UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year ended:

OR

OR

Commission File Number:

(Exact name of Registrant as specified in its charter)

| Not applicable | ||

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

c/o

People’s Republic of

Tel:

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each

of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: As of December 31,

2023:

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934.

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Emerging growth company |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange

Act.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

| Auditor’s name | Firm ID | Location | ||

SUNCAR TECHNOLOGY GROUP INC.

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F (including information incorporated by reference herein, the “Report”) contains or may contain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve significant risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements include information about our possible or assumed future results of operations or our performance. The words “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intends”, “may”, “might”, “plan”, “possible”, “potential”, “predict”, “project”, “should”, “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this Report may include, for example, statements about:

| ● | the Company’s plans to expand its customers base with market trends; |

| ● | the Company’s work to provide digitalized, online services under the electrification of the vehicles, and population of new energy vehicles; |

| ● | the Company’s coordinating with multiple insurance companies, and designing of new insurance plans for new energy vehicles drivers which will be sold exclusively through the Company; | |

| ● | the Company’s increasing monetization of the management tech it provides for small business partners; |

| ● | the Company’s future financial performance, including any expansion plans and opportunities; |

| ● | the Company’s success in retaining or recruiting, or changes required in, its officers, key employees or directors; |

| ● | changes in the Company’s strategy, future operations, financial position, estimated revenue and losses, projected costs, prospects and plans; |

| ● | the implementation, market acceptance and success of the Company’s business model; |

| ● | the Company’s expectations surrounding the growth of its digital platform as a part of its revenues; |

| ● | the Company’s expectations surrounding the insurance it will maintain going forward; |

| ● | the Company’s ability to utilize the “controlled company” exemption under the rules of Nasdaq; and |

| ● | the Company’s ability to maintain the listing of its Class A Ordinary Shares or Warrants on Nasdaq. |

ii

These forward-looking statements are based on information available as of the date of this Report, and current expectations, forecasts and assumptions involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

| ● | the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, the ability of the Company to grow and manage growth profitably, maintain relationships with customers, compete within its industry and retain its key employees; |

| ● | future exchange and interest rates; |

| ● | the significant uncertainties related to the COVID-19 pandemic; |

| ● | the Company is highly dependent on the services of its executive officers; |

| ● | the Company may experience difficulties in managing its growth and expanding its operations; |

| ● | the outcome of any legal proceedings that may be instituted against the Company or others in connection with the Business Combination and the related transactions; |

| ● | the Company may face risks and uncertainties associated with laws and regulations within the People’s Republic of China, which may have a material adverse effect on its business; |

| ● | the Company’s auto services (automobile after-sales services) business and auto eInsurance (digitalized insurance intermediation) business largely depend on relationships with customers; |

| ● | the Company relies on our auto service providers and external referral sources to operate its business, therefore relationships with its service providers are crucial to its business; |

| ● | the Company is subject to customer concentration risk; |

| ● | the Company is subject to credit risks from its customers; |

| ● | the Company’s negative net operating cash flows in the past may expose it to certain liquidity risks and could constrain operational flexibility; and |

| ● | any significant disruption in services on the Company’s apps, websites or computer systems. |

The risk factors and cautionary language referred to or incorporated by reference in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in our forward-looking statements, including among other things, the items identified in the section entitled “Risk Factors” of this Report.

iii

DEFINED TERMS

In this Report, unless otherwise stated, references to:

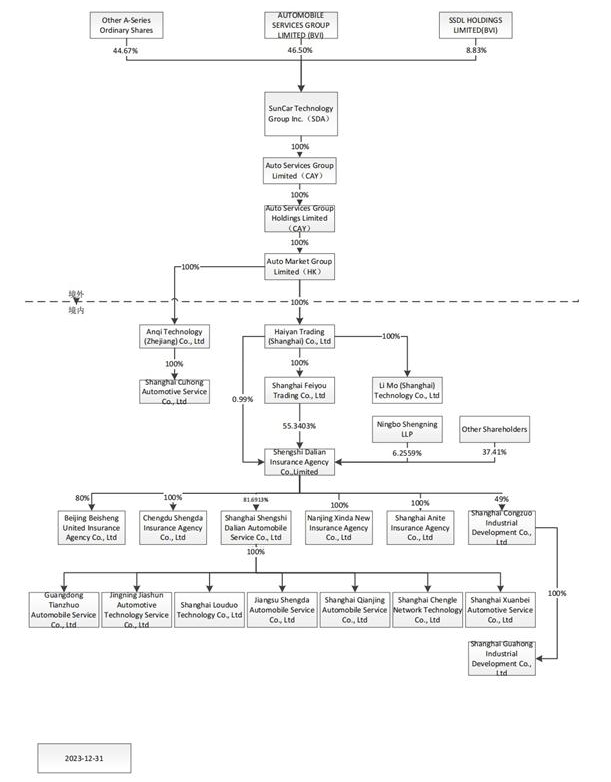

“ASGL” are to Auto Services Group Limited, a Cayman Islands exempted company;

“Business Combination” or “Mergers” are to the mergers contemplated under the Merger Agreement;

“China” or “PRC” are to the People’s Republic of China;

“Class A Ordinary Shares” are to the Class A ordinary shares of the Company, each having a nominal value in U.S. dollars of $0.0001 per share;

“Class B Ordinary Shares” are to the Class B ordinary shares of the Company, each having a nominal value in U.S. dollars of $0.0001 per share;

“Closing” are to the consummation of the Business Combination;

“Closing Date” are to May 17, 2023;

“Company”, “SunCar”, “we,” “our” or “us” are to SunCar Technology Group Inc., a Cayman Islands exempted company;

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

“Merger Agreement” are to the agreement and plan of merger among SunCar, Goldenbridge, Merger Sub, and certain other parties;

“Merger Sub” are to SunCar Technology Global Inc., a Cayman Islands exempted company and a direct wholly owned subsidiary of SunCar;

“Nasdaq” are to the Nasdaq Capital Market;

“Ordinary Shares” are to the Class A Ordinary Shares together with the Class B Ordinary Shares;

“PRC Operating Entities” are to Anqi Technology (Zhejiang) Co., Ltd (“Anqi Technology”) and its subsidiary, Shanghai Xuanbei Automobile Service Co., Limited (“Shanghai Xuanbei”), Shanghai Chengle Network Technology Co., Limited, Shanghai Qianjing Automobile Service Co., Limited, Shanghai Louduo Technology Co., Limited, Jingning Jiashan Automobile Technology Co., Limited, Beijing Beisheng United Insurance Agency Co., Ltd, Chengdu Shengda Insurance Agency Co., Ltd, Nanjing Xinda New Insurance Agency Co., Ltd, Shanghai Anite insurance Agency Co., Ltd, Shanghai Shengshi Dalian Automobile Service Co., Ltd (“Shengda Automobile”), Shengshi Dalian Insurance Agency Co., Ltd. (“SUNCAR Online”), Shanghai Feiyou Trading Co., Limited (“Shanghai Feiyou”);

“Private Warrants” are to warrants to purchase our Class A Ordinary Shares, with each Private Warrant exercisable to purchase one-half (1/2) of one Class A Ordinary Share at a price of $11.50 per share, originally issued in a private placement by GBRG in connection with the initial public offering of GBRG.

“Public Warrants” are to warrants to purchase our Class A Ordinary Shares, with each Public Warrant exercisable to purchase one-half (1/2) of one Class A Ordinary Share at a price of $11.50 per share, originally issued in the initial public offering of GBRG.

“RMB” or “Renminbi” are to the legal currency of the PRC;

“SEC” are to the U.S. Securities and Exchange Commission;

“U.S. Dollars,” “$,” or “US$” are to the legal currency of the United States;

“U.S. GAAP” or “GAAP” are to accounting principles generally accepted in the United States; and

“Warrants” are to, collectively, the Public Warrants and the Private Warrants.

iv

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Unless otherwise indicated in Item 6.A below, the business address for each of the Company’s directors and members of Executive Management is Suite 209, No. 656 Lingshi Road, Jing’an District, Shanghai, 200072, People’s Republic of China. The following table identifies our current executive officers and directors as of the date of this report, their respective offices and positions, and their respective dates of election or appointment:

| Name | Age (1) | Position | Date of Election or Appointment | |||

| Zaichang Ye | 54 | Chairman, Director and Chief Executive Officer | May 17, 2023 | |||

| Bohong Du | 53 | Director and Chief Financial Officer | May 17, 2023 | |||

| Zhunfu Lei | 46 | Chief Technology Officer and Chief Operating Officer | May 17, 2023 | |||

| Tianshi Yang | 34 | Chief Strategy Officer | January 25, 2024 | |||

| Saiye Gu | 51 | Vice President | May 17, 2023 | |||

| Yizhi Qian | 45 | Vice President | May 17, 2023 | |||

| Haidong Zhang (2)(3)(4) | 45 | Independent Director | May 17, 2023 | |||

| Lin Bao (2)(3) | 50 | Independent Director | May 17, 2023 | |||

| Yongsheng Liu (2) | 54 | Independent Director | May 17, 2023 |

| (1) | As of the date of this report. |

| (2) | Member of the Audit Committee. |

| (3) | Member of the Compensation Committee. |

| (4) | Member of the Nominating and Corporate Governance Committee. |

Biographical Information of Our Current Directors and Executive Officers

Mr. Zaichang Ye serves as Chairman, Director and Chief Executive Officer of SunCar. He is primarily responsible for formulating corporate strategy, planning, business development and supervising the overall operations of SunCar. He established Shengda Limited, a predecessor of SunCar, on December 5, 2007 and served as an executive Director and legal representative until May 2012 and served as general manager from April 2010 to May 2012. Mr. Ye has 20 years of experience in corporate and business management and over 10 years of experience in investment management. Prior to founding SunCar, he served as the legal representative and an executive director of Shanghai Jiamei Shenghai Culture Communication Co., Ltd. from December 2003 to April 2016. Mr. Ye has been a director of Shanghai Evening News Media Co., Ltd. since August 2004. He has been a supervisor of Shanghai Shouheng Commercial Consulting Co., Ltd. since August 2005. He has been the legal representative and an executive director of Haiyan Trading since November 2012. He became the chief strategy officer of Shengda Group in March 2014. He has been the legal representative and an executive director of Jiachen Information Technology (Shanghai) Co., Ltd. since March 2007. Mr. Ye obtained a bachelor’s degree in engineering from the department of mechanical engineering of Shanghai Jiao Tong University in China in July 1991. He also obtained a master’s degree in business administration from Cheung Kong Graduate School of Business in China in September 2007.

Mr. Bohong Du serves as Director and Chief Financial Officer of SunCar. He is primarily responsible for formulating corporate strategy, planning, business development and supervising the overall operations of SunCar. He joined SunCar in March 2008 as a supervisor of Jiangsu Shengda. He has been a supervisor of Shengshi Dalian Automobile and Chengdu Shengda since June 2013 and December 2010, respectively. Mr. Du has 20 years of experience in corporate and business management. Prior to joining SunCar, Mr. Du served as a manager of Shanghai Fosun High Technology (Group) Co., Ltd. from March 1998 to September 2002. Mr. Du served as a manager of Shanghai Fosun Information Industry Co., Ltd from October 2002 to January 2003. He was a vice president at Jiamei Communication Holdings Limited from April 2003 to November 2013. Mr. Du has been a vice president of SunCar since December 2013. Mr. Du obtained a college degree in financial accounting from Shanghai University in China in July 1997. Mr. Du obtained a bachelor’s degree in business administration from the School of Continuing Education of Shandong University in China in January 2013. He also obtained a master’s degree in business administration for senior executives from Xiamen University in China in June 2016.

1

Mr. Zhunfu Lei serves as Chief Technology Officer and Chief Operating Officer of SunCar. He joined SunCar as the legal representative and an executive Director of Shengda Limited in May 2012. He was approved to serve as general manager of Shengda Limited on September 21, 2012 by the Shanghai bureau of the CIRC. He is primarily responsible for formulating corporate strategy, planning, business development and supervising the overall operations of our Group. He has been the legal representative, a director and a general manager of Jiangsu Shengda Automobile Service Co., Ltd., a wholly-owned subsidiary of SunCar, since July 2012. He has been the legal representative, an executive director and a manager of Beijing Beisheng since January 2010. He also served as the legal representative, a director and a manager of Shengshi Dalian Automobile from June 2013 to April 2016. Mr. Lei has 20 years of experience in corporate and business management. Prior to joining SunCar, Mr. Lei served as a director of Shanghai Jiamei Information Advertisement Co., Ltd. from November 2001 to April 2007. Mr. Lei served as a chief officer of Lianming Advertising from May 2007 to February 2008. He was also a chief officer of Shengda Group from February 2008 to September 2012. From December 2015 to December 2017, he also served as the legal representative of Shengshi Dalian Financial Leasing. Mr. Lei obtained a bachelor’s degree in computer software from Zhejiang University in China in June 1999.

Mr. Tianshi Yang serves as Chief Strategy Officer of the Company since January 25, 2024. He has more than 12 years of experience in finance, and investment in China, Hong Kong, and the U.S. as well as management experiences in three Nasdaq listed companies and a public company listed in the Stock Exchange of Hong Kong. From June 2021 to September 2023, Mr. Yang has served as the chief financial officer of TD Holdings, Inc. (NASDAQ: GLG), currently BAIYU Holdings, Inc. (NASDAQ: BYU), a company engaged in commodity trading business and supply chain service business in China. From March 2020 to May 2021, Mr. Yang served as the director of investor relation in Aesthetic Medical International Holdings Group Limited (NASDAQ: AIH), a company that provides aesthetic medical service. From January 2019 to February 2020, Mr. Yang served as the financial department director of Meten International Education Group Ltd. (NASDAQ: METX), an English language training service provider. From May 2016 to October 2018, Mr. Yang served as the investment director of China First Capital Group (HKEX: 01269), an educational investment company. Mr. Yang has also served as an Auditor at Ernst & Young from September 2011 to September 2013. Mr. Yang earned his Bachelor’s degree of Economics from Tianjin University of Finance and Economics in China in June 2011 and a Master’s degree of Finance from Brandeis University in Boston, U.S. in February 2016.

Ms. Saiye Gu serves as a Vice President of SunCar. She joined SunCar as a Director on March 23, 2014. She is primarily responsible for the overall operations of our Group’s auto eInsurance division. She was the legal representative, a director and a manager of Shengshi Dalian Automobile from April 2016 to December 2016. She has been the legal representative and a director of Shanghai Xuanbei Automobile Service Co., Ltd. since April 2018. Ms. Gu has nearly 20 years of experience in corporate and business management. Prior to joining our Group, Ms. Gu served as a secretary of the general manager at China Electronics Import and Export Ningbo Branch from July 1993 to September 1995. She served as a responsible editor of Shanghai Wanshitong Economic Information Service Co., Ltd. from January 1996 to September 2002. She served as an assistant to the general manager for Shanghai Jiamei Information Advertisement Co. from January 2004 to December 2006. Ms. Gu was a vice president of Lianming Advertising from January 2007 to February 2008. She served as a vice president of Shengda Group from February 2008 to March 2014. Ms. Gu obtained a college degree in humanities from the University of Electronic Science and Technology of China in July 1993. Ms. Gu obtained a master’s degree in business administration from Fudan University in China in December 2012.

Mr. Yizhi Qian serves as a Vice President of SunCar. He was appointed as SunCar’s shareholders representative supervisor on September 23, 2015. Mr. Qian joined SunCar as a vice president of Shengshi Dalian Automobile in May 2015 and was responsible for the business development and service network coverage. He has been the legal representative, an executive director and manager of Shengshi Dalian Automobile since December 2016. Prior to joining SunCar, Mr. Qian was the account manager of the Shanghai advertising department of the Global Times from February 2001 to March 2002. He was a business director of Shanghai Jiamei Information Advertisement Co. from February 2005 to January 2014 and a business director of Shanghai Zhongrun Jiefang Media Co., Ltd. from February 2014 to May 2015, respectively. Mr. Qian completed his education specialized in investment economic management from Tongling College of Finance and Economics (currently known as Tongling University) in China in July 2000.

Mr. Haidong Zhang serves as an independent director of SunCar. He is an experienced entrepreneur in the field of artificial intelligence. He is the founder and chairman of First Pacific Technology Group, a technology company in Shanghai focusing on development of and investment in artificial intelligence related technologies. Before founding First Pacific in September 2006, Mr. Zhang served as manager of North China Region at Oracle, Inc. from May 2004 to September 2006. Mr. Zhang received his bachelor’s degree in Computer Science from Harvard University in 2002 and then went on for his graduate school studies, also in Computer Science and Engineering, at the Massachusetts Institute of Technology.

Ms. Lin Bao serves as an independent director of SunCar. Ms. Lin is an experienced accounting professional. She holds CPA or equivalent qualifications in the U.S., Ontario, Canada, and Hong Kong. Since October 2022, she has served as the Chief Financial Officer of Jayud Global Logistics Limited. She served as the Chief Financial Officer of Shanghai Eagsen Intelligent Co., Ltd in Shanghai from November 2019 to March 2020, and from April 2020 to September 2022, She served as the Chief Financial Officer of Eagsen, Inc., where she was responsible for bringing Eagsen public on Nasdaq. Previously, she was Chief Financial Officer at Jufeel International Group in Shanghai from 2018 to 2019, and Chief Financial Officer at Balintimes Online Media Ltd. in Shanghai from 2014 to 2015. She was responsible for the initial public offering of both Jufeel and Balintimes. Earlier, she served similar roles at other public companies in Shanghai and in Toronto, Canada. She also worked at Ernst & Young LLP, where she was senior auditor from 2005 to 2008. Ms. Bao received her bachelor’s degree in economics from Concordia University in Canada.

2

Mr. Yongsheng Liu serves as an independent director of SunCar. Throughout the past 20 years, Mr. Liu has assumed various corporate leadership positions and demonstrated his strong execution ability and in-depth knowledge in private equity and corporate mergers & acquisitions transactions across a wide range of sectors including aviation, consumer, financial institutions, and technology. Mr. Liu has served as the chief executive officer and chairman of our board of directors of Goldenbridge since August 2020. He has served as Chief Operating Officer of Goldenstone Acquisition Limited, a special purpose acquisition company (“Goldenstone”) since April 2021. Mr. Liu served as the Chairman and Chief Executive Officer of Wealthbridge Acquisition Limited, a special purpose acquisition company, from June 2018 until its business combination with Scienjoy Inc. in May 2020, and had served as the Vice Chairman of Scienjoy’s Board of Directors since then. From March 2017 to April 2018, Mr. Liu served as the Chairman of the Board of Directors and Chief Executive Officer of Royal China Holdings Limited (HKEx: 01683), during which he spearheaded the company’s international growth strategy focused at acquiring targets in the aviation industry and financial sector. From the beginning of 2013 to March 2017, Mr. Liu was the Chairman of Joy Air General Aviation, Chairman of Cambodia Bayon Airlines, Vice Chairman of Everbright and Joy International Leasing Company, and President of General Aviation Investment Company (Shanghai). From April 2004 to August 2008, Mr. Liu also served as Chief Strategy Officer of United Eagle Airlines (subsequently renamed to Chengdu Airlines). From December 1994 to June 2000, Mr. Liu was a manager of China Southern Airlines responsible for ground staff training. Mr. Liu received his master degree from the University of Ottawa in 2002 and his bachelor’s degree from Civil Aviation University of China in 1992.

Family Relationships

Mr. Zhunfu Lei is the brother of the wife of Mr. Ye Zaichang. Other than that, there are no family relationships among our officers and directors and those of our subsidiaries and affiliated companies.

Board Diversity

The Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity. However, the Board of Directors and the Nominating and Corporate Governance Committee believe that it is essential that the members of the Board of Directors represent diverse viewpoints. In considering candidates for the Board of Directors, the Board of Directors and the Nominating and Corporate Governance Committee consider the entirety of each candidate’s credentials in the context of the factors mentioned above. The Company is currently in compliance with the diversity requirements of Nasdaq Rule 5605(f) and 5606.

| Board Diversity Matrix (As of December 31, 2023) | ||

| Country of Principal Executive Offices | China | |

| Foreign Private Issuer | Yes | |

| Disclosure Prohibited under Home Country Law | No | |

| Total Number of Directors | 5 | |

| Part I: Gender Identity | Female | Male | Non- Binary | Did Not Disclose Gender | ||||

| Directors | 1 | 4 | 0 | 0 | ||||

| Part II: Demographic Background | ||||||||

| Underrepresented Individual in Home Country Jurisdiction | 0 | 0 | 0 | 0 | ||||

| LGBTQ+ | 0 | 0 | 0 | 0 | ||||

| Did Not Disclose Demographic Background | 0 | 0 | 0 | 0 |

B. Advisers

Not applicable.

C. Auditors

Friedman LLP acted as independent auditor of Goldenbridge Acquisition Limited’s (“GBRG”) for the period from March 2, 2021 (inception) to October 7, 2022. Marcum LLP acted as GBRG’s independent auditor for the period from October 7, 2022 for the year ending June 30, 2023.

Marcum Asia CPAs LLP (formerly, Marcum Bernstein & Pinchuk LLP) acted as ASGL’s independent registered public accounting firm for the years ended December 31, 2020, 2021.

3

On June 7, 2023, the Company decided to dismiss Marcum Asia CPAs LLP. On June 8, 2023, Enrome LLP was appointed as the Company’s independent registered public accounting firm to audit the Company’s consolidated financial statements as of and for the fiscal years ended December 31, 2021, 2022 and 2023.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The following table presents SunCar’s summary consolidated statements of operations data for the years ended December 31, 2021, 2022 and 2023.

| For the year Ended December 31, | ||||||||||||

| 2021 | 2022 | 2023 | ||||||||||

| Revenues | ||||||||||||

| Auto service | $ | 187,880 | $ | 199,294 | $ | 214,979 | ||||||

| Auto eInsurance service | 56,766 | 67,640 | 118,109 | |||||||||

| Technology service | 4,589 | 15,479 | 30,658 | |||||||||

| Total revenues | 249,235 | 282,413 | 363,746 | |||||||||

| Operating cost and expenses | ||||||||||||

| Integrated service cost | (156,852 | ) | (166,793 | ) | (209,553 | ) | ||||||

| Promotional service expenses | (55,222 | ) | (65,500 | ) | (112,504 | ) | ||||||

| Selling expenses | (12,731 | ) | (16,477 | ) | (20,578 | ) | ||||||

| General and administrative expenses | (10,420 | ) | (37,742 | ) | (22,462 | ) | ||||||

| Research and development expenses | (3,651 | ) | (8,478 | ) | (14,111 | ) | ||||||

| Total operating costs and expenses | (238,876 | ) | (294,990 | ) | (379,208 | ) | ||||||

| Operating profit/(loss) | 10,359 | (12,577 | ) | (15,462 | ) | |||||||

| Other income/(expenses) | ||||||||||||

| Financial expenses, net | (3,045 | ) | (3,659 | ) | (4,435 | ) | ||||||

| Investment income | 759 | 441 | 518 | |||||||||

| Change of fair value of warrant liabilities | (629 | ) | ||||||||||

| Other income, net | 2,457 | 5,121 | 5,001 | |||||||||

| Total other income, net | 171 | 1,903 | 455 | |||||||||

| Income/(loss) before income tax expense | 10,530 | (10,674 | ) | (15,007 | ) | |||||||

| Income tax expense | (938 | ) | (231 | ) | (2,572 | ) | ||||||

| Income/(Loss) from continuing operations, net of tax | 9,592 | (10,905 | ) | (17,579 | ) | |||||||

| Discontinued operations: | ||||||||||||

| Net loss from the operations of the discontinued operations, net of tax | (27,682 | ) | (994 | ) | - | |||||||

| Net loss | $ | (18,090 | ) | (11,899 | ) | $ | (17,579 | ) | ||||

The following table presents SunCar’s summary consolidated balance sheet data as of December 31, 2022 and 2023.

| As of December 31, | ||||||||

| 2022 | 2023 | |||||||

| (In USD thousands) | ||||||||

| Total assets | $ | 191,968 | $ | 223,235 | ||||

| Total liabilities | $ | 155,192 | $ | 155,245 | ||||

| Total shareholders’ (deficit) equity | $ | (5,284 | ) | $ | 16,078 | |||

| Non-controlling interests | $ | 42,060 | $ | 51,912 | ||||

| Total equity | $ | 36,776 | $ | 67,990 | ||||

4

The following table presents SunCar’s summary consolidated cash flow data for the years ended December 31, 2021, 2022 and 2023.

| For the years ended December 31, | ||||||||||||

| 2021 | 2022 | 2023 | ||||||||||

| (In USD thousands) | ||||||||||||

| Net cash used in operating activities of continuing operations | $ | (19,105 | ) | $ | (16,092 | ) | $ | (27,651 | ) | |||

| Net cash (used in) provided by investing activities of continuing operations | $ | (20,091 | ) | $ | (5,402 | ) | $ | (2,394 | ) | |||

| Net cash (used in) provided by financing activities of continuing operations | $ | (1,185 | ) | $ | 10,636 | $ | 40,434 | |||||

B. Capitalization and Indebtedness

The following table sets forth the capitalization of the Company as of December 31, 2023.

| As of December 31, 2023 | ||||

| Cash and cash equivalents | $ | 30,854 | ||

| Short-term borrowings | 83,029 | |||

| Amounts due to related parties | 34,439 | |||

| Total shareholders’ equity | 16,078 | |||

| Non-controlling interests | 51,912 | |||

| Total capitalization | $ | 185,458 | ||

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this report that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our ordinary shares could decline, and you may lose all or part of your investment.

5

Summary of Risk Factors

General Risks Related to SunCar’s Business

| ● | Our auto services business and auto eInsurance business largely depend on our relationships with our customers. See Risk Factor - Our auto services business and auto eInsurance business largely depend on our relationships with our customers. If we cannot maintain good relationships or provide satisfactory services to them, we may lose some of our business. | |

| ● | We rely on our auto service providers and external referral sources to operate our business, therefore our relationships with our service providers are crucial to our business. See Risk Factor - We rely on our auto service providers and external referral sources to operate our business, therefore our relationships with our service providers are crucial to our business. Failure to establish and maintain stable relationships with them and other supply chain disruptions may adversely affect our results of operations and business prospects. | |

| ● |

We are subject to customer concentration risk. See Risk Factor - We are subject to customer concentration risk. Our growth and revenue could be materially and adversely affected if we lose any significant customer, or if any significant customer fails to cooperate with us at anticipated levels.

| |

| ● | We are subject to credit risks from our customers. | |

| ● | Our negative net operating cash flows in the past may expose us to certain liquidity risks and could constrain our operational flexibility. See Risk Factor under such title. | |

| ● | Any significant disruption in services on our apps, websites or computer systems, including events beyond our control, could materially and adversely affect our business, financial condition and results of operation. See Risk Factor under such title. | |

| ● | If we are unable to manage our growth or execute our strategies effectively, our business and prospects may be materially and adversely affected. See Risk Factor under such title. | |

| ● | We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to “emerging growth companies” will make our ordinary shares less attractive to investors. See Risk Factor under such title. | |

| ● | We may not be able to use certain of our leased properties due to defects related to these properties. See Risk Factor - We may not be able to use certain of our leased properties due to defects related to these properties. And failure to comply with PRC laws and regulations on leased property may expose us to potential fines and negatively affect our ability to use the properties we lease. | |

| ● | If we fail to protect our intellectual property rights and proprietary information, we may lose our competitive edge and our brand, reputation and operations may be materially and adversely affected. See Risk Factor under such title. |

Risks Related to SunCar’s Insurance Services

| ● | We participate in the business as an insurance intermediary, therefore, we only obtained necessary licenses for the sale of insurance, but these insurances do not allow us to create/modify insurance products either. See Risk Factor under such title. | |

| ● | Our business is subject to regulation and administration by the China Banking and Insurance Regulatory Commission and other government authorities, and failure to comply with any applicable regulations and rules by us could result in financial losses or harm to our business. See Risk Factor under such title. | |

| ● |

Misconduct of the external referral sources we engaged to promote our auto eInsurance services is difficult to detect and deter and could harm our reputation or lead to regulatory sanctions or litigation costs. See Risk Factor under such title. |

6

| ● | Examinations and investigations by the PRC regulatory authorities may result in fines and/or other penalties that may have a material adverse effect on our reputation, business, results of operations and financial condition. See Risk Factor under such title. | |

| ● | Because the commission revenue we earn on the sale of insurance products is based on premium and commission rates set by insurance companies, any decrease in these premiums or commission rates, or increase in the referral fees we pay to our external referral sources, may have an adverse effect on our results of operation. See Risk Factor under such title. | |

| ● | The insurance business is historically cyclical in nature, and there may be periods with excess underwriting capacity and unfavorable premium rates, which may negatively affect SunCar’s overall revenues. See Risk Factor - The insurance business is historically cyclical in nature, and there may be periods with excess underwriting capacity and unfavorable premium rates, which may negatively affect SunCar’s overall revenues. SunCar also plans to further develop new insurance products narrowly tailored to the new trend in the car industry, but there is no guarantee that such innovation will receive positive feedback from the market or bring more revenues to SunCar. |

Risks Related to Doing Business in China

| ● | PRC regulations relating to investments in offshore companies by PRC residents may subject our PRC-resident beneficial owners or our PRC Operating Entities to liability or penalties. See Risk Factor - PRC regulations relating to investments in offshore companies by PRC residents may subject our PRC-resident beneficial owners or our PRC Operating Entities to liability or penalties, limit our ability to inject capital into our PRC Operating Entities or limit the ability of our PRC Operating Entities to increase their registered capital or distribute profits. | |

| ● | Substantial uncertainties exist with respect to the interpretation and implementation of the PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations. See Risk Factor under such title. | |

| ● | The Chinese government exerts substantial influence over the manner in which SunCar must conduct our business activities. See Risk Factor - The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. We are currently not required to obtain permission or approval from Chinese authorities to list on U.S exchanges, however, if we were required to obtain permission or approval in the future and were denied permission or approval from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange and the value of our ordinary shares may significantly decline or be worthless, which would materially affect the interest of the investors. | |

| ● | Our business is conducted in RMB and the price of our ordinary shares is quoted in United States dollars, changes in currency conversion rates may affect the value of your investments. See Risk Factor - Because our business is conducted in RMB and the price of our ordinary shares is quoted in United States dollars, changes in currency conversion rates may affect the value of your investments. Any significant revaluation of the RMB may materially and adversely affect our cash flows, revenue and financial condition. Changes in the conversion rate between the United States dollar and the RMB will affect the amount of proceeds we will have available for our business. | |

| ● | We may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. SunCar may be liable for improper use or appropriation of personal information. See Risk Factor under such title. | |

| ● | If SunCar is classified as a PRC resident enterprise for PRC income tax purposes, such classification could result in unfavorable tax consequences to us and our non-PRC shareholders and ordinary shareholders. See Risk Factor under such title. |

7

| ● | Failure to obtain any preferential tax treatments or the discontinuation, reduction or delay of any of the preferential tax treatments that may be available to us in the future could materially and adversely affect our business, financial condition and results of operations. See Risk Factor under such title. |

| ● | The permission or approval of the China Securities Regulatory Commission may be required in future offerings or financings, and, if required, we cannot predict whether we will be able to obtain such permission or approval. See Risk Factor under such title. | |

| ● | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies may delay us from using the proceeds of future offerings. In addition, the PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of China, to the extent cash in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of SunCar or SunCar’s subsidiaries, by the PRC government to transfer cash. In terms of the cash transfer among SunCar and its subsidiaries, subject to the amounts of cash transfer and the nature of the use of funds, requisite internal approval shall be obtained prior to each cash transfer. Specifically, all transactions require the approvals of the financial controllers of the entities involved. As for an internal cash transfer exceeds RMB10,000,000 (approximately $1.5 million), the general manager is also required to conduct review and approval. See Risk Factor - PRC regulation of loans to and direct investment in PRC entities by offshore holding companies may delay us from using the proceeds of future offerings to make loans or additional capital contributions to our PRC Operating Entities, which could materially and adversely affect our liquidity and our ability to fund and expand our business. | |

| ● | Recently, the PRC government initiated a series of regulatory actions and released guidelines to regulate business operations in China with little advance notice, including those related to data security or anti-monopoly concerns, which may have an impact on our ability to conduct certain business in China, accept foreign investments, or list on a U.S. or other foreign exchange. See Risk Factor - We face uncertainties with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies and Risk Factor - The M&A Rules and certain other PRC regulations may make it more difficult for us to pursue growth through acquisitions. | |

| ● | The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. Therefore, investors in the securities and our business face potential uncertainty from the PRC government’s policy. The Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of our securities. Any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or to be worthless. See Risk Factor - The permission or approval of the China Securities Regulatory Commission may be required in connection with this Transaction, and, if required, we cannot predict whether we will be able to obtain such permission or approval. | |

| ● | Our auditor is headquartered in Singapore, Singapore, and is subject to inspection by the PCAOB on a regular basis. See Risk Factor - Holding Foreign Companies Accountable Act, or the HFCAA, and the related regulations are evolving quickly. Further implementations and interpretations of our amendments to the HFCAA or the related regulations, or a PCAOB’s determination of its lack of sufficient access to inspect our auditor, might pose regulatory risks to and impose restrictions on us because of our operations in mainland China that PCAOB may not be able to inspect or investigate completely such audit documentation and, as such, you may be deprived of the benefits of such inspection and our ordinary share could be delisted from the stock exchange pursuant to the HFCAA. |

8

Risks Related to Ownership of SunCar Securities

| ● | Because there are no current plans to pay cash dividends on the Class A Ordinary Share for the foreseeable future, you may not receive any return on investment unless you sell your Class A Ordinary Share for a price greater than that which you paid for it. See Risk Factor under such title. | |

| ● | If SunCar fails to implement and maintain an effective system of internal controls to remediate its material weaknesses over financial reporting, SunCar may be unable to accurately report its results of operations, meets its reporting obligations or prevent fraud, and investor confidence and the market price of SunCar’s ordinary shares may be materially and adversely affected. See Risk Factor under such title. | |

| ● | Future sales or perceived sales of substantial amounts of our securities in the public market could have a material adverse effect on the prevailing market price of our Ordinary Shares and our ability to raise capital in the future, and may result in dilution of your shareholdings. See Risk Factor under such title. | |

| ● | We may have conflicts of interest with our largest shareholder and may not be able to resolve such conflicts on favorable terms for us. See Risk Factor under such title. |

General Risks Related to SunCar’s Business

Our historical business growth and profitability may not be indicative of future performance. You should not rely on the results of our operations as an indication of future revenue, profit or growth.

We commenced our auto eInsurance business in May 2007 and launched our auto services business in June 2013, both through our operating entities in China. Our revenue and net profit increased continually. For the years ended December 31, 2021, 2022 and 2023, we generated revenue from continuing operations of $249.2 million, $282.4 million and $363.7 million, respectively. For the same periods, our net profit from continuing operations was $9.6 million, and net loss from continuing operations of $10.9 million and $17.6 million, representing a net profit margin from continuing operations of 3.85% and net loss margin from continuing operation of 3.86% and 4.83% in the respective periods. Our net losses were $18.1 million, $11.9 million and $17.6 million for the years ended December 31, 2021, 2022 and 2023, respectively. Due to the stringent regulations for the financial leasing industry and sluggish economic environment especially impacted by COVID-19, payments receivable from lessees were severely overdue. Accordingly, we made significant bad debt provision. In addition, fixed and required basis costs and expenses, including fund cost, personnel expenditure, rental expense and other expense to maintain normal operating activities were stable, and hence, the financial business line was under performance. For the purpose of concentrating on our remaining major business lines, we disposed the financial leasing business line as of March 1, 2022.

However, our historical performance may not be indicative of our future growth or financial results. We cannot assure you that we will be able to deliver similar growth or avoid any decline in the future. Our growth may slow down and our revenue and net profit may decline for a number of possible reasons, including the risk factors set forth in this Report. Some of the risks are beyond our control, including declining growth of our overall market or industry, increasing competition, the emergence of alternative business models, decreasing customer base, changes in rules, regulations, government policies or general economic conditions, and we may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors. You should consider our business and prospects in light of these risks, and not unduly rely on our past results of operations or historical growth rate as an indicator of our future performance.

9

If we fail to maintain cordial relationships with our business partners, our business, results of operations, financial condition and business prospects could be materially and adversely affected.

We are a company working as an intermediary in auto services and insurance. Therefore, we depend on our auto service providers and insurance companies partners to provide services to our clients and customers. Our success depends on our ability to, among other things, develop and maintain relationships with our existing business partners and attract new business partners.

Our auto services business and auto eInsurance business largely depend on our relationships with our customers. If we cannot maintain good relationships or provide satisfactory services to them, we may lose some of our business.

For our auto services business, our enterprise clients are our clients, mainly consisting of banks, insurance companies and other large corporations. We secure service contracts with a substantial number of our enterprise clients through a bidding or centralized procurement process. These contracts generally have a term of one or two years which, upon expiry, we are typically subject to a new round of bidding or centralized procurement process to be awarded a renewed contract. We cannot assure you that we will always be invited to participate in the bidding or procurement process of our existing customers upon expiry of our existing contract terms or potential customers that we strive to establish business relationship with, or that we would be able to succeed in the bidding or procurement processes or maintain comparable success rates in the future. Furthermore, our cooperation with our enterprise clients is subject to their annual budget constraints, which could indirectly affect the growth of our auto services business.

For our auto eInsurance business, we provide agency services for major insurance companies in China by distributing primarily auto eInsurance products underwritten by them, and receive commissions from these insurance companies. Our relationships with these insurance companies are governed by agreements between the insurance companies and us. These contracts generally provide, among other things, the scope of our authority and our commission rates, and typically have a term of one or three years. Certain of these contracts can also be terminated by the insurance companies with a relatively short notice under certain circumstances. There is no assurance that we would be able to renew any such contracts upon their expiry with terms that are comparable to or better than the existing ones, if at all. Any interruption to or discontinuation of our relationships with these insurance companies may severely and negatively impact our results of operations.

In addition, client and end-consumer recognition is critical for us to remain competitive. Our ability to maintain and enhance client and end-consumer recognition and reputation depends primarily on the quality of the products and services they receive. If we are unable to maintain and further enhance our client and end-consumer recognition and reputation and promote awareness of our product offerings and services, we may not be able to maintain or continue to expand our client base, and our results of operations may be materially and adversely affected. Furthermore, any negative or malicious publicity relating to our Group, products and services could harm our brand image and in turn materially and adversely affect our business and results of operations.

We rely on our auto service providers and external referral sources to operate our business, therefore our relationships with our service providers are crucial to our business. Failure to establish and maintain cordial relationships with them and other supply chain disruptions may adversely affect our results of operations and business prospects.

For our auto services business, we rely on our auto service providers to deliver a variety of automobile-related services to customers of our enterprise clients. Accordingly, our relationships with the auto service providers and their quality of service are crucial for us to continue our business growth and promote our brand and reputation among our customers. If our relationships with them deteriorate, our business, financial condition and results of operations may be materially and adversely affected. Similarly, failure of our auto service providers to deliver services of satisfactory quality may cause our clients to stop using our services, which could adversely affect our revenue or even jeopardize the business relationship with our customers.

For our auto eInsurance business, we collaborate with various external referral sources to expedite our market penetration and broaden our end consumer base. Our external referral sources are our service providers in the auto eInsurance business. Failure to establish and maintain cordial relationships with our external referral sources may materially and adversely affect our ability to expand our business scale and geographical coverage, which in turn could adversely affect our results of operations and business prospects.

10

In addition, our contracts with our clients and service providers are typically on a non-exclusive basis, and they may choose to cooperate with our competitors or offer competing services themselves. For example, there is an increasing trend that major insurance companies build their own Internet or mobile channels and strengthen their in-house capabilities to distribute their insurance products, as well as establishing their own auto eInsurance arms. Our auto service providers may also choose to work with our competitors or other service platforms, which may offer better terms or bring upon more business volume to them. In any event, there is no assurance that we will be able to continuously maintain positive relationships with our business partners, or continue to work with them on terms favorable to us, or at all. If any of the foregoing occurs, our business growth, results of operations and financial condition will be adversely affected.

Moreover, our auto service providers depend upon frequent use of auto parts, products, and supplies to perform the services they provide for us. Shortages or interruptions in the supply chain caused by unexpected demand, problems in production or distribution, acts of terrorism, financial or other difficulties of suppliers, labor issues, inclement weather, natural disasters such as floods, drought and hurricanes, outbreak of armed conflicts or disease, such as COVID-19, or other conditions could adversely affect the availability, quality and cost of supplies for such products, which could materially and adversely affect the businesses of our auto service providers and us. Recent global supply chain disruptions have had minimal direct impacts on our operations, because our business is digitalized and require very little continuous supply of physical materials. Moreover, the labor supply of our auto service providers have been affected only minimally, since we source these providers in China locally, close to the locations of our clients service requests. For examples, Russia, Ukraine, and the United States have no nexus to our supply chains, so events happening in these locations have minimal effect on our supply chain management or risks.

Global inflationary pressures could negatively impact our results of operations and cash flows.

We face two types of possible inflationary pressures: a general pressure from inflation-related economic slowdown, and a specific pressure from inflation of the prices of fuel. First, inflation could slow down the global economy and the economic activity in China in particular, and thus decrease the over amount of automobile usage in China which would impact our business. So far, this risk has not been realized, and we see automobile usage in China continue to steadily grow. Second, since the 2022 inflation episode was triggered by the conflict in Ukraine and the resulting increase in fossil fuel prices, it particularly impacts the automobile industry which still mainly relies on fossil fuel to power the vehicles. Thus, the automotive and related industries, including insurance and auto service industries where we operate, would face increased cost of operation even more significant than the global economy as a whole, drive by the increase in fuel prices. Our efforts in developing our NEV (new energy vehicles) business line may not be able to completely offset this risk, since NEV is still a minority portion of the entire automotive industry.

Increases in labor costs and employee benefits may adversely affect our business and profitability.

Labor costs in China have risen in recent years as a result of social and economic development including the increasing inflation. Average wages in China are expected to continue increasing. We may also need to increase our total compensation packages to attract and retain experienced personnel to achieve our business objectives. In addition, we are required by the PRC laws and regulations to pay various statutory employee benefits, including pension, housing fund, and insurance, to designated government authorities for the benefits of our employees. We may be determined by the relevant government authorities to have failed to make adequate payments to the statutory employee benefits, due to the inconsistent implementation or interpretation of the PRC laws and regulations by local authorities or our lack of understanding of the relevant PRC laws and regulations. As a result, we may be subject to late payment fees or other penalties. As of the date of this Report, our PRC Operating Entities have not been materially impacted, in part because our labor suppliers, the auto service providers, are highly fragmented and not coordinated as US-style labor unions do not exist in the PRC. However, we expect that our labor costs, including wages and employee benefits, will continue to increase. Our financial condition and results of operations may be adversely affected as a result of any material increase in our labor costs.

11

We are subject to customer concentration risk. Our growth and revenue could be materially and adversely affected if we lose any significant customer, or if any significant customer fails to cooperate with us at anticipated levels.

For the year 2023, there was three customer who accounted for more than 10% of our revenue for a total of 48%, and four customers each accounting for more than 10% of our accounts receivables for a total of 50%. For the year 2022, we had two customers each accounting for more than 10% of our revenue for a total of 26%, and four customers each accounting for more than 10% of our accounts receivables for a total of 70%. For the year of 2021, we had one customer accounting for more than 15% of our revenue, and three customers each accounting for more than 10% of our accounts receivables for a total of 46%.

There are a number of factors, other than our performance, that could cause loss of, or decrease in the volume of business from, a customer. Despite our moderate and decreasing customer concentration and our record of maintaining customer loyalty, our top customers, especially the insurance companies, are large state-owned enterprises, who may enjoy significant bargaining power over us, and who may be difficult for us to replace if we lose them. We cannot assure you that we will continue to maintain the business cooperation with these customers at the same level, or at all. The loss of business from any of these significant customers, or any downward adjustment of the commission rates paid to us, could materially adversely affect our revenue and profit. Furthermore, if any significant customer terminates its relationship with us, we cannot assure you that we will be able to secure an alternative arrangement with comparable insurance company in a timely manner, or at all.

We are subject to credit risks from our customers.

We typically grant credit period to our automobile enterprise clients. While they are principally insurance companies and banking institutions, there is no assurance that income receivable by us will not be subject to disputes with our clients and partners. Given the scale of our clients and the negotiating positions they enjoy, in case of dispute we are typically in a less favorable position to succeed in recovering the trade receivables and our financial position and results of operations may be negatively impacted as a result.

Our outstanding accounts receivable are not covered by collateral or credit insurance. While we have procedures to monitor and limit exposure to credit risk on our accounts receivable, which risk is heightened during periods of uncertain economic conditions, there can be no assurance such procedures will effectively limit our credit risk and enable us to avoid losses, which could have a material adverse effect on our financial condition and operating results. Our net accounts receivable balance was US$85.6 million and US$56.0 million as of December 31, 2022 and December 31, 2023, respectively, and we recognized bad debt expenses of nil and US$26.0 million during the years ended December 31, 2021 and 2022, respectively, and reversed credit losses of $4.1 million for the years ended December 31, 2023.

We may not be able to facilitate diversified products and services to effectively address our end consumers’ needs, which could have a material adverse effect on our business, results of operations and financial condition.

We strive to continuously upgrade our auto services by offering more comprehensive service solutions and upgraded experience. We also seek to collaborate with more insurance companies located in our existing and new geographical markets, while maintaining full spectrum insurance product choices. Expansion into new product and service categories and geographies involves new risks and challenges. If we fail to respond to the changing and emerging needs and preferences of our customers and end consumers, or we incorrectly respond to the changing and emerging needs and preferences, our business, results of operations and financial condition may be materially and adversely affected.

Any breaches to our security measures, including unauthorized access to our systems, computer viruses and cyber-attacks may adversely affect our database and reduce the use of our services and damage our reputation and brand names.

In connection with our business as a provider of online platform, we collect, host, store, transfer, process, disclose, use, secure and retain and dispose of large amounts of personal and business information about our clients and partners. We focus on ensuring that we safeguard and protect personal and business information and client funds, and we devote significant resources to maintain and regularly update our systems and processes. Nonetheless, the global environment continues to grow increasingly hostile as attacks on information technology systems continue to grow in frequency, complexity and sophistication, and we are regularly targeted by unauthorized parties using malicious tactics, code and viruses.

12

Any cyberattack, unauthorized intrusion, malicious software infiltration, network disruption, denial of service, corruption of data, theft of non-public or other sensitive information, or similar act by a malevolent party (including our personnel), or inadvertent acts or inactions by our vendors, partners or personnel, could result in the loss, disclosure or misuse of confidential personal or business information or the theft of client, and could have a materially adverse effect on our business or results of operations or that of our clients, result in liability, litigation, regulatory investigations and sanctions or a loss of confidence in our ability to serve clients, or cause current or potential clients to choose another service provider. As the global environment continues to grow increasingly hostile, the security of our operating environment is ever more important to our clients and potential clients. As a result, the breach or perceived breach of our security systems could result in a loss of confidence by our clients or potential clients and cause them to choose another service provider, which could have a materially adverse effect on our business.

As of the date of this Report, we believe we are not subject to any material cybersecurity risks. Although we believe that we maintain a robust program of information security and controls and none of the data or cyber security incidents that we have encountered to date have materially impacted us, we cannot guarantee that our measures will always be reliable, a data or cyber security incident could disrupt our continuing service to our customers and their end users, force us in providing inferior services, or delay the completion of our service, and then in turn have a materially adverse effect on our business, results of operations, financial condition and reputation.

We face intense competition in the markets we operate in, and some of our competitors may have greater resources or brand recognition than us.

The automobile auto eInsurance market and the integrated auto service market in China are highly fragmented and competitive. In our auto services business, we primarily compete with a large number of large integrated service providers and other independent auto service providers. We compete for customers on the basis of product offerings, pricing, customer services and reputation. In our auto eInsurance business, we face competition from insurance companies that use their in-house sales force, exclusive sales agents, telemarketing, and Internet or mobile channels to distribute their insurance products, and from business entities that distribute insurance products on an ancillary basis, such as commercial banks, postal offices and automobile dealerships, as well as from other professional insurance intermediaries.

Some of our current and future competitors may have greater financial and marketing resources than we do, and may be able to offer services that we do not currently have and may not offer in the future. The disruption of business cooperation with major banks and insurance companies we work with may cause us to lose our competitive advantages in certain areas. If we are unable to compete effectively against and stay ahead of our competitors, we may lose customers and our financial results may be negatively affected.

Our negative net operating cash flows in the past may expose us to certain liquidity risks and could constrain our operational flexibility.

We had negative net operating cash flows in years 2021, 2022 and 2023. Our cash flows have been affected by a general mis-match of cash inflow and outlay on the operational level resulting from our significantly longer trade receivables turnover days compared to our trade payables turnover days, as our customers are mostly banks and insurance companies and their respective payment process is generally significantly longer than our payment process to our external referral sources and auto service providers.

We cannot assure you that we will not experience net current liabilities or negative net operating cash flows in the future. Our future liquidity, ability to make necessary capital expenditures, the payment of trade and other payables, as and when they become due, will primarily depend on our ability to maintain adequate cash inflows from our operating activities and adequate external financing. Our ability to generate adequate cash inflows from operating activities may be affected by our future operating performance, prevailing economic conditions, our financial, business and other factors, many of which are beyond our control. Also, we may not be able to renew or refinance our existing bank borrowings or secure additional external financing on a timely basis or on acceptable terms, or at all. The occurrence of any of the foregoing may cause us not to have sufficient cash flow to fund our operating costs and constrain our operational flexibility and, in that event, our business, financial condition and results of operations could be adversely affected.

13

Our latest business growth strategy may negatively impact our financial results and profit margins in the short run.

To better fit into the development of current vehicle industry pioneer in the new energy vehicles (“NEVs”) market and transform to the sustainable growth strategy, we plan to focus on several marketing points to further increase the revenue of SunCar. Our growth strategy includes the following: (1) expanding customers base with market trends; (2) under the electrification of the vehicles, and population of NEVs, SunCar is working to provide digitalized, online services; (3) coordinating with multiple insurance companies, and design new insurance plans for NEV drivers which will be sold exclusively through SunCar; and (4) increasingly monetize the management tech (SaaS) we provide for small business partners. Although we do not expect our profit margin to decrease as a result of our latest business growth strategy, given that the strategy does not require a significant increase in capital expenditures, we may not succeed in achieving one or more of the goals under our growth strategy and it may cost us more expenses to achieve them than we anticipate. If we incur substantial expenses for implementing the plan without being able to achieve the anticipated business growth and expansion, our operating and financial results and our business prospects may be materially and adversely affected.

Our business is subject to seasonality.

In our auto eInsurance business, our revenue (i.e., commissions from insurance companies) is subject to quarterly fluctuations as a result of, among other factors, the seasonality of our business, the timing of policy renewals of individual policy owners and the net effect of new and lost business. During any given year, our revenue derived from distribution of insurance products is generally lower during the first quarter. The factors that cause such quarterly variations are not within our control. Specifically, change of end-consumer demand, timing of renewals, cancellations of insurance policies would cause seasonal fluctuations in our results of operations. On the other hand, revenue derived from our auto service business in any given year also exhibits seasonality generally, and is generally highest in the second quarter and the fourth quarter, mainly resulting from the expiry of reward points in our enterprise clients’ reward programs or customer loyalty programs and the promotional activities launched by our major customers in June and December of each year. In addition, changes in certain of our expenses do not necessarily correspond with such fluctuations. For example, we spend on marketing activities, staff recruitment and training, and product development throughout the year, and we pay rent for our facilities based on the terms of the lease agreements. We may also incur significant costs for our information technology systems and enhancements and upgrades of our apps from time to time in support of our business developments. We expect to continue to experience seasonal fluctuations in our revenue and results of operations. These fluctuations could result in volatility in our results of operations. As a result, you may not be able to rely on quarterly comparisons of our operating results as an indication of our future performance.

Any significant disruption in services on our apps, websites or computer systems, including events beyond our control, could materially and adversely affect our business, financial condition and results of operation.

Our business is highly dependent on the ability of our information technology systems to timely process a large number of transactions across different markets and products at a time when the volume of such transactions is growing rapidly. We are also increasingly relying on our apps to facilitate the business process of both our auto eInsurance and our auto services. Usability of our apps as perceived by users can influence customer satisfaction. The proper functioning and improvement of our apps, our accounting, customer database, customer service and other data processing systems, together with the communication systems between our various branches and our principal executive office in Shanghai, is critical to our business and to our ability to compete effectively. We cannot assure you that our business activities would not be materially disrupted in the event of a partial or complete failure of any of these primary information technology or communication systems, which could be caused by, among other things, software malfunction, computer virus attacks or conversion errors due to system upgrading. In addition, a prolonged failure of any of our information technology systems could damage our reputation and materially and adversely affect our operations and profitability.

14

Our business model and our planned business developments are dependent on the proper function of our IT systems and infrastructure and our ability to continuously improve our IT systems and infrastructure and adopt advancing technologies. Breakdown of any of our major IT systems or failure to keep up with technological developments would materially and adversely affect our business, results of operations and future prospects.

Our proprietary technology and technological capabilities are critical to the development and maintenance of our IT systems and infrastructure underlying our apps and platforms, which in turn is vital to our business operations and planned developments. We need to keep abreast of the fast evolving IT developments, and continuously invest in significant resources, including financial and human capital resources to maintain, upgrade and expand our IT systems and infrastructure in tandem with our business growth and developments. However, research and development activities are inherently uncertain, and investments in information technologies and development of proprietary technologies may not always lead to commercialization or monetarization, or lead to increased business volume and/or profitability. The fast evolving IT developments may also render our existing systems and infrastructure and those that are newly developed and implemented obsolete before we are able to reap sufficient benefits to recover their investment costs, and may lead to substantial impairments which would adversely affect our results of operations. Obsolescence in our proprietary technology, IT systems and infrastructure may also significantly impair our ability to conduct and grow our business and compete effectively, which could materially and adversely impact our results of operations and business prospects. On the other hand, any significant breakdown of our IT systems and infrastructure may materially and adversely affect our business, results of operations, reputation and business prospects, and may even subject us to potential claims or even litigations, particularly as parts of our IT systems and infrastructure are linked to or connected with IT systems and infrastructure of our insurance company partners and enterprise clients, who are mostly sizeable and reputable financial institutions whom themselves are subject to stringent regulatory supervision. As we rely heavily on our apps and our IT systems and infrastructure to facilitate and conduct our business, any prolonged breakdown of systems and infrastructure could also materially impact our business and results of operations.

Failure to ensure and protect the confidentiality of the personal data of end consumers could subject us to penalties, negatively impact our reputation and deter end consumers from using our platforms.