As filed with the Securities and Exchange Commission on July 14, 2023.

Registration No. 333-271198

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4 to

FORM S-1/A

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INSPIRE VETERINARY PARTNERS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | 8900 | 85-4359258 | ||

| (State or jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification No.) |

780 Lynnhaven Parkway

Suite 400

Virginia Beach, Virginia 23452

Telephone: (757) 734-5464

(Address, Including Zip Code, and Telephone Number, Including

Area Code, of Registrant’s Principal Executive Offices)

The Crone Law Group, PC

One East Liberty

Suite 600

Reno, Nevada 89501

Telephone: 646-861-7891

(Name, address, including zip code, and telephone

number,

including area code, of agent for service)

Copies to:

|

Mark E. Crone, Esq. Joe Laxague, Esq. Mason L. Allen, Esq. The Crone Law Group, PC 420 Lexington Avenue Suite 2446 New York, NY 10170 (775) 234-5221 |

Ross David Carmel, Esq. Jeffrey P. Wofford, Esq. Carmel, Milazzo & Feil LLP 55 West 39th Street 18th Floor, New York, NY 10018 (212) 658-0458 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer: ¨ | Accelerated filer: ¨ | |

| Non-accelerated filer: ¨ | Smaller reporting company: x | |

| Emerging Growth Company: x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion. Dated July 14, 2023

PRELIMINARY PROSPECTUS

INSPIRE VETERINARY PARTNERS, INC.

1,000,000 Class A Common Stock to be sold by the Company

Up to 5,747,915 shares of Class A Common Stock to be sold by the Selling Stockholders

This is an initial public offering of up to 5,747,915 shares of Inspire Veterinary Partners, Inc.’s Class A common stock of which up to 4,747,915 shares may be offered for resale or otherwise or otherwise disposed of by each stockholder named in this prospectus (the “Selling Stockholders”) in an amount equal to 100% of the shares held by each Selling Stockholder and of which 1,000,000 shares are being sold by the Company on a firm commitment underwritten basis.

The per share public offering price of the shares of Class A common stock to be sold by the Company is assumed to be $5.00, the midpoint of the estimated price range of $4.00 and $6.00 per share.

The sale of the Selling Stockholder Shares is conditioned upon the successful completion of the sale of the shares by the Company in the underwritten primary offering. The per share public offering price of the shares of Class A common stock to be sold by the Selling Stockholders will be the then-prevailing market price.

We have applied to list our Class A common stock on the Nasdaq Capital Market (“Nasdaq”) under the symbol “IVP”. However, there is no assurance that our shares of Common Stock will be traded on the Nasdaq Capital Market. The successful listing of our shares on the Nasdaq Capital Market is a condition to the closing of our underwritten primary offering and the secondary offering by our selling stockholders.

This prospectus also relates to the resale, from time to time, of up to 4,747,915 shares of Class A common stock (the Selling Stockholder Shares”) by the selling stockholders identified in this prospectus under the caption “Selling Stockholders,” consisting of: (i) 925,001 shares of Class A common stock that are issued and outstanding as of the date of this prospectus; (ii) 663,688 shares of Class A common stock that are potentially issuable upon the exercise of certain warrants outstanding as of the date of this prospectus; (iii) 1,275,865 shares of Class A common stock that are potentially issuable upon the conversion of existing convertible subordinated debentures of the Company outstanding as of the date of this prospectus; (iv) 408,500 shares of Class A common stock that are potentially issuable upon conversion of 408,500 shares of Class B common stock issue and outstanding as of the date of this prospectus held by non-affiliates; and (v) 1,474,861 shares of Class A common stock that are potentially issuable upon conversion of 442,458 shares of Series A preferred stock. The registration of the Selling Stockholder Shares does not mean that the selling stockholders will offer or sell any of Selling Stockholder Shares. The sale of the Selling Stockholder Shares is conditioned upon the successful completion of the underwritten primary offering. We will not receive any proceeds from any sale or disposition of the Selling Stockholder Shares. In addition, we will pay all fees and expenses incident to the registration of the resale of the Selling Stockholder Shares. The selling stockholders may offer their shares from time to time directly or through one or broker-dealers or agents or in the over-the-counter market at market prices prevailing at the time of sale. However, the Selling Stockholders will not sell any Selling Stockholder Shares until after the closing of the underwritten primary offering. The offering by the Selling Stockholders will remain open for 180 days following the date of this prospectus. For additional information on the possible methods of sale that may be used by the selling stockholders, you should refer to the section of this prospectus entitled “Selling Stockholders—Plan of Distribution”.

Upon the completion of this offering, we will have two classes of authorized common stock outstanding: Class A common stock and Class B common stock (collectively, our “common stock”). The rights of the holders of each class of our common stock are identical, except each share of Class B common stock is entitled to 25 votes per share and is convertible into one share of Class A common stock. See the section titled “Description of Capital Stock” for more information. Immediately following this offering, we will have 1,970,457 shares of Class A common stock outstanding, representing approximately 1.8% of the outstanding voting power of the Company. Assuming conversion of all existing convertible subordinated debentures of the Company, the full exercise of existing warrants and the conversion of all the newly-issued Series A Preferred Stock (giving effect to the Preferred Share Conversion (as defined below)), we will have 3,464,414 shares of Class A common stock outstanding representing approximately 3.1% of the outstanding voting power of the Company on a fully diluted basis. In addition, the Company will have 4,300,000 outstanding shares of Class B common stock outstanding representing approximately 96.0% of the combined voting power of the Company. As a result of the exchange of the senior secured convertible indebtedness of the Company for shares of a new series of Series A Preferred Stock, the Company has 442,458 shares of Series A preferred stock outstanding representing approximately 1.3% of the combined voting power of our outstanding common stock. Assuming an initial public offering of $5.00 per share, all of the shares of Series A Preferred Stock will be convertible into 1,474,861 shares of Class A Common Stock (the “Preferred Share Conversion”).

Investing in our Class A common stock involves risks. You should carefully read the “Risk Factors” beginning on page 11 of this prospectus before deciding to invest in shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Shares of Class A common stock to be sold by the Company

| Per Share | Total | |||||||

| Public offering price | $ | 5.00 | $ | 5,000,000 | ||||

| Underwriting discounts(1) | $ | 0.40 | $ | 400,000 | ||||

| Proceeds to Inspire Veterinary Partners, Inc. before expenses | $ | 4.60 | $ | 4,600,000 | ||||

| (1) | We refer you to “Underwriting” beginning on page 74 of this prospectus for additional information regarding underwriting compensation. |

The underwriters may also exercise their option to purchase up to an additional 150,000 shares of Class A common stock from us at the initial public offering price, less underwriting discounts, for 45-days after the date of this prospectus.

The shares will be ready for delivery on or about , 2023.

Sole Book-Running Manager

Spartan Capital Securities, LLC

The date of this prospectus is , 2023.

TABLE OF CONTENTS

We have not, and the underwriter has not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We and the underwriter take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not, and the underwriter has not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

Until , 2023, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

This summary highlights information contained in more detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should carefully read this prospectus in its entirety before investing in our common stock, including the sections titled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Cautionary Statement Regarding Forward-Looking Statements,” and our consolidated financial statements and the accompanying notes thereto included elsewhere in this prospectus.

Unless the context requires otherwise, references to “Inspire Veterinary,” the “Company,” “we,” “us,” and “our,” refer to Inspire Veterinary Partners, Inc. and its consolidated subsidiaries.

About Inspire Veterinary Partners

Inspire Veterinary was incorporated in the state of Delaware in 2020 and on June 29, 2022, converted into a Nevada corporation. The Company owns and operates veterinary hospitals throughout the United States. The Company specializes in small animal general practice hospitals which serve all manner of companion pets, emphasizing canine and feline breeds. As the Company expands, additional services are becoming a part of the offerings at its hospitals, including mixed animal facilities, critical care and other specialty services, and, as of December 2022, equine, or horse, care and emergency in one location.

As of the date of this prospectus, the Company currently has thirteen veterinary hospitals located in nine states. Inspire Veterinary has expanded and plans to further expand through acquisitions of existing hospitals which have the financial track record, marketplace advantages and future growth potential. Because the Company leverages a leadership and support structure which is distributed throughout the United States, acquisitions are not centralized to one geographic area; the Company recently acquired its first veterinary hospital in the Northeast with the acquisition of Williamsburg Animal Clinic in Williamsburg, Massachusetts.

Services provided at the Company’s hospitals include preventive care for companion animals consisting of annual health exams which include: parasite control; dental health; nutrition and body condition counseling; neurological examinations; radiology; bloodwork; skin and coat health and many breed specific preventive care services. Surgical offerings include all soft tissue procedures such as spays and neuters, mass removals, splenectomies and can also include gastropexies, orthopedic procedures and other types of surgical offerings based on a doctor’s training. In many locations additional means of care and alternative procedures are also offered such as acupuncture, chiropractic and various other health and wellness offerings.

| 1 |

| 2 |

Market Opportunity

In 2020, veterinary care made up 30% of the $103 billon U.S. pet industry. In that same year there were 83.7 million pet dogs and 60 million pet cats in the United States, with 45% and 26% of households owning at least one of those species respectively. From 2016 to 2020, there has been marked growth in both the pet population and in the number of households which own a pet and, therefore, the addressable population which requires care is expanding. Due to strong trends in year over year growth, we believe there is continued upside in the pet care industry and for owners of veterinary practices. With nearly 30,000 veterinary clinics in the United States and less than 30% of that figure having been consolidated under current multi-unit veterinary operators, management believes there exists a large opportunity for acquisitions within the pet care space. Despite a marked increase in acquisition and consolidation activity in recent years, with attendant increases in veterinary clinic valuations as a multiple of EBITDA, management believes there are industry indications that the purchase price for clinic practices may be stabilizing. *

(* Industry data reported in American Veterinary Medical Association/Today’s Veterinary Business).

With new technologies and therapies entering the space, new care models and increasing education regarding the availability, and adoption, of pet insurance as well as other factors contributing to longer pet life expectancy, pet care spending continues to increase for pet owners who appear willing to pay larger sums for routine and advanced care for their pets. These factors, coupled with industry data from the American Pet Products Association which shows millennial consumers spending more on pets, plus an explosion of pet adoption during 2020’s Covid-19 epidemic (according to Associated Press reports), suggest that veterinary care will continue to be an essential service with strong growth in the coming years.

During the last decade, consolidation has become an increasing factor in the highly-fragmented pet care industry, with corporate buying groups, private equity firms and veterinary service organizations increasing their holdings in the U.S. veterinary care market.

Multi-unit veterinary organizations must possess several disciplines and capabilities to be successful in this dynamic industry. The management of Inspire Veterinary believes they bring the following qualities and capabilities to the business:

| · | Operational and financial acumen, including capabilities focused on efficiency and productivity. |

| · | A talented leadership team which marries medical and business skillsets. |

| · | Skilled talent scouts and people developers who can select the right professionals and keep them engaged. |

| · | An understanding of unit economics in the veterinary space along with clear-eyed valuations for practices. |

| · | Nearly a century of cumulative experience in investment banking and financial and legal advisory services, including company start-ups, unit expansion and acquisitions and business development domestically and internationally. |

| · | Visionary senior leadership with experience in an industry that is growing and changing rapidly. |

Why Consolidate?

With few career paths open to veterinary professionals beyond general practice, many veterinarians find themselves as veterinary practice owners as ‘the next step’ after a few years in practice. Many, unfortunately, do not have the business training or skill to transition to become successful entrepreneurs such as knowing how to lead teams, deliver profitability and protect their service offerings. Many such professionals have difficulty maintaining their value or growing their hospitals year over year. For these reasons, and others, many clinicians seek a less stressful path after their initial stint as owners. Others, having been owners for years, seek to exit the space or the need to work on a full-time basis in it. These are the owners who consolidators have traditionally sought out.

| 3 |

Anticipated Growth through Acquisitions

Inspire Veterinary anticipates targeting a ten unit per year acquisition pipeline with the five-year goal to acquire 50 locations throughout the United States. We plan to emphasize acquisitions of seasoned existing veterinary hospitals but we have not ruled out the acquisition of newer practices.

Company actions/characteristics critical to the achievement of these goals are:

| · | Identification of states which have favorable designated market area where the following combination of factors exists: |

| o | Strong pet counts and addressable market as measured by a three-, five- and ten-mile radius measurements; |

| o | Favorable household income and other factors in households within such radius measurements; and |

| o | Positive livability and resident growth trends which indicate location is an area of choice for veterinary professionals to settle and achieve a stable workforce; and |

| o | Veterinary practice laws and regulations that are complementary to our business model; management intends to states (including at present New York State) in which the usage of non-licensed veterinary technicians is extremely limited. |

| · | The Company leverages strategic partners’ core competencies; |

| · | Geographically decentralized corporate leadership, which is located throughout the United States. The ability for management to work in all 50 states removes the need to only analyze and purchase targets close to a headquarters or ‘home’ market. This results in far larger numbers of potential acquisition candidates than competitors who are only operating in certain regions. By leveraging a consultative field leadership approach and a high touch/high support model which is not specific to geographies, the Company leverages the flexibility which allows us to purchase hospitals for their attributes versus being bound by having to ‘cluster’ locations. When advantages are evident from purchasing in geographic clusters, the Company will seek opportunities to do so. |

| · | Balanced portfolio of companies and target portfolio companies that include the following hospital types: |

| o | Financially healthy hospitals which have stable teams, strong financials and modest room for growth. |

| o | Smaller profit clinic locations which show room for growth based on our careful proprietary analysis, thereby representing an upside which allows us to buy at relatively low valuations and pursue well-articulated growth. |

| o | Hospitals that were acquired or are targeted to be acquired strategically because they have attractive real estate holdings or other elements, which represent value opportunities to the Company. Management anticipates that such strategic acquisitions may include ‘in-fill’ purchases allowing us to share resources such as talent within a designated market area while acquiring the ability to serve more pets in an area where our current footprint of hospitals is at full capacity. |

| · | Initially focus on small animal companion hospitals which are focused on general practice as opposed to specialty or emergency hospitals. Operationally, we will build a base portfolio of these locations for the predictable revenue characteristics and comparatively easier staffing requirements. When an infill opportunity arises or we see the need to have internal referrals between our GP locations and an internally owned emergency location, we may seek critical care hospitals to acquire. |

| · | Target EBITDA for the Company will be 15% with locations managed on a +/- scale with that EBITDA figure as the target mean. |

| · | Because of our limited operating history, from inception to March 31, 2023, the Company’s net losses amount to $7,782,397 and accumulated deficit of $7,782,397. As of March 31, 2023, the Company had $444,253 in cash on hand and indebtedness of $22,854,174 consisting of bridge notes of $4,204,545, convertible debentures of $4,340,777 and notes payable of $15,094,764, of which $5,843,376 is due and payable in the next 12 months. Approximately $8,545,322 of our outstanding indebtedness is convertible into shares of Class A common stock, all of which such shares are being registered pursuant to this registration statement. Although none of our outstanding indebtedness is automatically or mandatorily convertible in connection with the offering, we have received written commitments from 70 convertible debenture holders, representing $3.9 million of outstanding indebtedness, to convert to shares of Class A common stock. In addition, the indebtedness formerly held by Dragon Dynamic Catalytic Bridge SAC Fund, Target Capital 1 LLC and 622 Capital LLC has been exchanged for newly issued shares of Series A Preferred Stock effective June 30, 2023. |

| 4 |

Acquisition Philosophy

As largely private equity-backed firms have fueled over a decade of rampant buying in the pet care industry, management believes certain identifiable trends have emerged:

| · | Valuations (multiples) have risen to untenable figures, causing downward pressure on the hospital income statements and causing private equity firms to pay massive sums for multiunit rollups. Recent examples include Berkshire Partners’ purchase of Vet Strategy in 2020 for a multiple of 22 times the target’s earnings before interest, tax, and depreciation and amortization (“EBITDA”). For example, TSG Consumers’ purchase of Pathway Vet Alliance for a multiple of 18 times the target’s EBITDA, in 2020; and Gryphon Investors’ acquisition of Heartland Veterinary Partners in 2019 for a multiple of 22 times the target’s EDITDA. SOLUTION: Purchase hospitals after a strict evaluation process at a proper market value which allows post purchase upside. |

| · | Staffing issues within the veterinary space remain the number one strategic barrier to growth and consistency, while earning potential for the veterinarian does not match their similarly credentialled counterparts in human medicine. SOLUTION: Provide a healthy working environment to clinicians which allows them to do what they do best while giving them equity in the overall organization. This dual aim provides greater stability and less turnover. In short, give doctors shared value for less worry and stress. |

| · | Other cyclical business factors necessitate a deep understanding of how veterinary hospitals and those that staff them must be supported. These managerial complexities are often not understood by investors or the teams they put in place to manage rollups. SOLUTION: Combine leadership with experience and understanding of veterinary medicine and operations and partner this leadership team with a skilled consulting team that leads the industry in growth of veterinary hospitals. |

These trends above, and others, are factors in an ongoing disconnect with the private equity backed model which keeps the largest share of monetary benefit held for those investors and leaders at senior level and those equity-backed entities typically working toward a four-to-six-year exit horizon. These factors coupled with double-digit multiples of earnings being paid for acquisitions can create pressure at hospital level to over produce and can tend to create a separation between management and the clinical workforce.

Inspire Veterinary Partners Strengths:

Inspire has entered the veterinary hospital ownership sector by leveraging several key processes and relationships which make the Company well-positioned to achieve the growth targets outline below under “—Anticipated Growth through Acquisitions” in the years ahead. Among these competencies and demonstrated capabilities:

| · | A purchase model which focuses on upside potential by identifying individual hospitals and multi-unit practices that have operational opportunity and can be improved within a 12-month window of acquisition but leverages a valuation process based on 3 years of weighted income, not the trailing twelve months or valuations based on projection. |

| · | Experienced Company leadership including veterinary professionals with decades of experience in veterinary operations, veterinary medicine, recruiting, campus outreach and training and development. Our Chief Executive Officer and Director, Kimball Carr, is also a Managing Director of Star Circle Advisory, LLC, an investment advisory and advisory services firm, and is President of Grom Coast Surf & Skate, a surf shop in Virginia Beach, Virginia. Our Chief Operating Officer, Vice-Chairman and Director, Charles Stith Keiser, is also Chief Executive Officer of Blue Heron Consulting, a veterinary consulting company serving hospitals of all sizes and specialties across North America. The Company currently has consulting agreements in place with each of Star Circle Advisory, LLC and Blue Heron Consulting, copies of which are attached as exhibits to this prospectus as exhibit 10.12 and exhibit 10.11, respectively. |

| · | Ability to leverage partner firm Blue Heron Consulting (“BHC”) in the following ways: |

| o | Geography – Utilizing a national consultancy model allows Inspire to buy hospitals opportunistically when the financials and personnel are right, without the need to work from a ‘hub and spoke’ model. |

| o | Operational oversight – with experienced medical and operational coaches, BHC has proven itself as the leading veterinary consulting firm in the United States whose clients’ experience growth that outpaces the industry. |

| 5 |

| o | Valuation – following processes previously perfected by BHC, Inspire Veterinary intends to utilize their consulting partners in assessing potential purchases, evaluating growth potential and determining the right cost basis before purchase, targeting those hospitals which have room for improvement and for which coaching will be provided by BHC post-acquisition. |

| · | Take advantage of the aforementioned decentralized ownership approach to expand into states with favorable state practice guidelines which allow for a maximum use of licensed and non-licensed technicians. |

| · | Build in a shared-value model from inception, rolling the initial financed operation into a share-held structure which allows principals and all key contributors to profit share and participate as shareholders. |

| · | Build unit productivity and financial models on reasonable patient counts and case load mix which allow for efficiency of staffing, competitive schedules for veterinary professionals and prevent arduous workloads that lead to turn and churn. |

Strategic Partnership with Subject Matter Experts

In addition to internal expertise and a leadership team which possesses deep understanding of the veterinary sector, Inspire leverages a close relationship with BHC, an industry leading and veterinary-only firm which has engaged with owners and grown veterinary practices all over the United States. Inspire and BHC have a partnership agreement which leverages BHC coaches as field support, working directly with hospitals, building and executing growth strategies. With Inspire board members also having leadership and ownership within BHC, this partnership is a mutually beneficial one and brings core competencies to each of the hospitals purchased by Inspire.

Recent Developments

Acquisitions

In December 2022, the Company closed on its purchase Williamsburg Animal Clinic in Williamsburg, Massachusetts and The Old 41 Animal Hospital in Bonita Springs, Florida. The Company now operates thirteen animal hospitals and veterinary practices across nine states.

Exchange of Senior Secured Indebtedness

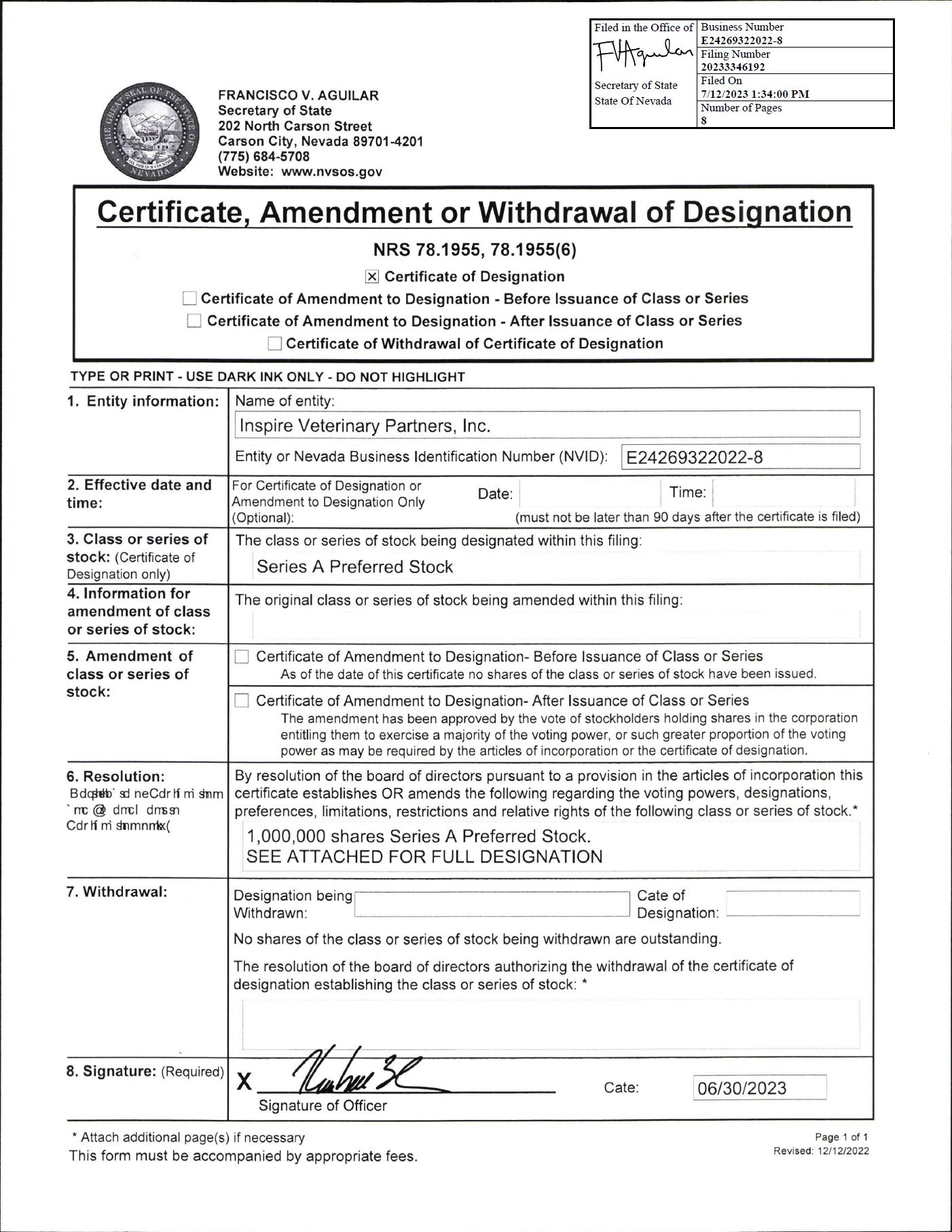

Effective June 30, 2023, the Company entered into exchange agreements (the “Exchange Agreements”) with each of Dragon Dynamic Catalytic Bridge SAC Fund, Target Capital 1 LLC and 622 Capital LLC, the Company’s senior secured lenders, pursuant to which the lenders exchanged their existing 12% original issue discount secured convertible notes for 29,296 shares, 352,771 shares, and 59,792 shares, respectively, of a new series of Series A Preferred Stock (442,458 shares of preferred stock in total).(the “Exchange”). As a result of the Exchange, all of the Company’s senior secured indebtedness with those lenders was extinguished. The Series A preferred stock earns a dividend rate equal to 12% of the stated rate per annum, which such dividend may be payable either in cash or in-kind at the sole option of the Company.

In connection with the Exchange, the Company amended its articles of incorporation by the filing of a certificate of designation for the Series A preferred stock (the “Series A Certificate of Designation”). One million shares of the Series A preferred stock are authorized under the Series A Certificate of Designation, with each such share having a stated value of $10.00 per share.

Holders of shares of the Series A preferred stock are entitled to a liquidation preference in the event of any dissolution, liquidation or winding up of the Company equal to the stated value plus any accrued and unpaid dividends on such stock. Holders of shares of Series A Preferred Stock are also entitled to convert such shares at any time and from time, at the option of such holder, into a number of shares of Class A common stock equal to the stated value divided by a conversion price. The conversion price is equal to 60% of the dollar volume-weighted average price for shares for the Company’s Class A common stock for the three trading days immediately preceding the date of the conversion. However, the conversion price can never be less than 50% of the per-share price for shares of Class A common stock during the Company’s initial public offering. For any conversion during the Company’s initial three days of market trading, the conversion price will be equal to 60% of the price for the Company’s underwritten initial public offering.

The Series A Certificate of Designation also contains certain beneficial ownership limitations on the holders of the Series A preferred stock, as more fully described in the Series A Certificate of Designation. The holders of the Series A preferred stock have the right to vote on all matters submitted to a vote of shareholders on an as-if-converted basis together with the holders of shares of the Company’s Class A and Class B common stock, voting together as a single class.

In connection with the Exchange, the Company also issued warrants (the “New Warrants”) to purchase additional shares of Class A common stock. The New Warrants were issued in exchange for the existing warrants held by the former senior secured lenders. The exercise price of the shares to be issued pursuant to the New Warrants is the price of the shares of Class A common stock to be issued in this offering. The number of shares to be issued upon exercise of the New Warrants is equal to the quotient of 75% of the outstanding Series A preferred stock value divided by the exercise price. Also, in connection with the Exchange, the Company entered into new registration rights agreements (the “New Registration Rights Agreements”) with each of Dragon Dynamic Catalytic Bridge SAC Fund, Target Capital 1 LLC and 622 Capital LLC, pursuant to which the Company has agreed to register the public resale of the shares of Class A common stock issuable upon conversion of the Series A Preferred Stock and upon exercise of the under the New Warrants. The New Registration Rights Agreements supersede in their entirety the prior registration rights agreements with the former senior secured lenders. If the Company does not close this offering on or before September 1, 2023, the Exchange Agreements will be deemed rescinded and the former senior secured convertible notes will be deemed reinstated.

The foregoing descriptions of the Series A Certificate of Designation, Exchange Agreements, New Warrants and New Registration Rights Agreements are qualified in its entirety by the full text of the same, which are attached as Exhibits 3.4, 4.1 through 4.15, and 10.23 through 10.25 to the registration statement of which this prospectus forms a part and are herein incorporated by reference.

| 6 |

SUMMARY OF RISK FACTORS

Risks Related to our Business

| · | We have a limited operating history, are not profitable and may never become profitable. |

| · | If our business plan is not successful, we may not be able to continue operations as a going concern and our shareholders may lose their entire investment in us. |

| · | We will be dependent on our senior management, especially our Chief Executive Officer Kimball Carr and our Chief Operating Officer Charles Stith Keiser, and each of them has significant responsibilities for other businesses. Neither Mr. Carr nor Mr. Keiser will be obligated to dedicate all of their time or resources or any specific portion of their time exclusively to us. |

| · | We may need to raise additional capital to achieve our goals. |

| · | The Company will incur significant increased expenses and administrative burdens as a public company, which could have an adverse effect on its business, financial condition and results of operations. |

| · | We may seek to raise additional funds in the future through debt financing which may impose operational restrictions on our business and may result in dilution to existing or future holders of our common shares. |

| · | We have generated net operating loss carryforwards for U.S. income tax purposes, but our ability to use these net operating losses may be limited by our inability to generate future taxable income. |

| · | If we fail to attract and keep senior management, we may be unable to successfully integrate acquisitions, scale our offerings of veterinary services, and deliver enhanced customer services, which may impact our results of operations and financial results. |

| · | Purchasing real estate with hospital acquisitions brings additional complexity and cost. |

| · | The animal health industry is highly competitive. |

| · | We may be unable to execute our growth strategies successfully or manage and sustain our growth, and as a result, our business may be adversely affected. |

| · | We may experience difficulties recruiting and retaining skilled veterinarians due to shortages that could disrupt our business. |

| · | The COVID-19 outbreak has disrupted our business, and any future outbreak of a health epidemic or other adverse public health developments could materially and adversely affect our business and operating results. |

| · | Our continued success is largely dependent on positive perceptions of our company. |

| · | Natural disasters and other events beyond our control could harm our business. |

Risks Related to Government Regulation

| · | Various government regulations could limit or delay our ability to develop and commercialize our services or otherwise negatively impact our business. |

| · | With state-to-state variability regarding the guidelines for ownership and operation of veterinary hospitals, we must be selective when acquiring hospitals and avoid states where ownership structures are prohibitive to corporate management or where licensure and certification are pre-requisites for full-fledged operation. |

| · | We may fail to comply with various state or federal regulations covering the dispensing of prescription pet medications, including controlled substances, through our veterinary services businesses, which may subject us to reprimands, sanctions, probations, fines, or suspensions. |

| · | We are subject to environmental, health, and safety laws and regulations that could result in costs to us. |

Risks Related to this Offering and Ownership of our Common Shares

| · | We are not currently traded on an exchange or market, and the number of shares being offered by us in our primary underwritten offering is significantly smaller than the number of shares being offered by our selling stockholders. If we are successful at being traded or listed, an active, liquid trading market for our common stock may not develop or be sustained. If and when an active market develops the price of our common stock may be volatile. |

| · | If securities or industry analysts do not publish research or reports about our company, or if they issue adverse or misleading opinions regarding us or our stock, our stock price and trading volume could decline. |

| · | We do not intend to pay cash dividends for the foreseeable future. |

| · | Our shares will be subordinate to all of our debts and liabilities, which increases the risk that you could lose your entire investment. |

| · | Our board of directors may authorize and issue shares of new classes of stock, including the issuance of up to 15,700.000 additional shares of Class B common stock, that could be superior to or adversely affect you as a holder of our Class A common stock. Although a majority of our board of directors are independent, our non-independent directors, officers, and their affiliates control approximately 85.4% of the voting power of our outstanding common stock. |

| · | If we are successful at obtaining quotation of or a listing for our shares, the trading price of our Common Stock is likely to be volatile, which could result in substantial losses to investors. |

| · | The sale or availability for sale of substantial amounts of our Class A common stock could adversely affect their market price. |

| · | We expect that the price of our Class A common shares will fluctuate substantially. |

| · | We are an “emerging growth company” and a “smaller reporting company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies and a smaller reporting companies will make our common stock less attractive to investors. |

| · | Our management will have broad discretion over the use of any net proceeds from this offering and you may not agree with how we use the proceeds, and the proceeds may not be invested successfully. |

| · | Investors in this offering may experience future dilution as a result of this and future equity offerings. |

| 7 |

THE OFFERING

| Class A common stock offered by us | 1,000,000 shares of Class A common stock. | ||

| Class A common stock offered by the Selling Stockholders | Up to 4,747,915 shares of Class A common stock previously issued in exempt private offerings, consisting of: | ||

| (i) | 925,001 shares of Class A common stock that are issued and outstanding as of the date of this prospectus; | ||

| (ii) | 663,688 shares of Class A common stock that are potentially issuable upon the exercise of warrants outstanding as of the date of this prospectus; | ||

| (iii) | 1,275,865 shares of Class A common stock that are potentially issuable upon the conversion of existing convertible subordinated debentures of the Company outstanding as of the date of this prospectus; and | ||

| (iv) | 408,500 shares of Class A common stock that are potentially issuable upon conversion of 408,500 shares of Class B common stock issue and outstanding as of the date of this prospectus held by non-affiliates. | ||

| (v) | 1,474,861 shares of Class A common stock that are potentially issuable upon conversion of 442,458 shares of Series A preferred stock. | ||

| Class A common stock to be outstanding after this offering | 5,434,871 shares of Class A common stock (or 5,584,871 shares if the underwriters exercise their option to purchase additional shares in full), based on an assumed initial public offering price of $5.00 per share and assuming the full conversion of all existing convertible indebtedness of the Company, full exercise of warrants outstanding as of the date of this prospectus and the conversion of all the newly-issued Series A Preferred Stock. | ||

| Class B common stock to be outstanding after the primary underwritten offering | 4,300,000 shares of Class B common stock, prior to any conversion of 408,500 shares of Class B common stock held by non-affiliates into shares of Class A common stock. Each share of Class B common stock entitles the holder of record to twenty-five (25) votes on all matters submitted to a vote of stockholders and is convertible into one share of Class A common stock at the option of the holder. | ||

| Option to purchase additional shares | We have granted the underwriters a 45-day option to purchase up to 150,000 additional shares of our Class A common stock at the public offering price, less the underwriting discounts and commissions. | ||

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $4,100,000 million (or approximately $4,790,000 million if the underwriters exercise their option to purchase additional shares in full), assuming an initial public offering price of $5.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

The principal purposes of this offering are to increase our capitalization and financial flexibility, create a public market for our Class A common stock and facilitate our future access to the capital markets. We currently intend to use the net proceeds we receive from this offering for veterinary hospital acquisitions, real estate acquisitions, hiring of additional personnel, capital improvements and general corporate purposes. See “Use of Proceeds.”

All proceeds from the sale of the Selling Stockholder Shares under this prospectus by the selling stockholders will be for the account of the selling stockholders. We will not receive any proceeds from the sale of the Selling Stockholder Shares. | ||

| Representative’s warrants | We will issue to Spartan Capital Securities, LLC, the lead underwriter or its designee(s), at the closing of this offering, warrants to purchase a number of shares of our common stock equal to 5% of the aggregate number of shares of common stock sold in this offering (including any shares sold pursuant to the underwriters’ option to purchase additional shares). The representative’s warrants will be exercisable on the effective date of the registration statement of which this prospectus is a part and will expire five years after the effective date of the registration statement of which this prospectus is a part. The exercise price of the representative’s warrants will equal 110% of the public offering price per share. See “Plan of Distribution.” | ||

| Risk factors | Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 11 and the other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our common stock. | ||

| 8 |

The initial number of shares of our Class A common stock to be outstanding after this offering is based on 970,457 shares of our Class A common stock outstanding as of the date of this prospectus. Assuming no conversion or exchange of existing convertible indebtedness or exercise of outstanding warrants (neither of which are mandatory in connection with the offering), then the Company expects there will be 1,970,457 shares of Class A common stock outstanding upon the consummation of the offering.

In addition, assuming the full conversion of existing convertible subordinated debentures of the Company, the conversion of all newly-issued Series A Preferred Stock, and the full exercise of warrants outstanding as of the date of this prospectus, the Company anticipate that the aggregate number of shares of our Class A common stock to be outstanding after this offering will be 5,434,871, consisting of: (i) 713,688 shares of Class A common stock that are potentially issuable upon the exercise of warrants outstanding as of the date of this prospectus; (ii) 1,275,865 shares of Class A common stock that are potentially issuable upon the conversion of existing convertible subordinated debentures of the Company outstanding as of the date of this prospectus (iii) 1,474,861 shares of Class A common stock that are potentially issuable upon conversion of 442,458 shares of Series A Preferred Stock; (iv) 970,457 shares of our Class A common stock outstanding as of the date of this prospectus; and (v) the 1,000,000 shares of Class A common stock being offering in the underwritten offering.

| Shares of Class A common stock outstanding before this offering (1) | 970,457 | |||

| Underwritten shares to be issued in this offering | 1,000,000 | |||

| Subtotal: | 1,970,457 | |||

| Underwriter’s full exercise of the over-allotment option | 150,000 | |||

| Subtotal (assuming full exercise of the over-allotment option and no conversion or exchange of existing indebtedness or exercise of outstanding warrants): | 2,120,457 | |||

| Shares of Class A common stock that are potentially issuable upon exercise of warrants outstanding as of the date of this prospectus (2) | 713,688 | |||

| Shares of Class A common stock that are potentially issuable upon conversion of outstanding convertible indebtedness of the Company (3) | 1,275,865 | |||

| Shares of Class A common stock that are potentially issuable upon conversion of the newly-issued Series A Preferred Stock(4) | 1,474,861 | |||

| Total shares of Class A common stock (no exercise of over-allotment option) on a fully diluted basis: (5) | 5,434,871 | |||

| Total shares of Class A common stock (full exercise of over-allotment option) on a fully diluted basis: (5) | 5,584,871 |

| (1) | Includes 45,456 shares of Class A common stock held by Messrs. Carr and Keiser which are not being registered in this offering. |

| (2) | Includes a warrant for 50,000 shares of Class A common stock issued to Mr. Carr in connection with his personal guaranty of certain loans to the Company; the shares of Class A common stock issuable upon exercise of the warrant are not being registered in this offering. |

| (3) | Consists of 1,275,865 shares of Class A common stock issuable upon conversion of outstanding convertible subordinated debentures of the Company, including the Company’s most recent issuance of convertible promissory notes in February and March of 2023. |

| (4) | Represents 442,458 shares of the newly-issued Series A Preferred Stock convertible into 1,474,861 Class A common stock assuming an applicable market price of $5.00 per share. |

| (5) | Excludes 4,300,000 shares of Class B common stock issued and outstanding as of the time of this prospectus. Each share of Class B common stock is entitled to 25 votes per share and is convertible into one share of Class A common stock. |

| 9 |

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize our consolidated financial data for the periods and as of the dates indicated. The summary statements of operations data for the years ended December 31, 2022 and 2021 are derived from our audited consolidated financial statements and related notes included elsewhere in this prospectus. The summary statements of operations data for the three months ended March 31, 2023 and 2022 and balance sheet data as of March 31, 2023 are derived from our unaudited interim condensed consolidated financial statements and related notes included elsewhere in this prospectus. The unaudited interim condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles and, in the opinion of management, reflect all normal, recurring adjustments that are necessary to state fairly the unaudited interim condensed financial statements. Our historical results are not necessarily indicative of results that may be expected in the future, and the results for the three months ended March 31, 2023 are not necessarily indicative of results that may be expected for the full year or any other period. You should read the summary financial data together with our consolidated financial statements and related notes appearing elsewhere in this prospectus and the information in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The summary financial data in this section are not intended to replace our consolidated financial statements and the related notes and are qualified in their entirety by the consolidated financial statements and related notes included elsewhere in this prospectus.

Consolidated Statements of Operations for the Years Ended December 31, 2022 and 2021 and Three Months Ended March 31, 2023 and 2022 and Select Balance Sheet Data as of December 31, 2022 and March 31, 2023:

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||

| 2022 | 2021 | 2023 | 2022 | |||||||||||||

| (As Restated) | ||||||||||||||||

| Service revenue | $ | 7,032,800 | $ | 1,813,621 | $ | 3,072,885 | $ | 982,447 | ||||||||

| Product revenue | 2,801,978 | 735,513 | 1,209,630 | 429,532 | ||||||||||||

| Total revenue | 9,834,778 | 2,549,134 | 4,282,515 | 1,411,979 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Cost of service revenue (exclusive of depreciation and amortization, shown separately below) | 5,308,104 | 1,284,407 | 2,307,903 | 720,953 | ||||||||||||

| Cost of product revenue (exclusive of depreciation and amortization, shown separately below) | 1,981,046 | 435,437 | 879,400 | 279,559 | ||||||||||||

| General and administrative expenses | 5,467,642 | 1,792,046 | 1,801,659 | 893,175 | ||||||||||||

| Depreciation and amortization | 596,124 | 84,465 | 298,492 | 82,499 | ||||||||||||

| Total operating expenses | 13,352,916 | 3,596,355 | 5,287,454 | 1,976,186 | ||||||||||||

| Loss from operations | (3,518,138 | ) | (1,047,221 | ) | (1,004,939 | ) | (564,207 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Interest income | 1,021 | 161 | 1 | 20 | ||||||||||||

| Interest expense | (1,425,260 | ) | (194,811 | ) | (545,435 | ) | (389,045 | ) | ||||||||

| Other expenses | 357 | (14,861 | ) | 11,424 | 392 | |||||||||||

| Total other expense | (1,423,882 | ) | (209,511 | ) | (534,010 | ) | (388,633 | ) | ||||||||

| Loss before income taxes | (4,942,020 | ) | (1,256,732 | ) | (1,538,949 | ) | (952,840 | ) | ||||||||

| Benefit (provision) for income taxes | 30,094 | (74,330 | ) | - | 30,094 | |||||||||||

| Net loss | $ | (4,911,926 | ) | $ | (1,331,062 | ) | $ | (1,538,949 | ) | $ | (922,746 | ) | ||||

| Net loss per Class A and B common shares: | ||||||||||||||||

| Basic and diluted | $ | (0.95 | ) | $ | (0.27 | ) | $ | (0.29 | ) | $ | (0.18 | ) | ||||

| Weighted average shares outstanding per Class A and B common shares: | ||||||||||||||||

| Basic and diluted | 5,160,182 | 5,001,699 | 5,270,457 | 5,145,456 | ||||||||||||

| |

As of December 31, 2022 |

|

|

As of March 31, 2022 (Unaudited) |

|

|||

| Selected Balance Sheet Data (end of period): | ||||||||

| Cash and cash equivalent | $ | 444,253 | $ | 593,865 | ||||

| Total assets | 20,185,695 | 20,053,385 | ||||||

| Total debt | 22,854,174 | 23,640,086 | ||||||

| Total liabilities | 25,321,176 | 26,725,114 | ||||||

| Total stockholders’ deficit | $ | (5,135,481 | ) | $ | (6,671,729 | ) | ||

| 10 |

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the accompanying notes thereto included elsewhere in this prospectus, before deciding whether to invest in our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of or that we deem immaterial may also become important factors that adversely affect our business. The realization of any of these risks and uncertainties could have a material adverse effect on our reputation, business, financial condition, results of operations, growth and future prospects, as well as our ability to accomplish our strategic objectives. In that event, the market price of our common stock could decline and you could lose part or all of your investment.

Unless the context otherwise requires, references in this section to “we,” “us,” “our,” “Inspire Veterinary” and the “Company” refer to Inspire Veterinary Partners, Inc.

Risks Related to our Business

We have a limited operating history, are not profitable and may never become profitable.

We have not generated any net profits to date, and we expect to continue to incur significant acquisition related costs and other expenses. Our net loss for the three months ended March 31, 2023 was $(1,538,949) and for the years ended December 31, 2022 and 2021 was $(4,911,926) and $(1,331,062), respectively. Our accumulated deficit as of March 31, 2023 was $(7,782,397). As of March 31, 2023, we had total stockholders’ deficit of approximately $(6,671,729). We expect to continue to incur net losses for the foreseeable future, as we continue our development and acquisition of veterinary hospitals and related veterinary servicing activities. If we fail to achieve or maintain profitability, then we may be unable to continue our operations at planned levels and be forced to reduce or cease operations.

If our business plan is not successful, we may not be able to continue operations as a going concern and our shareholders may lose their entire investment in us.

As discussed in the Notes to Financial Statements included in this Registration Statement, as of March 31, 2023, we had $593,865 cash out of which $0 will be used to pay the unpaid amount of the estimated costs of this offering.

If we fail to raise sufficient capital in this offering, we will have to explore other financing activities to provide us with the liquidity and capital resources we need to meet our working capital requirements and to make capital investments in connection with ongoing operations. We cannot give assurance that we will be able to secure the necessary capital when needed. Consequently, we raise substantial doubt that we will be able to continue operations as a going concern, and our independent auditors included an explanatory paragraph regarding this uncertainty in their report on our financial statements for the year ended December 31, 2022. Our ability to continue as a going concern is dependent upon our generating cash flow sufficient to fund operations and reducing operating expenses. Our business plans may not be successful in addressing the cash flow issues. If we cannot continue as a going concern, our shareholders may lose their entire investment in us. If we fail to raise sufficient capital in this offering, we will have to explore other financing activities to provide us with the liquidity and capital resources we need to meet our working capital requirements and to make capital investments in connection with ongoing operations. We cannot give assurance that we will be able to secure the necessary capital when needed. Consequently, we raise substantial doubt that we will be able to continue operations as a going concern, and our independent auditors included an explanatory paragraph regarding this uncertainty in their report on our financial statements for the years ended December 31, 2022 and 2021. Our ability to continue as a going concern is dependent upon our generating cash flow sufficient to fund operations and reducing operating expenses. Our business plans may not be successful in addressing the cash flow issues. If we cannot continue as a going concern, our shareholders may lose their entire investment in us.

We will be dependent on our senior management, especially our Chief Executive Officer Kimball Carr and our Chief Operating Officer Charles Stith Keiser, and each of them has significant responsibilities for other businesses. Neither Mr. Carr nor Mr. Keiser will be obligated to dedicate all of their time or resources or any specific portion of their time exclusively to us.

We will be dependent on our senior management, especially our Chief Executive Officer Kimball Carr and our Chief Operating Officer Charles Stith Keiser and we may not find a suitable replacement for such senior management if they leave or otherwise become unavailable to us. Each of them has significant responsibilities for other businesses. Mr. Carr is also a Managing Director of Star Circle Advisory, LLC, an investment advisory and advisory services firm, and is President of Grom Coast Surf & Skate, a surf shop in Virginia Beach, Virginia. Mr. Keiser is also Chief Executive Officer of Blue Heron Consulting, a veterinary consulting company serving hospitals of all sizes and specialties across North America. Neither Mr. Carr nor Mr. Keiser will be obligated to dedicate all of their time or resources or any specific portion of their time exclusively to us. Accordingly, these individuals may not always be able to devote sufficient time to the management of our business. As a result, we may not receive the level of managerial support and assistance that we might require, and our results of operations may suffer.

| 11 |

We may need to raise additional capital to achieve our goals.

We currently incur operate at a net loss and a comprehensive loss and anticipate incurring additional expenses as a public company. We are also seeking to identify potential complementary acquisition opportunities in the veterinary services and animal health sectors. Some of our anticipated future expenditures will include: costs of identifying additional potential acquisitions; costs of obtaining regulatory approvals; and costs associated with marketing and selling our services. We also may incur unanticipated costs. Because the outcome of our development activities and commercialization efforts is inherently uncertain, the actual amounts necessary to successfully complete the development and commercialization of our existing or future veterinary services s may be greater or less than we anticipate.

As a result, we will need to obtain additional capital to fund the development of our business. Except for our WealthSouth (a division of Farmers National Bank of Danville, Kentucky) master lending and credit facility, we have no master agreements or arrangements with respect to any financings, and any such financings may result in dilution to our shareholders, the imposition of debt covenants and repayment obligations or other restrictions that may adversely affect our business or the value of our common shares.

Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available to us on a timely basis, we may be required to delay, limit, reduce or terminate one or more of our veterinary service programs or any future commercialization efforts.

The Company will incur significant increased expenses and administrative burdens as a public company, which could have an adverse effect on its business, financial condition and results of operations.

The Company will face a significant increase in insurance, legal, accounting, administrative and other costs and expenses as a public company that none of the formerly corporate or company privately-held acquisition targets that we may attempt to purchase incur as a private company. The Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley Act”), including the requirements of Section 404, as well as rules and regulations subsequently implemented by the Securities and Exchange Commission (the “Commission”), the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and the rules and regulations promulgated and to be promulgated thereunder, the Public Company Accounting Oversight Board, the Commission and the securities exchanges, impose additional reporting and other obligations on public companies. Compliance with public company requirements will increase costs and make certain activities more time-consuming. A number of those requirements will require the Company to carry out activities that it previously has not done. For example, the Company will adopt new internal controls and disclosure controls and procedures. In addition, additional expenses associated with the Commission’s reporting requirements will be incurred. Furthermore, if any issues in complying with those requirements are identified (for example, if the auditors identify a material weakness or significant deficiency in the internal control over financial reporting), The Company could incur additional costs rectifying those issues, and the existence of those issues could adversely affect the Company’s reputation or investor perceptions of it. Being a public company could make it more difficult or costly for the Company to obtain certain types of insurance, including director and officer liability insurance, and the Company may be forced to accept reduced policy limits and coverage with increased self-retention risk or incur substantially higher costs to obtain the same or similar coverage. Being a public company could also make it more difficult and expensive for the Company to attract and retain qualified persons to serve on the board, board committees or as executive officers. Furthermore, if the Company is unable to satisfy its obligations as a public company, it could be subject to fines, sanctions and other regulatory action and potentially civil litigation.

The additional reporting and other obligations imposed by various rules and regulations applicable to public companies will increase legal and financial compliance costs and the costs of related legal, accounting and administrative activities. These increased costs will require the Company to divert a significant amount of money that could otherwise be used to expand the business and achieve strategic objectives. Advocacy efforts by shareholders and third parties may also prompt additional changes in governance and reporting requirements, which could further increase costs.

| 12 |

If we fail to manage our growth effectively, our brand, business and operating results could be harmed.

We have experienced, and expect to continue to experience, rapid growth in our headcount and operations, which places substantial demands on management and our operational infrastructure. We will need to significantly expand our organization and systems to support our future expected growth. If we fail to manage our growth effectively, we will not be successful, and our business could fail. To manage the expected growth of our operations and personnel, we will be required to improve existing, and implement new, transaction-processing, operational and financial systems, procedures and controls. We will also be required to expand our finance, administrative and operations staff. We intend to continue making substantial investments in our technology, sales and data infrastructure. As we continue to grow, we must effectively integrate, develop and motivate a significant number of new employees, while maintaining the beneficial aspects of our existing corporate culture, which we believe fosters innovation, teamwork and a passion for our veterinary services and clients. In addition, our revenue may not grow at the same rate as the expansion of our business. There can be no assurance that our current and planned personnel, systems, procedures and controls will be adequate to support our future operations or that management will be able to hire, train, retrain, motivate and manage required personnel. If we are unable to manage our growth effectively, the quality of our platform, efficiency of our operations, and management of our expenses could suffer, which could negatively impact our brand, business, operating results and profitability.

We may seek to grow our business through acquisitions of, or investments in, new or complementary businesses, and facilities, or through strategic alliances, and the failure to manage these acquisitions or strategic alliances, or to integrate them with our existing business, could have a material adverse effect on us.

The pet care industry is highly fragmented. We have completed acquisitions in the past and may pursue expansion, acquisition, investment and other strategic alliance opportunities in the future. If we are unable to manage acquisitions, or strategic ventures, or integrate any acquired businesses effectively, we may not realize the expected benefits from the transaction relative to the consideration paid, and our business, financial condition, and results of operations may be adversely affected. Acquisitions, investments and other strategic alliances involve numerous risks, including:

| · | problems integrating the acquired business, facilities or services, including issues maintaining uniform standards, procedures, controls and policies; |

| · | unanticipated costs associated with acquisitions or strategic alliances; |

| · | losses we may incur as a result of declines in the value of an investment or as a result of incorporating an investee’s financial performance into our financial results; |

| · | diversion of management’s attention from our existing business; |

| · | risks associated with entering new markets in which we may have limited or no experience; |

| · | potential loss of key employees of acquired businesses; |

| · | the risks associated with businesses we acquire or invest in, which may differ from or be more significant than the risks our other businesses face; |

| · | potential unknown liabilities associated with a business we acquire or in which we invest; and |

| · | increased legal and accounting compliance costs. |

Our ability to successfully grow through strategic transactions depends upon our ability to identify, negotiate, complete and integrate suitable target businesses, facilities and services and to obtain any necessary financing. These efforts could be expensive and time-consuming and may disrupt our ongoing business and prevent management from focusing on our operations. As a result of future strategic transactions, we might need to issue additional equity securities, spend our cash, or incur debt (which may only be available on unfavorable terms, if at all), contingent liabilities, or amortization expenses related to intangible assets, any of which could reduce our profitability and harm our business. If we are unable to identify suitable acquisitions, investments or strategic relationships, or if we are unable to integrate any acquired businesses, facilities and services effectively, our business, financial condition, and results of operations could be materially and adversely affected. Also, while we employ several different methodologies to assess potential business opportunities, the new businesses or investments may not meet or exceed our expectations or desired objectives.

| 13 |

We may seek to raise additional funds in the future through debt financing which may impose operational restrictions on our business and may result in dilution to existing or future holders of our common shares.

We expect that we will need to raise additional capital in the future to help fund our business operations. Debt financing, if available, may require restrictive covenants, which may limit our operating flexibility and may restrict or prohibit us from:

| · | paying dividends or making certain distributions, investments and other restricted payments; |

| · | incurring additional indebtedness or issuing certain preferred shares; |

| · | selling some or all of our assets; |

| · | entering into transactions with affiliates; |

| · | creating certain liens or encumbrances; |

| · | merging, consolidating, selling or otherwise disposing of all or substantially all of our assets; and |

| · | designating our subsidiaries as unrestricted subsidiaries. |

Debt financing may also involve debt instruments that are convertible into or exercisable for our common shares. The conversion of the debt-to-equity financing may dilute the equity position of our existing shareholders.

We may acquire other businesses or form joint ventures that may be unsuccessful and could adversely dilute your ownership of our company.

As part of our business strategy, we may pursue in-licenses or acquisitions of other complementary assets and businesses and may also pursue strategic alliances. We have no experience in acquiring other assets or businesses and have limited experience in forming such alliances. We may not be able to successfully integrate any acquisitions into our existing business, and we could assume unknown or contingent liabilities or become subject to possible stockholder claims in connection with any related-party or third-party acquisitions or other transactions. We also could experience adverse effects on our reported results of operations from acquisition-related charges, amortization of acquired technology and other intangibles and impairment charges relating to write-offs of goodwill and other intangible assets from time to time following an acquisition. Integration of an acquired company requires management resources that otherwise would be available for ongoing development of our existing business. We may not realize the anticipated benefits of any acquisition, technology license or strategic alliance.

To finance future acquisitions, we may choose to issue shares of our common stock as consideration, which would dilute your ownership interest in us. Alternatively, it may be necessary for us to raise additional funds through public or private financings. Additional funds may not be available on terms that are favorable to us and, in the case of equity financings, may result in dilution to our stockholders.

We have generated net operating loss carryforwards for U.S. income tax purposes, but our ability to use these net operating losses may be limited by our inability to generate future taxable income.

Our U.S. businesses have generated consolidated net operating loss carryforwards (“U.S. NOLs”) for U.S. federal and state income tax purposes of $8,087,467 as of March 31, 2023. These U.S. NOLs can be available to reduce income taxes that might otherwise be incurred on future U.S. taxable income. The utilization of these U.S. NOLs would have a positive effect on our cash flow. However, there can be no assurance that we will generate the taxable income in the future necessary to utilize these U.S. NOLs and realize the positive cash flow benefit. A portion of our U.S. NOLs have expiration dates. There can be no assurance that, if and when we generate taxable income in the future from operations or the sale of assets or businesses, we will generate such taxable income before such portion of our U.S. NOLs expire. Under the Tax Cuts and Jobs Act (the “TCJA”), federal NOLs generated in tax years ending after December 31, 2017 may be carried forward indefinitely. Under the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”), federal NOL carryforwards arising in tax years beginning after December 31, 2017 and before January 1, 2021 may be carried back to each of the five tax years preceding the tax year of such loss. Due to our cumulative losses through December 31, 2022 we do not anticipate that such provision of the CARES Act will be relevant to us. The deductibility of federal NOLs may be limited. It is uncertain if and to what extent various states will conform to TCJA or the CARES Act.

| 14 |

Our ability to utilize the U.S. NOLs after an “ownership change” is subject to the rules of the United States Internal Revenue Code of 1986, as amended (the “Code”) Section 382. An ownership change occurs if, among other things, the shareholders (or specified groups of shareholders) who own or have owned, directly or indirectly, 5% percent or more of the value of our shares or are otherwise treated as 5% percent shareholders under Code Section 382 and the Treasury Regulations promulgated thereunder increase their aggregate percentage ownership of the value of our shares by more than 50 percentage points over the lowest percentage of the value of the shares owned by these shareholders over a three-year rolling period. An ownership change could also be triggered by other activities, including the sale of our shares that are owned by our 5% shareholders. In the event of an ownership change, Section 382 would impose an annual limitation on the amount of taxable income we may offset with U.S. NOLs. This annual limitation is generally equal to the product of the value of our shares on the date of the ownership change multiplied by the long-term tax-exempt rate in effect on the date of the ownership change. The long-term tax-exempt rate is published monthly by the IRS. Any unused Section 382 annual limitation may be carried over to later years until the applicable expiration date for the respective U.S. NOLs (if any). In the event an ownership change as defined under Section 382 were to occur, our ability to utilize our U.S. NOLs would become substantially limited. The consequence of this limitation would be the potential loss of a significant future cash flow benefit because we would no longer be able to substantially offset future taxable income with U.S. NOLs. There can be no assurance that such ownership change will not occur in the future.

If we fail to attract and keep senior management, we may be unable to successfully integrate acquisitions, scale our offerings of veterinary services, and deliver enhanced customer services, which may impact our results of operations and financial results.

Our success depends in part on our continued ability to attract, retain and motivate highly qualified management and senior personnel. We are highly dependent upon our senior management, particularly Kimball Carr and Charles Stith Keiser. The loss of services of any of these individuals could negatively impact our ability to successfully integrate acquisitions, scale our employee roster, and deliver enhanced veterinary services, which may impact our results of operations and financial results. Although we have entered an employment agreement with Kimball Carr, our Chairman, Chief Executive Officer and President, for one 3-year term (automatically extending for one-year terms thereafter) there can be no assurance that Mr. Carr or any other senior executive officer will extend their terms of service. The Company has not entered into an employment agreement with Charles Stith Keiser.