As filed with the Securities and Exchange Commission on May 28, 2024

Registration No. 333-275243

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________

________________________

| | 7999 | 92-0261853 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

1768 Park Center Drive

Orlando, FL 32835

(407) 909-9350

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

________________________

Bruce A. Brown

Chief Legal Officer and

Corporate Secretary

1768 Park Center Drive

Orlando, FL 32835

(407) 909-9350

(Name, address, including zip code, and telephone number, including area code, of agent for service)

________________________

Copies to:

Joel L. Rubinstein

Jonathan P. Rochwarger

Maia R. Gez

White & Case LLP

1221 Avenue of the Americas

New York, New York 10020

Tel: (212) 819-8200

________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. ☐

| Large accelerated filer: | ☐ | Accelerated filer: | ☐ | |||

| | ☒ | Smaller reporting company: | | |||

| Emerging growth company: | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

______________________________

Rule 429 Statement

Pursuant to Rule 429 under the Securities Act, the prospectus contained in this Post-Effective Amendment to the Registration Statement on Form S-1 (File No. 333-275243) that was originally declared effective by the Securities and Exchange Commission on December 12, 2023 (referred to herein as the “Registration Statement”) will be used as a combined prospectus in connection with this Registration Statement and the registrant’s Registration Statement on Form S-4 (File No. 333-269778), that was originally declared effective by the Securities and Exchange Commission on September 15, 2023 (as amended, the “Prior Registration Statement”). Accordingly, this Registration Statement also constitutes Post-Effective Amendment No. 2 on Form S-4 to the Prior Registration Statement. Such Post-Effective Amendment will become effective concurrently with the effectiveness of this Registration Statement in accordance with Section 8(c) of the Securities Act.

________________________

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

Falcon’s Beyond Global, Inc., a Delaware corporation, filed a Registration Statement on Form S-1 (Registration No. 333-275243) on November 1, 2023, which was subsequently amended on November 30, 2023 and declared effective by the U.S Securities and Exchange Commission on December 12, 2023 (as amended and supplemented, the “registration statement”). This Post-Effective Amendment No. 1 to Form S-1 (the “Post-Effective Amendment”) is being filed in order to include the registrant’s annual report on Form 10-K, filed with the Securities and Exchange Commission on April 29, 2024, and the registrant’s quarterly report on Form 10-Q for the quarter ended March 31, 2024, filed with the Securities and Exchange Commission on May 16, 2024, to update certain disclosures in the registration statement and to update the information regarding the selling securityholders named in the prospectus and the number of shares of Class A common stock being offered by the selling securityholders to remove shares previously included in the registration statement that were sold by the selling securityholders and earnout shares which were forfeited upon the failure of certain earnout conditions.

The information included in this filing amends the registration statement and the prospectus contained therein (and all amendments thereto). No additional securities are being registered under this Post-Effective Amendment. All applicable registration fees were paid at the time of the original filing of the registration statement.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated May 28, 2024.

Falcon’s Beyond Global, Inc.

5,380,360 Shares of Class A Common Stock Underlying Warrants (For Issuance)

119,096,355 Shares of Class A Common Stock (For Resale)

This prospectus relates to the issuance by Falcon’s Beyond Global, Inc. (“we,” “us,” “our,” and the “Company”) of 5,380,360 shares of Class A Common Stock issuable upon exercise of upon the exercise of 5,198,420 public warrants (the “Warrants”) at an exercise price of $11.50 per warrant, that were originally issued by FAST Acquisition Corp. II (“FAST II”) as part of its initial public offering of units at a price of $10.00 per unit, with each unit consisting of one share of FAST II class A common stock and one-quarter FAST II redeemable warrant, and were assumed by the Company in connection with the Business Combination between the Company and FAST II. Capitalized terms used but not otherwise defined herein shall have the meaning ascribed to such term in the section entitled “Frequently Used Terms and Basis of Presentation.”

This prospectus also relates to the resale from time to time by the selling securityholders (including their transferees, donees, pledgees and other successors-in-interest) named in this prospectus (the “selling securityholders”) of up to 119,096,355 shares of Class A Common Stock, which includes (i) 225,000 shares of Class A Common Stock issued to Infinite Acquisitions Partners LLC (formerly known as Infinite Acquisitions LLLP and Katmandu Collections, LLLP, “Infinite Acquisitions”) upon conversion of the principal amount of $2.25 million outstanding under the Infinite Promissory Note at an equity consideration value of $10.00 per share, (ii) up to 4,995,934 shares of Class A Common Stock issuable upon the redemption of Falcon’s Opco Financing Units and Additional Falcon’s Opco Financing Unit Consideration, issued to Infinite Acquisitions prior to the Business Combination in connection with the Falcon’s Opco Financing at a subscription price of $10.00 per unit, and the simultaneous cancellation of an equal number of shares of class B common stock, par value $0.0001 per share (the “Class B Common Stock”), of the Company, of which Infinite Acquisitions has converted 2,000,000 of such units into 2,000,000 shares of Class A Common Stock and has delivered 274,306 of such shares to Infinite Acquisitions Partners LLC — Founder Series (“Infinite Founder Series”) as described in more detail elsewhere in this prospectus, (iii) up to 46,763,877 shares of Class A Common Stock issuable upon the redemption of 46,763,877 units of Falcon’s Beyond Global LLC, a subsidiary of the Company (“Falcon’s Opco”), issued to the members of Falcon’s Opco at an average price of $0.35 per common unit of Falcon’s Opco prior to the Business Combination, and the simultaneous cancellation of an equal number of shares of Class B Common Stock, (iv) 56,062,500 shares of Class A Common Stock issuable upon the redemption of 56,062,500 common units of Falcon’s Opco and the simultaneous cancellation of an equal number of shares of Class B Common Stock issued to Infinite Acquisitions, Katmandu Ventures LLC (“Katmandu Ventures”) and CilMar Ventures LLC (“CilMar”) in connection with the Business Combination as Earnout Units and Earnout Shares at an equity consideration value of $10.00 per share (after reflecting shares forfeited and vested following the filing of the 2023 Form 10-K pursuant to the terms of the Earnout Escrow Agreement), if such Earnout Units and Earnout Shares vest and are released from escrow in accordance with the terms of the Escrow Agreement, (v) 7,312,500 shares of Class A Common Stock issuable upon the redemption of 7,312,500 units of Falcon’s Opco and the cancelation of an equal number of shares of Class B Common Stock of the Company, reflecting vested Earnout Shares released to Infinite Acquisitions, Katmandu Ventures, and CilMar following the filing of the 2023 Form 10-K pursuant to the terms of the Earnout Escrow Agreement, (vi) 1,437,500 shares of Class A Common Stock issued to FAST Sponsor II LLC (the “Sponsor”) and Infinite Acquisitions in connection with the Business Combination as Earnout Shares at an equity consideration value of $10.00 per share (after reflecting shares forfeited and vested following the filing of the 2023 Form 10-K pursuant to the terms of the Earnout Escrow Agreement), if such Earnout Shares vest and are released from escrow in accordance with the terms of the Escrow Agreement, (vii) 187,500 vested Earnout Shares released to the Sponsor and Infinite Acquisitions following the filing of the 2023 Form 10-K pursuant to the terms of the Earnout Escrow Agreement, (viii) 1,230,000 shares of Class A Common Stock issued to the Sponsor in connection with the Business Combination in exchange for shares of class A common stock, par value $0.0001 per share (“FAST II Class A Common Stock”), of FAST II that were originally issued to the Sponsor in the form of Founder Shares prior to the FAST II IPO at a price of approximately $0.0045 per share, after giving effect to sales by the Sponsor since

Closing, (ix) 861,544 shares of Class A Common Stock that were issued to the Sponsor upon the net share exercise of warrants on a cashless basis that were originally issued to the Sponsor by FAST II in a private placement at a price of $1.50 per warrant and were assumed by the Company in the Business Combination, (x) 20,000 shares of Class A Common Stock held by Meteora Strategic Capital, LLC (“Meteora”), which were received from the Sponsor after the Closing of the Business Combination.

We will receive the proceeds from any exercise of the Warrants for cash, but not from the net share exercise of any Warrants on a cashless basis (if applicable) or from the resale of any shares of Class A Common Stock by the selling securityholders pursuant to this prospectus or the sale of the shares of Class A Common Stock issuable upon the exercise of the Warrants. Each Warrant entitles the holder thereof to purchase 1.034999 shares of Class A Common Stock at an exercise price of $11.50 per Warrant. We will receive up to $59.8 million in cash proceeds from the exercise of the Warrants for cash, but we will not receive any proceeds from the sales of the shares of Class A Common Stock issuable upon such exercise. We believe the likelihood that the holders will exercise their Warrants is dependent upon the trading price of our Class A Common Stock. If the trading price of our Class A Common Stock is less than the exercise price of the Warrants, we believe the holders are unlikely to exercise their Warrants. Conversely, the holders are more likely to exercise their Warrants, the higher the prices of our Class A Common Stock is above the exercise price of the Warrant. On May 24, 2024, the closing price of our Class A Common Stock was $10.25. If the price of our Class A Common Stock remains below $11.50 per share, warrant holders will be unlikely to exercise their Warrants for cash, resulting in little or no cash proceeds to us from such exercises. The Warrants are exercisable on a cashless basis under certain circumstances specified in the Warrant Agreement. To the extent that any Warrants are exercised on a cashless basis, the aggregate amount of cash we would receive from the exercise of the Warrants will decrease. On November 6, 2023, the Sponsor net share exercised 2,882,245 Private Placement Warrants on a cashless basis. We did not receive any cash proceeds in connection with the exercise of the Private Placement Warrants.

The selling securityholders can sell under this prospectus up to 119,096,355 shares of our Class A Common Stock, constituting approximately 95% of our outstanding shares of Common Stock, or approximately 1,035% of our outstanding shares of Class A Common Stock, as of May 24, 2024. Sales of a substantial number of our shares of Class A Common Stock in the public market by the selling securityholders and/or by our other existing securityholders, or the perception that those sales might occur, could increase the volatility of and cause a significant decline in the market price of our securities and could impar our ability to raise capital through the sale of additional equity securities. See “— Sales of a substantial number of our securities in the public market by the selling securityholders and/or by our existing securityholders could cause the price of our shares of Class A Common Stock and Warrants to fall.”

The shares that Infinite Acquisitions may sell under this prospectus includes up to 35,907,551 shares of Class A Common Stock which Infinite Acquisitions is obligated to deliver to Infinite Founder Series pursuant to the terms of a redemption agreement between Infinite Acquisitions and Infinite Founder Series. Beginning on or about February 14, 2024 and continuing on each February 14 on an annual basis for eight years thereafter, Infinite Acquisitions is obligated (such obligations, the “Founder Series Redemption Obligation”) to transfer to Infinite Founder Series up to an aggregate of up to 35,907,551 shares of Class A Common Stock, consisting of up to 13,441,004 shares of Class A Common Stock which may be received by Infinite Acquisitions upon redemption of an equal number of units of Falcon’s Opco and up to an additional 22,466,547 shares of Class A Common Stock which may be received by Infinite Acquisitions upon redemption of an equal number of units of Falcon’s Opco if the criteria for release under the Earnout Escrow Agreement is met. The number of shares of Class A Common Stock to be delivered at each payment date is to be reduced by up to 20% of the amount deliverable, subject to an implied minimum share price of $10 per share. In February 2024, Infinite Acquisitions initiated the delivery of 273,413 shares of Class A Common Stock in satisfaction of the first of the required transfers under the Founder Series Redemption Obligation.

All the securities offered in this prospectus may be resold for so long as the registration statement, of which this prospectus forms a part, is available for use. The sale of all or a portion of the securities being offered in this prospectus could result in a significant decline in the public trading price of our securities. Despite such a decline in the public trading price, some of the selling securityholders may still experience a positive rate of return on the securities they purchased due to the price at which such selling securityholder initially purchased the securities. See the sections of this prospectus entitled “Information Related to the Offered Securities” and “Risk Factors — Certain existing securityholders purchased, or may purchase, securities in the Company at a price below the current trading price of

such securities, and may experience a positive rate of return based on the current trading price. Future investors in the Company may not experience a similar rate of return” for additional information on the potential profits the selling securityholders may experience.

We are registering the securities for resale pursuant to the selling securityholders’ registration rights under certain agreements between us, on the one hand, and the selling securityholders, on the other hand. Our registration of the securities covered by this prospectus does not mean that the selling securityholders will offer or sell any of the securities registered for resale.

We will bear all costs, expenses, and fees in connection with the registration of the shares of Class A Common Stock. The selling securityholders may offer, sell or distribute all or a portion of their shares of Class A Common Stock publicly or through private transactions at prevailing market prices or at negotiated prices. The selling securityholders will bear all commissions and discounts, if any, attributable to their respective sales of the shares of Class A Common Stock. We provide more information about how the selling securityholders may sell the shares of Class A Common Stock in the section titled “Plan of Distribution.”

Our shares of Class A Common Stock and Warrants are listed on the Nasdaq Stock Market LLC (“Nasdaq”) under the symbols “FBYD” and “FBYDW,” respectively. On May 24, 2024, the closing price of our Class A Common Stock was $10.25 per share and the closing price for our Warrants was $1.05 per warrant.

We are an “emerging growth company” and a “smaller reporting company” under the federal securities laws and will be subject to reduced disclosure and public reporting requirements. See “Summary — Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

Investing in shares of our securities involves risks that are described in the “Risk Factors” section beginning on page 9 of this prospectus.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

|

Page |

||

|

ii |

||

|

iii |

||

|

iv |

||

|

v |

||

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND RISK FACTOR SUMMARY |

viii |

|

|

1 |

||

|

4 |

||

|

5 |

||

|

9 |

||

|

54 |

||

|

55 |

||

|

56 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

70 |

|

|

101 |

||

|

108 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

115 |

|

|

119 |

||

|

124 |

||

|

126 |

||

|

137 |

||

|

139 |

||

|

142 |

||

|

147 |

||

|

147 |

||

|

147 |

||

|

F-1 |

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC using the “shelf” registration process. Under the shelf registration process, the selling securityholders may, from time to time, sell the securities offered by them described in this prospectus through any means described in the section titled “Plan of Distribution.” More specific terms of any securities that the selling securityholders and their permitted transferees offer and sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. This prospectus also relates to the issuance by us of shares of Class A Common Stock issuable upon exercise of the Warrants.

We may also provide a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part to add information to, or update or change information contained in, this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement or post-effective amendment modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part together with the additional information to which we refer you in the sections of this prospectus titled “Where You Can Find More Information.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed, or will be incorporated by reference as exhibits to the registration statement of which this prospectus forms a part, and you may obtain copies of those documents as described under “Where You Can Find More Information.”

As used in this prospectus, unless otherwise indicated or the context otherwise requires, references to “we,” “us,” “our,” the “Company,” “Registrant,” and “Falcon’s” refer to Falcon’s Beyond Global, Inc. and its subsidiaries. References to “FBD” refer to the Company’s Falcon’s Beyond Destinations division; references to “FCG” refer to the Company’s Falcon’s Creative Group division; and references to “FBB” refer to the Company’s Falcon’s Beyond Brands division. References to Falcon’s Opco refer to Falcon’s Beyond Global, LLC.

ii

INDUSTRY AND MARKET DATA

This prospectus contains, and any amendment or any prospectus supplement may contain, industry and market data which have been obtained from industry publications, market research and other publicly available information. Such information is supplemented, where necessary, with the Company’s own internal estimates, taking into account publicly available information about other industry participants and the judgment of the Company’s management where information is not publicly available. This information appears in the sections entitled, among others, “Business — Market and Industry Overview” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Industry publications and market research generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed and that the projections they contain are based on a number of significant assumptions. In some cases, the sources from which this data is derived is not expressly referred to. While the Company compiled, extracted and reproduced industry data from these sources, and believes that the information used is reliable, the Company did not independently verify the data that was extracted or derived from such industry publications or market reports, and cannot guarantee its accuracy or completeness.

The industry and market data that appears in this prospectus is inherently uncertain, involves a number of assumptions and limitations and may not necessarily be reflective of actual market conditions and you are cautioned not to give undue weight to such industry and market data because it may differ from current data due to material changes in market conditions or otherwise. Such statistics are based on market research, which itself is based on sampling and subjective judgements by both the researchers and the respondents, including judgements about what types of products and transactions should be included in the relevant market. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

The Company does not intend or assume any obligation to update industry or market data set forth in this prospectus. Because market behavior, preferences and trends are subject to change, prospective investors should be aware that market and industry information in this prospectus and estimates based on any data therein may not be reliable indicators of future market performance or the Company’s future results of operations.

iii

TRADEMARKS

This prospectus contains, and any amendment or any prospectus supplement may contain, references to trademarks and service marks belonging to other entities. Solely for convenience, trademarks and trade names, referred to in this prospectus may appear without the® or ™ symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

iv

FREQUENTLY USED TERMS AND BASIS OF PRESENTATION

As used in this prospectus, unless otherwise noted or the context otherwise requires, references to:

“2023 Form 10-K” are to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023;

“Acquisition Merger Closing Date” are to the date on which the Acquisition Merger occurred;

“Additional Falcon’s Opco Financing Unit Consideration” are to the shares of Class B Common Stock and New Falcon’s Opco Units issued in connection with the Business Combination;

“A&R Operating Agreement” are to the Amended and Restated Operating Agreement of Falcon’s Beyond Global, LLC;

“Approved Exchange” are to NYSE (including NYSE American) or Nasdaq (including Nasdaq Capital Market);

“Class A Common Stock” are to the shares of Class A common stock, par value $0.0001 per share, which are economic and voting equity interests in the Company;

“Class B Common Stock” are to the shares of Class B common stock, par value $0.0001 per share, which are non-economic voting equity interests in the Company;

“Board” are to the Board of Directors of Falcon’s Beyond Global, Inc.;

“Bylaws” are to the bylaws of Falcon’s Beyond Global, Inc.;

“Charter” are to the amended and restated certificate of incorporation of Falcon’s Beyond Global, Inc.;

“Class B Exchange” are to the exchange by the Sponsor of FAST II Class B Common Stock for shares of FAST II Class A Common Stock in accordance with the FAST II Charter and subject to the terms and subject to the conditions set forth in the Sponsor Support Agreement;

“Closing” are to the closing of the Business Combination;

“Code” are to the U.S. Internal Revenue Code of 1986, as amended;

“Common Share Price” are to the share price equal to the volume weighted average closing sale price of one share of Class A Common Stock as reported on an Approved Exchange (or the exchange on which the shares of Class A Common Stock are then listed) for a period of at least 20 trading days out of 30 consecutive trading days ending on the trading day immediately prior to the date of determination, as adjusted as appropriate to reflect any stock splits, reverse stock splits, stock dividends (including any dividend or distribution of securities convertible into Class A Common Stock), extraordinary cash dividend, reorganization, recapitalization, reclassification, combination, exchange of shares or other like change or transaction with respect to Class A Common Stock, as determined by the Board (or a committee thereof) in good faith;

“Common Stock” are to the Class A Common Stock and Class B Common Stock;

“Company” are to Falcon’s Beyond Global, Inc.;

“Company EBITDA” are to net income before interest expense, tax expense, depreciation and amortization, each of the Company determined in accordance with GAAP, subject to certain adjustments; provided that the Company’s indirect share of any net income, interest expense, tax expense, depreciation and amortization of any unconsolidated joint ventures shall also be included;

“Company Revenue” are to the gross revenue of the Company determined in accordance with GAAP; provided that the Company’s indirect share of any revenue of any unconsolidated joint ventures shall also be included;

“Continental” are to Continental Stock Transfer & Trust Company;

“DGCL” are to the Delaware General Corporation Law, as may be amended from time to time;

v

“Earnout Period” are to the five-year period beginning on the one-year anniversary of the Acquisition Merger and ending on the Earnout Period End Date.

“Earnout Period End Date” are to 11:59 p.m. New York City time on the six-year anniversary of the Acquisition Merger;

“Earnout Shares” are to, collectively, the shares of Class B Common Stock and shares of Class A Common Stock, in each case that were deposited into escrow at the Acquisition Merger Effective Time and be earned, released and delivered upon satisfaction of certain milestones related to the Common Share Price, Company EBITDA or Company Revenue, as applicable, during the Earnout Period;

“Earnout Units” are to the New Falcon’s Opco Units that were deposited into escrow at the Acquisition Merger Effective Time and be earned, released and delivered upon satisfaction of certain milestones related to the Common Share Price, Company EBITDA or Company Revenue, as applicable, during the Earnout Period;

“Escrow Agreement” are to Escrow Agreement, dated as of October 6, 2023, by and among the Company, Falcon’s Opco, the persons receiving Earnout Shares and Earnout Units and Continental Stock Transfer & Trust Company, as escrow agent;

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

“Falcon’s Opco” are to Falcon’s Beyond Global, LLC, a Delaware limited liability company;

“Falcon’s Opco Financing” are to the subscription for and purchase of up to $80,000,000 of Opco Units by Infinite Acquisitions at a price of $10.00 per Opco Unit and Falcon’s Opco’s issuance and sale thereof, in each case, pursuant to the Subscription Agreement and the Subsequent Subscription Agreement, as applicable;

“Falcon’s Opco Financing Units” are to the Opco Units issued in connection with the Falcon’s Opco Financing;

“Falcon’s Opco Unit” are to any limited liability company interests in Falcon’s Opco prior to the closing of the Business Combination;

“Falcon’s Opco Unitholders” are to the holders of Falcon’s Opco Units prior to the closing of the Business Combination;

“FAST II” are to FAST Acquisition Corp. II, a Delaware corporation;

“FAST II Charter” are to the amended and restated certificate of incorporation of FAST II, dated as of March 15, 2021, as amended;

“FAST II Class A Common Stock” are to the shares of FAST II’s Class A common stock, par value $0.0001 per share;

“FAST II Class B Common Stock” are to the shares of FAST II’s Class B common stock, par value $0.0001 per share;

“FAST II IPO” are to FAST II’s initial public offering of FAST II Units, which closed on March 18, 2021;

“FAST II Private Placement Warrants” are to the private placement warrants, each exercisable to purchase one share of FAST II Class A Common Stock at $11.50 per share, issued to the Sponsor in a private placement simultaneously with the closing of the FAST II IPO;

“FAST II Public Warrants” are to the redeemable warrants of FAST II included in the FAST II Units;

“FAST II Unit” are to the units issued in the FAST II IPO, each consisting of one share of FAST II Class A Common Stock and one-quarter of one FAST II Public Warrant;

“FAST II Warrants” are to, collectively, (i) the FAST II Public Warrants and (ii) the FAST II Private Placement Warrants;

“Founder Shares” are to the shares of FAST II Class B Common Stock and FAST II Class A Common Stock issued upon the Class B Exchange;

“GAAP” are to generally accepted accounting principles in the United States, as applied on a consistent basis;

vi

“Infinite Acquisitions” are to Infinite Acquisitions Partners LLC, a Delaware limited liability company (formerly known as Infinite Acquisitions LLLP and Katmandu Collections, LLLP);

“Infinite Promissory Note” are to the Promissory Note, dated as of January 31, 2023, by and between FAST Acquisition Corp. II and Infinite Acquisitions Partners LLC (formerly known as Infinite Acquisitions LLLP and Katmandu Collections, LLLP), as amended by the Amendment to Promissory Note, dated July 7, 2023;

“Merger Sub” are to Palm Merger Sub LLC, a Delaware limited liability company and a wholly-owned subsidiary of the Company;

“New Falcon’s Opco Units” are to the limited liability company interests of Falcon’s Opco which are forth in the A&R Operating Agreement;

“Private Placement Warrants” are to the private placement warrants of the Company that were assumed in connection with the Business Combination;

“Preferred Unit” are to any limited liability company interest in Falcon’s Opco designated as a “Preferred Unit” in Falcon’s Opco’s A&R Operating Agreement;

“Public Warrants” are to the public warrants of the Company that were assumed in connection with the Business Combination;

“SEC” are to the U.S. Securities and Exchange Commission;

“Securities Act” are to the Securities Act of 1933, as amended;

“Series A Preferred Stock” are to the 8% Series A Cumulative Convertible Preferred Stock of the Company, which automatically converted into Class A Common Stock pursuant to its terms in November 2023;

“SPAC Merger Closing Date” are to the date on which the SPAC Merger occurred;

“Sponsor” are to FAST Sponsor II LLC, a Delaware limited liability company, which is FAST II’s sponsor;

“Warrants” are to the Public Warrants;

“Warrant Agreement” are to the second amended and restated warrant agreement, dated as of November 3, 2023 between the Company and Continental Stock Transfer & Trust Company, as warrant agent;

“Warrant Units” are to the warrant units of the Company which are set forth in the A&R Operating Agreement.

Unless specified otherwise, amounts in this prospectus are presented in U.S. dollars.

Defined terms in the financial statements contained in this prospectus have the meanings ascribed to them in the financial statements.

vii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

AND RISK FACTOR SUMMARY

This prospectus contains statements that the Company believes are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements relating to expectations for future financial performance, business strategies or expectations for our business. These statements are based on the beliefs and assumptions of the management of the Company. Although the Company believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, it cannot provide assurance that it will achieve or realize these plans, intentions or expectations. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this in this prospectus, words such as “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “strive,” “target,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

You should not place undue reliance on these forward-looking statements. Should one or more of a number of known and unknown risks and uncertainties materialize, or should any of our assumptions prove incorrect, the Company’s actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include, but are not limited to the risks below, which also serves as a summary of the principal risks of an investment in our securities:

• We may not be able to sustain our growth, effectively manage our anticipated future growth, implement our business strategies or achieve the results we anticipate.

• The impairments of our intangible assets and equity method investment in our joint ventures, have materially and adversely impacted our business and results of operations and may do so again in the future.

• Our current liquidity resources raise substantial doubt about our ability to continue as a going concern and holders of our securities could suffer a total loss of their investment.

• We will require additional capital, which additional financing may result in restrictions on our operations or substantial dilution to our stockholders, to support the growth of our business, and this capital might not be available on acceptable terms, if at all.

• Following the closure of Katmandu Park DR, our FBD business is in transition, and the repositioning and rebranding of FBD projects will be subject to timing, budgeting and other risks which could have a material adverse effect on us. In addition, the ongoing need for capital expenditures to develop our FBD business could have a material adverse effect on us, including our financial condition, liquidity and results of operations.

• Our growth plans in FCG may take longer than anticipated or may not be successful.

• Our ability to execute on our strategy and business model is dependent on the quality of our services, and our failure to offer high quality services could have a material adverse effect on its sales and results of operations.

• Anticipated synergies across our three business lines may not create the diversified revenue streams that we believe they will.

• A significant portion of our revenue is derived from one large client and any loss of, or decrease in services to, that client could harm our results of operations.

• Following the completion of the Strategic Investment (as defined below), the Company, Falcon’s Opco and FCG LLC are subject to contractual restrictions that may affect our ability to access the public markets and expand our business.

• The significance of our operations and partnerships outside of the United States makes us susceptible to the risks of doing business internationally, which could lower our revenues, increase our costs, reduce our profits, disrupt our business, or damage our reputation.

viii

• We are exposed to risks related to operating in the Kingdom of Saudi Arabia.

• Our indebtedness and liabilities could limit the cash flow available for our operations, which may adversely affect our financial condition and future financial results. The principal, premium, if any, and interest payment obligations of such debt may restrict our future operations and impair our ability to invest in our businesses.

• We may expand into new lines of business in our FBB division and may face risks associated with such expansion.

• We have entered and expect to continue to enter into joint venture, strategic collaborations, teaming and other business arrangements, and these activities involve risks and uncertainties. A failure of any such relationship could have a material adverse effect on our business and results of operations.

• In certain jurisdictions into which we are currently contemplating expanding, we will rely on strategic relationships with local partners in order to be able to offer and market our products and services. If we cannot establish and maintain these relationships, our business, financial condition and results of operations could be adversely affected.

• We are dependent on the continued contributions of our senior management and other key employees, and the loss of any of whom could adversely affect our business, operating results, and financial condition.

• If we are unable to hire, retain, train and motivate qualified personnel and senior management for our businesses and deploy our personnel and resources to meet customer demand around the world, our business could suffer.

• Failures in, material damage to, or interruptions in our information technology systems, software or websites, and difficulties in updating our systems or software or implementing new systems or software could adversely affect our businesses or operations.

• Protection of electronically stored data and other cybersecurity is costly, and if our data or systems are materially compromised in spite of this protection, we may incur additional costs, lost opportunities, damage to our reputation, disruption of services or theft of our assets.

• Our insurance may not be adequate to cover the potential losses, liabilities and damages of our FBD division, the cost of insurance may continue to increase materially, including as a result of natural disasters, some of which may be related to climate change, and we may not be able to secure insurance to cover all of our risks, all of which could have a material adverse effect on us.

• Theft of our intellectual property, including unauthorized exhibition of our content, may decrease our licensing, franchising and programming revenue which may adversely affect our business and profitability.

• We are a holding company and our only material asset is our interest in Falcon’s Opco, and accordingly we will generally be dependent upon distributions from Falcon’s Opco to pay taxes, make payments under the Tax Receivable Agreement and pay dividends.

• Under the Tax Receivable Agreement, the Company is required to make payments to the Company’s unitholders for certain tax benefits to which the Company may become entitled, and those payments may be substantial.

• In certain cases, payments under the Tax Receivable Agreement may be accelerated and/or significantly exceed the actual benefits the Company realizes in respect of the tax attributes subject to the Tax Receivable Agreement.

• If Falcon’s Opco were to become a publicly traded partnership taxable as a corporation for U.S. federal income tax purposes, the Company and Falcon’s Opco might be subject to potentially significant tax inefficiencies, and the Company would not be able to recover payments previously made by it under the Tax Receivable Agreement even if the corresponding tax benefits were subsequently determined to have been unavailable due to such status.

ix

• As a public reporting company, we are subject to rules and regulations established from time to time by the SEC and Public Company Accounting Oversight Board regarding our internal control over financial reporting. If we fail to establish and maintain effective internal control over financial reporting and disclosure controls and procedures, we may not be able to accurately report our financial results or report them in a timely manner.

• We have identified material weaknesses in our internal controls over financial reporting. If we are unable to remediate these material weaknesses, if management identifies additional material weaknesses in the future or if we otherwise fail to maintain effective internal controls over financial reporting, we may not be able to accurately or timely report our financial position or results of operations, which may adversely affect our business and stock price or cause our access to the capital markets to be impaired.

• The Demerau Family is expected to have significant influence over stockholder decisions because of its share ownership.

• Cecil D. Magpuri, our Chief Executive Officer, controls over twenty percent of our voting power and is able to exert significant influence over the direction of our business.

• There can be no assurance that we will be able to comply with the continued listing standards of Nasdaq.

• The other factors described in the section entitled “Risk Factors” in this prospectus.

Forward-looking statements are provided for illustrative purposes only and are not guarantees of performance. You should not put undue reliance on these statements which speak only as of the date hereof. You should understand that the factors discussed under the heading “Risk Factors” and elsewhere in this prospectus, could affect the future results of the Company, and could cause those results or other outcomes to differ materially from those expressed or implied in the forward-looking statements in this prospectus.

In addition, the risks described under the heading “Risk Factors” are not exhaustive. Other sections of this prospectus describe additional factors that could adversely affect the businesses, financial conditions, or results of operations of the Company. New risk factors emerge from time to time and it is not possible to predict all such risk factors, nor can the Company assess the impact of all such risk factors on the businesses of the Company, or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements attributable to the Company or persons acting on their behalf are expressly qualified in their entirety by the foregoing cautionary statements. The Company undertakes no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, this prospectus contains statements of belief and similar statements that reflect the beliefs and opinions of the Company on the relevant subject. These statements are based upon information available to the Company as of the date of this prospectus, and while the Company believes such information forms a reasonable basis for such statements, such information may be limited or incomplete, and statements should not be read to indicate that the Company has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements.

x

SUMMARY

This summary highlights selected information from this prospectus and may not contain all of the information that is important to you in making an investment decision. Before investing in our securities, you should read this entire document carefully, including our financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Some of the statements in this prospectus constitute forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements and Risk Factor Summary.”

Overview of the Company

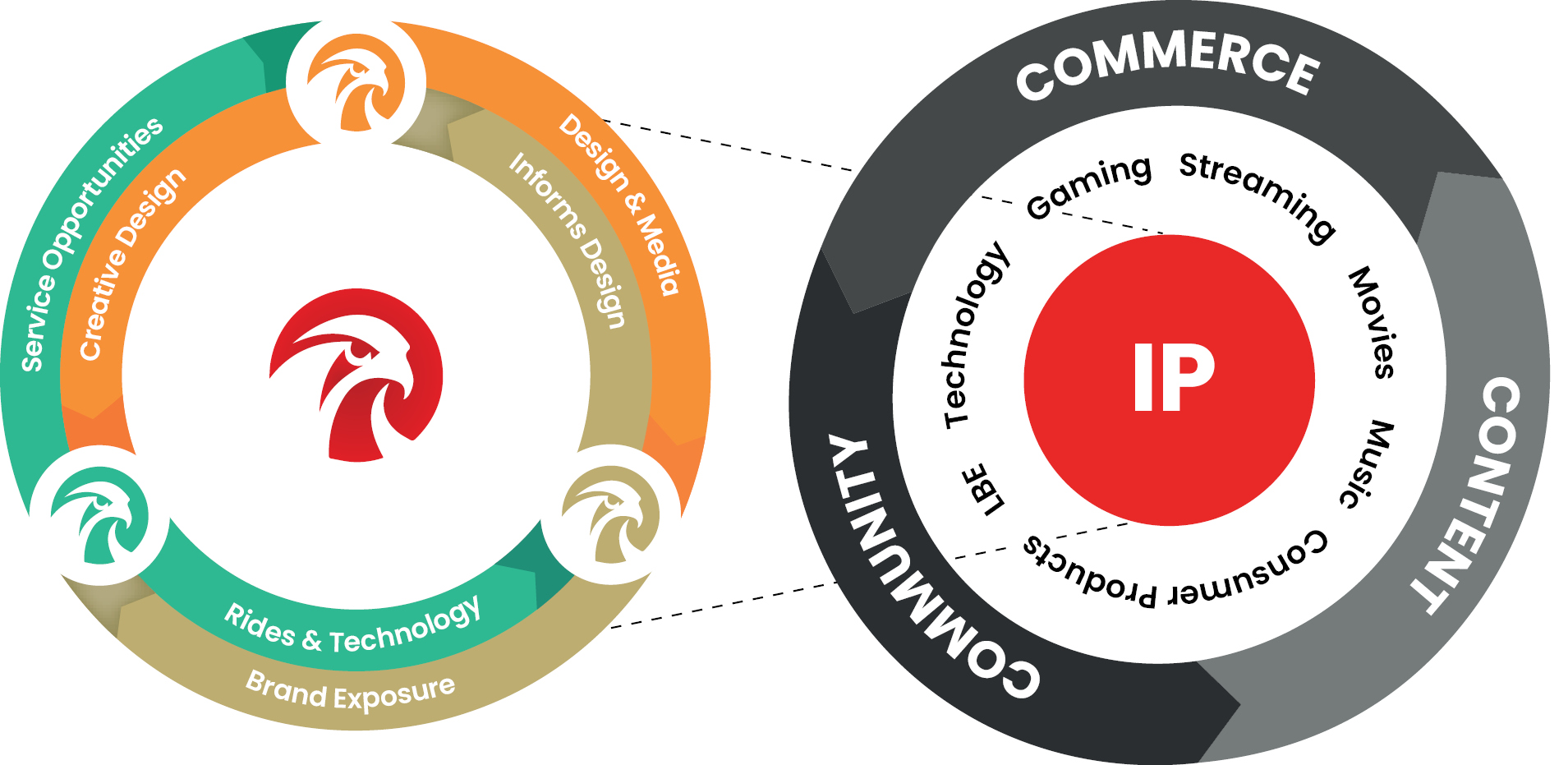

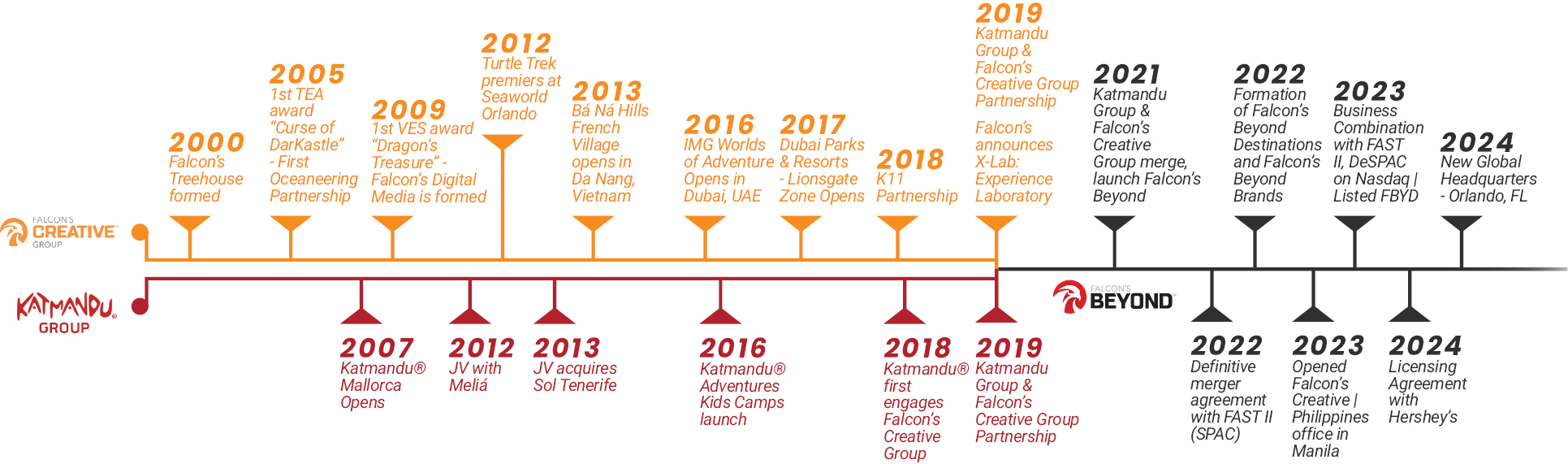

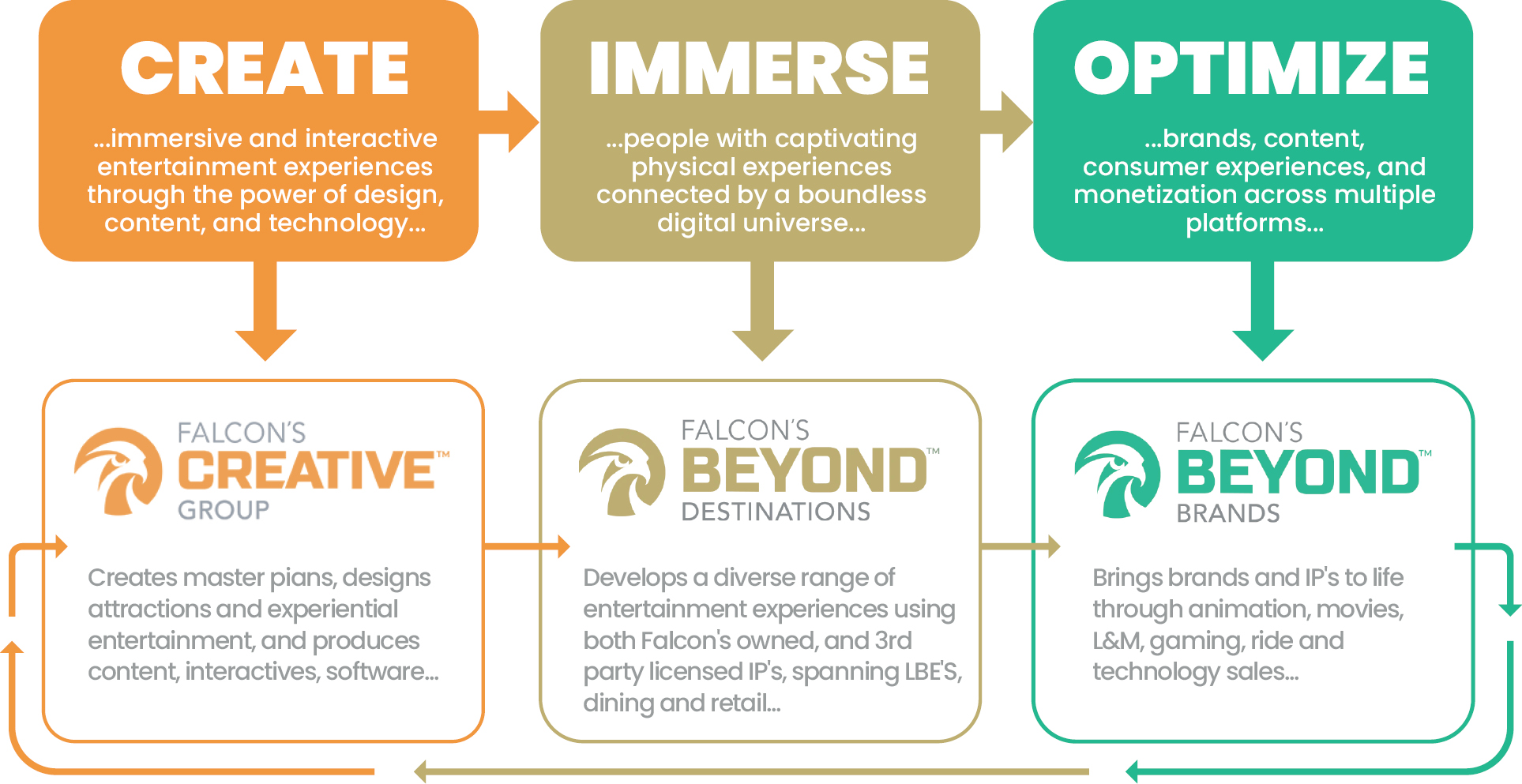

We are a visionary leader in innovative and immersive storytelling, sitting at the intersection of three potential high growth business opportunities, content, technology and experiences. We aim to engage, inspire and entertain people through our creativity and innovation, and to connect people with brands, with each other, and with themselves through the combination of digital and physical experiences. At the core of our business is brand creation and optimization, facilitated by our multi-disciplinary creative teams. We believe the complementary strengths of our business divisions facilitates invaluable insights and streamlined growth. The Company has three business divisions, which are conducted through five operating segments.

Our business divisions complement each other as we pursue our growth strategy: (i) FCG creates master plans, designs attractions and experiential entertainment, and produces content, interactives and software; (ii) FBD, consisting of PDP, Sierra Parima (Sierra Parima’s Katmandu Park in Punta Cana, Dominican Republic (“Katmandu Park DR”) was closed to visitors on March 7, 2024), and Destinations Operations, develops a diverse range of entertainment experiences using both Falcon’s owned and third party licensed intellectual property, spanning LBE, dining, and retail; and (iii) FBB endeavors to bring brands and intellectual property to life through animation, movies, licensing and merchandising, gaming, as well as ride and technology sales.

The Business Combination and Related Transactions

We entered into that certain Amended and Restated Agreement and Plan of Merger, dated as of January 31, 2023, as amended by Amendment No. 1 dated June 25, 2023, Amendment No. 2 dated July 7, 2023, and Amendment No. 3 dated September 1, 2023 (the “Merger Agreement”), by and among us, FAST II, Falcon’s Opco, and Merger Sub.

As contemplated by the Merger Agreement, the Business Combination (as defined below) was effected in two steps: (a) on October 5, 2023 (the “SPAC Merger Effective Time”), FAST II merged with and into us (the “SPAC Merger”), with us surviving as the sole owner of Merger Sub, followed by a contribution by us of all of our cash (except for cash required to pay certain transaction expenses) to Merger Sub to effectuate the “UP-C” structure; and (b) on October 6, 2023 (the “Acquisition Merger Effective Time”), Merger Sub merged with and into Falcon’s Opco (the “Acquisition Merger,” and collectively with the SPAC Merger, the “Business Combination”), with Falcon’s Opco as the surviving entity of such merger. Following the consummation (the “Closing”) of the Business Combination, the direct interests in Falcon’s Opco are held by the Company and certain holders of the Falcon’s Opco Units outstanding as of immediately prior to the Business Combination.

The Earnout Shares and Earnout Units were deposited into escrow at the Acquisition Merger Effective Time and are to be earned, released and delivered upon satisfaction of, or forfeited and canceled upon the failure of, certain milestones related to the EBITDA of the Company and the gross revenue of the Company during periods between July 1, 2023 and December 31, 2024 and the volume weighted average closing sale price of shares of Class A Common Stock during the five-year period beginning on the one-year anniversary of the Acquisition Merger and ending on the six-year anniversary of the Acquisition Merger. In connection with the Closing, as of the Acquisition Merger Effective Time, Jefferies LLC assigned all of its rights to receive 775,000 Earnout Shares to Infinite Acquisitions, without any payment or other consideration therefor.

The total number of shares of Class A Common Stock outstanding immediately following the Closing was 7,986,019; the total number of shares of Class B Common Stock outstanding immediately following the Closing was 127,596,617; the total number of shares of Series A Preferred Stock outstanding immediately following the Closing was 656,415; and the total number of Public Warrants and Private Placement Warrants outstanding immediately following the Closing was 8,440,641. Following the automatic conversion of the Series A Preferred Stock and the net share exercise of the Private Placement Warrants on November 6, 2023 described below, and the exercise of Public Warrants and earnout

1

forfeitures, as of May 24, 2024, the total number of shares of Class A Common Stock outstanding is 11,504,248; the total number of shares of Class B Common Stock outstanding is 113,409,117; and the total number of Warrants outstanding is 5,198,420.

Emerging Growth Company

We qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a registration statement under the Securities Act declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have not elected to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard.

This may make comparison of our consolidated financial statements with another public company which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible because of the potential differences in accounting standards used.

We will remain an emerging growth company until the earlier of: (1) the last day of the fiscal year (a) following the fifth anniversary of the effectiveness of our registration statement on Form S-4 in connection with the Business Combination, (b) in which we have total annual revenue of at least $1,235,000,000, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common equity that is held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter; and (2) the date on which we have issued more than $1.00 billion in non-convertible debt securities during the prior three-year period.

Smaller Reporting Company

Additionally, we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of the fiscal year in which (i) the market value of the shares of Class A Common Stock held by non-affiliates exceeds $250 million as of the prior June 30, and (ii) our annual revenue exceeds $100 million during such completed fiscal year and the market value of the shares of Class A Common Stock held by non-affiliates exceeds $700 million as of the prior June 30. To the extent we take advantage of such reduced disclosure obligations, it may also make comparison of our financial statements with other public companies difficult or impossible.

Automatic Conversion of Preferred Stock

On November 6, 2023, pursuant to the terms of the Certificate of Designation of the Rights and Preferences of the 8% Series A Cumulative Convertible Preferred Stock, all outstanding shares of Series A Preferred Stock automatically converted into shares of Class A Common Stock at a conversion rate of 0.90909 shares of Class A Common Stock for each share of Series A Preferred Stock. An aggregate of approximately 600,000 shares of Class A Common Stock were issued upon conversion of the Series A Preferred Stock. Following the automatic conversion of the Series A Preferred Stock, there were no outstanding shares of Series A Preferred Stock and, as of the close of trading on November 6, 2023, the shares of Series A Preferred Stock ceased trading on Nasdaq.

On November 3, 2023, in connection with the automatic conversion of all outstanding Series A Preferred Stock, the Company and Continental entered into a second amended and restated warrant agreement (referred to herein as the “Warrant Agreement”) to reflect the withdrawal and delisting of the Series A Preferred Stock following the automatic conversion thereof. In connection with the automatic conversion of the Series A Preferred Stock, the Company’s outstanding warrants will be exercisable for 1.034999 shares of Class A Common Stock.

2

Exercise of Warrants

Each whole Warrant is exercisable, at an initial exercise price of $11.50, subject to adjustment, for 1.034999 shares of Class A Common Stock. We will receive up to $59.8 million in cash proceeds from the exercise of the Warrants for cash, but we will not receive any proceeds from the sales of the shares of Class A Common Stock issuable upon such exercise. We believe the likelihood that the holders will exercise their Warrants is dependent upon the trading price of our Class A Common Stock. If the trading price of our Class A Common Stock is less than the exercise price of the Warrants, we believe the holders are unlikely to exercise their Warrants. Conversely, the holders are more likely to exercise their Warrants, the higher the prices of our Class A Common Stock is above the exercise price of the Warrant. On May 24, 2024, the closing price of our Class A Common Stock was $10.25. If the price of our Class A Common Stock remains below $11.50 per share, warrant holders will be unlikely to exercise their Warrants for cash, resulting in little or no cash proceeds to us from such exercises. The Warrants are exercisable on a cashless basis under certain circumstances specified in the Warrant Agreement. To the extent that any Warrants are exercised on a cashless basis, the aggregate amount of cash we would receive from the exercise of the Warrants will decrease.

On November 6, 2023, the Sponsor net share exercised 2,882,245 Private Placement Warrants on a cashless basis for an aggregate of 861,444 shares of Class A Common Stock. We did not receive any cash proceeds in connection with the exercise of the Private Placement Warrants.

Corporate Information

We were incorporated as a Delaware corporation on July 8, 2022. We are a holding company whose principal assets are the New Falcon’s Opco Units we hold in Falcon’s Opco.

Our principal executive office is located at 1768 Park Center Drive, Orlando, FL 32835. Our telephone number is (407) 909-9350. Our website address is https://falconsbeyond.com. Information contained on our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

3

THE OFFERING

|

Issuer |

Falcon’s Beyond Global, Inc. |

|

|

Issuance of Class A Common Stock |

||

|

Shares of Class A Common Stock offered by us |

|

|

|

Resale of Class A Common Stock |

||

|

Class A Common Stock offered by the selling securityholders |

|

|

|

Shares of Class A Common Stock outstanding prior to this offering |

|

|

|

Shares of Class B Common Stock outstanding prior to this offering |

|

|

|

Shares of Class A Common Stock outstanding assuming surrender of Class B Common Stock |

|

|

|

Terms of the Offering |

The selling securityholders will determine when and how they will dispose of any shares of Class A Common Stock registered under this prospectus for resale. |

|

|

Use of proceeds |

We will not receive any proceeds from the sale of shares of Class A Common Stock by the selling securityholders pursuant to this prospectus, nor from the sale of the shares of Class A Common Stock issuable upon the exercise of the Warrants. We will receive an aggregate of approximately $59.8 million upon the cash exercise of all Warrants. We intend to use such proceeds for general corporate purposes. To the extent the Warrants are exercised on a cashless basis (if applicable), we will receive no proceeds from such exercises. As of the date of this prospectus, our Warrants are “out of the money” which means that the trading price of our Class A common stock underlying such warrants is below the $11.50 exercise price of the warrants. As a result, we do not expect warrant holders to exercise such warrants until such time as the trading price of our Class A common stock exceeds the warrant exercise price and, therefore, we will not receive cash proceeds from any such exercise for the foreseeable future. |

|

|

Risk factors |

You should carefully read the “Risk Factors” beginning on page 9 and the other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our Class A Common Stock. |

|

|

Material U.S. Federal Income Tax Considerations |

|

|

|

Nasdaq symbol for our Class A Common Stock |

|

|

|

Nasdaq symbol for our Warrants |

“FBYDW” |

4

INFORMATION RELATED TO THE OFFERED SECURITIES

This prospectus relates to the issuance by us of 5,380,360 shares of Class A Common Stock issuable upon exercise of upon the exercise of 5,198,420 Warrants at an exercise price of $11.50 per warrant, that were originally issued by FAST II as part of its initial public offering of units at a price of $10.00 per unit, with each unit consisting of one share of FAST II Class A Common Stock and one-quarter of one FAST II Public Warrant, and were assumed by the Company in connection with the Business Combination.

This prospectus also relates to the offer and resale from time to time by the selling securityholders of up to 119,096,355 shares of Class A Common Stock, constituting approximately 95% of our outstanding shares of Common Stock, or approximately 1,035% of our outstanding shares of Class A Common Stock, as of May 24, 2024, which includes (i) 225,000 shares of Class A Common Stock issued to Infinite Acquisitions upon conversion of the principal amount of $2.25 million outstanding under the Infinite Promissory Note, (ii) up to 4,995,934 shares of Class A Common Stock issuable upon the redemption of Falcon’s Opco Financing Units and Additional Falcon’s Opco Financing Unit Consideration, issued to Infinite Acquisitions prior to the Business Combination in connection with the Falcon’s Opco Financing, and the simultaneous cancellation of an equal number of shares of Class B Common Stock of the Company, of which Infinite Acquisitions has converted 2,000,000 of such units into 2,000,000 shares of Class A Common Stock and has delivered 274,306 of such shares to Infinite Founder Series under the Founder Series Redemption Obligation, (iii) up to 46,763,877 shares of Class A Common Stock issuable upon the redemption of 46,763,877 units of Falcon’s Opco issued to the members of Falcon’s Opco prior to the Business Combination, and the simultaneous cancellation of an equal number of shares of Class B Common Stock, of the Company, (iv) 56,062,500 shares of Class A Common Stock issuable upon the redemption of 56,062,500 common units of Falcon’s Opco and the simultaneous cancellation of an equal number of shares of Class B Common Stock issued to Infinite Acquisitions, Katmandu Ventures, and CilMar in connection with the Business Combination as Earnout Units and Earnout Shares, after reflecting shares forfeited and vested following the filing of the 2023 Form 10-K pursuant to the terms of the Earnout Escrow Agreement, if such Earnout Units and Earnout Shares vest and are released from escrow in accordance with the terms of the Escrow Agreement, (v) 7,312,500 shares of Class A Common Stock issuable upon the redemption of 7,312,500 units of Falcon’s Opco and the cancelation of an equal number of shares of Class B Common Stock of the Company, reflecting vested Earnout Shares released to Infinite Acquisitions, Katmandu Ventures, and CilMar following the filing of the 2023 Form 10-K pursuant to the terms of the Earnout Escrow Agreement, (vi) 1,437,500 shares of Class A Common Stock issued to the Sponsor and Infinite Acquisitions in connection with the Business Combination as Earnout Shares, after reflecting shares forfeited and vested following the filing of the 2023 Form 10-K pursuant to the terms of the Earnout Escrow Agreement, if such Earnout Shares vest and are released from escrow in accordance with the terms of the Escrow Agreement, (vii) 187,500 vested Earnout Shares released to the Sponsor and Infinite Acquisitions following the filing of the 2023 Form 10-K pursuant to the terms of the Earnout Escrow Agreement, (viii) 1,230,000 shares of Class A Common Stock issued to the Sponsor in connection with the Business Combination in exchange for shares of FAST II Class A Common Stock, after giving effect to sales by the Sponsor since Closing; (ix) 861,544 shares of Class A Common Stock issued to the Sponsor upon the net share exercise of the Private Placement Warrants and Working Capital Warrants, and (x) 20,000 shares of Class A Common Stock held by Meteora which were received from the Sponsor after the Closing of the Business Combination.

The following table includes information relating to the securities held by the selling securityholders, including the price each selling securityholder paid for the securities, the potential profit relating to such securities and any applicable lock-up restrictions. The following table is derived in part from our internal records and is for illustrative purposes only. The table should not be relied upon for any purpose outside of its illustrative nature. The public offering price in the FAST II IPO was $10.00 per FAST II Unit. As set forth in the table below, some of the selling security holders may realize a positive rate of return on the sale of the securities covered by this prospectus even if the market price per share of our Class A Common Stock is below $10.00 per share, in which case the public shareholders may experience a negative rate of return on their investment.

5

|

Selling Securityholder |

Number of Securities Offered |

Effective Purchase Price per Offered Security |

Potential Profit Per Offered Security(1) |

Potential Aggregate Gross Profit |

Lock-Up Restrictions |

|||||||||

|

FAST Sponsor II LLC |

|

|

|

|

||||||||||

|

Class A Common Stock |

1,230,000 |

(2) |

$ |

0.0045 |

$ |

10.25 |

$ |

12,601,965 |

(14) |

|||||

|

Class A Common Stock issued upon net share exercise of Private Placement Warrants |

861,544 |

(3) |

$ |

— |

$ |

10.25 |

$ |

8,830,826 |

— |

|||||

|

Vested Class A Earnout Shares |

112,500 |

(4) |

$ |

10.00 |

$ |

0.25 |

$ |

28,125 |

(15) |

|||||

|

Class A Earnout Shares Subject to Vesting |

862,500 |

(4) |

$ |

10.00 |

$ |

0.25 |

$ |

215,625 |

(16) |

|||||

|

Infinite Acquisitions Partners LLC(17) |

|

|

|

|

||||||||||

|

Class A Common Stock issued upon conversion of Convertible Promissory Note |

225,000 |

(5) |

$ |

10.00 |

$ |

0.25 |

$ |

56,250 |

— |

|||||

|

Class A Common Stock underlying units issued in the Falcon’s Opco Financing |

4,995,934 |

(6) |

$ |

10.00 |

$ |

0.25 |

$ |

1,248,984 |

— |

|||||

|

Vested Class A Earnout Shares |

75,000 |

(7) |

$ |

10.00 |

$ |

0.25 |

$ |

18,750 |

(15) |

|||||

|

Class A Earnout Shares Subject to Vesting |

575,000 |

(7) |

$ |

10.00 |

$ |

0.25 |

$ |

143,750 |

(16) |

|||||

|

Class A Common Stock underlying Falcon’s Opco Units |

22,272,939 |

(8) |

$ |

0.35 |

$ |

9.90 |

$ |

220,502,096 |

— |

|||||

|

Class A Common Stock underlying Vested Earnout Units |

5,026,608 |

(9) |

$ |

10.00 |

$ |

0.25 |

$ |

1,256,652 |

(15) |

|||||

|

Class A Common Stock underlying Earnout Units Subject to Vesting |

21,890,000 |

(9) |

$ |

10.00 |

$ |

0.25 |

$ |

5,472,500 |

(16) |

|||||

|

CilMar Ventures LLC |

|

|

|

|

||||||||||

|

Class A Common Stock underlying Falcon’s Opco Units |

12,245,469 |

(10) |

$ |

0.35 |

$ |

9.90 |

$ |

121,230,143 |

— |

|||||

|

Class A Common Stock underlying Vested Earnout |

1,142,946 |

(11) |

$ |

10.00 |

$ |

0.25 |

$ |

285,737 |

(15) |

|||||

|

Class A Common Stock underlying Earnout Units Subject to Vesting |

17,086,250 |

(11) |

$ |

10.00 |

$ |

0.25 |

$ |

4,271,563 |

(16) |

|||||

|

Katmandu Ventures LLC |

|

|

|

|

||||||||||

|

Class A Common Stock underlying Falcon’s Opco Units |

12,245,469 |

(12) |

$ |

0.35 |

$ |

9.90 |

$ |

121,230,143 |

— |

|||||

|

Class A Common Stock underlying Vested Earnout Units |

1,142,946 |

(13) |

$ |

10.00 |

$ |

0.25 |

$ |

285,737 |

(15) |

|||||

|

Class A Common Stock underlying Earnout Units Subject to Vesting |

17,086,250 |

(13) |

$ |

10.00 |

$ |

0.25 |

$ |

4,271,563 |

(16) |

|||||

6

|

Selling Securityholder |

Number of Securities Offered |

Effective Purchase Price per Offered Security |

Potential Profit Per Offered Security(1) |

Potential Aggregate Gross Profit |

Lock-Up Restrictions |

||||||||

|

Meteora Strategic Capital LLC |

|

|

|

||||||||||

|

Class A Common Stock |

20,000 |

(18) |

— |

$ |

10.25 |

$ |

205,000 |

(14) |

|||||

____________

(1) Notwithstanding any restrictions on the transferability of the shares of our Class A Common Stock, the potential vesting of any Earnout Shares and/or Earnout Units, as applicable, or the shares of our Class A Common Stock issuable upon the redemption of Falcon’s Opco units and simultaneous cancellation of shares of Class B Common Stock, the potential profit per security offered and potential aggregate gross profit are calculated assuming that all such shares of Class A Common Stock were sold at a price of $10.25 per share, which was the closing price of our Class A Common Stock on May 24, 2024. The trading price of our Class A Common Stock may be different at the time a selling securityholder decides to sell its securities.

(2) Represents the shares of Class A Common Stock issued to the Sponsor in connection with the Business Combination in exchange for shares of FAST II Class A Common Stock, originally issued to the Sponsor in the form of Founder Shares prior to the FAST II IPO, after giving effect to sales by the Sponsor following the Closing.

(3) Represents the shares of Class A Common Stock issued to the Sponsor on November 3, 2023 pursuant to the Warrant Agreement upon the net share exercise of 2,882,245 Private Placement Warrants on a cashless basis.

(4) Represents the number of Earnout Shares issued to the Sponsor in connection with the Business Combination, of which 112,500 have vested and been released from escrow.

(5) Represents the number of shares of Class A Common Stock issued upon conversion of the principal amount of $2.25 million outstanding under the Infinite Promissory Note.

(6) Represents the shares of Class A Common Stock issuable upon the redemption of Falcon’s Opco Financing Units and Additional Falcon’s Opco Financing Unit Consideration, issued to Infinite Acquisitions prior to the Business Combination in connection with the Falcon’s Opco Financing, and the simultaneous cancellation of an equal number of shares of Class B Common Stock of the Company; Infinite Acquisitions has converted 2,000,000 of such units into 2,000,000 shares of Class A Common Stock and has delivered 274,306 of such shares to Infinite Founder Series under the Founder Series Redemption Obligation.

(7) Represents the number of Earnout Shares issued to Infinite Acquisitions in connection with the Business Combination, of which 75,000 have been released from escrow.

(8) Represents the number of shares of Class A Common Stock issuable upon the redemption of units of Falcon’s Opco issued to Infinite Acquisitions prior to the Business Combination and the simultaneous cancellation of an equal number of shares of Class B Common Stock of the Company.

(9) Represents the shares of Class A Common Stock issuable upon the redemption of units of Falcon’s Opco and the simultaneous cancellation of an equal number of shares of Class B Common Stock issued to Infinite Acquisitions in connection with the Business Combination as Earnout Units and Earnout Shares, after reflecting 5,026,608 shares and units earned and 6,350,000 shares and units forfeited following the filing of the 2023 Form 10-K pursuant to the terms of the Earnout Escrow Agreement.

(10) Represents the number of shares of Class A Common Stock issuable upon the redemption of 12,245,469 units of Falcon’s Opco and the simultaneous cancellation of an equal number of shares of Class B Common Stock of the Company issued to CilMar prior to the Business Combination.

(11) Represents the shares of Class A Common Stock issuable upon the redemption of units of Falcon’s Opco and the simultaneous cancellation of an equal number of shares of Class B Common Stock issued to CilMar in connection with the Business Combination as Earnout Units and Earnout Shares, after reflecting 1,142,946 shares and units earned and 2,918,750 shares and units forfeited following the filing of the 2023 Form 10-K pursuant to the terms of the Earnout Escrow Agreement.

(12) Represents the number of shares of Class A Common Stock issuable upon the redemption of units of Falcon’s Opco and the simultaneous cancellation of an equal number of shares of Class B Common Stock of the Company issued to Katmandu Ventures prior to the Business Combination.

(13) Represents the shares of Class A Common Stock issuable upon the redemption of units of Falcon’s Opco and the simultaneous cancellation of an equal number of shares of Class B Common Stock issued to Katmandu Ventures in connection with the Business Combination as Earnout Units and Earnout Shares, after reflecting 1,142,946 shares and units earned and 2,918,750 shares and units forfeited following the filing of the 2023 Form 10-K pursuant to the terms of the Earnout Escrow Agreement.

(14) Such shares of Class A Common Stock are subject to a two-year lock-up from the Acquisition Merger Effective Time (subject to early release if the volume weighted average closing sale price of the Class A Common Stock equals or exceeds $12.00 per share for any 20 trading days within any 30-consecutive trading day period commencing at least 150 days after the Acquisition Merger Effective Time) in accordance with the terms of the Amended and Restated Sponsor Lock-Up Agreement, dated as of January 31, 2023 (the “Sponsor Lock-Up Agreement”), by and between the Sponsor, Company, Falcon’s Opco and FAST II.

7

(15) Vested Earnout Shares and Earnout Units are subject to restrictions on transfer for a period of 365 days from the date of release.

(16) The Earnout Shares and Earnout Units were deposited into escrow at the Acquisition Merger Effective Time and are to be earned, released and delivered upon satisfaction of, or forfeited and canceled upon the failure of, certain milestones related to the EBITDA of the Company and the gross revenue of the Company during periods between July 1, 2023 and December 31, 2024 and the volume weighted average closing sale price of shares of the Class A Common Stock during the five-year period beginning on the one-year anniversary of the Acquisition Merger and ending on the six-year anniversary of the Acquisition Merger. Such Earnout Shares and Earnout Units, as applicable, may not be transferred until the date that is 365 days after the date that such Earnout Shares and Earnout Units, as applicable, are delivered to such holder in accordance with the terms of the stockholders agreement among the Company, Falcon’s Opco and the persons receiving such Earnout Shares and Earnout Units.