UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A

REGULATION A OFFERING STATEMENT

UNDER THE SECURITIES ACT OF 1933

OMEGA RESOURCES, INC.

(Exact name of issuer as specified in its charter)

Colorado

(State or other jurisdiction of incorporation or organization)

8541 North County Road 11

Wellington, CO 80549

(970-568-6862)

(Address, including zip code, and telephone number,

including area code of issuer’s principal executive office)

Byron E. Thomas, Esq.

Law Offices of Byron Thomas

3275 S. Jones Blvd, Ste 104

Las Vegas, NV 89146

702-747-3103

byronthomaslaw@gmail.com

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

1311

| 82-3689006

|

(Primary Standard Industrial

Classification Code Number)

| (I.R.S. Employer

Identification Number)

|

THIS OFFERING STATEMENT SHALL ONLY BE QUALIFIED UPON ORDER OF THE COMMISSION, UNLESS A SUBSEQUENT AMENDMENT IS FILED INDICATING THE INTENTION TO BECOME QUALIFIED BY OPERATION OF THE TERMS OF REGULATION A.

[The Balance of This Page Has Intentionally Been Left Blank.]

i

PART II

OFFERING CIRCULAR

Omega Resources, Inc.

8541 North County Road 11

Wellington, CO 80549

(970-568-6862)

Dated: July 13, 2022

22,500,000 Shares of Common Stock

$0.50 per share

Minimum purchase: 500 Shares ($250.00)

This Offering Circular relates to the offering (the “Offering”) of up to 22,500,000 shares of common stock (the “Share(s)”) in Omega Resources, Inc. (the “Company”, “we” or “us”) at a price of $0.50 per Share. The Offering will commence promptly after the date of this Offering Circular and will close upon the earlier of (1) the sale of 22,500,000 Shares, (2) one year from the date this Offering begins, or (3) a date prior to one year from the date this Offering begins that is so determined by the Company (the “Offering Period”). See the section entitled “Distributions” for a discussion of the term “Cash Flow.”

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

The officers and directors currently own 7,500,000 common shares. If all 22,500,000 Shares are purchased, the 7,500,000 shares would represent 29% of all issued and outstanding shares of common stock.

This Offering is being conducted on a “best-efforts” basis, which means the officers and directors will use their commercially reasonable best efforts in an attempt to sell the Shares. They will not receive any commission or any other remuneration for these sales. In offering the Shares on our behalf, they will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934. Ziegler is a promoter.

The Shares will be offered for sale at a fixed price of $0.50 per Share. If all of the Shares are purchased, the gross proceeds to the Company will be $11,250,000. However, since the Offering is being conducted on a “best-efforts” basis, there is no minimum number of Shares that must be sold, meaning we will retain any proceeds from the sale of the Shares sold in this Offering. Accordingly, all funds raised in the Offering will become immediately available to the Company and may be used as they are accepted. Investors will not be entitled to a refund and could lose their entire investment.

Our Shares are not listed on any national securities exchange or on the over-the counter inter-dealer quotation system. There is no market for our Shares.

These are speculative securities. Investment in the Shares involves significant risk. You should purchase these securities only if you can afford a complete loss of your investment. See the “Risk Factors” section on page 11 of this Offering Circular for a discussion of the following and other risks:

·Since its inception through present, the Company has recorded a net loss and has had minimal revenue;

·The Company has limited operating history, and the officers have a lack of experience in managing a public company;

ii

·The Company has not established any minimum offering amount, and there is no assurance that the Company will raise sufficient funds to carry out its business objectives;

·The determination of the offering price and other terms of the Offering have been arbitrarily determined and may not reflect the value of your investment;

·Your investment is highly illiquid and the Company does not intend to provide any liquidity options;

·If the Company was to become subject to the Investment Company Act of 1940 (the “1940 Act”) it could have a material adverse effect on the Company, and it is probable that the Company would be terminated and liquidated; and

·The interests of the officers and directors may conflict with your interests.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

iii

| Offering

Price to

the Public

| Commissions

| Net Proceeds

(With 25% of

Shares Sold)

| Net Proceeds

(With 50% of

Shares Sold)

| Net Proceeds

(With 75% of

Shares Sold)

| Net Proceeds

(With 100% of

Shares Sold)

|

Per Share

| $0.50

| N/A

| $0.50

| $0.50

| $0.50

| $0.50

|

Total (1)

| $11,250,000

| N/A

| $2,812,500

| $5,625,000

| $8,437,500

| $11,250,000

|

(1)Before deducting expenses of the Offering, which are estimated to be approximately 10% of gross proceeds.

IMPORTANT NOTICES TO INVESTORS

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE COMPANY AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED OR APPROVED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THESE AUTHORITIES HAVE NOT PASSED UPON THE ACCURACY OR ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE SHARES HAVE NOT BEEN QUALIFIED UNDER THE SECURITIES LAWS OF ANY STATE OR JURISDICTION. WE MAY ALSO OFFER OR SELL SHARES IN OTHER STATES IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF THE LAWS OF THOSE OTHER STATES.

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS OTHER THAN THOSE CONTAINED IN OR INCORPORATED BY REFERENCE IN THIS OFFERING CIRCULAR AND, IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY US.

[The Balance of This Page Has Intentionally Been Left Blank.]

iv

TABLE OF CONTENTS

THIS OFFERING CIRCULAR CONTAINS ALL OF THE REPRESENTATIONS BY THE COMPANY CONCERNING THIS OFFERING, AND NO PERSON SHALL MAKE DIFFERENT OR BROADER STATEMENTS THAN THOSE CONTAINED HEREIN. INVESTORS ARE CAUTIONED NOT TO RELY UPON ANY INFORMATION NOT EXPRESSLY SET FORTH IN THIS OFFERING CIRCULAR.

This Offering Circular, together with Financial Statements and other Attachments, consists of a total of ____ pages.

v

OFFERING CIRCULAR SUMMARY

This Summary highlights information contained elsewhere in this Offering Circular. This Summary is not complete and does not contain all of the information that you should consider before investing in the Shares.

You should carefully read the entire Offering Circular, especially concerning the risks associated with the investment in the Shares discussed under the “Risk Factors” section on Page 5.

Unless we state otherwise, the terms “we”, “us”, “our”, “Company”, “management”, or similar terms collectively refer to Omega Resources, Inc., a Colorado Corporation.

Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “Special Note Regarding Forward-Looking Statements” on Page 9.

OUR BUSINESS

The Company

The Company will primarily focus on two fields of investments. Real Estate and Oil and Gas investments will both be considered. Omega will focus primarily on the real estate sector and secondarily on the oil and gas market place through limited partnerships in each investment sector.

Land Acquisition and Property Acquisition and Management

Omega is uniquely positioned geographically. Geographically, Omega is advantageously located in Colorado’s dynamic front range, and over the previous seven to eight years this region has experienced increases in certain property values of up to five to seven percent annually. In addition, its real estate management team has a combined 135 years of experience in agricultural, commercial and residential properties, including all of its Board Members and LLP managers.

Agricultural properties have shared in this dynamic valuation escalation. Raw farm ground has typically increased from $6,000 to $10,000 per acre over the same period within the areas to be considered for investment. Residential home prices have seen valuations escalate from $200,000 to $400,000 during this same period. While economic slowdowns have adversely affected real estate nationally, the effects have been less severe over Colorado’s front range.

Omega’s business plan is to concentrate its efforts on these front range land opportunities. The Company intends to expand this focus to Wyoming, Nebraska and Kansas in time as funds are raised for expansion. The contiguity of these areas to our headquarters in Colorado will be economically advantageous in reducing travel related costs. These savings will contribute to profitability to our investors.

In general, agricultural lands will be rented to growers/grazers. The Company anticipates returns of 3% to 6% depending on farm economies in each local area selected. Agricultural properties are anticipated to appreciate at a rate of three to four percent annually. The combination of these factors is expected to produce between six and ten percent overall returns over time.

Omega’s investment team’s extensive experience in commercial and residential properties purchase, sales and development leads it to believe that average returns of 9 to 12 percent annually are not out of the anticipated range of return over and extended period of investment.

Oil and Gas

The current market for oil and gas exploration and development of new and existing oil and gas projects is very favorable for Omega Resources, Inc. It is our business strategy to capitalize on new drilling technology to pursue existing and by-passed opportunities in the highly profitable energy industry. Our low overhead and highly

1

experienced team is ideally suited to take maximum advantage of the opportunities that may be uneconomical to larger or heavily leveraged oil and gas companies.

The Company is to be an active participant in the oil and gas industry by acquiring existing oil and gas assets and developing new exploration opportunities. Two primary approaches are being followed to accomplish this goal. The first approach is to acquire “orphan wells”, then bring them up to operational capability. In some cases, the Company will also increase their production capability by employing enhanced recovery methods. The second approach is to own oil and gas production, either by buying existing production with potential for upside through more drilling, or by employing enhanced recovery methods. The third approach is to purchase oil and gas leases with good seismic data located in close proximity to or covering existing fields with good drilling and development potential. These are opportunities that are unattractive to most larger oil and gas organizations, but ideal for our operational approach.

In the initial phase of the Company, we will concentrate on obtaining “orphan wells” and existing gas production in Colorado, western Kansas and Wyoming that can be enhanced over time and with the added potential of additional future drilling. These well projects will target shallower formations resulting in lower operating costs, higher profitability and lower risk. In the second phase we will seek opportunities to acquire existing production with potential for in-field development or new exploratory drilling in Oklahoma and Texas. As the Company grows, our plans include entry into the gas marketing business focusing on marketing direct to end users and expanding our areas of interest for purchasing oil production, oil and gas leases and localized field gas gathering systems. We are confident that with the experience of our corporate personnel and our contract consulting personnel the Company will thrive.

2

THE OFFERING

Issuer

| Omega Resources, Inc., a Colorado corporation

|

|

|

Security Offered

| Shares of Common Stock

|

|

|

Price per Share

| $0.50

|

|

|

Minimum Offering

| None

|

|

|

Maximum Offering

| $11,250,000 (22,500,000 Shares)

|

|

|

Minimum Investment

| $250 (i.e., 500 Shares at $0.50 per Share)

|

|

|

Offering Period

| The offering will commence promptly after the date of this Offering Circular and will close upon the earlier of (1) the sale of all 22,500,000 Shares, (2) one year after the date of this Offering Circular, or (3) at such date prior to one year as may be determined by the Company. The Offering may be terminated at our election at any time.

|

|

|

Investors

| Those persons who purchase Shares in accordance with the terms of this Offering.

|

|

|

Shareholders

| Those persons who own shares in the Company.

|

|

|

Voting Rights

| Investors will have no rights to contribute to, direct or vote on the management of the Company’s affairs, including whether or not the Company should dissolve.

|

|

|

Distributions

| The declaration of any future cash dividend will be at the sole discretion of the Board of Directors and will depend upon earnings, if any, capital requirements, and our financial position, general economic conditions, and other pertinent conditions. The Company does not intent to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in the Company’s business operations.

|

|

|

Dilution

| Following this Offering, assuming all the Shares are sold, the current Interest Holders’ as of the date of this Offering will be diluted from 100% to 25.0% of all issued and outstanding shares of common stock.

|

|

|

Use of Proceeds

| The net proceeds of this Offering will be used (i) to expand operations, and/or (ii) for working capital. Expenses of the Offering are estimated to be approximately 10% of the gross proceeds from the Offering.

|

|

|

Liquidity of Shares

| There is no public market for the Shares, the Company does not expect such a market to develop in the future, and the Company does not intend to offer any additional liquidity options to investors.

|

|

|

Exchange Act

| The Company is not required to provide disclosure pursuant to the Exchange Disclosure Act.

|

|

|

Risk Factors

| An investment in the Company is highly speculative and involves substantial risks. Prospective Investors should carefully review and consider the factors described under the “Risk Factors” section below the Summary Of Financial Information.

|

We plan to file notice of the Offering with the securities regulators in all of the 50 states.

3

SUMMARY OF FINANCIAL INFORMATION

| As at December 31,

|

| 2021

| 2020

|

| ($)

| ($)

|

ASSETS

|

|

|

Current Assets

|

|

|

Cash and Cash Equivalents

| 818

| 585

|

Advances to Shareholder

| 6,068

|

|

Total Current Assets

| 6,886

| 585

|

|

|

|

FIXED ASSETS

|

|

|

Gas Wells

| 3,000

| 3,000

|

Plant and Equipment

| 3,000

| 3,000

|

Accumulated Depreciation

| (2,253)

| (1,803)

|

Accumulated Depletion

| (3,000)

| (3,000)

|

Total Fixed Assets

| 747

| 1,197

|

|

|

|

Total Assets

| 7,633

| 1,782

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

|

Current Liabilities

|

|

|

Accounts Payable

| 0

| 0

|

Total Current Liabilities

| 0

| 0

|

|

|

|

Long Term Liabilities

|

|

|

Notes Payable

| 10,816

| 8,158

|

Total Long Term Liabilities

| 10,816

| 8,158

|

|

|

|

Total Liabilities

| 10,816

| 8,158

|

|

|

|

EQUITY

|

|

|

Common Stock-65,000,000 common stock par value $0.001 authorized. Issued and outstanding December 31, 2020 is 1,000. Issued and outstanding December 31, 2021 is 1,000.

| 1

| 1

|

Additional paid in capital

| 736

| 736

|

Retained earnings or (Deficit accumulated during development stage)

| (3,920)

| (7,113)

|

Total Stockholder’s Equity

| (3,183)

| (6,376)

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS EQUITY

| 7,633

| 1,782

|

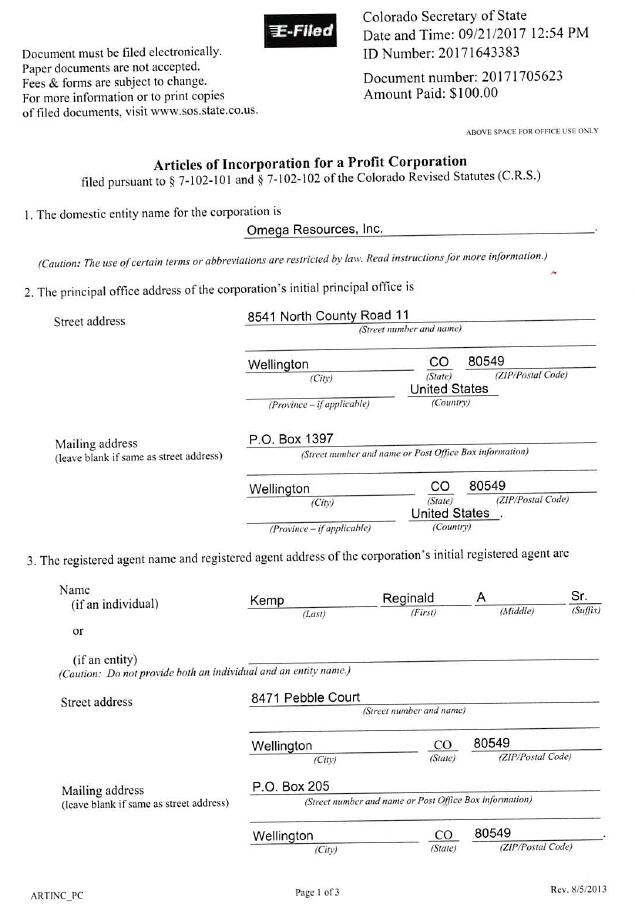

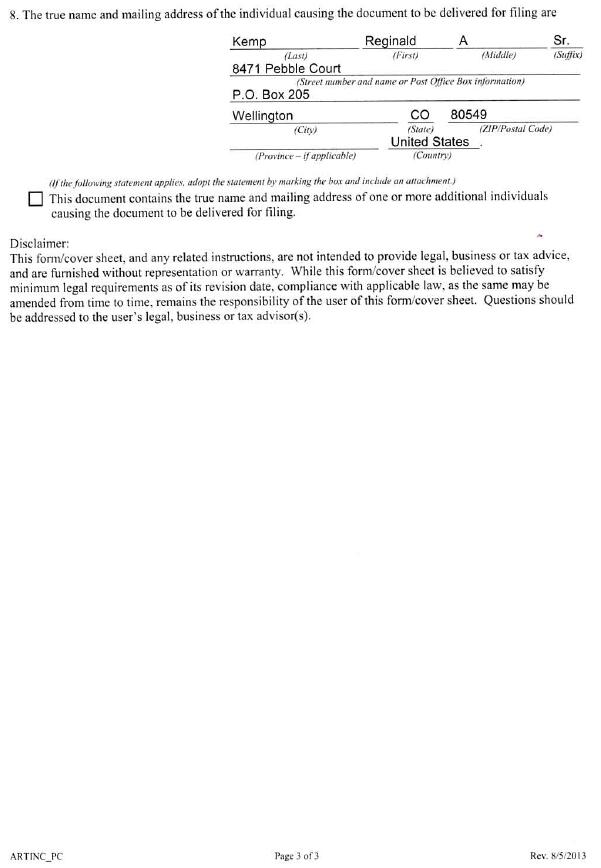

Corporate Information

We are a Colorado corporation. We maintain principal executive offices at the office of our Director, 8541 North County Road 11, Wellington, CO 80549. Our telephone number is 970-568-6862.

4

RISK FACTORS

An investment in the Company carries risks, several of which are set out below including those related to the Company, those related to the Offering, and those related to taxes. In addition to those risks, businesses are often subject to risks not foreseen or fully appreciated by management. In reviewing this Offering Circular, potential Investors should keep in mind other possible risks that could be important.

This is a speculative investment, and the value of your investment in the Company may decrease significantly or entirely. You should not make an investment in the Company if you are unable to bear the loss of your entire investment. You should only consider an investment in the Company after considering the following risks and consulting with your investment, legal, and tax advisors.

Risks Related to the Company’s Business

The Company’s net loss, lack of revenue, and minimal assets results in no assurance of success.

Since its inception to the present, we have recorded a net loss and have had minimal revenue. The losses have been due to expenses related to start-up costs incurred as the officers grew the business and established the Company. The Company has no significant assets or financial resources. There can be no assurance that the officers will generate significant revenues or be profitable in the future. If the Company is not profitable, it may need to curtail or cease operations, or seek additional revenue through the sale of its Shares.

The Company may require additional capital and may be unable to obtain such capital on favorable terms or at all.

In the future, we may need to raise additional capital through the issuance of additional Shares or securities convertible into Shares. If we issue additional Shares or convertible securities, our then-existing shareholders may face substantial dilution. In addition to diluting our then-existing shareholders, we may be obligated to pay a substantial amount of regular income to future investors, which would reduce our cash available for working capital. Equity interests in the subsidiaries of the Company, if any, may also be publicly or privately offered. Such offerings would have the effect of indirectly diluting members of the Company. Currently, we do not have any arrangements for any financing for the sale of shares or any other method of financing, and we can provide no assurances to Investors that we will be able to obtain any financing when required on favorable terms or at all. The only cash immediately available to us is the cash in our bank account.

The Company has not established any minimum offering amount, and there is no assurance that the Company will raise sufficient funds to carry out its business objectives.

The Company has not established any minimum offering amount that must be raised to carry out the business objectives contemplated in the offering document. There is no assurance that the Company will raise sufficient funds to carry out its business objectives, including payment of offering expenses, establishment of debt service reserves, provision for other construction cost contingencies and other working capital needs.

Sole Officers and Directors may hinder operations.

Omega Resources, Inc.’s operations depend solely on the efforts of the officers and directors of the Company. They have very little experience, if any, related to public company management or as a principal accounting officer. Because of this, the Company may be unable to offer and sell the shares in this offering, develop our business or manage our public reporting requirements. The Company cannot guarantee that it will be able overcome any such obstacles.

The Company has no operating history, and the Officers and Directors lack experience.

The Company was recently organized and has no history of operations. The Company therefore should be considered a development stage company, and its operations will be subject to all of the risks inherent in the

5

establishment of a new business enterprise, including, but not limited to, hurdles or barriers to the implementation of its business plans. Further, because there is no history of operations there is also no operating history from which to evaluate the officer and directors’ ability to manage the Company’s operations and achieve its goals or the likely performance of the Company. Prospective Investors should also consider that the officers and directors Manager, the principals not previously managed a public company. No assurances can be given that the Company can operate profitably.

The Company will face competition.

Competition in the real estate and oil industries contains many companies with longer operating histories, more market experience or contacts, or greater financial resources than the Company. The Company may not be able to compete effectively.

The Company may never make distributions.

Payment of distributions and the amounts thereof will depend upon returns received by the Company. The Company may not operate profitably or be able to declare and pay any distributions to the Shareholders, and you may not earn a positive return on your investment or receive a return of any or all of your investment.

You may be liable in certain circumstances for the repayment of distributions.

You are not personally liable for any debts or losses of the Company beyond the amount of your capital contributions and profits attributable thereto (if any) if the Company is otherwise unable to meet its obligations. However, you may be required to repay to the Company cash or in-kind distributions (including distributions on partial or complete redemption of Shares and distributions deemed a return of capital) received by you to the extent of overpayments and to the extent such distribution made the Company insolvent at the time of the payment or the distribution.

The Company is not required to provide disclosure pursuant to the Securities Exchange Act of 1934.

The Company is not required to provide disclosure pursuant to the Exchange Act. As such, the Company is not required to file quarterly or annual reports. In addition, the Company is not required to prepare proxy or information statements; our common stock will not be subject to the protection of the going private regulations; the Company will be subject to only limited portions of the tender offer rules; our officers, directors, and more than ten percent (10%) shareholders (“insiders”) are not required to file beneficial ownership reports about their holdings in our Company; insiders will not be subject to the short-swing profit recovery provisions of the Exchange Act; and more than five percent (5%) shareholders of classes of our equity securities will not be required to report information about their ownership positions in the securities.

The Company does not maintain key man life insurance on its officers.

The Company depends on the continued contributions of its officers who handle all of the managerial responsibilities of the Company. We do not carry key person life insurance on any of their lives and the loss of services of any of these individuals could disrupt our operations and interfere with our ability to successfully develop the Property or compete with others.

Risks Related to Investment in our Common Stock

The ownership of our common stock is concentrated among existing executive officers and directors.

Upon the sale of all of the Shares offered in this Offering, our executive officers and directors will continue to own beneficially, in the aggregate, a vast majority of the outstanding Shares. As a result, they will be able to exercise a significant level of control over all matters requiring shareholder approval, including the election of directors, amendments to our Articles of Incorporation, and approval of significant corporate transactions. This control could have the effect of delaying or preventing a change of control of Omega or changes in management and will make the approval of certain transactions difficult or impossible without the support of these shareholders.

6

There currently is no public trading market for our securities and an active market may not develop or, if developed, be sustained. If a public trading market does not develop, you may not be able to sell any of your securities.

There is currently no public trading market for our common stock, and an active market may not develop or be sustained. If an active public trading market for our securities does not develop or is not sustained, it may be difficult or impossible for you to resell your shares at any price. Even if a public market does develop, the market price could decline below the amount you paid for your Shares.

Risks Related to the Offering

The determination of the Offering Price and other terms of the Offering have been arbitrarily determined and may not reflect the value of your investment.

The Offering Price has been arbitrarily determined by the management and may not bear any relationship to assets acquired or to be acquired or the book value of the Company or any other established criteria or quantifiable indicia for valuing a business. Neither the Company nor the management represents that the Shares have or will have a market value equal to their Offering Price or that the Shares could be resold (if at all) at their original Offering Price.

Your investment is highly illiquid and the Company does not intend to offer any liquidity options.

There is no public market for the Shares, the Company does not expect such a market to develop in the future, and the Company does not intend to offer any additional liquidity options to investors. Consequently, your ability to control the timing of the liquidation of your investment in the Company will be restricted and you may not be able to liquidate your investment. You should be prepared to hold your Shares indefinitely.

Risks Related to the Investment Company Act of 1940.

The Company intends to avoid becoming subject to the Investment Company Act of 1940, as amended (the “1940 Act”). However, under certain conditions, changing circumstances or changes in the law, it may become subject to the 1940 Act in the future. Becoming subject to the 1940 Act could have a material adverse effect on the Company. It is also probable that the Company would be terminated and liquidated due to the cost of registration under the 1940 Act.

Risks Related to Certain Conflicts of Interest

Potential conflicts of interest may conflict with your interests and/or result in loss of business.

Our officers and directors are involved in other employment opportunities and may periodically face a conflict in selecting between Omega Resources, Inc. and other personal and professional interests. The Company has not formulated a policy for the resolution of such conflicts should they occur. If the Company loses officers or directors to other pursuits without a sufficient warning, the Company may, consequently, go out of business. Potential conflicts of interest include, but are not limited to, the following:

·the officers, directors, and/or other affiliates may acquire and operate other companies for their own respective accounts, whether or not competitive with the Company;

·the officers, directors, and/or other affiliates will not be required to disgorge any profits or fees or other compensation they may receive from any other business they own separate from the Company, and you will not be entitled to receive or share in any of the profits, return, fees or compensation from any other business owned and operated by the officers, directors, and/or other affiliates for their own benefit;

·the Company may engage the officers, directors, and/or their affiliates to perform services at prevailing market rates. Prevailing market rates are determined by the officers and/or directors based on industry

7

standards and expectations of what the officers and/or directors would be able to negotiate with a third party on an arm’s length basis;

·the officers, directors, and/or other affiliates are not required to devote all of their time and efforts to the affairs of the Company; and

·the Company and its officers and/or directors, and the prospective Investors have not been represented by separate counsel in connection with the formation of the Company, the drafting of the Articles of Incorporation or the Subscription Agreement, or this Offering.

Certain affiliates of the Company may, from time to time, loan the Company funds to pay third-party costs and some or all of the proceeds of the Offering or distributions could be used to repay such loans with interest.

In the event that Cash Flow from the Company is insufficient to pay third-party costs, such as accounting fees, real estate taxes, and/or debt service, the officers, and/or one or more of their affiliates may loan the Company the funds necessary to pay such shortfalls on commercially reasonable terms. Proceeds of the Offering or future distributions may be used in whole or in part to repay any such loans, with interest.

Risks Related to Taxes

Federal and State Taxation of Business Combination May Discourage Business Combinations

Federal and state tax consequences will, in all likelihood, be major considerations in any business combination the Company may undertake. Currently, such transactions may be structured so as to result in tax- free treatment to both companies, pursuant to various federal and state tax provisions. The Company intends to structure any business combination, if any, so as to minimize the federal and state tax consequences to both the Company and the target entity; however, there can be no assurance that such business combination will meet the statutory requirements of a tax-free reorganization or that the parties will obtain the intended tax-free treatment upon a transfer of stock or assets. A non-qualifying reorganization could result in the imposition of both federal and state taxes which may have an adverse effect on both parties to the transaction, reduce the future value of the shares and potentially discourage a business combination.

IN VIEW OF THE FOREGOING, IT IS ABSOLUTELY NECESSARY THAT EACH AND EVERY PROSPECTIVE INVESTOR CONSULT WITH THE PROSPECTIVE INVESTOR’S OWN ATTORNEYS, ACCOUNTANTS AND OTHER PROFESSIONAL ADVISORS AS TO THE LEGAL, TAX, ACCOUNTING AND OTHER CONSEQUENCES OF AN INVESTMENT IN THE SHARES.

PURSUANT TO INTERNAL REVENUE SERVICE CIRCULAR NO. 230, BE ADVISED THAT ANY FEDERAL TAX ADVICE IN THIS COMMUNICATION, INCLUDING ANY ATTACHMENTS OR ENCLOSURES, WAS NOT INTENDED OR WRITTEN TO BE USED, AND IT CANNOT BE USED BY ANY PERSON OR ENTITY TAXPAYER, FOR THE PURPOSE OF AVOIDING ANY INTERNAL REVENUE CODE PENALTIES THAT MAY BE IMPOSED ON SUCH PERSON OR ENTITY. SUCH ADVICE WAS WRITTEN TO SUPPORT THE PROMOTION OR MARKETING OF THE TRANSACTION(S) OR MATTER(S) ADDRESSED BY THE WRITTEN ADVICE. EACH PERSON OR ENTITY SHOULD SEEK ADVICE BASED ON THE ITS PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

8

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Offering Circular, including the sections entitled “The Company,” “Risk Factors,” “Business and Properties,” “Offering Price Factors” and “Use of Proceeds”, contains forward-looking statements. In some cases you can identify these statements by forward-looking words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect” or the negative or plural of these words or similar expressions. These forward-looking statements include, but are not limited to, statements concerning the Company, risk factors, plans and projections.

You should not rely upon forward-looking statements as predictions of future events. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors.” In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Offering Circular may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward- looking statements for any reason after the date of this Offering Circular to conform these statements to actual results or to changes in our expectations.

You should read this Offering Circular and the documents that we reference in this Offering Circular and have filed with the Securities and Exchange Commission as exhibits to the Form 1-A of which this preliminary Offering Circular is a part with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

DESCRIPTION OF THE COMPANY’S BUSINESS

Company Overview

Operating with two-fold strategy, Omega will focus primarily on the real estate sector and secondarily on the oil and gas market place thru limited partnerships in both sectors. The company will also serve as a project incubator through spin offs of both internal and external projects. The company intends to convert the limited partnerships into subsidiary corporations for these spin offs. The current management has right of first refusal for up to two spin offs from the projects.

Land Acquisitions

Omega is uniquely positioned geographically. Geographically, Omega is advantageously located in Colorado’s dynamic front range, and over the previous seven to eight years this region has experienced increases in certain property values of up to five to seven percent annually. In addition, its real estate management team has a combined 135 years of experience in agricultural, commercial and residential properties, including its Board Members and LLP managers.

Agricultural properties have shared in this dynamic valuation escalation. Raw farm ground has typically increased from $6,000 to $10,000 per acre over the same period within the areas to be considered for investment. Residential home prices have seen valuations escalate from $200,000 to $400,000 during this same period. While economic slowdowns have adversely affected real estate nationally, the effects have been less severe over Colorado’s front range.

Omega’s business plan is to concentrate its efforts on these front range land opportunities. The Company intends to expand this focus to Wyoming, Nebraska and Kansas in time as funds are raised for expansion. The contiguity of these areas to our headquarters in Colorado will be economically advantageous in reducing travel related costs. These savings will contribute to profitability to our investors.

In general, agricultural lands will be rented to growers/grazers. The Company anticipates returns of 3% to 6% depending on farm economies in each area selected. Agricultural properties are anticipated to appreciate at a rate of

9

three to four percent annually. The combination of these factors is expected to produce between six and ten percent overall returns over time.

Omega’s investment team’s extensive experience in commercial and residential properties purchase, sales and development leads it to believe that average returns of 9% to 12% percent annually are not out of the anticipated range of return over an extended period of time.

Oil and Gas

The current market for oil and gas exploration and development of new and existing oil and gas projects is very favorable for Omega Resources, Inc. It is our business strategy to capitalize on new drilling technology to pursue existing and by-passed opportunities in the highly profitable energy industry. Our low overhead and highly experienced team is ideally suited to take maximum advantage of the opportunities that may be uneconomical to larger or heavily leveraged oil and gas companies.

The company is to be an active participant in the oil and gas industry by acquiring existing oil and gas assets and developing new exploration opportunities. Two primary approaches are being followed to accomplish this goal. The first approach is to acquire “orphan wells”, then bring them up to operational capability. In some cases the Company will also increase their production capability by employing enhanced recovery methods. The second approach, is to own oil and gas production, either by buying existing production with potential for upside through more drilling, or by employing enhanced recovery methods. The third approach is to purchase oil and gas leases with good seismic data located in close proximity or covering existing fields with good drilling and development potential. These are opportunities that are unattractive to the most larger oil and gas organizations, but ideal for our operational approach.

In the initial phase of the company, we will concentrate on obtaining “orphan wells” and existing gas production in Colorado, western Kansas and Wyoming that can be enhanced over time and with the added potential of additional future drilling. These wells would target shallower formations resulting in lower operating costs, higher profitability and lower risk. In the second phase we will seek opportunities to acquire existing production with potential for in-field development or new exploratory drilling in Oklahoma and Texas. As the company grows, our plans include entry into the gas marketing business focusing on marketing direct to end users, and expanding our areas of interest for purchasing oil production, oil and gas leases and localized field gas gathering systems. We are confident that with the experience of our corporate personnel and our contract consulting personnel the Company will thrive.

DESCRIPTION OF OPERATING PROPERTY

Our corporate office is located at 8541 North County Road 11, Wellington, CO 80549. Office space, utilities and storage are currently being provided free of charge to the Company at the present time at this address. There are currently no proposed programs for the renovation, improvement or development of the facilities currently in use.

10

USE OF PROCEEDS

With respect to up to 22,500,000 shares of common stock to be sold by the Company, unless we provide otherwise in a supplement to this prospectus, the Company intends to use the net proceeds from the sale of our securities for general corporate purposes.

However, the table below outlines management’s current anticipated use of proceeds. In the event that 100% of the funds are not raised, management has outlined how they perceive the funds will be allocated, at various levels of funding. The Offering scenarios are presented for illustrative purposes only and the actual amount of proceeds, if any, may differ. The table is set out in the perceived order of priority of such purposes, provided; however, management may reallocate such proceeds among purposes as the situation dictates.

Use of Proceeds*

% of Shares Sold

|

| 25%

|

| 50%

|

| 75%

|

| 100%

|

# of Shares Sold

|

| 5,625,000

|

| 11,250,000

|

| 16,875,000

|

| 22,500,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Proceeds

|

| $

| 2,812,500

|

| $

| 5,750,000

|

| $

| 8,437,000

|

| $

| 11,250,000

|

Less: Offering Expenses**(1)

|

| $

| 562,500

|

| $

| 1,125,000

|

| $

| 1,687,500

|

| $

| 2,250,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Proceeds to the Company

|

| $

| 2,250,000

|

| $

| 4,625,000

|

| $

| 6,749,500

|

| $

| 9,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use of Proceeds:

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal & Accounting

|

| $

| 12,500

|

| $

| 25,000

|

| $

| 37,500

|

| $

| 50,000

|

General Operational Expenses

|

| $

| 42,500

|

| $

| 85,000

|

| $

| 127,500

|

| $

| 170,000

|

Work Over Expenses

|

| $

| 52,500

|

| $

| 105,000

|

| $

| 157,000

|

| $

| 210,000

|

Colorado Bond

|

| $

| 30,000

|

| $

| 60,000

|

| $

| 90,000

|

| $

| 120,000

|

Lease Acquisitions

|

| $

| 1,090,000

|

| $

| 2.180,000

|

| $

| 3,270,000

|

| $

| 4,360,000

|

Land Acquisitions

|

| $

| 1,022,500

|

| $

| 1,950,000

|

| $

| 3,067,000

|

| $

| 4,090,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

| $

| 2,250,000

|

| $

| 4,625,000

|

| $

| 6,749,500

|

| $

| 9,000,000

|

*Offering Expenses $0.00/share

**Estimated expenses including legal, accounting and miscellaneous fees.

1Offering expenses consists of legal expenses, accounting expenses, printing expenses, shipping expenses, broker and crowdfunding expenses etc.

DETERMINATION OF THE OFFERING PRICE

The offering price of the common stock has been arbitrarily determined and bears no relationship to any objective criterion of value. The price does not bear any relationship to our assets, book value, historical earnings or net worth. No valuation or appraisal has been prepared for our business. We cannot assure you that a public market for our securities will develop or continue or that the securities will ever trade at a price higher than the offering price.

CAPITALIZATION

The following table reflects the capitalization of the Company as of the most recent balance sheet date. The table is not adjusted to reflect any subsequent stock splits, stock dividends, recapitalizations or refinancing.

The historical data in the table is derived from and should be read in conjunction with our financial statements for the period from our inception until December 31, 2021 included in this Offering Circular. You should also read this table in conjunction with the “Use of Proceeds” section and the section entitled “Management Discussion & Analysis of Financial Condition and Results of Operation.”

11

DISTRIBUTIONS

We do not intend to make any cash distributions to shareholders until such time as we have made payment of all liabilities. Due to the inherent risk of the Company being a developmental stage company, we cannot ensure that we will make any cash distributions, and even if we do, we can give no assurances about the amount and timing of such distributions.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The following discussion and analysis should be read in conjunction with (i) our financial statements and (ii) the section entitled “Description of the Company’s Business”, included in this Offering Circular. The discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including, but not limited to, those set forth under “Risk Factors” and elsewhere in this Offering Circular.

Going Concern

The future of our company is dependent upon its ability to obtain financing and upon future profitable operations from the sale of services. Management has plans to seek additional capital through a private placement and public offering of its common stock, if necessary. Our auditors have expressed a going concern opinion which raises substantial doubts about the Company’s ability to continue as a going concern.

PLAN OF OPERATION

Liquidity and Capital Resources

As of December 31, 2021, we had $7,134 in current assets and $10,941 in current liabilities at December 31, 2021. Our accountants have included a going concern opinion and the accompanying financial statements have been prepared in conformity with generally accepted accounting principles, which contemplate continuation of the Company as a going concern. However, the Company has accumulated deficit of ($4,544) as of December 31, 2021. The Company has not completed its efforts to establish a stabilized source of revenues sufficient to cover operating costs over an extended period of time.

We have no material commitments for the next twelve months. We will however, require additional capital to meet our liquidity needs. Currently, the Company has determined that its anticipated monthly cash flow needs should not exceed of $7,500 per month for the first 6 months of 2022. Expenses are expected to increase in the second half of 2022 due to a projected need to increase personnel.

The Company’s projected capital needs and its projected increase in expenses are based upon the Company’s projected roll-out over the coming twelve months, however, in the event that the full offering proceeds are not raised, the Company would roll-out at a slower pace. The Company’s success does not depend on a scheduled roll-out and therefore it has flexibility to scale back its expenses to meet actual income.

We anticipate that we will receive proceeds from investors through this offering, but there is no assurance that such proceeds will be received and there are no agreements or understandings currently in effect from any potential investors. It is anticipated that the Company will receive revenues from operations in the coming year, however, it is difficult to anticipate what those revenues might be, if any, and therefore, management has assumed for planning purposes only that it may need to sell common stock, take loans or advances from officers, directors or shareholders or enter into debt financing agreements in order to meet our cash needs over the coming twelve months. The Issuer has no agreements or understandings for any of the above-listed financing options.

The Use of Proceeds section includes a detailed description of the use of proceeds over the differing offering scenarios of 100%, 75%, 50% and 25%. As the Company’s expenses are relatively stable, unless additional websites are rolled out, the Company believes it can continue with its present operations with projected revenues together with offering proceeds under any of the offering scenarios. The Company will consider raising additional capital

12

during 2022 through sales of equity, debt and convertible securities, if it is deemed necessary as well as the sale of LLP interests.

The Company has no intention in investing in short-term or long-term discretionary financial programs of any kind.

Results of Operations

We generated revenue for the period ended December 31, 2021 of $18,304. As a result, we have reported a net gain of $ 1,683 for the period ended December 31, 2021.

Our independent registered public accounting firm has expressed a going concern opinion which raises substantial doubts about our ability to continue as a going concern. Due to the limited nature of the Company’s operations to date, the Company does not believe that past performance is any indication of future performance. The impact on the Company’s revenues of recognized trends and uncertainties in our market will not be recognized until such time as the Company has had sufficient operations to provide a baseline.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Critical Accounting Policies

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

We regularly evaluate the accounting policies and estimates that we use to prepare our financial statements. In general, management's estimates are based on historical experience, on information from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

Research and Development.

All market research and website development costs, including all related salaries, and facility costs are charged to expense when incurred.

Loss Per Common Share.

Basic net loss per share is calculated by dividing the net loss by the weighted-average number of common shares outstanding for the period, without consideration for common stock equivalents.

LEGAL PROCEEDINGS

There are no known pending legal or administrative proceedings against the Company.

13

MANAGEMENT PERSONS

Background of Directors, Executive Officers, Promoters, and Control Persons

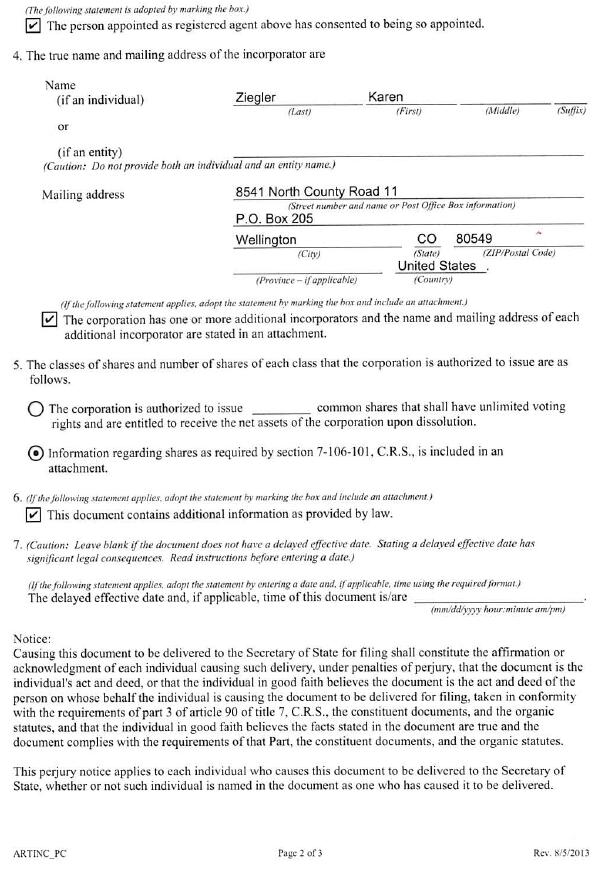

Karen Ziegler - President

Ms. Ziegler was an officer and director of a public company from September 2013 to December 2017 (resigned December 2017) and for many years participated in a variety of roles in major real estate development projects. These involved simultaneous projects for multiple residential developments, major water and sewer infrastructure improvement projects and multiple commercial development projects.

In addition, she has served in several administrative activities in various oil and gas ventures. In these capacities, she has performed analytical, accounting, cost projections, budgeting, scheduling and profit and loss analysis functions.

John Edge - Board Member

Mr. Edge has served as President and Director of his own companies since 1969. He has been responsible for overseeing all areas from the office to working in the field. His business was involved in land development, residential and commercial building projects. It was also active in modular housing developments.

His background includes the development of strategic corporate multi-year planning, budgeting, contracts, procurement, acquisition of materials, financing, supervising sub-contractors and his support staff. His was an approved builder for the Veteran's Administration and an approved "Dealer/Contractor for the U.S. Department of Agriculture Rural Housing Program.

Eric Van Horn - Corporation Secretary and Office Manager

Mr. Van Horn has been a systems engineer/architect for International Business Machines where he produced multi-year staffing plans, specifications and budgets consisting of software and hardware for outsourcing IT operations of major corporations (financial institutions, retail & insurance companies in the Fortune 100).

Dennis Arends - Board Member

Mr. Arends is a graduate of Colorado State University with a Bachelor of Science degree in General Agriculture. Over his agricultural career, he has owned and/or managed an array of farming and cattle operations in Colorado and Oklahoma. Receiving his Colorado real estate license in 1996, Mr. Arends has specialized in farm, ranch and grazing properties while continuing to manage farm and cattle operations. Over the past seven years he has worked exclusively in the real estate arena.

His more than 20-years of real estate experience while specializing in agricultural related properties has uniquely prepared him for identifying and acquiring properties with profitable investment returns.

Fred L. Croci - Board Member, Vice President and Asset Advisor Manager

Mr. Croci’s 52-year business career has spanned many facets of the real estate and oil and gas industries. Mr. Croci has been an officer and director of Alpha Energy, Inc. from September 2013 to December 2017 (resigned December 2017). A graduate of Iowa State University, he has held brokerage licenses in Iowa, Illinois, Wyoming and Colorado and has been involved in the brokerage, sales, leasing, development, and construction activities of, or provided consulting services on hundreds of millions of dollars’ worth of development properties, most recently in Northern Colorado, including a wide variety of project types including single and multi-family developments, self-storage and commercial shopping centers and office buildings.

He also has extensive experience with oil and gas marketing and oil operating companies. This includes participation with gas and oil drilling programs over several central and western states involving multiple drilling rigs. His activities focused on marketing, renovation, rework and improvement of old producing oil fields. The

14

company’s focus included a major emphasis on waterflood projects where old producing oil fields were reworked to improve production via waterflooding the permeable sandstone formations.

As president of a professional management firm, Mr. Croci oversaw other entities including corporations, liability companies and limited liability limited partnerships controlling dozens of real estate properties of the types mentioned above.

Contract Personnel and Companies

Jack A. McCartney

Manager, McCartney Engineering, LLC

Mr. McCartney graduated from the Colorado School of Mines in 1965 with the degree of Petroleum Engineer and in 1971 with the degree of Master of Engineering (Petroleum Engineer). He has completed the Industry short course at the University of Oklahoma as well as various continuing education courses. Mr. McCartney is a member of the Society of Professional Engineers and is a Registered Professional Engineer under Colorado registration #14618.

From 1965 to 1968, Mr. McCartney was employed by Kerr McGee Corporation as a production engineer. His responsibilities included well completions, work-overs, and recommendations of infill drilling locations, primarily offshore Louisiana. After a brief period with Kerr McGee in Calgary, Canada, he joined National Cooperative Refinery Association as a reservoir engineer. During his three years with NCRA, his duties included property evaluation, secondary recovery, and unitization. He also attended night school at this time and received his Masters Degree with emphasis on reservoir engineering and enhanced recovery methods. From 1971 to 1972 he was employed by Scientific Software Corporation in Denver, and later in Houston, where he performed reservoir simulation studies. He then joined Davis Oil Company in Denver as their reservoir engineer. Mr. McCartney was responsible for secondary recovery projects, unitization, and evaluation of the Company's oil and gas properties for loan negotiations.

In September of 1973, he formed McCartney & Associates, later to become McCartney Engineering, LLC, for the purpose of providing consulting services in the areas of property management, secondary and enhanced recovery, reservoir engineering, property evaluation, and expert testimony.

During the past thirty-six years Mr. McCartney has continued to be actively involved in reservoir studies, reserve and revenue forecasting, oil and gas property appraisals, secondary recovery feasibility studies, property management, and petroleum software development. He also has served on numerous occasions as an expert witness before the Oil and Gas Regulatory Commissions in Colorado, Wyoming, Montana, Nebraska, and North Dakota regarding matters ranging from well spacing applications to field unitization. He has also given expert testimony in civil litigations with respect to oil and gas related matters.

Mr. McCartney managed field operations in the Denver Basin for Macey Mershon Oil & Gas, Inc. during the late 1970's. He is currently managing field operations for all operated properties for an independent management company. McCartney Engineering, LLC owns interests in oil and gas properties in the Rocky Mountain region and operates wells in Colorado and Wyoming.

Mr. McCartney’s professional references include commercial banks including American National Bank, Wells Fargo Bank, US Bank in Denver, Colorado, and Casper First Bank in Casper, Wyoming. References from professional accounting firms include Arthur Andersen & Company and Hein & Associates LLP.

McCartney Engineering serves multiple clients which include Anchor Bay Corporation, Anderson Management Company, Mountain Petroleum Corporation, Pendragon Energy Partners, Inc., St. Anselm Exploration, Windsor Energy Group LLC, and many other oil and gas companies.

Mr. McCartney has provided expert testimony for major law firms including Welborn, Sullivan, Meck & Tooley; Astrella & Rice, Holme Roberts & Owen, Welborn, Dufford, Brown & Tooley; Poulson, Odell & Peterson; Shaw, Spangler & Roth; Faegre & Benson, Bjork, Lindley, & Little; and Robinson, Waters & O’Dorisio, all of Denver, Colorado, and Burford & Ryburn of Dallas, Texas, and Pearce & Durick of Bismarck, North Dakota. He has also

15

served on various Select Committees and was selected by the Colorado Oil and Gas Conservation Commission to serve on the Advisory Committee on Horizontal Drilling.

Along with his Engineering services, Mr. McCartney has authored several publications including "Polymers Reduce Risk In Waterflooding", Petroleum Engineer, Dec. 1972 and “Reservoir Engineering Aspects of Coalbed Methane”, A.A.P.G. Hydrocarbons From Coal, Chapter 16, 1993.

Directors’ Compensation

Our directors are not entitled to receive compensation for services rendered to Omega Resources, Inc., or for any meeting attended. There are no formal or informal arrangements or agreements to compensate directors for services provided as a director.

Employment Contracts and Officers’ Compensation

Any future compensation to be paid will be determined by the Board of Directors, and, as appropriate, an employment agreement may be executed. We do not currently have plans to pay any compensation until such time as the Company maintains a positive cash flow.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of the date of this offering with respect to the beneficial ownership of our common stock by all persons known to us to be beneficial owners of more than 5% of any such outstanding classes, and by each director and executive officer, and by all officers and directors as a group. Unless otherwise specified, the named beneficial owner has, to our knowledge, either sole or majority voting and investment power.

|

|

| Percent of Class

|

Title Of Class

| Name, Title and Address

of Beneficial Owner of Shares (1)

| Amount of

Beneficial

Ownership (2)

| Before

Offering

| After

Offering (3)

|

Common

| Karen Zeigler, President/Dir.

| 800,000

| 10.67%

| 2.6%

|

| Fred Croci

| 800,000

| 10.67%

| 2.6%

|

| Eric Von Horn

| 800,000

| 10.67%

| 2.6%

|

| John Edge

| 800,000

| 10.67%

| 2.6%

|

| Dennis Arends

| 800,000

| 10.67%

| 2.6%

|

| AG Management

| 2,988,500

| 46.65%

| 9.95%

|

| All Directors, Officers and

shareholders as a group (1)

| 6,988,500

| 100%

| 22.95%

|

Footnotes

(1)The address of the executive officers and directors is 8541 North County Road 11, Wellington, CO 80549.

(2)As used in this table, "beneficial ownership" means the sole or shared power to vote, or to direct the voting of, a security, or the sole or share investment power with respect to a security (i.e., the power to dispose of, or to direct the disposition of a security).

(3)Assumes the sale of the maximum amount of this offering (22,500,000 shares of common stock newly issued). The aggregate amount of shares to be issued and outstanding after the offering is 10,500,000.

16

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

An officer of the Company has lent the Company funds in 2021 and in 2022. The Company also advanced funds to an officer in 2021.

REPORTS TO SECURITY HOLDERS

1.After this offering, the Company will furnish shareholders with audited annual financial reports certified by independent accountants, and may, in its discretion, furnish unaudited quarterly financial reports.

2.After this offering, the Company will file periodic and current reports with the Securities and Exchange Commission as required to maintain the fully reporting status. The Company intends to file Form 8-K upon effectiveness of this registration.

3.The public may read and copy any materials the Company files with the SEC at the SEC's Public Reference Room at 100 F Street, N.E. Washington D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The Company’s SEC filings will also be available on the SEC's Internet site. The address of that site is: http://www.sec.gov

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

The Securities and Exchange Commission's Policy on Indemnification

In so far as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers, and controlling persons of the company pursuant to any provisions contained in its Articles of Incorporation, Bylaws, or otherwise, Omega Resources, Inc. has been advised that, in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Company will, unless in the opinion of the Company’s legal counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether indemnification is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

PLAN OF DISTRIBUTION

The shares to be offered in connection with this Offering shall be offered by the officers, on behalf of the Company through their contacts and word of mouth. In efforts to sell this Offering, mass advertising methods such as the internet or print media will be used. The Company may use a broker, selling agent or finder in connection with this Offering.

This Offering Circular will be furnished to prospective Investors upon their request via electronic PDF format and will be available for viewing and download 24 hours per day, 7 days per week.

In order to subscribe to purchase the Shares, a prospective Investor must complete, sign and deliver the executed Subscription Agreement and Investor Questionnaire to Omega and wire funds for its subscription amount in accordance with the instructions included in the Subscription Agreement attached as Exhibit 4.

The Company reserves the right to reject any Investor’s subscription in whole or in part for any reason. If the Offering terminates or if any prospective Investor’s subscription is rejected, all funds received from such Investors will be returned without interest or deduction.

This Offering is made only by means of this Offering Circular and prospective Investors must read and rely on the information provided in this Offering Circular in connection with their decision to invest in the Shares.

17

State Qualification and Suitability Standards

This Offering Circular does not constitute an offer to sell or the solicitation of an offer to purchase any shares in any jurisdiction in which, or to any person to whom, it would be unlawful to do so. An investment in the shares involves substantial risks and possible loss by Investors of their entire investment. See “Risk Factors.”

These shares have not been qualified under the securities laws of any state or jurisdiction. We plan to qualify the Offering in state securities regulatory bodies as we may determine from time to time. We may also offer or sell shares in other states in reliance on exemptions from registration requirements of the laws of those states.

The investing section of the website hosting this Offering will be coded to only allow access to invest to those prospective Investors that reside in jurisdictions where the Offering is registered and meet any state-specific Investor suitability standards.

No Escrow

The proceeds of this Offering will not be escrowed.

Common Stock

Omega. is authorized to issue 65,000,000 shares of common stock and 10,000,000 shares of preferred stock. The company has issued 7,500,000 shares of common stock to date held by Ten (10) shareholders of record.

The holders of Omega Resources, Inc.'s common stock:

1.Have equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board of Directors;

2.Are entitled to share ratably in all of assets available for distribution to holders of common stock upon liquidation, Dissolution, or winding up of corporate affairs.

3.Do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights; and

4.Are entitled to one vote per share on all matters on which stockholders may vote.

All shares of common stock now outstanding are fully paid for and non-assessable and all shares of common stock which are the subject of this offering, when issued, will be fully paid for and non-assessable.

Preferred Stock

The Company is authorized to issue 10,000,000 shares of preferred stock par value $0.0001.

LEGAL MATTERS

All prospective Investors are encouraged to consult their own legal advisors for advice in connection with this Offering.

EXPERTS

Byron Thomas, Esq. is legal counsel to the Company. Mr. Thomas has provided an opinion on the validity of the common stock to be issued pursuant to this Registration Statement. Mr. Thomas has also been retained as special counsel to our Company for purposes of facilitating our efforts in securing registration before the Commission and eventual listing on the OTCQB®.

18

The financial statements included in this prospectus as of December 31, 2021 and for the period from inception through December 31, 2022 have been audited by Ben Borgers, CPA, an independent registered public accounting firm, to the extent and for the periods set forth in their report appearing elsewhere herein and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

Transfer Agent

Empire Stock Transfer, a transfer agent registered with the SEC will act as our transfer agent. They are located in Las Vegas, NV.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We undertake to make available to every Investor, during the course of this Offering, the opportunity to ask questions of, and receive answers from us concerning the terms and conditions of this Offering and to obtain any appropriate additional information: (i) necessary to verify the accuracy of the information contained in this Offering Circular, or (ii) for any other purpose relevant to a prospective investment in the Company.

The Company will also provide to each Investor, upon request, copies of the following documents:

(i)copies of all of our material contracts; and

(ii)an opinion of counsel to the Company as to the legality of the Shares, indicating that they will when sold, be legally issued, fully paid and non-assessable.

All communications or inquiries relating to these materials or other questions regarding the Company or the Offering should be directed to the Company at 8541 North County Road 11, Wellington, CO 80549.

19

FINANCIAL STATEMENT AND EXHIBITS

OMEGA, INC.

INDEX TO FINANCIAL STATEMENTS

FINANCIAL STATEMENTS

December 31, 2020 and December 31, 2021

TABLE OF CONTENTS

20

COMPILATION REPORT

March 31, 2022

Board of Directors

Omega Resources, Inc.

The accompanying balance sheet of Omega Resources, Inc., as of December 31, 2020 and December 31, 2021 and the related statements of income for the year ended December 31, 2020 and the year ended, December 31, 2021, have been compiled in accordance with Business Accounting Standards utilized by businesses in the United States. The financials have been prepared using the accrual basis of accounting.

A compilation is limited to presenting in the form of financial statements information that is the representation of management. The accompanying financial statements have not been audited or reviewed and, accordingly, do not have an opinion or any other form of assurance on them.

F-1

BALANCE SHEET

| As at December 31,

|

| 2021

| 2020

|

| ($)

| ($)

|

ASSETS

|

|

|

Current Assets

|

|

|

Cash and Cash Equivalents

| 818

| 585

|

Total Current Assets

| 818

| 585

|

|

|

|

FIXED ASSETS

|

|

|

Gas Wells

| 3,000

| 3,000

|

Plant and Equipment

| 3,000

| 3,000

|

Accumulated Depreciation

| (2,253)

| (1,803)

|

Accumulated Depletion

| (3,000)

| (3,000)

|

Total Fixed Assets

| 747

| 1,197

|

|

|

|

OTHER ASSETS

|

|

|

Advances to Shareholder

| 6,068

| 0

|

Total Other Assets

| 6,068

| 0

|

|

|

|

Total Assets

| 7,633

| 1,782

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

|

|

Current Liabilities

|

|

|

Accounts Payable

| 0

| 0

|

Total Current Liabilities

| 0

| 0

|

|

|

|

Long Term Liabilities

|

|

|

Notes Payable

| 10,816

| 8,158

|

Total Long Term Liabilities

| 10,816

| 8,158

|

|

|

|

Total Liabilities

| 10,816

| 8,158

|

|

|

|

EQUITY

|

|

|

Common Stock-65,000,000 common stock par value $0.001

authorized. Issued and outstanding December 31, 2020 is 1,000.

Issued and outstanding December 31, 2021 2021 is 1,000.

| 1

| 1

|

Additional paid in capital

| 736

| 736

|

Retained earnings or (Deficit accumulated during development stage)

| (3,920)

| (7,113)

|

Total Stockholder's Equity

| (3,183)

| (6,376)

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDER’S EQUITY

| 7,633

| 1,782

|

See accompanying notes to financial statements

F-2

STATEMENTS OF OPERATIONS

| For the Year Ended

December 31,

|

| 2021

| 2020

|

| ($)

| ($)

|

|

|

|

REVENUES

| 18304

| 7978

|

|

|

|

OPERATING EXPENSES

|

|

|

|

|

|

Accounting

| 1,275

| 0

|

Maintenance

| 3,234

| 2,848

|

Financial Expenses

| 658

| 604

|

Professional Fees

| 5,584

| 0

|

Depletion Expense

| 0

| 13

|

Depreciation Expense

| 450

| 610

|

Other Operating Expenses

| 4,680

| 10,509

|

|

|

|

Total Operating Expenses

| 15,881

| 14,584

|

|

|

|

NET OPERATING PROFIT OR ( LOSS)

| 2,423

| (6,606)

|

|

|

|

OTHER INCOME

| 0

| 125

|

|

|

|

Total Other Income

| 0

| 125

|

|

|

|

NET LOSS BEFORE INCOME TAXES

| 2,423

| (6,481)

|

|

|

|

INCOME TAX EXPENSE

| 1,577

| 0

|

|

|

|

NET GAIN OR (LOSS)

| 846

| (6,481)

|

|

|

|

BASIC GAIN OR (LOSS PER COMMON SHARE

| 0.85

| (6.48)

|

|

|

|

NUMBER OF COMMON SHARES OUTSTANDING

| 1,000

| 1,000

|

See accompanying notes to financial statements

F-3

STATEMENTS OF STOCKHOLDERS' EQUITY

from January 1, 2018 to December 31, 2020

| Common Stock

|

|

|

|

| Shares

| Amount

| Additional

Paid In

Capital

| Retained

Earnings

(Deficit)

| Total

Stockholder's

Equity

|

|

| ($)

| ($)

| ($)

| ($)

|

Balance, December 31, 2017

| 0

| 0

| 0

| (411)

| (411)

|

|

|

|

|

|

|

Shares issued for cash

in a private placement during

the year ended December 31, 2018

| 1,000

| 1

| 736

| 0

| 737

|

Net Gain or (Loss) for year ended

December 31,2018

|

|

|

| (3,071)

| (3,071)

|

Balance as at 12/31/2018

| 1,000

| 1

| 736

| (3,482)

| (2,745)

|

|

|

|

|

|

|

Equity Adjustment

| 0

| 0

| 0

| 6,123

| 6,123

|

Net Gain or (Loss) for year ended

ended December 31, 2019

| 0

| 0

| 0

| (9,083)

| (9,083)

|

Balance as at 12/31/2019

| 1,000

| 1

| 736

| (6,442)

| (5,705)

|

|

|

|

|

|

|

Equity Adjustment

| 0

| 0

| 0

| 6,994

| 6,994

|

Net Gain or (Loss) for year ended

ended December 31, 2020

| 0

| 0

| 0

| (7,665)

| (7,665)

|

Balance as at 12/31/2020

| 1,000

| 1

| 736

| (7,113)

| (6,376)

|

|

|

|

|

|

|

Equity Adjustment

| 0

| 0

| 0

| 5,092

| 5,092

|