency of China

• “$,” “US$,” “dollar” or “U.S. dollar” refers to the legal currency of the United States

Our reporting and functional currency is U.S. dollar. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, or at all. The PRC government imposes control over its foreign currency reserves in part through direct regulation of the conversion of RMB into foreign exchange and through restrictions on foreign trade. This prospectus contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations of related assets and liabilities of Renminbi into U.S. dollars were made at the rate of RMB6.8972 to US$1.00, the exchange rate as set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System in effect as of December 30, 2022, and all translations of related profit or loss and cash flow of Renminbi into U.S. dollars were made at the rate of RMB6.7290 to US$1.00, the exchange rate as set forth the annual average exchange rates for 2022 in the H.10 statistical release of the Board of Governors of the Federal Reserve System.

iv

PROSPECTUS SUMMARY

The summary highlights, and should be read in conjunction with, the more detailed information contained elsewhere in this prospectus and the documents incorporated therein by reference. You should read carefully the entire documents, including our financial statements and related notes, to understand our business, the ordinary shares, and the other considerations that are important to your decision to invest in our securities. You should pay special attention to the “Risk Factors” section of this prospectus.

Overview

ETAO is a holding company incorporated in the Cayman Islands with no material operations. As a holding company with no material operations of its own, ETAO conducts substantially all of the operations through the VIEs, which have entered into a series of the VIE Agreements with the WFOEs, indirect subsidiaries of ETAO. For accounting purposes, ETAO is the primary beneficiary of the Consolidating VIEs’ business operations through the VIE Agreements, which enables ETAO to consolidate the financial results in our consolidated financial statements under U.S. GAAP for the Consolidating VIEs and one VIE in which ETAO does not own an interest and whose financial statements will not be consolidated with the financial statements of ETAO. We have evaluated the guidance in Financial Accounting Standards Board Accounting Standards Codification 810 and determined that we are regarded as the primary beneficiary of the VIEs for accounting purposes, as a result of our direct ownership in the WFOEs and the provisions of the VIE Agreements. Our shares offered in this prospectus are shares of our holding company incorporated in Cayman Islands, not the shares of the VIEs.

ETAO is a Cayman Islands exempted company that was formed to on June 30, 2022 as a wholly owned subsidiary of Mountain Crest Acquisition Corp. III (“MCAE”). ETAO was formed to facilitate the two-step business combination transaction between MCAE and ETAO International Group (the “Business Combination”). As the first step of the business combination transaction, on February 17, 2023, MCAE merged with and into ETAO, with ETAO surviving as the surviving corporation in such merger, thereby consummating a change in MCAE’s domicile from a Delaware corporation to a Cayman Islands exempted company (the “Redomestication Merger”). ETAO Merger Sub, Inc. (“Merger Sub”) was a Cayman Islands exempted company that was wholly owned by ETAO. The Merger Sub was formed to facilitate the two-step Business Combination. As the second step of the Business Combination, on February 17, 2023, Merger Sub merged with and into ETAO International Group, with ETAO International Group surviving as the surviving corporation in such merger, thereby consummating ETAO’s acquisition, through its Merger Sub subsidiary, of ETAO International Group (the “Acquisition Merger”).

On January 27, 2022, MCAE, ETAO, the Merger Sub and Wensehng Liu, in his capacity as the ETAO’s shareholders’ representative, entered into an Agreement and Plan of Merger (the “Merger Agreement”). On February 17, 2023, the parties consummated the Business Combination in accordance with the Merger Agreement, resulting in ETAO International Group as a wholly-owned subsidiary of ETAO.

Business Overview

We are a digital healthcare group providing transformative medical care and quality service, developing a healthcare ecosystem leveraging a technology platform that allows it to extend the reach of traditional healthcare services beyond the hospital wall to reach patients in modern clinical facilities in distant communities and even in their homes. However, China’s healthcare system is at the developing stage with still many issues to be overcome. Through our online and offline ecosystem, supported by a network of bilingual, highly trained international specialists, the company is able to deliver medical services and quality care for Chinese patients via telemedicine and other services powered by technology.

1

Healthcare Business Model

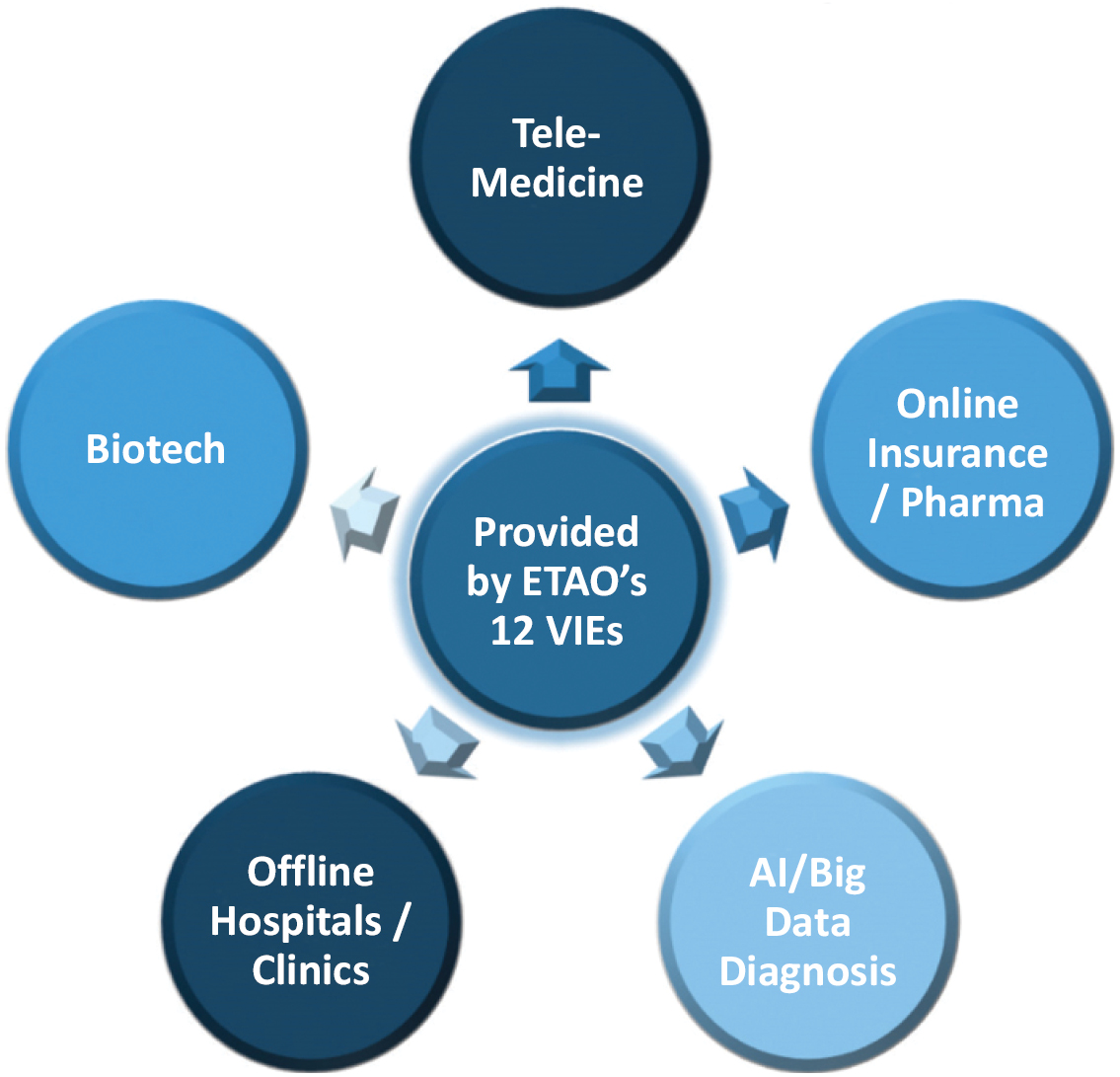

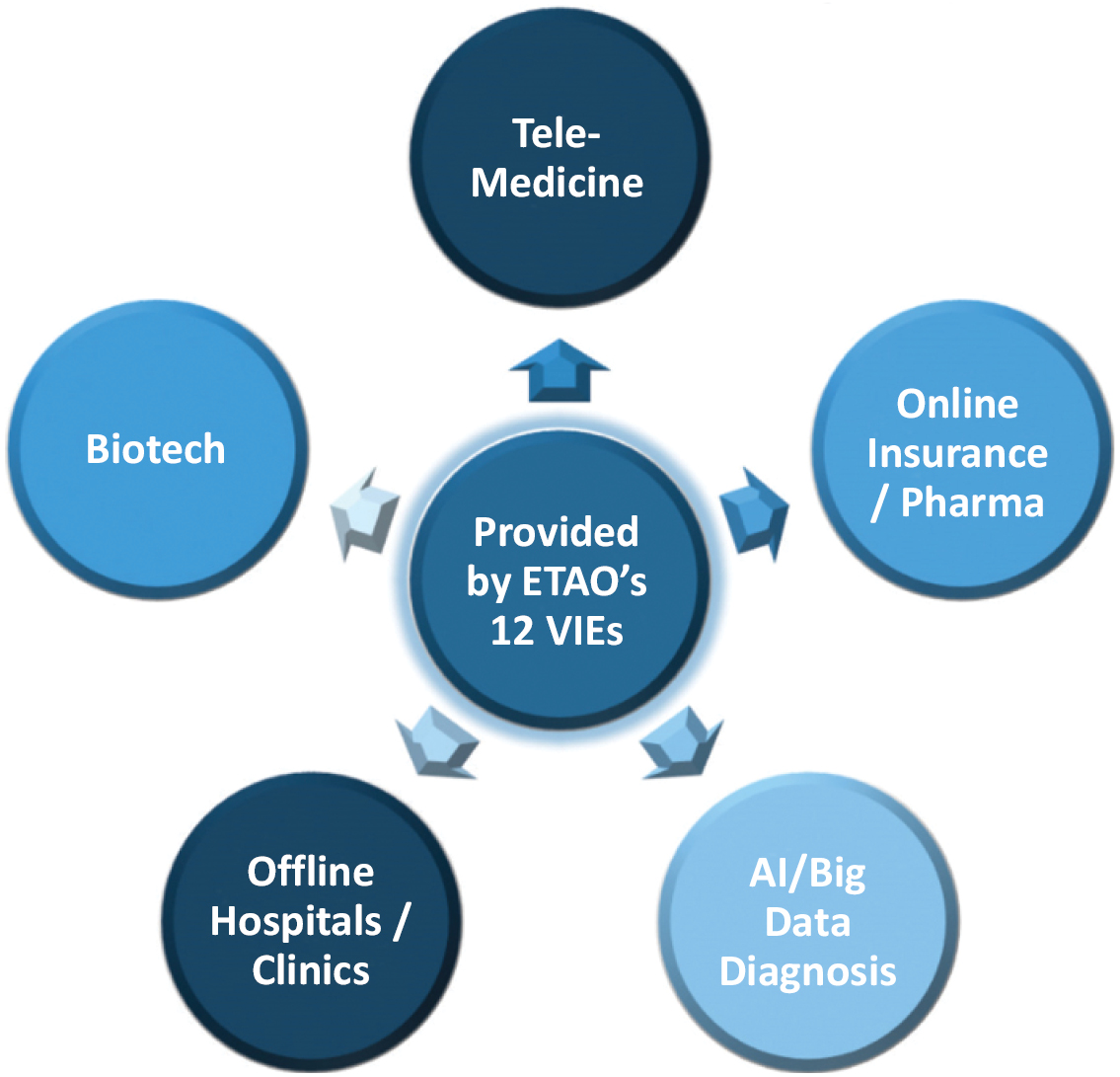

ETAO is currently in the process of integrating a comprehensive medical ecosystem that will merge online telemedicine + AI/Big Data Evaluation + Online Insurance/Pharmacy + Biotech + Offline hospitals and specialty clinics (see below for a description of each VIE). ETAO believes this ecosystem will bestow synergistic advantages and allow for opportunistic bolt-on acquisitions strategically positioned in China’s fastest growing healthcare segments.

Permissions Required from the PRC Government Authorities

On February 17, 2023, the CSRC published the Interim Administrative Measures on Overseas Securities Offering and Listing by Domestic Enterprises (CSRC Announcement [2022] No. 43) (the “Overseas Listing Measures”), which took effect on March 31, 2023. Under the Overseas Listing Measures, a filing-based regulatory system applies to “indirect overseas offerings and listings” of companies in mainland China, which refers to securities offerings and listings in an overseas market made under the name of an offshore entity but based on the underlying equity, assets, earnings or other similar rights of a company in mainland China that operates its main business in mainland China. The Overseas Listing Measures state that an overseas listed company that conducts any post-listing offering, including issuance of shares, convertible notes and other similar securities, in the same overseas market shall submit a filing with the CSRC within three business days after the completion of such offering in accordance with the Overseas Listing Measures. In connection with the Overseas Listing Measures, on February 17, 2023 the CSRC also published the Notice on the Administrative Arrangements for the Filing of Overseas Securities Offering and Listing by Domestic Enterprises (the “Notice on Overseas Listing Measures”). According to the Notice on Overseas Listing Measures, issuers that have already been listed in an overseas market by March 31, 2023, the date the Overseas Listing Measures became effective, are not required to make any immediate filing and are only required to comply with the filing requirements under the Overseas Listing Measures when they subsequently seek to conduct an offering in an overseas market. Therefore, we are required to submit a filing with the CSRC within three business days after the completion of this offering.

VIEs

In addition to its plans to build and expand its medical ecosystem in the U.S. and internationally, through series of agreements with each VIE, ETAO conducts substantial operations in the PRC, primarily in the following areas: tele-medicine platforms, insurance brokerage, biotechnology research and development, and healthcare services. The following sections shall summarize each VIE’s business and the VIE agreements by and among the WFOEs, each VIE and each VIE’s shareholders.

2

Neither we nor our subsidiaries own any equity interest in the VIEs. Instead, we receive the economic benefits of the VIE’s business operation through a series of contractual arrangements. The VIEs, certain of their shareholders, and ETAO Healthcare, along with DILE, entered into a series of contractual arrangements, also known as VIE Agreements, as further described below. The VIE Agreements are designed to provide the WFOEs with the power, rights and obligations, including majority control rights and the rights to the assets, property and net income of the VIEs.

From October 12, 2023 to October 13, 2023, pursuant to the terms of the Exclusive Business Cooperation Agreements, ETao Healthcare, the Company’s indirectly subsidiary in China, notified DTalks, DNurse, Kangning, Guiyang, Qianhu, Chainworks, Biohelix and each of their respective equity holders of the immediate termination of the series of VIE Agreements with them, including the Exclusive Business Cooperation Agreements, the Exclusive Option Agreements, the Share Pledge Agreements, the Timely Reporting Agreements and the Powers of Attorney. ETao Healthcare is entitled to collect the accrued and unpaid Service Fee, which is 51% of the Monthly Net Income of DTalks, Kangning, Guiyang, and Qianhu; 55% of the Monthly Net Income of Biohelix; 100% of the Monthly Net Income of Chainworks and DNurse, respectively, pursuant to the term of the respective VIE Agreements.

None of the seven disposed VIEs had incurred any profit and have an aggregate net loss of $7.5 million for the fiscal year ended December 31, 2022. The disposition was made for the purpose of streamlining ETAO’s business activities to focus on its core competitiveness and accelerate the integration process.

Upon termination of the above-referenced VIE agreements, ETAO’s corporate structure contains five VIEs, namely, Changsha Zhenghe, Changxing, Mengzhou, 6D Dental and Aalliance.

I. VIEs with Online and Offline Operations

Dental Industry

6D Dental

6D Dental was formed in 2010, with its main location in Hangzhou and other locations of Nanning and Quzhou. Geared towards the dental industry, 6D Dental is a high-tech enterprise that provides digital technical support for dental implant surgery. It includes a digital dental implant technology platform, dental clinics and digital dental implant education and training. 6D Dental’s main goal is to allow digital technology to help dentists achieve safe, accurate and fast implant surgeries. Client fees are the main source of revenue for 6D Dental.

The Company has a 51% contractual interest in 6D Dental via the 6D Dental VIE agreements (the “6D Dental VIE Agreements”) for the purposes of consolidation of 6D Dental under U.S. GAAP.

ETAO does not own any equity interest in 6D Dental. Instead, the Company receives the economic benefits of 6D Dental’s business operation through a series of contractual arrangements. 6D Dental, all of its shareholders (including 4 registered shareholders and 9 beneficial shareholders who hold their shares through Jia You, collectively, the “6D Dental Shareholders”), and ETAO Healthcare entered into a series of contractual arrangements, also known as 6D Dental VIE Agreements, on or about March 18, 2021. The 6D Dental VIE Agreements are designed to provide ETAO Healthcare with the power, rights and obligations, including majority control rights and the rights to the assets, property and revenue of 6D Dental. Through the 6D Dental VIE Agreements, ETAO has the power to direct the activities that most significantly impact 6D Dental’s economic performance, bears the risks of and recognizes the financial results of 6D Dental for accounting purposes only. Consequently, ETAO consolidates the accounts of 6D Dental for the periods presented. Any references to control or benefits that accrue to ETAO because of 6D Dental are limited to, and subject to conditions we have satisfied for consolidation of 6D Dental under U.S. GAAP. 6D Dental is consolidated for accounting purposes but is not an entity in which ETAO owns equity.

According to the Exclusive Business Cooperation and Service Agreement, 6D Dental is obligated to pay service fees to ETAO Healthcare approximately equal to 51% of net income of 6D Dental after deduction of the required PRC statutory reserve.

3

Each of the 6D Dental VIE Agreements is described in detail below:

Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement between 6D Dental and ETAO Healthcare dated March 18, 2021, ETAO Healthcare shall provide 6D Dental with technical support, consulting services, intellectual services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, ETAO Healthcare will be the owner of any and all intellectual property to be developed in the future either by 6D Dental or ETAO Healthcare to perform the Exclusive Business Cooperation Agreement from the date of this Exclusive Business Cooperation Agreement. For services rendered by ETAO Healthcare to 6D Dental under this agreement, ETAO Healthcare is entitled to collect a service fee calculated based on the actual income of 6D Dental, which is approximately equal to 51% of the net income of 6D Dental after deduction of the losses (if any) in previous years, necessary operating costs, expenses, tax and other required PRC statutory reserve.

The Exclusive Business Cooperation Agreement shall remain in effect for the time same as the period with 6D Dental’s Operating, and can only be terminated earlier if one of the parties enters into a bankruptcy or liquidation process (either voluntary or involuntary) or the ETAO Healthcare issues a written decision to terminate.

Kewei Wang, Xingtao Dong, Wei Peng, Jia You, and Xiaodong Wang are currently directors of 6D Dental. ETAO Healthcare has control and authority relating to the management of 6D Dental, including but not limited to decisions with regard to expenses, salary raises and bonuses, hiring, firing and other operational functions. Etao’s audit committee will be required to review and approve in advance any related party transactions, including transactions involving the ETAO Healthcare and 6D Dental.

Equity Pledge Agreement

Under the Equity Pledge Agreement among ETAO Healthcare, 6D Dental and certain of the 6D Dental Shareholders, each 6D Dental Shareholder pledged certain percentages of his or her equity interests in 6D Dental in the total amount of 51% outstanding equity interest of 6D Dental to ETAO Healthcare to guarantee the performance of 6D Dental’s obligations under the 6D Dental VIE Agreements. Under the terms of the Equity Pledge Agreement, in the event that 6D Dental or any of 6D Dental Shareholders breaches its respective contractual obligations under the 6D Dental VIE Agreements, ETAO Healthcare, as pledgee, will be entitled to certain rights, including, but not limited to, the right to collect dividends distributed from the pledged equity interests. All of the 6D Dental Shareholders also agreed that upon occurrence of any event of default, as set forth in the Equity Pledge Agreement, ETAO Healthcare is entitled to dispose the pledged equity interest in accordance with applicable PRC laws. Each 6D Dental Shareholder further agreed not to dispose of the pledged equity interests or take any actions that would prejudice ETAO Healthcare’s interest.

The Equity Pledge Agreement is effective until all payments due under the Exclusive Business Cooperation Agreement have been paid by 6D Dental. ETAO Healthcare shall cancel or terminate the Equity Pledge Agreement upon 6D Dental’s full payment of the fees payable under the Exclusive Business Cooperation Agreement and full performance of the obligations under the 6D Dental VIE Agreements.

The purposes of the Equity Pledge Agreement are to (1) guarantee the performance of 6D Dental’s obligations under the 6D Dental VIE Agreements, (2) make sure any 6D Dental Shareholder does and will not transfer or assign the pledged equity interests, or create or allow any encumbrance that would prejudice ETAO Healthcare’s interests without ETAO Healthcare’s prior written consent, and (3) provide ETAO Healthcare de facto control over 6D Dental. In the event that 6D Dental breaches its contractual obligations under the Exclusive Business Cooperation Agreement, ETAO Healthcare will be entitled to foreclose on and dispose all of 6D Dental’s issued and outstanding equity interests, have the right to (1) dispose of the pledged equity of 6D Dental and (2) require 6D Dental to pay the fund and all any payment due and payable under the 6D Dental VIE Agreements to the ETAO Healthcare.

Exclusive Option Agreement

Under the Exclusive Option Agreement dated March 18, 2021, certain 6D Dental Shareholders irrevocably granted ETAO Healthcare (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, certain portion of its equity interests in 6D Dental. The option price shall be RMB100 or equal to the lowest price legally permitted by applicable PRC laws and regulations.

4

The Exclusive Option Agreement shall remain effective until the 51% equities in 6D Dental are transferred to the ETAO Healthcare and/or an entity designated by ETAO Healthcare.

Proxy Agreement

Under the Proxy Agreement dated March 18, 2021, certain 6D Dental Shareholders authorized ETAO Healthcare to act on its behalf as its exclusive agent and attorney with respect to all rights as shareholders of 6D Dental, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all of the shareholders’ rights that the shareholders are entitled to under PRC laws and the articles of association of 6D Dental, including but not limited to voting, the sale or transfer or pledge or disposition of shares of 6D Dental in part or in whole; and (c) designating and appointing on behalf of 6D Dental Shareholders the legal representative, the executive directors, supervisors, the chief executive officer and other senior management members of 6D Dental.

The Proxy Agreement shall remain effective until the shareholder does not hold any equity in 6D Dental or terminated earlier by ETAO Healthcare in writing. The Proxy Agreement is irrevocable and continuously valid from the date of execution of the Proxy Agreement, so long as any of the 6D Dental Shareholders is the shareholder of 6D Dental. The sale or transfer of one 6D Dental Shareholder’s equity interest in 6D Dental shall not interfere with or affect the force and validity of the Proxy Agreement as to the remaining 6D Dental Shareholders.

The Exclusive Business Cooperation Agreement, together with the Equity Pledge Agreement, and Exclusive Option Agreement, and the Proxy Agreement, enable ETAO Healthcare to exercise effective control over 6D Dental.

II. VIEs with Offline Hospitals or Healthcare Facilities

Changsha Zhenghe

Changsha Zhenghe was formed in 2010, with its main location in Changsha. As a specialty hospital narrowed in on orthopedics and rehabilitation, Changsha Zhenghe deals with preventive health care, emergency medicine, internal medicine, surgery, orthopedics, pain, rehabilitation medicine, Chinese medicine, and combined Chinese and Western medicine. Revenue of Changsha Zhenghe is derived from client fees and government reimbursement for basic insurance.

ETAO has a 51% contractual interest in Changsha Zhenghe via the Changsha Zhenghe VIE Agreements (the “Changsha Zhenghe VIE Agreements”).

ETAO does not own any equity interest in Changsha Zhenghe. Instead, ETAO receives the economic benefits of Changsha Zhenghe’s business operation through a series of contractual arrangements. Changsha Zhenghe, all of its shareholders (except for Deju Wei; collectively, the “Changsha Zhenghe Shareholders”), and ETAO Healthcare entered into a series of contractual arrangements, also known as Changsha Zhenghe VIE Agreements, on or about March 31, 2021. The Changsha Zhenghe VIE Agreements are designed to provide ETAO Healthcare with the power, rights and obligations, and the rights to the assets, property and revenue of Changsha Zhenghe. Through the VIE arrangements, ETAO has the right to vote to direct the activities that most significantly impact Changsha Zhenghe’s economic performance, bears the risks of and recognizes the financial results of Changsha Zhenghe for accounting purposes only.

In May 20, 2023, ETAO acquired another 10% contractual interest in Changsha Zhenghe by investment of 5 million RMB in exchange 602,560 shares of ETAO. Thus Changsha Zhenghe owns 979,160 shares of ETAO in total.

According to the Exclusive Business Cooperation and Service Agreement, Changsha Zhenghe is obligated to pay service fees to ETAO Healthcare approximately equal to 51% of the net income of Changsha Zhenghe after deduction of the losses (if any) in previous years, necessary operating costs, expenses, tax and other required PRC statutory reserve.

Each of the Changsha Zhenghe VIE Agreements is described in detail below:

Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement between Changsha Zhenghe and ETAO Healthcare dated March 31, 2021, ETAO Healthcare shall provide Changsha Zhenghe with technical support, consulting services, intellectual services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, ETAO

5

Healthcare will be the owner of any and all intellectual property to be developed in the future either by Changsha Zhenghe or ETAO Healthcare to perform the Exclusive Business Cooperation Agreement from the date of this Exclusive Business Cooperation Agreement. For services rendered by ETAO Healthcare to Changsha Zhenghe under this agreement, ETAO Healthcare is entitled to collect a service fee calculated based on the actual income of Changsha Zhenghe, which is approximately equal to 51% of the net income of Changsha Zhenghe after deduction of the required PRC statutory reserve.

The Exclusive Business Cooperation Agreement shall remain in effect for the time same as the period of Changsha Zhenghe’s operating, and can only be terminated earlier if one of the parties enters into a bankruptcy or liquidation process (either voluntary or involuntary) or ETAO Healthcare issues a written decision to terminate.

Yonghua Zhu, Yuandu Zhu, Jie Yu, and Wei Hu are currently directors of Changsha Zhenghe. ETAO Healthcare has control and authority relating to the management of Changsha Zhenghe, including but not limited to decisions with regard to expenses, salary raises and bonuses, hiring, firing and other operational functions. ETAO’s audit committee will be required to review and approve in advance any related party transactions, including transactions involving the ETAO Healthcare and Changsha Zhenghe.

Equity Pledge Agreement

Under the Equity Pledge Agreement among ETAO Healthcare, Changsha Zhenghe and certain of the Changsha Zhenghe Shareholders pledged certain percentages of his or her equity interests in Changsha Zhenghe in the total amount of 51% outstanding equity interest of Changsha Zhenghe to ETAO Healthcare to guarantee the performance of Changsha Zhenghe’s obligations under the Changsha Zhenghe VIE Agreements. Under the terms of the Equity Pledge Agreement, in the event that Changsha Zhenghe or any of Changsha Zhenghe Shareholders breaches its respective contractual obligations under the Changsha Zhenghe VIE Agreements, ETAO Healthcare, as pledgee, will be entitled to certain rights, including, but not limited to, the right to collect dividends distributed from the pledged equity interests. All of the Changsha Zhenghe Shareholders also agreed that upon occurrence of any event of default, as set forth in the Equity Pledge Agreement, ETAO Healthcare is entitled to dispose the pledged equity interest in accordance with applicable PRC laws. Each Changsha Zhenghe Shareholder further agreed not to dispose of the pledged equity interests or take any actions that would prejudice ETAO Healthcare’s interest.

The Equity Pledge Agreement is effective until all payments due under the Exclusive Business Cooperation Agreement have been paid by Changsha Zhenghe. ETAO Healthcare shall cancel or terminate the Equity Pledge Agreement upon Changsha Zhenghe’s full payment of the fees payable under the Exclusive Business Cooperation Agreement and full performance of the obligations under the Changsha Zhenghe VIE Agreements.

The purposes of the Equity Pledge Agreement are to (1) guarantee the performance of Changsha Zhenghe’s obligations under the Changsha Zhenghe VIE Agreements, (2) make sure any Changsha Zhenghe Shareholder does and will not transfer or assign the pledged equity interests, or create or allow any encumbrance that would prejudice ETAO Healthcare’s interests without ETAO Healthcare’s prior written consent, and (3) provide ETAO Healthcare de facto control over Changsha Zhenghe. In the event that Changsha Zhenghe breaches its contractual obligations under the Exclusive Business Cooperation Agreement, ETAO Healthcare will be entitled to foreclose on and dispose all of Changsha Zhenghe’s issued and outstanding equity interests, have the right to (1) dispose of the pledged equity of Changsha Zhenghe and (2) require Changsha Zhenghe’s shareholders (except Deju Wei) to pay the fund and all any payment due and payable under the Changsha Zhenghe VIE Agreements to the ETAO Healthcare.

Exclusive Option Agreement

Under the Exclusive Option Agreement dated March 31, 2021, certain Changsha Zhenghe Shareholders (except for Deju Wei) irrevocably granted ETAO Healthcare (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, certain portion of its equity interests in Changsha Zhenghe. The option price shall be RMB100 or equal to the lowest price legally permitted by applicable PRC laws and regulations.

The Exclusive Option Agreement shall remain effective until the 51% equities in Changsha Zhenghe are transferred to the ETAO Healthcare and/or an entity designated by ETAO Healthcare.

6

Proxy Agreement

Under the Proxy Agreement dated March 31, 2021, certain Changsha Zhenghe Shareholders (except for Deju Wei) authorized ETAO Healthcare to act on its behalf as its exclusive agent and attorney with respect to all rights as shareholders of Changsha Zhenghe, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all of the shareholders’ rights that the shareholders are entitled to under PRC laws and the articles of association of Changsha Zhenghe, including but not limited to voting, the sale or transfer or pledge or disposition of shares of Changsha Zhenghe in part or in whole; and (c) designating and appointing on behalf of Changsha Zhenghe Shareholders the legal representative, the executive directors, supervisors, the chief executive officer and other senior management members of Changsha Zhenghe.

The Proxy Agreement shall remain effective until the shareholder does not hold any equity in Changsha Zhenghe or terminated earlier by ETAO Healthcare. The Proxy Agreement is irrevocable and continuously valid from the date of execution of the Proxy Agreement, so long as any of the Changsha Zhenghe Shareholders is the shareholder of Changsha Zhenghe. The sale or transfer of one Changsha Zhenghe Shareholder’s equity interest in Changsha Zhenghe shall not interfere with or affect the force and validity of the Proxy Agreement as to the remaining Changsha Zhenghe Shareholders.

The Exclusive Business Cooperation Agreement, together with the Equity Pledge Agreement, and Exclusive Option Agreement, and the Proxy Agreement, enable ETAO Healthcare to exercise effective control over 51% equity interests in Changsha Zhenghe.

Changxing

Changxing formed in 2019, has its main and only location in Huzhou. As a general hospital, Changxing conducts a wide array of activities such as the development of cardiovascular medicine, respiratory medicine, gastroenterology, geriatrics, neurology, nephrology (hemodialysis), immuno-rheumatology; trauma surgery, general surgery (minimally invasive), orthopedics, urology, brain surgery, gynecology, ophthalmology, otorhinolaryngology, stomatology, emergency medicine, critical care medicine, and traditional Chinese medicine (TCM). Revenue of Changxing is derived from client fees and government reimbursement for basic insurance.

ETAO has a 51% contractual interest in Changxing via the Changxing VIE Agreements (the “Changxing VIE Agreements”) for the purposes of consolidation of Changxing under U.S. GAAP.

ETAO does not own any equity interest in Changxing. Instead, ETAO receives the economic benefits of Changxing’s business operation through a series of contractual arrangements. Changxing, all of its shareholders (collectively, the “Changxing Shareholders”), and ETAO Healthcare entered into a series of contractual arrangements, also known as Changxing VIE Agreements, on or about March 20, 2021. The Changxing VIE Agreements are designed to provide ETAO Healthcare with the power, rights and obligations, including majority control rights and the rights to the assets, property and revenue of Changxing. Through the VIE arrangements, ETAO has the power to direct the activities that most significantly impact Changxing’s economic performance, bears the risks of and recognizes the financial results of Changxing for accounting purposes only. Consequently, ETAO consolidates the accounts of Changxing for the periods presented. Any references to control or benefits that accrue to ETAO because of Changxing are limited to, and subject to conditions we have satisfied for consolidation of Changxing under U.S. GAAP. Changxing is consolidated for accounting purposes but is not an entity in which ETAO owns equity.

According to the Exclusive Business Cooperation and Service Agreement, Changxing is obligated to pay service fees to ETAO Healthcare approximately equal to 51% of the net income of Changxing after deduction of the losses (if any) in previous years, necessary operating costs, expenses, tax and other required PRC statutory reserve.

Each of the Changxing VIE Agreements is described in detail below:

Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement between Changxing and ETAO Healthcare dated March 20, 2021, ETAO Healthcare shall provide Changxing with technical support, consulting services, intellectual services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, ETAO Healthcare will be

7

the owner of any and all intellectual property to be developed in the future either by Changxing or ETAO Healthcare to perform the Exclusive Business Cooperation Agreement from the date of this Exclusive Business Cooperation Agreement. For services rendered by ETAO Healthcare to Changxing under this agreement, ETAO Healthcare is entitled to collect a service fee calculated based on the actual income of Changxing, which is approximately equal to 51% of the net income of Changxing after deduction of the required PRC statutory reserve.

The Exclusive Business Cooperation Agreement shall remain in effect for the time same as the period of Changxing’s operating, and can only be terminated earlier if one of the parties enters into a bankruptcy or liquidation process (either voluntary or involuntary) or the ETAO Healthcare issues a written decision to terminate.

Hongming Yong is currently directors of Changxing. ETAO Healthcare has control and authority relating to the management of Changxing, including but not limited to decisions with regard to expenses, salary raises and bonuses, hiring, firing and other operational functions. ETAO’s audit committee will be required to review and approve in advance any related party transactions, including transactions involving the ETAO Healthcare and Changxing.

Equity Pledge Agreement

Under the Equity Pledge Agreement among ETAO Healthcare, Changxing and certain of the Changxing Shareholders pledged certain percentages of his or her equity interests in Changxing in the total amount of 51% outstanding equity interest of Changxing to ETAO Healthcare to guarantee the performance of Changxing’s obligations under the Changxing VIE Agreements. Under the terms of the Equity Pledge Agreement, in the event that Changxing or any of Changxing Shareholders breaches its respective contractual obligations under the Changxing VIE Agreements, ETAO Healthcare, as pledgee, will be entitled to certain rights, including, but not limited to, the right to collect dividends distributed from the pledged equity interests. All of the Changxing Shareholders also agreed that upon occurrence of any event of default, as set forth in the Equity Pledge Agreement, ETAO Healthcare is entitled to dispose the pledged equity interest in accordance with applicable PRC laws. Each Changxing Shareholder further agreed not to dispose of the pledged equity interests or take any actions that would prejudice ETAO Healthcare’s interest.

The Equity Pledge Agreement will become effective upon registration with competent company registration authorities of the PRC. The Equity Pledge Agreement will be effective until all payments due under the Exclusive Business Cooperation Agreement have been paid by Changxing. ETAO Healthcare shall cancel or terminate the Equity Pledge Agreement upon Changxing’s full payment of the fees payable under the Exclusive Business Cooperation Agreement and full performance of the obligations under the VIE agreements.

The purposes of the Equity Pledge Agreement are to (1) guarantee the performance of Changxing’s obligations under the Changxing VIE Agreements, (2) make sure any Changxing Shareholder does and will not transfer or assign the pledged equity interests, or create or allow any encumbrance that would prejudice ETAO Healthcare’s interests without ETAO Healthcare’s prior written consent, and (3) provide ETAO Healthcare de facto control over Changxing. In the event that Changxing breaches its contractual obligations under the Exclusive Business Cooperation Agreement, ETAO Healthcare will be entitled to foreclose on and dispose all of Changxing’s issued and outstanding equity interests, have the right to (1) dispose of the pledged equity of Changxing and (2) require Changxing’s shareholder to pay the fund and all any payment due and payable under the Changxing VIE Agreements to the ETAO Healthcare.

Exclusive Option Agreement

Under the Exclusive Option Agreement dated March 20, 2021, certain Changxing Shareholders irrevocably granted ETAO Healthcare (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, certain portion of its equity interests in Changxing. The option price shall be RMB100 or equal to the lowest price legally permitted by applicable PRC laws and regulations.

The Exclusive Option Agreement shall remain effective for a term of ten (10) years from the date of the Exclusive Option Agreement, may be extended for another ten (10) years at the choice of the ETAO Healthcare, and can only be terminated if one party defaults and/or by the ETAO Healthcare unilaterally.

Proxy Agreement

Under the Proxy Agreement dated March 20, 2021, certain Changxing Shareholders authorized ETAO Healthcare to act on its behalf as its exclusive agent and attorney with respect to all rights as shareholders of Changxing, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all of the shareholders’ rights that the shareholders

8

are entitled to under PRC laws and the articles of association of Changxing, including but not limited to voting, the sale or transfer or pledge or disposition of shares of Changxing in part or in whole; and (c) designating and appointing on behalf of Changxing Shareholders the legal representative, the executive directors, supervisors, the chief executive officer and other senior management members of Changxing.

The Proxy Agreement shall remain effective until the shareholder does not hold any equity in Changxing or terminated earlier by ETAO Healthcare. The Proxy Agreement is irrevocable and continuously valid from the date of execution of the Proxy Agreement, so long as any of the Changxing Shareholders is the shareholder of Changxing. The sale or transfer of one Changxing Shareholder’s equity interest in Changxing shall not interfere with or affect the force and validity of the Proxy Agreement as to the remaining Changxing Shareholders.

The Exclusive Business Cooperation Agreement, together with the Equity Pledge Agreement, and Exclusive Option Agreement, and the Proxy Agreement, enable ETAO Healthcare to exercise effective control over Changxing.

Mengzhou

Mengzhou, formed in 2018, has its main and only location in Mengzhou City. As a general hospital, Mengzhou is well equipped with various specialties and has more than 30 clinical medical and technical departments, such as orthopedic surgery, general surgery, neurosurgery, neurology, urology, microsurgery, quinturology, obstetrics and gynecology, internal medicine, cardiovascular medicine, pediatrics, oncology, rehabilitation, geriatrics and other disciplines. Revenue of Mengzhou is derived from client fees and government reimbursement for basic insurance.

ETAO has a 51% contractual interest in Mengzhou via the Mengzhou VIE Agreements (the “Mengzhou VIE Agreements”) for the purposes of consolidation of Mengzhou under U.S. GAAP.

ETAO does not own any equity interest in Mengzhou. Instead, ETAO receives the economic benefits of Mengzhou’s business operation through a series of contractual arrangements. Mengzhou, all of its shareholders (collectively, the “Mengzhou Shareholders”), and ETAO Healthcare entered into a series of contractual arrangements, also known as Mengzhou VIE Agreements, on or about March 31, 2021. The Mengzhou VIE Agreements are designed to provide ETAO Healthcare with the power, rights and obligations, including majority control rights and the rights to the assets, property and revenue of Mengzhou. Through the VIE arrangements, ETAO has the power to direct the activities that most significantly impact Mengzhou’s economic performance, bears the risks of and recognizes the financial results of Mengzhou for accounting purposes only. Consequently, ETAO consolidates the accounts of Mengzhou for the periods presented. Any references to control or benefits that accrue to ETAO because of Mengzhou are limited to, and subject to conditions we have satisfied for consolidation of Mengzhou under U.S. GAAP. Mengzhou is consolidated for accounting purposes but is not an entity in which ETAO owns equity.

According to the Exclusive Business Cooperation and Service Agreement, Mengzhou is obligated to pay service fees to ETAO Healthcare approximately equal to 51% of the net income of Mengzhou after deduction of the losses (if any) in previous years, necessary operating costs, expenses, tax and other required PRC statutory reserve.

Each of the Mengzhou VIE Agreements is described in detail below:

Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement between Mengzhou and ETAO Healthcare dated March 31, 2021, ETAO Healthcare shall provide Mengzhou with technical support, consulting services, intellectual services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, ETAO Healthcare will be the owner of any and all intellectual property to be developed in the future either by Mengzhou or ETAO Healthcare to perform the Exclusive Business Cooperation Agreement from the date of this Exclusive Business Cooperation Agreement. For services rendered by ETAO Healthcare to Mengzhou under this agreement, ETAO Healthcare is entitled to collect a service fee calculated based on the actual income of Mengzhou, which is approximately equal to 51% of the net income of Mengzhou after deduction of the required PRC statutory reserve.

The Exclusive Business Cooperation Agreement shall remain in effect for the time same as the period of Mengzhou’s operating, and can only be terminated earlier if one of the parties enters into a bankruptcy or liquidation process (either voluntary or involuntary) or ETAO Healthcare issues a written decision to terminate.

9

Zhiqiang Li is currently the director of Mengzhou. ETAO Healthcare has control and authority relating to the management of Mengzhou, including but not limited to decisions with regard to expenses, salary raises and bonuses, hiring, firing and other operational functions. ETAO’s audit committee will be required to review and approve in advance any related party transactions, including transactions involving the ETAO Healthcare and Mengzhou.

Equity Pledge Agreement

Under the Equity Pledge Agreement among ETAO Healthcare, Mengzhou and certain of the Mengzhou Shareholders pledged certain percentages of his or her equity interests in Mengzhou in the total amount of 51% outstanding equity interest of Mengzhou to ETAO Healthcare to guarantee the performance of Mengzhou’s obligations under the Mengzhou VIE Agreements. Under the terms of the Equity Pledge Agreement, in the event that Mengzhou or any of Mengzhou Shareholders breaches its respective contractual obligations under the Mengzhou VIE Agreements, ETAO Healthcare, as pledgee, will be entitled to certain rights, including, but not limited to, the right to collect dividends distributed from the pledged equity interests. All of the Mengzhou Shareholders also agreed that upon occurrence of any event of default, as set forth in the Equity Pledge Agreement, ETAO Healthcare is entitled to dispose the pledged equity interest in accordance with applicable PRC laws. Each Mengzhou Shareholder further agreed not to dispose of the pledged equity interests or take any actions that would prejudice ETAO Healthcare’s interest.

The Equity Pledge Agreement will become effective upon registration with competent company registration authorities of the PRC. The Equity Pledge Agreement will be effective until all payments due under the Exclusive Business Cooperation Agreement have been paid by Mengzhou. ETAO Healthcare shall cancel or terminate the Equity Pledge Agreement upon Mengzhou’s full payment of the fees payable under the Exclusive Business Cooperation Agreement and full performance of the obligations under the Mengzhou VIE Agreements.

The purposes of the Equity Pledge Agreement are to (1) guarantee the performance of Mengzhou’s obligations under the Mengzhou VIE Agreements, (2) make sure any Mengzhou Shareholder does and will not transfer or assign the pledged equity interests, or create or allow any encumbrance that would prejudice ETAO Healthcare’s interests without ETAO Healthcare’s prior written consent, and (3) provide ETAO Healthcare de facto control over Mengzhou. In the event that Mengzhou breaches its contractual obligations under the Exclusive Business Cooperation Agreement, ETAO Healthcare will be entitled to foreclose on and dispose all of Mengzhou’s issued and outstanding equity interests, have the right to (1) dispose of the pledged equity of Mengzhou and (2) require Mengzhou’s shareholder to pay the fund and all any payment due and payable under the Mengzhou VIE Agreements to the ETAO Healthcare.

Exclusive Option Agreement

Under the Exclusive Option Agreement dated March 31, 2021, certain Mengzhou Shareholders irrevocably granted ETAO Healthcare (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, certain portion of its equity interests in Mengzhou. The option price shall be RMB100 or equal to the lowest price legally permitted by applicable PRC laws and regulations.

The Exclusive Option Agreement shall remain effective until the 51% equities in Mengzhou are transferred to the ETAO Healthcare and/or an entity designated by ETAO Healthcare.

Proxy Agreement

Under the Proxy Agreement dated March 31, 2021, certain Mengzhou Shareholders authorized ETAO Healthcare to act on its behalf as its exclusive agent and attorney with respect to all rights as shareholders of Mengzhou, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all of the shareholders’ rights that the shareholders are entitled to under PRC laws and the articles of association of Mengzhou, including but not limited to voting, the sale or transfer or pledge or disposition of shares of Mengzhou in part or in whole; and (c) designating and appointing on behalf of Mengzhou Shareholders the legal representative, the executive directors, supervisors, the chief executive officer and other senior management members of Mengzhou.

The Proxy Agreement shall remain effective until the shareholder does not hold any equity in Mengzhou or terminated earlier by ETAO Healthcare. The Proxy Agreement is irrevocable and continuously valid from the date of execution of the Proxy Agreement, so long as any of the Mengzhou Shareholders is the shareholder of Mengzhou. The sale or transfer of one Mengzhou Shareholder’s equity interest in Mengzhou shall not interfere with or affect the force and validity of the Proxy Agreement as to the remaining Mengzhou Shareholders.

10

The Exclusive Business Cooperation Agreement, together with the Equity Pledge Agreement, and Exclusive Option Agreement, and the Proxy Agreement, enable ETAO Healthcare to exercise effective control over Mengzhou.

Insurance Agency

Aaliance

Aaliance was formed in 2010. Aaliance’s operations are geared towards insurance brokerage services, particularly in the property, health, and life insurance fields. Aaliance has its headquarters in Shanghai and is located in 7 different cities and provinces, including Shandong, Beijing, Anhui, Henan, Fujian, Yunnan, Qingdao. Based on its insurance brokerage services, Aaliance’s main source of revenue is from its insurance premiums.

ETAO has a 85% contractual interest in Aaliance via the Aaliance VIE Agreements (the “Aaliance VIE Agreements”) for the purposes of consolidation of Aaliance under U.S. GAAP.

ETAO does not own any equity interest in Aaliance. Instead, ETAO receives the economic benefits of Aaliance’s business operation through a series of contractual arrangements. Aaliance, all of its shareholders (collectively, the “Aaliance Shareholders”), and ETAO Healthcare entered into a series of contractual arrangements, also known as Aaliance VIE Agreements, on or about March 15, 2021. The Aaliance VIE Agreements are designed to provide ETAO Healthcare with the power, rights and obligations, including majority control rights and the rights to the assets, property and revenue of Aaliance. Through the VIE arrangements, ETAO has the power to direct the activities that most significantly impact Aaliance’s economic performance, bears the risks of and recognizes the financial results of Aaliance for accounting purposes only. Consequently, ETAO consolidates the accounts of Aaliance for the periods presented. Any references to control or benefits that accrue to ETAO because of Aaliance are limited to, and subject to conditions we have satisfied for consolidation of Aaliance under U.S. GAAP. Aaliance is consolidated for accounting purposes but is not an entity in which ETAO owns equity.

According to the Exclusive Business Cooperation and Service Agreement, Aaliance is obligated to pay service fees to ETAO Healthcare approximately equal to 85% of the net income of Aaliance after deduction of the losses (if any) in previous years, necessary operating costs, expenses, tax and other required PRC statutory reserve.

Each of the VIE Agreements is described in detail below:

Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement between Aaliance and ETAO Healthcare dated March 15, 2021, ETAO Healthcare shall provide Aaliance with technical support, consulting services, intellectual services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, ETAO Healthcare will be the owner of any and all intellectual property to be developed in the future either by Aaliance or ETAO Healthcare to perform the Exclusive Business Cooperation Agreement from the date of this Exclusive Business Cooperation Agreement. For services rendered by ETAO Healthcare to Aaliance under this agreement, ETAO Healthcare is entitled to collect a service fee calculated based on the actual income of Aaliance, which is approximately equal to 85% of the net income of Aaliance after deduction of the required PRC statutory reserve.

The Exclusive Business Cooperation Agreement shall remain in effect for the time same as the period of Aaliance’s operating, and can only be terminated earlier if one of the parties enters into a bankruptcy or liquidation process (either voluntary or involuntary) or ETAO Healthcare issues a written decision to terminate.

Lei Chen, Ping Wang, and Min Tang are currently directors of Aaliance. ETAO Healthcare has control and authority relating to the management of Aaliance, including but not limited to decisions with regard to expenses, salary raises and bonuses, hiring, firing and other operational functions. ETAO’s audit committee will be required to review and approve in advance any related party transactions, including transactions involving the ETAO Healthcare and Aaliance.

Equity Pledge Agreement

Under the Equity Pledge Agreement among ETAO Healthcare, Aaliance and certain of the Aaliance Shareholders pledged certain percentages of his or her equity interests in Aaliance in the total amount of 85% outstanding equity interest of Aaliance to ETAO Healthcare to guarantee the performance of Aaliance’s obligations under the Aaliance

11

VIE Agreements. Under the terms of the Equity Pledge Agreement, in the event that Aaliance or any of Aaliance Shareholders breaches its respective contractual obligations under the Aaliance VIE Agreements, ETAO Healthcare, as pledgee, will be entitled to certain rights, including, but not limited to, the right to collect dividends distributed from the pledged equity interests. All of the Aaliance Shareholders also agreed that upon occurrence of any event of default, as set forth in the Equity Pledge Agreement, ETAO Healthcare is entitled to dispose the pledged equity interest in accordance with applicable PRC laws. Each Aaliance Shareholder further agreed not to dispose of the pledged equity interests or take any actions that would prejudice ETAO Healthcare’s interest.

The Equity Pledge Agreement will become effective upon registration with competent company registration authorities of the PRC. The Equity Pledge Agreement will be effective until all payments due under the Exclusive Business Cooperation Agreement have been paid by Aaliance. ETAO Healthcare shall cancel or terminate the Equity Pledge Agreement upon Aaliance’s full payment of the fees payable under the Exclusive Business Cooperation Agreement and full performance of the obligations under the Aaliance VIE Agreements.

The purposes of the Equity Pledge Agreement are to (1) guarantee the performance of Aaliance’s obligations under the Aaliance VIE Agreements, (2) make sure any Aaliance Shareholder does and will not transfer or assign the pledged equity interests, or create or allow any encumbrance that would prejudice ETAO Healthcare’s interests without ETAO Healthcare’s prior written consent, and (3) provide ETAO Healthcare de facto control over Aaliance. In the event that Aaliance breaches its contractual obligations under the Exclusive Business Cooperation Agreement, ETAO Healthcare will be entitled to foreclose on and dispose all of Aaliance’s issued and outstanding equity interests, have the right to (1) dispose of the pledged equity of Aaliance and (2) require Aaliance’s shareholders to pay the fund and all any payment due and payable under the Aaliance VIE Agreements to the ETAO Healthcare.

Exclusive Option Agreement

Under the Exclusive Option Agreement dated March 15, 2021, certain Aaliance Shareholders irrevocably granted ETAO Healthcare (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, certain portion of its equity interests in Aaliance. The option price shall be RMB100 or equal to the lowest price legally permitted by applicable PRC laws and regulations.

The Exclusive Option Agreement shall remain effective until the 85% equities in Aaliance are transferred to the ETAO Healthcare and/or an entity designated by ETAO Healthcare.

Proxy Agreement

Under the Proxy Agreement dated March 15, 2021, certain Aaliance Shareholders authorized ETAO Healthcare to act on its behalf as its exclusive agent and attorney with respect to all rights as shareholders of Aaliance, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all of the shareholders’ rights that the shareholders are entitled to under PRC laws and the articles of association of Aaliance, including but not limited to voting, the sale or transfer or pledge or disposition of shares of Aaliance in part or in whole; and (c) designating and appointing on behalf of Aaliance Shareholders the legal representative, the executive directors, supervisors, the chief executive officer and other senior management members of Aaliance.

The Proxy Agreement shall remain effective until the shareholder does not hold any equity in Aaliance or terminated earlier by ETAO Healthcare. The Proxy Agreement is irrevocable and continuously valid from the date of execution of the Proxy Agreement, so long as any of the Aaliance Shareholders is the shareholder of Aaliance. The sale or transfer of one Aaliance Shareholder’s equity interest in Aaliance shall not interfere with or affect the force and validity of the Proxy Agreement as to the remaining Aaliance Shareholders.

The Exclusive Business Cooperation Agreement, together with the Equity Pledge Agreement, and Exclusive Option Agreement, and the Proxy Agreement, enable ETAO Healthcare to exercise effective control over Aaliance.

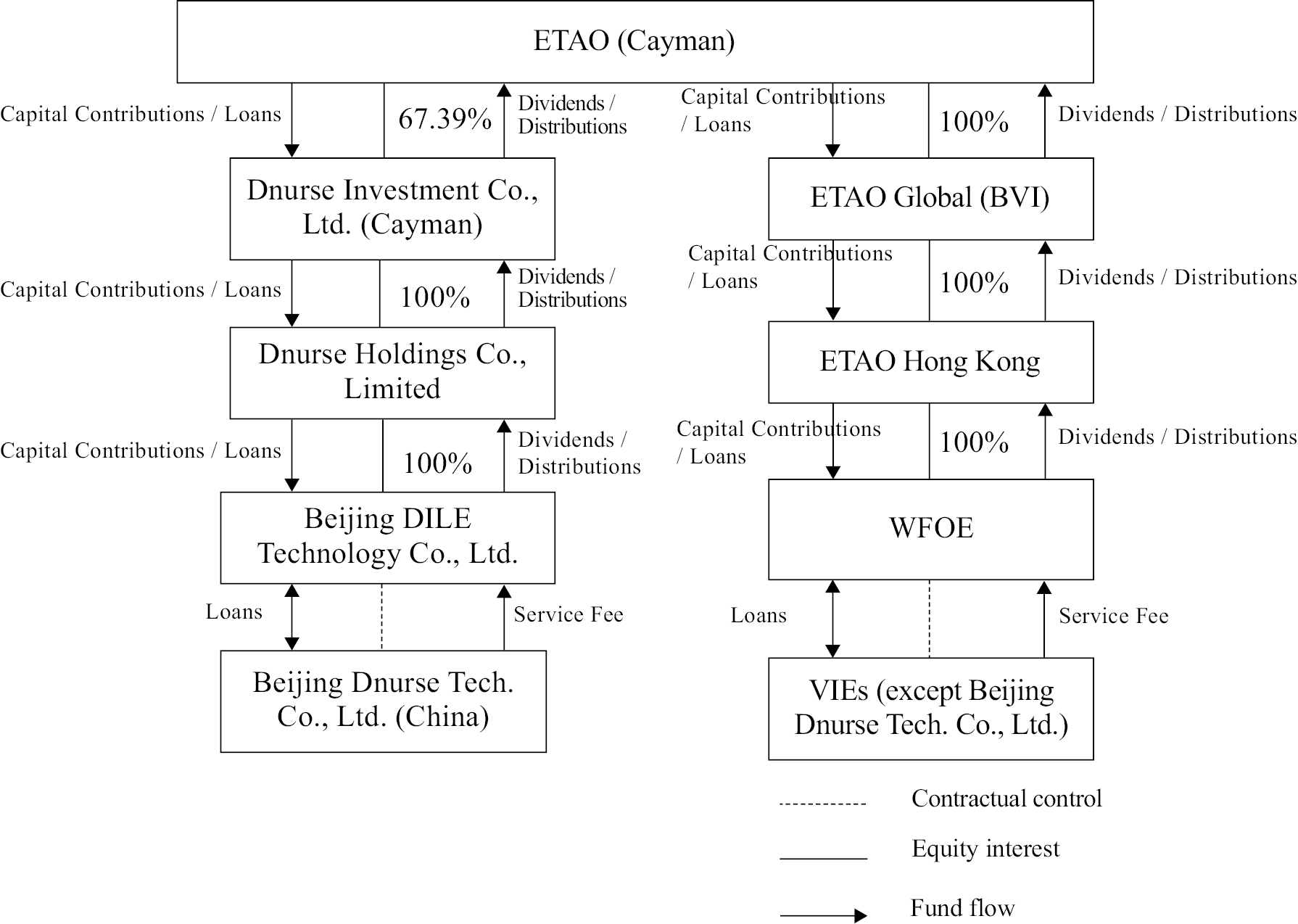

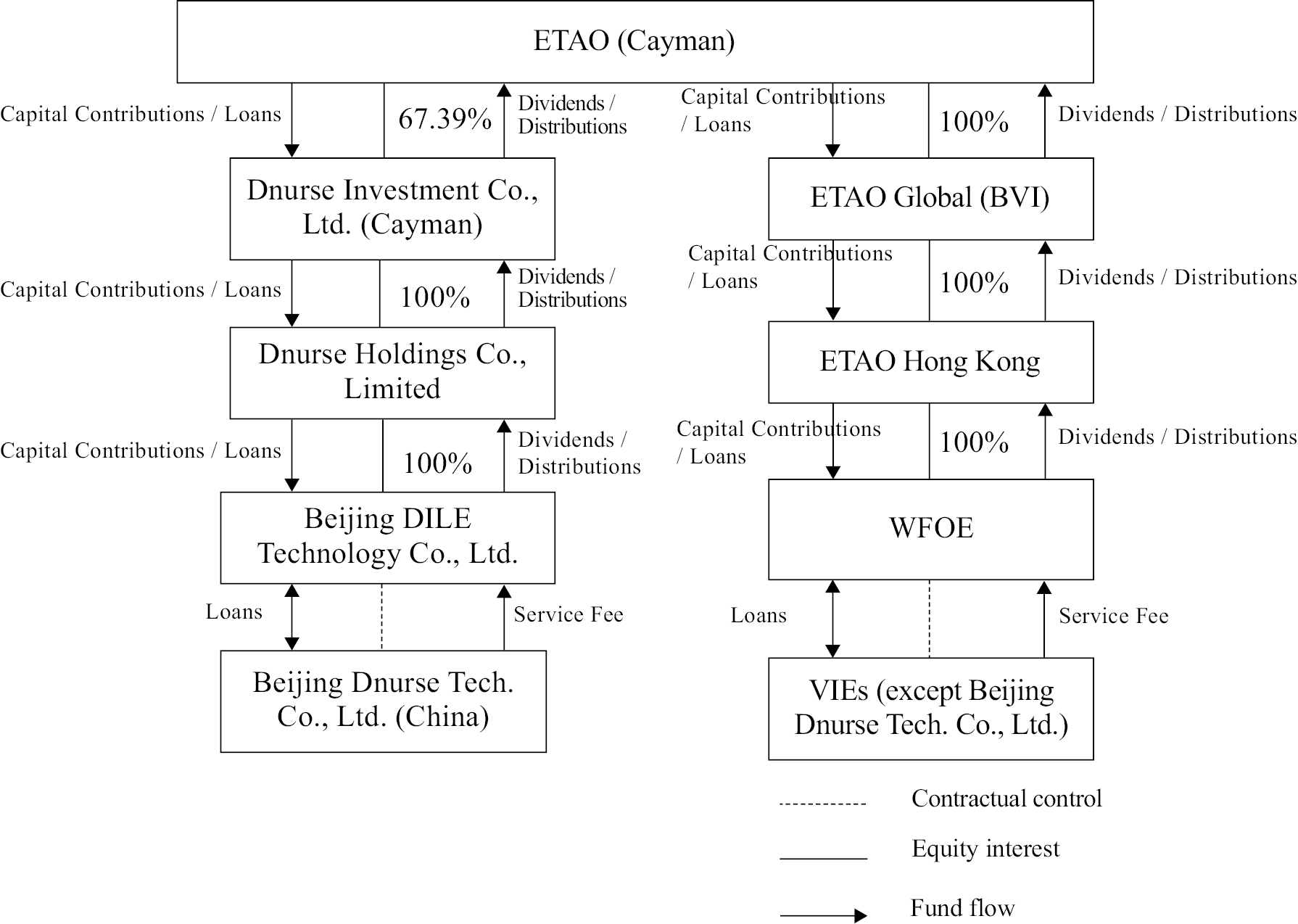

The chart below illustrates our corporate and shareholding structure:

[ ]

12