As filed with the U.S. Securities and Exchange Commission on August 12, 2024

Registration No. 333-[-]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrants name into English)

| 3990 | Not Applicable | |||

| (State

or Other Jurisdiction of Incorporation or Organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification No.) |

Tel:

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cogency Global, Inc.

Tel:

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| David L. Ficksman, Esq. | William S. Rosenstadt, Esq. | |

| R. Joilene Wood, Esq. | Yarona L. Yieh, Esq. | |

| Troy Gould PC | Ortoli Rosenstadt LLP | |

| 1801 Century Park East, Suite 1600 | 366 Madison Avenue, 3rd Floor | |

| Los Angeles, CA 90067-2367 | New York, NY 10017 | |

| Tel: (310) 553-4441 | Tel: (212) 588-0022 |

Approximate date of commencement of proposed sale to the public: Promptly after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act.

† The term new or revised financial accounting standard refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| ● | Public Offering Prospectus. A prospectus to be used for the initial public offering of 2,250,000 Ordinary Shares of US$0.001 par value each (“Ordinary Shares”) of the Registrant (the “Public Offering Prospectus”), which Ordinary Shares are offered by the Company through the underwriters named in the Underwriting section of the Public Offering Prospectus. | |

| ● | Resale Prospectus. A prospectus to be used for the potential resale by the Resale Prospectus Shareholders identified therein of 1,884,337 Ordinary Shares of the Registrant (the “Resale Prospectus”), which Ordinary Shares will only be offered once such shares are listed on the Nasdaq Capital Market and only be offered for sale after the 2,250,000 Ordinary Shares in the Public Offering Prospectus are sold. |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| ● | they contain different front covers; | |

| ● | all references in the Public Offering Prospectus to “this offering” will be changed to “the IPO,” defined as the underwritten initial public offering of our Ordinary Shares, in the Resale Prospectus; | |

| ● | all references in the Public Offering Prospectus to “underwriters” will be changed to “underwriters of the IPO” in the Resale Prospectus; | |

| ● | they contain different “Use of Proceeds” sections; | |

| ● | the Public Offering Prospectus contains a “Principal Shareholder” section and the Resale Prospectus contains a “Selling Shareholder” section; | |

| ● | they contain different “Summary — The Offering” sections; | |

| ● | the section “Shares Eligible For Future Sale — Resale Prospectus Shareholders Resale Prospectus” from the Public Offering Prospectus is deleted from the Resale Prospectus; | |

| ● | the “Underwriting” section from the Public Offering Prospectus is deleted from the Resale Prospectus and a Plan of Distribution section is inserted in its place; | |

| ● | the “Legal Matters” section in the Resale Prospectus deletes the reference to counsel for the underwriters; and | |

| ● | they contain different back covers. |

The Registrant has included in this Registration Statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the initial public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the Resale Prospectus Shareholders.

| ii |

The information in this prospectus is not complete and may be changed or supplemented. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION AUGUST 12, 2024

2,250,000 Ordinary Shares

This is an initial public offering of our ordinary shares, US$0.001 par value per share of FBS Global Limited. We are offering, on a firm commitment engagement basis, 2,250,000 Ordinary Shares to be sold pursuant to this prospectus. We anticipate that the initial public offering price of the Ordinary Shares will be between US$4.50 and US$5.00 per Ordinary Share. In addition, up to 1,884,337 Ordinary Shares will be offered for potential resale by the Resale Prospectus Shareholders pursuant to the Resale Prospectus only once the initial public offering has closed. We will not receive any proceeds from the sale of the Ordinary Shares by the Resale Prospectus Shareholders.

Prior to this offering, there has been no public market for our Ordinary Shares. We have applied to list our Ordinary Shares on Nasdaq under the symbol “FBGL.” This offering is contingent upon the listing of our Ordinary Shares on the Nasdaq Capital Market or another national securities exchange. There can be no assurance that we will be successful in listing our Ordinary Shares on the Nasdaq or another national securities exchange.

Investing in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 14 to read about factors you should consider before buying our Ordinary Shares.

We are an “Emerging Growth Company” and a “Foreign Private Issuer” under applicable U.S. federal securities laws and, as such, are eligible for reduced public company reporting requirements. Please see “Implications of Being an Emerging Growth Company” and “Implications of Being a Foreign Private Issuer” beginning on page 10 of this prospectus for more information.

We are a holding company that is incorporated in the Cayman Islands. As a holding company with no operations, we conduct all of our operations through our subsidiary in Singapore. The Ordinary Shares offered in this offering are shares of the holding company that is incorporated in the Cayman Islands. Investors of our Ordinary Shares should be aware that they may never directly hold equity interests in our subsidiaries.

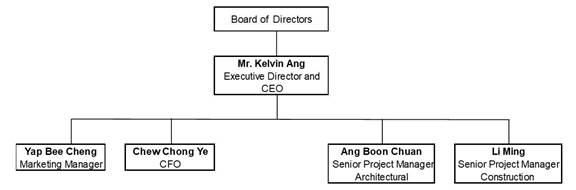

Upon completion of this offering, our issued and outstanding share capital will consist of 13,500,000 Ordinary Shares. We will be a controlled company as defined under Nasdaq Marketplace Rule 5615(c) because, immediately after the completion of this offering, Kelvin Ang, our controlling shareholder, will own approximately 69.4% of our total issued and outstanding Ordinary Shares, representing approximately 69.4% of the total voting power (assuming he sells all of the 800,000 shares he is offering under the Resale Prospectus).

Neither the United States Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| PER SHARE | TOTAL WITHOUT OVER-ALLOTMENT OPTION | TOTAL WITH OVER-ALLOTMENT OPTION | ||||||||||

| Initial public offering price(1) | US$ | 4.50 | US$ | 10,125,000 | 11,643,750 | |||||||

| Underwriting discounts(2) | US$ | 0.32 | US$ | 708,750 | 815,063 | |||||||

| Proceeds to us, before expenses(3) | US$ | 4.18 | US$ | 9,416,250 | 10,828,688 | |||||||

(1) Initial public offering price per share is assumed to be US$4.50.

(2) We have agreed to pay the underwriters a discount equal to 7.0% of the gross proceeds of the offering. This table does not include a non-accountable expense allowance equal to 1.5% of the gross proceeds of this offering payable to the underwriters. For a description of the other compensation to be received by the underwriters, see “Underwriting” beginning on page 105.

(3) Excludes fees and expenses payable to the underwriters. The total amount of underwriters’ expenses related to this offering is set forth in the section entitled “Expenses Relating to This Offering” on page 100.

If we complete this offering, net proceeds will be delivered to us on the closing date.

We have granted a 45-day option to the underwriters to purchase up to an additional 337,000 Ordinary Shares, equal to 15% of the number of Ordinary Shares sold in this offering by the Company solely to cover over-allotment.

The underwriters expect to deliver the Ordinary Shares to the purchasers against payment on or about [●], 2024.

You should not assume that the information contained in the registration statement to which this prospectus is a part is accurate as of any date other than the date hereof, regardless of the time of delivery of this prospectus or of any sale of the Ordinary Shares being registered in the registration statement of which this prospectus forms a part.

No dealer, salesperson or any other person is authorized to give any information or make any representations in connection with this offering other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction in which the offer or solicitation is not authorized or is unlawful.

WallachBeth Capital, LLC

The date of this prospectus is [●], 2024.

| iii |

TABLE OF CONTENTS

Until [●], 2024 (the 25th day after the date of this prospectus), all dealers that effect transactions in these Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

| 1 |

ABOUT THIS PROSPECTUS

Neither we nor any of the underwriters have authorized anyone to provide you with any information or to make any representations other than as contained in this prospectus or in any related free writing prospectus. Neither we nor the underwriters take responsibility for, and provide no assurance about the reliability of, any information that others may give you. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Ordinary Shares and the distribution of this prospectus outside the United States.

We obtained statistical data, market data and other industry data and forecasts used in this prospectus from market research, publicly available information and industry publications. While we believe that the statistical data, industry data, forecasts and market research are reliable, we have not independently verified the data. See “Market and Industry Data.”

PRESENTATION OF FINANCIAL INFORMATION

Basis of Presentation

Unless otherwise indicated, all financial information contained in this prospectus is prepared and presented in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP” or “GAAP”) and pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”).

Certain amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, amounts, percentages and other figures shown as totals in certain tables or charts may not be the arithmetic aggregation of those that precede them and amounts and figures expressed as percentages in the text may not total 100% or, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

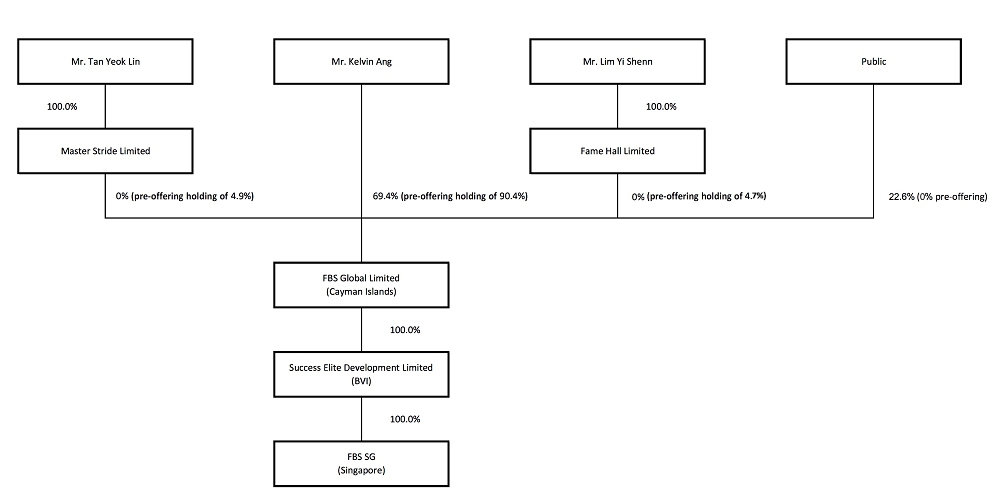

For the sake of undertaking a public offering of our Ordinary Shares, a reorganization of the Company’s legal structure was completed on August 2, 2022. The reorganization involved the incorporation of FBS Cayman, and its wholly-owned subsidiary, SEDL; and the transfer of all equity ownership of FBS SG to SEDL from the former shareholders of FBS SG and the transfer of all equity ownership of SEDL to FBS Cayman. Pursuant to the incorporation of FBS Cayman and in consideration of the transfer, the Company issued an aggregate of 11,250,000 ordinary shares with par value $0.001 per share.

After the reorganization, FBS Cayman owns 100% equity interests of SEDL and FBS SG. The controlling shareholder of FBS Cayman is same as that of FBS SG prior to the reorganization.

The series of reorganizing transactions resulting in 11,250,000 Ordinary Shares issued and outstanding have been retroactively restated to the beginning of the first period presented herein.

Financial Information in U.S. Dollars

Our reporting currency is the Singapore dollar. This prospectus also contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, translations of balances in the consolidated balance sheets, consolidated statements of income and comprehensive income, consolidated statements of change in shareholders’ equity, and consolidated statements of cash flows from SGD into USD are solely for the convenience of the reader and were calculated at the rate of SGD 1.00 to USD 0.75 as of and for the year ended December 31, 2022 and SG 1.00 to USD 0.74 for the year ended December 31, 2023, each representing the noon buying rate in the City of New York for cable transfers of SGD as certified for customs purposes by the Federal Reserve Bank of New York on the last trading day of December 31, 2022 and December 31, 2023, respectively. We make no representation that the SGD amounts represent or could have been, or could be, converted, realized or settled into USD at that rate, or at any particular rate or at all.

| 2 |

MARKET AND INDUSTRY DATA

Certain market data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, reports of governmental and international agencies and industry publications and surveys, in particular, regular market and industry reports issued by BCA and Ministry of Trade and Industry of Singapore. Industry publications and third-party research, surveys and reports generally indicate that their information has been obtained from sources believed to be reliable. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Industry Overview” and “Business.” These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “believe”, “plan”, “expect”, “intend”, “should”, “seek”, “estimate”, “will”, “aim” and “anticipate”, or other similar expressions, but these are not the exclusive means of identifying such statements. All statements other than statements of historical facts included in this document, including those regarding future financial position and results, business strategy, plans and objectives of management for future operations (including development plans and dividends) and statements on future industry growth are forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements which are forward-looking statements, including in our periodic reports that we will file with the SEC, other information sent to our shareholders and other written materials.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Risk Factors” and the following:

| ● | our business and operating strategies and our various measures to implement such strategies; | |

| ● | our operations and business prospects, including development and capital expenditure plans for our existing business; | |

| ● | changes in policies, legislation, regulations or practices in the industry and those countries or territories in which we operate that may affect our business operations; | |

| ● | our financial condition, results of operations and dividend policy; | |

| ● | changes in political and economic conditions and competition in the area in which we operate, including a downturn in the general economy; | |

| ● | the regulatory environment and industry outlook in general; | |

| ● | future developments in the construction industry and actions of our competitors; | |

| ● | catastrophic losses from man-made or natural disasters, such as fires, floods, windstorms, earthquakes, diseases, epidemics, other adverse weather conditions or natural disasters, war, international or domestic terrorism, civil disturbances and other political or social occurrences; |

| 3 |

| ● | the loss of key personnel and the inability to replace such personnel on a timely basis or on terms acceptable to us; | |

| ● | the overall economic environment and general market and economic conditions in the jurisdictions in which we operate; | |

| ● | our ability to execute our strategies; | |

| ● | changes in the need for capital and the availability of financing and capital to fund those needs; | |

| ● | our ability to anticipate and respond to changes in the markets in which we operate, and in client demands, trends and preferences; | |

| ● | exchange rate fluctuations, including fluctuations in the exchange rates of currencies that are used in our business; | |

| ● | changes in interest rates or rates of inflation; and | |

| ● | legal, regulatory and other proceedings arising out of our operations. |

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

This prospectus contains certain data and information that we obtained from various government and private publications. Statistical data in these publications also include projections based on a number of assumptions. The markets for the construction industry may not grow at the rate projected by such market data, or at all. Failure of this industry to grow at the projected rate may have a material and adverse effect on our business and the market price of our Ordinary Shares. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

| 4 |

DEFINITIONS

“Amended Memorandum of Association” or “Amended Memorandum” means the amended and restated memorandum of association of our Company adopted on January 30, 2023 and as amended from time to time, a copy of which is filed as Exhibit 3.1 to our Registration Statement filed with the SEC on March 16, 2023.

“Amended and Restated Articles of Association” or “Amended Articles of Association” means the second amended and restated articles of association of our Company adopted on March 28, 2023, as amended from time to time, a copy of which is filed as Exhibit 3.2 to our Registration Statement filed with the SEC on July 27, 2023.

“ASEAN” means the Association of Southeast Asian Nations.

“BCA” means the Building and Construction Authority in Singapore.

“Business Day” means a day (other than a Saturday, Sunday or public holiday in the U.S.) on which licensed banks in the U.S. are generally open for normal business to the public.

“BVI” means the British Virgin Islands.

“CAGR” means compound annual growth rate.

“Company,” “our Company,” or “FBS Cayman” means FBS Global Limited, an exempted company incorporated in the Cayman Islands with limited liability under the Companies Act on March 10, 2022.

“Companies Act” means the Companies Act (As Revised) of the Cayman Islands.

“CONQUAS” means the Construction Quality Assessment System, Singapore’s national construction standard protocol.

“COVID-19” means the Coronavirus Disease 2019.

“Exchange Act” means the United States Securities Exchange Act of 1934, as amended.

“FBS SG” means Finebuild Systems Pte. Ltd., our operating company incorporated and operating in Singapore held as a wholly-owned subsidiary of Success Elite, which in turn is a wholly-owned subsidiary of our Company.

“Group,” “our Group,” “we,” “us,” or “our” means our Company and its subsidiaries or any of them, or where the context so requires, in respect of the period before our Company becoming the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of our Company at the relevant time or the businesses which have since been acquired or carried on by them or as the case may be their predecessors.

“Independent Third Party” means a person or company who or which is independent of and is not a 5% owner of, does not control and is not controlled by or under common control with any 5% owner and is not the spouse or descendant (by birth or adoption) of any 5% owner of the Company.

“Kelvin Ang” is Ang Poh Guan, the principal shareholder of the Company.

“Memorandum and Articles of Association” means the Company’s Amended Memorandum of Association and the Company’s Amended Articles of Association.

“MOM” means the Ministry of Manpower, the government agency in Singapore that regulates employment.

“Resale Prospectus Shareholders” means collectively Kelvin Ang, Master Stride Limited a limited liability company incorporated under the laws of the British Virgin Islands (solely owned by Mr. Tan Yeok Lin (“Master Stride”)), and Fame Hall Investment Limited a limited liability company incorporated under the laws of the British Virgin Islands (solely owned by Mr. Lim Yi Shenn (“Fame Halls”)).

“S$” or “SGD” means Singapore dollars(s), the lawful currency of Singapore.

“SEC” or “Securities and Exchange Commission” means the United States Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Success Elite” or “SEDL” means Success Elite Developments Limited, a company incorporated in BVI incorporated on February 22, 2022.

“US$,” “$” or “USD” means United States dollar(s), the lawful currency of the United States.

| 5 |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and notes to those statements, included elsewhere in this prospectus, before deciding to invest in our Ordinary Shares. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.”

Overview

The predecessor of our principal operating company was incorporated on March 9, 1996 in Singapore under the name Finebuild Systems Pte Ltd. Pursuant to a restructuring that took effect on August 2, 2022, FBS Global Limited, an exempted company incorporated in the Cayman Islands, through its wholly owned subsidiary, Success Elite Developments Limited, a company incorporated in BVI, became the ultimate holding company of our current principal operating subsidiary referred to herein as FBS SG.

From its beginning as a construction company since 1996, FBS SG has developed into a premier integrated engineering company that provides a full suite of construction and engineering services. These services include the supply of building materials and precast concrete components, recycling of construction and industrial wastes, as well as pavement consultancy services.

We are an established interior design and build (also referred to as “fit-out”) specialist in Singapore with a track record of over 20 years in institutional, residential, commercial and industrial building projects. Our scope of services comprises design, supply and installation of ceilings, partitions, timber deck, carpet, lead lining, acoustic wall panel, built-in furnishing, carpentry and mechanical & electrical services of a building. We also undertake main construction and building works projects.

Our Pledge

“To be conscientious in the production of construction solutions that is sustainable and environmentally friendly”

Over the years, we have sought to bring value to our construction and engineering business through what we believe to be an innovative use of sustainable processes and materials. We are committed to sustainable development and corporate social responsibility through the environmental focus of our building materials. We believe that this commitment has differentiated us from other traditional construction companies in Singapore that are less focused on sustainability and that this commitment has been a key driver of our growth.

We strive to use new technological equipment including a pole gun for ceiling installations, allowing us to minimize the use of scaffolding in congested areas with mechanical and engineering (or “M&E”) services. Further, we use sanding machines for wall & ceiling instead of manual sanding.

We also work with manufacturers and suppliers to develop new materials such as an impact wall for toilets and a shaft wall for core areas of an elevator shaft.

Sustainable Business

We strongly believe that sustainability in both business and the environment is the only way to responsibly move forward. We have a proven record of completing numerous civil and infrastructure projects while also expanding our expertise into different fields such as sales and marketing of green building materials to consolidate access to the supply chain of essential building materials for the construction sector. These green building materials include but are not limited to special gypsum boards, aluminum ceiling materials, and green resin timber materials for timber desks. We seek to source sustainable materials and work with environmental experts to speed up the process of building zero energy infrastructure.

Our Vision for Sustainable Business for the Future

We believe that our comprehensive and diversified experiences well-position us to undertake a broad range of forward looking green civil engineering and infrastructure construction projects. Our depth of experience is further supported by our team of in-house technical specialists. We believe that, in addition to this depth of experience and specialized technical staff, our innovative ideas, productivity, and efficiency set us apart from our competition and allow us to be poised to provide cutting edge construction and engineering services in furtherance of sustainability.

| 6 |

Green buildings are becoming increasingly popular and more prevalent globally, including in Singapore, where both consumer demand and government regulations are pushing for more sustainable building projects by 2030. Since 2007, we have sought to use environmentally friendlier materials on our projects. We believe that sustainability in both business and environment is the only way to move forward, and we intend to lead the way in developing and implementing more sustainable building materials and practices.

Competitive Strengths

We believe that our competitive strengths are:

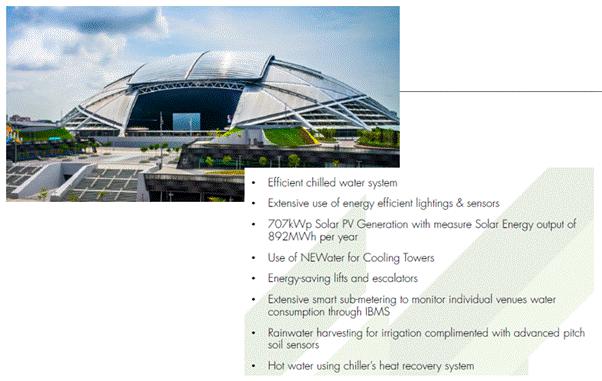

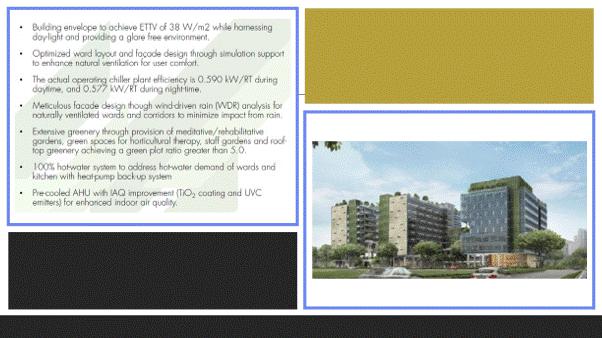

| - | Established track record of over 20 years in interior build outs: We have an established track record of over 20 years in interior design and build out, or “fitting-out” works, with experience in a wide range of project types, including mixed developments, private residential developments, hospitals, and commercial developments. Notable projects that we acted as subcontractors in Singapore include Marina One (an integrated development at Marina Bay), Sengkang General Hospital, Outram Community Hospital, Khoo Teck Puat Hospital and South Beach Development (a mixed development at downtown Singapore) and Vivocity (Mega Shopping Mall near Sentosa Island). We believe that our track record of successfully completing a range of projects gives us a competitive advantage in future bids as we have experience in both small and large-scale projects and a variety of types of projects. Moreover, we also have completed interior-fitting out works for several hospitals in Singapore and have gained a reputation as an established subcontractor in this segment, which is a highly specialized area given the different requirements for interior fitting-out works with respect to hospital buildings as they require specific sound insulation, fire-retardation, chemical resistance (as a result of frequent cleaning) and prevention of radiation leakage. Our prospective customers typically take into consideration a subcontractor’s relevant project track record when evaluating the tender proposal, and we believe that our varied experience positions us to be competitive for similar upcoming projects. | |

| - | Providing competent and experienced value engineering design solutions for our customers: We believe that we have the competencies and experience to provide value engineering design solutions for our customers, in order to optimize the cost, durability and design considerations and maximize efficiency. For instance, we may propose modifications to the materials selection or the drawings of a build out project so that the installation can be carried out more efficiently. In certain instances, modifications to the drawings or method statements may allow for improved feasibility of the installation within the planned construction schedule, helping to control costs and avoid overages. We have also undertaken more complex projects such as those requiring shock mounted walls and ceilings, and lead lining walls and partitions (in hospitals) for radiation shielding purpose. There are also certain designs that are more complex such as curved or non-flat interior walls and ceilings and interiors that accommodate water features, which require a higher level of expertise to ensure that the interfacing and finishing works are of quality and reliable. We believe that our customer focused perspective and our specialized experience allow us to service our clients better and generate new project mandates. | |

| - | Proven track record safety, quality and timely project execution track record: We have obtained various certifications and gradings which we believe place us in an advantageous position when our customers review our tender proposal or quotation. For instance, we have obtained the following International Organization for Standardization qualifications: ISO 9001:2015, which reflects our quality management standards, and ISO 14001:2015 and ISO 45001: 2018, which reflect our environmental, occupational and workplace safety management systems. We have also obtained the highest level bizSAFE Level Star certification, reflecting our workplace safety practices. We are also typically subject to the national standards under the Construction Quality Assessment System (“CONQUAS”) set forth by the Building and Construction Authority in Singapore (“BCA”) for our projects that fall under architectural works, with the quality standards being assessed based on the finishing, alignment and evenness, jointing and no visible defect and delamination. We completed the ceiling works for a private residential development, Jewel @ Buangkok in 2014, and this project was awarded the CONQUAS “Star” rating in recognition of the excellence of the workmanship. We understand that customers value subcontractors who complete their projects in a timely manner as they manage many subcontractors concurrently, with each playing a crucial role to ensure the adherence to the overall construction schedule. We believe that experience plays a critical role in timely completion of projects, and we believe that due to our considerable experience, we can accurately assess the challenges that may be posed by site conditions (such as limited access area or restrictions in working hours or noise level), material requisitions, design specifications, and can respond to customers’ requests to meet related deadlines. |

| 7 |

| - | We have an experienced and dedicated management and project team: Each of our executives has over 20 years of experience in this industry and has accumulated experience and goodwill in the industry, which has helped us to grow our business through word-of-mouth recommendations. Our Executive Directors are supported by a stable management team with extensive business development and project management experience. Further details of our management team’s working experience are set out in the section entitled “Directors and Executive Officers”. |

Growth Strategies

Our business growth strategy is to provide green and sustainable building solutions through offering a full spectrum of environmentally-focused services, products and project management for our customer’s building projects in Singapore. Our core strategy remains focused on creating opportunities for growth through winning green project mandates, driving internal operational improvements and maintaining a high-performance firm culture. We believe that with our extensive experience in the industry, we have strong positions in profitable and growing end-markets across the green building fit-out industry, enhanced by our comprehensive service portfolio and already strong client base. We believe we are well positioned to capitalize on the prevailing trend towards sustainability and innovations in the buildings industry, including decarbonization, healthy buildings/indoor environmental quality and smart buildings.

To capitalize on these trends, we are building on our priorities of maintaining leading positions in commercial as well as residential building solutions. In furtherance of these goals, we have three strategic priorities:

| - | Capitalize on Key Growth Vectors: We believe that increased focus on sustainable development through such initiatives as reducing carbon emissions (“decarbonization”), improved indoor air quality and smart buildings that are developed with environmental efficiency at the forefront represent key growth opportunities. We are seeking to leverage our existing portfolio breadth and investments in services and product development, combined with the expansion of its green building materials, to offer differentiated solutions and innovative fit-out plans to help customers achieve their objectives to have healthier work and living spaces, both for the inhabitants of these buildings and the environment at large. We intend to invest in services and products as well as expand our partnerships locally and globally such as in other ASEAN countries and other English-speaking countries where our experiences can be utilized to power green building innovations that will allow us to provide differentiated services that are tailored to our customers’ desired outcomes to achieve these goals. | |

| - | Accelerate in High Growth Regions and Verticals: We intend to explore expansion into regional high growth regions in ASEAN countries, namely Malaysia, Indonesia and Brunei, by partnering with other companies through joint ventures, enabling us to provide our expertise in green building through large project contracts in the region. We further plan to invest in supply chain vertical integration within the markets we already serve, including healthcare, commercial offices/campuses, and educational and data centers, to directly source specialized equipment and materials for green building. This will enable us to have more control over building supplies and ideally optimize our cost of revenues. | |

| - | Sustain a High-Performance, Customer-Centric Culture: We recognize that developing talent and creating positive customer experiences is central to accomplishing our business strategies. We are investing in talent to build a diverse workforce that is solutions oriented and focused on continuous learning and growth. The Company aims to leverage our talent capabilities and training to create a customer-focused culture to drive customer loyalty and decisions. |

To realize these priorities, we intend to leverage our position as a steward of green building and use our experience in providing comprehensive service and as reflected by our product portfolio, along with our strong building industry networks, in seeking to monetize opportunities to provide retrofit and new build services. We are seeking to augment our strategic priorities with disciplined execution, productivity enhancements and sustainable cost management in order to realize higher margins and enhanced profitability.

| 8 |

Risks Factor Summary

Investing in our Ordinary Shares involves risks. The risks summarized below are qualified by reference to “Risk Factors” beginning on page 14 of this Prospectus, which you should carefully consider before making a decision to purchase our Ordinary Shares. If any of these risks actually occur, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our Ordinary Shares would likely decline, and you may lose all or part of your investment.

These risks include but are not limited to the following:

Risks Related to Our Business and Industry

| ● | We are dependent on the construction industry in Singapore and other countries which we operate in | |

| ● | We are dependent on our major customers and any significant decrease in projects secured from them may affect our operations and financial performance | |

| ● | We are subject to the risks of default or delays in the collection of our trade receivables | |

| ● | We are reliant on the renewal of our existing registrations and licenses | |

| ● | We are dependent on foreign workers and may face debarment from hiring (including due to non-compliance with the relevant employment laws and regulations), imposition of penalties, labor shortages or increased labor costs for our operations | |

| ● | We are subject to a number of project execution risks, many of which are beyond our control | |

| ● | We are dependent on our suppliers and subcontractors to fulfil their contractual obligations to us, and the inability of these suppliers and contractors, due to increased demand or other factors, to deliver key materials at prices and volumes, performance and specifications acceptable to us, could have a material adverse effect on our business, prospects, financial condition and operating results. | |

| ● | We are subject to risks associated with the quality of our works | |

| ● | Our short-term revenue and profitability may not be indicative of the long-term results of operations | |

| ● | We operate in a highly competitive industry and may not be able to compete effectively | |

| ● | Our lack of effective internal controls over financial reporting may affect our ability to accurately report our financial results or prevent fraud which may affect the market for and price of our Ordinary Shares. | |

| ● | Our Chief Executive Officer will continue to own a substantial number of our Ordinary Shares and, as a result, may be able to exercise control over us, including the outcome of shareholder votes. | |

| ● | We are subject to compliance with and changes in regulatory requirements and codes | |

| ● | Our cash flows may fluctuate due to the payment practice applied to our projects or foreign currency exchange rates | |

| ● | We are required by our customers to arrange performance bonds or banker’s guarantee to secure our due performance of contracts | |

| ● | We may be subject to litigation, claims or other disputes | |

| ● | We may not be able to implement our future plans and strategies successfully | |

| ● | Our insurance coverage may not be sufficient to cover all losses or potential claims and insurance premiums may increase | |

| ● | We are affected by the macroeconomic, political, social and other factors beyond our control in Singapore and other countries which we operate in | |

| ● | We are exposed to risks of infringement of our intellectual property rights and the unauthorized use of our trademarks by third parties | |

| ● | Geopolitical conditions, including direct or indirect acts of war or terrorism, could have an adverse effect on our operations and financial results. | |

| ● | Our financial condition and results of operations may be adversely affected by the recurrence of a global pandemic | |

| ● | Certain market opportunity data, forecasts, third-party website data and imagery contained in this prospectus were obtained from third-party sources and were not independently verified by us. We believe the data represented in those images, estimates of market opportunity data, forecasts of market growth included in this prospectus are reliable, but may prove to be inaccurate, and even if the markets in which we compete achieve the forecasted growth, our business could fail to grow at similar rates, if at all. |

| 9 |

Risks Related to Our Securities and This Offering

| ● | An active trading market for our Ordinary Shares may not be established or, if established, may not continue and the trading price for our Ordinary Shares may fluctuate significantly. | |

| ● | We may not maintain the listing of our Ordinary Shares on the Nasdaq which could limit investors’ ability to make transactions in our Ordinary Shares and subject us to additional trading restrictions. | |

| ● | The initial public offering price for our Ordinary Shares may not be indicative of prices that will prevail in the trading market and such market prices may be volatile. | |

| ● | The trading price of our Ordinary Shares may be subject to rapid and substantial volatility, which could make it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares and result in substantial losses to investors. | |

| ● | If securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding our Ordinary Shares, the market price for our Ordinary Shares and trading volume could decline. | |

| ● | The sale or availability for sale of substantial amounts of our Ordinary Shares could adversely affect their market price. | |

| ● | Short selling may drive down the market price of our Ordinary Shares. | |

| ● | Because we do not expect to declare dividends in the foreseeable future, you must rely on price appreciation of our Ordinary Shares for a return on your investment. | |

| ● | Because our public offering price per share is substantially higher than our net tangible book value per share, you will experience immediate and substantial dilution. | |

| ● | Our Amended Articles of Association contains anti-takeover provisions that could discourage a third party from acquiring us and adversely affect the rights of holders of our Ordinary Shares. | |

| ● | You must rely on the judgment of our management as to the uses of the net proceeds from this offering, and such uses may not produce income or increase our share price. | |

| ● | If we are classified as a passive foreign investment company, United States taxpayers who own our securities may have adverse United States federal income tax consequences. | |

| ● | Our controlling shareholder has substantial influence over the Company. His interests may not be aligned with the interests of our other shareholders, and it could prevent or cause a change of control or other transactions. | |

| ● | As a company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from Nasdaq corporate governance listing standards. In the event we rely on these exemptions, these practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq corporate governance listing standards. | |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law. | |

| ● | Certain judgments obtained against us by our shareholders may not be enforceable. | |

| ● | We are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirements. | |

| ● | We are a foreign private issuer within the meaning of the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies. | |

| ● | We are a “controlled company” within the meaning of the Nasdaq Stock Market Rules and, as a result, may rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies. | |

| ● | We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses to us. | |

| ● | Economic substance legislation of the Cayman Islands may adversely impact us or our operations. | |

| ● | We will incur significantly increased costs and devote substantial management time as a result of the listing of our Ordinary Shares on the Nasdaq. | |

| ● | Recent joint statement by the SEC and the PCAOB, rule changes by Nasdaq, and the Holding Foreign Company Accounting Act (“HFCAA”) all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our continued listing or future offerings of our securities in the U.S. |

Corporate Information

Our Company was incorporated in the Cayman Islands on March 10, 2022. Our registered office in the Cayman Islands is located at the offices of Conyers Trust Company (Cayman) Limited, Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman, KY1-1111, Cayman Islands. Our principal executive office is at 74 Tagore Lane, #02-00 Sindo Industrial Estate, Singapore 787498. Our telephone at this location is +(65) 6285-7781.

Our agent for service of process in the United States is Cogency Global, Inc. located at 122 E. 42nd St., 18th Floor, New York, NY 10168, with the telephone (888) 741-6830.

Our website is www.FBSGlobal.com.sg. Information contained on, or that can be accessed through, our website is not a part of, and shall not be incorporated by reference into, this prospectus.

Because we are incorporated under the laws of the Cayman Islands, you may encounter difficulty protecting your interests as a shareholder, and your ability to protect your rights through the U.S. federal court system may be limited. Please refer to the sections entitled “Risk Factors” and “Enforcement of Civil Liabilities” for more information.

Corporate Structure

Prior to the offering, Master Stride Limited, Kelvin Ang and Fame Hall Limited held 4.9%, 90.4%, and 4.7% of our Company, respectfully. The chart below sets out our corporate structure after this offering, assuming the sale of all of the shares offered by the Resale Shareholders pursuant to the Resale Prospectus (with the numbers in parentheticals reflecting the holdings immediately prior to the offering).

Implications of Our Being a “Controlled Company”

Upon completion of this offering, our controlling shareholder, Kelvin Ang, will be the beneficial owner of an aggregate of 9,365,663 Ordinary Shares, which will represent approximately 69.4% of the then total issued and outstanding Ordinary Shares (assuming Mr. Ang sells all 800,000 shares is offering pursuant to the Resale Prospectus). As a result, we will remain a “controlled company” within the meaning of the Nasdaq Stock Market Rules and therefore we are eligible for, and in the event we no longer qualify as a foreign private issuer, we may rely on, certain exemptions from the corporate governance listing requirements of the Nasdaq.

Implications of Our Being an Emerging Growth Company

As a company with less than US$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include:

| ● | being permitted to provide only two years of selected financial information (rather than five years) and only two years of audited financial statements (rather than three years), in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; and |

| 10 |

| ● | an exemption from compliance with the auditor attestation requirement of the Sarbanes-Oxley Act, on the effectiveness of our internal control over financial reporting. |

We may take advantage of these reporting exemptions until we are no longer an emerging growth company. We will remain an emerging growth company until the earliest of (1) the last day of the fiscal year in which the fifth anniversary of the completion of this offering occurs, (2) the last day of the fiscal year in which we have total annual gross revenue of at least US$1.235 billion, (3) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended, which means the market value of our Ordinary Shares that are held by non-affiliates exceeds US$700.0 million as of the prior June 30, and (4) the date on which we have issued more than US$1.0 billion in non-convertible debt during the prior three-year period. We may choose to take advantage of some, but not all, of the available exemptions. We have included two years of selected financial data in this prospectus in reliance on the first exemption described above. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold stock.

Implications of Our Being a Foreign Private Issuer

Upon completion of this offering, we will report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; | |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and | |

| ● | the rules under the Exchange Act requiring the filing with the Securities and Exchange Commission, or the SEC, of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither emerging growth companies nor foreign private issuers.

In addition, as a company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the corporate governance listing requirements of the Nasdaq. These practices may afford less protection to shareholders than they would enjoy if we complied fully with corporate governance listing requirements of the Nasdaq. While we currently do not intend to rely on home country practice exemptions following this offering, we may choose to rely on home country practice to be exempted from certain of the corporate governance requirements of the Nasdaq, such that a majority of the directors on our board of directors are not required to be independent directors and neither our compensation committee nor our nomination committee is required to be comprised entirely of independent directors.

| 11 |

THE OFFERING

| Offering Price | The initial public offering price will be between US$4.50 and US$5.00 per Ordinary Share. | |

| Ordinary Shares offered by us | 2,250,000 Ordinary Shares | |

| Ordinary Shares issued and outstanding immediately prior to this offering | 11,250,000 Ordinary Shares | |

| Ordinary Shares to be issued and outstanding immediately after this offering | 13,500,000 Ordinary Shares | |

| Over-Allotment Option | The underwriters have an option for a period of 45 days to purchase up to 337,500 Ordinary Shares offered by the Company to cover over-allotments, if any. | |

| Use of proceeds | We currently intend to use the net proceeds from this offering |

| ● | to expand our existing locations to develop new customers by hiring more qualified personnel and undertake more marketing efforts; | ||

| ● | for research and development and artificial intelligence analytics for new green building materials; | ||

| ● | for M&A projects, partnerships and future business development; and | ||

| ● | for working capital and general corporate purposes. |

| Lock-up Agreement | We have agreed with the underwriters not to (1) offer, sell, issue, pledge, contract to sell, contract to purchase, grant any option, right or warrant to purchase, lend, make any short sale or otherwise transfer or dispose of, directly or indirectly, any Ordinary Shares or any other securities so owned convertible into or exercisable or exchangeable for Ordinary Shares, (2) enter into any swap, hedge or any other agreement that transfers, in whole or in part, the economic consequences of ownership of the Ordinary Shares, whether any such transaction described in clause (1) or (2) above is to be settled by delivery of Ordinary Shares or such other securities, in cash or otherwise, or (3) file any registration statement with the SEC relating to the offering of any Ordinary Shares or any securities convertible into or exercisable or exchangeable for Ordinary Shares, or publicly disclose the intention to take any such action for a period of six months from the date of this prospectus.

All of our directors and officers and shareholders of more than 5% of our issued and outstanding Ordinary Shares have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our Ordinary Shares or securities convertible into or exercisable or exchangeable for our Ordinary Shares for a period of six months from the date of this prospectus. | |

| Dividend policy | We do not intend to pay any dividends on our Ordinary Shares for the foreseeable future. Instead, we anticipate that all of our earnings, if any, will be used for the operation and growth of our business. See “Dividends” for more information. | |

| Risk factors | Investing in our Ordinary Shares involves risks. See “Risk Factors” beginning on page 14 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Ordinary Shares. | |

| Listing | We have applied to list our Ordinary Shares on the Nasdaq Capital Market under the symbol “FBGL,” however, there can be no assurance that we will be successful in listing our Ordinary Shares on the Nasdaq Capital Market. We will not consummate and close this offering without a listing approval letter from Nasdaq Capital Market. | |

| Proposed Nasdaq trading symbol | FBGL | |

| Transfer agent | VStock Transfer, 18 Lafayette Place, Woodmere, New York 11598; telephone: 212-828-8436; facsimile: 646-536-3179 | |

| Payment and settlement | The underwriters expect to deliver the Ordinary Shares against payment therefor through the facilities of the Depository Trust Company on [●], 2024. |

The number of our Ordinary Shares, which will be issued and outstanding immediately after this offering, is based on our Company’s issued share capital of 11,250,000 Ordinary Shares, which are issued and outstanding as of the date hereof, and this offering of 2,250,000 Ordinary Shares.

| 12 |

Summary Consolidated Financial Data

You should read the following summary financial data together with our financial statements and the related notes appearing at the end of this prospectus, “Selected Consolidated Financial Data,” “Capitalization” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” We have derived the audited financial data for the fiscal years ended December 31, 2022 and 2023 from our audited financial statements included in this prospectus.

Results of Operations Data:

| For the years ended December 31, | ||||||||||||

| 2022 | 2023 | 2023 | ||||||||||

| S$ | S$ | US$ | ||||||||||

| Revenues | 16,824,168 | 21,810,317 | 16,139,634 | |||||||||

| Net income | 68,627 | 4,685 | 3,467 | |||||||||

| Basic and diluted earnings per share | 0.01 | 0.00 | 0.00 | |||||||||

| Weighted average number of Ordinary Shares issued and outstanding | 11,250,000 | 11,250,000 | 11,250,000 | |||||||||

Balance Sheet Data:

| As of December 31, | ||||||||||||

| 2022 | 2023 | 2023 | ||||||||||

| S$ | S$ | US$ | ||||||||||

| Cash and restricted cash | 1,989,817 | 4,482,359 | 3,316,946 | |||||||||

| Working capital | 2,165,248 | 1,206,943 | 893,138 | |||||||||

| Total assets | 17,188,320 | 18,268,519 | 13,518,705 | |||||||||

| Total liabilities | 12,098,492 | 13,174,006 | 9,748,764 | |||||||||

| Total shareholders’ equity | 5,089,828 | 5,094,513 | 3,769,941 | |||||||||

| 13 |

RISK FACTORS

Investing in our shares is highly speculative and involves a significant degree of risk. You should carefully consider the following risks, as well as other information contained in this prospectus, before making an investment in our Company. The risks discussed below could materially and adversely affect our business, prospects, financial condition, results of operations, cash flows, ability to pay dividends and the trading price of our shares. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, prospects, financial condition, results of operations, cash flows and ability to pay dividends, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

We are dependent on the construction industry in Singapore and other countries which we operate in

We are dependent on the pipeline of new building development and major additional and alteration works (“A&A projects”), as our sources of revenue come from interior-fitting out works, construction and building works. We operate mainly in Singapore and new building development projects are in part affected by the general economic, regulatory, political and social conditions, property market, construction industry, government initiatives and spending (including spending on healthcare that includes the building and/or refurbishment of hospitals), property and resale prices and rental yields (as the case may be), factors which are beyond our control. Other factors such as natural disasters, recession, epidemics and any other incidents in Singapore and/or countries which we operate in may adversely affect our business, financial position, financial performance and prospects. The construction industry in Singapore is also subject to cyclical fluctuations, and any downturn in the construction industry will have direct impact on our business, financial performance and financial position, due to possibility of postponement, delay or cancellation of new building and A&A projects and delay in the recovery of receivables.

Our contracts are typically on a non-recurring and project basis, and therefore we cannot guarantee that we will continue to secure new projects from our customers after the completion of our existing projects. In the event that the construction industry in Singapore or other countries that we operate in undergoes a downturn or other factors lead to a reduced pipeline of construction projects, we may not be able to secure new projects, or secure new projects of similar value as we had in the past. In the case of such an event, our business, financial performance, financial position and prospects will be materially and adversely affected.

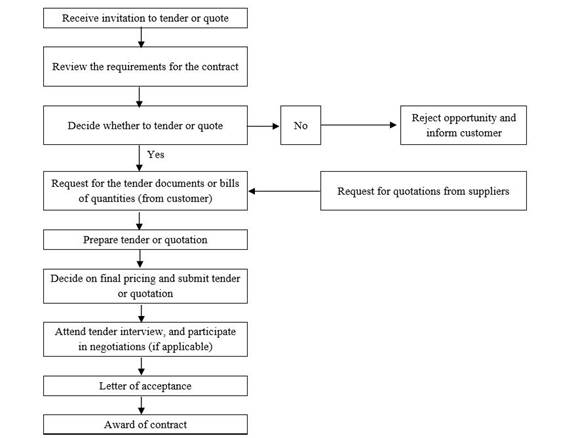

We are dependent on our major customers and any significant decrease in projects secured from them may affect our operations and financial performance

Our top two customers listed under the section entitled “Business – Our Major Customers” contributed 41% and 12% of our revenue for the year ended December 31, 2022 and 32% and 15% for the year ended December 31, 2023, respectively. Given that our contracts are typically secured via invited tenders from our customers, we are dependent on our major customers or past customers inviting us for future tenders. However, there is no assurance that these customers will continue to invite us for tenders or award tenders to us at contract values and/or terms comparable to those which we have received in the past. As such, if we are not invited to tender or are unable to secure new projects with our major and past customers, or secure replacement customers, or are unable to secure new projects on terms that are favorable to us, our business, financial performance, financial position and liquidity will be materially and adversely affected.

We are subject to the risks of default or delays in the collection of our trade receivables

Our major customers are all private customers, and therefore, we are subject to higher risks of default or delays in collection of our trade receivables as compared to contracting with Singapore government agencies. We typically make monthly progress claims to our customers for the value of the work we have performed as of that time, and our billings are subject to our customer’s approval of our progress claims. Accounts receivable are recognized and carried at original invoiced amount net of allowance for doubtful accounts. Accounts are considered overdue after 120 days. Please refer to the section entitled “Business – Credit Management” for further details.

In accordance with the Building and Construction Industry Security of Payment Act 2004 of Singapore, referred to as BCISPA, we must make payment to our suppliers and subcontractors carrying out work in Singapore within a specific period, whether or not we have received payment from our customers. Please refer to the section entitled “Government Regulations” of this prospectus for further details on BCISPA.

| 14 |

Further, a portion of the contract value (typically 5% or 10%) is withheld by our customers as retention money, a portion of which will be released upon substantial completion and the remaining amounts will be released upon final completion (which is after the defects liability period, being typically 12 months from date of substantial completion).

If a customer fails to make payment of our progress claims in a timely manner or at all, or fails to release our retention monies as scheduled, there is a time lag which could potentially be significant, between any costs incurred for the work we have performed and the receipt of any payment from our customers. Any progress claim that we submit may also be the subject of a dispute between us and our customer which could not only delay any payment made to us but also could be such that the amount that is paid to us being less than the amount we claim for. In this event, our cash flow and working capital may be materially and adversely affected.

Even when we are able to recover any part of the contracted value pursuant to the terms of the contract, the process of such recovery is usually time-consuming and requires financial and other resources to settle the disputes. Furthermore, there can be no assurance that any outcome will be in our favor or that any dispute will be resolved in a timely manner. Failure to collect adequate payments in time or to manage past due debts effectively will have a material and adverse effect on our business, liquidity, financial performance and financial position.

We are reliant on the renewal of our existing registrations and licenses

We are regulated in Singapore by the Commissioner of Building Control (“CBC”), which is the body that oversees compliance with BCA and various other regulatory bodies. These regulatory bodies stipulate the criteria that must be satisfied before registrations and licenses are granted to, and/or renewed and/or maintained for, our business. The maintenance and renewal of our registrations and licenses are subject to compliance with the relevant regulations. BCA designates what are known as “workhead” gradings and we are designated to have met certain qualifications to perform various construction works under the Singapore’s Construction Registration System (“CRS”). In particular, we are graded L5 under the workhead category CR06 for interior decoration and finishing works and B2 under the workhead category CW01 for general building. Our private customers would typically have a preferred workhead grading of their subcontractors for their projects and should we tender directly for Singapore government projects, the required workhead grading will also be stipulated in the tender for bid.

Our current workhead gradings will expire on July 1, 2025 and as the requirements laid down by BCA may change from time to time, there is no assurance that we will be able to meet the changing requirements and maintain and/or renew our registrations and licenses. In the event that we fail to maintain or renew our existing workhead registrations, our business, financial performance and prospects will be adversely affected. For details, please refer to the section entitled “Government Regulations”.

We have not encountered any non-renewal or suspension of BCA registrations and licenses which had a material adverse impact on our business.

We are dependent on foreign workers and may face debarment from hiring (including due to non-compliance with the relevant employment laws and regulations), imposition of penalties, labor shortages or increased labor costs for our operations

Our business is highly dependent on foreign workers as the pool of local construction workers is scarce. Typically, approximately 3/4ths% of our workforce is made up of foreign employees (including site workers and other employees). Any shortage in the supply of foreign workers, increase in foreign worker levy or restriction on the number of foreign workers that we can employ will adversely affect our operations and financial performance. The supply of foreign labor in Singapore is highly controlled and subject to a number of policies and regulations.

We are required to comply with all relevant laws and regulations and we may be liable to penalties if there are any breaches relating thereto. While we aim to comply with the relevant laws and regulations at all times and have put in place the necessary systems to monitor our compliance, we are susceptible to breaches that may arise from inadvertent oversight.

| 15 |

In the past, we have received notices in relation to non-compliance with the numerous regulations that apply to us and been subject to fines for failure to comply with rules relating to foreign workers’ accommodation.

While we have taken steps to ensure compliance with laws relating to the hiring of foreign workers, we cannot be assured that we will not inadvertently be subject to additional fines or punishments.

There is no assurance that we and/or our Executive Directors will not be penalized for past contraventions or that we will not inadvertently contravene any employment laws and regulations in the future. Any further debarment from applying for new work passes for foreign workers may cause disruptions to our operations and adversely affect our operations and financial performance.

Moreover, the MOM imposes a MYE quota in respect of the number of foreign workers (excluding those from Malaysia and NAS countries/regions) that the main contractor and its subcontractors can employ in respect of each construction project that was awarded or had the tender called on or before 18 February 2022. The number of foreign workers a company can employ in respect of construction projects awarded or which had the tender called after 18 February 2022 does not depend on MYE quota, but instead, on the dependency ratio ceiling applicable to that company (as described below). Depending on the requirements of our projects, the tightening of such quota on the number of foreign workers that the main contractors and their subcontractors can employ may affect our operations and accordingly our business and financial performance. We are also subject to dependency ratio ceilings, being the percentage of foreign employees permitted in a company calculated as a ratio to local employees. Any changes in the policies of the foreign workers’ countries of origin may affect the supply of foreign labor and cause disruptions to our operations which may in turn result in a delay in the completion of our projects. We are also subject to foreign worker levy for foreign workers (subject to changes as and when announced by the Singapore government) and any increase in foreign worker levy may materially and adversely affect our business and financial performance.

We are subject to a number of project execution risks, many of which are beyond our control

In the preparation of our bid tenders, we will carry out internal cost estimates that are based on, among other factors, the anticipated schedule for the project execution. Our revenue is recognized on the stage of completion method, and billing is based on approved monthly progress claims. Any delay in a project will therefore affect our billings, revenue, increase our operating costs (for instance, labor costs and equipment leasing costs), operational cash flows and financial performance. We are also required to pay our suppliers and subcontractors regardless of such delay if the purchase orders have been fulfilled, therefore affecting our operational cash flows. A delay in the project can be due to various factors, including but not limited to, shortage of manpower, materials and/or equipment, delays by subcontractors, accidents at the work site, adverse weather or other unforeseen circumstances. In the event of a delay, we are liable to pay our contracting parties for the liquidated damages stipulated in our contracts, and our reputation (including our prospects for being invited for future bid tenders) will also be materially and adversely affected.

Moreover, other than liquidated damages, we may also have to bear additional costs as our customers can require us to complete the uncompleted works within a reasonable period at our expense, to avoid or minimize further delay. In addition, to minimize further delay, we may also be required to incur overtime man hours and the related labor costs at our own expense. In such circumstances, our operations and financial performance will be materially and adversely affected.

Additionally, our contracts with our customers are typically on a fixed and pre-determined fee basis for the duration of the contract period and the terms of the contracts allow limited price adjustments. Nonetheless, we still have to bear the risk of any cost fluctuations due to, including but not limited to, inaccurate costs estimation at the tender stage, ineffective cost management during project implementation, higher than estimated costs of materials, labor, subcontracting fees or equipment leasing. Other situations such as changes in the regulatory requirements, disputes with suppliers and subcontractors, labor disputes as well as accidents, delays and other unforeseen problems may also adversely affect our project costs. Should we be unable to control our costs within our original estimates, or we are not able to fully cover the increases in costs during the project, our business, financial performance and liquidity will be materially and adversely affected.