bam-20231231FALSE00019379262023FY00019379262023-01-012023-12-3100019379262023-12-31iso4217:USD00019379262022-12-310001937926us-gaap:CommonClassAMember2022-12-31xbrli:shares0001937926us-gaap:CommonClassAMember2023-12-310001937926us-gaap:CommonClassBMember2023-12-310001937926us-gaap:CommonClassBMember2022-12-3100019379262022-07-042022-12-31iso4217:USDxbrli:shares0001937926us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-07-030001937926us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-07-030001937926us-gaap:CommonStockMember2022-07-030001937926us-gaap:TreasuryStockCommonMember2022-07-030001937926us-gaap:AdditionalPaidInCapitalMember2022-07-030001937926us-gaap:RetainedEarningsMember2022-07-030001937926us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-030001937926us-gaap:NoncontrollingInterestMember2022-07-0300019379262022-07-030001937926us-gaap:RetainedEarningsMember2022-07-042022-12-310001937926us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-07-042022-12-310001937926us-gaap:CommonStockMember2022-07-042022-12-310001937926us-gaap:AdditionalPaidInCapitalMember2022-07-042022-12-310001937926us-gaap:TreasuryStockCommonMember2022-07-042022-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-07-042022-12-310001937926us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001937926us-gaap:CommonStockMember2022-12-310001937926us-gaap:TreasuryStockCommonMember2022-12-310001937926us-gaap:AdditionalPaidInCapitalMember2022-12-310001937926us-gaap:RetainedEarningsMember2022-12-310001937926us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001937926us-gaap:NoncontrollingInterestMember2022-12-310001937926us-gaap:RetainedEarningsMember2023-01-012023-12-310001937926us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001937926us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-12-310001937926us-gaap:CommonStockMember2023-01-012023-12-310001937926us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001937926us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001937926us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001937926us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310001937926us-gaap:CommonStockMember2023-12-310001937926us-gaap:TreasuryStockCommonMember2023-12-310001937926us-gaap:AdditionalPaidInCapitalMember2023-12-310001937926us-gaap:RetainedEarningsMember2023-12-310001937926us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001937926us-gaap:NoncontrollingInterestMember2023-12-310001937926bam:BrookfieldAssetManagementULCMember2022-12-09xbrli:pure0001937926bam:BrookfieldAssetManagementULCMember2023-12-31bam:director0001937926bam:BrookfieldAssetManagementULCMember2023-12-310001937926bam:BrookfieldAssetManagementULCMember2022-12-310001937926bam:BrookfieldAssetManagementULCMember2023-01-012023-12-310001937926bam:BrookfieldAssetManagementULCMember2022-07-042022-12-310001937926us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001937926us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-12-310001937926us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001937926us-gaap:EmployeeStockOptionMember2023-12-310001937926bam:EscrowedSharesMember2023-01-012023-12-310001937926bam:EscrowedSharesMember2023-12-310001937926bam:EquityClassifiedAwardsMember2023-01-012023-12-310001937926bam:EquityClassifiedAwardsMember2022-07-042022-12-310001937926bam:LiabilityClassifiedAwardsMember2023-01-012023-12-310001937926bam:LiabilityClassifiedAwardsMember2022-07-042022-12-310001937926bam:ManagementShareOptionPlanMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001937926bam:ManagementShareOptionPlanMemberus-gaap:EmployeeStockOptionMember2022-07-042022-12-310001937926bam:ManagementShareOptionPlanMemberus-gaap:EmployeeStockOptionMember2022-12-310001937926bam:BrookfieldCorporationMemberbam:ManagementShareOptionPlanMemberus-gaap:EmployeeStockOptionMember2022-12-310001937926bam:BrookfieldCorporationMemberbam:ManagementShareOptionPlanMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001937926bam:ManagementShareOptionPlanMemberus-gaap:EmployeeStockOptionMember2023-12-310001937926bam:BrookfieldCorporationMemberbam:ManagementShareOptionPlanMemberus-gaap:EmployeeStockOptionMember2023-12-310001937926bam:ManagementShareOptionPlanMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:EmployeeStockOptionMember2023-12-310001937926bam:BrookfieldCorporationMemberbam:ManagementShareOptionPlanMemberus-gaap:EmployeeStockOptionMember2022-07-042022-12-310001937926bam:EscrowedStockPlanMemberbam:EscrowedSharesMember2023-01-012023-12-310001937926bam:EscrowedStockPlanMemberbam:EscrowedSharesMember2022-07-042022-12-310001937926bam:EscrowedStockPlanMemberbam:EscrowedSharesMember2022-12-310001937926bam:BrookfieldCorporationMemberbam:EscrowedStockPlanMemberbam:EscrowedSharesMember2022-12-310001937926bam:BrookfieldCorporationMemberbam:EscrowedStockPlanMemberbam:EscrowedSharesMember2023-01-012023-12-310001937926bam:EscrowedStockPlanMemberbam:EscrowedSharesMember2023-12-310001937926bam:BrookfieldCorporationMemberbam:EscrowedStockPlanMemberbam:EscrowedSharesMember2023-12-310001937926bam:BrookfieldCorporationMemberbam:EscrowedStockPlanMemberbam:EscrowedSharesMember2022-07-042022-12-310001937926us-gaap:RestrictedStockMember2023-01-012023-12-310001937926us-gaap:RestrictedStockMember2022-07-042022-12-310001937926us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001937926bam:DeferredShareUnitMember2023-01-012023-12-310001937926bam:DeferredShareUnitsAndRestrictedShareUnitsMember2023-01-012023-12-310001937926bam:DeferredShareUnitsAndRestrictedShareUnitsMember2022-07-042022-12-310001937926bam:DeferredShareUnitsTrackingToBrookfieldAssetManagementLtdSharePriceMemberbam:BrookfieldCorporationMember2022-12-310001937926bam:BrookfieldCorporationMemberbam:DeferredShareUnitsTrackingToBNSharePriceMember2022-12-310001937926bam:BrookfieldCorporationMemberus-gaap:RestrictedStockUnitsRSUMember2022-12-310001937926bam:DeferredShareUnitsTrackingToBrookfieldAssetManagementLtdSharePriceMemberbam:BrookfieldCorporationMember2023-01-012023-12-310001937926bam:BrookfieldCorporationMemberbam:DeferredShareUnitsTrackingToBNSharePriceMember2023-01-012023-12-310001937926bam:BrookfieldCorporationMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001937926bam:DeferredShareUnitsTrackingToBrookfieldAssetManagementLtdSharePriceMemberbam:BrookfieldCorporationMember2023-12-310001937926bam:BrookfieldCorporationMemberbam:DeferredShareUnitsTrackingToBNSharePriceMember2023-12-310001937926bam:BrookfieldCorporationMemberus-gaap:RestrictedStockUnitsRSUMember2023-12-310001937926us-gaap:CommonClassAMember2023-01-012023-12-310001937926us-gaap:CommonClassBMember2023-01-012023-12-310001937926us-gaap:CommonClassAMember2022-07-042022-12-310001937926us-gaap:CommonClassBMember2022-07-042022-12-310001937926us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001937926us-gaap:EmployeeStockOptionMember2022-07-042022-12-310001937926bam:EscrowSharesMember2023-01-012023-12-310001937926bam:EscrowSharesMember2022-07-042022-12-310001937926us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001937926us-gaap:RestrictedStockUnitsRSUMember2022-07-042022-12-310001937926us-gaap:EquityMethodInvesteeMember2023-12-310001937926us-gaap:EquityMethodInvesteeMemberbam:AssetManagementServicesAgreementMember2023-01-012023-12-310001937926us-gaap:EquityMethodInvesteeMemberbam:AssetManagementServicesAgreementMember2022-07-042022-12-310001937926bam:RelationshipAgreementMembersrt:AffiliatedEntityMember2023-01-012023-12-310001937926bam:RelationshipAgreementMembersrt:AffiliatedEntityMember2022-07-042022-12-310001937926bam:TransitionalServicesAgreementMemberus-gaap:EquityMethodInvesteeMember2023-01-012023-12-310001937926us-gaap:EquityMethodInvesteeMemberbam:AssetManagementServicesAgreementMember2023-12-310001937926us-gaap:EquityMethodInvesteeMemberbam:AssetManagementServicesAgreementMember2022-12-310001937926srt:AffiliatedEntityMember2023-12-310001937926srt:AffiliatedEntityMember2022-12-310001937926us-gaap:EquityMethodInvesteeMemberbam:BrookfieldAssetManagementULCMember2023-01-012023-12-310001937926us-gaap:SubsequentEventMember2024-02-060001937926dei:BusinessContactMember2023-01-012023-12-31

BROOKFIELD ASSET MANAGEMENT LTD.

MANAGEMENT’S DISCUSSION AND ANALYSIS

ORGANIZATION OF MANAGEMENT’S DISCUSSION AND ANALYSIS (“MD&A”)

| | | | | | | | | | | | | | |

PART 1 – OVERVIEW OF OUR BUSINESS | | Real Estate | |

| Introduction | | | Private Equity | |

| Basis of Presentation | | | Credit and Other | |

| Business History | | | PART 6 – RECONCILIATION OF U.S. GAAP TO |

| Business Overview | | | NON-GAAP MEASURES | |

| Value Creation | | | Reconciliation of Net Income to Fee-Related | |

| Competitive Advantages | | | Earnings and Distributable Earnings | |

| Our People | | | Reconciliation of Revenues to Fee Revenues | |

| Investment Process | | | PART 7 – LIQUIDITY AND CAPITAL RESOURCES |

| Products and Principal Strategies | | | Liquidity | |

PART 2 – REVIEW OF FINANCIAL RESULTS | | Capital Resources | |

| Income Statement Analysis | | | Contractual Obligations | |

| Balance Sheet Analysis | | | Exposures to Financial Instruments | |

| Cash Flows Statement Analysis | | | Off-Balance Sheet Arrangements | |

| Summary of Quarterly Results | | | Related Party Transactions | |

PART 3 – KEY FINANCIAL OPERATING MEASURES | | Recent Developments | |

| Non-GAAP Measures | | | PART 8 – SUMMARY OF SIGNIFICANT | |

| Supplemental Financial Measures Utilized by | | | ACCOUNTING POLICIES | |

| Our Asset Management Business | | | Accounting Policies, Estimates, and Judgements | |

| Fee-Bearing Capital Diversification | | | Assessments and Changes in Internal Control Over | |

PART 4 – ANALYSIS OF KEY NON-GAAP FINANCIAL | | Financial Reporting | |

AND OPERATING MEASURES | | | PART 9 – BUSINESS ENVIRONMENT AND | |

| Distributable Earnings | | | RISK DISCLOSURES | |

| Fee-Bearing Capital | | | Risks Relating to the Manager | |

| Fee Revenues and Fee-Related Earnings | | | Risks Relating to our Business | |

PART 5 – INVESTMENT STRATEGY RESULTS | | Risks Relating to Taxation | |

| Renewable Power and Transition | | | GLOSSARY OF TERMS | |

| Infrastructure | | | | |

"BAM Ltd." or the "Manager" refers to Brookfield Asset Management Ltd. The "Asset Management Company", the "asset management business", "BAM ULC", or the "Company" refers to Brookfield Asset Management ULC. Please refer to the Glossary of Terms beginning on page 78 which defines certain key terms. Additional information about the Manager, including our Annual Information Form, is available on our website at www.bam.brookfield.com, on the Canadian Securities Administrators’ website at www.sedarplus.ca and on the EDGAR section of the U.S. Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

The Manager is incorporated in British Columbia, Canada, and qualify as an eligible Canadian issuer under the Multijurisdictional Disclosure System and as a “foreign private issuer” as such term is defined in Rule 405 under the U.S. Securities Act of 1933, as amended, and Rule 3b-4 under the U.S. Securities Exchange Act of 1934, as amended. As a result, the Manager complies with U.S. continuous reporting requirements by filing the Canadian disclosure documents with the SEC; the Manager's annual report is filed under Form 40-F and the Manager furnishes its quarterly interim reports under Form 6-K.

Information contained in or otherwise accessible through the websites mentioned throughout this report does not form part of this report. All references in this report to websites are inactive textual references and are not incorporated by reference. Any other reports of the company referred to herein are not incorporated by reference unless explicitly stated otherwise.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This MD&A contains “forward-looking information” within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of the U.S. Securities Act of 1933, the U.S. Securities Exchange Act of 1934, “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and in any applicable Canadian securities regulations (collectively, “forward-looking statements”). Forward-looking statements include statements that are predictive in nature, depend upon or refer to future results, events or conditions, and include, but are not limited to, statements which reflect management’s current estimates, beliefs and assumptions regarding the operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies, capital management and outlook of the Manager, the Asset Management Company and its subsidiaries, as well as the outlook for North American and international economies for the current fiscal year and subsequent periods, and which are in turn based on our experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. The estimates, beliefs and assumptions of the Manager are inherently subject to significant business, economic, competitive and other uncertainties and contingencies regarding future events and as such, are subject to change. Forward-looking statements are typically identified by words such as “expect”, “anticipate”, “believe”, “foresee”, “could”, “estimate”, “goal”, “intend”, “plan”, “seek”, “strive”, “will”, “may” and “should” and similar expressions.

Although the Manager believes that such forward-looking statements are based upon reasonable estimates, beliefs and assumptions, actual results may differ materially from the forward-looking statements. Factors that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include, but are not limited to:

•the Manager’s lack of independent means of generating revenue;

•the Manager’s material assets consisting solely of its interest in the Asset Management Company;

•challenges relating to maintaining our relationship with the Corporation (as defined below) and potential conflicts of interest;

•the Manager being a newly formed company;

•our liability for our asset management business;

•the difficulty for investors to effect service of process and enforce judgments in the United States, Canada and/or other applicable jurisdictions;

•the impact on growth in Fee-Bearing Capital of poor product development or marketing efforts;

•our ability to maintain our global reputation;

•volatility in the trading price of the Class A Shares;

•being subjected to numerous laws, rules and regulatory requirements;

•the potential ineffectiveness of our policies to prevent violations of applicable law;

•meeting our financial obligations due to our cash flow from our asset management business;

•foreign currency risk and exchange rate fluctuations;

•requirement of temporary investments and backstop commitments to support our asset management business;

•rising interest rates;

•revenues impacted by a decline in the size or pace of investments made by our managed assets;

•our earnings growth can vary, which may affect our dividend and the trading price of the Class A Shares;

•exposed risk due to increased amount and type of investment products in our managed assets;

•difficulty in maintaining our culture or managing our human capital;

•political instability or changes in government;

•inflationary pressures;

•unfavorable economic conditions or changes in the industries in which we operate;

•catastrophic events, such as earthquakes, hurricanes, or pandemics/epidemics;

•deficiencies in public company financial reporting and disclosures;

•ineffective management of sustainability considerations, and inadequate or ineffective health and safety programs;

•failure of our information technology systems;

•us and our managed assets becoming involved in legal disputes;

•losses not covered by insurance;

•inability to collect on amounts owing to us;

•information barriers that may give rise to conflicts and risks;

•risks related to our renewable power and transition, infrastructure, private equity, real estate, and other alternatives, including credit strategies;

•risks relating to Canadian and United States taxation laws; and

•other factors described in this MD&A.

We caution that the foregoing list of important factors that may affect future results is not exhaustive and other factors could also adversely affect future results. Readers are urged to consider these risks, as well as other uncertainties, factors and assumptions carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements, which are based only on information available to us as of the date of this MD&A. Except as required by law, the Manager undertakes no obligation to publicly update or revise any forward-looking statements, whether written or oral, that may be as a result of new information, future events or otherwise. For further information on these known and unknown risks, please see Part 9 “Business Environment and Risk Disclosures”.

Certain of the information contained herein is based on or derived from information provided by independent third-party sources. While the Manager believes that such information is accurate as of the date it was produced and that the sources from which such information has been obtained are reliable, the Manager makes no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of any of the information or the assumptions on which such information is based, contained herein, including but not limited to, information obtained from third parties.

CAUTIONARY STATEMENT REGARDING THE USE OF NON-GAAP MEASURES

The Manager and the Asset Management Company prepare their financial statements in conformity with the accounting principles generally accepted in the United States of America ("U.S. GAAP"). This MD&A discloses a number of non-GAAP financial and supplemental financial measures which are utilized in monitoring the Manager and our asset management business, including for performance measurement, capital allocation and valuation purposes. The Manager believes that providing these performance measures is helpful to investors in assessing the overall performance of our asset management business. These non-GAAP financial measures should not be considered as the sole measure of the Manager’s or our asset management business’ performance and should not be considered in isolation from, or as a substitute for, similar financial measures calculated in conformity with U.S. GAAP financial measures. Non-GAAP measures include, but are not limited to: (i) distributable earnings (“Distributable Earnings”), (ii) fee revenues (“Fee Revenues”) and (iii) fee-related earnings (“Fee-Related Earnings”). These non-GAAP measures are not standardized financial measures and may not be comparable to similar financial measures used by other issuers. Supplemental financial measures include assets under management (“AUM”), fee-bearing capital (“Fee-Bearing Capital”) and uncalled fund commitments. The Manager includes the asset management activities of Oaktree (meaning collectively Oaktree Capital II, L.P., Oaktree Capital Management, L.P., Oaktree AIF Investments, L.P., Oaktree Capital Management (Cayman) L.P. and Oaktree Investment Holdings, L.P. and their consolidated subsidiaries), an equity accounted affiliate, in its key financial and operating measures for the asset management business.

For more information on non-GAAP measures and other financial metrics, see “Key Financial and Operating Measures” and “Glossary of Terms” in our MD&A. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP, where applicable, are included in Part 6 "Reconciliation of U.S. GAAP to Non-GAAP Measures" of this MD&A. The MD&A is available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov/edgar.

PART 1

OVERVIEW OF OUR BUSINESS

Introduction

This management’s discussion and analysis (“MD&A”) included in this Annual Report presents the financial position of Brookfield Asset Management Ltd. and its consolidated subsidiaries (the "Manager") as at December 31, 2023, and December 31, 2022, and the results of operations for the year ended December 31, 2023 and for the period from July 4, 2022 to December 31, 2022. This MD&A also presents the financial position of Brookfield Asset Management ULC and its consolidated subsidiaries (the "Asset Management Company", the "asset management business" or the "Company") as at December 31, 2023, and December 31, 2022, and the results of operations for the years ended December 31, 2023 and 2022. Unless context suggest otherwise, references to "we", "us", and "our" refers to our asset management business and the Manager, individually or collectively, where applicable.

The information in this MD&A should be read in conjunction with the following Consolidated Financial Statements included elsewhere in this Annual Report: (i) the audited Consolidated Financial Statements of the Manager as at December 31, 2023 and December 31, 2022, and the results of operations for the year ended December 31, 2023, and for the period from July 4, 2022 to December 31, 2022 (ii) the audited Consolidated and Combined Financial Statements of the Asset Management Company as at December 31, 2023 and December 31, 2022 and the results of operations for the years ended December 31, 2023 and 2022.

The financial information contained in this MD&A is presented in U.S. dollars and, unless otherwise indicated, all references to “$” are to U.S. dollars.

Basis of Presentation

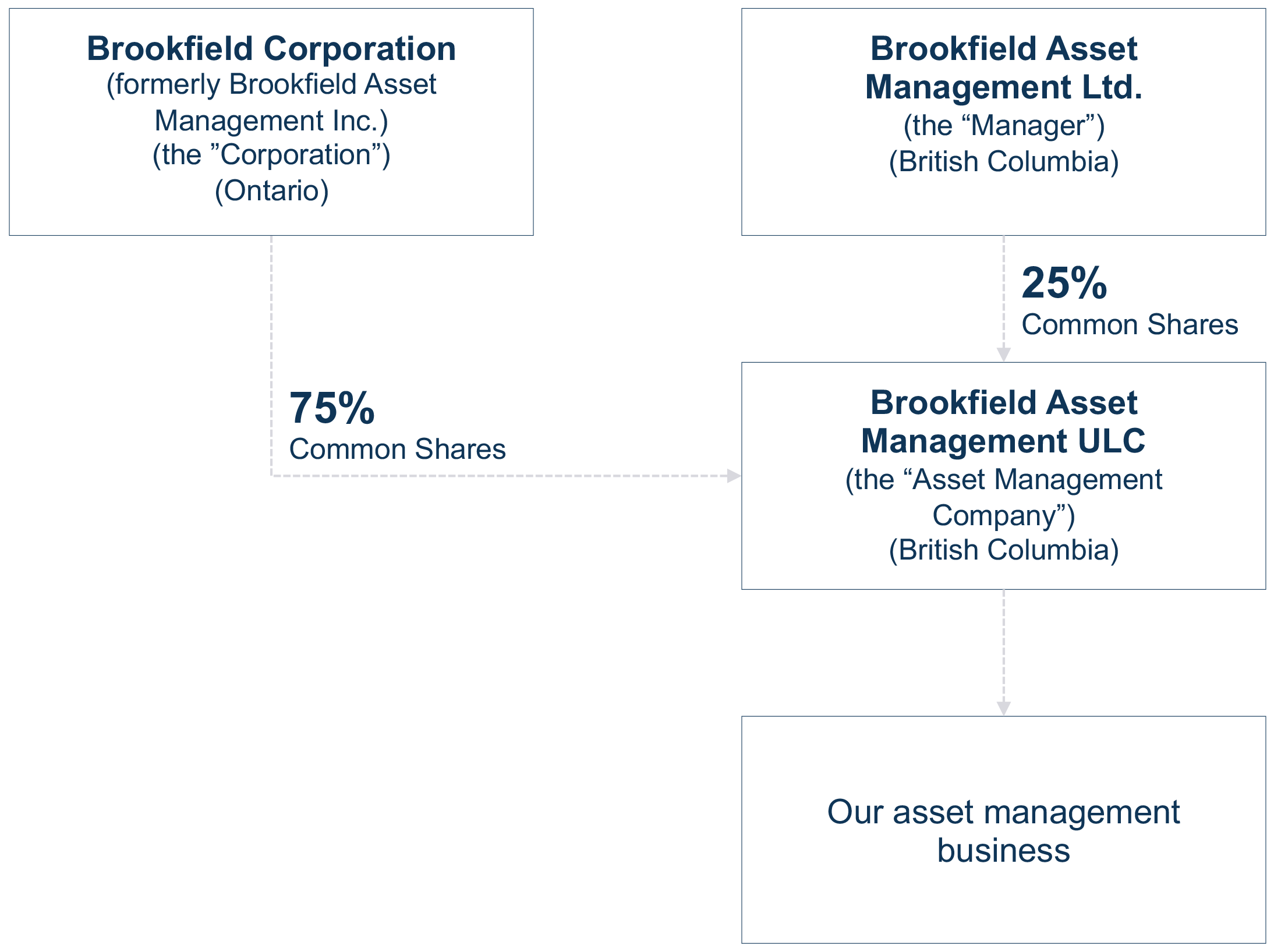

The Manager, a Canadian corporation, through its ownership interests in its single investment, our asset management business, is a leading global alternative asset manager. The Manager was incorporated on July 4, 2022 and does not have historical operations or activities. The Manager’s sole material asset is its 25% interest in the Asset Management Company, which is accounted for using the equity method. The Manager’s returns are earned from its interest in our asset management business, and therefore this MD&A focuses on the results and operations thereof, underlying the equity earnings of the Manager.

All financial data is presented in U.S. dollars and, unless otherwise indicated, has been prepared in conformity with U.S. GAAP. Non-GAAP measures used in this MD&A are reconciled to the most directly comparable GAAP measure.

Business History

The Manager and the Asset Management Company were formed by Brookfield Corporation (the “Corporation”), formerly known as Brookfield Asset Management Inc., to facilitate a plan of arrangement (the “Arrangement”). The Arrangement, which closed on December 9, 2022, involved the division of Brookfield Asset Management Inc. into two publicly traded companies – the Manager, which is listed on the NYSE and TSX under the ticker symbol “BAM”, is a pure-play leading global alternative asset management business; and the Corporation, listed under the ticker symbol "BN", a leading global investment firm focused on building long-term wealth for institutions and individuals around the world.

The Manager allows investors to directly access the global alternative asset management business previously carried on by the Corporation and its subsidiaries. This business is now owned and operated through the Asset Management Company, which is owned approximately 75% by the Corporation and approximately 25% by the Manager.

Business Overview

We are one of the world’s leading global alternative asset managers, with $916 billion of assets under management ("AUM") as of December 31, 2023, across renewable power and transition, infrastructure, real estate, private equity, and credit. We invest client capital for the long-term with a focus on real assets and essential service businesses that form the backbone of the global economy. We draw on our heritage as an owner and operator to invest for value and generate strong returns for our clients across economic cycles.

To do this, we leverage our team of over 2,400 investment and asset management professionals, our global reach, deep operating expertise, and access to large-scale capital to identify attractive investment opportunities and invest on a proprietary basis. Our investment approach and strong track record have been the foundation and driver of our growth.

We provide a highly diversified suite of alternative investment strategies to our clients and are constantly seeking to innovate new strategies to meet their needs. We have approximately 50 unique active strategies that span a wide range of risk-adjusted returns, including opportunistic, value-add, core, super-core, and credit. We evaluate the performance of these product offerings and our investment strategies using a number of non-GAAP measures as outlined in "Key Financial and Operating Measures" within this MD&A. The Manager utilizes Fee-Bearing Capital, Fee Revenues, Fee-Related Earnings and Distributable Earnings to assess the performance of our asset management business.

We are in a fortunate position to be trusted with our clients’ capital and our objective is to meet their financial goals and provide for a better financial future while providing a market leading experience. Our team of approximately 200 client service professionals across 18 global offices are dedicated to ensuring that the business is exceeding their service expectations.

We have over 2,300 clients, with some of our clients being among the world’s largest institutional investors, including sovereign wealth funds, pension plans, endowments, foundations, financial institutions, insurance companies, and individual investors.

Our guiding principle is to operate our business and conduct our relationships with the highest level of integrity. Our emphasis on diversity and inclusion reinforces our culture of collaboration, allowing us to attract and retain top talent. We strive to embed strong sustainability practices throughout our business, underpinning our goal of having a positive impact on the communities and environment in which we operate.

Value Creation

We create shareholder value by increasing the earnings profile of our asset management business. Alternative asset management businesses such as ours are typically valued based on a multiple of their Fee-Related Earnings and performance income. Accordingly, we create value by increasing the amount and quality of Fee-Related Earnings and carried interest, net of associated costs. This growth is achieved primarily by expanding the amount of Fee-Bearing Capital we manage, earning performance income such as carried interest, through strong investment results and maintaining competitive operating margins.

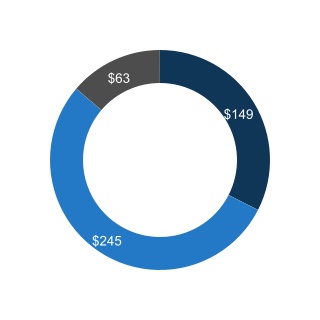

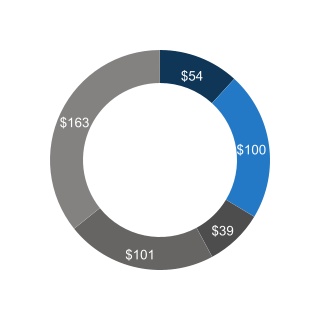

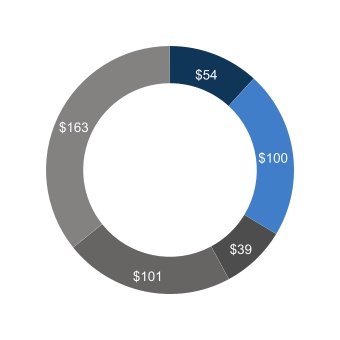

As at December 31, 2023, we had Fee-Bearing Capital of $457 billion, of which 86% is long-dated or perpetual in nature, providing significant stability to our earnings profile. We consider Fee-Bearing Capital that is long-dated or perpetual in nature to be Fee-Bearing Capital relating to our long-term private funds, which are typically committed for 10 years with 2 one-year extension options, and Fee-Bearing Capital relating to our perpetual strategies, which include our permanent capital vehicles as well as capital we manage in our perpetual core and core plus private fund strategies. We seek to increase our Fee-Bearing Capital by growing the size of our existing product offerings and developing new strategies that cater to our clients’ investment needs. We also aim to deepen our existing institutional relationships, develop new institutional relationships, and access new distribution channels such as high net worth individuals and retail.

As of December 31, 2023, we had a diversified client base of over 2,300 clients, which continues to grow. Our private wealth channel also continues to grow and represents over 5% of capital raised. We have a dedicated team of over 100 people that are focused on distributing and developing catered products to the private wealth channel.

We are also actively progressing new growth strategies, including transition, insurance, secondaries, and technology. These new initiatives, in addition to our existing strategies are expected to have a very meaningful impact on our growth trajectory in the long term.

As we grow our Fee-Bearing Capital, we earn incremental base management fees. In order to support this growth, we have been growing our team of investment and asset management professionals. Our costs are predominantly in the form of compensation for the over 2,400 professionals we employ globally.

When deploying our clients’ capital, we seek to leverage our competitive advantages to acquire high-quality real assets and essential service businesses that form the backbone of the global economy. We use our global reach and access to scale capital to source attractive investment opportunities and leverage our deep operating expertise to underwrite investments and create value throughout our ownership. Our goal is to deliver superior investment returns to our clients and successfully doing so should result in the growth of realized carried interest over time.

We generate robust Distributable Earnings, which is our primary financial performance metric. Distributable Earnings of the Manager represent our share of Distributable Earnings from the Asset Management Company less general and administrative expenses, but excluding equity-based compensation costs of the Manager. The Manager intends to pay out approximately 90% of its Distributable Earnings to shareholders quarterly and reinvest the balance back into the business.

We also monitor the broader markets and occasionally identify attractive, strategic investment opportunities that have the potential to supplement our existing business. We expect acquisitions to allow us to achieve immediate scale in a new asset class

or grant us access to additional distribution channels. An example of such growth is the partnership we formed with Oaktree in 2019, which deepened the capabilities we offer our clients and better positions us across market cycles. Such acquisitions may occur from time to time should they be additive to our franchise, attractive to our clients, and accretive to our shareholders.

Competitive Advantages

We seek to harness the following four distinct competitive advantages that enable us to consistently identify and acquire high-quality assets and create significant value in the assets that we invest in and operate on behalf of our clients.

Large Scale

We have $916 billion in assets under management and approximately $457 billion in Fee-Bearing Capital as of December 31, 2023. We offer our investors a large portfolio of private funds that have global mandates and diversified strategies. Our access to large-scale, flexible capital that is further enhanced by our relationship with the Corporation, enables us to pursue transactions of a size that others cannot.

Operating Expertise

We are supported globally by approximately 240,000 operating employees of our managed businesses, who are instrumental in maximizing the value and cash flows of our managed assets. We believe that strong operating experience is essential in maximizing efficiency and productivity – and ultimately, returns. We do this by maintaining a culture of long-term focus, alignment of interest and collaboration through the people we hire, our compensation philosophy, and our operating philosophy. This operating expertise developed through our heritage as an owner-operator is invaluable in underwriting acquisitions and executing value-creating development and capital projects.

Global Reach

We invest on behalf of our clients in more than 30 countries on five continents around the world. We believe that our global reach allows us to diversify and identify a broad range of opportunities. We can invest where capital is scarce, and we believe that our scale enables us to move quickly and pursue multiple opportunities across different markets. Our global reach also allows us to operate our assets more effectively: we believe that a strong on-the-ground presence is critical to operating successfully in many of our markets, and many of our businesses are truly local. Furthermore, the combination of our strong local presence and global reach enables us to bring global relationships and operating practices to bear across markets to enhance returns.

Brookfield Ecosystem

The unique intelligence we generate from the ongoing interconnectivity between our over $900 billion portfolio, our global partnerships and our visibility into global capital flows helps us identify themes and trends in investing, spot pockets of value and source attractive investment opportunities. This competitive advantage has allowed us to build leading positions in assets classes that are most in favor and deliver strong investment returns to our clients across multiple business cycles.

Our People

We have a team of over 2,400 investment and asset management professionals that are integral to the business, including individuals focused on our core investment strategies and those undertaking various corporate activities. Approximately 200 of these are employed by the Manager and the remainder are employed by the Asset Management Company and their subsidiaries. The Manager provides the services of our employees to the Asset Management Company on a cost recovery basis under the Asset Management Services Agreement, which is described in Note 1 of the Consolidated and Combined Financial Statements of the Asset Management Company - "Organization". Our long-term approach to our business influences everything we do, including how we make investment decisions, how we support and oversee our businesses, and how we develop our people and compensate them. Our employee compensation programs link a significant portion of employee rewards to successful investment outcomes. Our emphasis on fostering collaboration enables us to benefit from a diverse set of skills and experiences. Our talent management processes and our approach to long-term compensation encourage collaboration. This shows itself in a number of ways, including in the sharing of expertise and best practices through both formal and informal channels and building relationships and capabilities through employee secondments and transfers.

We have a group of dedicated operations professionals in all our key regions that have extensive experience leading businesses. We take an active role in enhancing the performance of the assets and businesses we acquire. As a result, our operations team is fully integrated – meaning our operations professionals sit alongside our experienced investment team working hand in hand from diligence to the execution of our business plan and through the monetization phase of an investment. The team works closely with the senior management teams of the companies in which we invest to develop and implement business improvements that enable

us to increase cash flow and our return on capital. While enhancement opportunities may differ across assets and businesses, they generally involve a combination of strategic repositioning, focus on operational excellence and enhanced commercial execution.

We recognize that people drive our success, and therefore hiring, developing and retaining our people is one of our top priorities. We do this by ensuring our people are constantly engaged and provide a wide range of development opportunities across all levels. We aim to create an environment that is built on strong relationships and conducive to developing our workforce, and where individuals from diverse backgrounds can thrive.

Investment Process

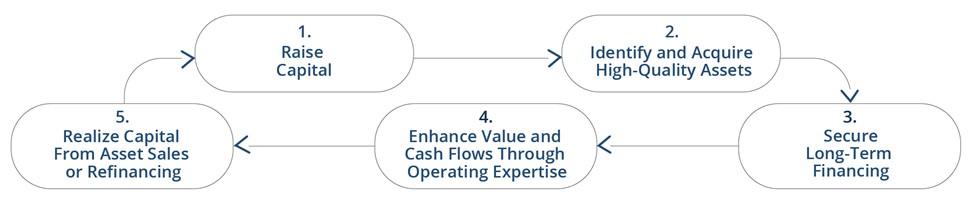

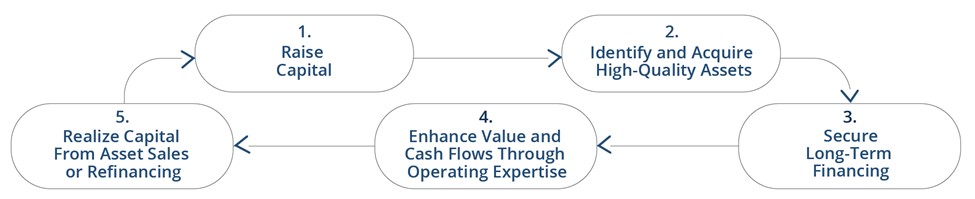

Our Investment Process Leads to Value Creation

Earning robust returns on the investments we make on behalf of our clients enhances our ability to increase our Fee-Bearing Capital and generates carried interest, both of which grow our cash flows and create value for our shareholders.

1. Raise Capital

As an asset manager, the starting point to the investment cycle is establishing new funds and other investment products for our clients. This in turn provides the capital to invest, from which we earn base management fees, incentive distributions and performance-based returns such as carried interest. Accordingly, we create value by increasing our amount of Fee-Bearing Capital and by achieving strong investment performance that leads to growth in Fee-Bearing Capital and increased cash flows.

2. Identify and Acquire High-Quality Assets

We follow a value-based approach to investing and allocating capital. We believe that our disciplined approach, global reach and our operating expertise afford us access to a wide range of potential opportunities and enable us to invest at attractive valuations and generate superior risk-adjusted returns for our clients. We also leverage our considerable expertise in executing recapitalizations, operational turnarounds and large development and capital projects, providing additional opportunities to deploy capital.

3. Secure Long-Term Financing

We finance the investments we make on behalf of our clients predominantly on a long-term investment-grade basis and asset-by-asset, where possible, with minimal recourse. This financing approach provides us with considerable stability, improves our ability to withstand financial downturns and enables our asset management teams to focus on operations and other growth initiatives.

4. Enhance Value and Cash Flows Through Operating Expertise

We use our operating capabilities to increase the value of the assets within our product offerings and the cash flows they produce, and they help to protect our clients’ capital in adverse conditions. The combination of operating expertise, development capabilities and effective financing can help ensure that an investment’s full value creation potential is realized, which we believe is one of our most important competitive advantages.

5. Realize Capital from Asset Sales or Refinancing

We actively monitor opportunities to sell or refinance assets to generate proceeds for our investors. Capital generated in our limited life funds is returned to investors, and in the case of our perpetual funds, we then redeploy the capital to enhance returns. In many cases, returning capital from private funds completes the investment process, locks in investor returns and gives rise to performance income.

Products and Principal Strategies

Our products broadly fall into one of three categories: (i) long-term private funds, (ii) permanent capital vehicles and perpetual strategies, and (iii) liquid strategies. These are invested across five principal strategies: (i) renewable power and transition, (ii) infrastructure, (iii) real estate, (iv) private equity, and (v) credit and other.

Renewable Power and Transition

Overview

•We are a leading global investment manager in renewable power and transition, with $102 billion of AUM as of December 31, 2023.

•Clean energy occupies a uniquely complementary position to the global goals of net-zero emissions, low-cost energy, and energy security. We believe that the growing global demand for low-carbon energy, especially amongst corporate off-takers, will lead to continued growth opportunities for us in the future. The investment environment for renewable power and transition remains favorable and we expect to continue to advance our substantial pipeline of renewable power and transition opportunities on behalf of our clients and managed assets.

•We have approximately 140 investment and asset management professionals globally that are focused on our renewable power and transition strategy, supported by approximately 19,200 operating employees in the renewable power and transition operating businesses that we manage. Our extensive experience and knowledge in this industry enable us to be a leader in all major technologies with deep operating and development capabilities.

Our Products

Long-term Private Funds

•Brookfield Global Transition Fund (“BGTF”) is our flagship transition fund series which is focused on investments aimed at accelerating the global transition to a net-zero carbon economy. The mandate of this product is to assist utility, energy and industrial businesses reduce carbon dioxide emissions, expand low-carbon and renewable energy production levels and advance sustainable solutions.

Permanent Capital Vehicles and Perpetual Strategies

•We also manage Brookfield Renewable Partners L.P. (“BEP”), one of the world’s largest publicly traded renewable power platforms, which is listed on the NYSE and TSX and had a market capitalization of over $17.9 billion as of December 31, 2023.

Across our renewable power and transition products, we have invested on behalf of our clients in:

•Hydroelectric operations, through river systems and facilities that provide electricity and have grid stabilizing capabilities;

•Wind operations that use turbines to create electricity;

•Utility solar operations that harness energy from the sun to generate electricity;

•Distributed energy and storage which provides small-scale generation that can be locally installed, and pump storage facilities; and

•Sustainable solutions including renewable natural gas, carbon capture and storage, recycling, cogeneration biomass, nuclear services, and power transformation.

Infrastructure

Overview

•We are one of the world’s largest investment managers in infrastructure, with $191 billion of AUM as of December 31, 2023.

•We focus on acquiring high-quality businesses on behalf of our clients that deliver essential goods and services, diversified across the utilities, transport, midstream and data infrastructure sectors. We partner closely with management teams to enable long-term success through operational and other improvements.

•We have approximately 240 investment and asset management professionals globally that are focused on our infrastructure strategy, supported by approximately 53,400 operating employees in the infrastructure operating businesses that we manage.

Our Products

Long-term Private Funds

•Brookfield Infrastructure Funds (“BIF”) is our flagship infrastructure fund series. In this product offering, we invest on behalf of our clients in high-quality infrastructure assets on a value basis and seek to add value through the investment life cycle by utilizing our operations-oriented approach.

•Brookfield Infrastructure Debt (“BID”) is our infrastructure debt fund series, which invests on behalf of our clients in mezzanine debt investments in high-quality, core infrastructure assets.

Permanent Capital Vehicles and Perpetual Strategies

•We manage Brookfield Infrastructure Partners L.P. (“BIP”), one of the largest, pure-play, publicly traded global infrastructure platforms, which is listed on the NYSE and TSX and had a market capitalization of $25.6 billion as of December 31, 2023. In this product offering, we invest on behalf of our clients in high-quality, long-life assets that provide essential products and services for the global economy.

•We manage Brookfield Super-Core Infrastructure Partners (“BSIP”), which is our perpetual infrastructure private fund strategy. In this product offering, we invest on behalf of our clients in core infrastructure assets in developed markets, with a focus on yield, diversification, and inflation-protection.

•We also manage Brookfield Infrastructure Income Fund (“BII”), a semi-liquid infrastructure product strategy, offering private wealth investors access to our best-in-class infrastructure platform.

The infrastructure investments that we manage provide a diversified exposure for our clients to scarce, high-quality businesses that benefit from significant barriers to entry and deliver essential goods and services. Through the various products outlined, we have invested in:

•Regulated or contracted businesses that earn a return on asset base, including electricity and gas connections, natural gas pipelines and electricity transmission lines;

•Systems involved in the movement of freight, commodities and passengers, including rail operations, toll roads, terminal and export facilities;

•Assets that handle the movement and storage of commodities from a source of supply to a demand center, including transmission pipelines, natural gas process plants and natural gas storage; and

•Businesses that provide essential services and critical infrastructure to transmit and store data globally, including telecom towers and active rooftop sites, fiber optic cable and data centers.

Real Estate

Overview

•We are one of the world’s largest investment managers in real estate, with over $276 billion of AUM as of December 31, 2023.

•We have invested, on behalf of clients, in iconic properties in the world’s most dynamic markets with the goal of generating stable and growing distributions for our investors while protecting them against downside risk.

•We have approximately 660 investment and asset management professionals that are focused on generating superior returns across our real estate strategies, supported by approximately 29,400 operating employees in the real estate operating businesses that we manage.

Our Products

Long-term Private Funds

•Our opportunistic real estate flagship fund series is Brookfield Strategic Real Estate Partners (“BSREP”). Through this product, we invest globally across various sectors and geographies on behalf of our clients in high-quality real estate with a focus on large, complex, distressed assets, turnarounds, and recapitalizations.

•Our commercial real estate debt fund series, Brookfield Real Estate Finance Fund (“BREF”), targets investments in transactions, predominantly in the U.S., that are senior to traditional equity and subordinate to first mortgages or investment-grade corporate debt.

•We also manage a real estate secondaries strategy, Brookfield Real Estate Secondaries (“BRES”), with a focus on providing liquidity solutions for other real estate general partners.

Permanent Capital Vehicles and Perpetual Strategies

•We manage $18 billion of Fee-Bearing Capital in Brookfield Property Group (“BPG”) as of December 31, 2023, which we invest, on behalf of the Corporation, directly in real estate assets or through our real estate private fund offerings. BPG owns, operates, and develops iconic properties in the world’s most dynamic markets with a global portfolio of office, retail, multifamily, logistics, hospitality, land and housing, triple net lease, manufactured housing, and student housing assets on five continents.

•We also manage capital in our perpetual private fund real estate strategy, Brookfield Premier Real Estate Partners (“BPREP”). This is a core plus strategy that invests in high-quality, stabilized real assets located primarily in the U.S. with a focus on office, retail, multifamily and logistics real estate assets. We also have two regional BPREP strategies that are dedicated specifically to investments in Australia (“BPREP-A”) and Europe (“BPREP-E”).

•We manage capital across our perpetual real estate debt strategy, Brookfield Senior Mezzanine Real Estate Finance Fund (“BSREF”). We seek to originate, acquire, and actively manage investments in U.S. senior commercial real estate debt for this strategy.

•We also manage a non-traded REIT, Brookfield Real Estate Income Trust (“Brookfield REIT”), which is a semi-liquid strategy catering specifically to the private wealth channel. This product invests in high quality income-producing opportunities globally through equity or real estate-related debt.

Through the various products outlined, we have invested in multiple asset classes including:

•Office properties in key gateway cities in the U.S., Canada, the U.K., Germany, Australia, Brazil and India;

•High-quality retail destinations that are central gathering places for the communities they serve, combining shopping, dining, entertainment and other activities;

•Full-service hotels and leisure-style hospitality assets in high-barrier markets across North America, the U.K. and Australia; and

•High-quality assets with operational upside across multifamily, alternative living, life sciences and logistics sectors globally.

Private Equity

Overview

•We are a leading private equity investment manager with $130 billion of AUM as of December 31, 2023.

•We focus on high-quality businesses that provide essential products and services, diversified across business services and industrials sectors. We partner closely with management teams to enable long-term success through operational and other improvements.

•We have approximately 280 investment and asset management professionals globally that are focused on our private equity strategy, supported by approximately 133,700 operating employees in the operating businesses that we manage.

Our Products

Long-term Private Funds

•Our global opportunistic flagship fund series, Brookfield Capital Partners (“BCP”), is our leading private equity offering. The series of funds focuses on owning and operating operations that benefit from a strong competitive position, with high barriers to entry that provide essential products and services. We seek to build value through enhancing the cash flows of our businesses by improving strategy and execution and opportunistically recycling capital generated from operations and dispositions.

•Our special investments strategy, Brookfield Special Investments (“BSI”), is focused on structured, large-scale, non-control investments. This product capitalizes on transactions that do not fit our traditional control-oriented flagship private equity fund series. Transactions may include recapitalizations or strategic growth capital where we expect to generate equity-like returns while ensuring downside protection through contracted returns.

•Our growth equity strategy, Brookfield Growth (“BTG”), focuses on investing in technology-related growth stage companies that surround our broader ecosystem of managed assets.

•Our secondaries strategy, Brookfield Sponsor Solutions (“BSS”), provides bespoke capital solutions to sponsor-backed companies at an inflection point of growth.

Permanent Capital Vehicles and Perpetual Strategies

•We manage Brookfield Business Partners L.P. (“BBU”), which is a publicly traded global business services and industrials company focused on owning and operating high-quality providers of essential products and services. BBU is listed on the NYSE and TSX and had a market capitalization of $4.7 billion as at December 31, 2023.

Our private equity vehicles acquire high-quality operations globally. The broad investment mandate provides us with the flexibility to invest on behalf of our clients across multiple industries through many forms. Through the various products outlined above, we have invested on behalf of our clients in:

•Leading service providers to large-scale infrastructure assets, including a leading provider of work access services, modular building leasing services and a leading global provider of lottery services and technology solutions;

•Operationally intense industrial businesses that benefit from a strong competitive position, including a leading global provider of advanced automotive battery technology, a leading private water and wastewater services company in Brazil, and a leading manufacturer of engineered components for industrial trailers and other towable equipment providers, among others; and

•Essential services providers, including the largest private sector residential mortgage insurer in Canada and a leading provider of software and technology services to automotive dealers.

Credit and Other

Overview

•As a result of our partnership with Oaktree in 2019, we established ourselves as a leader among global investment managers specializing in alternative credit investments. As of December 31, 2023, our ownership interest in Oaktree is approximately 68%. Oaktree is one of the premier credit franchises globally and an expert in investing across the capital structure with an emphasis on an opportunistic, value-oriented, and risk-controlled approach to investing.

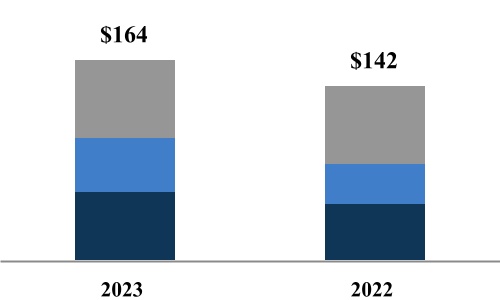

•We provide one of the most comprehensive alternative credit offerings available today, with $164 billion of Fee-Bearing Capital as of December 31, 2023, and an experienced team of investment professionals around the world.

Our Products

•Our credit strategies invest in both liquid and illiquid instruments, sourced directly from borrowers and via public markets. We focus primarily on rated and non-rated debt of sub-investment grade issuers in developed and emerging markets, and we invest in an array of private credit, high yield bonds, convertible securities, leveraged loans, structured credit instruments, and opportunistic credit.

•The flagship credit strategy, Global Opportunities, seeks to generate current income and long-term capital appreciation by investing in private loans to large private-equity-owned companies by focusing on protecting against loss by buying claims on assets at bargain prices. We aim to achieve substantial gains by actively participating in restructurings to restore companies to financial viability and creating value at every stage of the investment process.

•The recently launched credit strategy, Oaktree Lending Partners (“OLP”), seeks to generate current income and long-term capital appreciation by investing in private loans to large private-equity-owned companies in the U.S. We aim to build a diverse portfolio of first-lien secured loans to mature, buyout, and late-stage (primarily for life sciences businesses) companies across industries.

•Included in our other strategies is our Insurance Solutions Business, a leading capital solutions business providing insurance and reinsurance services to individuals and institutions. This business manages policy capital and deploys it across liquid credit strategies, direct loans, and private funds.

•Also included amongst our strategies is our Public Securities Group (“PSG”), which manages the Fee-Bearing Capital associated with our liquid strategies. PSG serves institutions and individuals seeking the investment advantages of real assets through actively managed listed equity and debt strategies.

PART 2

REVIEW OF FINANCIAL RESULTS

Income Statement Analysis

Consolidated Statement of Comprehensive Income

The following table summarizes the financial results of the Manager for the year ended December 31, 2023 and the period from July 4, 2022 to December 31, 2022:

| | | | | | | | | | | | | |

| | | | | |

FOR THE YEAR ENDED DECEMBER 31, 2023 AND FOR THE PERIOD JULY 4, 2022 TO DECEMBER 31, 2022 (MILLIONS) | | | 2023 | | 2022 |

| Operating recoveries | | | $ | 383 | | | $ | 37 | |

| | | | | |

| Expenses | | | | | |

| Compensation and benefits | | | (326) | | | (1) | |

| Other operating expense | | | (5) | | | (35) | |

| Carried interest allocation compensation | | | | | |

| Realized | | | (24) | | | — | |

| Unrealized | | | (38) | | | (3) | |

| Total carried interest allocation compensation | | | (62) | | | (3) | |

| Interest expense | | | (9) | | | — | |

| Total expenses | | | (402) | | | (39) | |

| Share of income from Brookfield Asset Management ULC | | | 470 | | | 21 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net income | | | $ | 451 | | | $ | 19 | |

For the year ended December 31, 2023

During the year ended December 31, 2023, the Manager recorded net income of $451 million. Net income consists of the Manager’s equity interest in the earnings of the Asset Management Company and compensation and benefit costs, primarily attributable to executive compensation costs of the Manager and unrealized carried interest compensation expense. A material portion of these costs are reimbursed by the Corporation and the Asset Management Company in accordance with the Relationship Agreement and the Asset Management Services Agreement. Refer to the following discussion for details on the earnings of the Asset Management Company.

For the period from July 4, 2022 to December 31, 2022

During the period ended December 31, 2022, the Manager recorded net income of $19 million, driven mostly by the Manager's equity interest in the earnings of the Asset Management Company offset by compensation and benefit costs. A material portion of these costs are reimbursed by the Corporation and the asset management business in accordance with the Asset Management Services Agreement and the Relationship Agreement. Refer to the following discussion for details on the earnings of the Asset Management Company.

Consolidated and Combined Statement of Operations

The following table summarizes the Consolidated and Combined Statement Of Operations for BAM ULC for the years ended December 31, 2023 and 2022:

| | | | | | | | | | | | | | | | | |

| | | | | |

FOR THE YEARS ENDED DECEMBER 31, (MILLIONS) | | | | | 2023 | | 2022 | | |

| Revenues | | | | | | | | | |

| | | | | | | | | |

| Base management and advisory fees | | | | | $ | 3,142 | | | $ | 2,835 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Investment income | | | | | | | | | |

| Carried interest allocations | | | | | | | | | |

| Realized | | | | | 51 | | | 241 | | | |

| Unrealized | | | | | 348 | | | 249 | | | |

| Total investment income | | | | | 399 | | | 490 | | | |

| Interest and dividend revenue | | | | | 172 | | | 258 | | | |

Other revenues | | | | | 349 | | | 44 | | | |

| Total revenues | | | | | 4,062 | | | 3,627 | | | |

| Expenses | | | | | | | | | |

| Compensation, operating, and general and administrative expenses | | | | | | | | | |

| Compensation and benefits | | | | | (1,048) | | | (700) | | | |

| Other operating expenses | | | | | (342) | | | (236) | | | |

| General, administrative and other | | | | | (56) | | | (81) | | | |

| Total compensation, operating, and general and administrative expenses | | | | | (1,446) | | | (1,017) | | | |

| Carried interest allocation compensation | | | | | | | | | |

| Realized | | | | | (26) | | | (61) | | | |

| Unrealized | | | | | (60) | | | (139) | | | |

| Total carried interest allocation compensation | | | | | (86) | | | (200) | | | |

| Interest expense | | | | | (14) | | | (154) | | | |

| Total expenses | | | | | (1,546) | | | (1,371) | | | |

| Other (expenses) income, net | | | | | (129) | | | 1,090 | | | |

| Share of income from equity accounted investments | | | | | 167 | | | 146 | | | |

| Income before taxes | | | | | 2,554 | | | 3,492 | | | |

| Income tax expense | | | | | (417) | | | (627) | | | |

| Net income | | | | | 2,137 | | | 2,865 | | | |

| Net (income) attributable to: | | | | | | | | | |

| Redeemable non-controlling interests in consolidated funds | | | | | — | | | (909) | | | |

| Preferred shares redeemable non-controlling interest | | | | | (262) | | | (35) | | | |

| Non-controlling interest | | | | | (36) | | | (6) | | | |

| Net income attributable to the common stockholders | | | | | $ | 1,839 | | | $ | 1,915 | | | |

For the years ended December 31, 2023 and 2022

Net income for the year ended December 31, 2023 was $2.1 billion, of which $1.8 billion was attributable to common stockholders. This compares to net income of $2.9 billion for the year ended December 31, 2022, of which $1.9 billion was attributable to common stockholders.

Revenues

Revenues for the year ended December 31, 2023 were $4.1 billion, which represents an increase of $435 million or 12% compared to $3.6 billion of revenue for the year ended December 31, 2022.

Base Management and Advisory Fees

Base management and advisory fees, excluding incentive distributions, for the year ended December 31, 2023 were $2.8 billion, which represents an increase of $266 million or 11% compared to the year ended December 31, 2022. The increase was predominantly driven by incremental contributions from capital raised for our latest flagship funds and capital deployed across our complementary strategies. Incentive distributions for the year ended December 31, 2023, were $376 million, an increase of $41 million or 12% from the year ended December 31, 2022, driven by growth in BIP and BEP's dividends of 6% and 5%, respectively.

Carried Interest Allocations

Realized carried interest allocations were $51 million for the year ended December 31, 2023, which represents a decrease of $190 million compared to the year ended December 31, 2022. Realized carried interest allocations in the year were primarily driven by dispositions within our real estate flagship funds. Realized carried interest allocations of $241 million for the year ended December 31, 2022 were primarily driven by realizations within our real estate long-term and perpetual funds, as well as a realization within our infrastructure business.

Unrealized carried interest allocations were $348 million for the year ended December 31, 2023, which represents an increase of $99 million compared to the year ended December 31, 2022. The unrealized carried interest allocations were primarily related to growth in valuations in our private equity, real estate and transition flagship funds, partially offset by realizations in the year.

Unrealized carried interest allocations attributable to the asset management business, which represents unrealized carried interest on new funds, was $167 million for the year ended December 31, 2023, compared to $124 million for the year ended December 31, 2022. The Asset Management Company is entitled to 66.67% of unrealized carried interest on new funds with the remaining 33.33% interest attributable to the Corporation.

Interest and Dividend Revenue

Interest and dividend revenue for the year ended December 31, 2023 were $172 million, which represents a decrease of $86 million compared to the year ended December 31, 2022. The decrease was a result of the transfer of certain investments and loans of the asset management business to the Corporation as part of the Arrangement. Prior year interest and dividend income was earned from legacy investments and interest bearing loans with affiliates.

Other Revenues

Other revenues were $349 million for the year ended December 31, 2023, an increase of $305 million compared to the year ended December 31, 2023. The increase is due to amounts recoverable from the Corporation associated with share and performance based compensation as defined by the Relationship Agreement.

Expenses

Total expenses for the year ended December 31, 2023 were $1.5 billion, an increase of $175 million or 13% compared to the year ended December 31, 2022.

Compensation and Benefits

Compensation and benefits for the year ended December 31, 2023 were $1.0 billion, which represents an increase of $348 million compared to the year ended December 31, 2022. This is primarily attributable to increased compensation costs resulting from the ongoing growth of our asset management business and mark-to-market increases of liability based awards.

Other Operating Expenses

Other operating expenses are comprised of professional fees, facilities costs, as well as costs directly associated with our fundraising and investment functions. Other operating expenses were $342 million for the year ended December 31, 2023, compared to $236 million for the year ended December 31, 2022. The increase was primarily attributable to the growth in our business relative to the prior year.

Carried Interest Allocation Compensation

Compensation expenses related to carried interest allocation compensation were $86 million for the year ended December 31, 2023, which represents a decrease of $114 million compared to the year ended December 31, 2022. This is predominantly driven by lower relative valuation gains compared to the year ended December 31, 2022 across certain of our funds. As outlined in the Relationship Agreement, the carried interest compensation expense associated with mature funds is fully recoverable from the Corporation. Carried interest compensation expense on new funds was $2 million on a net basis.

Other (Expenses) Income, net

Other (expenses) income, net for the year ended December 31, 2023, primarily consists of mark-to-market movements on our investment in BSREP III and mark-to-market adjustments on call and put options to acquire an additional interest in Oaktree and Primary Wave in the future. BSREP III mark-to-market movements and dividend distributions during 2023 are not attributable to the Asset Management Company on a net basis. The Asset Management Company also recorded impairment charges associated with intangible assets and goodwill of $30 million related to legacy acquisitions, and transaction costs related to the spin-off of the asset management business. Other income in the prior year relates to dividend income received from BSREP III.

Share of Income from Equity Accounted Investments

Our share of income from equity accounted investments was $167 million compared to $146 million in the prior year, or an increase of 14%. This is predominantly our share of income from our investment in Oaktree, primarily driven by unrealized carried interest generated during the year.

Income Tax Expense

Income tax expense was $417 million for the year ended December 31, 2023, which represents a decrease of $210 million compared to the year ended December 31, 2022. This decrease was driven by lower taxable income relative to prior year.

Net (Income) Attributable to Preferred Share Redeemable Non-Controlling Interest

Net (income) attributable to preferred redeemable non-controlling interest was $262 million for the year ended December 31, 2023. This balance primarily represents the movement in carried interest net of carried interest allocation expense and taxes associated with mature funds owing to the Corporation.

Net (Income) Attributable to Non-Controlling Interest

Net (income) attributable to non-controlling interest was $36 million for the year ended December 31, 2023. This balance is primarily the carried interest generated on new funds that is attributable to the Corporation.

Balance Sheet Analysis

Consolidated Balance Sheets

The following table summarizes the Consolidated Balance Sheets of the Manager as at December 31, 2023 and December 31, 2022:

| | | | | | | | | | | |

AS AT DECEMBER 31, (MILLIONS) | 2023 | | 2022 |

| Assets | | | |

| Cash and cash equivalents | $ | 9 | | | $ | 1 | |

| | | |

| Due from affiliates | 886 | | | 782 | |

| Other assets | 40 | | | — | |

| Investment in Brookfield Asset Management ULC | 2,270 | | | 2,378 | |

| | | |

| Total assets | $ | 3,205 | | | $ | 3,161 | |

| | | |

| Liabilities | | | |

| Accounts payable and accrued liabilities | $ | 859 | | | $ | 781 | |

| Due to affiliates | 261 | | | 3 | |

| Total liabilities | 1,120 | | | 784 | |

| Equity | | | |

| | | |

| Common Stock: | | | |

Class A (unlimited authorized and 413,026,253 issued and 388,733,466 outstanding) | 2,354 | | | 2,410 | |

Class B (unlimited authorized and 21,280 issued and outstanding) | — | | | — | |

Class A held in treasury (24,292,787 shares) | (649) | | | (330) | |

| Additional paid-in-capital | 403 | | | 278 | |

| Retained (deficit) earnings | (35) | | | 19 | |

| Accumulated other comprehensive income | 3 | | | — | |

| Total common equity | 2,076 | | | 2,377 | |

| Non-controlling interest | 9 | | | — | |

| Total equity | 2,085 | | | 2,377 | |

| Total liabilities, non-controlling interest and equity | $ | 3,205 | | | $ | 3,161 | |

As at December 31, 2023 and December 31, 2022

As at December 31, 2023, the Manager’s total assets were $3.2 billion. Total assets consist primarily of the 25% interest in the Asset Management Company and reimbursements due from affiliates related to long-term executive compensation programs of the Manager.

As at December 31, 2023, the Manager’s total liabilities were $1.1 billion, an increase of $336 million compared to the prior year, driven by an increase in due to affiliates of $258 million primarily due to draws on the Manager credit facility with the Asset Management Company to fund share repurchases.

As at December 31, 2023, the Manager's total equity was $2.1 billion, which decreased by $292 million compared to the prior year due to share buybacks and distributions in the year, partially offset by increases in additional paid-in-capital related to stock based compensation plans.

Consolidated and Combined Balance Sheets

The following table is the BAM ULC Consolidated and Combined Balance Sheets as at December 31, 2023 and December 31, 2022:

| | | | | | | | | | | |

AS AT DECEMBER 31,

(MILLIONS) | 2023 | | 2022 |

| Assets | | | |

| Cash and cash equivalents | $ | 2,667 | | | $ | 3,545 | |

| Accounts receivable and other | 588 | | | 429 | |

| Due from affiliates | 2,504 | | | 2,121 | |

| Investments | 7,522 | | | 6,877 | |

| Property, plant and equipment | 73 | | | 68 | |

| Intangible assets | 42 | | | 59 | |

| Goodwill | 251 | | | 249 | |

| Deferred income tax assets | 643 | | | 739 | |

| Total assets | $ | 14,290 | | | $ | 14,087 | |

| | | |

| Liabilities | | | |

| Accounts payable and other | $ | 1,799 | | | $ | 1,842 | |

| Due to affiliates | 986 | | | 811 | |

| Deferred income tax liabilities | 40 | | | 17 |

| Total liabilities | 2,825 | | | 2,670 | |

| | | |

| Preferred shares redeemable non-controlling interest | 2,166 | | | 1,811 | |

| | | |

| Equity | | | |

| Common equity (common shares - unlimited authorized, 1,635,349,629 issued and outstanding) | 9,014 | | | 9,271 | |

| Retained (deficit) earnings | (178) | | | 84 | |

| Accumulated other comprehensive income | 168 | | | 153 | |

| Additional paid-in capital | 122 | | | — | |

| Total common equity | 9,126 | | | 9,508 | |

| Non-controlling interest | 173 | | | 98 | |

| Total equity | 9,299 | | | 9,606 | |

| Total liabilities, redeemable non-controlling interest and equity | $ | 14,290 | | | $ | 14,087 | |

As at December 31, 2023 and December 31, 2022

Assets

Total assets were $14.3 billion as at December 31, 2023, an increase of $203 million or 1% compared to December 31, 2022 due to increases in investments and due from affiliates, partially offset by a decrease in cash and cash equivalents and deferred income tax assets.

Cash and Cash Equivalents

Cash and cash equivalents were $2.7 billion, a decrease of $878 million or 25% from the prior year. This decrease is largely due to the acquisition of our incremental 4% ownership interest in Oaktree, temporary working capital provided to our managed funds, interest bearing loans to affiliates and the Manager, and the settlements of amounts owing to affiliates. Of this balance, $2.5 billion is on deposit with the Corporation.

Accounts Receivable and Other

Accounts receivable and other of $588 million primarily consists of receivables from third parties and prepaid expenses. The increase of $159 million or 37% over the prior year is largely driven by the prepayments of stock based compensation costs to the Manager in accordance with the Asset Management Services Agreement.

Due from Affiliates

Due from affiliates of $2.5 billion primarily relates to management fees earned but not collected from our managed funds, as well as reimbursements due from the Corporation for long-term compensation awards. The increase of $383 million or 18% from the prior year was primarily the result of the timing of settlements, higher recharges associated with long-term compensation awards, draws on the Manager credit facility, and other interest bearing related party loans.

Investments

Investments are predominantly comprised of our 16% limited partnership interest in BSREP III and an approximate 68% ownership interest in Oaktree. The increase from the prior year of $645 million or 9% was primarily a result of income earned from our investment in Oaktree as well as the increase in our ownership interest in Oaktree from approximately 64% to approximately 68% during the year.

Liabilities

Total liabilities were $2.8 billion as at December 31, 2023, an increase of $155 million or 6% compared to the prior year.

Accounts Payable and Other

Accounts payable and other primarily consists of accrued bonus compensation, performance and cash settled share based compensation, and the mark-to-market of derivatives associated with put options on certain of our investments. The increase in 2023 of $43 million reflects the timing of payments and movements in the mark-to-market of put options to acquire additional interests in Oaktree and Primary Wave in the future.

Due to Affiliates

Due to affiliates of $986 million reflects amounts owed to affiliates. The increase of $175 million or 22% relative to the prior year was the result of higher borrowings on our credit facility with the Corporation and reflects the timing of payments in the normal course of operations.

Preferred Shares Redeemable Non-Controlling Interest

Preferred shares redeemable non-controlling interest was $2.2 billion as at December 31, 2023, an increase of $355 million or 20% compared to $1.8 billion as at December 31, 2022. This increase was due to carried interest generated on mature funds during the year.

Non-Controlling Interest

Non-controlling interest was $173 million as at December 31, 2023, an increase of $75 million compared to $98 million as at December 31, 2022. This increase was primarily due to carried interest generated by new funds that is owed to the Corporation and other non-controlling interests associated with various entities within the asset management business.

Cash Flow Statement Analysis

Review of Consolidated Statement of Cash Flows

The following table summarizes the changes in the Manager’s cash for the year ended December 31, 2023 and the period from July 4, 2022 to December 31, 2022:

| | | | | | | | | | | | | |

| | | | | |

FOR THE YEAR ENDED DECEMBER 31, 2023 AND FOR THE PERIOD JULY 4, 2022 TO DECEMBER 31, 2022

(MILLIONS) | | | 2023 | | 2022 |

| | | | | |

| | | | | |

| | | | | |

| Operating activities | | | $ | 508 | | | $ | (2) | |

| Investing activities | | | (41) | | | — | |

| Financing activities | | | (459) | | | 3 | |

| Change in cash and cash equivalents | | | $ | 8 | | | $ | 1 | |

For the year ended December 31, 2023 and period ended December 31, 2022

During the year, the Manager's operating activities generated positive cashflows of $508 million primarily attributable to the share of income driven from its investment in the Asset Management Company. During the period ended December 31, 2022, the Manager's operating cash outflows were $2 million.

Net cash outflows from investing activities totaled $41 million, primarily reflecting the purchase of an option to acquire additional shares of the Asset Management Company.

Net cash outflows from financing activities totaled $459 million, primarily attributed to the distributions paid to the Manager's shareholders and share buybacks. These outflows were partially offset by cash drawn on the credit facility between the Manager and the Asset Management Company.

During the period ended December 31, 2022, net cash inflows from financing activities totaled $3 million, primarily attributed to movements of loan balances from an affiliate of the Corporation as a result of the Arrangement and share subscriptions of the Corporation. These inflows were partially offset by share repurchases.

Review of Consolidated and Combined Statement of Cash Flows

Refer to the following table that summarizes the Consolidated and Combined Statement of Cash Flows for our asset management business for the years ended December 31, 2023 and 2022:

| | | | | | | | | | | | | | | | | |

| | | | | |

FOR THE YEARS ENDED DECEMBER 31,

(MILLIONS) | | | | | 2023 | | 2022 | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Operating activities | | | | | $ | 1,439 | | | $ | (374) | | | |

| Investing activities | | | | | (475) | | | 1,706 | | | |

| Financing activities | | | | | (1,842) | | | (280) | | | |

| Change in cash and cash equivalents | | | | | $ | (878) | | | $ | 1,052 | | | |

For the years ended December 31, 2023 and 2022

During the year, the Company's operating activities generated positive cashflows of $1.4 billion, compared to cash outflows of $374 million in the prior year. Excluding the net change in working capital and other non-cash operating items, operating cash inflows were $2.1 billion, representing an increase of $76 million or 4% compared to the prior year, primarily driven by the impact of the Arrangement.

Investing Activities

Net cash outflows from investing activities totaled $475 million, compared to inflows of $1.7 billion in the prior year. The current year investing activity primarily consists of the purchase of the incremental 4% ownership interest in Oaktree and advances provided to the Manager on its credit facility. The prior year investing activity inflow was predominantly driven by the disposition of financial assets as part of the Arrangement.

Financing Activities